Investment Performance: Arithmetic vs. Time-Weighted Returns

advertisement

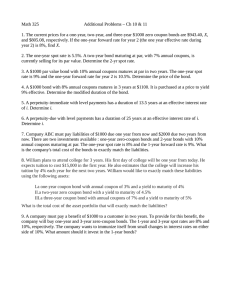

1. Suppose that the monthly return for two bond managers is as follows:

Month Manager I Manager II

1

9%

25%

2

13%

13%

3

22%

22%

4

–18%

–24%

What is the arithmetic average monthly rate of return for the two managers?

The arithmetic average rate of return is an unweighted average of the subperiod returns. The general

formula is

RA =

RP1 RP 2 RPN

N

where RA = arithmetic average rate of return; Rpk = portfolio return for subperiod k for k = 1, . . . , N;

and, N = number of subperiods in the evaluation period.

In our problem, we have subperiod or monthly portfolio returns for Manager I of RP1 = 9%, RP21 =

13%, RP3 = 22% and RP4 = 18%, for months 1, 2, 3, and 4, respectively.

Solving for N = 4, the arithmetic average rate of return is:

RManager I =

9% 13% 22% ( 18%)

= 0.0650 or 6.50%.

4

Similarly, for Manager II, we get the portfolio return of:

RManager II =

25% 13% 22% (24%)

= 0.0900 or 9.00%.

4

2. What is the time-weighted average monthly rate of return for the two managers in Question

2?

The time-weighted rate of return measures the compounded rate of growth of the initial portfolio

market value during the evaluation period, assuming that all cash distributions are reinvested in the

portfolio. It is also commonly referred to as the geometric rate of return because it is computed by

taking the geometric average of the portfolio subperiod returns. The general formula is

RT = [(1 + RP1)(1 + RP2) . . . (1 + RPN)]1/ N – 1

where RT is the time-weighted rate of return, RPk is the return for subperiod k for k = 1, . . . , N, and

N is the number of subperiods.

In our problem, we have the portfolio returns for Manager I of RP1 = 9%, RP2 = 13%, RP3 = 22% and

RP4 = 18%, for months 1, 2, 3, and 4, respectively. Solving for N = 4, the time-weighted rate of return

is:

RManager I = [(1 + 0.09)(1 + 0.13)(1 + 0.22)(1 + {1 + 0.18}]1/4 – 1 = [(1.09)(1.13)(1.22)(0.82)]1/4 – 1

= [1.23211943]1/4 – 1 = 1.05358519 – 1 = 0.05358519 or about 5.36%.

If the time-weighted rate of return is 5.36% per month, one dollar invested in the portfolio at the

beginning of month 1 would have grown at a rate of 5.36% per month during the four-month

evaluation period.

Similarly, for Manager II, we get the portfolio return of:

RManager II = [(1 + 0.25)(1 + 0.13)(1 + 0.22)(1 + {1 + 0.24}]1/4 – 1 = [(1.25)(1.13)(1.22)(0.76)]1/4 – 1

= [1.30967000]1/4 – 1 = 1.06977014 – 1 = 0.06977014 or about 6.98%.

3. Why does the arithmetic average monthly rate of return diverge more from the

time-weighted monthly rate of return for manager II than for manager I in Question 2?

The table below summarizes the managerial performances and differences between the two types of

monthly returns.

Two Types of Monthly Returns:

Arithmetic Average Return Time-Weighted Return Difference in Returns

Manager I

6.50%

5.36%

1.14%

Manager II

9.00%

6.98%

2.02%

As can be seen in the last column of the above table, the arithmetic average monthly rate of return

diverges more from the time-weighted monthly rate of return for manager II than for manager I. This

is because the arithmetic average rate of return typically is greater than the

time-weighted average rate of return with the magnitude of the difference between the two averages

greater when the variation (in the subperiod returns over the evaluation period) is greater. Thus,

because there is more variation in returns for Manager II, this causes a greater difference between the

arithmetic average monthly rate of return and the time-weighted monthly rate of return. More details

are given below.

In general, the arithmetic and time-weighted average returns will give different values for the

portfolio return over some evaluation period. This is because in computing the arithmetic average

rate of return, the amount invested is assumed to be maintained (through additions or withdrawals) at

its initial portfolio market value. The time-weighted return, on the other hand, is the return on a

portfolio that varies in size because of the assumption that all proceeds are reinvested.

In general, the arithmetic average rate of return will exceed the time-weighted average rate of return.

The exception is in the special situation where all the subperiod returns are the same, in which case

the averages are identical. The magnitude of the difference between the two averages is smaller the

less the variation in the subperiod returns over the evaluation period. For example, suppose that the

evaluation period is four months and that the four monthly returns are as follows:

RP1 = 4%; RP1 = 6%; RP1 = 2%; RP1 = –2%.

The average arithmetic rate of return is 2.50% and the time-weighted average rate of return is 2.46%.

Not much of a difference. However, in the textbook example elsewhere, there was an arithmetic

average rate of return of 25% but a time-weighted average rate of return of 0%. The large

discrepancy is due to the substantial variation in the two monthly returns.

4. Smith & Jones is a money management firm specializing in fixed-income securities. One of

its clients gave the firm $100 million to manage. The market value for the portfolio for the four

months after receiving the funds was as follows:

End of Month

1

2

3

4

Market Value (in millions)

$ 50

$150

$ 75

$100

Answer the below questions based on the above table.

(a) Calculate the rate of return for each month.

In equation form, the portfolio’s return can be expressed as follows:

Rp =

MV1 MV0 D

MV0

where Rp = return on the portfolio, MV1 = portfolio market value at the end of the evaluation period;

MV0 = portfolio market value at the beginning of the evaluation period; and, D = cash distributions

from the portfolio to the client during the evaluation period. Since there is no cash distribution (i.e.,

D = 0), we have:

MV1 MV0

Rp =

.

MV0

For period or month 1, we have:

Rmonth 1 =

$50 million $100 million

MV1 MV0

$50

=

=

= 0.5000 or 50.00%.

$100 million

$100

MV0

For month 2, we have:

Rmonth 2 =

$150 million $50 million

$100 million

=

= 2.000 or 200.00%.

$50 million

$50 million

For month 3, we have:

Rmonth 3 =

$75 million $150 million

$75 million

=

= 0.5000 or 50.00%.

$150 million

$150 million

For month 4, we have:

Rmonth 4 =

$100 million $75 million

$25 million

=

= 0.333333 or about 33.33%.

$75 million

$75 million

(b) Smith & Jones reported to the client that over the four-month period the average monthly

rate of return was 33.33%. How was that value obtained?

The value was obtained by using arithmetic average rate of return, which is an unweighted average

of the subperiod returns. The general formula is

RA =

RP1 RP 2 RPN

N

where RA = arithmetic average rate of return; Rpk = portfolio return for subperiod k for k = 1, . . . , N;

and, N = number of subperiods in the evaluation period.

In our problem, we have subperiod or monthly portfolio returns for a client of RP1 = 50%,

RP21 = 200%, RP3 = 50% and RP4 = 33.33%, for months 1, 2, 3, and 4, respectively. Solving for N

= 4, the arithmetic average rate of return is:

RSmith & Jones =

50% 200% ( 50%) 33.33%

= 0.3333333 or about 33.33%.

4

(c) Is the average monthly rate of return of 33.33% indicative of the performance of Smith &

Jones? If not, what would be a more appropriate measure?

The 33.33% monthly rate of return is not indicative of the performance of Smith & Jones. A more

appropriate measure would be the time-weighted rate of return or the dollar-weighted rate of

return.

First, let us look at the time-weighted rate of return, which measures the compounded rate of growth

of the initial portfolio market value during the evaluation period, assuming that all cash distributions

are reinvested in the portfolio. It is also commonly referred to as the geometric rate of return

because it is computed by taking the geometric average of the portfolio subperiod returns. The

general formula is

RT = [(1 + RP1)(1 + RP2) . . . (1 + RPN)]1/ N – 1

where RT is the time-weighted rate of return, RPk is the return for subperiod k for k = 1, . . . , N, and

N is the number of subperiods.

In our problem, we have the portfolio returns for the client of RP1 = 50%, RP2 = 200%, RP3 =

50% and RP4 = 33.33%, for months 1, 2, 3, and 4, respectively. Solving for N = 4,

the time-weighted rate of return is:

RManager I = [(1 + {0.500})(1 + 2.00)(1 + {0.500})(1 + {0.3333}]1/4 – 1

= [(0.50)(2.00)(0.55)(1.33333)]1/4 – 1 = [1.00000]1/4 – 1 = 1 – 1 = 0 or 0%.

If the time-weighted rate of return is 0% per month, one dollar invested in the portfolio at the

beginning of month 1 would have grown at a rate of 0% per month during the four-month evaluation

period. This answer is consistent with the fact that Smith and Jones’ client began with $100 million

and ended with $100 million. Note that the computation does not take into account the time value of

money which is influenced by the fact inflation causes purchasing power to decline. Thus, the client

is actually worse off than they began.

Now, let us look at the dollar-weighted rate of return, which is computed by finding the interest

rate that will make the present value of the cash flows from all the subperiods in the evaluation

period plus the terminal market value of the portfolio equal to the initial market value of the

portfolio.

Cash flows, referred to above, are defined as follows:

(1) A cash withdrawal is treated as a cash inflow. So, in the absence of any cash contribution made by

a client for a given time period, a cash withdrawal (e.g., a distribution to a client) is

a positive cash flow for that time period.

(2) A cash contribution is treated as a cash outflow. Consequently, in the absence of any cash

withdrawal for a given time period, a cash contribution is treated as a negative cash flow for that

period.

(3) If there are both cash contributions and cash withdrawals for a given time period, then the cash

flow is as follows for that time period: If cash withdrawals exceed cash contributions, then there is

a positive cash flow. If cash withdrawals are less than cash contributions, then there is a negative

cash flow.

The dollar-weighted rate of return is simply an internal rate-of-return calculation and hence it is also

called the internal rate of return. The general formula for the dollar-weighted return is:

V0 =

C1

C1

1 RD 1 RD 2

CN VN

1 RD

N

where RD = dollar-weighted rate of return; V0 = initial market value of the portfolio;

VN = terminal market value of the portfolio; and, Ck = cash flow for the portfolio (cash inflows minus

cash outflows) for subperiod k for k = 1, . . . , N.

Notice that it is not necessary to know the market value of the portfolio for each subperiod to

determine the dollar-weighted rate of return.

For our problem, we have: V0 = $100 million, N = 4, C1 = $0 million, C2 = $0 million,

C3 = $0 million, C4 = $0 million, and V4 = $100 million. Given these values, RD is the interest rate

that satisfies the below equation:

$100,000,000 =

$100,000,000 =

$0

$0

$0

$0 $100, 000, 000

2

3

4

1 RD 1 RD 1 RD

1 RD

$100, 000, 000

1 RD

4

(1 + RD)4 =

$100,000,000

(1 + RD) =

$100,000,000

4

1– 1

RD = 1 – 1 RD = 0. Thus, RD = 0% satisfies the equation.

Another way of looking at this problem is to consider the change in value each period to be like a

cash inflow (withdrawal) or cash outflow (contribution). If so, for our problem, we would have: V0 =

$100 million, N = 4, C1 = $50 million, C2 = $100 million, C3 = $75 million,

C4 = $25 million, and V4 = $100 million. Given these values, RD is the interest rate that satisfies the

below equation:

$100,000,000 =

$50, 000, 000 $100, 000, 000 $75, 000, 000 $25, 000, 000 $100, 000, 000

2

3

4

1 RD

1 RD

1 RD

1 RD

Inserting RD = 0% gives:

$100,000,000 =

$50,000,000 $100,000,000 $75,000,000 $75,000,000

1.00

(1) 2

(1) 4

(1) 4

$100,000,000 = $50,000,000 + $100,000,000 + $75,000,000 + $75,0000

$100,000,000 = $100,000,000. Thus, RD = 0% satisfies the equation.

Because zero percent is the internal rate of return that satisfies our expression above, zero percent is

the dollar-weighted return. The dollar-weighted rate of return and the time-weighted rate of return

will produce the same result if no withdrawals or contributions occur over the evaluation period and

all investment income is reinvested. The dollar-weighted rate of return can be affected by factors that

are beyond the control of the manager. Specifically, any contributions made by the client or

withdrawals that the client requires will affect the calculated return. This makes it difficult to

compare the performance of two managers when using this method.

Finally, the evaluation period may be less than or greater than one year. Typically, return measures

are reported as an average annual return. This requires the annualization of the subperiod returns.

The subperiod returns are typically calculated for a period of less than one year. The subperiod

returns are then annualized using the following formula:

annual return = (1 + average period return)number of periods in year – 1.

For example, suppose that the evaluation period is three years and a monthly period return is

calculated. Suppose further that the average monthly return is 2%. Then the annual return is

annual return = (1 + average period return)number of periods in year – 1 = (1.02)12 – 1 = 26.8%.

In our problem, the evaluation period is four months and the average monthly return is 0%. Then the

annual return is

annual return = (1 + average period return)number of periods in year – 1 = (1 + 0.0)12 – 1 = 1 – 1 = 0

or zero percent (which we already knew).

In conclusion, either a time-weighted or dollar-weighted rate of return is more indicative of the

portfolio’s performance and thus a more appropriate measure.

5. If the average quarterly return for a portfolio is 1.78%, what is the annualized return?

We use the following formula:

annual return = (1 + average period return)number of periods in year – 1.

For our problem, the period used to calculate returns is quarterly and the average quarterly return is

1.78%. Thus, the annual return is:

annual return = (1 + average period return)number of periods in year – 1

= (1.0178)4 – 1 = 1.073124 – 1 = 0.073124 or about 7.31%.

6. The current on-the-run yields for the Ramsey Corporation are as follows:

Maturity (years) Yield to Maturity (%) Market Value

1

7.5

100

2

7.6

100

3

7.7

100

Assume that each bond is an annual-pay bond. Each bond is trading at par, so its coupon rate

is equal to its yield to maturity.

Answer the below questions.

(a) Using the bootstrapping methodology, complete the following table:

Year Spot Rate (%) One-Year Forward Rate (%)

1

2

3

The one-year spot rate for year one is its annualized yield of 7.50%. Using this value and the yield to

maturity for year 2, we can solve for the one-year spot rate for year two as shown below. We do this

below using the bootstrapping methodology.

The price of a theoretical 2-year zero-coupon security should equal the present value of two cash flows

from an actual 2-year coupon security, where the yield used for discounting is the spot rate

corresponding to each cash flow. The coupon rate for a 2-year security is given as 7.6% (since yield to

maturity of 7.6% is the same as coupon rate given the market value is 100). Using $100 as par, the

cash flow for this security for year one is CF1 = $7.60 and for year two is CF2 = $7.60 + $100 =

$107.60.

Given the one year spot rate of s1 = 7.5%, we can now solve for the 2-year theoretical spot rate, s2,

CF1

CF2

using the following expression:

= $100. Below we insert values for CF1, CF2, and

1 s1 1 s2 2

s1 to solve for s2.

CF1

CF2

$107.60

$7.60 $7.60 $100

= $100

= $100 $7.06977 +

= $100

2

2

2

1.075

1 s1 1 s2

1 s2

1 s2

$107.60

1 s2

s2 =

2

= $92.93023

1.1578579

$107.60

= (1 + s2)2 s2 =

$92.93023

$107.60

–1

$92.93023

– 1 s2 = 1.0760381 – 1 s2 = 0.076038 or about 7.6038%.

Next we solve for the 3-year theoretical spot rate. The price of a theoretical 3-year zero-coupon

security should equal the present value of three cash flows from an actual 3-year coupon security,

where the yield used for discounting is the spot rate corresponding to each cash flow. The coupon

rate for a 3-year security is given as 7.7%. Using $100 as par, the cash flow for this security is $7.70

for years one and two. For year three, it is $7.70 + $100 = $107.70 for year two.

We can now solve for the 3-year theoretical spot rate, s3, using the below expression with

CF1 = CF2 = $7.70, CF3 = $107.70, s1 = 7.5%, and s2 = 7.6038%. We have:

CF3

CF1

CF2

$7.70

$7.70

$7.70 $100

= $100

= $100

2

3

2

3

1.075 1.076038

1 s1 1 s2 1 s3

1 s3

$7.16279 + $6.6502123 +

$107.70

= (1 + s3)3 s3 =

$86.18700

$107.70

1 s3

3

= $100

$107.70

$86.186700

1

3

$107.70

1 s3

3

= $86.186700

– 1 s3 = 1.2496084

1

3

–1

s3 = 1.0771049 – 1 s3 = 0.0771049 or about 7.7105%.

Thus, the spot rates are 7.50%, 7.6038%, and 7.7105% for years one, two, and three.

We now compute the one-year forward rates for years one, two, and three. The one-year forward rate

for year one is the same as the one-year spot rate of 7.50%. The one-year forward rate for year two is

given by:

2

1 s2

f2 =

1 .

1 s1

Inserting in our values for s1 and s2 and solving, we have:

1.076038 2

1.1578578

1 = 1.077077 – 1 = 0.077077 or about 7.7077%.

f2 =

1 =

1.075

1.075

The one-year forward rate for year three is given by:

1 s3

1.

2

1 s2

3

f3 =

Inserting in our values for s2 and s3 and solving, we have:

f3 =

1.077105 3

1.2496084

1 = 1.0792425 – 1 = 0.0792417 or about 7.9242%.

1 =

2

1.1578578

1.076038

As seen below, we can now complete our table by inserting in all spot rates and one-year forward

rates. We have:

Year Spot Rate (%) One-Year Forward Rate (%)

1

s1 = 7.5000

f1 = 7.5000

2

s2 = 7.6038

f2 = 7.7077

3

s3 = 7.7105

f3 = 7.9242

(b) Using the spot rates, what would be the value of an 8.5% option-free bond of this issuer?

The value of an 8.5% three-year option-free bond is the present value of the cash flows using the

spot rates as the discount rates. Thus, using the one-year spot rates, the value of an 8.5% coupon

option-free bond is given by:

$100 C3

C1

C2

option-free bond price =

.

2

1 s1 1 s2 1 s3 3

where the coupon payments per period (year) are C1 = C2 = C3 = $8.50 per $100 and the spot rates

for years one, two and three are s1 = 7.50%, s2 = 7.6038%, and s3 = 7.7105%. Inserting in our

coupon values and spot rate values and solving, we get:

option-free bond price =

$8.50

$8.50

$100 $8.50

=

2

1.075 1.076038

1.0771053

$7.90698 + $7.34114 + $86.82720 = $102.07532 or about $102.08 per $100.

(c) Using the one-year forward rates, what would be the value of an 8.5% coupon option-free

bond of this issuer?

It should be the same $102.08 per $100 which we just computed in part (b). Below we demonstrate it

is $102.08 using the one-year forward rates.

Using the one-year forward rates, the value of an 8.5% coupon option-free (annual pay) bond is

given by:

$100 C3

C1

C2

option-free bond price =

1 s1 1 s1 1 f 2 1 s1 1 f 2 1 f3

where C1 = C2 = C3 = $8.50 per $100, the spot rate for year one is s1 = 7.50%, and the one-year

forward rates for years two and three are f2 = 7.7077%, and f3 = 7.9242%, respectively. Inserting in

our values, we have:

option-free bond price =

$8.50

$8.50

$100 $8.50

=

1.075 1.0751.077077 1.0751.077077 1.079242

$7.90698 + $7.34114 + $86.82720 = $102.07532 or about $102.08 per $100.

(d) Using the binomial model (which assumes that one-year rates undergo a lognormal random

walk with volatility ), show that if is assumed to be 10%, the lower one-year forward rate

one year from now cannot be 7%.

The point denoted N is the root of the binomial interest-rate tree and is the current one-year rate, or

equivalently, the one-year forward rate, denoted by r0. In our problem, we have r0 = 7.5%.

Assuming a one-factor interest-rate model, the one-year forward rate can evolve over time based on

a random process called a lognormal random walk with a certain volatility. The following notation is

used to describe the tree in the first year: = assumed volatility of the one-year forward rate; r1,L =

the lower one-year rate one year from now; and, r1,H = the higher one-year rate one year from now.

The relationship between r1,L and r1,H is as follows: r1,H = r1,L(e2) where e is the base of the natural

logarithm 2.71828 or equivalently r1,L = r1,H / e2.

To see how to construct the binomial interest-rate tree, let’s use the assumed current on-the-run

yields given in part (a) which are yield to maturities of 7.5%, 7.6%, and 7.7% for maturities of

1, 2, and 3 years, respectively, for our annual pay bond. Given our volatility, , is 10%, we can

construct a two-year model using the two-year bond with a coupon rate of 7.60% (yield to maturity

equals the coupon rate since all bonds sell at par of 100). As noted above, the root rate for the tree,

r0, is simply the current one-year spot rate or forward rate of 7.5%. In the first year there are two

possible one-year rates, the higher rate and the lower rate. What we want to find is the two forward

rates that will be consistent with the volatility assumption, the process that is assumed to generate the

forward rates, and the observed market value of the bond. There is no simple formula for this. It

must be found by an iterative process (i.e., trial and error). The steps are described and illustrated

below.

Step 1: Select a value for r1. Recall that r1 is the lower one-year forward rate one year from now. In

this first trial we can arbitrarily select a value. In this problem, however, we are asked to take 7.00%

so that will be our “arbitrary” value reported at node NL.

Step 2: Determine the corresponding value for the higher one-year forward rate, r1,H. This rate is

related to the lower one-year forward rate, r1 or r1,L, as follows: r1,H = r1(e2). For r1 = 7.00% and =

10%, the higher one-year forward rate, r1,H = 7.00%(2.71828182(0.10)) = 7.00%(1.2214028) = 8.5498%.

This value would be reported at node NH.

Step 3: Compute the bond’s value one year from now. This value is determined as follows:

3a. The bond’s value two years from now must first be determined. We are using a two-year bond,

so the bond’s value at the end of year one (after the first coupon has been paid) is its maturity value

($100) plus its final coupon payment = (coupon rate)($1,000) = 0.076($1,000) = $7.60. Thus, the

bond value two years from now is $107.60.

3b. At t = 1, compute the present value of the bond’s value found in 3a using the higher rate, r1,H. In

our example the appropriate discount rate is the one-year higher forward rate, 8.5498%. The present

value is $107.60 / 1.085498 = $99.12499. This is the value of VH reported at node NH.

3c. At t =1, compute the present value of the bond’s value found in 3a using the lower rate, r1,L. The

discount rate used is the lower one-year forward rate, 7.00%. The value is $107.60 / 1.07 =

$100.56075. This is the value of VL reported at node NL.

3d. Add the coupon to VH and VL to get the respective cash flow at NH and NL at the end of the first

period. In our example we have $99.12499 + $7.60 = $106.72499 for the higher rate and $100.56075

+ $7.60 = $108.16075 for the lower rate.

3e. Calculate the present value of the two values using the one-year forward rate using r*. At this

point in the valuation, r* is the root rate, 7.50%. Therefore,

VH C $106.72499

V C $108.16075

=

= $99.27906 and L

=

= $100.61465.

1.075

1.075

1 r*

1 r*

Step 4: Calculate the average present value of the two cash flows in step 3. This is the value at node

1 V C V L C

N. We have: V = H

. Inserting the value for our example, we have:

2 1 r*

1 r*

value at node N = V =

1

$99.27906 $100.61465 = $99.946856.

2

Step 5: Compare the value in step 4 with the bond’s market value. If the two values are the same, the

r1 used in this trial is the one we seek. This is the one-year forward rate at t = 1 that would then be

used in the binomial interest-rate tree for the lower rate, and the corresponding rate would be for the

higher rate. If, instead, the value found in step 4 is not equal to the market value of the bond, this

means that the value r1 in this trial is not the one-period forward rate that is consistent with (1) the

volatility assumption of 10%, (2) the process assumed to generate the one-year forward rate, and (3)

the observed market value of the bond. In this case, when r1 is 7.00% we get a value of $99.946856

in step 4, which is less than the observed market value of $100. Therefore, 7.00% is too large and

the five steps must be repeated, trying a lower value for r1.

In conclusion, we have demonstrated that the lower one-year forward rate one year from now cannot

be 7.00%.

(e) Demonstrate that if σ is assumed to be 10%, the lower one-year forward rate one year from

now is 6.944%.

Given our volatility, , is 10%, we can construct a two-year model using the two-year bond with a

coupon rate of 7.60%. As noted above, the root rate for the tree, r0, is simply the current

one-year spot rate or forward rate of 7.5%. The steps for r1 = 6.944% are described and illustrated

below.

Step 1: Select a value for r1, which is the lower one-year forward rate one year from now. In this

second trial we would select a value based on our results in our first trial. However, we are asked to

try 6.944% so that will be our value reported at node NL.

Step 2: Determine the corresponding value for the higher one-year forward rate, r1,H. This rate is related

to the lower one-year forward rate, r1 or r1,L, as follows: r1,H = r1(e2). Inserting in our values of r1 =

6.944% and = 10%, the higher one-year forward rate one year from now (at t =1) is r1,H =

6.944%(2.71828182(0.10)) = 6.944%(1.2214028) = 8.4814%. This value is reported at node NH.

Step 3: Compute the bond’s value one year from now. This value is determined as follows:

3a. The bond’s value two years from now must first be determined. We are using a two-year bond,

so the bond’s value at the end of year one (after the first coupon has been paid) is its maturity value

($100) plus its final coupon payment = (coupon rate)($1,000) = 0.076($1,000) = $7.60. Thus, the

bond value two years from now is $107.60.

3b. At t = 1, compute the present value of the bond’s value found in 3a using the higher rate, r1,H. In

our example the appropriate discount rate is the one-year higher forward rate, 8.4814%. The present

value is $107.60 / 1.084814 = $99.18749. This value is called VH.

3c. At t =1, compute the present value of the bond’s value found in 3a using the lower rate, r1,L. The

discount rate used is the lower one-year forward rate, 6.944%. The computed value is $107.60 /

1.06944 = $100.61341. This value is called VL.

3d. Add the coupon to VH and VL to get the respective cash flow at NH and NL at the end of the first

period. In our example we have $99.18749 + $7.60 = $106.78749 for the higher rate and $100.61341

+ $7.60 = $108.21341 for the lower rate.

3e. Calculate the present value of the two values using the one-year forward rate using r*. At this

point in the valuation, r* is the root rate, 7.50%. We get:

$106.78749

VH C

V C $108.21341

=

= $99.33720 and L

=

= $100.66363.

1.075

1.075

1 r*

1 r*

Step 4: Calculate the average present value of the two cash flows in step 3. This is the

value at node N using the formula: V =

1 V H C V L C

. Inserting in the values form 3e,

2 1 r*

1 r*

we get:

V=

1

$99.33720 $100.666363 = $100.0004 $100.00.

2

Step 5: Compare the value in step 4 with the bond’s market value. If the two values are the same,

then the selected r1 is the one-year forward rate one year from now used in the binomial interest-rate

tree for the lower rate, and the corresponding rate would be for the higher rate.

For the selection of r1 = 6.944 % we got a value of $100.0004 in step 4, which is extremely close to

the observed market value of $100. Thus, for practical purposes we have demonstrated that 6.944%

is the one-year forward rate one year from now.

(f) Demonstrate that if σ is assumed to be 10%, the lower one-year forward rate two years

from now is approximately 6.437%.

Now we want to “grow” our binomial tree for one more year—that is, we want to determine r2. Now

we will use the three-year on-the-run issue, the 7.7% coupon bond, to get r2. The same five steps are

used in an iterative process to find the one-year forward rate two years from now. The steps for r2 (or

r2,LL) = 6.437% are described and illustrated below.

Step 1: Select a value for r2. Recall that r2 is the lower one-year forward rate at t = 2. In this first

trial we can arbitrarily select a value. In this problem, however, we are asked to try 6.437% so that

will be our “arbitrary” value. This value would be reported at node NLL.

Step 2: Determine the corresponding value for the higher one-year forward rate, r2,LH at t = 2. This rate

is related to the lower one-year forward rate, r2 or r2,LL, as follows: r2,LH = r2(e2). For r2 = 6.437% and

= 10%, the higher one-year forward rate, r2,LH = 6.437%(2.71828182(0.10)) = 6.437%(1.221403) =

7.863%. This value is reported at node NLH and is also the value reported at NHL for r2,LH. For NHH, we

get r2,HH = r2,LL(e4) = 7.863%(2.71828184(0.1)) = 9.604%.

Step 3: Compute the bond’s value one year from t = 1.

First, the bond’s value three years from now must first be determined. Since we are using a threeyear bond, the bond’s value (after the coupon is paid) is its maturity value ($100) plus its final

coupon payment given by taking the coupon rate times $1,000. Doing this, we get: (coupon

rate)($1,000) = 0.077($1,000) = $7.70. Thus, the bond value three years from now is $107.70.

At t = 2, compute the present value of the bond’s value found in 3a using the higher rate, r2,LH. In our

example the appropriate discount rate is the one-year higher forward rate, 7.863%. The present value

is $107.70 / 1.07863 = $99.8496 at NLH. This value is called VLH. This is also the same value at NHL

and is called VHL. Next, we compute the present value of the bond’s value using the lower rate, r12,LL.

The discount rate used is the lower one-year forward rate, 6.437%. The value is $107.70 / 1.06437 =

$101.1866 at NLL. This value is called VLL. The value for VHH is $107.70 / 1.09604 = $98.2638 given

our rate of 9.604% reported at NHH in Step 2.

Add the coupon to VLH and VLL to get the respective cash flow at NLH and NLL at the end of the

second period. Doing this gives $99.84965 + $7.70 = $107.54965 and $101.18662 + $7.70 =

$108.88662. Similarly, add the coupon to VHL and VHH to get the respective cash flow at NHL and

NHH at the end of the second period. We get: $98.263845 + $7.70 = $105.963845 and $99.84965 +

$7.70 = $107.54965.

Now calculate the present value for VLH and VLL using the root rate of r* = 6.944%. We get:

VLH C $107.54965

V C $108.88662

=

= $100.5663 and LL

=

= $101.8165.

1.06944

1.06944

1 r*

1 r*

Now calculate the present value for VHL and VHH using r* = 6.944%(1.221402758) = 8.4814%. We

get:

VHL C $105.963845

V C $107.54965

=

= $97.6793 and HH

=

= $99.1411.

1.084814

1.084814

1 r*

1 r*

Step 4: Calculate the average present value of the two cash flows in step 3 for both NL and NH. For

the value at node NL, with r* = 6.944%, we get:

VL =

1 VLH C VLL C 1

= $100.5663 $101.8165 = $101.19111 $101.19.

2 1 r*

1 r* 2

For the value at node NH, with r* = 8.4814%, we get:

VH =

1 VHL C VHH C 1

= $97.6793 $99.1411 = $98.4102 $98.41.

2 1 r*

1 r* 2

Calculating the average present value of $101.19 and $98.41 with r* = 7.5%, we get:

V=

1 VH C VL C 1 $98.41 $7.70 $101.19 $7.70

=

=

1.075

1.075

2 1 r*

1 r* 2

1

$99.33720 $100.666363= $100.0007 $100.00.

2

Step 5: Compare the value in step 4 with the bond’s market value. If the two values are the same, the

r2 used in this trial is the one we seek. If the value is greater than (lesser than) the bond’s market

value then we need to try a larger (smaller) value for r2. Since the values are both $100.00, we have

demonstrated that the lower one-year forward rate two years from now is approximately 6.437%.

(g) Show the binomial interest-rate tree that should be used to value any bond of this issuer.

At node N, we have: r0 = 7.5%

At node NL, we have: r1 = 6.944%

At node NH, we have: r1(e2) = 8.481%*

*r1(e2) = 6.944(2.71828182(0.1)) = 8.481%

At node NLL, we have: r2 = 6.437%

At node NLH (and NHL), we have: r2(e2) = 7.863%**

** r2(e2) = 6.437%(2.71828182(0.1)) = 7.863%

At node NHH, we have: r2(e2) = 9.604%***

***r2(e4) = 7.863%(2.71828184(0.1)) = 9.604%

(h) Determine the value of an 8.5% coupon option-free bond for this issuer using the binomial

interest-rate tree given in part g.

The value of an 8.5% coupon option-free bond for this issuer using the binomial interest-rate tree

given in part (g) is $102.0763. Details are given below.

At node N, we have: V = 102.0763, C = 0, r0 = 7.5%

[NOTE: Divide the following by two: (99.826+8.5 / 1.075) + (102.638+8.5 / 1.075) = 100.7684 +

103.3842 = 204.1526. Dividing by two gives: 102.0763.]

At node NL, we have: VL = 102.638, C = 8.5, r1,L = 6.944%

[NOTE: Divide the following by two: (100.5915+8.5 / 1.06944) + ($101.938+8.5 / 1.06944) =

102.0081 + 103.2671 = 205.2752. Dividing by two gives: 102.6376.]

At node NH, we have: VH = 99.826, C = 8.5, r1,H = 8.481%*

[NOTE: Divide the following by two: ($98.9936+8.5 / 1.08481) + (100.5915+8.5 / 1.08481) =

99.08979 + 100.56277 = 199.65257. Dividing by two gives: 99.8263.]

At node NLL, we have: VLL = 101.938, C = 8.5, r2,LL = 6.437%

[NOTE: (100+8.5) / 1.064378 = $101.9382.]

At node NLH, we have: VLH = 100.5915, C = 8.5, r2,LH = 7.862%**

[NOTE: (100+8.5) / 1.07863 = 100.5915.]

At node NHH, we have: VHH = 98.9936, C = 8.5, r2,HH = 9.603%***

[NOTE: (100+8.5) / 1.09604 = 98.9936.]

*r1,H = r1,L(e2) = 6.944(2.71828182(0.1)) = 8.4814%

**r2,LH = r2,LL(e2) = 6.4378%(2.71828182(0.1)) = 7.8632%

***r2,HH = r2,LL(e4) = 7.86315%(2.71828184(0.1)) = 9.6041%

(i) Determine the value of an 8.5% coupon bond that is callable at par (100) assuming that the

issue will be called if the price exceeds par.

The value of an 8.5% coupon callable bond for this issuer using the binomial interest-rate tree given

in part (g) is $100.723. Details are given below.

The value of an 8.5% coupon option-free bond for this issuer using the binomial interest-rate tree

given in part (g) is $102.723. Details are given below.

At node N, we have: V = 100.722, C = 0, r0 = 7.5%

[NOTE: Divide the following by two: (99.554+8.5 / 1.075) + (100+8.5 / 1.075) = 100.7684 +

103.3842 = 201.4456. Dividing by two gives: 100.7228.]

At node NL, we have: VL = MIN(100;101.455) = 100, C = 8.5, r1,L = 6.944%

[NOTE: Divide the following by two: (100+8.5 / 1.06944) + ($100+8.5 / 1.06944) = 101.45497 +

101.45497 = 202.90993. Dividing by two gives: 101.45497.]

At node NH, we have: VH = 99.554, C = 8.5, r1,H = 8.481%*

[NOTE: Divide the following by two: ($98.9936+8.5 / 1.08481) + (100+8.5 / 1.08481) = 99.08979 +

100.0175 = 199.1073. Dividing by two gives: 99.55365.]

At node NLL, we have: VLL = MIN(100;101.938) = 100, C = 8.5, r2,LL = 6.437%

[NOTE: (100+8.5) / 1.06437 = $101.9382.]

At node NLH, we have: VLH = MIN(100;100.5915) = 100, C = 8.5, r2,LH = 7.862%**

[NOTE: (100+8.5) / 1.07862 = 100.5915.]

At node NHH, we have: VHH = 98.9936, C = 8.5, r2,HH = 9.603%***

[NOTE: (100+8.5) / 1.09603 = 98.9936.]

*r1,H = r1,L(e2) = 6.944(2.71828182(0.1)) = 8.4814%

**r2,LH = r2,LL(e2) = 6.4378%(2.71828182(0.1)) = 7.8632%

***r2,HH = r2,LL(e4) = 7.86315%(2.71828184(0.1)) = 9.6041%