Advanced Marketing Group Assignment: Macro-Environment Analysis

advertisement

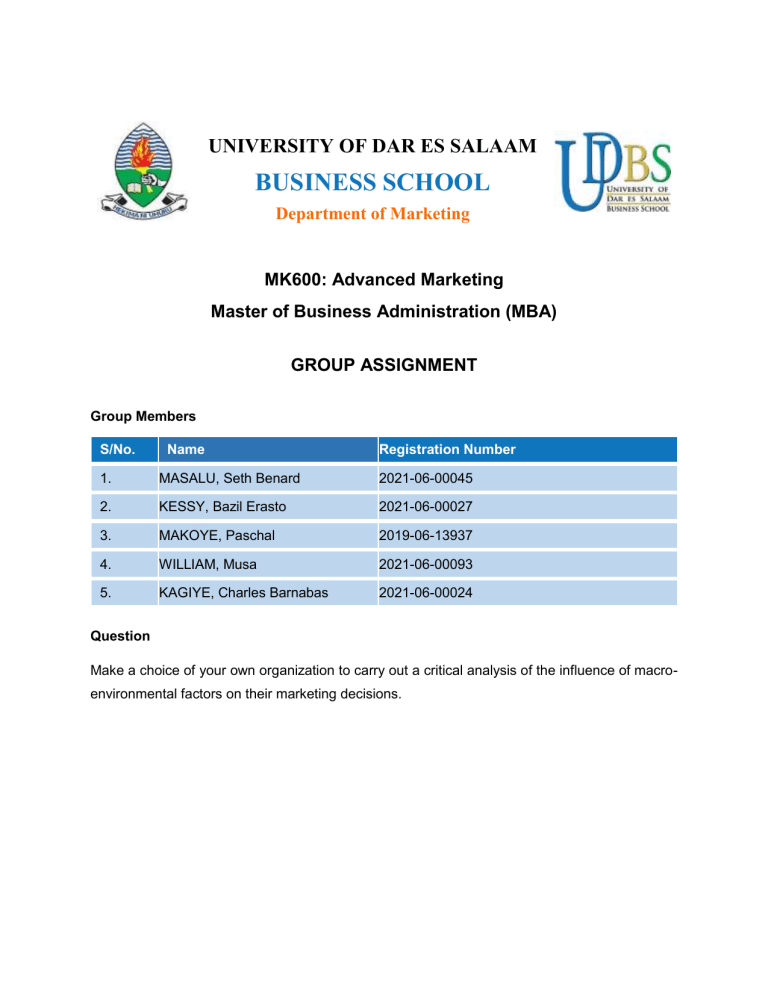

UNIVERSITY OF DAR ES SALAAM BUSINESS SCHOOL Department of Marketing MK600: Advanced Marketing Master of Business Administration (MBA) GROUP ASSIGNMENT Group Members S/No. Name Registration Number 1. MASALU, Seth Benard 2021-06-00045 2. KESSY, Bazil Erasto 2021-06-00027 3. MAKOYE, Paschal 2019-06-13937 4. WILLIAM, Musa 2021-06-00093 5. KAGIYE, Charles Barnabas 2021-06-00024 Question Make a choice of your own organization to carry out a critical analysis of the influence of macroenvironmental factors on their marketing decisions. 1 Introduction 1.1 Background Information Marketing, a source of interaction between an organization or a business and its outside world, has to balance internal capabilities and resources with external opportunities. These internal capabilities, resources, and external opportunities form a marketing environment in which an organization operates. In this marketing environment, an organization is not alone; it is surrounded by actors (e.g., suppliers and competitors, among others) and forces which affect its ability to build and maintain successful relationships with its customers1. Even though the definition and understanding of customer’s needs are at the heart of an organization’s marketing strategy as defined by several studies, several factors have been seen to influence how those customer’s needs evolve and affecting the organization’s ability to meet those needs in the competitive business environment. Those factors are what formed the macro-environment of an organization. An organization’s macro-environment consists of unforeseeable and uncontrollable forces that can shape opportunities for the organization or pose threats. These forces influence an organization’s marketing strategies and, therefore, affect how it serves its customers. They include stimuli related to demography, economy, society, politics, technology, and ecology. Thus, an organization should be flexible by analyzing and adopting the rapid changes resulting from its demographic environment, economic environment, social factors, political factors, technological factors, and ecological factors from the point of which it operates2. This will help an organization understand its customer’s future needs and develop feasible marketing strategies and marketing decisions that will satisfy its customers. This assignment intends to undertake a critical analysis of the influence of those macroenvironmental factors, specifically on marketing decisions of the services organizations, a case of Absa Bank Tanzania Limited. 1.2 1.2.1 Absa Bank Tanzania Limited Overview Absa Bank Tanzania Limited (Absa), formerly Barclays Bank Tanzania Limited, is a commercial bank in Tanzania and a South Africa-based Absa Group Limited subsidiary. Absa is licensed by 1 2 Kotler, P., & Armstrong, G. (2018). Mbura, O. K. (2017). Page 1 of 8 the Bank of Tanzania and offers retail, business, corporate and investment, and wealth management solutions3. It serves large corporations, small-to-medium enterprises, and individuals. As of March 2013, its total assets were valued at about USD 382 million (approximately TZS 634.34 billion)4. As of December 2013, Absa had 87,000 customers and 42 automated teller machines and maintained 24 networked branches5. 1.2.2 History Barclays Bank Tanzania Limited (Barclays) was established in Tanzania in 1925. In 1967, it was nationalized and converted into the National Bank of Commerce, Tanzania’s largest Bank by assets. With the liberalization of the economy in the 1990s, Barclays re-entered the country, resuming business in 20006. As of March 2016, Barclays Bank Plc. was seeking regulatory approval in Tanzania to merge this Bank with the National Bank of Commerce (Tanzania), in which Barclays maintains 55% shareholding7. In 2016, Barclays Africa Group (BAG) was owned 62.3% by Barclays Bank Plc. of the United Kingdom. In February 2016, Barclays decided to downsize its shareholding in BAG, valued at GBP 3.5 billion8. In December 2017, Barclays reduced its shareholding in BAG to 14.9%9. In 2018, BAG rebranded to Absa Group Limited. Under the terms of that rebrand, Absa Group Limited has until June 2020 to change the names of its subsidiaries in 12 African countries10. In Tanzania, the rebrand concluded on 11 February 2020, when both the Bank’s legal and business names became Absa Bank Tanzania Limited11. 2 Approach and Methodology The analysis of the influence of macro-environmental factors on the marketing decisions of Absa adopted a case study with systematic and analytical review approaches to study and document the marketing decisions of Absa that are influenced by its external environment. The first task was to collect and review Absa’s background information and other grey literature to familiarize with the Bank, its market, and the business environment in which it operates and identify sources for 3 Bank of Tanzania (2017, June 30). Corporate Digest (2013, May 18). 5 Ndzamela, P. (2014, June 9). 6 Barclays Bank Tanzania (2012). 7 Olingo, A. (2016, March 12). 8 Arnold, M., & Jenkins, P. (2016, February 26). 9 Cronje, J. (2017, December 1). 10 Reuters (2018, July 11). 11 The Guardian Tanzania (2020, February 11). 4 Page 2 of 8 additional information. Data were mainly obtained from the internet, specifically from used academic texts, journal articles, and lecture notes. The collected information was analyzed in terms of external factors that shape opportunities to the Bank or pose threats. The analysis was based on macro-environmental factors that can affect the marketing decisions of the Bank. Those factors are; demographic environment, economic environment, social factors, political factors, technological factors, and ecological factors12. The team drafted and used an analysis framework (please see table 1 below) as a lens through which the gathered information was analyzed. For this assignment, we only present the findings that arose from the analysis using the tool. The detailed data will not be provided to maintain a good number of pages. Table 1: The Analysis Framework S/No. Macro Environmental Factors 3 1. Demographic Environment 2. Economic Environment 3. Social Factors 4. Political Factors 5. Technological Factors 6. Ecological Factors Opportunities Threats Findings and Discussion The findings and discussion are structured to answer this assignment’s objective: to undertake an analysis of macro-environmental marketing factors on marketing decisions of the services organizations, a case of Absa Bank Tanzania Limited. The section consists of six subsections: the macro-environmental factors, namely, demographic environment, economic environment, social factors, political factors, technological factors, and ecological factors. 12 Mbura, O. K. (2017). Page 3 of 8 3.1 Demographic Environment Since demography relates to human population dynamics, an organization’s investment must consider the people’s needs. This leads to the fact that peoples’ needs may push an organization to strategize its marketing strategies. To this end, Absa has conducted marketing research to understand the requirements and expectations of the Tanzania ethnic-minority, personal and small business customers markets. Overall demographics trends have led to a new way of banking to Absa. With the change in family and trends in the make-up of households, Absa has provided a sort of family banking to its customers. Absa is committed to equality diversity; it has provided Junior Eagle Account to children and Salary Account for employees, among others. Junior Eagle Accounts are the accounts available for children’s and Salary Accounts for individuals who are employed. 3.2 Economic Environment Considering the scope of marketing that there must be something of value to exchange before any service introduction, the organization must go through a critical economic analysis to evaluate the purchasing power of the targeted market. Some criteria like the GDP and disposable personal income must be considered. The analysis results showed that Absa identified a vital role in dealing with economic addition as it aims to improve access to financial services for individuals, businesses, and social enterprises. It is dedicated and open to any changes or any new resolution by national bodies to do business at ease. For example, in the case of transaction rates that the Central Bank oversees, the Bank of Tanzania, Absa analyzes the purchasing power of the individual in the market to evaluate the expected return and income before making price adjustments of their services. Considering this, Absa was forced to strategize its marketing plan and decide what basis or price the service could offer. 3.3 Social Factors With the effect of change in the social environment, Absa is committed to equality and diversity, financial inclusion, community affairs, and disability issues. For example, recently, following the COVID-19 pandemic, Absa played a significant role in financing the healthcare system to reduce the impacts of the pandemic. Ultimately, its partnership with EngenderHealth promoted continued health service delivery to ensure that Tanzania remains open for business. Page 4 of 8 A decrease in deaths and increase in the birth rate over the last few years made Absa form a team that prepared the profile on the older and the young, which will make it easier for the Bank to understand the requirements of the goods and services needed overtime. In education, a lot of trends have also been noticed in recent years. More students have been enrolled in higher learning institutions which accounts for full-time and part-time students due to which new strategies and new look of banking for students have been introduced. Absa provides students with current and savings accounts. Students now have access to Absa cards and internet banking, which allows them to check their accounts and paying their credit card bills using a debit card. 3.4 Political Factors The political environment has a considerable influence upon the spending power of customers, which covers the issues such as government policies, and marketing ethics, among others. The analysis of how the political environment influences Absa’s marketing decisions, studied how the Government may influence its marketing strategies and decisions. The results indicated that the political climate influenced Absa’s marketing decisions. Any future changes in the governments’ priorities or a change in Government impacts how the Bank should be made its marketing decisions. Absa is currently the fast-growing Bank in Tanzania; recognizing that business expansion has to take place within the boundaries of the political environment, Absa formulates strategies accordingly. It has adapted itself to working within the local political system, having to adjust, for example, its mortgage schemes to suit the customer’s needs. In keeping this working, Absa has made it compulsory for all its customers to be positively identified and all details filled out to minimize the risk of suspicious funding accounts. Thus, it meets the specific needs of its customers within the boundaries specified by the Government and other local authorities while ensuring that the political scenario and the issues it throws up are not comprised. 3.5 Technological Factors Technology influences all aspects of the business, from the very general to the very specific, at all different levels of the external environment. Absa uses electronic-based computing and information technologies to coordinate and control the transforming and transfer of tasks. Absa’s website allows customers to retrieve their bank accounts online. Absa can use its internet presence for advertising its products and services for its potential and actual customers who visit the website. It has broadened the internet service for disabled customers also improved the text Page 5 of 8 on its online banking website, making it easier for partially sighted customers to read on-screen. Absa’s card allows customers to check their account and pay their credit card using a debit card. The use of the internet in this manner is in its infancy and will grow as the technology develops. For Absa, technology is increasingly the key to improve products and service delivery. In addition to the communication technology discussed above, Absa makes use of technology daily. The most apparent benefit of technology has taken place in the development of cashpoint machines found almost everywhere, allowing customers to withdraw money with a cash card, credit card, or debit card anywhere in the country. Technology is another factor for Absa to train its staff to sell a broader range of financial services, including digital banking platforms. 3.6 Ecological Factors In recent years, the most fundamental change in the financial sector has been the increasing use of technology in the services relationship, which raises the question of how customers feel about technology in causing or solving environmental problems. Technology is more often seen as part of the solution than the problem. The analysis found out that there is no green value proposition for customers of Absa. Absa, unlike other banks, does not consider the relevance of the green movement to their marketing decisions. The analysis furthermore found out that based on the kind of services Absa provides to its targeted customers, it turns out that their customers do not care about green attitudes. Therefore, for Absa, an opportunity to build a brand and solidify customer loyalty through carefully targeted ecological marketing programs based on a sincere desire to partner with customers does not exist. 4 Conclusion The analysis demonstrates that five macro-environmental factors (i.e., demographic environment, economic environment, social factors, political factors, and technological factors) substantially impact Absa’s marketing decisions. Ecological factors were found not to influence the marketing decisions of Absa. This is because customers place tremendous stress on value for money due to changes in values. Absa is aware that the lack of meaningful value of the customer leads to low product acceptance. The demand for convenience in banking is increasing because of changes in lifestyle and values; Absa has launched almost every single way of banking so far in the market and is currently researching a better way of banking in the future. Page 6 of 8 5 Recommendations To compete successfully, Absa must identify and strengthen areas with a comparative advantage while developing additional strengths. While some customers are especially receptive to green issues, Absa should show its commitment to the environment by developing new marketing programs that may go with issues like planting trees and donating to environmental groups, among others. This is because the bottom line is that many customers are waiting for financial services providers to create opportunities to help them achieve their green dreams. Absa needs to develop or re-market green financial products and services and communicate their value to key segments of its customers. Taking advantage of the green trend can earn Absa new customers, save them money, and make a difference. Page 7 of 8 6 References Arnold, M., & Jenkins, P. (2016, February 26). Barclays set to exit African business. Retrieved August 30, 2021, from https://www.ft.com/content/01d64502-dca4-11e5-827d4dfbe0213e07 Bank of Tanzania (2017, June 30). The Directory of Banks and Financial Institutions Operating in Tanzania as at 30th June 2017. Retrieved August 29, 2021, from https://web.archive.org/web/20180127145134/http:/www.bot.go.tz/BankingSupervision/D irectory of Banks and Financial institutions operating in Tanzania _June 2017.pdf Barclays Bank Tanzania (2012). Profile & History of Barclays Bank Tanzania. Barclays Bank Tanzania. Retrieved August 30, 2021, from http://www.barclays.co.tz/personal/aboutus/index.html Corporate Digest (2013, May 18). Barclays Bank Tanzania Manages to Cut Expenses. Retrieved August 29, 2021, from http://www.corporate-digest.com/index.php/barclays-banktanzania-manages-to-cut-expenses Cronje, J. (2017, December 1). Barclays to further reduce stake in Barclays Africa. Cape Town: Fin24.com. Retrieved August 30, 2021, from https://www.fin24.com/Companies/FinancialServices/barclays-to-further-reduce-stake-in-barclays-africa-20171201 Jobber, D., & Ellis-Chadwick, F. (2019). Principles and Practices of Marketing, 9th Edition. McGraw-Hill Education/ Europe, Middle East & Africa. Kotler, P., & Armstrong, G. (2018). Principles of Marketing, 17th Edition. United Kingdom: Pearson Education Limited. Mbura, O. K. (2017). Principles and Practices of Marketing in Tanzania. Dar es Salaam. Ndzamela, P. (2014, June 9). Barclays to Keep Two Tanzanian Banks. Business Day (South Africa). Retrieved August 30, 2021, from http://www.bdlive.co.za/africa/africanbusiness/2014/06/09/barclays-to-keep-twotanzanian-banks Olingo, A. (2016, March 12). Barclays to merge Tanzania units, says it will not split Africa business. The EastAfrican, Nairobi. Retrieved August 30, 2021, from https://www.theeastafrican.co.ke/business/Barclays-to-merge-Tanzania-units-not-splitAfrica-business-/-/2560/3114130/-/item/1/-/iqnn1q/-/index.html Reuters (2018, July 11). Barclays Africa returns to its SA roots with rebrand. Business Daily Africa. The Guardian Tanzania (2020, February 11). Barclays Officially Switches Name to Absa Bank Tanzania. Dar es Salaam: IPP Media Online. Retrieved August 30, 2021, from https://www.ippmedia.com/en/features/barclays-officially-switches%C2%A0name-absabank-tanzania Page 8 of 8