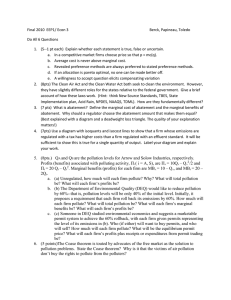

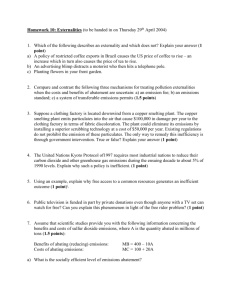

Markets and the Environment: Environmental Economics Textbook

advertisement