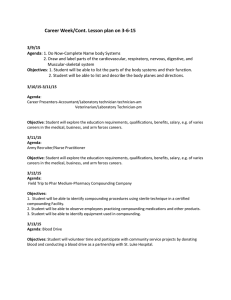

THE TIME VALUE OF MONEY Chapter 3 WHAT COMPANIES DO Transports of delight? Meyrick and Associates, a consulting group, together with EconSearch and Steer Davies Gleave, presented a report to the Victorian Government on a range of transport options for the East–West Link. The report summarised extensive analyses undertaken to evaluate the benefits and costs of developing the new transport infrastructure options, and described a series of present values that had been determined. The present values were determined by: 1. estimating revenue per day for the base case and for each option 2. estimating revenue per year for each option 3. discounting the future cash flows 4. estimating the yearly increase of revenue for each option 5. calculating the difference between the base case and each option. THE TIME VALUE OF MONEY Financial managers compare the marginal benefits and marginal costs of investment projects. Projects usually have a long-term horizon: the timing of benefits and costs matters. The time value of money: a dollar received today is worth more than a dollar received in the future. FUTURE VALUE Future value: the value of an investment made today measured at a specific future date using compound interest. FVn = PV×(1+r)n Future value depends on: Interest rate Number of periods Compounding interval PRESENT VALUE Present value: the value today of a cash flow to be received at a specific date in the future, assuming an opportunity to earn interest at a specified rate. FVn PV 1 r n PV FVn (1 r ) n FUTURE VALUE OF CASH FLOW STREAMS Mixed stream • A series of unequal cash flows reflecting no particular pattern. Annuity • A stream of equal periodic cash flows. n FV CFt 1 r t1 nt (1 r ) n 1 FV PMT $5750.74 r (1 r ) n 1 FV PMT 1 r $6153.29 r PRESENT VALUE OF CASH FLOW STREAMS • Mixed streams • Annuities • Perpetuities: cash flow streams that continue forever n PV CFt t1 1 1 r t PRESENT VALUE OF A PERPETUITY • For a constant stream of cash flows that continues forever 1 PV PMT t ( 1 r ) t 1 1 PMT r PMT r PRESENT VALUE OF A GROWING PERPETUITY CF1 PV0 rg 0 1 $1000 $1000(1+0.02)1 $1000 $1020 2 $1000(1+0.02)2 $1040.4 rg 3 4 $1000(1+0.02)3 … $1061.2 Growing perpetuity CF1 = $1000 r = 7% per year g = 2% per year $1000 PV0 $20 000 0.07 0.02 COMPOUNDING MORE FREQUENTLY THAN ANNUALLY • m compounding periods r FVn PV 1 m • Continuous compounding mn FVn PV e r n • The more frequent the compound period, the larger the FV! COMPOUNDING MORE FREQUENTLY THAN ANNUALLY FV at end of two years of $125 000 at 5% interest • Semiannual compounding: 0.05 FV2 $125 000 1 2 22 $137 976.61 • Quarterly compounding: 0.05 FV2 $125 000 1 4 42 $138 060.76 • Continuous compounding: FV2 $125 000 e0.052 $138 146.365 STATED VERSUS EFFECTIVE ANNUAL INTEREST RATES Stated annual rate • The contractual annual rate of interest charged by a lender or promised by a borrower. Effective annual rate • The annual rate of interest actually paid or earned, reflecting the impact of compounding frequency. r EAR 1 m m 1 STATED VERSUS EFFECTIVE ANNUAL INTEREST RATES Average annual percentage rate (AAPR) Annual percentage yield (APY) • The stated annual rate calculated by multiplying the periodic rate by the number of periods in one year. • The annual rate of interest actually paid or earned, reflecting the impact of compounding frequency. The same as the effective annual rate.