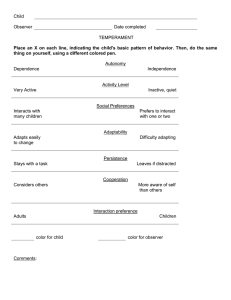

Analytic Evaluation of Financial Results for the NMG and The Observer in FY 2015 The Observer Information was collected from The Nation Media Group(Namwongo) and The Observer(Kamwokya) Results Nation Media Group NMG organization structure Chairman Abstract CEO The paper presents empirical analytic evaluation of the financial result of Operations of the Nation Media Group, NMG, and The Observer in the Financial Year 2015. . In the paper the scope for replacing a ratio in paper sector country and time effects by observed variables and the limitations were instrumental. This study was for the award of a higher degree in Agribusiness, “Analytical evaluation of Financial Results of NMG and The Observer. The results indicate that total factor relatively stagnated for NMG despite its regional size, productivity increased at an average rate t, accounting period considered (2015) for The observer itself being a product of the Observer Group considering overall growth. Most of the remaining gains stem from large inflows of fixed capital into from subsidiaries associates, and joint ventures. The results also suggest possible constraints to hostile environment, competition and management lapses in Kenya the major market for NMG among a multiplicity other. Key word: Media, Agribusiness, Finance, NMG, The Observer, Management lapses’, Associates, joint venture Introduction Nation Media Group was founded by Agha khan in 1959 in Kenya and The Observer newspaper was founded in 2004 by American Observer Media Ltd . Methodology Director Finance Director Marketing Director Investments Director Mgt Services Director Research . DividendsThe directors have recommended for shareholders’ approval, the payment of a final dividend for the year of Shs 7.50 (300%) per share on the issued share capital as at 31st December 2015, which ,together with the interim dividend of Shs 2.50 (100%) per share paid out on 30th September 2015, makes a total dividend payout ofShs 10.00 per share (400%) for the year ended 31st December 2015. The proposed dividend payout has been maintained at the same level as that of the previous year Discussion of Results.The profits of the group have shown slight decline and hence a course to worry in the profit trends shown above though relatively low. Such trend should be arrested before it begins to jump in multiples of base year profitability if NMG is Going concern anyway NMG Liquidity Receivables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method less provision is established when there is objective evidence that the Group or Company will not be able to collect all the amounts due according to the original terms of receivables. Conclusion Board of Directors of Nation Media Group The observer- Organogram Current Asset ratio=C A= 7524.9= 2.1(2015) CL 3591.1 = 7375.0=2.(2014) 3118.8 Quick assets Ratio=C A-Inv=6431=1.8(2015) CL 3591.1 =6430.5=2.1…....(2014) 3118.5 Accounting method used The NMG uses accrual accounting method under which it consolidates financial results of all subsidiaries, Associates and joint activities using the acquisition method. The company and the group comply with International Accounting Standards Board (IFRSB). However IASB published a new Standard, IFRS 15 Revenue from Contracts with Customers (‘the new Standard’) yet to be complied with. According to the Directors the impact is insignificant!!! Financial statements of Nation Media GroupThe financial statements were prepared in complete compliance with IFRS, under the historical convention as modified by the revaluation for building and stated in the groups functional currency, (Kshs). Rounded nearest million (M). Management has been assumed judgement1 in the application of group accounting policies especially where complexity is significant. Profitability NMG The observer 2015 2014 2015 2014 NMG The Observer 2015 2014 2015 2014 G P ratio =0.80 0.81 0.76 0.57 N P Ratio =0.18 0.18 0.11 0.12 Oper. Ratio =0.81 0.77 0.54 0.43 Oper.P ratio =0.19 0.23 0.22 0.16 Expense rati =0.61 0.58 0.77 0.73 EPS = 11.8 13.1 10.12 14.10 Leverage Ratio NMG The Observer 2015 2014 2015 2014 D/E 0.42 0.36 0. 55 0. 47 P. R. 0.42 0.36 0.55 0.48 S.R. 3.39 3.76 5.11 4.88 CA/NW 0.84 0.84 0.85 0.81 CL/NW 0.02 0.017 0.12 0.16 CGR 0.0008 0.00781 0.004 0.000453 Debt serv. 0.004 0.005 0.005 0.006 D C R 0.69 0.59 0.12 0.13 Activity Asset utilization Ratios NMG Observer 2015 2014 2015 2014 Debt. turn 1.01 1 1.03 1 Cred. Turn1.03 1 1.04 1 The group has significant concentrations of effort of credit risk. It has policies in place to ensure that sales are made to Customers with an appropriate credit history. The Observer still grapples with competition in this highly competitive sector and substitute A single paper portfolio for The Observer with it’s absence in the digital portal hurts its revenues prospect. Recommendations-NMG needs Turn round strategies and plan Focus on the analysis and design of workforce and their process. Rethink how they do their work in order to dramatically improve readership.The Observer needs restructuring plan of the tabloid company is required to address top management, business area responsible for the process being addressed, technology groups References N.A. Saleemi Advanced Financial Accounting Text CPA paper (Pg 424-455) ,N.A. Saleemi Publishers, Nairobi Kenya Bitange Bogonko Financial Accounting Kenya,Fountain Publisher, Kenya. Pg 16-45 CPA Author – Oluoch Onyango George Bsc. CPA FM 0772683705 0703730744 jabilloinvestments@yahoo.com Analytic Evaluation of Financial Results for the NMG and The Observer in FY 2015 .