BSP's 3 Pillars: Price & Financial Stability, Payments System

advertisement

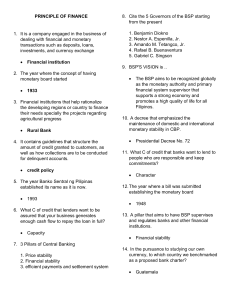

3 Pillars of BSP WARNING: No part of this E-module/LMS content can be reproduced or transported or shared to others without permission from the University. Unauthorized use of the materials, other than personal learning use, will be penalized. For this week, the following shall be your guide for the different lessons and tasks that you need to accomplish. Be patient, read them carefully before proceeding to the tasks expected of you. HAVE A FRUITFUL LEARNING EXPERIENCE Lesson 3: Functions and operations of the BSP 3 Pillars of BSP Topics: Learning Outcomes: At the end of this module, you are expected to: Evaluate the effectiveness of the three pillars of BSP LEARNING CONTENT Introduction: Lesson Proper: Three Pillars of BSP The Bangko Sentral ng Pilipinas (BSP), the Philippines' central bank is responsible for maintaining low and stable inflation and providing proactive leadership to ensure a strong financial system for the balance and sustainable growth of the Philippine economy. The economy is constantly evolving. It grows and responds to changes and innovations. The BSP provides a solid anchor for the economy while meeting the challenges of the times. The Bank prioritizes the stability and well-being of the economy but it is also dynamic. The work of the BSP centers on the 3 main areas or pillars. The first pillar is price stability through the conduct of monetary policy. The second is financial stability through financial system supervision and regulation. The third is an efficient payments and settlements system through the issuance of currency, the operation of the real-time gross settlement system, and oversight over the payments system. First Pillar: Price Stability Price stability also means monetary stability. It can be achieved through the conduct of monetary policy. The BSP formulates and implements monetary policy aimed at managing the expansion or contraction of money supply that is consistent with the maintenance of price stability. What is price stability? According to Alan Greenspan, price stability is an environment in which inflation is sufficiently low that is no loner a consideration in the economic decisions of households and firms. In addition, Alan Blinder mentioned that prices are stable when ordinary people stop talking about inflation. Price stability therefore refers to the condition of low and stable inflation. By keeping inflation low, the BSP helps ensure strong and sustainable economic growth and better living standards. With price stability, prices of goods do not rise too quickly and people have a degree of certainty when deciding how to spend, save or invest their money. In short, prices neither increase nor decrease markedly. What is inflation? Inflation is the sustained increase in the average prices of goods and services typically purchased by consumers. It is measured as the annual percentage change in the Consumer Price Index (CPI). How are prices measured? Consumer price index represents the average price of a standard basket of goods and services consumed by a Filipino family for a given period and monitored monthly by NSO. Take note: Positive rate of change in CPI= Inflation rate BSP: Guardian of Price Stability The BSP has the exclusive ability to influence the supply of money in the economy and is therefore uniquely qualified to promote price stability. By controlling the money supply, the BSP is able to exert some influence on the prices of goods and services. Price stability can be maintained through the monetary policy. Monetary policy refers to the measures or actions taken by the BSP to help keep inflation low and stable. The BSP conducts monetary policy using an approach called inflation targeting. In this approach, the BSP promises to keep average inflation close to pre-announce target. If for example, prices are rising more rapidly than the desired inflation rate. Because of the very strong demand for goods and services relative to supply, then the BSP will take action to bring down inflation to the target level by tightening monetary policy. On the other hand, if forecasted inflation below the target, and then there's a weak demand for goods and services, then the BSP will ease monetary policy. The BSP has several means or instruments to carry out its monetary policy. To tighten monetary policy, the BSP can raise its policy interest rates pumping market interest rates to follow suit. It can also sell government securities as part of its open market operations to reduce the amount of money in the financial system. Or it can raise reserve requirements imposed on banks. What is the BSP’s Monetary Policy Framework? In the past, the BSP followed the monetary aggregate targeting approach to monetary policy.This approach is based on the assumption that there is a stable abd predictable relationship between money and output and inflation. To strengthen further the structure for conducting monetary policy towards achieving price stability, the Monetary Board approved the adoption of inflation targeting as the new framework for monetary policy on January 24, 2000. The new framework was implemented formally beginning January 2002. The BSP’s shift to inflation targeting was aimed at improving further the consistency and transparency of monetary policy and providing a clearer framework for assessing the impact of domestic and external influences on inflation outlook. Essential elements of inflation targeting 1. Set a target inflation rate- explicit inflation targets for some period ahead 2. Forecast the future path of inflation using a model that uses relevant variables and information indicators 3. Compare forecast with the target 4. Difference determines the extent that monetary policy has to be adjusted Second Pillar: Financial Stability through proactive regulation and effective supervision Financial stability is a property of a financial system that dissipates financial imbalances that arise endogenously in the financial markets or as a result of significant adverse and unforeseeable events. When stable, the system absorbs economic shocks primarily via self-corrective mechanisms, preventing the adverse events from disrupting the real economy or spreading over to other financial systems. Financial stability is paramount for economic growth, as most transactions in the real economy are made through the financial system. Without financial stability, banks are more reluctant to finance profitable projects, asset prices may deviate significantly from their intrinsic values, and the payment settlement schedule diverges from the norm. Hence, financial stability is essential for maintaining confidence in the economy. Possible consequences of excessive instability include financial crisis, bank runs, hyperinflation, and stock market crashes. Why is Financial Stability Important? Financial stability is an essential requirement not only for price stability, the policy goal of the central bank, but also for healthy development of the economy. This is because financial instability entails heavy costs for an economy, since the volatility of price variables in the financial markets increases and financial institutions or corporations may go bankrupt. In addition, economic development can be limited at such a time, since economic agents find it difficult to make rational decisions and the efficiency of resource allocation is reduced. Since the 1980s, many countries around the world have achieved the positive effects of rapid financial industry growth owing to the progress of financial liberalization. At the same time, however, they have also experienced periods of dramatic slowdown in economic growth, due to heavy economic expenses arising from financial instability or financial crises. Against this backdrop, many countries have started to place great emphasis on financial stability when implementing their policies. Attention paid to financial stability is growing, as new factors with the potential to generate financial instability, including the strengthening of financial sector links among countries and the rampant development of complex financial instruments, have recently emerged. Maintaining Financial Stability is an Intrinsic Part of the Central Bank's Role When the financial system becomes unstable, such as with financial market turbulence and deterioration in the soundness of financial institutions, a massive supply of funds is generally needed to solve the problem. Historically, the central bank has therefore naturally performed the role of promoting financial stability, since it has the ability to promptly inject a huge amount of liquidity by virtue of its exclusive right to create fiat money. Financial Stability Enhances the Efficiency of the Central Bank's Monetary Policy The financial system provides much of the information needed by the central bank to implement its monetary policy. It is also a major channel through which the effects of monetary policy are transmitted to the real economy. Financial system instability causes a decrease in the usefulness of the information variables used for monetary policy, including price variables and transaction movements in the financial markets, and the lending behaviors of financial institutions, and thus reduces policy efficiency. Consequently, the central bank places high value on financial stability, so that the efficiency of its monetary policy can be enhanced. BSP’s approach to supervision and regulation The BSP conducts on and off site supervision and regulation 1. consolidated supervision ensures that activities of the branches are like the main office. A risk-based approach is used giving emphasis on: 1. Underscoring the responsibility of the BOD and Senior Management of the institution to ensure soundness and stability 2. Evaluating the quality of oversight, adequacy of policies and procedures, and effectiveness of internal audit function 2. Issuance of prudential rules and regulation 1. Gate keeper function 2. Capital adequacy requirements 3. Regulatory limits on various activities 3. Financial reporting requirements 1. Financial reporting package 2. Consistent with PAS and PFRS 3. Data warehouse 4. Prompt corrective action 1. Memorandum of undertaking Third Pillar: Efficient payments and settlements system Payment systems are essential to the effective functioning of financial systems worldwide. They provide the channels through which funds are transferred among banks and other institutions to discharge payment obligations arising from economic and financial transactions across the entire economy. An efficient, secure and reliable payment system reduces the cost of exchanging goods and services, and it is an essential tool for the effective implementation of monetary policy, and the smooth functioning of money and capital markets. It is this key role played by payment and settlement systems (PSS) in the smooth functioning of an economy in general and its financial and monetary system in particular that gives the central bank (CB) a strong incentive for ensuring that an effective, reliable and secure payment and settlement system is in place. In the Philippines, the BSP takes the lead in promoting an efficient payments and settlements system by providing the necessary infrastructure through the operations of the Philippine Real Time Gross Settlement System or the “PhilPaSS”. Roles of the BSP in Payment and Settlement Systems The BSP performs the following role in the payments and settlements system: 1) Operator of the real time gross settlement system known as PhilPaSS The BSP, through its Payments and Settlements Office (PSO), serves as the payment system operator responsible for the operation and maintenance of PhilPaSS and its critical components. It ensures that the operation of PhilPaSS is continuous, safe and efficient so that time-critical payments are completed as expected to facilitate and enhance economic processes, manage risks, and absorb shocks in order to promote financial stability. 2. Provider of credit facilities to banks as a lender of last resort As payment systems affect the daily demand for liquidity of banks/financial institutions and may therefore affect the level of money market interest rates, the BSP, as a lender of last resort, provides the following liquidity tools to PhilPaSS participants: 1. Intraday Liquidity Facility (ILF) – a fully collateralized facility established to maintain the smooth and efficient operation of the payments system in order to avoid interbank payments gridlock in the settlement process within PhilPaSS business hours. 2. Overdraft Credit Line (OCL) – another collateralized facility which aims to assist bank experiencing unexpected or higher than usual volume of inward check transactions. The governing policies and procedures are provided under BSP Circular 681 in order to provide additional liquidity for banks encountering liquidity problems due to check clearing losses as well as protect the BSP against settlement exposures. 3. Overseer of the payments and settlements system The BSP, through its Core Information Technology Sub-Group of the Supervision and Examination Sector conducts information technology (IT) supervision and examination of banks and non-bank financial institutions (FIs) and the payments systems. Its assessments of systems focus on determining the adequacy of IT management and operational controls over data integrity and confidentiality, and attendant risk exposures. 4. User of its own RTGS system The BSP, through its different departments, also make use of the payments and settlements system for the settlement of its own transactions with its stakeholders, such as: 1. The automated collection and settlement of Supervision and Examination Sector annual supervisory fees; 2. Online processing of eRediscounting loan proceeds and collection of banks’ maturing loans with Department of Loans and Credit; 3. Processing/posting of banks’ cash deposit and withdrawal transactions with Cash Department; 4. Investment/maturities of funds placed by the Provident Fund Office; and 5. Trading transactions as well as payments of maturing RRP/SDA placements with Treasury Department 5) Initiate changes/reforms for the payments system The BSP, through its Payments and Settlements Steering Committee (PSSCOM), initiate the conduct of studies/research relating to payments system to ensure that it grows and matures in accordance with the global standards. Functions and operations of the BSP WARNING: No part of this E-module/LMS content can be reproduced or transported or shared to others without permission from the University. Unauthorized use of the materials, other than personal learning use, will be penalized. For this week, the following shall be your guide for the different lessons and tasks that you need to accomplish. Be patient, read them carefully before proceeding to the tasks expected of you. HAVE A FRUITFUL LEARNING EXPERIENCE Lesson 4: Functions and operations of the BSP Characteristics of Central Bank Functions of Central Bank Topic: Monetary Tools Learning Outcomes: At the end of this module, you are expected to: 1. Exxplain the functions played by BSP to the economy 2. Describe the various monetary tools 3. Discuss the activities and credit operations of central bank LEARNING CONTENT Introduction: The Bangko Sentral ng Pilipinas is not only engaged in central banking operations, but also, it is a central monetary authority. Its main function is to maintain monetary stability. It has monetary tools to do this job. In the fulfilment of its duties and responsibilities, the Bangko Sentral is primarily involved in the management of money supply. Hence, all financial institutions that can influence the volume and flow of money and credit are subject to the supervision and/or regulation of the Bangko Sentral. Professor Raymond Kent said; “A central bank is so called because it occupies a or pivotal position in the monetary and banking structure of the country. Lesson Proper: Characteristics of Central Bank A central bank has an extra-ordinary position and role in a developing economy.it is not only concerned with the proper monetary and credit structure, but it has also a more important responsibility of promoting the common good. In a poor country like ours, common good refers to the general welfare of the poor masses. 1. It is a bank of issue. The Bangko Sentral has a complete monopoly of note issue. The main reasons for granting the central banks the sole power to issue notes are: (1) to ensure uniformity in money, (2) to effect government supervision over money supply, (3) to give prestige to central banks, and (4) to provide a source of income or reduce printing expenses on the part of the government. 2. It is the government’s banker, agent and adviser. As a government’s banker, the Bangko Sentral conducts the banking accounts of government agencies. It provides FOREX to the government for the importation of goods and for payment of debts. As agent of government, the BSP performs a variety of financial services for the government. The BSP lends to the government, buys and sells securities, administers and manages national debts among others. And as adviser, the BSP informs the top officials about the monetary and financial conditions of the economy. 3. It is the custodian of cash reserves of banks. A legal reserve requirement is imposed on the deposit liabilities of banks to control the volume of money generated by the credit operations of the banking system. 4. It is the custodian of the nation’s reserves for international currency. International reserves refer to gold and foreign exchange. A central bank is required to maintain reserves of international currency as a support fund for balance of payments difficulties and for the maintenance of external monetary stability. 5. It is a bank of rediscount and lender of last resort. The central bank’s function as a lender of last resort has been derived from its rediscounting function. (Recall previous lesson on lender of last resort) A central bank lends money to distressed banks on the basis of their promissory notes. It charges interests on its loans to such banks. This central bank lending is called rediscounting 6. It is a bank of central clearance and settlement. Settlements among banks is easier, faster and more convenient if these are done by a central bank. (Recall discussion on this item in your BFI subject) 7. It controls credit. This is a major function of any central bank. The BSP uses its monetary tools in regulating credit to maintain price stability or monetary stability which is very vital in the growth of the whole economy. Monetary Tools The BSP uses various monetary instruments in the pursuit of its general objectives of maintaining monetary stability, both internal and external, and fostering sustainable economic growth. These monetary tools are utilized to regulate both the supply of and demand for money in the economy as well as the sectoral flow of credit in the financial system. 4. moral suasion This particular means of controlling credit or money supply is popularly known as moral influence. The BSP influences the direction and conduct of business enterprise, investors and consumers. Informal contacts, consultations and meetings are conducted to explain the position of central bank on various issues. 5. Interest rate policy The BSP is given the power to fix or regulate interest rates based on prevailing credit conditions and the thrusts of the monetary policy. Through this monetary tool, the BSP can encourage or discourage the expansion of certain business activities. The deregulation of interest rates is designed to increase savings and improve the allocation of capital funds. 6. Swap facility This refers to a swap transaction between BSP and firms engaged in exportoriented or other preferred activities. The BSP swaps pesos for foreign exchange with an authorized agent bank at the exchange rate prevailing on availment date.