Global Business Context: Marketplaces, Trade, and Management

advertisement

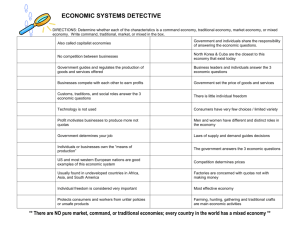

Chapter 2: The Global Context of Business The global market has evolved into major world marketplaces, held together by trade agreements and alliances. A number of factors affect how countries and businesses respond to the international environment. Further, managers and entrepreneurs find themselves challenged by a number of factors that influence their international involvement. The Contemporary Global Economy Globalization means that more and more firms are engaging in international business. As the world becomes more globalized, the number of imports—goods that are produced and grown abroad and shipped into Canada and exports—goods that are produced or grown in Canada but shipped abroad will continue to increase. International trade is not a new concept, yet it is increasingly becoming central to the fortunes of most nations and their businesses. A. The Major World Marketplaces— Distinctions are made between countries based on percapita income. The World Bank classifies countries into high-income, upper middleincome, lower middle-income, and low-income. 1. Distinctions based on wealth—The World Bank uses per capita income to make distinctions between four kinds of countries: high-income, upper middle income, lower middle income, and low income. 2. Geographic clusters—The contemporary world economy revolves around three major marketplaces that represent the home to most of the world’s largest economies, biggest multinational corporations, most influential financial markets, and highestincome consumers. a. North America—This is the single largest marketplace and enjoys the most stable and sound economy. b. Europe—Has evolved into a unified marketplace through the European Union. c. Pacific Asia—The Pacific Asia economies grew rapidly in the 1970s and 1980 and are now an important force in the world economy and a major source of competition for North American firms. B. Emerging Markets: BRICS and Beyond—Five countries (Brazil, Russia, India, China, and South Africa) are increasingly important in world trade. Each of these countries has somewhat different strengths. C. Forms of Competitive Advantage—No country can produce all the goods and services that its people need, so countries tend to export those things that they can produce better or less expensively than other countries. 1. Absolute advantage—Exists when one country can produce something more cheaply than any other country. 2. Comparative advantage—Exists when a country can produce certain goods more efficiently or better than other goods. 3. National competitive advantage—This idea has become a widely accepted model of why nations engage in international trade (derives from four conditions: factors of Copyright © 2017 Pearson Canada Inc. production, demand conditions, related and supporting industries, and strategies, structures, and rivalries). International competitiveness refers to the ability of a country to generate more wealth than its competitors in world markets. D. The Balance of Trade—A country’s balance of trade is the difference between in value between its total exports and its total imports. A favourable balance of trade means that a country exports more than it imports, and an unfavourable balance of trade means that a country imports more than it exports. Canada's overall trade balance is generally favourable (very favourable with the U.S., but unfavourable with its other major trading partners). E. The Balance of Payments—A country’s balance of payments is the difference between money flowing into the country and money flowing out of the country as a result of trade and other transactions. Canada has had an unfavourable balance of payments for many years. F. Exchange Rates—An exchange rate is the rate at which a currency of one nation can be exchanged for that of another. The effect of fluctuations in the exchange rate is discussed in terms of balance of trade. The significance of exchange rates is also discussed in terms of how fluctuations affect demand for companies that conduct international operations. 1. Exchange rates and competition—Companies that conduct international operations must watch exchange-rate fluctuations very carefully because these changes can affect foreign demand for their products. The exchange rate for the Canadian dollar has fluctuated greatly during the last decade and this has influenced exports to, and imports from, the U.S. International Business Management No matter where it is located, the success of a business firm depends largely on how well it is managed. A. Going International—Several factors enter into the decision to conduct business internationally (see Figure 5.3) 1. Gauging international demand—Products that are vital in one country may not be needed in another country, so careful assessment of demand is necessary. 2. Adapting to customer needs—A firm must decide whether it needs to adapt its product or service offering for sale in a foreign country. An example is given. B. Levels of Involvement in International Business—Several different levels are possible. 1. Exporters and importers—An exporter is a firm that makes products in one country and then distributes and sells them in others. An importer buys products in foreign markets and then imports them for resale in its home country. Almost 40 percent of all goods made in Canada are exported. The benefits of exporting are discussed, as are the drawbacks, and the need for improvement in Canada's export record. 2. International firms—An international firm conducts a significant portion of its business abroad. Copyright © 2017 Pearson Canada Inc. 3. Multinational firms—These firms controls assets, factories, mines, sales offices and affiliates in two or more countries. Their impact on world markets is described in terms of revenues generated, profits, assets, and as employers. C. International Organizational Structures—Different levels of involvement in international business require different kinds of organizational structures. 1. Independent agents—A foreign individual or organization who agrees to represent an exporter’s interests in foreign markets. 2. Licensing arrangements—An owner of a process or product allows another businesses to produce, distribute, or market the product or process for a fee or royalty. Several examples are given. 3. Branch offices—Locations that an exporting firm establishes in a foreign country in order to sell its products more effectively (i.e., more direct control, better reputation in foreign country, etc.). 4. Strategic alliances—Enterprises in which two or more persons or companies temporarily join forces to undertake a particular project (also known as joint ventures). The increase of the use of strategic alliances indicates the benefits associated with them (e.g., increased control, easing the way into new markets, etc.). 5. Foreign direct investment—Buying or establishing tangible assets in another country. The concerns about foreign direct investment in Canada are discussed. Barriers to International Trade A. Social and Cultural Differences—Lack of understanding cultural differences will hinder and may prevent a company's success in international business activities. A variety of differences are discussed (e.g., language, physical stature, average age of population, shopping habits, etc.). B. Economic Differences—Although cultural differences are often subtle, economic differences can be fairly pronounced. Different economies (market economies vs. planned economies) require different strategies for success. Planned economies require establishing a close relationship with the government. In mixed economies firms must be aware of when and to what extent government is involved. C. Legal and Political Differences—These include tariffs and quotas, local-content laws, and business-practice laws. 1. Quotas, tariffs, and subsidies—A quota restricts the number of units of certain products that can be imported into a country. An embargo is a government order forbidding the importation of any units of certain products into a country. A tariff is a tax charged on each unit of certain products that are imported. A subsidy is a government payment to help a domestic business compete with foreign firms. The pros and cons of protectionism—protecting domestic businesses at the expense of free market competition—are also addressed. 2. Local-content laws—These require that products sold in a particular country be at least partly made in that country. 3. Cartels and dumping—A cartel is an association of producers whose purpose is to control the supply and price of a commodity (OPEC is a prominent example). Dumping Copyright © 2017 Pearson Canada Inc. refers to the practice of selling a product abroad for less than the comparable price charged in the home country. Overcoming Barriers to International Trade World trade is flourishing despite the barriers because both organizations and free-trade treaties exist to promote trade. A. The General Agreement on Tariffs and Trade (GATT)—Its goal is to reduce or eliminate trade barriers such as tariffs and quotas. B. World Trade Organization (WTO)—Its goal is to promote international trade. C. The European Union—The EU includes 27 countries in western Europe that have eliminated quotas and set uniform tariff levels on products that are imported and exported within their group. D. The North American Free Trade Agreement (NAFTA, currently CUSMA)—This agreement took effect in 1994; its goal is to create a free trade area for all of North America (including Mexico). E. Other Free Trade Agreements—Mercosur includes Argentina, Brazil, Uruguay, and Paraguay. Several other regional trade associations have been formed; these include the ASEAN Free Trade Area, the Asia-Pacific Economic Cooperation, The Economic Community of Central African States, and the Gulf Cooperation Council (several countries in the Mideast). Copyright © 2017 Pearson Canada Inc.