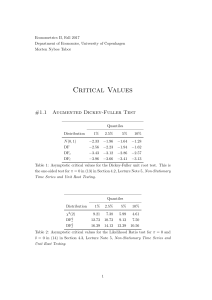

Introductory Econometrics: A Modern Approach (7e) Chapter 18 Advanced Time Series Topics 1 © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (1 of 17) • Testing for unit roots • For the validity of regression analysis, it is crucial to know whether dependent or independent variables are highly persistent. or not • Dickey-Fuller test • One can use the t-statistic to test the hypothesis, but under the null, it has not got the t-distribution but the Dickey-Fuller distribution. • The Dickey-Fuller distribution has to be looked up in tables. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 2 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (2 of 17) • Alternative Formulation of the Dickey-Fuller test • Critical values for Dickey-Fuller test Significance level 1% 2.5% 5% 10% Critical value -3.43 -3.12 -2.86 2.57 © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 3 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (3 of 17) • Example: Unit root test for three-month T-Bill rates • Augmented Dickey-Fuller test • The augmented Dickey-Fuller test allows for more serial correlation. • The critical values and the rejection rule are the same as before. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 4 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (4 of 17) • Dickey-Fuller test for time series that have a time trend • Critical values for Dickey-Fuller test with time trend Significance level 1% 2.5% 5% 10% Critical value -3.96 -3.66 -3.41 -3.12 • There are many other unit root tests … © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 5 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (5 of 17) • Spurious regression • Regressing one I(1)-series on another I(1)-series may lead to extre-mely high tstatistics even if the series are completely independent. • Similarly, the R-squared of such regressions tends to be very high. • This means that regression analysis involving time series that have a unit root may generally lead to completely misleading inferences. • Cointegration • Fortunately, regressions with I(1)-variables are not always spurious. • If there is a stable relationship between time series that, individually, display unit root behavior, these time series are called “co-integrated”. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 6 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (6 of 17) • Example for time-series that are potentially cointegrated It is unlikely that the spread has a unit root because this would mean the interest rates can move arbitrarily far away from each other with no tendency to come back together (this is implausible as it contradicts arbitrage arguments). If the spread is an I(0) variable, there is a stable relationship between the interest rates: © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 7 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (7 of 17) • General definition of cointegration • Two I(1) time series yt, xt are said to be cointegrated if there exists a stable relationship between them in the sense that: • Test for cointegration if the cointegration parameters are known • Form residuals of the known cointegration relationship: • Test whether the residuals have a unit root. • If the unit root can be rejected, yt and xt are cointegrated. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 8 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (8 of 17) • Example: Cointegration between interest rates (cont.) • Testing for cointegration if the parameters are unknown • If the potential relationship is unknown, it can be estimated by OLS. • After that, one tests whether the regression residuals have a unit root. • If the unit root is rejected, this means that yt and xt are cointegrated. • Due to the pre-estimation of parameters, critical values are different. 9 © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (9 of 17) • Critical values for cointegration test Significance level 1% 2.5% 5% 10% Critical value -3.90 -3.59 -3.34 -3.04 • The cointegration relationship may include a time trend • If the two series have differential time trends (drifts in this case), the deviation between them may still be I(0) but with a linear time trend. • In this case one should include a time trend in the first stage regression but one has to use different critical values when testing residuals. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 10 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (10 of 17) • Critical values for cointegration test including time trend Significance level 1% 2.5% 5% 10% Critical value -4.32 -4.03 -3.78 -3.50 • Example: Cointegration between fertility and tax exemption • DF-tests suggest that fertiliy and tax exemption have unit roots. • Regressing fertility on tax exemption and a time trend and carrying out a cointegration test suggests there is no evidence for cointegration. • This means that the regression in levels is probably spurious. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 11 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (11 of 17) • Summary of cointegration methods • All concepts can be generalized to arbitrarily many time series. • Cointegration is the leading methodology in empirical macro/finance as it models equilibrium relationships between nonstationary variables. • Estimation and inference is complicated and requires extra care. • Error correction models • One can show that when variables are cointegrated, their short-term dynamics are related in a so-called error correction representation: © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 12 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (12 of 17) • Forecasting economic time series • Forecasting economic time series is of great practical importance. • In forecasting, one is not interested in modeling causal relationships, but in predicting future outcomes using currently available information. • One can show that the forecasting rule with the minimum expected squared forecasting error is given by the conditional expectation. • Here, we only consider one-step-ahead forecasts, multiple-step-ahead forecasts are similar but more complicated (and also less precise). © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 13 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (13 of 17) • Regression based forecast models • Typical forecast models predict a variable in a linear regression using lagged values of the variable and lagged values of other variables. • One may include the lagged value of arbitrarily many other variables. • If enough lags have been included, the model is dynamically complete and there is no serial corr. in the error (but may be heteroskedasticity). • OLS inference methods can be used if the error is conditionally normal. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 14 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (14 of 17) • Example: Forecasting the U.S. unemployment rate © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 15 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (15 of 17) • Vector autoregressive models (VAR) • VAR models model a collection (vector) of time series as linear functions of their own past values and the past values of other series. They can be estimated eq. by eq. using OLS. • Using an F-test, one can test whether the past values of a series helps to predict the values of another series. If this is the case, the other series is caused by the first series in the sense of Granger-Causality. • VAR models work for arbitrarily many simultaneously observed time series. They are widely used in practice. They are also well suited to model systems of variables that are related to each other through cointegration relationships. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 16 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (16 of 17) • Evaluating forecast quality of one-step-ahead forecasts • One can measure how good the forecasted values fit the actual values over the whole sample (in-sample criteria, e.g. R-squared). • It is better, however, to evaluate the forecasting performance when forecasting out-of-sample values (out-of-sample criteria). • For this purpose, use first n observations for estimation, and the remaining m observations to calculate forecast errors en+h+1. • There are different forecast evaluation measures, e.g. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 17 Introductory Econometrics: A Modern Approach (7e) Advanced Time Series Topics (17 of 17) • Further topics in forecasting time series • Multiple-step forecasts are possible, but necessarily less precise. • Forecasts may make use of deterministic trends, but the error made by extrapolating time trends too far into the future may be large. • Similarly, seasonal patterns may be incorporated into forecasts. • Forecasting integrated time series is either based on regressions in levels, or on adding predicted changes (which are I(0)) to base levels. • It is possible to calculate confidence intervals for the point forecasts. • Forecast intervals for nonintegrated series converge to the unconditional variance, whereas for integrated series, they are unbounded. © 2020 Cengage版權所有,為課本著作之延伸教材,亦受著作權法之規範保護,僅作為授課教學使用,禁止列印、影印、未經授權重製和公開散佈 18