Accounting Diagnostic Exam: Petty Cash, Bank Reconciliation, A/R

advertisement

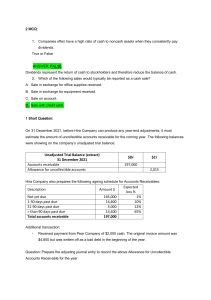

DIAGNOSTIC EXAM - DAY 1 ( JULY 18, 2022) Petty Cash Fund #1 1. The petty cash fund was established on May 2, 2022, in the amount of P10,000. 2. Expenditures from the fund by the custodian as of May 31, 2022, were evidenced by approved petty cash vouchers for the following: Various office supplies P3,920 IOU from employees 1,200 Shipping charges 2,298 Miscellaneous expense 1,526 On May 31, 2022, the petty cash fund was replenished and increased to P12,000; currency and coins in the fund at that time totaled P756. Disbursements Receipts Balance Balance, May 1, 2022 Deposits P1,120,000 P350,760 Note payment direct from customer (interest of PI,200) 37,200 Checks cleared during May P1,246,000 Bank service charges Balance, May 31, 2022 1,080 Balance, May 31, 2022 (hindi ata to naibigay ni sir?) Disbursements 260,880 Receipts ABX, Inc.'s Cash Account Balance, May 1, 2022 P 354,000 Deposits during May 2022 Checks written during May 2022 Balance 1,240,000 1,273,400 (dito siya nakalagay sabi ni G) (dito siya nakalagay sabi ni G) Deposits in transit are determined to be P 120,000, and checks outstanding at May 31 total P34,000. Cash on hand (besides petty cash) at May 31, 2022, is P9,840. 1. What is the amount of petty cash shortage? A. P2300 C. P300 B. P11,244 D. PO 2. The journal entry to record the replenishment of, and increase in the petty cash fund includes a credit to A. Cash of P10,944 B. Cash ofP11,244 C. Petty cash fund of P 10,944 D. Petty cash fund of P 11,244 3. What amount of cash should be reported in the May 31, 2018, statement of financial position? A. P368,720 B. P356,720 C. P368,420 D.P358,880 SOLUTION: SOLUTION 1-1 1. Coins and currency P 756 Fund disbursements (P3,920 + PI,200 + 2,298 + PI,526) Petty cash accounted Custodian's accountability Petty cash shortage Answer: C 8,944 9,700 10 000 P 300 2. Petty cash fund 2,000 Office supplies Accounts receivable-employees Shipping expense Miscellaneous expense Cash short/over Cash Answer: B 3,920 1,200 2,298 1,526 300 11,244 3. Book P320,600 Unadjusted balances Deposit in transit Cash on hand Outstanding checks Note collected by bank Bank service charges Adjusted Balances Adjusted cash balance (P356,720 + P12,OOO) Bank P260,880 120,000 9,840 (34,000) 37,200 (1,080)_________________________________ 356.720 P368,720 356.720 Answer: A Bank Reconciliation #1 A company is reconciling its bank statement with internal records. The cash balance per the company’s books is P45,000. There are P5,000 of bank charges not yet recorded, P7,500 of outstanding checks, P12,500 of deposits in transit, and P15,000 of bank credits and collections not yet taken up in the company’s books. Requirement: What is the cash balance per bank? SOLUTION: Balance per books Bank charges Outstanding checks Deposits in transit Bank credits and collections Balance per bank 45,000 (5,000) 7,500 (12,500) 15,000 50,000 Bank Reconciliation #2 E company was organized on January 2, 2022. The following items are from the company’s trial balance on December 31, 2022. Ordinary Share capital 1,500,000 Share premium 150,000 Merchandise inventory 69,000 Land 1,000,000 Building 1,400,000 Furnitures & Fixtures 367,000 Account Receivable 165,400 Account Payable 389,650 Notes Payable – bank 500,000 Sales 6,235,200 Operating Expense (including depreciation of 400,000) 892,000 Additional Information is as follows: Deposits in Transit, Dec 31 384,660 Service Charge for December 2,000 Outstanding checks for Dec 31 475,000 E company’s mark up on sales 30% 892,000 Questions: 1. 2. 3. 4. 5. 6. What is the total collection from sales? What is the total payment for merchandise purchases? What is the total cash receipts per books? What is the total cash disbursement per book? What is the cash balance per book on Dec. 31? What is the adjusted cash balance on Dec. 31? 7,416,140 803,660 801,660 SOLUTION: 1) Sales 6,235,200 Less: Account Receivable (165,400) Total collection from sales 6,069,800 2) Sales 6,235,200 Sales Times (x) mark up 30%____ _______________________________________(1,870,560)____ 1,870,560 6,235,200 4,364,640 Merchandise Inventory _____________69,000_______ 4,433,640 Account Payable_________________________(389,650)_____ 2) Total payment for merchandise purchases 4,043,990 3) Total collection from sales 6,069,800 Ordinary share capital 1,500,000 Share premium 150,000 Notes Payable – bank 500,000 3) Total cash receipts per books 8,219,800 Account Receivable #1 The following information pertains to B inc. ● ● Sales made during 2023 Cash 100,000 Credit 320,000 Account Receivable classified by age on Dec 31, 2023. Under 30 days 30 – 36 days 61 – 120 days Over 120 days ● – – – – 40,000 20,000 10,000 5,000 Allowance for Doubtful account had a 400 credit balance before adjusted on Dec. 31, 2023. Prepare adjustment on Dec. 31, 2023. Under the following assumptions: 1. The entity uses income statement approach. Assuming the uncollected rate is 1% of credit sales. 320,000 x 1% = 3,200 Doubtful Expense Allowance for doubtful account 3,200 3,200 2. Assume the uncollectible rate is 0.75 of total sales Cash 100,000 Credit 320,000_ 420,000 x 75%____ 3,150 Doubtful Expense Allowance for doubtful account 3,150 3. Assume the entity uses the balance sheet approach Under 30 days – 1% 30 – 60 days – 3% 61 – 120 days – 10% Over 120 days – 30% Prepare Journal Entry. 3,150 Doubtful Expense Allowance for doubtful account 3,100 3,100 Account Receivable #2 An analysis and aging of accounts receivable of G company at December 31 revealed the following: Accounts receivable 900,000 Allowance for uncollectible accounts, per books 50,000 Amounts deemed uncollectible 64,000 The net realizable value of the accounts receivable at December 31 should be SOLUTION: Accounts receivable 900,000 Amounts deemed uncollectible (64,000) 836,000 Account Receivable #3 Purchases of merchandise - 900,000 Inventory, June 30, 2021 - 150,000 Goods were sold at 50% above cost 75% of sales were on account Estimated bad debts 1% of credit sales Collections from charge customers - 630,000 Allowance for bad debts June 30, 2021 after write-off of uncollectible accounts - 7,807.50 1. Compute Outstanding accounts receivable on June 30, 2021 2. Compute Sales on account? SOLUTION: Purchases of merchandise Inventory, June 30, 2021 900,000 (150,000) 750,000 Inventory, June 30, 2021 x 150,000 1,125,000 75% of sales were on account x 75% Sales on account 843,750 Estimated bad debts 1% of credit sales x .99 835,312.50 Collections from charge customers (630,000) 205,312.50 Allowance for bad debts June 30, 2021 after write-off of uncollectible accounts 7,807.50 Accounts receivable 213,120 Account Receivable #4 In your examination of the books of account of E Company for the year 2021 you have noted that the entire past due account of the company amounting to 400,000 should be set up as allowance for doubtful accounts. On this past due account, management improper recommendation for the company legal counsel has decided to write-off an account with balances totaling 80,000. As of December 31, 2020 the balance of allowance for doubtful accounts was 250,000. Compute the additional provision required for the company’s doubtful account. SOLUTION: Beginning ADA ADA, December 31, 2020 Doubtful account 400,000 (250,000) 150,000 Account Receivable #5 The following T account summarizing the transactions affecting the accounts receivable of C Company for 2016. (not complete accounting titles; basta may kulang kulang na words) ACCOUNTS RECEIVABLE DEBIT Jan. 1 balance after deducting Charge sales Charge for consignment Shareholder’s subscriptions Written off but recovered Cash paid to customer Deposit on contract Claims against common carrier for damages IOUs from employees Cash advance to affiliates Advances to a supplier 1. Compute current assets 2. Compute Non-current assets 3. Compute Adjusted Accounts receivable SOLUTION: AR CA 59,500 NCA CREDIT 53,000 625,000 5,000 300,000 1,000 2,500 15,000 1,500 500 10,000 5,000 Collections from customers including over payment of 5,000 Writeoff Merchandise returns Allowances to customer for shipping damages Collections on carrier claims Collection on subscriptions 620,000 3,500 2,500 1,500 1,000 15,000 Deposit Claims IOU Affiliate Suppliers 15,000 500 500 10,000 5,000______________ 1) 65,500 2) 25,000 ACCOUNT RECEIVABLE (T-ACC) DEBIT Beg. Bal Sales recovered CREDIT 56,000 625,000 1,000 682,000 3) Adjusted AR 59,500 Collections (620,000-5,000) writeoff returns shipping 615,000 3,500 2,500 1,500 622,500