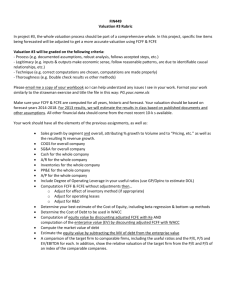

In order to calculate the Free Cash Flow for Columbia Sportswear, I used Net Income in order to determine the FCFF. The formula used for the calculation is: FCFF = NI + NCC + Int(1-Tax Rate) – FCInv – WCInv Where: FCFF = Free Cash Flow to the Firm NI = Net Income NCC = Net non-cash charges Int = Interest Expense (due to this being subtracted out to get net income so we need to add it back in) FCInv = Capital Expenditures WCInv = Current assets and liabilities, less cash and notes payable The Net Income (NI) found on the Consolidated Statement of Cash Flows is: $93,603,000 The NCC found on the Consolidated Statement of Cash Flows is the sum of the “Adjustments to reconcile net income to net cash provided by operating activities” which is: $66,379,000 The Int is found on the Consolidated Statements of Operations is $0 because it is income and was already added into the Net Income thus since it was not subtracted out it does not need to be added back in. The Tax Rate I am using is the Corporate Income Tax Rate which is 35% for companies whose Earnings Before Income Tax (EBIT) is over $18.33 million; Columbia Sportswear’s EBIT was well above that. The FCInv is the Capital Expenditures that is found in the Consolidated Statement of Cash Flows under Cash Flows from Investing Activities and is $69,443,000 The WCInv is found by looking at the Consolidated Balance Sheet and taking the Total Assets of $1,605,588,000 and minus that by the Cash and cash equivalents of $437,489,000 and getting $1,168,099,000 as the assets. Then you have minus the liabilities. The liabilities, since Notes Payable is $0, is $352,724,000. Finally, $1,168,099,000 - $352,724,000 to get $815,735,000. FCFF = $93,603,000 + $66,379,000 + $738,000(1-0.35) - $69,443,000 - $1,520,823,000 FCFF = $93,603,000 + $66,379,000 + $0 - $69,443,000 - $815,375,000 FCFF = -$724,836,000 This study source was downloaded by 100000752884017 from CourseHero.com on 06-19-2022 16:22:26 GMT -05:00 https://www.coursehero.com/file/33454167/Week-4-Practice-Assignmentdocx/ In order to calculate the Free Cash Flow for Under Armour Inc., I used Net Income in order to determine the FCFF. The formula used for the calculation is: FCFF = NI + NCC + Int(1-Tax Rate) – FCInv – WCInv Where: FCFF = Free Cash Flow to the Firm NI = Net Income NCC = Net non-cash charges Int = Interest Expense (due to this being subtracted out to get net income so we need to add it back in) FCInv = Capital Expenditures WCInv = Current assets and liabilities, less cash and notes payable The Net Income (NI) found on the Consolidated Statement of Cash Flows is: $162,330,000 The NCC found on the Consolidated Statement of Cash Flows is the sum of the “Adjustments to reconcile net income to net cash provided by operating activities” which is: $91,083,000 The Int is found on the Consolidated Statements of Operations is $2,933,000 The Tax Rate I am using is the Corporate Income Tax Rate which is 35% for companies whose Earnings Before Income Tax (EBIT) is over $18.33 million. The FCInv is the Capital Expenditures (or Property and Equipment) that is found in the Consolidated Statement of Cash Flows under Cash Flows from Investing Activities and is $87,830,000 The WCInv is $354,692,000 FCFF = $162,330,000 + $91,083,000 + $2,933,000(1-0.35) - $87,830,000 - $354,692,000 FCFF = $162,330,000 + $91,083,000 + $1,906,450 - $87,830,000 - $354,692,000 FCFF = -$187,202,550 This study source was downloaded by 100000752884017 from CourseHero.com on 06-19-2022 16:22:26 GMT -05:00 https://www.coursehero.com/file/33454167/Week-4-Practice-Assignmentdocx/