On the Value of Environmental Certification in the Commercial Real Estate market

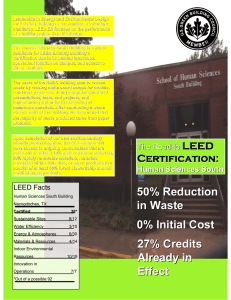

advertisement