Financial Statements: Balance Sheet, Income Statement, Cash Flow

advertisement

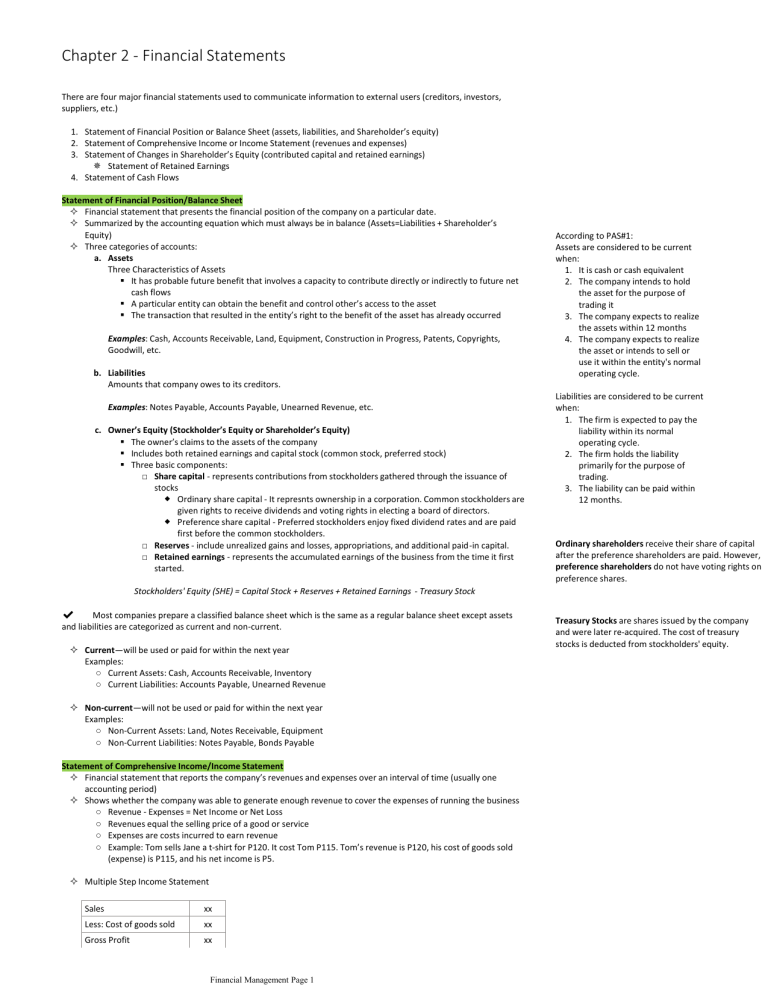

Chapter 2 - Financial Statements There are four major financial statements used to communicate information to external users (creditors, investors, suppliers, etc.) 1. Statement of Financial Position or Balance Sheet (assets, liabilities, and Shareholder’s equity) 2. Statement of Comprehensive Income or Income Statement (revenues and expenses) 3. Statement of Changes in Shareholder’s Equity (contributed capital and retained earnings) Statement of Retained Earnings 4. Statement of Cash Flows Statement of Financial Position/Balance Sheet Financial statement that presents the financial position of the company on a particular date. Summarized by the accounting equation which must always be in balance (Assets=Liabilities + Shareholder’s Equity) Three categories of accounts: a. Assets Three Characteristics of Assets ▪ It has probable future benefit that involves a capacity to contribute directly or indirectly to future net cash flows ▪ A particular entity can obtain the benefit and control other’s access to the asset ▪ The transaction that resulted in the entity’s right to the benefit of the asset has already occurred Examples: Cash, Accounts Receivable, Land, Equipment, Construction in Progress, Patents, Copyrights, Goodwill, etc. b. Liabilities Amounts that company owes to its creditors. Examples: Notes Payable, Accounts Payable, Unearned Revenue, etc. c. Owner’s Equity (Stockholder’s Equity or Shareholder’s Equity) ▪ The owner’s claims to the assets of the company ▪ Includes both retained earnings and capital stock (common stock, preferred stock) ▪ Three basic components: □ Share capital - represents contributions from stockholders gathered through the issuance of stocks Ordinary share capital - It represnts ownership in a corporation. Common stockholders are given rights to receive dividends and voting rights in electing a board of directors. Preference share capital - Preferred stockholders enjoy fixed dividend rates and are paid first before the common stockholders. □ Reserves - include unrealized gains and losses, appropriations, and additional paid-in capital. □ Retained earnings - represents the accumulated earnings of the business from the time it first started. According to PAS#1: Assets are considered to be current when: 1. It is cash or cash equivalent 2. The company intends to hold the asset for the purpose of trading it 3. The company expects to realize the assets within 12 months 4. The company expects to realize the asset or intends to sell or use it within the entity's normal operating cycle. Liabilities are considered to be current when: 1. The firm is expected to pay the liability within its normal operating cycle. 2. The firm holds the liability primarily for the purpose of trading. 3. The liability can be paid within 12 months. Ordinary shareholders receive their share of capital after the preference shareholders are paid. However, preference shareholders do not have voting rights on preference shares. Stockholders' Equity (SHE) = Capital Stock + Reserves + Retained Earnings - Treasury Stock ✔ Most companies prepare a classified balance sheet which is the same as a regular balance sheet except assets and liabilities are categorized as current and non-current. Current—will be used or paid for within the next year Examples: ○ Current Assets: Cash, Accounts Receivable, Inventory ○ Current Liabilities: Accounts Payable, Unearned Revenue Non-current—will not be used or paid for within the next year Examples: ○ Non-Current Assets: Land, Notes Receivable, Equipment ○ Non-Current Liabilities: Notes Payable, Bonds Payable Statement of Comprehensive Income/Income Statement Financial statement that reports the company’s revenues and expenses over an interval of time (usually one accounting period) Shows whether the company was able to generate enough revenue to cover the expenses of running the business ○ Revenue - Expenses = Net Income or Net Loss ○ Revenues equal the selling price of a good or service ○ Expenses are costs incurred to earn revenue ○ Example: Tom sells Jane a t-shirt for P120. It cost Tom P115. Tom’s revenue is P120, his cost of goods sold (expense) is P115, and his net income is P5. Multiple Step Income Statement Sales xx Less: Cost of goods sold xx Gross Profit xx Financial Management Page 1 Treasury Stocks are shares issued by the company and were later re-acquired. The cost of treasury stocks is deducted from stockholders' equity. Less: Operating Expenses xx Operating Income xx Add: Other Income xx Less: Other Expenses xx Net Income before taxes xx Less: Income Tax Expenses xx Net Income xx Cost of goods sold is computed as follows: For manufacturing: For merchandising: Merchandise inventory, beg. xx Add: Net Purchases Direct materials (raw materials) xx Direct labor xx Purchases xx Factory overhead xx Freight In xx Manufacturing cost xx Less: Purchase returns and allowances xx Add: Work in process, beg. xx xx Less: Work in process, end. xx xx Cost of goods manufactured xx xx Add: Finished goods, beg. xx xx Less: Finished goods, end. xx Cost of goods sold xx Purchase discounts xx Cost of goods available for sale Less: Merchandise Inventory, end. Cost of goods sold Statement of Changes in Shareholder’s Equity Contributed Capital and retained earnings Retained Earnings: Beginning Retained Earnings xx Less: Dividends xx Less: Appropriations xx Add: Net Income or Minus Net Loss xx Ending Retained Earnings xx Statement of Cash Flows Financial statement that measures activities involving cash receipts and cash payments over an interval of time (usually one accounting period). Cash flows can be classified into one of three categories: 1. Operating Activities - day-to-day general activities to run the business Examples: Purchasing inventory for cash, selling inventory for cash, paying cash for a business license, paying cash for utilities, etc. 2. Investing Activities - purchase and sale of assets that last longer than one year Examples: Purchasing land for cash, selling property for cash, etc. 3. Financing Activities - cash transactions involving a company’s long-term creditors or owners Examples: Receiving cash from a bank loan, receiving cash from the issue of common stock, receiving cash from the sale of bonds, paying cash for dividends, paying cash for principal on a loan Financial Management Page 2 Chapter 2 - Preparing Financial Statements Preparation of Financial Statements: Example 1: The following items were taken from the accounting records of CBA Incorporated. The income statement account balances are for the year ending December 31, 2012. The balance sheet account balances are the balances at December 31, 2012 except for the retained earnings balance which is the balance at 1/1/2012: Accounts Payable Equipment 61,000 Accounts Receivable 11,000 132,000 Advertising Expense 26,200 Cash 54,500 Common Stock 5,000 Administrative Expense 12,300 Dividends 2,200 Insurance Expense 3,000 Notes Payable (long-term) 70,000 Prepaid Insurance 6,550 Rent Expense 17,000 Salaries Expense 32,000 Office Supplies 4,000 Salaries Payable 3,100 Additional Paid in Capital 20,000 Retained Earnings (beg) Service Revenue Supplies Expense Accumulated Depreciation 16,310 117,700 6,000 20,000 Income tax rate 30% Instructions: Prepare an income statement, a statement of retained earnings, and a classified balance sheet for CBA Incorporated for the year 2012. Financial Management Page 3 CBA Incorporated Statement of Financial Position At December 31, 2012 Note: The amount of Retained Earnings in the Shareholders’ Equity section came from the Statement of Retained Earnings of CBA Incorporated for the year ended 2012. Financial Management Page 4