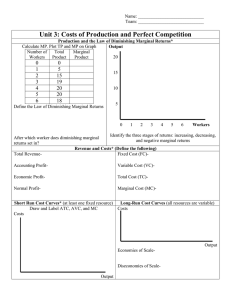

Lecture 4 Perfect Competition OUTLINE Perfect Competition and Why It Matters How Perfectly Competitive Firms Make Output Decisions Entry and Exit Decisions in the Long Run Efficiency in Perfectly Competitive Markets Introduction: A Scenario Three years after graduating, you run your own business. • You must decide what and how much to produce, what price to charge, how many workers to hire, etc. What factors should affect these decisions? • Your costs (studied in preceding chapter) • Expected prices • The market structure (How much competition you face) We begin by studying the behavior of firms in perfectly competitive markets. 3 ● Market structure - the conditions in an industry, such as number of sellers, how easy or difficult it is for a new firm to enter, and the type of products that are sold. ● Perfect competition - each firm faces many competitors that sell identical products. • 4 criteria: • many firms produce identical products, • many buyers and many sellers are available, • sellers and buyers have all relevant information to make rational decisions, • firms can enter and leave the market without any restrictions. Consequence ● Price taker - a firm in a perfectly competitive market that must take the prevailing market price as given. How Perfectly Competitive Firms Make Output Decisions ● A perfectly competitive firm must accept the price for its output as determined by the product’s market demand and supply. ● A perfectly competitive firm must accept the price for its inputs as determined by the input’s market demand and supply. ● Thus, a perfectly competitive firm has only one major decision to make - what quantity to produce? ● The maximum profit will occur at the quantity where the difference between total revenue and total cost is largest. Profit = TR - TC The Revenue of a Competitive Firm ●Total revenue (TR) TR = P x Q ●Average revenue (AR) AR = ●Marginal revenue (MR) The change in TR from an additional unit sold. 6 TR = (P*Q)/Q =>AR= P Q ∆TR MR = ∆Q Total Cost and Total Revenue at the Raspberry Farm P= $4 Quantity (Q) Total Cost (TC) Total Revenue (TR) Profit 0 $62 $0 −$62 10 $90 $40 −$50 20 $110 $80 −$30 30 $126 $120 −$6 40 $138 $160 $22 50 $150 $200 $50 60 $165 $240 $75 70 $190 $280 $90 80 $230 $320 $90 90 $296 $360 $64 100 $400 $400 $0 110 $550 $440 $−110 120 $715 $480 $−235 Total Cost and Total Revenue at a Raspberry Farm ● Total revenue for a perfectly competitive firm is a straight line sloping up; the slope is equal to the price of the good. ● Total cost also slopes up, but with some curvature. ● At higher levels of output, total cost begins to slope upward more steeply because of diminishing marginal returns. ● The maximum profit will occur at the quantity where the difference between total revenue and total cost is largest. Profit Maximization Profit = TR – TC Profit = (Price of final good * Quantity of output) – (Prices of inputs * Quantity of inputs) Relationship between TR and Quantity of output TR increases at a constant rate as the quantity of output increase. (Price of final good is constant from the standpoint of the firm, only true in a competitive market) Relationship between TC and Quantity of output TC increases as the quantity of output increase but at varying rates. It could increase at a diminishing or constant or increasing marginal product. The firm has no control over the price of the final goods and price of inputs. It is a price taker in both markets. The firm has control over how many units to produce and how many units of inputs to hire (labor in our example, in the short run) When the firm produces more units of the final good TR increases (at constant rate) When the firm produces more units of the final good TC increases (at varying rates) So, the firm must find the balance between the quantity of output and the quantity of input (labor) that max profits. Both are interdependent in profit maximization. Cost maximization vs. profit maximization In this chapter the firm picks the quantity of final product to max profits. 9 Profit Maximization Comparing Marginal Revenue and Marginal Costs ● Marginal revenue (MR) - the additional revenue gained from selling one more unit. change in total revenue MR = change in quantity ● Marginal cost (MC) - the cost per additional unit sold. change in total cost MC = change in quantity What Q maximizes the firm’s profit? Marginal Analysis To find the answer, “think at the margin.” If Q increases by one unit Revenue rises by MR or P (in the competitive market structure only) Cost rises by MC If MR > MC, then increase Q to raise profit If MR < MC, then reduce Q to raise profit So Profit is max when MR=MC Alternately: Profit = TR – TC Maximization of the profit function: ▲Profit/▲Q = (▲TR/▲Q) – (▲TC/▲Q) and set to zero (see previous diagram) MR = MC The profit-maximizing choice for a perfectly competitive firm will occur at the level of output where MR=MC. Note: For each unit, a firm in a competitive market receives the price, which is determined by the entire market participants, and is constant for an individual firm. So, MR = P This is true only for a firm in a competitive market. Because the firm takes the price as given. Marginal Revenues and Marginal Costs at the Raspberry Farm: Raspberry Market ● The equilibrium price of raspberries is determined through the interaction of market supply and market demand at $4.00. Marginal Revenues and Marginal Costs at the Raspberry Farm Quantity Total Cost Marginal Cost Total Revenue Marginal Revenue Profit 0 $62 - $0 $4 -$62 10 $90 $2.80 $40 $4 -$50 20 $110 $2.00 $80 $4 -$30 30 $126 $1.60 $120 $4 -$6 40 $138 $1.20 $160 $4 $22 50 $150 $1.20 $200 $4 $50 60 $165 $1.50 $240 $4 $75 70 $190 $2.50 $280 $4 $90 80 $230 $4.00 $320 $4 $90 90 $296 $6.60 $360 $4 $64 100 $400 $10.40 $400 $4 $0 110 $550 $15.00 $440 $4 -$110 120 $715 $16.50 $480 $4 -$235 Marginal Revenues and Marginal Costs at the Raspberry Farm: Individual Farmer ● For a perfectly competitive firm, the marginal revenue curve is a horizontal line because it’s equal to the price of the good ($4), determined by the market. ● The marginal cost curve is sometimes initially downward-sloping, if there is a region of increasing marginal returns at low levels of output. ● It is eventually upward-sloping at higher levels of output as diminishing marginal returns kick in. MC and the Firm’s Supply Decision Rule: MR = MC at the profit-maximizing Q. At Qa, MC < MR. Costs MC So, increase Q to raise profit. At Qb, MC > MR. So, reduce Q to raise profit. MR (P) P1 At Q1, MC = MR. Profit is maximized Changing Q would lower profit. 16 Qa Q1 Qb Q MC and the Firm’s Supply Decision If price rises to P2, then the profit-maximizing quantity rises to Q2. Costs The MC curve determines the firm’s Q at any price. P2 MR2 Hence, P1 MR The MC curve is the firm’s supply curve. 17 MC Q1 Q2 Q Profits and Losses with the Average Cost Curve Does maximizing profit (producing where MR = MC) imply an actual economic profit? The answer depends on the relationship between price and average total cost, which is the average profit or profit margin. A Firm’s Short-run Decision to Shut Down Cost of shutting down: revenue loss = TR Benefit of shutting down: cost savings = VC (firm must still pay FC in the short run, SR ) So, shut down if TR < VC Divide both sides by Q: TR/Q < VC/Q (P*Q)/Q < VC/Q So, firm’s decision rule is: Shut down if P < AVC Produce if P > AVC 19 Production Decisions If P > ATC, then firm produces Q, where MR= P = MC, at positive profit Costs MC (S) If ATC >P > AVC, then firm produces Q, where P = MC, at a loss ATC AVC If P < AVC, then firm shuts down (produces Q = 0). Q The firm’s SR supply curve is the portion of its MC curve above AVC. The firm’s LR supply curve is the portion of its MC curve above ATC. 20 Q A Firm’s Long-Run Decision to Exit Cost of exiting the market: revenue loss = TR Benefit of exiting the market: cost savings = TC (zero FC in the long run) So, firm exits if TR < TC Divide both sides by Q TR/Q=AR=P Write the firm’s decision rule as: Exit if P < ATC 21