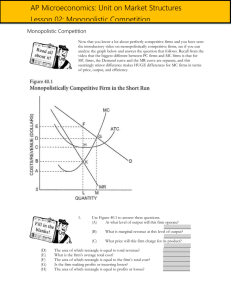

Market Structures & Profit Maximization Analysis

advertisement

MBSA1523 MANAGERIAL ECONOMIC AND POLICY ANALYSIS SECTION 22 TITLE: CONCEPT AND THEORY; WHAT DO YOU UNDERSTAND ABOUT MARKET STRUCTURES (PERFECT COMPETITION & MONOPOLISTIC COMPETITION) AND PROFIT MAXIMIZATION CONDITIONS GROUP 1 NO. NAME MATRIC NO. 1 MOHD IZNAMSHAHMI BIN MUSTAPHA MBS211036 2 SAIHANI IDAFFIE BIN SAIDIN MBS211024 3 NORANIZAH BINTI MOHD ABIDI MBS211032 4 NADIA BINTI SAAID MBS211034 Submission Date: 07 SEPT 2022 Presentation Date: 07 SEPT 2022 PHOTO Table of Contents 1.0 Market Structure .......................................................................................................... 1 Long-Run Decisions on Output and Price.................................................................... 9 Table of Figures Figure 1: Quantity Demand Due To Price Changes ...... Ошибка! Закладка не определена. Figure 2: Demand Curve ................................................ Ошибка! Закладка не определена. Figure 3: Supply Curve .................................................. Ошибка! Закладка не определена. Figure 4: Price Equilibrium Curves ............................... Ошибка! Закладка не определена. TOC KANG NT Page | ii 1.0 Market Structure In economics, market structure refers to how various industries are classified and differentiated based on the degree and nature of competition for goods and services. It is founded on the characteristics that influence the behaviour and outcomes of businesses operating in a particular market. 2.0 Types of market structure Perfect competition, monopolistic competition, monopoly, and oligopoly are the four basic types of market structures. Each has its own set of characteristics and assumptions, which affect firm decision making and the profits they can make. 2.1 Perfect Competition Pure competition is distinguished by many independent competitors offering identical products. There are no barriers to entering or exiting the market. Pure competition is difficult to achieve, and there is a claim that it is a theoretical structure that does not exist (Farnham, 2010) Companies in pure competition must accept market prices determined by demand and supply (Welch & Welch, 2010). Non-business factors cannot be used to compete for a competitive position. Thus, company operations should focus on minimizing production costs and monitoring the market to profit whenever possible. However, pure competition assumes that the price will be as low as possible in the long run. It has a many characteristic in perfect competition such as: 2.1.1 Large Number of Sellers and Buyers Because no individual can influence the market price, there are a large number of buyers and sellers. When the number of firms is large, each firm or seller in a perfectly competitive market constitutes a negligible portion of the market. As a result, each firm in the market has no significant share of total output and, as a result, no ability to influence the product price. Rather than coordinating decisions collectively, each firm acts independently. The forces of market demand and supply determine a commodity's Price in a perfectly competitive market. Because each firm accepts the market price, it is classified as a Price-taker. It is the Pricemaker because the market determines the Price. Page | 1 2.1.2 Perfect Knowledge of Market The perfect competition model necessitates that buyers and sellers be well informed about prices, sources of supply, goods being offered, etc. It also implies that no supplier has any confidential information. For example, if one supplier discovers a more sophisticated and cost-effective method of producing a commodity, every other supplier gains immediate access to the process. Under perfect competition, there would be no patents, copyrights, or trade secrets. Buyers and sellers must be fully aware of the prices at which goods are bought and sold and the prices at which others are willing to buy and sell. This will help to ensure price consistency. 2.1.3 Free Entry and Exit There is a very low barrier to entry when there are no hurdles to a new company's entry into a market. Financial, technological, and government-imposed obstacles, such as licenses, permissions, and patents, can constitute barriers. This characteristic implies that firms can earn either abnormally high profits or losses in the short run. Still, in the long run, all firms in the market receive just typical earnings. 2.1.4 Homogeneous Product This characteristic indicates that the product sold by one firm is treated the same as the product sold by another firm. It is standardized, homogeneous, and uniform across firms. In the minds of buyers, these products are identical. 2.1.5 Perfect Mobility of Factors Production The factors of production are free to travel across firms in the economy as a whole. People also believe individuals can swiftly acquire new skills by switching jobs frequently. Therefore, there is perfect rivalry among production factors on the market. 2.1.6 Cheap and Efficient Transport and Communication Page | 2 A uniform price for the commodity is not possible if price fluctuations are not rapidly corrected or if the commodity cannot be moved quickly. Therefore, inexpensive and efficient modes of transportation and communication are required. 3.0 Perfect Competition in the Short Run Firms in a perfectly competitive market will have a perfectly elastic demand curve (horizontal) for their product in the short run (AR=MR=D). Because we assume that no single trader can influence the price of a product, firms are price takers, meaning they accept the price set by the market (under equilibrium). It will not sell anything if it tries to sell above the market price (we are assuming perfect knowledge). This means that the total revenue curve will be slanted upwards. In the short run, a company can make a supernormal profit. The graph below depicts a price that exceeds the short-run average total costs. The firm will produce at MC = SRATC and thus in Q1, as profit equals total revenue minus total costs, and the profit will be the highlighted green line. Where π= (AR-AC). Q* The left graph shows the supernormal profit of a subnormal profit of is made on the right (a loss). This is because SRATC is greater than revenue (at P2), resulting in a loss. If the company is not making a normal profit, it will be forced to close. Page | 3 If the market price increases or decreases, the firm's output will change, but it will always supply at the level MR=MC. As a result, in the short run, the firm's marginal cost curve represents the firm's supply curve at any given price. If the price falls below the firm's shortrun average variable costs, it will exit the market because it is better off incurring fixed costs than losing money on variable costs. As a result, a firm's (short-run) supply curve is the marginal cost curve above the point where it intersects the short-run average variable cost curve. The demand curve will be negatively correlated across the industry (the demand curve for a firm is perfectly elastic because it is not a price maker and cannot set a price above the demand curve, and they would not set a price below the demand curve because they would not make a normal profit). It will be a normal demand curve set by the market for industry, while the supply curve will be the sum of the short-run supply curves of individual firms. This is the sum of firms' short-run marginal cost curves over the short-run average variable cost curves. The price will intersect the supply and demand curves at the industry equilibrium. 4.0 Perfect Competition in the Long Run Page | 4 As previously demonstrated, a firm can make a supernormal profit in the short run; however, this profit may encourage other firms to enter the market (we assume easy access to the entry). If more firms enter the market, supply will increase (a rightward shift), causing prices to fall. If this occurs, the profit will be reduced until the firm only makes a normal profit. Similarly, suppose a firm loses money in the short run. In that case, firms will leave the industry, and supply will fall (a leftward shift), causing prices to rise until the firm only makes a normal profit (supernormal profit = 0, subnormal profit = 0). As a result, in the long run, the firm will not make a supernormal profit and will instead produce Q*. The industry equilibrium is depicted in the same way; like the short-run equilibrium, the demand curve is downward sloping, and the supply curve is the sum of the individual firms' supply curves (MC after AVC). At the minimum point of the LRAC curve, the industry long-run supply curve for a perfectly competitive industry is horizontal. 4.1 Efficiency under Perfect Competition Productive efficiency is achieved in an individual market when a firm is at the minimum point on its LRAC curve (Q1=MC=LRAC). Firms operating in perfect competition achieve long-run productive efficiency, but this is not the case in the short run when a firm needs to produce at the lowest average cost. Allocative efficiency occurs in an individual market when the price equals the marginal cost (P=MC). In a perfectly competitive market, supernormal profits are competed away (as new firms enter the market and thus the price falls), so in the long run, price equals marginal cost. This is also true in the short run, so a perfectly competitive firm achieves allocative efficiency in both the long and short run. Page | 5 5.0 IMPERFECT COMPETITION MARKET STRUCTURE Imperfect competition is a competitive market situation where many sellers sell heterogeneous (dissimilar) goods, unlike the perfect competitive market scenario. Imperfect competitive markets, as the name implies. When a seller sells a non-identical good in the market, he can raise the price and profit. High profits attract other sellers to enter the market and sellers, who are incurring losses, can very easily exit the market There are four types of imperfect competition-: i. Monopoly (only one seller) ii. Oligopoly (few sellers of goods) iii. Monopsony (only one buyer of a product) iv. Monopolistic competition (many sellers with highly differentiated product) 5.1 Monopolistic Competition Monopolistic competition is a market structure in which there are many firms, but each offers a slightly different product. Low entry and exit barriers are distinguished, resulting in fierce competition. Because of the low entry barriers, new competitors constantly enter the market to prevent existing firms from making above-average profits. A market with a monopolistic structure is a hybrid of a monopoly and perfect competition. While monopoly and perfect competition are at opposite ends of the spectrum, monopolistic competition falls in the middle. It is similar to a monopoly in that a company can make extraordinary profits in the short term. At the same time, market entry and exit are simple, with few barriers to entry: this is similar to perfect competition. Monopolistic competition, in a nutshell, is a market structure in which many competitors sell slightly different products. As a result, they compete on criteria other than prices, such as quality and dependability. 5.2 Characteristic Monopolistic Competition 5.2.1 Many buyers and sellers Similar to perfect competition, the market contains several buyers and sellers. However, in Monopolistic Competition, there are fewer. Other market arrangements, such as monopoly and oligopoly, do not provide consumers with as many options as a competitive market. Page | 6 5.2.2 Slightly different products and services Monopolistic competition is distinguished by the fact that the products sold by companies in this structure are similar but slightly different. Depending on the needs of each company, these distinctions may be physical or artificial. 5.2.3 Free entry and exit from the market free entry into an economic market means a company can begin selling a good or service with few barriers to entry. In contrast, free exit means a company can leave a market relatively freely if it incurs monetary losses. Although starting a business has costs, the flexibility of monopolistic competition allows companies to enter and exit relatively easily. This is critical because once one company generates profits, new businesses frequently attempt to enter the market and reap the same benefits, necessitating companies to plan for competition affecting their profits. 5.2.4 Profits Companies may earn extraordinary profits in a monopolistic competition market in the short term. This is frequently due to consumers' desire to try a new brand or to take advantage of new deals. As more firms enter the market, many firms' profits fall to more normal levels. 5.2.5 Inadequate consumer knowledge frequently consider information such as pricing and quality when making purchasing decisions. It can be difficult for consumers to properly assess their options in a highly competitive market with dozens of nearly identical options. Consumers rarely have complete knowledge of each product they purchase. Companies use this to create a perception of difference through advertising and marketing campaigns, even if there is no actual difference. 5.3 Limitations of the model of monopolistic competition: 5.3.1 Some businesses will be superior at brand differentiation, allowing them to generate supernormal profits in the actual world. 5.3.2 If a company has significant brand loyalty and product distinctiveness, this becomes an entry barrier in and of itself. A new company cannot readily acquire brand loyalty. 5.3.3 Page | 7 New companies will not be viewed as near substitutes. 5.3.4 There is substantial overlap with oligopoly, with the exception that the model of monopolistic competition assumes no entry barriers. There are likely to be at least some entry obstacles in the real world. 5.3.5 Numerous monopolistically competitive industries are extremely profitable; therefore the assumption of normal earnings is overly simplistic. Examples of monopolistic competition include coffee shops, fast food restaurants, and the toy industry. There are several producers and sellers in each of these markets, but the products are not identical. The competitiveness is a result of the large number of businesses. Short-Run Decisions on Output and Price Profit is maximized when marginal revenue (MR) equals marginal cost (MC) (MC). The point determines the equilibrium output of the company. The price is determined at the point where the imaginary line from the equilibrium output passes through the intersection of the MR, MC, and AR curves, which is also the demand curve. The cyan-colored rectangle in the diagram above represents total profit. It is calculated by multiplying the equilibrium output by the difference between AR and the average total cost (ATC). Companies in monopolistic competition make price and output decisions in the short run, just like monopolistic companies. Page | 8 As illustrated below, companies in monopolistic competition can also suffer short-term economic losses. They continue to produce equilibrium output when MR equals MC and losses are minimized. The cyan-colored rectangle represents the economic loss. ADA GAMBAR SINI NT Long-Run Decisions on Output and Price ADA GAMBAR SINI Companies in monopolistic competition continue to produce at a level where marginal cost and marginal revenue are equal in the long run. However, the demand curve will shift to the left as more companies enter the market. The shift in the demand curve is caused by decreased demand for a single company's products due to increased competition. Depending on the magnitude of the new player's entry, such action reduces economic profits. Individual businesses will no longer be able to sell their goods at above-average prices. Monopolistic competitors will earn no economic profit in the long run. There is currently no incentive for new entrants into the industry. 5.4 The advantages of Monopolistic Competition Market Structure:5.4.1 Increases consumer choice and diversifies the market 5.4.2 Encourages innovation 5.4.3 Free entry and exit 5.4.4 helps a small business survive 5.5 The disadvantages of Monopolistic Competition Market Structure:5.5.1 There is a tendency for excess capacity to be created, resulting in economic inefficiency. 5.5.2 Consumer and labour exploitation as a result of a lack of market knowledge Page | 9