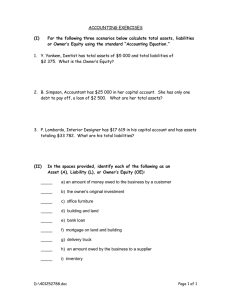

Publishing 2013 ACCA F7 (INT) Financial Reporting Exam Kit emilewoolfpublishing.com KIT ACCA EXAM Paper F7 (INT) Financial Reporting (International) Publishing Sixth edition published by Emile Woolf Publishing Limited Crowthorne Enterprise Centre, Crowthorne Business Estate, Old Wokingham Road, Crowthorne, Berkshire RG45 6AW Email: info@ewiglobal.com www.emilewoolfpublishing.com © Emile Woolf Publishing Limited, January 2013 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, without the prior permission in writing of Emile Woolf Publishing Limited, or as expressly permitted by law, or under the terms agreed with the appropriate reprographics rights organisation. You must not circulate this book in any other binding or cover and you must impose the same condition on any acquirer. Notice Emile Woolf Publishing Limited has made every effort to ensure that at the time of writing the contents of this study text are accurate, but neither Emile Woolf Publishing Limited nor its directors or employees shall be under any liability whatsoever for any inaccurate or misleading information this work could contain. British Library Cataloguing in Publications Data A catalogue record for this book is available from the British Library. ISBN: 978‐1‐84843‐289‐5 Printed and bound in Great Britain. Acknowledgements The syllabus, study guide, exam questions and answers (where indicated) are reproduced by kind permission of the Association of Chartered Certified Accountants. ii © Emile Woolf Publishing Limited Paper F7 (INT) Financial Reporting c Contents Page Questions and answers index v Syllabus and study guide ix Exam techniques xxi Section 1 Practice questions 1 A conceptual framework and a regulatory framework for financial reporting 1 Financial statements – Statements of cash flows 7 Financial statements – Preparation of accounts from a trial balance 25 Financial statements – Amendment of draft financial statements 46 Financial statements – Application of accounting standards 63 Business combinations – Statements of financial position 79 Business combinations – Statements of financial performance 100 Business combinations – Statements of financial position and performance 111 Analysing and interpreting financial statements 118 2 Answers to practice questions 131 A conceptual framework and a regulatory framework for financial reporting 131 Financial statements – Statements of cash flows 145 Financial statements – Preparation of accounts from a trial balance 169 Financial statements – Amendment of draft financial statements 203 Financial statements – Application of accounting standards 226 © Emile Woolf Publishing Limited iii iv Business combinations – Statements of financial position 255 Business combinations – Statements of financial performance 287 Business combinations – Statements of financial position and performance 301 Analysing and interpreting financial statements 311 3 Mock exam questions 329 4 Answers to mock exam questions 335 © Emile Woolf Publishing Limited Paper F7 (INT) Financial Reporting i Questions and answers index Question page Answer page Exam A conceptual framework and regulatory framework for financial reporting 1 Recost 1 131 2 Worthright 1 133 3 Revenue recognition 2 135 4 Angelino 3 137 5 Emerald 4 140 F7 D07 6 Conceptual Framework 5 141 F7 J08 7 Promoil (IAS 37) 5 143 F7 D08 8 Wardle 6 144 F7 J10 Financial statements – Statements of cash flows 9 Tabba 7 145 10 Boston 9 149 11 Planter 10 152 12 Casino 12 153 13 Minster 14 156 F7 J07 (amended) 14 Pinto 16 159 F7 J08 15 Coaltown 18 162 F7 J09 16 Crosswire 20 165 F7 D09 17 Deltoid 22 167 F7 J10 Financial statements – Preparation of accounts from a trial balance 18 Petra 25 169 19 Darius 26 172 © Emile Woolf Publishing Limited v Paper F7: Financial Reporting (International) Question page Answer page Exam 20 Danzig 28 175 21 Allgone 30 178 22 Tourmalet 32 181 23 Chamberlain 34 183 24 Tadeon 35 185 25 Llama 36 188 26 Candel 38 191 F7 D08 27 Sandown 39 193 F7 D09 28 Pricewell 41 196 F7 J09 29 Dune 43 198 F7 J10 30 Cavern 45 200 F7 D10 Financial statements – Amendment of draft financial statements 31 Deltoid 46 203 32 Tintagel 48 206 33 Harrington 50 209 34 Wellmay 53 211 35 Dexon 55 214 36 Bodyline (IAS 37) 57 216 37 Niagara (IAS 33) 57 217 38 Taxes (IAS 12) 58 218 39 Broadoak (IAS 16) 59 220 40 Merryview (IAS 16 and IAS 36) 60 222 41 Impairment and Wilderness (IAS 36) 61 223 F7 J08 Financial statements – Application of accounting standards 42 Torrent and Savoir (IAS 11, IAS 33 and IAS 32) 63 226 43 Elite Leisure and Hideaway (IAS 16 and IAS 24) 64 228 44 Triangle (IASs 37, 10, 18) 66 231 45 Construction (IAS 11) 67 233 46 Bowtock (IAS 10, 2 and 11) 67 234 47 Multiplex and Simpkins (IAS 32) 68 235 48 Convertibles (IAS 32) 69 237 49 Errsea (IAS 16, 20 and 10) 70 238 50 Partway (IFRS 5 and IAS 8) 71 240 51 Pingway (IAS 32) 73 243 F7 J08 52 Dearing (IAS 16) 73 244 F7 D08 53 Waxwork (IAS 10) 74 245 F7 J09 54 Flightline (Non‐current assets) 74 247 F7 J09 vi © Emile Woolf Publishing Limited Index to questions and answers Question page Answer page Exam 248 F7 D09 55 Darby (Non‐current assets) 75 56 Barstead (IAS 33) 76 256 F7 D09 57 Apex (IAS 23) 77 251 F7 J10 58 Tunshill (IAS 8) 77 252 F7 D10 59 Manco (IFRS 5 and IAS 37) 78 253 F7 D10 Business combinations – Statements of financial position 60 Hydrox 79 255 61 Hedra 80 257 62 Harden 82 260 63 Halogen 84 263 64 Horsefield 86 265 65 Highmoor 87 267 66 Hapsburg 89 270 67 Highveldt 90 273 68 Hark, Spark and Ark 92 275 69 Parentis 94 279 70 Plateau 95 280 F7 D07 71 Pacemaker 96 283 F7 J09 72 Picant 98 285 F7 J10 Business combinations – Statements of financial performance 73 Hydan 100 287 74 Holdrite, Staybrite and Allbrite 102 290 75 Python, Snake and Adder 103 292 76 Hosterling 105 294 77 Patronic 106 295 F7 J08 78 Pandar 107 297 F7 D09 79 Premier 109 299 F7 D10 Business combinations – Statements of financial position and performance 80 Hepburn 111 301 81 Hydrate 113 304 82 Hillusion 114 306 83 Pedantic 116 309 F7 D08 Analysing and interpreting financial statements 84 Comparator 118 311 85 Ryetrend 120 315 86 Greenwood 121 318 © Emile Woolf Publishing Limited vii Paper F7: Financial Reporting (International) Question page Answer page Exam 87 Harbin 123 320 F7 D07 88 Victular 125 323 F7 D08 89 Hardy 127 326 F7 D10 viii © Emile Woolf Publishing Limited Paper F7 (INT) Financial Reporting S Syllabus and study guide Aim To develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities, including groups and how to analyse and interpret those financial statements. Main capabilities On successful completion of this paper candidates should be able to: A Discuss and apply a conceptual framework for financial reporting B Discuss a regulatory framework for financial reporting C Prepare and present financial statements which conform with International accounting standards D Account for business combinations in accordance with International accounting standards E Analyse and interpret financial statements © Emile Woolf Publishing Limited ix Paper F7: Financial Reporting (International) Rationale The financial reporting syllabus assumes knowledge acquired in Paper F3, Financial Accounting, and develops and applies this further and in greater depth. The syllabus begins with the conceptual framework of accounting with reference to the qualitative characteristics of useful information and the fundamental bases of accounting introduced in the Paper F3 syllabus within the Knowledge module. It then moves into a detailed examination of the regulatory framework of accounting and how this informs the standard setting process. The main areas of the syllabus cover the reporting of financial information for single companies and for groups in accordance with generally accepted accounting principles and relevant accounting standards. Finally, the syllabus covers the analysis and interpretation of information from financial reports. Detailed Syllabus A B C x A conceptual framework for financial reporting 1. The need for a conceptual framework 2. The fundamental concepts of relevance and faithful representation (‘true and fair view’) 3. The enhancing characteristics of comparability, verifiability, timeliness and understandability 4. Recognition and measurement 5. The legal versus the commercial view of accounting 6. Alternative models and practices A regulatory framework for financial reporting 1. Reasons for the existence of a regulatory framework 2. The standard setting process 3. Specialised, not-for-profit, and public sector entities Financial statements 1. Statements of cash flows 2. Tangible non-current assets 3. Intangible assets 4. Inventory 5. Financial assets and financial liabilities 6. Leases © Emile Woolf Publishing Limited Syllabus and study guide D E 7. Provisions, contingent liabilities, and contingent assets 8. Impairment of assets 9. Taxation 10. Regulatory requirements relating to the preparation of financial statements 11. Reporting financial performance Business combinations 1. The concept and principles of a group 2. The concept of consolidated financial statements 3. Preparation of consolidated financial statements including an associate Analysing and interpreting financial statements 1. Limitations of financial statements 2. Calculation and interpretation of accounting ratios address users’ and stakeholders’ needs 3. Limitations of interpretation techniques 4. Specialised, not-for-profit, and public sector and trends to entities Approach to examining the syllabus The syllabus is assessed by a three-hour paper-based examination. All questions are compulsory. It will contain both computational and discursive elements. Some questions will adopt a scenario/case study approach. Question 1 will be a 25 mark question on the preparation of group financial statements and/or extracts thereof, and may include a small discussion element. Computations will be designed to test an understanding of principles. Question 2, for 25 marks, will test the reporting of non-group financial statements. This may be from information in a trial balance or by restating draft financial statements. Question 3, for 25 marks, is likely to be an appraisal of an entity’s performance and may involve statements of cash flows. Questions 4 and 5 will cover the remainder of the syllabus and will be worth 15 and 10 marks respectively. © Emile Woolf Publishing Limited xi Paper F7: Financial Reporting (International) An individual question may often involve elements that relate to different subject areas of the syllabus. For example the preparation of an entity’s financial statements could include matters relating to several accounting standards. Questions may ask candidates to comment on the appropriateness or acceptability of management’s opinion or chosen accounting treatment. An understanding of accounting principles and concepts and how these are applied to practical examples will be tested. Questions on topic areas that are also included in Paper F3 will be examined at an appropriately greater depth in this paper. Candidates will be expected to have an appreciation of the need for specified accounting standards and why they have been issued. For detailed or complex standards, candidates need to be aware of their principles and key elements. xii © Emile Woolf Publishing Limited Syllabus and study guide Study guide This study guide provides more detailed guidance on the syllabus. You should use this as the basis of your studies. A A conceptual framework for Financial Reporting 1 The need for a conceptual framework a) b) 2 The fundamental concepts of relevance and faithful representation (‘true and fair view’) a) b) c) 3 Discuss what is meant by relevance and faithful representation and describe the qualities that enhance these characteristics. Discuss whether faithful representation constitutes more than compliance with accounting standards. Indicate the circumstances and required disclosures where a ‘true and fair’ override may apply. The enhancing characteristics timeliness and understandability a) b) c) d) 4 Describe what is meant by a conceptual framework of accounting. Discuss whether a conceptual framework is necessary and what an alternative system might be. of comparability, verifiability, Discuss what is meant by understandability and verifiability in relation to the provision of financial information. Discuss the importance of comparability and timeliness to users of financial statements. Distinguish between changes in accounting policies and changes in accounting estimates and describe how accounting standards apply the principle of comparability where an entity changes its accounting policies. Recognise and account for changes in accounting policies and the correction of prior period errors. Recognition and measurement a) b) c) d) e) © Emile Woolf Publishing Limited Define what is meant by ‘recognition’ in financial statements and discuss the recognition criteria. Apply the recognition criteria to: i) assets and liabilities. ii) income and expenses Discuss revenue recognition issues; indicate when income and expense recognition should occur. Demonstrate the role of the principle of substance over form in relation to recognising sales revenue. Explain the following measures and compute amounts using: i) historical cost xiii Paper F7: Financial Reporting (International) ii) iii) iv) 5 The legal versus the commercial view of accounting a) b) c) d) 6 b) c) Describe the advantages and disadvantages of the use of historical cost accounting. Discuss whether the use of current value accounting overcomes the problems of historical cost accounting. Describe the concept of financial and physical capital maintenance and how this affects the determination of profits. A regulatory framework for financial reporting 1 Reasons for the existence of a regulatory framework a) b) c) 2 Explain why a regulatory framework is needed also including the advantages and disadvantages of IFRS over a national regulatory framework. Explain why accounting standards on their own are not a complete regulatory framework. Distinguish between a principles based and a rules based framework and discuss whether they can be complementary. The standard setting process a) b) xiv Explain the importance of recording the commercial substance rather than the legal form of transactions – give examples where recording the legal form of transactions may be misleading. Describe the features which may indicate that the substance of transactions differs from their legal form. Apply the principle of substance over form to the recognition and derecognition of assets and liabilities. Recognise the substance of transactions in general, and specifically account for the following types of transaction: i) goods sold on sale or return/consignment inventory ii) sale and repurchase/leaseback agreements iii) factoring of receivables. Alternative models and practices a) B fair value/current cost net realisable value present value of future cash flows. Describe the structure and objectives of the IFRS Foundation, the International Accounting Standards Board (IASB), the IFRS Advisory Council (IFRS AC) and the IFRS Interpretations Committee (IFRS IC). Describe the IASB’s Standard setting process including revisions to and interpretations of Standards. © Emile Woolf Publishing Limited Syllabus and study guide c) 3 Specialised, not-for-profit and public sector entities a) b) C Explain the relationship of national standard setters to the IASB in respect of the standard setting process. Distinguish between the primary aims of not-for profit and public sector entities and those of profit oriented entities. Discuss the extent to which International Financial Reporting Standards (IFRSs) are relevant to specialised, not-for-profit and public sector entities. Financial statements 1 Statements of Cash flows a) b) c) 2 Tangible non-current assets a) b) c) d) e) f) g) h) 3 Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the direct and the indirect method . Compare the usefulness of cash flow information with that of a statement of profit or loss or a statement of profit or loss and other comprehensive income. Interpret a statement of cash flows (together with other financial information) to assess the performance and financial position of an entity. Define and compute the initial measurement of a non-current (including a self-constructed and borrowing costs) asset. Identify subsequent expenditure that may be capitalised, distinguishing between capital and revenue items. Discuss the requirements of relevant accounting standards in relation to the revaluation of non-current assets. Account for revaluation and disposal gains and losses for noncurrent assets. Compute depreciation based on the cost and revaluation models and on assets that have two or more significant parts (complex assets). Apply the provisions of relevant accounting standards in relation to accounting for government grants. Discuss why the treatment of investment properties should differ from other properties. Apply the requirements of relevant accounting standards for investment property. Intangible assets a) © Emile Woolf Publishing Limited Discuss the nature and accounting treatment of internally generated and purchased intangibles. xv Paper F7: Financial Reporting (International) b) c) d) e) f) 4 Inventory a) b) c) d) 5 b) c) d) e) Explain the need for an accounting standard on financial instruments. Define financial instruments in terms of financial assets and financial liabilities. Indicate for the following categories of financial instruments how they should be measured and how any gains and losses from subsequent measurement should be treated in the financial statements: i) amortised cost ii) fair value ( including option to elect to present gains and losses on equity instruments in other comprehensive income) Distinguish between debt and equity capital. Apply the requirements of relevant accounting standards to the issue and finance costs of: i) equity ii) redeemable preference shares and debt instruments with no conversion rights (principle of amortised cost) iii) convertible debt Leases a) b) xvi Describe and apply the principles of inventory valuation. Define a construction contract and discuss the role of accounting concepts in the recognition of profit. Describe the acceptable methods of determining the stage (percentage) of completion of a contract. Prepare financial statement extracts for construction contracts. Financial assets and financial liabilities a) 6 Distinguish between goodwill and other intangible assets. Describe the criteria for the initial recognition and measurement of intangible assets. Describe the subsequent accounting treatment, including the principle of impairment tests in relation to goodwill. Indicate why the value of purchase consideration for an investment may be less than the value of the acquired identifiable net assets and how the difference should be accounted for. Describe and apply the requirements of relevant accounting standards to research and development expenditure. Explain why recording the legal form of a finance lease can be misleading to users (referring to the commercial substance of such leases). Describe and apply the method of determining a lease type (i.e. an operating or finance lease). © Emile Woolf Publishing Limited Syllabus and study guide c) d) e) 7 Provisions, contingent liabilities and contingent assets a) b) c) d) e) f) 8 c) d) Define an impairment loss. Identify the circumstances that may indicate impairments to assets. Describe what is meant by a cash generating unit. State the basis on which impairment losses should be allocated, and allocate an impairment loss to the assets of a cash generating unit. Taxation a) b) c) d) 10 Explain why an accounting standard on provisions is necessary. Distinguish between legal and constructive obligations. State when provisions may and may not be made and demonstrate how they should be accounted for. Explain how provisions should be measured. Define contingent assets and liabilities and describe their accounting treatment. Identify and account for: i) warranties/guarantees ii) onerous contracts iii) environmental and similar provisions iv) provisions for future repairs or refurbishments. Impairment of assets a) b) 9 Discuss the effect on the financial statements of a finance lease being incorrectly treated as an operating lease. Account for assets financed by finance leases in the records of the lessee. Account for operating leases in the records of the lessee. Account for current taxation in accordance with relevant accounting standards. Record entries relating to income tax in the accounting records. Explain the effect of taxable temporary differences on accounting and taxable profits. Compute and record deferred tax amounts in the financial statements. Regulatory requirements relating to the preparation of financial statements a) b) © Emile Woolf Publishing Limited Describe the structure (format) and content of financial statements presented under IFRS. Prepare an entity’s financial statements in accordance with the prescribed structure and content. xvii Paper F7: Financial Reporting (International) 11 Reporting financial performance a) b) c) d) e) f) g) D Business combinations 1 The concept and principles of a group a) b) c) d) e) f) xviii Discuss the importance of identifying and reporting the results of discontinued operations. Define and account for non-current assets held for sale and discontinued operations. Indicate the circumstances where separate disclosure of material items of income and expense is required. Prepare and explain the contents and purpose of the statement of changes in equity. Describe and prepare a statement of changes in equity. Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) iii) explain why the trend of eps may be a more accurate indicator of performance than a company’s profit trend and the importance of eps as a stock market indicator iv) discuss the limitations of using eps as a performance measure. Events after the reporting date i) distinguish between and account for adjusting and nonadjusting events after the reporting date ii) Identify items requiring separate disclosure, including their accounting treatment and required disclosures Describe the concept of a group as a single economic unit. Explain and apply the definition of a subsidiary within relevant accounting standards. Identify and outline using accounting standards and other applicable regulation the circumstances in which a group is required to prepare consolidated financial statements. Describe the circumstances when a group may claim exemption from the preparation of consolidated financial statements. . Explain why directors may not wish to consolidate a subsidiary and outline using accounting standards and other applicable regulation the circumstances where this is permitted.[2 Explain the need for using coterminous year ends and uniform accounting polices when preparing consolidated financial statements. © Emile Woolf Publishing Limited Syllabus and study guide g) 2 The concept of consolidated financial statements a) b) c) d) 3 Explain why it is necessary to eliminate intra-group transactions. Explain the objective of consolidated financial statements. Indicate the effect that the related party relationship between a parent and subsidiary may have on the subsidiary’s entity statements and the consolidated financial statements. Explain why it is necessary to use fair values for the consideration for an investment in a subsidiary together with the fair values of a subsidiary’s identifiable assets and liabilities when preparing consolidated financial statements. Describe and apply the required accounting treatment of consolidated goodwill. Preparation of consolidated financial statements including an associate a) b) c) d) e) f) g) h) © Emile Woolf Publishing Limited Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Prepare a consolidated statement of profit or loss and consolidated statement of profit or loss and other comprehensive income for a simple group dealing with an acquisition in the period and noncontrolling interest. Explain and account for other reserves (e.g. share premium and revaluation reserves). Account for the effects in the financial statements of intra-group trading. Account for the effects of fair value adjustments (including their effect on consolidated goodwill) to: i) depreciating and non-depreciating non-current assets ii) inventory iii) monetary liabilities iv) assets and liabilities not included in the subsidiary’s own statement of financial position, including contingent assets and liabilities Account for goodwill impairment. Define an associate and explain the principles and reasoning for the use of equity accounting. Prepare consolidated financial statements to include a single subsidiary and an associate. xix Paper F7: Financial Reporting (International) E Analysing and interpreting financial statements 1 Limitations of financial statements a) b) c) d) 2 Calculation and interpretation of accounting ratios and trends to address users’ and stakeholders’ needs a) b) c) d) e) 3 b) c) Discuss the limitations in the use of ratio analysis for assessing corporate performance. Discuss the effect that changes in accounting policies or the use of different accounting polices between entities can have on the ability to interpret performance. Indicate other information, including non-financial information, that may be of relevance to the assessment of an entity’s performance. Specialised, not-for-profit and public sector entities a) xx Define and compute relevant financial ratios. Explain what aspects of performance specific ratios are intended to assess. Analyse and interpret ratios to give an assessment of an entity’s performance and financial position in comparison with: i) an entity’s previous period’s financial statements ii) another similar entity for the same reporting period iii) industry average ratios. Interpret an entity’s financial statements to give advice from the perspectives of different stakeholders. Discuss how the interpretation of current value based financial statements would differ from those using historical cost based accounts. Limitations of interpretation techniques a) 4 Indicate the problems of using historic information to predict future performance and trends. Discuss how financial statements may be manipulated to produce a desired effect (creative accounting, window dressing). Recognise how related party relationships have the potential to mislead users. Explain why figures in a statement of financial position may not be representative of average values throughout the period for example, due to: i) seasonal trading ii) major asset acquisitions near the end of the accounting period. Discuss the different approaches that may be required when assessing the performance of specialised, not-for-profit and public sector organisations. © Emile Woolf Publishing Limited Paper F7 (INT) Financial Reporting e Exam techniques Five steps to exam success 1 Know your subject It sounds obvious, but you really need to know all topics in the syllabus – ACCA can test you on any area of the syllabus so even those topics you think might ‘never come up’ could be on your next exam. Whatever the format, questions require that you have learnt definitions, know key words and their meanings and understand concepts, theories and rules. 2 Know your exam structure Do you know how many questions you need to attempt? Do you know how long you exam is? What type of questions come up? Knowing this is essential! The F7 exam is three hours long (plus an additional 15 minutes reading time) and has five compulsory questions. Question 1 will be on group financial statements, Question 2 will be on non‐group financial statements, Question 3 may involve cash flow statements and Questions 4 and 5 cover the rest of the syllabus. 3 Practice makes perfect One of the best ways to prepare for your actual exam is to try lots of examination‐ standard questions under timed conditions. Attempt ALL of the questions in this exam kit and compare your answers with the answers to see what you need to improve on and the areas you need to go back and revise! Go back and revise and then attempt questions again if you get any wrong. © Emile Woolf Publishing Limited xxi Paper F7: Financial Reporting (International) 4 Time yourself If you are sitting an exam worth 100 marks in three hours, you should aim to spend 1.8 minutes on each mark. Make sure that you have double‐checked your strategy of how you are going to allocate your time before you go into the exam and that you are comfortable answering five questions in three hours. Since you don’t need to attempt the questions in order, a good strategy could be to attempt the ‘easy’ questions (such as those you either know or you don’t) at the beginning and save those that involve calculations or a bit more thought to the end. 5 Reading and planning time in the exam You have been given an extra 15 minutes ‘reading and planning’ time in the exam. Use it wisely! You are allowed to read the questions, begin to plan your answers and use your calculator to make some preliminary numerical calculations. You’re allowed to write on your exam paper, so try going through and highlighting the key points and requirements in the questions, or jot down some ideas as to how you are going to structure your answers. xxii © Emile Woolf Publishing Limited SECTION 1 Paper F7 (INT) Financial Reporting Q&A Practice questions 1 Recost For over 20 years the accounting profession in many countries has attempted to formulate a method of preparing financial statements that takes account of the effects of price increases (inflation). It seems that no proposed method of reflecting the effects of changing prices has gained international acceptance. The decision of the IASB, and the accounting standard setters in many countries, is that no form of accounting for price changes should be made compulsory, but enterprises are encouraged to present such information. There have been two main methods put forward by various accounting standard bodies for reporting the effects of price changes. One method is based on the movements in general price inflation and is referred to as a General (or Current) Purchasing Power Approach, the other method is based on specific price changes of goods and assets and is generally referred to as a Current Cost Approach. Some bodies have also suggested an approach which combines features of each method. Required: (a) Explain the limitations of (pure) historical cost accounts when used as a basis for assessing the performance of an enterprise. You should give an example of how each of three different user groups may be misled by such information. (10 marks) (b) Describe the advantages and criticisms of Current Cost Accounting. (5 marks) (Total: 15 marks) 2 Worthright Although it may come as a surprise to many non-accountants, the accounting profession internationally has encountered a great deal of problems in arriving at robust definitions for the ‘elements’ of financial statements. Defining assets, liabilities, and gains and losses (income and expenditure) has been particularly problematical. These definitions form the core of any conceptual framework that is to be used as a basis for preparing financial statements. It is also in this area that the International Accounting Standards Board’s original conceptual framework, Framework for the Preparation and Presentation of Financial Statements (Framework) has come in for © Emile Woolf Publishing Limited 1 Paper F7: Financial Reporting (International) some criticism. It seems that the current accounting treatment of certain items does not (fully) agree with definitions in the Framework. A major objective of the Framework is to exclude from the statement of financial position items that are neither assets nor liabilities; and to make ‘off balance sheet’ assets and liabilities more visible by putting them on the statement of financial position whenever practicable. This is one of the reasons that the IASB has been engaged on a project to develop a new framework. This project has resulted in amendment to the original document and is ongoing. Required: (a) Critically discuss the definition of assets and liabilities contained in the Conceptual Framework. Your answer should explain the importance of the definitions and the relevance of each component of the definitions. (10 marks) (b) Worthright undertakes a considerable amount of research and development work. Most of this work is done on its own behalf, but occasionally it undertakes this type of work for other companies. Before any of its own projects progress to the development stage they are assessed by an internal committee, which carefully analyses all information relating to the project. This process has led to a very good record of development projects delivering profitable results. Despite this, Worthright deems it prudent to write off immediately all research and development work, including that which it does for other companies. (5 marks) Required: Discuss whether the above transactions and events give rise to assets; and describe how they should be recognised and measured under current International Accounting Standards and conventionally accepted practice. (Total: 15 marks) 3 Revenue recognition Revenue recognition is the process by which companies decide when and how much income should be included in the income statement. It is a topical area of great debate in the accounting profession. The IASB looks at revenue recognition from conceptual and substance points of view. There are occasions where a more traditional approach to revenue recognition does not entirely conform to the IASB guidance; indeed neither do some International Accounting Standards. Required: 2 (a) Explain the implications that the IASB’s Conceptual Framework and the application of substance over form have on the recognition of income. Give examples of how this may conflict with traditional practice and some accounting standards. (6 marks) (b) Derringdo acquired an item of plant at a gross cost of $800,000 on 1 October 2011. The plant has an estimated life of 10 years with a residual value equal to 15% of its gross cost. Derringdo uses straight-line depreciation on a time-apportioned basis. The company received a government grant of 30% of its cost price at the time of its purchase. The terms of the grant are that if the company retains the asset for four years or more, then no repayment liability will be incurred. If the plant is sold within four years a repayment on a sliding scale would be applicable. The repayment is 75% if sold within the first year of purchase and this amount decreases by 25% per annum. Derringdo has no intention to sell the plant within the first four years. Derringdo’s accounting policy for capital based © Emile Woolf Publishing Limited Section 1: Practice questions government grants is to treat them as deferred credits and release them to income over the life of the asset to which they relate. Required: (i) Discuss whether the company’s policy for the treatment of government grants meets the definition of a liability in the IASB Conceptual Framework. (3 marks) (ii) Prepare extracts of Derringdo’s financial statements for the year to 31 March 2012 in respect of the plant and the related grant: applying the company’s policy; in compliance with the definition of a liability in the Conceptual Framework. Your answer should consider whether the sliding scale repayment should be used in determining the deferred credit for the grant. (6 marks) (Total: 15 marks) 4 Angelino (a) Recording the substance of transactions, rather than their legal form, is an important principle in financial accounting. Abuse of this principle can lead to profit manipulation, non-recognition of assets and substantial debt not being recorded on the statement of financial position. Required: Describe how the use of off statement of financial position financing can mislead users of financial statements. Note: your answer should refer to specific user groups and include examples where recording the legal form of transactions may mislead them. (9 marks) (b) Angelino has entered into the following transactions during the year ended 30 September 2012: (i) In September 2012 Angelino sold (factored) some of its trade receivables to Omar, a finance house. On selected account balances Omar paid Angelino 80% of their book value. The agreement was that Omar would administer the collection of the receivables and remit a residual amount to Angelino depending upon how quickly individual customers paid. Any balance uncollected by Omar after six months will be refunded to Omar by Angelino. (5 marks) (ii) On 1 October 2011 Angelino owned a freehold building that had a carrying amount of $7·5 million and had an estimated remaining life of 20 years. On this date it sold the building to Finaid for a price of $12 million and entered into an agreement with Finaid to rent back the building for an annual rental of $1·3 million for a period of five years. The auditors of Angelino have commented that in their opinion the building had a market value of only $10 million at the date of its sale and to rent an equivalent building under similar terms to the agreement between Angelino and Finaid would only cost $800,000 per annum. Assume any finance costs are 10% per annum. (6 marks) (iii) Angelino is a motor car dealer selling vehicles to the public. Most of its new vehicles are supplied on consignment by two manufacturers, Monza and Capri, who trade on different terms. © Emile Woolf Publishing Limited 3 Paper F7: Financial Reporting (International) Monza supplies cars on terms that allow Angelino to display the vehicles for a period of three months from the date of delivery or when Angelino sells the cars on to a retail customer if this is less than three months. Within this period Angelino can return the cars to Monza or can be asked by Monza to transfer the cars to another dealership (both at no cost to Angelino). Angelino pays the manufacturer’s list price at the end of the three month period (or at the date of sale if sooner). In recent years Angelino has returned several cars to Monza that were not selling very well and has also been required to transfer cars to other dealerships at Monza’s request. Capri’s terms of supply are that Angelino pays 10% of the manufacturer’s price at the date of delivery and 1% of the outstanding balance per month as a display charge. After six months (or sooner if Angelino chooses), Angelino must pay the balance of the purchase price or return the cars to Capri. If the cars are returned to the manufacturer, Angelino has to pay for the transportation costs and forfeits the 10% deposit. Because of this Angelino has only returned vehicles to Capri once in the last three years. (5 marks) Required: Describe how the above transactions and events should be treated in the financial statements of Angelino for the year ended 30 September 2012. Your answer should explain, where relevant, the difference between the legal form of the transactions and their substance. Note: The mark allocation is shown against each of the three transactions above. (Total: 25 marks) 5 Emerald Product development costs are a material cost for many companies. They are either written off as an expense or capitalised as an asset. Required: (a) Discuss the conceptual issues involved and the definition of an asset that may be applied in determining whether development expenditure should be treated as an expense or an asset. (4 marks) (b) Emerald has had a policy of writing off development expenditure to the income statement as it was incurred. In preparing its financial statements for the year ended 30 September 2012 it has become aware that, under IFRS rules, qualifying development expenditure should be treated as an intangible asset. Below is the qualifying development expenditure for Emerald: $’000 Year ended 30 September 2009 300 Year ended 30 September 2010 240 Year ended 30 September 2011 800 Year ended 30 September 2012 400 All capitalised development expenditure is deemed to have a four year life. Assume amortisation commences at the beginning of the accounting period following capitalisation. Emerald had no development expenditure before that for the year ended 30 September 2009. 4 © Emile Woolf Publishing Limited Section 1: Practice questions Required: Treating the above as the correction of an error in applying an accounting policy, calculate the amounts which should appear in the income statement and statement of financial position (including comparative figures), and statement of changes in equity of Emerald in respect of the development expenditure for the year ended 30 September 2012. Note: ignore taxation. (6 marks) (Total: 10 marks) 6 Conceptual Framework (a) The IASB’s Conceptual Framework requires financial statements to be prepared on the basis that they comply with certain accounting concepts, underlying assumptions and (qualitative) characteristics. Five of these are: Matching/accruals Substance over form Prudence Comparability Materiality Required: Briefly explain the meaning of each of the above concepts/assumptions. (5 marks) (b) For most entities, applying the appropriate concepts/assumptions in accounting for inventories is an important element in preparing their financial statements. Required: Illustrate with examples how each of the concepts/assumptions in (a) may be (10 marks) applied to accounting for inventory. (Total: 15 marks) 7 Promoil (a) The definition of a liability forms an important element of the IASB’s Conceptual Framework which, in turn, forms the basis for IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Required: Define a liability and describe the circumstances under which provisions should be recognised. Give two examples of how the definition of liabilities enhances the (5 marks) reliability of financial statements. (b) On 1 October 2011, Promoil acquired a newly constructed oil platform at a cost of $30 million together with the right to extract oil from an offshore oilfield under a government licence. The terms of the licence are that Promoil will have to remove the platform (which will then have no value) and restore the sea bed to an environmentally satisfactory condition in 10 years’ time when the oil reserves have been exhausted. The estimated cost of this on 30 September 2021 will be $15 million. The present value of $1 receivable in 10 years at the appropriate discount rate for Promoil of 8% is $0·46. © Emile Woolf Publishing Limited 5 Paper F7: Financial Reporting (International) Required: (i) Explain and quantify how the oil platform should be treated in the financial statements of Promoil for the year ended 30 September 2012; (7 marks) (ii) Describe how your answer to (b)(i) would change if the government licence did not require an environmental clean-up. (3 marks) (Total: 15 marks) 8 Wardle (a) An important aspect of the International Accounting Standards Board’s Framework for the preparation and presentation of financial statements is that transactions should be recorded on the basis of their substance over their form. Required: Explain why it is important that financial statements should reflect the substance of the underlying transactions and describe the features that may indicate that (5 marks) the substance of a transaction may be different from its legal form. (b) Wardle’s activities include the production of maturing products which take a long time before they are ready to retail. Details of one such product are that on 1 April 2009 it had a cost of $5 million and a fair value of $7 million. The product would not be ready for retail sale until 31 March 2012. On 1 April 2009 Wardle entered into an agreement to sell the product to Easyfinance for $6 million. The agreement gave Wardle the right to repurchase the product at any time up to 31 March 2012 at a fixed price of $7,986,000, at which date Wardle expected the product to retail for $10 million. The compound interest Wardle would have to pay on a three-year loan of $6 million would be: $ Year 1 600,000 Year 2 660,000 Year 3 726,000 This interest is equivalent to the return required by Easyfinance. Required: Assuming the above figures prove to be accurate, prepare extracts from the income statement of Wardle for the three years to 31 March 2012 in respect of the above transaction: (i) Reflecting the legal form of the transaction; (ii) Reflecting the substance of the transaction. Note: statement of financial position extracts are NOT required. The following mark allocation is provided as guidance for this requirement: (c) (i) 2 marks (ii) 3 marks (5 marks) Comment on the effect the two treatments have on the income statements and the statements of financial position and how this may affect an assessment of (5 marks) Wardle’s performance. (Total: 15 marks) 6 © Emile Woolf Publishing Limited Section 1: Practice questions Financial statements – Statements of cash flows 9 Tabba The following draft financial statements relate to Tabba, a private company. Statements of financial position (balance sheets) as at: 30 September 2012 $000 Tangible non-current assets (note (ii)) Current assets Inventories Trade receivables Insurance claim (note (iii)) Cash and bank Non-current liabilities Finance lease obligations (note (ii)) 6% loan notes 10% loan notes Deferred tax Government grants (note (ii)) Current liabilities Bank overdraft Trade payables Government grants (note (ii)) Finance lease obligations (note (ii)) Current tax payable 2,550 3,100 1,500 850 ―――― 15,800 8,000 ―――― ―――― ―――― ―――― 6,000 6,000 nil 2,550 2,550 2,450 ―――― ―――― 8,550 8,450 1,700 nil 4,000 500 900 4,400 nil 4,050 600 900 100 ―――― 21,450 1,600 850 2,000 800 nil 200 1,400 ―――― 5,650 ―――― 18,600 ―――― $000 1,850 2,600 1,200 nil ―――― 7,100 550 2,950 400 800 1,200 5,650 ―――― 5,900 ―――― ―――― ―――― ―――― 18,600 © Emile Woolf Publishing Limited $000 10,600 Total assets Equity and liabilities Share capital ($1 each) Reserves: Revaluation (note (ii)) Retained earnings $000 30 September 2011 21,450 7 Paper F7: Financial Reporting (International) The following information is relevant: (i) Income statement extract for the year ended 30 September 2012: $000 Operating profit before interest and tax Interest expense 270 (260) Interest receivable 40 Profit before tax 50 Net income tax credit 50 Profit for the period 100 Note: the interest expense includes finance lease interest. (ii) The details of the tangible non-current assets are: Cost At 30 September 2011 At 30 September 2012 $000 20,200 16,000 Accumulated depreciation $000 4,400 5,400 Carrying value $000 15,800 10,600 During the year Tabba sold its factory for its fair value $12 million and agreed to rent it back, under an operating lease, for a period of five years at $1 million per annum. At the date of sale it had a carrying value of $7.4 million based on a previous revaluation of $8.6 million less depreciation of $1.2 million since the revaluation. The profit on the sale of the factory has been included in operating profit. The surplus on the revaluation reserve related entirely to the factory. No other disposals of non-current assets were made during the year. Plant acquired under finance leases during the year was $1.5 million. Other purchases of plant during the year qualified for government grants of $950,000. Amortisation of government grants has been credited to cost of sales. (iii) The insurance claim relates to flood damage to the company’s inventories which occurred in September 2011. The original estimate has been revised during the year after negotiations with the insurance company. The claim is expected to be settled in the near future. Required: (a) Prepare a statement of cash flows using the indirect method for Tabba in accordance with IAS 7 Statement of Cash Flows for the year ended 30 September 2012. (17 marks) (b) Using the information in the question and your statement of cash flows, comment on the change in the financial position of Tabba during the year ended 30 September 2012. (8 marks) Note: You are not required to calculate any ratios. 8 (Total: 25 marks) © Emile Woolf Publishing Limited Section 1: Practice questions 10 Boston Shown below are the summarised financial statements for Boston, a publicly listed company, for the years ended 31 March 2011 and 2012, together with some segment information analysed by class of business for the year ended 31 March 2012 only: Income statements Carpeting Revenue Cost of sales (note (i)) Gross profit Operating expenses Segment result Unallocated corporate expense $m 90 (30) Hotels $m 130 (95) $m 280 (168) Total 31 March 2012 $m 500 (293) Total 31 March 2011 $m 450 (260) 112 (32) 207 (72) 190 (60) Housebuilding ――― ――― ――― ――― ――― ――― 60 (25) 35 (15) 35 20 ――― 80 Unallocated bank balance ――― ――― ――― ――― ――― ――― ――― ――― 65 (25) Profit for the period Segment assets ――― 75 (10) Profit before tax Income tax expense Tangible non-current assets Current assets ――― 135 (60) Profit from operations Finance costs 40 40 40 140 40 200 75 ――― ――― ――― ――― ――― ――― 80 180 275 Consolidated total assets 380 155 535 Consolidated equity and total liabilities 9 51 12 53 75 (30) 45 332 462 15 nil ――― ――― ――― ――― ――― ――― 462 100 20 232 4 4 80 (5) ――― 80 nil 192 352 Segment current liabilities – tax – other Unallocated loans Unallocated bank overdraft 130 (50) 130 ――― 550 Ordinary share capital Share premium Retained earnings ――― 108 65 nil 272 25 30 115 40 5 ――― ――― ――― ――― 550 462 The following notes are relevant: (i) Depreciation for the year to 31 March 2012 was $35 million. During the year a hotel with a carrying amount of $40 million was sold at a loss of $12 million. Depreciation and the loss on the sale of non-current assets are charged to cost of sales. There were no other non-current asset disposals. As part of the company’s overall acquisition of new non-current assets, the hotel segment acquired $104 million of new hotels during the year. © Emile Woolf Publishing Limited 9 Paper F7: Financial Reporting (International) (ii) The above figures are based on historical cost values. The fair values of the segment net assets are: At 31 March 2011 At 31 March 2012 (iii) Hotels $m 150 240 House building $m 250 265 The following ratios (which can be taken to be correct) have been calculated based on the overall group results: Year ended Return on capital employed Gross profit margin Operating profit margin Net assets turnover Current ratio Gearing (iv) Carpeting $m 80 97 31 March 2012 18.0% 41.4% 15.0% 1.2 times 1.3:1 15.6% 31 March 2011 25.6% 42.2% 17.8% 1.4 times 0.9:1 12.8% The following segment ratios (which can be taken to be correct) have been calculated for the year ended 31 March 2012 only: Segment return on net assets Segment asset turnover (times) Gross profit margin Net profit margin Current ratio (excluding bank) Carpeting 48.6% 1.3 66.7% 38.9% 5:1 Hotels 16.7% 1.1 26.9% 15.4% 0.7:1 House building 38.1% 1.3 40.0% 28.6% 1.2:1 Required: (a) Prepare a statement of cash flows for Boston for the year ended 31 March 2012. (10 marks) Note: You are not required to show separate segmental cash flows or any disclosure notes. (b) Using the ratios provided, write a report to the Board of Boston analysing the company’s financial performance and position for the year ended 31 March 2012. (15 marks) Your answer should make reference to your statement of cash flows and the segmental information and consider the implication of the fair value information. (Total: 25 marks) 11 Planter The following information relates to Planter, a small private company. It consists of an opening statement of financial position as at 1 April 2011 and a listing of the company’s ledger accounts at 31 March 2012 after the draft operating profit before interest and taxation (of $17,900) had been calculated. 10 © Emile Woolf Publishing Limited Section 1: Practice questions Planter – Statement of financial position as at 1 April 2011 $ Non-current assets Land and buildings (at valuation $49,200 less accumulated depreciation of $5,000) Plant (at cost of $70,000 less accumulated depreciation of $22,500) Investments at cost Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Capital and reserves: Ordinary shares of $1 each Reserves: Share premium Revaluation reserve Retained earnings $ 44,200 47,500 16,900 108,600 57,400 28,600 1,200 87,200 195,800 25,000 5,000 12,000 70,300 87,300 112,300 Non-current liabilities 8% Loan notes Current liabilities Trade payables Taxation 43,200 31,400 8,900 40,300 195,800 Total equity and liabilities Ledger account listings at 31 March 2012 Ordinary shares of $1 each Share premium Retained earnings – 1 April 2011 Profit before interest and tax – year to 31 March 2012 Revaluation reserve 8% Loan notes Trade payables Accrued loan interest Taxation Land and buildings at valuation Plant at cost Buildings – accumulated depreciation 31 March 2012 Plant – accumulated depreciation 31 March 2012 Investments at cost Trade receivables Inventory – 31 March 2012 Bank Investment income Loan interest © Emile Woolf Publishing Limited Dr $ Cr $ 50,000 8,000 70,300 17,900 18,000 39,800 26,700 300 1,100 62,300 84,600 6,800 37,600 8,200 50,400 43,300 1,900 400 1,700 11 Paper F7: Financial Reporting (International) Ledger account listings at 31 March 2012 Dr $ 26,100 277,700 Ordinary dividend Cr $ 277,700 Notes (i) There were no disposals of land and buildings during the year. The increase in the revaluation reserve was entirely due to the revaluation of the company’s land. (ii) Plant with a net book value of $12,000 (cost $23,500) was sold during the year for $7,800. The loss on sale has been included in the profit before interest and tax. (iii) Investments with a cost of $8,700 were sold during the year for $11,000. The profit has been included in the profit before interest and tax. There were no further purchases of investments. (iv) On 10 October 2011 a bonus issue of 1 for 10 ordinary shares was made utilising the share premium account. The remainder of the increase in ordinary shares was due to an issue for cash on 30 October 2011. (v) The balance on the taxation account is after settlement of the provision made for the year to 31 March 2011. A provision for the current year has not yet been made. Required: From the above information, prepare a statement of cash flows using the indirect method for Planter in accordance with IAS 7 Statement of Cash Flows for the year to 31 March 2012. (Total: 25 marks) 12 Casino (a) Casino is a publicly listed company. Details of its statements of financial position as at 31 March 2012 and 2011 are shown below together with other relevant information: Statement of financial position as at 31 March 2012 $m $m 31 March 2011 $m $m 880 400 1,280 760 510 1,270 Non-current assets (note (i)) Property, plant and equipment Intangible assets Current assets Inventory Trade receivables Interest receivable Short term deposits Bank Total assets Share capital and reserves Ordinary shares of $1 each 12 350 808 5 32 15 420 372 3 120 75 1,210 2,490 990 2,260 300 200 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position as at Reserves Share premium Revaluation reserve Retained earnings 31 March 2012 $m $m 31 March 2011 $m $m 60 112 1,098 nil 45 1,165 1,270 1,570 Non-current liabilities 12% loan note 8% variable rate loan note Deferred tax 1,210 1,410 nil 160 90 150 nil 75 250 Current liabilities Trade payables Bank overdraft Taxation 225 530 125 15 515 nil 110 670 2,490 Total equity and liabilities 625 2,260 The following supporting information is available: (i) Details relating to the non-current assets are: Property, plant and equipment at: Cost/ Valuation $m Land and buildings 600 Plant 440 31 March 2012 Depreciation Carrying value $m $m 12 588 148 292 880 Cost/ Valuation $m 500 445 31 March 2011 Depreciation Carrying value $m $m 80 420 105 340 760 Casino revalued the carrying value of its land and buildings by an increase of $70 million on 1 April 2011. On 31 March 2012 Casino transferred $3 million from the revaluation reserve to retained earnings representing the realisation of the revaluation reserve due to the depreciation of buildings. During the year Casino acquired new plant at a cost of $60 million and sold some old plant for $15 million at a loss of $12 million. There were no acquisitions or disposals of intangible assets. (ii) The following extract is from the draft income statement for the year to 31 March 2012: $m Operating loss Interest receivable Finance costs Loss before tax Income tax repayment claim Deferred tax charge Loss for the period © Emile Woolf Publishing Limited $m (32) 12 (24) (44) 14 (15) (1) (45) 13 Paper F7: Financial Reporting (International) $m The finance costs are made up of: Interest expenses Penalty cost for early redemption of fixed rate loan Issue costs of variable rate loan $m (16) (6) (2) (24) iii) The short-term deposits meet the definition of cash equivalents. (iv) Dividends of $25 million were paid during the year. Required: As far as the information permits, prepare a statement of cash flows for Casino for the year to 31 March 2012 in accordance with IAS 7 Statement of Cash Flows. (20 marks) (b) In recent years many analysts have commented on a growing disillusionment with the usefulness and reliability of the information contained in some companies’ income statements. Required: Discuss the extent to which a company’s statement of cash flows may be more (5 marks) useful and reliable than its income statement. (Total: 25 marks) 13 Minster Minster is a publicly listed company. Details of its financial statements for the year ended 30 September 2012, together with a comparative statement of financial position, are: Statement of financial position at 30 September 2012 30 September 2011 $000 $000 $000 $000 Non-current assets (note (i)) Property, plant and equipment Software Investments at fair value through profit and loss Current assets Inventories Trade receivables Amounts due from construction contracts Bank Total assets Equity and liabilities Equity shares of 25 cents each Reserves Share premium (note (ii)) Revaluation reserve Retained earnings 14 1,280 135 150 ⎯⎯⎯ 1,565 480 270 80 nil ⎯⎯⎯ 830 ⎯⎯⎯ 2,395 ⎯⎯⎯ 940 nil 125 ⎯⎯⎯ 1,065 510 380 55 35 ⎯⎯⎯ 500 150 60 950 ⎯⎯⎯ 1,160 ⎯⎯⎯ 1,660 980 ⎯⎯⎯ 2,045 ⎯⎯⎯ 300 85 25 965 ⎯⎯⎯ 1,075 ⎯⎯⎯ 1,375 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position at Non-current liabilities 9% loan note Environmental provision Deferred tax Current liabilities Trade payables Bank overdraft Current tax payable Total equity and liabilities 30 September 2012 30 September 2011 $000 $000 $000 $000 120 162 18 ⎯⎯⎯ 350 25 60 ⎯⎯⎯ Income statement for the year ended 30 September 2012 Revenue Cost of sales 300 435 ⎯⎯⎯ 2,395 ⎯⎯⎯ Gross profit Operating expenses Finance costs (note (i)) Investment income and gain on investments Profit before tax Income tax expense Profit for the year The following supporting information is available: (i) nil nil 25 ⎯⎯⎯ 555 40 50 ⎯⎯⎯ 25 645 ⎯⎯⎯ 2,045 ⎯⎯⎯ 1,397 (1,110) ⎯⎯⎯ 287 (125) ⎯⎯⎯ 162 (40) 20 ⎯⎯⎯ 142 (57) ⎯⎯⎯ 85 ⎯⎯⎯ Included in property, plant and equipment is a coal mine and related plant that Minster purchased on 1 October 2011. Legislation requires that in ten years’ time (the estimated life of the mine) Minster will have to landscape the area affected by the mining. The future cost of this has been estimated and discounted at a rate of 8% to a present value of $150,000. This cost has been included in the carrying amount of the mine and, together with the unwinding of the discount, has also been treated as a provision. The unwinding of the discount is included within finance costs in the income statement. Other land was revalued (upward) by $35,000 during the year. Depreciation of property, plant and equipment for the year was $255,000. There were no disposals of property, plant and equipment during the year. The software was purchased on 1 April 2012 for $180,000. The market value of the investments had increased during the year by $15,000. There have been no sales of these investments during the year. (ii) On 1 April 2012 there was a bonus (scrip) issue of equity shares of one for every four held utilising the share premium reserve. A further cash share issue was made on 1 June 2012. No shares were redeemed during the year. (iii) A dividend of 5 cents per share was paid on 1 July 2012. © Emile Woolf Publishing Limited 15 Paper F7: Financial Reporting (International) Required: (a) Prepare a statement of cash flows for Minster for the year to 30 September 2012 in accordance with IAS 7 Statement of cash flows. (15 marks) (b) Comment on the financial performance and position of Minster as revealed by the above financial statements and your Statement of cash flows. (10 marks) (Total: 25 marks) 14 Pinto Pinto is a publicly listed company. The following financial statements of Pinto are available: Statement of comprehensive income for the year ended 31 March 2012 Revenue Cost of sales Gross profit Income from and gains on investment property Distribution costs Administrative expenses (note (ii)) Finance costs Profit before tax Income tax expense Profit for the year Other comprehensive income Gains on property revaluation 100 –––––– 380 –––––– Total comprehensive income Statements of financial position as at 31 March 2012 $’000 $’000 31 March 2011 $’000 $’000 2,880 420 –––––– 3,300 1,860 400 –––––– 2,260 Assets Non-current assets (note (i)) Property, plant and equipment Investment property Current assets Inventory Trade receivables Income tax asset Bank Total assets 16 $’000 5,740 (4,840) –––––– 900 60 (120) (350) (50) –––––– 440 (160) –––––– 280 –––––– 1,210 480 nil 10 ––––– 1,700 –––––– 5,000 –––––– 810 540 50 nil –––––– 1,400 –––––– 3,660 –––––– © Emile Woolf Publishing Limited Section 1: Practice questions Statement of comprehensive income for the year ended 31 March 2012 Equity and liabilities Equity shares of 20 cents each (note (iii)) 1,000 Share premium 600 nil Revaluation reserve 150 50 Retained earnings 1,440 2,190 1,310 ––––– –––––– –––––– 3,190 Non-current liabilities 6% loan notes (note (ii)) nil 400 Deferred tax 50 50 30 ––––– –––––– Current liabilities Trade payables 1,410 1,050 Bank overdraft nil 120 Warranty provision (note (iv)) 200 100 Current tax payable 150 1,760 nil ––––– –––––– –––––– Total equity and liabilities 5,000 –––––– $’000 600 1,360 –––––– 1,960 430 1,270 –––––– 3,660 –––––– The following supporting information is available: (i) An item of plant with a carrying amount of $240,000 was sold at a loss of $90,000 during the year. Depreciation of $280,000 was charged (to cost of sales) for property, plant and equipment in the year ended 31 March 2012. Pinto uses the fair value model in IAS 40 Investment Property. There were no purchases or sales of investment property during the year. (ii) The 6% loan notes were redeemed early incurring a penalty payment of $20,000 which has been charged as an administrative expense in the income statement. (iii) There was an issue of shares for cash on 1 October 2011. There were no bonus issues of shares during the year. (iv) Pinto gives a 12 month warranty on some of the products it sells. The amounts shown in current liabilities as warranty provision are an accurate assessment, based on past experience, of the amount of claims likely to be made in respect of warranties outstanding at each year end. Warranty costs are included in cost of sales. (v) A dividend of 3 cents per share was paid on 1 January 2012. Required: (a) Prepare a statement of cash flows for Pinto for the year to 31 March 2012 in accordance with IAS 7 Statement of cash flows. (15 marks) (b) Comment on the cash flow management of Pinto as revealed by the statement of cash flows and the information provided by the above financial statements. Note: ratio analysis is not required, and will not be awarded any marks. (10 marks) (Total: 25 marks) © Emile Woolf Publishing Limited 17 Paper F7: Financial Reporting (International) 15 Coaltown Coaltown is a wholesaler and retailer of office furniture. Extracts from the company’s financial statements are set out below: Statements of comprehensive income for the year ended: Revenue – cash – credit Cost of sales Gross profit Operating expenses Finance costs – loan notes – overdraft Profit before tax Income tax expense Profit for period Other comprehensive income Gain on property revaluation 31 March 2012 $’000 $’000 12,800 53,000 65,800 ––––––– (43,800) ––––––– 22,000 (11,200) (380) (220) (600) ––––––– ––––––– 10,200 (3,200) ––––––– 7,000 31 March 2011 $’000 $’000 26,500 28,500 55,000 ––––––– (33,000) ––––––– 22,000 (6,920) (180) nil (180) ––––––– ––––––– 14,900 (4,400) ––––––– 10,500 5,000 ––––––– 12,000 ––––––– 1,200 ––––––– 11,700 ––––––– Total comprehensive income for the year Statement of changes in equity for the year ended 31 March 2012: Balances b/f Share issue Comprehensive income Dividends paid $’000 Equity shares $’000 Share premium $’000 Revaluation reserve $’000 Retained earnings 8,000 8,600 500 4,300 2,500 15,800 5,000 7,000 (4,000) ––––––– 18,800 ––––––– ––––––– –––––– 16,600 4,800 ––––––– –––––– Statements of financial position as at 31 March: Balances c/f 2012 $’000 Assets Non-current assets (see note) Cost Accumulated depreciation Current assets Inventory Trade receivables Bank Total assets 18 –––––– 7,500 –––––– $’000 $’000 93,500 (43,000) ––––––– 50,500 5,200 7,800 nil ––––––– $’000 Total 26,800 12,900 12,000 (4,000) ––––––– 47,700 ––––––– 2011 $’000 80,000 (48,000) –––––––– 32,000 4,400 2,800 13,000 –––––––– 63,500 ––––––– 700 ––––––– 7,900 –––––––– 39,900 –––––––– © Emile Woolf Publishing Limited Section 1: Practice questions 2012 $’000 Equity and liabilities Equity shares of $1 each Share premium Revaluation reserve Retained earnings Non-current liabilities 10% loan notes Current liabilities Bank overdraft Trade payables Taxation Warranty provision Total equity and liabilities 3,600 4,200 3,000 1,000 ––––––– $’000 $’000 2011 $’000 16,600 4,800 7,500 18,800 ––––––– 47,700 ––––––– 8,000 500 2,500 15,800 –––––––– 26,800 –––––––– 4,000 3,000 11,800 –––––––– 63,500 ––––––– nil 4,500 5,300 300 ––––––– 10,100 –––––––– 39,900 –––––––– Note Non-current assets During the year the company redesigned its display areas in all of its outlets. The previous displays had cost $10 million and had been written down by $9 million. There was an unexpected cost of $500,000 for the removal and disposal of the old display areas. Also during the year the company revalued the carrying amount of its property upwards by $5 million, the accumulated depreciation on these properties of $2 million was reset to zero. All depreciation is charged to operating expenses. Required: (a) Prepare a statement of cash flows for Coaltown for the year ended 31 March 2012 in accordance with IAS 7 Statement of Cash Flows by the indirect method. (15 marks) (b) The directors of Coaltown are concerned at the deterioration in its bank balance and are surprised that the amount of gross profit has not increased for the year ended 31 March 2012. At the beginning of the current accounting period (i.e. on 1 April 2011), the company changed to importing its purchases from a foreign supplier because the trade prices quoted by the new supplier were consistently 10% below those of its previous supplier. However, the new supplier offered a shorter period of credit than the previous supplier (all purchases are on credit). In order to encourage higher sales, Coaltown increased its credit period to its customers, and some of the cost savings (on trade purchases) were passed on to customers by reducing selling prices on both cash and credit sales by 5% across all products. Required: (i) Calculate the gross profit margin that you would have expected Coaltown to achieve for the year ended 31 March 2012 based on the selling and purchase price changes described by the directors; (2 marks) © Emile Woolf Publishing Limited 19 Paper F7: Financial Reporting (International) (ii) Comment on the directors’ surprise at the unchanged gross profit and suggest what other factors may have affected gross profit for the year ended 31 March 2012; (4 marks) (iii) Applying the trade receivables and payables credit periods for the year ended 31 March 2011 to the credit sales and purchases of the year ended 31 March 2012, calculate the effect this would have had on the company’s bank balance at 31 March 2012 assuming sales and purchases would have remained unchanged. (4 marks) Note: the inventory at 31 March 2011 was unchanged from that at 31 March 2010; assume 365 trading days. (Total: 25 marks) 16 Crosswire (a) The following information relates to Crosswire a publicly listed company. Summarised statements of financial position as at: 30 September 2012 $’000 $’000 30 September 2011 $’000 $’000 32,500 1,000 –––––– 33,500 8,200 –––––– 41,700 –––––– 13,100 2,500 –––––– 15,600 6,800 –––––– 22,400 –––––– 5,000 4,000 Assets Non-current assets Property, plant and equipment (note (i)) Development costs (note (ii)) Current assets Total assets Equity and liabilities Equity Equity shares of $1 each Share premium Other equity reserve Revaluation reserve Retained earnings Non-current liabilities 10% convertible loan notes (note (iii)) Environmental provision Finance lease obligations Deferred tax Current liabilities Finance lease obligations Trade payables Total equity and liabilities 20 6,000 500 2,000 5,700 –––––– 1,000 3,300 5,040 3,360 –––––– 1,760 8,040 –––––– 14,200 –––––– 19,200 12,700 9,800 –––––– 41,700 –––––– 2,000 500 nil 3,200 –––––– 5,000 nil nil 1,200 –––––– nil 6,500 –––––– 5,700 –––––– 9,700 6,200 6,500 –––––– 22,400 –––––– © Emile Woolf Publishing Limited Section 1: Practice questions Information from the income statements for the year ended: Revenue Finance costs (note (iv)) Income tax expense Profit for the year (after tax) 30 September 2012 $’000 52,000 1,050 1,000 4,000 30 September 2011 $’000 42,000 500 800 3,000 The following information is available: (i) During the year to 30 September 2012, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are: On 1 October 2011 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The present value of this cost at the date of the purchase was calculated at $3 million (in addition to the purchase price of the mine of $5 million). Also on 1 October 2011 Crosswire revalued its freehold land for the first time. The credit in the revaluation reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum. On 1 April 2012 Crosswire took out a finance lease for some new plant. The fair value of the plant was $10 million. The lease agreement provided for an initial payment on 1 April 2012 of $2·4 million followed by eight sixmonthly payments of $1·2 million commencing 30 September 2012. Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was the cost of replacing plant. (ii) From 1 October 2011 to 31 March 2012 a further $500,000 was spent completing the development project at which date marketing and production started. The sales of the new product proved disappointing and on 30 September 2012 the development costs were written down to $1 million via an impairment charge. (iii) During the year ended 30 September 2012, $4 million of the 10% convertible loan notes matured. The loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option. Ignore any effect of this on the other equity reserve. All the above items have been treated correctly according to International Financial Reporting Standards. © Emile Woolf Publishing Limited 21 Paper F7: Financial Reporting (International) (iv) The finance costs are made up of: For year ended: finance lease charges unwinding of environmental provision loan-note interest Required: (i) 30 September 2012 $’000 400 300 350 –––––– 1,050 –––––– 30 September 2011 $’000 nil nil 500 –––– 500 –––– Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the year ended 30 September 2012; (9 marks) (ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’ and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended 30 September 2012. Note: Crosswire includes finance costs paid as a financing activity. (8 marks) (b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the deterioration of the company’s return on capital employed (ROCE) Required: Calculate Crosswire’s ROCE for the two years ended 30 September 2011 and 2012 and comment on the apparent cause of its deterioration. Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year-end). (8 marks) (Total: 25 marks) 17 Deltoid (a) The following information relates to the draft financial statements of Deltoid. Summarised statements of financial position as at: Assets Non-current assets Property, plant and equipment (note (i)) Current assets Inventory Trade receivables Tax refund due Bank Total assets 22 31 March 2010 $’000 $’000 31 March 2009 $’000 $’000 19,000 25,500 12,500 4,500 500 nil ––––––– 36,500 ––––––– 4,600 2,000 nil 1,500 ––––––– 33,600 ––––––– © Emile Woolf Publishing Limited Section 1: Practice questions Equity and liabilities Equity Equity shares of $1 each (note (ii)) Share premium (note (ii)) Retained earnings Non-current liabilities 10% loan note (note (iii)) Finance lease obligations Deferred tax Current liabilities 10% loan note (note (iii)) Tax Bank overdraft Finance lease obligations Trade payables 31 March 2010 $’000 $’000 31 March 2009 $’000 $’000 10,000 3,200 4,500 –––––– nil 4,800 1,200 ––––––– 5,000 nil 1,400 1,700 4,700 –––––– 7,700 ––––––– 17,700 6,000 8,000 4,000 6,300 –––––– 5,000 2,000 800 ––––––– 10,300 ––––––– 18,300 7,800 nil 2,500 nil 800 4,200 –––––– 12,800 7,500 ––––––– ––––––– Total equity and liabilities 36,500 33,600 ––––––– ––––––– Summarised income statements for the years ended: 31 March 2010 31 March 2009 $’000 $’000 Revenue 55,000 40,000 Cost of sales (43,800) (25,000) ––––––– ––––––– Gross profit 11,200 15,000 Operating expenses (12,000) (6,000) Finance costs (note (iv)) (1,000) (600) ––––––– ––––––– Profit (loss) before tax (1,800) 8,400 Income tax relief (expense) 700 (2,800) ––––––– ––––––– Profit (loss) for the year (1,100) 5,600 ––––––– ––––––– The following additional information is available: (i) Property, plant and equipment is made up of: As at: 31 March 2010 31 March 2009 $’000 $’000 Leasehold property nil 8,800 Owned plant 12,500 14,200 Leased plant 6,500 2,500 ––––––– ––––––– 19,000 25,500 ––––––– ––––––– During the year Deltoid sold its leasehold property for $8·5 million and entered into an arrangement to rent it back from the purchaser. There were no additions to or disposals of owned plant during the year. The depreciation charges (to cost of sales) for the year ended 31 March 2010 were: © Emile Woolf Publishing Limited 23 Paper F7: Financial Reporting (International) $’000 200 1,700 1,800 ––––––– 3,700 ––––––– On 1 July 2009 there was a bonus issue of shares from share premium of one new share for every 10 held. Leasehold property Owned plant Leased plant (ii) On 1 October 2009 there was a fully subscribed cash issue of shares at par. (iii) The 10% loan note is due for repayment on 30 June 2010. Deltoid is in negotiations with the loan provider to refinance the same amount for another five years. (iv) The finance costs are made up of: For year ended: Finance lease charges Overdraft interest Loan note interest 31 March 2010 $’000 300 200 500 –––––– 1,000 –––––– 31 March 2009 $’000 100 nil 500 –––– 600 –––– Required: (b) (i) Prepare a statement of cash flows for Deltoid for the year ended 31 March 2010 in accordance with IAS 7 Statement of cash flows, using the indirect method; (12 marks) (ii) Based on the information available, advise the loan provider on the matters you would take into consideration when deciding whether to grant Deltoid a renewal of its maturing loan note. (8 marks) On a separate matter, you have been asked to advise on an application for a loan to build an extension to a sports club which is a not-for-profit organisation. You have been provided with the audited financial statements of the sports club for the last four years. Required: Identify and explain the ratios that you would calculate to assist in determining whether you would advise that the loan should be granted. (5 marks) (Total: 25 marks) 24 © Emile Woolf Publishing Limited Section 1: Practice questions Financial statements – Preparation of accounts from trial balance 18 Petra The following trial balance relates to Petra, a public listed company, at 30 September 2012: $000 Revenue (note (i)) Cost of sales (note (i)) Distribution costs Administration expenses Loan interest paid Ordinary shares of 25 cents each fully paid Share premium Retained earnings 1 October 2011 6% Redeemable loan note (issued in 2010) Land and buildings at cost ((land element $40 million) note (ii)) Plant and equipment at cost (note (iii)) Deferred development expenditure (note (iv)) Accumulated depreciation at 1 October 2011: – buildings – plant and equipment Accumulated amortisation of development expenditure at 1 October 2011 Income tax (note (v)) Deferred tax (note (v)) Trade receivables Inventories – 30 September 2012 Cash and bank Trade payables $000 197,800 114,000 17,000 18,000 1,500 40,000 12,000 34,000 50,000 100,000 66,000 40,000 16,000 26,000 8,000 1,000 15,000 24,000 21,300 11,000 413,800 15,000 413,800 The following notes are relevant: (i) Included in revenue is $12 million for receipts that the company’s auditors have advised are commission sales. The costs of these sales, paid for by Petra, were $8 million. $3 million of the profit of $4 million was attributable to and remitted to Sharma (the auditors have advised that Sharma is the principal for these transactions). Both the $8 million cost of sales and the $3 million paid to Sharma have been included in cost of sales. (ii) The buildings had an estimated life of 30 years when they were acquired and are being depreciated on the straight-line basis. (iii) Included in the trial balance figures for plant and equipment is plant that had cost $16 million and had accumulated depreciation of $6 million. Following a © Emile Woolf Publishing Limited 25 Paper F7: Financial Reporting (International) review of the company’s operations this plant was made available for sale during the year. Negotiations with a broker have concluded that a realistic selling price of this plant will be $7.5 million and the broker will charge a commission of 8% of the selling price. The plant had not been sold by the year end. Plant is depreciated at 20% per annum using the reducing balance method. Depreciation of buildings and plant is charged to cost of sales. (iv) The development expenditure relates to the capitalised cost of developing a product called the Topaz. It had an original estimated life of five years. Production and sales of the Topaz started in October 2010. A review of the sales of the Topaz in late September 2012, showed them to be below forecast and an impairment test concluded that the fair value of the development costs at 30 September 2012 was only $18 million and the expected period of future sales (from this date) was only a further two years. (v) The balance on the income tax account in the trial balance is the under-provision in respect of the income tax liability for the year ended 30 September 2011. The directors have estimated the provision for income tax for the year ended 30 September 2012 to be $4 million and the required balance sheet provision for deferred tax at 30 September 2012 is $17.6 million. Required: Prepare for Petra: (a) An income statement for the year ended 30 September 2012 (10 marks) (b) A statement of financial position as at 30 September 2012. (10 marks) Note: A statement of changes in equity and a statement of comprehensive income are NOT required. Disclosure notes are also NOT required. (c) The directors hold options to purchase 24 million shares for a total of $7.2 million. The options were granted two years ago and have been correctly accounted for. The options do not affect your answer to (a) and (b) above. The average stock market value of Petra’s shares for the year ended 30 September 2012 can be taken as 90 cents per share. Required: A calculation of the basic and diluted earnings per share for the year ended 30 (5 marks) September 2012 (comparatives are not required). (Total: 25 marks) 19 Darius The following trial balance relates to Darius at 31 March 2012: $000 Revenue Cost of sales Closing inventories – 31 March 2012 (note (i)) Operating expenses Rental income from investment property Finance costs (note (ii)) Land and building – at valuation (note (iii)) Plant and equipment – cost (note (iii)) 26 $000 213,800 143,800 10,500 22,400 1,200 5,000 63,000 36,000 © Emile Woolf Publishing Limited Section 1: Practice questions $000 Investment property – valuation 1 April 2011 (note (iii)) Accumulated depreciation 1 April 2011 – plant and equipment Joint venture (note (iv)) Trade receivables Bank Trade payables Ordinary shares of 25c each 10% Redeemable preference shares of $1 each Deferred tax (note (v)) Revaluation reserve (note (iii)) Retained earnings – 1 April 2011 $000 16,000 16,800 8,000 13,500 900 11,800 20,000 10,000 5,200 21,000 17,500 318,200 318,200 The following notes are relevant: (i) An inventory count at 31 March 2012 listed goods with a cost of $10.5 million. This includes some damaged goods that had cost $800,000. These would require remedial work costing $450,000 before they could be sold for an estimated $950,000. (ii) Finance costs include overdraft charges, the full year’s preference dividend and an ordinary dividend of 4c per share that was paid in September 2011. (iii) Non-current assets: Land and building The land and building were revalued at $15 million and $48 million respectively on 1 April 2011 creating a $21 million revaluation reserve. At this date the building had a remaining life of 15 years. Depreciation is on a straight-line basis. Darius does not make a transfer to realised profits in respect of excess depreciation. Plant All plant, including that of the joint venture (note (iv)), is depreciated at 12·5% on the reducing balance basis. Depreciation on both the building and the plant should be charged to cost of sales. Investment property On 31 March 2012 a qualified surveyor valued the investment property at $13.5 million. Darius uses the fair value model in IAS 40 Investment property to value its investment property. (iv) On 1 April 2011 Darius entered into a joint venture with two other entities. Each venturer contributes their own assets and is responsible for their own expenses including depreciation on joint venture assets. Darius is entitled to 40% of the joint venture’s total revenues. The joint venture is not a separate entity. © Emile Woolf Publishing Limited 27 Paper F7: Financial Reporting (International) Details of Darius’s joint venture transactions are: $000 Plant and equipment at cost 12,000 Share of joint venture revenue (40% of total sales revenue) (8,000) Related joint venture cost of sales excluding depreciation 5,000 Trade receivables 1,500 Trade payables (2,500) Net balance included in the above list of balances (v) 8,000 The directors have estimated the provision for income tax for the year ended 31 March 2012 at $8 million. The deferred tax provision at 31 March 2012 is to be adjusted (through the income statement) to reflect that the tax base of the company’s net assets is $12 million less than their carrying amounts. The rate of income tax is 30%. Required: (a) Prepare the statement of comprehensive for Darius for the year ended 31 March (12 marks) 2012. (c) Prepare the statement of financial position for Darius as at 31 March 2012. (13 marks) Notes to the financial statements are not required. 20 (Total: 25 marks) Danzig The following trial balance relates to Danzig, a public listed company, at 30 September 2012. $000 Cost of sales Operating expenses Loan interest paid (see note (1)) Rental of vehicles (see note (2)) Revenue Investment income Leasehold property at cost (see note (4)) Plant and equipment at cost Accumulated depreciation at 1 October 2011: - leasehold property - plant and equipment Investments at amortised cost Equity shares of $0.50 each, fully paid Retained earnings at 1 October 2011 3% loan notes (see note (1)) Deferred tax balance at 1 October 2011 (see note (5)) Inventory at 30 September 2012 Trade receivables 28 $000 134,000 35,000 1,500 8,600 295,300 2,000 250,000 197,000 40,000 47,000 92,400 180,000 19,300 50,000 20,000 23,700 76,400 © Emile Woolf Publishing Limited Section 1: Practice questions $000 Trade payables Bank Suspense account (see note (6)) $000 14,100 12,100 830,700 163,000 830,700 The following notes are relevant: (1) The loan notes were issued on 1 October 2011 and are redeemable on 30 September 2016. They are redeemable at a large premium to nominal value because of the low nominal interest rate payable. It has been calculated that the effective interest rate on these loan notes is 6% per year. (2) There are two separate contracts for rental of vehicles. A recent review by the finance department of these contracts has reached the conclusion that of the total rental cost of vehicles, $7 million relates to a finance lease rather than an operating lease or rental arrangement. The finance lease was entered into on 1 October 2011 which was when the $7 million was paid: the lease agreement is for a four-year period in total, and there will be three more annual payments in advance of $7 million, payable on 1 October in each year. The vehicles in the finance lease agreement had a fair value of $24 million at 1 October 2011 and they should be depreciated using the straight line method to a nil residual value. The interest rate implicit in the lease is 10% per year. The other contract for vehicle rental is an operating lease and the rental payment should be charged to operating expenses. (Note: You are not required to calculate the present value of the minimum lease payments for the finance lease.) (3) Other plant and equipment is depreciated at 20% per year by the reducing balance method. All depreciation of property, plant and equipment should be charged to cost of sales. (4) The leasehold property has a 25-year life and is amortised at a straight-line rate. On 30 September 2012 the leasehold property was re-valued to $220 million and the directors wish to incorporate this re-valuation in the financial statements. (5) The provision for income tax for the year ended 30 September 2012 has been estimated at $18 million. At 30 September 2012 there are taxable temporary differences of $92 million. Of these $20 million is related to the revaluation of the leasehold property (see note (2) above). The rate of income tax on profits is 25%. (6) The suspense account balance can be reconciled from the following transactions. The payment of a dividend in October 2011. This was calculated to give a 5% yield on the company’s share price as at 30 September 2011. The share price as at this date was $2.00. The net receipts from a rights issue of shares in March 2012. The issue was of one new share for every three held at a price of $1.70 per share. The issue was fully subscribed. The expenses of the share issue were $5 million. These should be charged against share premium. Note that the cash entries for these transactions have already been fully accounted for. © Emile Woolf Publishing Limited 29 Paper F7: Financial Reporting (International) Required: (a) Prepare an income statement for Danzig for the year to 30 September 2012 (8 marks) (b) Prepare a statement of financial position for Danzig as at 30 September 2012. (17 marks) Note: A statement of changes in equity is not required. 21 (Total: 25 marks) Allgone The following trial balance relates to Allgone at 31 March 2012: $000 Sales revenue (note (i)) Purchases Operating expenses Loan note interest paid Preference dividend Land and buildings – at valuation (note (ii)) Plant and equipment – cost Software – cost 1 April 2009 Stock market investments – valuation 1 April 2011 (note (iii)) Depreciation 1 April 2011 – plant and equipment Depreciation 1 April 2011 – software Extraordinary item (note (iv)) Trade receivables Inventory – 1 April 2011 Bank Trade payables Ordinary shares of 25c each 10% Redeemable preference shares 12% Loan note (issued 1 July 2011) Deferred tax Revaluation reserve (relating to land and buildings and the investments) Retained earnings – 1 April 2011 $000 236,200 127,850 12,400 2,400 1,000 130,000 84,300 10,000 12,000 24,300 6,000 32,000 23,000 19,450 350 15,200 60,000 20,000 40,000 3,000 454,400 45,000 4,350 454,400 The following notes are relevant: (i) Sales revenue includes $8 million for goods sold in March 2012 for cash to Funders, a merchant bank. The cost of these goods was $6 million. Funders has the option to require Allgone to repurchase these goods within one month of the year-end at their original selling price plus a facilitating fee of $250,000. The inventory at 31 March 2012 was counted at a cost value of $8.5 million. This includes $500,000 of slow moving inventory that is expected to be sold for a net $300,000. 30 © Emile Woolf Publishing Limited Section 1: Practice questions (ii) Non-current assets: On 1 April 2011 Allgone re-valued its land and buildings. The details are: Cost 1 April 2006 Valuation 1 April 2011 $000 $000 Land 20,000 25,000 Building 80,000 105,000 The building had an estimated life of 40 years when it was acquired and this has not changed as a result of the revaluation. Depreciation is on a straight-line basis. The surplus on the revaluation has been added to the revaluation reserve, but no other movements on the revaluation reserve have been recorded. Plant and equipment is depreciated at 20% per annum on the reducing balance basis. Software is depreciated by the sum of the digits method over a five-year life. (iii) The investment represents 7.5% of the ordinary share capital of Wondaworld. Allgone has a policy of revaluing its investments at their market price at each year-end. The auditors have agreed that changes in value can be taken to the revaluation reserve which at 1 April 2011 contained a surplus of $5 million for previous revaluations of the investments. The stock market price of Wondaworld ordinary shares was $2.50 each on 1 April 2011 and by 31 March 2012 this had fallen to $2.25. (iv) The extraordinary item is a loss incurred due to a fraud relating to the company’s investments. A senior employee of the company, who left in January 2011, had diverted investment funds into his private bank account. The fraud was discovered by the employee’s replacement in April 2011. It is unlikely that any of the funds will be recovered. Allgone has now implemented tighter procedures to prevent such a fraud recurring. The company has been advised that this loss will not qualify for any tax relief. (v) The directors have estimated the provision for income tax for the year to 31 March 2012 at $11.3 million. The deferred tax provision at 31 March 2012 is to be adjusted to reflect the tax base of the company’s net assets being $16 million less than carrying values. The rate of income tax is 30%. The movement on deferred tax should be charged to the income statement. Required: In accordance with International Accounting Standards and International Financial Reporting Standards as far as the information permits, prepare: (a) the income statement of Allgone for the year to 31 March 2012; and (7 marks) (b) the statement of changes in equity for the year to 31 March 2012; and (5 marks) (c) a statement of financial position as at 31 March 2012. Notes to the financial statements are not required. © Emile Woolf Publishing Limited (13 marks) (Total: 25 marks) 31 Paper F7: Financial Reporting (International) 22 Tourmalet The following extracted balances relate to Tourmalet at 30 September 2012: $000 Ordinary shares of 20 cents each Retained earnings at 1 October 2011 Revaluation reserve at 1 October 2011 6% Redeemable preference shares 2014 Trade accounts payable Tax Land and buildings – at valuation (note (iii)) Plant and equipment – cost (note (v)) Investment property – valuation at 1 October 2011 (note (iv)) Depreciation 1 October 2011 – land and buildings Depreciation 1 October 2011 – plant and equipment Trade accounts receivable Inventory – 1 October 2011 Bank Sales revenue (note (i)) Investment income (from properties) Purchases Distribution expenses Administration expenses Interim preference dividend Ordinary dividend paid $000 50,000 47,800 18,500 30,000 35,300 2,100 150,000 98,600 10,000 9,000 24,600 31,200 26,550 3,700 313,000 1,200 158,450 26,400 23,200 900 2,500 531,500 531,500 The following notes are relevant: 32 (i) Sales revenue includes $50 million for an item of plant sold on 1 June 2012. The plant had a book value of $40 million at the date of its sale, which was charged to cost of sales. On the same date, Tourmalet entered into an agreement to lease back the plant for the next five years (being the estimated remaining life of the plant) at a cost of $14 million per annum payable annually in arrears. An arrangement of this type is deemed to have a financing cost of 12% per annum. No depreciation has been charged on the item of plant in the current year. (ii) The inventory at 30 September 2012 was valued at cost of $28.5 million. This includes $4.5 million of slow moving goods. Tourmalet is trying to sell these to another retailer but has not been successful in obtaining a reasonable offer. The best price it has been offered is $2 million. (iii) On 1 October 2008 Tourmalet had its land and buildings revalued by a firm of surveyors at $150 million, with $30 million of this attributed to the land. At that date the remaining life of the building was estimated to be 40 years. These figures were incorporated into the company’s books. There has been no significant change in property values since the revaluation. $500,000 of the revaluation reserve will be realised in the current year as a result of the depreciation of the buildings. © Emile Woolf Publishing Limited Section 1: Practice questions (iv) Details of the investment property are: Value – 1 October 2011 $10 million Value – 30 September 2012 $9.8 million The company adopts the fair value method in IAS 40 Investment Property of valuing its investment property. (v) Plant and equipment (other than that referred to in note (i) above) is depreciated at 20% per annum on the reducing balance basis. All depreciation is to be charged to cost of sales. (vi) The above balances contain the results of Tourmalet’s car retailing operations which ceased on 31 December 2011 due to mounting losses. The results of the car retailing operation, which is to be treated as a discontinued operation, for the year to 30 September 2012 are: $000 Sales 15,200 Cost of sales 16,000 Operating expenses 3,200 The operating expenses are included in administration expenses in the trial balance. Tourmalet is still paying rentals for the lease of its car showrooms. The rentals are included in operating expenses. Tourmalet is hoping to use the premises as an expansion of its administration offices. This is dependent on obtaining planning permission from the local authority for the change of use, however this is very difficult to obtain. Failing this, the best option would be early termination of the lease which will cost $1.5 million in penalties. This amount has not been provided for. (vii) The balance on the taxation account in the trial balance is the result of the settlement of the previous year’s tax charge. The directors have estimated the provision for income tax for the year to 30 September 2012 at $9.2 million. Required: (a) Comment on the substance of the sale of the plant and the directors’ treatment of it. (5 marks) (b) Prepare the income statement; and (c) Prepare a statement of changes in equity for Tourmalet for the year to 30 September 2012 in accordance with current International Accounting Standards. (17 marks) (3 marks) Note: A statement of financial position is NOT required. Disclosure notes are NOT required. (Total: 25 marks) © Emile Woolf Publishing Limited 33 Paper F7: Financial Reporting (International) 23 Chamberlain The following trial balance relates to Chamberlain, a publicly listed company, at 30 September 2012: $000 $000 Ordinary share capital 200,000 Retained profits at 1 October 2011 162,000 6% Loan note (issued in 2010) 50,000 Deferred tax (note (iv)) 17,500 Land and buildings at cost (land element $163 million (note (i))) 403,000 Plant and equipment at cost (note (i)) 180,000 Accumulated depreciation 1 October 2011 – buildings 60,000 Accumulated depreciation 1 October 2011 – plant & equipment 60,000 Trade receivables 48,000 Inventory – 1 October 2011 35,500 Bank 12,500 Trade payables 45,000 Revenue Purchases Construction contract balance (note (ii)) Operating expenses 246,500 78,500 5,000 29,000 Loan interest paid 1,500 Interim dividend 8,000 Research and development expenditure (note (iii)) 40,000 841,000 841,000 The following notes are relevant: (i) The building had an estimated life of 40 years when it was acquired and is being depreciated on a straight-line basis. Plant and equipment is depreciated at 12.5% per annum using the reducing balance basis. Depreciation of buildings and plant and equipment is charged to cost of sales. (ii) The construction contract balance represents costs incurred to date of $35 million less progress billings received of $30 million on a two-year construction contract that commenced on 1 October 2011. The total contract price has been agreed at $125 million and Chamberlain expects the total contract cost to be $75 million. The company policy is to accrue for profit on uncompleted contracts by applying the percentage of completion to the total estimated profit. The percentage of completion is determined by the proportion of the contract costs to date compared to the total estimated contract costs. At 30 September 2012, $5 million of the $35 million costs incurred to date related to unused inventory of materials on site. Other inventory at 30 September 2012 amounted to $38.5 million at cost. (iii) 34 The research and development expenditure is made up of $25 million of research, the remainder being development expenditure. The directors are confident of the success of this project which is likely to be completed in March 2013. © Emile Woolf Publishing Limited Section 1: Practice questions (iv) The directors have estimated the provision for income tax for the year to 30 September 2012 at $22 million. The deferred tax provision at 30 September 2012 is to be adjusted to a credit balance of $14 million. Required: Prepare for Chamberlain: (a) an income statement for the year to 30 September 2012; and (b) a statement of financial position as at 30 September 2012 in accordance with International Financial Reporting Standards as far as the information permits. (11 marks) (14 marks) Note: A statement of changes in equity is NOT required. 24 (Total: 25 marks) Tadeon The following trial balance relates to Tadeon, a publicly listed company, at 30 September 2012: $’000 Revenue Cost of sales Operating expenses Loan interest paid (note (i)) Rental of vehicles (note (ii)) Investment income 25 year leasehold property at cost (note (iii)) Plant and equipment at cost Investments at amortised cost Accumulated depreciation at 1 October 2011: – leasehold property – plant and equipment Equity shares of 20 cents each fully paid Retained earnings at 1 October 2011 2% Loan note (note (i)) Deferred tax balance 1 October 2011 (note (iv)) Trade receivables Inventories at 30 September 2012 Bank Trade payables Suspense account (note (v)) $’000 277,800 118,000 40,000 1,000 6,200 2,000 225,000 181,000 42,000 36,000 85,000 150,000 18,600 50,000 12,000 53,500 33,300 1,900 18,700 700,000 48,000 700,000 The following notes are relevant: (i) The loan note was issued on 1 October 2011. It is redeemable on 30 September 2012 at a large premium (in order to compensate for the low nominal interest rate). The finance department has calculated that the effective interest rate on the loan is 5·5% per annum. (ii) The rental of the vehicles relates to two separate contracts. These have been scrutinised by the finance department and they have come to the conclusion that $5 million of the rentals relate to a finance lease. The finance lease was entered into on 1 October 2011 (the date the $5 million was paid) for a four year period. The vehicles had a fair value of $20 million (straight-line depreciation should be © Emile Woolf Publishing Limited 35 Paper F7: Financial Reporting (International) used) at 1 October 2011 and the lease agreement requires three further annual payments of $6 million each on the anniversary of the lease. The interest rate implicit in the lease is to be taken as 10% per annum. (Note: you are not required to calculate the present value of the minimum lease payments.) The other contract is an operating lease and should be charged to operating expenses. Other plant and equipment is depreciated at 121/2% per annum on the reducing balance basis. All depreciation of property, plant and equipment is charged to cost of sales. (iii) On 30 September 2012 the leasehold property was revalued to $200 million. The directors wish to incorporate this valuation into the financial statements. (iv) The directors have estimated the provision for income tax for the year ended 30 September 2012 at $38 million. At 30 September 2012 there were $74 million of taxable temporary differences, of which $20 million related to the revaluation of the leasehold property (see (iii) above). The income tax rate is 20%. (v) The suspense account balance can be reconciled from the following transactions: The payment of a dividend in October 2011. This was calculated to give a 5% yield on the company’s share price of 80 cents as at 30 September 2011. The net receipt in March 2012 of a fully subscribed rights issue of one new share for every three held at a price of 32 cents each. The expenses of the share issue were $2 million and should be charged to share premium. Note: the cash entries for these transactions have been correctly accounted for. Required: Prepare for Tadeon: (a) An income statement for the year ended 30 September 2012; and (b) A statement of financial position as at 30 September 2012. (8 marks) (17 marks) Note: A statement of changes in equity is not required. Disclosure notes are not required. (25 marks) 25 Llama The following trial balance relates to Llama, a listed company, at 30 September 2012: $’000 Land and buildings – at valuation 1 October 2011 (note (i)) Plant – at cost (note (i)) Accumulated depreciation of plant at 1 October 2011 Investments – at fair value through profit and loss (note (i)) Investment income Cost of sales (note (i)) Distribution costs Administrative expenses Loan interest paid Inventory at 30 September 2012 Income tax (note (ii)) Trade receivables Revenue Equity shares of 50 cents each fully paid Retained earnings at 1 October 2011 36 $’000 130,000 128,000 32,000 26,500 2,200 89,200 11,000 12,500 800 37,900 400 35,100 180,400 60,000 25,500 © Emile Woolf Publishing Limited Section 1: Practice questions $’000 $’000 471,000 80,000 34,700 14,000 11,200 24,000 6,600 471,000 2% loan note 2014 (note (iii)) Trade payables Revaluation reserve (arising from land and buildings) Deferred tax Suspense account (note (iv)) Bank The following notes are relevant: (i) Llama has a policy of revaluing its land and buildings at each year end. The valuation in the trial balance includes a land element of $30 million. The estimated remaining life of the buildings at that date (1 October 2011) was 20 years. On 30 September 2012, a professional valuer valued the buildings at $92 million with no change in the value of the land. Depreciation of buildings is charged 60% to cost of sales and 20% each to distribution costs and administrative expenses. During the year Llama manufactured an item of plant that it is using as part of its own operating capacity. The details of its cost, which is included in cost of sales in the trial balance, are: $’000 Materials cost 6,000 Direct labour cost 4,000 Machine time cost 8,000 Directly attributable overheads 6,000 The manufacture of the plant was completed on 31 March 2012 and the plant was brought into immediate use, but its cost has not yet been capitalised. All plant is depreciated at 121/2% per annum (time apportioned where relevant) using the reducing balance method and charged to cost of sales. No non-current assets were sold during the year. The fair value of the investments held at fair value through profit and loss at 30 September 2012 was $27·1 million. (ii) The balance of income tax in the trial balance represents the under/over provision of the previous year’s estimate. The estimated income tax liability for the year ended 30 September 2012 is $18·7 million. At 30 September 2012 there were $40 million of taxable temporary differences. The income tax rate is 25%. Note: you may assume that the movement in deferred tax should be taken to the income statement. (iii) The 2% loan note was issued on 1 April 2012 under terms that provide for a large premium on redemption in 2014. The finance department has calculated that the effect of this is that the loan note has an effective interest rate of 6% per annum. (iv) The suspense account contains the corresponding credit entry for the proceeds of a rights issue of shares made on 1 July 2012. The terms of the issue were one share for every four held at 80 cents per share. Llama’s share price immediately before the issue was $1. The issue was fully subscribed. © Emile Woolf Publishing Limited 37 Paper F7: Financial Reporting (International) Required: Prepare for Llama: (a) An income statement for the year ended 30 September 2012. (b) A statement of financial position as at 30 September 2012. (c) A calculation of the earnings per share for the year ended 30 September 2012. (9 marks) (13 marks) (3 marks) Note: a statement of changes in equity is not required. 26 (Total: 25 marks) Candel The following trial balance relates to Candel at 30 September 2012: Leasehold property – at valuation 1 October 2011 (note (i)) Plant and equipment – at cost (note (i)) Plant and equipment – accumulated depreciation at 1 October 2011 Capitalised development expenditure – at 1 October 2011 (note (ii)) Development expenditure – accumulated amortisation at 1 October 2011 Closing inventory at 30 September 2012 Trade receivables Bank Trade payables and provisions (note (iii)) Revenue (note (i)) Cost of sales Distribution costs Administrative expenses (note (iii)) Preference dividend paid Interest on bank borrowings Equity dividend paid Research and development costs (note (ii)) Equity shares of 25 cents each 8% redeemable preference shares of $1 each (note (iv)) Retained earnings at 1 October 2011 Deferred tax (note (v)) Leasehold property revaluation reserve The following notes are relevant: (i) $’000 50,000 76,600 $’000 24,600 20,000 6,000 20,000 43,100 1,300 23,800 300,000 204,000 14,500 22,200 800 200 6,000 8,600 ––––––– 466,000 ––––––– 50,000 20,000 24,500 5,800 10,000 –––––––– 466,000 –––––––– Non-current assets – tangible: The leasehold property had a remaining life of 20 years at 1 October 2011. The company’s policy is to revalue its property at each year end and at 30 September 2012 it was valued at $43 million. Ignore deferred tax on the revaluation. On 1 October 2011 an item of plant was disposed of for $2·5 million cash. The proceeds have been treated as sales revenue by Candel. The plant is still included in the above trial balance figures at its cost of $8 million and accumulated depreciation of $4 million (to the date of disposal). 38 © Emile Woolf Publishing Limited Section 1: Practice questions All plant is depreciated at 20% per annum using the reducing balance method. Depreciation and amortisation of all non-current assets is charged to cost of sales. (ii) Non-current assets – intangible: In addition to the capitalised development expenditure (of $20 million), further research and development costs were incurred on a new project which commenced on 1 October 2011. The research stage of the new project lasted until 31 December 2011 and incurred $1·4 million of costs. From that date the project incurred development costs of $800,000 per month. On 1 April 2012 the directors became confident that the project would be successful and yield a profit well in excess of its costs. The project is still in development at 30 September 2012. Capitalised development expenditure is amortised at 20% per annum using the straight-line method. All expensed research and development is charged to cost of sales. (iii) Candel is being sued by a customer for $2 million for breach of contract over a cancelled order. Candel has obtained legal opinion that there is a 20% chance that Candel will lose the case. Accordingly Candel has provided $400,000 ($2 million x 20%) included in administrative expenses in respect of the claim. The unrecoverable legal costs of defending the action are estimated at $100,000. These have not been provided for as the legal action will not go to court until next year. (iv) The preference shares were issued on 1 April 2012 at par. They are redeemable at a large premium which gives them an effective finance cost of 12% per annum. (v) The directors have estimated the provision for income tax for the year ended 30 September 2012 at $11·4 million. The required deferred tax provision at 30 September 2012 is $6 million. Required: (a) Prepare the statement of comprehensive income for the year ended 30 September 2012. (12 marks) (b) Prepare the statement of changes in equity for the year ended 30 September 2012. (3 marks) (c) Prepare the statement of financial position as at 30 September 2012. Note: notes to the financial statements are not required. 27 (10 marks) (Total: 25 marks) Sandown The following trial balance relates to Sandown at 30 September 2011: $’000 Revenue (note (i)) Cost of sales Distribution costs Administrative expenses (note (ii)) Loan interest paid (note (iii)) Investment income Profit on sale of investments (note (iv)) Current tax (note (v)) Freehold property – at cost 1 October 2002 (note (vi)) Plant and equipment – at cost (note (vi)) Brand – at cost 1 October 2007 (note (vi)) © Emile Woolf Publishing Limited $’000 380,000 246,800 17,400 50,500 1,000 1,300 2,200 2,100 63,000 42,200 30,000 39 Paper F7: Financial Reporting (International) Accumulated depreciation – 1 October 2010 – building – plant and equipment Accumulated amortisation – 1 October 2010 – brand Equity investments (note (iv)) Inventory at 30 September 2011 Trade receivables Bank Trade payables Equity shares of 20 cents each Equity option Other reserve (note (iv)) 5% convertible loan note 2014 (note (iii)) Retained earnings at 1 October 2010 Deferred tax (note (v)) The following notes are relevant: (i) (ii) (iii) (iv) (v) (vi) 40 $’000 $’000 8,000 19,700 9,000 26,500 38,000 44,500 8,000 ––––––––– 570,000 ––––––––– 42,900 50,000 2,000 5,000 18,440 26,060 5,400 ––––––––– 570,000 ––––––––– Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2010. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money. Administrative expenses include an equity dividend of 4·8 cents per share paid during the year. The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2009. It has an effective interest rate of 8% due to the value of its conversion option. Sandown invests in quoted equity instruments but never takes a holding of more than 5% in any company. During the year Sandown sold an investment for $11 million. At the date of sale it had a carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the investment. The remaining investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2011. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2010. Ignore deferred tax on these transactions. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2010. The directors have estimated the provision for income tax for the year ended 30 September 2011 at $16·2 million. At 30 September 2011 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%. Non-current assets: The freehold property has a land element of $13 million. The building element is being depreciated on a straight-line basis. Plant and equipment is depreciated at 40% per annum using the reducing balance method. Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2011 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years. © Emile Woolf Publishing Limited Section 1: Practice questions However, on the same date as the impairment review, Sandown received an offer to purchase the brand for $15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a 10-year life. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September 2011. Depreciation, amortisation and impairment charges are all charged to cost of sales. Required: (a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2011. (13 marks) (b) Prepare the statement of financial position of Sandown as at 30 September 2011. (12 marks) Notes to the financial statements are not required. A statement of changes in equity is not required. 28 (Total: 25 marks) Pricewell The following trial balance relates to Pricewell at 31 March 2011: Leasehold property – at valuation 31 March 2010 (note (i)) Plant and equipment (owned) – at cost (note (i)) Plant and equipment (leased) – at cost (note (i)) Accumulated depreciation at 31 March 2010 Owned plant and equipment Leased plant and equipment Finance lease payment (paid on 31 March 2011) (note (i)) Obligations under finance lease at 1 April 2010 (note (i)) Construction contract (note (ii)) Inventory at 31 March 2011 Trade receivables Bank Trade payables Revenue (note (iii)) Cost of sales (note (iii)) Distribution costs Administrative expenses Preference dividend paid (note (iv)) Equity dividend paid Equity shares of 50 cents each 6% redeemable preference shares at 31 March 2010 (note (iv)) Retained earnings at 31 March 2010 Current tax (note (v)) Deferred tax (note (v)) The following notes are relevant: (i) Non-current assets: $’000 25,200 46,800 20,000 $’000 12,800 5,000 6,000 15,600 14,300 28,200 33,100 5,500 33,400 310,000 234,500 19,500 27,500 2,400 8,000 40,000 41,600 4,900 700 ––––––– 471,700 ––––––– 8,400 –––––––– 471,700 –––––––– The 15 year leasehold property was acquired on 1 April 2009 at cost $30 million. The company policy is to revalue the property at market value at each year end. © Emile Woolf Publishing Limited 41 Paper F7: Financial Reporting (International) The valuation in the trial balance of $25·2 million as at 31 March 2010 led to an impairment charge of $2·8 million which was reported in the income statement of the previous year (i.e. year ended 31 March 2010). At 31 March 2011 the property was valued at $24·9 million. Owned plant is depreciated at 25% per annum using the reducing balance method. The leased plant was acquired on 1 April 2009. The rentals are $6 million per annum for four years payable in arrears on 31 March each year. The interest rate implicit in the lease is 8% per annum. Leased plant is depreciated at 25% per annum using the straight-line method. No depreciation has yet been charged on any non-current assets for the year ended 31 March 2011. All depreciation is charged to cost of sales. (ii) On 1 October 2010 Pricewell entered into a contract to construct a bridge over a river. The agreed price of the bridge is $50 million and construction was expected to be completed on 30 September 2012. The $14·3 million in the trial balance is: $’000 materials, labour and overheads 12,000 specialist plant acquired 1 October 2010 8,000 payment from customer (5,700) ––––––– 14,300 ––––––– The sales value of the work done at 31 March 2011 has been agreed at $22 million and the estimated cost to complete (excluding plant depreciation) is $10 million. The specialist plant will have no residual value at the end of the contract and should be depreciated on a monthly basis. Pricewell recognises profits on uncompleted contracts on the percentage of completion basis as determined by the agreed work to date compared to the total contract price. (iii) Pricewell’s revenue includes $8 million for goods it sold acting as an agent for Trilby. Pricewell earned a commission of 20% on these sales and remitted the difference of $6·4 million (included in cost of sales) to Trilby. (iv) The 6% preference shares were issued on 1 April 2009 at par for $40 million. They have an effective finance cost of 10% per annum due to a premium payable on their redemption. (v) The directors have estimated the provision for income tax for the year ended 31 March 2011 at $4·5 million. The required deferred tax provision at 31 March 2011 is $5·6 million; all adjustments to deferred tax should be taken to the income statement. The balance of current tax in the trial balance represents the under/over provision of the income tax liability for the year ended 31 March 2010. Required: (a) Prepare the statement of comprehensive income for the year ended 31 March 2011. (12 marks) (b) Prepare the statement of financial position as at 31 March 2011. (13 marks) Note: a statement of changes in equity and notes to the financial statements are not required. (Total: 25 marks) 42 © Emile Woolf Publishing Limited Section 1: Practice questions 29 Dune The following trial balance relates to Dune at 31 March 2010: $’000 Equity shares of $1 each 5% loan note (note (i)) Retained earnings at 1 April 2009 Leasehold (15 years) property – at cost (note (ii)) 45,000 Plant and equipment – at cost (note (ii)) 67,500 Accumulated depreciation – 1 April 2009 – leasehold property – plant and equipment Investments at fair value through profi t or loss (note (iii)) 26,500 Inventory at 31 March 2010 48,000 Trade receivables 40,700 Bank Deferred tax (note (v)) Trade payables Revenue (note (iv)) Cost of sales 294,000 Construction contract (note (vi)) 20,000 Distribution costs 26,400 Administrative expenses (note (i)) 34,200 Dividend paid 10,000 Loan note interest paid (six months) 500 Bank interest 200 Investment income Current tax (note (v)) –––––––– 613,000 –––––––– The following notes are relevant: $’000 60,000 20,000 38,400 6,000 23,500 4,500 6,000 52,000 400,000 1,200 1,400 –––––––– 613,000 –––––––– (i) The 5% loan note was issued on 1 April 2009 at its nominal (face) value of $20 million. The direct costs of the issue were $500,000 and these have been charged to administrative expenses. The loan note will be redeemed on 31 March 2012 at a substantial premium. The effective finance cost of the loan note is 10% per annum. (ii) Non-current assets: In order to fund a new project, on 1 October 2009 the company decided to sell its leasehold property. From that date it commenced a short-term rental of an equivalent property. The leasehold property is being marketed by a property agent at a price of $40 million, which was considered a reasonably achievable price at that date. The expected costs to sell have been agreed at $500,000. Recent market transactions suggest that actual selling prices achieved for this type of property in the current market conditions are 15% less than the value at which they are marketed. At 31 March 2010 the property had not been sold. Plant and equipment is depreciated at 15% per annum using the reducing balance method. No depreciation/amortisation has yet been charged on any non-current asset for the year ended 31 March 2010. Depreciation, amortisation and impairment charges are all charged to cost of sales. © Emile Woolf Publishing Limited 43 Paper F7: Financial Reporting (International) (iii) The investments at fair value through profit or loss had a fair value of $28 million on 31 March 2010. There were no purchases or disposals of any of these investments during the year. (iv) It has been discovered that goods with a cost of $6 million, which had been correctly included in the count of the inventory at 31 March 2010, had been invoiced in April 2010 to customers at a gross profit of 25% on sales, but included in the revenue (and receivables) of the year ended 31 March 2010. (v) A provision for income tax for the year ended 31 March 2010 of $12 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2009. At 31 March 2010 the tax base of Dune’s net assets was $14 million less than their carrying amounts. The income tax rate of Dune is 30%. (vi) The details of the construction contract are: costs to further costs 31 March 2010 to complete $’000 $’000 materials 5,000 8,000 labour and other direct costs 3,000 7,000 ––––––– ––––––– 8,000 15,000 ––––––– plant acquired at cost 12,000 ––––––– per trial balance 20,000 ––––––– The contract commenced on 1 October 2009 and is scheduled to take 18 months to complete. The agreed contract price is fi xed at $40 million. Specialised plant was purchased at the start of the contract for $12 million. It is expected to have a residual value of $3 million at the end of the contract and should be depreciated using the straight-line method on a monthly basis. An independent surveyor has assessed that the contract is 30% complete at 31 March 2010. The customer has not been invoiced for any progress payments. The outcome of the contract is deemed to be reasonably certain as at the year end. Required: (a) Prepare the income statement for Dune for the year ended 31 March 2010. (b) Prepare the statement of financial position for Dune as at 31 March 2010. Notes to the financial statements are not required. A statement of changes in equity is not required. The following mark allocation is provided as guidance for this question: 44 (a) 13 marks (b) 12 marks (25 marks) © Emile Woolf Publishing Limited Section 1: Practice questions 30 Cavern The following trial balance relates to Cavern as at 30 September 2010: $’000 $’000 50,000 30,600 12,100 3,000 7,000 11,000 Equity shares of 20 cents each (note (i)) 8% loan note (note (ii)) Retained earnings – 30 September 2009 Other equity reserve Revaluation reserve Share premium Land and buildings at valuation – 30 September 2009: Land ($7 million) and building ($36 million) (note (iii)) 43,000 Plant and equipment at cost (note (iii)) 67,400 Accumulated depreciation plant and equipment – 30 September 2009 13,400 Available-for-sale investments (note (iv)) 15,800 Inventory at 30 September 2010 19,800 Trade receivables 29,000 Bank 4,600 Deferred tax (note (v)) 4,000 Trade payables 21,700 Revenue 182,500 Cost of sales 128,500 Administrative expenses (note (i)) 25,000 Distribution costs 8,500 Loan note interest paid 2,400 Bank interest 300 Investment income 700 Current tax (note (v)) 900 –––––––– –––––––– 340,600 340,600 –––––––– –––––––– The following notes are relevant: (i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance. (ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective finance cost of 10% per annum. (iii) Non-current assets: Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the financial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus. Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which © Emile Woolf Publishing Limited 45 Paper F7: Financial Reporting (International) will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method. No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales. (iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010. (v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%. Required: (a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010. (b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010. (c) Prepare the statement of financial position of Cavern as at 30 September 2010. Notes to the financial statements are not required. The following mark allocation is provided as guidance for this question: (a) 11 marks (b) 5 marks (c) 9 marks (25 marks) Financial statements – Amendments of draft financial statements 31 Deltoid The following balance sheet has been extracted from the draft financial statements of Deltoid for the year to 31 March 2012: Statement of financial position as at 31 March 2012 $000 Non-current assets Property, plant and equipment Current assets Inventory Trade accounts receivable Bank Total assets 46 $000 12,110 3,850 2,450 250 6,550 18,660 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position as at 31 March 2012 $000 Equity and liabilities Equity: Ordinary shares of 50 cents each Reserves Share premium Revaluation reserve Retained earnings b/f at 1 April 2011 Profit after tax for year to 31 March 2012 $000 2,000 1,000 3,000 2,500 2,000 4,500 10,500 Non-current liabilities Environmental provision (note 4) 6% Convertible loan note (note 3) 1,200 3,000 4,200 Current liabilities Trade accounts payable Taxation 2,820 1,140 3,960 18,660 Total equity and liabilities The following additional information is available: (1) The financial statements include an item of plant based on its treatment in the company’s management accounts where plant is depreciated on a machine hour use basis. The details of this item of plant are: Cost (1 April 2010) $250,000 Estimated residual value $50,000 Estimated machine hour life 8,000 hours Measured usage in year to: 31 March 2011 2,000 hours 31 March 2012 800 hours In the financial statements the company policy is that plant and machinery should be written off at 20% per annum on the reducing balance basis. (2) The income statement includes a charge of $150,000 being the first two of ten payments of $75,000 each in respect of a five-year lease of an item of plant. The payments were made on 1 April 2011 and 1 October 2011. The fair value of this plant at the date it was leased was $600,000. Information obtained from the finance department confirms that this is a finance lease and an appropriate periodic rate of interest is 10% per annum. Deltoid has treated the lease as an operating lease in the above financial statements. The company depreciates plant used under finance leases on a straight-line basis over the life of the lease. (3) On 1 April 2011 Deltoid issued a $3 million 6% convertible loan note at par. The loan note is redeemable at a premium of 10% on 31 March 2015 or it may be converted into ordinary shares on the basis of 50 shares for each $100 of loan note at the option of the holder. The interest (coupon) rate for an equivalent loan note without the conversion rights would have been 10%. In the draft financial © Emile Woolf Publishing Limited 47 Paper F7: Financial Reporting (International) statements Deltoid has paid and charged interest of $180,000 and shown the loan note at $3 million on the statement of financial position. The present value of $1 receivable at the end of each year, based on discount rates of 6% and 10% can be taken as: (4) End of year 6% 10% 1 0.94 0.91 2 0.89 0.83 3 0.84 0.75 4 0.79 0.68 The draft financial statements contain an accumulating provision for the cost of restoring (landscaping) the site of a quarry that is being operated by Deltoid. The result of an environmental audit has concluded that the provision has been calculated on the wrong basis and is materially underprovided. A firm of environmental consultants has summarised the required revision: Income statement charge – year to 31 March 2012 Balance sheet liability – at 31 March 2012 Current provision Required provision $000 $000 180 245 1,200 2,150 The directors consider that the incorrect original estimate constitutes a material error. (5) Deltoid made a 1 for 4 bonus issue of shares on 1 March 2012 utilising the revaluation reserve. This has not yet been recorded in the above financial statements. Required: (a) Redraft the statement of financial position of Deltoid as at 31 March 2012 making appropriate adjustments for the items in (1) to (5) above. (20 marks) Note: Work to the nearest $000 and show separately your working for the retained earnings included in the statement of financial position. (b) Calculate the basic and diluted earnings per share for Deltoid for the year to 31 March 2012. Assume a tax rate of 25% and that only the actual loan interest paid is available for tax relief. Ignore deferred tax. (5 marks) (Total: 25 marks) 32 Tintagel Reproduced below is the draft statement of financial position of Tintagel as at 31 March 2012. $000 Non-current assets (note (i)) Freehold property Plant 48 $000 126,000 110,000 © Emile Woolf Publishing Limited Section 1: Practice questions $000 Investment property at 1 April 2011 (note (ii)) Current assets Inventory (note (iii)) Trade receivables and prepayments Bank 15,000 251,000 60,400 31,200 13,800 105,400 356,400 Total assets Equity and liabilities Ordinary shares of 25c each Reserves: Share premium Retained earnings – 1 April 2011 Retained earnings – Year to 31 March 2012 $000 150,000 10,000 52,500 47,500 110,000 260,000 Non-current liabilities Deferred tax – at 1 April 2011 (note (v)) Trade payables (note (iii)) Provision for plant overhaul (note (iv)) Taxation Suspense account (note (vi)) Total equity and liabilities 18,700 47,400 12,000 4,200 63,600 14,100 356,400 Notes: (i) The income statement has been charged with $3.2 million being the first of four equal annual rental payments for an item of excavating plant. This first payment was made on 1 April 2011. Tintagel has been advised that this is a finance lease with an implicit interest rate of 10% per annum. The plant had a fair value of $11.2 million at the inception of the lease. None of the non-current assets have been depreciated for the current year. The freehold property should be depreciated at 2% on its cost of $130 million, the leased plant is depreciated at 25% per annum on a straight-line basis and the non-leased plant is depreciated at 20% on the reducing balance basis. (ii) Tintagel adopts the fair value model for its investment property. Its value at 31 March 2012 has been assessed by a qualified surveyor at $12.4 million. (iii) During an inventory count on 31 March 2012 items that had cost $6 million were identified as being either damaged or slow moving. It is estimated that they will only realise $4 million in total, on which sales commission of 10% will be payable. An invoice for materials delivered on 12 March 2012 for $500,000 has been discovered. It has not been recorded in Tintagel’s bookkeeping system, although the materials were included in the inventory count. © Emile Woolf Publishing Limited 49 Paper F7: Financial Reporting (International) (iv) Tintagel operates some heavy excavating plant which requires a major overhaul every three years. The overhaul is estimated to cost $18 million and is due to be carried out in April 2013. The provision of $12 million represents two annual amounts of $6 million made in the years to 31 March 2011 and 2012. (v) The deferred tax provision required at 31 March 2012 has been calculated at $22.5 million. (vi) The suspense account contains the credit entry relating to the issue on 1 October 2011 of a $15 million 8% loan note. It was issued at a discount of 5% and incurred direct issue costs of $150,000. It is redeemable after four years at a premium of 10%. Interest is payable six months in arrears. The first payment of interest has not been accrued and is due on 1 April 2012. Apportionment of issue costs, discounts and premiums can be made on a straight-line basis. Required: (a) Commencing with the retained earnings figures in the above balance sheet ($52.5 million and $47.5 million), prepare a schedule of adjustments required to these figures taking into account any adjustments required by notes (i) to (vi) above. (11 marks) (b) Redraft the statement of financial position of Tintagel as at 31 March 2012 taking (14 marks) into account the adjustments required in notes (i) to (vi) above. (Total: 25 marks) 33 Harrington Reproduced below are the draft financial statements of Harrington, a public company, for the year to 31 March 2012: Income statement – Year to 31 March 2012 Sales revenue (note (i)) Cost of sales (note (ii)) Gross profit Operating expenses Loan note interest paid (refer to balance sheet) Profit before tax Income tax expense (note (vi)) Profit for the period $000 13,700 (9,200) 4,500 (2,400) (25) 2,075 (55) 2,020 Statement of financial position as at 31 March 2012 $000 Property, plant and equipment (note (iii)) Investments (note (iv)) Current assets Inventory Trade receivables Bank $000 6,270 1,200 7,470 1,750 2,450 350 4,550 50 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position as at 31 March 2012 $000 Total assets Equity and liabilities: Ordinary shares of 25c each (note (v)) Reserves: Share premium Retained earnings – 1 April 2011 – Year to 31 March 2012 – dividends paid $000 12,020 2,000 600 2,990 2,020 (500) 4,510 7,110 Non-current liabilities 10% loan note (issued 2009) Deferred tax (note (vi)) 500 280 780 Current liabilities Trade payables 4,130 12,020 The company policy for ALL depreciation is that it is charged to cost of sales and a full year’s charge is made in the year of acquisition or completion and none in the year of disposal. The following matters are relevant: (i) Included in sales revenue is $300,000 being the sale proceeds of an item of plant that was sold in January 2012. The plant had originally cost $900,000 and had been depreciated by $630,000 at the date of its sale. Other than recording the proceeds in sales and cash, no other accounting entries for the disposal of the plant have been made. All plant is depreciated at 25% per annum on the reducing balance basis. (ii) On 31 December 2011 the company completed the construction of a new warehouse. The construction was achieved using the company’s own resources as follows: Purchased materials Direct labour Supervision Design and planning costs $000 150 800 65 20 Included in the above figures are $10,000 for materials and $25,000 for labour costs that were effectively lost due to the foundations being too close to a neighbouring property. All the above costs are included in cost of sales. The building was brought into immediate use on completion and has an estimated life of 20 years (straight-line depreciation). © Emile Woolf Publishing Limited 51 Paper F7: Financial Reporting (International) (iii) Details of the other property, plant and equipment at 31 March 2012 are: $000 Land at cost Buildings at cost Less accumulated depreciation at 31 March 2008 $000 1,000 4,000 (800) 3,200 Plant at cost Less accumulated depreciation at 31 March 2008 5,200 (3,130) 2,070 6,270 At the beginning of the current year (1 April 2011), Harrington had an open market basis valuation of its properties (excluding the warehouse in note (ii) above). Land was valued at $1.2 million and the property at $4.8 million. The directors wish these values to be incorporated into the financial statements. The properties had an estimated remaining life of 20 years at the date of the valuation (straight-line depreciation is used). Harrington makes a transfer to realised profits in respect of the excess depreciation on revalued assets. Note: Depreciation for the year to 31 March 2012 has not yet been accounted for in the draft financial statements. (iv) The investments are in quoted companies that are carried at their stock market values with any gains and losses recorded in the income statement. The value shown in the statement of financial position is that at 31 March 2011 and during the year to 31 March 2012 the investments have risen in value by an average of 10%. Harrington has not reflected this increase in its financial statements. (v) On 1 October 2011 there had been a fully subscribed rights issue of 1 for 4 at 60c. This has been recorded in the above statement of financial position. (vi) Income tax on the profits for the year to 31 March 2012 is estimated at $260,000. The figure in the income statement is the under-provision for income tax for the year to 31 March 2011. The carrying value of Harrington’s net assets is $1.4 million more than their tax base at 31 March 2012. The income tax rate is 25%. Required: (a) Prepare a re-stated income statement for the year to 31 March 2012 reflecting the information in notes (i) to (vi) above. (9 marks) (b) Prepare a statement of changes in equity for the year to 31 March 2012. (6 marks) (c) Prepare a re-stated statement of financial position at 31 March 2012 reflecting the information in notes (i) to (vi) above. (10 marks) (Total: 25 marks) 52 © Emile Woolf Publishing Limited Section 1: Practice questions 34 Wellmay The summarised draft financial statements of Wellmay are shown below. Income statement year ended 31 March 2012: $’000 4,200 (2,700) ——— 1,500 (470) 20 (55) ——— 995 (360) ——— 635 ——— Revenue (note (i)) Cost of sales (note (ii)) Gross profit Operating expenses Investment property rental income Finance costs Profit before tax Income tax Profit for the period Statement of financial position as at 31 March 2012: $’000 Assets Non-current assets Property, plant and equipment (note (iii)) Investment property (note (iii)) 4,200 400 ——— 4,600 1,400 ——— 6,000 ——— Current assets Total assets Equity and liabilities Equity Equity shares of 50 cents each (note (vii)) Reserves: Revaluation reserve Retained earnings (note (iv)) Non-current liabilities 8% Convertible loan note (2015) (note (v)) Deferred tax (note (vi)) Current liabilities Total equity and liabilities $’000 1,200 350 2,850 3,200 ——— ——— 4,400 600 180 ——— 780 820 ——— 6,000 ——— The following information is relevant to the draft financial statements: (i) Revenue includes $500,000 for the sale on 1 April 2011 of maturing goods to Westwood. The goods had a cost of $200,000 at the date of sale. Wellmay can repurchase the goods on 31 March 2013 for $605,000 (based on achieving a © Emile Woolf Publishing Limited 53 Paper F7: Financial Reporting (International) lender’s return of 10% per annum) at which time the goods are estimated to have a value of $750,000. (ii) Past experience shows that in the period after the reporting date the company often receives unrecorded invoices for materials relating to the previous year. As a result of this an accrued charge of $75,000 for contingent costs has been included in cost of sales and as a current liability. (iii) Non-current assets: Wellmay owns two properties. One is a factory (with office accommodation) used by Wellmay as a production facility and the other is an investment property that is leased to a third party under an operating lease. Wellmay revalues all its properties to current value at the end of each year and uses the fair value model in IAS 40 Investment property. Relevant details of the fair values of the properties are: Factory Investment property $’000 $’000 Valuation 31 March 2011 1,200 400 Valuation 31 March 2012 1,350 375 The valuations at 31 March 2012 have not yet been incorporated into the financial statements. Factory depreciation for the year ended 31 March 2012 of $40,000 was charged to cost of sales. As the factory includes some office accommodation, 20% of this depreciation should have been charged to operating expenses. (iv) The balance of retained earnings is made up of: balance b/f 1 April 2011 profit for the period dividends paid during year ended 31 March 2012 (v) 8% Convertible loan note (2015) $’000 2,615 635 (400) ——— 2,850 ——— On 1 April 2011 an 8% convertible loan note with a nominal value of $600,000 was issued at par. It is redeemable on 31 March 2015 at par or it may be converted into equity shares of Wellmay on the basis of 100 new shares for each $200 of loan note. An equivalent loan note without the conversion option would have carried an interest rate of 10%. Interest of $48,000 has been paid on the loan and charged as a finance cost. The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are: 8% 10% 1 0·93 0·91 2 0·86 0·83 3 0·79 0·75 4 0·73 0·68 The carrying amounts of Wellmay’s net assets at 31 March 2012 are $600,000 higher than their tax base. The rate of taxation is 35%. The income tax charge of $360,000 does not include the adjustment required to the deferred tax provision which should be charged in full to the income statement. End of year (vi) 54 © Emile Woolf Publishing Limited Section 1: Practice questions (vii) Bonus/scrip issue: On 15 March 2012, Wellmay made a bonus issue from retained earnings of one share for every four held. The issue has not been recorded in the draft financial statements. Required: Redraft the financial statements of Wellmay, including a statement of changes in equity, for the year ended 31 March 2012 reflecting the adjustments required by notes (i) to (vii) above. Note: Calculations should be made to the nearest $’000. 35 (25 marks) Dexon Below is the summarised draft statement of financial position of Dexon, a publicly listed company, as at 31 March 2012. $’000 $’000 Assets Non-current assets Property at valuation (land $20,000; buildings $165,000 (note (ii)) Plant (note (ii)) Investments at fair value through profit and loss at 1 April 2011 (note (iii)) 185,000 180,500 12,500 ––––––– 378,000 Current assets Inventory Trade receivables (note (iv)) Bank 84,000 52,200 3,800 ––––––– Total assets Equity and liabilities Equity Ordinary shares of $1 each Share premium Revaluation reserve Retained earnings – at 1 April 2011 – for the year ended 31 March 2012 Non-current liabilities Deferred tax – at 1 April 2011 (note (v)) Current liabilities Total equity and liabilities $’000 140,000 ––––––– 518,000 ––––––– 250,000 40,000 18,000 12,300 96,700 ––––––– 109,000 ––––––– 167,000 ––––––– 417,000 19,200 81,800 ––––––– 518,000 ––––––– The following information is relevant: (i) Dexon’s income statement includes $8 million of revenue for credit sales made on a ‘sale or return’ basis. At 31 March 2012, customers who had not paid for the goods, had the right to return $2·6 million of them. Dexon applied a mark up on © Emile Woolf Publishing Limited 55 Paper F7: Financial Reporting (International) cost of 30% on all these sales. In the past, Dexon’s customers have sometimes returned goods under this type of agreement. (ii) The non-current assets have not been depreciated for the year ended 31 March 2012. Dexon has a policy of revaluing its land and buildings at the end of each accounting year. The values in the above statement of financial position are as at 1 April 2011 when the buildings had a remaining life of fifteen years. A qualified surveyor has valued the land and buildings at 31 March 2012 at $180 million. Plant is depreciated at 20% on the reducing balance basis. (iii) The investments at fair value through profit and loss are held in a fund whose value changes directly in proportion to a specified market index. At 1 April 2011 the relevant index was 1,200 and at 31 March 2012 it was 1,296. (iv) In late March 2012 the directors of Dexon discovered a material fraud perpetrated by the company’s credit controller that had been continuing for some time. Investigations revealed that a total of $4 million of the trade receivables as shown in the statement of financial position at 31 March 2012 had in fact been paid and the money had been stolen by the credit controller. An analysis revealed that $1·5 million had been stolen in the year to 31 March 2011 with the rest being stolen in the current year. Dexon is not insured for this loss and it cannot be recovered from the credit controller, nor is it deductible for tax purposes. (v) During the year the company’s taxable temporary differences increased by $10 million of which $6 million related to the revaluation of the property. The deferred tax relating to the remainder of the increase in the temporary differences should be taken to the income statement. The applicable income tax rate is 20%. (vi) The above figures do not include the estimated provision for income tax on the profit for the year ended 31 March 2012. After allowing for any adjustments required in items (i) to (iv), the directors have estimated the provision at $11·4 million (this is in addition to the deferred tax effects of item (v)). (vii) On 1 September 2011 there was a fully subscribed rights issue of one new share for every four held at a price of $1·20 each. The proceeds of the issue have been received and the issue of the shares has been correctly accounted for in the above statement of financial position. (viii) In May 2011 a dividend of 4 cents per share was paid. In November 2011 (after the rights issue in item (vii) above) a further dividend of 3 cents per share was paid. Both dividends have been correctly accounted for in the above statement of financial position. Required: Taking into account any adjustments required by items (i) to (viii) above (a) Prepare a statement showing the recalculation of Dexon’s profit for the year ended 31 March 2012. (8 marks) (b) Prepare the statement of changes in equity of Dexon for the year ended 31 March 2012. (8 marks) (c) Redraft the statement of financial position of Dexon as at 31 March 2012. (9 marks) Note: notes to the financial statements are NOT required. 56 (Total: 25 marks) © Emile Woolf Publishing Limited Section 1: Practice questions 36 Bodyline IAS 37 Provisions, Contingent Liabilities and Contingent Assets sets out the principles of accounting for these items and clarifies when provisions should and should not be made. Prior to its issue, the inappropriate use of provisions had been an area where companies had been accused of manipulating the financial statements and of creative accounting. Required: (a) Briefly describe the nature of provisions and the accounting requirements for them contained in IAS 37. (5 marks) (b) Briefly explain why there is a need for an accounting standard in this area. Illustrate your answer with three practical examples of how the standard addresses controversial issues. (5 marks) (c) Rockbuster has recently purchased an item of earth moving plant at a total cost of $24 million. The plant has an estimated life of 10 years with no residual value, however its engine will need replacing after every 5,000 hours of use at an estimated cost of $7.5 million. The directors of Rockbuster intend to depreciate the plant at $2.4 million ($24 million/10 years) per annum and make a provision of $1,500 ($7.5 million/5,000 hours) per hour of use for the replacement of the engine. Required: Explain how the plant should be treated in accordance with International Accounting Standards and comment on the directors’ proposed treatment. (5 marks) (Total: 15 marks) 37 Niagara Extracts of Niagara’s consolidated income statement for the year to 31 March 2012 are as follows: Sales Cost of sales Gross profit Other operating expenses Finance costs Impairment of non-current assets Income from associates Profit before tax Taxation Profit for the period Attributable to: Equity shareholders of the parent Non controlling interests © Emile Woolf Publishing Limited $000 36,000 (21,000) 15,000 (6,200) (800) (4,000) 1,500 5,500 (2,800) 2,700 2,585 115 2,700 57 Paper F7: Financial Reporting (International) The impairment of non-current assets attracted tax relief of $1 million which has been included in the tax charge. Niagara paid an interim ordinary dividend of 3c per share in June 2011 and declared a final dividend on 25 March 2012 of 6c per share. The issued share capital of Niagara on 1 April 2011 was: Ordinary shares of 25c each $3 million 8% Preference shares $1 million The preference shares are non-redeemable. The company also had in issue $2 million 7% convertible loan stock dated 2014. The loan stock will be redeemed at par in 2014 or converted to ordinary shares on the basis of 40 new shares for each $100 of loan stock at the option of the stockholders. Niagara’s income tax rate is 30%. There are also in existence directors’ share warrants (issued in 2010) which entitle the directors to receive 750,000 new shares in total in 2014 at no cost to the directors. The following share issues took place during the year to 31 March 2012: 1 July 2011: a rights issue of 1 new share at $1.50 for every 5 shares held. The market price of Niagara’s shares the day before the rights was $2.40. 1 October 2011: an issue of $1 million 6% non‐redeemable preference shares at par. Both issues were fully subscribed. Niagara’s basic earnings per share in the year to 31 March 2011 was correctly disclosed as 24c. Required: Calculate for Niagara for the year to 31 March 2012: (a) the basic earnings per share including the comparative (b) the fully diluted earnings per share (ignore comparative); and advise a prospective investor of the significance of the diluted earnings per share figure. (3 marks) (7 marks) (Total: 10 marks) 38 Taxes (a) (i) IAS 12 Income Taxes details the requirements relating to the accounting treatment of deferred tax. Required: Explain why it is considered necessary to provide for deferred tax and briefly outline the principles of accounting for deferred tax contained in IAS 12 Income Taxes. (5 marks) (ii) 58 Bowtock purchased an item of plant for $2,000,000 on 1 October 2009. It had an estimated life of eight years and an estimated residual value of $400,000. The plant is depreciated on a straight‐line basis. The tax authorities do not allow depreciation as a deductible expense. Instead a tax expense of 40% of the cost of this type of asset can be claimed against income tax in the year of purchase and 20% per annum (on a reducing © Emile Woolf Publishing Limited Section 1: Practice questions balance basis) of its tax base thereafter. The rate of income tax can be taken as 25%. Required: In respect of the above item of plant, calculate the deferred tax charge/credit in Bowtock’s income statement for the year to 30 September 2012 and the deferred tax balance in the statement of financial position at that date. (5 marks) Note: Work to the nearest $000. (b) The tax charge for a company called Stepper is $5 million on profits before tax of $35 million. This is an effective rate of tax of 14.3%. Another company Jenni has an income tax charge of $10 million on profit before tax of $30 million. This is an effective rate of tax of 33.3%. However both companies state the rate of income tax applicable to them is 25%. The statements of cash flows show that each company has paid the same amount of tax of $8 million. Required: Explain the possible reasons why the income tax charge in the financial statements as a percentage of the profit before tax may not be the same as the applicable income tax rate, and why the tax paid in the statement of cash flows may not be the same as the tax charge in the income statement. (5 marks) (Total: 15 marks) 39 Broadoak The broad principles of accounting for tangible non-current assets involve distinguishing between capital and revenue expenditure, measuring the cost of assets, determining how they should be depreciated and dealing with the problems of subsequent measurement and subsequent expenditure. IAS 16 Property, Plant and Equipment has the intention of improving consistency in these areas. Required: (a) Briefly explain: (i) how the initial cost of tangible non-current assets should be measured; and (3 marks) (b) (ii) the circumstances in which subsequent expenditure on those assets should be capitalised. (2 marks) (i) Broadoak has recently purchased an item of plant from Plantco, the details of this are: $ Basic list price of plant trade discount applicable to Broadoak Ancillary costs: shipping and handling costs estimated pre-production testing maintenance contract for three years site preparation costs © Emile Woolf Publishing Limited $ 240,000 12.5% on list price 2,750 12,500 24,000 59 Paper F7: Financial Reporting (International) electrical cable installation concrete reinforcement own labour costs $ 14,000 4,500 7,500 $ 26,000 Broadoak paid for the plant (excluding the ancillary costs) within four weeks of order, thereby obtaining an early settlement discount of 3%. Broadoak had incorrectly specified the power loading of the original electrical cable to be installed by the contractor. The cost of correcting this error of $6,000 is included in the above figure of $14,000. The plant is expected to last for 10 years. At the end of this period there will be compulsory costs of $15,000 to dismantle the plant and $3,000 to restore the site to its original use condition. Required: Calculate the amount at which the initial cost of the plant should be (5 marks) measured. (Ignore discounting.) (Total: 10 marks) 40 Merryview Merryview conducts its activities from two properties, a head office in the city centre and a property in the countryside where staff training is conducted. Both properties were acquired on 1 April 2009 and had estimated lives of 25 years with no residual value. The company has a policy of carrying its land and buildings at current values. However, until recently property prices had not changed for some years. On 1 October 2011 the properties were revalued by a firm of surveyors. Details of this and the original costs are: Head office Training premises Land Buildings $ $ – cost 1 April 2009 500,000 1,200,000 – revalued 1 October 2011 700,000 1,350,000 – cost 1 April 2009 300,000 900,000 – revalued 1 October 2011 350,000 600,000 The fall in the value of the training premises is due mainly to damage done by the use of heavy equipment during training. The surveyors have also reported that the expected life of the training property in its current use will only be a further 10 years from the date of valuation. The estimated life of the head office remained unaltered. Note: Merryview treats its land and its buildings as separate assets. Depreciation is based on the straight-line method from the date of purchase or subsequent revaluation. Required: Prepare extracts of the financial statements of Merryview in respect of the above properties for the year to 31 March 2012. (Total: 10 marks) 60 © Emile Woolf Publishing Limited Section 1: Practice questions 41 Impairment and Wilderness (a) The main objective of IAS 36 Impairment of Assets is to prescribe the procedures that should ensure that an entity’s assets are included in its statement of financial position at no more than their recoverable amounts. Where an asset is carried at an amount in excess of its recoverable amount, it is said to be impaired and IAS 36 requires an impairment loss to be recognised. Required: (i) Define an impairment loss explaining the relevance of fair value less costs to sell and value in use; and state how frequently assets should be tested for impairment. (6 marks) Note: Your answer should NOT describe the possible indicators of an impairment. (ii) (b) Explain how an impairment loss is accounted for after it has been (5 marks) calculated. The assistant financial controller of the Wilderness group, a public listed company, has identified the matters below which she believes may indicate an impairment to one or more assets: (i) Wilderness owns and operates an item of plant that cost $640,000 and had accumulated depreciation of $400,000 at 1 October 2011. It is being depreciated at 12½% on cost. On 1 April 2012 (exactly half way through the year) the plant was damaged when a factory vehicle collided into it. Due to the unavailability of replacement parts, it is not possible to repair the plant, but it still operates, albeit at a reduced capacity. Also it is expected that as a result of the damage the remaining life of the plant from the date of the damage will be only two years. Based on its reduced capacity, the estimated present value of the plant in use is $150,000. The plant has a current disposal value of $20,000 (which will be nil in two years’ time), but Wilderness has been offered a trade-in value of $180,000 against a replacement machine which has a cost of $1 million (there would be no disposal costs for the replaced plant). Wilderness is reluctant to replace the plant as it is worried about the long-term demand for the product produced by the plant. The trade-in value is only available if the plant is replaced. Required: Prepare extracts from the statement of financial position and income statement of Wilderness in respect of the plant for the year ended 30 September 2012. Your answer should explain how you arrived at your figures. (7 marks) (ii) On 1 April 2011 Wilderness acquired 100% of the share capital of Mossel, whose only activity is the extraction and sale of spa water. Mossel had been profitable since its acquisition, but bad publicity resulting from several consumers becoming ill due to a contamination of the spa water supply in April 2012 has led to unexpected losses in the last six months. The carrying amounts of Mossel’s assets at 30 September 2012 are: © Emile Woolf Publishing Limited 61 Paper F7: Financial Reporting (International) Brand (Quencher – see below) Land containing spa Purifying and bottling plant Inventories $000 7,000 12,000 8,000 5,000 32,000 The source of the contamination was found and it has now ceased. The company originally sold the bottled water under the brand name of ‘Quencher’, but because of the contamination it has re-branded its bottled water as ‘Phoenix’. After a large advertising campaign, sales are now starting to recover and are approaching previous levels. The value of the brand in the balance sheet is the depreciated amount of the original brand name of ‘Quencher’. The directors have acknowledged that $1.5 million will have to be spent in the first three months of the next accounting period to upgrade the purifying and bottling plant. Inventories contain some old ‘Quencher’ bottled water at a cost of $2 million; the remaining inventories are labelled with the new brand ‘Phoenix’. Samples of all the bottled water have been tested by the health authority and have been passed as fit to sell. The old bottled water will have to be relabelled at a cost of $250,000, but is then expected to be sold at the normal selling price of (normal) cost plus 50%. Based on the estimated future cash flows, the directors have estimated that the value in use of Mossel at 30 September 2012, calculated according to the guidance in IAS 36, is $20 million. There is no reliable estimate of the fair value less costs to sell of Mossel. Required: Calculate the amounts at which the assets of Mossel should appear in the consolidated statement of financial position of Wilderness at 30 September 2012. Your answer should explain how you arrived at your figures. (7 marks) (Total: 25 marks) 62 © Emile Woolf Publishing Limited Section 1: Practice questions Financial statements – Application of accounting standards 42 Torrent contracts and Savoir EPS (a) Torrent is a large publicly listed company whose main activity involves construction contracts. Details of three of its contracts for the year ended 31 March 2012 are: Contract Alfa Beta Ceta Date commenced 1 April 2010 1 October 2011 1 October 2011 Estimated duration 3 years 18 months 2 years $m $m $m Fixed contract price 20 6 12 Estimated costs at start of contract 15 7.5 (note (iii)) 10 at 31 March 2011 5 nil nil at 31 March 2012 12.5 (note (ii) 2 4 Estimated costs at 31 March 2012 to complete 3.5 5.5 (note (iii)) 6 Progress payments received at 31 March 2011: (note (i)) 5.4 nil nil Progress payments received at 31 March 2012: (note (i)) Notes 12.6 1.8 nil Cost to date: (i) The company’s normal policy for determining the percentage completion of contracts is based on the value of work invoiced to date compared to the contract price. Progress payments received represent 90% of the work invoiced. However, no progress payments will be invoiced or received from contract Ceta until it is completed, so the percentage completion of this contract is to be based on the cost to date compared to the estimated total contract costs. (ii) The cost to date of $12.5 million at 31 March 2012 for contract Alfa includes $1 million relating to unplanned rectification costs incurred during the current year (ended 31 March 2012) due to subsidence occurring on site. (iii) Since negotiating the price of contract Beta, Torrent has discovered the land that it purchased for the project is contaminated by toxic pollutants. The estimated cost at the start of the contract and the estimated costs to complete the contract include the unexpected costs of decontaminating the site before construction could commence. Required: Prepare extracts of the income statement and statement of financial position for Torrent in respect of the above construction contracts for the year ended 31 March 2012. (12 marks) © Emile Woolf Publishing Limited 63 Paper F7: Financial Reporting (International) (b) (i) The issued share capital of Savoir, a publicly listed company, at 31 March 2009 was $10 million. Its shares are denominated at 25 cents each. Savoir’s earnings attributable to its ordinary shareholders for the year ended 31 March 2009 were also $10 million, giving an earnings per share of 25 cents. Year ended 31 March 2010 On 1 July 2009 Savoir issued eight million ordinary shares at full market value. On 1 January 2010 a bonus issue of one new ordinary share for every four ordinary shares held was made. Earnings attributable to ordinary shareholders for the year ended 31 March 2010 were $13,800,000. Year ended 31 March 2011 On 1 October 2010 Savoir made a rights issue of shares of two new ordinary shares at a price of $1.00 each for every five ordinary shares held. The offer was fully subscribed. The market price of Savoir’s ordinary shares immediately prior to the offer was $2.40 each. Earnings attributable to ordinary shareholders for the year ended 31 March 2011 were $19,500,000. Required: Calculate Savoir’s earnings per share for the years ended 31 March 2010 and 2011 including comparative figures. (9 marks) (ii) On 1 April 2011 Savoir issued $20 million 8% convertible loan stock at par. The terms of conversion (on 1 April 2014) are that for every $100 of loan stock, 50 ordinary shares will be issued at the option of loan stockholders. Alternatively the loan stock will be redeemed at par for cash. Also on 1 April 2011 the directors of Savoir were awarded share options on 12 million ordinary shares exercisable from 1 April 2014 at $1.50 per share. The average market value of Savoir’s ordinary shares for the year ended 31 March 2012 was $2.50 each. The income tax rate is 25%. Earnings attributable to ordinary shareholders for the year ended 31 March 2012 were $25,200,000. The share options have been correctly recorded in the income statement. Required: Calculate Savoir’s basic and diluted earnings per share for the year ended 31 March 2012 (comparative figures are not required). You may assume that both the convertible loan stock and the directors’ options are dilutive. (4 marks) (Total: 25 marks) 43 Elite Leisure and Hideaway (a) Assume that ‘now’ is the end of September 2012. Elite Leisure is a private limited liability company that operates a single cruise ship. The ship was acquired on 1 October 2003. Details of the cost of the ship’s components and their estimated useful lives are: Component Ship’s fabric (hull, decks etc) Cabins and entertainment area fittings Propulsion system 64 Original cost ($ million) 300 150 100 Depreciation basis 25 years straight-line 12 years straight-line Useful life of 40,000 hours © Emile Woolf Publishing Limited Section 1: Practice questions At 30 September 2011 no further capital expenditure had been incurred on the ship. In the year ended 30 September 2011 the ship had experienced a high level of engine trouble which had cost the company considerable lost revenue and compensation costs. The measured expired life of the propulsion system at 30 September 2011 was 30,000 hours. Due to the unreliability of the engines, a decision was taken in early October 2011 to replace the whole of the propulsion system at a cost of $140 million. The expected life of the new propulsion system was 50,000 hours and in the year ended 30 September 2012 the ship had used its engines for 5,000 hours. At the same time as the propulsion system replacement, the company took the opportunity to do a limited upgrade to the cabin and entertainment facilities at a cost of $60 million and repaint the ship’s fabric at a cost of $20 million. After the upgrade of the cabin and entertainment area fittings it was estimated that their remaining life was five years (from the date of the upgrade). For the purpose of calculating depreciation, all the work on the ship can be assumed to have been completed on 1 October 2011. All residual values can be taken as nil. Required: Calculate the carrying amount of Elite Leisure’s cruise ship at 30 September 2012 and its related expenditure in the income statement for the year ended 30 September 2012. Your answer should explain the treatment of each item. (12 marks) (b) Related party relationships are a common feature of commercial life. The objective of IAS 24 Related party disclosures is to ensure that financial statements contain the necessary disclosures to make users aware of the possibility that financial statements may have been affected by the existence of related parties. Required: (i) Describe the main circumstances that give rise to related parties. (ii) Explain why the disclosure of related party relationships and transactions may be important. (3 marks) (iii) Assume that ‘now’ is the end of September 2012. (4 marks) Hideaway is a public listed company that owns two subsidiary company investments. It owns 100% of the equity shares of Benedict and 55% of the equity shares of Depret. During the year ended 30 September 2012 Depret made several sales of goods to Benedict. These sales totalled $15 million and had cost Depret $14 million to manufacture. Depret made these sales on the instruction of the Board of Hideaway. It is known that one of the directors of Depret, who is not a director of Hideaway, is unhappy with the parent company’s instruction as he believes the goods could have been sold to other companies outside the group at the far higher price of $20 million. All directors within the group benefit from a profit sharing scheme. Required: Describe the financial effect that Hideaway’s instruction may have on the financial statements of the companies within the group and the implications this may have for other interested parties. (6 marks) (Total: 25 marks) © Emile Woolf Publishing Limited 65 Paper F7: Financial Reporting (International) 44 Triangle Assume that ‘now’ is June 2012 Triangle, a public listed company, is in the process of preparing its draft financial statements for the year to 31 March 2012. The following matters have been brought to your attention: (i) On 1 April 2011 the company brought into use a new processing plant that had cost $15 million to construct and had an estimated life of ten years. The plant uses hazardous chemicals which are put in containers and shipped abroad for safe disposal after processing. The chemicals have also contaminated the plant itself which occurred as soon as the plant was used. It is a legal requirement that the plant is decontaminated at the end of its life. The estimated present value of this decontamination, using a discount rate of 8% per annum, is $5 million. The financial statements have been charged with $1.5 million ($15 million/10 years) for plant depreciation and a provision of $500,000 ($5 million/10 years) has been made towards the cost of the decontamination. (8 marks) (ii) On 15 May 2012 the company’s auditors discovered a fraud in the material requisitions department. A senior member of staff who took up employment with Triangle in August 2011 had been authorising payments for goods that had never been received. The payments were made to a fictitious company that cannot be traced. The member of staff was immediately dismissed. Calculations show that the total amount of the fraud to the date of its discovery was $240,000 of which $210,000 related to the year to 31 March 2012. (Assume the fraud is material). (5 marks) (iii) The company has contacted its insurers in respect of the above fraud. Triangle is insured for theft, but the insurance company maintains that this is a commercial fraud and is not covered by the theft clause in the insurance policy. Triangle has not yet had an opinion from its lawyers. (4 marks) (iv) On 1 April 2011 Triangle sold maturing inventory that had a carrying value of $3 million (at cost) to Factorall, a finance house, for $5 million. Its estimated market value at this date was in excess of $5 million. The inventory will not be ready for sale until 31 March 2012 and will remain on Triangle’s premises until this date. The sale contract includes a clause allowing Triangle to repurchase the inventory at any time up to 31 March 2015 at a price of $5 million plus interest at 10% per annum compounded from 1 April 2011. The inventory will incur storage costs until maturity. The cost of storage for the current year of $300,000 has been included in trade receivables (in the name of Factorall). If Triangle chooses not to repurchase the inventory, Factorall will pay the accumulated storage costs on 31 March 2012. The proceeds of the sale have been debited to the bank and the sale has been included in Triangle’s sales revenue. (8 marks) Required: Explain how the items in (i) to (iv) above should be treated in Triangle’s financial statements for the year to 31 March 2012 in accordance with current international accounting standards. Your answer should quantify the amounts where possible. The mark allocation is shown against each of the four matters above. 66 (Total: 25 marks) © Emile Woolf Publishing Limited Section 1: Practice questions 45 Construction Magpie specialises in construction contracts. It is “now” the end of March 2012. One of its contracts, with Better Homes, is to build a complex of luxury flats. The price agreed for the contract is $40 million and its scheduled date of completion is 31 December 2012. Details of the contract to 31 March 2012 are: Commencement date 1 July 2010 Contract costs: $000 Architects’ and surveyors’ fees Materials delivered to site Direct labour costs Overheads are apportioned at 40% of direct labour costs Estimated cost to complete (excluding depreciation – see below) 500 3,100 3,500 14,800 Plant and machinery used exclusively on the contract cost $3,600,000 on 1 July 2010. At the end of the contract it is expected to be transferred to a different contract at a value of $600,000. Depreciation is to be based on a time apportioned basis. Inventory of materials on site at 31 March 2011 is $300,000. Better Homes paid a progress payment of $12,800,000 to Magpie on 31 March 2011. At 31 March 2012 the details for the construction contract have been summarised as: $000 Contract costs to date (i.e. since the start of the contract) excluding all depreciation 20,400 Estimated cost to complete (excluding depreciation) 6,600 A further progress payment of $16,200,000 was received on 31 March 2012. Magpie accrues profit on its construction contracts using the percentage of completion basis as measured by the percentage of the cost to date compared to the total estimated contract cost. Required: Prepare extracts of the financial statements of Magpie for the construction contract with Better Homes for: (a) the year to 31 March 2011 (8 marks) (b) the year to 31 March 2012. (7 marks) (Total: 15 marks) 46 Bowtock (a) Explain why events occurring after the reporting date may be relevant to the financial statements of the previous period. (4 marks) (b) At 30 September 2007 Bowtock had included in its draft statement of financial position inventory of $250,000 valued at cost. Up to 5 November 2012, Bowtock had sold $100,000 of this inventory for $150,000. On this date new government legislation (enacted after the year end) came into force which meant that the unsold inventory could no longer be marketed and was worthless. Bowtock is part way through the construction of a housing development. It has prepared its financial statements to 30 September 2012 in accordance with IAS 11 © Emile Woolf Publishing Limited 67 Paper F7: Financial Reporting (International) Construction Contracts and included a proportionate amount of the total estimated profit on this contract. The same legislation referred to above (in force from 5 November 2012) now requires modifications to the way the houses within this development have to be built. The cost of these modifications will be $500,000 and will reduce the estimated total profit on the contract by that amount, although the contract is still expected to be profitable. Required: Assuming the amounts are material, state how the information above should be reflected in the financial statements of Bowtock for the year ended 30 September 2012. (6 marks) (Total: 10 marks) 47 Multiplex and Simpkins The following transactions and events have arisen during the preparation of the draft financial statements of Multiplex for the year to 31 March 2012: (a) On 1 April 2011 Multiplex issued $80 million 8% convertible loan stock at par. The stock is convertible into equity shares, or redeemable at par, on 31 March 2016, at the option of the stockholders. The terms of conversion are that each $100 of loan stock will be convertible into 50 equity shares of Multiplex. A finance consultant has advised that if the option to convert to equity had not been included in the terms of the issue, then a coupon (interest) rate of 12% would have been required to attract subscribers for the stock. The value of $1 receivable at the end of each year at a discount rate of 12% can be taken as: Year 1 2 3 4 5 $ 0.89 0.80 0.71 0.64 0.57 Required: Calculate the income statement finance charge for the year to 31 March 2012 and the extracts from the statement of financial position at 31 March 2012 in respect of the issue of the convertible loan stock. (5 marks) (b) On 1 October 2011 Simpkins issued $10 million 6% Convertible Loan Stock on the following terms: The issue price was at par. The loan stock is convertible into the company’s equity shares at the option of the stockholders four years after the date of its issue (30 September 2015) on the basis of 20 shares for each $100 of loan stock. Alternatively it will be redeemed at par. Merchant Financial Services had advised that if Simpkins had issued similar loan stock without the conversion rights, then it would have had to pay an interest (coupon) rate of 10% on the loan stock. This is because the terms of conversion to equity shares are favourable. 68 © Emile Woolf Publishing Limited Section 1: Practice questions Merchant Financial Services further advised that because it is almost certain that the loan stock holders will exercise their right to convert to equity shares, the loan stock has the substance of equity and can be included as such on the statement of financial position. This has the added advantage of improving/reducing the company’s gearing (debt/equity) in comparison to what would be the case with the issue of ‘straight’ loan stock. The present value of $1 receivable at the end of each year, based on discount rates of 6% and 10% can be taken as: End of year 1 2 3 4 6% 0.94 0.89 0.84 0.79 10% 0.91 0.83 0.75 0.68 Required: In relation to the 6% Convertible Loan Stock, calculate the finance cost to be shown in the income statement and the extracts from the statement of financial position for the year to 30 September 2012; and comment on Merchant Financial Services’ advice. (5 marks) (Total: 10 marks) 48 Convertibles Torpid issued $10 million of 4% convertible loan notes on 1 October 2011, on which interest is paid annually in arrears on 30 September. The loan notes are convertible into equity shares of Torpid on 30 September 2014 at the rate of 20 shares in Torpid for every $100 of notes. Alternatively the notes can be redeemed on that date for cash at par, at the option of the note holder. If Torpid had issued straight loan notes, redeemable at par after 3 years, it would have had to pay interest at the rate of 7% in order to persuade investors to subscribe for them. The directors of Torpid chose to issue convertible loan notes, rather than straight loan notes, because annual profits would be higher due to the lower interest charge, and the company’s gearing, currently at a high level, would be reduced. The present value of $1 receivable at the end of the year, at discount rates of 4% and 7% are as follows: End of year 1 End of year 2 End of year 3 4% $ 0.96 0.92 0.89 7% $ 0.93 0.87 0.81 Required (a) Show how the convertible loan notes would be accounted for in the financial statements of Torpid for the year to 30 September 2012. (7 marks) (b) Comment on the validity of the reasons of the directors for choosing to issue convertible loan notes. (3 marks) (Total: 10 marks) © Emile Woolf Publishing Limited 69 Paper F7: Financial Reporting (International) 49 Errsea (a) The following is an extract of Errsea’s balances of property, plant and equipment and related government grants at 1 April 2011. Property, plant and equipment Non-current liabilities Government grants Current liabilities Government grants cost $’000 240 accumulated depreciation $’000 180 carrying amount $’000 60 30 10 Details including purchases and disposals of plant and related government grants during the year are: (i) Included in the above figures is an item of plant that was disposed of on 1 April 2011 for $12,000 which had cost $90,000 on 1 April 2008. The plant was being depreciated on a straight-line basis over four years assuming a residual value of $10,000. A government grant was received on its purchase and was being recognised in the income statement in equal amounts over four years. In accordance with the terms of the grant, Errsea repaid $3,000 of the grant on the disposal of the related plant. (ii) An item of plant was acquired on 1 July 2011 with the following costs: Base cost Modifications specified by Errsea Transport and installation $ 192,000 12,000 6,000 The plant qualified for a government grant of 25% of the base cost of the plant, but it had not been received by 31 March 2012. The plant is to be depreciated on a straight-line basis over three years with a nil estimated residual value. (iii) All other plant is depreciated by 15% per annum on cost (iv) $11,000 of the $30,000 non-current liability for government grants at 1 April 2011 should be reclassified as a current liability as at 31 March 2012. (v) Depreciation is calculated on a time apportioned basis. Required: Prepare extracts of Errsea’s income statement and statement of financial position in respect of the property, plant and equipment and government grants for the year ended 31 March 2012. Note: Disclosure notes are not required. (b) After the reporting date, prior to authorising for issue the financial statements of Tentacle for the year ended 31 March 2012, the following material information has arisen. (i) 70 (10 marks) The notification of the bankruptcy of a customer. The balance of the trade receivable due from the customer at 31 March 2012 was $23,000 and at the © Emile Woolf Publishing Limited Section 1: Practice questions date of the notification it was $25,000. No payment is expected from the bankruptcy proceedings. (3 marks) (ii) Sales of some items of product W32 were made at a price of $5·40 each in April and May 2012. Sales staff receive a commission of 15% of the sales price on this product. At 31 March 2012 Tentacle had 12,000 units of product W32 in inventory included at cost of $6 each. (4 marks) (iii) Tentacle is being sued by an employee who lost a limb in an accident while at work on 15 March 2012. The company is contesting the claim as the employee was not following the safety procedures that he had been instructed to use. Accordingly the financial statements include a note of a contingent liability of $500,000 for personal injury damages. In a recently decided case where a similar injury was sustained, a settlement figure of $750,000 was awarded by the court. Although the injury was similar, the circumstances of the accident in the decided case are different from those of Tentacle’s case. (4 marks) (iv) Tentacle is involved in the construction of a residential apartment building. It is being accounted for using the percentage of completion basis in IAS 11 Construction contracts. The recognised profit at 31 March 2012 was $1·2 million based on costs to date of $3 million as a percentage of the total estimated costs of $6 million. Early in May 2012 Tentacle was informed that due to very recent industry shortages, building materials will cost $1·5 million more than the estimate of total cost used in the calculation of the percentage of completion. Tentacle cannot pass on any additional costs to the customer. (4 marks) Required: State and quantify how items (i) to (iv) above should be treated when finalising the financial statements of Tentacle for the year ended 31 March 2012. Note: The mark allocation is shown against each of the four items above. (Total: 25 marks) 50 Partway (a) (i) State the definition of both non-current assets held for sale and discontinued operations and explain the usefulness of information for discontinued operations. (4 marks) Partway is in the process of preparing its financial statements for the year ended 31 October 2012. The company’s main activity is in the travel industry mainly selling package holidays (flights and accommodation) to the general public through the Internet and retail travel agencies. During the current year the number of holidays sold by travel agencies declined dramatically and the directors decided at a board meeting on 15 October 2012 to cease marketing holidays through its chain of travel agents and sell off the related high-street premises. Immediately after the meeting the travel agencies’ staff and suppliers were notified of the situation and an announcement was made in the press. The directors wish to show the travel agencies’ results as a discontinued operation in the financial statements to 31 October 2012. Due to the declining business of the travel agents, on 1 August 2012 (three months before the year end) Partway © Emile Woolf Publishing Limited 71 Paper F7: Financial Reporting (International) expanded its Internet operations to offer car hire facilities to purchasers of its Internet holidays. The following are Partway’s summarised income statement results – years ended: 31 October 2012 31 October 2011 travel Internet car hire total total agencies $’000 $’000 $’000 $’000 $’000 Revenue 23,000 14,000 2,000 39,000 40,000 Cost of sales (18,000) (16,500) (1,500) (36,000) (32,000) ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ Gross profit/(loss) 5,000 (2,500) 500 3,000 8,000 (1,500) (100) (2,600) (2,000) Operating expenses (1,000) ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ Profit/(loss) before tax 4,000 (4,000) 400 400 6,000 ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ ⎯⎯⎯⎯ The results for the travel agencies for the year ended 31 October 2011 were: revenue $18 million, cost of sales $15 million and operating expenses of $1·5 million. Required: (ii) Discuss whether the directors’ wish to show the travel agencies’ results as a (4 marks) discontinued operation is justifiable. (iii) Assuming the closure of the travel agencies is a discontinued operation, prepare the (summarised) income statement of Partway for the year ended 31 October 2012 together with its comparatives. Note: Partway discloses the analysis of its discontinued operations on the face of its income statement. (6 marks) (b) (i) Describe the circumstances in which an entity may change its accounting policies and how a change should be applied. (5 marks) The terms under which Partway sells its holidays are that a 10% deposit is required on booking and the balance of the holiday must be paid six weeks before the travel date. In previous years Partway has recognised revenue (and profit) from the sale of its holidays at the date the holiday is actually taken. From the beginning of November 2011, Partway has made it a condition of booking that all customers must have holiday cancellation insurance and as a result it is unlikely that the outstanding balance of any holidays will be unpaid due to cancellation. In preparing its financial statements to 31 October 2012, the directors are proposing to change to recognising revenue (and related estimated costs) at the date when a booking is made. The directors also feel that this change will help to negate the adverse effect of comparison with last year’s results (year ended 31 October 2011) which were better than the current year’s. Required: (ii) Comment on whether Partway’s proposal to change the timing of its recognition of its revenue is acceptable and whether this would be a change of accounting policy. (6 marks) (Total: 25 marks) 72 © Emile Woolf Publishing Limited Section 1: Practice questions 51 Pingway Pingway issued a $10 million 3% convertible loan note at par on 1 April 2011 with interest payable annually in arrears. Three years later, on 31 March 2015, the loan note is convertible into equity shares on the basis of $100 of loan note for 25 equity shares or it may be redeemed at par in cash at the option of the loan note holder. One of the company’s financial assistants observed that the use of a convertible loan note was preferable to a non-convertible loan note as the latter would have required an interest rate of 8% in order to make it attractive to investors. The assistant has also commented that the use of a convertible loan note will improve the profit as a result of lower interest costs and, as it is likely that the loan note holders will choose the equity option, the loan note can be classified as equity which will improve the company’s high gearing position. The present value of $1 receivable at the end of the year, based on discount rates of 3% and 8% can be taken as: End of year 1 2 3 3% $ 0·97 0·94 0·92 8% $ 0·93 0·86 0·79 Required: Comment on the financial assistant’s observations and show how the convertible loan note should be accounted for in Pingway’s income statement for the year ended 31 March 2012 and statement of financial position as at that date. (Total: 10 marks) 52 Dearing On 1 October 2009 Dearing acquired a machine under the following terms: Hours Manufacturer’s base price Trade discount (applying to base price only) Early settlement discount taken (on the payable amount of the base cost only) Freight charges Electrical installation cost Staff training in use of machine Pre-production testing Purchase of a three-year maintenance contract Estimated residual value Estimated life in machine hours Hours used – year ended 30 September 2010 – year ended 30 September 2011 – year ended 30 September 2012 (see below) $ 1,050,000 20% 5% 30,000 28,000 40,000 22,000 60,000 20,000 6,000 1,200 1,800 850 On 1 October 2011 Dearing decided to upgrade the machine by adding new components at a cost of $200,000. This upgrade led to a reduction in the production time per unit of the goods being manufactured using the machine. The upgrade also increased the estimated remaining life of the machine at 1 October 2011 to 4,500 machine hours and its estimated residual value was revised to $40,000. © Emile Woolf Publishing Limited 73 Paper F7: Financial Reporting (International) Required: Prepare extracts from the income statement and statement of financial position for the above machine for each of the three years to 30 September 2012. (Total: 10 marks) 53 Waxwork (IAS 10) (a) The objective of IAS 10 Events after the Reporting Period is to prescribe the treatment of events that occur after an entity’s reporting period has ended. Required: Define the period to which IAS 10 relates and distinguish between adjusting and (5 marks) non-adjusting events. (b) Waxwork’s current year end is 31 March 2012. Its financial statements were authorised for issue by its directors on 6 May 2012 and the AGM (annual general meeting) will be held on 3 June 2012. The following matters have been brought to your attention: (i) On 12 April 2012 a fire completely destroyed the company’s largest warehouse and the inventory it contained. The carrying amounts of the warehouse and the inventory were $10 million and $6 million respectively. It appears that the company has not updated the value of its insurance cover and only expects to be able to recover a maximum of $9 million from its insurers. Waxwork’s trading operations have been severely disrupted since the fire and it expects large trading losses for some time to come. (4 marks) (ii) A single class of inventory held at another warehouse was valued at its cost of $460,000 at 31 March 2012. In April 2012 70% of this inventory was sold for $280,000 on which Waxworks’ sales staff earned a commission of 15% of the selling price. (3 marks) (iii) On 18 May 2012 the government announced tax changes which have the effect of increasing Waxwork’s deferred tax liability by $650,000 as at 31 March 2012. (3 marks) Required: Explain the required treatment of the items (i) to (iii) by Waxwork in its financial statements for the year ended 31 March 2012. Note: assume all items are material and are independent of each other. (10 marks as indicated) (Total: 15 marks) 54 Flightline Flightline is an airline which treats its aircraft as complex non-current assets. The cost and other details of one of its aircraft are: $’000 estimated life Exterior structure – purchase date 1 April 1998 120,000 20 years Interior cabin fittings – replaced 1 April 2008 25,000 5 years Engines (2 at $9 million each) – replaced 1 April 2008 18,000 36,000 flying hours No residual values are attributed to any of the component parts. 74 © Emile Woolf Publishing Limited Section 1: Practice questions At 1 April 2011 the aircraft log showed it had flown 10,800 hours since 1 April 2008. In the year ended 31 March 2012, the aircraft flew for 1,200 hours for the six months to 30 September 2011 and a further 1,000 hours in the six months to 31 March 2012. On 1 October 2011 the aircraft suffered a ‘bird strike’ accident which damaged one of the engines beyond repair. This was replaced by a new engine with a life of 36,000 hours at cost of $10·8 million. The other engine was also damaged, but was repaired at a cost of $3 million; however, its remaining estimated life was shortened to 15,000 hours. The accident also caused cosmetic damage to the exterior of the aircraft which required repainting at a cost of $2 million. As the aircraft was out of service for some weeks due to the accident, Flightline took the opportunity to upgrade its cabin facilities at a cost of $4·5 million. This did not increase the estimated remaining life of the cabin fittings, but the improved facilities enabled Flightline to substantially increase the air fares on this aircraft. Required: Calculate the charges to the income statement in respect of the aircraft for the year ended 31 March 2012 and its carrying amount in the statement of financial position as at that date. Note: the post accident changes are deemed effective from 1 October 2011. (Total: 10 marks) 55 Darby (a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as ‘a physical asset of substantial cost, owned by the company, which will last longer than one year’. Required: Provide an explanation to your assistant of the weaknesses in his definition of non-current assets when compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks) (b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 2011. He has given an explanation of his treatment of them. (i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks) (ii) During the year the company started research work with a view to the eventual development of a new processor chip. By 30 September 2011 it had spent $1·6 million on this project. Darby has a past history of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the assistant has treated the expenditure to date on this project as an asset in the statement of financial position. Darby was also commissioned by a customer to research and, if feasible, produce a computer system to install in motor vehicles that can © Emile Woolf Publishing Limited 75 Paper F7: Financial Reporting (International) automatically stop the vehicle if it is about to be involved in a collision. At 30 September 2011, Darby had spent $2·4 million on this project, but at this date it was uncertain as to whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an expense in the income statement. (4 marks) (iii) Darby signed a contract (for an initial three years) in August 2011 with a company called Media Today to install a satellite dish and cabling system to a newly built group of residential apartments. Media Today will provide telephone and television services to the residents of the apartments via the satellite system and pay Darby $50,000 per annum commencing in December 2011. Work on the installation commenced on 1 September 2011 and the expenditure to 30 September 2011 was $58,000. The installation is expected to be completed by 31 October 2011. Previous experience with similar contracts indicates that Darby will make a total profit of $40,000 over the three years on this initial contract. The assistant correctly recorded the costs to 30 September 2011 of $58,000 as a non-current asset, but then wrote this amount down to $40,000 (the expected total profit) because he believed the asset to be impaired. The contract is not a finance lease. Ignore discounting. (4 marks) Required: For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial statements for the year ended 30 September 2011 and advise him how they should be treated under International Financial Reporting Standards. Note: the mark allocation is shown against each of the three items above. (Total: 15 marks) 56 Barstead (a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for the year ended 30 September 2012: increase in profit after taxation increase in (basic) earnings per share increase in diluted earnings per share Required: 80% 5% 2% Explain why the three measures of earnings (profit) growth for the same company over the same period can give apparently differing impressions. (4 marks) (b) The profit after tax for Barstead for the year ended 30 September 2012 was $15 million. At 1 October 2011 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2012 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2012 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2011 was 35 cents. Barstead’s income tax rate is 25%. 76 © Emile Woolf Publishing Limited Section 1: Practice questions Required: Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2012. (6 marks) (Total: 10 marks) 57 Apex (a) Apex is a publicly listed supermarket chain. During the current year it started the building of a new store. The directors are aware that in accordance with IAS 23 Borrowing costs certain borrowing costs have to be capitalised. Required: Explain the circumstances when, and the amount at which, borrowing costs should be capitalised in accordance with IAS 23. (5 marks) (b) Details relating to construction of Apex’s new store: Apex issued a $10 million unsecured loan with a coupon (nominal) interest rate of 6% on 1 April 2009. The loan is redeemable at a premium which means the loan has an effective finance cost of 7·5% per annum. The loan was specifically issued to finance the building of the new store which meets the definition of a qualifying asset in IAS 23. Construction of the store commenced on 1 May 2009 and it was completed and ready for use on 28 February 2010, but did not open for trading until 1 April 2010. During the year trading at Apex’s other stores was below expectations so Apex suspended the construction of the new store for a two-month period during July and August 2009. The proceeds of the loan were temporarily invested for the month of April 2009 and earned interest of $40,000. Required: Calculate the net borrowing cost that should be capitalised as part of the cost of the new store and the finance cost that should be reported in the income statement for the year ended 31 March 2010. (5 marks) (Total: 10 marks) 58 Tunshill (a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors contains guidance on the use of accounting policies and accounting estimates. Required: Explain the basis on which the management of an entity must select its accounting policies and distinguish, with an example, between changes in accounting policies and changes in accounting estimates. (5 marks) (b) The directors of Tunshill are disappointed by the draft profit for the year ended 30 September 2010. The company’s assistant accountant has suggested two areas where she believes the reported profit may be improved: (i) A major item of plant that cost $20 million to purchase and install on 1 October 2007 is being depreciated on a straight-line basis over a five-year period (assuming no residual value). The plant is wearing well and at the beginning of the current year (1 October 2009) the production manager believed that the plant was likely to last eight years in total (i.e. from the date of its purchase). The assistant accountant has calculated that, based on © Emile Woolf Publishing Limited 77 Paper F7: Financial Reporting (International) an eight-year life (and no residual value) the accumulated depreciation of the plant at 30 September 2010 would be $7·5 million ($20 million/8 years x 3). In the financial statements for the year ended 30 September 2009, the accumulated depreciation was $8 million ($20 million/5 years x 2). Therefore, by adopting an eight-year life, Tunshill can avoid a depreciation charge in the current year and instead credit $0·5 million ($8 million – $7·5 million) to the income statement in the current year to improve the reported profit. (5 marks) (ii) Most of Tunshill’s competitors value their inventory using the average cost (AVCO) basis, whereas Tunshill uses the first in first out (FIFO) basis. The value of Tunshill’s inventory at 30 September 2010 (on the FIFO basis) is $20 million, however on the AVCO basis it would be valued at $18 million. By adopting the same method (AVCO) as its competitors, the assistant accountant says the company would improve its profit for the year ended 30 September 2010 by $2 million. Tunshill’s inventory at 30 September 2009 was reported as $15 million, however on the AVCO basis it would have been reported as $13·4 million. (5 marks) Required: Comment on the acceptability of the assistant accountant’s suggestions and quantify how they would affect the financial statements if they were implemented under IFRS. Ignore taxation. Note: the mark allocation is shown against each of the two items above. (15 marks) 59 Manco Manco has been experiencing substantial losses at its furniture making operation which is treated as a separate operating segment. The company’s year end is 30 September. At a meeting on 1 July 2010 the directors decided to close down the furniture making operation on 31 January 2011 and then dispose of its non-current assets on a piecemeal basis. Affected employees and customers were informed of the decision and a press announcement was made immediately after the meeting. The directors have obtained the following information in relation to the closure of the operation: (i) On 1 July 2010, the factory had a carrying amount of $3·6 million and is expected to be sold for net proceeds of $5 million. On the same date the plant had a carrying amount of $2·8 million, but it is anticipated that it will only realise net proceeds of $500,000. (ii) Of the employees affected by the closure, the majority will be made redundant at cost of $750,000, the remainder will be retrained at a cost of $200,000 and given work in one of the company’s other operations. (iii) Trading losses from 1 July to 30 September 2010 are expected to be $600,000 and from this date to the closure on 31 January 2011 a further $1 million of trading losses are expected. Required: Explain how the decision to close the furniture making operation should be treated in Manco’s financial statements for the years ending 30 September 2010 and 2011. Your answer should quantify the amounts involved. (10 marks) 78 © Emile Woolf Publishing Limited Section 1: Practice questions Business combinations – Statements of financial position 60 Hydrox Hydrox acquired 90% of Syntax’s equity shares on 1 April 2010 for $30 million when Syntax’s retained earnings were $15 million. The statements of financial position of the two companies at 31 March 2012 are shown below: Statement of financial position Hydrox $000 $000 Non-current assets: Property, plant and equipment at depreciated historic cost Investment in Syntax Other quoted investments at cost Current assets: Inventory Accounts receivable Bank Non-current liabilities: 12% Debenture Bank loan Current liabilities: Accounts payable Provision for taxation Dividends payable (announced before the year end) Overdraft 26,400 16,200 30,000 1,000 57,400 6,000 22,200 9,500 7,200 300 Total assets: Equity and liabilities Share capital and reserves: Equity shares of $1 each Reserves: Retained earnings Syntax $000 $000 4,000 1,500 nil 17,000 74,400 5,500 27,700 10,000 5,000 48,600 58,600 6,300 11,300 4,000 6,000 6,700 4,100 1,000 5,200 700 nil nil 4,500 11,800 74,400 Total equity and liabilities: 10,400 27,700 The following information is relevant: (i) The movements on the retained earnings of Syntax since the date of acquisition have been: Balance at acquisition, 1 April 2010 Year to 31 March 2011 Year to 31 March 2012 © Emile Woolf Publishing Limited Loss after tax $000 Dividends paid $000 (3,000) (1,700) nil (4,000) $000 15,000 (3,000) (5,700) ―――― 6,300 ―――― 79 Paper F7: Financial Reporting (International) Hydrox accounted for its share of Syntax’s dividend as a credit to its income statement. The group policy is that only dividends paid out of post-acquisition profits are credited to income. (ii) At the date of acquisition the fair values of Syntax’s net assets were approximately equal to their book values with the exception of two items. Specialised plant of Syntax had a net replacement cost of $6 million in excess of its book value; it had an estimated remaining life of five years. The stock market value of Syntax’s investments was $8 million There have been no acquisitions or disposals of non-current assets since the date of acquisition. (iii) An impairment test at 31 March 2012 on the consolidated goodwill concluded that it should be written down by $400,000. No other assets were impaired. (iv) Three days before the current year-end Hydrox processed the accounting entries in respect of a credit sale of goods to Syntax at a selling price of $600,000. Hydrox charges a standard mark-up on cost of 20% on all its sales. Syntax had not received the goods and had therefore not included them in inventories, nor had it received the invoice for them by the year-end. The agreed balance on Syntax’s purchase ledger account with Hydrox prior to this transaction was $1.4 million. Required: Prepare the consolidated statement of financial position of Hydrox as at 31 March 2012. (Total: 25 marks) 61 Hedra Hedra, a public listed company, acquired the following investments: (i) On 1 October 2011, 72 million shares in Salvador for an immediate cash payment of $195 million. Hedra agreed to pay further consideration on 30 September 2012 of $49 million if the post-acquisition profits of Salvador exceeded an agreed figure at that date. Hedra has not accounted for this deferred payment as it did not believe it would be payable, however Salvador’s profits have now exceeded the agreed amount (ignore discounting). Salvador also accepted a $50 million 8% loan from Hedra at the date of its acquisition. (ii) On 1 April 2012, 40 million shares in Aragon by way of a share exchange of two shares in Hedra for each acquired share in Aragon. The stock market value of Hedra’s shares at the date of this share exchange was $2.50. Hedra has not yet recorded the acquisition of the investment in Aragon. The summarised statements of financial position of the three companies as at 30 September 2012 are: Statement of financial position Hedra $m $m Non-current assets Property, plant and equipment Investments – in Salvador – other Current assets Inventories 80 Salvador $m $m 358 245 45 648 130 Aragon $m $m 240 nil nil 240 80 270 nil nil 270 110 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position Trade receivables Cash and bank Total assets Equity and liabilities Ordinary share capital ($1each) Reserves Share premium Revaluation Retained earnings Hedra Salvador Aragon $m $m $m $m $m $m 142 97 70 nil 4 20 272 181 200 920 421 470 400 40 15 240 120 50 nil 60 295 695 Non-current liabilities 8% loan note Deferred tax Total equity and liabilities nil nil 300 110 230 300 400 50 nil 50 nil nil 45 45 Current liabilities Trade payables Bank overdraft Current tax payable 100 118 12 50 141 nil nil 180 920 40 nil 30 141 421 70 470 The following information is relevant: (a) (b) Fair value adjustments and revaluations: (i) Hedra’s accounting policy for land and buildings is that they should be carried at their fair values. The fair value of Salvador’s land at the date of acquisition was $20 million in excess of its carrying value. By 30 September 2012 this excess had increased by a further $5 million. Salvador’s buildings did not require any fair value adjustments. The fair value of Hedra’s own land and buildings at 30 September 2012 was $12 million in excess of its carrying value in the above statement of financial position. (ii) The fair value of some of Salvador’s plant at the date of acquisition was $20 million in excess of its carrying value and had a remaining life of four years (straight-line depreciation is used). (iii) At the date of acquisition Salvador had unrelieved tax losses of $40 million from previous years. Salvador had not accounted for these as a deferred tax asset as its directors did not believe the company would be sufficiently profitable in the near future. However, the directors of Hedra were confident that these losses would be utilised and accordingly they should be recognised as a deferred tax asset. By 30 September 2012 the group had not yet utilised any of these losses. The income tax rate is 25%. The retained earnings of Salvador and Aragon at 1 October 2011, as reported in their separate financial statements, were $20 million and $200 million respectively. All profits are deemed to accrue evenly throughout the year. © Emile Woolf Publishing Limited 81 Paper F7: Financial Reporting (International) (c) An impairment test on 30 September 2012 showed that consolidated goodwill should be written down by $20 million. Hedra has applied IFRS 3 Business Combinations since the acquisition of Salvador. (d) The investment in Aragon has not suffered any impairment. Required: Prepare the consolidated statement of financial position of Hedra as at 30 September 2012. (Total: 25 marks) 62 Harden Harden acquired 800,000 of Solder’s $1 equity shares on 1 October 2010 for $2.5million. One year later, on 1 October 2011, Harden acquired 200,000 $1 equity shares in Active for $800,000. The statements of financial position of the three companies at 30 September 2012 are shown below: Non-current assets Property, plant and equipment Patents Investments – in Solder – in Active – in others Current assets Inventories Trade receivables Bank Harden $000 $000 Solder $000 $000 Active $000 $000 3,980 2,300 1,340 250 420 nil 3,450 7,680 200 2,920 60 1,400 2,500 800 150 570 420 nil Total assets Equity and liabilities Capital and reserves: Equity shares of $1 each Reserves: Share premium Retained earnings Total equity and liabilities 82 300 400 120 990 8,670 930 3,850 820 2,220 2,000 1,000 500 1,000 4,500 Non-current liabilities Deferred tax Current liabilities Trade payables Taxation Overdraft 400 380 150 500 1,900 100 1,200 5,500 7,500 2,400 3,400 1,300 1,800 200 nil 80 750 140 80 450 nil nil 970 8,670 280 60 nil 450 3,850 340 2,220 © Emile Woolf Publishing Limited Section 1: Practice questions The following information is relevant: (i) The balances of the retained earnings of the three companies were: Harden Solder Active $000 $000 $000 at 1 October 2010 2,000 1,200 500 at 1 October 2011 3,000 1,500 800 (ii) At the date of its acquisition the fair values of Solder’s net assets were equal to their book values with the exception of a plot of land that had a fair value of $200,000 in excess of its book value. (iii) On 26 September 2012 Harden processed an invoice for $50,000 in respect of an agreed allocation of central overhead expenses to Solder. At 30 September 2012 Solder had not accounted for this transaction. Prior to this the current accounts between the two companies had been agreed at Solder owing $70,000 to Harden (included in trade receivables and trade payables respectively). (iv) During the year Active sold goods to Harden at a selling price of $140,000 which gave Active a profit of 40% on cost. Harden had half of these goods in inventory at 30 September 2012. (v) An impairment test at 31 March 2012 on the consolidated goodwill concluded that there was no write down necessary. No other assets were impaired. Required: (a) Prepare the consolidated statement of financial position of Harden as at 30 September 2012. (20 marks) (b) At the beginning of the following year, on 1 October 2012, the shareholders of Deployed accepted a bid from Harden to purchase the whole of its equity share capital. Harden is currently considering whether and at what value certain of Deployed’s assets and liabilities should be recognised in the consolidated financial statements. The details are: (i) Deployed has made an accounting and taxable loss of $200,000 in the year to 30 September 2012. This loss will be allowable for tax purposes for relief against any future trading profit that Deployed may make. Deployed has not recognised the loss as a deferred tax asset because the directors are not confident that the company will make sufficient profits in the near future to absorb the loss. The directors of Harden are firmly of the opinion that the profitability of the group is such that Deployed’s tax losses can be utilised on a group basis. Assume a tax rate of 30%. (ii) Deployed is in dispute over an insurance claim relating to one of its buildings that has been damaged in a fire. The insurance company is disputing the claim on the basis that the use of the building was not properly disclosed when it was insured. A copy of the insurance proposal form has been obtained and sent to Deployed’s lawyers. The lawyers have said that in their opinion the use of the building was adequately disclosed and in any event its use was not the cause of the fire and therefore they believe the claim is valid. The cost of the damage caused by the fire has been provided for, but as the claim is a contingent asset, the directors of Deployed have not recognised it in the financial statements. © Emile Woolf Publishing Limited 83 Paper F7: Financial Reporting (International) Required: Discuss how the directors of Harden should treat the above items when preparing consolidated financial statements to reflect the acquisition of Deployed. (5 marks) (Total: 25 marks) 63 Halogen On 1 April 2011 Halogen acquired a controlling interest of 75% of Stimulus, a previously wholly owned subsidiary of Exowner. At this date Halogen issued one new ordinary share valued at $5 and paid $1.40 in cash, for every two shares it acquired in Stimulus. The reserves of Stimulus at the time of the date of the acquisition were: Retained earnings $180 million Revaluation reserve $40 million The statements of financial position of Halogen and Stimulus at 31 March 2012 are: Halogen $m $m Assets Non-current assets Property, plant and equipment Development expenditure Investments (including that in Stimulus) Current assets Inventory Trade receivables Bank 910 100 700 1,710 224 264 nil Total assets Equity and liabilities Equity: Equity shares of $1 each Reserves: Share premium Retained earnings Revaluation reserve Non-current liabilities 10% Debenture Current liabilities Trade payables Taxation Bank overdraft Total equity and liabilities 84 Stimulus $m $m 330 nil 60 390 120 84 25 488 2,198 229 619 1,000 200 300 530 60 nil 260 40 890 1,890 300 500 nil 60 128 94 86 24 35 nil 308 2,198 59 59 619 © Emile Woolf Publishing Limited Section 1: Practice questions The following information is relevant: (i) At the date of acquisition the statement of financial position of Stimulus included an intangible non-current asset of $8 million in respect of the development of a new medical drug. On this date an independent specialist assessed the fair value of this intangible asset at $28 million. Halogen had been developing a similar drug and shortly after the acquisition it was decided to combine the two development projects. All information and development work on Stimulus’s project was transferred to Halogen in return for a payment of $36 million. The carrying value of Stimulus’s development expenditure at the date of transfer was still $8 million. Stimulus has taken the profit on this transaction to its income statement. Approval to market the drug is expected in September 2012. (ii) Both companies have a policy of keeping their land (included in property, plant and equipment) at current value. The balances on the revaluation reserves represent the revaluation surpluses at 1 April 2011. Neither company has yet recorded further increases of $10 million and $8 million for Halogen and Stimulus respectively for the year to 31 March 2012. (iii) During the year to 31 March 2012 Halogen sold goods at a price of $26 million to Stimulus at a mark-up on cost of 30%. Half of these goods were still in inventory at the year-end. (iv) On 28 March 2012 Stimulus recorded a payment of $12 million to settle its current account balance with Halogen. Halogen had not received this by the year-end. Inter company current account balances are included in trade payables/receivables as appropriate. (v) An impairment test at 31 March 2012 on the consolidated goodwill concluded that it should be written down by $30,000. No other assets were impaired. Required: (a) Prepare the consolidated statement of financial position of Halogen as at 31 March 2012. (20 marks) (b) Included within the investments of Halogen is an investment in a wholly owned private limited company called Lockstart. Prior to the current year Halogen has consolidated the results of Lockstart. In recent years the profits of Lockstart have been declining and in the year to 31 March 2012 it made significant losses. In January of 2012 the management of Halogen held a Board meeting where it was decided that the investment in Lockstart would be sold as soon as possible. No buyer had been found by 31 March 2012. The directors of Halogen are aware that shareholders often use a company’s published financial statements to predict future performance, and this is one of the reasons why IFRS 5 Non-current Assets Held for Sale and Discontinued Operations requires the results of discontinued operations to be separately identified. Shareholders are thus made aware of those parts of the business that will not contribute to future profits or losses. In the spirit of the above, the management of Halogen have decided not to consolidate the results of Lockstart for the current year (to 31 March 2012), believing that if they were consolidated, it would give a misleading basis for predicting the group’s future performance. © Emile Woolf Publishing Limited 85 Paper F7: Financial Reporting (International) Required: Comment on the suitability of the Directors’ treatment of Lockstart; and state how you believe Lockstart should be treated in the group financial statements of Halogen. (5 marks) Note: You are not required to amend your answer to (a) in respect of this information. (Total: 25 marks) 64 Horsefield Horsefield, a public company, acquired 90% of Sandfly’s $1 ordinary shares on 1 April 2010 paying $3.00 per share. The balance on Sandfly’s retained earnings at this date was $800,000. On 1 October 2011, Horsefield acquired 30% of Anthill’s $1 ordinary shares for $3.50 per share. The statements of financial position of the three companies at 31 March 2012 are shown below: Horsefield $000 $000 Non-current assets Property, plant and equipment Investments Current assets Inventory Accounts receivable Bank Equity and liabilities Equity: Ordinary shares of $1 each Reserves: Retained earnings b/f Profit year to 31 March 2012 Non-current liabilities 10% Loan notes Current liabilities Accounts payable Taxation Overdraft Total equity and liabilities 86 Sandfly $000 $000 Anthill $000 8,050 3,600 1,650 4,000 12,050 910 4,510 nil 1,650 830 520 240 Total assets $000 340 290 nil 250 350 100 1,590 13,640 630 5,140 700 2,350 5,000 1,200 600 6,000 1,500 1,400 900 800 600 7,500 12,500 2,300 3,500 1,400 2,000 500 240 nil 420 220 nil 960 250 190 640 13,640 200 150 nil 1,400 5,140 350 2,350 © Emile Woolf Publishing Limited Section 1: Practice questions The following information is relevant: (i) Fair value adjustments: On 1 April 2010 Sandfly owned an investment property that had a fair value of $120,000 in excess of its carrying value (book value). The value of this property has not changed since acquisition. This property is included within investments in the balance sheet. Just prior to its acquisition, Sandfly was successful in applying for a six-year licence to dispose of hazardous waste. The licence was granted by the government at no cost, however Horsefield estimated that the licence was worth $180,000 at the date of acquisition. (ii) In January 2012 Horsefield sold goods to Anthill for $65,000. These were transferred at a mark up of 30% on cost. Two thirds of these goods were still in the inventory of Anthill at 31 March 2012. (iii) To facilitate the consolidation procedures the group insists that all inter company current account balances are settled prior to the year-end. However a cheque for $40,000 from Sandfly to Horsefield was not received until early April 2012. Inter company balances are included in accounts receivable and payable as appropriate. (iv) Anthill is to be treated as an associated company of Horsefield. (v) An impairment test at 31 March 2012 on the consolidated goodwill of Sandfly and Anthill concluded that it should be written down by $468,000 and $12,000 respectively. No other assets were impaired. Required: (a) (b) Prepare the consolidated statement of financial position of Horsefield as at 31 (20 marks) March 2012. Discuss the matters to consider in determining whether an investment in another company constitutes associated company status. (5 marks) (Total: 25 marks) 65 Highmoor Highmoor, a public listed company, acquired 80% of Slowmoor’s ordinary shares on 1 October 2011. Highmoor paid an immediate $2 per share in cash and agreed to pay a further $1.20 per share if Slowmoor made a profit within two years of its acquisition. Highmoor has not recorded the contingent consideration. The statements of financial position of the two companies at 30 September 2012 are shown below: Tangible non-current assets Investments (note (ii)) Software (note (iii)) Current assets Inventory Accounts receivable Tax asset 1 © Emile Woolf Publishing Limited Highmoor $ million $ million 585 225 nil ―――― 810 85 95 nil Slowmoor $ million $ million 172 13 40 ―――― 225 42 36 80 87 Paper F7: Financial Reporting (International) Bank Total assets Equity and liabilities Equity: Ordinary shares of $1 each Retained earnings – 1 October 2011 – profit/loss for year Non-current liabilities 12% loan note 8% Inter company loan (note (ii)) Current liabilities Accounts payable Taxation Overdraft Highmoor Slowmoor $ million $ million $ million $ million 20, nil ―――― ―――― 200 158 ―――― ―――― 1,010 383 ―――― ―――― 400 230 100 ―――― nil nil ―――― 210 70 nil ―――― Total equity and liabilities The following information is relevant: 330 ―――― 730 nil 280 ―――― 1,010 ―――― 100 150 (35) ―――― 135 45 ―――― 71 nil 17 ―――― 115 ―――― 215 80 88 ―――― 383 ―――― (i) At the date of acquisition the fair values of Slowmoor’s net assets were approximately equal to their carrying values (book values). (ii) Included in Highmoor’s investments is a loan of $50 million made to Slowmoor. On 28 September 2012, Slowmoor paid $9 million to Highmoor. This represented interest of $4 million for the year and the balance was a capital repayment. Highmoor had not received nor accounted for the payment, but it had accrued for the loan interest receivable as part of its accounts receivable figure. There are no other intra group balances. (iii) The software was developed by Highmoor during 2011 at a total cost of $30 million. It was sold to Slowmoor for $50 million immediately after its acquisition. The software had an estimated life of five years and is being amortised by Slowmoor on a straight-line basis. (iv) Due to the losses of Slowmoor since its acquisition, the directors of Highmoor are not confident it will return to profitability in the short term. (v) It is the accounting policy of Highmoor that the non-controlling interests in its subsidiary should be valued at a proportionate share of net assets. Required: (a) Prepare the consolidated statement of financial position of Highmoor as at 30 September 2012, explaining your treatment of the contingent consideration. (20 marks) 88 © Emile Woolf Publishing Limited Section 1: Practice questions (b) Describe the circumstances in which negative goodwill may arise. Your answer should refer to the particular issues of the above acquisition. (5 marks) (Total: 25 marks) 66 Hapsburg (a) Hapsburg, a public listed company, acquired the following investments: On 1 April 2011, 24 million shares in Sundial. This was by way of an immediate share exchange of two shares in Hapsburg for every three shares in Sundial plus a cash payment of $1 per Sundial share payable on 1 April 2014. The market price of Hapsburg’s shares on 1 April 2011 was $2 each. On 1 October 2011, 6 million shares in Aspen paying an immediate $2.50 in cash for each share. Based on Hapsburg’s cost of capital (taken as 10% per annum), $1 receivable in three years’ time can be taken to have a present value of $0.75. Hapsburg has not yet recorded the acquisition of Sundial but it has recorded the investment in Aspen. The summarised statements of financial position at 31 March 2012 are: Hapsburg $000 $000 Sundial $000 $000 Aspen $000 $000 41,000 15,000 56,000 34,800 3,000 37,800 37,700 nil 37,700 Non-current assets Property, plant and equipment Investments Current assets Inventory Trade and other receivables Cash Total assets Equity and liabilities Capital and reserves Ordinary shares $1 each Reserves: Share premium Retained earnings Non-current liabilities 10% loan note Current liabilities Trade and other payables Bank overdraft Taxation Total equity and liabilities © Emile Woolf Publishing Limited 9,900 13,600 1,200 4,800 8,600 3,800 7,900 14,400 nil 24,700 80,700 17,200 55,000 22,300 60,000 20,000 30,000 20,000 8,000 10,600 2,000 8,500 nil 8,000 18,600 38,600 10,500 40,500 8,000 28,000 16,000 4,200 12,000 16,500 nil 9,600 6,900 nil 3,400 26,100 80,700 13,600 4,500 1,900 10,300 55,000 20,000 60,000 89 Paper F7: Financial Reporting (International) The following information is relevant: (i) Below is a summary of the results of a fair value exercise for Sundial carried out at the date of acquisition: Asset Plant Carrying value at acquisition Fair value at Notes acquisition $000 $000 10,000 15,000 remaining life at acquisition = four years no change in value since acquisition The carrying values (book values) of the net assets of Aspen at the date of acquisition were considered to be a reasonable approximation to their fair values. Investments 3,000 4,500 (ii) The profits of Sundial and Aspen for the year to 31 March 2012, as reported in their entity financial statements, were $4.5 million and $6 million respectively. No dividends have been paid by any of the companies during the year. All profits are deemed to accrue evenly throughout the year. (iii) In January 2012 Aspen sold goods to Hapsburg at a selling price of $4 million. These goods had cost Aspen $2.4 million. Hapsburg had $2.5 million (at cost to Hapsburg) of these goods still in inventory at 31 March 2012. (iv) All depreciation is charged on a straight-line basis. (v) It is the accounting policy of Hapsburg that the non-controlling interests in its subsidiary should be valued at a proportionate share of net assets. (vi) An impairment test at 31 March 2012 on the consolidated goodwill for Sundial and Aspen concluded that it should be written down by $3,200,000 and $750,000 and treated as an operating expense. No other assets were impaired. Required: Prepare the consolidated statement of financial position of Hapsburg as at 31 March 2012. (20 marks) (b) Some commentators have criticised the use of equity accounting on the basis that it can be used as a form of ‘off balance sheet’ financing. Required: Explain the reasoning behind the use of equity accounting and discuss the above (5 marks) comment. (Total: 25 marks) 67 Highveldt Assume that ‘now’ is June 2012 Highveldt, a public listed company, acquired 75% of Samson’s ordinary shares on 1 April 2011. Highveldt paid an immediate $3.50 per share in cash and agreed to pay a further amount of $108 million on 1 April 2012. Highveldt’s cost of capital is 8% per annum. Highveldt has only recorded the cash consideration of $3.50 per share. 90 © Emile Woolf Publishing Limited Section 1: Practice questions The summarised statements of financial position of the two companies at 31 March 2012 are shown below: Highveldt $m Tangible non-current assets (note (i)) Samson $m $m $m 420 320 nil 40 300 20 720 380 Current assets 133 91 Total assets 853 471 270 80 Share premium 80 40 Revaluation reserve 45 nil Development costs (note (iv)) Investments (note (ii)) Equity and liabilities Ordinary share capital ($1each) Reserves Retained earnings: 1 April 2011 - Year to 31 March 2012 160 134 190 76 350 210 745 330 nil 60 Current liabilities 108 81 Total equity and liabilities 853 471 Non-current liabilities 10% inter company loan (note (ii)) The following information is relevant: (i) Highveldt has a policy of revaluing land and buildings to fair value. At the date of acquisition Samson’s land and buildings had a fair value $20 million higher than their carrying value (book value) and at 31 March 2012 this had increased by a further $4 million (ignore any additional depreciation). (ii) Included in Highveldt’s investments is a loan of $60 million made to Samson at the date of acquisition. Interest is payable annually in arrears. Samson paid the interest due for the year on 31 March 2012, but Highveldt did not receive this until after the year end. Highveldt has not accounted for the accrued interest from Samson. (iii) Samson had established a line of products under the brand name of Titanware. Acting on behalf of Highveldt, a firm of specialists, had valued the brand name at a value of $40 million with an estimated life of 10 years as at 1 April 2011. The brand is not included in Samson’s statement of financial position. (iv) Samson’s development project was completed on 30 September 2011 at a cost of $50 million. $10 million of this had been amortised by 31 March 2012. Development costs capitalised by Samson at the date of acquisition were $18 million. Highveldt’s directors are of the opinion that Samson’s development costs do not meet the criteria in IAS 38 ‘Intangible Assets’ for recognition as an asset. © Emile Woolf Publishing Limited 91 Paper F7: Financial Reporting (International) (v) Samson sold goods to Highveldt during the year at a profit of $6 million, onethird of these goods were still in the inventory of Highveldt at 31 March 2012. (vi) It is the accounting policy of Highveldt that the non-controlling interests in its subsidiary should be valued at a proportionate share of net assets. An impairment test at 31 March 2012 on the consolidated goodwill concluded that it should be written down by $22 million. No other assets were impaired. Required: (a) Calculate the following figures as they would appear in the consolidated statement of financial position of Highveldt at 31 March 2012: (i) goodwill (8 marks) (ii) non-controlling interest (4 marks) (iii) the following consolidated reserves: share premium, revaluation reserve (8 marks) and retained earnings. Note: Show your workings (b) Explain why consolidated financial statements are useful to the users of financial statements (as opposed to just the parent company’s separate (entity) financial (5 marks) statements). (Total: 25 marks) 68 Hark, Spark and Ark Hark acquired the following non-current investments on 1 April 2011: (1) 4 million equity shares in Spark, by means of an exchange of one share in Handel for every one share in Spark, plus $6.05 million in cash for each Spark share acquired. The professional fees associated with the acquisition amounted to $1 million. The market price of shares in Hark at the date of the acquisition was $9 per share. The market price of Spark shares just before the acquisition was $7. The cash part of the consideration is deferred and will not be paid until two years after the acquisition. (2) 25% of the equity shares in Ark, at a cost of $6 per share. The money to make this payment was obtained by issuing one million new shares in Hark at $9 per share. None of these transactions has yet been recorded in the summary statements of financial position that are shown below. The summarised draft statements of financial position of the three companies at 31 March 2012 are as follows. Statement of financial position Assets Non-current assets Property, plant and equipment Other equity investments Current assets Total assets 92 Hark $ million 60.0 0.8 60.8 18.2 79.0 Spark $ million Ark $ million 31.0 nil 31.0 8.0 39.0 16.0 nil 16.0 9.0 25.0 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position Equity and liabilities Equity shares of $1 each Share premium Retained earnings: at 1 April 2011 - for year ended 31 March 2012 Non-current liabilities 6% loan notes 7% loan notes Current liabilities Total equity and liabilities Hark $ million Spark $ million Ark $ million 16.0 2.0 36.0 8.0 62.0 5.0 4.0 16.0 3.0 28.0 6.0 4.0 8.0 2.0 20.0 10.0 7.0 79.0 6.0 5.0 39.0 3.0 2.0 25.0 The following information is relevant: (1) Hark has chosen to value the non-controlling interest in Spark using the fair value method permitted by IFRS 3 (revised). The fair value of the non-controlling interests at the acquisition date is estimated to be the market value of the shares before the acquisition. (2) At the date of acquisition of Spark, the fair values of its assets were equal to their carrying amounts. (3) The cost of capital of Hark is 10% per year. (4) During the year ended 31 March 2012, Spark sold goods to Hark for $3.6 million, at a mark-up of 50% on cost. Hark had 75% of these goods in its inventory at 31 March 2012. (5) There were no intra-group receivables and payables at 31 March 2012. (6) On 1 April 2011, Hark sold a group of machines to Spark at their agreed fair value of $3 million. At the time of the sale, the carrying amount of the machines was $2 million. The estimated remaining useful life of the plant at the date of the sale was four years. Plant and machinery is depreciated to a residual value of nil using straight-line depreciation and at 1 April 2011 the machines had an estimated remaining life of five years. (7) “Other equity investments” are included in the summary statement of financial position of Hark at their fair value on 1April 2011. Their fair value at 31 March 2012 is $0.65 million. (8) Impairment tests were carried out on 31 March 2012. These show that there is no impairment of the value of the investment in Ark or in the consolidated goodwill. (9) No dividends were paid during the year by any of the three companies. Required Prepare the consolidated statement of financial position for Hark as at 31 March 2012. (Total: 25 marks) © Emile Woolf Publishing Limited 93 Paper F7: Financial Reporting (International) 69 Parentis Parentis, a public listed company, acquired 600 million equity shares in Offspring on 1 April 2011. The purchase consideration was made up of: a share exchange of one share in Parentis for two shares in Offspring the issue of $100 10% loan note for every 500 shares acquired; and a deferred cash payment of 11 cents per share acquired payable on 1 April 2012. Parentis has only recorded the issue of the loan notes. The value of each Parentis share at the date of acquisition was 75 cents and Parentis has a cost of capital of 10% per annum. The statements of financial position of the two companies at 31 March 2012 are shown below: Assets Property, plant and equipment (note (i)) Investments Intellectual property (note (ii)) Current assets Inventory (note (iii)) Trade receivables (note (iii)) Bank Total assets Equity and liabilities Equity shares of 25 cents each Retained earnings – 1 April 2011 – year ended 31 March 2012 Parentis $ million $ million 640 120 nil ——— 760 76 84 nil ——— Total equity and liabilities The following information is relevant: 94 160 ——— 920 ——— 340 nil 30 ——— 370 22 44 4 ——— 300 210 90 ——— Non-current liabilities 10% loan notes Current liabilities Trade payables (note (iii)) Current tax payable Overdraft Offspring $ million $ million 200 300 ——— 600 120 20 ——— 120 130 45 25 ——— 70 ——— 440 ——— 140 ——— 340 20 200 ——— 920 ——— 57 23 nil ——— 80 ——— 440 ——— (i) At the date of acquisition the fair values of Offspring’s net assets were approximately equal to their carrying amounts with the exception of its properties. These properties had a fair value of $40 million in excess of their carrying amounts which would create additional depreciation of $2 million in the post acquisition period to 31 March 2012. The fair values have not been reflected in Offspring’s statement of financial position. (ii) The intellectual property is a system of encryption designed for internet use. Offspring has been advised that government legislation (passed since © Emile Woolf Publishing Limited Section 1: Practice questions acquisition) has now made this type of encryption illegal. Offspring will receive $10 million in compensation from the government. (iii) Offspring sold Parentis goods for $15 million in the post acquisition period. $5 million of these goods are included in the inventory of Parentis at 31 March 2012. The profit made by Offspring on these sales was $6 million. Offspring’s trade payable account (in the records of Parentis) of $7 million does not agree with Parentis’s trade receivable account (in the records of Offspring) due to cash in transit of $4 million paid by Parentis. (iv) Due to the impact of the above legislation, Parentis has concluded that the consolidated goodwill has been impaired by $27 million. Required: Prepare the consolidated statement of financial position of Parentis as at 31 March (Total: 25 marks) 2012. 70 Plateau On 1 October 2011 Plateau acquired the following non-current investments: – 3 million equity shares in Savannah by an exchange of one share in Plateau for every two shares in Savannah plus $1 per acquired Savannah share in cash. The market price of each Plateau share at the date of acquisition was $6. – 30% of the equity shares of Axle at a cost of $7·50 per share in cash. Only the cash consideration of the above investments has been recorded by Plateau. The summarised draft statements of financial position of the three companies at 30 September 2012 are: Assets Non-current assets Property, plant and equipment Investments in Savannah and Axle Other equity investments Current assets Inventory Trade receivables Total assets Equity and liabilities Equity shares of $1 each Retained earnings – at 30 September 2011 – for year ended 30 September 2012 Non-current liabilities 7% Loan notes Current liabilities Total equity and liabilities © Emile Woolf Publishing Limited Plateau $’000 Savannah $’000 Axle $’000 18,400 12,000 6,500 ––––––– 36,900 10,400 nil nil ––––––– 10,400 18,000 nil nil ––––––– 18,000 6,900 3,200 ––––––– 6,200 1,500 ––––––– 3,600 2,400 ––––––– 47,000 ––––––– 10,000 16,000 8,000 ––––––– 34,000 18,100 ––––––– 4,000 6,500 2,400 ––––––– 12,900 24,000 ––––––– 4,000 11,000 5,000 ––––––– 20,000 5,000 8,000 ––––––– 47,000 ––––––– 1,000 4,200 ––––––– 18,100 ––––––– 1,000 3,000 ––––––– 24,000 ––––––– 95 Paper F7: Financial Reporting (International) The following information is relevant: (i) At the date of acquisition the fair values of Savannah’s assets were equal to their carrying amounts with the exception of Savannah’s land which had a fair value of $500,000 below its carrying amount; it was written down by this amount shortly after acquisition and has not changed in value since then. (ii) On 1 October 2011, Plateau sold an item of plant to Savannah at its agreed fair value of $2·5 million. Its carrying amount prior to the sale was $2 million. The estimated remaining life of the plant at the date of sale was five years (straightline depreciation). (iii) During the year ended 30 September 2012 Savannah sold goods to Plateau for $2·7 million. Savannah had marked up these goods by 50% on cost. Plateau had a third of the goods still in its inventory at 30 September 2012. There were no intragroup payables/receivables at 30 September 2012. (iv) Impairment tests on 30 September 2012 concluded that the value of the investment in Axle was not impaired, but consolidated goodwill was impaired by $900,000. (v) “Other equity investments” are included in Plateau’s statement of financial position (above) at their fair value on 1 October 2011, but they have a fair value of $9 million at 30 September 2012 (vi) No dividends were paid during the year by any of the companies. Required: (a) Prepare the consolidated statement of financial position for Plateau as at 30 September 2012. (20 marks) (b) A financial assistant has observed that the fair value exercise means that a subsidiary’s net assets are included at acquisition at their fair (current) values in the consolidated statement of financial position. The assistant believes that it is inconsistent to aggregate the subsidiary’s net assets with those of the parent because most of the parent’s assets are carried at historical cost. Required: Comment on the assistant’s observation and explain why the net assets of acquired subsidiaries are consolidated at acquisition at their fair values. (5 marks) (25 marks) 71 Pacemaker Below are the summarised statements of financial position for three companies as at 31 March 2012: Pacemaker $ $ million million Assets Non-current assets Property, plant and equipment Investments 96 Syclop $ $ million million Vardine $ $ million million 520 280 240 345 –––––– 865 40 –––– 320 nil –––– 240 © Emile Woolf Publishing Limited Section 1: Practice questions Current assets Inventory Trade receivables Cash and bank Pacemaker $ $ million million Total assets Equity and liabilities Equity shares of $1each Share premium Retained earnings Non-current liabilities 10% loan notes Current liabilities Total equity and liabilities 142 95 8 –––– 245 –––––– 1,110 –––––– Syclop $ $ million million 160 88 22 –––– 500 100 130 –––– 230 –––––– 730 270 –––– 590 –––– Vardine $ $ million million 120 50 10 –––– 145 nil 260 –––– 260 –––– 405 180 –––– 420 –––– 100 nil 240 –––– 240 –––– 340 180 200 –––––– 20 165 –––– nil 80 –––– 1,110 –––––– 590 –––– 420 –––– Notes: Pacemaker is a public listed company that acquired the following investments: (i) Investment in Syclop On 1 April 2010 Pacemaker acquired 116 million shares in Syclop for an immediate cash payment of $210 million and issued at par one 10% $100 loan note for every 200 shares acquired. Syclop’s retained earnings at the date of acquisition were $120 million. (ii) Investment in Vardine On 1 October 2011 Pacemaker acquired 30 million shares in Vardine in exchange for 75 million of its own shares. The stock market value of Pacemaker’s shares at the date of this share exchange was $1·60 each. Pacemaker has not yet recorded the investment in Vardine. (iii) Pacemaker’s other investments, and those of Syclop, are equity investments which are carried at their fair values as at 31 March 2011. The fair value of these investments at 31 March 2012 is $82 million and $37 million respectively. Each of these investments is no bigger than a 10% holding. Other relevant information: (iv) Pacemaker’s policy is to value non-controlling interests at their fair values. The directors of Pacemaker assessed the fair value of the non-controlling interest in Syclop at the date of acquisition to be $65 million. There has been no impairment to goodwill or the value of the investment in Vardine. (v) At the date of acquisition of Syclop owned a recently built property that was carried at its (depreciated) construction cost of $62 million. The fair value of this property at the date of acquisition was $82 million and it had an estimated remaining life of 20 years. For many years Syclop has been selling some of its products under the brand name of ‘Kyklop’. At the date of acquisition the directors of Pacemaker valued © Emile Woolf Publishing Limited 97 Paper F7: Financial Reporting (International) this brand at $25 million with a remaining life of 10 years. The brand is not included in Syclop’s statement of financial position. The fair value of all other identifiable assets and liabilities of Syclop were equal to their carrying values at the date of its acquisition. (vi) The inventory of Syclop at 31 March 2012 includes goods supplied by Pacemaker for $56 million (at selling price from Pacemaker). Pacemaker adds a mark-up of 40% on cost when selling goods to Syclop. There are no intra-group receivables or payables at 31 March 2012. (vii) Vardine’s profit is subject to seasonal variation. Its profit for the year ended 31 March 2012 was $100 million. $20 million of this profit was made from 1 April 2011 to 30 September 2011. (viii) None of the companies have paid any dividends for many years. Required: Prepare the consolidated statement of financial position of Pacemaker as at 31 March 2012. (Total: 25 marks) 72 Picant On 1 April 2009 Picant acquired 75% of Sander’s equity shares in a share exchange of three shares in Picant for every two shares in Sander. The market prices of Picant’s and Sander’s shares at the date of acquisition were $3·20 and $4·50 respectively. In addition to this Picant agreed to pay a further amount on 1 April 2010 that was contingent upon the post-acquisition performance of Sander. At the date of acquisition Picant assessed the fair value of this contingent consideration at $4·2 million, but by 31 March 2010 it was clear that the actual amount to be paid would be only $2·7 million (ignore discounting). Picant has recorded the share exchange and provided for the initial estimate of $4·2 million for the contingent consideration. On 1 October 2009 Picant also acquired 40% of the equity shares of Adler paying $4 in cash per acquired share and issuing at par one $100 7% loan note for every 50 shares acquired in Adler. This consideration has also been recorded by Picant. Picant has no other investments. The summarised statements of financial position of the three companies at 31 March 2010 are: Assets Non-current assets Property, plant and equipment Investments Current assets Inventory Trade receivables Total assets 98 Picant $’000 Sander $’000 Adler $’000 37,500 45,000 ––––––– 82,500 24,500 nil ––––––– 24,500 21,000 nil ––––––– 21,000 10,000 6,500 ––––––– 99,000 ––––––– 9,000 1,500 ––––––– 35,000 ––––––– 5,000 3,000 ––––––– 29,000 ––––––– © Emile Woolf Publishing Limited Section 1: Practice questions Equity and liabilities Equity Equity shares of $1 each Share premium Retained earnings – at 1 April 2009 – for the year ended 31 March 2010 Non-current liabilities 7% loan notes Current liabilities Contingent consideration Other current liabilities Total equity and liabilities The following information is relevant: (i) Picant $’000 Sander $’000 Adler $’000 25,000 19,800 16,200 11,000 ––––––– 72,000 8,000 nil 16,500 1,000 ––––––– 25,500 5,000 nil 15,000 6,000 ––––––– 26,000 14,500 2,000 nil 4,200 8,300 ––––––– 99,000 ––––––– nil 7,500 ––––––– 35,000 ––––––– nil 3,000 ––––––– 29,000 ––––––– At the date of acquisition the fair values of Sander’s property, plant and equipment was equal to its carrying amount with the exception of Sander’s factory which had a fair value of $2 million above its carrying amount. Sander has not adjusted the carrying amount of the factory as a result of the fair value exercise. This requires additional annual depreciation of $100,000 in the consolidated financial statements in the post-acquisition period. Also at the date of acquisition, Sander had an intangible asset of $500,000 for software in its statement of financial position. Picant’s directors believed the software to have no recoverable value at the date of acquisition and Sander wrote it off shortly after its acquisition. (ii) At 31 March 2010 Picant’s current account with Sander was $3·4 million (debit). This did not agree with the equivalent balance in Sander’s books due to some goods-in-transit invoiced at $1·8 million that were sent by Picant on 28 March 2010, but had not been received by Sander until after the year end. Picant sold all these goods at cost plus 50%. (iii) Picant’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sander’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. (iv) Impairment tests were carried out on 31 March 2010 which concluded that the value of the investment in Adler was not impaired but, due to poor trading performance, consolidated goodwill was impaired by $3·8 million. (v) Assume all profits accrue evenly through the year. Required: (a) Prepare the consolidated statement of financial position for Picant as at 31 March 2010. (21 marks) (b) Picant has been approached by a potential new customer, Trilby, to supply it with a substantial quantity of goods on three months credit terms. Picant is concerned at the risk that such a large order represents in the current difficult economic climate, especially as Picant’s normal credit terms are only one month’s credit. To support its application for credit, Trilby has sent Picant a copy of © Emile Woolf Publishing Limited 99 Paper F7: Financial Reporting (International) Tradhat’s most recent audited consolidated financial statements. Trilby is a wholly-owned subsidiary within the Tradhat group. Tradhat’s consolidated financial statements show a strong statement of financial position including healthy liquidity ratios. Required: Comment on the importance that Picant should attach to Tradhat’s consolidated financial statements when deciding on whether to grant credit terms to Trilby. (4 marks) (Total: 25 marks) Business combinations – Statements of financial performance 73 Hydan On 1 October 2011 Hydan, a publicly listed company, acquired a 60% controlling interest in Systan paying $9 per share in cash. Prior to the acquisition Hydan had been experiencing difficulties with the supply of components that it used in its manufacturing process. Systan is one of Hydan’s main suppliers and the acquisition was motivated by the need to secure supplies. In order to finance an increase in the production capacity of Systan, Hydan made a non-dated loan at the date of acquisition of $4 million to Systan that carried an actual and effective interest rate of 10% per annum. The interest to 31 March 2012 on this loan has been paid by Systan and accounted for by both companies. The summarised draft financial statements of the companies are: Income statements for the year ended 31 March 2012 Hydan $000 Revenue Cost of sales Gross profit Operating expenses Interest income Finance costs Profit/(loss) before tax Income tax (expense)/relief Profit/(loss) for the period 100 Systan Preacquisition Postacquisition $000 $000 98,000 24,000 35,200 (76,000) ――――― 22,000 (18,000) ――――― 6,000 (31,000) ――――― 4,200 (11,800) (1,200) (8,000) 350 nil nil (420) ――――― 10,130 nil ――――― 4,800 (200) ――――― (4,000) (4,200) ――――― 5,930 ――――― (1,200) ――――― 3,600 ――――― 1,000 ――――― (3,000) ――――― © Emile Woolf Publishing Limited Section 1: Practice questions Statements of financial position as at 31 March 2012 Non-current assets Property, plant and equipment Investments (including loan to Systan) Current assets Total assets Equity and liabilities Ordinary shares of $1 each Share premium Retained earnings Non-current liabilities 7% Bank loan 10% loan from Hydan Current liabilities Total equity and liabilities Hydan $000 Systan $000 18,400 16,000 ――――― 34,400 18,000 ――――― 52,400 ――――― 9,500 nil ――――― 9,500 7,200 ――――― 16,700 ――――― 10,000 5,000 20,000 ――――― 35,000 2,000 500 6,300 ――――― 8,800 6,000 nil 11,400 ――――― 52,400 ――――― nil 4,000 3,900 ――――― 16,700 ――――― The following information is relevant: (i) At the date of acquisition, the fair values of Systan’s property, plant and equipment were $1.2 million in excess of their carrying amounts. This will have the effect of creating an additional depreciation charge (to cost of sales) of $300,000 in the consolidated financial statements for the year ended 31 March 2012. Systan has not adjusted its assets to fair value. (ii) In the post acquisition period Systan’s sales to Hydan were $30 million on which Systan had made a consistent profit of 5% of the selling price. Of these goods, $4 million (at selling price to Hydan) were still in the inventory of Hydan at 31 March 2012. Prior to its acquisition Systan made all its sales at a uniform gross profit margin. (iii) Included in Hydan’s current liabilities is $1 million owing to Systan. This agreed with Systan’s receivables ledger balance for Hydan at the year end. (iv) An impairment review of the consolidated goodwill at 31 March 2012 revealed that its current value was 12.5% less than its carrying amount. (v) Neither company paid a dividend in the year to 31 March 2012. Required: (a) Prepare the consolidated income statement for the year ended 31 March 2012 and the consolidated balance sheet at that date. (20 marks) (b) Discuss the effect that the acquisition of Systan appears to have had on Systan’s operating performance. (5 marks) (Total: 25 marks) © Emile Woolf Publishing Limited 101 Paper F7: Financial Reporting (International) 74 Holdrite, Staybrite and Allbrite Holdrite purchased 75% of the issued share capital of Staybrite and 40% of the issued share capital of Allbrite on 1 April 2012. Details of the purchase consideration given at the date of purchase are: Staybrite: A share exchange of 2 shares in Holdrite for every 3 shares in Staybrite plus an issue to the shareholders of Staybrite of 8% loan notes redeemable at par on 30 June 2014 on the basis of $100 loan note for every 250 shares held in Staybrite. Allbrite: A share exchange of 3 shares in Holdrite for every 4 shares in Allbrite plus $1 per share acquired in cash. The market price of Holdrite’s shares at 1 April 2012 was $6 per share. The summarised income statements for the three companies for the year to 30 September 2012 are: Holdrite Staybrite Allbrite $000 $000 $000 Revenue Cost of sales 75,000 (47,400) –––––––– Gross profit 27,600 Operating expenses (10,480) –––––––– Operating profit 17,120 Finance cost (170) –––––––– Profit before tax 16,950 Income tax expense (4,800) –––––––– Profit for period 12,150 –––––––– The following information is relevant: (i) 40,700 (19,700) –––––––– 21,000 (9,000) –––––––– 12,000 – –––––––– 12,000 (3,000) –––––––– 9,000 –––––––– 31,000 (15,300) –––––––– 15,700 (9,700) –––––––– 6,000 – –––––––– 6,000 (2,000) –––––––– 4,000 –––––––– A fair value exercise was carried out for Staybrite at the date of its acquisition with the following results: Book value Fair value $000 $000 Land 20,000 23,000 Plant 25,000 30,000 The fair values have not been reflected in Staybrite’s financial statements. The increase in the fair value of the plant would create additional depreciation of $500,000 in the post acquisition period in the consolidated financial statements to 30 September 2012. Depreciation of plant is charged to cost of sales. 102 © Emile Woolf Publishing Limited Section 1: Practice questions (ii) The details of each company’s share capital and reserves at 1 October 2011 are: Holdrite Staybrite Allbrite $000 $000 $000 20,000 10,000 5,000 Share premium 5,000 4,000 2,000 Retained profits 18,000 7,500 6,000 Equity shares of $1 each (iii) In the post acquisition period Holdrite sold goods to Staybrite for $10 million. Holdrite made a profit of $4 million on these sales. One-quarter of these goods were still in the inventory of Staybrite at 30 September 2012. (iv) Impairment tests on the goodwill of Staybrite at 30 September 2012 resulted in the need to write down Staybrite’s goodwill by $750,000. Non-controlling interests are valued at their proportionate share of net assets. (v) Holdrite paid a dividend of $5 million on 20 September 2012. Required: (a) Calculate the goodwill arising on the purchase of the shares in both Staybrite and Allbrite at 1 April 2012. (8 marks) (b) Prepare a consolidated income statement for the Holdrite Group for the year to 30 September 2012. (15 marks) (c) Show the movement on the consolidated retained profits attributable to Holdrite for the year to 30 September 2012. (2 marks) (Total: 25 marks) Note: The additional disclosures in IFRS 3 Business Combinations relating to a newly acquired subsidiary are not required. 75 Python, Snake and Adder On 1 October 2011, Python acquired 24 million of the 32 million issued equity shares of Snake. The purchase consideration was two shares in Python for every three shares in Snake. The market price of Python’s shares at 1 October 2011 was $4.80 per share. In addition, Python will make a cash payment of $1.21 for each share in Snake that it has acquired: this is payable on 30 September 2013, two years after the acquisition. Python’s cost of capital is 10%. The reserves of Snake at 1 July 2011 were $67 million. The shares of Python and of Snake have a nominal value of $1 each. Python has held an investment of 25% of the shares of Adder for many years. The summarised income statements of the three companies for the year ended 30 June 2012 are as follows. Income statements Python Snake Adder $000 $000 $000 Revenue 160,000 72,000 72,000 Cost of sales (99,000) (42,000) (50,000) Gross profit 61,000 30,000 22,000 Distribution costs (7,900) (4,000) (5,000) (13,200) (6,000) (7,000) Administrative expenses © Emile Woolf Publishing Limited 103 Paper F7: Financial Reporting (International) Income statements Python Snake Adder $000 $000 $000 Finance costs (see note 2) (2,500) (1,000) nil Profit before tax 37,400 19,000 10,000 Income tax expense (12,300) (2,600) (2,000) Profit for the period 25,100 16,400 8,000 The following information is relevant: (1) The carrying amounts of the assets and liabilities of Snake at the date of acquisition were equal to their fair values, with the exception of some property and plant. Property had a fair value $2.5 million in excess of its carrying value, and the plant had a fair value $2.4 million in excess of carrying value. The fair values are not reflected in the financial statements of Snake. The plant had a remaining useful life of four years from the date of acquisition and is depreciated by the straight line method. The increase in the fair value of the property creates additional depreciation of $50,000 for the post-acquisition period to 30 June 2012. All depreciation should be treated as part of the cost of sales. No fair value adjustments were required on the acquisition of Adder. (2) The finance costs in the income statement of Python do not include the finance cost of the deferred consideration. (3) Python’s accounting policy is to value non-controlling interests at a proportionate share of the identifiable net assets of the subsidiary. (4) Snake has been a regular buyer of goods from Python, both before and after the acquisition. Throughout the year to 30 June 2012, Snake purchased goods at a price of $1 million per month. Python makes a profit of 25% on cost on these sales. At 30 June 2012, Snake held $2 million (at cost to Snake) in inventory of goods purchased from Python in the post-acquisition period. (5) A test for impairment on 30 June 2012 found that goodwill should be written down by $1.5 million. (6) It should be assumed that all items in the income statement accrue at an even rate through the year. Deferred tax should be ignored. Required (a) Calculate the goodwill arising on the acquisition of Snake on 1 October 2011. (6 marks) 104 (b) Prepare the consolidated income statement of Python for the year ended 30 June 2012. You should assume that the investment in Adder has been accounted for by the equity method since the investment was originally acquired. (15 marks) (c) Until 30 June 2012, the other equity shares in Adder (75%) were held by a large number of investors, but shortly after this date, 70% of the shares in Adder were acquired by a single investor, Mamba Company. A director of Python, who had been serving as a director of Adder, resigned from his position on the Adder board of directors. © Emile Woolf Publishing Limited Section 1: Practice questions Explain how the accounting treatment of the investment in Adder would be affected for the year ended 30 June 2013 by this event. (4 marks) (Total: 25 marks) 76 Hosterling Hosterling purchased the following equity investments: On 1 October 2011: 80% of the issued share capital of Sunlee. The acquisition was through a share exchange of three shares in Hosterling for every five shares in Sunlee. The market price of Hosterling’s shares at 1 October 2011 was $5 per share. On 1 July 2012: 6 million shares in Amber paying $3 per share in cash and issuing to Amber’s shareholders 6% (actual and effective rate) loan notes on the basis of $100 loan note for every 100 shares acquired. The summarised income statements for the three companies for the year ended 30 September 2012 are: Hosterling $’000 Revenue 105,000 Cost of sales (68,000) –––––––– Gross profit/(loss) 37,000 Other income (note (i)) 400 Distribution costs (4,000) Administrative expenses (7,500) Finance costs (1,200) –––––––– Profit/(loss) before tax 24,700 Income tax (expense)/credit (8,700) –––––––– Profit/(loss) for the period 16,000 –––––––– The following information is relevant: Sunlee $’000 62,000 (36,500) –––––––– 25,500 nil (2,000) (7,000) (900) –––––––– 15,600 (2,600) –––––––– 13,000 –––––––– Amber $’000 50,000 (61,000) –––––––– (11,000) nil (4,500) (8,500) nil –––––––– (24,000) 4,000 –––––––– (20,000) –––––––– (i) The other income is a dividend received from Sunlee on 31 March 2012. (ii) The details of Sunlee’s and Amber’s share capital and reserves at 1 October 2011 were: Equity shares of $1 each Retained earnings (iii) Amber $’000 15,000 35,000 Sunlee $’000 20,000 18,000 A fair value exercise was carried out at the date of acquisition of Sunlee with the following results: Intellectual property Land Plant © Emile Woolf Publishing Limited carrying amount $’000 18,000 17,000 30,000 fair value $’000 22,000 20,000 35,000 remaining life (straight line) still in development not applicable five years 105 Paper F7: Financial Reporting (International) The fair values have not been reflected in Sunlee’s financial statements. Plant depreciation is included in cost of sales. No fair value adjustments were required on the acquisition of Amber. (iv) In the year ended 30 September 2012 Hosterling sold goods to Sunlee at a selling price of $18 million. Hosterling made a profit of cost plus 25% on these sales. $7·5 million (at cost to Sunlee) of these goods were still in the inventories of Sunlee at 30 September 2012. (v) Impairment tests for both Sunlee and Amber were conducted on 30 September 2012. They concluded that the goodwill of Sunlee should be written down by $1·6 million and, due to its losses since acquisition, the investment in Amber was worth $21·5 million. (vi) All trading profits and losses are deemed to accrue evenly throughout the year. Required: (a) Calculate the goodwill arising on the acquisition of Sunlee at 1 October 2011. (5 marks) (b) Calculate the carrying amount of the investment in Amber at 30 September 2012 under the equity method prior to the impairment test. (4 marks) (c) Prepare the consolidated income statement for the Hosterling Group for the year ended 30 September 2012. (16 marks) (Total: 25 marks) 77 Patronic On 1 August 2010 Patronic purchased 18 million of a total of 24 million equity shares in Sardonic. The acquisition was through a share exchange of two shares in Patronic for every three shares in Sardonic. Both companies have shares with a par value of $1 each. The market price of Patronic’s shares at 1 August 2010 was $5·75 per share. Patronic will also pay in cash on 31 July 2012 (two years after acquisition) $2·42 per acquired share of Sardonic. Patronic’s cost of capital is 10% per annum. The reserves of Sardonic on 1 April 2010 were $69 million. Patronic has held an investment of 30% of the equity shares in Acerbic for many years. The summarised income statements for the three companies for the year ended 31 March 2011 are: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs (note (ii)) Profit before tax Income tax expense Profit for the period 106 Patronic $’000 150,000 (94,000) –––––––– 56,000 (7,400) (12,500) Sardonic $’000 78,000 (51,000) ––––––– 27,000 (3,000) (6,000) Acerbic $’000 80,000 (60,000) ––––––– 20,000 (3,500) (6,500) (2,000) –––––––– 34,100 (10,400) –––––––– 23,700 –––––––– (900) ––––––– 17,100 (3,600) ––––––– 13,500 ––––––– nil ––––––– 10,000 (4,000) ––––––– 6,000 ––––––– © Emile Woolf Publishing Limited Section 1: Practice questions The following information is relevant: (i) The fair values of the net assets of Sardonic at the date of acquisition were equal to their carrying amounts with the exception of property and plant. Property and plant had fair values of $4·1 million and $2·4 million respectively in excess of their carrying amounts. The increase in the fair value of the property would create additional depreciation of $200,000 in the consolidated financial statements in the post acquisition period to 31 March 2011 and the plant had a remaining life of four years (straight-line depreciation) at the date of acquisition of Sardonic. All depreciation is treated as part of cost of sales. The fair values have not been reflected in Sardonic’s financial statements. No fair value adjustments were required on the acquisition of Acerbic. (ii) The finance costs of Patronic do not include the finance cost on the deferred consideration. (iii) Prior to its acquisition, Sardonic had been a good customer of Patronic. In the year to 31 March 2011, Patronic sold goods at a selling price of $1·25 million per month to Sardonic both before and after its acquisition. Patronic made a profit of 20% on the cost of these sales. At 31 March 2011 Sardonic still held inventory of $3 million (at cost to Sardonic) of goods purchased in the post acquisition period from Patronic. (iv) An impairment test on the goodwill of Sardonic conducted on 31 March 2011 concluded that it should be written down by $2 million. The value of the investment in Acerbic was not impaired. (v) All items in the above income statements are deemed to accrue evenly over the year. (vi) Ignore deferred tax. Required: (a) Calculate the goodwill arising on the acquisition of Sardonic at 1 August 2010. (6 marks) (b) Prepare the consolidated income statement for the Patronic Group for the year ended 31 March 2011. Note: assume that the investment in Acerbic has been accounted for using the (15 marks) equity method since its acquisition. (c) At 31 March 2011 the other equity shares (70%) in Acerbic were owned by many separate investors. Shortly after this date Spekulate (a company unrelated to Patronic) accumulated a 60% interest in Acerbic by buying shares from the other shareholders. In May 2011 a meeting of the board of directors of Acerbic was held at which Patronic lost its seat on Acerbic’s board. Required: Explain, with reasons, the accounting treatment Patronic should adopt for its investment in Acerbic when it prepares its financial statements for the year ending 31 March 2012. (4 marks) (Total: 25 marks) 78 Pandar On 1 April 2012 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. © Emile Woolf Publishing Limited 107 Paper F7: Financial Reporting (International) The market prices of Pandar’s and Salva’s shares at 1 April 2012 were $6 per share and $3.20 respectively. On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share. The summarised income statements for the three companies for the year ended 30 September 2012 are: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income (interest and dividends) Finance costs Profit (loss) before tax Income tax (expense) relief Profit (loss) for the year Pandar $’000 210,000 (126,000) ––––––––– 84,000 (11,200) (18,300) 9,500 (1,800) ––––––––– 62,200 (15,000) ––––––––– 47,200 ––––––––– Salva $’000 150,000 (100,000) ––––––––– 50,000 (7,000) (9,000) Ambra $’000 50,000 (40,000) –––––––– 10,000 (5,000) (11,000) (3,000) ––––––––– 31,000 (10,000) ––––––––– 21,000 ––––––––– nil –––––––– (6,000) 1,000 –––––––– (5,000) –––––––– The following information for the equity of the companies at 30 September 2012 is available: Equity shares of $1 each Share premium Retained earnings 1 October 2011 Profit (loss) for the year ended 30 September 2012 Dividends paid (26 September 2012) 200,000 300,000 40,000 47,200 nil 120,000 nil 152,000 21,000 (8,000) 40,000 nil 15,000 (5,000) nil The following information is relevant: (i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales. In addition Salva owns the registration of a popular internet domain name. The registration, which had a negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million. The fair values of the plant and the domain name have not been reflected in Salva’s financial statements. No fair value adjustments were required on the acquisition of the investment in Ambra. (ii) 108 Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2012 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2012. © Emile Woolf Publishing Limited Section 1: Practice questions (iii) Pandar has credited the whole of the dividend it received from Salva to investment income. (iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2012. There are no intra-group current account balances at 30 September 2012. (v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest. (vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s investment in Ambra has been impaired by $3 million at 30 September 2012. (vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated. Required: (a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2012; (6 marks) (ii) (b) Calculate the carrying amount of the investment in Ambra to be included within the consolidated statement of financial position as at 30 September 2012. (3 marks) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2012. (16 marks) (Total: 25 marks) 79 Premier On 1 June 2010, Premier acquired 80% of the equity share capital of Sanford. The consideration consisted of two elements: a share exchange of three shares in Premier for every five acquired shares in Sanford and the issue of a $100 6% loan note for every 500 shares acquired in Sanford. The share issue has not yet been recorded by Premier, but the issue of the loan notes has been recorded. At the date of acquisition shares in Premier had a market value of $5 each and the shares of Sanford had a stock market price of $3·50 each. Below are the summarised draft financial statements of both companies. Statements of comprehensive income for the year ended 30 September 2010 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year © Emile Woolf Publishing Limited Premier $’000 92,500 (70,500) ––––––– 22,000 (2,500) (5,500) (100) ––––––– 13,900 (3,900) ––––––– 10,000 Sanford $’000 45,000 (36,000) ––––––– 9,000 (1,200) (2,400) nil ––––––– 5,400 (1,500) ––––––– 3,900 109 Paper F7: Financial Reporting (International) Other comprehensive income: Gain on revaluation of land (note (i)) Total comprehensive income Statements of financial position as at 30 September 2010 Assets Non-current assets Property, plant and equipment Investments Current assets Total assets Equity and liabilities Equity Equity shares of $1 each Land revaluation reserve – 30 September 2010 (note (i)) Other equity reserve – 30 September 2009 (note (iv)) Retained earnings Non-current liabilities 6% loan notes Current liabilities Total equity and liabilities The following information is relevant: (i) Premier $’000 Sanford $’000 500 ––––––– 10,500 ––––––– nil ––––––– 3,900 ––––––– 25,500 1,800 ––––––– 27,300 12,500 ––––––– 39,800 ––––––– 13,900 nil ––––––– 13,900 2,400 ––––––– 16,300 ––––––– 12,000 2,000 500 12,300 ––––––– 26,800 5,000 nil nil 4,500 ––––––– 9,500 3,000 10,000 ––––––– 39,800 ––––––– nil 6,800 ––––––– 16,300 ––––––– At the date of acquisition, the fair values of Sanford’s assets were equal to their carrying amounts with the exception of its property. This had a fair value of $1.2 million below its carrying amount. This would lead to a reduction of the depreciation charge (in cost of sales) of $50,000 in the post-acquisition period. Sanford has not incorporated this value change into its entity financial statements. Premier’s group policy is to revalue all properties to current value at each year end. On 30 September 2010, the value of Sanford’s property was unchanged from its value at acquisition, but the land element of Premier’s property had increased in value by $500,000 as shown in other comprehensive income. 110 (ii) Sales from Sanford to Premier throughout the year ended 30 September 2010 had consistently been $1 million per month. Sanford made a mark-up on cost of 25% on these sales. Premier had $2 million (at cost to Premier) of inventory that had been supplied in the post-acquisition period by Sanford as at 30 September 2010. (iii) Premier had a trade payable balance owing to Sanford of $350,000 as at 30 September 2010. This agreed with the corresponding receivable in Sanford’s books. (iv) Premier’s investments include some available-for-sale investments that have increased in value by $300,000 during the year. The other equity reserve relates to these investments and is based on their value as at 30 September 2009. There © Emile Woolf Publishing Limited Section 1: Practice questions were no acquisitions or disposals of any of these investments during the year ended 30 September 2010. (v) Premier’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sanford’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest. (vi) There has been no impairment of consolidated goodwill. Required: (a) Prepare the consolidated statement of comprehensive income for Premier for the year ended 30 September 2010. (b) Prepare the consolidated statement of financial position for Premier as at 30 September 2010. The following mark allocation is provided as guidance for this question: (a) 9 marks (b) 16 marks (25 marks) Business combinations – Statements of financial position and performance 80 Hepburn (a) On 1 October 2011 Hepburn acquired 80% of the equity share capital of Salter by way of a share exchange. Hepburn issued five of its own shares for every two shares it acquired in Salter. The market value of Hepburn’s shares on 1 October 2011 was $3 each. The share issue has not yet been recorded in Hepburn’s books. The summarised financial statements of both companies are: Income statements: Year to 31 March 2012 Revenue Cost of sales Gross profit Operating expenses Financial costs Profit before tax Income tax expense Profit for the period Hepburn $000 1,200 (650) 550 (120) nil 430 (100) 330 Salter $000 1,000 (660) 340 (88) (12) 240 (40) 200 Statements of financial position: as at 31 March 2012 Hepburn Non-current assets Property, plant and equipment Investments © Emile Woolf Publishing Limited Salter 620 660 20 640 10 670 111 Paper F7: Financial Reporting (International) Hepburn Current assets Inventory Accounts receivable Bank 240 170 20 Total assets Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 8% Debentures Current liabilities Trade accounts payable Taxation Salter 280 210 40 430 1,070 530 1,200 400 410 810 150 700 850 nil 150 210 50 155 45 260 1,070 Total equity and liabilities 200 1,200 The following information is relevant: (i) The fair values of Salter’s assets were equal to their carrying values (book values) with the exception of its land, which had fair value of $125,000 in excess of its carrying value at the date of acquisition. (ii) In the post acquisition period Hepburn sold goods to Salter at a price of $100,000, this was calculated to give a mark-up on cost of 25% to Hepburn. Salter had half of these goods in inventory at the year end. (iii) Consolidated goodwill is to be written off as an operating expense. An impairment test at 31 March 2012 on the consolidated goodwill concluded that it should be written down by $20,000. No other assets were impaired. (iv) The current accounts of the two companies disagreed due to a cash remittance of $20,000 to Hepburn on 26 March 2012 not being received until after the year end. Before adjusting for this, Salter’s debit balance in Hepburn’s books was $56,000. Required: Prepare a consolidated income statement and consolidated statement of financial position for Hepburn for the year to 31 March 2012. (20 marks) (b) At the same date as Hepburn made the share exchange for Salter’s shares, it also acquired 6,000 ‘A’ shares in Woodbridge for a cash payment of $20,000. The share capital of Woodbridge is made up of: Equity voting A shares 10,000 Equity non-voting B shares 14,000 All of Woodbridge’s equity shares are entitled to the same dividend rights; however during the year to 31 March 2012 Woodbridge made substantial losses and did not pay any dividends. Hepburn has treated its investment in Woodbridge as an ordinary long-term investment on the basis that: 112 © Emile Woolf Publishing Limited Section 1: Practice questions it is only entitled to 25% of any dividends that Woodbridge may pay it does not any have directors on the Board of Woodbridge; and it does not exert any influence over the operating policies or management of Woodbridge. Required: Comment on the accounting treatment of Woodbridge by Hepburn’s directors and state how you believe the investment should be accounted for. (5 marks) Note: You are not required to amend your answer to part (a) in respect of the information in part (b). (Total: 25 marks) 81 Hydrate Hydrate is a public company operating in the industrial chemical sector. In order to achieve economies of scale, it has been advised to enter into business combinations with compatible partner companies. As a first step in this strategy Hydrate acquired 80% of the ordinary share capital of Sulphate by way of a share exchange on 1 April 2012. Hydrate issued five of its own shares for every four shares in Sulphate. The market value of Hydrate’s shares on 1 April 2012 was $6 each. The share issue has not yet been recorded in Hydrate’s books. The summarised financial statements of both companies for the year to 30 September 2012 are: Income statement – year to 30 September 2012 Revenue Cost of sales Gross profit Operating expenses Profit before tax Taxation Profit after tax Hydrate $000 24,000 (16,600) 7,400 (1,600) 5,800 (2,000) 3,800 Sulphate $000 20,000 (11,800) 8,200 (1,000) 7,200 (3,000) 4,200 Statement of financial position as at 30 September 2012 Non-current assets Property, plant and equipment Investment Current assets Inventory Accounts receivable Bank Total assets © Emile Woolf Publishing Limited Hydrate $000 $000 64,000 nil 64,000 22,800 16,400 500 Sulphate $000 $000 35,000 12,800 47,800 23,600 24,200 200 39,700 103,700 48,000 95,800 113 Paper F7: Financial Reporting (International) Statement of financial position as at 30 September 2012 Hydrate Equity and liabilities Ordinary shares of $1 each Reserves: Share premium Retained earnings Non-current liabilities 8% Loan note Current liabilities Accounts payable Taxation Sulphate 20,000 12,000 2,400 42,700 4,000 57,200 61,200 81,200 45,100 57,100 Hydrate $000 $000 Sulphate $000 $000 5,000 18,000 15,300 2,200 17,700 3,000 17,500 103,700 20,700 95,800 The following information is relevant: (i) The fair value of an item of plant of Sulphate’s was $5 million in excess of its book value at the date of acquisition. The asset has a remaining life of five years. The fair values of Sulphate’s other net assets were equal to their book values. (ii) An impairment test at 30 September 2012 on the consolidated goodwill concluded that it should be written down by $1,000,000 and treated as an operating expense. No other assets were impaired. (iii) In the post acquisition period Hydrate sold goods to Sulphate at a price of $100,000, this was calculated to give a mark-up on cost of 25% to Hydrate. Sulphate had half of these goods in inventory at the year end. (iv) It is the accounting policy of Hydrate that the non-controlling interests in its subsidiary should be valued at a proportionate share of net assets. Required: Prepare the consolidated income statement and consolidated statement of financial (25 marks) position of Hydrate for the year to 30 September 2012 82 Hillusion In recent years Hillusion has acquired a reputation for buying modestly performing businesses and selling them at a substantial profit within a period of two to three years of their acquisition. On 1 July 2011 Hillusion acquired 80% of the ordinary share capital of Skeptik at a cost of $10,280,000. On the same date it also acquired 50% of Skeptik 10% loan notes at par. The summarised draft financial statements of both companies are: 114 © Emile Woolf Publishing Limited Section 1: Practice questions Income statements: Year to 31 March 2012 Revenue Cost of sales Gross profit Operating expenses Loan interest received (paid) Profit before tax Taxation Profit for the year Retained earnings brought forward Retained earnings per balance sheet Hillusion $000 60,000 (42,000) 18,000 (6,000) 75 12,075 (3,000) 9,075 16,525 25,600 Skeptik $000 24,000 (20,000) 4,000 (200) (200) 3,600 (600) 3,000 5,400 8,400 Statements of financial position: as at 31 March 2012 Hillusion Skeptik $000 $000 19,320 8,000 11,280 ―――― 30,600 nil ―――― 8,000 Current assets 15,000 8,000 Total assets 45,600 16,000 10,000 2,000 25,600 ―――― 35,600 8,400 ―――― 10,400 nil 2,000 10,000 ―――― 45,600 ―――― 3,600 ―――― 16,000 ―――― Tangible non-current assets Investments Equity and liabilities Ordinary shares of $1 each Retained earnings Non-current liabilities 10% loan notes Current liabilities The following information is relevant: (i) The fair values of Skeptik assets were equal to their carrying values (book values) with the exception of its plant, which had a fair value of $3.2 million in excess of its carrying value at the date of acquisition. The remaining life of all of Skeptik’s plant at the date of its acquisition was four years and this period has not changed as a result of the acquisition. Depreciation of plant is on a straight-line basis and charged to cost of sales. Skeptik has not adjusted the value of its plant as a result of the fair value exercise. (ii) In the post acquisition period Hillusion sold goods to Skeptik at a price of $12 million. These goods had cost Hillusion $9 million. During the year Skeptik had sold $10 million (at cost to Skeptik) of these goods for $15 million. © Emile Woolf Publishing Limited 115 Paper F7: Financial Reporting (International) (iii) Hillusion bears almost all of the administration costs incurred on behalf of the group (invoicing, credit control, etc). It does not charge Skeptik for this service as to do so would not have a material effect on the group profit. (iv) Revenues and profits should be deemed to accrue evenly throughout the year. (v) The current accounts of the two companies were reconciled at the year-end with Skeptik owing Hillusion $750,000. (vi) It is the accounting policy of Hillusion that the non-controlling interests in its subsidiary should be valued at a proportionate share of net assets. (vii) An impairment test at 31 March 2012 on the consolidated goodwill concluded that it should be written down by $300,000 and treated as an operating expense. No other assets were impaired. Required: (a) Prepare a consolidated income statement and consolidated statement of financial (20 marks) position for Hillusion for the year to 31 March 2012. (b) Explain why it is necessary to eliminate unrealised profits when preparing group financial statements; and how reliance on the entity financial statements of Skeptik may mislead a potential purchaser of the company. (5 marks) (Total: 25 marks) Note: Your answer should refer to the circumstances described in the question. 83 Pedantic On 1 April 2012, Pedantic acquired 60% of the equity share capital of Sophistic in a share exchange of two shares in Pedantic for three shares in Sophistic. The issue of shares has not yet been recorded by Pedantic. At the date of acquisition shares in Pedantic had a market value of $6 each. Below are the summarised draft financial statements of both companies. Income statements for the year ended 30 September 2012 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year Statements of financial position as at 30 September 2012 Assets Non-current assets Property, plant and equipment Current assets Total assets 116 Pedantic $’000 85,000 (63,000) –––––––– 22,000 (2,000) (6,000) (300) –––––––– 13,700 (4,700) –––––––– 9,000 –––––––– Sophistic $’000 42,000 (32,000) –––––––– 10,000 (2,000) (3,200) (400) –––––––– 4,400 (1,400) –––––––– 3,000 –––––––– 40,600 16,000 –––––––– 56,600 –––––––– 12,600 6,600 –––––––– 19,200 –––––––– © Emile Woolf Publishing Limited Section 1: Practice questions Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 10% loan notes Current liabilities Total equity and liabilities The following information is relevant: Pedantic $’000 Sophistic $’000 10,000 35,400 –––––––– 45,400 4,000 6,500 –––––––– 10,500 3,000 8,200 –––––––– 56,600 –––––––– 4,000 4,700 –––––––– 19,200 –––––––– (i) At the date of acquisition, the fair values of Sophistic’s assets were equal to their carrying amounts with the exception of an item of plant, which had a fair value of $2 million in excess of its carrying amount. It had a remaining life of five years at that date [straight-line depreciation is used]. Sophistic has not adjusted the carrying amount of its plant as a result of the fair value exercise. (ii) Sales from Sophistic to Pedantic in the post acquisition period were $8 million. Sophistic made a mark up on cost of 40% on these sales. Pedantic had sold $5·2 million (at cost to Pedantic) of these goods by 30 September 2012. (iii) Other than where indicated, income statement items are deemed to accrue evenly on a time basis. (iv) Sophistic’s trade receivables at 30 September 2012 include $600,000 due from Pedantic which did not agree with Pedantic’s corresponding trade payable. This was due to cash in transit of $200,000 from Pedantic to Sophistic. Both companies have positive bank balances. (v) Pedantic has a policy of accounting for any non-controlling interest at fair value. For this purpose the fair value of the goodwill attributable to the non-controlling interest in Sophistic is $1·5 million. Consolidated goodwill was not impaired at 30 September 2012. Required: (a) Prepare the consolidated income statement for Pedantic for the year ended 30 (9 marks) September 2012. (b) Prepare the consolidated statement of financial position for Pedantic as at 30 (16 marks) September 2012. Note: a statement of changes in equity is not required. © Emile Woolf Publishing Limited (Total: 25 marks) 117 Paper F7: Financial Reporting (International) Analysing and interpreting financial statements 84 Comparator Comparator assembles computer equipment from bought in components and distributes them to various wholesalers and retailers. It has recently subscribed to an interfirm comparison service. Members submit accounting ratios as specified by the operator of the service, and in return, members receive the average figures for each of the specified ratios taken from all of the companies in the same sector that subscribe to the service. The specified ratios and the average figures for Comparator’s sector are shown below. Ratios of companies reporting a full year’s results for periods ending between 1 July 2012 and 30 September 2012 Return on capital employed Net assets turnover Gross profit margin Net profit (before tax) margin Current ratio Quick ratio Inventory holding period Accounts receivable collection period Accounts payable payment period Debt to equity Dividend yield Dividend cover 22.1% 1.8 times 30% 12.5% 1.6:1 0.9:1 46 days 45 days 55 days 40% 6% 3 times Comparator’s financial statements for the year to 30 September 2012 are set out below: Income statement Revenue Cost of sales Gross profit Other operating expenses Profit from operations Finance costs Exceptional item (note (ii)) Profit before taxation Income tax Profit for the period $000 2,425 (1,870) 555 (215) 340 (34) (120) 186 (90) 96 $000 Extracts of changes in equity Retained earnings – 1 October 2011 Net profit for the period Dividends paid (interim $60,000; final $30,000) Retained earnings – 30 September 2012 118 179 96 (90) 185 © Emile Woolf Publishing Limited Section 1: Practice questions Statement of financial position Non-current assets (note (i)) Current assets Inventory Accounts receivable Bank $000 $000 540 275 320 nil 595 1,135 Equity Ordinary shares (25 cents each) Retained earnings 150 185 335 Non-current liabilities 8% loan notes Current liabilities Bank overdraft Trade accounts payable Taxation 300 65 350 85 500 1,135 Notes (i) The details of the non-current assets are: Cost At 30 September 2007 $000 3,600 Accumulated depreciation $000 3,060 Net book value $000 540 (ii) The exceptional item relates to losses on the sale of a batch of computers that had become worthless due to improvements in microchip design. (iii) The market price of Comparator’s shares throughout the year averaged $6.00 each. Required: (a) Explain the problems that are inherent when ratios are used to assess a company’s financial performance. Your answer should consider any additional problems that may be encountered when using interfirm comparison services such as that used by Comparator. (7 marks) (b) Calculate the ratios for Comparator equivalent to those provided by the interfirm comparison service. (6 marks) (c) Write a report analysing the financial performance of Comparator based on a comparison with the sector averages. (12 marks) (Total: 25 marks) © Emile Woolf Publishing Limited 119 Paper F7: Financial Reporting (International) 85 Rytetrend Rytetrend is a retailer of electrical goods. Extracts from the company’s financial statements are set out below: Income statement for the year ended 31 March: 2012 $000 Revenue Cost of sales Gross profit Other operating expenses Operating profit Interest payable – loan notes Interest payable – overdraft $000 31,800 (22,500) 9,300 (5,440) 3,860 (260) (200) (460) 3,400 (1,000) 2,400 Profit before taxation Taxation Profit for the period 2011 $000 $000 23,500 (16,000) 7,500 (4,600) 2,900 (500) nil (500) 2,400 (800) 1,600 Statements of financial position as at 31 March: 2012 $000 Non-current assets (note (i)) Current assets Inventory Receivables Bank Equity and liabilities Ordinary capital ($1 shares) Share premium Retained earnings Total equity and liabilities 120 $000 24,500 2,650 1,100 nil Total assets Non-current liabilities 10% loan notes 6% loan notes Current liabilities Bank overdraft Trade payables Taxation Warranty provision (note (ii)) 2011 $000 $000 17,300 3,270 1,950 400 3,750 28,250 5,620 22,920 11,500 1,500 8,130 21,130 10,000 nil 6,160 16,160 nil 2,000 4,000 nil 1,050 2,850 720 500 nil 1,980 630 150 5,120 28,250 2,760 22,920 © Emile Woolf Publishing Limited Section 1: Practice questions Notes (i) The details of the non-current assets are: Cost Accumulated depreciation Net book value $000 $000 $000 At 31 March 2011 27,500 10,200 17,300 At 31 March 2012 37,250 12,750 24,500 During the year there was a major refurbishment of display equipment. Old equipment that had cost $6 million in September 2008 was replaced with new equipment at a gross cost of $8 million. The equipment manufacturer had allowed Rytetrend a trade in allowance of $500,000 on the old display equipment. In addition to this Rytetrend used its own staff to install the new equipment. The value of staff time spent on the installation has been costed at $300,000, but this has not been included in the cost of the asset. All staff costs have been included in operating expenses. All display equipment held at the end of the financial year is depreciated at 20% on its cost. No equipment is more than five years old. (ii) Operating expenses contain a charge of $580,000 for the cost of warranties on the goods sold by Rytetrend. The company makes a warranty provision when it sells its products and cash payments for warranty claims are deducted from the provision as they are settled. Required: (a) Prepare a statement of cash flows for Rytetrend for the year ended 31 March 2012. (12 marks) (b) Write a report briefly analysing the operating performance and financial position of Rytetrend for the years ended 31 March 2011 and 2012. (13 marks) Your report should be supported by appropriate ratios. 86 (Total: 25 marks) Greenwood Greenwood is a public listed company. During the year ended 31 March 2012 the directors decided to cease operations of one of its activities and put the assets of the operation up for sale (the discontinued activity has no associated liabilities). The directors have been advised that the cessation qualifies as a discontinued operation and has been accounted for accordingly. Extracts from Greenwood’s financial statements are set out below. Note: the income statement figures down to the profit for the period from continuing operations are those of the continuing operations only. Income statements for the year ended 31 March: Revenue Cost of sales Gross profit Operating expenses © Emile Woolf Publishing Limited 2012 $’000 27,500 (19,500) –––––––– 8,000 (2,900) –––––––– 5,100 2011 $’000 21,200 (15,000) –––––––– 6,200 (2,450) –––––––– 3,750 121 Paper F7: Financial Reporting (International) Income statements for the year ended 31 March: Finance costs Profit before taxation Income tax expense Profit for the period from continuing operations Profit/(Loss) from discontinued operations Profit for the period 2012 $’000 (600) –––––––– 4,500 (1,000) –––––––– 3,500 (1,500) –––––––– 2,000 –––––––– 2011 $’000 (250) –––––––– 3,500 (800) –––––––– 2,700 320 –––––––– 3,020 –––––––– 7,500 (8,500) –––––––– (1,000) (400) –––––––– (1,400) 300 –––––––– (1,100) (500) 100 –––––––– (1,500) –––––––– 9,000 (8,000) –––––––– 1,000 (550) –––––––– 450 (130) –––––––– 320 – – –––––––– 320 –––––––– Analysis of discontinued operations: Revenue Cost of sales Gross profit/(loss) Operating expenses Profit/(loss) before tax Tax (expense)/relief Loss on measurement to fair value of disposal group Tax relief on disposal group Profit/(Loss) from discontinued operations Statements of financial position as at 31 March $’000 Non-current assets Current assets Inventory 1,500 Trade receivables 2,000 Bank nil Assets held for sale (at fair value) 6,000 –––––– Total assets Equity and liabilities Equity shares of $1 each Retained earnings Non-current liabilities 5% loan notes Current liabilities 122 2012 $’000 17,500 9,500 ––––––– 27,000 ––––––– 10,000 4,500 ––––––– 14,500 8,000 $’000 1,350 2,300 50 nil –––––– 2011 $’000 17,600 3,700 ––––––– 21,300 ––––––– 10,000 2,500 ––––––– 12,500 5,000 © Emile Woolf Publishing Limited Section 1: Practice questions Statements of financial position as at 31 March $’000 Bank overdraft 1,150 Trade payables 2,400 Current tax payable 950 –––––– Total equity and liabilities 2012 $’000 4,500 ––––––– 27,000 ––––––– $’000 nil 2,800 1,000 –––––– 2011 $’000 3,800 ––––––– 21,300 ––––––– Note: the carrying amount of the assets of the discontinued operation at 31 March 2011 was $6·3 million. Required: Analyse the financial performance and position of Greenwood for the two years ended 31 March 2012. Note: Your analysis should be supported by appropriate ratios (up to 10 marks (25 marks) available) and refer to the effects of the discontinued operation. 87 Harbin Shown below are the recently issued (summarised) financial statements of Harbin, a listed company, for the year ended 30 September 2012, together with comparatives for 2011 and extracts from the Chief Executive’s report that accompanied their issue. Income statement Revenue Cost of sales Gross profit Operating expenses Finance costs Profit before tax Income tax expense (at 25%) Profit for the period Statement of financial position Non-current assets Property, plant and equipment Goodwill Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Equity shares of $1 each © Emile Woolf Publishing Limited 2012 2011 $’000 250,000 (200,000) 50,000 (26,000) (8,000) 16,000 (4,000) 12,000 $’000 180,000 (150,000) 30,000 (22,000) (nil) 8,000 (2,000) 6,000 210,000 90,000 10,000 220,000 nil 90,000 25,000 13,000 15,000 8,000 nil 38,000 258,000 14,000 37,000 127,000 100,000 100,000 123 Paper F7: Financial Reporting (International) Income statement Retained earnings Non-current liabilities 8% loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 2012 2011 $’000 $’000 14,000 114,000 12,000 112,000 100,000 nil 17,000 23,000 nil 13,000 4,000 44,000 258,000 2,000 15,000 127,000 Extracts from the Chief Executive’s report: ‘Highlights of Harbin’s performance for the year ended 30 September 2012: an increase in sales revenue of 39% gross profit margin up from 16·7% to 20% a doubling of the profit for the period. In response to the improved position the Board paid a dividend of 10 cents per share in September 2012 an increase of 25% on the previous year.’ You have also been provided with the following further information. On 1 October 2011 Harbin purchased the whole of the net assets of Fatima (previously a privately owned entity) for $100 million. The contribution of the purchase to Harbin’s results for the year ended 30 September 2012 was: $’000 Revenue 70,000 Cost of sales (40,000) ––––––– Gross profit 30,000 Operating expenses (8,000) ––––––– Profit before tax 22,000 ––––––– There were no disposals of non-current assets during the year. The following ratios have been calculated for Harbin for the year ended 30 September 2011: Return on year-end capital employed (profit before interest and tax over total assets less current liabilities) Net asset (equal to capital employed) turnover 1·6 Net profit (before tax) margin 124 7·1% 4·4% Current ratio 2·5 Closing inventory holding period (in days) 37 Trade receivables’ collection period (in days) 16 Trade payables’ payment period (based on cost of sales) (in days) 32 Gearing (debt over debt plus equity) nil © Emile Woolf Publishing Limited Section 1: Practice questions Required: (a) Calculate ratios for Harbin for the year ended 30 September 2012 equivalent to those calculated for the year ended 30 September 2011 (showing your workings). (8 marks) (b) Assess the financial performance and position of Harbin for the year ended 30 September 2012 compared to the previous year. Your answer should refer to the information in the Chief Executive’s report and the impact of the purchase of the net assets of Fatima. (17 marks) (Total: 25 marks) 88 Victular Victular is a public company that would like to acquire (100% of) a suitable private company. It has obtained the following draft financial statements for two companies, Grappa and Merlot. They operate in the same industry and their managements have indicated that they would be receptive to a takeover. Income statements for the year ended 30 September 2012 $’000 Revenue Cost of sales Gross profit Operating expenses Finance costs – loan – overdraft – lease Profit before tax Income tax expense Grappa $’000 12,000 (10,500) –––––––– 1,500 (240) (210) nil nil –––––––– 1,050 (150) –––––––– Profit for the year 900 –––––––– Note: dividends paid during the year 250 –––––––– Statements of financial position as at 30 September 2012 Assets Non-current assets Freehold factory (note (i)) 4,400 Owned plant (note (ii)) 5,000 Leased plant (note (ii)) nil –––––––– 9,400 Current assets Inventory 2,000 Trade receivables 2,400 Bank 600 5,000 –––––––– –––––––– Total assets 14,400 –––––––– © Emile Woolf Publishing Limited $’000 Merlot $’000 20,500 (18,000) –––––––– 2,500 (500) (300) (10) (290) –––––––– 1,400 (400) –––––––– 1,000 –––––––– 700 –––––––– nil 2,200 5,300 –––––––– 7,500 3,600 3,700 nil –––––––– 7,300 –––––––– 14,800 –––––––– 125 Paper F7: Financial Reporting (International) $’000 Grappa $’000 Merlot $’000 $’000 Equity and liabilities Equity shares of $1 each Property revaluation reserve Retained earnings Non-current liabilities Finance lease obligations (note (iii)) 7% loan notes 10% loan notes Deferred tax Government grants Current liabilities Bank overdraft Trade payables Government grants Finance lease obligations (note (iii)) Taxation 2,000 900 2,600 –––––––– 3,500 –––––––– 5,500 nil 3,000 nil 600 1,200 –––––––– 4,800 2,000 nil 800 –––––––– 3,200 nil 3,000 100 nil –––––––– nil 3,100 400 1,200 3,800 nil nil 600 –––––––– 500 200 –––––––– Total equity and liabilities 4,100 –––––––– 14,400 –––––––– 800 –––––––– 2,800 6,300 5,700 –––––––– 14,800 –––––––– Notes (i) Both companies operate from similar premises. (ii) Additional details of the two companies’ plant are: Owned plant – cost Leased plant – original fair value Grappa Merlot $’000 $’000 8,000 10,000 nil 7,500 There were no disposals of plant during the year by either company. (iii) The interest rate implicit within Merlot’s finance leases is 7·5% per annum. For the purpose of calculating ROCE and gearing, all finance lease obligations are treated as long-term interest bearing borrowings. (iv) The following ratios have been calculated for Grappa and can be taken to be correct: Return on year end capital employed (ROCE) 14·8% (capital employed taken as shareholders’ funds plus long-term interest bearing borrowings – see note (iii) above) Pre-tax return on equity (ROE) 126 19·1% © Emile Woolf Publishing Limited Section 1: Practice questions Net asset (total assets less current liabilities) turnover 1·2 times Gross profit margin 12·5% Operating profit margin 10·5% Current ratio 1·2:1 Closing inventory holding period 70 days Trade receivables’ collection period 73 days Trade payables’ payment period (using cost of sales) 108 days Gearing (see note (iii) above) 35·3% Interest cover 6 times Dividend cover 3·6 times Required: (a) Calculate for Merlot the ratios equivalent to all those given for Grappa above. (8 marks) (b) Assess the relative performance and financial position of Grappa and Merlot for the year ended 30 September 2012 to inform the directors of Victular in their acquisition decision. (12 marks) (c) Explain the limitations of ratio analysis and any further information that may be useful to the directors of Victular when making an acquisition decision. (5 marks) (Total: 25 marks) 89 Hardy Hardy is a public listed manufacturing company. Its summarised financial statements for the year ended 30 September 2010 (and 2009 comparatives) are: Income statements for the year ended 30 September: Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income Finance costs Profit (loss) before taxation Income tax (expense) relief Profit (loss) for the year © Emile Woolf Publishing Limited 2010 $’000 29,500 (25,500) ––––––– 4,000 (1,050) (4,900) 50 (600) ––––––– (2,500) 400 ––––––– (2,100) ––––––– 2009 $’000 36,000 (26,000) ––––––– 10,000 (800) (3,900) 200 (500) ––––––– 5,000 (1,500) ––––––– 3,500 ––––––– 127 Paper F7: Financial Reporting (International) Statements of financial position as at 30 September: Assets Non-current assets Property, plant and equipment Investments at fair value through profit or loss Current assets Inventory and work-in-progress Trade receivables Tax asset Bank Total assets Equity and liabilities Equity Equity shares of $1 each Share premium Revaluation reserve Retained earnings Non-current liabilities Bank loan Deferred tax Current liabilities Trade payables Current tax payable $’000 2010 $’000 $’000 17,600 2,400 ––––––– 20,000 2009 $’000 24,500 4,000 ––––––– 28,500 2,200 1,900 2,200 2,800 600 nil 1,200 6,200 100 4,800 –––––– ––––––– –––––– ––––––– 26,200 33,300 ––––––– ––––––– 13,000 1,000 nil 3,600 ––––––– 17,600 12,000 nil 4,500 6,500 ––––––– 23,000 4,000 1,200 5,000 700 3,400 2,800 nil 3,400 1,800 4,600 –––––– ––––––– –––––– ––––––– Total equity and liabilities 26,200 33,300 ––––––– ––––––– The following information has been obtained from the Chairman’s Statement and the notes to the financial statements: ‘Market conditions during the year ended 30 September 2010 proved very challenging due largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values. Hardy has not been immune from these effects and our properties have suffered impairment losses of $6 million in the year.’ The excess of these losses over previous surpluses has led to a charge to cost of sales of $1·5 million in addition to the normal depreciation charge. ‘Our portfolio of investments at fair value through profit or loss has been ‘marked to market’ (fair valued) resulting in a loss of $1·6 million (included in administrative expenses).’ There were no additions to or disposals of non-current assets during the year. ‘In response to the downturn the company has unfortunately had to make a number of employees redundant incurring severance costs of $1·3million (included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.’ 128 © Emile Woolf Publishing Limited Section 1: Practice questions ‘The difficulty in the credit markets has meant that the finance cost of our variable rate bank loan has increased from 4·5% to 8%. In order to help cash flows, the company made a rights issue during the year and reduced the dividend per share by 50%.’ ‘Despite the above events and associated costs, the Board believes the company’s underlying performance has been quite resilient in these difficult times.’ Required: Analyse and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided. Your analysis should be supported by profitability, liquidity and gearing and other appropriate ratios (up to 10 marks available). (25 marks) © Emile Woolf Publishing Limited 129 Paper F7: Financial Reporting (International) 130 © Emile Woolf Publishing Limited SECTION 2 Paper F7 (INT) Financial Reporting Q&A Answers to practice questions A conceptual framework and regulatory framework for financial reporting 1 Recost (a) The main drawback of the use of historical cost accounts for assessing the performance of a business is that they do not take into account the current values of assets and, to a lesser extent, liabilities. This can become a serious problem and give misleading information when either specific or general price inflation rates are considered to be high. The effect is that many of the values of the assets in the statement of financial position are understated, and, partly because of related depreciation, profits tend to be overstated. More detailed criticisms of historical cost accounts during a period of rising prices are: Effects on the statement of financial position (i) Most non-current assets can be considerably understated in terms of their current worth. The most affected assets tend to be land and buildings, investments and some plant. (ii) In general net current assets tend not to be affected by inflation mainly because they are monetary in nature. The possible exception is trading inventories. (iii) Liabilities tend to be ignored when current values are discussed. This may be an error because, for example, a long term loan carrying a fixed rate of interest, may have a current value that is considerably different to when it was taken out (ignoring the possibility of any repayments). This is because current interest rates may have changed (often as a reaction to levels of inflation) since the loan was originally taken out. (iv) If the net assets are understated, then so too are shareholders’ funds. © Emile Woolf Publishing Limited 131 Paper F7: Financial Reporting (International) Effects on the income statement Many costs tend to be understated in terms of their current value. Where this occurs it means the profit is overstated in as much as the use of lower costs leads to a higher profit. Many commentators argue that pure historical cost profits are made up of a current operating profit (see below) plus inflationary gains relating to the: costs of goods sold (both purchased and manufactured). This can be mitigated, but not completely removed, by the use of LIFO, however this is not common practice in many countries and is now prohibited by IAS 2Inventories. depreciation charges for non-current assets. In historic cost accounts these are based on historical values rather than current values, and therefore understate the values of the assets that have been used (consumed) during the period. some methods of accounting for inflation include monetary working capital and/or ‘gearing’ adjustments to historical cost profits. These are intended to reflect the inflation effects of holding net monetary working capital and debt. The above combined effects lead to the following criticisms and limitations of the use of historic cost accounts to assess a business’s performance: Lack of comparability It may be invalid to compare the results of two companies. One company may have assets that are relatively old (and of lower cost) whereas another company may have similar, but more recently purchased (and of higher cost) assets. In effect such companies would have a similar operating capacity, but it would be recorded at different values. This situation can also be found within a single company that has operating divisions with similar characteristics to the above scenario. Management may assess their relative performance using historical costs (which would be an invalid basis) to make decisions relating to future investment or even closure. There is also a lack of comparability between a company’s current year’s results and those of previous years i.e. trend analysis may be distorted. Conceptual inconsistency Accounting theorists sometimes argue that historical cost accounts are not internally consistent because they are in fact ‘mixed value’ accounts. This means that some historical costs are at current values, whereas other historical costs are at out-of-date values. Thus current values, of say sales revenues, are being matched with out-of-date values such as depreciation relating to older assets. Many important ratios which are calculated as a basis for interpreting and assessing company performance can be distorted by inflation. Important examples are: return on capital employed, profit margins, many asset turnover ratios, gearing levels and earnings per share. The misleading effects of the above on different users Investors may find it difficult to compare the results of different companies as a basis for investment decisions. A shareholder may be tempted to accept a low bid for his shares if weight is given to the asset backing, based on carrying values, of the shares. Dividends may seem low in relation to reported profits, 132 © Emile Woolf Publishing Limited Section 2: Answers to practice questions this may be because management is recommending dividends based on a current operating profit. Employees may make high wage demands based on reported profit rather than current operating profits. Governments generally tax reported profits which means companies pay tax on higher, inflation boosted, profits. (b) The advantages and criticisms of Current Cost Accounting are set out below: Current cost accounting principles, from a conceptual point of view, are more soundly based and therefore more difficult to criticise than GPP accounts. They correct most of the limitations (that are due to increased price changes) of historical cost accounts. They reflect the current values (which is not necessarily the current costs) of a company’s specific assets. The reported current operating profit is considered to be more relevant to many decisions such as dividend distribution, employee wage claims and even as a basis for taxation. The problems of CCA lie in their preparation and understanding. In practical terms it can be very difficult to determine the current value of assets, and many alternative forms of current value exist e.g. replacement cost, realisable value and value in use. Methods of determining current costs include the use of manufacturers’ price lists for plant and inventory, professional revaluation of assets e.g. land and buildings and the use of specific price indexes published by government agencies. Whatever method is used it is often subjective and sometimes complex. This makes the cost of the preparation and audit of current cost accounts expensive. 2 Worthright (a) Importance of the definitions: The definitions of assets and liabilities are fundamental to the IASB’s Conceptual Framework. Apart from forming the obvious basis for the preparation of a statement of financial position, they are also the two elements of financial statements that are used to derive the other elements. Equity (ownership) interest is the residue of assets less liabilities. Gains and losses are changes in ownership interests, other than contributions from, and distributions to, the owners. In effect, a gain is an increase in an asset or a reduction of a liability whereas a loss is the reverse of this. Transactions with owners are defined in a straightforward manner in order to exclude them from the definitions of gains and losses. Assets: The IASB Conceptual Framework defines assets as ‘a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity’. The first part of the definition ‘a resource controlled by an entity’ is a refinement of the principle that an asset must be owned by the entity. This refinement allows assets that are not legally owned by an entity, but over which the entity has the rights that are normally conveyed by ownership, such as the right to use or occupy an asset, to be recognised as an asset of the entity. The essence of this approach is that an asset is not the physical item that one might expect it to be such as a machine or a building, but it is the right to enjoy the future economic benefits that the asset will produce (normally future cash flows). Perhaps the best known example of this type of arrangement © Emile Woolf Publishing Limited 133 Paper F7: Financial Reporting (International) is a finance lease or asset being bought under a hire purchase agreement. Control not only allows the entity to obtain the economic benefits of assets but also to restrict the access of others to them. Where an entity develops an alternative manufacturing process that reduces future cash outflows in terms of lower cost of production, this too can be an asset. Assets can also arise where there is no legal control. The Conceptual Framework cites the example of ‘knowhow’ derived from a development activity. Where an entity has the capacity to keep this a secret, the entity controls the benefits that are expected to flow from it. Other definitions of an asset refer to future economic benefits being ‘probable’. This wording recognises that all future economic benefits are subject to some degree of risk or uncertainty. The IASB deals with the ‘probable’ issue by saying that future economic benefits are only ‘expected’ and therefore need not be certain. The reference to past events makes it clear that transactions arising after the reporting period that may lead to economic benefits cannot be treated as assets. The use of the word ‘events’ in this part of the definition recognises that it is not only transactions that can create assets or liabilities (see below), but other events such as ‘legal wrongs’ which may lead to damages claims. This aspect of the definition does cause some problems. For example, it could be argued that signing a profitable contract before the end of the reporting period is an ‘event’ that gives rise to a future economic benefit. It is widely held that the justification for not recognising future profitable contracts as assets is that the rights and obligations under these contracts are equal (which is unlikely to be true) and also that the historical cost of ‘signing’ them is zero. Liabilities: The IASB defines liabilities as ‘a present obligation of the entity arising from past events which is expected to result in an outflow from the entity of resources embodying economic benefits’. The IASB stress that the essential characteristic is the ‘present obligation’. Although the definition is complementary to that of assets, it is perceived as less controversial. Most components of the definition have the same meaning e.g. the terms ‘economic benefits’ and ‘past events’. Most liabilities are legal or contractual obligations to transfer known amounts of cash e.g. trade payables and loans. Occasionally they may be settled other than for cash such as in a barter transaction, but this still constitutes transferring economic benefits. It is necessary to consider the principles and definitions in The Conceptual Framework alongside those of IAS 37 Provisions, Contingent Liabilities and Contingent Assets. Within the Conceptual Framework the IASB introduces the concept of obligations arising from ‘normal business practice’ being liabilities. One such example is rectifying faults in goods sold even when the warranty period has expired. IAS 37 explores this principle more fully and refers to them as ‘constructive’ obligations. These occur where an entity creates a valid expectation that it will discharge responsibilities that it is not legally obliged to. This is usually as a result of past behaviour, or by commitments given in a published statement (e.g. voluntarily incurring environmental costs). Where the exact amount of a liability is uncertain it is usually referred to as a provision. Obligations may exist that are not expected to require ‘transfers of economic benefits’. These again are described in IAS 37 and are more generally known as 134 © Emile Woolf Publishing Limited Section 2: Answers to practice questions contingent liabilities. For example, where a holding company guarantees a subsidiary’s loan. Similar to assets, costs to be incurred in the future do not represent liabilities. This is because either the entity has the ability to avoid the costs, or if it cannot (e.g. where a contract exists), then incurring the cost would be matched by receiving an asset of equal value. (b) An issue with research and development costs is whether they are an asset or an expense. If they result in future economic benefits, they are assets; if not, they are expenses. Unfortunately the resolution to the question whether development costs are an asset lies in the future and is therefore unknown. Since most development projects do not result in a profitable project, , most research and development costs are not an asset. In the case of the development expenditure of Worthright it appears that it may satisfy the criteria in IAS 38 Intangible Assets to be treated as an intangible asset, particularly in view of its impressive track record on development projects. More details would have to be obtained in order to determine whether the expenditure does qualify as an asset. If it does the company’s existing policy would not be permitted under IAS 38, as this says that if the recognition criteria are met, the expenditure should be capitalised. It does not offer a choice. The above only applies to Worthright’s own development costs. The company also performs research and development for clients and here the case is different. Although it is conducting research and development, it is in fact work in progress. The costs of this research and development should be matched with the revenues it will bring. To the extent it has been invoiced to clients, it will appear as cost of sales in the income statement (not as research and development). Any unbilled costs should appear as a current asset under work in progress. 3 Revenue recognition (a) The IASB Conceptual Framework advocates that revenue recognition issues are resolved within the definition of assets (gains) and liabilities (losses). Gains include all forms of income and revenue as well as gains on non-revenue items. Gains and losses are defined as increases or decreases in net assets other than those resulting from transactions with owners. Thus in its Conceptual Framework, the IASB takes a ‘statement of financial position approach’ to defining revenue (i.e. an approach based on the statement of financial position).. In effect a recognisable increase in an asset results in a gain. The more traditional view, which is largely the basis used in IAS 18 Revenue, is that (net) revenue recognition is part of a transactions based accruals or matching process with the statement of financial position recording any residual assets or liabilities such as receivables and payables. The issue of revenue recognition arises out of the need to report company performance for specific periods. The Conceptual Framework identifies three stages in the recognition of assets (and liabilities): initial recognition, when an item first meets the definition of an asset; subsequent remeasurement, which may involve changing the value (with a corresponding effect on income) of a recognised item; and possible derecognition, where an item no longer meets the definition of an asset. For many simple transactions both the Conceptual Framework’s approach and the traditional approach (IAS 18) will result in the same profit (net income). If an item of inventory is bought © Emile Woolf Publishing Limited 135 Paper F7: Financial Reporting (International) for $100 and sold for $150, net assets have increased by $50 and the increase would be reported as a profit. The same figure would be reported under the traditional transactions based reporting (sales of $150 less cost of sales of $100). However, in more complex areas the two approaches can produce different results. An example of this would be deferred income. If a company received a fee for a 12 month tuition course in advance, IAS 18 would treat this as deferred income (in the statement of financial position) and release it to income as the tuition is provided and matched with the cost of providing the tuition. Thus the profit would be spread (accrued) over the period of the course. If an asset/liability approach were taken, then the only liability the company would have after the receipt of the fee would be for the cost of providing the course. If only this liability is recognised in the statement of financial position, the whole of the profit on the course would be recognised on receipt of the income. This is not a prudent approach and has led to criticism of the IASB Conceptual Framework for this very reason. Other standards that may be in conflict with the Conceptual Framework are the use of the accretion approach in IAS 11 Construction Contracts and a deferred tax liability in IAS 12 Income Taxes may not fully meet the Conceptual Framework’s definition of a liability. The principle of substance over form should also be applied to revenue recognition. An example of where this can impact on reporting practice is on sale and repurchase agreements. Companies sometimes ‘sell’ assets to another company with the right to buy them back on predetermined terms that will almost certainly mean that they will be repurchased in the future. In substance this type of arrangement is a secured loan and the ‘sale’ should not be treated as revenue. A less controversial area of the application of substance in relation to revenue recognition is with agency sales. IAS 18 says, where a company sells goods acting as an agent, those sales should not be treated as sales of the agent, instead only the commission from the sales is income of the agent. (b) 136 (i) The IASB Conceptual Framework defines liabilities as obligations to transfer economic benefits as a result of past transactions. Such transfers of economic benefits are to third parties and normally as cash payments. Traditionally and in compliance with IAS 20, capital-based government grants are treated as deferred credits and spread over the life of the related assets. This is the application of the matching concept. A strict interpretation of the Conceptual Framework would not normally allow deferred credits to be treated as liabilities as there is usually no obligation to transfer economic benefits. In this particular example the only liability that may occur in respect of the grant would be if Derringdo were to sell the related asset within four years of its purchase. A possible argument would be that the grant should be treated as a reducing liability (in relation to a potential repayment) over the four-year claw back period. On closer consideration this would not be appropriate. The repayment would only occur if the asset were sold, thus it is potentially a contingent liability. As Derringdo has no intention to sell the asset there is no reason to believe that the repayment will occur, thus it is not a reportable contingent liability. The implication of this is that the company’s policy for the government grant does not comply with the definition of a liability in the Conceptual Framework. Applying the guidance in the Conceptual Framework would require the whole of the grant to be included in income as it is ‘earned’ i.e. in the year of receipt. © Emile Woolf Publishing Limited Section 2: Answers to practice questions (ii) Treatment under the company’s policy Income statement extract year to 31 March 2012 Depreciation – plant ((800,000 – 120,000 estimated residual value)/10 years × 6/12) Government grant ((800,000 × 30%)/10 years × 6/12) $ Dr 34,000 Cr 12,000 Statement of financial position extracts as at 31 March 2012 Non-current assets: $ Plant at cost 800,000 Accumulated depreciation (34,000) ―――― 766,000 ―――― Current liabilities: Government grant (240,000/10 years) 24,000 Non-current liabilities: Government grant (240,000 – 12,000 – 24,000) 204,000 Treatment under the IASB Conceptual Framework Income statement extract year to 31 March 2012 Depreciation – plant ((800,000 – 120,000 estimated residual value) /10 years × 6/12) Government grant (whole amount) $ Dr 34,000 Cr 240,000 Statement of financial position extracts as at 31 March 2012 Non-current assets: $ Plant at cost 800,000 Accumulated depreciation (34,000) 766,000 4 Angelino (a) Most forms of off statement of financial position financing have the effect of what is, in substance, debt finance either not appearing on the statement of financial position at all or being netted off against related assets such that it is not classified as debt. Common examples would be structuring a lease such that it fell to be treated as an operating lease when it has the characteristics of a finance lease, complex financial instruments classified as equity when they may have, at least in part, the substance of debt and ‘controlled’ entities having large borrowings (used to benefit the group as a whole), that are not consolidated because the financial structure avoids the entities meeting the definition of a subsidiary. The main problem of off statement of financial position finance is that it results in financial statements that do not faithfully represent the transactions and events that have taken place. Faithful representation is an important qualitative © Emile Woolf Publishing Limited 137 Paper F7: Financial Reporting (International) characteristic of useful information (as described in the Conceptual Framework). Financial statements that do not faithfully represent that which they purport to lack reliability. A lack of reliability may mean that any decisions made on the basis of the information contained in financial statements are likely to be incorrect or, at best, suboptimal. The level of debt on a statement of financial position is a direct contributor to the calculation of an entity’s statement of financial position gearing, which is considered as one of the most important financial ratios. It should be understood that, to a point, the use of debt financing is perfectly acceptable. Where statement of financial position gearing is considered low, borrowing is relatively inexpensive, often tax efficient and can lead to higher returns to shareholders. However, when the level of borrowings becomes high, it increases risk in many ways. Off statement of financial position financing may lead to a breach of loan covenants (a serious situation) if such debt were to be recognised on the statement of financial position in accordance with its substance. High gearing is a particular issue to equity investors. Equity (ordinary shares) is sometimes described as residual return capital. This description identifies the dangers (to equity holders) when an entity has high gearing. The dividend that the equity shareholders might expect is often based on the level of reported profits. The finance cost of debt acts as a reduction of the profits available for dividends. As the level of debt increases, higher interest rates are also usually payable to reflect the additional risk borne by the lender, thus the higher the debt the greater the finance charges and the lower the profit. Many off statement of financial position finance schemes also disguise or hide the true finance cost which makes it difficult for equity investors to assess the amount of profits that will be needed to finance the debt and consequently how much profit will be available to equity investors. Furthermore, if the market believes or suspects an entity is involved in ‘creative accounting’ (and off statement of financial position finance is a common example of this) it may adversely affect the entity’s share price. An entity’s level of gearing will also influence any decision to provide further debt finance (loans) to the entity. Lenders will consider the nature and value of the assets that an entity owns which may be provided as security for the borrowings. The presence of existing debt will generally increase the risk of default of interest and capital repayments (on further borrowings) and existing lenders may have a prior charge on assets available as security. In simple terms if an entity has high borrowings, additional borrowing is more risky and consequently more expensive. A prospective lender to an entity that already has high borrowings, but which do not appear on the statement of financial position is likely to make the wrong decision. If the correct level of borrowings were apparent, either the lender would not make the loan at all (too high a lending risk) or, if it did make the loan, it would be on substantially different terms (e.g. charge a higher interest rate) so as to reflect the real risk of the loan. Some forms of off statement of financial position financing may specifically mislead suppliers that offer credit. It is a natural precaution that a prospective supplier will consider the statement of financial position strength and liquidity ratios of the prospective customer. The existence of consignment inventories may be particularly relevant to trade suppliers. Sometimes consignment inventories and their related current liabilities are not recorded on the statement of financial position as the wording of the purchase agreement may be such that the legal 138 © Emile Woolf Publishing Limited Section 2: Answers to practice questions ownership of the goods remains with the supplier until specified events occur (often the onward sale of the goods). This means that other suppliers cannot accurately assess an entity’s true level of trade payables and consequently the average payment period to suppliers, both of which are important determinants in deciding whether to grant credit. (b) (i) Debt factoring is a common method of entities releasing the liquidity of their trade receivables. The accounting issue that needs to be decided is whether the trade receivables have been sold, or whether the income from the finance house for their ‘sale’ should be treated as a short term loan. The main substance issue with this type of transaction is to identify which party bears the risks (i.e. of slow and non-payment by the customer) relating to the asset. If the risk lies with the finance house (Omar), the trade receivables should be removed from the statement of financial position (derecognised in accordance with IAS 39). In this case it is clear that Angelino still bears the risk relating to slow and non-payment. The residual payment by Omar depends on how quickly the receivables are collected; the longer it takes, the less the residual payment (this imputes a finance cost). Any balance uncollected by Omar after six months will be refunded by Angelino which reflects the non-payment risk. Thus the correct accounting treatment for this transaction is that the cash received from Omar (80% of the selected receivables) should be treated as a current liability (a short term loan) and the difference between the gross trade receivables and the amount ultimately received from Omar (plus any amounts directly from the credit customers themselves) should be charged to the income statement. The classification of the charge is likely to be a mixture of administrative expenses (for Omar collecting receivables), finance expenses (reflecting the time taken to collect the receivables) and the impairment of trade receivables (bad debts). (ii) This is an example of a sale and leaseback of a property. Such transactions are part of normal commercial activity, often being used as a way to improve cash flow and liquidity. However, if an asset is sold at an amount that is different to its fair value there is likely to be an underlying reason for this. In this case it appears (based on the opinion of the auditor) that Finaid has paid Angelino $2 million more than the building is worth. No (unconnected) company would do this knowingly without there being some form of ‘compensating’ transaction. This sale is ‘linked’ to the five year rental agreement. The question indicates the rent too is not at a fair value, being $500,000 per annum ($1,300,000 – $800,000) above what a commercial rent for a similar building would be. It now becomes clear that the excess purchase consideration of $2 million is an ‘in substance’ loan (rather than sales proceeds – the legal form) which is being repaid through the excess ($500,000 per annum) of the rentals. Although this is a sale and leaseback transaction, as the building is freehold and has an estimated remaining life (20 years) that is much longer than the five year leaseback period, the lease is not a finance lease and the building should be treated as sold and thus derecognised. The correct treatment for this item is that the sale of the building should be recorded at its fair value of $10 million, thus the profit on disposal would be $2·5 million ($10 million – $7·5 million). The ‘excess’ of $2 million ($12 © Emile Woolf Publishing Limited 139 Paper F7: Financial Reporting (International) million – $10 million) should be treated as a loan (non-current liability). The rental payment of $1·3 million should be split into three elements; $800,000 building rental cost, $200,000 finance cost (10% of $2 million) and the remaining$300,000 is a capital repayment of the loan. (iii) The treatment of consignment inventory depends on the substance of the arrangements between the manufacturer and the dealer (Angelino). The main issue is to determine if and at what point in time the cars are ’sold’. The substance is determined by analysing which parties bear the risks (e.g. slow moving/obsolete inventories, finance costs) and receive the benefits (e.g. use of inventories, potential for higher sales, protection from price increases) associated with the transaction. Supplies from Monza Angelino has, and has actually exercised, the right to return the cars without penalty (or been required by Monza to transfer them to another dealer), which would indicate that it has not ‘bought’ the cars. There are no finance costs incurred by Angelino, however Angelino would suffer from any price increases that occurred during the three month holding/display period. These factors seem to indicate that the substance of this arrangement is the same as its legal form i.e. Monza should include the cars in its statement of financial position as inventory and therefore Angelino will not record a purchase transaction until it becomes obliged to pay for the cars (three months after delivery or until sold to customers if sooner). Supplies from Capri Although this arrangement seems similar to the above, there are several important differences. Angelino is bearing the finance costs of 1% per month (calling it a display charge is a distraction). The option to return the cars should be ignored because it is not likely to be exercised due to commercial penalties (payment of transport costs and loss of deposit). Finally the purchase price is fixed at the date of delivery rather than at the end of six months. These factors strongly indicate that Angelino bears the risks and rewards associated with ownership and should recognise the inventory and the associated liability in its financial statements at the date of delivery. 5 Emerald (a) 140 The Conceptual Framework defines an asset as a resource controlled by an entity as a result of past transactions or events from which future economic benefits (normally net cash inflows) are expected to flow to the entity. However assets can only be recognised (on the statement of financial position) when those expected benefits are probable and can be measured reliably. The Conceptual Framework recognises that there is a close relationship between incurring expenditure and generating assets, but they do not necessarily coincide. Development expenditure, perhaps more than any other form of expenditure, is a classic example of the relationship between expenditure and creating an asset. Clearly entities commit to expenditure on both research and development in the hope that it will lead to a profitable product, process or service, but at the time that the expenditure is being incurred, entities cannot be certain (or it may not even be probable) that the project will be successful. Relating this to accounting concepts would mean that if there is doubt that a project will be successful the © Emile Woolf Publishing Limited Section 2: Answers to practice questions application of prudence would dictate that the expenditure is charged (expensed) to the income statement. At the stage where management becomes confident that the project will be successful, it meets the definition of an asset and the accruals/matching concept would mean that it should be capitalised (treated as an asset) and amortised over the period of the expected benefits. Accounting Standards (IAS 38 Intangible Assets) interpret this as writing off all research expenditure and only capitalising development costs from the point in time where they meet strict conditions which effectively mean the expenditure meets the definition of an asset. (b) Emerald Income statement: Amortisation of development expenditure Statement of financial position Development expenditure 30 September 2012 $’000 335 (w (ii)) 30 September 2011 $’000 135 (w (i)) 1,195 (w (iv)) 1,130 (w (iii)) Statement of changes in equity Prior period adjustment (credit required to restate retained earnings at 1 October 2010) (cumulative carrying amount at 2010 of 300 + 165) 465 Workings (All figures in $’000. Note: references to 2009, 2010 etc should be taken as for the year ended 30 September Year Expenditure Amortisation (25%) Total amortisation Carrying amount 6 2009 300 –––– 2010 240 –––– 2011 cumulative 2011 1,340 800 –––– –––––– 2012 cumulative 2012 400 1,740 –––– –––––– nil nil nil –––– (75) nil nil –––– (75) (60) nil –––– (150) (60) nil –––––– (75) (60) (200) –––– (225) (120) (200) –––––– nil –––– 300 –––– (75) (w (i)) –––– 165 –––– (135) –––– 665 (w (iii)) –––– (210) (w (ii)) –––––– 1,130 –––––– (335) –––– 65 (w (iv)) –––– (545) –––––– 1,195 –––––– Conceptual Framework (a) The accruals basis requires transactions (or events) to be recognised when they occur (rather than on a cash flow basis). Revenue is recognised when it is earned (rather than when it is received) and expenses are recognised when they are incurred (i.e. when the entity has received the benefit from them), rather than when they are paid. Recording the substance of transactions (and other events) requires them to be treated in accordance with economic reality or their commercial intent rather than in accordance with the way they may be legally constructed. This is an important element of faithful representation. Prudence is used where there are elements of uncertainty surrounding transactions or events. Prudence requires the exercise of a degree of caution when making judgements or estimates under conditions of uncertainty. Thus when estimating the expected life of a newly acquired asset, if we have past experience of the use of similar assets and they had had lives of (say) between © Emile Woolf Publishing Limited 141 Paper F7: Financial Reporting (International) five and eight years, it would be prudent to use an estimated life of five years for the new asset. Comparability is fundamental to assessing the performance of an entity by using its financial statements. Assessing the performance of an entity over time (trend analysis) requires that the financial statements used have been prepared on a comparable (consistent) basis. Generally this can be interpreted as using consistent accounting policies (unless a change is required to show a fairer presentation). A similar principle is relevant to comparing one entity with another; however it is more difficult to achieve consistent accounting policies across entities. Information is material if its omission or misstatement could influence (economic) decisions of users based on the reported financial statements. Clearly an important aspect of materiality is the (monetary) size of a transaction, but in addition the nature of the item can also determine that it is material. For example the monetary results of a new activity may be small, but reporting them could be material to any assessment of what it may achieve in the future. Materiality is considered to be a threshold quality, meaning that information should only be reported if it is considered material. Too much detailed (and implicitly immaterial) reporting of (small) items may confuse or distract users. (b) Accounting for inventory, by adjusting purchases for opening and closing inventories is a classic example of the application of the accruals principle whereby revenues earned are matched with costs incurred. Closing inventory is by definition an example of goods that have been purchased, but not yet consumed. In other words the entity has not yet had the ‘benefit’ (i.e. the sales revenue they will generate) from the closing inventory; therefore the cost of the closing inventory should not be charged to the current year’s income statement. Consignment inventory is where goods are supplied (usually by a manufacturer) to a retailer under terms which mean the legal title to the goods remains with the supplier until a specified event (say payment in three months time). Once the goods have been transferred to the retailer, normally the risks and rewards relating to those goods then lie with the retailer. Where this is the case then (in substance) the consignment inventory meets the definition of an asset and the goods should appear as such (inventory) on the retailer’s statement of financial position (along with the associated liability to pay for them) rather than on the statement of financial position of the manufacturer. At the year end, the value of an entity’s closing inventory is, by its nature, uncertain. In the next accounting period it may be sold at a profit or a loss. Accounting standards require inventory to be valued at the lower of cost and net realisable value. This is the application of prudence. If the inventory is expected to sell at a profit, the profit is deferred (by valuing inventory at cost) until it is actually sold. However, if the goods are expected to sell for a (net) loss, then that loss must be recognised immediately by valuing the inventory at its net realisable value. There are many acceptable ways of valuing inventory (e.g. average cost or FIFO). In order to meet the requirement of comparability, an entity should decide on the most appropriate valuation method for its inventory and then be consistent in the use of that method. Any change in the method of valuing (or accounting for) inventory would break the principle of comparability. 142 © Emile Woolf Publishing Limited Section 2: Answers to practice questions For most businesses inventories are a material item. An error (omission or misstatement) in the value or treatment of inventory has the potential to affect decisions users may make in relation to financial statements. Therefore (correctly) accounting for inventory is a material event. Conversely there are occasions where on the grounds of immateriality certain ‘inventories’ are not (strictly) accounted for correctly. For example, at the year end a company may have an unused supply of stationery. Technically this is inventory, but in most cases companies would charge this ‘inventory’ of stationery to the income statement of the year in which it was purchased rather than show it as an asset. Note: other suitable examples would be acceptable. 7 Promoil (a) A liability is a present obligation of an entity arising from past events, the settlement of which is expected to result in an outflow of economic benefits (normally cash). Provisions are defined as liabilities of uncertain timing or amount, i.e. they are normally estimates. In essence provisions should be recognised if they meet the definition of a liability. Equally they should not be recognised if they do not meet the definition. A statement of financial position would not give a ‘fair representation’ if it did not include all of an entity’s liabilities (or if it did include, as liabilities, items that were not liabilities). These definitions benefit the reliability of financial statements by preventing profits from being ‘smoothed’ by making a provision to reduce profit in years when they are high and releasing those provisions to increase profit in years when they are low. It also means that the statement of financial position cannot avoid the immediate recognition of long-term liabilities (such as environmental provisions) on the basis that those liabilities have not matured. (b) (i) Future costs associated with the acquisition/construction and use of noncurrent assets, such as the environmental costs in this case, should be treated as a liability as soon as they become unavoidable. For Promoil this would be at the same time as the platform is acquired and brought into use. The provision is for the present value of the expected costs and this same amount is treated as part of the cost of the asset. The provision is ‘unwound’ by charging a finance cost to the income statement each year and increasing the provision by the finance cost. Annual depreciation of the asset effectively allocates the (discounted) environmental costs over the life of the asset. Income statement for the year ended 30 September 2012 Depreciation (see below) Finance costs ($6·9 million x 8%) Statement of financial position as at 30 September 2012 Non-current assets Cost ($30 million + $6·9 million ($15 million x 0·46)) Depreciation (over 10 years) Non-current liabilities $’000 3,690 552 36,900 (3,690) ––––––– 33,210 ––––––– Environmental provision ($6·9 million x 1·08) 7,452 © Emile Woolf Publishing Limited 143 Paper F7: Financial Reporting (International) (ii) If there was no legal requirement to incur the environmental costs, then Promoil should not provide for them as they do not meet the definition of a liability. Thus the oil platform would be recorded at $30 million with $3 million depreciation and there would be no finance costs. However, if Promoil has a published policy that it will voluntarily incur environmental clean up costs of this type (or if this may be implied by its past practice), then this would be evidence of a ‘constructive’ obligation under IAS 37 and the required treatment of the costs would be the same as in part (i) above. 8 Wardle (a) For financial statements to be of value to their users they must possess certain characteristics; reliability is one such important characteristic. In order for financial statements to be reliable, they must faithfully represent an entity’s underlying transactions and other events. For financial statements to achieve faithful representation, transactions must be accounted for and presented in accordance with their substance and economic reality where this differs from their legal form. For example, if an entity ‘sold’ an asset to a third party, but continued to enjoy the future benefits embodied in that asset, then this transaction would not be represented faithfully by recording it as a sale (in all probability this would be a financing transaction). The features that may indicate that the substance of a transaction is different from its legal form are: – where the control of an asset differs from the ownership of the asset – where assets are ‘sold’ at prices that are greater or less than their fair values – the use of options as part of an agreement – where there are a series of ‘linked’ transactions. It should be noted that none of the above necessarily mean there is a difference between substance and legal form. (b) Extracts from the income statements (i) reflecting the legal form: Year ended: Revenue Cost of sales Gross profit Finance costs Net profit 144 31 March 2010 31 March 2011 31 March 2012 Total $’000 $’000 $’000 $’000 6,000 nil 10,000 16,000 (5,000) –––––– 1,000 nil ––– nil (7,986) ––––––– 2,014 (12,986) ––––––– 3,014 nil –––––– 1,000 –––––– nil ––– nil ––– nil ––––––– 2,014 ––––––– nil ––––––– 3,014 ––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions (ii) reflecting the substance: Year ended: Revenue Cost of sales Gross profit 31 March 2010 31 March 2011 31 March 2012 Total $’000 $’000 $’000 $’000 nil nil 10,000 10,000 (nil) –––––– nil nil ––– nil (5,000) ––––––– 5,000 (5,000) ––––––– 5,000 Finance costs (c) (600) (660) (726) (1,986) –––––– ––– ––––––– ––––––– Net profit (600) (660) 4,274 3,014 –––––– ––– ––––––– ––––––– It can be seen from the above that the two treatments have no effect on the total net profit reported in the income statements, however, the profit is reported in different periods and the classification of costs is different. In effect the legal form creates some element of profit smoothing and completely hides the financing cost. Although not shown, the effect on the statements of financial position is that recording the legal form of the transaction does not show the inventory, nor does it show the in-substance loan. Thus recording the legal form would be an example of off balance sheet (statement of financial position) financing. The effect on an assessment of Wardle using ratio analysis may be that recording the legal form rather than the substance of the transaction would be that interest cover and inventory turnover would be higher and gearing lower. All of which may be considered as reporting a more favourable performance. Financial statements – Statements of cash flow 9 Tabba (a) Tabba: Statement of cash flows for the year ended 30 September 2012 $000 Cash flows from operating activities Profit before tax 50 Adjustments for: Depreciation (w (i)) 2,200 Amortisation of government grant (w (iii)) (250) Profit on sale of factory (w (i)) (4,600) Increase in insurance claim provision (1,500 – 1,200) (300) Interest receivable (40) Interest expense 260 (2,680) Working capital adjustments: Increase in inventories (2,550 – 1,850) (700) Increase in trade receivables (3,100 – 2,600) (500) Increase in trade payables (4,050 – 2,950) 1,100 Cash outflow from operations (2,780) Interest paid (260) © Emile Woolf Publishing Limited $000 145 Paper F7: Financial Reporting (International) Tabba: Statement of cash flows for the year ended 30 September 2012 $000 $000 Cash flows from operating activities Income taxes paid (w (iv)) (1,350) Net cash outflow from operating activities (4,390) Cash flows from investing activities Sale of factory Purchase of non-current assets (w (i)) Receipt of government grant (from question) Interest received Net cash from investing activities Cash flows from financing activities Issue of 6% loan notes Redemption of 10% loan notes Repayment of finance leases (w (ii)) Net cash from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period 12,000 (2,900) 950 40 10,090 800 (4,000) (1,100) (4,300) 1,400 (550) 850 Tutorial note: Interest paid may also be presented as a financing activity and interest received may be presented as an operating cash flow. Workings (figures in $000) (i) Non-current assets Cost/valuation at beginning of the year New finance leases (from question) Disposals in the year 20,200 1,500 (8,600) –––––– 13,100 Cost/valuation at end of the year Therefore acquisitions during the year Accumulated depreciation at beginning of the year Accumulated depreciation on disposals 16,000 –––––– 2,900 –––––– 4,400 (1,200) –––––– 3,200 Accumulated depreciation at end of the year Therefore depreciation charge for the year 5,400 –––––– 2,200 –––––– Sale of factory Proceeds (from question) 12,000 Net book value (7,400) Profit on sale 146 –––––– 4,600 –––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions (ii) Finance lease obligations Balance brought forward: current 800 Balance brought forward: over 1 year 1,700 –––––– 2,500 New leases (from question) 1,500 –––––– 4,000 Balance carried forward: current Balance carried forward: over 1 year 900 2,000 –––––– (2,900) –––––– Cash repayments – balancing figure (iii) 1,100 –––––– Government grant Balance brought forward: current 400 Balance brought forward: over 1 year 900 –––––– 1,300 Grants received in year (from question) 950 –––––– 2,250 Balance carried forward: current Balance carried forward: over 1 year 600 1,400 –––––– –––––– Difference – amortisation credited to income statement (iv) (2,000) 250 –––––– Taxation Current provision brought forward Deferred tax brought forward 1,200 500 –––––– 1,700 (50) Tax credit in income statement –––––– 1,650 Current provision carried forward Deferred tax carried forward Tax paid – balancing figure (v) –––––– (300) –––––– 1,350 –––––– Reconciliation of retained earnings Balance b/f Transfer from revaluation reserve Profit for period Balance c/f (b) 100 200 850 1,600 100 –––––– 2,550 –––––– Consideration of the statement of cash flows reveals some important information in assessing the change in the financial position of Tabba during the year. There © Emile Woolf Publishing Limited 147 Paper F7: Financial Reporting (International) is a huge net cash outflow from operating activities of $4,390,000 despite Tabba reporting a small operating profit of $270,000. More detailed analysis of this difference reveals some worrying concerns for the future. Many companies have higher operating cash flows than their underlying operating profit, mainly due to depreciation charges being added back to profits to arrive at the cash flows. In Tabba’s case, operating profits have been ‘improved’ by $2.2 million during the year in terms of the underlying cash flows. However, the major reconciling difference is the profit on the sale of Tabba’s factory of $4.6 million. This amount has been credited in the income statement and has dramatically distorted the operating profit. If the sale and lease back of the factory had not taken place, Tabba’s operating profits would show losses of $4.33 million (ignoring any possible tax effects). When Tabba publishes its financial statements this profit will almost certainly require separate disclosure which should make the effects of the transaction more transparent to the users of the financial statements. A further indication of poor operating profits is that they have been boosted by $300,000 due to an increase in the insurance claim provision (again this is not a cash flow) and $250,000 amortisation of government grants. Many commentators believe that the net cash flow from operating activities is the most important figure in the statement of cash flows. This is because it is a measure of expected or maintainable future cash flows. In Tabba’s case this highlights a very important point; although Tabba has increased its cash position during the year by $1.4 million, $12 million has come from the sale of its factory. Clearly this is a one-off transaction that cannot be repeated in future years. If the drain on the operating cash flows continues at the current rates, the company will not survive for very long. The tax position: there is a small tax credit in the income statement, perhaps due to current year trading losses, whereas the cash flow statement shows that tax of $1.35 million has been paid during the year. This payment of tax is on what must have been a substantial profit for the previous year. This seems to confirm the deteriorating position of the company. There has been a very small increase in working capital of $100,000. However, underlying this is the fact that both inventories and trade receivables are showing substantial increases (despite the profit deterioration), which may indicate the presence of bad debts or obsolete inventories, and trade payables have also increased substantially (by $1.1 million) which may be a symptom of liquidity problems prior to the sale of the factory. On the positive side there has been substantial investment in non-current assets (after allowing for the sale of the factory), but even this is partly due to leasing assets of $1.5 million (companies often lease assets when they do not have the resources to purchase them outright) and finance from a government grant of $950,000. The company appears to have taken advantage of the proceeds from the sale of the factory to redeem the expensive 10% $4 million loan note. (This has partly been replaced by a less expensive 6% $800,000 loan note). In conclusion the statement of cash flows reveals some interesting and worrying issues that may indicate a worrying future for Tabba and serves as an illustration of the importance of a statement of cash flows to the users of financial statements. 148 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 10 Boston (a) Boston: Statement of cash flows for the year ended 31 March 2012 $000 65 Cash flows from operating activities Profit before tax Adjustments for: Depreciation of non-current assets Loss on sale of hotel Interest expense $000 35 12 10 122 Working capital adjustments: Increase in current assets (155 – 130) Decrease in other current liabilities (115 – 108) Cash generated from operations Interest paid (see note) Income tax paid Net cash outflow from operating activities Cash flows from investing activities Purchase of non-current assets (see below) Sale of non-current assets: 40 – 12 Net cash used in investing activities Cash flows from financing activities Issue of ordinary shares (20 + 20) Issue of loans (65 – 40) Net cash from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period: Cash and cash equivalents at end of period (25) (7) 90 (10) (30) 50 (123) 28 (95) 40 25 65 20 (5) 15 Tutorial note: Interest paid may also be presented as a cash flow from financing activities. Workings (figures in $000) Non-current assets: carrying amount $m Balance b/f 332 Disposal (40) Depreciation for the year (35) 257 Balance c/f 380 Cash purchases (balancing figure) 123 © Emile Woolf Publishing Limited 149 Paper F7: Financial Reporting (International) (b) Report on the financial performance of Boston for the year ended 31 March 2012 To: The Board of Boston From: Date: Profitability The most striking feature of the current year’s performance is the deterioration in the ROCE, down from 25.6% to only 18.0%. This represents an overall fall in profitability of 30% (= (25.6 – 18·.0)/25.6). An examination of the other ratios shows that this is due to a decline in both profit margins and asset utilisation. A closer look at the profit margins shows that the decline in gross margin is relatively small (42.2% down to 41.4%), whereas the fall in the operating profit margin is down by 2.8%, this represents a 15.7% decline in profitability (i.e. 2.8% on 17.8%). This has been caused by increases in operating expenses of $12m and unallocated corporate expenses of $10m. These increases represent more than half of the net profit for the period and further investigation into the cause of these increases should be made. The company is generating only $1.20 of sales per $1 of net assets this year compared to a figure of $1.40 in the previous year. This decline in asset utilisation represents a fall of 14.3% (= (1.4 – 1.2)/1.4). Liquidity/solvency From the limited information provided a poor current ratio of 0·9:1 in 2011 has improved to 1·3:1 in the current year. Despite the improvement, it is still below the accepted norm. At the same time gearing has increased from 12.8% to 15.6%. Information from the statement of cash flows shows the company raised $65 million in new capital ($40m in equity and $25m in loans). The disproportionate increase in the loans is the cause of the increase in gearing. However, at 15.6% this is still not a highly-geared company. The increase in finance has been used mainly to purchase new non-current assets, but it has also improved liquidity, mainly by reversing an overdraft of $5 million to a bank balance in hand of $15 million. A common feature of new investment is that there is often a delay between making the investment and benefiting from the returns. This may be the case with Boston, and it may be that in future years the increased investment will be rewarded with higher returns. Another aspect of the investment that may have caused the lower return on assets is that the investment is likely to have occurred part way through the year (maybe even near the year end). This means that the income statement may not include returns for a full year, whereas in future years it will. Segment issues Segment information is intended to help the users to better assess the performance of an enterprise by looking at the detailed contribution made by the differing activities that comprise the enterprise as a whole. Referring to the segment ratios it appears that the carpeting segment is giving the greatest contribution to overall profitability achieving a 48.6% return on its segment assets, whereas the equivalent return for house building is 38.1% and for hotels it is only 16.7%. The main reason for the better return from carpeting is due to its 150 © Emile Woolf Publishing Limited Section 2: Answers to practice questions higher segment net profit margin of 38.9% compared to hotels at 15·4% and house building at 28·6%. Carpeting’s higher segment net profit is in turn a reflection of its underlying very high gross margin (66.7%). The segment net asset turnover of the hotels (1.1 times) is also very much lower than the other two segments (1.3 times). It seems that the hotel segment is also responsible for the group’s fairly poor liquidity ratios (ignoring the bank balances) the segment current liabilities are 50% greater than its current assets ($60m compared to $40m). The opposite of this would be a more acceptable current ratio. These figures are based on historical values. Most commentators argue that the use of fair values is more consistent and thus provides more reliable information on which to base assessments (they are less misleading than the use of historical values). If fair values are used all segments understandably show lower returns and poorer performance (as fair values are higher than historical values), but the figures for the hotels are proportionately much worse, falling by a half of the historic values (as the fair values of the hotel segment are exactly double the historical values). Fair value adjusted figures may even lead one to question the future of the hotel activities. However, before making any conclusions an important issue should be considered. Although the reported profit of the hotels is poor, the market values of its segment assets have increased by a net $90 million. New net investment in hotel capital expenditure is $64 million ($104m – $40m disposal); this leaves an increase in value of $26 million. The majority of this appears to be from market value increases. Whilst this is not a realised profit, it is nevertheless a significant and valuable gain (equivalent to 65% of the group reported net profit). Conclusion Although the company’s overall performance has deteriorated in the current year, it is clear that at least some areas of the business have had considerable new investment which may take some time to produce returns. This applies to the hotel segment in particular and may explain its poor performance, which is also partly offset by the strong increase in the market value of its assets. Appendix Further segment ratios Return on net assets at fair values (35/97 × 100%) Asset turnover on fair values (times) (90/97) Carpeting Hotels 36.1% 0.9 8.3% 0.5 House building 30.2% 1.1 Note: Workings have been shown for the figures for the carpeting segment only, the figures for the other segments are based on similar calculations. © Emile Woolf Publishing Limited 151 Paper F7: Financial Reporting (International) 11 Planter Planter: Statement of cash flows for the year to 31 March 2012 $ Cash flows from operating activities Net profit before interest and tax (per question) Adjustments: Depreciation – buildings (W1) – plant (W2) 17,900 1,800 26,600 28,400 4,200 (2,300) 48,200 14,100 (21,800) (4,700) 35,800 (1,400) (10,000) 24,400 Loss on sale of plant (W1) Profit on sale of investments (11,000 – 8,700) Decrease in inventory (57,400 – 43,300) Increase in receivables (50,400 – 28,600) Decrease in payables (31,400 – 26,700) Cash generated from operations Interest paid (1,700 – 300 accrued) Income tax paid (8,900 + 1,100) Net cash from operating activities Cash flows from investing activities Purchase of plant (W1) Purchase of land and buildings (W1) Investment income Sale of plant (W1) Sale of investments Net cash used in investing activities Cash flows from financing activities Issue of ordinary shares (W2) Redemption of 8% loan notes Ordinary dividend paid Net cash used in financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at 1 April 2011 Cash and cash equivalents at 31 March 2012 $ (38,100) (7,100) 400 7,800 11,000 (26,000) 28,000 (3,400) (26,100) (1,500) (3,100) 1,200 (1,900) Workings (W1) Non-current assets $ Land and buildings Opening balance Revaluation surplus (18,000 – 12,000) 49,200 6,000 55,200 Closing balance Acquisitions – balancing figure 152 62,300 7,100 © Emile Woolf Publishing Limited Section 2: Answers to practice questions $ Accumulated depreciation: opening balance 5,000 Accumulated depreciation: closing balance 6,800 Depreciation charge for year – balancing figure 1,800 $ Plant Opening balance at cost Disposals at cost 70,000 (23,500) 46,500 84,600 38,100 Closing balance at cost Acquisitions – balancing figure Accumulated depreciation: opening balance Accumulated depreciation: disposals 22,500 (11,500) 11,000 37,600 26,600 $ 12,000 (7,800) 4,200 Accumulated depreciation: closing balance Depreciation charge for year – balancing figure Disposal of plant: Disposal at net book value Sale proceeds (given in the question) Loss on sale (W2) Share capital and share premium $m 25,000 2,500 27,500 50,000 22,500 Opening balance, ordinary shares Bonus issue 1 for 10 (from share premium) Closing balance, ordinary shares Difference: shares issued for cash (nominal value) Opening balance, share premium Bonus issue Closing balance, share premium Increase in premium on cash issue of shares Total cash proceeds of share issue 12 5,000 (2,500) 2,500 8,000 5,500 28,000 Casino (a) Casino Statement of cash flows for the Year to 31 March 2012 $m Cash flows from operating activities Operating loss Adjustments for: © Emile Woolf Publishing Limited $m (32) 153 Paper F7: Financial Reporting (International) Casino Statement of cash flows for the Year to 31 March 2012 Depreciation – buildings (W1) – plant (W2) – intangibles (510 – 400) Loss on disposal of plant (from question) $m 12 81 110 12 215 183 70 (436) 15 (168) (16) (81) (265) Operating profit before working capital changes Decrease in inventory (420 – 350) Increase in trade receivables (808 – 372) Increase in trade payables (530 – 515) Cash generated from operations Interest paid Income tax paid (W3) Net cash used in operating activities Cash flows from investing activities Purchase of – land and buildings (W1) – plant (W2) Sale of plant (W2) Interest received (12 – 5 + 3) Net cash used in investing activities Cash flows from financing activities Issue of ordinary shares (100 + 60) Issue of 8% variable rate loan (160 – 2 issue costs) Repayments of 12% loan (150 + 6 penalty) Dividends paid Net cash from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period (120 + 75) Cash and cash equivalents at end of period (125 – (32 + 15)) $m (110) (60) 15 10 (145) 160 158 (156) (25) 137 (273) 195 (78) Interest and dividends received and paid may be shown as operating cash flows or as investing or financing activities as appropriate. Workings (in $ million) (W1) Land and buildings Net book value b/f 420 Revaluation gains 70 Depreciation for year 154 (12) Net book value c/f (588) Difference is cash purchases (110) © Emile Woolf Publishing Limited Section 2: Answers to practice questions (W2) Plant: Cost b/f Additions from question Balance c/f Difference is cost of disposal Loss on disposal Proceeds Difference accumulated depreciation of plant disposed of 445 60 (440) 65 (12) (15) 38 Depreciation b/f Less – disposal (above) Depreciation c/f Charge for year 105 (38) (148) (81) (W3) Taxation: Tax provision b/f (110) Deferred tax b/f (75) Income statement net charge (1) Tax provision c/f 15 Deferred tax c/f 90 Difference is cash paid (81) (W4) Revaluation reserve: Balance b/f 45 Revaluation gains 70 Transfer to retained earnings (3) Balance c/f 112 (W5) Retained earnings: Balance b/f Loss for period (45) Dividends paid (25) Transfer from revaluation reserve Balance c/f (b) 1,165 3 1,098 The accruals/matching concept applied in preparing an income statement has the effect of smoothing cash flows for reporting purposes. This practice arose because interpreting ‘raw’ cash flows can be very difficult and the accruals process has the advantage of helping users to understand the underlying performance of a company. For example if an item of plant with an estimated life of five years is purchased for $100,000, then in the statement of cash flows for the five year period there would be an outflow in year 1 of the full $100,000 and no further outflows for the next four years. Contrast this with the income statement where by applying the accruals principle, depreciation of the plant would give a charge of $20,000 per annum (assuming straight-line depreciation). Many would see this example as an advantage of an income statement, however it is important to realise that profit is affected by many subjective items. This has led to © Emile Woolf Publishing Limited 155 Paper F7: Financial Reporting (International) accusations of profit manipulation or creative accounting, disillusionment of the usefulness of the income statement. hence the Another example of the difficulty in interpreting cash flows is that counterintuitively a decrease in overall cash flows is not always a bad thing (it may represent an investment in extra productive capacity). Nor is an increase in cash flows necessarily a good thing, since this may be from the sale of non-current assets because of the need to raise cash urgently. The advantages of cash flows are: 13 it is difficult to manipulate cash flows, they are real and possess the qualitative characteristic of objectivity (as opposed to subjective profits). cash flows are an easy concept for users to understand, indeed many users misinterpret income statement items as being cash flows. cash flows help to assess a company’s liquidity, solvency and financial adaptability. Healthy liquidity is vital to a company’s going concern. many business investment decisions and company valuations are based on projected cash flows. the ‘quality’ of a company’s operating profit is said to be confirmed by closely correlated cash flows. Some analysts take the view that if a company shows a healthy operating profit, but has low or negative operating cash flows, there is a suspicion of profit manipulation or creative accounting. Minster (a) Statement of cash flows of Minster for the Year ended 30 September 2012: $000 Cash flows from operating activities Profit before tax Adjustments for: Depreciation of property, plant and equipment Amortisation of software (180 – 135) 142 255 45 ⎯⎯⎯ Investment income Finance costs ⎯⎯⎯ Working capital adjustments Decrease in trade receivables (380 – 270) 110 $000 (25) 30 (90) ⎯⎯⎯ Increase in amounts due from construction contracts (80 – 55) Decrease in inventories (510 – 480) Decrease in trade payables (555 – 350) (205) Cash generated from operations Interest paid (40 – 12 re unwinding of environmental provision) Income taxes paid (w (ii)) Net cash from operating activities Cash flows from investing activities 156 $000 300 ⎯⎯⎯ (20) 40 ⎯⎯⎯ 462 $000 ⎯⎯⎯ 372 (28) (54) ⎯⎯⎯ 290 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Purchase of – property, plant and equipment (w (i)) – software – investments (150 – (15 + 125)) Investment income received (20 – 15 gain on investments) Net cash used in investing activities Cash flows from financing activities Proceeds from issue of equity shares (w (iii)) Proceeds from issue of 9% loan note Dividends paid (500 x 4 x 5 cents) Net cash from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period (40 – 35) Cash and cash equivalents at end of period $000 (410) (180) (10) 5 ⎯⎯⎯ $000 (595) 265 120 (100) ⎯⎯⎯ 285 ⎯⎯⎯ (20) (5) ⎯⎯⎯ (25) ⎯⎯⎯ Note: interest paid may be presented under financing activities and dividends paid may be presented under operating activities. Workings (in $’000) (i) Property, plant and equipment: carrying amount b/f non-cash environmental provision revaluation depreciation for period carrying amount c/f difference is cash acquisitions (ii) Taxation: tax provision b/f deferred tax b/f income statement charge tax provision c/f deferred tax c/f difference is cash paid (iii) Equity shares balance b/f bonus issue (1 for 4) balance c/f difference is cash issue Share premium balance b/f bonus issue (1 for 4) balance c/f 940 150 35 (255) (1,280) ⎯⎯⎯ (410) ⎯⎯⎯ (50) (25) (57) 60 18 ⎯⎯⎯ (54) ⎯⎯⎯ (300) (75) 500 ⎯⎯⎯ 125 ⎯⎯⎯ (85) 75 150 ⎯⎯⎯ difference is cash issue 140 ⎯⎯⎯ Therefore the total proceeds of cash issue of shares are $265,000 (125 + 140). © Emile Woolf Publishing Limited 157 Paper F7: Financial Reporting (International) (b) Report on the financial position of Minster for the year ended 30 September 2012 To: From: Date: Minster shows healthy operating cash inflows of $372,000 (prior to finance costs and taxation). This is considered by many commentators as a very important figure as it is often used as the basis for estimating the company’s future maintainable cash flows. Subject to (inevitable) annual expected variations and allowing for any changes in the company’s structure this figure is more likely to be repeated in the future than most other figures in the statement of cash flows which are often ‘one-off’ cash flows such as raising loans or purchasing noncurrent assets. The operating cash inflow compares well with the underlying profit before tax $142,000. This is mainly due to depreciation charges of $300,000 being added back to the profit as they are a non-cash expense. The cash inflow generated from operations of $372,000 together with the reduction in net working capital of $90,000 is more than sufficient to cover the company’s taxation payments of $54,000, interest payments of $28,000 and the dividend of $100,000 and leaves an amount to contribute to the funding of the increase in non-current assets. It is important that these short term costs are funded from operating cash flows; it would be of serious concern if, for example, interest or income tax payments were having to be funded by loan capital or the sale of non-current assets. There are a number of points of concern. The dividend of $100,000 gives a dividend cover of less than one (85/100 = 0·85) which means the company has distributed previous year’s profits. This is not a tenable situation in the longterm. The size of the dividend has also contributed to the lower cash balances (see below). There is less investment in both inventory levels and trade receivables. This may be the result of more efficient inventory control and better collection of receivables, but it may also indicate that trading volumes may be falling. Also of note is a large reduction in trade payable balances of $205,000. This too may be indicative of lower trading (i.e. less inventory purchased on credit) or pressure from suppliers to pay earlier. Without more detailed information it is difficult to come to a conclusion in this matter. Investing activities: The statement of cash flows shows considerable investment in non-current assets, in particular $410,000 in property, plant and equipment. These acquisitions represent an increase of 44% of the carrying amount of the property, plant and equipment as at the beginning of the year. As there are no disposals, the increase in investment must represent an increase in capacity rather than the replacement of old assets. Assuming that this investment has been made wisely, this should bode well for the future (most analysts would prefer to see increased investment rather than contraction in operating assets). An unusual feature of the required treatment of environmental provisions is that the investment in non-current assets as portrayed by the statement of cash flows appears less than if statement of financial position figures are used. The statement of financial position at 30 September 2012 includes $150,000 of non-current assets (the discounted cost of the environmental provision), which does not appear in the cash flow figures as it is not a cash ‘cost’. A further consequence is that the ‘unwinding’ of the discounting of the provision causes a financing expense in the income statement 158 © Emile Woolf Publishing Limited Section 2: Answers to practice questions which is not matched in the statement of cash flows as the unwinding is not a cash flow. Many commentators have criticised the required treatment of environmental provisions because they cause financing expenses which are not (immediate) cash costs and no ‘loans’ have been taken out. Viewed in this light, it may be that the information in the statement of cash flows is more useful than that in the income statement and statement of financial position. Financing activities: The increase in investing activities (before investment income) of $600,000 has been largely funded by an issue of shares at $265,000 and raising a 9% $120,000 loan note. This indicates that the company’s shareholders appear reasonably pleased with the company's past performance (or they would not be very willing to purchase further shares). The interest rate of the loan at 9% seems quite high, and virtually equal to the company’s overall return on capital employed of 9·1% (162/(1,660 + 120)). Provided current profit levels are maintained, it should not reduce overall returns to shareholders. Cash position: The overall effect of the year’s cash flows has worsened the company’s cash position by an increased net cash liability of $20,000. Although the company’s short term borrowings have reduced by $15,000, the cash at bank of $35,000 at the beginning of the year has now gone. In comparison to the cash generation ability of the company and considering its large investment in non-current assets, this $20,000 is a relatively small amount and should be relieved by operating cash inflows in the near future. Summary The above analysis shows that Minster has invested substantially in new noncurrent assets suggesting expansion. To finance this, the company appears to have no difficulty in attracting further long-term funding. At the same time there are indications of reduced inventories, trade receivables and payables which may suggest the opposite i.e. contraction. It may be that the new investment is a change in the nature of the company’s activities (e.g. mining) which has different working capital characteristics. The company has good operating cash flow generation and the slight deterioration in short term net cash balance should only be temporary. Yours ………………….. 14 Pinto (a) Statement of cash flows of Pinto for the Year to 31 March 2012: Cash flows from operating activities Profit before tax Adjustments for: Depreciation of property, plant and equipment Loss on sale of property, plant and equipment $’000 280 90 ––––––– Increase in warranty provision (200 – 100) Investment income Finance costs Redemption penalty costs included in administrative expenses © Emile Woolf Publishing Limited $’000 440 370 100 (60) 50 20 ––––––– 920 159 Paper F7: Financial Reporting (International) Working capital adjustments Increase in inventories (1,210 – 810) Decrease in trade receivables (540 – 480) Increase in trade payables (1,410 – 1,050) Cash generated from operations Finance costs paid Income tax refund (w (ii)) Net cash from operating activities Cash flows from investing activities Purchase of property, plant and equipment (w (i)) Sale of property, plant and equipment (240 – 90) Investment income received (60 – 20 gain on investment property) Net cash used in investing activities Cash flows from financing activities Proceeds from issue of equity shares (400 + 600) Redemption of loan notes (400 plus 20 penalty) Dividends paid (1,000 x 5 x 3 cents) Net cash from financing activities $’000 (400) 60 360 ––––––– $’000 20 ––––––– 940 (50) 60 ––––––– 950 (1,440) 150 40 ––––––– (1,250) 1,000 (420) (150) ––––––– 430 ––––––– Net increase in cash and cash equivalents 130 Cash and cash equivalents at beginning of period (120) ––––––– Cash and cash equivalents at end of period 10 ––––––– Note: investment income received and dividends paid may alternatively be shown in operating activities. Workings (in $’000) (i) Property, plant and equipment: carrying amount b/f revaluation depreciation for period disposal carrying amount c/f difference is cash acquisitions (ii) Income tax: tax asset b/f deferred tax b/f income statement charge tax provision c/f deferred tax c/f difference is cash received (b) Comments on the cash management of Pinto 1,860 100 (280) (240) (2,880) ––––––– (1,440) ––––––– 50 (30) (160) 150 50 ––––––– 60 ––––––– Operating cash flows: Pinto’s operating cash inflows at $940,000 (prior to investment income, finance costs and taxation) are considerably higher than the equivalent profit before 160 © Emile Woolf Publishing Limited Section 2: Answers to practice questions investment income, finance costs and tax of $430,000. This shows a satisfactory cash generating ability and is more than sufficient to cover finance costs, taxation (see later) and dividends. The major reasons for the cash flows being higher than the operating profit are due to the (non-cash) increases in the depreciation and warranty provisions. Working capital changes are relatively neutral; a large increase in inventory appears to be being financed by a substantial increase in trade payables and a modest reduction in trade receivables. The reduction in trade receivables is perhaps surprising as other indicators point to an increase in operating capacity which has not been matched with an increase in trade receivables. This could be indicative of good control over the cash management of the trade receivables (or a disappointing sales performance). An unusual feature of the cash flow is that Pinto has received a tax refund of $60,000 during the current year. This would indicate that in the previous year Pinto was making losses (hence obtaining tax relief). Whilst the current year’s profit performance is an obvious improvement, it should be noted that next year’s cash flows are likely to suffer a tax payment (estimated at $150,000 in current liabilities at 31 March 2012) as a consequence. In any forward planning, Pinto should be aware that the tax reversal position will create an estimated total incremental outflow of $210,000 in the next period. Investing activities: There has been a dramatic investment/increase in property, plant and equipment. The carrying value at 31 March 2012 is substantially higher than a year earlier (admittedly $100,000 is due to revaluation rather than a purchase). It is difficult to be sure whether this represents an increase in operating capacity or is the replacement of the plant disposed of. (The voluntary disclosure encouraged by IAS 7 Statement of cash flows would help to assess this issue more accurately). However, judging by the level of the increase and the (apparent) overall improvement in profit position, it seems likely that there has been a successful increase in capacity. It is not unusual for there to be a time lag before increased investment reaches its full beneficial effect and in this context it could be speculated that the investment occurred early in the accounting year (because its effect is already making an impact) and that future periods may show even greater improvements. The investment property is showing a good return which is composed of rental income (presumably) of $40,000 and a valuation gain of $20,000. Financing activities: It would appear that Pinto’s financial structure has changed during the year. Debt of $400,000 has been redeemed (for $420,000) and there has been a share issue raising $1 million. The company is now nil geared compared to modest gearing at the end of the previous year. The share issue has covered the cost of redemption and contributed to the investment in property, plant and equipment. The remainder of the finance for the property, plant and equipment has come from the very healthy operating cash flows. If ROCE is higher than the finance cost of the loan note at 6% (nominal) it may call into question the wisdom of the early redemption especially given the penalty cost (which has been classified within financing activities) of the redemption. Cash position: The overall effect of the year’s cash flows is that they have improved the company’s cash position dramatically. A sizeable overdraft of $120,000, which © Emile Woolf Publishing Limited 161 Paper F7: Financial Reporting (International) may have been a consequence of the (likely) losses in the previous year, has been reversed to a modest bank balance of $10,000 even after the payment of a $150,000 dividend. Summary The above analysis indicates that Pinto has invested substantially in renewing and/or increasing its property, plant and equipment. This has been financed largely by operating cash flows, and appears to have brought a dramatic turnaround in the company’s fortunes. All the indications are that the future financial position and performance will continue to improve. 15 Coaltown (a) Coaltown – Statement of cash flows for the year ended 31 March 2012: Cash flows from operating activities Profit before tax Adjustments for: depreciation of non-current assets (w (i)) loss on disposal of displays (w (i)) interest expense increase in warranty provision (1,000 – 300) increase in inventory (5,200 – 4,400) increase in receivables (7,800 – 2,800) decrease in payables (4,500 – 4,200) $’000 10,200 6,000 1,500 –––––––– Cash generated from operations Interest paid Income tax paid (w (ii)) Net cash from operating activities Cash flows from investing activities (w (i)) Purchase of non-current assets Disposal cost of non-current assets Net cash used in investing activities Cash flows from financing activities: Issue of equity shares (8,600 capital + 4,300 premium) Issue of 10% loan notes Equity dividends paid Net cash from financing activities (20,500) (500) –––––––– 600 700 (800) (5,000) (300) –––––––– 12,900 (600) (5,500) –––––––– 6,800 (21,000) –––––––– (14,200) 9,900 –––––––– (4,300) 700 –––––––– (3,600) –––––––– Cash and cash equivalents at end of period 162 7,500 12,900 1,000 (4,000) –––––––– Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Workings (i) Non-current assets Cost Balance b/f $’000 $’000 80,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Revaluation (5,000 – 2,000 depreciation) Disposal Balance c/f Cash flow for acquisitions Depreciation Balance b/f Revaluation Disposal Balance c/f Difference – charge for year Disposal of displays Cost Depreciation Cost of disposal Loss on disposal (ii) Income tax paid: Provision b/f Income statement tax charge Provision c/f Difference cash paid (b) (i) $’000 3,000 (10,000) (93,500) –––––––– 20,500 –––––––– $’000 48,000 (2,000) (9,000) (43,000) –––––––– 6,000 –––––––– 10,000 (9,000) 500 –––––––– 1,500 –––––––– $’000 (5,300) (3,200) 3,000 –––––––– (5,500) –––––––– Workings – all monetary figures in $’000 (note: references to 2011 and 2012 should be taken as to the years ended 31 March 2011 and 2012) The effect of a reduction in purchase costs of 10% combined with a reduction in selling prices of 5%, based on the figures from 2011, would be: Sales (55,000 x 95%) Cost of sales (33,000 x 90%) 52,250 (29,700) ––––––– Expected gross profit 22,550 ––––––– This represents an expected gross profit margin of 43·2% (22,550/52,250 x 100) The actual gross profit margin for 2012 is 33·4% (22,000/65,800 x 100) (ii) The directors’ expression of surprise that the gross profit in 2012 has not increased seems misconceived. A change in the gross profit margin does not necessarily mean there will be an equivalent change in the absolute gross profit. This is because the gross profit figure is the product of the gross profit margin and the volume of sales and these may vary independently of each other. That said, in this case the expected gross profit margin in 2012 shows an increase over that earned in 2011 (to 43·2% from 40·0% (22,000/55,000 x100)) and the sales have also increased, so it is understandable that the directors expected a © Emile Woolf Publishing Limited 163 Paper F7: Financial Reporting (International) higher gross profit. As the actual gross profit margin in 2012 is only 33·4%, something other than the changes described by the directors must have occurred. Possible reasons for the reduction are: The opening inventory being at old (higher) cost and the closing inventory is at the new (lower) cost will have caused slight distortion. Inventory write downs due to damage/obsolescence. A change in the sales mix (i.e. from higher margin sales to lower margin sales). New (lower margin) products may have been introduced from other new suppliers. Some selling prices may have been discounted because of sales promotions. Import duties (perhaps not allowed for by the directors) or exchange rate fluctuations may have caused the actual purchase cost to be higher than the trade prices quoted by the new supplier. Change in cost classification: some costs included as operating expenses in 2011 may have been classified as cost of sales in 2012 (if intentional and material this should be treated as a change in accounting policy) – for example it may be worth checking that depreciation has been properly charged to operating expenses in 2012. The new supplier may have put his prices up during the year due to market conditions. Coaltown may have felt it could not pass these increases on to its customers. (iii) Note – all monetary figures in $’000 Trade receivables collection period in 2011: 2,800/28,500 x 365 = 35·9 days Applying the 35·9 days collection period to the credit sales made in 2012: 53,000 x 35·9/365 = 5,213, the actual receivables are 7,800 thus potentially increasing the bank balance by 2,587. A similar exercise with the trade payables period in 2011: 4,500/33,000 x 365 = 49·8 days Note the 33,000 above is the cost of sales for 2011. This was the same as the credit purchases as there was no change in the value of inventory. However, in 2012 the credit purchases will be 44,600 (43,800 + 5,200 closing inventory – 4,400 opening inventory). Applying the 49·8 days payment period to purchases made in 2012 gives: 44,600 x 49·8/365 = 6,085, the actual payables are 4,200 thus potentially increasing the bank balance by 1,885. Inevitably a shortening of the period of credit offered by suppliers and lengthening the credit offered to customers will put a strain on cash resources. For Coaltown the combination of maintaining the same credit periods for both trade receivables and payables would have led to a reduction in cash outflows of 4,472 (2,587 + 1,885), which would have eliminated the overdraft of 3,600 leaving a balance in hand of 872. 164 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 16 Crosswire (a) (i) Non-current assets Property, plant and equipment Carrying amount b/f Mine (5,000 + 3,000 environmental cost) Revaluation (2,000/0·8 allowing for effect of deferred tax transfer) Fair value of leased plant Plant disposal Depreciation Replacement plant (balance) Carrying amount c/f Development costs Carrying amount b/f Additions during year Amortisation and impairment (balance) Carrying amount c/f (ii) Cash flows from investing activities Purchase of property, plant and equipment (w (i)) Disposal proceeds of plant Development costs Net cash used in investing activities Cash flows from financing activities: Issue of equity shares (w (ii)) Redemption of convertible loan notes ((5,000 – 1,000) x 25%) Lease obligations (w (iii)) Interest paid (400 + 350) Net cash used in financing activities $’000 13,100 8,000 2,500 10,000 (500) (3,000) 2,400 –––––––– 32,500 –––––––– 2,500 500 (2,000) –––––––– 1,000 –––––––– (7,400) 1,200 (500) –––––––– (6,700) –––––––– 2,000 (1,000) (3,200) (750) –––––––– (2,950) –––––––– Workings (figures in brackets in $’000) (i) The cash elements of the increase in property, plant and equipment are $5 million for the mine (the capitalised environmental provision is not a cash flow) and $2·4 million for the replacement plant making a total of $7·4 million. (ii) Of the $4 million convertible loan notes (5,000 – 1,000) that were redeemed during the year, 75% ($3 million) of these were exchanged for equity shares on the basis of 20 new shares for each $100 in loan notes. This would create 600,000 (3,000/100 x 20) new shares of $1 each and share premium of $2·4 million (3,000 – 600). As 1 million (5,000 – 4,000) new shares were issued in total, 400,000 must have been for cash. The remaining increase (after the effect of the conversion) in the share premium of $1·6 million (6,000 – 2,000 b/f – 2,400 conversion) must relate to the cash issue of shares, thus cash proceeds from the issue of shares is $2 million (400 nominal value + 1,600 premium). (iii) The initial lease obligation is $10 million (the fair value of the plant). At 30 September 2012 total lease obligations are $6·8 million (5,040 + 1,760), thus repayments in the year were $3·2 million (10,000 – 6,800). © Emile Woolf Publishing Limited 165 Paper F7: Financial Reporting (International) (b) Taking the definition of ROCE from the question: Year ended 30 September 2012 $’000 Profit before tax and interest on long-term borrowings (4,000 + 1,000 + 400 + 350) 5,750 Equity plus loan notes and finance lease obligations (19,200 + 1,000 + 5,040 + 1,760) 27,000 ROCE 21·3% Equivalent for year ended 30 September 2011 (3,000 + 800 + 500) 4,300 (9,700 + 5,000) 14,700 ROCE 29·3% To help explain the deterioration it is useful to calculate the components of ROCE i.e. operating margin and net asset turnover (utilisation): 2012 Operating margin (5,750/52,000 x 100) Net asset turnover (52,000/27,000) 2011 11·1% (4,300/42,000) 1·93 times (42,000/14,700) 10·2% 2·86 times From the above it can be clearly seen that the 2012 operating margin has improved by nearly 1% point, despite the $2 million impairment charge on the write down of the development project. This means the deterioration in the ROCE is due to poorer asset turnover. This implies there has been a decrease in the efficiency in the use of the company’s assets this year compared to last year. Looking at the movement in the non-current assets during the year reveals some mitigating points: The land revaluation has increased the carrying amount of property, plant and equipment without any physical increase in capacity. This unfavourably distorts the current year’s asset turnover and ROCE figures. The acquisition of the platinum mine appears to be a new area of operation for Crosswire which may have a different (perhaps lower) ROCE to other previous activities or it may be that it will take some time for the mine to come to full production capacity. The substantial acquisition of the leased plant was half-way through the year and can only have contributed to the year’s results for six months at best. In future periods a full year’s contribution can be expected from this new investment in plant and this should improve both asset turnover and ROCE. In summary, the fall in the ROCE may be due largely to the above factors (effectively the replacement and expansion programme), rather than to poor operating performance, and in future periods this may be reversed. It should also be noted that had the ROCE been calculated on the average capital employed during the year (rather than the year end capital employed), which is arguably more correct, then the deterioration in the ROCE would not have been as pronounced. 166 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 17 Deltoid (a) (i) Deltoid – Statement of cash flows for the year ended 31 March 2010: (Note: figures in brackets are in $’000) $’000 Cash flows from operating activities: Loss before tax Adjustments for: depreciation of non-current assets 3,700 loss on sale of leasehold property (8,800 – 200 – 8,500) interest expense increase in inventory (12,500 – 4,600) increase in trade receivables (4,500 – 2,000) increase in trade payables (4,700 – 4,200) Cash deficit from operations Interest paid Income tax paid (w (i)) Net cash deficit from operating activities Cash flows from investing activities: Disposal of leasehold property Cash flows from financing activities: Shares issued (10,000 – 8,000 – 800 bonus issue) 1,200 Payment of finance lease obligations (w (ii)) (2,100) Equity dividends paid (w (iii)) (700) –––––– Net cash from financing activities Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Workings (i) Income tax paid: Provision b/f – current – deferred Income statement tax relief Provision c/f – current – deferred Difference – cash paid (ii) Leased plant: Balance b/f Depreciation Leased during year (balance) Balance c/f Lease obligations: Balance b/f – current – non-current © Emile Woolf Publishing Limited $’000 (1,800) 100 1,000 (7,900) (2,500) 500 –––––– (6,900) (1,000) (1,900) –––––– (9,800) 8,500 (1,600) –––––– (2,900) 1,500 –––––– (1,400) –––––– $’000 (2,500) (800) 700 (500) 1,200 –––––– (1,900) –––––– 2,500 (1,800) 5,800 –––––– 6,500 –––––– (800) (2,000) 167 Paper F7: Financial Reporting (International) New leases (from above) Balance c/f – current – non-current Difference – repayment during year (iii) Equity dividends paid: (5,800) 1,700 4,800 –––––– (2,100) –––––– Retained earnings b/f Loss for period Dividends paid (balance) (ii) 6,300 (1,100) (700) –––––– Retained earnings c/f 4,500 –––––– The main concerns of a loan provider would be whether Deltoid would be able to pay the servicing costs (interest) of the loan and the eventual repayment of the principal amount. Another important aspect of granting the loan would be the availability of any security that Deltoid can offer. Interest cover is a useful measure of the risk of non-payment of interest. Deltoid’s interest cover has fallen from a healthy 15 times (9,000/600) to be negative in 2010. Although interest cover is useful, it is based on profit whereas interest is actually paid in cash. It is usual to expect interest payments to be covered by operating cash flows (it is a bad sign when interest has to be paid from long-term sources of funding such as from the sale of non-current assets or a share issue). Deltoid’s position in this light is very worrying; there is a cash deficit from operations of $6·9 million and after interest and tax payments the deficit has risen to $9·8 million. When looking at the prospect of the ability to repay the loan, Deltoid’s position is deteriorating as measured by its gearing (debt including finance lease obligations/equity) which has increased to 65% (5,000 + 6,500/17,700) from 43% (5,000 + 2,800/18,300). What may also be indicative of a deteriorating liquidity position is that Deltoid has sold its leasehold property and rented it back. This has been treated as a disposal, but, depending on the length of the rental agreement and other conditions of the tenancy agreement (which are not specified in the question) it may be that the substance of the sale is a loan/finance leaseback (e.g. if the period of the rental agreement was substantially the same as the remaining life of the property). If this were the case the company’s gearing would increase even further. Furthermore, there is less value in terms of ownership of noncurrent assets which may be used as security (in the form of a charge on assets) for the loan. It is also noteworthy that, in a similar vein, the increase in other non-current assets is due to finance leased plant. Whilst it is correct to include finance leased plant on the statement of financial position (applying substance over form), the legal position is that this plant is not owned by Deltoid and offers no security to any prospective lender to Deltoid. Therefore, in view of Deltoid’s deteriorating operating and cash generation performance, it may be advisable not to renew the loan for a further five years. 168 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) Although the sports club is a not-for-profit organisation, the request for a loan is a commercial activity that should be decided on according to similar criteria as would be used for other profit-orientated entities. The main aspect of granting a loan is how secure the loan would be. To this extent a form of capital gearing ratio should be calculated; say existing long-term borrowings to net assets (i.e. total assets less current liabilities). Clearly if this ratio is high, further borrowing would be at an increased risk. The secondary aspect is to measure the sports club’s ability to repay the interest (and ultimately the principal) on the loan. This may be determined from information in the income statement. A form of interest cover should be calculated; say the excess of income over expenditure (broadly the equivalent of profit) compared to (the forecast) interest payments. The higher this ratio the less risk of interest default. The calculations would be made for all four years to ascertain any trends that may indicate a deterioration or improvement in these ratios. As with other profitoriented entities the nature and trend of the income should be investigated: for example, are the club’s sources of income increasing or decreasing, does the reported income contain ‘one-off’ donations (which may not be recurring) etc? Also matters such as the market value of, and existing prior charges against, any assets intended to be used as security for the loan would be relevant to the lender’s decision-making process. It may also be possible that the sports club’s governing body (perhaps the trustees) may be willing to give a personal guarantee for the loan. Financial statements – Preparation of accounts from a trial balance 18 Petra (a) Petra – Income statement for the year ended 30 September 2012 $000 $000 Revenue: 197,800 – 12,000 (w (i)) 185,800 Cost of sales (w (ii)) (128,100) ――――― Gross profit Other income – commission received (w (i)) 57,700 1,000 ――――― 58,700 Distribution costs Administration expenses Interest expense: 1,500 + 1,500 Profit before tax Income tax expense: 4,000 +1,000 + (17,600 – 15,000) Profit for the period © Emile Woolf Publishing Limited 17,000 18,000 3,000 ―――― (38,000) ――――― 20,700 (7,600) ――――― 13,100 ――――― 169 Paper F7: Financial Reporting (International) (b) Petra – Statement of financial position as at 30 September 2012 Cost Accumulated Carrying depreciation amount Non-current assets (w (iii)) $000 $000 $000 44,000 106,000 Property, plant and equipment 150,000 Development costs 40,000 22,000 18,000 ―――― ―――― ―――― 190,000 66,000 124,000 ―――― ―――― Current assets Inventories 21,300 Trade receivables 24,000 Bank 11,000 Held for sale asset – plant (w (iii)) 6,900 ―――― 63,200 ―――― Total assets 187,200 ―――― Equity and liabilities Ordinary shares of 25c each 40,000 Reserves: Share premium 12,000 Retained earnings: 34,000+ 13,100 47,100 ―――― 59,100 ―――― 99,100 Non-current liabilities 6% loan note 50,000 Deferred tax 17,600 ―――― 67,600 Current liabilities Trade payables 15,000 Accrued interest 1,500 Current tax payable 4,000 ―――― 20,500 ―――― Total equity and liabilities 187,200 ―――― (c) Basic EPS Nominal value per share: 25 cents Therefore number of shares: $40 million/25c per share = 160 million shares EPS = $13,100,000/16 million = 8.2 cents. Diluted EPS The existence of the directors’ share options to buy 24 million shares requires the disclosure of a diluted EPS. The dilution effect of the options is as follows: Proceeds from options when exercised $7.2 million. This is equivalent to buying 8 million shares at full market value (= $7.2 million/90c per share). 170 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Thus the dilutive number of shares is 16 million (- 24 million – 8 million). Diluted EPS = $13,100,000/ (160 million + 16 million) = 7.4 cents. Workings (figures are in $000) (i) Agency sales Petra has treated the sales it made on behalf of Sharma as its own sales. The advice from the auditors is that these are agency sales. Thus $12 million should be removed from revenue and the cost of the sales of $8 million and the $3 million ‘share’ of profit to Sharma should also be removed from cost of sales. Petra should only recognise the commission of $1 million as income. (The answer has included this as other income, but it would also be acceptable to include the commission in revenue.) (ii) Cost of sales $000 Cost of sales in trial balance Remove agency sales and Sharma profit ($8m + $3m) Charge annual depreciation/amortisation Buildings (w (iii)) Plant (w (iii)) Deferred development expenditure (w (iii)) Impairment of development expenditure (w (iii)) Impairment of plant held for sale (w (iii)) 2,000 6,000 8,000 6,000 3,100 ―――― Adjusted cost of sales (iii) Non-current assets and depreciation $000 114,000 (11,000) 103,000 25,100 ―――― 128,100 ―――― The cost of the buildings = $60 million (= $100 million – $40 million for the land). Annual depreciation of buildings = $60 million/30 years = $2 million. IFRS 5 Non-current assets held for sale and discontinued operations requires plant whose carrying amount will be recovered principally through sale (rather than use) to be classified as ‘held for sale’. It must be shown separately in the statement of financial position and carried at the lower of its carrying amount (when classified as for continuing use) and its fair value less estimated costs to sell. Assets classified as held for sale should not be depreciated. Figures in $millions Cost at start of year Less: held for sale Cost at end of year Accumulated depreciation Start of year © Emile Woolf Publishing Limited Land 40 - Buildings 60 - 40 60 ―――― Plant 66 (16) Total 166 (16) ―――― ―――― ―――― ―――― ―――― ―――― ―――― - 16 26 42 50 150 171 Paper F7: Financial Reporting (International) Figures in $millions Less: Plant held for sale Land Buildings Plant (6) Total (6) ―――― 20 Depreciation charge: buildings Depreciation charge: plant: 20% × (50 – 20) End of year Carrying amount: end of year 2 2 6 6 ―――― ―――― ―――― ―――― ―――― ―――― ―――― ―――― - 40 ―――― 18 42 ―――― 26 44 24 106 ―――― ―――― Plant held for sale must be valued at $6.9 million (7,500 selling price less commission of 600 (7,500 × 8%)) as this is lower than its carrying amount of $10 million. Thus an impairment charge of $3.1 million ($10 million – $6.9 million) is required for the plant held for sale and this is a charge in the income statement. Development expenditure This has suffered impairment as a result of disappointing sales. The asset should be written down to $18 million in the statement of financial position. The impairment loss should be calculated after charging amortisation of $8 million (40,000/5 years) for the current year. $m Cost of development expenditure in the statement of financial position Amortisation to beginning of year Amortisation charge in the year $m 40 8 8 16 24 18 6 Carrying amount before revaluation Carrying amount after revaluation Impairment loss: charge to income statement The carrying amount of $18 million will then be written off over the next two years. 19 Darius (a) Darius Statement of comprehensive income for the year ended 31 March 2012 Revenue (w (i)) Cost of sales (w (i)) Gross profit Operating expenses Investment income Loss on investment property (16,000 – 13,500 w (ii)) Financing cost (5,000 – 3,200 ordinary dividend (w (v)) Profit before tax Income tax expense (w (iii)) Profit for the period Other comprehensive income 172 $000 221,800 (156,200) 65,600 (22,400) 1,200 (2,500) (1,800) 40,100 (6,400) 33,700 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Darius Statement of comprehensive income for the year ended 31 March 2012 Unrealised surplus on land and building Total comprehensive income for the year $000 21,000 54,700 (b) Darius statement of financial position as at 31 March 2012 Non-current assets Property, plant and equipment (w (iv)) Investment property (w (ii)) Current assets Inventories (10,500 – 300 (w (i))) Trade receivables (13,500 + 1,500 joint venture) Total assets Equity and liabilities Ordinary shares of 25c each Reserves: Revaluation reserve Retained earnings (w (v)) $000 $000 87,100 13,500 100,600 10,200 15,000 25,200 125,800 20,000 21,000 48,000 69,000 89,000 Non-current liabilities Deferred tax (w (iii)) Redeemable preference shares of $1 each 3,600 10,000 13,600 Current liabilities Trade payables (11,800 + 2,500 joint venture) Bank overdraft Current tax payable Total equity and liabilities Workings (figures in $000) (i) Revenue As stated in the question Joint venture revenue Cost of sales As stated in the question Closing inventories adjustment (see below) Joint venture costs Depreciation (w (iv)) – building – plant © Emile Woolf Publishing Limited 14,300 900 8,000 23,200 125,800 213,800 8,000 221,800 143,800 300 5,000 3,200 3,900 156,200 173 Paper F7: Financial Reporting (International) Note on closing inventories adjustment. The damaged inventories will require expenditure of $450,000 to repair them and then have an expected selling price of $950,000. This gives a net realisable value of $500,000: as their cost was $800,000, a write down of $300,000 is required. (ii) The fair value model in IAS 40 Investment property requires investment properties to be included in the statement of financial position at their fair value (in this case taken to be the open market value). Any surplus or deficit is recorded in income. (iii) $000 8,000 (1,600) 6,400 Taxation Provision for the year Deferred tax (see below) Taxable temporary differences are $12 million. At a rate of 30% this would require a statement of financial position provision for deferred tax of $3.6 million. The opening provision is $5.2 million, thus a credit of $1.6 million will be made for deferred tax in the income statement. (iv) $000 Non-current assets Land and building Depreciation of the building for the year ended 31 March 2012 will be (48,000/15 years) Plant and equipment As stated in the trial balance Joint venture plant 3,200 36,000 12,000 48,000 (16,800) 31,200 (3,900) 27,300 Accumulated depreciation 1 April 2011 Carrying amount prior to depreciation for the year Depreciation year ended 31 March 2012 at 12.5% Carrying amount at 31 March 2012 Cost/valuation Land and building Plant and equipment Property, plant and equipment (v) 63,000 48,000 ―――― Accumulated depreciation 3,200 20,700 ―――― Carrying amount 59,800 27,300 ―――― 111,000 23,900 87,100 ―――― ―――― ―――― Retained earnings $000 Balance b/f 17,500 Profit for period 33,700 Ordinary dividends paid (20,000 × 4 × 4c) (3,200) 48,000 174 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 20 Danzig (a) Danzig Income statement for the year ended 30 September 2012 $000 Revenue Cost of sales: see working (1) Gross profit Operating expenses: see working (2) Investment income Finance costs: Loan notes – see working (3) Finance lease – see working (2) $000 295,300 (180,000) 105,300 (36,600) 2,000 (3,000) (1,700) (4,700) 76,000 (16,000) 60,000 Profit before tax Income tax expense: see working (4) Profit for the period (b) Danzig Statement of financial position as at 30 September 2012 $000 Non-current assets Property, plant and equipment: see working (5) Investments at amortised cost Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Capital and reserves Equity shares of $0.50 each fully paid : see working (6) Share premium: see working (6) Revaluation reserve: see working (7) Retained earnings: see working (8) $000 358,000 92,400 450,400 23,700 76,400 12,100 112,200 562,600 240,000 139,000 15,000 43,300 197,300 437,300 Non-current liabilities 3% loan notes: see working (3) Deferred tax: see working (4) Finance lease obligation: see working (2) 51,500 23,000 11,700 86,200 © Emile Woolf Publishing Limited 175 Paper F7: Financial Reporting (International) Danzig Statement of financial position as at 30 September 2012 $000 Current liabilities Trade payables Accrued lease finance costs: see working (2) Finance lease obligation: see working (2) Income tax payable $000 14,100 1,700 5,300 18,000 39,100 562,600 Total equity and liabilities Workings (1) Cost of sales $000 As given in the trial balance 134,000 Depreciation of plant and equipment: 20% × (197,000 – 47,000) 30,000 Depreciation of leased vehicles: 24,000/4 years 6,000 Amortisation of leasehold property: 250,000/25 years 10,000 180,000 (2) Vehicle rentals and finance lease. Operating expenses $000 Rental costs given in the trial balance 8,600 Relating to finance lease (7,000) Balance: relating to operating lease – operating expense (3) 1,600 Other operating expenses (trial balance in question) 35,000 Total operating expenses 36,600 Finance lease $000 $000 Fair value of leased assets 24,000 Less: First rental payment, paid in advance 1 October 2011 (7,000) Remaining obligation, 1 October 2011 17,000 Interest at 10% to 30 September 2012 (current liability) 1,700 Lease payment due 1 October 2012 7,000 Capital repayment due (= balance, current liability) (5,300) Remaining lease obligation = non-current liability 11,700 Loan notes Although the nominal interest rate on the loan notes is 3%, the effective interest rate is 6%. The finance charge in the income statement should be based on the effective interest rate (= 6% × $50 million) = $3 million. Actual interest paid was $1,500,000 (in trial balance); therefore the balancing $1,500,000 should be added to the loan notes obligation, to make the total loan notes liability $50 million + $1,500,000 = $51.5 million. 176 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (4) Taxation $000 $000 Deferred tax on taxable temporary differences (92,000 × 25%) 23,000 (= liability in the statement of financial position) Taxable temporary differences relating to revaluation 20,000 Credit to deferred tax, debit to revaluation reserve (at 25%) 5,000 18,000 Deferred tax liability in the trial balance 20,000 Deferred tax: credit in the income statement 2,000 $000 (5) Income tax on profits for the year 18,000 Deferred tax movement (2,000) Tax charge in the income statement 16,000 Non-current assets and depreciation $000 Leasehold property Carrying value in the trial balance (250,000 – 40,000) 210,000 Amortisation charge for the year to 30 September 2012 (10,000) 200,000 Re-valued amount 220,000 Transfer to revaluation reserve 20,000 The annual depreciation charges for plant and equipment and the leased vehicles are shown in workings (1) Accumulated depreciation Carrying amount $000 $000 $000 Leasehold property 220,000 0 220,000 Plant and equipment (non-leased) 197,000 77,000 120,000 Leased vehicles (6) Cost or valuation 24,000 6,000 18,000 ―――― ―――― ―――― 441,000 83,000 358,000 ―――― ―――― ―――― Suspense account Shares in issue at 1 October 2011 = $180,000,000/$0.50 per share = 360 million. Value at 30 September 2011 = (× $2 per share) = $720,000,000. Dividend to give a 5% yield = 5% × = $36,000,000 = dividend paid. Rights issue Number of shares issued (360 million × 1/3) = 120 million Nominal value of shares at 1 October 2011 Rights issue: nominal value (120 million × $0.50) Nominal value of shares at 30 September 2012 © Emile Woolf Publishing Limited $000 180,000 60,000 240,000 177 Paper F7: Financial Reporting (International) $000 204,000 (60,000) 144,000 (5,000) 139,000 Rights issue Cash raised from rights issue (120 million × $1.70) Nominal value of shares issued Therefore share premium before deducting issue costs Less issue costs Share premium (7) Revaluation reserve Revaluation of leasehold property Associated deferred tax Revaluation reserve in the statement of financial position (8) Retained profits $000 19,300 60,000 (36,000) 43,300 At 1 October 2011 (trial balance) Profit for the year Dividends paid (working (6)) Retained profits at 30 September 2012 21 $000 20,000 (5,000) 15,000 Allgone (a) Allgone: Income statement – Year to 31 March 2012 Revenue (236,200 – 8,000 (see below)) Cost of sales (W1) Gross profit Operating expenses Finance costs (W2) Profit before tax Taxation (W3) Net profit for the period $000 228,200 (150,000) 78,200 (12,400) (5,850) 59,950 (13,100) 46,850 The sale of goods to Funders is an attempt to ‘window dress’ the statement of financial position by improving its liquidity position. It is in substance a (short term) loan with a finance cost of $250,000. (b) Allgone – Statement of changes in equity – Year to 31 March 2012 Balance at 1 April 2011 Material error (see below) Surplus on revaluation of land and buildings (W4) 178 Share Revaluation reserve capital $000 $000 60,000 5,000 ――― 60,000 ――― 5,000 40,000 Retained earnings Total $000 4,350 (32,000) ――― (27,650) $000 89,350 (32,000) ――― 57,350 40,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Share Revaluation reserve capital $000 $000 Transferred to realised profits re building: (35,000/35 years) Deficit on value of investments Net profit for the period (1,000) (1,200) Retained earnings Total $000 $000 1,000 (1,200) 46,850 46,850 ――― ――― ――― ―――― Balance at 31 March 2012 60,000 42,800 20,200 123,000 ――― ――― ――― ―――― The discovery of the major fraud is not an extraordinary item. As it occurred in previous years and is material it should be treated as a prior period adjustment. (c) Allgone – Statement of financial position as at 31 March 2012 $000 $000 Assets Non-current assets 2,000 Software (W4) Property, plant and equipment (W4) 175,000 Investments (12,000 – 1,200 (W4)) 10,800 187,800 Current assets Inventory (W1) 14,300 Trade receivables 23,000 37,300 Total assets 225,100 Equity and liabilities: Ordinary shares of 25c each 60,000 Reserves: Retained earnings 20,200 Revaluation reserve (W4) 42,800 63,000 123,000 Non-current liabilities (W5) 64,800 Current liabilities Trade payables 15,200 Bank overdraft 350 In substance loan from Funders 8,000 Accrued finance costs (1,200 + 250 (W2)) 1,450 Taxation 11,300 Preference dividend 1,000 37,300 Total equity and liabilities 225,100 Workings (W1) Cost of sales: Opening inventory Purchases © Emile Woolf Publishing Limited $000 19,450 127,850 179 Paper F7: Financial Reporting (International) $000 2,000 3,000 12,000 (14,300) 150,000 Depreciation (W4) – software Depreciation (w (iv)) – building Depreciation (w (iv)) – plant Closing inventory (8,500 – 200 + 6,000 see below) The slow moving inventory requires a write down of $200,000 to net realisable value of $300,000 ($500,000 – $200,000). The cost of the goods of the sale and repurchase agreement ($6 million) should be treated as inventory. (W2) Finance costs: Per question Accrued loan note interest (see below) Accrued facilitating fee for in substance a loan (see below) Preference dividend (10% x 20,000) $000 2,400 1,200 250 2,000 5,850 The loan notes have been in issue for nine months, but only six months’ interest has been paid. Accrued interest of $1,200,000 is required. The substance of the sale and repurchase agreement is that it is a loan with effective interest of $250,000, the facilitating fee. Therefore this has been treated as a finance cost. (W3) Taxation: Provision for year Deferred tax (see below) $000 11,300 1,800 13,100 The difference between the tax base of the assets and their carrying value of $16 million would require a provision in the statement of financial position for deferred tax of $4.8 million (at 30%). The opening provision is $3 million, thus an additional charge of $1·8 million is required. (W4) Non-current assets/depreciation/revaluation: The software was purchased on 1 April 2009 with a five year life. The depreciation for the year to 31 March 2012 will be for the third year of its life. Using the sum of the digits method this will be 3/15 of the cost i.e. $2 million. This will give accumulated depreciation of $8 million ($6m brought forward+ $2m). Land and buildings Cost 1 April 2004 Five years’ depreciation (80,000 × 5/40) Carrying value prior to revaluation Valuation 1 April 2011 180 Buildings Land $000 $000 80,000 20,000 (10,000) ――― 70,000 105,000 ――― 25,000 ――― © Emile Woolf Publishing Limited Section 2: Answers to practice questions Land and buildings Buildings Land $000 $000 Revaluation surplus 35,000 ――― Depreciation year to 31 March 2012 (105,000/35 years) 5,000 ――― 3,000 Plant depreciation ((84,300 – 24,300) × 20%) 12,000 Summarising: Cost/ valuation Land and building (25 + 105) Plant and equipment Property, plant and equipment Software Accumulated depreciation Net book value $000 $000 $000 130,000 3,000 127,000 84,300 36,300 48,000 214,300 ――― 10,000 ――― 39,300 175,000 ――― ――― 8,000 2,000 ――― ――― Revaluation reserve: Given in the trial balance 45,000 Loss of value of investments (12,000 – (12,000 × 2.25/2.50)) (1,200) Transfer to realised profits re building (35,000/35 years) (1,000) Balance at 31 March 2005 42,800 (W5) Non-current liabilities: Deferred tax (3,000 + 1,800) (W3) 4,800 12% loan note 40,000 10% Irredeemable preference shares 20,000 64,800 22 Tourmalet (a) The sale of the plant has been incorrectly treated on two counts. Firstly even if it were a genuine sale it should not have been included in sales and cost of sales, rather it should have been treated as the disposal of a non-current asset. Only the profit or loss on the disposal would be included in the income statement (requiring separate disclosure if material). However even this treatment would be incorrect. As Tourmalet will continue to use the plant for the remainder of its useful life, the substance of this transaction is a secured loan. Thus the receipt of $50 million for the ‘sale’ of the plant should be treated as a loan. The rentals, when they are eventually paid, will be applied partly as interest (at 12% per annum) and the remainder will be a capital repayment of the loan. In the income statement an accrual for loan interest of 12% per annum on $50 million for four months ($2 million) is required. © Emile Woolf Publishing Limited 181 Paper F7: Financial Reporting (International) (b) Tourmalet – Income statement for the year ending 30 September 2012 $000 Continuing operations Revenue (313,000 – 50,000 – 15,200 (discontinued) Cost of sales (W1) Gross profit Distribution costs Administrative expenses (W2) Finance costs (W3) Loss on investment properties ($10 million – $9.8 million) Investment income Profit before tax Income tax expense (9,200 – 2,100) Profit for the period from continuing operations Discontinued operations Loss for the period from discontinued operations (15,200 – 16,000 – 3,200 – 1,500) (W4) Profit for the period (c) 247,800 (128,800) 119,000 (26,400) (20,000) (3,800) (200) 1,200 69,800 (7,100) 62,700 (5,500) 57,200 Tourmalet: Statement of changes in equity – Year to 30 September 2012 Balance at 1 October 2011 Share Revaluation $000 $000 50,000 18,500 Retained i $000 Profit for the period Transferred to realised profit (500) Ordinary dividends paid Balance at 31 March 2012 ――― 50,000 ――― ――― 18,000 ――― Total $000 47,800 116,300 57,200 57,200 500 - (2,500) (2,500) ―――― ―――― 103,000 171,000 ―――― ―――― Note: IAS 32 Financial Instruments: Presentation says redeemable preference shares have the substance of debt and should be treated as non-current liabilities and not as equity. This also means that preference dividends are treated as a finance cost in the income statement. Workings (W1) Cost of sales Opening inventory Purchases Transfer to plant (see (a)) Depreciation (W2) Closing inventory (28.5 million – 2.5 million see below) 182 $000 26,550 158,450 (40,000) 25,800 (26,000) 144,800 © Emile Woolf Publishing Limited Section 2: Answers to practice questions The slow-moving inventory should be written down to its estimated realisable value. Despite the optimism of the Directors, it would seem prudent to base the realisable value on the best offer so far received (i.e. $2 million). (W2) Depreciation $000 3,000 14,800 8,000 25,800 Buildings 120/40 years Plant – per trial balance ((98,600 – 24,600) × 20%) Plant – plant treated as sold (40,000/5 years) Note: Investment properties do not require depreciating under the fair value model in IAS 40. Instead they are revalued each year with the surplus or deficit being taken to income. For information only: In the statement of financial position Land and buildings Plant – per trial balance Plant incorrectly treated as sold Cost/ valuation $000 150,000 98,600 40,000 Accumulated depreciation $000 12,000 39,400 8,000 Net book value $000 138,000 59,200 32,000 229,200 (W3) Finance costs: income statement Accrued interest on in-substance loan (see (a)) Preference dividends (30,000 × 6%) $000 2,000 1,800 3,800 (W4) The penalty on the lease has been accrued for as it would appear to be unlikely that the permission for change of use will be granted. The $1.5m has therefore been included in the loss from discontinuing operations. 23 Chamberlain (a) Chamberlain – Income statement – Year to 30 September 2012 Revenue (246,500 + 50,000 (W1) Cost of sales (W2) Gross profit Operating expenses Profit before interest and tax Interest expense (1,500 + 1,500 accrued) © Emile Woolf Publishing Limited $000 296,500 (151,500) ––––––––– 145,000 (29,000) ––––––––– 116,000 (3,000) ––––––––– 183 Paper F7: Financial Reporting (International) Chamberlain – Income statement – Year to 30 September 2012 $000 113,000 (18,500) ––––––––– 94,500 ––––––––– Profit before tax Income tax (22,000 – (17,500 – 14,000)) Profit for the period (b) Chamberlain – Statement of financial position as at 30 September 2012 Non-current assets $000 $000 Property, plant and equipment (W3) 442,000 Development costs (40,000 – 25,000) 15,000 –––––––– 457,000 Current assets Inventory 38,500 Amounts due from construction contracts (W1) 25,000 Trade receivables 48,000 Bank 12,500 ––––––– 124,000 –––––––– Total assets 581,000 –––––––– Equity and liabilities Capital and reserves: Ordinary share capital 200,000 Retained profits – 1 October 2011 162,000 – Year to 30 September 2012 (less dividends paid) 86,500 –––––––– 248,500 –––––––– 448,500 Non-current liabilities (W4) 64,000 Current liabilities Trade payables 45,000 Accrued finance costs 1,500 Taxation 22,000 ––––––– 68,500 –––––––– Total equity and liabilities 581,000 –––––––– Workings (all figures in $000) (W1) Construction contract: $000 125,000 (75,000) 50,000 Contract price Estimated cost Estimated total profit Contract cost for year (35,000 – 5,000 inventory on site) Estimated cost Percentage complete (30,000/75,000) 184 30,000 75,000 40% © Emile Woolf Publishing Limited Section 2: Answers to practice questions $000 Year to 30 September 2012 Contract revenue – included in sales (125,000 × 40%) Contract costs – included in cost of sales (35,000 – 5,000) Amounts due from customers: Cost to date plus profit taken (35,000 + 20,000) Less progress billings received 50,000 (30,000) 55,000 (30,000) 25,000 (W2) Cost of sales: Opening inventory Purchases Contract costs (W1) Research costs Depreciation (W3) – buildings – plant Closing inventory 35,500 78,500 30,000 25,000 6,000 15,000 (38,500) 151,500 (W3) Non-current assets/depreciation Buildings A cost of $240,000 ($403,000 – $163,000 for the land) over a 40 year life gives annual depreciation of $6,000 per annum. This gives accumulated depreciation at 30 September 2012 of $66,000 ($60,000 + $6,000) and a carrying value of $337,000 ($403,000 – $66,000). Plant The carrying value prior to the current year’s depreciation is $120,000 ($180,000 – $60,000). Depreciation at 12.5% on the reducing balance basis gives an annual charge of $15,000. This gives a carrying value at 30 September 2012 of $105,000 ($120,000 – $15,000). Therefore the carrying value of property, plant and equipment at 30 September 2012 is $442,000 ($337,000 + $105,000). (W4) Non-current liabilities 6% loan note Deferred tax 24 50,000 14,000 64,000 Tadeon (a) Tadeon – Income statement – Year to 30 September 2012 Revenue Cost of sales (w (i)) Gross profit Operating expenses (40,000 + 1,200 (w (ii))) Investment income © Emile Woolf Publishing Limited $’000 $’000 277,800 (144,000) ⎯⎯⎯⎯ 133,800 (41,200) 2,000 185 Paper F7: Financial Reporting (International) Finance costs – finance lease (w (ii)) – loan (w (iii)) Profit before tax Income tax expense (w (iv)) $’000 (1,500) (2,750) ⎯⎯⎯⎯ (4,250) ⎯⎯⎯⎯ 90,350 (36,800) ⎯⎯⎯⎯ Profit for the period (b) $’000 53,550 Tadeon – Statement of financial position as at 30 September 2012 Non-current assets Property, plant and equipment (w (v)) Investments at amortised cost ⎯⎯⎯⎯ $’000 $’000 299,000 42,000 ⎯⎯⎯⎯ 341,000 Current assets Inventories Trade receivables Total assets Equity and liabilities Capital and reserves: Equity shares of 20 cents each fully paid (w (vi)) Reserves Share premium (w (vi)) Revaluation reserve (w (v)) Retained earnings (w (vii)) Non-current liabilities 2% Loan note (w (iii)) Deferred tax (w (iv)) Finance lease obligation (w (ii)) Current liabilities Trade payables Accrued lease finance costs (w (ii)) Finance lease obligation (w (ii)) Bank overdraft Income tax payable (w (iv)) Total equity and liabilities Workings (note figures in brackets are in $’000) (i) Cost of sales: Per trial balance Depreciation (12,000 + 5,000 + 9,000 w (v)) (ii) 186 33,300 53,500 ⎯⎯⎯⎯ 86,800 ⎯⎯⎯⎯ 427,800 ⎯⎯⎯⎯ 200,000 28,000 16,000 42,150 86,150 ⎯⎯⎯⎯ ⎯⎯⎯⎯ 51,750 14,800 10,500 77,050 ⎯⎯⎯⎯ 18,700 1,500 4,500 1,900 38,000 ⎯⎯⎯⎯ 286,150 64,600 ⎯⎯⎯⎯ 427,800 ⎯⎯⎯⎯ $’000 118,000 26,000 –––––––– 144,000 –––––––– Vehicle rentals/finance lease: The total amount of vehicle rentals is $6·2 million of which $1·2 million are operating lease rentals and $5 million is identified as © Emile Woolf Publishing Limited Section 2: Answers to practice questions finance lease rentals. The operating rentals have been included in operating expenses. Finance lease $’000 Fair value of vehicles 20,000 First rental payment – 1 October 2011 (5,000) –––––––– Capital outstanding to 30 September 2012 15,000 Accrued interest 10% (current liability) 1,500 –––––––– Total outstanding 30 September 2012 16,500 –––––––– In the year to 30 September 2013 (i.e. on 1 October 2012) the second rental payment of $6 million will be made, of this $1·5 million is for the accrued interest for the previous year, thus $4·5 million will be a capital repayment. The remaining $10·5 million (16,500 – (4,500 + 1,500)) will be shown as a non-current liability. (iii) Although the loan has a nominal (coupon) rate of only 2%, amortisation of the large premium on redemption, gives an effective interest rate of 5·5% (from question). This means the finance charge to the income statement will be a total of $2·75 million (50,000 x 5·5%). As the actual interest paid is $1 million an accrual of $1·75 million is required. This amount is added to the carrying amount of the loan in the statement of financial position. (iv) Income tax and deferred tax The income statement charge is made up as follows: Current year’s provision Deferred tax (see below) $'000 38,000 (1,200) 36,800 There are $74 million of taxable temporary differences at 30 September 2012. With an income tax rate of 20%, this would require a deferred tax liability of $14·8 million (74,000 x 20%). $4 million ($20m x 20%) is transferred to deferred tax in respect of the revaluation of the leasehold property (and debited to the revaluation reserve), thus the effect of deferred tax on the income statement is a credit of $1·2 million (14,800 – 4,000 – 12,000 b/f). (v) Non-current assets/depreciation: Non-leased plant This has a carrying amount of $96 million (181,000 – 85,000) prior to depreciation of $12 million at 121/2% reducing balance to give a carrying amount of $84 million at 30 September 2012. The leased vehicles will be included in non-current assets at their fair value of $20 million and depreciated by $5 million (four years straight-line) for the year ended 30 September 2012 giving a carrying amount of $15 million at that date. The 25 year leasehold property is being depreciated at $9 million per annum (225,000/25 years). Prior to its revaluation on 30 September 2012 there would be a further year’s depreciation charge of $9 million giving a carrying amount of $180 million (225,000 – (36,000 + 9,000)) prior to its revaluation to $200 million. Thus $20 million would be transferred to a revaluation reserve. The question says the revaluation gives rise to $20 million of the deductible temporary differences, at a tax rate of 20%, this would give a credit to deferred tax of $4 million which is © Emile Woolf Publishing Limited 187 Paper F7: Financial Reporting (International) debited to the revaluation reserve to give a net balance of $16 million. Summarising: 25 year leasehold property Non-leased plant Leased vehicles (vi) Cost/ Accumulated valuation depreciation $,000 $,000 200,000 nil 181,000 97,000 20,000 5,000 401,000 102,000 Carrying amount $,000 200,000 84,000 15,000 299,000 Suspense account The called up share capital of $150 million in the trial balance represents 750 million shares (150m/0·2) which have a market value at 1 October 2011 of $600 million (750m x 80 cents). A yield of 5% on this amount would require a $30 million dividend to be paid. A fully subscribed rights issue of one new share for every three shares held at a price of 32c each would lead to an issue of 250 million (150m/0·2 x 1/3). This would yield a gross amount of $80 million, and after issue costs of $2 million, would give a net receipt of $78 million. This should be accounted for as $50 million (250m x 20 cents) to equity share capital and the balance of $28 million to share premium. The receipt from the share issue of $78 million less the payment of dividends of $30 million reconciles the suspense account balance of $48 million. (vii) Retained earnings $,000 At 1 October 2011 18,600 Year to 30 September 2012 53,550 less dividends paid (w (vi)) 25 (30,000) ––––––– 42,150 ––––––– Llama (a) Llama – Income statement – Year ended 30 September 2012 $’000 Revenue Cost of sales (w (i)) Gross profit Distribution costs (11,000 + 1,000 depreciation) Administrative expenses (12,500 + 1,000 depreciation) (12,000) (13,500) ––––––– 2,200 600 ––––––– Investment income Gain on fair value of investments (27,100 – 26,500) Finance costs (w (ii)) Profit before tax Income tax expense (18,700 – 400 – (11,200 – 10,000) deferred tax) Profit for the period 188 $’000 180,400 (81,700) 98,700 ––––––– (25,500) 2,800 (2,400) ––––––– 73,600 (17,100) ––––––– 56,500 ––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) Llama – Statement of financial position as at 30 September 2012 Assets Non-current assets Property, plant and equipment (w (iv)) Investments at fair value through profit and loss Current assets Inventory Trade receivables Total assets Equity and liabilities Equity Equity shares of 50 cents each ((60,000 + 15,000) w (iii)) Share premium (w (iii)) Revaluation reserve (14,000 – 3,000 (w (iv))) Retained earnings (56,500 + 25,500) Non-current liabilities 2% loan note (80,000 + 1,600 (w (ii))) Deferred tax (40,000 x 25%) Current liabilities Trade payables Bank overdraft Current tax payable Total equity and liabilities $’000 $’000 228,500 27,100 ––––––– 255,600 37,900 35,100 73,000 ––––––– ––––––– 328,600 ––––––– 75,000 9,000 11,000 82,000 102,000 ––––––– ––––––– 177,000 81,600 10,000 ––––––– 91,600 34,700 6,600 18,700 60,000 ––––––– ––––––– 328,600 ––––––– Workings (monetary figures in brackets are in $’000) (i) Cost of sales: Per question Plant capitalised (w (iv)) Depreciation (w (iv)) – buildings – plant (ii) $’000 89,200 (24,000) 3,000 13,500 –––––– 81,700 –––––– The loan has been in issue for six months. The total finance charge should be based on the effective interest rate of 6%. This gives a charge of $2·4 million (80,000 x 6% x 6/12). As the actual interest paid is $800,000 an accrual (added to the carrying amount of the loan) of $1·6 million is required. (iii) The rights issue was 30 million shares (60 million/50 cents is 120 million shares at 1 for 4) at a price of 80 cents this would increase share capital by $15 million (30 million x 50 cents) and share premium by $9 million (30 million x 30 cents). © Emile Woolf Publishing Limited 189 Paper F7: Financial Reporting (International) (iv) Non-current assets/depreciation: Land and buildings: On 1 October 2011 the value of the buildings was $100 million (130,000 – 30,000 land). The remaining life at this date was 20 years, thus the annual depreciation charge will be $5 million (3,000 to cost of sales and 1,000 each to distribution and administration). Prior to the revaluation at 30 September 2012 the carrying amount of the building was $95 million (100,000 – 5,000). With a revalued amount of $92 million, this gives a revaluation deficit of $3 million which should be debited to the revaluation reserve. The carrying amount of land and buildings at 30 September 2012 will be $122 million (92,000 buildings + 30,000 land (unchanged)). Plant The existing plant will be depreciated by $12 million ((128,000 – 32,000) x 121/2%) and have a carrying amount of $84 million at 30 September 2012. The plant manufactured for internal use should be capitalised at $24 million (6,000 + 4,000 + 8,000 + 6,000). Depreciation on this will be $1·5 million (24,000 x 121/2% x 6/12). This will give a carrying amount of $22·5 million at 30 September 2012. Thus total depreciation for plant is $13·5 million with a carrying amount of $106·5 million (84,000 + 22,500) Summarising the carrying amounts: Land and buildings Plant $’000 122,000 106,500 ––––––– 228,500 ––––––– Property, plant and equipment (c) Earnings per share (eps) for the year ended 30 September 2012 Theoretical ex rights value Holding (say) Issue (1 for 4) $ 100 at $1 100 at 80 cents 20 25 –––– –––– 120 New holding 125 ex rights price is 96 cents –––– –––– Weighted average number of shares 120,000,000 x 9/12 x 100/96 93,750,000 150,000,000 (120 x 5/4) x 3/12 37,500,000 –––––––––– 131,250,000 –––––––––– Earnings per share ($56,500,000/131,250,000) 43 cents 190 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 26 Candel (a) Candel – Statement of comprehensive income for the year ended 30 September 2012 $’000 297,500 (225,400) ––––––––– 72,100 (14,500) (21,900) (1,400) ––––––––– 34,300 (11,600) ––––––––– 22,700 Revenue (300,000 – 2,500) Cost of sales (w (i)) Gross profit Distribution costs Administrative expenses (22,200 – 400 + 100 see note below) Finance costs (200 + 1,200 (w (ii))) Profit before tax (Income tax expense (11,400 + (6,000 – 5,800 deferred tax)) Profit for the year Other comprehensive income Loss on leasehold property revaluation (w (iii)) (4,500) ––––––––– Total comprehensive income for the year 18,200 ––––––––– Note: as it is considered that the outcome of the legal action against Candel is unlikely to succeed (only a 20% chance) it is inappropriate to provide for any damages. The potential damages are an example of a contingent liability which should be disclosed (at $2 million) as a note to the financial statements. The unrecoverable legal costs are a liability (the start of the legal action is a past event) and should be provided for in full. (b) Candel – Statement of changes in equity for the year ended 30 September 2012 Balances at 1 October 2011 Dividend Comprehensive income Balances at 30 September 2012 (c) Equity shares $’000 50,000 Revaluation reserve $’000 10,000 ––––––– 50,000 ––––––– (4,500) –––––– 5,500 –––––– Retained earnings $’000 24,500 (6,000) 22,700 ––––––– 41,200 ––––––– Total equity $’000 84,500 (6,000) 18,200 ––––––– 96,700 ––––––– Candel – Statement of financial position as at 30 September 2012 Assets Non-current assets (w (iii)) Property, plant and equipment (43,000 + 38,400) Development costs Current assets Inventory Trade receivables Total assets © Emile Woolf Publishing Limited $’000 $’000 81,400 14,800 –––––––– 96,200 20,000 43,100 ––––––– 63,100 –––––––– 159,300 –––––––– 191 Paper F7: Financial Reporting (International) $’000 Equity and liabilities: Equity (from (b)) Equity shares of 25 cents each Revaluation reserve Retained earnings Non-current liabilities Deferred tax 8% redeemable preference shares (20,000 + 400 (w (ii))) Current liabilities Trade payables (23,800 – 400 + 100 – re legal action) Bank overdraft Current tax payable Total equity and liabilities $’000 50,000 5,500 41,200 ––––––– 6,000 20,400 ––––––– 23,500 1,300 11,400 ––––––– 46,700 –––––––– 96,700 26,400 36,200 –––––––– 159,300 –––––––– Workings (figures in brackets in $’000) (i) Cost of sales: $’000 Per trial balance Depreciation (w (iii)) – leasehold property – plant and equipment Loss on disposal of plant (4,000 – 2,500) Amortisation of development costs (w (iii)) Research and development expensed (1,400 + 2,400 (w (iii))) (ii) (iii) 204,000 2,500 9,600 1,500 4,000 3,800 –––––––– 225,400 –––––––– The finance cost of $1·2 million for the preference shares is based on the effective rate of 12% applied to $20 million issue proceeds of the shares for the six months they have been in issue (20m x 12% x 6/12). The dividend paid of $800,000 is based on the nominal rate of 8%. The additional $400,000 (accrual) is added to the carrying amount of the preference shares in the statement of financial position. As these shares are redeemable they are treated as debt and their dividend is treated as a finance cost. Non-current assets: Leasehold property Valuation at 1 October 2011 Depreciation for year (20 year life) Carrying amount at date of revaluation Valuation at 30 September 2012 Revaluation deficit 192 50,000 (2,500) –––––––– 47,500 (43,000) –––––––– 4,500 –––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions Plant and equipment per trial balance (76,600 – 24,600) Disposal (8,000 – 4,000) Depreciation for year (20%) Carrying amount at 30 September 2012 Capitalised/deferred development costs Carrying amount at 1 October 2011 (20,000 – 6,000) Amortised for year (20,000 x 20%) Capitalised during year (800 x 6 months) Carrying amount at 30 September 2012 $’000 52,000 (4,000) –––––––– 48,000 (9,600) –––––––– 38,400 –––––––– 14,000 (4,000) 4,800 –––––––– 14,800 –––––––– Note: development costs can only be treated as an asset from the point where they meet the recognition criteria in IAS 38 Intangible assets. Thus development costs from 1 April to 30 September 2012 of $4·8 million (800 x 6 months) can be capitalised. These will not be amortised as the project is still in development. The research costs of $1·4 million plus three months’ development costs of $2·4 million (800 x 3 months) (i.e. those incurred before 1 April 2012) are treated as an expense. 27 Sandown (a) Sandown – Statement of comprehensive income for the year ended 30 September 2011 $’000 Revenue (380,000 – 4,000 (w (i))) 376,000 Cost of sales (w (ii)) (265,300) –––––––– Gross profit 110,700 Distribution costs (17,400) Administrative expenses (50,500 – 12,000 (w (iii))) (38,500) Investment income 1,300 Profit on sale of investments (w (iv)) 2,200 Finance costs (w (v)) (1,475) –––––––– Profit before tax 56,825 Income tax expense (16,200 + 2,100 – 1,500 (w (vi))) (16,800) –––––––– Profit for the year 40,025 –––––––– Other comprehensive income Gain on available-for-sale investments (w (iv)) 2,500 –––––––– Total other comprehensive income 2,500 –––––––– Total comprehensive income 42,525 –––––––– © Emile Woolf Publishing Limited 193 Paper F7: Financial Reporting (International) (b) Sandown – Statement of financial position as at 30 September 2011 Assets Non-current assets Property, plant and equipment (w (vii)) Intangible – brand (15,000 – 2,500 (w (ii))) Equity investments (at fair value) Current assets Inventory Trade receivables Bank Total assets $’000 67,500 12,500 29,000 –––––––– 109,000 38,000 44,500 8,000 –––––––– Equity and liabilities Equity Equity shares of 20 cents each Equity option Other reserve (w (viii)) Retained earnings (26,060 + 40,025 + 1,800 – 12,000 dividend (w (iii)) Non-current liabilities Deferred tax (w (vi)) Deferred income (w (i)) 5% convertible loan note (w (v)) Current liabilities Trade payables Deferred income (w (i)) Current tax payable 16,200 Total equity and liabilities $’000 3,900 2,000 18,915 –––––––– 42,900 2,000 61,100 –––––––– 90,500 –––––––– 199,500 –––––––– 50,000 2,000 5,700 55,885 –––––––– 113,585 24,815 –––––––– 199,500 –––––––– Workings (figures in brackets in $’000) (i) IAS 18 Revenue requires that where sales revenue includes an amount for after sales servicing and support costs then a proportion of the revenue should be deferred. The amount deferred should cover the cost and a reasonable profit (in this case a gross profit of 40%) on the services. As the servicing and support is for three years and the date of the sale was 1 October 2010, revenue relating to two years’ servicing and support provision must be deferred: ($1·2 million x 2/0·6) = $4 million. This is shown as $2 million in both current and non-current liabilities. (ii) Cost of sales Per question Depreciation – building (50,000/50 years – see below) – plant and equipment (42,200 – 19,700) x 40%)) Amortisation – brand (1,500 + 2,500 – see below) Impairment of brand (see below) 194 246,800 1,000 9,000 4,000 4,500 –––––––– 265,300 –––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions The cost of the building of $50 million (63,000 – 13,000 land) has accumulated depreciation of $8 million at 30 September 2010 which is eight years after its acquisition. Thus the life of the building must be 50 years. The brand is being amortised at $3 million per annum (30,000/10 years). The impairment occurred half way through the year, thus amortisation of $1·5 million should be charged prior to calculation of the impairment loss. At the date of the impairment review the brand had a carrying amount of $19·5 million (30,000 – (9,000 + 1,500)). The recoverable amount of the brand is its fair value of $15 million (as this is higher than its value in use of $12 million) giving an impairment loss of $4·5 million (19,500 – 15,000). Amortisation of $2·5 million (15,000/3 years x 6/12) is required for the second-half of the year giving total amortisation of $4 million for the full year. (iii) A dividend of 4·8 cents per share would amount to $12 million (50 million x 5 (i.e. shares are 20 cents each) x 4·8 cents). This is not an administrative expense but a distribution of profits that should be accounted for through equity. (iv) Profit on the sale of the investments has already been recorded at 2,200 (11,000 proceeds – 8,800 carrying amount) The previous cumulative net gain on this investment is included in an equity reserve. It should be transferred to retained earnings as a movement in the statement of changes in equity(not through OCI). The transfer is: (8,800 carrying amount – 7,000 original cost) = 1,800 The remaining investments of $26·5 million have a fair value of $29 million at 30 September 2011 which gives a fair value increase (credited to other reserve) of $2·5 million. (v) The finance cost of the convertible loan note is based on its effective rate of 8% applied to $18,440,000 carrying amount at 1 October 2010 = $1,475,000 (rounded). The accrual of $475,000 (1,475 – 1,000 interest paid) is added to the carrying amount of the loan note giving a figure of $18,915,000 (18,440 + 475) in the statement of financial position at 30 September 2011. (vi) Deferred tax credit balance required at 30 September 2011 (13,000 x 30%) balance at 1 October 2010 credit (reduction in balance) to income statement (vii) Non-current assets Freehold property (63,000 – (8,000 + 1,000)) (w (ii)) Plant and equipment (42,200 – (19,700 + 9,000)) (w (ii)) Property, plant and equipment (viii) Other reserve (re investments in equity) At 1 October 2010 Transferred to retained earnings (w (iv)) Increase in year ((w (iv)) © Emile Woolf Publishing Limited 3,900 (5,400) –––––––– 1,500 –––––––– 54,000 13,500 –––––––– 67,500 –––––––– 5,000 (1,800) 2,500 –––––––– 5,700 –––––––– 195 Paper F7: Financial Reporting (International) 28 Pricewell (a) Pricewell – Statement of comprehensive income for the year ended 31 March 2011: Revenue (310,000 + 22,000 (w (i)) – 6,400 (w (ii))) Cost of sales (w (iii)) Gross profit Distribution costs Administrative expenses Finance costs (4,160 (w (v)) + 1,248 (w (vi))) Profit before tax Income tax expense (4,500 +700 – (8,400 – 5,600 deferred tax) Profit for the year (b) Pricewell – Statement of financial position as at 31 March 2011: Assets Non-current assets Property, plant and equipment (24,900 + 41,500 w (iv)) Current assets Inventory Amount due from customer (w (i)) Trade receivables Bank Total assets $’000 Current liabilities Trade payables Finance lease obligation (10,848 – 5,716) (w (vi))) Current tax payable Total equity and liabilities Workings (figures in brackets in $’000) (i) Construction contract: Selling price Estimated cost To date To complete Plant Estimated profit 196 $’000 66,400 28,200 17,100 33,100 5,500 ––––––– Equity shares of 50 cents each Retained earnings (w (vii)) Non-current liabilities Deferred tax Finance lease obligation (w (vi)) 6% Redeemable preference shares (41,600 + 1,760 (w (v))) $’000 325,600 (255,100) ––––––––– 70,500 (19,500) (27,500) (5,408) ––––––––– 18,092 (2,400) ––––––––– 15,692 ––––––––– 5,600 5,716 43,360 ––––––– 33,400 5,132 4,500 ––––––– 83,900 –––––––– 150,300 –––––––– 40,000 12,592 –––––––– 52,592 54,676 43,032 –––––––– 150,300 –––––––– $'000 50,000 (12,000) (10,000) (8,000) ––––––––– 20,000 ––––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions Work done is agreed at $22 million so the contract is 44% complete (22,000/50,000). Revenue Cost of sales (= balance) (ii) (iii) 22,000 (13,200) ––––––––– Profit to date (44% x 20,000) 8,800 ––––––––– Cost incurred to date materials and labour 12,000 Plant depreciation (8,000 x 6/24 months) 2,000 Profit to date 8,800 ––––––––– 22,800 Cash received (5,700) ––––––––– Amount due from customer 17,100 ––––––––– Pricewell is acting as an agent (not the principal) for the sales on behalf of Trilby. Therefore the income statement should only include $1·6 million (20% of the sales of $8 million). Therefore $6·4 million (8,000 – 1,600) should be deducted from revenue and cost of sales. It would also be acceptable to show agency sales (of $1·6 million) separately as other income. Cost of sales Per question Contract (w (i)) Agency cost of sales (w (ii)) Depreciation (w (iv)) – leasehold property – owned plant ((46,800 – 12,800) x 25%) – leased plant (20,000 x 25%) Surplus on revaluation of leasehold property (w (iv)) (iv) Non-current assets $'000 234,500 13,200 (6,400) 1,800 8,500 5,000 (1,500) ––––––––– 255,100 ––––––––– Leasehold property valuation at 31 March 2010 depreciation for year (14 year life remaining) 25,200 (1,800) ––––––– carrying amount at date of revaluation 23,400 valuation at 31 March 2011 (24,900) ––––––– revaluation surplus (to income statement – see below) 1,500 ––––––– The $1·5 million revaluation surplus is credited to the income statement as this is the partial reversal of the $2·8 million impairment loss recognised in the income statement in the previous period (i.e. year ended 31 March 2010). Plant and equipment – owned (46,800 – 12,800 – 8,500) – leased (20,000 – 5,000 – 5,000) – contract (8,000 – 2,000 (w (i))) (v) 25,500 10,000 6,000 ––––––– Carrying amount at 31 March 2011 41,500 ––––––– The finance cost of $4,160,000 for the preference shares is based on the effective rate of 10% applied to $41·6 million balance at 1 April 2010. The accrual of $1,760,000 (4,160 – 2,400 dividend paid) is added to the carrying © Emile Woolf Publishing Limited 197 Paper F7: Financial Reporting (International) amount of the preference shares in the statement of financial position. As these shares are redeemable they are treated as debt and their dividend is treated as a finance cost. (vi) Finance lease liability balance at 31 March 2010 interest for year at 8% lease rental paid 31 March 2011 15,600 1,248 (6,000) ––––––– 10,848 868 (6,000) ––––––– 5,716 ––––––– total liability at 31 March 2011 interest next year at 8% lease rental due 31 March 2012 total liability at 31 March 2012 (vii) Retained earnings balance at 1 April 2010 profit for year equity dividend paid 4,900 15,692 (8,000) ––––––– 12,592 ––––––– balance at 31 March 2011 29 Dune (a) Dune – Income statement for the year ended 31 March 2010 Revenue (400,000 – 8,000 + 12,000 (w (i) and (ii))) Cost of sales (w (iii)) Gross profit Distribution costs Administrative expenses (34,200 – 500 loan note issue costs) Investment income Profit (gain) on investments at fair value through profit or loss (28,000 – 26,500) Finance costs (200 + 1,950 (w (iv))) Profit before tax Income tax expense (12,000 – 1,400 – 1,800 (w (v))) Profit for the year (b) Dune – Statement of financial position as at 31 March 2010 Assets Non-current assets Property, plant and equipment (w (vi)) Investments at fair value through profit or loss Current assets Inventory Construction contract – amounts due from customer (w (ii)) Trade receivables (40,700 – 8,000 (w (i))) 198 $’000 $’000 404,000 (315,700) ––––––– 88,300 (26,400) (33,700) 1,200 1,500 (2,150) ––––––– 28,750 (8,800) ––––––– 19,950 ––––––– $’000 46,400 28,000 ––––––– 74,400 48,000 13,400 32,700 ––––––– 94,100 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Non-current assets held for sale (w (iii)) $’000 Total assets Equity and liabilities Equity Equity shares of $1 each Retained earnings (38,400 + 19,950 – 10,000 dividend paid) Non-current liabilities Deferred tax (w (v)) 5% loan notes (2012) (w (iv)) Current liabilities Trade payables Bank overdraft Accrued loan note interest (w (iv)) Current tax payable Total equity and liabilities 4,200 20,450 ––––––– 52,000 4,500 500 12,000 ––––––– $’000 33,500 ––––––– 202,000 ––––––– 60,000 48,350 ––––––– 108,350 24,650 69,000 –––––––– 202,000 ––––––– Workings (figures in brackets in $’000) (i) This appears to be a ‘cut off’ error in that Dune has invoiced goods that are still in inventory. The required adjustment is to remove the sale of $8 million (6,000 x 100/75) from revenue and trade receivables. No adjustment is required to cost of sales or closing inventory. (ii) Construction contract: Agreed selling price Costs to date Costs to complete Plant (12,000 – 3,000) Total estimated profit $’000 8,000 15,000 9,000 ––––––– Amounts for inclusion in the income statement for the year ended 31 March 2010 Revenue (40,000 x 30%) Cost of sales (balance) Gross profit (8,000 x 30%) Amounts for inclusion in the statement of financial position as at 31 March 2010 Cost to date – materials, labour and other direct costs Plant depreciation ((12,000 – 3,000) x 6/18) Profit to date Payments received Amounts due from customer © Emile Woolf Publishing Limited $’000 40,000 (32,000) –––––––– 8,000 –––––––– 12,000 (9,600) –––––––– 2,400 –––––––– 8,000 3,000 –––––––– 11,000 2,400 –––––––– 13,400 (nil) –––––––– 13,400 –––––––– 199 Paper F7: Financial Reporting (International) (iii) Cost of sales $’000 Per question 294,000 Construction contract (w (ii)) 9,600 Depreciation of leasehold property (see below) 1,500 Impairment of leasehold property (see below) 4,000 Depreciation of plant and equipment ((67,500 – 23,500) x 15%) 6,600 –––––– 315,700 –––––– The leasehold property must be classed as a non-current asset held for sale from 1 October 2009 at its fair value less costs to sell. It must be depreciated for six months up to this date (after which depreciation ceases). This is calculated at $1·5 million (45,000/15 years x 6/12). Its carrying amount at 1 October 2009 is therefore $37·5 million (45,000 – (6,000 + 1,500)). Its fair value less cost to sell at this date is $33·5 million ((40,000 x 85%) – 500). It is therefore impaired by $4 million (37,500 – 33,500). (iv) The finance cost of the loan note, at the effective rate of 10% applied to the correct carrying amount of the loan note of $19·5 million is, $1·95 million (the issue costs must be deducted from the proceeds of the loan note; they are not an administrative expense). The interest actually paid is $500,000 (20,000 x 5% x 6/12); however, a further $500,000 needs to be accrued as a current liability (as it will be paid soon). The difference between the total finance cost of $1·95 million and the $1 million interest payable is added to the carrying amount of the loan note to give $20·45 million (19,500 + 950) for inclusion as a non-current liability in the statement of financial position. (v) Deferred tax Provision required at 31 March 2010 (14,000 x 30%) Provision at 1 April 2009 Credit (reduction in provision) to income statement (vi) Property, plant and equipment Property, plant and equipment (67,500 – 23,500 – 6,600) Construction plant (12,000 – 3,000) 30 37,400 9,000 –––––––– 46,400 –––––––– Cavern (a) Cavern – Statement of comprehensive income for the year ended 30 September 2010 Revenue Cost of sales (w (i)) Gross profit Distribution costs Administrative expenses (25,000 – 18,500 dividends (w (iii))) Investment income Finance costs (300 + 400 (w (ii)) + 3,060 (w (iv))) 200 4,200 (6,000) –––––––– 1,800 –––––––– $’000 182,500 (137,400) ––––––– 45,100 (8,500) (6,500) 700 (3,760) ––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions $’000 27,040 (6,250) ––––––– 20,790 ––––––– Profit before tax Income tax expense (5,600 + 900 – 250 (w (v))) Profit for the year Other comprehensive income Loss on available-for-sale investments (15,800 – 13,500) Gain on revaluation of land and buildings (w (ii)) (b) (2,300) 800 ––––––– Total other comprehensive losses for the year (1,500) ––––––– Total comprehensive income 19,290 ––––––– Craven – Statement of changes in equity for the year ended 30 September 2010 Share capital Balance at 1 October 2009 Rights issue (w (iii)) Dividends (w (iii)) Comprehensive income Share premium $’000 $’000 40,000 10,000 nil 11,000 Other Revaluation Retained equity reserve earnings reserve $’000 $’000 $’000 (18,500) 20,790 ––––––– 19,290 ––––––– 50,000 11,000 700 7,800 14,390 ––––––– ––––––– –––––– –––––– ––––––– Cavern – Statement of financial position as at 30 September 2010 83,890 ––––––– ––––––– (2,300) –––––– 7,000 800 –––––– 12,100 Balance at 30 September 2010 (c) $’000 62,100 21,000 (18,500) ––––––– 3,000 Total equity Assets Non-current assets Property, plant and equipment (41,800 + 51,100 (w (ii))) Available-for-sale investments Current assets Inventory Trade receivables Total assets Equity and liabilities Equity (see (b) above) Equity shares of 20 cents each Share premium Other equity reserve Revaluation reserve Retained earnings © Emile Woolf Publishing Limited $’000 19,800 29,000 ––––––– 11,000 700 7,800 14,390 ––––––– $’000 92,900 13,500 –––––––– 106,400 48,800 –––––––– 155,200 –––––––– 50,000 33,890 –––––––– 83,890 201 Paper F7: Financial Reporting (International) $’000 Non-current liabilities Provision for decontamination costs (4,000 + 400 (w (ii))) 4,400 8% loan note (w (iv)) 31,260 Deferred tax (w (v)) 3,750 ––––––– Current liabilities Trade payables 21,700 Bank overdraft 4,600 Current tax payable 5,600 ––––––– Total equity and liabilities Workings (monetary figures in brackets in $’000) (i) Cost of sales Per trial balance 128,500 Depreciation of building (36,000/18 years) Depreciation of new plant (14,000/10 years) Depreciation of existing plant and equipment ((67,400 – 10,000 – 13,400) x 12·5%) (ii) Property, plant and equipment $’000 39,410 31,900 –––––––– 155,200 –––––––– 2,000 1,400 5,500 –––––––– 137,400 –––––––– The new plant of $10 million should be grossed up by the provision for the present value of the estimated future decontamination costs of $4 million to give a gross cost of $14 million. The ‘unwinding’ of the provision will give rise to a finance cost in the current year of $400,000 (4,000 x 10%) to give a closing provision of $4·4 million. The gain on revaluation and carrying amount of the land and building will be: Valuation – 30 September 2009 Building depreciation (w (i)) (iii) 43,000 (2,000) ––––––– Carrying amount before revaluation 41,000 Revaluation – 30 September 2010 41,800 ––––––– Gain on revaluation 800 ––––––– The carrying amount of the plant and equipment will be: New plant (14,000 – 1,400) 12,600 Existing plant and equipment (67,400 – 10,000 – 13,400 – 5,500) 38,500 ––––––– 51,100 ––––––– Rights issue/dividends paid Based on 250 million (50 million x 5 – as shares are 20 cents each) shares in issue at 30 September 2010, a rights issue of 1 for 4 on 1 April 2010 would have resulted in the issue of 50 million new shares (250 million – (250 million x 4/5)). This would be recorded as share capital of $10 million (50,000 x 20 cents) and share premium of $11 million (50,000 x (42 cents – 20 cents)). The dividend of 3 cents per share paid on 30 November 2009 would have been based on 200 million shares and been $6 million. The dividend of 5 202 © Emile Woolf Publishing Limited Section 2: Answers to practice questions cents per share paid on 31 May 2010 would have been based on 250 million shares and been $12·5 million. Therefore the total dividends paid, incorrectly included in administrative expenses, were $18·5 million. (iv) Loan note The finance cost of the loan note, at the effective rate of 10% applied to the carrying amount of the loan note of $30·6 million, is $3·06 million. The interest actually paid is $2·4 million. The difference between these amounts of $660,000 (3,060 – 2,400) is added to the carrying amount of the loan note to give $31·26 million (30,600 + 660) for inclusion as a non-current liability in the statement of financial position. (v) Deferred tax Provision required at 30 September 2010 (15,000 x 25%) Provision at 1 October 2009 Credit (reduction in provision) to income statement 3,750 (4,000) ––––– 250 ––––– Financial statements – Amendment of draft financial statements 31 Deltoid (a) Statement of financial position of Deltoid as at 31 March 2012 $000 $000 Non-current assets Property, plant and equipment (12,110 + 600 – 20 (W1) – 120 (W3)) 12,570 Current assets Inventory 3,850 Trade accounts receivable 2,450 Bank 250 6,550 Total assets Equity and liabilities: Equity Ordinary shares of 50c each (2,000 + 500 bonus issue) Conversion rights (equity element of convertible loan note (W4) © Emile Woolf Publishing Limited 19,120 2,500 186 2,686 203 Paper F7: Financial Reporting (International) Statement of financial position of Deltoid as at 31 March 2012 $000 Reserves Share premium Revaluation reserve (3,000 – 500 bonus issue) Retained earnings (W1) $000 1,000 2,500 3,409 6,909 9,595 Non-current liabilities Environmental provision – revised amount Finance lease (W3) 6% Convertible loan note (2,814 + 101 accrued interest (W4)) 2,150 371 2,915 5,436 Current liabilities Trade accounts payable Accrued interest (W3) Finance lease (W3) Taxation 2,820 24 105 1,140 4,089 19,120 Total equity and liabilities Workings (figures in $000): (W1) Recalculation of retained earnings Retained profit for year to 31 March 2012 from question 2,000 Additional depreciation of: plant (W2) (20) leased plant (W3) (120) (140) 150 Add back: lease rentals (W3) Addition finance costs: for loan notes (281 – 180) (W4) (101) for leased plant (W3) (50) Additional environmental provision (245 – 180) (151) (65) Restated retained profit for year 1,794 Retained profit b/f at 1 April 2011 from question 2,500 Prior year effect of error in environmental provision: (2,150 – 1,200 – 65) (885) Retained earnings in statement of financial position 3,409 (W2) Change of depreciation policy Management accounts 204 Financial accounts Year to 31 March 2011 ((250 – 50) × 2,000/8,000) 50 (250 × 20%) 50 Year to 31 March 2012 ((250 –50) × 800/8,000) 20 (200 × 20%) 40 © Emile Woolf Publishing Limited Section 2: Answers to practice questions The net effect of this is an increase in the depreciation charge of $20,000 for the current year only. (W3) Leased plant – This has been treated as an operating lease whereas it should be treated as a finance lease: Fair value/cost 1st payment 1 April 2011 Interest to 30 September 2011 (10% for 6 months) 2nd payment 1 October 2011 Capital outstanding at 31 March 2012 Accrued interest to 31 March 2012 (10% for 6 months) Total outstanding at 31 March 2012 3rd payment due 1 April 2012 Interest to 30 September 2012 (10% for 6 months) 4th payment 1 October 2012 Capital outstanding at 31 March 2013 $000 600 (75) 525 26 551 (75) 476 24 500 (75) 425 21 446 (75) 371 Summarising: The lease payments of $150,000 should be eliminated from expenses and replaced with a depreciation charge of $120,000 ($600,000 × 20% p.a.) Interest of $50,000 ($26,000 paid, $24,000 accrued) should be included as a finance cost. Current liabilities are $24,000 for accrued interest and $105,000 ($476,000 – $371,000) for the capital element of the finance lease. Non-current liabilities are $371,000 for the capital element of the finance lease. (W4) The convertible loan note is a compound financial instrument and IAS 32 Financial Instruments: Presentation requires that the debt element and the equity element of such instruments are accounted for separately. The amount of the issue proceeds attributable to the conversion rights is classed as equity. This amount is normally calculated as the ‘residue’ after the value of the debt has been calculated: Cash flows Year 1 interest Year 2 interest Year 3 interest Year 4 interest, redemption premium and capital © Emile Woolf Publishing Limited $000 180 180 180 3,480 Factor at 10% 0.91 0.83 0.75 0.68 Present value $000 164 149 135 2,366 ––––– 205 Paper F7: Financial Reporting (International) Cash flows Factor at 10% Present value $000 $000 2,814 3,000 ––––– 186 ––––– Total value of debt component Proceeds of the issue Equity component (residual amount) The interest cost in the income statement should be increased from $180 to $281 (10% of 2,814) by accruing $101, and this accrual should be added to the carrying value of the debt. (b) Basic earnings per share Profit attributable to ordinary shareholders (W1) Number of shares in issue (2.5 million × 2) Earnings per share $1,794,000 5 million 35.9 cents Diluted earnings per share The potential dilution of the convertible loan note must be assessed. On an assumed conversion to ordinary shares there would be an increase in shares of 1.5 million (3 million × 50/100). The effect on earnings is that there will also be an increase based on the after tax finance costs saved. Although the finance costs are $281,000, only the actual interest paid of $180,000 is available for tax relief, thus the after tax increase in earnings will be $281,000 – ($180,000 × 25%) = $236,000. The diluted earnings per share is: Earnings (1,794 basic earnings + 236 above) $2,030,000 Number of shares (5 million + 1.5 million) 6.5 million Diluted earnings per share 32 31.2 cents Tintagel (a) $000 Accumulated profits at 1 April 2011 Reversal of provision plant overhaul (W4) Profit for the year to 31 March 2012 Lease rental charge added back (W1) Lease interest (W1) Depreciation (W2) – building – owned plant – leased plant Loss on investment property (15,000 – 12,400) Write down of inventory (W3) Unrecorded trade payable 206 $000 52,500 6,000 58,500 47,500 3,200 (800) 2,600 22,000 2,800 (27,400) (2,600) (2,400) (500) © Emile Woolf Publishing Limited Section 2: Answers to practice questions $000 6,000 (3,800) (900) Reversal of provision for plant overhaul (W4) Increase in deferred tax (22.5 − 18.7) Loan note interest (0.6 + 0.3 (W5)) $000 18,300 76,800 Accumulated profits at 31 March 2012 (b) Tintagel – Statement of financial position as at 31 March 2012 $000 $000 Non-current assets Freehold property (126,000 – 2,600 (W2)) 123,400 Plant – owned (110,000 – 22,000 (W2)) 88,000 – leased (11,200 – 2,800 (W2)) 8,400 12,400 Investment property 232,200 Current assets Inventory (60,400 – 2,400 (W3)) 58,000 Trade receivables and prepayments 31,200 Bank 13,800 103,000 Total assets 335,200 Equity and liabilities Capital and Reserves: Ordinary shares of 25c each Reserves: Share premium Accumulated profits – 31 March 2012 (part (a)) 150,000 10,000 76,800 86,800 236,800 Non-current liabilities Deferred tax Finance lease obligations (W1) 8% Loan note (14,100 + 300 (W5)) 22,500 5,600 14,400 42,500 Current liabilities Trade payables (47,400 + 500) Accrued lease finance interest (W1) Accrued loan note interest (W5) Finance lease obligation (W1) Taxation Total equity and liabilities © Emile Woolf Publishing Limited 47,900 800 600 2,400 4,200 55,900 335,200 207 Paper F7: Financial Reporting (International) Workings (W1) Finance lease: The lease has been incorrectly treated as an operating lease. Treating it as a finance lease gives the following figures: Cash price/recorded cost First instalment (reversed in income statement) Capital outstanding at 1 April 2011 $000 11,200 (3,200) 8,000 Interest at 10% p.a. to 31 March 2012 (current liability) 800 The capital outstanding of $8 million must be split between current and non-current liabilities. The second instalment payable on 1 April 2012 will contain $800,000 of interest (8,000 × 10%), therefore the capital element in this payment will be $2.4 million and this is a current liability. This leaves $5.6 million (8,000 – 2,400) as a non-current liability. (W2) Depreciation $000 Buildings (130,000 × 2%) 2,600 Non-leased plant (110,000 × 20%) 22,000 Leased plant (11,200 × 25%) 2,800 (W3) The damaged and slow moving inventory should be written down to its estimated realisable value. This is $3.6 million ($4 million less sales commission at 10%). Therefore the required write down is $2.4 million ($6 million – $3.6 million). The unrecorded invoice would be an addition to purchases therefore a deduction from profit. (W4) A provision for a future major overhaul does not meet the definition of a liability in IAS 37 Provisions, Contingent Liabilities and Contingent Assets and must be reversed; this will increase the current year’s profit and the previous year’s profit by $6 million each. (W5) International accounting standards require issue costs, discounts on issue and premiums on redemptions of loan instruments to be included as part of the finance costs: $000 Issue proceeds (15,000 × 95%) Issue costs Initial carrying value (as per suspense account) 208 $000 14,250 (150) 14,100 © Emile Woolf Publishing Limited Section 2: Answers to practice questions $000 $000 Less Payable on redemption (15,000 × 110%) 16,500 Total interest payments (15,000 × 8% × 4 years) 4,800 (21,300) Total finance costs (7,200) The question states that these may be apportioned on a straight-line basis at $1.8 million pa. The loan stock was issued on 1 October 2011 therefore an interest charge of $900,000 is required for the current year. Of this $600,000 is represented by the accrual to be paid on 1 April 2012 and the remainder is also accrued, but added to the carrying value of the loan stock in the statement of financial position. 33 Harrington (a) Harrington: $000 Restated income statement – Year to 31 March 2012 Sales revenues (13,700 – 300 plant sale proceeds) 13,400 Cost of sales (W1) (8,910) Gross profit 4,490 Operating expenses (b) (2,400) Investment income (1,320 – 1,200 increase in market value) 120 Loan interest (25 + 25) (50) Profit before tax 2,160 Income tax expense (55 + 260 + (350 – 280) deferred tax) (385) Profit for the period 1,775 Statement of changes in equity – Year to 31 March 2012 Balance at 1 April 2011 Rights issue (see below) Profit for the period (see (a)) Revaluation of property (W2) Ordinary dividends paid Transferred to realised profits Balance at 31 March 2012 Retained profits $000 2,990 Revaluation reserve $000 nil Ordinary shares $000 1,600 400 Share premium $000 40 560 ––––––– 2,000 ––––––– ––––––– 600 ––––––– 1,775 1,800 (500) 80 ––––––– 4,345 ––––––– (80) ––––––– 1,720 ––––––– The number of 25c ordinary shares at the year end is 8 million ($2 million × 4). This is after a rights issue of 1 for 4. Thus the number of shares prior to the issue would be 6.4 million (8 million × 4/5) and the rights issue would have been for 1.6 million shares. The rights issue price is 60c each which would be recorded as © Emile Woolf Publishing Limited 209 Total $000 4,630 960 1,775 1,800 (500) –––––– 8,665 –––––– Paper F7: Financial Reporting (International) an increase in share capital of $400,000 (1.6 million × 25c) and an increase in share premium of $560,000 (1.6 million × 35c). (c) Statement of financial position as at 31 March 2012 Non-current assets Property, plant and equipment (6,710 + 1,350 (W2) Investments (1,200 × 110%) Current assets Inventory Trade receivables Bank $000 $000 8,060 1,320 9,380 1,750 2,450 350 4,550 13,930 Total assets Equity and liabilities: Ordinary shares of 25c each Reserves (see (b)): Share premium Revaluation reserve (W2) Retained earnings (from (b)) 2,000 600 1,720 4,345 6,665 8,665 Non-current liabilities 10% loan note (issued 2004) Deferred tax (1,400 × 25%) 500 350 850 Current liabilities Trade payables Accrued loan interest ((500 × 10%) – 25 paid) Current tax payable 4,130 25 260 4,415 13,930 Total equity and liabilities Workings (all figures in $000): (W1) Cost of sales As given in the question Profit on sale of plant ((900 – 630) – 300) Depreciation – plant (W3) – buildings (W2) Capitalised expenses net of error (W2) 9,200 (30) 450 290 (1,000) 8,910 (W2) Land and buildings: cost/revaluation depreciation Cost/revaluation Self constructed (see below) Re-valued 210 1,000 Depreciation 50 6,000 240 ――― ――― 7,000 290 ――― ――― (20-year life) (see below) © Emile Woolf Publishing Limited Section 2: Answers to practice questions The carrying value of the land and buildings at 31 March 2012 is $6,710,000 (7,000 – 290). Depreciation on the building element will be $240 (4,800/20 years). The revaluation of the land and buildings will create a revaluation reserve initially of $1,800 (6,000 – (1,000 + (4,000 – 800)). However a transfer of $80 (1,600/20 building element of the revaluation) to realised profit is required. Self-constructed asset: Purchased materials Direct labour Supervision Design and planning costs Error in construction (10 + 25) 150 800 65 20 (35) 1,000 Note: The cost of the error cannot be capitalised; it must therefore be written off. (W3) Plant Cost Per SofFP Disposal 5,200 (900) ――― Depreciation 31 March 2011 Carrying value 3,130 (630) ――― 4,300 2,500 ――― ――― 1,800 Depreciation for the current year will be $450,000 (25% reducing balance), giving a carrying value at 31 March 2012 of $1,350,000. 34 Wellmay Wellmay Income Statement year ended 31 March 2012: Revenue (4,200 – 500 (w (i))) Cost of sales (w (ii)) Gross profit Operating expenses (470 + 8 depreciation) Investment property – rental income – fair value loss (400 – 375) Finance costs (w (iii)) Profit before tax Income tax (360 + 30 (w (v))) Profit for the period © Emile Woolf Publishing Limited $’000 20 (25) $’000 3,700 (2,417) 1,283 (478) (5) (113) 687 (390) 297 211 Paper F7: Financial Reporting (International) Statement of changes in equity – year ended 31 March 2012 Balances at 1 April 2011 Equity conversion option (W4) Bonus issue (1 for 4) Revaluation of factory (W4) Profit for the period Dividends Balances at 31 March 2012 Equity shares $’000 1,200 Equity option $’000 Revaluation reserve $’000 350 40 300 Total $’000 4,165 40 (300) 190 1,500 40 540 Statement of financial position as at 31 March 2012: Assets Non-current assets Property, plant and equipment (W6) Investment property (W4) 4,390 375 4,765 1,600 6,365 Equity and liabilities (see statement of changes in equity above) Equity shares of 50 cents each Equity option (W4) Reserves: Revaluation reserve Retained earnings Non-current liabilities Deferred tax (W5) 8% Convertible loan note ((560 + 8) (W4) Current liabilities (820 – 75 (W2) Loan from Westwood (500 + 50 accrued interest (W1) 297 (400) 2,212 190 297 (400) 4,292 $’000 Current assets (1,400 + 200 inventory (W1) Total assets Total equity and liabilities Retained earnings $’000 2,615 1,500 40 1,540 540 2,212 4,292 210 568 778 745 550 1,295 6,365 Workings (note: all figures in $’000) (1) Secured loan: The ‘sale’ to Westwood is, in substance, a secured loan. The repurchase price is the cost of sale plus compound interest at 10% for two years. The correct accounting treatment is to reverse the sale with the goods going back into inventory and the ‘proceeds’ treated as a loan with accrued interest of 10% ($50,000) for the current year. 212 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (2) Cost of sales: From draft financial statements Sale of goods added back to inventory (see above) Reversal of contingency provision (see below) Depreciation transferred to operating costs (40 x 20%) 2,700 (200) (75) (8) 2,417 General or non-specific provisions do not meet the definition of a liability in IAS 37 Provisions, contingent liabilities and contingent assets and must therefore be reversed. (3) Finance costs: From draft financial statements Additional accrued interest on convertible loan (w (iv)) Finance cost on in-substance loan (500 x 10%) (4) 55 8 50 113 Convertible Loan: This is a compound financial instrument that contains an element of debt and an element of equity (the option to convert). IAS 32 Financial instruments: disclosure and presentation requires that the substance of such instruments should be applied to the reporting of them. The value of the debt element is calculated by discounting the future cash flows (at 10%). The residue of the issue proceeds is recorded as the value of the equity option: Cash flows 48 48 48 Discount factor at 10% 0·91 0·83 0·75 Present value $’000 43·6 39·8 36·0 Year 1 interest Year 2 interest Year 3 interest Year 4 interest, redemption premium and capital 648 0·68 440·6 Total value of debt component 560·0 Proceeds of the issue 600·0 Equity component (residual amount) 40·0 For the year ended 31 March 2012, the interest cost for the convertible loan in the income statement should be increased from $48,000 to $56,000 (10% x 560) by accruing $8,000, which should be added to the carrying value of the debt. (5) Taxation: The required deferred tax balance is $210,000 (600 x 35%), the current balance is $180,000, and thus a further transfer of $30,000 (via the income statement) is required. (6) Properties: The fair value model in IAS 40 Investment property requires the loss of $25,000 on the fair value of investment properties to be reported in the income statement. This differs from revaluations of other properties. IAS 16 Property, plant and equipment requires surpluses and deficits to be recorded as movements in equity (a revaluation reserve). After depreciation of $40,000 for the year ended 31 March 2012, the factory (used by Wellmay) would have a carrying amount of $1,160,000 (1,200 – 40). The valuation of $1,350,000 at 31 March 2012 would give a further © Emile Woolf Publishing Limited 213 Paper F7: Financial Reporting (International) revaluation surplus of $190,000 (1,350 – 1,160) and a carrying amount of property, plant and equipment of $4,390,000 (4,200 + 190) at that date. 35 Dexon (a) $’000 Retained profit for period per question Dividends paid (w (i)) Draft profit for year ended 31 March 2012 Discovery of fraud (w (ii)) Goods on sale or return (w (iii)) Depreciation (w (iv)) – buildings (165,000/15 years) – plant (180,500 x 20%) Increase in investments ((12,500 x 1,296/1,200) – 12,500) Provision for income tax Increase in deferred tax (w (v)) 11,000 36,100 ––––––– Recalculated profit for year ended 31 March 2012 (b) $’000 96,700 15,500 ––––––– 112,200 (2,500) (600) (47,100) 1,000 (11,400) (800) ––––––– 50,800 ––––––– Dexon – Statement of Changes in Equity – Year ended 31 March 2012 At 1 April 2011 Prior period adjustment (w (ii)) Restated earnings at 1 April 2011 Rights issue (see below) Total comprehensive income (from (a) and (w (iv)) Dividends paid (w (i)) At 31 March 2012 Ordinary shares $’000 200,000 50,000 Share premium $’000 30,000 10,000 Revaluation Retained reserve earnings $’000 $’000 18,000 12,300 (1,500) –––––––– 10,800 4,800 –––––––– 250,000 –––––––– ––––––– 40,000 ––––––– ––––––– 22,800 ––––––– 50,800 (15,500) –––––––– 46,100 –––––––– Total $’000 260,300 (1,500) 60,000 55,600 (15,500) –––––––– 358,900 –––––––– Rights issue: 250 million shares in issue after a rights issue of one for four would mean that 50 million shares were issued (250,000 x 1/5). As the issue price was $1·20, this would create $50 million of share capital and $10 million of share premium. (c) Dexon – Statement of financial position as at 31 March 2012: Non-current assets Property (w (iv)) Plant (180,500 – 36,100 depreciation see (a)) Investments at fair value through profit and loss (12,500 + 1,000 see (a)) Current assets Inventory (84,000 + 2,000 (w (iii))) 214 $’000 $’000 180,000 144,400 13,500 ––––––– 337,900 86,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions $’000 Trade receivables (52,200 – 4,000 – 2,600 (w (ii) and (iii))) 45,600 Bank 3,800 ––––––– Total assets Equity and liabilities Equity (from (b)) Ordinary shares of $1 each Share premium Revaluation reserve Retained earnings Non-current liabilities Deferred tax (19,200 + 2,000 (w (v))) Current liabilities (81,800 + 11,400 income tax) Total equity and liabilities $’000 135,400 ––––––– 473,300 ––––––– 250,000 40,000 22,800 46,100 ––––––– 108,900 ––––––– 358,900 21,200 93,200 ––––––– 473,300 ––––––– Workings (figures in brackets in $’000) (i) Dividends paid The dividend in May 2011 would be $8 million (200 million shares at 4 cents) and in November 2011 would be $7·5 million (250 million shares x 3 cents). Total dividends would therefore have been $15·5 million. (ii) The discovery of the fraud means that $4 million should be written off trade receivables. $1·5 million debited to retained earnings as a prior period adjustment (in the statement of changes in equity) and $2·5 written off in the income statement for the year ended 31 March 2012. (iii) Goods on sale or return The sales over which customers still have the right of return should not be included in Dexon’s recognised revenue. The reversing effect is to reduce the relevant trade receivables by $2·6 million, increase inventory by $2 million (the cost of the goods (2,600 x 100/130)) and reduce the profit for the year by $600,000. (iv) Property The carrying amount of the property (after the year’s depreciation) is $174 million (185,000 – 11,000). A valuation of $180 million would create a revaluation surplus of $6 million of which $1·2 million (6,000 x 20%) would be transferred to deferred tax. (v) Deferred tax An increase in the taxable temporary differences of $10 million would create a transfer (credit) to deferred tax of $2 million (10,000 x 20%). Of this $1·2 million relates to the revaluation of the property and is debited to the revaluation reserve. The balance, $800,000, is charged to the income statement. © Emile Woolf Publishing Limited 215 Paper F7: Financial Reporting (International) 36 Bodyline (a) IAS 37 Provisions, Contingent Liabilities and Contingent Assets defines a provision as a liability of uncertain timing or amount. There is clearly an overlap between provisions and contingencies. Because of the ‘uncertainty’ aspects of the definition, it can be argued that to some extent all provisions have an element of contingency. The IASB distinguishes between the two by stating that a contingency is not recognised as a liability if it is either: (i) only possible and therefore yet to be confirmed as a liability, or (ii) where there is a liability but it cannot be measured with sufficient reliability (although this situation should be rare). IAS 37 requires provisions to satisfy all of the following three recognition criteria: There is a present obligation (legal or constructive) as a result of a past event. It is probable that a transfer of economic benefits will be required to settle the obligation. The obligation can be estimated reliably. A provision is triggered by an obligating event. This must have already occurred, future events cannot create current liabilities. The first of the three criteria refers to legal or constructive obligations. A legal obligation is straightforward and uncontroversial in nature. Constructive obligations arise where a company creates an expectation that it will meet certain obligations that it is not legally bound to meet. These may arise due to a published statement or even by a pattern of past practice. In reality constructive obligations are usually accepted because the alternative action is unattractive or may damage the reputation of the company. An example is a commitment to pay for environmental damage caused by the company, even where there is no legal obligation to do so. To summarise: a company must provide for a liability where the three defining criteria of a provision are met, but conversely a company cannot provide for a liability where these criteria are not met. (b) The main need for an accounting standard in this area was to clarify and regulate when provisions should and should not be made. In the past, it was fairly common to ‘abuse’ the use of provisions by creating a provision when the IAS37 criteria did not exist. One of the most common yet controversial examples of provisioning was in relation to future restructuring or reorganisation costs (often as part of an acquisition). This was sometimes extended to making provisions for future operating losses. The attraction of providing for this type of expense/loss was that once the provision had been made, the future actual costs were then charged to the provision and did not get reported in the income statement as they occurred. Such provisions could be described by management as ‘exceptional items’, which analysts were expected to disregard when assessing the company’s future prospects. IAS 37 now prevents this practice as future costs and operating losses (unless they are for an onerous contract) do not constitute past events, and so a provision cannot be created in these circumstances. Another important change initiated by IAS 37 was the way in which environmental provisions are treated. IAS 37 requires that if the environmental costs are a liability (legal or constructive), then the whole of the costs must be 216 © Emile Woolf Publishing Limited Section 2: Answers to practice questions provided for immediately. That has led to large liabilities appearing in the statements of financial position of some companies. A third example of bad practice prior to IAS37 was the use of ‘big bath’ provisions and over-provisioning. In its simplest form this occurred when a company made a large provision, often for non-specific future expenses, or as part of an overall restructuring package. If the provision was deliberately overprovided (i.e. too large), then its later release improved future profits. Alternatively the company could charge to the provision a different cost than the one it was originally created for. IAS 37 prevents this practice in two ways: by not allowing provisions to be created if they do not meet the definition of an obligation; and specifically preventing a provision made for one expense to be used for a different expense. Under IAS 37 the original provision would have to be reversed and a new one would be created with appropriate disclosures. Whilst this treatment does not affect overall profits, it does enhance transparency. (c) The directors’ proposed treatment is incorrect. The replacement of the engine is an example of what has been described as cyclic repairs or replacement. Whilst it may seem logical and prudent to accrue for the cost of a replacement engine as the old one is being worn out, such practice leads to double counting. Under the directors’ proposals the cost of the engine is being depreciated as part of the cost of the asset, albeit over an incorrect time period. The solution to this problem lies in IAS 16 Property, Plant and Equipment. The plant constitutes a ‘complex’ asset i.e. one that may be thought of as having separate components within a single asset. Thus part of the plant $16.5 million (total cost of $24 million less $7.5 assumed cost of the engine) should be depreciated at $1.65 million per annum over a 10year life and the engine should be depreciated at $1,500 per hour of use (assuming machine hour depreciation is the most appropriate method). If a further provision of $1,500 per machine hour is made, there would be a double charge against profit for the cost of the engine. IAS 37 also refers to this type of provision and says that the future replacement of the engine is not a liability. The reasoning is that the replacement could be avoided if, for example, the company chose to sell the asset before replacement was due. If an item does not meet the definition of a liability it cannot be provided for. 37 Niagara (a) All items in arriving at the profit for the financial year are included in the calculation of the earnings per share. Earnings attributable to the ordinary shares are after the deduction of the following dividends on the non-redeemable preference shares: 8% on $1 million for full year New issue 6% on $1 million for six months Preference dividends Earnings attributable to ordinary shares (2,585,000 – 110,000) © Emile Woolf Publishing Limited $ 80,000 30,000 110,000 $2,475,000 217 Paper F7: Financial Reporting (International) Calculation of theoretical ex-rights price: 100 current shares at $2.40 are worth Rights to 20 shares at $1.50 each cost 120 shares are theoretically worth $ 240 30 270 Theoretical ex-rights price = $270/120 shares = $2.25 per share. Weighted average number of shares in issue 12,000,000 × $2.4/$2.25 × 3/12 14,400,000 (12 million × 1.2) × 9/12 Weighted average number 3,200,000 10,800,000 14,000,000 Earnings per share = 17.7c ($2,475,000/14,000,000 × 100) Restated earnings per share for the year to 31 March 2011 is 22.5c (= 24 × 2.25/2.40) (b) Fully diluted earnings per share On conversion the loan stock would create an extra 800,000 new shares ($2 million × 40/$100). The effect on earnings would be a saving of interest of $140,000 ($2 million × 7%) before tax and $98,000 after tax (140,000 × (100% – 30%)) The directors’ warrants would create an additional 750,000 new shares without any effect on earnings. Fully diluted earnings per share is 16.5c ((2,475,000 + 98,000)/(14,000,000 + 800,000 + 750,000)). The basic earnings per share is a measure of past performance. The diluted earnings per share figure is more forward looking and is intended to act as a warning to existing and prospective shareholders. Although it is still based on past performance, it does give effect to potential ordinary shares outstanding during the period. Its disclosure is required where circumstances exist that would cause the EPS to be lower if those circumstances had crystallised. It is not a prediction of the future earnings per share figures, as these will be based on the future profits and the number of shares in issue in the future. The diluted EPS is more a ‘theoretical’ value, as it is unlikely that the profit in the period when the circumstances crystallise will be the same as the current year’s profit. The convertible loan stock in the question is a good example of diluting circumstance. On conversion the share entitlement will cause the number of shares in issue in the future to be greater than the present (assuming loan stockholders opt for conversion). There will be a compensating increase in profit as a result of the non-payment of interest but overall the expected conversion will cause a dilution. 38 Taxes (a) 218 (i) The need to provide for deferred tax arises from the fact that accounting profit (as reported in a company’s financial statements) differs from the profit figure used by the tax authorities to calculate a company’s income tax liability for a given period. If deferred tax were ignored then a company’s tax charge for a particular period may not be proportional to the reported profit. © Emile Woolf Publishing Limited Section 2: Answers to practice questions For example if a company makes a large profit in a particular period, but, perhaps because of high levels of capital expenditure, it is entitled to claim large tax allowances for that period, this would reduce the amount of tax it has to pay. The result of this would be that the company would report a large profit, but very little, if any, tax charge. This situation is usually ‘reversed’ in subsequent periods such that tax charges appear to be much higher than the reported profit would suggest that they should be. Such a reporting system is misleading in that the profit after tax, which is used for calculating the company’s earnings per share, may bear very little resemblance to the pre-tax profit. This can mean that a government’s tax rules may distort a company’s profit trends. Providing for deferred tax goes some way towards relieving this anomaly, although it can never be entirely corrected. This is because of the fact that some items of expense in the income statement are not allowed for tax purposes. Where tax depreciation is different from the related accounting depreciation charges this leads to the tax base of an asset being different to its carrying value on the statement of financial position (these differences are called temporary differences) and a provision for deferred tax is made. This ‘statement of financial position liability’ approach is the general principle on which IAS 12 bases the calculation of deferred tax. The effect of this is that it usually brings the total tax charge (i.e. the provision for the current year’s income tax plus the deferred tax) in proportion to the profit reported to shareholders. (ii) IAS 12 Income Taxes requires the temporary difference to be calculated and the rate of income tax applied to this difference to give the deferred tax asset or liability. Temporary differences are the differences between the carrying amount of an asset and its tax base. $000 $000 Carrying value at 30 September 2012 Cost of plant 2,000 Accumulated depreciation at 30 September 2012 (2,000 – 400)/8 years for 3 years (600) Carrying value 1,400 Tax base at 30 September 2012 Initial tax base (original cost) 2,000 Tax depreciation Year to 30 September 2010 (2,000 × 40%) 800 Year to 30 September 2011 (1,200 × 20%) 240 Year to 30 September 2012 (960 × 20%) 192 (1,232) Tax base 30 September 2012 © Emile Woolf Publishing Limited 768 219 Paper F7: Financial Reporting (International) Temporary differences at 30 September 2012: (1,400 – 768) 632 Deferred tax liability at 30 September 2012: (632 × 25% tax rate) 158 Income statement credit – year to 30 September 2012: ((200 – 192) × 25%) (b) 2 There are two main reasons why the income tax charge in the financial statements is not at the same rate as the stated percentage. The first reason is that tax is payable on the taxable profits of a company, which may differ considerably from the accounting profit. Such differences may be because some items of income or expenditure included in the financial statements may be disallowable for tax purposes (or allowed in a different accounting period) and some taxation allowances (e.g. tax depreciation allowances) are not included in the accounting profit. These differences may be mitigated by deferred tax on temporary differences. The second reason for differences is that the income tax charge does not usually consist solely of the charge on the current year’s profit. Commonly the tax charge also includes an element of deferred tax (this may be a debit or credit) and possibly an adjustment to the previous year’s tax provision (due to it being settled at an amount different to the provision). Other more complex items such as withholding taxes on income and double (dual) taxation relief may also be included in the tax charge. The main reason why the income tax charge in the income statement differs to the amount for income tax in the statement of cash flows is that the tax charge in the financial statements is a provision for tax that is normally settled in the following period. This means that the cash flow figure for tax actually paid is the amount needed to settle the previous year’s tax liability. Other differences may be due to items referred to above such as deferred tax movements that are not cash flows. 39 Broadoak (a) (i) Although the broad principles of accounting for non-current assets are well understood by the accounting profession, applying these principles to practical situations has resulted in complications and inconsistency. For the most part, IAS 16 codified existing good practice, but it does include specific rules which were intended to achieve improved consistency and more transparency. Cost The cost of an item of property, plant and equipment comprises its purchase price and any other costs directly attributable to bringing the asset into a working condition for its intended use. This is expanded upon as follows: 220 Purchase price is after the deduction of any trade discounts or rebates (but not early settlement discounts), but it does include any transport and handling costs (delivery, packing and insurance), non-refundable taxes (e.g. sales taxes such as VAT or GST, stamp duty, import duty). If the payment is deferred beyond normal credit terms this should be © Emile Woolf Publishing Limited Section 2: Answers to practice questions taken into account either by the use of discounting or substituting a cash equivalent price. Directly attributable costs are the incremental costs that would have been avoided had the assets not been acquired. For self-constructed assets this includes labour costs of own employees. Abnormal costs such as wastage and errors are excluded. Installation costs and site preparation costs. Professional fees (e.g. legal fees, architects fees). In addition to the ‘traditional’ costs above two further groups of cost may be capitalised: IAS 23 Borrowing Costs allows (under the allowed alternative method) directly attributable borrowing costs to be capitalised. Directly attributable borrowing costs are those that would have been avoided had there been no expenditure on the asset. IAS 37 Provisions, Contingent Liabilities and Contingent Assets says that if the estimated costs of removing and dismantling an asset and restoring its site qualify as a liability, they should be provided for and added to the cost of the relevant asset. Finally, the carrying amount of an asset may be reduced by any applicable government grants under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance. (ii) Subsequent expenditure Traditionally the appropriate accounting treatment of subsequent expenditure on non-current assets revolved around whether it represented a revenue expense, in effect maintenance or a repair, or whether it represented an improvement that should be capitalised. IAS 16 bases the question of capitalisation of subsequent expenditure on whether it results in a probable future economic benefit in excess of the amount originally assessed for the asset and on whether the cost of the item can be measured reliably. All other subsequent expenditure should be recognised in the income statement as it is incurred. Examples of circumstances where subsequent expenditure should be capitalised are where it: represents a modification that enhances the economic benefits of an asset (in excess of its previously assessed standard of performance). This could be an increase in its life or production capacity; upgrades an asset with the effect of improving the quality of output; or is on a new production process that reduces operating costs. In addition to the above, the Standard says it is important to take into account the circumstances of the expenditure. For example, normal servicing and overhaul of plant is a revenue cost but, if the expenditure represents a major overhaul of an asset that restores its previous life, and the consumption of the previous economic benefits has been reflected by past depreciation charges, then the expenditure should be capitalised (subject to not exceeding its recoverable amount). A further example of where subsequent expenditure should be capitalised is where a major © Emile Woolf Publishing Limited 221 Paper F7: Financial Reporting (International) component of an asset that has been treated separately (for depreciation purposes) is replaced or restored (e.g. new engines for an aircraft). (b) (i) The initial measurement of the cost at which the plant would be capitalised is calculated as follows: $ Basic list price of plant Less trade discount of 12.5% on list price Shipping and handling costs Estimated pre-production testing Site preparation costs Electrical cable installation (14,000 – 6,000) Concrete reinforcement Own labour costs $ 240,000 (30,000) ―――― 210,000 ―――― 2,750 12,500 8,000 4,500 7,500 ――― 20,000 Dismantling and restoration costs (15,000 + 3,000) 18,000 ―――― Initial cost of plant 263,250 ―――― Note: The early settlement discount is a revenue item (probably deducted from administration costs). The maintenance cost is also a revenue item, although a proportion of it would be a prepayment at the end of the year of acquisition (the amount would be dependent on the date of acquisition). The cost of the specification error must be charged to the income statement. 40 Merryview Merryview income statement (extracts) – year to 31 March 2012 Note: workings in brackets are in $000 Depreciation: head office – 6 months to 1 October 2011 (1,200/25 × 6/12) – 6 months to 31 March 2012 (1,350/22.5 (W1) × 6/12) $ $ 24,000 30,000 ––––––– 54,000 ––––––– Depreciation: training premises – 6 months to 1 October 2012 (900/25 × 6/12) – 6 months to 31 March 2012 (600/10 × 6/12) Impairment loss (W2) 18,000 30,000 –––––––– 48,000 –––––––– 210,000 –––––––– 258,000 –––––––– 222 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Statement of financial position (extracts) as at 31 March 2012 $ $ Non-current assets Land and buildings – head office (700 + 1,350 – 30) 2,020,000 – training premises (350 + 600 – 30) 920,000 –––––––––– 2,940,000 –––––––––– Revaluation reserve Head office land (700 – 500) 200,000 Building (1,350 – 1,080 (W1)) 270,000 Training premises land (350 – 300) 50,000 –––––––– 520,000 Transfer to realised profit (270/22.5 (W1) × 6/12 re depreciation of buildings) Workings (6,000) –––––––– 514,000 –––––––– (W1) The date of the revaluation is two and a half years after acquisition. This means the remaining life of the head office would be 22.5 years. The carrying value of the head office building at the date of revaluation is $1,080,000 i.e. its cost less two and a half years at $48,000 per annum ($1,200,000 – $120,000). (W2) Impairment loss: the carrying value of training premises at date of revaluation is $810,000 i.e. its cost less two and a half years at $36,000 per annum ($900,000 – $90,000). It is revalued down to $600,000 giving a loss of $210,000. As the land and the buildings are treated as separate assets the gain on the land cannot be used to offset the loss on the buildings. 41 Impairment and Wilderness (a) (i) An impairment loss arises where the carrying amount of an asset is higher than its recoverable amount. The recoverable amount of an asset is defined in IAS 36 Impairment of Assets as the higher of its fair value less costs to sell and its value in use (fair value less cost to sell was previously referred to as net selling price). Thus an impairment loss is simply the difference between the carrying amount of an asset and the higher of its fair value less costs to sell and its value in use. Fair value The fair value could be based on the amount of a binding sale agreement or the market price where there is an active market. However many (used) assets do not have active markets and in these circumstances the fair value is based on a ‘best estimate’ approach to an arm’s length transaction. It would not normally be based on the value of a forced sale. In each case the costs to sell would be the incremental costs directly attributable to the disposal of the asset. Value in use © Emile Woolf Publishing Limited 223 Paper F7: Financial Reporting (International) The value in use of an asset is the estimated future net cash flows expected to be derived from the asset discounted to a present value. The estimates should allow for variations in the amount, timing and inherent risk of the cash flows. A major problem with this approach in practice is that most assets do not produce independent cash flows i.e. cash flows are usually produced in conjunction with other assets. For this reason IAS 36 introduces the concept of a cash-generating unit (CGU) which is the smallest identifiable group of assets, which may include goodwill, that generates (largely) independent cash flows. Frequency of testing for impairment Goodwill and any intangible asset that is deemed to have an indefinite useful life should be tested for impairment at least annually, as too should any intangible asset that has not yet been brought into use. In addition, at the end of each reporting period an entity must consider if there has been any indication that other assets may have become impaired and, if so, an impairment test should be done. If there are no indications of impairment, testing is not required. (b) (ii) Once an impairment loss for an individual asset has been identified and calculated it is applied to reduce the carrying amount of the asset, which will then be the base for future depreciation charges. The impairment loss should be charged to income immediately. However, if the asset has previously been revalued upwards, the impairment loss should first be charged to the revaluation surplus. The application of impairment losses to a CGU is more complex. They should first be applied to eliminate any goodwill and then to the other assets on a pro rata basis to their carrying amounts. However, an entity should not reduce the carrying amount of an asset (other than goodwill) to below the higher of its fair value less costs to sell and its value in use if these are determinable. (i) The plant had a carrying amount of $240,000 on 1 October 2011. The accident that may have caused impairment occurred on 1 April 2012 and an impairment test would be done at this date. The depreciation on the plant from 1 October 2011 to 1 April 2012 would be $40,000 (640,000 x 121/2% x 6/12) giving a carrying amount of $200,000 at the date of impairment. An impairment test requires the plant’s carrying amount to be compared with its recoverable amount. The recoverable amount of the plant is the higher of its value in use of $150,000 or its fair value less costs to sell. If Wilderness trades in the plant it would receive $180,000 by way of a part exchange, but this is conditional on buying new plant which Wilderness is reluctant to do. A more realistic amount of the fair value of the plant is its current disposal value of only $20,000. Thus the recoverable amount would be its value in use of $150,000 giving an impairment loss of $50,000 ($200,000 – $150,000). The remaining effect on income would be that a depreciation charge for the last six months of the year would be required. As the damage has reduced the remaining life to only two years (from the date of the impairment) the remaining depreciation would be $37,500 ($150,000/ 2 years × 6/12).Thus extracts from the financial statements for the year ended 30 September 2012 would be: 224 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Statement of financial position Non-current assets Plant (150,000 – 37,500) Income statement Plant depreciation (40,000 + 37,500) Plant impairment loss $ 112,500 77,500 50,000 There are a number of issues relating to the carrying amount of the assets of Mossel that have to be considered. It appears the value of the brand is based on the original purchase of the ‘Quencher’ brand. The company no longer uses this brand name; it has been renamed ‘Phoenix’. Thus it would appear the purchased brand of ‘Quencher’ is now worthless. Mossel cannot transfer the value of the old brand to the new brand, because this would be the recognition of an internally developed intangible asset and the brand of ‘Phoenix’ does not appear to meet the recognition criteria in IAS 38. Thus prior to the allocation of the impairment loss the value of the brand should be written off as it no longer exists. The inventories are valued at cost and contain $2 million worth of old bottled water (Quencher) that can be sold, but will have to be relabelled at a cost of $250,000. However, as the expected selling price of these bottles will be $3 million ($2 million × 150%), their net realisable value is $2,750,000. Thus it is correct to carry them at cost i.e. they are not impaired. The future expenditure on the plant is a matter for the following year’s financial statements. Applying this, the revised carrying amount of the net assets of Mossel’s cash-generating unit (CGU) would be $25 million ($32 million – $7 million re the brand). The CGU has a recoverable amount of $20 million, thus there is an impairment loss of $5 million. This would be applied first to goodwill (of which there is none) then to the remaining assets pro rata. However under IAS2 the inventories should not be reduced as their net realisable value is in excess of their cost. This would give revised carrying amounts at 30 September 2012 of: Brand Land containing spa: 12,000 – [(12,000/20,000) × 5,000] Purifying and bottling plant: 8,000 – [(8,000/20,000) × 5,000] Inventories © Emile Woolf Publishing Limited $000 nil 9,000 6,000 5,000 21,000 225 Paper F7: Financial Reporting (International) Financial statements – Application of accounting standards 42 Torrent contracts and Savoir EPS (a) Income statement for the year ended 31 March 2012 Alfa Beta $m $m Revenue 8.0 2.0 Cost of sales (7.0) (3.5) ――― ――― Profit/(loss) 1.0 (1.5) ――― ――― Statement of financial position as at 31 March 2012 2.4 Gross amounts due from customers (see below) Gross amounts due to customers (see below) Gross amounts from and to customers: Contract cost incurred Recognised profits less (losses) Provision for losses to date Payments received Due from customers 12.5 2.5 (12.6) ――― 2.4 ――― Due to customers (contract liability) Ceta Total $m $m 4.8 14.8 (4.0) 14.5 ――― ――― 0.8 0.3 ――― ――― 4.8 (1.3) 3.5 (1.5) (1.5) (1.8) ――― ――― (1.3) ――― 7.2 (1.3) 4.0 0.8 nil ――― 4.8 ――― 20.0 1.8 (1.5) (14.4) ――― 7.2 ――― (1.3) ――― Workings (in $m) Alfa (5.4/90%) Work invoiced Cost of sales (balancing figure) Profit (see below) Percentage (6/20 × complete 100%) Attributable ($5m × profit 30%) 226 At 31 March 2011 At 31 March 2012 14.0 Year ended 31 March 2012 8.0 (4.5) (11.5) (7.0) 1.5 30% 2.5 70% 1.0 6.0 1.5 (12.6/90%) (14/20 × 100%) (($5m × 70%) – $1m rectification) 2.5 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Prior to the rectification costs (which must be charged to the year in which they are incurred), the estimated total profit on the contract is $5 million ($20m – $15m). Beta Due to the increase in the estimated cost Beta is a loss-making contract and the whole of the loss must be provided for as soon as it is can be anticipated. The loss is expected to be $1.5 million ($7.5m – $6m). The sales value of the contract at 31 March 2012 is $2 million ($1.8/90%), thus the cost of sales must be recorded as $3.5 million. As costs to date are $2 million, this means a provision of $1.5 million is required. Ceta Based on the costs to date at 31 March 2012 of $4 million and the total estimated costs of $10 million, this contract is 40% complete. The estimated profit is $2 million ($12m – $10m); therefore the profit at 31 March 2012 is $0.8 million ($2m × 40%). This gives an imputed sales (and receivable) value of $4.8 million. (b) (i) Savoir: EPS year ended 31 March 2010 The share issue on 1 July 2009 at full market value needs to be weighted: New shares 40m 8m 48m × 3/12 = 10m × 9/12 = 36m 46m Without the bonus issue this would give an EPS of 30c ($13.8m/46m). The bonus issue of one for four would result in 12 million new shares giving a total number of ordinary shares of 60 million. The dilutive effect of the bonus issue would reduce the EPS to 24c (30c × 48m/60m). The comparative EPS (for 2009) would be restated at 20c (25c × 48m/60m). EPS year ended 31 March 2011 The rights issue of two for five on 1 October 2010 is half way through the year. The theoretical ex rights value is calculated as follows: Holder of subscribes for Theoretical value of 100 shares 40 shares 140 shares worth $2.40 at $1 = $ 240 40 280 Theoretical ex-rights price = $280/140 = $2 per share. Weighting Rights issue (2 for 5) New total Weighted average 60m × 6/12 × 2.40/2.00 = 24m 84m × 6/12 = 36m 42m 78m EPS is therefore 25c (= $19.5m/78m). The comparative (for 2010) would be restated at 20c (24c × 2.00/2.40). © Emile Woolf Publishing Limited 227 Paper F7: Financial Reporting (International) (ii) The basic EPS for the year ended 31 March 2012 is 30c ($25.2m/84m × 100). Dilution Convertible loan stock On conversion loan interest of $1.2 million after tax would be saved ($20 million × 8% × (100% – 25%)) and a further 10 million shares would be issued ($20m/$100 × 50). Directors’ options Options for 12 million shares at $1.50 each would yield proceeds of $18 million. At the average market price of $2.50 per share this would purchase 7.2 million shares ($18m/$2.50). Therefore the ‘bonus’ element of the options is 4.8 million shares (12m – 7.2m). Using the above figures the diluted EPS for the year ended 31 March 2012 is 26.7c ($25.2m + $1.2m)/(84m + 10m + 4.8m)). 43 Elite Leisure and Hideaway (a) The cruise ship is an example of what can be called a complex asset. This is a single asset that should be treated as if it was a collection of separate assets, each of which may require a different depreciation method/life. In this case the question identifies three components to the cruise ship. The carrying amount of the asset at 30 September 2011 (eight years after acquisition) would be: Component Ship’s fabric Cabins and entertainment area fittings Propulsion system Cost $m 300 150 100 ――― 550 ――― Depreciation $m 96 100 75 ――― 271 ――― (300/25) × 8) Carrying value $m 204 (150/12) × 8) (100/40,000) × 30,000 50 25 ――― 279 ――― Ship’s fabric This is the most straightforward component. It is being depreciated over a 25 year life and depreciation of $12 million (300/25 years) would be required in the year ended 30 September 2012. The repainting of the ship’s fabric does not meet the recognition criteria of an asset and should be treated as repairs and maintenance. Cabins and entertainment area and fittings During the year these have had a limited upgrade at a cost of $60 million. This has extended the remaining useful life from four to five years. The costs of the upgrade meet the criteria for recognition as an asset. The original fittings have not been replaced thus the additional $60 million would be added to the cost of the fittings and the new carrying amount of $110 million will be depreciated over the remaining life of five years to give a charge for the year of $22 million. 228 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Propulsion system This has been replaced by a new system so the carrying value of the system ($25 million) must be written off and depreciation of the new system for the year ended 30 September 2012 (based on use) would be $14 million (140 million/50,000 × 5,000). Elite Leisure – income statement extract: year ended 30 September 2012 Depreciation – ship’s fabric – cabin and entertainment fittings – propulsion system Disposal loss – propulsion system Repainting ship’s fabric $m 12 22 14 25 20 93 Elite Leisure – statement of financial position extract as at 30 September 2012 Cruise ship (see working): $406m Working (in $ million) Component Cost Depreciation $m $m Ship’s fabric 300 108 Cabins and entertainment area fittings 210 122 Propulsion system 140 ――― 650 ――― (b) (i) (ii) 14 ――― 244 ――― Carrying value $m (300/25) × 9) (110/5) + 100) (100/50,000) × 5,000 192 88 126 ――― 406 ――― IAS 24 Related party disclosures states that a party is related to an entity in the following circumstances: – The party, directly or indirectly, controls, is controlled by or is under common control with the entity (e.g. parent/subsidiary or subsidiaries of the same group) – One party has an interest in another entity that gives it significant influence over the entity (e.g. an associate) or has joint control over the entity (e.g. joint venturers are related parties). – In addition members of key management and close family members of related parties are also themselves related parties. In the absence of related party disclosures, users of financial statements would assume that an entity has acted independently and in its own best interests. Principally within this assumption is that all transactions have been entered into willingly and at arm’s length (i.e. on normal commercial terms at fair value). Where related party relationships and transactions exist, this assumption may not be justified. These relationships and transactions lead to the danger that financial statements may have been distorted or manipulated, © Emile Woolf Publishing Limited 229 Paper F7: Financial Reporting (International) both favourably and unfavourably. The most obvious example of this type of transaction would be the sale of goods or rendering of services from one party to another on non-commercial terms (this may relate to the price charged or the credit terms given). Other examples of disclosable transactions are agency, licensing and leasing arrangements, transfer of research and development and the provision of finance, guarantees and collateral. Collectively this would mean there is hardly an area of financial reporting that could not be affected by related party transactions. It is a common misapprehension that related party transactions need only be disclosed if they are not at arm’s length. This is not the case. For example, a parent may instruct all members of its group to buy certain products or services (on commercial terms) from one of its subsidiaries. In the absence of the related party relationships, these transactions may not have occurred. If the parent were to sell the subsidiary, it would be important for the prospective buyer to be aware that the related party transactions would probably not occur in the future. Indeed even where there are no related party transactions, the disclosure of the related party relationship is still important as a subsidiary may obtain custom, receive favourable credit ratings, and benefit from a superior management team simply by being a part of a well respected group. (iii) The subsidiaries of Hideaway are related parties to each other and to Hideaway itself as they are under common control. One of the important aspects of related party relationships is that one of the parties may have its interests subordinated, i.e. it may not be able to act in its own best interest. This appears to be the case in this situation. Depret (or at least one of its directors) believes that the price it is charging Benedict is less than it could have achieved by selling the goods to non-connected parties. In effect these sales have not been made at an arm’s length fair value. The obvious implication of this is that the transactions have moved profits from Depret to Benedict. If the director’s figures are accurate Depret would have made a profit on these transactions of $6 million (20 – 14) rather than the $1 million it has actually made. The transactions will also affect reported revenue and cost of sales and working capital in the individual financial statements of Benedict and Depret. Some might argue that as the profit remains within the group, there is no real overall effect as, in the consolidated financial statements, intra-group transactions are eliminated. This is not entirely true. The implications of these related party sales are serious: 230 – Depret has a non controlling interest of 45% and they have been deprived of their share of the $5 million transferred profit. This could be construed as oppression of the non controlling interest and is probably illegal. – There is a similar effect on the profit share that the directors of Depret might be entitled to under the group profit sharing scheme as Depret’s profits are effectively $5 million lower than they should be. – Shareholders, independent analysts or even the (independent) managers of Depret would find it difficult to appraise the true performance of Depret. The related party transaction gives the © Emile Woolf Publishing Limited Section 2: Answers to practice questions impression that Depret is under-performing. This may lead to the non controlling interest selling their shares for a low price (because of poor returns) or calls for the company’s closure or some form of rationalisation which may not be necessary. 44 – The tax authorities may wish to investigate the transactions under transfer pricing rules. The profit may have been moved to Benedict’s financial statements to avoid paying tax in Depret’s tax jurisdiction which may have high levels of taxation. – In the same way as Depret’s results appear poorer due to the effect of the related party transactions, Benedict’s results would look better. This may have been done deliberately. Hideaway may intend to dispose of Benedict in the near future and thus its more favourable results may allow Hideaway to obtain a higher sale price for Benedict. Triangle Item (i) Future decontamination costs must be provided for in full at the time they become unavoidable. Where they are based on future values, they should be discounted to their present value. Instead of being immediately written off as a charge in the income statement, the decontamination costs are added to the cost of the related asset and amortised over the expected life of the asset. The current treatment of these costs by Triangle is incorrect. The depreciation charge must be based on the full cost of the plant which must include the decontamination costs. In addition an imputed finance cost must be applied to the provision (often referred to as unwinding). Applying this to the financial statements of Triangle at 31 March 2012: Statement of financial position extracts Non-current assets Plant at cost ($15 million + $5 million) Depreciation at 10% per annum Non-current liabilities Provision Accrued finance costs Income statement extracts Depreciation Accrued finance costs ($5 million × 8%) $m 20.0 (2.0) 18.0 5.0 0.4 5.4 $m 2.0 0.4 Item (ii) This is an example of an adjusting event after the reporting period. To some extent the figures in the draft financial statements already reflect the effects of the fraud (up to the amount at the year end i.e. $210,000) in that presumably the cost of the materials paid © Emile Woolf Publishing Limited 231 Paper F7: Financial Reporting (International) for are included in cost of sales. However, the financial statements are incorrect in their presentation. As the fraud is considered material, $210,000 should be removed from the cost of sales and included as an income statement operating expense (perhaps with separate disclosure). This will affect the gross profit and other ratios, though it will not affect the net profit. The further costs beyond the year end of $30,000 should be disclosed in a note as a nonadjusting event (if these costs are material in their own right). Item (iii) Triangle is of the opinion that the cost of the fraud may be covered by an insurance claim. However the insurance company is disputing the claim. This appears to be a contingent asset. If the contingent asset is ‘probable’ it should be disclosed in a note in the financial statements. However if it is only ‘possible’, it should be ignored. As this claim is at an early stage and the company has not yet sought a legal opinion, it would be premature to consider the claim probable. In these circumstances the contingent asset should be ignored and the financial statements will be unaffected. Item (iv) Although this transaction has been treated as a sale, this is probably not its substance. The clause in the agreement that allows Triangle to repurchase the inventory makes this a sale and repurchase agreement. Assuming Triangle acts rationally it will repurchase the inventory if its retail value at 31 March 2012 is more than $7,320,500 ($5 million plus compound interest at 10% for four years) plus the accumulated storage costs (as these can be recovered from Factorall in the event that the inventory is not repurchased). There is no indication in the question as to what the inventory is likely to be worth on 31 March 2012. However it is unlikely that a finance company will really want to acquire this inventory (it is not its normal line of business) and thus it would not have entered into the contract unless it believed Triangle would repurchase the inventory. If the above is correct the substance of the transaction is that it is a secured loan rather than a sale. The required adjustments would therefore be as follows: 232 – Remove $5 million from sales (debit) and treat this as a long term (4 year) loan. – Remove $3 million from cost of sales and treat this as inventory. – The receivable for the storage cost should be removed from trade receivables and added to the cost of the inventory. – Accrued interest of $500,000 ($5 million × 10%) should be charged to the income statement and added to the carrying value of the loan. © Emile Woolf Publishing Limited Section 2: Answers to practice questions 45 Construction (a) 2011 $000 Magpie – Income statement (extracts) – year to 31 March 2011 Sales revenue (40,000 × 35% (W1)) 14,000 Cost of sales (W1) (9,100) ––––––– 4,900 ––––––– Profit on contract (b) Statement of financial position (extracts) as at 31 March 2011 Non-current assets Plant and machinery (3,600 – 900 (W2)) 2,700 Current assets Amount due from customer (W3) 1,500 2012 $000 Income statement (extracts) – year to 31 March 2012 Sales revenue (40,000 × 75% – 14,000 (W1)) 16,000 Cost of sales (22,500 – 9,100 (W1)) (13,400) –––––– 2,600 –––––– Profit on contract Statement of financial position (extracts) as at 31 March 2012 Non-current assets Plant and machinery (3,600 – 900 – 1,200 (W2)) 1,500 Current assets Amount due from customer (W3) 1,000 Workings (all figures $000): (W1) Contract costs as at 31 March 2011: Architects’ and surveyors’ fees Materials used (3,100 – 300 inventory) Direct labour costs Overheads (40% of 3,500) Plant depreciation (9 months (W2)) 500 2,800 3,500 1,400 900 –––––– Cost at 31 March 2011 9,100 –––––– Cost at 31 March 2011 (see above) 9,100 Estimated cost to complete: Excluding depreciation Plant depreciation (3,600 – 600 – 900) 14,800 2,100 –––––– 16,900 ––––––– Estimated total costs on completion © Emile Woolf Publishing Limited 26,000 ––––––– 233 Paper F7: Financial Reporting (International) Percentage of completion at 31 March 2011 (9,100/26,000) = 35% Contract costs as at 31 March 2012: Summarised costs excluding depreciation 20,400 Plant depreciation (21 months at $100 per month) 2,100 ––––––– Cost to date 22,500 Estimated cost to complete: Excluding depreciation 6,600 Plant depreciation (9 months) 900 –––––– 7,500 ––––––– Estimated total costs on completion 30,000 ––––––– Percentage of completion at 31 March 2012 (22,500/30,000) = 75% (W2) The plant has a depreciable amount of $3,000 (3,600 – 600 residual value). Its estimated life on this contract is 30 months (1 July 2010 to 31 December 2012). Depreciation would be $100 per month i.e. $900 for the period to 31 March 2011; $1,200 for the period to 31 March 2012; and a further $900 to completion. (W3) Amount due from customer at 31 March 2011: Contract costs incurred (9,100 + 300 material inventory) 9,400 Recognised profit 4,900 –––––––– 14,300 Cash received at 31 March 2011 (12,800) –––––––– Amount due at 31 March 2011 1,500 –––––––– Amount due from customer at 31 March 2012: Contract costs incurred 22,500 Recognised profit (4,900 + 2,600) 7,500 –––––––– 30,000 Cash received – 31 March 2011 – 31 March 2012 (12,800) (16,200) –––––––– (29,000) –––––––– Amount due at 31 March 2012 46 Bowtock (a) 234 1,000 –––––––– Most events occurring after the reporting period should be properly reflected in the following year’s financial statements. There are two circumstances where events occurring after the reporting period are relevant to the current year’s financial statements. The first category, known as adjusting events, provides additional evidence of conditions that existed at the end of the reporting period. This usually means that they help to determine the value of an item that may © Emile Woolf Publishing Limited Section 2: Answers to practice questions have been uncertain at the year-end. Common examples of this are receipts from accounts receivable and sales of inventory after the end of the reporting period.. These receipts help to confirm the bad debt and inventory write down allowances. The second category is non-adjusting events. These do not affect the amounts contained in the financial statements, but are considered of such importance that unless they are disclosed, users of financial statements would not be properly able to assess the financial position of the company. Common examples of these are the loss of a major asset (say due to a fire) after the reporting period and the sale of an investment (often a subsidiary) after the reporting period. (b) Inventory Sales of goods after the reporting period are normally a reflection of circumstances that existed prior to the year end. They are usually interpreted as a confirmation of the value of inventory as it existed at the year end, and are thus adjusting events. In this case the sale of the goods after the year-end confirmed that the value of the inventory was correctly stated as it was sold at a profit. Goods remaining unsold at the date the new legislation was enacted are worthless. Whilst this may imply that they should be written off in preparing the financial statements to 30 September 2012, this is not the case. What it is important to realise is that the event that caused the inventory to become worthless did not exist at the year end and its consequent losses should be reflected in the following accounting period. Thus there should be no adjustment to the value of inventory in the draft financial statements, but given that it is material, it should be disclosed as a non-adjusting event. Construction contract On first appearance this new legislation appears similar to the previous example, but there is a major difference. Profits on an uncompleted long term construction contract are based on assessment of the overall eventual profit that the contract is expected to make. This new legislation will mean the overall profit is $500,000 less than originally thought. This information must be taken into account when calculating the profit at 30 September 2012. This is an adjusting event. 47 Multiplex and Simpkins (a) Income statement extracts: Loan stock interest paid ($80 million × 8%) Required accrual of finance cost Total finance cost for loan stock ($68,704,000 × 12%) Statement of financial position extracts: Non-current liabilities 8% loan stock 2014 Accrual of finance costs Equity and liabilities Share options © Emile Woolf Publishing Limited $000 6,400 1,844 –––––– 8,244 –––––– 68,704 1,844 ––––––– 70,548 ––––––– 11,296 ––––––– 235 Paper F7: Financial Reporting (International) Workings IAS 32 and 39, dealing with financial instruments, require compound or hybrid financial instruments such as convertible loan stock to be treated under the substance of the contractual agreement. For this type of instrument this means that its equity element and liability (debt) element must be separately identified and presented as such in the statement of financial position. In practice there are several methods of calculating the split between the two elements. For example there are several option pricing models. However, given the limited information in the question, the split can only be calculated by a ‘residual value of equity’ approach. This involves calculating the present value of the cash flows attributable to a ‘pure’ debt instrument and treating the difference between this and the issue proceeds (the residue) as the equity component. Year 1 interest Year 2 interest Year 3 interest Year 4 interest Year 5 interest and capital Cash flow $m 6.4 6.4 6.4 6.4 86.4 Factor at 12% × 0.89 × 0.80 × 0.71 × 0.64 × 0.57 Discounted cash flow $000 5,696 5,120 4,544 4,096 49,248 68,704 (b) Residual equity element (share options) 11,296 Proceeds of issue 80,000 IAS 32 Financial Instruments: Disclosure and Presentation says that the issuer of a compound (hybrid) instrument (i.e. one that contains both a liability debt and an equity element) should classify the instrument’s components separately. Thus the advice of Merchant Financial Services is wrong; convertible loan stock cannot be classified as pure equity. The proceeds of the issue have to be split between the amount attributable to the conversion rights, which is then classed as equity, and the balance of the proceeds being classed a liability/debt. There are several methods of obtaining these amounts, but from the information given in the question these can only be calculated on a ‘residual value of equity’ basis: Year 1 interest Year 2 interest Year 3 interest Year 4 interest and capital Total value of debt component Proceeds of the issue Equity component (residual amount) 236 Cash flows $000 600 600 600 10,600 Factor at 10% 0.91 0.83 0.75 0.68 Present value $000 546 498 450 7,208 –––––– 8,702 10,000 –––––– 1,298 –––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions $ 600,000 270,000 870,000 Income statement: Interest paid (6% of $10 million) Provision for additional finance costs ((10% × 8.702m) – 0.6m) Statement of financial position: Non-current liabilities: 6% Convertible Loan Stock (from above) Provision for additional finance costs 8,702,000 270,000 8,972,000 Capital and reserves: Option to convert to equity (from above) 48 1,298,000 Convertibles Workings Year 1 2 3 $10 million of loan notes Annual cash flow $000 400 400 10,400 Interest Interest Interest + Redemption Value as straight loan notes Issue price Equity component (residual amount) Discount factor at 7% Present value $000 372 348 8,424 9,144 10,000 856 0.93 0.87 0.81 Finance cost: year to 30 September 2012 $000 Total finance cost: 9,144 × 7% Interest payable on 30 September 2012 ($10 million × 4%) Accrual to add to carrying value of debt 640 400 240 Carrying value of loan notes: 30 September 2012 $000 Initial valuation of debt element Add accrued interest Carrying amount at 30 September 2012 (a) 9,144 240 9,384 In the financial statements of Torpid for the year to 30 September 2012. In the income statement, the finance cost relating to the loan notes is $640,000. In the statement of financial position: Non-current liability for the loan notes = $9,384,000 Equity component of loan notes = $856,000. © Emile Woolf Publishing Limited 237 Paper F7: Financial Reporting (International) (b) The directors are not fully correct in their views. If the company had issued straight convertible loan notes, the interest cost would be 7% per year or $700,000. By issuing convertible loan notes, the total finance cost is not much lower in the first year ($640,000) and it will increase in the next two years as the liability for the loan notes increases. The company’s gearing will be reduced after three years if the loan note holders exercise their option to convert their notes into equity shares. In the short term however, the issue of the convertible loan notes will add to debt capital and only a small amount to equity (the residual amount); therefore it seems likely that gearing will increase in the short term and will not fall. 49 Errsea (a) Errsea – income statement extracts year ended 31 March 2012 Loss on disposal of plant – see note below ((90,000 – 60,000) – 12,000) Depreciation for year (wkg (i)) Government grants (a credit item) – see note below and (wkg (iv)) $ 18,000 75,000 (19,000) Note: the repayment of government grant of $3,000 may instead have been included as an increase of the loss on disposal of the plant. Errsea – statement of financial position extracts as at 31 March 2012 cost Property, plant and equipment (wkg (v)) Non-current liabilities Government grants (wkg (iv)) Current liabilities Government grants (wkg (iv)) $ 360,000 –––––––– accumulated depreciation $ 195,000 –––––––– carrying amount $ 165,000 –––––––– 39,000 27,000 Workings 238 (i) Depreciation for year ended 31 March 2012 On acquired plant (wkg (ii)) Other plant (wkg (iii)) (ii) The cost of the acquired plant is recorded at $210,000 being its base cost plus the costs of modification and transport and installation. Annual depreciation over three years will be $70,000. Time apportioned for year ended 31 March 2012 by 9/12 = $52,500. (iii) The other remaining plant is depreciated at 15% on cost (b/f 240,000 – 90,000 (disposed of) x 15%) $ 52,500 22,500 ––––––– 75,000 ––––––– $ 22,500 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (iv) Government grants Transferred to income for the year ended 31 March 2012: From current liability in 2011 (10,000 – 3,000 (repaid)) From acquired plant (see below): Non-current liability b/f transferred to current on acquired plant (see below) $ 7,000 12,000 ––––––– 19,000 ––––––– $ 30,000 (11,000) 20,000 ––––––– 39,000 ––––––– Grant on acquired plant is 25% of base cost only = $48,000 This will be treated as: To income in year ended 31 March 2012 (48,000/3 x 9/12) Classified as current liability (48,000/3) Classified as a non-current liability (balance) 12,000 16,000 20,000 ––––––– 48,000 ––––––– Note: government grants are accounted for from the date they are receivable (i.e. when the qualifying conditions for the grant have been met). Current liability Transferred from non-current (per question) On acquired plant (see above) 11,000 16,000 ––––––– 27,000 ––––––– (v) cost (b) accumulated depreciation carrying amount $ $ $ Property, plant and equipment Balances b/f 240,000 180,000 60,000 Disposal (90,000) (60,000) (30,000) Addition (w (ii)) 210,000 52,500 157,500 Other plant depreciation for year (wkg (iii)) 22,500 (22,500) ––––––– –––––––– –––––––– Balances at 31 March 2012 360,000 195,000 165,000 ––––––– –––––––– –––––––– (i) This is an example of an adjusting event within IAS 10 Events after the reporting date. This means that an impairment of trade receivables of $23,000 must be recognised (and charged to income). The increase in the receivable after the year end should be written off in the following year’s financial statements. (ii) Sales of the year-end inventory in the following accounting period may provide evidence that the inventory’s net realisable value has fallen below its cost. This appears to be the case for product W32 and is another example © Emile Woolf Publishing Limited 239 Paper F7: Financial Reporting (International) of an adjusting event. With a selling price of $5·40 and after paying a 15% commission, the net realisable value of W32 is $4·59 each. Assuming that the fall in selling price is not due to circumstances that occurred after the year end and that the selling price is typical of what the remainder of the product will sell for, inventory should be written down (via a charge to the income statement) by $16,920 ((6·00 – 4·59) x 12,000 units). 50 (iii) Tentacle has correctly treated the outstanding litigation as a contingent liability. The settlement of a court case after the reporting date may confirm (or otherwise) the existence of an obligation at the year end and would be an example of an adjusting event. This would then require that either the disclosure note of the contingency is removed or the obligation should be provided for dependent on the outcome of the litigation. However, this is not quite the case in Tentacle’s example. The circumstances of the claim against Tentacle are different from those of the recently settled case. So this settlement does not appear to have any effect on the likelihood of Tentacle losing the case. What it does (potentially) affect is the estimated amount of the liability. IAS 10 refers to this situation as an updating disclosure. The only required change to the financial statements would be to update the disclosure note on the contingent liability to reflect that the potential liability has increased from $500,000 to $750,000. (iv) Normally the effect of price increases of materials after the reporting date would be a matter for the following year’s financial statements as such increases do not affect the costs as they existed at the reporting date (i.e. they would not be an adjusting event). However, Tentacle’s method of recognising profit (using a cost basis to determine the percentage of completion) requires an estimate (at 31 March 2012) of the future costs of the contract. This estimate directly determines the amount of profit recognised at 31 March 2012. Therefore the information indicating that the total estimated costs of the contract have increased should be taken as providing additional evidence of conditions that existed at the year end. Thus this is an adjusting event which requires the recognised profit to be recalculated. The original estimate of the recognised profit at 31 March 2012 of $1·2 million would be half of the estimated total profit of $2·4 million (percentage of completion is 50% i.e. $3 million/$6 million). The increase in the costs of $1·5 million means the revised estimated total profit is only $900,000 (2·4m – 1·5m). The revised total costs are $7·5 million (6m + 1·5m). Thus the recognised profit on the contract should be recalculated as $360,000 (900,000 x 3m/7·5m) with appropriate amendments to the income statement and statement of financial position figures. Partway (a) (i) IFRS 5 Non-current assets held for sale and discontinued operations defines non-current assets held for sale as those assets (or a group of assets) whose carrying amounts will be recovered principally through a sale transaction rather than through continuing use. A discontinued operation is a component of an entity that has either been disposed of, or is classified as ‘held for sale’ and: (i) 240 represents a separate major line of business or geographical area of operations © Emile Woolf Publishing Limited Section 2: Answers to practice questions (ii) is part of a single co-ordinated plan to dispose of such, or (iii) is a subsidiary acquired exclusively for sale. IFRS 5 says that a ‘component of an entity’ must have operations and cash flows that can be clearly distinguished from the rest of the entity and will in all probability have been a cash-generating unit (or group of such units) whilst held for use. This definition also means that a discontinued operation will also fall to be treated as a ‘disposal group’ as defined in IFRS 5. A disposal group is a group of assets (possibly with associated liabilities) that it is intended will be disposed of in a single transaction by sale or otherwise (closure or abandonment). Assets held for disposal (but not those being abandoned) must be presented separately (at the lower of cost or fair value less costs to sell) from other assets and included as current assets (rather than as non-current assets) and any associated liabilities must be separately presented under liabilities. The results of a discontinued operation should be disclosed separately as a single figure (as a minimum) on the face of the income statement with more detailed figures disclosed either also on the face of the income statement or in the notes. The intention of this requirement is to improve the usefulness of the financial statements by improving the predictive value of the (historical) income statement. Clearly the results from discontinued operations should have little impact on future operating results. Thus users can focus on the continuing activities in any assessment of future income and profit. (ii) The timing of the board meeting and consequent actions and notifications is within the accounting period ended 31 October 2012. The notification of staff, suppliers and the press seems to indicate that the sale will be highly probable and the directors are committed to a plan to sell the assets and are actively locating a buyer. From the financial and other information given in the question it appears that the travel agencies’ operations and cash flows can be clearly distinguished from its other operations. The assets of the travel agencies appear to meet the definition of non-current assets held for sale; however the main difficulty is whether their sale and closure also represent a discontinued operation. The main issue is with the wording of ‘a separate major line of business’ in part (i) of the above definition of a discontinued operation. The company is still operating in the holiday business, but only through Internet selling. The selling of holidays through the Internet compared with through high-street travel agencies requires very different assets, staff knowledge and training and has a different cost structure. It could therefore be argued that although the company is still selling holidays the travel agencies do represent a separate line of business. If this is the case, it seems the announced closure of the travel agencies appears to meet the definition of a discontinued operation. (iii) Partway income statement year ended: Continuing operations Revenue Cost of sales Gross profit Operating expenses © Emile Woolf Publishing Limited 31 October 2012 $’000 31 October 2011 $’000 25,000 (19,500) ⎯⎯⎯ 5,500 (1,100) ⎯⎯⎯ 22,000 (17,000) ⎯⎯⎯ 5,000 (500) ⎯⎯⎯ 241 Paper F7: Financial Reporting (International) Profit/(loss) from continuing operations Discontinued operations Profit/(loss) from discontinued operations 31 October 2012 $’000 4,400 31 October 2011 $’000 4,500 (4,000) ⎯⎯⎯ 400 ⎯⎯⎯ 1,500 ⎯⎯⎯ 6,000 ⎯⎯⎯ 14,000 (16,500) ⎯⎯⎯ (2,500) (1,500) ⎯⎯⎯ (4,000) ⎯⎯⎯ 18,000 (15,000) ⎯⎯⎯ 3,000 (1,500) ⎯⎯⎯ 1,500 ⎯⎯⎯ Profit for the period Analysis of discontinued operations Revenue Cost of sales Gross profit/(loss) Operating expenses Profit/(loss) from discontinued operations Note: other presentations may be acceptable. (b) (i) Comparability is one of the four principal qualitative characteristics of useful financial information. It is a vital attribute when assessing the performance of an entity over time (trend analysis) and to some extent with other similar entities. For information to be comparable it should be based on the consistent treatment of transactions and events. In effect a change in an accounting policy breaks the principle of consistency and should generally be avoided. That said there are circumstances where it becomes necessary to change an accounting policy. These are mainly where it is required by a new or revised accounting standard, interpretation or applicable legislation or where the change would result in financial statements giving a more reliable and relevant representation of the entity’s transactions and events. It is important to note that the application of a different accounting policy to transactions or events that are substantially different to existing transactions or events or to transactions or events that an entity had not previously experienced does NOT represent a change in an accounting policy. It is also necessary to distinguish between a change in an accounting policy and a change in an estimation technique. In an attempt to limit the problem of reduced comparability caused by a change in an accounting policy, the general principle is that the financial statements should be prepared as if the new accounting policy had always been in place. This is known as retrospective application. The main effect of this is that comparative financial statements should be restated by applying the new policy to them and adjusting the opening balance of each component of equity affected in the earliest prior period presented. IAS 8 Accounting policies, changes in accounting estimates and errors says that a change in accounting policy required by a specific Standard or Interpretation should be dealt with under the transitional provisions (if any) of that Standard or Interpretation (normally these apply the general rule of retrospective application). There are some limited exemptions (mainly on the grounds of impracticality) to the general principle of retrospective application in IAS 8. (ii) 242 This issue is one of the timing of when revenue should be recognised in the income statement. This can be a complex issue which involves identifying © Emile Woolf Publishing Limited Section 2: Answers to practice questions the transfer of significant risks, reliable measurement, the probability of receiving economic benefits, relevant accounting standards and legislation and generally accepted practice. Applying the general guidance in IAS 18 Revenue, the previous policy, applied before cancellation insurance was made a condition of booking, seemed appropriate. At the time the holiday is taken it can no longer be cancelled, all monies would have been received and the flights and accommodation have been provided. There may be some compensation costs involved if there are problems with the holiday, but this is akin to product warranties on normal sales of goods which may be immaterial or provided for based on previous experience of such costs. The appendix to IAS 18 specifically refers to payments in advance of the ‘delivery’ of goods and says that revenue should be recognised when the goods are delivered. Interpreting this for Partway’s transaction would seem to confirm the appropriateness of its previous policy. The directors of Partway wish to change the timing of recognition of sales because of the change in circumstances relating to the compulsory cancellation insurance. The directors are apparently arguing that the new ‘transactions and events’ are substantially different to previous transactions therefore the old policy should not apply. Even if this does justify revising the timing of the recognition of revenue, it is not a change of accounting policy because of the reasons outlined in (i) above. An issue to consider is whether compulsory cancellation insurance represents a substantial change to the risks that Partway experiences. An analysis of past experience of losses caused by uninsured cancellations may help to assess this, but even if the past losses were material (and in future they won’t be), it is unlikely that this would override the general guidance in the appendix to IAS 18 relating to payments made in advance of delivery. It seems the main motivation for the proposed change is to improve the profit for the year ended 31 October 2012 so that it compares more favourably with that of the previous period. To summarise, it is unlikely that the imposition of compulsory cancellation insurance justifies recognising sales at the date of booking when a deposit is received, and, even if it did, it would not be a change in accounting policy. This means that comparatives would not be restated (which is something that would actually suit the suspected objectives of the directors). 51 Pingway Accounting correctly for the convertible loan note in accordance with IAS 32 Financial Instruments: Presentation and IAS 39 Financial Instruments: Recognition and Measurement would mean that virtually all the financial assistant’s observations are incorrect. The convertible loan note is a compound financial instrument containing a (largely) debt component and an equity component – the value of the option to receive equity shares. These components must be calculated using the residual equity method and appropriately classified (as debt and equity) on the statement of financial position. As some of the proceeds of the instrument will be equity, the gearing will not be quite as high as if a non-convertible loan was issued, but gearing will be increased. However, if the loan note is converted to equity in March 2012, gearing will be reduced. The interest rate that would be applicable to a non-convertible loan (8%) is representative © Emile Woolf Publishing Limited 243 Paper F7: Financial Reporting (International) of the true finance cost and should be applied to the carrying amount of the debt to calculate the finance cost to be charged to the income statement thus giving a much higher charge than the assistant believes. Accounting treatment: financial statements year ended 31 March 2012 Income statement: Finance costs (see working) Statement of financial position: Non-current liabilities 3% convertible loan note (8,674 + 393·92) Equity Option to convert Working (figures in brackets in $’000) cash flows year 1 interest 300 year 2 interest 300 year 3 interest and capital 10,300 $693,920 $9,067,920 $1,326,000 present value $’000 279 258 8,137 ––––––– total value of debt component 8,674 proceeds of the issue 10,000 ––––––– equity component (residual amount) 1,326 ––––––– The interest cost in the income statement should be $693,920 (8,674 x 8%), requiring an accrual of $393,920 (693·92 – 300 i.e. 10,000 x 3%). This accrual should be added to the carrying value of the debt. 52 Dearing Year ended/as at: Income statement Depreciation (see workings) Maintenance (60,000/3 years) Discount received (840,000 x 5%) Staff training Statement of financial position (see below) Property, plant and equipment Cost Accumulated depreciation Carrying amount 244 factor at 8% 0·93 0·86 0·79 30 September 2010 $ 180,000 20,000 (42,000) 40,000 –––––––– 198,000 –––––––– 30 September 2011 $ 270,000 20,000 30 September 2012 $ 119,000 20,000 –––––––– 290,000 –––––––– –––––––– 139,000 –––––––– 920,000 (180,000) –––––––– 740,000 –––––––– 920,000 (450,000) –––––––– 470,000 –––––––– 670,000 (119,000) –––––––– 551,000 –––––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions Workings Manufacturer’s base price Less trade discount (20%) Base cost Freight charges Electrical installation cost Pre-production testing Initial capitalised cost $ 1,050,000 (210,000) –––––––– 840,000 30,000 28,000 22,000 –––––––– 920,000 –––––––– The depreciable amount is $900,000 (920,000 – 20,000 residual value) and, based on an estimated machine life of 6,000 hours, this gives depreciation of $150 per machine hour. Therefore depreciation for the year ended 30 September 2010 is $180,000 ($150 x 1,200 hours) and for the year ended 30 September 2011 is $270,000 ($150 x 1,800 hours). Note: early settlement discount, staff training in use of machine and maintenance are all revenue items and cannot be part of capitalised costs. Carrying amount at 1 October 2011 Subsequent expenditure 470,000 200,000 –––––––– Revised ‘cost’ 670,000 –––––––– The revised depreciable amount is $630,000 (670,000 – 40,000 residual value) and with a revised remaining life of 4,500 hours, this gives a depreciation charge of $140 per machine hour. Therefore depreciation for the year ended 30 September 2012 is $119,000 ($140 x 850 hours). 53 Waxwork (IAS 10) (a) Events after the reporting period are defined by IAS 10 Events after the Reporting Period as those events, both favourable and unfavourable, that occur between the end of the reporting period and the date that the financial statements are authorised for issue (normally by the Board of directors). An adjusting event is one that provides further evidence of conditions that existed at the end of the reporting period, including an event that indicates that the going concern assumption in relation to the whole or part of the entity is not appropriate. Normally trading results occurring after the end of the reporting period are a matter for the next reporting period, however, if there is an event which would normally be treated as non-adjusting that causes a dramatic downturn in trading (and profitability) such that it is likely that the entity will no longer be a going concern, this should be treated as an adjusting event. A non-adjusting event is an event after the end of the reporting period that is indicative of a condition that arose after the end of the reporting period and, subject to the exception noted above, the financial statements would not be adjusted to reflect such events. The outcome (and values) of many items in the financial statements have a degree of uncertainty at the end of the reporting period. IAS 10 effectively says that where events occurring after the end of the reporting period help to determine what those values were at the end of the reporting period, they should be taken in account (i.e. adjusted for) in preparing the financial statements. © Emile Woolf Publishing Limited 245 Paper F7: Financial Reporting (International) If non-adjusting events, whilst not affecting the financial statements of the current year, are of such importance (i.e. material) that without disclosure of their nature and estimated financial effect, users’ ability to make proper evaluations and decisions about the future of the entity would be affected, then they should be disclosed in the notes to the financial statements. (b) (i) This is normally classified as a non-adjusting event as there was no reason to doubt that the value of warehouse and the inventory it contained was worth less than its carrying amount at 31 March 2012 (the last day of the reporting period). The total loss suffered as a result of the fire is $16 million. The company expects that $9 million of this loss will be recovered from an insurance policy. Recoveries from third parties should be assessed separately from the related loss. As this event has caused serious disruption to trading, IAS 10 would require the details of this nonadjusting event to be disclosed as a note to the financial statements for the year ended 31 March 2012 as a total loss of $16 million and the effect of the insurance recovery to be disclosed separately. The severe disruption in Waxwork’s trading operations since the fire, together with the expectation of large trading losses for some time to come, may call in to question the going concern status of the company. If it is judged that Waxwork is no longer a going concern, then the fire and its consequences become an adjusting event requiring the financial statements for the year ended 31 March 2012 to be redrafted on the basis that the company is no longer a going concern (i.e. they would be prepared on a liquidation basis). (ii) 70% of the inventory amounts to $322,000 (460,000 x 70%) and this was sold for a net amount of $238,000 (280,000 x 85%). Thus a large proportion of a class of inventory was sold at a loss after the reporting period. This would appear to give evidence of conditions that existed at 31 March 2012 i.e. that the net realisable value of that class of inventory was below its cost. Inventory is required to be valued at the lower of cost and net realisable value, thus this is an adjusting event. If it is assumed that the remaining inventory will be sold at similar prices and terms as that already sold, the net realisable value of the whole of the class of inventory would be calculated as: $280,000/70% = $400,000, less commission of 15% = $340,000. Thus the carrying amount of the inventory of $460,000 should be written down by $120,000 to its net realisable value of $340,000. In the unlikely event that the fall in the value of the inventory could be attributed to a specific event that occurred after the date of the statement of financial position then this would be a non-adjusting event. (iii) 246 The date of the government announcement of the tax change is beyond the period of consideration in IAS 10. Thus this would be neither an adjusting nor a non-adjusting event. The increase in the deferred tax liability will be provided for in the year to 31 March 2012. Had the announcement been before 6 May 2012, it would have been treated as a non-adjusting event requiring disclosure of the nature of the event and an estimate of its financial effect in the notes to the financial statements. © Emile Woolf Publishing Limited Section 2: Answers to practice questions 54 Flightline Flightline – Income statement for the year ended 31 March 2012: $’000 Depreciation (w (i)) 13,800 Loss on write off of engine (w (iii)) 6,000 Repairs – engine 3,000 – exterior painting 2,000 Statement of financial position as at 31 March 2012 Non-current asset – Aircraft Exterior (w (i)) Cabin fittings (w (ii)) Engines (w (iii)) cost $’000 120,000 29,500 19,800 –––––––– 169,300 –––––––– accumulated depreciation $’000 84,000 21,500 3,700 –––––––– 109,200 –––––––– carrying amount $’000 36,000 8,000 16,100 ––––––– 60,100 ––––––– Workings (figures in brackets in $’000) (i) The exterior of the aircraft is depreciated at $6 million per annum (120,000/20 years). The cabin is depreciated at $5 million per annum (25,000/5 years). The engines would be depreciated by $500 ($18 million/36,000 hours) i.e. $250 each, per flying hour. The carrying amount of the aircraft at 1 April 2011 is: cost (ii) carrying amount $’000 $’000 Exterior (13 years old) 120,000 42,000 Cabin (3 years old) 25,000 10,000 Engines (used 10,800 hours) 18,000 12,600 –––––––– ––––––– 163,000 64,600 –––––––– ––––––– Depreciation for year to 31 March 2012: $’000 Exterior (no change) 6,000 Cabin fittings – six months to 30 September 2011 (5,000 x 6/12) 2,500 – six months to 31 March 2012 (w (ii)) 4,000 Engines – six months to 30 September 2011 (500 x 1,200 hours) 600 – six months to 31 March 2012 ((400 + 300) w (iii)) 700 ––––––– 13,800 ––––––– Cabin fittings – at 1 October 2011 the carrying amount of the cabin fittings is $7·5 million (10,000 – 2,500). The cost of improving the cabin facilities of $4·5 million should be capitalised as it led to enhanced future economic benefits in the form of substantially higher fares. The cabin fittings would then have a carrying amount of $12 million (7,500 + 4,500) and an unchanged remaining life of 18 months. Thus depreciation for the six months to 31 March 2012 is $4 million (12,000 x 6/18). © Emile Woolf Publishing Limited accumulated depreciation $’000 78,000 15,000 5,400 –––––––– 98,400 –––––––– 247 Paper F7: Financial Reporting (International) (iii) Engines – before the accident the engines (in combination) were being depreciated at a rate of $500 per flying hour. At the date of the accident each engine had a carrying amount of $6 million ((12,600 – 600)/2). This represents the loss on disposal of the written off engine. The repaired engine’s remaining life was reduced to 15,000 hours. Thus future depreciation on the repaired engine will be $400 per flying hour, resulting in a depreciation charge of $400,000 for the six months to 31 March 2012. The new engine with a cost of $10·8 million and a life of 36,000 hours will be depreciated by $300 per flying hour, resulting in a depreciation charge of $300,000 for the six months to 31 March 2012. Summarising both engines: Cost $’000 9,000 10,800 –––––––– 19,800 –––––––– Note: marks are awarded for clear calculations rather Full explanations are given for tutorial purposes. Old engine New engine 55 accumulated carrying depreciation amount $’000 $’000 3,400 5,600 300 10,500 –––––––– ––––––– 3,700 16,100 –––––––– ––––––– than for detailed explanations. Darby (a) There are four elements to the assistant’s definition of a non-current asset and he is substantially incorrect in respect of all of them. The term non-current assets will normally include intangible assets and certain investments; the use of the term ‘physical asset’ would be specific to tangible assets only. Whilst it is usually the case that non-current assets are of relatively high value this is not a defining aspect. A waste paper bin may exhibit the characteristics of a non-current asset, but on the grounds of materiality it is unlikely to be treated as such. Furthermore the past cost of an asset may be irrelevant; no matter how much an asset has cost, it is the expectation of future economic benefits flowing from a resource (normally in the form of future cash inflows) that defines an asset according to the IASB’s Conceptual Framework for the preparation and presentation of financial statements. The concept of ownership is no longer a critical aspect of the definition of an asset. It is probably the case that most noncurrent assets in an entity’s statement of financial position are owned by the entity; however, it is the ability to ‘control’ assets (including preventing others from having access to them) that is now a defining feature. For example: this is an important characteristic in treating a finance lease as an asset of the lessee rather than the lessor. It is also true that most non-current assets will be used by an entity for more than one year and a part of the definition of property, plant and equipment in IAS 16 Property, plant and equipment refers to an expectation of use in more than one period, but this is not necessarily always the case. It may be that a non-current asset is acquired which proves unsuitable for the entity’s intended use or is damaged in an accident. In these circumstances assets may not have been used for longer than a year, but nevertheless they were reported as non-currents during the time they were in use. A non-current asset may be within a year of the end of its useful life but (unless a sale agreement has been reached under IFRS 5 248 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Non-current assets held for sale and discontinued operations) would still be reported as a non-current asset if it was still giving economic benefits. Another defining aspect of non-current assets is their intended use i.e. held for continuing use in the production, supply of goods or services, for rental to others or for administrative purposes. (b) (i) The expenditure on the training courses may exhibit the characteristics of an asset in that they have and will continue to bring future economic benefits by way of increased efficiency and cost savings to Darby. However, the expenditure cannot be recognised as an asset on the statement of financial position and must be charged as an expense as the cost is incurred. The main reason for this lies with the issue of ’control’; it is Darby’s employees that have the ‘skills’ provided by the courses, but the employees can leave the company and take their skills with them or, through accident or injury, may be deprived of those skills. Also the capitalisation of staff training costs is specifically prohibited under International Financial Reporting Standards (specifically IAS 38 Intangible assets). (ii) The question specifically states that the costs incurred to date on the development of the new processor chip are research costs. IAS 38 states that research costs must be expensed. This is mainly because research is the relatively early stage of a new project and any future benefits are so far in the future that they cannot be considered to meet the definition of an asset (probable future economic benefits), despite the good record of success in the past with similar projects. Although the work on the automatic vehicle braking system is still at the research stage, this is different in nature from the previous example as the work has been commissioned by a customer, As such, from the perspective of Darby, it is work in progress (a current asset) and should not be written off as an expense. A note of caution should be added here in that the question says that the success of the project is uncertain which presumably means it may not be completed. This does not mean that Darby will not receive payment for the work it has carried out, but it should be checked to the contract to ensure that the amount it has spent to date ($2·4 million) will be recoverable. In the event that say, for example, the contract stated that only $2 million would be allowed for research costs, this would place a limit on how much Darby could treat as work in progress. If this were the case then, for this example, Darby would have to expense $400,000 and treat only $2 million as work in progress. (iii) The question suggests the correct treatment for this kind of contract is to treat the costs of the installation as a non-current asset and (presumably) depreciate it over its expected life of (at least) three years from when it becomes available for use. In this case the asset will not come into use until the next financial year/reporting period and no depreciation needs to be provided at 30 September 2012. The capitalised costs to date of $58,000 should only be written down if there is evidence that the asset has become impaired. Impairment occurs where the recoverable amount of an asset is less than its carrying amount. The assistant appears to believe that the recoverable amount is the future profit, whereas (in this case) it is the future (net) cash inflows. Thus any © Emile Woolf Publishing Limited 249 Paper F7: Financial Reporting (International) impairment test at 30 September 2012 should compare the carrying amount of $58,000 with the expected net cash flow from the system of $98,000 ($50,000 per annum for three years less future cash outflows to completion the installation of $52,000 (see note below)). As the future net cash flows are in excess of the carrying amount, the asset is not impaired and it should not be written down but shown as a non-current asset (under construction) at cost of $58,000. Note: as the contract is expected to make a profit of $40,000 on income of $150,000, the total costs must be $110,000, with costs to date at $58,000 this leaves completion costs of $52,000. 56 Barstead (a) Whilst profit after tax (and its growth) is a useful measure, it may not give a fair representation of the true underlying earnings performance. In this example, users could interpret the large annual increase in profit after tax of 80% as being indicative of an underlying improvement in profitability (rather than what it really is: an increase in absolute profit). It is possible, even probable, that (some of) the profit growth has been achieved through the acquisition of other companies (acquisitive growth). Where companies are acquired from the proceeds of a new issue of shares, or where they have been acquired through share exchanges, this will result in a greater number of equity shares of the acquiring company being in issue. This is what appears to have happened in the case of Barstead as the improvement indicated by its earnings per share (EPS) is only 5% per annum. This explains why the EPS (and the trend of EPS) is considered a more reliable indicator of performance because the additional profits which could be expected from the greater resources (proceeds from the shares issued) is matched with the increase in the number of shares. Simply looking at the growth in a company’s profit after tax does not take into account any increases in the resources used to earn them. Any increase in growth financed by borrowings (debt) would not have the same impact on profit (as being financed by equity shares) because the finance costs of the debt would act to reduce profit. The calculation of a diluted EPS takes into account any potential equity shares in issue. Potential ordinary shares arise from financial instruments (e.g. convertible loan notes and options) that may entitle their holders to equity shares in the future. The diluted EPS is useful as it alerts existing shareholders to the fact that future EPS may be reduced as a result of share capital changes; in a sense it is a warning sign. In this case the lower increase in the diluted EPS is evidence that the (higher) increase in the basic EPS has, in part, been achieved through the increased use of diluting financial instruments. The finance cost of these instruments is less than the earnings their proceeds have generated leading to an increase in current profits (and basic EPS); however, in the future they will cause more shares to be issued. This causes a dilution where the finance cost per potential new share is less than the basic EPS. (b) 250 (Basic) EPS for the year ended 30 September 2012 ($15 million/43·25 million x 100) 34·7 cents Comparative (basic) EPS (35 x 3·60/3·80) 33·2 cents © Emile Woolf Publishing Limited Section 2: Answers to practice questions Effect of rights issue (at below market price) 100 shares at $3·80 25 shares at $2·80 ––– 125 shares at $3·60 (calculated theoretical ex-rights value) ––– Weighted average number of shares 36 million x 3/12 x $3·80/$3·60 45 million x 9/12 Diluted EPS for the year ended 30 September 2012 ($15·6 million/45·75 million x 100) 380 70 –––– 450 –––– 9·50 million 33·75 million –––––– 43·25 million –––––– 34·1 cents Adjusted earnings 15 million + (10 million x 8% x 75%) $15·6 million Adjusted number of shares 43·25 million + (10 million x 25/100) 57 45·75 million Apex (a) Where borrowing costs are directly incurred on a ‘qualifying asset’, they must be capitalised as part of the cost of that asset. A qualifying asset may be a tangible or an intangible asset that takes a substantial period of time to get ready for its intended use or eventual sale. Property construction would be a typical example, but it can also be applied to intangible assets during their development period. Borrowing costs include interest based on its effective rate (which incorporates the amortisation of discounts, premiums and certain expenses) on overdrafts, loans and (some) other financial instruments and finance charges on finance leased assets. They may be based on specifically borrowed funds or on the weighted average cost of a pool of funds. Any income earned from the temporary investment of specifically borrowed funds would normally be deducted from the amount to be capitalised. Capitalisation should commence when expenditure is being incurred on the asset, which is not necessarily from the date funds are borrowed. Capitalisation should cease when the asset is ready for its intended use, even though the funds may still be incurring borrowing costs. Also capitalisation should be suspended if there is a suspension of active development of the asset. Any borrowing costs that are not eligible for capitalisation must be expensed. Borrowing costs cannot be capitalised for assets measured at fair value. (b) The finance cost of the loan must be calculated using the effective rate of 7·5%, so the total finance cost for the year ended 31 March 2010 is $750,000 ($10 million x 7·5%). As the loan relates to a qualifying asset, the finance cost (or part of it in this case) can be capitalised under IAS 23. The Standard says that capitalisation commences from when expenditure is being incurred (1 May 2009) and must cease when the asset is ready for its intended use (28 February 2010); in this case a 10-month period. However, interest cannot be capitalised during a period where development activity is suspended; in this case the two months of July and August 2009. Thus only eight © Emile Woolf Publishing Limited 251 Paper F7: Financial Reporting (International) months of the year’s finance cost can be capitalised = $500,000 ($750,000 x 8/12). The remaining four-months finance costs of $250,000 must be expensed. IAS 23 also says that interest earned from the temporary investment of specific loans should be deducted from the amount of finance costs that can be capitalised. However, in this case, the interest was earned during a period in which the finance costs were NOT being capitalised, thus the interest received of $40,000 would be credited to the income statement and not to the capitalised finance costs. In summary: $ Income statement for the year ended 31 March 2010: Finance cost (debit) Investment income (credit) Statement of financial position as at 31 March 2010: Property, plant and equipment (finance cost element only) 58 (250,000) 40,000 500,000 Tunshill (a) Management’s choices of which accounting policies they may adopt are not as wide as generally thought. Where an International Accounting Standard, IAS or IFRS (or an Interpretation) specifically applies to a transaction or event the accounting policy used must be as prescribed in that Standard (taking in to account any Implementation Guidance within the Standard). In the absence of a Standard, or where a Standard contains a choice of policies, management must use its judgement in applying accounting policies that result in information that is relevant and reliable given the circumstances of the transactions and events. In making such judgements, management should refer to guidance in the Standards related to similar issues and the definitions, recognition criteria and measurement concepts for assets, liabilities, income and expenses in the IASB’s Framework for the preparation and presentation of financial statements. Management may also consider pronouncements of other standard-setting bodies that use a similar conceptual framework to the IASB. A change in an accounting policy usually relates to a change of principle, basis or rule being applied by an entity. Accounting estimates are used to measure the carrying amounts of assets and liabilities, or related expenses and income. A change in an accounting estimate is a reassessment of the expected future benefits and obligations associated with an asset or a liability. Thus, for example, a change from non-depreciation of a building to depreciating it over its estimated useful life would be a change of accounting policy. To change the estimate of its useful life would be a change in an accounting estimate. (b) 252 (i) The main issue here is the estimate of the useful life of a non-current asset. Such estimates form an important part of the accounting estimate of the depreciation charge. Like most estimates, an annual review of their appropriateness is required and it is not unusual, as in this case, to revise the estimate of the remaining useful life of plant. It appears, from the information in the question, that the increase in the estimated remaining useful life of the plant is based on a genuine reassessment by the production manager. This appears to be an acceptable reason for a revision of the plant’s life, whereas it would be unacceptable to increase the estimate © Emile Woolf Publishing Limited Section 2: Answers to practice questions simply to improve the company’s reported profit. That said, the assistant accountant’s calculation of the financial effect of the revised life is incorrect. Where there is an increase (or decrease) in the estimated remaining life of a non-current asset, its carrying amount (at the time of the revision) is allocated over the new remaining life (after allowing for any estimated residual value). The carrying amount at 1 October 2009 is $12 million ($20 million – $8 million accumulated depreciation) and this should be written off over the estimated remaining life of six years (eight years in total less two already elapsed). Thus a charge for depreciation of $2 million would be required in the year ended 30 September 2010 leaving a carrying amount of $10 million ($12 million – $2 million) in the statement of financial position at that date. A depreciation charge for the current year cannot be avoided and there will be no credit to the income statement as suggested by the assistant accountant. It should be noted that the incremental effect of the revision to the estimated life of the plant would be to improve the reported profit by $2 million being the difference between the depreciation based on the old life ($4 million) and the new life ($2 million). (ii) 59 The appropriateness of the proposed change to the method of valuing inventory is more dubious than the previous example. Whilst both methods (FIFO and AVCO) are acceptable methods of valuing inventory under IAS 2 Inventories, changing an accounting policy to be consistent with that of competitors is not a convincing reason. Generally changes in accounting policies should be avoided unless a change is required by a new or revised accounting standard or the new policy provides more reliable and relevant information regarding the entity’s position. In any event the assistant accountant’s calculations are again incorrect and would not meet the intention of improving reported profit. The most obvious error is that changing from FIFO to AVCO will cause a reduction in the value of the closing inventory at 30 September 2010 effectively reducing, rather than increasing, both the valuation of inventory and reported profit. A change in accounting policy must be accounted for as if the new policy had always been in place (retrospective application). In this case, for the year ended 30 September 2010, both the opening and closing inventories would need to be measured at AVCO which would reduce reported profit by $400,000 (($20 million – $18 million) – ($15 million – $13·4 million) – i.e. the movement in the values of the opening and closing inventories). The other effect of the change will be on the retained earnings brought forward at 1 October 2009. These will be restated (reduced) by the effect of the reduced inventory value at 30 September 2009 i.e. $1·6 million ($15 million – $13·4 million). This adjustment would be shown in the statement of changes in equity. Manco From the information in the question, the closure of the furniture making operation is a restructuring as defined in IAS 37 Provisions, contingent liabilities and contingent assets and, due to the timing of the decision, a provision for the closure costs will be required in the year ended 30 September 2010. Although the Standard says that a Board of directors’ decision to close an operation is alone not sufficient to trigger a provision the other actions of the management, informing employees, customers and a press announcement indicate that this is an irreversible decision and that therefore there is an obligating event. © Emile Woolf Publishing Limited 253 Paper F7: Financial Reporting (International) Commenting on each element in turn for both years: (i) Factory and plant At 30 September 2010 – these assets cannot be classed as ‘held-for-sale’ as they are still in use (i.e. generating revenue) and therefore are not available for sale. Both assets will therefore continue to be depreciated. Despite this, it does appear that the plant is impaired. Based on its carrying amount of $2·8 million an impairment charge of $2·3 million ($2·8 million – $0·5 million) would be required (subject to any further depreciation for the three months from July to September 2010). The expected gain on the sale of the factory cannot be recognised or used to offset the impairment charge on the plant. The impairment charge is not part of the restructuring provision, but should be reported with the depreciation charge for the year. At 30 September 2011 – the realised profit on the disposal of the factory and any further loss on the disposal of the plant will both be reported in the income statement. (ii) Redundancy and retraining costs At 30 September 2010 – a provision for the redundancy costs of $750,000 should be made, but the retraining costs relate to the ongoing actives of Manco and cannot be provided for. At 30 September 2011 – the redundancy costs incurred during the year will be offset against the provision created last year. Any under- or over-provision will be reported in the income statement. The retraining costs will be written off as they are incurred. (iii) Trading losses The losses to 30 September 2010 will be reported as part of the results for the year ended 30 September 2010. The expected losses from 1 October 2010 to the closure on 31 January 2011 cannot be provided in the year ended 30 September 2010 as they relate to ongoing activities and will therefore be reported as part of the results for the year ended 30 September 2011 as they are incurred. It should also be considered whether the closure fulfils the definition of a discontinued operation in accordance with IFRS 5 Non-current assets held for sale and discontinued operations. As there is a co-ordinated plan to dispose of a separate major line of business (the furniture making operation is treated as an operating segment) this probably is a discontinued operation. However, the timing of the closure means that it is not a discontinued operation in the year ended 30 September 2010; rather it is likely that it will be such in the year ended 30 September 2011. Some commentators believe that this creates an anomalous situation in that most of the closure costs are reported in the year ended 30 September 2010 (as described above), but the closure itself is only identified and reported as a discontinued operation in the year ended 30 September 2011 (although the comparative figures for 2010 would then restate this as a discontinued operation). 254 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Business combinations – Statements of financial position 60 Hydrox Hydrox Consolidated statement of financial position of Hydrox as at 31 March 2012 $000 $000 Assets Non-current assets Property, plant and equipment (W1) 45,840 800 Goodwill (1,200 − 400) Investments (W1) 8,800 55,440 Current assets Inventory (W2) 14,000 Trade accounts receivable (7,200 + 1,500 - 2,000) 6,700 Cash and bank 300 21,000 Total assets 76,440 Equity and liabilities Share capital and reserves: Equity shares $1 each Reserves: Retained earnings (W3) 10,000 34,510 44,510 1,130 45,640 Non-controlling interest (W5) Non-current liabilities 12% Debenture Bank loan 4,000 6,000 10,000 Current liabilities Trade accounts payable (6,700 + 5,200 − 1,400) Operating overdraft Income tax liability (4,100 + 700) Dividends payable – Hydrox 10,500 4,500 4,800 1,000 20,800 76,440 Total equity and liabilities Workings (Note: all figures in $000) (W1) Property, plant and equipment Balance from question – Hydrox 26,400 – Syntax 16,200 Fair value adjustment on acquisition Depreciation on fair value adjustment (5,400/5 × 2) 5,400 (2,160) 45,840 © Emile Woolf Publishing Limited 255 Paper F7: Financial Reporting (International) Investments Investments Balance from question – Hydrox 1,000 – Syntax 6,000 Fair value adjustment on acquisition (90% × (8,000 − 6,000)) 1,800 8,800 (W2) Inventory Amounts per question (9,500 + 4,000) 13,500 Add back ‘in transit’ goods at cost (600 × 100/120) 500 14,000 Note: A mark-up of 20% (1/5) on cost is equivalent to a gross profit on selling price of 1/6. Therefore the cost of the inventory is $500,000 and there is an unrealised profit of $100,000. (W3) Retained earnings Unrealised profit (W2) Additional depreciation (W1) Pre acq. dividend to cost of control (90% × 4,000) (W8) Non-controlling interest (10% × 6,300) Pre-acquisition profit (90% × 15,000) Post acquisition loss (90% × (15,000 − 6,300)) Goodwill impairment Balance c/f Hydrox 100 Hydrox 48,600 B/f Syntax 6,300 2,160 3,600 630 13,500 Post acquisition loss (7,830) (7,830) 400 34,510 ―――― (W4) Cost of control Syntax ―――― 40,770 6,300 ―――― ―――― ―――― ――― 40,770 6,300 ―――― ――― Investments at cost 30,000 Equity shares (90% × 5,000) 4,500 Pre acquisition dividend (W3) (3,600) Pre acquisition profit (W3) 13,500 Fair value adjustments (W1) (plant 5,400, investments 1,800) 7,200 Goodwill 1,200 26,400 26,400 (W5) Non-controlling interest Balance c/f 1,130 1,130 256 Equity shares (10% × 5,000) 500 Retained earnings (W4) 630 1,130 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (W6) Elimination of current accounts The current accounts of Hydrox and Syntax were agreed at $1,400,000 before the ‘in transit’ sale. When Hydrox processed this transaction it would have debited the sale to Syntax’s current account. In effect, this must be reversed to eliminate intra-group balances. A summary of the ‘reversal’, including the effect of the unrealised profit is: Dr Accounts payable (elimination of Hydrox’s credit balance) 1,400 Inventory at cost (W2) Income statement of Hydrox (unrealised profit) Cr 500 100 Accounts receivable (elimination of Syntax’s debit balance) 2,000 2,000 2,000 (W7) Hydrox’s treatment of the dividend received from Syntax is incorrect and must be adjusted for on consolidation. As Syntax has not made any profits since acquisition, and seems unlikely to in the future, the dividend must be considered as being paid out of pre-acquisition profits and should be treated as a partial return of the cost of the investment. It should not be treated as income in the consolidated financial statements. 61 Hedra Hedra: Consolidated statement of financial position as at 30 September 2012 $000 $000 Non-current assets Property, plant and equipment: 358 + 240 + 12 + 20 + 5 +15 (w (iv)) 650 Goodwill: 100 – 20 (w (i)) 80 Investment in associate (w (v)) 220 Other investments 45 995 Current assets Inventories: 130 + 80 210 Trade receivables: 142 + 97 239 Cash and bank 4 453 Total assets 1,448 Equity and liabilities Equity attributable to the parent Ordinary share capital: 400 + 80 (w (v)) Reserves: Share premium: 40 + 120 (w (v)) Revaluation: 15 + 12 + (5 × 60%) (w (iv)) Retained earnings (w (ii)) 480 160 30 261 451 931 © Emile Woolf Publishing Limited 257 Paper F7: Financial Reporting (International) Hedra: Consolidated statement of financial position as at 30 September 2012 $000 $000 Non-controlling interest (w (iii)) 112 1,043 Non-current liabilities Deferred tax: 45 – 10 35 Current liabilities Bank overdraft 12 Trade payables: 118 + 141 259 Deferred consideration (w (i)) 49 Current tax payable 50 370 Total equity and liabilities 1,448 Workings The investment in Salvador represents 60% (72/120) of its equity and is likely to give Hedra control thus Salvador should be consolidated as a subsidiary. The investment in Aragon represents 40% (40/100) of its equity. Normally this would give Hedra significant influence and Aragon would be classed as an associate that should be equity accounted. (i) Cost of control $000 $000 Cost of acquisition Immediate Deferred Acquired Share capital Share premium of Salvador (60% × 50) Pre-acquisition profit of Salvador (60% × 20) Fair value adjustments: Land Plant Deferred tax asset (40 × 25% tax rate) $000 195 49 244 72 30 12 20 20 10 50 Group share (60%) 30 144 100 Goodwill (balancing figure) The deferred contingent consideration has now become payable and has to be accounted for. Goodwill must be adjusted accordingly. (ii) Retained earnings $000 Hedra: per statement of financial position at end of year $000 240 Salvador Retained profits in year-end statement of financial position 258 60 © Emile Woolf Publishing Limited Section 2: Answers to practice questions $000 Less: Additional plant depreciation (w(iv)) $000 (5) 55 Non controlling interest share (40%) 22 Group share 33 Pre-acquisition profit (60% × 20) (12) 21 Impairment of goodwill (20) Share of Aragon profits (6 months) 6/12 × (300 – 200) × 40% 20 Consolidated retained earnings (iii) 261 Non-controlling interest Salvador: $000 $000 Share capital 120 Share premium 50 Retained profit as in statement of financial position 60 Less: Additional plant depreciation (w(iv)) (5) 55 225 Non-controlling interest share (40% 90 Non-controlling interest share in: Fair value adjustments (see w(i)) 40% × 50 Post-acquisition revaluation of land: 40% × 5 Non-controlling interest (iv) 20 2 112 Fair value adjustments/revaluation There are fair value adjustments of $50,000, see working (i). Group share (60%) = 30 Non-controlling interest share (40%) = 20 The increase in the fair value of the land at the date of acquisition is accounted for as a fair value adjustment. The increase of a further $5 million in the year ended 30 September 2012 is a revaluation increase (accounted for as 60% to the group revaluation reserve and 40% to non controlling interest). The fair value adjustment of $20 million to plant will be realised evenly over the next four years in the form of additional depreciation at $5 million per annum. In the year ended 30 September 2012 the effect on the consolidated financial statements is that $5 million will be charged to Salvador’s profit (as additional depreciation); and a net $15 million added to the carrying value of the plant. © Emile Woolf Publishing Limited 259 Paper F7: Financial Reporting (International) (v) Investment in associate Investment at cost: 80 million share of Hedra × $2.50 per share Share of post acquisition profit: 6/12 × (300 – 200) × 40% $000 200 20 220 The purchase consideration by way of a share exchange (80 million in Hedra for 40 million in Aragon) would be recorded in the accounts of Hedra as an increase in share capital of $80 million ($1 nominal value) and an increase in share premium of $120 million (80 × $1.50). As shown in the statement of financial position of Hedra Acquisition of shares in Aragon In the consolidated statement of financial position 62 Share capital $000 400 80 ――― 480 ――― Share premium $000 40 120 ――― 160 ――― Harden (a) Harden Consolidated statement of financial position as at 30 September 2012 $000 $000 Non-current assets Property, plant and equipment (W1) 6,480 Patents (250 + 420) 670 Consolidated goodwill (W4) 180 850 Investments Associate (W7) 960 Others (150 + 200) 350 1,310 8,640 Current assets Inventories (W2) 962 Trade receivables (420 + 380 – 70 – 50) (W6) 680 Bank 150 1,792 Total assets 10,432 Equity attributable to equity holders of the parent Equity shares of $1 each 2,000 Reserves Share premium 1,000 Retained earnings (W3) 5,172 6,172 8,172 Non-controlling interest (W5) 710 8,882 260 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Harden Consolidated statement of financial position as at 30 September 2012 $000 Non-current liabilities Deferred tax Current liabilities Trade payables (750 + 450 – 70) (W6) Taxation Overdraft $000 200 1,130 140 80 1,350 10,432 Total equity and liabilities Workings ($000) (W1) Tangible non-current assets Balance from question – Harden – Solder Land fair value increase 3,980 2,300 200 6,480 (W2) Inventories Amounts per question (570 + 400) Group share of unrealised profit (140 × 40/140 × ½ × 40%) 970 (8) 962 (W3) Retained earnings Unrealised profit (W2) Management charge (W6) Non-controlling interest (20% × (1,900 – 50)) Pre-acq profit (80% × 1,200) Post acq profit (80% × (1,900 – 50 – 1,200)) Balance c/f (W4) Goodwill Investments at cost Harden 8 Solder 50 370 960 Solder 1,900 ――― 520 5,172 ――― ――― ――― 5,180 1,900 5,180 1,900 ――― ――― ――― ――― 2,500 2,500 © Emile Woolf Publishing Limited Harden B/f 4,500 Post acq profit – Solder 520 Post acq profit – Active 160 (W7) Equity shares (80% × 1,000) 800 800 Share premium (80% × 500) 400 Pre acq profit (80% x 1,200)) 960 Fair value adjustments (80% × 200) 160 Goodwill 180 2,500 261 Paper F7: Financial Reporting (International) (W5) Non-controlling interest Balance c/f 710 Equity shares (20% × 1,000) 200 Share premium (20% × 500) 100 Fair value adjustments (20% × 200) Retained earnings (W3) 40 370 710 710 (W6) Elimination of current accounts The current accounts of Harden and Solder were agreed at $70,000 before the charge for the allocation of central overheads. When Harden processed this transaction it would have debited Solder’s current account to give a balance of $120,000 which must be eliminated. The corresponding adjustments are to eliminate $70,000 from Solder’s trade payables and debit $50,000 to the retained earnings of Solder. In summary: Dr 70 50 Trade payables (elimination of intra-group creditor) Retained earnings of Solder reflecting the charge Trade receivables (elimination of intra-group debtor) 120 Cr 120 120 (W7) Associate Investment at cost Post-acquisition profits (40% × (1,200 – 800)) 800 160 960 (b) 262 IFRS 3 Business Combinations states the assets and liabilities that should be recognised on the acquisition of an acquired entity are those that existed at the date of acquisition. Whilst this sounds relatively obvious, it does raise some issues. It may be that an entity has in existence some assets and liabilities that are not (and in some cases cannot be) recognised on the entity’s own statement of financial position. Applying this guidance to items (i) and (ii): (i) Trading losses available for future tax relief can represent a deferred tax asset, but only where their recovery can be assured with a high degree of certainty. Prior to the acquisition it is clear that this degree of certainty did not exist and the directors of Deployed are correct in not recognising a deferred tax asset in respect of the losses. However when Deployed becomes a member of the Harden group, deferred tax has to be determined on a group basis and the directors of Harden are confident that the tax losses of Deployed can be utilised on a group basis. IFRS 3 says that any benefit to the group of an acquired entity’s tax losses should be recognised on acquisition. Therefore it would appear that a deferred tax asset of $60,000 ($200,000 × 30%) should be recognised as part of the fair value exercise. This would be either as a reduction of the group deferred tax liability or as a deferred tax asset, provided it meets the recognition criteria in IAS 12 Income Taxes. (ii) Again the management of Deployed are correct in not recognising the disputed insurance claim as it is probably not ‘virtually certain’ which is the recognition criterion required under IAS 37 Provisions, Contingent © Emile Woolf Publishing Limited Section 2: Answers to practice questions Liabilities and Contingent Assets. Despite this IFRS 3 says that identifiable assets, liabilities and contingent liabilities of the acquired entity have to be recognised in the consolidated financial statements even if they were not recognised, or did not qualify for recognition, in the acquired entity’s own financial statements. If an acquired entity has a contingent asset it is possible that future economic benefits will flow to the acquirer, although it could be disputed that there is the required reliable measure of their fair value. There is a case for recognising this asset as part of the fair value exercise at the best estimate of its likely outcome. However, IFRS 3 does not state that contingent assets should be recognised and therefore the insurance claim should not be recognised. 63 Halogen (a) Halogen Consolidated statement of financial position as at 31 March 2012 $m Assets Non-current assets Property, plant and equipment (910 + 330 + 10 + 8) Goodwill (150 – 30)(W2) Development expenditure (100 – 8 ) Investments ((700 – 480 (W3))) + 60) $m 1,258 120 92 280 1,750 Current assets Inventory (224 +120 – 3) Trade receivables (264 + 84 – 12 (W4)) Bank Total assets Equity and liabilities Equity shares $1 each Share premium Retained earnings (W6) Revaluation reserve: 70 + 75% × (48 – 40)) Non-controlling interest (W5) Equity Non-current liabilities 10% Debenture Current liabilities Trade payables (128 + 24) Taxation (94 + 35) Overdraft (86 – 12 (W4)) Total equity and liabilities © Emile Woolf Publishing Limited 341 336 25 702 2,452 1,000 300 536 76 912 1,912 125 2,037 60 152 129 74 355 2,452 263 Paper F7: Financial Reporting (International) Workings (W1) Net assets in subsidiary At acquisition At end of reporting period $m 200 48 260 20 528 $m 200 40 180 20 440 Share capital Revaluation reserve Retained earnings Fair value adjustments – dev exp (28 – 8) (W2) Goodwill Cost of investment 75 million (200m/2 × 75%) x $5 Cash paid (200m/2 × 75%) × $1.40 Net assets acquired 75% × 440 (W1) Goodwill Less impairment $m 480 375 105 480 330 150 (30) 120 (W3) Unrealised profit adjustments Unrealised profit in inventory (26 × 30/130 × 1/2) = (3) Parent sells to subsidiary so no NCI adjustment (W5) Non-controlling interest 25% × (528 – 28) (W1) = $125,000 (W6) Retained earnings Halogen Less: unrealised profit in inventory (W4) Stimulus: group share post acquisition 75% × ((260 – 28) – 180) Less impairment (b) $m 530 (3) 39 (30) 536 There is a view that an income statement prepared under the concept of ‘current operating income’ has some merit. The principal advantage of this method of reporting is said to be that it reports the results of those parts of a business that can be expected to be operating in the future and this forms a useful basis from which to predict the future profit and income streams of the entity. Whilst this view may have some benefits, the accounting profession has rejected it mainly because it would lead to incomplete reporting and the introduction of greater subjectivity. It would give management scope to report selectively certain aspects of performance. The directors of Halogen are partly correct in interpreting the usefulness of IFRS 5, in that by identifying and separately reporting discontinued operations and assets and subsidiaries held for sale this does help the predictive/forecasting process. However, it is important to realise that IFRS 5 does not permit the 264 © Emile Woolf Publishing Limited Section 2: Answers to practice questions omission of the results of those parts of the business that have been (or are about to be) discontinued, which is what the directors of Halogen are proposing. IFRS 10 Consolidated Financial Statements does not allow any subsidiary to be excluded from the consolidation process. The Standard prevents managers from selectively excluding the results of subsidiaries that have made losses or have a poor liquidity position. Subsidiaries must continue to be consolidated up to the date of their disposal. It seems the directors of Halogen may be attempting to avoid reporting the losses of Lockstart. This they cannot do. There is however some value in ascertaining those parts of a business that will not affect group profits in the future. Provided the future disposal meets the criteria in IFRS 5 to be reported as a discontinued operation, this information need would be satisfied. (Although the sale has not yet taken place, it is possible that Lockstart meets the definition of a disposal group held for sale, in which case it might be possible to classify it as a discontinued operation.) Thus the directors’ current treatment of excluding Lockstart from the consolidated financial statements is incorrect and they should be advised to redraft the group financial statements to include its results, possibly as part of discontinued operations, and there may need to be further provisions for some of the future costs associated with the disposal and for impairment losses. 64 Horsefield (a) Horsefield Consolidated statement of financial position as at 31 March 2012 $000 Non-current assets Property, plant and equipment (8,050 + 3,600) Goodwill (W2) Licence (180 – 60) (W3) Investments Associate (W5) Others (4,000 + 910 – 3,240 – 630 + 120 FV) $000 11,650 702 120 12,472 705 1,160 1,865 14,337 Current assets Inventory (830 + 340) Accounts receivable (520 + 290 – 40) Bank (240 + 40) Total assets Equity and liabilities Equity attributable to equity holders of the parent: Ordinary shares of $1 each Retained earnings (W4) Non-controlling interest (W3) © Emile Woolf Publishing Limited 1,170 770 280 2,220 16,557 5,000 8,403 13,403 374 13,757 265 Paper F7: Financial Reporting (International) Horsefield Consolidated statement of financial position as at 31 March 2012 $000 Non-current liabilities 10% Loan notes (500 + 240) Current liabilities Accounts payable (420 + 960) Taxation (220 + 250) Overdraft $000 740 1,380 470 190 2,040 16,557 Total equity and liabilities Workings (W1) Net assets in subsidiary Share capital Retained earnings Fair value adjustment: Investment property Licence Amortisation of licence 180/6 x 2yrs At acquisition $000 1,200 800 120 180 120 180 (60) ――― ――― ――― ――― 2,300 (W2) Goodwill At end of reporting period $000 1,200 2,300 Cost of investment ($3 × 1,200 × 90%) Net assets acquired (90% × 2,300) (W1) Goodwill Less impairment 3,740 $000 3,240 2,070 1,170 (468) 702 (W3) Unrealised profit in inventory ((2/3 × 65,000) × 30/130) × 30% = $3,000 Parent sells to associate, therefore reduce group retained earnings and Investment in associate (W3) Non-controlling interest 10% × 3,740 = $374,000 (W4) Retained earnings Horsefield Sandfly – group share post acquisition 90% × (3,740 – 2,300) Anthill – group share post acquisition 30% × (600 × 6/12) Unrealised profit (W3) Less impairment (468 + 12) 266 $000 7,500 1,296 90 (3) (480) 8,403 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (W5) Investment in associate $000 Investment at cost Post acquisition profit (30% × (600 × 1/2)) Less impairment 630 90 (12) 718 Unrealised profit in inventory (3) 705 (b) IAS 28 Investments in Associates and Joint Ventures defines associates. In order for an investment to be classified as an investment in an associate the investor must have ‘significant influence’ over the investee. Significant influence is presumed to exist where there is a holding of 20% or more of the voting power unless the investor can clearly demonstrate that this is not the case. Conversely a holding of less than 20% is presumed not to be an associate, unless it can be clearly demonstrated that the investor can exercise significant influence. The voting rights can be held directly or through subsidiaries. IAS 28 says that a majority holding by one investor does not preclude another investor having significant influence. An investing company owning a majority holding in another company normally has control over the investee and would thus class it as a subsidiary. In normal circumstances it is difficult to see how a company could be controlled by one entity and be significantly influenced by a different entity unless ‘control’ was passive. The 20% test is not definitive and the following other evidence should be considered. Does the investing company: 65 have representation on the Board of the investee? participate in the policy making processes (operational and financial); have material transactions with the investee? interchange managerial personnel with the investee; or provide technical expertise to the investee? Highmoor (a) Highmoor Consolidated statement of financial position as at 30 September 2012 $m $m Assets Non-current assets Tangible (585 + 172) 757 Intangible: Software (W7) 1 24 Investments (225 – 160 shares – 50 loan (W6) + 13) 28 809 © Emile Woolf Publishing Limited 267 Paper F7: Financial Reporting (International) Highmoor Consolidated statement of financial position as at 30 September 2012 $m $m Current assets Inventory (85 + 42) 127 Accounts receivable (95 – 4 in transit (W6) + 36) 127 Tax asset 80 Bank (20 + 9 in transit (W6)) 29 363 Total assets 1,172 Equity and liabilities Equity attributable to equity holders of the parent Ordinary shares $1 each Retained earnings (W4) 400 326 726 43 769 Non-controlling interest (W3) Non-current liabilities 12% loan notes Current liabilities Accounts payable (210 + 71) Overdraft Taxation 35 281 17 70 368 1,172 Total equity and liabilities Workings (Note: all figures in $ million) (W1) Net assets in subsidiary At acquisition Share capital Retained earnings $000 100 150 250 At end of reporting period $000 100 115 215 (W2) Goodwill $000 Cost of investment 160 Net assets acquired (80% × 250) (W1) 200 Negative goodwill Transfer to income statement immediately 40 (40) ‐ The contingent consideration has not been included in the above calculation. 268 © Emile Woolf Publishing Limited Section 2: Answers to practice questions IFRS 3 Business Combinations only requires contingent consideration to be included in the cost of an acquisition if it is probable that the amount will be paid and it can be measured reliably. The additional $96 million (i.e. $1.20 per share) is only payable if Slowmoor makes a profit within two years of acquisition. In the year since acquisition the company made a loss of $35 million and the directors of Highmoor are now less confident of the future prospects of Slowmoor. This seems to indicate that it is unlikely that any further consideration will be paid and the above treatment is justified. (W3) Non-controlling interest 20% × 215 (W1) = $43,000 (W4) Retained earnings Highmoor Slowmoor – group share of post-acquisition losses = 80% × 35 Negative goodwill Unrealised profit (W6) $000 330 (28) 40 (16) 326 (W5) Elimination of loan and accrued interest The investments of Highmoor will show an unadjusted amount of $50 million as a loan to Slowmoor. The cash in transit of $9 million from Slowmoor should be applied $4 million to cancel the accrued interest receivable and the balance of $5 million to the investment (loan). When this adjustment is made the investment and the loan will cancel each other out. (W6) The carrying value of the software in Slowmoor’s books is $40 million. If the software had been depreciated on its original cost of $30 million it would have a carrying value of $24 million ($30 less $6 million depreciation at 20% per annum). Thus there is an unrealised profit on the transfer of the software of $16 million ($40 million – $24 million). (b) Negative goodwill arises in book-keeping where the consideration given for a business is less than the fair value of the net assets acquired. Intuitively it does not make sense for a vendor to sell net assets for less than they are worth. This view is reflected by the IASB which requires that where an acquisition appears to create negative goodwill, a careful check of the value of the assets acquired and whether any liabilities have been omitted is required. Negative goodwill may arise for several reasons; the most obvious is that there has been a bargain purchase. This may occur through the vendor being in a poor financial position and needing to realise assets quickly, or it may be due to good negotiating skills on the part of the acquirer, or the vendor may not realise how much the assets are really worth. A more controversial occasion where negative goodwill arises is where a company, in determining the amount of consideration it is willing to pay for a business, will take into account the cost of anticipated future losses and postacquisition reorganisation expenditure that it believes will be required. The effect of this is that it would reduce the consideration offered/paid. As these costs © Emile Woolf Publishing Limited 269 Paper F7: Financial Reporting (International) cannot generally be recognised as a liability at the date of purchase, this can lead to the consideration being lower than the recognisable net assets. In relation to the acquisition of Slowmoor the following are questionable issues: 66 Highmoor may be trying to deliberately create losses at Slowmoor to avoid paying the further consideration. An example of this may be the transfer price of the software. The additional consideration of $96 million, if payable, would change the negative goodwill into positive goodwill of $56 million. The tax asset of Slowmoor may be questionable. Accounting standards are quite restrictive over the recognition of tax assets. Hapsburg (a) Hapsburg Consolidated statement of financial position as at 31 March 2012 $000 Non-current assets Goodwill (w (i)) Property, plant and equipment (41,000 + 34,800 + 3,750 (w (i))) Investments: – in associate (w (iv)) 15,150 – ordinary (3,000 + 1,500 (fair value increase)) 4,500 $000 12,800 79,550 19,650 112,000 Current assets Inventory (9,900 + 4,800 – 300 (w (v))) Trade receivables (13,600 + 8,600) Cash (1,200 + 3,800) 14,400 22,200 5,000 41,600 153,600 Total assets Equity and liabilities Ordinary share capital (20,000 + 16,000 (w (i))) Reserves: Share premium (8,000 + 16,000 (w (i))) Retained earnings(w (ii)) 36,000 24,000 8,050 32,050 68,050 9,150 77,200 Non-controlling interests (w (iii)) Non-current liabilities 10% Loan note (16,000 + 4,200) Deferred consideration (18,000 + 1,800) W2 20,200 19,800 40,000 270 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Hapsburg Consolidated statement of financial position as at 31 March 2012 $000 Current liabilities: Trade payables (16,500 + 6,900) 23,400 Taxation (9,600 + 3,400) 13,000 $000 36,400 153,600 Total equity and liabilities Workings – Note: all working figures in $000. (W1) Net assets in subsidiary At acquisition At end of reporting period $000 $000 30,000 30,000 Share premium 2,000 2,000 Retained earnings (8,500 – 4,500) 4,000 8,500 5,000 5,000 Share capital Fair value adjustment Plant (15 – 10) Depreciation 5,000 × 1/4 Investment (4.5 – 3) (1,250) 1,500 1,500 42,500 45,750 (W2) Goodwill $000 Investment at cost Shares (24m x 2/3 x $2) 32,000 Cash (24m x$1) x 0.75 18,000 50,000 Net assets at acquisition (80% × 42,500) (W2) (34,000) Goodwill on consolidation 16,000 Less impairment (3,200) In consolidated statement of financial position 12,800 In Hapsburgs books Dr Cost of investment 50,000 Cr Share capital (24m × 2/3) 16,000 Cr Share premium (32 – 16) 16,000 Cr Deferred consideration 18,000 Unwind the discount: 10% × 18,000 = 1,800 Dr Group finance cost (Group RE) Cr Deferred consideration © Emile Woolf Publishing Limited 1,800 1,800 271 Paper F7: Financial Reporting (International) (W3) Unrealised profit 2.5m × (4m – 2.4m/4m) × 30% = 300,000 Associate sells to Parent, therefore reduce the group retained earnings and group inventory by the full unrealised profit (W4) Non-controlling interest Statement of financial position 20% × 45,750 (W1) = 9,150 (W5) Consolidated retained earnings Hapsburg reserves 10,600 Sundial post acquisition 80% × (45,750 – 42,500) (W1)) 2,600 Aspen post acquisition 30% × (8,000 – 5,000) Unrealised profit inventory (W3) 900 (300) Less impairment (3,950) Less unwinding of discount (1,800) 8,050 (W6) Investment in associate Investment at cost Share of post acquisition profit (W5) 15,000 900 15,900 Less impairment (750) 15,150 (b) 272 In recent years many companies have conducted large parts of their business by acquiring substantial non-controlling interests in other companies. There are broadly three levels of investment. Below 20% of the equity shares of an investee would normally be classed as an ordinary investment and shown at cost (it is permissible to revalue them to market value) with only the dividends paid by the investee being included in the income of the investor. A holding above 50% normally gives control and would create subsidiary company status and consolidation is required. Between these two, in the range of over 20% up to 50%, the investment would normally be deemed to be an associate). The relevance of this level of shareholding is that it is presumed to give significant influence over the operating and financial policies of the investee (but this presumption can be rebutted). If such an investment were treated as an ordinary investment, the investing company would have the opportunity to manipulate its profit. The most obvious example of this would be by exercising influence over the size of the dividend the associate paid. This would directly affect the reported profit of the investing company. Also, as companies tend not to distribute all of their earnings as dividends, over time the cost of the investment in the statement of financial position may give very little indication of its underlying value. Equity accounting for associates is an attempt to remedy these problems. In the income statement any dividends received from an associate are replaced by the investor’s share of the associate’s results. In the statement of financial position © Emile Woolf Publishing Limited Section 2: Answers to practice questions the investment is initially recorded at cost and subsequently increased by the investor’s share of the retained profits of the associate (any other gains such as the revaluation of the associate’s assets would also be included in this process). This treatment means that the investor would show the same profit irrespective of the size of the dividend paid by the associate and the statement of financial position more closely reflects the worth of the investment. The problem of ‘off balance sheet’ finance relates to the fact that it is the net assets that are shown in the investor’s statement of financial position. Any share of the associate’s liabilities is effectively hidden because they have been offset against the associate’s assets. As a simple example, say a holding company owned 100% of another company that had assets of $100 million and debt of $80 million, both the assets and the debt would appear in the consolidated statement of financial position. Whereas if this single investment was replaced by owning 50% each of two companies that had the same statements of financial position (i.e. $100 million assets and $80 million debt), then under equity accounting only $20 million ((100 – 80) × 50% × 2) of net assets would appear in the statement of financial position thus hiding the $80 million of debt. Because of this problem, it has been suggested that proportionate consolidation is a better method of accounting for associates, as both assets and debts would be included in the investor’s statement of financial position. IAS 28 does not permit the use of proportionate consolidation. 67 Highveldt (a) (i) The deferred consideration of $108 million must be discounted for one year at a cost of capital of 8% to $100 million (= $108 million/(1.08)1. The $8 million difference is a finance charge in the year to 31 March 2012. Goodwill calculation $m $m Investments at cost Cash consideration (80 × 75% × $3.50) 210 Deferred consideration (see above) 100 310 Less: Ordinary shares (75% × 80) 60 Share premium (75% × 40) 30 Pre-acquisition profit (see working) 87 Fair value adjustments: brand (75% × 40) 30 - land and buildings (75% × 20) 15 (222) Goodwill on acquisition Impairment at 31 March 2012 (from question) Goodwill at 31 March 2012 88 (22) 66 Although the internally-generated brand cannot be recognised in Samson’s own financial statements, it should be recognised in the consolidated statement of financial position on the acquisition of Samson. This is because the method given in the question is an acceptable method of valuation and thus the brand can be ‘reliably measured’. © Emile Woolf Publishing Limited 273 Paper F7: Financial Reporting (International) The fair value adjustment for Samson’s land and buildings on acquisition is $20 million. (The subsequent increase in value of $4 million in the year to 31 March 2012 is treated as a revaluation in that year.). The non-controlling interest in the fair value adjustments and revaluation is $16 million (= 25% of $(20 + 4 + 40) million). (ii) $m 20 10 41 16 87 Non-controlling interest Ordinary shares (25% × 80) Share premium (25% × 40) Retained earnings (see working) Share of fair value adjustments (see above) (iii) Consolidated reserves Share premium: Highveldt only Revaluation reserve: 45 + (75% × 4) Retained earnings: Highveldt – from question Post-acquisition profit of Samson (see working) Interest receivable (see below) Finance cost on deferred consideration (see (i) above) Impairment of goodwill $m $m 80 48 350 36 6 392 8 22 (30) 362 Consolidated retained earnings Note on interest receivable: The intra-group interest has not been recorded by Highveldt. To do so it would credit interest receivable (which increases the profit for the year) and debit cash (in transit). Working (Note: All figures in $million) The pre and post acquisition profits of Samson are calculated as follows: Preacquisitio n Postacquisitio n As in the question 134 76 Apportionment of development costs (18) (22) Unrealised profit in inventory (= 6/3) At 31 March 2012 (2) Amortisation of brand (= 40/10 years) (4) ――― ――― 116 48 ――― ――― ――― 164 ――― Therefore non-controlling interest is 25% × 164 = 41 Pre-acquisition earnings are 75% × 116 = 87 Post-acquisition earnings are 75% × 48 = 36 274 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) The objective of consolidated financial statements is to show the financial performance and position of the group as if it was a single economic entity. There is a view that, as the entity financial statements of the parent company contain the investments in subsidiaries as non-current assets, they reflect the assets of the group as a whole. The more traditional view is that entity financial statements do not provide users with sufficient information about subsidiaries for them to make a reliable assessment of the performance of the group as a whole. The following are benefits of consolidated financial statements: – They identify the nature and classification of the subsidiary’s assets. For example, the investment in a subsidiary may be almost entirely in intangible assets or conversely they may be substantially land and buildings. Such a distinction is of obvious importance to users. – The amount of the subsidiary’s debt could not be assessed from the parent’s entity financial statements. In effect the subsidiary’s assets and liabilities are netted off when it is shown as an investment. This means group liquidity and gearing cannot be properly assessed. – The cost of the investment in the parent company statement of financial position does not reflect the size of a company. For example a parent company may show an investment in a subsidiary at a cost of $10 million. This may represent the purchase of a subsidiary that has $10 million of assets and no liabilities. Alternatively this could be a subsidiary that has $100 million in assets and $90 million of liabilities. – The cost of the investment may be a fair representation of its value at the date of purchase, but with the passage of time (assuming the subsidiary is profitable), its value will increase. This increase would not be reflected in the original cost, but it would be reflected in the consolidated net assets of the subsidiary (and the increase in group reserves). – The cost of the investment might represent all of the ownership of the subsidiary or only just over half of it, i.e. there would be no indication of the non-controlling interest. To summarise, in the absence of a consolidated statement of financial position, users would have no information on the current value of a subsidiary, its size, the composition of its net assets and how much of it was owned by the group. 68 Hark, Spark and Ark Hark Group Consolidated statement of financial position as at 31 March 2012 $000 $000 Non‐current assets Property, plant and equipment (working 1) 90,200 Goodwill (working 4) 23,000 Investment in associate (working 6) Other investments 9,500 650 123,350 Current assets (working 5) Total assets © Emile Woolf Publishing Limited 24,300 147,650 275 Paper F7: Financial Reporting (International) Hark Group Consolidated statement of financial position as at 31 March 2012 $000 $000 Equity and liabilities Equity shares of $1 each (working 3) 21,000 Share premium (working 3) 42,000 Retained earnings (working 8) 43,730 85,730 106,730 Non‐controlling interests (working 7) 7,420 Total equity 114,150 Non‐current liabilities Deferred consideration for Spark shares 5,500 6% loan notes 10,000 7% loan notes 6,000 21,500 Current liabilities: 7,000 + 5,000 Total equity and liabilities 12,000 147,650 Workings 1 Property, plant and equipment (PPE) $000 Hark Spark Profit on transfer of machines (3 million – 2 million) Less: Depreciation on this amount in accounts of Spark (1,000/5 years) Unrealised profit in machines PPE in consolidated statement of financial position 2 $000 60,000 31,000 1,000 (200) (800) 90,200 Deferred consideration The present value of the deferred consideration at 1 April 2011 is $6.05 million × 1/(1.10)2 = $5 million. During the year to 31 March 2012 there is a finance charge of 10% (= $500,000) on this amount, reducing the parent’s share of the consolidated profit. The deferred consideration at 31 March 2012 is $5 million + $500,000 = $5,500,000. This is payable in just over 12 months and is included in the consolidated statement of financial position as a non-current liability. 3 Share issues The share issues to acquire the shares in Spark and Ark are not recorded in the summary statement of financial position of Hark (as stated in the question). 276 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Total Share capital Share premium $000 $000 $000 36,000 4,000 32,000 9,000 1,000 8,000 5,000 40,000 In summary statement of financial position 16,000 2,000 In consolidated statement of financial position 21,000 42,000 To acquire the shares in Spark Hark shares issued: (4 million at $9) To acquire the shares in Ark Hark shares issued: (1 million at $9) Increase in share capital and share premium of Hark 4 Goodwill Hark has acquired 4 million/5 million = 80% of the shares of Spark. At 1 April 2011 the fair value of the net assets of Spark was (share capital plus reserves) = $(5 + 4 + 16) million = $25 million $000 Purchase consideration paid by the parent company Issue of 4 million shares at $9 Deferred consideration 36,000 5,000 41,000 Fair value of parent company share of net assets (80% × $25 million) 20,000 Purchased goodwill attributable to parent 21,000 $000 Fair value of NCI at acquisition date (1 million shares × $7) 7,000 NCI share of net assets at this date (20% × $25 million) 5,000 Purchased goodwill attributable to NCI 2,000 There has been no impairment of goodwill during the year. $000 Purchased goodwill attributable to parent Goodwill attributable to NCI Total goodwill in consolidated statement of financial position 21,000 2,000 23,000 Alternatively, total goodwill could be calculated as follows: $000 Purchase consideration paid by the parent company (see above) Fair value of NCI at acquisition date 41,000 7,000 48,000 5 Net assets of the subsidiary at the acquisition date (at fair value) 25,000 Total goodwill (parent and NCI) 23,000 Current assets The cost of the goods sold by Spark to Hark was $3,600,000 × 100/150 = $2,400,000 and the profit was $1,200,000. © Emile Woolf Publishing Limited 277 Paper F7: Financial Reporting (International) Since 75% of these goods are in closing inventory, the unrealised profit on intra-group sales is 75% × $1,200,000 = $900,000. Current assets in the consolidated statement of financial position (inventory) should be reduced by this amount. The question states that the transaction costs of the acquisition of Spark have not yet been recorded. These costs reduce the consolidated profit, and also (presumably) reduce the current assets of Hark. Current assets on consolidation Hark Spark Less: unrealised profit in closing inventory Less: expenses of acquisition of Spark Current assets in consolidated statement of financial position 6 $000 18,200 8,000 (900) (1,000) 24,300 Investment in associate (Ark) Since Hark owns 25% of the equity of Ark, it is assumed that Ark is an associated entity. Cost of investment: 25% × 6 million shares × $6 Share of post-acquisition retained profit: 25% × $2 million $000 9,000 500 9,500 7 Non-controlling interests $000 Share of net assets of Spark at 31 March 2012 (20% × $28 million) 5,600 Goodwill attributable to NCI (working 4) 2,000 7,600 8 NCI share of unrealised profit in inventory (20% × $900,000) (180) NCI at 31 March 2012: fair value method 7,420 Consolidated retained earnings $000 Hark retained earnings (36,000 + 8,000) $000 44,000 Spark Profit for year ended 31 March 2012 3,000 Unrealised profit in closing inventory (900) 2,100 Parent company share (80%) 1,680 Share of post-acquisition retained profits of Ark (25% × $2 million) Costs of acquisition of Spark (expensed) (1,000) Additional finance costs: deferred consideration (500) Unrealised profit in machines (working 1) (800) Loss on other (800 – 650) (150) Consolidated retained earnings at 31 March 2012 278 500 43,730 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 69 Parentis Consolidated statement of financial position of Parentis as at 31 March 2012: Assets Non-current assets Property, plant and equipment (640 + 340 + 40 – 2) Intangible Consolidated goodwill (135 (w (i)) – 27 impairment) Current assets Inventory (76 + 22 – 2 URP) Trade receivables (84 + 44 – 11 intra-group) Receivable re intellectual property Bank Total assets Equity and liabilities Equity attributable to equity holders of the parent Equity shares 25c each (w (i)) Reserves: Share Premium (w (i)) Retained earnings (w (ii)) $ million 1,018 108 –––––– 1,126 96 117 10 4 –––– 150 264 –––– Workings (Note: all figures in $ million) (i) 414 –––––– 789 89 –––––– 878 Total equity Total equity and liabilities 227 –––––– 1,353 –––––– 375 Non controlling interest (w (iii)) Non-current liabilities 10% loan notes (120 + 20) Current liabilities Trade payables (130 + 57 – 7 intra-group) Cash consideration due 1 April 2012 (60 + 6 interest) Overdraft (25 – 4 CIT) Taxation (45 + 23) $ million 140 180 66 21 68 –––– 335 –––––– 1,353 –––––– Goodwill: The acquisition of 600 million shares represents 75% of Offspring’s 800 million shares ($200m/25c). The share exchange of 300 million (i.e. 1 for 2) at $0·75 each will result in an increase in equity share capital of $75 million (the nominal value) and create a share premium balance of $150 million (i.e. $0·50 premium on 300 million shares). Consideration: Equity shares (600/2 x $0·75) 10% loan notes (see below) Cash (600 x $0·11/1·1 i.e. discounted at 10%) © Emile Woolf Publishing Limited 225 120 60 –––– 405 279 Paper F7: Financial Reporting (International) Acquired: Equity shares (600m x 25c) Pre acquisition retained earnings (120 x 75%) Fair value adjustment to properties (40 x 75%) 150 90 30 –––– (270) –––– Goodwill 135 –––– The issue of the 10% loan notes is calculated as 600 million/500 x $100 = $120 million. (ii) Retained earnings: Parentis Interest on deferred consideration (60 x 10%) Goodwill impairment (from question) Offspring URP in inventory (see below) Additional depreciation (from question) Write down intellectual property (30 – 10) Pre acquisition 300 (6) (27) 140 (2) (2) (20) (120) –––– (4) x 75% (3) –––– 264 –––– The unrealised profit in inventory (URP) is $5m/$15m of the profit of $6 million made by Offspring. (iii) Non controlling interest Offspring net assets at 31 March 2012 Fair value adjustment URP in inventory Additional depreciation Write down intellectual property (30 – 10) 70 340 40 (2) (2) (20) –––– 356 x 25% –––– Plateau (a) Consolidated statement of financial position of Plateau as at 30 September 2012 Assets Non-current assets: Property, plant and equipment (18,400 + 10,400 – 400 (w (i))) Goodwill (w (ii)) Investments – associate (w (iii)) Other equity investments Current assets Inventory (6,900 + 6,200 – 300 URP (w (iv))) Trade receivables (3,200 + 1,500) Total assets 280 89 ––– $’000 $’000 28,400 3,600 10,500 9,000 –––––– 51,500 12,800 4,700 17,500 –––––– –––––– 69,000 –––––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions $’000 Equity and liabilities Equity shares of $1 each (w (v)) Reserves: Share premium (w (v)) Retained earnings (w (vi)) Non controlling interest (w (vii)) Total equity Non-current liabilities 7% Loan notes (5,000 + 1,000) Current liabilities (8,000 + 4,200) $’000 11,500 7,500 28,650 36,150 –––––– –––––– 47,650 3,150 –––––– 50,800 6,000 12,200 –––––– 69,000 –––––– Total equity and liabilities Workings (figures in brackets are in $’000) (i) Property, plant and equipment The transfer of the plant creates an initial unrealised profit (URP) of $500,000. This is reduced by $100,000 for each year (straight-line depreciation over five years) of depreciation in the post-acquisition period. Thus at 30 September 2012 the net unrealised profit is $400,000. This should be eliminated from Plateau’s retained profits and from the carrying amount of the plant. The fall in the fair value of the land has already been taken into account in Savannah’s statement of financial position. (ii) Goodwill in Savannah: Goodwill in Savannah: Investment at cost: Shares issued (3,000/2 x $6) Cash (3,000 x $1) Less – equity shares of Savannah – pre-acquisition reserves (6,000 x 75% (see below)) $’000 $’000 9,000 3,000 –––––– 12,000 (3,000) (4,500) –––––– (7,500) –––––– Goodwill on consolidation 4,500 –––––– Goodwill is impaired by $900,000 thus has a carrying amount at 30 September 2012 of $3·6 million. Savannah’s pre-acquisition reserves of $6·5 million require an adjustment for a write down of $500,000 in respect of the fair value of its land being below its carrying amount. Thus the adjusted pre-acquisition reserves of Savannah are $6 million. A consequent effect is that the post-acquisition reserves which are reported as $2·4 million in Savannah’s statement of financial position will become $2·9 million. This is because the fall in the value of the land has effectively been treated by Savannah as a postacquisition loss. (iii) Carrying amount of Axle at 30 September 2012 Cost (4,000 x 30% x $7·50) Share post-acquisition profit (5,000 x 30%) © Emile Woolf Publishing Limited $’000 9,000 1,500 –––––– 10,500 –––––– 281 Paper F7: Financial Reporting (International) (iv) The unrealised profit (URP) in inventory is calculated as: Intra-group sales are $2·7 million on which Savannah made a profit of $900,000 (2,700 x 50/150). One third of these are still in the inventory of Plateau, thus there is an unrealised profit of $300,000. (v) The 1·5 million shares issued by Plateau in the share exchange at a value of $6 each would be recorded as $1 per share as capital and $5 per share as share premium giving an increase in share capital of $1·5 million and a share premium of $7·5 million. (vi) Consolidated retained earnings: $’000 Plateau’s retained earnings Savannah’s post-acquisition ((2,900 – 300 URP) x 75%) Axle’s post-acquisition profits (5,000 x 30%) URP in plant (see (i)) Gain on other equity investments (9,000 – 6,500) Impairment of goodwill (vii) Non controlling interest Adjusted equity at 30 September 2012: (12,900 – 300 URP) = 12,600 x 25% (b) $’000 24,000 1,950 1,500 (400) 2,500 (900) –––––– 28,650 –––––– 3,150 –––––– IFRS 3 Business Combinations requires the purchase consideration for an acquired entity to be allocated to the fair value of the assets, liabilities and contingent liabilities acquired (henceforth referred to as net assets and ignoring contingent liabilities) with any residue being allocated to goodwill. This also means that those net assets will be recorded at fair value in the consolidated statement of financial position. This is entirely consistent with the way other net assets are recorded when first transacted (i.e. the initial cost of an asset is normally its fair value). The purpose of this process is that it ensures that individual assets and liabilities are correctly classified (and valued) in the consolidated statement of financial position. Whilst this may sound obvious, consider what would happen if say a property had a carrying amount of $5 million, but a fair value of $7 million at the date it was acquired. If the carrying amount rather than the fair value was used in the consolidation it would mean that tangible assets (property, plant and equipment) would be understated by $2 million and intangible assets (goodwill) would be overstated by the same amount (note: in the consolidated statement of financial position of Plateau the opposite effect would occur as the fair value of Savannah’s land is below its carrying amount at the date of acquisition). There could also be a ‘knock on’ effect with incorrect depreciation charges in the years following an acquisition and incorrect calculation of any goodwill impairment. Thus the use of carrying amounts rather than fair values would not give a ‘faithful representation’ as required by the Conceptual Framework. The assistant’s comment regarding the inconsistency of value models in the consolidated statement of financial position is a fair point, but it is really a deficiency of the historical cost concept rather than a flawed consolidation technique. Indeed the fair values of the subsidiary’s net assets are the historical 282 © Emile Woolf Publishing Limited Section 2: Answers to practice questions costs to the parent. To overcome much of the inconsistency, there would be nothing to prevent the parent company from applying the revaluation model to its property, plant and equipment. 71 Pacemaker Consolidated statement of financial position of Pacemaker as at 31 March 2012: Non-current assets Tangible Property, plant and equipment (w (i)) Intangible Goodwill (w (ii)) Brand (25 – 5 (25/10 x 2 years post acq amortisation)) Investments Investment in associate (w (iii)) Other equity investments (82 + 37) Current assets Inventory (142 + 160 – 16 URP (w (iv))) Trade receivables (95 + 88) Cash and bank (8 + 22) Total assets Equity and liabilities Equity attributable to the parent Equity shares (500 + 75 (w (iii))) Share premium (100 + 45 (w (iii)) Retained earnings (w (iv)) Non-controlling interest (w (v)) Total equity Non-current liabilities 10% loan notes (180 + 20) Current liabilities (200 + 165) Total equity and liabilities $million $million 818 23 20 144 119 –––––– 1,124 286 183 30 ––––– 499 –––––– 1,623 –––––– 575 145 247 ––––– 392 –––––– 967 91 –––––– 1,058 200 365 –––––– 1,623 –––––– Workings (all figures in $ million) The investment in Syclop represents 80% (116/145) of its equity and is likely to give Pacemaker control thus Syclop should be consolidated as a subsidiary. The investment in Vardine represents 30% (30/100) of its equity and is normally treated as an associate that should be equity accounted. © Emile Woolf Publishing Limited 283 Paper F7: Financial Reporting (International) (i) Property, plant and equipment Pacemaker Syclop Fair value property (82 – 62) Post-acquisition depreciation (2 years) (20 x 2/20 years) (ii) 520 280 20 (2) –––– 818 –––– Goodwill in Syclop: Investment at cost – cash – loan note (116/200 x $100) 210 58 –––– 268 65 Cost of the controlling interest Fair value of non-controlling interest (from question) Equity shares Pre-acquisition profit Fair value adjustments – property (w (i)) – brand 145 120 20 25 –––– Fair value of net assets at acquisition Goodwill (iii) Investment in associate: (310) –––– 23 –––– $million Investment at cost (75 x $1·60) 120 Share of post-acquisition profit (100 – 20) x 30% 24 –––– 144 –––– The purchase consideration by way of a share exchange (75 million shares in Pacemaker for 30 million shares in Vardine) would be recorded as an increase in share capital of $75 million ($1 nominal value) and an increase in share premium of $45 million (75 million x $0·60). (iv) Consolidated retained earnings: Pacemaker’s retained earnings Syclop’s post-acquisition profits (130 x 80% see below) Gain on investments – Pacemaker (see below) Vardine’s post-acquisition profits (w (iii)) URP in Inventories (56 x 40/140) 130 104 5 24 (16) –––– 247 –––– Syclop’s retained earnings: Post-acquisition (260 – 120) Additional depreciation/amortisation (2 + 5) Loss on other equity investments (40 – 37) Adjusted post-acquisition profits Gain on the value of Pacemaker’s available-for-sale investments: Carrying amount at 31 March 2011 (345 – 210 cash – 58 loan note) Carrying amount at 31 March 2012 Gain to retained earnings (or other components of equity) 284 140 (7) (3) –––– 130 –––– 77 82 –––– 5 –––– © Emile Woolf Publishing Limited Section 2: Answers to practice questions (v) 72 Non-controlling interest Fair value on acquisition (from question) Share of adjusted post acquisition profit (130 x 20% (w (iv))) 65 26 –––– 91 –––– Picant (a) Consolidated statement of financial position of Picant as at 31 March 2010 $’000 Assets Non-current assets: Property, plant and equipment (37,500 + 24,500 + 2,000 – 100) Goodwill (16,000 – 3,800 (w (i))) Investment in associate (w (ii)) Current assets Inventory (10,000 + 9,000 + 1,800 GIT – 600 URP (w (iii))) Trade receivables (6,500 + 1,500 – 3,400 intra-group (w (iii))) Total assets Equity and liabilities Equity attributable to owners of the parent Equity shares of $1 each Share premium Retained earnings (w (iv)) 63,900 12,200 13,200 –––––––– 89,300 20,200 4,600 ––––––– Total equity and liabilities 2,700 14,200 ––––––– 16,900 –––––––– 114,100 –––––––– $’000 $’000 Controlling interest Share exchange (8,000 x 75% x 3/2 x $3·20) Contingent consideration Non-controlling interest (8,000 x 25% x $4·50) © Emile Woolf Publishing Limited 47,300 –––––––– 72,300 8,400 –––––––– 80,700 16,500 Workings (figures in brackets are in $’000) (i) Goodwill in Sander Equity shares 24,800 –––––––– 114,100 –––––––– 25,000 19,800 27,500 ––––––– Non-controlling interest (w (v)) Total equity Non-current liabilities 7% loan notes (14,500 + 2,000) Current liabilities Contingent consideration Other current liabilities (8,300 + 7,500 – 1,600 intra-group (w (iii))) $’000 28,800 4,200 9,000 ––––––– 42,000 8,000 285 Paper F7: Financial Reporting (International) Pre-acquisition reserves: At 1 April 2009 Fair value adjustments – factory – software (see below) 16,500 2,000 (500) ––––––– (26,000) –––––––– Goodwill arising on acquisition 16,000 –––––––– Goodwill is impaired by $3·8 million and therefore has a carrying amount at 31 March 2010 of $12·2 million. The goodwill impairment is charged against Sander’s retained earnings (see working (iv)), thus ensuring it is allocated between the controlling and non-controlling interests in proportion to their share ownership in Sander. The effect of the software having no recoverable amount is that its write-off in the post-acquisition period should be treated as a fair value adjustment at the date of acquisition for consolidation purposes. The consequent effect is that this will increase the post-acquisition profit for consolidation purposes by $500,000. (ii) Carrying amount of Adler at 31 March 2010 Cash consideration (5,000 x 40% x $4) 7% loan notes (5,000 x 40% x $100/50) Share of post-acquisition profits (6,000 x 6/12 x 40%) $’000 8,000 4,000 1,200 ––––––– 13,200 ––––––– (iii) Goods in transit and unrealised profit (URP) The intra-group current accounts differ by the goods-in-transit sales of $1·8 million on which Picant made a profit of $600,000 (1,800 x 50/150). Thus inventory must be increased by $1·2 million (its cost), $600,000 is eliminated from Picant’s profit, $3·4 million is deducted from trade receivables and $1·6 million (3,400 – 1,800) is deducted from trade payables (other current liabilities). (iv) Consolidated retained earnings $’000 Picant’s retained earnings 27,200 Sander’s post-acquisition losses (2,400 x 75% see below) (1,800) Gain from reduction of contingent consideration (4,200 – 2,700 see below) 1,500 URP in inventory (w (iii)) (600) Adler’s post-acquisition profits (6,000 x 6/12 x 40%) 1,200 ––––––– 27,500 ––––––– The adjustment to the provision for contingent consideration due to events occurring after the acquisition is reported in income (goodwill is not recalculated). Post-acquisition adjusted losses of Sander are: Profit as reported 1,000 Add back write off software (treated as a pre-acquisition fair value adjustment) 500 Additional depreciation on factory (100) Goodwill written off (w (i)) (3,800) ––––––– (2,400) ––––––– 286 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (v) Non-controlling interest Fair value on acquisition (w (i)) Post-acquisition losses (2,400 x 25% (w (iv))) (b) 9,000 (600) ––––––– 8,400 ––––––– Although the concept behind the preparation of consolidated financial statements is to treat all the members of the group as if they were a single economic entity, it must be understood that the legal position is that each member is a separate legal entity and therefore the group itself does not exist as a separate legal entity. This focuses on a criticism of group financial statements in that they aggregate the assets and liabilities of all the members of the group. This can give the impression that all of the group’s assets would be available to discharge all of the group’s liabilities. This is not the case. Applying this to the situation in the question, it would mean that any liability of Trilby to Picant would not be a liability of any other member of the Tradhat group. Thus the fact that the consolidated statement of financial position of Tradhat shows a strong position with healthy liquidity is not necessarily of any reassurance to Picant. Any decision on granting credit to Trilby must be based on Trilby’s own (entity) financial statements (which Picant should obtain), not the group financial statements. The other possibility, which would take advantage of the strength of the group’s statement of financial position, is that Picant could ask Tradhat if it would act as a guarantor to Trilby’s (potential) liability to Picant. In this case Tradhat would be liable for the debt to Picant in the event of a default by Trilby. Business combinations – Statements of financial performance 73 Hydan (a) Hydan: Consolidated income statement year ended 31 March 2012 Revenue (98,000 + 35,200 – 30,000 intra-group sales) Cost of sales (w (i)) Gross profit Operating expenses: 11,800 + 8,000 + 375 goodwill (w (ii)) Interest receivable: 350 – 200 intra-group (= 4,000 × 10% × 6/12)) Finance costs Income tax expense (4,200 – 1,000 tax relief) Profit for the period Attributable to: Equity holders of the parent Non-controlling interest (w (iv)) © Emile Woolf Publishing Limited $000 103,200 (77,500) 25,700 (20,175) 150 (420) 5,255 (3,200) 2,055 3,455 (1,400) 2,055 287 Paper F7: Financial Reporting (International) Hydan: Consolidated statement of financial position as at 31 March 2012 $000 Non-current assets Property, plant and equipment (18,400 + 9,500 + 1,200 – 300 depreciation adjustment) Goodwill: 3,000 – 375 (w (ii)) Investment (16,000 – 10,800 – 4,000 loan) 28,800 2,625 1,200 32,625 24,000 56,625 Current assets (w (v)) Total assets Equity attributable to holders of the parent Ordinary shares of $1 each Share premium Retained earnings (w (iii)) 10,000 5,000 17,525 32,525 3,800 36,325 Non-controlling interest (w (iv)) Total equity Non-current liabilities 7% bank loan Current liabilities (w (v)) 6,000 14,300 56,625 Workings: All figures in $000 (i) Cost of sales Hydan Systan Intra-group sales Unrealised profit in inventories Additional depreciation re fair values 76,000 31,000 (30,000) 200 300 77,500 (ii) Goodwill/Cost of control in Systan Investment at cost (2,000 × 60% × $9) Less: Ordinary shares of Systan Share premium Pre-acquisition reserves (= 6,300 + 3,000 post acquisition loss) Fair value adjustment 10,800 2,000 500 9,300 1,200 13,000 × 60% Goodwill on consolidation (7,800) 3,000 Goodwill is impaired by 12.5% of its carrying amount = 375 288 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (iii) Consolidated reserves Hydan’s reserves 20,000 Systan’s post-acquisition losses (see below) (3,500 × 60%) (2,100) Goodwill impairment (w (ii)) (375) 17,525 6,300 The adjusted profits of Systan are: Profit as stated in the question Adjustments: Unrealised profit in inventories (4,000 × 5%) Additional depreciation (200) (300) (500) 5,800 (iv) Non-controlling interest in income statement Systan’s post acquisition loss after tax Adjustments from (w (iii)) Adjusted losses NCI in statement of financial position Ordinary shares and premium of Systan Adjusted profits (w (iii)) Fair value adjustments 3,000 500 3,500 × 40% = 1,400 2,500 5,800 1,200 9,500 × 40% = 3,800 (v) Current assets and liabilities Current assets: Hydan 18,000 Systan 7,200 Unrealised profit in inventories (200) Intra-group balance (1,000) 24,000 Current liabilities: Hydan 11,400 Systan 3,900 Intra-group balance (1,000) 14,300 (b) Although Systan’s revenue has increased since its acquisition by Hydan, its operating performance appears to have deteriorated markedly. Its gross profit margin has fallen from 25% (6m/24m) in the six months prior to the acquisition to only 11.9% (4.2m/35.2m) in the post-acquisition period. The decline in gross profit is made worse by a huge increase in operating expenses in the postacquisition period. These have gone from $1.2 million pre-acquisition to $8 million post-acquisition. © Emile Woolf Publishing Limited 289 Paper F7: Financial Reporting (International) Taking into account the effects of interest and tax, a $3.6 million first half profit (pre-acquisition) has turned into a $3 million second half loss (post-acquisition). Whilst it is possible that some of the worsening performance may be due to market conditions, the major cause is probably due to the effects of the acquisition. Hydan has acquired a controlling interest in Systan and thus the two companies are related parties. Since the acquisition most of Systan’s sales have been to Hydan. This is not surprising as Systan was acquired to secure supplies to Hydan. The terms under which the sales are made are now determined by the management of Hydan, whereas they were previously determined by the management of Systan. The question says sales to Hydan yield a consistent gross profit of only 5%. This is very low and much lower than the profit margin on sales to Hydan prior to the acquisition and also much lower than the few sales that were made to third parties in the post acquisition period. It may also be that Hydan has shifted the burden of some of the group operating expenses to Systan – this may explain the large increase in Systan’s post-acquisition operating expenses. The effect of these (transfer pricing) actions would move profits from Systan’s books into those of Hydan. The implications of this are quite significant. Initially there may be a tendency to think the effect is not important as on consolidation both companies’ results are added together, but other parties are affected by these actions. The most obvious is the significant (40%) non-controlling interests. The NCI in Systan are effectively having some of their share of Systan’s profit and net asset value taken from them. 74 Holdrite, Staybrite and Allbrite (a) Cost of control in Staybrite Consideration Shares (10,000 × 75% × 2/3) × $6 8% loan notes (10,000 × 75%) × $100/250 75% of net assets at acquisition (W1) (75% × 34,000) Goodwill on the purchase of Staybrite Goodwill on the purchase of Allbrite Consideration Shares (40% x 5,000 × 3/4) × $6 Cash (40% × 5,000) × $1 40% of net assets at acquisition (W1) (40% × 15,000) Goodwill 290 $000 30,000 3,000 33,000 (25,500) 7,500 9,000 2,000 11,000 (6,000) 5,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) Holdrite Group Consolidated income statement for the year ended 30 September 2012 $000 Revenue 75,000 + (40,700 × 6/12) – 10,000 Cost of sales 47,400 +(6/12 × 19,700) – 10,000 + 500 +1,000 Gross profit Operating expenses 10,480 +(6/12 × 9,000) +750 Profit from operations Income from associate 40% × (6/12 × 6,000) Interest expense Profit before tax Income tax expense – Group (4,800 + (3,000 × 6/12)) – Associate (w (iii)) $000 85,350 (48,750) 36,600 (15,730) 20,870 1,200 22,070 (170) 21,900 (6,300) (400) (6,700) 15,200 Profit for the period Attributable to: Equity holders of the parent Non-controlling interest (W3) 14,200 1,000 15,200 (c) Movement on consolidated retained profits $000 14,200 (5,000) 9,200 18,000 27,200 Net profit for period (group only) Dividend paid Retained profits b/f Retained profits c/f Workings (W1) Net assets in subsidiary Acquisition $000 Share capital Share premium Retained earnings (7,500 + 6/12 × 9,000) 10,000 4,000 12,000 Fair value adjustment Land 3,000 Plant 5,000 34,000 © Emile Woolf Publishing Limited 291 Paper F7: Financial Reporting (International) Net assets in associate Acquisition $000 Share capital Share premium Retained earnings (6,000 + 6/12 × 4,000) 5,000 2,000 8,000 15,000 (W2) Unrealised profit 4m × 1/4 = 1m Parent selling to subsidiary, reduce group retained earnings and increase group cost of sales (W3) Non-controlling interest Subsidiary post acquisition profit after tax(9,000 × 6/12) 4,500 Less: Depreciation adjustment on FV (500) 4,000 Non controlling interest share 25% × 4,000 75 1,000 Python, Snake and Adder (a) Goodwill on acquisition Purchase consideration $000 $000 Issue of new shares in Python: 24 million × 2/3 × $4.80 76,800 Deferred consideration: working 1 24,000 Total purchase consideration 100,800 Equity shares 32,000 Pre-acquisition reserves at 1July 2011 67,000 Pre-acquisition reserves from 1 July – 1 Oct 2011: 16,400 × 3/12 4,100 Fair value adjustments ($2.5 million + $2.4 million) 4,900 Total net assets at fair value, 1 October 2011 108,000 Share acquired by Python: 75% (81,000) Goodwill on acquisition 19,800 (b) Python Group Consolidated income statement for the year ended 30 June 2012 $000 $000 Revenue: 160,000 + (72,000 × 9/12) – (1,000 × 9 months) 205,000 Cost of sales: working 3 (122,400) Gross profit Distribution costs: 7,900 + (4,000 × 9/12) 292 82,600 (10,900) © Emile Woolf Publishing Limited Section 2: Answers to practice questions Python Group Consolidated income statement for the year ended 30 June 2012 $000 Administrative expenses: 13,200 + (6,000 × 9/12) $000 (17,700) Finance costs: working 2 (5,050) Impairment of goodwill (1,500) Share of profits of associate: 8,000 × 25% 2,000 (33,150) Profit before tax 49,450 Income tax expense: 12,300 + (2,600 × 9/12) (14,250) Profit for the year after tax 35,200 Attributable to: Equity shareholders of parent company: 35,200 – 2,950 32,250 Non-controlling interests (working 4) 2,950 35,200 Workings (1) Deferred consideration per share = $1.21 per share × 1/(1.10)2 = $1. Total deferred consideration = 24 million shares × $1 = $24 million. (2) Finance costs $000 Python (as given in income statement) 2,500 Finance cost of deferred consideration: $24 million × 10% × 9/12 1,800 Snake: 1,000 × 9/12 750 5,050 (3) Cost of sales Python (as given in income statement) Snake: 42,000 × 9/12 Less: Post-acquisition purchases from Python by Snake: 1,000 × 9 months Additional depreciation: property Additional depreciation: plant ($2.4 million/4 years) × 9/12 Unrealised profit in inventory: $2 million × 25/125 $000 99,000 31,500 (9,000) 50 450 400 122,400 Note: Only post-acquisition intra-group sales are removed from revenue and the cost of sales. © Emile Woolf Publishing Limited 293 Paper F7: Financial Reporting (International) (4) NCI share of consolidated profit $000 Snake post-acquisition profit: 16,400 × 9/12 12,300 Less: Additional post-acquisition depreciation on snake assets: 50 + 450 (500) 11,800 NCI share = 25% 2,950 The parent company share is the difference between the total consolidated profit and the profit attributable to the NCI. The unrealised profit on inventory is attributable to Python (sales by Python). Similarly the impairment of goodwill is attributable to the parent company shareholders, since there is no goodwill attributable to the NCI. (c) Python has accounted for its investment in Adder using the equity method on the basis that it has been able to exert significant influence even though it has not been able to exercise control. Significant influence was evident from the shareholding of 25% in Adder’s equity (in excess of the 20% minimum where significant influence is presumed to exist) and from the fact that a director of Python was also a director of Adder. Following the purchase of shares in Adder by Mambo, Mambo has acquired control and will account for Snake as a subsidiary. Python has lost its position on the Adder board. It seems clear that Python no longer has significant influence over Adder, and should therefore no longer account for its investment in Adder by the equity method. The investment should be carried in the financial statements of Python at fair value, in accordance with IAS 39. 76 Hosterling (a) Cost of control in Sunlee: Consideration Shares (20,000 x 80% x 3/5 x $5) Less Equity shares Pre acq reserves Fair value adjustments (4,000 + 3,000 + 5,000) Goodwill (b) 294 $’000 $’000 48,000 20,000 18,000 12,000 50,000 x 80% (40,000) 8,000 Carrying amount of Amber 30 September 2012 (prior to impairment loss): At cost $’000 Cash (6,000 x $3) 18,000 6% loan notes (6,000 x $100/100) 6,000 24,000 Less Post acquisition losses (20,000 x 40% x 3/12) (2,000) 22,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (c) Hosterling Group Consolidated income statement for the year ended 30 September 2012 $’000 149,000 (89,000) 60,000 (6,000) (14,500) (2,100) Revenue (105,000 + 62,000 – 18,000 intra group) Cost of sales (see working) Gross profit Distribution costs (4,000 + 2,000) Administrative expenses (7,500 + 7,000) Finance costs (1,200 + 900) Impairment losses: Goodwill Investment in associate (22,000 – 21,500) Share of loss from associate (20,000 x 40% x 3/12) Profit before tax Income tax expense (8,700 + 2,600) Profit for the period (1,600) (500) (2,000) 33,300 (11,300) 22,000 Attributable to: Equity holders of the parent Non controling interest ((13,000 – 1,000 depreciation adjustment) x 20%) 19,600 2,400 22,000 Note: the dividend from Sunlee is eliminated on consolidation. Working Cost of sales Hosterling Sunlee Intra group purchases Additional depreciation of plant (5,000/5 years) Unrealised profit in inventories (7,500 x 25%/125%) 77 $’000 68,000 36,500 (18,000) 1,000 1,500 89,000 Patronic (a) Cost of control in Sardonic: $’000 $’000 Cost of control in Sardonic: Consideration Shares (18,000 x 2/3 x $5·75) Deferred payment (18,000 x 2·42/1·21 (see below)) Less Equity shares Pre-acquisition reserves: At 1 April 2010 To date of acquisition (13,500 x 4/12) Fair value adjustments (4,100 + 2,400) Goodwill © Emile Woolf Publishing Limited $’000 24,000 69,000 4,500 6,500 –––––––– 104,000 x 75% $’000 69,000 36,000 –––––––– 105,000 (78,000) –––––––– 27,000 –––––––– 295 Paper F7: Financial Reporting (International) $1 compounded for two years at 10% would be worth $1·21. The acquisition of 18 million out of a total of 24 million equity shares is a 75% interest. (b) Patronic Group Consolidated income statement for the year ended 31 March 2011 Revenue (150,000 + (78,000 x 8/12) – (1,250 x 8 months intra group)) Cost of sales (w (i)) Gross profit Distribution costs (7,400 + (3,000 x 8/12)) Administrative expenses (12,500 + (6,000 x 8/12)) Finance costs (w (ii)) Impairment of goodwill Share of profit from associate (6,000 x 30%) Profit before tax Income tax expense (10,400 + (3,600 x 8/12)) Profit for the year Attributable to: Equity holders of the parent Minority interest (w (iii)) (c) $’000 192,000 (119,100) ––––––––– 72,900 (9,400) (16,500) (5,000) (2,000) 1,800 ––––––––– 41,800 (12,800) ––––––––– 29,000 ––––––––– 26,900 2,100 ––––––––– 29,000 ––––––––– An associate is defined by IAS 28 Investments in Associates and Joint Ventures as an investment over which an investor has significant influence. There are several indicators of significant influence, but the most important are usually considered to be a holding of 20% or more of the voting shares and board representation. Therefore it was reasonable to assume that the investment in Acerbic (at 31 March 2011) represented an associate and was correctly accounted for under the equity accounting method. The current position (from May 2011) is that although Patronic still owns 30% of Acerbic’s shares, Acerbic has become a subsidiary of Spekulate as it has acquired 60% of Acerbic’s shares. Acerbic is now under the control of Spekulate (part of the definition of being a subsidiary), therefore it is difficult to see how Patronic can now exert significant influence over Acerbic. The fact that Patronic has lost its seat on Acerbic’s board seems to reinforce this point. In these circumstances the investment in Acerbic falls to be treated under IAS 39 Financial Instruments: Recognition and Measurement. It will cease to be equity accounted from the date of loss of significant influence. Its carrying amount at that date will be its initial recognition value under IAS 39 and thereafter it will be carried at fair value. Workings (i) Cost of sales Cost of sales Patronic Sardonic (51,000 x 8/12) Intra group purchases (1,250 x 8 months) Additional depreciation: plant (2,400/ 4 years x 8/12) 296 $’000 $’000 94,000 34,000 (10,000) 400 © Emile Woolf Publishing Limited Section 2: Answers to practice questions property (per question) Unrealised profit in inventories (3,000 x 20/120) $’000 200 –––– $’000 600 500 ––––––––– 119,100 ––––––––– Note: for both sales revenues and cost of sales, only the post acquisition intra group trading should be eliminated. (ii) (iii) Finance costs $’000 Patronic per question Unwinding interest – deferred consideration (36,000 x 10% x 8/12) Sardonic (900 x 8/12) 2,000 Non-controlling interest Sardonic’s post acquisition profit (13,500 x 8/12) Less post acquisition additional depreciation (w (i)) 78 2,400 600 –––––– 5,000 –––––– 9,000 (600) –––––– 8,400 x 25% = 2,100 Pandar (a) (i) Goodwill in Salva at 1 April 2012: Controlling interest Shares issued (120 million x 80% x 3/5 x $6) Non-controlling interest (120 million x 20% x $3·20) Equity shares Pre-acquisition reserves: At 1 October 2011 To date of acquisition (see below) Fair value adjustments (5,000 + 20,000) $’000 $’000 345,600 76,800 –––––––– 422,400 120,000 152,000 11,500 25,000 –––––––– 308,500 –––––––– Goodwill arising on acquisition 113,900 –––––––– The interest on the 8% loan note is $2 million ($50 million x 8% x 6/12). This is included in Salva’s income statement in the post-acquisition period. Thus Salva’s profit for the year of $21 million has a split of $11·5 million pre-acquisition ((21 million + 2 million interest) x 6/12) and $9·5 million post-acquisition. (ii) Carrying amount of investment in Ambra at 30 September 2012 Cost (40 million x 40% x $2) Share of post-acquisition losses (5,000 x 40% x 6/12) Impairment charge (3,000) © Emile Woolf Publishing Limited $’000 32,000 (1,000) –––––––– 28,000 –––––––– 297 Paper F7: Financial Reporting (International) (b) Pandar Group Consolidated income statement for the year ended 30 September 2012 $’000 $’000 Revenue (210,000 + (150,000 x 6/12) – 15,000 intra-group sales) 270,000 Cost of sales (w (i)) (162,500) –––––––– Gross profit 107,500 Distribution costs (11,200 + (7,000 x 6/12)) (14,700) Administrative expenses (18,300 + (9,000 x 6/12)) (22,800) Investment income (w (ii)) 1,100 Finance costs (w (iii)) (2,300) Share of loss from associate (5,000 x 40% x 6/12) (1,000) Impairment of investment in associate (3,000) (4,000) –––––––– –––––––– Profit before tax 64,800 Income tax expense (15,000 + (10,000 x 6/12)) (20,000) –––––––– Profit for the year 44,800 –––––––– Attributable to: Owners of the parent 43,000 Non-controlling interest (w (iv)) 1,800 –––––––– 44,800 –––––––– Workings (figures in brackets in $’000) (i) Cost of sales $’000 Pandar 126,000 Salva (100,000 x 6/12) 50,000 Intra-group purchases (15,000) Additional depreciation: plant (5,000/5 years x 6/12) 500 Unrealised profit in inventories (15,000/3 x 20%) 1,000 –––––––– 162,500 –––––––– As the registration of the domain name is renewable indefinitely (at only a nominal cost) it will not be amortised. (ii) Investment income Per income statement 9,500 Intra-group interest (50,000 x 8% x 6/12) (2,000) Intra-group dividend (8,000 x 80%) (6,400) –––––––– 1,100 –––––––– (iii) Finance costs $’000 $’000 Pandar 1,800 Salva post-acquisition ((3,000 – 2,000) x 6/12 + 2,000) 2,500 Intra-group interest (w (ii)) (2,000) –––––––– 2,300 –––––––– (iv) Non-controlling interest Salva’s post-acquisition profit (see (i) above) 9,500 Less: post-acquisition additional depreciation (w (i)) (500) –––––––– 9,000 x 20% = 1,800 298 © Emile Woolf Publishing Limited Section 2: Answers to practice questions 79 Premier (a) Premier Consolidated statement of comprehensive income for the year ended 30 September 2010 Revenue (92,500 + (45,000 x 4/12) – 4,000 intra-group sales) Cost of sales (w (i)) Gross profit Distribution costs (2,500 + (1,200 x 4/12)) Administrative expenses (5,500 + (2,400 x 4/12)) Finance costs Profit before tax Income tax expense (3,900 + (1,500 x 4/12)) Profit for the year Other comprehensive income: Gain on available-for-sale investments Gain on revaluation of property Total other comprehensive income for the year Total comprehensive income Profit for year attributable to: Equity holders of the parent Non-controlling interest ((1,300 see below – 400 URP + 50 reduced depreciation) x 20%) Total comprehensive income attributable to: Equity holders of the parent (10,760 + 300 + 500) Non-controlling interest $’000 103,500 (78,850) –––––––– 24,650 (2,900) (6,300) (100) –––––––– 15,350 (4,400) –––––––– 10,950 –––––––– 300 500 –––––––– 800 –––––––– 11,750 –––––––– 10,760 190 –––––––– 10,950 –––––––– 11,560 190 –––––––– 11,750 –––––––– Sanford’s profits for the year ended 30 September 2010 of $3·9 million are $2·6 million (3,900 x 8/12) pre-acquisition and $1·3 million (3,900 x 4/12) postacquisition. (b) Consolidated statement of financial position as at 30 September 2010. $’000 Assets Non-current assets Property, plant and equipment (w (ii)) 38,250 Goodwill (w (iii)) 9,300 Available-for-sale investments (1,800 – 800 consideration + 300 gain) 1,300 ––––– 48,850 Current assets (w (iv)) 14,150 ––––– Total assets 63,000 ––––– © Emile Woolf Publishing Limited 299 Paper F7: Financial Reporting (International) $’000 Equity and liabilities Equity attributable to owners of the parent Equity shares of $1 each ((12,000 + 2,400) w (iii)) Share premium (w (iii)) Land revaluation reserve Other equity reserve (500 + 300) Retained earnings (w (v)) Non-controlling interest (w (vi)) Total equity Non-current liabilities 6% loan notes Current liabilities (10,000 + 6,800 – 350 intra group balance) Total equity and liabilities Workings in (i) Cost of sales Premier Sanford (36,000 x 4/12) Intra-group purchases URP in inventory Reduction of depreciation charge 14,400 9,600 2,000 800 13,060 ––––– 39,860 3,690 ––––– 43,550 3,000 16,450 ––––– 63,000 ––––– $’000 70,500 12,000 (4,000) 400 (50) ––––– 78,850 ––––– The unrealised profit (URP) in inventory is calculated as $2 million x 25/125 = $400,000. (ii) Non-current assets Premier 25,500 Sanford 13,900 Fair value reduction at acquisition (1,200) Reduced depreciation 50 ––––– 38,250 ––––– (iii) Goodwill in Sanford Investment at cost Shares (5,000 x 80% x 3/5 x $5) 12,000 6% loan notes (5,000 x 80% x 100/500) 800 Non-controlling interest (5,000 x 20% x $3·50) 3,500 ––––– 16,300 Net assets (equity) of Sanford at 30 September 2010 (9,500) Less: post-acquisition profits (see above) 1,300 Less: fair value adjustment for property 1,200 ––––– Net assets at date of acquisition (7,000) ––––– Goodwill 9,300 ––––– The 2·4 million shares (5,000 x 80% x 3/5) issued by Premier at $5 each would be recorded as share capital of $2·4 million and share premium of $9·6 million. 300 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (iv) (v) Current assets Premier 12,500 Sanford 2,400 URP in inventory (400 ) Intra-group balance (350 ) Retained earnings Premier 12,300 Sanford’s post-acquisition adjusted profit ((1,300 – 400 URP + 50 reduced depreciation) x 80%) 760 (vi) Non-controlling interest in statement of financial position At date of acquisition 3,500 Post-acquisition profit from income statement 190 ––––– 14,150 ––––– ––––– 13,060 ––––– ––––– 3,690 ––––– Business combinations – Statements of financial position and performance 80 Hepburn (a) Hepburn Consolidated income statement year to 31 March 2012 $000 Sale revenues (1,200 + 500 − 100 intra-group sales) Cost of sales (W1) Gross profit Operating expenses (120 + 44) Finance costs (12 × 6/12) Profit before tax Income tax expense (100 + 20) Profit for the period Attributable to: Equity holders of the parent Non-controlling interests (200 × 20% × 6/12) Consolidated statement of financial position at 31 March 2012 $000 Non-current assets Tangible Property, plant and equipment (620 + 660 + 125) Intangible: Goodwill (W2) © Emile Woolf Publishing Limited $000 1,600 (890) 710 (164) (6) 540 (120) 420 400 20 420 $000 1,405 200 301 Paper F7: Financial Reporting (International) Consolidated statement of financial position at 31 March 2012 $000 Investments (20 + 10) Current assets Inventory (240 + 280 − 10) Accounts receivable (170 + 210 − 56) Bank (20 + 40 + 20) $000 30 1,635 510 324 80 914 2,549 Total assets Equity and liabilities: Equity shares of $1 each (400 + 300 (W2)) Reserves: Share premium (W2) Retained earnings (W3) 700 600 480 1,080 1,780 195 1,975 Non-controlling interest (W4) Non-current liabilities 8% Debentures Current liabilities Trade payables (170 + 155 − 36) Taxation (50 + 45) Dividends 150 289 95 40 424 2,549 Workings (W1) Goodwill $000 Investment at cost (((150,000/2 × 5) × 80%) × $3) Less – equity shares of Salter (150 × 80%) – pre-acquisition profits ((700 − 100) × 80%) – fair value adjustment of land (125 × 80%) 302 (120) (480) (100) (700) 200 (40) 160 Goodwill on consolidation Less impairment In Hepburn’s books Dr Cost of investment $000 900 900,000 Cr Share Capital 300,000 Cr Share premium 600,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (W2) Unrealised profit ($100,000 × 50%) × 25/125 = $10,000 Parent sells to subsidiary so no non controlling interest adjustment (W3) Non-controlling interest Equity shares of Salter (150 × 20%) 30 Fair value adjustment of land (125 × 20%) 25 Retained earnings (700 × 20%) 140 195 (W4) Consolidated reserves $000 Hepburn’s reserves Share of Salter’s post acquisition profits (200 × 6/12 × 80%) Unrealised profit in inventory 410 80 (10) 480 (W5) Cost of sales Hepburn Salter (660 × 6/12) Intra-group sales Unrealised profit in inventory (b) $000 650 330 (100) 10 890 It seems that the directors of Hepburn are basing their arguments on the possibility that the investment in Woodbridge may be an associated company. The ownership of the total equity is 25%, giving Hepburn the right to 25% of any dividends Woodbridge may pay. If this were the basis on which the assessment of associate status is made, it may be that given the lack of involvement in the operating policies of Woodbridge, the directors may be able to rebut the normal presumption that Woodbridge is an associate by virtue of its 25% holding. The directors do however appear to be misunderstanding the basis of determining subsidiary company status. IFRS 10 Consolidated Financial Statements bases its definition of a subsidiary on control rather than ownership. In the case of Woodbridge, Hepburn in fact owns 6,000 of the 10,000 voting shares, and, in the absence of any other information, this would constitute control of Woodbridge by virtue of its 60% of voting rights. Thus, far from being an associate of Hepburn, Woodbridge is in fact a subsidiary, irrespective of the fact that control may be passive. Therefore Woodbridge’s results should be consolidated by Hepburn from the date of its acquisition. It may be that the motive for the directors’ position is that they wish to improve group profits by avoiding consolidation of Woodbridge’s losses. This raises the further point that these losses may indicate that the value of the investment in the subsidiary has been impaired under IAS 36 Impairment of Assets. If so, it will be necessary to perform an impairment test, which involves calculating the recoverable amount of the investment. If this is less than $20,000 the directors © Emile Woolf Publishing Limited 303 Paper F7: Financial Reporting (International) will have to write down the value of the investment (in Hepburn’s own (entity) financial statements) to its recoverable amount, and also write down the consolidated assets of Woodbridge. 81 Hydrate Hydrate Consolidated income statement – year to 30 September 2012 Sales revenue (24,000 + (6 /12 × 20,000)) – 100 Cost of sales (16,600 + (6 /12 × 11,800)) – 100 + 500 +10 Gross profit Operating expenses (1,600 + ( 6 /12 × 1,000) + 1,000 Taxation (2,000 + (6 /12 × 3,000)) Profit for the year Attributable to Group Non-controlling interest (W4) $000 33,900 (22,910) 10,990 (3,100) 7,890 (3,500) 4,390 4,070 320 Consolidated statement of financial position at 30 September 2012 $000 $000 Non-current assets Property, plant and equipment (64,000 + 35,000 + 5,000 – 500) 103,500 Investments 12,800 Goodwill (W2) 23,000 139,300 Current assets Inventory (22,800 + 23,600) – 10 46,390 Accounts receivable (16,400 + 24,200) 40,600 Bank (500 + 200) 700 87,690 Total assets 226,990 Equity and liabilities: Ordinary shares of $1 each (20,000 + 12,000 (W2)) 32,000 Reserves: Share premium (4,000 + 60,000 (W2)) 64,000 Retained earnings (W5) 57,470 121,470 153,470 Non-controlling interest (W4) 12,320 165,790 Non-current liabilities 8% Loan notes (5,000 + 18,000) 304 23,000 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Consolidated statement of financial position at 30 September 2012 $000 $000 Current liabilities Accounts payable (15,300 + 17,700) 33,000 Taxation (2,200 + 3,000) 5,200 38,200 226,990 Workings (W1) Net assets in subsidiary At acquisition Share capital Share premium Retained earnings 42,700 – (6/12 × 4,200) At end of reporting period $000 $000 12,000 12,000 2,400 2,400 40,600 42,700 5,000 5,000 Fair value adjustment Plant Depreciation 5,000 × 1/5 x 6/12 (500) 60,000 61,600 (W2) Goodwill $000 Investment at cost ((80% × 12,000) × 5/4) × $6 72,000 Net assets at acquisition (80% × 60,000) (W2) (48,000) Goodwill at acquisition 24,000 Less impairment (1,000) In consolidated statement of financial position 23,000 Dr Cost of investment 72,000 Cr Share capital (80% × 12,000) 05/4 12,000 Cr Share premium 60,000 (W3) Unrealised profit ($100,000 × 50%) × 25/125 = $10,000 Parent sells to subsidiary so no NCI adjustment © Emile Woolf Publishing Limited 305 Paper F7: Financial Reporting (International) (W4) Non-controlling interest Statement of financial position 20% × 61,600 (W1) = 12,320 Income statement Subsidiary post acquisition profit after tax (4,200 × 6/12) 2,100 Less depreciation adjustment on fair value (500) 1,600 NCI share: 20% × 1,600 320 (W5) Consolidated retained earnings: Hydrate reserves 57,200 Skeptik post acquisition (80% × 61,600 – 60,000 (W1)) Unrealised profit in inventory (W3) Less impairment 1,280 (10) (1,000) 57,470 82 Hillusion (a) Hillusion Consolidated income statement for the year to 31 March 2012 $000 Sales revenue (60,000 + (24,000 ×9/12)) – 12,000 Cost of sales (42,000 + (20,000 × 9/12)) – 12,000 + 500 + 600 Gross profit Operating expenses (6,000 + (200 × 9/12)) + 300 Loan interest (200 × 9/12) – 75 Profit before tax Taxation (3,000 + (600 × 9/12)) Profit for the period Attributable to: Equity holders of the parent Non-controlling interest (W4) 306 $000 66,000 (46,100) 19,900 (6,450) (75) (6,225) 13,375 (3,450) 9,925 9,595 330 9,925 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Consolidated statement of financial position at 31 March 2012 $000 Tangible non-current assets (19,320 + 8,000 + 3,200 – 600) Goodwill (W3) Current assets (15,000 + 8,000 – 500 – 750) Total assets Equity and liabilities Equity attributable to equity holders of the parent Ordinary shares of $1 each Retained earnings (W5) $000 29,920 900 30,820 21,750 52,570 10,000 26,120 36,120 2,600 38,720 Non-controlling interest (W4) Non-current liabilities 10% Loan notes (2,000 – 1,000 intra-group) Current liabilities (10,000 + 3,600 – 750) Total equity and liabilities 1,000 12,850 52,570 Workings in $000 (W1) Net assets in subsidiary At acquisition Share capital Retained earnings (5,400 + 3/12 × 3,000) Fair value adjustment Plant Depreciation 3,600 × 9/48 At end of reporting period $000 $000 2,000 6,150 2,000 8,400 3,200 (600) 3,200 11,350 13,000 (W2) Goodwill $000 Investment at cost Net assets at acquisition (80% × 11,350 (W2)) Goodwill on consolidation Less impairment In consolidated statement of financial position 10,280 (9,080) 1,200 (300) 900 (W3) Unrealised profit [(12m – 10m) × 12] – 9/12 = 500,000 Parent sells to subsidiary; therefore no non-controlling interest in this unrealised profit © Emile Woolf Publishing Limited 307 Paper F7: Financial Reporting (International) (W4) Non-controlling interest Statement of financial position 20% × 13,000 (W1) = 2,600 Income statement Subsidiary post acq profit after tax (3,000 × 9/12) 2,250 Less depreciation adjustment to fair value (600) 1,650 Non-controlling interest share: 20% x 1,650 330 (W5) Consolidated retained earnings: Hillusion’s reserves 25,600 Skeptik’s post acquisition (80% × 13,000 – 11,350 (W1)) 1,320 Unrealised profit inventory (W3) (500) Less impairment (300) 26,120 (b) The main reason why intra-group unrealised profits must be eliminated on consolidation is to achieve the main objective of group financial statements which is to show the position of the group as if it were a single economic entity. As such, a group cannot trade with itself, nor can it make a profit out of itself. In a similar way it cannot increase its sales or its net assets by transferring assets and liabilities between members of the group. As a simple illustrative example, but for the requirement to eliminate intra-group profits, a group could buy an item of inventory; sell it to another member of the group (at a profit), who in turn could sell it to another member of the group and so on. The result would be that each member of the group would make a profit which would then be combined to form a large group profit. This would be ‘balanced’ by an over-inflated inventory value in the statement of financial position (in practice this effect would be limited by the application of the lower of cost and net realisable value principle of valuing inventory). Such accounting would not give a fair presentation of the results and position. The main problem with using Skeptik entity financial statements to assess its performance is that it is a related party of its parent, Hillusion. Related party transactions can distort the true economic performance and financial position of a company. In this case, the related party relationship extends to complete control of Skeptik by Hillusion. From the information in the question, it can be seen that most of Skeptik’s trading is from goods it buys from Hillusion. Sales of non-group sourced goods are only $9 million (out of $24 million). It may be that these have been transferred at a favourable price allowing Skeptik to achieve a higher level of sales and make a higher than normal profit. Ultimately this course of action is no real detriment to the group as a whole as most of Skeptik’s profits (and all of them if it were 100% owned) are consolidated into the group profit. In a similar manner the fact that Hillusion does not make any charge for Skeptik’s administration costs acts to 308 © Emile Woolf Publishing Limited Section 2: Answers to practice questions increase Skeptik’s profit. If Skeptik was to be purchased by an external party, all these beneficial effects would cease and Skeptik’s profit would then be much lower. It could be observed that Hillusion may be ‘massaging’ Skeptik’s financial statements with a view to obtaining a favourable price on its future sale. Hillusion’s past record of success in selling previous businesses at a considerable profit after only a short period of ownership supports this view. 83 Pedantic (a) Pedantic Consolidated income statement for the year ended 30 September 2012 Revenue (85,000 + (42,000 x 6/12) – 8,000 intra-group sales) Cost of sales (w (i)) Gross profit Distribution costs (2,000 + (2,000 x 6/12)) Administrative expenses (6,000 + (3,200 x 6/12)) Finance costs (300 + (400 x 6/12)) Profit before tax Income tax expense (4,700 + (1,400 x 6/12)) Profit for the year Attributable to: Equity holders of the parent Non-controlling interest (((3,000 x 6/12) – (800 URP + 200 depreciation)) x 40%) (b) Consolidated statement of financial position as at 30 September 2012 Assets Non-current assets Property, plant and equipment (40,600 + 12,600 + 2,000 – 200 depreciation adjustment (w (i))) Goodwill (w (ii)) Current assets (w (iii)) Total assets Equity and liabilities Equity attributable to owners of the parent Equity shares of $1 each ((10, 000 + 1,600) w (ii)) Share premium (w (ii)) Retained earnings (w (iv)) Non-controlling interest (w (v)) Total equity © Emile Woolf Publishing Limited $’000 98,000 (72,000) ––––––– 26,000 (3,000) (7,600) (500) ––––––– 14,900 (5,400) ––––––– 9,500 ––––––– 9,300 200 ––––––– 9,500 ––––––– $’000 55,000 4,500 ––––––– 59,500 21,400 ––––––– 80,900 ––––––– 11,600 8,000 35,700 ––––––– 55,300 6,100 ––––––– 61,400 309 Paper F7: Financial Reporting (International) $’000 Non-current liabilities 10% loan notes (4,000 + 3,000) Current liabilities (8,200 + 4,700 – 400 intra-group balance) 7,000 12,500 ––––––– 80,900 ––––––– Total equity and liabilities Workings (figures in brackets in $’000) (i) Cost of sales $’000 Pedantic Sophistic (32,000 x 6/12) Intra-group sales URP in inventory Additional depreciation (2,000/5 years x 6/12) 63,000 16,000 (8,000) 800 200 ––––––– 72,000 ––––––– The unrealised profit (URP) in inventory is calculated as ($8 million – $5·2 million) x 40/140 = $800,000. (ii) Goodwill in Sophistic Investment at cost Shares (4,000 x 60% x 2/3 x $6) Less – Equity shares of Sophistic (4,000 x 60%) – pre-acquisition reserves (5,000 x 60% see below) – fair value adjustment (2,000 x 60%) $’000 (2,400) (3,000) (1,200) –––––– Parent’s goodwill Non-controlling interest’s goodwill (per question) Total goodwill The pre-acquisition reserves are: At 30 September 2012 Earned in the post acquisition period (3,000 x 6/12) $’000 9,600 (6,600) –––––– 3,000 1,500 –––––– 4,500 –––––– 6,500 (1,500) –––––– 5,000 –––––– Alternative calculation for goodwill in Sophistic Investment at cost (as above) Fair value of non-controlling interest (see below) Cost of the controlling interest Less fair value of net assets at acquisition (4,000 + 5,000 + 2,000) Total goodwill Fair value of non-controlling interest (at acquisition) Share of fair value of net assets (11,000 x 40%) Attributable goodwill per question 9,600 5,900 –––––– 15,500 (11,000) –––––– 4,500 –––––– 4,400 1,500 –––––– 5,900 –––––– The 1·6 million shares (4,000 x 60% x 2/3) issued by Pedantic would be recorded as share capital of $1·6 million and share premium of $8 million (1,600 x $5). 310 © Emile Woolf Publishing Limited Section 2: Answers to practice questions (iii) Current assets Pedantic Sophistic URP in inventory Cash in transit Intra-group balance $’000 16,000 6,600 (800) 200 (600) –––––– 21,400 –––––– (iv) Retained earnings (v) Pedantic per statement of financial position 35,400 Sophistic’s post acquisition profit (((3,000 x 6/12) – (800 URP + 200 depreciation)) x 60%) 300 –––––– 35,700 –––––– Non-controlling interest (in statement of financial position) Net assets per statement of financial position URP in inventory Net fair value adjustment (2,000 – 200) Share of goodwill (per question) $’000 10,500 (800) 1,800 –––––– 11,500 x 40% = 4,600 –––––– 1,500 –––––– 6,100 –––––– Analysing and interpreting financial statements 84 Comparator (a) Ratios are used to assess the financial performance of a company by comparing the calculated figures to various other sources. This may be to previous years’ ratios of the same company, it may be to the ratios of a similar rival company, to accepted norms (say of liquidity ratios) or, as in this example, to industry averages. The problems inherent in these processes are several. Probably the most important aspect of using ratios is to realise that they do not give the answers to the assessment of how well a company has performed, they merely raise the questions and direct the analyst into trying to determine what has caused favourable or unfavourable indicators. In many ways it can be said that ratios are only as useful as the skills of the person using them. It is also true that any assessment should also consider other information that may be available including non-financial information. More specific problem areas are: Accounting policies: if two companies have different accounting policies, it can invalidate any comparison between their ratios. For example return on capital employed is materially affected by revaluations of assets. Comparing this ratio for two companies where one has revalued its assets and the other carries them at depreciated historical cost would not be very meaningful. Similar examples may involve depreciation methods, inventory valuation policies, etc. © Emile Woolf Publishing Limited 311 Paper F7: Financial Reporting (International) Accounting practices: this is similar to differing accounting policies in its effects. An example of this would be the use of factoring of trade receivables. If one company collects its accounts receivable in the normal way, then the calculation of the accounts receivable collection period would be a reasonable indication of the efficiency of its credit control department. However if a company chose to factor its accounts receivable (i.e. ‘sell’ them to a finance company) then the calculation of its collection period would be meaningless. A more controversial example would be the engineering of a lease such that it fell to be treated as an operating lease rather than a finance lease. Statement of financial position averages: Many ratios are based on comparing income statement items with items in the statement of financial position. The ratio of accounts receivable collection period is a good example of this. For such ratios to have any meaning, there is an assumption that the year-end figures in the statement of financial position are representative of annual norms. Seasonal trading and other factors may invalidate this assumption. For example the level of accounts receivable and inventory of a toy manufacturer could vary largely due to the nature of its seasonal trading. Inflation can distort comparisons over time. The definition of an accounting ratio. If a ratio is calculated by two companies using different definitions, then there is an obvious problem. Common examples of this are gearing ratios (some use debt/equity, others may use debt/debt + equity). Also where a ratio is partly based on a profit figure, there can be differences as to what is included and what is excluded from the profit figure. Problems of this type include the treatment of finance costs. The use of norms can be misleading. A desirable range for the current ratio may be say between 1.5 and 2 : 1, but all businesses are different. This would be a very high ratio for a supermarket (with few accounts receivable), but a low figure for a construction company (with high levels of work in progress). Looking at a single ratio in isolation is rarely useful. It is necessary to form a view when considering ratios in combination with other ratios. A more controversial aspect of ratio analysis is that management have sometimes indulged in creative accounting techniques in order that the ratios calculated from published financial statements will show a more favourable picture than the true underlying position. Examples of this are sale and repurchase agreements, which manipulate liquidity figures, and ‘off balance sheet finance’ which distorts return on capital employed. Inter firm comparisons: Of particular concern with this method of using ratios is: 312 They are themselves averages and may incorporate large variations in their composition. Some inter firm comparison agencies produce the ratios analysed into quartiles to attempt to overcome this problem. It may be that the sector in which a company is included may not be sufficiently similar to the exact type of trade of the specific company. The type of products or markets may be different. © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) Companies of different sizes operate under different economies of scale, this may not be reflected in the industry average figures. The year end accounting dates of the companies included in the averages are not going to be all the same. Some companies try to minimise this by grouping companies with approximately similar year-ends together as in the example of this question, but this is not a complete solution. Calculation of specified ratios: Comparator Sector average Return on capital employed (186 + 34 loan interest/635) 34.6% 22.1% 3.8 times 1.8 times Gross profit margin (555/2,425 × 100) 22.9% 30% Net profit (before tax) margin (186/2,425 × 100) 7.7% 12.5% Current ratio (595/500) 1.19 : 1 1.6 : 1 Quick ratio (320/500) 0.64 : 1 0.9 : 1 Inventory holding period (275/1,870 × 365) 54 days 46 days Accounts receivable collection period (320/2,425 × 365) 48 days 45 days Creditor payment period (350/1,870 × 365) (based on cost of sales) 68 days 55 days Debt to equity (300/335 × 100) 90% 40% Dividend yield (see below) 2.5% 6% 1.07 times 3 times Net asset turnover (2,425/635) Dividend cover (96/90) The workings are in $000 (unless otherwise stated) and are for Comparator’s ratios. The dividend yield is calculated from a dividend per share figure of 15c ($90,000/150,000 × 4) and a share price of $6.00. Thus the yield is 2.5% (15c/$6.00 × 100%). (c) Analysis of Comparator’s financial performance compared to sector average for the year to 30 September 2012: To: From: Date: Operating performance The return on capital employed of Comparator is impressive being more than 50% higher than the sector average. The components of the return on capital employed are the asset turnover and profit margins. In these areas Comparator’s asset turnover is much higher (nearly double) than the average, but the net profit margin after exceptionals is considerably below the sector average. However, if the exceptionals are treated as one off costs and excluded, Comparator’s margins are very similar to the sector average. © Emile Woolf Publishing Limited 313 Paper F7: Financial Reporting (International) This short analysis seems to imply that Comparator’s superior return on capital employed is due entirely to an efficient asset turnover i.e. Comparator is making its assets work twice as efficiently as its competitors. A closer inspection of the underlying figures may explain why its asset turnover is so high. It can be seen from the note to the statement of financial position that Comparator’s noncurrent assets appear quite old. Their carrying amount is only 15% of their original cost. This has at least two implications; they will need replacing in the near future and the company is already struggling for funding; and their low carrying value gives a high figure for asset turnover. Unless Comparator has underestimated the life of its assets in its depreciation calculations, its noncurrent assets will need replacing in the near future. When this occurs its asset turnover and return on capital employed figures will be much lower. This aspect of ratio analysis often causes problems and to counter this anomaly some companies calculate the asset turnover using the cost of non-current assets rather than their carrying amount as this gives a more reliable trend. It is also possible that Comparator is using assets that are not in its statement of financial position. It may be leasing assets that do not meet the definition of finance leases and thus the assets and corresponding obligations are not recognised in the statement of financial position. A further issue is which of the two calculated margins should be compared to the sector average (i.e. including or excluding the effects of the exceptionals). The gross profit margin of Comparator is much lower than the sector average. If the exceptional losses were taken in at trading account level, which they should be as they relate to obsolete inventory, Comparator’s gross margin would be even worse. As Comparator’s net margin is similar to the sector average, it would appear that Comparator has better control over its operating costs. This is especially true as the other element of the net profit calculation is finance costs and as Comparator has much higher gearing than the sector average, one would expect Comparator’s interest to be higher than the sector average. Liquidity Here Comparator shows real cause for concern. Its current ratio and quick ratio are much worse than the sector average, and indeed far below expected norms. Current liquidity problems appear due to high levels of accounts payable and a high bank overdraft. The high levels of inventory contribute to the poor quick ratio and may be indicative of further obsolete inventory (the exceptional item is due to obsolete inventory). The accounts receivable collection figure is reasonable, but at 68 days, Comparator takes longer to pay its accounts payable than do its competitors. Whilst this is a source of ‘free’ finance, it can damage relations with suppliers and may lead to a curtailment of further credit. Gearing As referred to above, gearing (as measured by debt/equity) is more than twice the level of the sector average. Whilst this may be an uncomfortable level, it is currently beneficial for shareholders. The company is making an overall return of 34.6%, but only paying 8% interest on its loan notes. The gearing level may become a serious issue if Comparator becomes unable to maintain the finance costs. The company already has an overdraft and the ability to make further interest payments could be in doubt. 314 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Investment ratios Despite reasonable profitability figures, Comparator’s dividend yield is poor compared to the sector average. From the extracts of the changes in equity it can be seen that total dividends are $90,000 out of available profit for the year of only $96,000 (hence the very low dividend cover). It is worthy of note that the interim dividend was $60,000 and the final dividend only $30,000. Perhaps this indicates a worsening performance during the year, as normally final dividends are higher than interim dividends. Considering these factors it is surprising the company’s share price is holding up so well. Summary The company compares favourably with the sector average figures for profitability, however the company’s liquidity and gearing position is quite poor and gives cause for concern. If it is to replace its old assets in the near future, it will need to raise further finance. With already high levels of borrowing and poor dividend yields, this may be a serious problem for Comparator. 85 Rytetrend (a) Rytetrend – Statement of cash flows for the year to 31 March 2012 $000 $000 Cash flows from operating activities Operating profit per question 3,860 Capitalisation of installation costs 240 less depreciation (300 – 20%) (W1) Adjustments: Depreciation of non-current assets (W1) Loss on disposal of plant (W1) 7,410 700 8,110 Increase in warranty provision (500 – 150) 350 Decrease in inventory (3,270 – 2,650) 620 Decrease in receivables (1,950 – 1,100) 850 Increase in payables (2,850 – 1,980) 870 Cash generated from operations 14,900 Interest paid (460) Income taxes paid (W2) (910) Net cash from operating activities 13,530 Net cash used in investing activities Purchase of non-current assets (W1) © Emile Woolf Publishing Limited (15,550) 315 Paper F7: Financial Reporting (International) Rytetrend – Statement of cash flows for the year to 31 March 2012 $000 $000 Cash flows from financing activities Issue of ordinary shares (1,500 + 1,500) 3,000 Issue of 6% loan notes 2,000 Repayment of 10% loan notes (4,000) Ordinary dividends paid (280 + (600 – 450) interim) (430) Net cash from financing activities 570 Net decrease in cash and cash equivalents (1,450) Cash and cash equivalents at beginning of period 400 Cash and cash equivalents at end of period (1,050) Workings (W1) Non-current assets Non-current assets at cost Balance b/f Disposal Balance c/f (37,250 + 300 re installation) $000 27,500 (6,000) (37,550) Cost of assets acquired Trade in allowance Cash flow for acquisitions Depreciation Balance b/f Disposal (6,000 × 20% × 4 years) Balance c/f (12,750 + (300 × 20%)) Difference – charge for year (16,050) 500 (15,550) Disposal Cost Depreciation Net book value Trade in allowance Loss on sale (10,200) 4,800 12,810 7,410 6,000 (4,800) 1,200 (500) 700 (W2) Tax paid Tax provision b/f Income statement tax charge Tax provision c/f Difference – cash paid 316 (630) (1,000) 720 (910) © Emile Woolf Publishing Limited Section 2: Answers to practice questions (b) Report on the financial performance of Rytetrend for the year ended 31 March 2012 To: From: Date: Operating performance (i) Revenue up $8.3 million representing an increase of 35% on 2011 figures. (ii) Costs of sales up by $6.5 million (40% increase on 2011). Overall the increase in activity has led to an increase in gross profit of $1.8 million. However the gross profit margin has eased slightly from 31.9% in 2011 to 29.2% in 2012. Perhaps the slight reduction in margins gave a boost to sales. (iii) Operating expenses have increased by $840,000, an increase of 18% on 2011 figures. (iv) Interest costs reduced by $40,000. It is worth noting that the composition of them has changed. It appears that Rytetrend has taken advantage of a cyclic reduction in borrowing cost and redeemed its 10% loan notes and (partly) replaced these with lower cost 6% loan notes. From the interest cost figure, this appears to have taken place half way through the year. Although borrowing costs on long-term finance have decreased, other factors have led to a substantial overdraft which has led to further interest of $200,000. (v) The accumulated effect is an increase in profit before tax of $1 million (up 41.6% on 2011) which is reflected by an increase in dividends of $200,000. (vi) The company has invested heavily in acquiring new non-current assets (over $15 million – see cash flow statement). The refurbishment of the equipment may be responsible for the increase in the company’s sales and operating performance. Analysis of financial position (vii) Inventory and receivables have both decreased markedly. Inventory is now at 43 days from 75 days, this may be due to new arrangements with suppliers or that the different range of equipment that Rytetrend now sells may offer less choice requiring lower inventory. Receivables are only 13 days (from 30 days). This low figure is probably a reflection of a retailing business. (viii) Although payables have increased significantly, they still represent only 46 days (based on cost of sales) which is almost the same as in 2011. (ix) A very worrying factor is that the company has gone from net current assets of $2,580,000 to net current liabilities of $1,820,000. This is mainly due to a combination of the above mentioned item: decreased inventory and receivables and increased trade payables leading to a fall in cash balances of $1,450,000. That said, traditionally acceptable norms for liquidity ratios are not really appropriate to a mainly retailing business. © Emile Woolf Publishing Limited 317 Paper F7: Financial Reporting (International) (x) Long-term borrowing has fallen by $2 million; this has lowered gearing from 20% (4,000,000/19,880,000) to only 9% (2,000,000/22,680,000). This is a very modest level of gearing. The statement of cash flows This indicates very healthy cash flows generated from operations of $14,900,000, more than sufficient to pay interest costs, taxation and dividends. The main reason why the overall cash balance has fallen is that new non-current assets (costing over $15 million) have largely been financed from operating cash flows (only $1 million net of new capital has been raised). If Rytetrend continues to generate operating cash flows in the order of the current year, its liquidity will soon get back to healthy levels. 86 Greenwood Note IFRS 5 uses the term discontinued operation. The answer below also uses this term, but it should be realised that the assets of the discontinued operation are classed as held for sale and not yet sold. Profitability/utilisation of assets An important feature of the company’s performance in the year to 31 March 2012 is to evaluate the effect of the discontinued operation. When using an entity’s recent results as a basis for assessing how the entity may perform in the future, emphasis should be placed on the results from continuing operations as it is these that will form the basis of future results. For this reason most of the ratios calculated in the appendix are based on the results from continuing operations and ratio calculations involving net assets/capital employed generally exclude the value of the assets held for sale. On this basis, it can be seen that the overall efficiency of Greenwood (measured by its ROCE) has declined considerably from 33·5% to 29·7% (a fall of 11·3%). The fall in the asset turnover (from 1·89 to 1·67 times) appears to be mostly responsible for the overall decline in efficiency. In effect the company’s assets are generating less sales per $ invested in them. The other contributing factors to overall profitability are the company’s profit margins. Greenwood has achieved an impressive increase in headline sales revenues of nearly 30% (6·3m on 21·2m) whilst being able to maintain its gross profit margin at around 29% (no significant change from 2011). This has led to a substantial increase in gross profit, but this has been eroded by an increase in operating expenses. As a percentage of sales, operating expenses were 10·5% in 2012 compared to 11·6% in 2011 (they appear to be more of a variable than a fixed cost). This has led to a modest improvement in the profit before interest and tax margin which has partially offset the deteriorating asset utilisation. The decision to sell the activities which are classified as a discontinued operation is likely to improve the overall profitability of the company. In the year ended 31 March 2011 the discontinued operation made a modest pre tax profit of $450,000 (this would represent a return of around 7% on the activity’s assets of $6·3 million).This poor return acted to reduce the company’s overall profitability (the continuing operations yielded a return of 33·5%). The performance of the discontinued operation continued to deteriorate in the year ended 31 March 2012 making a pre tax operating loss of $1·4 million which creates a negative return on the relevant assets. Despite incurring losses on the measurement to fair value of the discontinued operation’s assets, it seems the 318 © Emile Woolf Publishing Limited Section 2: Answers to practice questions decision will benefit the company in the future as the discontinued operation showed no sign of recovery. Liquidity and solvency Superficially the current ratio of 2·11 in 2012 seems reasonable, but the improvement from the alarming current ratio in 2011 of 0·97 is more illusory than real. The ratio in the year ended 31 March 2012 has been distorted (improved) by the inclusion of assets of the discontinued operation under the heading of ‘held for sale’. These have been included at fair value less cost to sell (being lower than their cost – a requirement of IFRS 5). Thus the carrying amount should be a realistic expectation of the net sale proceeds, but it is not clear whether the sale will be cash (they may be exchanged for shares or other assets) or how Greenwood intends to use the disposal proceeds. What can be deduced is that without the assets held for sale being classified as current, the company’s liquidity ratio would be much worse than at present (at below 1 for both years). Against an expected norm of 1, quick ratios (acid test) calculated on the normal basis of excluding inventory (and in this case the assets held for sale) show an alarming position; a poor figure of 0·62 in 2011 has further deteriorated in 2012 to 0·44. Without the proceeds from the sale of the discontinued operation (assuming they will be for cash) it is difficult to see how Greenwood would pay its creditors (and tax liability), given a year end overdraft of $1,150,000. Further analysis of the current ratios shows some interesting changes during the year. Despite its large overdraft Greenwood appears to be settling its trade payables quicker than in 2011. At 68 days in 2011 this was rather a long time and the reduction in credit period may be at the insistence of suppliers – not a good sign. Perhaps to relieve liquidity pressure, the company appears to be pushing its customers to settle early. It may be that this has been achieved by the offer of early settlement discounts, if so the cost of this would have impacted on profit. Despite holding a higher amount of inventory at 31 March 2012 (than in 2011), the company has increased its inventory turnover; given that margins have been held, this reflects an improved performance. Gearing The additional borrowing of $3 million in loan notes (perhaps due to liquidity pressure) has resulted in an increase in gearing from 28·6% to 35·6% and a consequent increase in finance costs. Despite the increase in finance costs the borrowing is acting in the shareholders’ favour as the overall return on capital employed (at 29·7%) is well in excess of the 5% interest cost. Summary Overall the company’s performance has deteriorated in the year ended 31 March 2012. Management’s action in respect of the discontinued operation is a welcome measure to try to halt the decline, but more needs to be done. The company’s liquidity position is giving cause for serious concern and without the prospect of realising $6 million from the assets held for sale it would be difficult to envisage any easing of the company’s liquidity pressures. Appendix ROCE: continuing operations (4,500 + 400)/(14,500 + 8,000 – 6,000) 2012 29·7% (3,500 + 250)/ (12,500 + 5,000 – 6,300) 2011 33·5% The return has been taken as the profit before interest (on loan notes only) and tax from continuing operations. The capital employed is the normal equity plus loan capital (as at the © Emile Woolf Publishing Limited 319 Paper F7: Financial Reporting (International) year end), but less the value of the assets held for sale. This is because the assets held for sale have not contributed to the return from continuing operations. Gross profit percentage (8,000/27,500) Operating expense percentage of sales revenue (2,900/27,500) Profit before interest and tax margin (5,100/27,500) Asset turnover (27,500/16,500) Current ratio (9,500:4,500) Current ratio (excluding held for sale) (3,500:4,500) 29·1% (6,200/21,200) 29·2% 10·5% (2,450/21,200) 11·6% 18·5% 1·67 2·11 (3,750/21,200) (21,200/11,200) (3,700:3,800) 17·7% 1·89 0·97 0·77 not applicable 0·44 (2,350:3,800) Quick ratio (excluding held for sale) (2,000:4,500) 0·62 Inventory (closing) turnover (19,500/1,500) 11·1 13·0 Receivables (in days) (2,000/27,500) x 365 26·5 Payables/cost of sales (in days) (2,400/19,500) x 365 Gearing (8,000/8,000 + 14,500) 87 44·9 35·6% (2,300/21,200) x 365 39·6 (2,800/15,000) x 365 (5,000/5,000 + 12,500) 68·1 28·6% Harbin (a) Note: figures in the calculations of the ratios are in $million 2012 2011 2012 re Fatima (b) 11·2 % 7·1% 18·9% 1·2 x 20% 1·6x 16·7% 0·6x 42·9% Net profit (before tax) margin 16/250 6·4% 4·4% 31·4% Current ratio 38/44 0·9:1 2·5 Closing inventory holding period 25/200 x 365 46 days 37 days Trade receivables’ collection period 13/250 x 365 19 days 16 days Trade payables’ payment period 23/200 x 365 42 days 32 days 46·7% nil Return on year end capital employed 24/(114 + 100) x 100 Net asset turnover 250/214 Gross profit margin (given in question) Gearing 100/214 x 100 The gross profit margins and relevant ratios for 2011 are given in the question, and some additional ratios for Fatima are included above to enable a clearer 320 © Emile Woolf Publishing Limited Section 2: Answers to practice questions analysis in answering part (b) (references to Fatima should be taken to mean Fatima’s net assets). (b) Analysis of the comparative financial performance and position of Harbin for the year ended 30 September 2012. Note: references to 2012 and 2011 should be taken as the years ended 30 September 2012 and 2011. Introduction The figures relating to the comparative performance of Harbin ‘highlighted’ in the Chief Executive’s report may be factually correct, but they take a rather biased and one dimensional view. They focus entirely on the performance as reflected in the income statement without reference to other measures of performance (notably the ROCE); nor is there any reference to the purchase of Fatima at the beginning of the year which has had a favourable effect on profit for 2012. Due to this purchase, it is not consistent to compare Harbin’s income statement results in 2012 directly with those of 2011 because it does not match like with like. Immediately before the $100 million purchase of Fatima, the carrying amount of the net assets of Harbin was $112 million. Thus the investment represented an increase of nearly 90% of Harbin’s existing capital employed. The following analysis of performance will consider the position as shown in the reported financial statements (based on the ratios required by part (a) of the question) and then go on to consider the impact the purchase has had on this analysis. Profitability The ROCE is often considered to be the primary measure of operating performance, because it relates the profit made by an entity (return) to the capital (or net assets) invested in generating those profits. On this basis the ROCE in 2012 of 11·2% represents a 58% improvement (i.e. 4·1% on 7·1%) on the ROCE of 7·1% in 2011. Given there were no disposals of non-current assets, the ROCE on Fatima’s net assets is 18·9% (22m/100m + 16·5m). Note: the net assets of Fatima at the year end would have increased by profit after tax of $16·5 million (i.e. 22m x 75% (at a tax rate of 25%)). Put another way, without the contribution of $22 million to profit before tax, Harbin’s ‘underlying’ profit would have been a loss of $6 million which would give a negative ROCE. The principal reasons for the beneficial impact of Fatima’s purchase is that its profit margins at 42·9% gross and 31·4% net (before tax) are far superior to the profit margins of the combined business at 20% and 6·4% respectively. It should be observed that the other contributing factor to the ROCE is the net asset turnover and in this respect Fatima’s is actually inferior at 0·6 times (70m/116·5m) to that of the combined business of 1·2 times. It could be argued that the finance costs should be allocated against Fatima’s results as the proceeds of the loan note appear to be the funding for the purchase of Fatima. Even if this is accepted, Fatima’s results still far exceed those of the existing business. Thus the Chief Executive’s report, already criticised for focussing on the income statement alone, is still highly misleading. Without the purchase of Fatima, underlying sales revenue would be flat at $180 million and the gross margin would be down to 11·1% (20m/180m) from 16·7% resulting in a loss before tax of $6 million. This sales performance is particularly poor given it is likely that there must have been an increase in spending on property plant and equipment © Emile Woolf Publishing Limited 321 Paper F7: Financial Reporting (International) beyond that related to the purchase of Fatima’s net assets as the increase in property, plant and equipment is $120 million (after depreciation). Liquidity The company’s liquidity position as measured by the current ratio has deteriorated dramatically during the period. A relatively healthy 2·5:1 is now only 0·9:1 which is rather less than what one would expect from the quick ratio (which excludes inventory) and is a matter of serious concern. A consideration of the component elements of the current ratio suggests that increases in the inventory holding period and trade payables payment period have largely offset each other. There is a small increase in the collection period for trade receivables (up from 16 days to 19 days) which would actually improve the current ratio. This ratio appears unrealistically low, it is very difficult to collect credit sales so quickly and may be indicative of factoring some of the receivables, or a proportion of the sales being cash sales. Factoring is sometimes seen as a consequence of declining liquidity, although if this assumption is correct it does also appear to have been present in the previous year. The changes in the above three ratios do not explain the dramatic deterioration in the current ratio, the real culprit is the cash position, Harbin has gone from having a bank balance of $14 million in 2011 to showing short-term bank borrowings of $17 million in 2012. A cash flow statement would give a better appreciation of the movement in the bank/short term borrowing position. It is not possible to assess, in isolation, the impact of the purchase of Fatima on the liquidity of the company. Dividends A dividend of 10 cents per share in 2012 amounts to $10 million (100m x 10 cents), thus the dividend in 2011 would have been $8 million (the dividend in 2012 is 25% up on 2011). It may be that the increase in the reported profits led the Board to pay a 25% increased dividend, but the dividend cover is only 1·2 times (12m/10m) in 2012 which is very low. In 2011 the cover was only 0·75 times (6m/8m) meaning previous years’ reserves were used to facilitate the dividend. The low retained earnings indicate that Harbin has historically paid a high proportion of its profits as dividends, however in times of declining liquidity, it is difficult to justify such high dividends. Gearing The company has gone from a position of nil gearing (i.e. no long-term borrowings) in 2011 to a relatively high gearing of 46·7% in 2012. This has been caused by the issue of the $100 million 8% loan note which would appear to be the source of the funding for the $100 million purchase of Fatima’s net assets. At the time the loan note was issued, Harbin’s ROCE was 7·1%, slightly less than the finance cost of the loan note. In 2012 the ROCE has increased to 11·2%, thus the manner of the funding has had a beneficial effect on the returns to the equity holders of Harbin. However, it should be noted that high gearing does not come without risk; any future downturn in the results of Harbin would expose the equity holders to much lower proportionate returns and continued poor liquidity may mean payment of the loan interest could present a problem. Harbin’s gearing and liquidity position would have looked far better had some of the acquisition been funded by an issue of equity shares. 322 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Conclusion There is no doubt that the purchase of Fatima has been a great success and appears to have been a wise move on the part of the management of Harbin. However, it has disguised a serious deterioration of the underlying performance and position of Harbin’s existing activities which the Chief Executive’s report may be trying to hide. It may be that the acquisition was part of an overall plan to diversify out of what has become existing loss making activities. If such a transition can continue, then the worrying aspects of poor liquidity and high gearing may be overcome. 88 Victular (a) Equivalent ratios from the financial statements of Merlot (workings in $’000) Return on year end capital employed (ROCE) 20·9% Pre tax return on equity (ROE) Net asset turnover Gross profit margin 50% 2·3 times (1,400 + 590)/ (2,800 + 3,200 + 500 + 3,000) x 100 1,400/2,800 x 100 20,500/(14,800 – 5,700) 12·2% 2,500/20,500 x 100 Operating profit margin 9·8% 2,000/20,500 x 100 Current ratio 1·3:1 7,300/5,700 Closing inventory holding period 73 days 3,600/18,000 x 365 Trade receivables’ collection period 66 days 3,700/20,500 x 365 Trade payables’ payment period 3,800/18,000 x 365 Gearing 77 days 71% (3,200 + 500 + 3,000)/9,500 x 100 Interest cover 3·3 times 2,000/600 Dividend cover 1·4 times 1,000/700 As per the question, Merlot’s obligations under finance leases (3,200 + 500) have been treated as debt when calculating the ROCE and gearing ratios. (b) Assessment of the relative performance and financial position of Grappa and Merlot for the year ended 30 September 2012 Introduction This report is based on the draft financial statements supplied and the ratios shown in (a) above. Although covering many aspects of performance and financial position, the report has been approached from the point of view of a prospective acquisition of the entire equity of one of the two companies. Profitability The ROCE of 20·9% of Merlot is far superior to the 14·8% return achieved by Grappa. ROCE is traditionally seen as a measure of management’s overall efficiency in the use of the finance/assets at its disposal. More detailed analysis reveals that Merlot’s superior performance is due to its efficiency in the use of its net assets; it achieved a net asset turnover of 2·3 times compared to only 1·2 times for Grappa. Put another way, Merlot makes sales of $2·30 per $1 invested in net assets compared to sales of only $1·20 per $1 invested for Grappa. The other © Emile Woolf Publishing Limited 323 Paper F7: Financial Reporting (International) element contributing to the ROCE is profit margins. In this area Merlot’s overall performance is slightly inferior to that of Grappa, gross profit margins are almost identical, but Grappa’s operating profit margin is 10·5% compared to Merlot’s 9·8%. In this situation, where one company’s ROCE is superior to another’s it is useful to look behind the figures and consider possible reasons for the superiority other than the obvious one of greater efficiency on Merlot’s part. A major component of the ROCE is normally the carrying amount of the noncurrent assets. Consideration of these in this case reveals some interesting issues. Merlot does not own its premises whereas Grappa does. Such a situation would not necessarily give a ROCE advantage to either company as the increase in capital employed of a company owning its factory would be compensated by a higher return due to not having a rental expense (and vice versa). If Merlot’s rental cost, as a percentage of the value of the related factory, was less than its overall ROCE, then it would be contributing to its higher ROCE. There is insufficient information to determine this. Another relevant point may be that Merlot’s owned plant is nearing the end of its useful life (carrying amount is only 22% of its cost) and the company seems to be replacing owned plant with leased plant. Again this does not necessarily give Merlot an advantage, but the finance cost of the leased assets at only 7·5% is much lower than the overall ROCE (of either company) and therefore this does help to improve Merlot’s ROCE. The other important issue within the composition of the ROCE is the valuation basis of the companies’ non-current assets. From the question, it appears that Grappa’s factory is at current value (there is a property revaluation reserve) and note (ii) of the question indicates the use of historical cost for plant. The use of current value for the factory (as opposed to historical cost) will be adversely impacting on Grappa’s ROCE. Merlot does not suffer this deterioration as it does not own its factory. The ROCE measures the overall efficiency of management; however, as Victular is considering buying the equity of one of the two companies, it would be useful to consider the return on equity (ROE) – as this is what Victular is buying. The ratios calculated are based on pre-tax profits; this takes into account finance costs, but does not cause taxation issues to distort the comparison. Clearly Merlot’s ROE at 50% is far superior to Grappa’s 19·1%. Again the issue of the revaluation of Grappa’s factory is making this ratio appear comparatively worse (than it would be if there had not been a revaluation). In these circumstances it would be more meaningful if the ROE was calculated based on the asking price of each company (which has not been disclosed) as this would effectively be the carrying amount of the relevant equity for Victular. Gearing From the gearing ratio it can be seen that 71% of Merlot’s assets are financed by borrowings (39% is attributable to Merlot’s policy of leasing its plant). This is very high in absolute terms and double Grappa’s level of gearing. The effect of gearing means that all of the profit after finance costs is attributable to the equity even though (in Merlot’s case) the equity represents only 29% of the financing of the net assets. Whilst this may seem advantageous to the equity shareholders of Merlot, it does not come without risk. The interest cover of Merlot is only 3·3 times whereas that of Grappa is 6 times. Merlot’s low interest cover is a direct consequence of its high gearing and it makes profits vulnerable to relatively small changes in operating activity. For example, small reductions in sales, profit 324 © Emile Woolf Publishing Limited Section 2: Answers to practice questions margins or small increases in operating expenses could result in losses and mean that interest charges would not be covered. Another observation is that Grappa has been able to take advantage of the receipt of government grants; Merlot has not. This may be due to Grappa purchasing its plant (which may then be eligible for grants) whereas Merlot leases its plant. It may be that the lessor has received any grants available on the purchase of the plant and passed some of this benefit on to Merlot via lower lease finance costs (at 7·5% per annum, this is considerably lower than Merlot has to pay on its 10% loan notes). Liquidity Both companies have relatively low liquid ratios of 1·2 and 1·3 for Grappa and Merlot respectively, although at least Grappa has $600,000 in the bank whereas Merlot has a $1·2 million overdraft. In this respect Merlot’s policy of high dividend payouts (leading to a low dividend cover and low retained earnings) is very questionable. Looking in more depth, both companies have similar inventory days; Merlot collects its receivables one week earlier than Grappa (perhaps its credit control procedures are more active due to its large overdraft), and of notable difference is that Grappa receives (or takes) a lot longer credit period from its suppliers (108 days compared to 77 days). This may be a reflection of Grappa being able to negotiate better credit terms because it has a higher credit rating. Summary Although both companies may operate in a similar industry and have similar profits after tax, they would represent very different purchases. Merlot’s sales revenues are over 70% more than those of Grappa, it is financed by high levels of debt, it rents rather than owns property and it chooses to lease rather than buy its replacement plant. Also its remaining owned plant is nearing the end of its life. Its replacement will either require a cash injection if it is to be purchased (Merlot’s overdraft of $1·2 million already requires serious attention) or create even higher levels of gearing if it continues its policy of leasing. In short although Merlot’s overall return seems more attractive than that of Grappa, it would represent a much more risky investment. Ultimately the investment decision may be determined by Victular’s attitude to risk, possible synergies with its existing business activities, and not least, by the asking price for each investment (which has not been disclosed to us). (c) The generally recognised potential problems of using ratios for comparison purposes are: – inconsistent definitions of ratios – financial statements may have been deliberately manipulated (creative accounting) – different companies may adopt different accounting policies (e.g. use of historical costs compared to current values) – different managerial policies (e.g. different companies offer customers different payment terms) – statement of financial position figures may not be representative of average values throughout the year (this can be caused by seasonal trading or a large acquisition of non-current assets near the year end) © Emile Woolf Publishing Limited 325 Paper F7: Financial Reporting (International) – the impact of price changes over time/distortion caused by inflation When deciding whether to purchase a company, Victular should consider the following additional useful information: 89 – in this case the analysis has been made on the draft financial statements; these may be unreliable or change when being finalised. Audited financial statements would add credibility and reliance to the analysis (assuming they receive an unmodified Auditors’ Report). – forward looking information such as profit and financial position forecasts, capital expenditure and cash budgets and the level of orders on the books. – the current (fair) values of assets being acquired. – the level of risk within a business. Highly profitable companies may also be highly risky, whereas a less profitable company may have more stable ‘quality’ earnings – not least would be the expected price to acquire a company. It may be that a poorer performing business may be a more attractive purchase because it is relatively cheaper and may offer more opportunity for improving efficiencies and profit growth. Hardy Note: references to 2009 and 2010 should be taken as being to the years ended 30 September 2009 and 2010 respectively. Profitability: Income statement performance: Hardy’s income statement results dramatically show the effects of the downturn in the global economy; revenues are down by 18% (6,500/36,000 x 100), gross profit has fallen by 60% and a healthy after tax profit of $3·5 million has reversed to a loss of $2·1 million. These are reflected in the profit (loss) margin ratios shown in the appendix (the ‘as reported’ figures for 2010). This in turn has led to a 15·2% return on equity being reversed to a negative return of 11·9%. However, a closer analysis shows that the results are not quite as bad as they seem. The downturn has directly caused several additional costs in 2010: employee severance, property impairments and losses on investments (as quantified in the appendix). These are probably all non-recurring costs and could therefore justifiably be excluded from the 2010 results to assess the company’s ‘underlying’ performance. If this is done the results of Hardy for 2010 appear to be much better than on first sight, although still not as good as those reported for 2009. A gross margin of 27·8% in 2009 has fallen to only 23·1% (rather than the reported margin of 13·6%) and the profit for period has fallen from $3·5 million (9·7%) to only $2·3 million (7·8%). It should also be noted that as well as the fall in the value of the investments, the related investment income has also shown a sharp decline which has contributed to lower profits in 2010. Given the economic climate in 2010 these are probably reasonably good results and may justify the Chairman’s comments. It should be noted that the cost saving measures which have helped to mitigate the impact of the downturn could have some unwelcome effects should trading conditions improve; it may not be easy to re-hire employees and a lack of advertising may cause a loss of market share. 326 © Emile Woolf Publishing Limited Section 2: Answers to practice questions Statement of financial position: Perhaps the most obvious aspect of the statement of financial position is the fall in value ($8·5 million) of the non-current assets, most of which is accounted for by losses of $6 million and $1·6 million respectively on the properties and investments. Ironically, because these falls are reflected in equity, this has mitigated the fall in the return of the equity (from 15·2% to 13·1% underlying) and contributed to a perhaps unexpected improvement in asset turnover from 1·6 times to 1·7 times. Liquidity: Despite the downturn, Hardy’s liquidity ratios now seem at acceptable levels (though they should be compared to manufacturing industry norms) compared to the low ratios in 2009. The bank balance has improved by $1·1 million. This has been helped by a successful rights issue (this is in itself a sign of shareholder support and confidence in the future) raising $2 million and keeping customer’s credit period under control. Some of the proceeds of the rights issue appear to have been used to reduce the bank loan which is sensible as its financing costs have increased considerably in 2010. Looking at the movement on retained earnings (6,500 – 2,100 – 3,600) it can be seen that the company paid a dividend of $800,000 during 2010. Although this is only half the dividend per share paid in 2009, it may seem unwise given the losses and the need for the rights issue. A counter view is that the payment of the dividend may be seen as a sign of confidence of a future recovery. It should also be mentioned that the worst of the costs caused by the downturn (specifically the property and investments losses) are not cash costs and have therefore not affected liquidity. The increase in the inventory and work-in-progress holding period and the trade receivables collection period being almost unchanged appear to contradict the declining sales activity and should be investigated. Although there is insufficient information to calculate the trade payables credit period as there is no analysis of the cost of sales figures, it appears that Hardy has received extended credit which, unless it had been agreed with the suppliers, has the potential to lead to problems obtaining future supplies of goods on credit. Gearing: On the reported figures debt to equity shows a modest increase due to income statement losses and the reduction of the revaluation reserve, but this has been mitigated by the repayment of part of the loan and the rights issue. Conclusion: Although Hardy’s results have been adversely affected by the global economic situation, its underlying performance is not as bad as first impressions might suggest and supports the Chairman’s comments. The company still retains a relatively strong statement of financial position and liquidity position which will help significantly should market conditions improve. Indeed the impairment of property and investments may well reverse in future. It would be a useful exercise to compare Hardy’s performance during this difficult time to that of its competitors – it may well be that its 2010 results were relatively very good by comparison. Appendix: An important aspect of assessing the performance of Hardy for 2010 (especially in comparison with 2009) is to identify the impact that several ‘one off’ charges have had on the results of 2010. These charges are $1·3 million redundancy costs and a $1·5 million (6,000 – 4,500 previous surplus) property impairment, both included in cost of sales and a $1·6 million loss on the market value of investments, included in © Emile Woolf Publishing Limited 327 Paper F7: Financial Reporting (International) administrative expenses. Thus in calculating the ‘underlying’ figures for 2010 (below) the adjusted cost of sales is $22·7 million (25,500 – 1,300 – 1,500) and the administrative expenses are $3·3 million (4,900 – 1,600). These adjustments feed through to give an underlying gross profit of $6·8 million (4,000 + 1,300 + 1,500) and an underlying profit for the year of $2·3 million (–2,100 + 1,300 + 1,500 + 1,600). Note: it is not appropriate to revise Hardy’s equity (upwards) for the one-off losses when calculating equity based underlying figures, as the losses will be a continuing part of equity (unless they reverse) even if/when future earnings recover. Gross profit % (6,800/29,500 x 100) 2010 underlying as reported 23·1% 13·6% Profit (loss) for period % (2,300/29,500 x 100) 7·8% 2009 27·8% (7·1)% 9·7% 13·1% (11·9)% 15·2% Net asset (taken as equity) turnover (29,500/17,600) 1·7 times same 1·6 times Return on equity (2,300/17,600 x 100) Debt to equity (4,000/17,600) 22·7% same 21·7% Current ratio (6,200:3,400) 1·8:1 same 1·0:1 Quick ratio (4,000:3,400) 1·2:1 same 0·6:1 Receivables collection (in days) (2,200/29,500 x 365) 27 days same 28 days Inventory and work-in-progress holding period (2,200/22,700 x 365) 35 days 31 days 27 days Note: the figures for the calculation of the 2010 ‘underlying’ ratios have been given; those of 2010 ‘as reported’ and 2009 are based on equivalent figures from the summarised financial statements provided. Alternative ratios/calculations are acceptable, for example net asset turnover could be calculated using total assets less current liabilities. 328 © Emile Woolf Publishing Limited SECTION 3 Paper F7 (INT) Financial Reporting Q&A Mock exam questions This mock exam is the pilot paper produced for the new syllabus and is © The Association of Chartered Certified Accountants. ALL FIVE questions are compulsory and MUST be attempted 1 On 1 October 2011 Pumice acquired the following non-current investments: 80% of the equity share capital of Silverton at a cost of $13.6 million 50% of Silverton’s 10% loan notes at par 1.6 million equity shares in Amok at a cost of $6.25 each. The summarised draft statements of financial position of the three companies at 31 March 2012 are: Non-current assets Property, plant and equipment Investments Current assets Total assets Equity and liabilities Equity Equity shares of $1 each Retained earnings Non-current liabilities 8% loan note 10% loan note Current liabilities Total equity and liabilities © Emile Woolf Publishing Limited Pumice $000 Silverton $000 Amok $000 20,000 26,000 ‒‒‒‒‒‒‒ 46,000 15,000 ‒‒‒‒‒‒‒ 61,000 ‒‒‒‒‒‒‒ 8,500 nil ‒‒‒‒‒‒‒ 8,500 8,000 ‒‒‒‒‒‒‒ 16,500 ‒‒‒‒‒‒‒ 16,500 1,500 ‒‒‒‒‒‒‒ 18,000 11,000 ‒‒‒‒‒‒‒ 29,000 ‒‒‒‒‒‒‒ 10,000 37,000 ‒‒‒‒‒‒‒ 47,000 3,000 8,000 ‒‒‒‒‒‒‒ 11,000 4,000 20,000 ‒‒‒‒‒‒‒ 24,000 4,000 nil 10,000 ‒‒‒‒‒‒‒ 61,000 ‒‒‒‒‒‒‒ nil 2,000 3,500 ‒‒‒‒‒‒‒ 16,500 ‒‒‒‒‒‒‒ Nil Nil 5,000 ‒‒‒‒‒‒‒ 29,000 ‒‒‒‒‒‒‒ 329 Paper F7: Financial Reporting (International) The following information is relevant: (i) The fair values of Silverton’s assets were equal to their carrying amounts with the exception of land and plant. Silverton’s land had a fair value of $400,000 in excess of its carrying amount and plant had a fair value of $1.6 million in excess of its carrying amount. The plant had a remaining life of four years (straight-line depreciation) at the date of acquisition. (ii) In the post acquisition period Pumice sold goods to Silverton at a price of $6 million. These goods had cost Pumice $4 million. Half of these goods were still in the inventory of Silverton at 31 March 2012. Silverton had a balance of $1.5 million owing to Pumice at 31 March 2012 which agreed with Pumice’s records. (iii) The net profit after tax for the year ended 31 March 2012 was $2 million for Silverton and $8 million for Amok. Assume profits accrued evenly throughout the year. (iv) An impairment test at 31 March 2012 concluded that consolidated goodwill was impaired by $400,000 and the investment in Amok was impaired by $200,000. (v) No dividends were paid during the year by any of the companies. Required: (a) Discuss how the investments purchased by Pumice on 1 October 2011 should be treated in its consolidated financial statements. (5 marks) (b) Prepare the consolidated statement of financial position for Pumice as at 31 (20 marks) March 2012. (Total: 25 marks) 2 The following trial balance relates to Kala, a publicly listed company, at 31 March 2012: Land and buildings at cost (note (i)) Plant – at cost (note (i)) Investment properties – valuation at 1 April 2011 (note (i)) Purchases Operating expenses Loan interest paid Rental of leased plant (note (ii)) Dividends paid Inventory at 1 April 2011 Trade receivables Revenue Income from investment property Equity shares of $1 each fully paid Retained earnings at 1 April 2011 8% (actual and effective) loan note (note (iii)) Accumulated depreciation at 1 April 2011 – buildings – plant 330 $000 270,000 156,000 $000 90,000 78,200 15,500 2,000 22,000 15,000 37,800 53,200 278,400 4,500 150,000 119,500 50,000 60,000 26,000 © Emile Woolf Publishing Limited Section 3: Mock exam questions $000 Trade payables Deferred tax Bank The following notes are relevant: (i) $000 33,400 12,500 5,400 ‒‒‒‒‒‒‒‒ 739,700 ‒‒‒‒‒‒‒‒ ‒‒‒‒‒‒‒‒ 739,700 ‒‒‒‒‒‒‒‒ The land and buildings were purchased on 1 April 1990. The cost of the land was $70 million. No land and buildings have been purchased by Kala since that date. On 1 April 2011 Kala had its land and buildings professionally valued at $80 million and $175 million respectively. The directors wish to incorporate these values into the financial statements. The estimated life of the buildings was originally 50 years and the remaining life has not changed as a result of the valuation. Later, the valuers informed Kala that investment properties of the type Kala owned had increased in value by 7% in the year to 31 March 2012. Plant, other than leased plant (see below), is depreciated at 15% per annum using the reducing balance method. Depreciation of buildings and plant is charged to cost of sales. (ii) On 1 April 2011 Kala entered into a lease for an item of plant which had an estimated life of five years. The lease period is also five years with annual rentals of $22 million payable in advance from 1 April 2011. The plant is expected to have a nil residual value at the end of its life. If purchased this plant would have a cost of $92 million and be depreciated on a straight-line basis. The lessor includes a finance cost of 10% per annum when calculating annual rentals. (Note: you are not required to calculate the present value of the minimum lease payments.) (iii) The loan note was issued on 1 July 2011 with interest payable six monthly in arrears. (iv) The provision for income tax for the year to 31 March 2012 has been estimated at $28.3 million. The deferred tax provision at 31 March 2012 is to be adjusted to a credit balance of $14.1 million. (v) The inventory at 31 March 2012 was valued at $43.2 million. Required: Prepare for Kala: (a) An income statement for the year ended 31 March 2012. (b) A statement of changes in equity for the year ended 31 March 2012. (c) A statement of financial position as at 31 March 2012. (10 marks) (4 marks) (11 marks) (Total: 25 marks) 3 Reactive is a publicly listed company that assembles domestic electrical goods which it then sells to both wholesale and retail customers. Reactive’s management were disappointed in the company’s results for the year ended 31 March 2011. In an attempt to improve performance the following measures were taken early in the year ended 31 March 2012: © Emile Woolf Publishing Limited 331 Paper F7: Financial Reporting (International) a national advertising campaign was undertaken, rebates to all wholesale customers purchasing goods above set quantity levels were introduced, the assembly of certain lines ceased and was replaced by bought in completed products. This allowed Reactive to dispose of surplus plant. Reactive’s summarised financial statements for the year ended 31 March 2012 are set out below: Income statement Revenue (25% cash sales) Cost of sales Gross profit Operating expenses Profit on disposal of plant (note (i)) Finance charges Profit before tax Income tax expense Profit for the period Statement of financial position $ million 4,000 (3,450) ‒‒‒‒‒‒‒ 550 (370) ‒‒‒‒‒‒‒ 180 40 (20) ‒‒‒‒‒‒‒ 200 (50) ‒‒‒‒‒‒‒ 150 ‒‒‒‒‒‒‒ $ million Non-current assets Property, plant and equipment (note (i)) Current assets Inventory Trade receivables Bank 550 250 360 nil ‒‒‒‒‒‒‒ Total assets Equity and liabilities Equity shares of 25 cents each Retained earnings Non-current liabilities 8% loan notes Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 332 $ million 610 ‒‒‒‒‒‒‒ 1,160 ‒‒‒‒‒‒‒ 100 380 ‒‒‒‒‒‒‒ 480 200 10 430 40 ‒‒‒‒‒‒‒ 480 ‒‒‒‒‒‒‒ 1,160 ‒‒‒‒‒‒‒ © Emile Woolf Publishing Limited Section 3: Mock exam questions Below are ratios calculated for the year ended 31 March 2011. Return on year end capital employed (profit before interest and tax over total assets less current liabilities) 28.1% Net asset (equal to capital employed) turnover 4 times Gross profit margin 17% Net profit (before tax) margin 6.3% Current ratio 1.6:1 Closing inventory holding period 46 days Trade receivables’ collection period 45 days Trade payables’ payment period 55 days Dividend yield 3.75% Dividend cover 2 times Notes: (i) Reactive received $120 million from the sale of plant that had a carrying amount of $80 million at the date of its sale. (ii) the market price of Reactive’s shares throughout the year averaged $3.75 each. (iii) there were no issues or redemption of shares or loans during the year. (iv) dividends paid during the year ended 31 March 2012 amounted to $90 million, maintaining the same dividend paid in the year ended 31 March 2011. Required: (a) Calculate ratios for the year ended 31 March 2012 (showing your workings) for Reactive, equivalent to those provided above. (10 marks) (b) Analyse the financial performance and position of Reactive for the year ended 31 March 2012 compared to the previous year. (10 marks) (c) Explain in what ways your approach to performance appraisal would differ if you were asked to assess the performance of a not-for-profit organisation. (5 marks) (Total: 25 marks) 4 (a) Chapter 3 of the IASB’s Conceptual Framework states that in order to be useful for decision making purposes information must have certain characteristics. It goes on to describe both fundamental and enhancing qualitative characteristics of financial information. Fundamental qualitative characteristics are relevance and faithful representation. Enhancing qualitative characteristics include comparability. Required: Explain what is meant by relevance, faithful representation and comparability and how they make financial information useful. (9 marks) © Emile Woolf Publishing Limited 333 Paper F7: Financial reporting (International) (b) During the year ended 31 March 2012, Porto experienced the following transactions or events: (i) entered into a finance lease to rent an asset for substantially the whole of its useful economic life. (ii) a decision was made by the Board to change the company’s accounting policy from one of expensing the finance costs on building new retail outlets to one of capitalising such costs. (iii) the company’s income statement prepared using historical costs showed a loss from operating its hotels, but the company is aware that the increase in the value of its properties during the period far outweighed the operating loss. Required: Explain how you would treat the items in (i) to (iii) above in Porto’s financial statements and indicate on which of the Framework’s qualitative characteristics your treatment is based. (6 marks) (Total: 15 marks) 5 (a) IAS 11 Construction contracts deals with accounting requirements for construction contracts whose durations usually span at least two accounting periods. Required: Describe the issues of revenue and profit recognition relating to construction (4 marks) contracts. (b) Beetie is a construction company that prepares its financial statements to 31 March each year. During the year ended 31 March 2012 the company commenced two construction contracts that are expected to take more than one year to complete. The position of each contract at 31 March 2012 is as follows: Contract 1 2 $’000 $’000 Agreed contract price 5,500 1,200 Estimated total cost of contract at commencement 4,000 900 Estimated total cost at 31 March 2012 4,000 1,250 Agreed value of work completed at 31 March 2012 3,300 840 Progress billings invoiced and received at 31 March 2012 3,000 880 Contract costs incurred to 31 March 2012 3,900 720 The agreed value of the work completed at 31 March 2012 is considered to be equal to the revenue earned in the year ended 31 March 2012. The percentage of completion is calculated as the agreed value of work completed to the agreed contract price. Required: Calculate the amounts which should appear in the income statement and statement of financial position of Beetie at 31 March 2012 in respect of the above contracts. (6 marks) (Total: 10 marks) 334 © Emile Woolf Publishing Limited SECTION 4 Paper F7 (INT) Financial Reporting Q&A Answers to mock exam questions 1 (a) As the investment in shares represents 80% of Silverton’s equity, it is likely to give Pumice control of that company. Control is the ability to direct the operating and financial policies of an entity. This would make Silverton a subsidiary of Pumice and require Pumice to prepare group financial statements which would require the consolidation of the results of Silverton from the date of acquisition (1 October 2011). Consolidated financial statements are prepared on the basis that the group is a single economic entity. The investment of 50% ($1 million) of the 10% loan note in Silverton is effectively a loan from a parent to a subsidiary. On consolidation Pumice’s asset of the loan ($1 million) is cancelled out with $1 million of Silverton’s total loan note liability of $2 million. This would leave a net liability of $1 million in the consolidated statement of financial position. The investment in Amok of 1.6 million shares represents 40% of that company’s equity shares. This is generally regarded as not being sufficient to give Pumice control of Amok, but is likely to give it significant influence over Amok’s policy decisions (e.g. determining the level of dividends paid by Amok). Such investments are generally classified as associates and IAS 28 Investments in associates requires the investment to be included in the consolidated financial statements using equity accounting. (b) Consolidated statement of financial position of Pumice at 31 March 2012 $000 $000 Non-current assets: Plant, property and equipment (w (i)) 30,300 Goodwill (4,000 (w (ii)) – 400 impairment) 3,600 Investments – associate (w (iii)) 11,400 – other ((26,000 – 13,600 – 10,000 – 1,000 intra-group loan note)) 1,400 ‒‒‒‒‒‒ 46,700 © Emile Woolf Publishing Limited 335 Paper F7: Financial Reporting (International) Current assets (15,000 + 8,000 - 1,000 (w (iv)) – 1,500 current account) 20,500 ‒‒‒‒‒‒ 67,200 ‒‒‒‒‒‒ Total assets Equity and liabilities Equity attributable to equity holders of the parent Equity shares of $1 each Reserves: Retained earnings (w (v)) Non controlling interest (w (vi)) 2,560 Total equity 50,200 Non-current liabilities 8% Loan note 10% Loan note (2,000 – 1,000 intra-group) 10,000 37,640 ‒‒‒‒‒‒ 47,640 4,000 1,000 ‒‒‒‒‒‒ Current liabilities (10,000 + 3,500 – 1,500 current account) 12,000 ‒‒‒‒‒‒ 67,200 ‒‒‒‒‒‒ Workings in $’000 (i) Property, plant and equipment Pumice Silverton Fair value – land – plant 5,000 20,000 8,500 400 1,600 ‒‒‒‒‒‒ Additional depreciation (see below) 2,000 (200) ‒‒‒‒‒‒ 30,300 ‒‒‒‒‒‒ The fair value adjustment to plant will create additional depreciation of $400,000 per annum (1,600/4 years) and in the post acquisition period of six months this will be $200,000. (ii) Goodwill in Silverton: Investment at cost Less – equity shares of Silverton (3,000 × 80%) (2,400) – pre-acquisition reserves(7,000 × 80% (see below)) (5,600) – fair value adjustments (2,000 (w (i)) × 80%) (1,600) Goodwill on consolidation The pre-acquisition reserves are: At 31 March 2012 Post acquisition (2,000 × 6/12) 336 13,600 (9,600) ‒‒‒‒‒‒ 4,000 ‒‒‒‒‒‒ 8,000 (1,000) ‒‒‒‒‒‒ 7,000 ‒‒‒‒‒‒ © Emile Woolf Publishing Limited Section 4: Answers to mock exam questions (iii) Carrying amount of Amok at 31 March 2012 Cost (1,600 × $6.25) Share post acquisition profit (8,000 × 6/12 × 40%) 10,000 1,600 ‒‒‒‒‒‒ 11,600 (200) ‒‒‒‒‒‒ 11,400 ‒‒‒‒‒‒ Impairment loss per question (iv) The unrealised profit (URP) in inventory is calculated as: Intra-group sales are $6 million of which Pumice made a profit of $2 million. Half of these are still in inventory, thus there is an unrealised profit of $1 million. (v) Consolidated reserves: Pumice’s reserves Silverton’s post acquisition (((2,000 × 6/12) - 200 depreciation) × 80%) Amok’s post acquisition profits (8,000 × 6/12 × 40%) URP in inventory (see (iv)) Impairment of goodwill – Silverton – Amok (vi) 2 (a) Non controlling interest Equity shares of Silverton (3,000 × 20%) Retained earnings ((8,000 – 200 depreciation) × 20%) Fair value adjustments (2,000 × 20%) 37,000 640 1,600 (1,000) (400) (200) ‒‒‒‒‒‒ 37,640 ‒‒‒‒‒‒ 600 1,560 400 ‒‒‒‒‒‒ 2,560 ‒‒‒‒‒‒ Kala – Income statement – Year ended 31 March 2012 $000 Revenue Cost of sales (w (i)) Gross profit Operating expenses Investment income – property rental – valuation gain (90,000 × 7%) Finance costs – loan (w (ii)) – lease (w (iii)) Profit before tax Income tax expense (28,300 + (14,100 – 12,500)) Profit for the period © Emile Woolf Publishing Limited 4,500 6,300 ‒‒‒‒‒‒‒ (3,000) (7,000) ‒‒‒‒‒‒‒ $000 278,400 (115,700) ‒‒‒‒‒‒‒ 162,700 (15,500) ‒‒‒‒‒‒‒ 147,200 ‒‒‒‒‒‒‒ 10,800 (10,000) ‒‒‒‒‒‒‒ 148,000 (29,900) ‒‒‒‒‒‒‒ 118,100 ‒‒‒‒‒‒‒ 337 Paper F7: Financial Reporting (International) (b) Kala – Statement of changes in equity – Year ended 31 March 2012 Equity shares At 1 April 2011 Revaluation reserve Equity dividends paid At 31 March 2012 (c) $000 $000 $000 150,000 nil 119,500 269,500 118,100 118,100 45,000 ‒‒‒‒‒‒‒ 150,000 ‒‒‒‒‒‒‒ 45,000 (15,000) ‒‒‒‒‒‒‒‒ 222,600 ‒‒‒‒‒‒‒‒ ‒‒‒‒‒‒‒ 45,000 ‒‒‒‒‒‒‒ (15,000) ‒‒‒‒‒‒‒‒ 417,600 ‒‒‒‒‒‒‒‒ Kala – Statement of financial position as at 31 March 2012 Non-current assets Property, plant and equipment (w (iv)) Investment property (90,000 + 6,300) Current assets Inventory Trade receivables $’000 43,200 53,200 ‒‒‒‒‒‒‒ Total assets Equity and liabilities Equity (see (b) above) Equity shares of $1 each Reserves: Revaluation Retained earnings Non-current liabilities 8% loan note Deferred tax Lease obligation (w (iii)) Current liabilities Trade payables Accrued loan interest (w (ii)) Bank overdraft Lease obligation (w (iii)) – accrued interest – capital Current tax payable Total equity and liabilities 338 Total $000 Profit for period (see (a)) Revaluation of property (w (iv)) Retained earnings $’000 434,100 96,300 ‒‒‒‒‒‒‒ 530,400 96,400 ‒‒‒‒‒‒‒ 626,800 ‒‒‒‒‒‒‒ 150,000 45,000 222,600 ‒‒‒‒‒‒‒ 50,000 14,100 55,000 33,400 1,000 5,400 7,000 15,000 28,300 ‒‒‒‒‒‒‒ 267,600 ‒‒‒‒‒‒‒ 417,600 119,100 ‒‒‒‒‒‒‒ 90,100 ‒‒‒‒‒‒‒‒ 626,800 ‒‒‒‒‒‒‒‒ © Emile Woolf Publishing Limited Section 4: Answers to mock exam questions Workings in brackets in $’000 (i) Cost of sales: Opening inventory Purchases Depreciation (w (iv)) – buildings – plant: owned – plant: leased Closing inventory (ii) (iii) 37,800 78,200 5,000 19,500 18,400 (43,200) ‒‒‒‒‒‒‒ 115,700 ‒‒‒‒‒‒‒ The loan has been in issue for nine months. The total finance cost for this period will be $3 million (50,000 x 8% x 9/12). Kala has paid six months interest of $2 million, thus accrued interest of $1 million should be provided for. Finance lease: $000 Net obligation at inception of lease (92,000 – 22,000) 70,000 Accrued interest 10% (current liability) 7,000 Total outstanding at 31 March 2012 77,000 The second payment in the year to 31 March 2007 (made on 1 April 2012) of $22 million will be $7 million for the accrued interest (at 31 March 2012) and $15 million paid of the capital outstanding. Thus the amount outstanding as an obligation over one year is $55 million (77,000 – 22,000). (iv) Non-current assets/depreciation: Land and buildings: At the date of the revaluation the land and buildings have a carrying amount of $210 million (270,000 – 60,000). With a valuation of $255 million this gives a revaluation surplus (to reserves) of $45 million. The accumulated depreciation of $60 million represents 15 years at $4 million per annum (200,000/50 years) and means the remaining life at the date of the revaluation is 35 years. The amount of the revalued building is $175 million, thus depreciation for the year to 31 March 2012 will be $5 million (175,000/35 years). The carrying amount of the land and buildings at 31 March 2012 is $250 million (255,000 – 5,000). Plant: owned The carrying amount prior to the current year’s depreciation is $130 million (156,000 – 26,000). Depreciation at 15% on the reducing balance basis gives an annual charge of $19.5 million. This gives a carrying amount at 31 March 2012 of $110.5 million (130,000 – 19,500). Plant: leased The fair value of the leased plant is $92 million. Depreciation on a straightline basis over five years would give a depreciation charge of $18.4 million and a carrying amount of $73.6 million. © Emile Woolf Publishing Limited 339 Paper F7: Financial Reporting (International) Summarising the carrying amounts: Land and buildings Plant (110,500 + 73,600) Property, plant and equipment 3 (a) 250,000 184,100 ‒‒‒‒‒‒‒‒ 434,100 ‒‒‒‒‒‒‒‒ Note: figures in the calculations are in $million Return on year end capital employed 32.3 % 220/(1,160 – 480) × 100 Net asset turnover 5.9 times 4,000/680 Gross profit margin 13.8 % (550/4,000) × 100 Net profit (before tax) margin 5.0 % (200/4,000) × 100 Current ratio 1.3 :1 610:480 Closing inventory holding period 26 days 250/3,450 × 365 Trade receivables’ collection period 44 days 360/(4,000 – 1,000) × 365 Trade payables’ payment period (based on cost of sales) 45 days (430/3,450) × 365 Dividend yield 6.0% (see below) Dividend cover 1.67 times 150/90 The dividend per share is 22.5 cents (90,000/(100,000 × 4 i.e. 25 cents shares). This is a yield of 6.0% on a share price of $3.75. (b) Analysis of the comparative financial performance and position of Reactive for the year ended 31 March 2012 Profitability The measures taken by management appear to have been successful as the overall ROCE (considered as a primary measure of performance) has improved by 15% (32.3 -28.1)/28.1). Looking in more detail at the composition of the ROCE, the reason for the improved profitability is due to increased efficiency in the use of the company’s assets (asset turnover), increasing from 4 to 5.9 times (an improvement of 48%). The improvement in the asset turnover has been offset by lower profit margins at both the gross and net level. On the surface, this performance appears to be due both to the company’s strategy of offering rebates to wholesale customers if they achieve a set level of orders and also the beneficial impact on sales revenue of the advertising campaign. The rebate would explain the lower gross profit margin, and the cost of the advertising has reduced the net profit margin (presumably management expected an increase in sales volume as a compensating factor). The decision to buy complete products rather than assemble them in house has enabled the disposal of some plant which has reduced the asset base. Thus possible increased sales and a lower asset base are the cause of the improvement in the asset turnover which in turn, as stated above, is responsible for the improvement in the ROCE. The effect of the disposal needs careful consideration. The profit (before tax) includes a profit of $40 million from the disposal. As this is a ‘one-off’ profit, recalculating the ROCE without its inclusion gives a figure of only 23.7% 340 © Emile Woolf Publishing Limited Section 4: Answers to mock exam questions (180m/(1,160 - 480m + 80m (the 80m is the carrying amount of plant)) and the fall in the net profit percentage (before tax) would be down even more to only 4.0% (160m/4,000m). On this basis the current year performance is worse than that of the previous year and the reported figures tend to flatter the company’s underlying performance. Liquidity The company’s liquidity position has deteriorated during the period. An acceptable current ratio of 1.6 has fallen to a worrying 1.3 (1.5 is usually considered as a safe minimum). With the trade receivables period at virtually a constant (45/44 days), the change in liquidity appears to be due to the levels of inventory and trade payables. These give a contradictory picture. The closing inventory holding period has decreased markedly (from 46 to 26 days) indicating more efficient inventory holding. This is perhaps due to short lead times when ordering bought in products. The change in this ratio has reduced the current ratio, however the trade payables payment period has decreased from 55 to 45 days which has increased the current ratio. This may be due to different terms offered by suppliers of bought in products. Importantly, the effect of the plant disposal has generated a cash inflow of $120 million, and without this the company’s liquidity would look far worse. Investment ratios The current year’s dividend yield of 6.0% looks impressive when compared with that of the previous year’s yield of 3.75%, but as the company has maintained the same dividend (and dividend per share as there is no change in share capital) , the ‘improvement’ in the yield is due to a falling share price. Last year the share price must have been $6.00 to give a yield of 3.75% on a dividend per share of 22.5 cents. It is worth noting that maintaining the dividend at $90 million from profits of $150 million gives a cover of only 1.67 times whereas on the same dividend last year the cover was 2 times (meaning last year’s profit (after tax) was $180 million). Conclusion Although superficially the company’s profitability seems to have improved as a result of the directors’ actions at the start of the current year, much, if not all, of the apparent improvement is due to the change in supply policy and the consequent beneficial effects of the disposal of plant. The company’s liquidity is now below acceptable levels and would have been even worse had the disposal not occurred. It appears that investors have understood the underlying deterioration in performance as there has been a marked fall in the company’s share price. (c) It is generally assumed that the objective of stock market listed companies is to maximise the wealth of their shareholders. This in turn places an emphasis on profitability and other factors that influence a company’s share price. It is true that some companies have other (secondary) aims such as only engaging in ethical activities (e.g. not producing armaments) or have strong environmental considerations. Clearly by definition not-for-profit organisations are not motivated by the need to produce profits for shareholders, but that does not mean that they should be inefficient. Many areas of assessment of profit oriented companies are perfectly valid for not-for-profit organisations; efficient inventory © Emile Woolf Publishing Limited 341 Paper F7: Financial Reporting (International) holdings, tight budgetary constraints, use of key performance indicators, prevention of fraud etc. There are a great variety of not-for-profit organisations; e.g. public sector health, education, policing and charities. It is difficult to be specific about how to assess the performance of a not-for-profit organisation without knowing what type of organisation it is. In general terms an assessment of performance must be made in the light of the stated objectives of the organisation. Thus for example in a public health service one could look at measures such as treatment waiting times, increasing life expectancy etc, and although such organisations don’t have a profit motive requiring efficient operation, they should nonetheless be accountable for the resources they use. Techniques such as ‘value for money’ and the three Es (economy, efficiency and effectiveness) have been developed and can help to assess the performance of such organisations. 4 (a) Relevance Information must be relevant to the decision-making needs of users. Information is relevant if it can be used for predictive and/or confirmatory purposes. • It has predictive value if it helps users to predict what might happen in the future. • It has confirmatory value if it helps users to confirm the assessments and predictions they have made in the past. The relevance of information is affected by its materiality. • Information is material if omitting it or misstating it could influence decisions that users make on the basis of financial information about a specific reporting entity. • Materiality is an entity-specific aspect of relevance based on the nature or magnitude (or both) of the items to which the information relates in the context of an individual entity’s financial report. Therefore, it is not possible for the IASB to specify a uniform quantitative threshold for materiality or predetermine what could be material in a particular situation. Faithful representation Financial reports represent economic phenomena (economic resources, claims against the reporting entity and the effects of transactions and other events and conditions that change those resources and claims) by depicting them in words and numbers. To be useful, financial information must not only represent relevant phenomena, but it must also faithfully represent the phenomena that it purports to represent. A perfectly faithful representation would have three characteristics. It would be: 342 • complete – the depiction includes all information necessary for a user to understand the phenomenon being depicted, including all necessary descriptions and explanations. • neutral – the depiction is without bias in the selection or presentation of financial information; and © Emile Woolf Publishing Limited Section 4: Answers to mock exam questions • free from error – where there are no errors or omissions in the description of the phenomenon, and the process used to produce the reported information has been selected and applied with no errors in the process. Comparability is the qualitative characteristic that enables users to identify and understand similarities in, and differences among, items Information about a reporting entity is more useful if it can be compared with similar information about other entities and with similar information about the same entity for another period or another date. Consistency is related to comparability but is not the same. Consistency refers to the use of the same methods for the same items, either from period to period within a reporting entity or in a single period across entities. Consistency helps to achieve the goal of comparability. (b) (i) This item involves the characteristic of faithful representation, specifically reporting the substance of transactions. As the lease agreement is for substantially the whole of the asset’s useful economic life, Porto will experience the same risks and rewards as if it owned the asset. Although the legal form of this transaction is a rental, its substance is the equivalent to acquiring the asset and raising a loan. Thus, in order for the financial statements to be provide a faithful representation (and comparable to those where an asset is bought from the proceeds of a loan), the transaction should be shown as an asset on Porto’s statement of financial position with a corresponding liability for the future lease rental payments. The income statement should be charged with depreciation on the asset and a finance charge on the ‘loan’. (ii) This item involves the characteristic of comparability. Changes in accounting policies should generally be avoided in order to preserve comparability. Presumably the directors have good reason to be believe the new policy presents a more reliable and relevant view. In order to minimise the adverse effect a change in accounting policy has on comparability, the financial statements (including the corresponding amounts) should be prepared on the basis that the new policy had always been in place (retrospective application). Thus the assets (retail outlets) should include the previously expensed finance costs and income statements will no longer show a finance cost (in relation to these assets whilst under construction). Any finance costs relating to periods prior to the policy change (i.e. for two or more years ago) should be adjusted for by increasing retained earnings brought forward in the statement of changes in equity. (iii) This item involves the characteristic of relevance. This situation questions whether historical cost accounting is more relevant to users than current value information. Porto’s current method of reporting these events using purely historical cost based information (i.e. showing an operating loss, but not reporting the increases in property values) is perfectly acceptable. However, the company could choose to revalue its hotel properties (which would subject it to other requirements). This option would still report an operating loss (probably an even larger loss than under historical cost if there are increased depreciation charges on the hotels), but the increases in value would also be reported (in equity) arguably giving a more complete picture of performance. © Emile Woolf Publishing Limited 343 Paper F7: Financial Reporting (International) 5 (a) The correct timing of when revenue (and profit) should be recognised is an important aspect of an income statement showing a faithful presentation. It is generally accepted that only realised profits should be included in the income statement. For most types of supply and sale of goods it is generally understood that a profit is realised when the goods have been manufactured (or obtained) by the supplier and satisfactorily delivered to the customer. The issue with construction contracts is that the process of completing the project takes a relatively long time and, in particular, will spread across at least one accounting period-end. If such contracts are treated like most sales of goods, it would mean that revenue and profit would not be recognised until the contract is completed (the “completed contracts” basis). This is often described as following the prudence concept. The problem with this approach is that it may not show a faithful presentation as all the profit on a contract is included in the period of completion, whereas in reality (a faithful representation), it is being earned, but not reported, throughout the duration of the contract. IAS 11 remedies this by recognising profit on uncompleted contracts in proportion to some measure of the percentage of completion applied to the estimated total contract profit. This is sometimes said to reflect the accruals concept, but it should only be applied where the outcome of the contract is reasonably foreseeable. In the event that a loss on a contract is foreseen, the whole of the loss must be recognised immediately, thereby ensuring the continuing application of prudence. (b) Beetie Income statement Revenue recognised Contract 1 Contract 2 Total $’000 $’000 $’000 3,300 840 4,140 (2,400) (720) (3,120) (170) ‒‒‒‒‒‒ (50) ‒‒‒‒‒‒ (170) ‒‒‒‒‒‒ 850 ‒‒‒‒‒‒ Contract expenses recognised (balancing figure contract 1) Expected loss recognised (contract 2) Attributable profit/(loss) (see working) ‒‒‒‒‒‒ 900 ‒‒‒‒‒‒ Statement of financial position Contact costs incurred 3,900 Recognised profit/(losses) 900 ‒‒‒‒‒ 4,800 (50) ‒‒‒‒‒‒ 670 850 ‒‒‒‒‒‒ 5,470 (3,000) ‒‒‒‒‒‒ 1,800 (880) ‒‒‒‒‒‒ (3,880) ‒‒‒‒‒‒ 1,800 (210) (210) Progress billings Amounts due from customers Amounts due to customers 344 720 4,620 © Emile Woolf Publishing Limited Section 4: Answers to mock exam questions Workings (in $’000) Estimated total profit: Agreed contract price Estimated contract cost Estimated total profit/(loss) 5,500 1,200 (4,000) ‒‒‒‒‒‒ 1,500 ‒‒‒‒‒‒ (1,250) ‒‒‒‒‒‒ (50) ‒‒‒‒‒‒ Percentage complete: Agreed value of work completed at 31 March 2012 Contract price Percentage complete at 31 March 2012 (3,300/5,500 × 100) Profit to 31 March 2012 (60% × 1,500) 3,300 5,500 60% 900 At 31 March 2012 the increase in the expected total costs of contract 2 mean that a loss of $50,000 is expected on this contract. In these circumstances, regardless of the percentage completed, the whole of this loss should be recognised immediately. © Emile Woolf Publishing Limited 345 Paper F7: Financial Reporting (International) 346 © Emile Woolf Publishing Limited 2013 ACCA F7 (INT) Financial Reporting A well-written and focused text, which will prepare you for the examination and which does not contain unnecessary information. • Comprehensive but concise coverage of the examination syllabus • • • • Simple English with clear and attractive layout A large bank of practice questions which test knowledge and application for each chapter A full index The text is written by Emile Woolf International’s Publishing division (EWIP). The only publishing company focused purely on the ACCA examinations. • EWIP’s highly experienced tutors / writers produce study materials for the professional examinations of the ACCA. • EWIP’s books are reliable and up-to-date with a user-friendly style and focused on what students need to know to pass the ACCA examinations. • EWIP’s association with the world renowned Emile Woolf Colleges means it has incorporated student feedback from around the world including China, Russia and the UK. emilewoolfpublishing.com