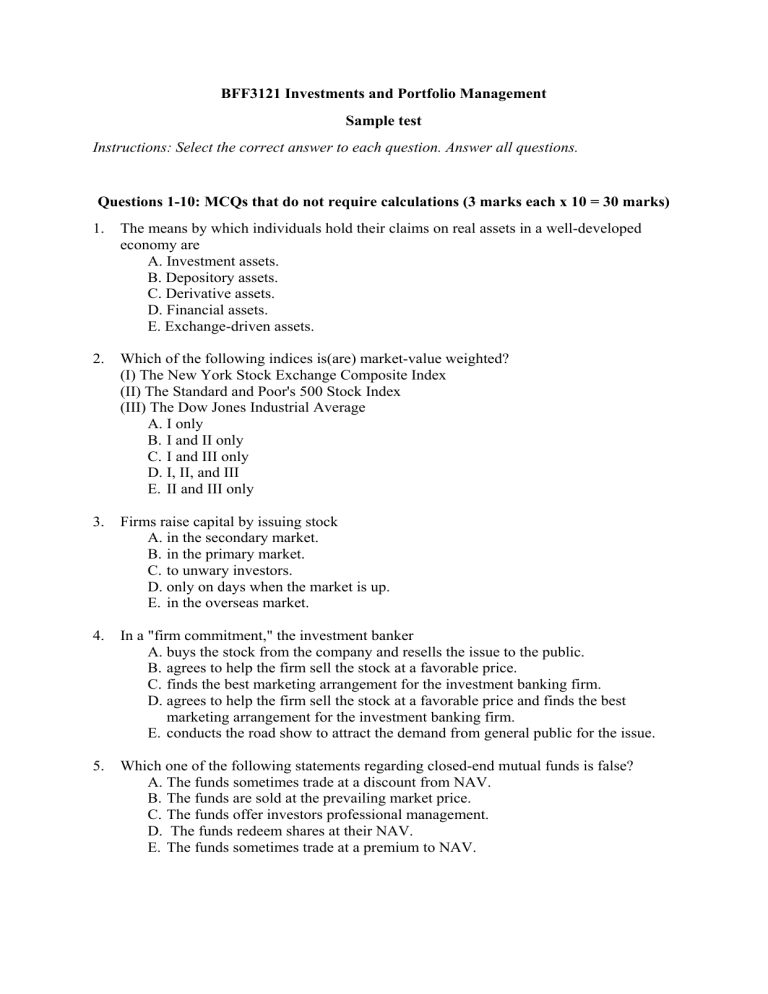

BFF3121 Investments and Portfolio Management Sample test Instructions: Select the correct answer to each question. Answer all questions. Questions 1-10: MCQs that do not require calculations (3 marks each x 10 = 30 marks) 1. The means by which individuals hold their claims on real assets in a well-developed economy are A. Investment assets. B. Depository assets. C. Derivative assets. D. Financial assets. E. Exchange-driven assets. 2. Which of the following indices is(are) market-value weighted? (I) The New York Stock Exchange Composite Index (II) The Standard and Poor's 500 Stock Index (III) The Dow Jones Industrial Average A. I only B. I and II only C. I and III only D. I, II, and III E. II and III only 3. Firms raise capital by issuing stock A. in the secondary market. B. in the primary market. C. to unwary investors. D. only on days when the market is up. E. in the overseas market. 4. In a "firm commitment," the investment banker A. buys the stock from the company and resells the issue to the public. B. agrees to help the firm sell the stock at a favorable price. C. finds the best marketing arrangement for the investment banking firm. D. agrees to help the firm sell the stock at a favorable price and finds the best marketing arrangement for the investment banking firm. E. conducts the road show to attract the demand from general public for the issue. 5. Which one of the following statements regarding closed-end mutual funds is false? A. The funds sometimes trade at a discount from NAV. B. The funds are sold at the prevailing market price. C. The funds offer investors professional management. D. The funds redeem shares at their NAV. E. The funds sometimes trade at a premium to NAV. 6. Which one of the following statements regarding orders is false? A. A market order is simply an order to buy or sell a stock immediately at the prevailing market price. B. A limit sell order is where investors specify prices at which they are willing to sell a security. C. If stock ABC is selling at $50, a limit-buy order may instruct the broker to buy the stock if and when the share price falls below $45. D. A market order is an order to buy or sell a stock on a specific exchange (market). E. None of the above. 7. If the Reserve Bank lowers the interest rate, ceteris paribus, the equilibrium levels of funds lent will __________ and the equilibrium level of real interest rates will ___________. A. increase; increase B. increase; decrease C. decrease; increase D. decrease; decrease E. reverse direction from their previous trends 8. When comparing investments with different horizons the ____________ provides the more accurate comparison. A. arithmetic average B. effective annual rate C. average annual return D. historical annual average E. geometric return 9. Which of the following statements is (are) false? (I) Risk-averse investors reject investments that are fair games. (II) Risk-neutral investors judge risky investments only by the expected returns. (III) Risk-averse investors judge investments only by their riskiness. (IV) Risk-loving investors will not engage in fair games. A. I only B. II only C. I and II only D. II and III only E. III, and IV only 10. The exact indifference curves of different investors A. cannot be known with perfect certainty. B. can be calculated precisely with the use of advanced calculus. C. allow the advisor to create more suitable portfolios for the client. D. cannot be known with perfect certainty but they do allow the advisor to create more suitable portfolios for the client. E. None of these is correct. Questions 11-20: MCQs that require calculations (4 marks each x 10 = 40 marks) 11. Consider the following three stocks: The price-weighted index constructed with the three stocks is A. 30 B. 40 C. 50 D. 60 E. 70 12. An investor purchases one municipal and one corporate bond that pay rates of return of 8% and 10%, respectively. If the investor is in the 20% marginal tax bracket, his or her after tax rates of return on the municipal and corporate bonds would be ________ and ______, respectively. A. 8% and 10% B. 8% and 8% C. 6.4% and 8% D. 6.4% and 10% E. 10% and 10% 13. Assume you purchased 200 shares of GE common stock on margin at $70 per share from your broker. If the initial margin is 55%, how much did you borrow from the broker? A. $6,000 B. $4,000 C. $7,700 D. $7,000 E. $6,300 14. You buy 300 shares of Qualitycorp for $30 per share and deposit initial margin of 50%. The next day Qualitycorp's price drops to $25 per share. What is your actual margin? A. 50% B. 40% C. 33% D. 60% E. 25% 15. The Profitability Fund had NAV per share of $17.50 on January 1, 2009. On December 31 of the same year the fund's NAV was $19.47. Income distributions were $0.75 and the fund had capital gain distributions of $1.00. Without considering taxes and transactions costs, what rate of return did an investor receive on the Profitability fund last year? A. 11.26% B. 15.54% C. 16.97% D. 21.26% E. 9.83% 16. The Popular Choice Fund had NAV per share of $37.25 on January 1, 2009. On December 31 of the same year the fund's rate of return for the year was 17.3%. Income distributions were $1.14 and the fund had capital gain distributions of $1.35. Without considering taxes and transactions costs, what ending NAV would you calculate for Investors' Choice? A. $41.20 B. $33.88 C. $43.69 D. $42.03 E. $46.62 17. You have been given this probability distribution for the holding-period return for KLG stock: What is the expected holding-period return for KLG stock? A. 10.40% B. 9.32% C. 11.63% D. 11.54% E. 10.88% 18. You have been given this probability distribution for the holding-period return for KLG stock: What is the expected standard deviation for KLG stock? A. 6.91% B. 8.13% C. 7.79% D. 7.25% E. 8.85% 19. You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15. The T-bill rate of return is 0.05. The slope of the Capital Allocation Line formed with the risky asset and the risk-free asset is equal to A. 0.4667. B. 0.8000. C. 2.14. D. 0.41667. E. Cannot be determined. 20. You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with 2 risky securities, X and Y. The weights of X and Y in P are 0.60 and 0.40, respectively. X has an expected rate of return of 0.14 and variance of 0.01; and Y has an expected rate of return of 0.10 and a variance of 0.0081. If you want to form a portfolio with an expected rate of return of 0.11, what percentages of your money must you invest in the T-bill and P, respectively? A. 0.25; 0.75 B. 0.19; 0.81 C. 0.65; 0.35 D. 0.50; 0.50 E. cannot be determined Questions 21-23: Short answer questions (10 marks each x 3 = 30 marks) 21. Discuss similarities and differences between the money market and the bond market 22. Explain the process of buying on margin. 23. Explain what happens to expected returns of stocks if investors expect the volatility of the equity market to go up in the near future? (TOTAL MARKS: 100) Answers Question Answer 1 Answer: D Financial assets allocate the wealth of the economy. Example: it is easier for an individual to own shares of an auto company than to own an auto company directly. 2 Answer: B The Dow Jones Industrial Average is a price-weighted index. 3 Answer: B Funds from the sale of new issues flow to the issuing corporation, making this a primary market transaction. 4 Answer: A In a "firm commitment," the investment banker buys the stock from the company and resells the issue to the public. 5 Answer: D Closed-end funds are sold at the prevailing market price in organised exchanges so investors have to sell to other investors. 6 Answer: D All of the order descriptions above are correct except D. 7 Answer: B A lower interest rate would encourage banks to make more loans, which would increase the money supply. The supply curve would shift to the right and the equilibrium level of funds would increase while the equilibrium interest rate would fall. 8 Answer: B The effective annual rate provides the more accurate comparison of investments with different horizons because it expresses the returns in a common period. 9 Answer: E Risk-averse investors consider a risky investment only if the investment offers a risk premium. Risk-neutral investors look only at expected returns when making an investment decision. 10 Answer: D Indifference curves cannot be calculated precisely, but the theory does allow for the creation of more suitable portfolios for investors of differing levels of risk tolerance. 11 Answer: B Index value = ($40 + $70 + $10)/3 = $40. 12 Answer: B rc = 0.10(1 - 0.20) = 0.08, or 8%; rm = 0.08(1 - 0) = 8%. 13 Answer: E 200 shares * $70/share * (1-0.55) = $14,000 * (0.45) = $6,300. 14 Answer: B Actual margin = [300 ($25) - 0.5 (300) ($30)]/[300 ($25)] = 0.40 15 Answer: D Return = ($19.47 - 17.50 + .75 + 1.00)/$17.50 = 21.26% 16 Answer: A 0.173 = (P - $37.25 + 1.14 + 1.35)/$37.25; P = $41.20 17 18 19 20 21 22 23 Answer: A HPR = 0.30 (18%) + 0.50 (12%) + 0.20 (-5%) = 10.4% Answer: B s = [0.30 (18 - 10.4)2 + 0.50 (12 - 10.4)2 + 0.20 (-5 - 10.4)2]1/2 = 8.13% Answer: A CAL slope = (0.12 - 0.05)/0.15 = 0.4667. Answer: B E(rp) = 0.6(14%) + 0.4(10%) = 12.4% 11% = 5x + 12.4(1 - x) x = 0.189 (T-bills) (1-x) = 0.811 (risky asset) Answer: Refer to chapter 2; pages 27-40 Answer: Refer to chapter 3; pages 75-78 Answer: Refer to chapter 6; pages 170-174