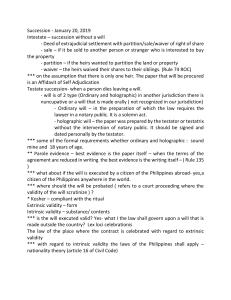

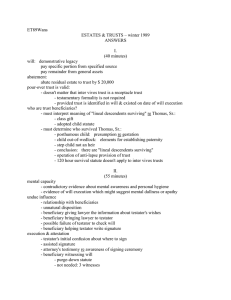

• 1) 2) • 1) 2) 3) Rea Bautista Patrick Manalo Loraine Saguinsin Naomi Quimpo Succession Reviewer Inside: Illustrative Problems by Mr. Patrick, Sample Exam Questions, Answer Key and more!!!1 accdg to extent of rights and obligations transmitted: universal – entire patrimony or an aliquot part particular – devise, legacy accdg to importance: compulsory testamentary intestate Parties: • Decedent o Testator o Decedent (intestate) • Successor o Heir o Devisee or Legatee Balane: • Only transmissible rights and obligations pass by succession o Criterion: if the rights or obligation is strictly personal (intuitu personae), it is intransmissible; otherwise, it is transmissible. • Pecuniary obligations must be paid first before distributing the residue of the estate to the heirs. Union Bank vs. Santibañez (2005) F: Decedent contracted loans during his lifetime. After decedent died, creditor filed an action for collection against the heirs. H: The bank should have filed its claim in the probate court pursuant to Sec. 5, Rule 86 of the Rules of Court. The filing of a money claim against the decedent’s estate in the probate court is mandatory. Estate of K.H. Hemady vs. Luzon Surety (1956) F: Lower court ruled that claims filed by Luzon Surety against decedent’s estate based on contracts of suretyship entered into by the decedent were not chargeable because death extinguished liability as surety/guarantor. “Solvitur Ambulando” I. General Provisions Art. 774. Succession is a mode of acquisition by virtue of which the property, rights and obligations to the extent of the value of the inheritance, of a person are transmitted through his death to another or others either by his will or by operation of law. (n) 2 Class Notes: Kinds of Succession • according to moment of transmission: 1) mortis causa 2) inter vivos (none in PH law, only donations) 1 Disclaimer: All photos lifted from Google images. No copyright infringement intended. 2 provisions recited H: Obligations of a guarantor are transmissible. Contracts take effect only between parties, their assigns and heirs, unless they are intransmissible by their nature, by stipulation or by operation of law. Alvarez vs. Intermediate Appellate Court (1990) F: A judgment ordering decedent to return the lots was entered during his lifetime but was not executed because he sold the lots to a 3rd person. A suit for recovery of the lots was filed against the heirs of seller. H: Liability that arose from the sale of decedent in bad faith was not extinguished by his death and was passed on to his heirs. However, the heirs are only liable to the extent of the value of their inheritance. Art. 775. In this Title, "decedent" is the general term applied to the person whose property is transmitted through succession, whether or not he left a will. If he left a will, he is also called the testator. (n) Art. 776. The inheritance includes all the property, rights and obligations of a person which are not extinguished by his death. (659) Art. 777. The rights to the succession are transmitted from the moment of the death of the decedent. (657a) Notes: • • 1. 3. Heir can sell his aliquot share but not specific property/physical portion of property. Otherwise, it is only pro tanto valid (to the extent of seller’s share) [Lee vs RTC (2007)] The heirs have the right to be substituted for deceased as party in an action that survives Bonilla vs. Barcena (1976) Infelicitous wording. The rights to the succession are vested; inheritance transmitted CONSEQUENCES: The law at the time of the decedent’s death will determine who the heirs should be. Uson vs. Del Rosario (1953) F: Nebreda died in 1945 and was survived by his wife and 4 illegitimate children. Wife brought action against illegitimate children for the recovery of the possession of land left by husband on the theory that she is the sole heir. Defense: while under the Old CC spurious children do not have successional rights, under the New CC they are granted the same status as natural children thus entitled to succeed from their father’s estate. H: The right granted under the New CC cannot be given retroactive effect. New rights have retroactive effect only when they do not prejudice or impair vested or acquired rights of the same origin. The right of ownership of Wife over the land became vested in 1945 upon decedent’s death because of Article 657 of the Old Civil Code (now 777) which was in effect at the time he died. 2. Note: • Ownership passes to the heir at the very moment of death who therefore, from that moment, acquires the right to dispose of his share. De Borja vs. Vda. De Borja (1972) F: Decedent died with a will. Before probate of his will and to end suits between them, D’s son by his first marriage and 2nd wife entered into a compromise agreement that 2nd wife will receive P800,000 as full and complete payment of her hereditary share. H: Agreement is valid. There is no legal bar for the heir to dispose of her share immediately upon death of the decedent even if actual extent is not yet determined. The agreement is a sale of the shares and not a settlement of the estate. Alfonso vs. Sps. Andres (2010) F: Jose inherited subject property from his father. This was assigned to him in a Deed of Extrajudicial Settlement. Jose sold it Sps Andres. H: The transfer is valid because title of property of person who died intestate passes at once to his heirs, subject to the claims of administration and payments of debts and expenses. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI F: Decedent, during her lifetime, filed an action to quiet title. During the pendency of the case, D died and counsel asked that her heirs be substituted. H: The heirs may be substituted to the deceased party because upon the latter’s death, her claim/rights to the land were not extinguished but were transmitted to her heirs. Note: • • What was transmitted was the right to prosecute the action If there is dispute as to who are the legal heirs, must first establish the right to succeed in a separate action [Heirs of Yaptinchay vs Del Rosario, 304 SCRA 18] Republic vs. Marcos (2012) F: Cases for reversion, reconveyance and restitution of ill‐ gotten wealth were filed against persons including heirs of Marcos were sought to be dismissed against the latter‐ mentioned defendants. H: Despite the finding that their involvement in the alleged illegal activities was not established, they should be maintained as defendants because the case is an action that survives thus it is imperative that the estate be represented. As to Imelda and Bongbong, they are the executors of FM’s estate, and as to Imee and Irene, they possibly possess/ed ill‐gotten properties. Art. 778. Succession may be: (1) Testamentary; (2) Legal or intestate; or (3) Mixed. (n) Art. 779. Testamentary succession is that which results from the designation of an heir, made in a will executed in the form prescribed by law. (n) Art. 780. Mixed succession is that effected partly by will and partly by operation of law. (n) Balane: • Some inaccuracies: o Did not mention compulsory o Mixed is not really a type of succession o No definition of Legal/intestate • Per Agbayani, our Expert in Succession, the 3 Kinds of Succession according to importance are: 1. Compulsory 2. Testamentary 3. Intestate Page 2 of 73 Art. 781. The inheritance of a person includes not only the property and the transmissible rights and obligations existing at the time of his death, but also those which have accrued thereto since the opening of the succession. (n) Balane: • Best deleted! Inheritance does not include accruals! 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Free and intelligent Solemn and formal Revocable and ambulatory Mortis causa Individual Executed with animus testandi Executed with testamentary capacity Unilateral Dispositive of property Statutory Balus vs. Balus (2010) Vitug vs. Court of Appeals (1990) F: Mortgage on decedent’s land was foreclosed by the Bank and there being to redemption, title was consolidated to the Bank. D died and 2 of his 3 children bought land from the Bank. 3rd child demanded share in the property as his inheritance. F: Husband and Decedent Wife executed a Survivorship Agreement with the Bank that after the death of either of them, the money in their joint savings account would belong to the survivor. H: Property, the ownership over which has been lost during the lifetime of a decedent, no longer forms part of the estate which his compulsory heirs may lay a claim over. Art. 782. An heir is a person called to the succession either by the provision of a will or by operation of law. Devisees and legatees are persons to whom gifts of real and personal property are respectively given by virtue of a will. (n) Balane: • Heir = one who succeeds to the whole or an aliquot part of the inheritance • Devisee = Succeeds to definite, specific, individual REAL properties • Legatee = Succeeds to definite, specific, individual PERSONAL properties • Distinction is important in preterition! II. Testamentary Succession a. Wills 1.1. Wills in General Art. 783. A will is an act whereby a person is permitted, with the formalities prescribed by law, to control to a certain degree the disposition of this estate, to take effect after his death. (667a) Balane: Operative words: 1. Act – too broad, it is suggested that it be delimited with a more specific term such as “instrument” 2. Permitted – purely statutory 3. Formalities prescribed by law – depends on whether attested or holographic 4. Control to a certain degree – power to dispose gratuitously is limited by rules on legitime 5. After his death – takes place mortis causa a. Sir says this should be “at the moment of/upon death” 11 Characteristics of Wills: <PRIME FEUDSS> 1. Purely personal SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI H: The agreement is not a mortis causa conveyance which needs to be in a will but a mere obligation with a term, the term being death. Take note of the definition of a will in this case: “a personal, solemn, revocable and free act by which a capacitated person disposes of his property and rights and declares or complies with duties to take effect after his death” (The deposit was not property of the decedent but was conjugal property.) Seangio vs. Reyes (2006) F: Holographic will contains only a clause disinheriting an heir without express disposition of property. H: While it does not make an affirmative disposition of the testator’s property, the disinheritance of the son is an act of disposition of the property of the testator in favor of those who would succeed in the absence of the person disinherited. Art. 784. The making of a will is a strictly personal act; it cannot be left in whole or in part of the discretion of a third person, or accomplished through the instrumentality of an agent or attorney. (670a) Notes: • • • Purely personal character of wills What is non‐delegable is the exercise of the disposing power, mechanical acts not included. In this article, “third person” should read as “another person” because who is the “second person”? Jericho Rosales?! Art. 785. The duration or efficacy of the designation of heirs, devisees or legatees, or the determination of the portions which they are to take, when referred to by name, cannot be left to the discretion of a third person. (670a) Notes: • The ff are non‐delegable: <DDD> 1. designation of heirs, devisees, legatees 2. duration or efficacy of such designation (including conditions, terms, substitutions) Page 3 of 73 3. determination of portions they are to receive to use them in another sense can be gathered, and that other can be ascertained. Art. 786. The testator may entrust to a third person the distribution of specific property or sums of money that he may leave in general to specified classes or causes, and also the designation of the persons, institutions or establishments to which such property or sums are to be given or applied. (671a) Technical words in a will are to be taken in their technical sense, unless the context clearly indicates a contrary intention, or unless it satisfactorily appears that he was unacquainted with such technical sense. (675a) Notes: • • Two things the T must determine: 1. Property or amount of money to be given 2. Class or cause to be benefitted Two things he may delegate: 1. Designation of persons, institutions or establishments within the class or cause 2. Manner of distribution Art. 787. The testator may not make a testamentary disposition in such manner that another person has to determine whether or not it is to be operative. (n) Notes: • This does not prejudice right of heirs, devisee, legatee to accept or renounce. RULES OF CONSTRUCTION AND INTERPRETATION In case of doubt as to different interpretations Art. 788. If a testamentary disposition admits of different interpretations, in case of doubt, that interpretation by which the disposition is to be operative shall be preferred. (n) • The thing may rather be effective than be without effect Ambiguity; Latent or Patent Art. 789. When there is an imperfect description, or when no person or property exactly answers the description, mistakes and omissions must be corrected, if the error appears from the context of the will or from extrinsic evidence, excluding the oral declarations of the testator as to his intention; and when an uncertainty arises upon the face of the will, as to the application of any of its provisions, the testator's intention is to be ascertained from the words of the will, taking into consideration the circumstances under which it was made, excluding such oral declarations. (n) • • • Latent = not obvious on the face of the will Patent = Obvious on the face of the will How to deal with ambiguities whether latent or patent: Clear up/resolve in order to give effect to the disposition by any evidence admissible and relevant excluding in either case, oral declarations of the testator (Dead Man’s Statute) Words; Technical Words Art. 790. The words of a will are to be taken in their ordinary and grammatical sense, unless a clear intention SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Preference to testacy Art. 791. The words of a will are to receive an interpretation which will give to every expression some effect, rather than one which will render any of the expressions inoperative; and of two modes of interpreting a will, that is to be preferred which will prevent intestacy. (n) Invalidity of one of several dispositions Art. 792. The invalidity of one of several dispositions contained in a will does not result in the invalidity of the other dispositions, unless it is to be presumed that the testator would not have made such other dispositions if the first invalid disposition had not been made. (n) • severability Property acquired after will was made Art. 793. Property acquired after the making of a will shall only pass thereby, as if the testator had possessed it at the time of making the will, should it expressly appear by the will that such was his intention. (n) Devise/Legacy Art. 794. Every devise or legacy shall cover all the interest which the testator could device or bequeath in the property disposed of, unless it clearly appears from the will that he intended to convey a less interest. (n) Art. 795. The validity of a will as to its form depends upon the observance of the law in force at the time it is made. Notes: • Aspects of Validity: o Extrinsic – Formal o Intrinsic – Substantive 1.2. Testamentary Intent Capacity and Art. 796. All persons who are not expressly prohibited by law may make a will. (662) Art. 797. Persons of either sex under eighteen years of age cannot make a will. (n) Art. 798. In order to make a will it is essential that the testator be of sound mind at the time of its execution. (n) Art. 799. To be of sound mind, it is not necessary that the testator be in full possession of all his reasoning faculties, or that his mind be wholly unbroken, unimpaired, or Page 4 of 73 Abangan vs. Abangan (1919) unshattered by disease, injury or other cause. It shall be sufficient if the testator was able at the time of making the will to know the nature of the estate to be disposed of, the proper objects of his bounty, and the character of the testamentary act. (n) Art. 800. The law presumes that every person is of sound mind, in the absence of proof to the contrary. The burden of proof that the testator was not of sound mind at the time of making his dispositions is on the person who opposes the probate of the will; but if the testator, one month, or less, before making his will was publicly known to be insane, the person who maintains the validity of the will must prove that the testator made it during a lucid interval. (n) Art. 801. Supervening incapacity does not invalidate an effective will, nor is the will of an incapable validated by the supervening of capacity. (n) Ortega vs. Valmonte (2005) F: 81 year old testator’s will was opposed on the ground that he was not of sound mind. H: Mere old age does not mean that a person is not of sound mind. To be of sound mind, at the time of making the will, the testator need only know (1) the nature of the estate to be disposed of, (2) the proper objects of his bounty, and (3) the character of the testamentary act. Baltazar vs. Laxa (2012) F: 78‐year‐old spinster’s will was being assailed because she was allegedly not of sound mind when it was made (because she was “forgetful”) H: Soundness of mind is presumed. Forgetfulness is not equivalent to unsoundness of mind. Art. 802. A married woman may make a will without the consent of her husband, and without the authority of the court. (n) Art. 803. A married woman may dispose by will of all her separate property as well as her share of the conjugal partnership or absolute community property. (n) 1.3. Forms of Wills Art. 804. Every will must be in writing and executed in a language or dialect known to the testator. (n) F: Records do not show that the will, executed in Cebu and written in the dialect of that locality where the testatrix is neighbor, was in a language known to the testatrix. H: Compliance with the language requirement presumed if (but Sir says “proved by”): (1) the will is the language/dialect generally spoken in the place execution and (2) the testator is a native or resident said locality. is in of of Art. 805. Every will, other than a holographic will, must be subscribed at the end thereof by the testator himself or by the testator's name written by some other person in his presence, and by his express direction, and attested and subscribed by three or more credible witnesses in the presence of the testator and of one another. The testator or the person requested by him to write his name and the instrumental witnesses of the will, shall also sign, as aforesaid, each and every page thereof, except the last, on the left margin, and all the pages shall be numbered correlatively in letters placed on the upper part of each page. The attestation shall state the number of pages used upon which the will is written, and the fact that the testator signed the will and every page thereof, or caused some other person to write his name, under his express direction, in the presence of the instrumental witnesses, and that the latter witnessed and signed the will and all the pages thereof in the presence of the testator and of one another. If the attestation clause is in a language not known to the witnesses, it shall be interpreted to them. (n) Art. 806. Every will must be acknowledged before a notary public by the testator and the witnesses. The notary public shall not be required to retain a copy of the will, or file another with the Office of the Clerk of Court. (n) (1) subscribed by the T or his agent in his presence and by his express direction at the end thereof, in the presence of the witnesses • signature Payad vs. Tolentino (1936) F: Testatrix thumb marked end and each and every page of the will then her lawyer wrote her name to indicate the places where her thumb marks were. Suroza vs. Honrado (1981) H: Will is valid. A statute requiring a will to be “signed” is satisfied if the signature is made by the testator’s mark. F: Will of illiterate testatrix was written in English, a language she did not understand. Matias vs. Salud (1958) H: Will is void because of the mandatory provision of Art 804 that every will must be executed in a language or dialect known to the testator. F: The testatrix placed her thumb mark in lieu of her usual signature on the will. Beside the thumb mark was the name of the testatrix as purportedly written by one of the witnesses. The attestation clause, however, does not SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 5 of 73 indicate that the person who wrote the name of the testatrix thereon was directed by the latter to do so. H: A thumb mark is considered a signature. It is therefore unnecessary to indicate in the attestation clause that another person has been directed by the testator to write his (testator’s) name thereon, because in effect, the testator signed the will himself. Garcia vs. Lacuesta (1951) of each signature must be such that they may see each other sign if they choose to do so. By merely casting the eyes in the proper direction they could have seen each other sign (2) attested and subscribed by at least 3 witnesses in the presence of the T and of one another • Attesting: act of witnessing • Subscribing: act of signing Q: Must W sign at the end of the will? A: Literally and ideally, the Ws should sign at the end of the will, though failure in this regard may be overlooked (Taboada vs Rosal [1982]) F: Lawyer wrote the name of the testator followed by “a ruego del testador” then the lawyer’s name on the testator’s will. Beside his name, the testator wrote an X. Attestation clause did not state that the lawyer was expressly directed to write testator’s name. H: Void for attestation clause’s failure to state that lawyer wrote T’s name under his express direction. The cross cannot be taken as a signature because it is not the usual way by which the deceased signed his name, nor is it one of the usual ways by which he signed. A cross does not have the trustworthiness of a thumb mark. (3) the T or his agent must sign every page, except the last, on the left margin in the presence of the witnesses • Mandatory – signing on every page in the witnesses’ presence • Directory – place of the signature Icasiano vs. Icasiano (1964) • Signing by an agent of T o Must sign in T’s presence o By his express direction Barut vs Cabacungan (1912) F: The agent (who was also a witness) signed the name of the testator in the latter's presence and by his express direction. Probate was opposed on the ground that the handwriting of the person who signed the name of the testator was of another witness. H: Valid. It is not essential that the person signing for the testator also sign his name. The law only requires: 1. name was written at T’s express direction; 2. in T’s presence; and 3. in the presence of all witnesses. F: Original of the will did not contain signature of one of the witnesses but duplicate copy does. H: Inadvertent failure of one witness to affix his signature to one page, due to simultaneous lifting of pages, is not per se sufficient denial of probate. Impossibility of substitution of page is assured by the signature of the testatrix and the two other witnesses, and the imprint of the seal of the notary public. (4) the witnesses must sign every page, except the last, on the left margin in the presence of the T and of one another Lee vs. Tambago (2008) F: Will was attested by only 2 witnesses. • ‐ ‐ ‐ • Signing at the end If there are non‐dispositive portions, there are 2 ends: o Physical end: where the writing stops o Logical end: where the testamentary disposition ends T may sign at either end as the non‐dispositive portions are not essential parts of the will. If T signs before the end, the ENTIRE will is invalid! Signing in the presence of witnesses Nera vs. Rimando (1911) Doctrine: Test of presence – not whether they actually saw each other sign but whether they might have seen each other sign had they chosen to do so, considering their mental and physical condition and position with relation to each other at the moment of inscription of each signature. • Such that the position of the parties with relation to each other at the moment of the subscription SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI H: Void! (5) all numbers must be numbered correlatively in letters on the upper part of each page • Mandatory – pagination by means of a conventional system • Directory – pagination in letters on the upper part of each page (6) attestation clause • Stating the number of pages of the will; • The fact that the T/his agent signed the will and every page thereof in the presence of the Ws • The fact that the W witnessed and signed the will and every page thereof in the presence of the T and of one another ‐ The attestation clause is the affair of the witnesses, therefore, it need not be signed by the T Cagro vs. Cagro (1953) Page 6 of 73 F: The signatures of the instrumental witnesses were not at the bottom of the attestation clause but on the left‐hand margin of the page containing the AC. H: Fatally defective. Signatures at the left‐hand side were in compliance with the mandate that the will be signed on the left‐hand margin of all its pages Azuela vs. CA (2006) F: Witnesses did not sign at the bottom of the attestation clause but they signed the left‐hand margin of the page where the AC is found. H: Will void. Signatures on the left‐hand margin comply with the requirement that witnesses sign each page of the will. The signatures to the attestation clause establish that the witnesses are referring to the statements contained in the attestation clause itself. The attestation clause is separate and apart from the disposition of the will. An unsigned attestation clause results in an unattested will. (7) acknowledgement before a notary public Javellana vs. Ledesma (1955) F: The notary public signed the certificate of acknowledgement in his office and not in the presence of T and witnesses. H: VALID. The Civil Code, while requiring that a will must be signed by the T and the witnesses in the presence of each other, does not require that the acknowledgement by the notary happen in the presence of the parties. Obiter: It is not required that the T and the Ws acknowledge on the same day it was executed. Logical inference: Neither does Art 806 require that T and Ws acknowledge in each other’s presence. Cruz vs. Villasor (1973) F: There were only three witnesses to the will and it was acknowledged before a notary public who was one of the witnesses. H: VOID for failing to meet the 3‐witness requirement. The notary public cannot acknowledge before himself his having signed the will. Balane asks: If one of the witnesses is a duly commissioned notary public and he notarizes the will, the will is void. TRUE OR FALSE? A: FALSE (If there are more than 3 witnesses, the will meets the 3‐witness requirement hence still valid) Guerrero vs. Bihis (2007) F: Notary public who acknowledged the will was acting outside the place of his commission. H: VOID. No notary shall possess authority to do any notarial act beyond the limits of his jurisdiction. Since Atty. in this case was not commissioned in the place where he notarized the document, he lacked the authority to take the acknowledgment of the testatrix and the witnesses. Ortega vs. Valmonte (2005) F: Valmonte’s will is being contested because the date of execution and the date of acknowledgment are different. H: Will is valid. Conflict between the dates does not invalidate the will because the law does even require that a notarial will be executed and acknowledged on the same occassion. Q: Must an attested will be dated? A: No. Consequently, variance between the indicated dates does not in itself invalidate a will (Ortega vs. Valmonte [2005]) Art. 807. If the testator be deaf, or a deaf‐mute, he must personally read the will, if able to do so; otherwise, he shall designate two persons to read it and communicate to him, in some practicable manner, the contents thereof. (n) Art. 808. If the testator is blind, the will shall be read to him twice; once, by one of the subscribing witnesses, and again, by the notary public before whom the will is acknowledged. (n) • Arts 807 and 808 are mandatory Garcia vs. Vasquez (1970) F: The will and the AC were crammed together on a single page and had typographical errors. It was alleged by proponents that T read the will silently before she signed it BUT there was evidence that T’s vision was for counting fingers at 5 ft and for distant objects only. H: VOID. T could not have read the will silently as she was not unlike a blind testator and execution of the will requires observance of Art. 808. Alvarado vs. Gaviola, Jr (1993) F: Testator had glaucoma. When the will was executed, each witness and the notary were given their own copies of the will. It was read aloud by the lawyer to the testator. The court held there was substantial compliance. H: T was blind for purposes of Art 808 but there was substantial compliance in this case. The purpose of the law was satisfied (to make known to the T the contents of the will and confirm his desires) Art. 809. In the absence of bad faith, forgery, or fraud, or undue and improper pressure and influence, defects and imperfections in the form of attestation or in the language used therein shall not render the will invalid if it is proved that the will was in fact executed and attested in substantial compliance with all the requirements of Article 805. (n) Note: SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 7 of 73 This is criticized as “liberalization running riot”. JBL’s suggested rewording: “In the absence of bad faith, forgery, or fraud, or undue and improper pressure and influence, defects and imperfections in the form of the attestation or in the language used therein shall not render the will invalid if such defects and imperfections can be supplied by an examination of the will itself and it is proved that the will was in fact executed and attested in substantial compliance with all the requirements of Article 805.” • Caneda vs. Court of Appeals (1993) XPN: Substantial compliance is considered valid if there is no appearance of fraud, BF, undue influence and pressure and the authenticity of the will is established. Labrador vs. Court of Appeals (1990) F: Date was stated in the first paragraph of the second page of the will. H: VALID. The law does not specify a particular location where the date should be placed in a will. (3) Signed by the T F: The attestation clause failed to specifically state the fact that the attesting witnesses and the testator signed the will and all its pages in their presence and that they, the witnesses, likewise signed the will and every page thereof in the presence of the testator and of each other. H: AC not valid. Art 809 does not apply. It cannot be conclusively inferred from the signatures that they were made in the presence of each other. Furthermore, the defects were not in the “form...or language.” Rule: Omissions which can be supplied by an examination of the will itself, without the need of resorting to extrinsic evidence, will not be fatal...However, those omissions which cannot be supplied except by evidence aliunde would result in the invalidation of the attestation clause and ultimately, of the will itself. Azuela vs. Court of Appeals (2006) F: Attestation clause failed to state the number of pages. H: VOID. Art 809 was not applied because there was no indication in any part of the will that it was composed of such a number of pages. Lopez vs. Lopez (2012) F: The will stated that it contained 7 pages but the acknowledgement stated that there were 8. AC did not state the number of pages. H: Art 809 does not apply. The discrepancy cannot be explained by mere examination of the will itself but through the presentation of evidence aliunde. Art. 810. A person may execute a holographic will which must be entirely written, dated, and signed by the hand of the testator himself. It is subject to no other form, and may be made in or out of the Philippines, and need not be witnessed. (678, 688a) (1) Entirely written by the hand of the T (2) Dated by the T Roxas vs. De Jesus (1985) F: The holographic will was dated FEB./61 H: VALID. GR: Date in a holographic will should include the day, month and year of its execution as this is relevant to provide for contingencies of ascertaining soundness of mind, or when there are two competing wills. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI SUMMARY: FORMAL REQUIREMENTS OF WILLS Testamentary Capacity 1. There is a general grant of testamentary capacity to natural persons 2. Exceptions: a. Under 18 b. Unsound mind • A legal question, not medical • Soundness of mind was defined Negatively ‐ Not necessary that testator be in full possession of reasoning faculties ‐ Not necessary that testator’s mind be wholly unbroken, unimpaired, or unshattered by disease, injury or other cause Positively Ability to know: ‐ Nature of estate to be disposed of ‐ Proper objects of one’s bounty ‐ Character of testamentary act 3. There is a presumption of soundness of mind, but a presumption of insanity exists when: (1) one month or less before making his will, T was publicly known to be insane (2) executed after being placed under guardianship or ordered committed because of insanity and before said order was lifted Common Requirements (Attested and Holographic) 1. in writing 2. language and dialect known to the testator • There is no presumption that language is known to the T • BUT the will need not state that it is a language known to the T. It may be proven by extrinsic evidence Special Requirements; Attested Wills 1. That the testator sign ‐ in the presence of the witnesses • Remember the test of presence! ‐ at the end ­ on each and every page, except the last, on the left­ hand margin ‐ if signing through an agent • In the T’s presence • Under his express direction • Write in his own hand the T’s name in the proper places • There is no need to sign the agent’s name (Barut) Page 8 of 73 • It is disputed whether the agent may be one of the 3 witnesses 2. Attested and subscribed by 3 or more credible witnesses ‐ on each and every page, except the last, on the left­ hand margin ­ in the T’s presence and in the presence of each other 3. All pages must be numbered correlatively in letters on the upper part of each page 4. Attestation clause ‐ stating the number of pages upon which the will is written ­ the fact that the T signed the will and each and every page thereof (or caused an agent to write his name, in his presence and under his express direction)in the presence of the witnesses ­ that the witnesses witnessed and signed the will and the pages thereof in the presence of T and of each other 5. Acknowledged before a notary public Special Requirements; Attested Wills; Handicapped Testators 1. Deaf/deaf‐mute • If able to read – must read personally • If unable to read – designate 2 persons to: (1) Read it (2) Communicate to him the contents ‐ in some practicable manner (sign language, lip reading, pictures, etc) 2. Blind, Illiterate, Unable to read • The will shall be read to him twice (1) One of the subscribing witnesses (2) Notary public before whom the will is acknowledged The burden of proof is upon the proponent of the will that the special requirement of the article was complied with. There is also no requirement that compliance be stated in the attestation clause. Special Requirements; Holographic wills 1. Entirely written Balane asks: What if the will was partly written? A: If with knowledge/consent of T, VOID AS A WHOLE; If without, the part written by another is void (the validity of a will cannot be placed in the hands of another; it may be sabotaged) 2. Dated • Test is if designated date can be independently checked and ascertained • Examples: Christmas Day 2012, 71st anniversary of Pearl Harbor, At the beginning of Ramadan 2013 3. Signed ART. 811. In the probate of a holographic will, it shall be necessary that at least one witness who knows the SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI handwriting and signature of the testator explicitly declare that the will and the signature are in the handwriting of the testator. If the will is contested, at least three of such witnesses shall be required. In the absence of any competent witness referred to in the preceding paragraph, and if the court deem it necessary, expert testimony may be resorted to. Notes: ‐ ‐ this article prescribes the statutory requisites for the probate of a holographic will; testimonial evidence (rule of evidence) jurisprudential requirement (in addition to the statutory requirements): o the will itself must be presented (Gan v. Yap [1958], infra) the will itself is the only material proof (Scaevola) Art. 811 applies only to post mortem (not ante mortem) probates How to prove genuineness of a handwriting (Sec. 22, Rule 132, Rules of Court) ‐ a witness who actually saw the person writing the instrument ‐ a witness familiar with such handwriting and who can give his opinion thereon, such opinion being an exception to the opinion rule ‐ a comparison by the court of the questioned handwriting and admitted genuine specimen thereof; and ‐ expert evidence The three­witness provision in case of contested holographic wills is directory, not mandatory Azaola v. Singson (1960) Facts: In probate of testatrix’s holographic will, only one witness was presented by proponent. Opposition: that the will was procured by undue and improper influence; that testatrix did not intend the instrument to be her last will. Held: That since the authenticity of the holographic will was not contested, production of more than one witness not required. That even if the will was contested, ART. 811 does not require presentation of three witnesses to identify handwriting of testator since no witness may have been present at execution. Balane Notes: ‐ to “contest” means to attack the authenticity of the will (i.e. that the will is forged) ‐ the Latin maxim testis unus, testis nullus (one witness is not witness) is too archaic a rule (quoting J.B.L. Reyes) o quality of testimony over number of witnesses Codoy v. Calugay (1999) Facts: Holographic will of the testatrix presented for probate. Proponents presented six witnesses. Opposition: Page 9 of 73 that the will was forged and that the same is illegible. Probate allowed, lower court citing Azaola v. Singson. Held: That the provisions of Article 811 are mandatory because of the word “shall.” That not all of the witnesses presented by the proponents were familiar with the testatrix’s handwriting. That a visual examination of the will reveals that the strokes are different compared with other documents written by the testatrix. That case must be remanded to allow contestants to adduce evidence in support of their opposition. Balane Asks: Did Codoy reverse Azaola? Balane Thinks: No, for the following reasons: ‐ Codoy ruling not based on there being less than three witnesses (there were in fact six) ‐ Codoy ruling did not state that since there were less than three witnesses, even if their testimonies were convincing, probate must be denied (testimonies were indecisive) ‐ Codoy ruling said that visual examination of the will reveals that strokes are different compared with standard documents ‐ basis of Codoy ruling: evidence for authenticity, inadequate, not failure on the part of proponents to present three witnesses Balane Notes: ‐ Codoy is consistent with Azaola (quality of testimony over quantity of witnesses) ‐ Codoy, rather than reversing Azaola, may have affirmed it ‐ the statement of the Court in Codoy to the effect that the use of the word “shall” in Article 811 denotes that it is mandatory, is too shallow In the probate of a holographic will, the document itself must be produced; a lost holographic will cannot be probated Gan v. Yap (1958) Facts: Petition for probate of testatrix’s will. Opposition: that testatrix left no will. Proponent did not present will and instead tried to establish contents and due execution thru testimonies. Held: That holographic will must be presented to court for probate, the document itself being material proof of authenticity. That if holographic will not presented, opportunity to oppose and assess the handwriting of the testator, foreclosed. That lost or destroyed holographic will may be proved by a photographic or photostatic copy or by other similar means. Exception to the Gan ruling: Rodelas v. Aranza (1982) made with the standard writings of the testator. That this exception to the general rule was stated in a footnote in Gan v, Yap (1958). ART. 812. In holographic wills, the dispositions of the testator written below his signature must be dated and signed by him in order to make them valid as testamentary dispositions. ART. 813. When a number of dispositions appearing in a holographic will are signed without being dated, and the last disposition has a signature and date, such date validates the dispositions preceding it, whatever be the time of prior dispositions. Formal requirement for additional dispositions in a holographic will ‐ signature, and ‐ date When there are several additional dispositions ‐ signature and date, or ‐ each additional disposition signed and undated, but the last disposition signed and dated If (in case of several additional dispositions) the additional ones before the last are dated but not signed— ‐ only the last will be valid, provided the last is signed and dated If there are several additional dispositions and the additional ones before the last are neither signed nor dated, but the last is both signed and dated— ‐ intermediate dispositions: o VALID if all dispositions made on one occasion (signature and date under last additional disposition validate all) o INVALID or VOID if dispositions made on different occasions ART. 814. In case of any insertion, cancellation, erasure or alteration in a holographic will, the testator must authenticate the same by his full signature. “Full signature,” meaning ‐ not necessarily full name of testator ‐ it means his usual and customary (habitual) signature Effect of noncompliance with article ‐ change (insertion, cancellation, etc.) is simply considered as not made ‐ will is not invalidated as a whole, but at most, only as regards the particular words erased, corrected, or inserted (Kalaw v. Relova [1984]) o unless the portion involved is an essential part of the will, such as the date Facts: A photostatic copy of testator’s holographic will was presented for probate. Opposition: that the original must be presented. Illustration— Held: That a photostatic copy or photocopy of the holographic will, allowed because comparison can be Facts: Proponent Gregorio filed a petition for probate of testatrix’s will. Opposition by Rosa: that she was named as SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Kalaw v. Relova (1984) Page 10 of 73 sole heir and sole executrix. There were two alterations: first, Rosa’s name crossed out as sole heir and Gregorio’s name written above it (no initial); second, Rosa’s name crossed out as sole executrix and Gregorio’s name written above it (with initial). Held: That ordinarily, erasures without proper signature do not invalidate the will as a whole, but at most only as respects the particular words erased. That that general rule does not apply in this case because the holographic will had only one substantial provision which was altered without proper authentication. That the entire will is void because nothing remains in the will that could remain valid. That not even the original unaltered text can be given effect because of the seeming change of mind of testatrix. Balane Comments: ‐ it is beyond cavil that the insertion of Gregorio’s name cannot be given effect because of lack of proper authentication ‐ but why was the cancellation given effect when it was not properly done? ‐ to say that giving effect to the will as first written would disregard the seeming change of mind of the testatrix is no argument at all o it is not enough that the testator manifest his intent—he must manifest it in a manner required by law ART. 815. When a Filipino is in a foreign country, he is authorized to make a will in any of the forms established by the law of the country in which he may be. Such will may be probated in the Philippines. ART. 816. The will of an alien who is abroad produces effect in the Philippines if made with the formalities prescribed by the law of the place in which he resides, or according to the formalities observed in his country, or in conformity with those which this Code prescribes. ART. 817. A will made in the Philippines by a citizen or subject of another country, which is executed in accordance with the law of the country of which he is a citizen or subject, and which might be proved and allowed by the law of his own country, shall have the same effect as if executed according to the laws of the Philippines. ART. 815 to 817 govern rules of formal validity in the following instances (not covered: a Filipino executing a will in the Philippines) ‐ a Filipino abroad (ART. 815) ‐ an alien abroad (ART. 816) ‐ an alien in the Philippines (ART. 817) The rule (combining these three articles, ART. 15 and 17): ‐ every testator, whether Filipino or alien, wherever he may be, has five choices as to what law to follow for the form of his will, viz.: o law of citizenship o law of place of execution o law of domicile o law of residence o law of the Philippines SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Illustration ‐ An engineer (German citizen), with permanent residence in Paris (where he and his wife reside), was contracted by the Brazilian government to construct a dam in Brasilia. He resided in Brazil for five years. One summer on a holiday, he goes to Tokyo for a tour. He also has investments in the Philippines. The German engineer, while in Tokyo, made a will. o the following laws may govern the form of the engineer’s will: law of Germany – German citizen law of France – domiciled in France law of Brazil – resident of Brazil law of Japan – place of execution law of the Philippines ART. 818. Two or more persons cannot make a will jointly, or in the same instrument, either for their reciprocal benefit or for the benefit of a third person. Joint will, meaning ‐ one document which constitutes the wills of two or more individuals The following is a joint will— ‐ “We, the testators, of legal age and of sound and disposing mind...” The following is NOT a joint will— ‐ if there are separate documents, each serving as one independent will (even if written on the same sheet) o e.g. will of testator A on front part of sheet; will of testator B on the back of the same sheet o e.g. will of testator A on upper part of sheet; will of testator B on lower part of the same sheet Joint wills are VOID, but reciprocal wills are VALID ‐ reciprocal wills: two wills instituting each of the respective testators as heirs o e.g. will of testator A designated B as heir; will of testator B designated A as heir Reasons for the prohibition against joint wills ‐ limitation on modes of revocation ‐ diminution of testamentary secrecy ‐ increased danger of undue influence ‐ increased danger of one testator killing the other ART. 819. Wills, prohibited by the preceding article, executed by Filipinos in a foreign country shall not be valid in the Philippines, even though authorized by the laws of the country where they may have been executed. Outline on joint wills ‐ executed by Filipinos in the Philippines Page 11 of 73 ‐ ‐ ‐ ‐ o VOID executed by Filipinos abroad o VOID, even if authorized by law of place of execution executed by aliens abroad o see ART. 816 executed by aliens in the Philippines o one view: VOID (public policy) o another view: ART. 817 applies executed by a Filipino and an alien o VOID as to Filipino o ART. 816 or 817 applies as to alien Subsection 4 – Witnesses to Wills ART. 820. Any person of sound mind and of the age of eighteen years or more, and not blind, deaf or dumb, and able to read and write, may be a witness to the execution of a will mentioned in article 805 of this Code. ART. 821. The following are disqualified from being witnesses to a will: (1) Any person not domiciled in the Philippines; (2) Those who have been convicted of falsification of a document, perjury, or false testimony. Six qualifications of witnesses ‐ of sound mind o attestation is an act of the senses ‐ at least 18 years of age ‐ not blind, deaf, or dumb o again, witnessing is an act of the senses o dumb means mute, not someone who is simply stupid ‐ able to read and write o or literate, because such literate witness would have a better understanding of the solemnity of the execution of a will and his act of being a witness thereto ‐ domiciled in the Philippines o citizenship of witness, immaterial (even if he is not a Filipino or a foreigner) o the only requirement is that the witness is domiciled in the Philippines there is a high probability that witness would be in the country if will is probated and said witness is called to testify in court ‐ must not have been convicted of falsification of a document, perjury, or false testimony o conviction must be by final judgment o these crimes relate to the witness’s trustworthiness or credibility if a witness had been convicted of murder or rape, he is qualified because he can still be honest Competence and credibility, distinguished Gonzales v. CA (1979) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Facts: Testatrix’s will submitted for probate. Opposition: that the will was not attested to by three credible witnesses. Witnesses were driver of the testatrix, driver’s wife, and piano teacher of testatrix’s grandchild. Contestant argued that witnesses must initially testify as to their good standing in the community, their reputation for trustworthiness and reliability, their honesty and uprightness, in order that their testimony may be believed and accepted. Held: That the credibility of a witness is presumed unless the contrary is proved. That the rule is that the instrumental witnesses in order to be competent must be shown to have the qualifications under ART. 820 and none of the disqualifications under ART. 821. That the contestant’s arguments must fail. ART. 822. If the witnesses attesting the execution of a will are competent at the time of attesting, their becoming subsequently incompetent shall not prevent the allowance of the will. Note: ‐ time of execution of the will is the only relevant temporal criterion ART. 823. If a person attests to the execution of a will, to whom or to whose spouse, or parent, or child, a devise or legacy is given by such will, such devise or legacy shall, so far only as concerns such person, or spouse, or parent, or child of such person, or any one claiming under such person or spouse, or parent, or child, be void, unless there are three other competent witnesses to such will. However, such person so attesting shall be admitted as a witness as if such devise or legacy had not been made or given. Notes: ‐ ‐ ‐ article is misplaced, since it is not concerned with capacity to be a witness, but with capacity to succeed in essence, a witness cannot succeed to a will he is witnessing o because such witness will be very partial; he will have some interest to protect (i.e. even if the will had some defect, witness will of course not testify as to said defect) it must be noted that the law does not disqualify the witness Disqualification of a witness to succeed to a devise or legacy when there are only three witnesses ‐ competence of witnesses, not affected ‐ will is valid but witness (or relatives specified in this article) cannot inherit Article also applies to heirs (not only legatees and devisees) ‐ intent of the law is to cover all testamentary institutions Disqualification to succeed applies only to testamentary disposition made in favor of the witness or the specified relatives Page 12 of 73 ‐ if the party is also entitled to a legitime or an intestate share, that portion is not affected by the party’s witnessing the will o testamentary disposition in favor of a witness, VOID o but if the same witness is a compulsory heir, his legitime is unaffected EXCEPTION ‐ if there are three other witnesses (or four witnesses)— o the testamentary disposition in favor of one of them is valid ART. 824. A mere charge on the estate of the testator for the payment of debts due at the time of the testator’s death does not prevent his creditors from being competent witnesses to his will. Notes: ‐ the creditor does not need the testator’s will in order that he may be paid o his claim will be proved in the settlement of the decedent’s estate o the creditor is not an heir Subsection 5 – Codicils and Incorporation by Reference ART. 825. A codicil is a supplement or addition to a will, made after the execution of a will and annexed to be taken as a part thereof, by which any disposition made in the original will is explained, added to, or altered. ART. 826. In order that a codicil may be effective, it shall be executed as in the case of a will. Codicil ‐ explains, adds to, or alters a disposition in a prior will Subsequent will ‐ makes independent and distinct dispositions Codicil need not conform to the form of the will to which it refers ‐ an attested will may have a holographic codicil ‐ a holographic will may have an attested codicil ART. 827. If a will, executed as required by this Code, incorporates into itself by reference any document or paper, such document or paper shall not be considered a part of the will unless the following requisites are present: (1) The document or paper referred to in the will must be in existence at the time of the execution of the will; (2) The will must clearly describe and identify the same, stating among other things the number of pages thereof; books of account or inventories. Documents ‐ inventories, books of accounts, documents of title, papers of similar nature ‐ must not make testamentary dispositions (lest formal requirements for wills be circumvented) Holographic wills cannot incorporate documents by reference ‐ par. 4 of the article requires the signatures of the testator and the witnesses on every page of the incorporated document (except voluminous annexes) Subsection 6 – Revocation of Wills and Testamentary Dispositions ART. 828. A will may be revoked by the testator at any time before his death. Any waiver or restriction of this right is void. A will is essentially revocable or ambulatory ‐ this characteristic cannot be waived even by the testator ‐ a will is revocable ad nutum, i.e. at the testator’s pleasure, during his lifetime ‐ no such thing as an irrevocable will ‐ cf. ART. 777 (successional rights vest only upon death) ART. 829. A revocation done outside the Philippines, by a person who does not have his domicile in this country, is valid when it is done according to the law of the place where the will was made, or according to the law of the place in which the testator had his domicile at the time; and if the revocation takes place in this country, when it is in accordance with the provisions of this Code. Rules for revocation ‐ if made in the Philippines o follow Philippine law ‐ if made outside the Philippines o if testator domiciled in the Philippines follow law of place of execution, or follow law of place where testator was domiciled at the time of revocation o if testator domiciled in the Philippines (not governed by ART. 829) follow Philippine law follow law of place of revocation follow law of place of execution ART. 830. No will shall be revoked except in the following cases: (a) By implication of law; or (3) It must be identified by clear and satisfactory proof as the document or paper referred to therein; and (4) It must be signed by the testator and the witnesses on each and every page, except in case of voluminous SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI (b) By some will, codicil, or other writing executed as provided in case of wills; or (c) By burning, tearing, cancelling, or obliterating the Page 13 of 73 will with intention of revoking it, by the testator himself, or by some other person in his presence, and by his express direction. If burned, torn, cancelled, or obliterated by some other person, without the express direction of the testator, the will may still be established, and the estate distributed in accordance therewith, if its contents, and due execution, and the fact of its unauthorized destruction, cancellation, or obliteration are established according to the Rules of Court. First mode of revocation: By operation of law— ‐ revocation may be total or partial ‐ examples o preterition (ART. 854) o legal separation (ART. 63, par. 4, Family Code) o unworthiness to succeed (ART. 1032) o transformation, alienation, or loss of the object devised or bequeathed (ART. 957) o judicial demand of a credit given as a legacy (ART. 936) Second mode of revocation: By a subsequent will or codicil— ‐ revocation may be total or partial ‐ requisites o subsequent instrument must comply with the formal requirements of a will o testator must possess testamentary capacity o subsequent instrument must either contain an express revocatory clause (express) or be incompatible with the prior will (implied) ‐ revocatory will must be probated same as in testamentary capacity the testator must have completed everything he intended to do o *must concur, otherwise, no revocation Testate Estate of Adriana Maloto v. CA (1988) Facts: Heirs of late Maloto instituted intestate proceeding for settlement of decedent’s estate. Later, a document purporting to be the will of decedent was discovered. Some heirs filed a petition for probate of alleged will. Opposition: that the testatrix’s will had been revoked, her maid having burned the same. Held: That there was no valid revocation by physical destruction because animus revocandi and corpus did not concur. That while animus revocandi may be conceded because that is a state of mind, corpus was not established. That it was not shown that the paper burned by the maid was the will of the testatrix; that the burning was not proven to have been done under the testatrix’s express direction; that the burning was not done in the presence of the testatrix. The loss or unavailability of a will may, under certain circumstances, give rise to the presumption that it had been revoked by physical destruction Gago v. Mamuyac (1927) Facts: Proponent sought to have will of decedent probated, presenting a carbon copy of same. Opposition: that original (will) had been revoked by testator, as testified to by witnesses. Original copy of will could not be found. Third mode of revocation: By physical destruction— ‐ four ways of destroying: o burning o tearing o cancelling o obliterating Held: That there is a presumption that the will had been revoked (cancelled or destroyed) if it cannot be found and is shown to be in the possession of the testator when last seen. That the presumption is that the will was revoked by the testator himself. That the will of the testator in this case is presumed to have been properly revoked. Physical destruction may be done— ‐ by testator personally, or ‐ by another person acting in the testator’s presence and by the testator’s express direction ART. 831. Subsequent wills which do not revoke the previous ones in an express manner, annul only such dispositions in the prior wills as are inconsistent with or contrary to those contained in the later wills. Effect of unauthorized destruction ‐ will may be proved as lost or destroyed o but only if will is attested o if holographic, will cannot be probated if lost or destroyed without authority (Gan v, Yap), unless a copy survives (Rodelas v. Aranza) Note: ‐ Elements of a valid revocation by physical destruction* ‐ corpus o the physical destruction itself o there must be evidence of physical destruction ‐ animus o capacity and intent to revoke SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI the execution of a subsequent will does not ipso facto revoke a prior one ART. 832. A revocation made in a subsequent will shall take effect, even if the new will should become inoperative by reason of the incapacity of the heirs, devisees or legatees designated therein, or by their renunciation. Efficacy of the revocatory clause does not depend on the testamentary dispositions of the revoking will ‐ unless the testator so provides Page 14 of 73 GENERAL RULE: Revocation is an absolute provision independent of the acceptance or capacity of the new heirs EXCEPTION (“dependent relative revocation”): If testator provides in the subsequent will that the revocation of the prior one is— ‐ dependent on the capacity of the heirs, devisees, or legatees instituted in the subsequent will, or ‐ dependent on the acceptance of the heirs, devisees, or legatees instituted in the subsequent will Dependent relative revocation, explanation (Molo v. Molo [1951]) ‐ if act of revocation of a previous (original) will is made by executing a subsequent (new) will, the revocation is conditional and dependent upon the efficacy of the subsequent will ‐ if, for any reason, the new will intended to be made as a substitute is inoperative, the revocation fails and the original will remains in full force ‐ failure of the new will upon whose validity the revocation depends is equivalent to the non‐ fulfillment of a suspensive condition, and hence prevents the revocation of the original will Dependent relative revocation applies ONLY if it appears that the testator intended his act of revocation to be conditioned on— ‐ the making of a new will, or ‐ the validity of a new will, or ‐ the efficacy of a new will Rule of dependent relative revocation applies if the revocation is by physical destruction Molo v. Molo (1951) Diaz v. De Leon (1922) Facts: Testator executed a second will revoking the first. First will presented to court for probate. Held: That the second will did not constitute sufficient revocation. That existence of animus revocandi, sufficient for revocation. That first will, having been shown to have been destroyed with animus revocandi, is considered revoked. That first will was returned to testator who ordered his servant to tear the same, which was done in the presence of testator, clearly manifesting his intent to revoke said first will. That first will cannot be probated for having been destroyed with animus revocandi. Rule if revocation is implied (incompatibility of provisions) ‐ rule in ART. 832 applies ‐ intent of testator to set aside prior will is clear ART. 833. A revocation of a will based on a false cause or illegal cause is null and void. Wills, revocable ad nutum ‐ testator does not have to have a reason or cause for revoking his will ‐ the law protects the testator’s true intent (i.e. to revoke), so this article sets aside a revocation that does not reflect such true intent Requisites for the application of ART. 833 regarding revocation for a false cause ‐ cause must be concrete, factual, and not purely subjective ‐ cause must be false ‐ testator must not know of the falsity of the cause ‐ it must appear from the will that the testator is revoking because of the false cause Facts: Testator left two wills: original and new which contained a revocatory clause. New will was probated. Later, probation was set aside as oppositors proved that new will not made in accordance with law. Proponents sought to have original will probated. Opposition: that original will had been revoked by new will, notwithstanding disallowance of new will. Evidence was presented by contestants that original will had been destroyed by testator. Extension of ART. 833 to illegal causes (reason: public policy), in effect, restricts the testator’s freedom to revoke ‐ illegal cause must be stated in the will as the cause of revocation Held: That original will stands because subsequent (new) will containing a revocatory clause has been disallowed. That a subsequent will containing a revocatory clause which was denied probate cannot produce the effect of annulling the original or previous will because the revocatory clause is void. That destruction of original will cannot have the effect of defeating said will (prior will) because of the fact that it is founded on mistaken belief that subsequent will has been validly executed and would be given effect. Notes: ‐ Balane Thinks: ‐ “Can it not be argued that the act of the testator in destroying the will in fact confirmed his intent to revoke it? (referring to the case of Molo v. Molo)” SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ART. 834. The recognition of an illegitimate child does not lose its legal effect, even though the will wherein it was made should be revoked. ‐ recognition of an illegitimate child in a will is irrevocable (i.e. even if the will is revoked, the recognition remains effective) under the Family Code (cf. ART. 175, Family Code), admission of illegitimate filiation in a will would constitute proof of illegitimate filiation Subsection 7 – Republication and Revival of Wills ART. 835. The testator cannot republish, without reproducing in a subsequent will, the dispositions contained in a previous one which is void as to its form. ART. 836. The execution of a codicil referring to a previous will has the effect of republishing the will as Page 15 of 73 modified by the codicil. with the Rules of Court. Notes: ‐ The testator himself may, during his lifetime, petition the court having jurisdiction for the allowance of his will. In such case, the pertinent provisions of the Rules of Court for the allowance of wills after the testator’s death shall govern. republication or revival to give back efficacy to a will which has become inefficacious Will, void as to form if it does not comply with the requirements of ART. 804 to 808; 810 to 814; 818 and 819 How to republish a will that is void as to its form— ‐ to execute a subsequent will and reproduce (i.e. copy out) the dispositions of the original will o mere reference, not enough How to republish a will that is not void as to its form but (a) void for a reason other than a formal defect [e.g. a will that institutes one of the three attesting witnesses], or (b) previously revoked— ‐ to execute a subsequent will or codicil referring to the previous will o no need to reproduce the provisions of the prior will in the subsequent instrument ART. 837. If after making a will, the testator makes a second will expressly revoking the first, the revocation of the second will does not revive the first will, which can be revived only by another will or codicil. Explanation— ‐ the revocation of a second will (revoking a first will) by a third will does not revive the first will o the revocatory clause of a revoked will (second will) remains effective (because third will revoking second will does not revive first will) Balane Notes: ‐ this article is based on the theory of instant revocation, which is inconsistent with the principle that wills take effect mortis causa ‐ a revocatory will, as in every will, in order to have effect must be probated; but a second will revoking the first, which second will has already been revoked, must be submitted to court for probate? ART. 837 does not apply in case of implied revocation (i.e. the article only applies if revocation of the first will by the second will is express)— ‐ the revocation of a second will (revoking a first will) by a third will would revive the first will, UNLESS the third will is itself inconsistent with the first EXCEPTION ‐ if the second will is holographic and is revoked by physical destruction o because it cannot be probated, unless a copy survives Subsection 8 – Allowance and Disallowance of Wills ART. 838. No will shall pass either real or personal property unless it is proved and allowed in accordance SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI The Supreme Court shall formulate such additional Rules of Court as may be necessary for the allowance of wills on petition of the testator. Subject to the right of appeal, the allowance of the will, either during the lifetime of the testator or after his death, shall be conclusive as to its due execution. Probate, defined ‐ a judicial process to determine the due execution (formal or extrinsic validity) of a will Probate of a will, mandatory Guevara v. Guevara (1943) Facts: Testator executed a will which was never presented to court for probate. Respondent sought to recover a parcel of land sold to petitioner, claiming that said land was part of her legitime. To support her claim, respondent presented the will before the court to prove that she was acknowledged by testator as his natural child, and only for that purpose (i.e. not for probate). Respondent claimed to be an intestate and compulsory heir of decedent. Held: That the procedure adopted by respondent cannot be sanctioned because presentation of will to court for probate is mandatory, and its allowance essential and indispensable for its efficacy. Two stages of settlement of estate ‐ probate of will o formal validity is determined ‐ settlement proper o substantive validity (i.e. efficacy of provisions) of will is passed upon Once a decree of probate becomes final, it is res judicata De la Cerna v. Potot (1964) Facts: Joint will executed by testator and testatrix. When testator died, will admitted to probate. Probate decree became final. Later, same will submitted to court for probate when testatrix died. Probate court denied probate (the second time) because joint wills are void. Held: That the admission of a joint will to probate is an error of law which should have been corrected by appeal, but which did not affect the jurisdiction of the probate court, nor the conclusive effect of its final decision. That since the probate court (during the first probate) has spoken with finality when it admitted the joint will to probate, the final decree of probate has conclusive effect as to testator’s will. Page 16 of 73 Scope of final decree of probate: GENERAL RULE: Conclusive as to due execution (i.e. extrinsic or formal validity only) Gallanosa v. Arcangel (1978) Facts: Legal heirs of testator filed an action for annulment of testator’s duly probated will. Ground: fraud in the execution and simulation. Testamentary heirs opposed. Lower court annulled probated will. Held: That procedural laws do not sanction an action for the “annulment” of a will. That decree of probate of will is conclusive as to its due execution or formal validity. That admission of will to probate means that the testator was of sound and disposing mind; that his consent was not vitiated; that the will was signed by him in the presence of the required number of witnesses; and that the will is genuine. That these facts cannot again be questioned in a subsequent proceeding, not even in a criminal action for forgery of will. That trial judge gravely abused his discretion in annulling duly probated will. What formal validity encompasses (Dorotheo v. CA [1999]) ‐ whether the will submitted is indeed the decedent’s last will and testament ‐ compliance with the prescribed formalities for the execution of wills ‐ testamentary capacity ‐ due execution of the will Due execution means: ‐ the testator’s sound and disposing mind ‐ freedom from vitiating factors (duress, menace, undue influence) ‐ will genuine, not forgery ‐ proper testamentary age ‐ the testator is not expressly prohibited bylaw from making a will Another way of defining the scope of a final decree of probate is to refer to ART. 839, infra— ‐ objection to a will on any of the grounds enumerated in that article is foreclosed by a final decree of probate EXCEPTION: A decree of probate does not concern itself with the question of intrinsic validity, and the probate court should not pass upon that issue, except if on its face the will appears to be intrinsically void Nepomuceno v. CA (1985) Facts: Testator devised entire free portion to kabit. Testator noted in his will that he could not marry kabit because he was legally married to someone else. Kabit presented will to court for probate. Legal wife opposed. Probate denied: the will was invalid on its face because of prohibited disposition. Appellate court reversed: will valid except that devise in favor of kabit is null and void, per ART. 739 in relation with ART. 1028 of the Civil Code. Held: That while the general rule is that in probate proceedings the court’s area of inquiry is limited to an SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI examination and resolution of the extrinsic validity of the will, the general rule is not inflexible and absolute, for probate court not powerless to pass upon certain provisions of will. That probate of a will might become an idle ceremony if on its face it appears to be intrinsically void. That a donation cannot be given between persons living in adultery or concubinage, in which case donation is void. That this rule also applies to testamentary dispositions. That therefore the testamentary disposition in favor of kabit is void. Baltazar v. Laxa (2012) Facts: Will of the testatrix presented to court for probate. Opposition: those enumerated in ART. 839, infra). Held: That courts are only tasked to pass upon the extrinsic validity of will in probate proceedings. That due execution of will or its extrinsic validity pertains to whether testator, being of sound mind, freely executed will in accordance with formalities prescribed by law (ART. 805 to 806). That there is faithful compliance with formalities laid down by law apparent from face of will. That contestants failed to substantiate their allegations, hence probate of will must be allowed. ART. 839. The will shall be disallowed in any of the following cases: (1) If the formalities required by law have not been complied with; (2) If the testator was insane, or otherwise mentally incapable of making a will, at the time of its execution; (3) If it was executed through force or under duress, or the influence of fear, or threats; (4) If it was procured by undue and improper pressure and influence, on the part of the beneficiary or of some other person; (5) If the signature of the testator was procured by fraud; (6) If the testator acted by mistake or did not intend that the instrument he signed should be his will at the time of affixing his signature thereto. Grounds for disallowance of a will listed in ART. 839, exclusive ‐ a final probate decree forecloses any subsequent challenge on any of the matters enumerated in this article ‐ if any of these grounds for disallowance is proved, the will shall be set aside as void o a will is either valid or void (no such thing as a voidable will) VALID – if none of defects in ART. 839 are present VOID – if any one of the defects is present Re ART. 839(1)— ‐ See ART. 804 to 814, 818 to 819, and 820 to 821 Page 17 of 73 Re ART. 839(2)— ‐ cf. ART. 796 to 803 Re ART. 839(3)— ‐ force (violence), as defined in contract law (ART. 1335) ‐ duress (intimidation), as defined in contract law (ART. 1335) Re ART. 839(4)— ‐ undue or improper pressure or influence (undue influence), as defined in contract law (ART. 1337) Re ART. 839(5)— ‐ fraud, as defined in contract law (ART. 1338) Re ART. 839(6)— ‐ mistake, as defined in contract law (ART. 1331) Section 2 – Institution of Heir ART. 840. Institution of heir is an act by virtue of which a testator designates in his will the person or persons who are to succeed him in his property and transmissible rights and obligations. Notes: ‐ ‐ rules on institution of heir apply also to institution of devisees and legatees wills are for institution of heirs ART. 841. A will shall be valid even though it should not contain an institution of an heir, or such institution should not comprise the entire estate, and even though the person so instituted should not accept the inheritance or should be incapacitated to succeed. In such cases the testamentary dispositions made in accordance with law shall be complied with and the remainder of the estate shall pass to the legal heirs. Notes: ‐ ‐ cf. Seangio v. Reyes (2006) o involving a will without testamentary dispositions (disinheritance) if heir, legatee, or devisee does not accept or is incapacitated o intestacy as to that part results ART. 842. One who has no compulsory heirs may dispose by will of all his estate or any part of it in favor of any person having capacity to succeed. One who has compulsory heirs may dispose of his estate provided he does not contravene the provisions of this Code with regard to the legitime of said heirs. Even if will does not contain any testamentary disposition— ‐ it will be formally valid provided it complies with all the formal requisites How much can be disposed of by will— ‐ if testator has no compulsory heirs: SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ‐ o the entire hereditary estate if testator has compulsory heirs: o the disposable portion (i.e. the net hereditary estate minus the legitimes) If testator disposes by will of less than he is allowed whether or not he leaves compulsory heirs— ‐ mixed succession results o testamentary succession as to that part disposed of by will, and o intestate succession as to that part not disposed of by will o (legitimes pass by strict operation of law) ART. 843. The testator shall designate the heir by his name and surname, and when there are two persons having the same names, he shall indicate some circumstance by which the instituted heir may be known. Even though the testator may have omitted the name of the heir, should he designate him in such manner that there can be no doubt as to who has been instituted, the institution shall be valid. ART. 844. An error in the name, surname, or circumstances of the heir shall not vitiate the institution when it is possible, in any other manner, to know with certainty the person instituted. If, among persons having the same names and surnames, there is a similarity of circumstances in such a way that, even with the use of other proof, the person instituted cannot be identified, none of them shall be an heir. Requirement for designation of heir ‐ that the heir, legatee, or devisee must be identified in the will with sufficient clarity to leave no doubt as to the testator’s intention Designation of name and surname is directory ‐ what is mandatory is that the identity of the heirs, legatees, or devisees must be sufficiently established (usually, by giving the name and surname, but there are other ways) Other ways of establishing identity of heir, devisee, or legacy ‐ “I designate as heir to one‐eighth of my estate my eldest first cousin” ‐ “I devise my lechon parlor to my Civil Procedure professor” If there is any ambiguity in the designation, the ambiguity must be resolved in accordance with ART. 789 ‐ i.e. by evidence aliunde, excluding oral declarations of the testator If ambiguity cannot be resolved— ‐ testator’s intent becomes unascertainable o intestacy therefore as to that portion results Page 18 of 73 ART. 845. Every disposition in favor of an unknown person shall be void, unless by some event or circumstance his identity becomes certain. However, a disposition in favor of a definite class or group of persons shall be valid. Unknown person ‐ refers to a successor whose identity cannot be determined because the designation in the will is so unclear or so ambiguous as to be incapable of resolution ‐ this does not refer to one with whom the testator is not personally acquainted ‐ testator may institute somebody who is a perfect stranger to him, provided the identity is clear Illustrations of a successor whose identity cannot be determined ‐ “I designate as heir to one‐fourth of my estate a fiction writer” ‐ “I give one‐third of my estate to someone who cares” Illustration of a designation of an unknown person whose identity, “by some event or circumstance” becomes certain ‐ “I designate as heir to one‐fourth of my estate, whoever tops the bar the year after my death” Illustration of a disposition in favor of a definite class or group of persons ‐ “I institute as heir to the entire free portion of my estate, the poor” ART. 846. Heirs instituted without designation of shares shall inherit in equal parts. General presumption in cases of collective designation— ‐ EQUALITY ‐ if testator intends an unequal apportionment, he should so specify ART. 846 applies only to testamentary heirs as such (or devisees or legatees), and NOT to an heir who is both a compulsory and a testamentary heir (because the heir will get his legitime and his testamentary share) To illustrate— ‐ a testator institutes his son, his friend, and his cousin as testamentary heirs o son will get his legitime plus his testamentary share o friend and cousin each get an equal share o son’s testamentary share is equal to each of friend’s and cousin’s testamentary share son gets more (legitime plus testamentary share) Not explicitly covered by ART. 846 is a situation where the shares of some of the heirs are designated and those of others are not SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ART. 847. When the testator institutes some heirs individually and others collectively as when he says, “I designate as my heirs A and B, and the children of C,” those collectively designated shall be considered as individually instituted, unless it clearly appears that the intention of the testator was otherwise. Equality and individuality of designation ‐ in addition, this article establishes the presumption that the heirs collectively referred to are designated per capita along with those separately designated ‐ if testator intends a block designation, he must so specify Illustration ‐ “I designate as heirs Mrs. Shoal Halimawis, her daughter Ms. Cera Halimawis, and Block A2015 of the PUP College of Law” (Block A2015 composed of 20 people; testator died single and without legitimate issue) o Mrs. Shoal, Ms. Cera, and the 20 people of Block A2015 would be considered as individually instituted each would receive 1/22 of the estate ART. 848. If the testator should institute his brothers and sisters, and he has some of full blood and others of half blood, the inheritance shall be distributed equally unless a different intention appears. Again, EQUALITY of shares ‐ if testator intends otherwise, he must so specify This article applies to testamentary succession only ‐ in testamentary succession o equality of shares of full‐ and half‐blood brothers and sisters, unless the testator provides otherwise ‐ in intestate succession o proportion of 2:1 between full‐ and half‐blood brothers and sisters (ART. 1006) and only if the disqualification in ART. 992 does not apply ART. 848 seems to apply even to illegitimate brothers and sisters, in cases where the testator is of legitimate status, and vice­versa ‐ the article makes no distinction ‐ ubi lex non distinguit, nec nos distinguere debemus ART. 849. When the testator calls to the succession a person and his children, they are all deemed to have been instituted simultaneously and not successively. Note: ‐ equality and individuality rule again ART. 850. The statement of a false cause for the institution of an heir shall be considered as not written, unless it appears from the will that the testator would not have made such institution if he had known the falsity of such cause. Page 19 of 73 Note: ‐ truth or falsity of cause is immaterial because the basis of institution, like donation, is liberality General Rule: Falsity of stated cause for testamentary disposition does not affect validity or efficacy of institution ‐ reason: testamentary dispositions are ultimately based on liberality Exception: Falsity of stated cause for institution will set aside or annul the institution if certain factors are present ‐ the factors / requisites (Austria v. Reyes [1970]) o the cause for the institution must be stated in the will o the cause must be shown to be false o it must appear from the face of the will that the testator would not have made such institution if he had known the falsity of the cause Austria v. Reyes (1970) Facts: Testatrix instituted as heirs her legally adopted children. Ante mortem probate of will allowed. Opposition to partition of estate: entire estate should descend to contestants by intestacy because of intrinsic nullity of institution of heirs (theory of false adoption); that testatrix was led into believing that instituted heirs entitled to legitimes as compulsory heirs, as evidenced by her use of the phrase “sapilitang mana.” Held: That requisites for annulment (see factors enumerated in the Exception above) of institution of heirs based on false cause not present. That there was not even a cause for institution stated in will. That testatrix’s use of phrase “sapilitang mana” probably means that she approved of system of legitimes. Correlate ART. 850 (annulling factor: falsity) with ART. 1028 in relation to ART. 739 (annulling factor: illegality) ART. 851. If the testator has instituted only one heir, and the institution is limited to an aliquot part of the inheritance, legal succession takes place with respect to the remainder of the estate. The same rule applies, if the testator has instituted several heirs each being limited to an aliquot part, and all the parts do not cover the whole inheritance. Wording of ART. 851, erroneous ‐ legal succession does not take place with respect to the remainder of the estate, but to the remainder of the disposable portion o there may be compulsory heirs whose legitimes will cover part of the estate o the legitimes do not pass by legal or intestate succession ART. 851 states exactly the same rule laid down in ART. 841 ART. 852. If it was the intention of the testator that the SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI instituted heirs should become sole heirs to the whole estate, or the whole free portion, as the case may be, and each of them has been instituted to an aliquot part of the inheritance and their aliquot parts together do not cover the whole inheritance, or the whole free portion, each part shall be increased proportionally. ART. 853. If each of the instituted heirs has been given an aliquot part of the inheritance, and the parts together exceed the whole inheritance, or the whole free portion, as the case may be, each part shall be reduced proportionally. Elements common to both ART. 852 and 853 ‐ there are more than one instituted heir ‐ the testator intended them to get the whole estate or the whole disposable portion ‐ the testator has designated a definite portion for each heir In ART. 852— ‐ total of all portions is less than the whole estate (or free portion) o therefore, a proportionate increase is necessary o difference cannot pass by intestacy because the intention of the testator is clear—to give the instituted heirs the entire amount In ART. 853— ‐ the total exceeds the whole estate (or free portion) o therefore, a proportionate reduction must be made Illustrations of ART. 852: ‐ X dies without any compulsory heirs but leaves a will: “I institute A, B, and C to my entire estate in the following proportions: A – 1/2, B – 1/3. C – 1/8.” The estate is valued at P600,000 at the time of X’s death. o the total of the specified portions is only 23/24 o total of proportions: 575,000 A = 300,000 (1/2 or 12/24 of 600,000) B = 200,000 (1/3 or 8/24) C = 75,000 (1/8 or 3/24) o to find A’s increased share (x): SOLUTION 1: x = 300,000_ 600,000 575,000 575x 575 x = 180,000,000_ 575 = 313,043.48 SOLUTION 2: A is entitled to 12/24 B is entitled to 8/24 C is entitled to 3/24 Total: 23/24 Page 20 of 73 Ratio of 12:8:3 = 23 SOLUTION 2: A is entitled to 6/24 B is entitled to 3/24 C is entitled to 2/24 Total: 11/24 So: 12 23 = x_____ 600,000 Ratio of 6:3:2 = 11 23x = 23 7,200,000__ 23 x 313,043.48 = o o o ‐ So: find B’s increased share using any of the solutions presented above (you may also use your own devised solution and share it with the class); your answer must be 208,695.65 6 11 = x_____ 300,000 11x 11 = 1,800,000__ 11 x = 163,636.36 o find B’s increased share; your answer must be 81,818.19 o find C’s increased share; your answer must be 54,545.45 o now add A’s, B’s, and C’s increased shares; the total must be 300,000 (Y is entitled to 300,000, his legitime) find C’s increased share; your answer must be 78,260.87 now add A’s, B’s, and C’s increased shares; total must be 600,000 X dies with Y (a legitimate child) as his only compulsory heir. X leaves a will: “I give A, B, and C the entire free portion of my estate, such that A gets 1/4, B gets 1/8, and C gets 1/2 of said free portion.” X’s net estate is worth P600,000. o the total of the specified portions is only 11/24 o total of proportions: 275,000 A = 150,000 (1/4 or 6/24 of 600,000) B = 75,000 (1/8 or 3/24) C = 50,000 (1/12 or 2/24) o NOTE: the free portion is only 1/2 of the estate, i.e. half of 600,000 or only 300,000 as the total legacies given to A, B, and C is only 275,000 (25,000 short of 300,000) their shares need to be proportionately increased SOLUTION 1: x 300,000 = 150,000__ 275,000 275x 275 = 45,000,000_ 275 x = Illustrations of ART. 853: ‐ X dies without any compulsory heirs but leaves a will: “I institute A, B, and C to my entire estate. A is to get 1/2, B is to get 1/3, and C is to get 1/4 thereof.” X’s net estate is valued at P600,000 at the time of his death. o the total of the specified portions is 13/12 o total proportions: 650,000 A = 300,000 (1/2 or 6/12 of 600,000) B = 200,000 (1/3 or 4/12) C = 150,000 (1/4 or 3/12) o to find A’s reduced share (x): SOLUTION 1: x = 600,000 650x 650 x = = 300,000__ 650,000 180,000,000_ 650 276,923.08 163,636.36 SOLUTION 2: SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 21 of 73 A is entitled to 6/12 B is entitled to 4/12 C is entitled to 3/12 Total: 13/12 325x 325 x = 45,000,000_ 325 = 138,461.54 Ratio of 6:4:3 = 13 SOLUTION 2: A is entitled to 6/24 B is entitled to 4/24 C is entitled to 3/24 Total: 13/24 So: 6 13 = _ x_____ 600,000 13x 13 = 13 x = 3,600,000__ Ratio of 6:4:3 = 13 So: o 276,923.08 find B’s reduced share; your answer must be 184,615.38 6 13 = x_____ 300,000 13x 13 = 1,800,000__ 13 x o o ‐ = 138,461.54 o find B’s reduced share; your answer must be 92,307.69 o find C’s reduced share; your answer must be 69,230.77 o now add A’s, B’s, and C’s reduced shares; the total must now be 300,000 (Y is entitled to 300,000, his legitime) find C’s reduced share; your answer must be 138,461.54 now add A’s, B’s, and C’s reduced shares; the total must now be 600,000 X dies with Y (a legitimate child) as his only compulsory heir. X leaves a will: “I give A, B, and C the entire disposable portion of my estate, such that A is to get 1/4 of the estate, B is to get 1/6 of my estate, and C is to get 1/8 of my estate.” X’s net estate is worth P600,000. o the total of the specified portions is 13/24 (more than 1/2 or 12/24 available as disposable) o total of proportions: 325,000 A = 150,000 (1/4 or 6/24 of 600,000) B = 100,000 (1/6 or 4/24) C = 75,000 (1/8 or 3/24) o NOTE: the free portion is only 1/2 of the estate, i.e. half of 600,000 or only 300,000 as the total legacies given to A, B, and C is 325,000 (25,000 in excess of the 300,000 disposable portion) their shares need to be proportionately decreased SOLUTION 1: x = 300,000 150,000__ 325,000 SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ART. 854. The preterition or omission of one, some, or all of the compulsory heirs in the direct line, whether living at the time of the execution of the will or born after the death of the testator, shall annul the institution of heir; but the devises and legacies shall be valid insofar as they are not inofficious. If the omitted compulsory heirs should die before the testator, the institution shall be effectual, without prejudice to the right of representation. Preterition (omission) in sum: ‐ omission from what? o from inheritance, NOT from the will (“total omission in the inheritance”) ‐ who can be preterited? o compulsory heirs in the direct line ‐ what is the effect of preterition? Page 22 of 73 o annuls the institution of heir but respects legacies and devises insofar as these do not impair the legitimes The following cases do NOT constitute preterition:* ‐ if the heir in question is instituted in the will but the portion given to him by the will is less than his legitime (Reyes v. Barretto­Datu [1967]) ‐ if the heir is given a legacy or devise (Aznar v. Duncan [1966]) ‐ if the heir had received a donation inter vivos from the testator o donation inter vivos is considered as an advance on the legitime (cf. ART. 906, 909, 910, and 1062) ‐ if the heir is not mentioned in the will nor was a recipient of a donation inter vivos from the testator, but not all of the estate is disposed of by will o the omitted heir would receive something by intestacy from the vacant portion (not disposed of by will) *in all these cases, the remedy of the compulsory heir, if the value of what he received is less than his legitime, is to demand completion of the same (ART. 906 and 907) Held: That there was no preterition because Helen Garcia, a compulsory heir, was not entirely omitted from the inheritance as in fact she received a legacy. That Helen Garcia’s remedy is to have her legitime satisfied. Heirs of Ureta v. Heirs of Ureta (2011) Facts: Heirs of Policronio argued that they had been preterited because they were deprived of a share in the estate of their late father. Held: That preterition is a concept of testamentary succession and that where decedent leaves no will, as in this case, there can be no preterition. There is preteriton if a compulsory heir received nothing from the testator by way of: ‐ testamentary succession ‐ legacy or devise ‐ donation inter vivos ‐ intestacy What constitutes preterition is not omission (in the sense of not being mention) in the will but being completely left out of the inheritance Seangio v. Reyes (2006) Reyes v. Barretto­Datu (1967) Facts: Testator instituted as heirs his two daughters, Salud and Milagros. Later, it turned out that Salud was not the testator’s daughter by his wife. Milagros claimed that Salud not entitled to any share in her father’s estate. Held: That while the share assigned to Salud impinged on the legitime of Milagros, Salud did not for that reason cease to be a testamentary heir. That there was no preterition or total omission of a forced heir (Milagros) despite the fact that Milagros was allotted in her father’s will a share smaller than her legitime. That such allotment did not invalidate the institution of heir (Salud). Balane Comments: ‐ in Reyes: (a) there was a compulsory heir [Milagros]; (b) such heir was instituted in the will; (c) the testamentary disposition given to such heir was less than her legitime o there was NO PRETERITION o reason: there was NO TOTAL OMISSION inasmuch as the heir received something from the inheritance o remedy of compulsory heir who received less than his legitime: completion or satisfaction of legitime (ART. 906 and 907) Facts: Testator executed a holographic will wherein he disinherited one of his compulsory heirs (Alfredo, testator’s son). Virginia’s name mentioned in the holographic will. Held: That there was no preterition because it was testator’s intention to bequeath his estate to all his compulsory heirs except Alfredo. That testator did not institute an heir to the exclusion of other compulsory heirs. That mere mention of Virginia’s name did not institute her as universal heir but a mere witness to Alfredo’s maltreatment of testator. Who are included within the terms of ART. 854 ‐ a compulsory heir in the direct line, “whether living at the time of the execution of the will or born after the death of the testator” o but quasi‐posthumous children also included those born after the execution of the will but before the testator’s death Compulsory heirs in the direct line— ‐ children or descendants* o including adopted children (Acain v. IAC [1987]) ‐ parents or ascendants (in default of children or descendants)* Aznar v. Duncan (1966) Facts: Testator instituted as heir his acknowledged natural daughter, Lucy Duncan. Helen Garcia, another natural daughter of testator who however was not acknowledged, complained that she had been preterited. Helen Garcia was given only a legacy of 3,600 pesos. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI *legitimate or illegitimate; the law does not distinguish (Manresa) Surviving spouse is NOT a compulsory heir in the direct line ‐ while a compulsory heir, he is NOT in the direct line (Balanay v. Martinez, Acain v. IAC) ‐ meaning of direct line (ART. 964, par. 2) Page 23 of 73 o “a direct line is that constituted by the series of degrees among ascendants and descendants” Predecease of preterited compulsory heir (par. 2, ART. 854) ‐ the determination of whether or not there are preterited heirs can be made only upon the testator’s death ‐ if the preterited heir predeceases (or is unworthy to succeed) the testator, preterition becomes moot o BUT if there is a descendant of that heir who is himself preterited, then the effects of preterition will arise o to illustrate— if a testator (X) makes a will which results in the preterition of one of his two sons (A); A predeceases his father X but A leaves a son (A‐ 1); ART. 854 applies (i.e. A‐1 is preterited because he succeeds X by representation of his father A, the son of X) Adopted children— Acain v. IAC (1987) Facts: Widow and legally adopted child of testator opposed probate of testator’s will: they had been preterited. Will had no legacies or devises. Held: That widow not preterited because she is not a compulsory heir in the direct line; but legally adopted child, preterited. That adoption gives to adopted person same rights and duties as if he were legitimate child of adopter and makes adopted person a legal heir of adopter. That will is totally abrogated. Effect of preterition ‐ annulment of the institution of heir, but ‐ validity of legacies and devises to the extent that these do not impair legitimes (to the extent of the free portion; legacies and devises merely to be reduced if legitimes are impaired) o preterition is the only instance where distinction between heirs and legatees / devisees is relevant if will contains only institutions of heirs and there is preterition—total intestacy results Meaning of annulment of institution of heir: Nuguid v. Nuguid (1966) abrogate, to make void, to reduce to nothing, to annihilate, to obliterate, to blot out, to make void or of no effect, to nullify, to abolish. That institution of testatrix’s sister as sole her is annulled. Preterition contra ineffective disinheritance ‐ preterition is the total omission from the inheritance, without the heir being expressly disinherited o implied basis: inadvertent omission by the testator so if testator explicitly disinherits the heir, ART. 854 will not apply ‐ if the disinheritance is ineffective for absence of one or other of the requisites for a valid disinheritance— o the heir is simply entitled to demand his rightful share ART. 855. The share of a child or descendant omitted in a will must first be taken from the part of the estate not disposed of by will, if any; if that is not sufficient, so much as may be necessary must be taken proportionally from the shares of the other compulsory heirs. Proper application of ART. 855— ‐ where a compulsory heir is not preterited but left something (because not all the estate is disposed of by will) less than his legitime How to fill up a compulsory heir’s impaired legitime: ‐ from the vacant portion ‐ from the shares of the testamentary heirs, legatees, and devises, proportionally ART. 855 is superfluous because is speaks of completion of legitime (dealt with in detail in ART. 907, et seq.) ART. 855 is inaccurate ‐ coverage should be all compulsory heirs, not just children or descendants ‐ proportionate reduction must be borne by testamentary heirs, including devisees and legatees, and NOT by the compulsory heirs ART. 856. A voluntary heir who dies before the testator transmits nothing to his heirs. A compulsory heir who dies before the testator, a person incapacitated to succeed, and one who renounces the inheritance, shall transmit no right to his own heirs except in cases expressly provided for in this Code. Right to succeed cannot be transmitted—it is a purely personal right Facts: Testatrix died without descendants. Testatrix instituted in her will her sister as sole heir. Testatrix’s parents opposed probate: that they had been preterited. Representation ‐ representative is raised to the level of the person represented Held: That testatrix’s parents (forced heirs in the direct ascending line) had been preterited, as will completely omits both of them. That the word “annul” means to Complete statement of the rule: ‐ an heir (whether compulsory, voluntary or testamentary, or legal) transmits nothing to his SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 24 of 73 heirs in case of predecease, incapacity, renunciation, or disinheritance o however, in case of predecease or incapacity of compulsory or legal heirs, as well as disinheritance of compulsory heirs— the rules on representation shall apply ‐ incapacity of the first heir How testator may provide for simple substitution with all three causes— ‐ by specifying all the three causes ‐ by merely providing for a simple substitution ART. 857. Substitution is the appointment of another heir so that he may enter into the inheritance in default of the heir originally instituted. Restricted simple substitution ‐ testator may limit the operation of simple substitution by specifying only one or two of the three causes o vacancy results if the cause specified does not happen (i.e. if another cause not specified in the will occurs) Simple substitution is really a form of conditional institution ART. 860. Two or more persons may be substituted for one; and one person for two or more heirs. Basis of substitutions ‐ testamentary freedom ‐ in simple substitutions, the testator simply makes a second choice, in case the first choice does not inherit ‐ in fideicommissary substitutions, the testator imposes a restriction or burden on the first heir coupled with a selection of a subsequent recipient of the property Brief or compendious substitution ‐ a possible variation of either a vulgar or a fideicomisaria ‐ brief o two or more substitutes for one original heir ‐ compendious o one substitute for two or more original heirs ART. 858. Substitution of heirs may be: Substitution will take place only if all the original heirs are disqualified— ‐ if one is substituted for two or more original heirs, and one but not all is not qualified to inherit o NO SUBSTITUTION—share left vacant will accrue to surviving co‐heir/s if A and B were instituted as heirs to 1/3 of the estate, with C as substitute, substitution will take place only if both A and B are disqualified to inherit; if only A is disqualified, B would inherit A’s share, exclusively o EXCEPTION— if testator provides otherwise (that substitution will take place in case any one of the original heirs dies, renounces, or is incapacitated Section 3 – Substitution of Heirs (1) Simple or common; (2) Brief of compendious; (3) Reciprocal; or (4) Fideicommissary. Four kinds of substitution: ‐ simple or common (vulgar) [ART. 859] ‐ brief or compendious (brevilocua o compendiosa) [ART. 860] ‐ reciprocal (recíproca) [ART. 861] ‐ fideicommissary (fideicomisaria) [ART. 863] In reality, there are only two kinds of substitutions: vulgar and fideicomisaria (mutually exclusive, i.e. substitution must be one or the other, cannot be both at the same time) ‐ the other two are modalidades of the vulgar or the fideicomisaria ART. 859. The testator may designate one or more persons to substitute the heir or heirs instituted in case such heir or heirs should die before him, or should not wish, or should be incapacitated to accept the inheritance. A simple substitution without a statement of the cases to which it refers, shall comprise the three mentioned in the preceding paragraph unless the testator has otherwise provided. Causes of simple substitution ‐ predecease of the first heir ‐ renunciation of the first heir SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ART. 861. If heirs instituted in unequal shares should be reciprocally substituted, the substitute shall acquire the share of the heir who dies, renounces, or is incapacitated, unless it clearly appears that the intention of the testator was otherwise. If there are more than one substitute, they shall have the same share in the substitution as in the institution. Reciprocal substitution ‐ just a variation of simple or fideicommissary substitution Illustration of second sentence, ART. 861— ‐ A, B, and C are instituted, respectively, to 1/2, 1/3, and 1/6 of the estate Page 25 of 73 o o o if A predeceases the testator, B and C will acquire A’s 1/2 portion in the proportion of 2:1 (their testamentary shares being 1/3 and 1/6) should B predecease, A and C will get B’s 1/3 portion in proportion of 3:1 (1/2 and 1/6) if C predeceases, A and B will share C’s 1/6 portion in the proportion of 3:2 ‐ ART. 862. The substitute shall be subject to the same charges and conditions imposed upon the instituted heir, unless the testator has expressly provided the contrary, or the charges or conditions are personally applicable only to the heir instituted. Rationale ‐ substitute merely takes the place of the original heir ART. 863. A fideicommissary substitution by virtue of which the fiduciary or first heir instituted is entrusted with the obligation to preserve and to transmit to a second heir the whole or part of the inheritance, shall be valid and shall take effect, provided such substitution does not go beyond one degree from the heir originally instituted, and provided, further, that the fiduciary or first heir and the second heir are living at the time of the death of the testator. Elements of the fideicomisaria ‐ a first heir (fiduciary / fiduciario) who takes the property upon the testator’s death o the fiduciary enters upon the inheritance upon the opening of the succession (i.e. when the testator dies) ‐ a second heir (fideicommissary heir / fideicomisario) who takes the property subsequently from the fiduciary o fideicommissary heir does not receive property until the fiduciary’s right expires o both heirs enter into the inheritance successively (i.e. one after the other, each in his own turn) o note that while the fideicommissary heir does not receive property upon the testator’s death, his right thereto vests at that time and merely becomes subject to a period, and that right passes to his own heirs should he die before the fiduciary’s right expires ‐ the second heir must be one degree from the fiduciary or first heir o only one transmission is allowed in the fideicomisaria (from fiduciary to the fideicommissary heir) o “one degree” means that the fideicommissary heir must be in the first degree of relationship with the fiduciary or first heir (i.e. second heir must either be a child or a parent of the first heir) per Palacios v. Ramirez (1982), infra the rule applies and is true a fortiori in case of an adopted SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ‐ child vis‐à‐vis his adopter (cf. Acain v. IAC) the dual obligation imposed upon the fiduciary to preserve the property and to transmit it after the lapse of the period to the fideicommissary heir o this is the essence of the fideicomisaria (Crisologo v. Singson [1962]) o fiduciary or first heir is basically a usufructuary, with the right to use and enjoy the property but without the right to dispose of the same (jus disponendi) o effect if there is no obligation to preserve and transmit—there is no fideicommissary substitution, but something else (PCIB v. Escolin [1974]) both heirs must be living and qualified to succeed at the time of the testator’s death o living o qualified (cf. ART. 1024 to 1034) these two requisites are met only upon the testator’s death, and applies to both the first and second heirs thus, the second heir need not survive the first heir if the second heir dies before the first heir, the second heir’s own heirs merely take his place Palacios v. Ramirez (1982) Facts: Testator’s will instituted his companion over 2/3 of estate (usufruct), and at the same time instituted as substitutes of companion two others not related at all to companion. Held: That the fideicommissary substitution is void because law mandates that “such substitution does not go beyond one degree from the heir originally instituted.” That “degree” means generation, and second heir must be related to and be one generation from first heir. That fideicommissary heir can only be either a child or a parent of first heir. Balane Criticizes the Palacios Ruling: ‐ per Justice José Vitug, the Palacios interpretation of “degree” as degree of relationship “would disenfranchise a juridical person from being either a fiduciary or fideicommissary heir” PCIB v. Escolin (1974) Facts: Testatrix instituted to the whole estate her husband, with right to dispose, and at the same time her siblings or the respective heirs of her siblings, as heirs to residue and remainder of estate, after death of husband. Held: That there is no fideicommissary substitution because there is no obligation on the part of testatrix’s husband as first heir, to preserve properties for substitute heirs. That siblings of testatrix instituted simultaneously Page 26 of 73 with testatrix’s husband, subject to certain conditions. That brothers and sisters of testatrix were to inherit what husband would not dispose of during his lifetime. That this is a valid simultaneous institution of heir. Balane Comments: ‐ the institution in PCIB is a simultaneous institution (not a fideicomisaria because there is no obligation imposed upon the husband to preserve the estate or any part thereof for anyone else) o on the one hand, of the husband subject to a resolutory condition (i.e. right terminates at the time of death) o on the other, of the husband’s brothers‐ and sisters‐in‐law subject to a suspensive condition (i.e. condition may or may not happen—remainder of estate) Tenure of the fiduciary or first heir ‐ primary rule o period indicated by the testator ‐ secondary rule o the fiduciary’s lifetime (if the testator did not indicate a period) ART. 864. A fideicommissary substitution can never burden the legitime. Note: ‐ the legitime passes by strict operation of law, therefore the testator has no power over it ART. 865. Every fideicommissary substitution must be expressly made in order that it may be valid. The fiduciary shall be obliged to deliver the inheritance to the second heir, without other deductions than those which arise from legitimate expenses, credits and improvements, save in the case where the testator has provided otherwise. Re par. 1: ‐ manner of imposing a fideicomisaria: express o two ways by the use of the term fideicommissary, or by imposing upon the first heir the absolute obligation to preserve and to transmit to the second heir Re par. 2: ‐ allowable deductions o general rule: the fiduciary should deliver the property intact and undiminished to the fideicommissary heir upon the arrival of the period o exception: the only deductions allowed, in the absence of a contrary provision in the will— legitimate expenses (i.e. necessary and useful, not ornamental expenses) credits SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI improvements Damage to, or deterioration of, property ‐ if caused by a fortuitous event or ordinary wear and tear o fiduciary not liable ‐ if caused by fiduciary’s fault or negligence o fiduciary liable ART. 866. The second heir shall acquire a right to the succession from the time of the testator’s death, even though he should die before the fiduciary. The right of the second heir shall pass to his heirs. Notes: ‐ ‐ second heir’s right vests upon the testator’s death (cf. ART. 777 and ART. 878 since as far as the second heir is concerned, the institution of him is one subject to a suspensive term) the second heir need not survive the first heir in order for substitution to be effective o the second heir’s own heirs simply take his place ART. 867. The following shall not take effect: (1) Fideicommissary substitutions which are not made in an express manner, either by giving them this name, or imposing upon the fiduciary the absolute obligation to deliver the property to a second heir; (2) Provisions which contain a perpetual prohibition to alienate, and even a temporary one, beyond the limit fixed in Article 863; (3) Those which impose upon the heir the charge of paying to various persons successively, beyond the limit prescribed in Article 863, a certain income or pension; (4) Those which leave to a person the whole or part of the hereditary property in order that he may apply or invest the same according to secret instructions communicated to him by the testator. Re par. 1: ‐ see notes under ART. 865 ‐ note that lack of this element does not, by that fact alone, nullify the institution o it only means that the institution is not a fideicomisaria; it could however be something else, as in PCIB Re par. 2: ‐ if there is a fideicomisaria, the limit is the first heir’s lifetime ‐ if there is no fideicomisaria, the limit is 20 years (ART. 870) Re par. 3: ‐ there can only be two beneficiaries of the pension, one after the other, and the second must be one degree from the first (as in ART. 863) ‐ there is no prohibition however on simultaneous beneficiaries Page 27 of 73 Re par. 4: ‐ the ostensible heir is in reality only a dummy, because in reality, the person intended to be benefited is the one to whom the secret instructions refer o purpose of surreptitious disposition is to circumvent some prohibition or disqualification—T.C.B.C.I.T.J. (this cannot be countenanced in this jurisdiction) o effect: entire disposition or provision is VOID ART. 868. The nullity of the fideicommissary substitution does not prejudice the validity of the institution of the heirs first designated; the fideicommissary clause shall simply be considered as not written. Effect if fideicommissary substitution is void or ineffective— ‐ institution of first heir simply becomes pure and unqualified Effect if the institution of the first heir is void or ineffective— ‐ not provided in ART. 868 ‐ “when the fiduciary predeceases or is unable to succeed, the fideicommissary heir takes the inheritance upon the death of the decedent” (Mr. Justice Vitug) o the nullity or inefficacy of the institution of the fiduciary should not nullify the institution of the fideicommissary heir o the right of the fideicommissary heir should then be absolute and effective upon the testator’s death, as if no fiduciary or first heir had been instituted since ultimately, the intention of the testator is to ultimately pass the property to the second heir (Manresa) ART. 869. A provision whereby the testator leaves to a person the whole or part of the inheritance, and to another the usufruct, shall be valid. If he gives the usufruct to various persons, not simultaneously, but successively, the provisions of Article 863 shall apply. Note: ‐ if testator institutes successive usufructuaries, there can only be two, one after the other, and as to the two of them, all the requisites of ART. 863 must be present ART. 870. The dispositions of the testator declaring all or part of the estate inalienable for more than twenty years are void. Effect if testator imposes a longer period than 20 years ‐ prohibition to partition is valid only for 20 years If there is a fideicommissary substitution— SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ‐ ‐ time limitation will not apply ART. 863 will apply, which allows, as a period, the lifetime of the first heir Rationale (as in ART. 867, par. 2, supra) ‐ commerce Section 4 – Conditional Testamentary Dispositions and Testamentary Dispositions With a Term Three kinds of testamentary dispositions ‐ conditional dispositions o condition (see ART. 1179, par. 1) ‐ dispositions with a term o term (see ART. 1193, par. 1 and 3) ‐ dispositions with a mode (modal dispositions) o mode (see ART. 882) General Provisions: ART. 871. The institution of an heir may be made conditionally, or for a certain purpose or cause. ART. 872. The testator cannot impose any charge, condition or substitution whatsoever upon the legitime prescribed in this Code. Should he do so, the same shall be considered as not imposed. Conditions: ART. 873. Impossible conditions and those contrary to law or good customs shall be considered as not imposed and shall in no manner prejudice the heir, even if the testator should otherwise provide. Impossible conditions ‐ may be factually or legally impossible Effect if impossible or illegal condition is imposed by testator ‐ condition is simply considered as not written o testamentary disposition is not annulled o disposition becomes pure (no condition) ‐ rule in donations is same (ART. 727) while rule in obligations is different (ART. 1183) o reason for the difference: basis of testamentary dispositions and donations, both gratuity (liberality); on the other hand, obligations are onerous (condition imposed is causa, and if eliminated for being impossible or illegal, there would be a failure of consideration) ART. 874. An absolute condition not to contract a first or subsequent marriage shall be considered as not written unless such condition has been imposed on the widow or widower by the deceased spouse, or by the latter’s ascendants or descendants. Nevertheless, the right of usufruct, or an allowance or some personal prestation may be devised or bequeathed to any person for the time during which he or she should remain unmarried or in widowhood. Page 28 of 73 Conditions prohibiting marriage ‐ if a first marriage is prohibited o condition always considered not imposed ‐ if a subsequent marriage is prohibited o if imposed by the deceased spouse or by his / her ascendants or descendants—VALID o if imposed by anyone else—considered not written Re par. 2: ‐ this paragraph may provide the testator of a means of terminating the testamentary benefaction should the heir contract marriage (even a first one) ‐ wording of disposition must not be so as to constitute a prohibition forbidden in par. 1 o e.g. “I institute as heir to 1/5 of my free portion Mr. Quevedough provided he does not marry a lawyer or a non‐ lawyer” NOT ALLOWED (absolute prohibition) o e.g. “I institute as heir to my entire free portion Ms. Buttad for as long as she remains single or a widow” ALLOWED ART. 874 does not prohibit the imposition of a condition to marry (either with reference to a particular person or not) ‐ cf. condition to marry Neither does ART. 874 declare void a relative prohibition ‐ e.g. “I institute to 2/5 of my free portion Mr. Seraphim Salvavidador provided he does not marry a hotel receptionist” ART. 875. Any disposition made upon the condition that the heir shall make some provision in his will in favor of the testator or of any other person shall be void. This article is the scriptura captatoria (“Legacy­ hunting dispositions, whether to heirs or legatees, are void”) ‐ it is not allowed ‐ quid pro quo, forbidden Reasons for the prohibition ‐ captatoria converts testamentary grants into contractual transactions ‐ it deprives the heir of testamentary freedom ‐ it gives the testator the power to dispose mortis causa not only of his property, but also of his heir’s What is declared void— ‐ testamentary disposition itself, not merely the condition ART. 876. Any purely potestative condition imposed upon an heir must be fulfilled by him as soon as he learns of the testator’s death. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI This rule shall not apply when the condition, already complied with, cannot be fulfilled again. ART. 877. If the condition is casual or mixed, it shall be sufficient if it happen or be fulfilled at any time before or after the death of the testator, unless he has provided otherwise. Should it have existed or should it have been fulfilled at the time the will was executed and the testator was unaware thereof, it shall be deemed as complied with. If he had knowledge thereof, the condition shall be considered fulfilled only when it is of such a nature that it can no longer exist or be complied with again. ART. 883. x x x If the person interested in the condition should prevent its fulfillment, without the fault of the heir, the condition shall be deemed to have been complied with. ART. 879. If the potestative condition imposed upon the heir is negative, or consists in not doing or not giving something, he shall comply by giving a security that he will not do or give that which has been prohibited by the testator, and that in case of contravention he will return whatever he may have received, together with its fruits and interests. These articles govern potestative, casual, and mixed conditions ‐ potestative: one that depends solely on the will of the heir / legatee / devisee o e.g. “I institute as heir to 4/5 of my free portion Ms. Chit Ha‐e provided that she establish a permanent residence in Burunggan” ‐ casual: one that depends on the will of a third person or on chance o e.g. “I institute as heir to 4/5 of my free portion Ms. Chit Ha‐e provided that Mt. Pinatubo erupts” (chance) o e.g. “I institute as heir to 4/5 of my free portion Ms. Chit Ha‐e provided that Knorr Miswari surrenders to the President” (will of a third person) ‐ mixed: one that depends partly on the will of the heir / legatee / devisee and partly either on the will of a third person or chance o e.g. “I institute as heir to 4/5 of my free portion Ms. Chit Ha‐e provided she marries during my lifetime Mr. Rubber Bellyhar” (dependent partly on the will of Ms. Chit Hae, the heiress, and the will of Mr. Bellyhar, a third person) Rule on potestative conditions (ART. 876) ‐ positive o general rule: must be fulfilled as soon as the heir learns of the testator’s death o exception: if the condition was already complied with at the time the Page 29 of 73 ‐ heir learns of the testator’s death, and the condition is of such a nature that it cannot be fulfilled again o constructive compliance (ART. 883, par. 2): condition deemed fulfilled negative (ART. 879) o heir must give security (caución muciana) to guarantee the return of the value of the property, fruits, and interests, in case of contravention if condition is violated, intestate or legal heirs must go after security (caución muciana) Rule on casual or mixed conditions (ART. 877) ‐ general rule: may be fulfilled at any time (before or after the testator’s death), unless the testator provides otherwise o qualification: if already fulfilled at the time of the execution of the will— if testator unaware of fact of fulfillment—deemed fulfilled if testator aware thereof—(a) if cannot be fulfilled again: deemed fulfilled; (b) if can be fulfilled again: must be fulfilled again ‐ constructive compliance (ART. 883, par. 2) o if casual—not applicable o if mixed— if dependent partly on chance—not applicable if dependent partly on the will of a third party—(a) if third party is an interested party: applicable; (b) if third party is not an interested party: not applicable ART. 880. If the heir be instituted under a suspensive condition or term, the estate shall be placed under administration until the condition is fulfilled, or until it becomes certain that it cannot be fulfilled, or until the arrival of the term. The same shall be done if the heir does not give the security required in the preceding article. ART. 881. The appointment of the administrator of the estate mentioned in the preceding article, as well as the manner of the administration and the rights and obligations of the administrator shall be governed by the Rules of Court. Between time of testator’s death and time of fulfillment of suspensive condition or of certainty of its non­occurrence— ‐ property to be placed under administration o if condition happens: property to be turned over to instituted heir o if it becomes certain that condition will not happen: property to be turned over to a secondary heir (if there is one) or SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI to the intestate heirs, as the case may be ART. 880 must not be applied to institutions with a term despite wording ‐ otherwise, there will be an irreconcilable conflict with ART. 885, par. 2, which mandates that before the arrival of the term, the property should be given to the legal heirs Re par. 2, ART. 880— ‐ property shall be in the executor’s or administrator’s custody until the heir furnishes the caución muciana Procedural rules governing appointment of administrator— ‐ Rules 77 to 90, Rules of Court ART. 884. Conditions imposed by the testator upon the heirs shall be governed by the rules established for conditional obligations in all matters not provided for by this Section. Note: ‐ suppletorily governing conditional institutions are ART. 1179 to 1192, on conditional obligations Terms: ART. 878. A disposition with a suspensive term does not prevent the instituted heir from acquiring his rights and transmitting them to his heirs even before the arrival of the term. Term: certain to arrive ‐ may either be suspensive or resolutory Condition: uncertain to happen When heir’s right vests (in dispositions with a term) ‐ upon the testator’s death o should heir die before the arrival of the suspensive term, he merely transmits his right to his own heirs who can demand when the term arrives (cf. ART. 866) Rule in conditional institutions (if instituted heir dies before the happening of the condition) ‐ cf. ART. 1034, par. 3 (“if the institution, devise, or legacy should be conditional, the time of the compliance with the condition shall also be considered”) o import: in conditional institutions, the heir should be living and qualified to succeed both at the time of the testator’s death and at the time of the happening of the condition i.e., the heir or devisee or legatee who dies before the happening of the condition, even if he survives the testator, transmits no right to his heirs (Spanish Civil Code) Page 30 of 73 ART. 885. The designation of the day or time when the effects of the institution of an heir shall commence or cease shall be valid. In both cases, the legal heir shall be considered as called to the succession until the arrival of the period or (from) its expiration. But in the first case he shall not enter into possession of the property until after having given sufficient security, with the intervention of the instituted heir. If term suspensive (ex die, “out in the day”; “[from] its [period’s] expiration”)— ‐ before the arrival of the term, the property should be delivered to the legal or intestate heirs ‐ a caución muciana has to be posted by them If term is resolutory (in diem, “into the day”; “until the arrival of the period”)— ‐ before the arrival of the term, the property should be delivered to the instituted heir ‐ no caución muciana required Modes: Ms. Coscolluela 100 piculs of sugar, and that should Mr. Rabadilla die, his heirs shall similarly have same obligation, and in the event that property devised is sold, etc., seller, etc. shall have same obligation. Held: That the institution of Mr. Rabadilla is a modal institution (because it imposes a charge or obligation upon the instituted heir without affecting the efficacy of such institution), and ART. 882 applies. That in modal institutions, the testator states (a) the object of the institution, (b) the purpose or application of the property left by the testator, or (c) the charge imposed by the testator upon the heir. That a condition suspends but does not obligate; and the mode obligates but does not suspend. That to some extent, mode is similar to a resolutory condition. Caución muciana to be posted by the instituted heir ART. 883. When without the fault of the heir, an institution referred to in the preceding article cannot take effect in the exact manner stated by the testator, it shall be complied with in a manner most analogous to and in conformity with his wishes. xxx ART. 882. The statement of the object of the institution or the application of the property left by the testator, or the charge imposed by him, shall not be considered as a condition unless it appears that such was his intention. That which has been left in this manner may be claimed at once provided that the instituted heir or his heirs give security for compliance with the wishes of the testator and for the return of anything he or they may receive, together with its fruits and interests, if he or they should disregard this obligation. ART. 882, par. 1— ‐ defines a mode obliquely ‐ in brief, a mode is an obligation imposed upon the heir, without suspending (as a condition does) the effectivity of the institution o a mode obligates but does not suspend o a condition suspends but does not obligate Note: ‐ intention of the testator should always be the guiding norm in determining the sufficiency of the analogous performance o e.g. “I institute as heir to 1/5 of my free portion Mr. St. Peter and he shall, every month, give to my daughter Ms. Cera Halimawis one sack of Milagrosa rice the expense for which is to be taken from said 1/5 share” if Milagrosa rice is no longer available in the market, then a variety of similar quality should be given by Mr. St. Peter, the instituted heir, to Ms. Cera Halimawis, in the same quantity Section 5 – Legitime Mode must be clearly imposed as an obligation ‐ mere preferences or wishes expressed by testator, not modes o e.g. “I institute as heir to 2/5 of my free portion Ms. Steffanie Summera and I would be very delighted and my soul would surely rest in peace if she gives my daughter Ms. Cera Halimawis money allowance of P50,000 per month to be taken from said 2/5 of my free portion”—NOT MODE Preliminary Notes: ‐ legitime o the portion of the decedent’s estate reserved by law in favor of certain heirs ‐ free or disposable portion o the portion left available for testamentary disposition after the legitimes have been covered ‐ compulsory heirs o the heirs for whom the law reserves a portion of the decedent’s estate A mode functions similarly to a resolutory condition Nature of legitimes ‐ legitimes are set aside by mandate of law ‐ testator is required to set aside or reserve them o the testator is prohibited from disposing by gratuitous title (inter vivos or mortis causa) of these legitimes Rabadilla v. CA (2000) Facts: Testatrix instituted as heir in her will Mr. Rabadilla, predecessor of petitioners. Will stated that Mr. Rabadilla shall have obligation until he dies, every year, to give to SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 31 of 73 but dispositions by onerous title are NOT prohibited because, in theory, nothing is lost from the estate in an onerous disposition, (there is merely an exchange of values) because the testator is compelled to set aside the legitimes, the heirs in whose favor the legitimes are set aside are called compulsory heirs o note: testator is the one compelled, not his heirs who are free to accept or reject the inheritance o ‐ ART. 886. Legitime is that part of the testator’s property which he cannot dispose of because the law has reserved it for certain heirs who are, therefore, called compulsory heirs. ART. 887. The following are compulsory heirs: (1) Legitimate children and descendants, with respect to their legitimate parents and ascendants; (2) In default of the foregoing, legitimate parents and ascendants, with respect to their legitimate children and descendants; (3) The widow or widower; (4) Acknowledged natural children, and natural children by legal fiction; (5) Other illegitimate children referred to in Article 287. Compulsory heirs mentioned in Nos. 3, 4, and 5 are not excluded by those in Nos. 1 and 2; neither do they exclude one another. In all cases of illegitimate children, their filiation must be duly proved. The father or mother of illegitimate children of the three classes mentioned, shall inherit from them in the manner and to the extent established by this Code. ART. 887 enumerates the compulsory heirs; enumeration is exclusive Classification of compulsory heirs ‐ primary – legitimate children and / or descendants o called as such because they are preferred over, and exclude, the secondary ‐ secondary – legitimate parents and / or ascendants; illegitimate parents o called as such because they receive legitimes only in default of the primary legitimate parents / ascendants – only in default of legitimate children / descendants illegitimate parents – only in default of any kind of children / descendants ‐ concurring – surviving spouse; illegitimate children and / or descendants SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI o called as such because they succeed as compulsory heirs together with primary or secondary heirs (except only that illegitimate children / descendants exclude illegitimate parents, i.e. only illegitimate children / descendants will get their legitimes, the illegitimate parents to get nothing in the form of legitimes) The COMPULSORY HEIRS ‐ legitimate children (law does not specify how they should share, but universal agreement is that they will share equally regardless of age, sex, or marriage of origin; include legitimate descendants other than children, in the proper cases) o ART. 164, Family Code children conceived or born during the marriage of parents children conceived of artificial insemination o ART. 54, Family Code children conceived or born before judgment of annulment or absolute nullity of marriage under ART. 36 has become final / executory children conceived or born of subsequent marriage under ART. 53 (i.e. after annulment / declaration of nullity of marriage, and separated spouses subsequently remarry) o ART. 179, Family Code legitimated children (i.e. subsequent valid marriage between parents of illegitimate children) o Sec. 17 and 18, RA 8552 (Domestic Adoption Act of 1998) adopted children (is an adopted child entitled to inherit by compulsory and intestate succession from his biological parents and relatives?—no answer) ‐ legitimate descendants o general rule: the nearer exclude the more remote children, if all qualified, will exclude grandchildren, and so on o qualification: right of representation (succession per stirpes), when proper ‐ legitimate parents (include legitimate ascendants other than parents, in the proper cases—see Baritua v. CA [1990], infra) o including adopter (per Sec. 18, RA 8552) ‐ legitimate ascendants o only in default of parents Page 32 of 73 the rule (absolute in the ascending line): the nearer exclude the more remote surviving spouse o of the decedent, not the spouse of a child who has predeceased the decedent (Rosales v. Rosales [1987], infra) o marriage must be valid or voidable (with no final decree of annulment at the time of the decedent’s death) o mere estrangement not a ground for disqualification of surviving spouse as heir o effect of decree of legal separation offending spouse: DISQUALIFIED to inherit innocent spouse: QUALIFIED to inherit o death of either spouse during pendency of petition for legal separation— dismissal of case surviving spouse, QUALIFIED to inherit (whether innocent or not) (Lapuz v. Eufemio [1972], infra) illegitimate children o in general: children conceived and born outside a valid marriage (ART. 165, Family Code) o in particular: children born of—(taken from Sempio­Diy) couples who are not legally married, or of common‐law marriages incestuous marriages bigamous marriages adulterous relations between the parents marriages void for reasons of public policy under ART. 38, Family Code couples below 18 years old, whether married (void) or not other void marriages under ART. 35, Family Code o note: rule if decedent died before the effectivity of the Family Code (August 3, 1988) is ART. 895 of the Civil Code o cf. right of representation (an illegitimate child can be represented by both legitimate and illegitimate descendants, while a legitimate child can only be represented by legitimate descendants, per ART. 902 and ART. 992) illegitimate descendants o same rule as in legitimate descendants nearer exclude the more remote right of representation illegitimate parents o only parents in the illegitimate ascending line) unlike in the legitimate ascending line (includes o ‐ ‐ ‐ ‐ SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI o ascendants of whatever degree) excluded by legitimate children and illegitimate children unlike legitimate parents (excluded only by legitimate children / descendants) Variations in legitimary portions ‐ general rule: 1/2 of estate is given to one heir or one group of heirs ‐ exceptions: o surviving spouse and illegitimate children (ART. 894) o surviving spouse in a marriage in articulo mortis, with the conditions specified (ART. 900, par. 2) o surviving spouse and illegitimate parents (ART. 903) The different combinations ‐ legitimate children alone (ART. 888) o 1/2 of estate divided equally ‐ legitimate children and surviving spouse (ART. 892, par. 2) o legitimate children – 1/2 of estate o surviving spouse – a share equal to that of one child ‐ one legitimate child and surviving spouse (ART. 892, par. 1) o legitimate child – 1/2 of estate o surviving spouse – 1/4 of estate ‐ legitimate children and illegitimate children (ART. 176, Family Code) o legitimate children – 1/2 of estate o illegitimate children – each will get 1/2 of share of one legitimate child ‐ legitimate children, illegitimate children, and surviving spouse o legitimate children – 1/2 of estate o illegitimate children – each will get 1/2 of share of one legitimate child o surviving spouse – a share equal to that of one legitimate child his or her share is preferred over those of the illegitimate children which shall be reduced if necessary (ART. 895) ‐ one legitimate child, illegitimate children, and surviving spouse o legitimate children – 1/2 of estate o illegitimate children – each will get 1/2 of share of one legitimate child in effect, just divide the 1/4 remainder of estate to the illegitimate children, equally o surviving spouse – 1/4 of estate his or her share is preferred over those of the illegitimate children which shall be reduced if necessary (ART. 895) ‐ legitimate parents alone (ART. 889) o 1/2 of estate Page 33 of 73 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ legitimate parents and illegitimate children (ART. 896) o legitimate parents – 1/2 of estate o illegitimate children – 1/4 of estate legitimate parents and surviving spouse (ART. 893) o legitimate parents – 1/2 of estate o surviving spouse – 1/4 of estate legitimate parents, illegitimate children, and surviving spouse (ART. 899) o legitimate parents – 1/2 of estate o illegitimate children – 1/4 of estate o surviving spouse – 1/8 of estate surviving spouse alone o 1/2 of estate (ART. 900, par. 1), or o 1/3 of estate (if marriage, being in articulo mortis, falls under ART. 900, par. 2) surviving spouse and illegitimate children (ART. 894) o surviving spouse – 1/3 of estate o illegitimate children – 1/3 of estate surviving spouse and illegitimate parents (ART. 903) o surviving spouse – 1/4 of estate o illegitimate parents – 1/4 of estate illegitimate children alone (ART. 901) o 1/2 of estate Illegitimate parents alone (ART. 903) o 1/2 of estate Rosales v. Rosales (1987) Facts: Decedent died intestate, leaving as heirs her husband, her child, and her grandchild by another child who predeceased her. Widow of the child who predeceased decedent claimed that she, as surviving spouse of predeceased child, was a compulsory heir of mother‐in‐law (decedent). Held: That spouse of predeceased child of decedent not a compulsory heir of decedent mother‐in‐law. That ART. 887 refers to estate of deceased spouse in which case surviving spouse is a compulsory heir, and does not apply to estate of parent‐in‐law. Lapuz v. Eufemio (1972) Held: That decedent’s parents not entitled to payment because payment was already received by decedent’s surviving spouse and child, the deceased’s compulsory heirs. That parents of deceased succeed only when latter dies without legitimate descendant. That surviving spouse concurs with all classes of heirs. Tumbokon v. Legaspi (2010) Facts: Grandmother (decedent) died intestate. She left as compulsory and intestate heirs her daughter and her grandson (son of predeceased daughter). Widower or son‐ in‐law (husband of predeceased daughter) claimed to be decedent’s compulsory heir. Held: That son‐in‐law (widower of decedent’s predeceased daughter) not a compulsory heir of decedent. Articles governing the particular combinations: ART. 888. The legitime of legitimate children and descendants consists of one‐half of the hereditary estate of the father and of the mother. The latter may freely dispose of the remaining half, subject to the rights of illegitimate children and of the surviving spouse as hereinafter provided. Equal sharing among legitimate children (including adopted children) regardless of age, sex, or marriage of origin, of 1/2 of the estate of their deceased parent Descendants other than children ‐ general rule: the nearer exclude the more remote o grandchildren cannot inherit since children will bar them, unless all the children renounce o the rule goes on down the line (no limit to the number of degrees in the descending line that may be called to succeed) ‐ qualification: right of representation ART. 889. The legitime of legitimate parents or ascendants consists of one‐half of the hereditary estates of their children and descendants. Facts: Wife filed a petition for legal separation against husband: sexual infidelity. Wife died pendente lite. Trial court dismissed action. The children or descendants may freely dispose of the other half, subject to the rights of illegitimate children and of the surviving spouse as hereinafter provided. Held: That death of either spouse during pendency of action for legal separation (before final decree) abates action. That this abatement also applies if action involves property rights. That effect is ultimately, surviving spouse, whether guilty or not (note: no final decree of legal separation because of death of one of the spouses), is not disqualified to inherit from decedent (spouse who died). ART. 890. The legitime reserved for the legitimate parents shall be divided between them equally; if one of the parents should have died, the whole shall pass to the survivor. Baritua v. CA (1990) Facts: Decedent died in an accident, and parties responsible for death settled with surviving spouse. Decedent’s parents later filed a complaint for damages against parties liable for death of their son. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI If the testator leaves neither father nor mother, but is survived by ascendants of equal degree of the paternal and maternal lines, the legitime shall be divided equally between both lines. If the ascendants should be of different degrees, it shall pertain entirely to the ones nearest in degree of either line. Legitimate parents / ascendants as secondary compulsory heirs Page 34 of 73 ‐ they succeed only in default of the legitimate descending line Three basic rules governing succession in the ascending line— ‐ the nearer exclude the more remote o rule is ABSOLUTE (i.e. no qualification; no right of representation) ‐ division by line o applies if there are more than one ascendant in the nearest degree o legitime to be divided in equal parts between the paternal and maternal lines ‐ equal division within the line o after portion corresponding to the line has been assigned, there will be equal apportionment between or among the recipients between the line, should there be more than one ART. 892. If only one legitimate child or descendant of the deceased survives, the widow or widower shall be entitled to one‐fourth of the hereditary estate. In case of a legal separation, the surviving spouse may inherit if it was the deceased who had given cause for the same. If there are two or more legitimate children or descendants, the surviving spouse shall be entitled to a portion equal to the legitime of each of the legitimate children or descendants. In both cases, the legitime of the surviving spouse shall be taken from the portion that can be freely disposed of by the testator. TEST: One legitimate child, surviving spouse—what is the sharing? If there has been legal separation— ‐ if there is a final decree of legal separation and the deceased is the offending spouse o surviving spouse gets his legitime (ART. 63, par. 4, Family Code) ‐ if there is a final decree of legal separation and the deceased is the innocent spouse o surviving (offending) spouse is disqualified from inheriting (idem.) ‐ if after the final decree of legal separation there was a reconciliation between the spouses o reciprocal right to succeed is restored (reconciliation sets aside the final decree) (ART. 66, par. 2, Family Code) Death pendente lite—see Lapuz v. Eufemio, supra Problem: Termination of marriage by reappearance of prior spouse / decree of annulment or absolute nullity of marriage ‐ reappearance of prior spouse o suppose a person (husband), believing in good faith that his wife had already died, remarries, and then subsequently his wife reappears, are both his first wife and second wife entitled to legitime from the husband if he dies? SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI ‐ ‐ marriages judicially annulled or declared void ab initio o same rule as in reappearance applies; problem arises if either or both partners in the defective marriage remarry later Balane comments: why should consorts of a terminated marriage, or an annulled one, or one declared void ab initio, continue to be heirs of each other when the very basis of the right of succession (i.e. marriage) no longer exists? TEST: Legitimate children, surviving spouse—what is the sharing? Determination of surviving spouse’s share: ‐ as long as at least one of several children inherits in his own right o equivalent to share of one child ‐ suppose all the children predecease (or are disinherited or unworthy to succeed): all the grandchildren inherit per stirpes, and therefore in different amounts o spouse still gets a share equivalent to that of what one child would have gotten if qualified ‐ suppose all the children renounce: all the grandchildren inherit per capita, and therefore equally o spouse still gets a share equivalent to that of what one child would have gotten had he succeeded In what instance then will the surviving spouse get a share equivalent to the share of a descendant? ART. 893. If the testator leaves no legitimate descendants, but leaves legitimate ascendants, the surviving spouse shall have a right to one‐fourth of the hereditary estate. This fourth shall be taken from the free portion of the estate. TEST: Legitimate ascendants, surviving spouse—what is the sharing? ART. 894. If the testator leaves illegitimate children, the surviving spouse shall be entitled to one‐third of the hereditary estate of the deceased and the illegitimate children to another third. The remaining third shall be at the free disposal of the testator. TEST: Illegitimate children, surviving spouse—what is the sharing? [ART. 895. The legitime of each of the acknowledged natural children and each of the natural children by legal fiction shall consist of one‐half of the legitime of each of the legitimate children or descendants. The legitime of an illegitimate child who is neither an acknowledged natural, nor a natural child by legal fiction, shall be equal in every case to four‐fifths of the legitime of an acknowledged natural child.] Page 35 of 73 The legitime of the illegitimate children shall be taken from the portion of the estate at the free disposal of the testator, provided that in no case shall the total legitime of such illegitimate children exceed that free portion, and that the legitime of the surviving spouse must first be fully satisfied. TEST: One legitimate child, illegitimate children, surviving spouse—what is the sharing? TEST: Legitimate children, illegitimate children, surviving spouse—what is the sharing? Reduction of shares (if total legitimes exceed the entire estate); rules ‐ legitimes of legitimate children never reduced (they are primary and preferred compulsory heirs) ‐ legitime of surviving spouse never reduced ‐ legitimes of illegitimate children will be reduced pro rata and without preference among them ART. 896. Illegitimate children who may survive with legitimate parents or ascendants of the deceased shall be entitled to one‐fourth of the hereditary estate to be taken from the portion at the free disposal of the testator. TEST: Illegitimate children, legitimate parents—what is the sharing? ART. 897. When the widow or widower survives with legitimate children or descendants, and acknowledged natural children, or natural children by legal fiction, such surviving spouse shall be entitled to a portion equal to the legitime of each of the legitimate children which must be taken from that part of the estate which the testator can freely dispose of. ART. 898. If the widow or widower survives with legitimate children or descendants, and with illegitimate children other than acknowledged natural, or natural children by legal fiction, the share of the surviving spouse shall be the same as that provided in the preceding article. ART. 899. When the widow or widower survives with legitimate parents or ascendants and with illegitimate children, such surviving spouse shall be entitled to one‐ eighth of the hereditary estate of the deceased which must be taken from the free portion, and the illegitimate children shall be entitled to one‐fourth of the estate which shall be taken also from the disposable portion. The testator may freely dispose of the remaining one‐ eighth of the estate. TEST: Legitimate parents, illegitimate children, surviving spouse—what is the sharing? ART. 900. If the only survivor is the widow or widower, she or he shall be entitled to one‐half of the hereditary estate of the deceased spouse, and the testator may freely dispose of the other half. testator was solemnized in articulo mortis, and the testator died within three months from the time of the marriage, the legitime of the surviving spouse as the sole heir shall be one‐third of the hereditary estate, except when they have been living as husband and wife for more than five years. In the latter case, the legitime of the surviving spouse shall be that specified in the preceding paragraph. Surviving spouse as sole compulsory heir ‐ general rule: 1/2 of estate ‐ exception: 1/3 of estate, if the following circumstances concur o the marriage was in articulo mortis o the testator died within three months from the time of the marriage o the parties did not cohabit for more than five years, and o the spouse who died was the party in articulo mortis at the time of the marriage ART. 901. When the testator dies leaving illegitimate children and no other compulsory heirs, such illegitimate children shall have a right to one‐half of the hereditary estate of the deceased. The other half shall be at the free disposal of the testator. TEST: Illegitimate children alone—how much do they get? ART. 902. The rights of illegitimate children set forth in the preceding articles are transmitted upon their death to their descendants, whether legitimate or illegitimate. Right of representation to the legitimate and illegitimate descendants of an illegitimate child ‐ compare with ART. 992 (in case of legitimate children, right of representation is given only to their legitimate descendants) ‐ effect: right of representation of illegitimate children is broader than right of representation of legitimate children ART. 903. The legitime of the parents who have an illegitimate child, when such child leaves neither legitimate descendants, nor a surviving spouse, nor illegitimate children, is one‐half of the hereditary estate of such illegitimate child. If only legitimate or illegitimate children are left, the parents are not entitled to any legitime whatsoever. If only the widow or widower survives with parents of the illegitimate child, the legitime of the parents is one‐fourth of the hereditary estate of the child, and that of the surviving spouse also one‐fourth of the estate. TEST: Illegitimate parents alone—how much do they get? TEST: Illegitimate parents, surviving spouse—what is the sharing? If the marriage between the surviving spouse and the SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 36 of 73 This is the only instance when illegitimate children exclude secondary compulsory heirs (illegitimate parents) 7) 1 legitimate child = surviving spouse = Intent of the law in giving spouse arbitrary shares— ‐ so that something may be left for free disposition 8) 1 legitimate parent = 2 illegitimate children = LEGITIMES QUIZZER SET 1: Write how much each compulsory heir would get. Do not show your solution. Time limit—5 minutes. 9) 3 legitimate children = 2 adopted children = surviving spouse = 1) 1 legitimate child = 1 adopted child = 2) 2 adopted children = legitimate parents = 3) 1 adopted child = 4 illegitimate children = 4) surviving spouse = 6 legitimate children = 5) 5 legitimate children = 1 illegitimate child = 6) 7) 5 illegitimate children = legitimate parents = 4 illegitimate children = legitimate parents = surviving spouse = 8) legitimate parents = surviving spouse = 9) 1 legitimate child = legitimate parents = 1 illegitimate child = surviving spouse = 10) surviving spouse = 1 illegitimate parent = LEGITIMES QUIZZER SET 2: Write how much each compulsory heir would get. Do not show your solution. Time limit—5 minutes. 1) 3 legitimate children = surviving spouse = 2) 2 legitimate children = 4 illegitimate children = surviving spouse = 3) 3 legitimate children = 2 adopted children = 4) illegitimate parents = 2 illegitimate children = 5) 2 legitimate children = 1 illegitimate child = 6) 3 adopted children = 1 legitimate parent = SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 10) 2 legitimate children = surviving spouse = The Reserva Troncal ART. 891. The ascendant who inherits from his descendant any property which the latter may have acquired by gratuitous title from another ascendant, or a brother or sister, is obliged to reserve such property as he may acquired by operation of law for the benefit of relatives who are within the third degree and who belong to the line from which the said property came. Illustration and diagram O or M.S. R’ista g.t. o. of l. P R’ios Explanation of illustration and diagram— ‐ P (prepositus) inherits a piece of land from his father, O or M.S. (origin or mediate source). Subsequently, P dies, intestate, single, and without legitimate issue, and the land is in turn inherited by his mother R’ista (reservista) ‐ R’ista is now required to reserve the property in favor of P’s paternal relatives within the third degree (R’ios or reservatarios) Other terms for reserva troncal ‐ lineal, familiar, extraordinaria, semi‐troncal, pseudo‐troncal Purpose ‐ “the reserva troncal is a special rule designed primarily to assure the return of the reservable property to the third degree relatives belonging to the line from which the property originally came, and to avoid its being dissipated...by the relatives of the inheriting ascendant (Padura v. Baldovino [1958]) ‐ “to avoid the danger that property existing for many years in a family’s patrimony might pass gratuitously to outsiders through the accident of marriage and untimely death (Gonzales v. CFI [1981]) ‐ “to prevent outsiders from acquiring, through an accident of life, property which, but for such Page 37 of 73 accident, would have remained in the family” (idem.) ‐ ‐ Requisites (as given in Chua v. CFI [1977]) ‐ that the property was acquired by a descendant from an ascendant or from a brother or sister by gratuitous title o term descendant should read person (if grantor is brother or sister, acquirer is not a descendant) o acquisition is by gratuitous title (título lucrative) when the recipient does not give anything in return encompasses transmissions by donation or by succession of whatever kind ‐ that said descendant died without an issue o should read: “that said person died without legitimate issue” (because only legitimate descendants will prevent the property from being inherited by the legitimate ascending line by operation of law) if descendant dies with illegitimate issue, there will be reserva troncal ‐ that the property is inherited by another ascendant by operation of law o by operation of law is limited to succession to the legitime or by intestacy, NOT testamentary succession no donation ‐ that there are relatives within the third degree belonging to the line from which said property came o reservatarios, to be discussed infra Process ‐ first transfer o by gratuitous title, from a person to his descendant, brother, or sister ‐ second transfer o by operation of law, from the transferee in the first transfer to another ascendant it is this second transfer that creates the reserva ‐ third transfer o from the transferee in the second transfer to the relatives (reservatarios) Solivio v. CA (1990) Facts: Mother died intestate, leaving all properties to sole heir, her child. Child (decedent) died intestate, single, and without legitimate issue. Decedent was survived by maternal aunt and paternal aunt. Maternal aunt: properties left by decedent belong to her because she is a third degree relative of decedent’s mother, from whose line property came. Held: That there is no reserva troncal because descendant (decedent) inherited from ascendant (mother), the reverse of situation covered by ART. 891. ‐ ‐ origin or mediate source o the transferor in the first transfer prepositus o the first transferee, who is a descendant or brother / sister of the origin reservista or reservor o the ascendant obliged to reserve reservatarios or reservees o the relatives benefited Two basic rules— ‐ no inquiry is to be made beyond the origin o it does not matter who the owner of the property was before it was acquired by the origin ‐ all the relationships among the parties must be legitimate The Origin / Mediate Source ‐ either an ascendant or a brother or sister of the prepositus o ascendant: may be of any degree of ascent o brother or sister: conflicting views one view – must be of the half‐blood (because otherwise, property would not change lines in passing to a common ascendant of the prepositus and the brother; no reserve if fraternal relationship is of the full‐ blood because it would be impossible to identify the line of origin—whether paternal or maternal) (J.B.L. Reyes) another view – does not matter whether of the full‐ or half‐blood (Sánchez Román) The Prepositus ‐ either a descendant or a brother or sister of the origin who receives property from the origin by gratuitous title o he is the first transferee ‐ while property is still with him, there is as yet no reserva o reserve arises only upon the second transfer o while prepositus owns the property, he has all rights of ownership over it and may exercise such rights in order to prevent a reserve from arising, by: substituting or alienating the property bequeathing or devising it either to the potential reservista or to third persons (subject to the constraints of the legitime), or partitioning in such a way as to assign the property to parties other than the potential reservista (subject Parties SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 38 of 73 ‐ to the constraints of the legitime) the prepositus therefore is the arbiter of the reserva troncal (Sánchez Román) The Reservista ‐ he is an ascendant of the prepositus, of whatever degree o must be an ascendant other than the origin (if the origin is also an ascendant) if two parties are the same person, no reserva troncal ‐ should the origin and the reservista belong to different lines (i.e. grandchild receives property by donation from paternal grandfather; grandchild dies; property received by donation passes by succession to the legitime and intestacy to the father, the paternal grandfather’s son)? o one view – no because another ascendant is one belonging to a line other than that of the reservista (purpose of reserve is only curative) (J.B.L. Reyes) o another view – yes because (a) the law does not distinguish, and (b) purpose of reserva is not only curative, but also preventive, i.e. to prevent the property from leaving the line (Sánchez Román) The Reservatarios ‐ the reserva is in favor of a class, collectively referred to as the reservatarios (reservees) ‐ requirements to be a reservatario: o he must be within the third degree of consanguinity from the prepositus (Cabardo v. Villanueva [1922]) o he must belong to the line from which the property came (determined by the origin) if origin is an ascendant— either of the paternal or maternal line if origin is a brother or sister of the full blood—it would be impossible to distinguish the lines o must the reservatario also be related to the origin? one view: no, because the article speaks only of two lines (paternal and maternal) of the descendant, without regard to subdivisions (Manresa) another view: yes, otherwise results would arise completely contrary to the purpose of the reserva, which is to prevent property from passing to persons not of the line of origin (Sánchez Román) ‐ reserva in favor of reservatarios as a class SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI it is not required that the reservatario must already be living when the prepositus dies, because the reserve is established in favor of a group or class, not in favor of specific individuals (Manresa) as long as the reservatario is alive at the time of the reservista’s death, he qualifies as such, even if he was conceived and born after the prepositus’s death preference among the reservatarios o rules on intestate succession govern how reservable property is to be distributed to reservatarios (Padura v. Baldovino [1958]) i.e. the nearer exclude the more remote, share of 2:1 in favor of full‐blood in relation to half‐blood relatives of the prepositus representation among the reservatarios (see Florentino v. Florentino [1919]) o there is only one instance of representation among the reservatarios: if the prepositus was survived by brothers or sisters and children of a predeceased or incapacitated brother or sister o ‐ ‐ Padura v. Baldovino (1958) Facts: Origin (father) died, leaving properties by will to surviving wife (mother or reservista) and three children (one from first marriage, two from second marriage). One of two children (prepositus, single, without legitimate issue) in the second marriage predeceased the mother (reservista). Reservatarios were full‐blood sister of prepositus and his half‐brother (child of origin from first marriage). Held: That reservatarios of the full‐blood are entitled to a share twice as large as that of others (half‐blood relatives). That reservable property should pass not to all reservatarios as a class but only to those nearest in degree to the prepositus, excluding those reservatarios of more remote degree. That reserva troncal merely determines group of relatives (reservatarios) to whom property should be returned; but within that group individual right to property should be decided by rules of intestate succession. That basic principles of intestacy to be applied are (a) proximity in degree, (b) right of representation, and (c) rule of double share for relatives or collaterals of whole blood. Florentino v. Florentino (1919) Facts: Origin left by will all his properties to 11 children. One child (prepositus) died intestate, single, and without legitimate issue, and was succeeded by his mother (reservista). Reservista instituted her daughter as sole heir, giving to daughter the properties she inherited from prepositus, her son. Surviving siblings and nephews and Page 39 of 73 nieces, as representatives of predeceased siblings of prepositus complained. Held: That properties given by reservista to her daughter are reservable. That reservatarios within the third degree, as in case of nephews and nieces of prepositus from whom reservable property came, have right of representation (to represent their ascendants, or fathers and mothers, who are brothers and sisters of prepositus). Juridical nature ‐ nature of reservista’s right (Edroso v. Sablan [1913], infra) o reservista’s right over the reserved property is one of ownership o ownership is subject to a resolutory condition (i.e. the existence of reservatarios at the time of the reservista’s death) o right of ownership is alienable, but subject to the same resolutory condition o reservista’s right of ownership is registrable (if property can be registered) ‐ nature of reservatarios’ right (Sienes v. Esparcia [1961], infra) o reservatarios’ right over the reserved property is one of expectancy o expectancy is subject to a suspensive condition (i.e. existence of reservista at the time of the reservatarios’ death; expectancy ripens into ownership if the reservatarios survive the reservista) o right of expectancy is alienable, but subject to the same suspensive condition o reservatarios’ right of expectancy is registrable (if property can be registered) Edroso v. Sablan (1913) Facts: Father (origin) died with a will. Property of father passed to only son (prepositus) who died intestate, single, and without legitimate issue. Property of son inherited from his father passed by operation of law to mother (reservista). Mother sought to have property inherited from son registered. Uncles of son or prepositus (brothers of father or origin), reservatarios, opposed. Held: See nature of reservista’s right, supra. Sienes v. Esparcia (1961) Facts: Father (origin) died with a will. Property of father passed to five children. One child (prepositus) died intestate, single, and without legitimate issue. Property of child inherited from his father passed by operation of law to mother (reservista). Mother sold property. Surviving half‐sisters of prepositus also sold same property. Gonzales v. CFI (1981) Facts: Father (origin) died intestate. Property of father passed to children. One child (prepositus) died intestate, single, and without legitimate issue. Property inherited by child passed by operation of law to mother (reservista). Mother gave by holographic will property she inherited from prepositus to her grandchildren (children of her surviving sons). Held: That reservista cannot convey reservable properties by will (mortis causa) to reservatarios within the third degree, to the exclusion of reservatarios in the second degree (her surviving daughters and sons). That the principle is that the nearer excluded the more remote. That reservista cannot by will select reservatarios to whom reservable property should be given and deprive the other reservatarios of their share therein. Balane Comments: ‐ the rule therefore is that upon the reservista’s death, the reserved property passes by strict operation of law (according to the rules of intestate succession) to the proper reservatarios ‐ thus the selection of which reservatarios will get the property is made by law and not by the reservista Property reserved ‐ kind of property reservable o any kind (real or personal, corporeal or incorporeal, fungible or non‐fungible, etc) in Rodriguez v. Rodriguez (1957), a sugar quota allotment (incorporeal) was held to be reservable ‐ effect of substitution o the rule is that the very same property must go thru the process of transmissions o what must come from the origin to the prepositus (by gratuitous title) and to the reservista (by operation of law) must be the same property if prepositus substitutes the property by selling, bartering, or exchanging it. the substitute cannot be reserved e.g. there would be no reserva if the prepositus sold the property he received from the origin under a pacto de retro and then redeemed it (because property would not be the same as prepositus bought it back from the vendee a retro) Reserved property, not part of reservista’s estate upon his death: Held: See nature of reservatarios’ right, supra. Cano v. Director (1959) Reservista has no power to appoint, by will, which reservatarios were to get the reserved property: SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 40 of 73 Facts: Reservista died. Surviving reservatario sought to have land (reserved property) registered in her name. Son of reservista opposed. Held: That reservatario is not reservista’s successor mortis causa nor is reservable property part of reservista’s estate. That upon death of reservista, reservatario nearest to prepositus becomes automatically and by operation of law owner of reservable property. That reservable property cannot be transmitted by a reservista to his own successors mortis causa so long as a reservatario within the third degree from prepositus and belonging to line where property came exists when reservista dies. Balane States: ‐ since the reserved property is not computed as part of the reservista’s estate, it is not taken into account in determining the legitimes of the reservista’s compulsory heirs A problem will arise if two circumstances concur: (a) the prepositus makes a will instituting the ascendant­ reservista to the whole or a part of the free portion; and (b) there is left in the prepositus’s estate, upon his death, in addition to the reserved property, property not reservable [or, if (a) prepositus dies with two or more properties, one reservable, one his own; and (b) prepositus makes a will giving all or part of the free porstion to reservista] ‐ two theories advanced: o reserva máxima – as much of the potentially reservable property as possible must be deemed included in the part that passes by operation of law (maximizing the scope of the reserva) o reserva mínima – every single property in the prepositus’s estate must be deemed to pass, partly by will and partly by operation of law, in the same proportion that the part given by will bears to the part not so given ‐ to illustrate: suppose prepositus receives 2M from origin, and earns 4M as his own; prepositus makes a will instituting his mother (reservista) to his free portion (1/2 of estate); prepositus dies single and without legitimate issue; reservista inherits entire estate of prepositus (half by legitime, half by testamentary succession); how much of the 2M will be reserved? o reserva máxima – all of the 2M (reservable property) will pass to reservista as her legitime (rule: fit as much of reservable property in that part which passes by operation of law) 3M as reservista’s legitime (included in this 3M is the 2M reservable property) o reserva mínima – only 1M of the 2M reservable property will pass to reservista as part of her legitime (rule: every item to pass to reservista in proportion or ratio as to how much of the free portion the prepositus gave to the reservista) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 3M as reservista’s legitime (composed of 1M from the 2M reservable property, and 2M from the 4M own property of the prepositus; 1M of the 2M reservable property passes to reservista by will, and 2M of the 4M own property of the prepositus passes to reservista by will) Rights of reservatarios and obligations of the reservista ‐ to inventory the reserved properties ‐ to annotate the reservable character (if registered immovables) in the Registry of Property within 90 days from acceptance by the reservista o there is only one title to the immovable property, the registered owner being the reservista, and the reservable character of the property has to be annotated at the back of the title as a lien or encumbrance in favor of the reservatarios ‐ to appraise the movables ‐ to secure by means of mortgage: (a) the indemnity for any deterioration of or damage to the property occasioned by the reservista’s fault or negligence, and (b) the payment of the value of such reserved movables as may have been alienated by the reservista onerously or gratuitously Extinguishment; how reserva troncal extinguished ‐ by death of reservista o reservatarios to get property; no more reserva reserva troncal begins when the prepositus dies reserva troncal ends when the reservista dies (reservatarios must be alive) ‐ by death of all the reservatarios o note: if one subscribes to the view that the reservista can belong to the line of origin, death of all reservatarios will not ipso facto extinguish the reserva because the reservista could have a child subsequently, who would be a reservatario ‐ by renunciation by all the reservatarios, provided that no other reservatario is born subsequently ‐ by total fortuitous loss of the reserved property ‐ by confusion or merger of rights o as when the reservatarios acquire the reservista’s right by a contract inter vivos e.g. sale of reserva to reservatarios ‐ prescription or adverse possession ART. 904. The testator cannot deprive his compulsory heirs of their legitime, except in cases expressly provided by law. Page 41 of 73 ‐ Neither can he impose upon the same any burden, encumbrance, condition, or substitution of any kind whatsoever. The legitime is not within the testator’s control ‐ legitime passes to compulsory heirs by strict operation of law Testator devoid of power to deprive compulsory heirs of legitime ‐ it is the law, not the testator, which determines the transmission of the legitimes ‐ EXCEPT: in disinheritance o the only instance in which the law allows the testator to deprive the compulsory heirs of their legitimes Testator devoid of power to impose burdens on legitime ‐ qualifications: in at least two instances, the law grants the testator some power over the legitime o payment of legitime in cash (ART. 1080, par. 2) as when a parent who wishes to keep an agricultural enterprise intact, and such agricultural enterprise was assigned to a child who does not know how to operate the same o prohibition on partition (ART. 1083, par. 1) ‐ restrictions on the legitime imposed by law o the family home cannot be partitioned (ART. 159, Family Code) o the reserva troncal ART. 905. Every renunciation or compromise as regards a future legitime between the person owing it and his compulsory heirs is void, and the latter may claim the same upon the death of the former; but they must bring to collation whatever they may have received by virtue of the renunciation or compromise. Reason for the rule— ‐ before predecessor’s death, heir’s right is simply inchoate Duty to collate ‐ any property which the compulsory heir may have gratuitously received from his predecessor by virtue of the renunciation or compromise will be considered as an advance on his legitime and must be duly credited o e.g. if son asked for 30M from his father in order to start a business, and the father agrees, the 30M would be considered as an advance on the son’s legitime during the settlement of his father’s estate, if it turns out that the son is entitled to 50M as legitime, he would be given 20M more (the 30M already credited to his legitime) Scope and prohibition SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI article only applies to transactions of compromise or renunciation between the predecessor and the prospective compulsory heir o BUT a transaction of similar character between a prospective compulsory heir and another prospective compulsory heir, or between a prospective compulsory heir and a stranger, also not allowed (ART. 1347, par. 2) e.g. A asked 50M from his wealthy brother, B in order to start a business, in exchange for which A renounces the legitime he will get from their father X in favor of B; X dies; during the settlement of X’s estate it turns out that A is entitled to 80M as legitime; B claims that A can no longer get the 30M balance as A already renounced his share in favor of B; B is wrong, for A can still get his 30M share ART. 906. Any compulsory heir to whom the testator has left by any title less than the legitime belonging to him may demand that the same be fully satisfied. ART. 906 applies only to transmissions by gratuitous title ‐ e.g. donation, etc. This is the well­known right of completion of legitime ‐ cf. ART. 855, 909 and 910 Principle: anything that a compulsory heir receives by gratuitous title from the predecessor is considered as an advance on the legitime and is deducted therefrom ‐ exceptions: o if the predecessor gave the compulsory heir a donation inter vivos and provided that it was not to be charged against the legitime (ART. 1062) o testamentary dispositions made by the predecessor to the compulsory heir, unless the testator provides that it should be considered part of the legitime (ART. 1063) ART. 907. Testamentary dispositions that impair or diminish the legitime of the compulsory heirs shall be reduced on petition of the same, insofar as they may be inofficious or excessive. Notes: ‐ ‐ ‐ same principle as in ART. 904 if testamentary dispositions exceed the disposable portion, compulsory heirs may demand their reduction to the extent that the legitimes have been impaired cf. ART. 911 ART. 908. To determine the legitime, the value of the property left at the death of the testator shall be considered, deducting all debts and charges, which shall Page 42 of 73 not include those imposed in the will. To the net value of the hereditary estate, shall be added the value of all donations by the testator that are subject to collation, at the time he made them. The net hereditary estate ‐ ART. 908 makes possible the computation of the absolute amounts of the legitimes by laying down the manner of computing the net value of the estate (the net hereditary estate), on which the proportions are based How to compute the hereditary estate: ‐ inventory of all existing assets o appraisal or valuation of existing assets at the time of the decedent’s death o assets include only those that survive the decedent (i.e. not extinguished by his death) o value determined by inventory will constitute the gross assets ‐ deduct unpaid debts and charges o all unpaid obligations of the decedent must be deducted from gross assets o only obligations with monetary value, not extinguished by death, are considered (i.e. not intuitu personae obligations) o difference between gross assets and unpaid obligations will be the available assets ‐ add the value of donations inter vivos o add to the value of available assets all the inter vivos donations made by the decedent o donations inter vivos must be valued as of the time they were made (increase or decrease in value, for the donee’s account) o sum of available assets and all donations inter vivos is the net hereditary estate To illustrate— ‐ inventoried assets: 17M (gross assets) ‐ deduct debts: 6M (11M as available assets) ‐ add donations inter vivos: 4M (15M as net hereditary estate) o if testator left 3 legitimate children and a surviving spouse, they will get the following: 2.5M each to 3 legitimate children (rule: 1/2 of estate) 2.5M to surviving spouse (rule: share equivalent to that of one child) total legitimes: 10M free portion: 1M (note: available assets, only 11M; value of net hereditary estate [15M] only relevant for purposes of computing the legitimes) Vizconde v. CA (1998) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Facts: Decedent sold parcel of land to daughter. Daughter had husband and two children. Daughter and children died in massacre, in which daughter died ahead. Children became heirs of mother. When children died, their father (husband) became sole heir. Husband (widower) extrajudicially settled estate of wife with parents‐in‐law (decedent and his wife). Decedent died and a collation was asked where widower included. Held: That inclusion of widower (son‐in‐law in relation to decedent) in settlement of intestate estate of his father‐in‐ law (father of his late wife) is erroneous because son‐in‐ law not a compulsory heir of his father‐in‐law. That assuming collation were proper, still property sold by decedent to his dead daughter (wife of decedent’s son‐in‐ law or the widower) not collationable for the reason that transfer was not by gratuitous title but by onerous title (sale). That obligation to collate is lodged with decedent’s compulsory heir, his dead daughter, and not to said deceased daughter’s husband. ART. 909. Donations given to children shall be charged to their legitime. Donations made to strangers shall be charged to that part of the estate of which the testator could have disposed by his last will. Insofar as they may be inofficious or may exceed the disposable portion, they shall be reduced according to the rules established by this Code. ART. 910. Donations which an illegitimate child may have received during the lifetime of his father or mother, shall be charged to his legitime. Should they exceed the portion that can be freely disposed of, they shall be reduced in the manner prescribed by this Code. Donations inter vivos to compulsory heirs, considered as an advance on their legitimes ‐ coverage of rule o applies to all compulsory heirs including ascendants excluding a surviving spouse (except in cases of donations propter nuptias and moderate gifts) ‐ exception o rule of imputation of legitime will not apply if donor provided otherwise (vide ART. 1062) in which case donation to be imputed to the free portion Donations inter vivos to strangers ‐ a stranger is anyone who does not succeed as a compulsory heir o e.g. father, if decedent has children ‐ donations inter vivos to strangers are imputed to the disposable portion ART. 911. After the legitime has been determined in accordance with the three preceding articles, the Page 43 of 73 reduction shall be made as follows: (1) Donations shall be respected as long as the legitime can be covered, reducing or annulling, if necessary, the devises or legacies made in the will; (2) The reduction of the devises or legacies shall be pro rata, without any distinction whatever; If the testator has directed that a certain devise or legacy be paid in preference to others, it shall not suffer any reduction until the latter have been applied in full to the payment of the legitime. (3) If the devise or legacy consists of a usufruct or life annuity, whose value may be considered greater than that of the disposable portion, the compulsory heirs may choose between complying with the testamentary provision and delivering to the devisee or legatee the part of the inheritance of which the testator could freely dispose. Legitimes are inviolable ‐ if impaired, gratuitous dispositions of the testator (inter vivos or mortis causa) have to be set aside or reduced as may be required to cover the legitimes Method of reduction* ‐ first, reduce pro rata the non‐preferred legacies and devises (ART. 911[2]), and the testamentary dispositions (to heirs) (ART. 907) o no preference among these legacies, devises, and testamentary dispositions ‐ second, reduce pro rata the preferred legacies and devises (ART. 911, last par.) ‐ third, reduce the donations inter vivos according to the inverse order of their dates (i.e. the oldest is the most preferred) *reductions shall be to the extent required to complete the legitimes, even if in the process, the disposition is reduced to nothing Devises / legacies of usufruct / life annuities / pensions (ART. 911[3]) ‐ if upon being capitalized according to actuarial standards, the value of the grant exceeds the free portion (i.e. it impairs the legitime), it has to be reduced, because the legitime cannot be impaired ‐ the testator can impose no usufruct or any other encumbrance on the part that passes as legitime ‐ subject to the two rules abovementioned, the compulsory heirs may elect between ceding to the devisee / legatee the free portion (or the proportional part thereof corresponding to the said legacy / devise, in case there are other dispositions), and complying with the terms of the usufruct or life annuity or pension Art. 912. If the devise subject to reduction should consist of real property, which cannot be conveniently divided, it shall go to the devisee if the reduction does not absorb SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI one‐half of its value; and in a contrary case, to the compulsory heirs; but the former and the latter shall reimburse each other in cash for what respectively belongs to them. The devisee who is entitled to a legitime may retain the entire property, provided its value does not exceed that of the disposable portion and of the share pertaining to him as legitime. (821) Balane: Provision covers the ff. cases: 1. The devisee has to be reduced 2. The thing given as a devise is indivisible • In either case, there should be pecuniary reimbursment to the party who did not get his physical portion of the thing Rules: 1. 2. If the extent of reduction is less than ½ of the value of the thing – it should be given to the devisee. If the extenet of reduction is ½ or more of the value of the thing – it should be given to the compulsory heir. Art. 913. If the heirs or devisees do not choose to avail themselves of the right granted by the preceding article, any heir or devisee who did not have such right may exercise it; should the latter not make use of it, the property shall be sold at public auction at the instance of any one of the interested parties. (822) Balane: • This article applies if neither party (the compulsory heir and the devisee) elects to exercise his right under Art. 912. Rules: 1. 2. Any other heir or devisee, who elects to do so, may acquire the thing and pay the parties (the compulsory heir and the devisee in question) their respective share in money. If no heir or devisee elects to acquire it, it shall be sold at public auction and the net proceeds accordingly divided between the parties concerned. Art. 914 The testator may devise and bequeath the free portion as he may deem fit. (n) 6. Disinheritance Art. 915. A compulsory heir may, in consequence of disinheritance, be deprived of his legitime, for causes expressly stated by law. (848a). Balane: Requisites of a valid disinheritance: (SLaW­PUTT) 1. It must be made in a will. • It must be admitted into probate. 2. It must be for a cause specified by law. 3. The will must specify the cause. 4. It must be unconditional. Page 44 of 73 5. 6. 7. It must be total. The cause must be true. If the truth of the cause is denied, it must be proved by the proponent. Effect of disinheritance: The disinherited heir forfeits: 1. his legitime 2. his intestate portion, if any, and 3. any testamentary disposition made in a prior will of the disinheriting testator Class Notes: • This should be correlated with Art. 904. Art. 916. Disinheritance can be effected only through a will wherein the legal cause therefor shall be specified. (849) Art. 917. The burden of proving the truth of the cause for disinheritance shall rest upon the other heirs of the testator, if the disinherited heir should deny it. (850) Art. 918. Disinheritance without a specification of the cause, or for a cause the truth of which, if contradicted, is not proved, or which is not one of those set forth in this Code, shall annul the institution of heirs insofar as it may prejudice the person disinherited; but the devises and legacies and other testamentary dispositions shall be valid to such extent as will not impair the legitime. (851a) Balane: • If the disinheritance lacks one or other of the requisites in this article, the heir in question gets his legitime. • As to whether he will get also any part of the intestate portion or not, it depends in whether the testator gave away the free portion through testamentary dispositions: o If through testamentary provision, these dispositions are valid and the compulsory heir improperly disinherited gets only his legitime. o He will get his corresponding share of the free portion is if is not through testamentary provision. Art. 919. The following shall be sufficient causes for the disinheritance of children and descendants, legitimate as well as illegitimate: (1) When a child or descendant has been found guilty of an attempt against the life of the testator, his or her spouse, descendants, or ascendants; (2) When a child or descendant has accused the testator of a crime for which the law prescribes imprisonment for six years or more, if the accusation has been found groundless; (3) When a child or descendant has been convicted of adultery or concubinage with the spouse of the testator; (4) When a child or descendant by fraud, violence, intimidation, or undue influence causes the testator to make a will or to change one already made; (5) A refusal without justifiable cause to support the parent or ascendant who disinherits such child or descendant; (6) Maltreatment of the testator by word or deed, by the child or descendant; SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI (7) When a child or descendant leads a dishonorable or disgraceful life; (8) Conviction of a crime which carries with it the penalty of civil interdiction. (756, 853, 674a) Balane: Grounds for disinheritance: (DAMA­FASI) 1. Attempt against the life • All stages of commission are included – attempted, frustrtaed or consumated. • Intent to kill must be present. • Final conviction is necessary. 2. Accusation • This includes the filing of the complaint before the prosecutor, or presenting incriminating evidence against the testator, or even supressing exculpatory evidence. • There should be imprisonment of more than six years. • The accusation must be found to be groundless. 3. Adultery and concubinage • Final conviction is required. 4. Fraud, violence, intimidation and undue influence in the making of the will 5. Refusal to support without justifiable cause • The demand must be unjustifiably refused. • Refusal may be justified: o E.g. If the obligor does not have enough resources for all whom he is obliged to support. The ascendants are only third in the hierarchy of preference among claimants of support. 6. Maltreatment • It is required that the act of verbal or physical assault be of serious nature. • No conviction is required. It is not even required that any criminal case be filed. • This may be proved by preponderance of evidence. 7. Leads a dishonorable or disgraceful life • There must be habituality to the conduct. • The conduct need not be sexual in nature. 8. Crime with civil interdiction o Final conviction is required. Class Notes: • Accusation o The exoneration or acquittal must be because the charge is groundless. If the acquittal is only beyond reasonable doubt, then there is some ground. • Fraud, violence, intimidation and undue influence in the making of the will o No conviction is required here • Maltreatment o Usually this is hard to prove because there is no witness and the testator is dead. • Leads a dishonorable or disgraceful life o It cannot be only once. o It need not be sexual in nature. For example, partaking in the pork barrel scam with Janet Napoles. Page 45 of 73 Compelling the child to be or Subjecting the child or allowing him to be subjected to acts of lasciviousness Attempt against the life of a parent by another • Includes all stages of consummation. No conviction is required. Art. 920. The following shall be sufficient causes for the disinheritance of parents or ascendants, whether legitimate or illegitimate: (1) When the parents have abandoned their children or induced their daughters to live a corrupt or immoral life, or attempted against their virtue; (2) When the parent or ascendant has been convicted of an attempt against the life of the testator, his or her spouse, descendants, or ascendants; (3) When the parent or ascendant has accused the testator of a crime for which the law prescribes imprisonment for six years or more, if the accusation has been found to be false; (4) When the parent or ascendant has been convicted of adultery or concubinage with the spouse of the testator; (5) When the parent or ascendant by fraud, violence, intimidation, or undue influence causes the testator to make a will or to change one already made; (6) The loss of parental authority for causes specified in this Code; (7) The refusal to support the children or descendants without justifiable cause; (8) An attempt by one of the parents against the life of the other, unless there has been a reconciliation between them. (756, 854, 674a) Balane: • Number 2, 3, 4, 5 and 7 are the same ground under Article 919. Other grounds for disinheritance of parents or ascendants: (CIA) 1. Abandonment by parent of his children • This is not restricted to those instances of abandonment penalized by law. 2. Inducement to live a corrupt or immoral life. • Applies only to daughters • It includes grandparents to granddaughters as the provision contemplates ascendants vis‐à‐vis descendants. • Mere attempt against their virtue is enough as long as it can be proven. • No conviction is required in all three cases provided in the provision. 3. Loss of parental authority • Not all causes for loss of parental authority are grounds for disinheritance; for instance, attainment of majority. • Only those causes which involve culpability on the part of the parents will provide grounds for disinheritance: o Judicial deprivation of parental authority on the ground of sexual abuse o Loss of parental authority as a result of judicial declaration of abandonment of the child o Judicial deprivation of parental authority on the grounds of Excessively harsh or cruel treatment of the child Giving the child corrupting orders, counsel or example SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 4. Class Notes: • Accusation Art. 921. The following shall be sufficient causes for disinheriting a spouse: (1) When the spouse has been convicted of an attempt against the life of the testator, his or her descendants, or ascendants; (2) When the spouse has accused the testator of a crime for which the law prescribes imprisonment of six years or more, and the accusation has been found to be false; (3) When the spouse by fraud, violence, intimidation, or undue influence cause the testator to make a will or to change one already made; (4) When the spouse has given cause for legal separation; (5) When the spouse has given grounds for the loss of parental authority; (6) Unjustifiable refusal to support the children or the other spouse. (756, 855, 674a) Balane: • The only new ground is number four. A decree of legal separation is not required. There are ten causes of legal separation given in Article 55 of the Family Code. • Art. 55. A petition for legal separation may be filed on any of the following grounds: o (1) Repeated physical violence or grossly abusive conduct directed against the petitioner, a common child, or a child of the petitioner; o (2) Physical violence or moral pressure to compel the petitioner to change religious or political affiliation; o (3) Attempt of respondent to corrupt or induce the petitioner, a common child, or a child of the petitioner, to engage in prostitution, or connivance in such corruption or inducement; o (4) Final judgment sentencing the respondent to imprisonment of more than six years, even if pardoned; o (5) Drug addiction or habitual alcoholism of the respondent; o (6) Lesbianism or homosexuality of the respondent; o (7) Contracting by the respondent of a subsequent bigamous marriage, whether in the Philippines or abroad; o (8) Sexual infidelity or perversion; o (9) Attempt by the respondent against the life of the petitioner; or o (10) Abandonment of petitioner by respondent without justifiable cause for more than one year. Page 46 of 73 For purposes of this Article, the term "child" shall include a child by nature or by adoption. (9a) Unlike in Art. 920 where actual loss of parental authority is required, here giving grounds therefor is sufficient. o • Art. 922. A subsequent reconciliation between the offender and the offended person deprives the latter of the right to disinherit, and renders ineffectual any disinheritance that may have been made. (856) Balane: Reconciliation is either: 1. An express pardon – which must be expressly and concretely extended to the offender who accepts it. A general pardon extended by the testator on his deatbed to all who have offended him will not suffice. 2. An unequivocal conduct – wherein the intent to forgive must be clear. This is ultimately a question of facts which must be resolved by the courts. Effects of reconciliation: 1. If it occurs before disinheritance is made – right to disinherit is distinguished. 2. If it occurs after the disinheritance is made, disinheritance is set aside. Effects of setting aside disinheritance: 1. Disinherited heir is restored to his legitime. 2. If the disinheriting will did not dispose of the disposable protion, the disinherited heir is entitled to his proportionate share, if any, of the disposable portion. 3. If the disposable will or any of the subsequent will disposed of the disposable portion (or any part thereof) in favor of testamentary heirs, legatees, or devisees, such dispositions remain valid. Art. 923. The children and descendants of the person disinherited shall take his or her place and shall preserve the rights of compulsory heirs with respect to the legitime; but the disinherited parent shall not have the usufruct or administration of the property which constitutes the legitime. (857) Balane: • The right of representation is granted only to descendants of disinherited descendants. However if the heir disinherited is a parent/ascendant or spouse, the children or descendants of the disinherited heir do not have any right of representation. • The representative takes the place of the disinherited heir not only with respect to the legitime, but also to any intestate portion the disinherited heir would have inherited. Representation therefore, occurs in compulsory and intestate succession but not in testamentary succession. 8. Legacies and Devises SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Art. 924. All things and rights which are within the commerce of man be bequeathed or devised. (865a) Balane: • What can be devised or bequethed: anything within the commerce of man. It is not required that the thing devised or bequethed belong to the testator. • Limitations on legacy or devise – it should not impair the legitime. Art. 925. A testator may charge with legacies and devises not only his compulsory heirs but also the legatees and devisees. The latter shall be liable for the charge only to the extent of the value of the legacy or the devise received by them. The compulsory heirs shall not be liable for the charge beyond the amount of the free portion given them. (858a) Balane: • The wording of this provision is erroneous. A compulsory heir as such cannot be burdened with a legacy or devise because that would impair his legitime. Only a testamentary heir can be so burdened. Art. 926. When the testator charges one of the heirs with a legacy or devise, he alone shall be bound. Should he not charge anyone in particular, all shall be liable in the same proportion in which they may inherit. (859) Balane: • General rule is that the estate is charged with the legacy. • Exception is that the testator may impose the burden on a testamentary heir or a legatee or devisee. If he does so, then the heir, legatee, or devisee charged will, if he accepts the disposition in his favor, be bound to deliver the legacy or devise to the person specified. Art. 927. If two or more heirs take possession of the estate, they shall be solidarily liable for the loss or destruction of a thing devised or bequeathed, even though only one of them should have been negligent. (n) Balane: • The liability imposed gere is based on malice, fault or negligence. The liability will also attach to the executor or administrator in the proper cases. Art. 928. The heir who is bound to deliver the legacy or devise shall be liable in case of eviction, if the thing is indeterminate and is indicated only by its kind. (860) Balane: • General rule, the estate is liable in case of eviction. • Exception is in the case of a subsidiary legacy or devise, the heir, legatee or devisee charged shall be liable. Art. 929. If the testator, heir, or legatee owns only a part Page 47 of 73 of, or an interest in the thing bequeathed, the legacy or devise shall be understood limited to such part or interest, unless the testator expressly declares that he gives the thing in its entirety. (864a) Art. 930. The legacy or devise of a thing belonging to another person is void, if the testator erroneously believed that the thing pertained to him. But if the thing bequeathed, though not belonging to the testator when he made the will, afterwards becomes his, by whatever title, the disposition shall take effect. (862a) Art. 931. If the testator orders that a thing belonging to another be acquired in order that it be given to a legatee or devisee, the heir upon whom the obligation is imposed or the estate must acquire it and give the same to the legatee or devisee; but if the owner of the thing refuses to alienate the same, or demands an excessive price therefor, the heir or the estate shall only be obliged to give the just value of the thing. (861a) Art. 932. The legacy or devise of a thing which at the time of the execution of the will already belonged to the legatee or devisee shall be ineffective, even though another person may have some interest therein. If the testator expressly orders that the thing be freed from such interest or encumbrance, the legacy or devise shall be valid to that extent. (866a) Art. 933. If the thing bequeathed belonged to the legatee or devisee at the time of the execution of the will, the legacy or devise shall be without effect, even though it may have subsequently alienated by him. If the legatee or devisee acquires it gratuitously after such time, he can claim nothing by virtue of the legacy or devise; but if it has been acquired by onerous title he can demand reimbursement from the heir or the estate. (878a) Art. 934. If the testator should bequeath or devise something pledged or mortgaged to secure a recoverable debt before the execution of the will, the estate is obliged to pay the debt, unless the contrary intention appears. The same rule applies when the thing is pledged or mortgaged after the execution of the will. Any other charge, perpetual or temporary, with which the thing bequeathed is burdened, passes with it to the legatee or devisee. (867a) Art. 935. The legacy of a credit against a third person or of the remission or release of a debt of the legatee shall be effective only as regards that part of the credit or debt existing at the time of the death of the testator. In the first case, the estate shall comply with the legacy by assigning to the legatee all rights of action it may have against the debtor. In the second case, by giving the legatee an acquittance, should he request one. In both cases, the legacy shall comprise all interests on the credit or debt which may be due the testator at the time of his death. (870a) Art. 936. The legacy referred to in the preceding article shall lapse if the testator, after having made it, should bring an action against the debtor for the payment of his debt, even if such payment should not have been effected SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI at the time of his death. The legacy to the debtor of the thing pledged by him is understood to discharge only the right of pledge. (871) Art. 937. A generic legacy of release or remission of debts comprises those existing at the time of the execution of the will, but not subsequent ones. (872) Balane: • Legacy/Devise of a thing owned in part by the testator: o General Rule: conveys only the interest or part owned by the testator. o Exception: if the testator provides otherwise. He may convey more than he owns. The estate should try to acquire the part of interest owned by other parties. If the other parties are unwilling to alienate, the estate should give the legatee/devisee the monetary equivalent. He may convey less than he owns. • Legacy/Devise of a thing belonging to another: o If the testator ordered the acquisition of the thing – the order should be complied with. If the owner is unwilling to part with the thing, the legatee/devisee should be given the monetary equivalent. o If the testator erroneously believed that the thing belonged to him – legacy/devise void. Exception: if subsequent to the making of the disposition, the thing is acquired by the testator onerously or gratuitously, the disposition is validated. o If the testator knew that the thing did not belong to him but did not order its acquisition, the Code is silent on this. • Legacy/Devise of thing belonging to the legatee/devisee or subsequently acquired by him: o If the thing already belonged to the legate/devisee at the time of the execution of the will – legacy/devise void. It is not validated by an alienation by the legatee/devisee subsequent to the making of the will, unless the acquirer is the testator himself. o If the thing was owned by another person at the time of the making of the will and acquired thereafter by the legatee/devisee: If the testator erroneously believed that it belonged to him – legacy/devise void. If the testator was not in error. • If the thing was acquired onerously by legatee/devisee – Page 48 of 73 • • • the legatee/devisee is entitled to reimbursement • If the thing was acquired gratuitously by legatee/devisee, nothing more is due. o If the thing was owned by the testator at the time of making the will and acquired thereafter from him by the legatee/devisee – Art 932 and 933 are silent on this but Art. 957 par. 2 can be applied and the legacy/devise should be deemed revoked. Legacy/Devise to remove an encumbrance over a thing belonging to the legatee/devisee: o Valid if the encumbrance can be removed for a consideration. Legacy/Devise of a thing pledged: o The encumbrance must be removed by paying the debt, unless the testator intended otherwise. o A charge other than a pledge or mortgage (as a usufruct or easement) passes to the legatee or devisee together with the thing Legacy of credit or remission: o Applies only to amount still unpaid at the time of the testator’s death o Revoked if testator subsequently sues the debtor for collection o If generic, applies only to those existing at the time of execution of the will, unless otherwise provided heir is so obliged. If the heir, legatee or devisee, who may have been given the choice, dies before making it, this right shall pass to the respective heirs. Once made, the choice is irrevocable. In the alternative legacies or devises, except as herein provided, the provisions of this Code regulating obligations of the same kind shall be observed, save such modifications as may appear from the intention expressed by the testator. (874a) Balane: To whom the right of choice (one made is irrevoacble) is to be given: • General rule o The estate through the executor or administrator – in a direct legacy/devise o The heir, legatee, or devisee charged – in a subsidiary legacy/devise • Exception: o The legatee/devisee (or indeed any other person), if the testator so provides If the person who is to choose dies before the choice is made: • If the choice belonged to executor or administrator – the right is transmitted to his successor in office. • If the choice belongs to an heir, legatee or devisee – the right is transmitted to his own heirs. Art. 938. A legacy or devise made to a creditor shall not be applied to his credit, unless the testator so expressly declares. In the latter case, the creditor shall have the right to collect the excess, if any, of the credit or of the legacy or devise. (837a) Art. 941. A legacy of generic personal property shall be valid even if there be no things of the same kind in the estate. A devise of indeterminate real property shall be valid only if there be immovable property of its kind in the estate. The right of choice shall belong to the executor or administrator who shall comply with the legacy by the delivery of a thing which is neither of inferior nor of superior quality. (875a Art. 939. If the testator orders the payment of what he believes he owes but does not in fact owe, the disposition shall be considered as not written. If as regards a specified debt more than the amount thereof is ordered paid, the excess is not due, unless a contrary intention appears. The foregoing provisions are without prejudice to the fulfilment of natural obligations. (n) Art. 942. Whenever the testator expressly leaves the right of choice to the heir, or to the legatee or devisee, the former may give or the latter may choose whichever he may prefer. (876a) Balane: • Legacy/Devise to a creditor o General rule: It will be treated like any other legacy/devise and therefore will not be imputed to the debt. o Exception: It will be imputed to the debt if the testator so provides, and if the debt exceeds the legacy/devise, the excess may be demanded as an obligation of the estate. Art. 940. In alternative legacies or devises, the choice is presumed to be left to the heir upon whom the obligation to give the legacy or devise may be imposed, or the executor or administrator of the estate if no particular SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Art. 943. If the heir, legatee or devisee cannot make the choice, in case it has been granted him, his right shall pass to his heirs; but a choice once made shall be irrevocable. (877a) Balane: Rules on validity: • Generic legacy – valid even If no such movable exist in the testator’s estate upon his death. The estate will simply have to acquire what is given by legacy. • Generic devise – valid only if there exists such an immovable in the testator’s estate at the time of his death Rules on right of choice: Page 49 of 73 • • General rule: the executor or administrator, acting for the estate has the right of choice. Exception: if the testator gives the right of choice to the legatee/devisee, or to the heirs on whom the obligation to give the benefit is imposed (in a subsidiary legacy or devise) Transmissibility of choices: • If the choice belongs to the executor/administrator and he dies before making the choice – right is transmitted to his successor in the position. • If the choice belongs to the legatee/devisee and he dies before making the choice – the right passed to his heirs. Regarding choices: • The choice must be limited to something which is neither superior nor inferior in quality. This rule applies whether the choice belongs to the executor/administrator or the legatee/devisee. Art. 944. A legacy for education lasts until the legatee is of age, or beyond the age of majority in order that the legatee may finish some professional, vocational or general course, provided he pursues his course diligently. A legacy for support lasts during the lifetime of the legatee, if the testator has not otherwise provided. If the testator has not fixed the amount of such legacies, it shall be fixed in accordance with the social standing and the circumstances of the legatee and the value of the estate. If the testator or during his lifetime used to give the legatee a certain sum of money or other things by way of support, the same amount shall be deemed bequeathed, unless it be markedly disproportionate to the value of the estate. (879a) Balane: • On legacy for education: o The duration is the age of majority or the completion of a professional, vocational, or general course, whichever comes later [in the latter instance only if the legatee pursues his studies diligently.] o On the amount, it is primarily fixed by the testator. Secodarily is that which is proper as determined by two variables: (i) the social standing and circumstances of the legatee, and (ii) the value of the disposable portion of the estate. • On legacy for support: o The duration must be the legatee’s lifetime unless the testator provides otherwise. o The amount is primarily fixed by the testator. Secondarily is that which the testator during his lifetime used to give the legatee by way of support, unless markedly disproportionate to the value of the disposable portion. Tertiarily is that which reasonable, on the basis of two variables: (i) the social standing and circumstances of the legatee, and SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI • (ii) the value of the disposable portion of the estate. Legacy of a periodical pension can be demanded upon testator’s death, and the succeeding ones at the beginning of the period without duty to reimburse should the legatee die before the lapse of the period. Art. 945. If a periodical pension, or a certain annual, monthly, or weekly amount is bequeathed, the legatee may petition the court for the first installment upon the death of the testator, and for the following ones which shall be due at the beginning of each period; such payment shall not be returned, even though the legatee should die before the expiration of the period which has commenced. (880a) Art. 946. If the thing bequeathed should be subject to a usufruct, the legatee or devisee shall respect such right until it is legally extinguished. (868a) Art. 947. The legatee or devisee acquires a right to the pure and simple legacies or devises from the death of the testator, and transmits it to his heirs. (881a) Art. 948. If the legacy or device is of a specific and determinate thing pertaining to the testator, the legatee or devisee acquires the ownership thereof upon the death of the testator, as well as any growing fruits, or unborn offspring of animals, or uncollected income; but not the income which was due and unpaid before the latter's death. From the moment of the testator's death, the thing bequeathed shall be at the risk of the legatee or devisee, who shall, therefore, bear its loss or deterioration, and shall be benefited by its increase or improvement, without prejudice to the responsibility of the executor or administrator. (882a) Art. 949. If the bequest should not be of a specific and determinate thing, but is generic or of quantity, its fruits and interests from the time of the death of the testator shall pertain to the legatee or devisee if the testator has expressly so ordered. (884a) Balane: Rules on demandability, ownership and fruits of legacies/devises: • Demandability: o pure – upon testator’s death o with a (suspensive) term – upon arrival of the term o conditional – upon the happening of the condition • When ownership vests: o pure and determinate – upon testator’s death o pure and generic – if from testator’s estate ‐ upon testator’s death if acquired from a third person – upon acquisition o with a (suspensive) term – upon arrival of the term, but the right to it vests upon the testator’s death Page 50 of 73 o • Fruits: o o o o conditional (suspensive) – upon the testator’s death, if the condition is fulfilled pure and determinate – upon testator’s death pure and generic ‐ upon determination, unless the testator provides otherwise with a term – upon arrival of the term with a condition – upon the happening of such condition, unless the testator provides otherwise Art. 950. If the estate should not be sufficient to cover all the legacies or devises, their payment shall be made in the following order: (1) Remuneratory legacies or devises; (2) Legacies or devises declared by the testator to be preferential; (3) Legacies for support; (4) Legacies for education; (5) Legacies or devises of a specific, determinate thing which forms a part of the estate; (6) All others pro rata. (887a) Art. 951. The thing bequeathed shall be delivered with all its accessories and accessories and in the condition in which it may be upon the death of the testator. (883a) Art. 952. The heir, charged with a legacy or devise, or the executor or administrator of the estate, must deliver the very thing bequeathed if he is able to do so and cannot discharge this obligation by paying its value. Legacies of money must be paid in cash, even though the heir or the estate may not have any. The expenses necessary for the delivery of the thing bequeathed shall be for the account of the heir or the estate, but without prejudice to the legitime. (886a) Art. 953. The legatee or devisee cannot take possession of the thing bequeathed upon his own authority, but shall request its delivery and possession of the heir charged with the legacy or devise, or of the executor or administrator of the estate should he be authorized by the court to deliver it. (885a) Art. 954. The legatee or devisee cannot accept a part of the legacy or devise and repudiate the other, if the latter be onerous. Should he die before having accepted the legacy or devise, leaving several heirs, some of the latter may accept and the others may repudiate the share respectively belonging to them in the legacy or devise. (889a) Art. 955. The legatee or devisee of two legacies or devises, one of which is onerous, cannot renounce the onerous one and accept the other. If both are onerous or gratuitous, he shall be free to accept or renounce both, or to renounce either. But if the testator intended that the two legacies or devises should be inseparable from each other, the legatee or devisee must either accept or renounce both. Any compulsory heir who is at the same time a legatee or devisee may waive the inheritance and accept the legacy or devise, or renounce the latter and accept the former, or waive or accept both. (890a) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Balane: Rules on acceptance and repudiation of legacies/devises: 1. Aceptance maybe total or partial (as implied from Art. 954, par.1) • Exception: If the legacy/devise is partly onerous and partly gratuitous, the recipient cannot accept the gratuitous part and the renounce the onerous part. Any other combination however is permitted. • If the legatee or devisee dies before accepting or renouncing, his heirs shall exercise such right as to their pro‐indiviso share, and in the same manner as outlined above. 2. When there is two legacies/devises to the same recipient: • If both gratuitous – the recipient may accept or renounce either or both • If both onerous – same rule as above • If one is gratuitous and the other is onerous – the recipient cannot accept the gratuitous part and the renounce the onerous part. Any other combination however is permitted. 3. When legacy or devise is also given to one who is a compulsory heir • The recipient may accept either or both 4. Effect if will provide otherwise – all the rules above outlined apply in the absence of a stipulation in the will providing otherwise. Art. 956. If the legatee or devisee cannot or is unwilling to accept the legacy or devise, or if the legacy or devise for any reason should become ineffective, it shall be merged into the mass of the estate, except in cases of substitution and of the right of accretion. (888a) Balane: Rules in case of repudiation by or incapacity of legatee/devisee: 1. Primarily – substitution 2. Secondarily – accretion 3. Tertiarily – intestacy Art. 957. The legacy or devise shall be without effect: (1) If the testator transforms the thing bequeathed in such a manner that it does not retain either the form or the denomination it had; (2) If the testator by any title or for any cause alienates the thing bequeathed or any part thereof, it being understood that in the latter case the legacy or devise shall be without effect only with respect to the part thus alienated. If after the alienation the thing should again belong to the testator, even if it be by reason of nullity of the contract, the legacy or devise shall not thereafter be valid, unless the reacquisition shall have been effected by virtue of the exercise of the right of repurchase; (3) If the thing bequeathed is totally lost during the lifetime of the testator, or after his death without the heir's fault. Nevertheless, the person obliged to pay the legacy or devise shall be liable for eviction if the thing bequeathed should not have been determinate as to its kind, in accordance with the provisions of Article 928. (869a) Page 51 of 73 Balane: Instances when legacy/devise is revoked by operation of law: 1. transformation – the testator converts a plantation into a fishpond 2. alienation – the alienation by the testator may be onerous or gratuitous. • The alienation revokes the legacy/devise even if for any reason the thing reverts to the testator. • Exceptions: o If the reversion is caused by the annulment of the alienation and the cause for annulment was vitiation of consent on the grantor’s part, either by reason of incapacity or of duress. o If the reversion is by virtue of redemption in a sale with pacto de retro. 3. total loss – this will be a cause for revocation only if it takes place before the testator’s death. Fortuitous loss after the testator’s death will not constitute revocation. Art. 958. A mistake as to the name of the thing bequeathed or devised, is of no consequence, if it is possible to identify the thing which the testator intended to bequeath or devise. (n) Art. 959. A disposition made in general terms in favor of the testator's relatives shall be understood to be in favor of those nearest in degree. (751) III. Legal or Intestate Succession 1. General Provisions Art. 960. Legal or intestate succession takes place: (1) If a person dies without a will, or with a void will, or one which has subsequently lost its validity; (2) When the will does not institute an heir to, or dispose of all the property belonging to the testator. In such case, legal succession shall take place only with respect to the property of which the testator has not disposed; (3) If the suspensive condition attached to the institution of heir does not happen or is not fulfilled, or if the heir dies before the testator, or repudiates the inheritance, there being no substitution, and no right of accretion takes place; (4) When the heir instituted is incapable of succeeding, except in cases provided in this Code. (912a) Balane: Intestacy: • That which takes place by operation of law in default of compulsory and testamentary succession. It is the least preferred among the three modes of succession, but is the most common. • It applies the principle of exclusion and concurrence (the same principle as in compulsory succession). Kinds: 1. Total – no testamentary disposition; only if there is no will disposing of the property. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 2. Partial – A will that disposes of part of the free portion; insofar as it does not impair Instances when legal or intestate succession operates: (WISE­PIR) 1. If a person dies without a will, or with a void will, or one which has subsequently lost its validity; • Sir: The will does not lose its validity. 2. When the will does not institute an heir to, or dispose of all the property belonging to the testator. In such case, legal succession shall take place only with respect to the property of which the testator has not disposed; 3. If the suspensive condition attached to the institution of heir does not happen or is not fulfilled, or if the heir does not happen or is not fulfilled, or if the heir dies before the testator or repudiates the inheritance, there being no substitution, and no right of accretion takes place. 4. When the heir instituted is incapable of succeeding, except in cases provided in this Code. 5. happening of resolutory condition 6. expiration of resolutory term 7. preterition Art. 961. In default of testamentary heirs, the law vests the inheritance, in accordance with the rules hereinafter set forth, in the legitimate and illegitimate relatives of the deceased, in the surviving spouse, and in the State. (913a) Art. 962. In every inheritance, the relative nearest in degree excludes the more distant ones, saving the right of representation when it properly takes place. Relatives in the same degree shall inherit in equal shares, subject to the provisions of article 1006 with respect to relatives of the full and half blood, and of Article 987, paragraph 2, concerning division between the paternal and maternal lines. (912a) Balane: Basis of Instate Succession: • The presumed will of the decedent, which would distribute the estate in accordance with the love and affection he has for his family and close relatives, and in default of these persons, the presumed desire of the decedent to promote charitable and humanitarian. Basic Rules of Intestacy: • The rule of preference of lines o The three lines of relationship are: the descending the ascending the collateral o The law lays down an order of preference among these lines, such that the descending excludes the ascending and the collateral, and the ascending excludes the collateral. • The rule of proximity of degree o The nearer exclude the more remote without prejudice to representation. Page 52 of 73 • The rule of equality among relatives of the same degree o If the nearer exlucde the more remote, logically those of equal degree should inherit in equal shares o Exceptions to rule of equality in the same degree: the rule of preference of lines, supra the distinction between the legitimate and illegitmate filiation the rule of division by line in the ascending line the distinction between full‐ blood and half‐blood relationships among brothers and sisters, as well as nephews and nieces representation Class Notes: Additional rule of intestacy (not found in the book): • The rule of relationship (there are four kinds): (FaBSS) a. Family – Jus familial, ascendants and descendants in the direct line b. Blood – Jus sanguinis, collaterals up to the fifth degree c. Spouse – Jus conjugis d. State – Jus imperii, the right of sovereignty 1.1. Relationship Art. 963. Proximity of relationship is determined by the number of generations. Each generation forms a degree. (915) Art. 964. A series of degrees forms a line, which may be either direct or collateral. A direct line is that constituted by the series of degrees among ascendants and descendants. A collateral line is that constituted by the series of degrees among persons who are not ascendants and descendants, but who come from a common ancestor. (916a) Art. 965. The direct line is either descending or ascending. The former unites the head of the family with those who descend from him. The latter binds a person with those from whom he descends. (917) Art. 966. In the line, as many degrees are counted as there are generations or persons, excluding the progenitor. In the direct line, ascent is made to the common ancestor. Thus, the child is one degree removed from the parent, two from the grandfather, and three from the great‐ grandparent. In the collateral line, ascent is made to the common ancestor and then descent is made to the person with whom the computation is to be made. Thus, a person is two degrees removed from his brother, three from his uncle, who is the brother of his father, four from his first cousin, and so forth. (918a) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Balane: Line: • Direct o Descending o Ascending • Collateral o Direct and Collateral – Importance of distinction: the direct is preferred over the collateral. o Descending direct and ascending direct – Importance of distinction: The desce Computation of degrees: • Direct line – there is no legal limit to the number of degrees for entitlement to intestate succession. The practical limit, of course, is human mortality. o Mode of counting degrees in the direct line: one generation = one degree parent‐child = one degree grandparent‐grandchild = two degrees great‐grandparents‐great‐ grandchild = third degrees; and so forth • Collateral line – Computation of degrees is particularly important in the collateral line because intestate succession extends only to the 5th of collateral relationship. o Modes of counting degrees in the collateral line: From one reference point, ascend to nearest common ancestor [If there are more than one nearest common ancestor, choose any one] Then descend to the other reference point Number of generations constituting the ascent and the descent is the degree of collateral relationship o Collateral by Degrees First degree – none Second degree – brothers/sisters Third degree • Uncles/Aunts • Nephews/Nieces Fourth degree • First cousins • Brothers/Sisters of a grandparent (granduncles/grand aunts) • Grandchildren of a brother/sister (grand‐ nephews/grand‐ nieces) Fifth degree • Children of a first cousin • First cousins of a parent Page 53 of 73 • • Brothers/sisters of a great‐grandparent Great grandchildren of a brother/sister Art. 967. Full blood relationship is that existing between persons who have the same father and the same mother. Half blood relationship is that existing between persons who have the same father, but not the same mother, or the same mother, but not the same father. (920a) Balane: Importance of rules on relationships: • The nearer excludes the more remote • Direct line is preferred over the collateral • Descending line is preferred over the ascending Two basic concepts in relationship: • Concept of degree – This method of computing the proximity of relationship. Every degree is one generation. • Concept of lines – These are relative positions in the family between 2 persons. o In intestacy: There is no limit in the direct line either ascending or descending. There is a limit of five degrees in the collateral line (2 persons having a common ancestor) Art. 968. If there are several relatives of the same degree, and one or some of them are unwilling or incapacitated to succeed, his portion shall accrue to the others of the same degree, save the right of representation when it should take place. (922) Balane: • There is accretion in intestacy among heirs of the same degree, in case of predecease, incapacity or renunciation of any of them. • In case of predecease or incapacity, representation, if proper, will prevent accretion from occurring. • Relatives must be in the same kind of relationship. For accretion to take place the heirs involved must be in the same kind of relationship to the decedent. Thus, there can be no accretion among a grandchild, a grandparent and a brother of the decedent because they are not inheriting together in the first place. Art. 969. If the inheritance should be repudiated by the nearest relative, should there be one only, or by all the nearest relatives called by law to succeed, should there be several, those of the following degree shall inherit in their own right and cannot represent the person or persons repudiating the inheritance. (923) Balane: Effect of Renunciation by All in the Same Degree: • The descending line first – if all the descendants of a certain degree renounce, succession passes to the descendants of the next degree, and so on, ad indefinitum. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI • • The ascending line next – Should no one be left in the descending line, the heirs in the ascending acquire the right of succession, again in order of degrees of proximity; The collateral line last – Only if all the descendants and ascendants renounce will the collateral relatives acquire the right to succeed. Predecease or Incapacity by All in the Same Degree: • This eventuality is not provided for by this article. The rules above are equally applicable to such a situation except in cases where representation is proper, i.e., in the descending line. • Representation does not apply in cases of universal renunciation outlined above. 1.2. Right of Representation Art. 970. Representation is a right created by fiction of law, by virtue of which the representative is raised to the place and the degree of the person represented, and acquires the rights which the latter would have if he were living or if he could have inherited. (942a) Art. 971. The representative is called to the succession by the law and not by the person represented. The representative does not succeed the person represented but the one whom the person represented would have succeeded. (n) Art. 972. The right of representation takes place in the direct descending line, but never in the ascending. In the collateral line, it takes place only in favor of the children of brothers or sisters, whether they be of the full or half blood. (925) Art. 973. In order that representation may take place, it is necessary that the representative himself be capable of succeeding the decedent. (n) Art. 974. Whenever there is succession by representation, the division of the estate shall be made per stirpes, in such manner that the representative or representatives shall not inherit more than what the person they represent would inherit, if he were living or could inherit. (926a) Art. 975. When children of one or more brothers or sisters of the deceased survive, they shall inherit from the latter by representation, if they survive with their uncles or aunts. But if they alone survive, they shall inherit in equal portions. (927) Art. 976. A person may represent him whose inheritance he has renounced. (928a) Art. 977. Heirs who repudiate their share may not be represented. (929a) Balane: Instances when representation operates: (DIP) • Predecease • Incapacity or Unworthiness • Disinheritance Page 54 of 73 In what kind of succession representation operates: • The legitime – there is no express provision on representation in legitime, except in Article 923, in case of disinheritance. • Intestacy – there is no representation in testamentary succession. In what lines does representation obtain: • With respect to the legitime – in the direct descending line only • With respect to intestacy o In the direct descending line o In one instance in the collateral; i.e. nephews and nieces representing brothers and sisters of the deceased. Representation by illegitimate children: • If the child to be represented is legitimate – only legitimate children/descendants can represent him • If the child to be represented is illegitimate ‐ both legitimate and illegitimate children/descendants can represent him Representation of and by an adopted child: • An adopted can neither represent or be represented. Teotico vs. Del Val (1965) F: Oppositor claims to be an adopted daughter of Francisca Mortera, a deceased sister of the testatrix. SC ruled that the oppositor has no right to intervene either as testamentary or as legal heir in the probate proceeding of the deceased sister of her adopted mother. H: Relationship of adoption is limited solely to the adopter and the adopted and does not extend to the relatives of the adopting parents or of the adopted child except only as expressly provided for by law. As a consequence, the adopted is an heir of the adopter but not of the relatives of the adopter. Represenation by a renouncer: • Although a renouncer cannot be represented, he can represent the person whose inheritance he has renounced. How representation operates: • Per stirpes – the representative or representatives receive only what the person represented would have received. If there are more than one representative in the same degree, then divide the portion equally, without prejudice to the distinction between legitimate and illegitimate children, when applicable. Rules on Qualification: • The representative must be qualified to succeed the decedent. • The representative need not be qualified to succeed the person represented. • The person represented need not be qualified to succeed the decedent – in fact, the reason why representation is taking place is that the person SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI represented is not qualified, because of predecease, or in capacity or disinheritance. Representation by grandchildren and Representation by nephews/nieces: Difference Rule • If all the children are disqualified – the grandchildren still inherit by representation. • If all the brothers/sisters are disqualified – the nephews/nieces inherit per capita. • Note: If only some, not all children or brothers/sisters are disqualifed the rule is the same. 2. Order of Intestate Succession Intestate Heirs I. Legitimate Children/Descendants II. Illegitimate Children/Descendants III. Legitimate Parents/Ascendants IV. Illegitimate Parents V. Surviving Spouse VI. Brothers, Sisters, Nephews, Nieces VII. Other Collaterals – to the 5th degree VIII. State Class Notes: • It is correct to say that a compulsory heir is an intestate heir. But it is not correct to say that an intestate heir is not a compulsory heir. Intestacy Balane: Rules of Exclusion and Concurrence: (Note: Children include, in proper cases, other descendants; and parents, other ascendants.) 1. legitimate children a. exclude parents, collaterals & State b. concur with surviving spouse & illegitimate children c. are excluded by no one 2. illegitimate children a. exclude illegitimate parents, collaterals & State b. concur with surviving spouse, legitimate children, and legitimate parents c. are excluded by no one 3. legitimate parents a. exclude collaterals & state b. concur with illegitimate children & surviving spouse c. are excluded by legitimate children 4. illegitimate parents [only, not ascendants] a. exclude collaterals & State b. concur with surviving spouse c. are excluded by legitimate children and illegitimate children 5. surviving spouse a. excludes collaterals other than brothers, sisters, nephews & nieces, & State b. concur with legitimate children, illegitimate children, legitimate Page 55 of 73 6. 7. 8. parents, illegitimate parents, brothers sisters, nephews & nieces c. is excluded by no one brothers & sisters, nephews & nieces a. exclude all other collaterals & the State b. concur with surviving spouse c. are excluded by legitimate children, illegitimate children, legitimate parents, and illegitimate parents Other collaterals a. exclude collaterals in remoter degrees & the State b. concur with collaterals in the same degree c. are excluded by legitimate children, illegitimate children, legitimate parents, illegitimate parents, surviving spouse, brothers & sisters, and nephews & nieces State a. excludes no one b. concurs with no one c. is excluded by everyone Class Notes: • Number 5 surviving spouse does not exclude the group in number 6. 12. 13. 14. 15. 16. 17. Balane: Combinations in Intestate Succession (found passim in Art. 978): 1. legitimate children alone • the whole estate divided equally 2. legitimate children & illegitimate children • the whole estate, each illegitimate child getting ½ the share of one legitimate child 3. legitimate children & surviving spouse • the whole estate, divided equally (the surviving spouse counted as one legitimate child) 4. legitimate children, surviving spouse & illegitimate children • the whole estate, the surviving spouse being counted as one legitimate child • each illegitimate child getting ½ the share of one legitimate 5. legitimate parents alone • the whole estate divided equally 6. legitimate ascendants (other than parents) alone • the whole estate, observing, in proper cases, the rule of division by line 7. legitimate parents & illegitimate children* • legitimate parents – ½ of the estate • illegitimate children – ½ of the estate 8. legitimate parents & suriving spouse* • legitimate parents – ½ of the estate • surviving spouse – ½ of the estate 9. legitimate parents, surviving spouse, illegitimate children* • legitimate parents – ½ of the estate • surviving spouse – ¼ of the estate • illegitimate children – ¼ of the estate 10. illegitimate children alone • the whole estate divided equally 11. illegitimate children & surviving spouse* SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 18. 19. 20. 21. 22. 23. 24. 25. • illegitimate children – ½ of the estate • surviving spouse – ½ of the estate surviving spouse alone • the whole estate surviving spouse & illegitimate parents (no article governing, combination applied by analogy with Art. 997)* • surviving spouse – ½ of the estate • illegitimate parents – ½ of the estate surviving spouse & legitimate brothers & sisters, nephews & nieces* • surviving spouse – ½ of the estate • legitimate brothers, sisters, nephews, nieces – ½ of the estate (the nephews & nieces inheriting by representation, in the proper cases) surviving spouse & illegitimate brothers & sisters, nephews & nieces* • surviving spouse – ½ of the estate • illegitimate brothers, sisters, nephews, nieces – ½ of the estate (the nephews & nieces inheriting by representation, in the proper cases) • the illegitimate brothers & sisters are those mentioned in Art. 994. illegitimate parents alone • the whole estate illegitimate parents & children of any kind • illegitimate parents – excluded • children inherit in accordance with Nos. 1, 2 & 10. legitimate brothers & sisters alone • the whole estate, with a brother/sister of the half‐blood inheriting ½ of the estate the share of a brother/sister of the full blood legitimate brothers & sisters, nephews & nieces • the whole estate, observing the 2:1 proportion of the full‐and half‐blood fraternity (No. 18 supra) and the nephews and nieces inheriting by representation in the proper cases nephew & nieces with uncles & aunts • by inference uncles and aunts – excluded (accdg. to Bacayo v. Borromeo) nephews and nieces inheriting in accordance with No. 23 infra illegitimate brothers and sisters alone – no article governing • the whole estate, observing the 2:1 proportion of full‐ and half‐ blood fraternity – by analogy with No. 18 supra illegitimate brothers, sisters, nephews and nieces ‐ no article governing • the whole estate, as in No. 19 supra, by analogy nephews & nieces alone • the whole estate, per capita, but observing the 2:1 proportion for the full‐ and the half‐ blood other collaterals • the whole estate, per capita, the nearer in degree excluding the more remote State Page 56 of 73 • • • the whole estate Assignment & disposition of decedent’s assets o If the decedent was a resident of the Philippines at any time: Personal property – to municipality of last residence Real property – where situated o If the decedent never a resident of the Philippines: Personal and real property – where respectively situated How property is to be used o For the benefit of public educational and charitable institutions in the respective municipalities/cities o Alternatively, at the instance of an interested party, or motu propio, court may order creation of a permanent trust for the benefit of the institutions concerned Class Notes: • Follow the rules except for number 2 and number 4. Both have different steps from the step. Be careful because you might end up impairing the legitime. • Just follow the rules on intestacy, the legitimes will never be impaired. They are automatically covered by the rules. • But Art. 983 (which covers number 2 also) might impair the legitime. Illustration on how Art. 983 can impair the legitime: X’s estate is worth P1,800,000 | A 4M | B 4M : C 2M X (decedent) : : D E 2M 2M : F 2M 2M : G Here the legitime of A and B is impaired because their legitime is P900,000 and their share together is P800,000. There is a deficit of P100,000 in their legitime. Since Art. 983 impairs the legitime as shown in the illustration, two steps must be followed to avoid such: 1. Give the legitime first – legitimate before illegitimate. 2. If there is an excess divided it to a ratio of 2:1. 3. If lacking, reduce the share of illegitimate children pro‐rata. | B 4.5 Reduction of share of each illegitimate child: 225,000 (deficit) / 5 (illegitimate children) = P45,000. The share of each illegitimate child should be reduced by P45,000. Thus from P225,000, each illegitimate child will now get P180,000 each. Class Notes: • Number 1 illustrated total intestacy. • Number 15 will only happen in one case. o In a case where X has three children, A (legitimate), B (illegitimate) and C (illegitimate), when B dies, A cannot inherit from him (and B cannot inherit from him) but C can. o This is not prohibited by Article 992. o In Manuel v. Ferrer: “When the law speaks of ‘brothers and sisters, nephews and nieces’ as legal heirs of an illegitimate child, it refers to illegitimate brothers and sisters as well as to the children, whether legitimate of illegitimate of such brothers and sisters.” • In number 20, if there are nephews and nieces, they exclude uncles and aunts. Sample Problems: 1. Patrick, illegitimate child of the late Don Ruben by his late mistress Evelyn dies in a vehicular accident while riding his Harley because he hates wearing a helmet. He did not leave a will and his estate is worth P25,000,000. His spouse Amirah and his full sister Cielo were devastated by his abrupt death. Meanwhile Robert, Don Ruben’s child by his wife Araceli, is also maddened with grief as he was not able to make peace with his estranged brother. How should Mr. Patrick’s estate be distributed? 2. Serafin, a notorious womanizer and self‐ proclaimed Cassanova, was killed in flagrante delicto with his current mistress Danica. He was shot by John Mark, Danica’s ex‐boyfriend when he caught them together. This scandalized his wife Lorie to no end. To compound the wife’s grief, Danica’s children with Serafin: Auring, Koring, Kristina, Paula, Ogie and Joselit are fighting with Lorie’s twin children Jess and Roslene over their late father’s estate which is worth only P500,000. How should the estate be apportioned? 2.1. Descending Direct Line Art. 978. Succession pertains, in the first place, to the descending direct line. (930) Illustration: | A 4.5 The total is P2,025,000. The estate is only P1,800,000. There is a deficit of P225,000. The solution is to reduce the shares of illegitimate children pro‐rata. : C 2.25 X (decedent) : : : D E F 2.25 2.25 2.25 2.25 SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI : G Art. 979. Legitimate children and their descendants succeed the parents and other ascendants, without distinction as to sex or age, and even if they should come from different marriages. An adopted child succeeds to the property of the adopting Page 57 of 73 parents in the same manner as a legitimate child. (931a) the entire estate of the child. (936) Balane: • The right of an adopted child in relation to his adopter is now governed by Secs. 17 and 18 of R.A. 8552, which lays down the same rule as the second paragraph of this article. Art. 987. In default of the father and mother, the ascendants nearest in degree shall inherit. Should there be more than one of equal degree belonging to the same line they shall divide the inheritance per capita; should they be of different lines but of equal degree, one‐half shall go to the paternal and the other half to the maternal ascendants. In each line the division shall be made per capita. (937) Sayson vs. Court of Appeals (1992) F: Private respondents who are adopted children of Teodoro and Isabel, filed a claim in the estate of the parents of their adopters. H: SC held that the private respondents exclusive heirs of their parents and deemed to as total strangers to their grandparents. The adopted child shall be deemed to be a legitimate child and have the same right as the latter, but these rights do not include the right of representation. Art. 980. The children of the deceased shall always inherit from him in their own right, dividing the inheritance in equal shares. (932) Art. 981. Should children of the deceased and descendants of other children who are dead, survive, the former shall inherit in their own right, and the latter by right of representation. (934a) Art. 982. The grandchildren and other descendants shall inherit by right of representation, and if any one of them should have died, leaving several heirs, the portion pertaining to him shall be divided among the latter in equal portions. (933) Art. 983. If illegitimate children survive with legitimate children, the shares of the former shall be in the proportions prescribed by Article 895. (n) Balane: • Segregate the legitimes of the children – both legitimate and illegitimate. • If any residue is left, apportion it in proportion of 2:1 • If the estate may not be sufficient to satisfy the legitimes, the legitimes of the illegitimates will have to be reduced pro rata. Art. 984. In case of the death of an adopted child, leaving no children or descendants, his parents and relatives by consanguinity and not by adoption, shall be his legal heirs. (n) Balane: • Repealed by Secs. 17 and 18 of R.A. 8552. 2.2. Ascending Direct Line Art. 985. In default of legitimate children and descendants of the deceased, his parents and ascendants shall inherit from him, to the exclusion of collateral relatives. (935a) Art. 986. The father and mother, if living, shall inherit in equal shares. Should one only of them survive, he or she shall succeed to SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 2.3. Illegitimate Children Art. 988. In the absence of legitimate descendants or ascendants, the illegitimate children shall succeed to the entire estate of the deceased. (939a) Art. 989. If, together with illegitimate children, there should survive descendants of another illegitimate child who is dead, the former shall succeed in their own right and the latter by right of representation. (940a) Art. 990. The hereditary rights granted by the two preceding articles to illegitimate children shall be transmitted upon their death to their descendants, who shall inherit by right of representation from their deceased grandparent. (941a) Art. 991. If legitimate ascendants are left, the illegitimate children shall divide the inheritance with them, taking one‐half of the estate, whatever be the number of the ascendants or of the illegitimate children. (942‐841a) Art. 992. An illegitimate child has no right to inherit ab intestato from the legitimate children and relatives of his father or mother; nor shall such children or relatives inherit in the same manner from the illegitimate child. (943a) Corpuz vs Administrator (1978) F: Deceased Teodoro has no forced heirs. His closest relatives were half‐siblings. Tomas, the son, of Juanita, who is in turn the daughter of Teodoro’s half‐brother Jose, filed an action to recover her mother’s supposed share in the intestate estate of the decedent. H: Juanita is not a legal heir of Teodoro since there is no reciprocal succession between legitimate and illegitimate relatives. The rule is based on the theory that the illegitimate child is disgracefully looked upon by the legitimate family, while the latter is, in turn, hated by the illegitimate child. Leonardo vs Court of Appeals (1983) F: Petitioner Cresenciano, claiming to be the son of the late Sotero, sought to be declared one of the lawful heirs of decedent who is the grandfather of Sotero. H: At most, petitioner would be an illegitimate child who has no right to inherit in ab intestato from the legitimate children and relatives of his father, like the deceased. Diaz vs. IAC (1987) Page 58 of 73 F: The case involves a dispute between the petitioners, the illegitimate children of decedent’s son Pablo Santero, and the decedent’s niece Felisa Pamuti Jardin, as to who could legally inherit from the decedent. Petitioners allege that they could inherit by right of representation of their father, who is a legitimate child of the decedent. H: SC held the legal heir to be the niece. The New Civil Code still does not confer to illegitimate children the right to represent their parents in the inheritance of their legitimate grandparents, even if the New Civil Code have made illegitimate children as compulsory primary heirs under Art. 887. Diaz vs. IAC (1990) F: A second MR from the earlier 1987 case. Issue here is does the term “relatives” in Art. 992 include the legitimate parents of the father or mother of the illegitimate children? May these illegitimate children of Pablo (father) inherit from Simona (grandmother), by right of representation of their father Pablo who was a legitimate son? H: Art. 992 prohibits absolutely a succession ab intestato between an illegitimate child and the legitimate children and “relatives” of the father or mother of said legitimate child. Art. 993. If an illegitimate child should die without issue, either legitimate or illegitimate, his father or mother shall succeed to his entire estate; and if the child's filiation is duly proved as to both parents, who are both living, they shall inherit from him share and share alike. (944) Art. 994. In default of the father or mother, an illegitimate child shall be succeeded by his or her surviving spouse who shall be entitled to the entire estate. If the widow or widower should survive with brothers and sisters, nephews and nieces, she or he shall inheritt one‐ half of the estate, and the latter the other half. (945a) Balane: • According to jurisprudence, when the law speaks of brothers and sisters, nephews and nieces as legal heirs of an illegitimate child, it refers to illegitimate brothers and sisters as well as the children, whether legitimate or illegitimate, of such brothers and sisters. 2.4. Surviving Spouse Art. 995. In the absence of legitimate descendants and ascendants, and illegitimate children and their descendants, whether legitimate or illegitimate, the surviving spouse shall inherit the entire estate, without prejudice to the rights of brothers and sisters, nephews and nieces, should there be any, under article 1001. (946a) Art. 996. If a widow or widower and legitimate children or descendants are left, the surviving spouse has in the succession the same share as that of each of the children. (834a) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Balane: • This rule holds even if there is only one legitimate child, in which case the child and the surviving spouse will divide the estate equally. Santillon vs. Miranda (1965) F: How shall the estate of a person who dies intestate be divided when the only survivors are the spouse and one legitimate child? The son is claiming that Art. 892 should be applied while the wife states that the division is ½ between them. H: SC ruled for the wife. Art. 996 which applies in intestacy should be read: “If the widow or widower and a legitimate child are left, the surviving spouse has the same share as that of the child.” Art. 997. When the widow or widower survives with legitimate parents or ascendants, the surviving spouse shall be entitled to one‐half of the estate, and the legitimate parents or ascendants to the other half. (836a) Art. 998. If a widow or widower survives with illegitimate children, such widow or widower shall be entitled to one‐ half of the inheritance, and the illegitimate children or their descendants, whether legitimate or illegitimate, to the other half. (n) Art. 999. When the widow or widower survives with legitimate children or their descendants and illegitimate children or their descendants, whether legitimate or illegitimate, such widow or widower shall be entitled to the same share as that of a legitimate child. (n) Art. 1000. If legitimate ascendants, the surviving spouse, and illegitimate children are left, the ascendants shall be entitled to one‐half of the inheritance, and the other half shall be divided between the surviving spouse and the illegitimate children so that such widow or widower shall have one‐fourth of the estate, and the illegitimate children the other fourth. (841a) Art. 1001. Should brothers and sisters or their children survive with the widow or widower, the latter shall be entitled to one‐half of the inheritance and the brothers and sisters or their children to the other half. (953, 837a) Art. 1002. In case of a legal separation, if the surviving spouse gave cause for the separation, he or she shall not have any of the rights granted in the preceding articles. (n) 2.5. Collateral Relatives Art. 1003. If there are no descendants, ascendants, illegitimate children, or a surviving spouse, the collateral relatives shall succeed to the entire estate of the deceased in accordance with the following articles. (946a) Art. 1004. Should the only survivors be brothers and sisters of the full blood, they shall inherit in equal shares. (947) Art. 1005. Should brothers and sisters survive together with nephews and nieces, who are the children of the Page 59 of 73 descendant's brothers and sisters of the full blood, the former shall inherit per capita, and the latter per stirpes. (948) Art. 1006. Should brother and sisters of the full blood survive together with brothers and sisters of the half blood, the former shall be entitled to a share double that of the latter. (949) Art. 1007. In case brothers and sisters of the half blood, some on the father's and some on the mother's side, are the only survivors, all shall inherit in equal shares without distinction as to the origin of the property. (950) Art. 1008. Children of brothers and sisters of the half blood shall succeed per capita or per stirpes, in accordance with the rules laid down for the brothers and sisters of the full blood. (915) Art. 1009. Should there be neither brothers nor sisters nor children of brothers or sisters, the other collateral relatives shall succeed to the estate. The latter shall succeed without distinction of lines or preference among them by reason of relationship by the whole blood. (954a) Art. 1010. The right to inherit ab intestato shall not extend beyond the fifth degree of relationship in the collateral line. (955a) 2.6. The State Art. 1011. In default of persons entitled to succeed in accordance with the provisions of the preceding Sections, the State shall inherit the whole estate. (956a) Art. 1012. In order that the State may take possession of the property mentioned in the preceding article, the pertinent provisions of the Rules of Court must be observed. (958a) Art. 1013. After the payment of debts and charges, the personal property shall be assigned to the municipality or city where the deceased last resided in the Philippines, and the real estate to the municipalities or cities, respectively, in which the same is situated. If the deceased never resided in the Philippines, the whole estate shall be assigned to the respective municipalities or cities where the same is located. Such estate shall be for the benefit of public schools, and public charitable institutions and centers, in such municipalities or cities. The court shall distribute the estate as the respective needs of each beneficiary may warrant. The court, at the instance of an interested party, or on its own motion, may order the establishment of a permanent trust, so that only the income from the property shall be used. (956a) IV. 1. Provisions Common to Testate and Intestate Succession Right of Accretion two or more persons are called to the same inheritance, devise or legacy, the part assigned to the one who renounces or cannot receive his share, or who died before the testator, is added or incorporated to that of his co‐ heirs, co‐devisees, or co‐legatees. (n) Art. 1016. In order that the right of accretion may take place in a testamentary succession, it shall be necessary: (1) That two or more persons be called to the same inheritance, or to the same portion thereof, pro indiviso; and (2) That one of the persons thus called die before the testator, or renounce the inheritance, or be incapacitated to receive it. (928a) Accretion a. Definition (Art. 1015) Occasions for the operation of accretion: • Renunciation • Predecease • Incapacity b. Elements (Art. 1016) Pro indiviso – “as undivided” or “in common”; does not import equality Ex: I give my portion to A, B and C I give 1/8 of my estate to A, B and C Can there be accretion if the shares are not equal? Ex: A to get ½, B to get 1/3, and C to get 1/6 • Tolentino: NO. Must be equal. • Sir: Yes, it is possible. See Art. 1019, which contemplates unequal shares. Art. 1017. The words "one‐half for each" or "in equal shares" or any others which, though designating an aliquot part, do not identify it by such description as shall make each heir the exclusive owner of determinate property, shall not exclude the right of accretion. In case of money or fungible goods, if the share of each heir is not earmarked, there shall be a right of accretion. (983a) Art. 1018. In legal succession the share of the person who repudiates the inheritance shall always accrue to his co‐heirs. (981) In intestacy, accretion occurs: (RIP) a. In repudiation or renunciation b. In predecease, only if representation does not take place c. In incapacity or unworthiness, only if representation does not take place The co‐heirs in whose favor accretion occurs must be co‐ heirs in the same category as the excluded heir. Art. 1015. Accretion is a right by virtue of which, when SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 60 of 73 Art. 1019. The heirs to whom the portion goes by the right of accretion take it in the same proportion that they inherit. (n) Art. 1020. The heirs to whom the inheritance accrues shall succeed to all the rights and obligations which the heir who renounced or could not receive it would have had. (984) Exceptions: a. In testamentary succession, if the testator provides otherwise b. If the obligation is purely personal, and hence, intransmissible Art. 1021. Among the compulsory heirs the right of accretion shall take place only when the free portion is left to two or more of them, or to any one of them and to a stranger. Should the part repudiated be the legitime, the other co‐ heirs shall succeed to it in their own right, and not by the right of accretion. (985) In what kinds of succession does accretion take place? 1) Testamentary succession 2) Intestate succession Not compulsory (refer to par. 2, Art. 1021) Art. 1022. In testamentary succession, when the right of accretion does not take place, the vacant portion of the instituted heirs, if no substitute has been designated, shall pass to the legal heirs of the testator, who shall receive it with the same charges and obligations. (986) In testamentary succession, accretion is subordinate to substitution, if the testator has so provided. • Substitution – express intent • Accretion – implied intent No substitution, No accretion: Vacant part will lapse into intestacy and be disposed of accordingly 2. Capacity to Succeed by Will or by Intestacy Art. 1024. Persons not incapacitated by law may succeed by will or ab intestato. The provisions relating to incapacity by will are equally applicable to intestate succession. (744, 914) Gen. Rule: In favor of capacity to succeed, as long as successor has juridical personality To prove incapacity: Legal ground; Must be shown Par. 2 is wrong. Art. 1025. In order to be capacitated to inherit, the heir, devisee or legatee must be living at the moment the SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI succession opens, except in case of representation, when it is proper. A child already conceived at the time of the death of the decedent is capable of succeeding provided it be born later under the conditions prescribed in article 41. (n) Par. 1 is wrong; there is no exception. Natural Persons: Requirement for capacity to succeed: Must be living when succession opens See Arts. 40 and 41 of the Civil Code • • Living: already conceived when decedent dies, provided it be born later When succession opens: Decedent’s death If institution is subject to a suspensive condition: Must be living both when decedent dies and when the condition happens. If institution is subject to a suspensive term: Must be living when decedent dies Exception: None Parish Priest of Roman Catholic Church of Victoria, Tarlac vs. Rigor (1979) F: Testator intended to devise his riceland to his “nearest male relative who would become a priest after his death”. There was an ambiguity as to whether he contemplated only his nearest male relative at the time of his death or any of his nearest male relatives at any time after the same. H: The bequest refers to the testator’s nearest male relative living at the time of his death and not to any indefinite time thereafter. Art. 1026. A testamentary disposition may be made to the State, provinces, municipal corporations, private corporations, organizations, or associations for religious, scientific, cultural, educational, or charitable purposes. All other corporations or entities may succeed under a will, unless there is a provision to the contrary in their charter or the laws of their creation, and always subject to the same. (746a) Juridical Persons: Requirement for capacity to succeed: Must exist as a juridical person when the decedent dies. (1) The State and its political subdivisions • State: must have acquired the 4 elements – territory, people, government, sovereignty • Local government unit: must have been created by law (2) Other corporations, institutions and entities for public interest or purpose, created by law • their personality begins as soon as they have been constituted according to law; Page 61 of 73 (3) Corporations, partnerships and associations for private interest or purpose • Corporation: must have been created in accordance with the Corporation Code • Partnership: partners must have agreed (except when real property is contributed, where you’ll need a public instrument Except for the State, Juridical persons cannot succeed by legitime or intestacy. Art. 1027. The following are incapable of succeeding: (1) The priest who heard the confession of the testator during his last illness, or the minister of the gospel who extended spiritual aid to him during the same period; (2) The relatives of such priest or minister of the gospel within the fourth degree, the church, order, chapter, community, organization, or institution to which such priest or minister may belong; (3) A guardian with respect to testamentary dispositions given by a ward in his favor before the final accounts of the guardianship have been approved, even if the testator should die after the approval thereof; nevertheless, any provision made by the ward in favor of the guardian when the latter is his ascendant, descendant, brother, sister, or spouse, shall be valid; A makes a will in favor of his pastor. Later, he becomes seriously ill, and calls the pastor for spiritual ministration. A dies. Is the pastor disqualified? No. Proper sequence: A is dying Summons pastor Spiritual ministration During or After spiritual ministration, he makes a will, with a disposition in favor of the pastor A dies Does the prohibition apply to ministers of religions other than the Christian denomination? Yes, if such religion has a counterpart (someone who gives spiritual ministration) Par. 2 Purpose: To prevent indirect violations or circumventions of Par. 1 Suppose B summons a priest, who is also his son, and he makes a disposition in his will, in his son’s favor. B’s son is disqualified from receiving the terstamentary disposition, but not to his legitime. Par. 3 • • Requisite: Will must have been executed by the ward during the effectivity of the guardianship To whom applicable: Guardians of persons and property (4) Any attesting witness to the execution of a will, the spouse, parents, or children, or any one claiming under such witness, spouse, parents, or children; Exception: Guardian who is also an ascendant, descendant, brother, sister or spouse of ward‐testator (5) Any physician, surgeon, nurse, health officer or druggist who took care of the testator during his last illness; Note: the provision does not exclude the relatives of the guardian, unlike the rule for priests (6) Individuals, associations and corporations not permitted by law to inherit. (745, 752, 753, 754a) There is an exception. See Art. 823, where the witness may be qualified if there are 3 other witnesses Par. 1­5: • Apply only to natural persons • Applicable in testamentary succession, not to legitime or intestacy • Rationale: The law seeks to prevent possible abuse of moral or spiritual ascendancy • Duress or influence is conclusively presumed; need not be proved Par. 1 • • Par. 4 • Par. 5 • Scope of prohibition: Person must have taken care of the testator during the latter’s final illness “Taking care” means medical attendance with some regularity or continuity Par. 6: Total disqualification; Should be a separate article To whom applicable: priests, pastors, ministers etc. belonging to religions, sects or cults, whose office or function it is to extend the peculiar spiritual ministrations of their creed Art. 1028. The prohibitions mentioned in article 739, concerning donations inter vivos shall apply to testamentary provisions. (n) Requisites: a. Will must have been executed during the testator’s last illness b. Spiritual ministration must have extended during the last illness c. Will must have been executed during or after the spiritual ministration Art. 1029. Should the testator dispose of the whole or part of his property for prayers and pious works for the benefit of his soul, in general terms and without specifying its application, the executor, with the court's approval shall deliver one‐half thereof or its proceeds to the church or denomination to which the testator may belong, to be used for such prayers and pious works, and the other half to the State, for the purposes mentioned in Article 1013. (747a) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 62 of 73 Requisites: a. Disposition for prayers and pious works for the benefit of the testator’s soul b. No specification of application of disposition Apportionment of disposition or its proceeds: • ½ to the church or denomination to which the testator belonged • ½ to the State (see Art. 1013) Art. 1030. Testamentary provisions in favor of the poor in general, without designation of particular persons or of any community, shall be deemed limited to the poor living in the domicile of the testator at the time of his death, unless it should clearly appear that his intention was otherwise. The designation of the persons who are to be considered as poor and the distribution of the property shall be made by the person appointed by the testator for the purpose; in default of such person, by the executor, and should there be no executor, by the justice of the peace, the mayor, and the municipal treasurer, who shall decide by a majority of votes all questions that may arise. In all these cases, the approval of the Court of First Instance shall be necessary. The preceding paragraph shall apply when the testator has disposed of his property in favor of the poor of a definite locality. (749a) Beneficiaries: The poor Par. 1 refers to the poor of the testator’s domicile, unless excluded by the testator in his will. Who determines the individual beneficiaries within the class designated by the testator? AEA a. Person authorized by the testator, or in his default b. Executor, or in his default c. Administator against the life of the testator, his or her spouse, descendants, or ascendants; (3) Any person who has accused the testator of a crime for which the law prescribes imprisonment for six years or more, if the accusation has been found groundless; (4) Any heir of full age who, having knowledge of the violent death of the testator, should fail to report it to an officer of the law within a month, unless the authorities have already taken action; this prohibition shall not apply to cases wherein, according to law, there is no obligation to make an accusation; (5) Any person convicted of adultery or concubinage with the spouse of the testator; (6) Any person who by fraud, violence, intimidation, or undue influence should cause the testator to make a will or to change one already made; (7) Any person who by the same means prevents another from making a will, or from revoking one already made, or who supplants, conceals, or alters the latter's will; (8) Any person who falsifies or forges a supposed will of the decedent. (756, 673, 674a) Application: all kinds of succession Grounds for unworthiness: Pars. 1, 2, 3, 5, 6: see discussion under Art. 919 (as grounds for disinheritance) Par. 4: a. b. c. d. e. Heir has knowledge of violent death of the decedent Heir is of legal age Heir fails to report it to all officer of the law within a month after learning of it Authorities have not yet taken action Legal obligation for the heir to make an accusation Effect of Unworthiness: Total disqualification by any form of succession Art. 1031. A testamentary provision in favor of a disqualified person, even though made under the guise of an onerous contract, or made through an intermediary, shall be void. (755) Effect of simulation or circumvention: Disposition is void, hence ineffective as to the intended beneficiary and the intermediary. Intestate heirs, to whom the property would go, have the right to claim the nullity. Art. 1032. The following are incapable of succeeding by reason of unworthiness: (1) Parents who have abandoned their children or induced their daughters to lead a corrupt or immoral life, or attempted against their virtue; Art. 1033. The cause of unworthiness shall be without effect if the testator had knowledge thereof at the time he made the will, or if, having known of them subsequently, he should condone them in writing. (757a) 2 ways to restore capacity: a. Written condonation b. Execution by the offended party of a will with knowledge of the cause of unworthiness (the will must also institute the unworthy heir or restore him to capacity) How to reconcile common grounds for Unworthiness and Disinheritance (Arts. 1033 and 922): a. If offended party does not make a will subsequent to the occurrence of the common cause: Art. 1033 applies (2) Any person who has been convicted of an attempt SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 63 of 73 b. If offended party makes a will subsequent to the occurrence of the common cause: This article grants a right of reimbursement of necessary expenses to the excluded heir. If he knew of the cause 1) If he disinherits – apply Art. 922 2) If he institutes or pardons the offender – restored to capacity 3) If will is silent – unworthiness stays Art. 1038. Any person incapable of succession, who, disregarding the prohibition stated in the preceding articles, entered into the possession of the hereditary property, shall be obliged to return it together it its accessions. If he did not know of the cause – unworthiness stays He shall be liable for all the fruits and rents he may have received, or could have received through the exercise of due diligence. (760a) Disqualified heir here is a possessor in bad faith. a. Obligation to return, with accessions b. Liability for fruits which were received and could have been received Art. 1034. In order to judge the capacity of the heir, devisee or legatee, his qualification at the time of the death of the decedent shall be the criterion. In cases falling under Nos. 2, 3, or 5 of Article 1032, it shall be necessary to wait until final judgment is rendered, and in the case falling under No. 4, the expiration of the month allowed for the report. If the institution, devise or legacy should be conditional, the time of the compliance with the condition shall also be considered. (758a) When capacity is to be determined: Gen. Rule: Time of decedent’s death If institution is subject to a suspensive condition: a. Time of decedent’s death, and b. Time of happening of condition If final judgment is a requisite of unworthiness: Time of final judgment Art. 1035. If the person excluded from the inheritance by reason of incapacity should be a child or descendant of the decedent and should have children or descendants, the latter shall acquire his right to the legitime. The person so excluded shall not enjoy the usufruct and administration of the property thus inherited by his children. (761a) Extent of Representation: Legitime and intestacy Representation in the collateral line: If the unworthy heir is a brother or sister, his children (nephews and nieces of the decedent) will represent Art. 1036. Alienations of hereditary property, and acts of administration performed by the excluded heir, before the judicial order of exclusion, are valid as to the third persons who acted in good faith; but the co‐heirs shall have a right to recover damages from the disqualified heir. (n) This applies the Doctrine of Innocent Purchaser for Value without prejudice to the right to damages of the prejudiced heirs against the incapacitated heir. Art. 1037. The unworthy heir who is excluded from the succession has a right to demand indemnity or any expenses incurred in the preservation of the hereditary property, and to enforce such credits as he may have against the estate. (n) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Art. 1039. Capacity to succeed is governed by the law of the nation of the decedent. (n) Art. 1040. The action for a declaration of incapacity and for the recovery of the inheritance, devise or legacy shall be brought within five years from the time the disqualified person took possession thereof. It may be brought by any one who may have an interest in the succession. (762a) The right of heir to recover the inheritance must be exercised within 5 years. 5‐year prescriptive period applies to: a. the declaration of incapacity of the heir b. the recovery of the inheritance or portion thereof wrongfully possessed by the disqualified heir. 3. Acceptance and Repudiation of the Inheritance Art. 1041. The acceptance or repudiation of the inheritance is an act which is purely voluntary and free. (988) Art. 1042. The effects of the acceptance or repudiation shall always retroact to the moment of the death of the decedent. (989) Retroactivity: a. Of acceptance – successor will be deemed to have owned and possessed the property from the moment of decedent’s death b. Of renunciation – substitute, co‐heir or intestate heir who gets the property in default of the renouncer, is deemed to have owned and possessed it from the moment of decedent’s death c. Conditional institutions 1) Condition happens – Property passes with retroactive effect 2) Condition does not happen – Property goes to the appropriate successor, with the same retroactive effect Art. 1043. No person may accept or repudiate an Page 64 of 73 inheritance unless he is certain of the death of the person from whom he is to inherit, and of his right to the inheritance. (991) Article requires: a. Certainty of death b. Established right to inherit Art. 1044. Any person having the free disposal of his property may accept or repudiate an inheritance. Any inheritance left to minors or incapacitated persons may be accepted by their parents or guardians. Parents or guardians may repudiate the inheritance left to their wards only by judicial authorization. The right to accept an inheritance left to the poor shall belong to the persons designated by the testator to determine the beneficiaries and distribute the property, or in their default, to those mentioned in Article 1030. (992a) Acts of mere preservation or provisional administration do not imply an acceptance of the inheritance if, through such acts, the title or capacity of an heir has not been assumed. (999a) Kinds of acceptance: a. Express 1) Public document 2) Private writing b. Tacit c. Implied Art. 1050. An inheritance is deemed accepted: (1) If the heirs sells, donates, or assigns his right to a stranger, or to his co‐heirs, or to any of them; (2) If the heir renounces the same, even though gratuitously, for the benefit of one or more of his co‐heirs; Art. 1045. The lawful representatives of corporations, associations, institutions and entities qualified to acquire property may accept any inheritance left to the latter, but in order to repudiate it, the approval of the court shall be necessary. (993a) (3) If he renounces it for a price in favor of all his co‐heirs indiscriminately; but if this renunciation should be gratuitous, and the co‐heirs in whose favor it is made are those upon whom the portion renounced should devolve by virtue of accretion, the inheritance shall not be deemed as accepted. (1000) Art. 1046. Public official establishments can neither accept nor repudiate an inheritance without the approval of the government. (994) Tacit acceptance is inferred from acts of ownership performed by the heir over the property. Art. 1047. A married woman of age may repudiate an inheritance without the consent of her husband. (995a) Art. 1048. Deaf‐mutes who can read and write may accept or repudiate the inheritance personally or through an agent. Should they not be able to read and write, the inheritance shall be accepted by their guardians. These guardians may repudiate the same with judicial approval. (996a) Accept Repudiate Parents or guardians Yes Yes* Authorized person Yes No Lawful Yes Yes* representatives Public official Yes, but only with approval of establishments government Married person (w/o Yes Yes spouse’s consent) Deaf‐mutes who can Yes, personally or through an read and write agent Deaf‐mutes who Yes, through Yes, through cannot read and their guardians their write guardians* *Requires judicial authorization Art. 1049. Acceptance may be express or tacit. An express acceptance must be made in a public or private document. A tacit acceptance is one resulting from acts by which the intention to accept is necessarily implied, or which one would have no right to do except in the capacity of an heir. SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Art. 1051. The repudiation of an inheritance shall be made in a public or authentic instrument, or by petition presented to the court having jurisdiction over the testamentary or intestate proceedings. (1008) Form of renunciation: a. Public or authentic (genuine) instrument b. Petition filed in the settlement proceedings Art. 1052. If the heir repudiates the inheritance to the prejudice of his own creditors, the latter may petition the court to authorize them to accept it in the name of the heir. The acceptance shall benefit the creditors only to an extent sufficient to cover the amount of their credits. The excess, should there be any, shall in no case pertain to the renouncer, but shall be adjudicated to the persons to whom, in accordance with the rules established in this Code, it may belong. (1001) This is an instance of accion pauliana, which is the right given to creditors to impugn or set aside contracts, transactions or dispositions of their debtors which will prejudice or defraud them. Extent of right of creditor to accept the inheritance in the name of the debtor: Only to the amount or value necessary to satisfy the credit Art. 1053. If the heir should die without having accepted or repudiated the inheritance his right shall be transmitted to his heirs. (1006) Art. 1054. Should there be several heirs called to the Page 65 of 73 inheritance, some of them may accept and the others may repudiate it. (1007a) Their right to accept or repudiate corresponds to the aliquot share to which they are entitled. Art. 1055. If a person, who is called to the same inheritance as an heir by will and ab intestato, repudiates the inheritance in his capacity as a testamentary heir, he is understood to have repudiated it in both capacities. Should he repudiate it as an intestate heir, without knowledge of his being a testamentary heir, he may still accept it in the latter capacity. (1009) Rationale: The testamentary disposition is the express will of the testator, whereas intestacy is only his implied will. One who renounces the express will is deemed to have renounced the implied also, but not the other way around. Rule does not apply to legitime. Art. 1056. The acceptance or repudiation of an inheritance, once made, is irrevocable, and cannot be impugned, except when it was made through any of the causes that vitiate consent, or when an unknown will appears. (997) Gen. Rule: Acceptance or repudiation of inheritance is irrevocable Exceptions: a. Factors vitiating consent are present –FIVUM (fraud, intimidation, undue influence, mistake, fraud) b. Appearance of an unknown will (which is valid and admitted to probate) Art. 1057. Within thirty days after the court has issued an order for the distribution of the estate in accordance with the Rules of Court, the heirs, devisees and legatees shall signify to the court having jurisdiction whether they accept or repudiate the inheritance. If they do not do so within that time, they are deemed to have accepted the inheritance. (n) Implied acceptance – failure to signify acceptance or renunciation within the 30‐day period 4. Executors and Administrators Art. 1058. All matters relating to the appointment, powers and duties of executors and administrators and concerning the administration of estates of deceased persons shall be governed by the Rules of Court. (n) Art. 1059. If the assets of the estate of a decedent which can be applied to the payment of debts are not sufficient for that purpose, the provisions of Articles 2239 to 2251 on Preference of Credits shall be observed, provided that the expenses referred to in Article 2244, No. 8, shall be those involved in the administration of the decedent's estate. (n) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Art. 1060. A corporation or association authorized to conduct the business of a trust company in the Philippines may be appointed as an executor, administrator, guardian of an estate, or trustee, in like manner as an individual; but it shall not be appointed guardian of the person of a ward. (n) See Rules 78‐90 of the Rules of Court 5. Collation 3 meanings of collation: 1. As computation – add all available assets, deduct debts, and add the donations to get the net hereditary estate Arts. 1061, 1067, 1071, 1072 2. As imputation – determine if the donation is chargeable/imputable to the legitime or free portion Arts. 1062 –1066, 1068, 1069, 1071–1073 3. As return – If donation to a stranger exceeds the free portion, he would have to give back to the estate as much as is needed to complete the legitimes Arts. 1075, 1076 Art. 1061. Every compulsory heir, who succeeds with other compulsory heirs, must bring into the mass of the estate any property or right which he may have received from the decedent, during the lifetime of the latter, by way of donation, or any other gratuitous title, in order that it may be computed in the determination of the legitime of each heir, and in the account of the partition. (1035a) Donations inter vivos – made to compulsory heirs AND strangers Value of donation: At the time donation was made Art. 1062. Collation shall not take place among compulsory heirs if the donor should have so expressly provided, or if the donee should repudiate the inheritance, unless the donation should be reduced as inofficious. (1036) Gen. Rule: Donations inter vivos to compulsory heirs should be imputed to the heir’s legitime (considered an advance to the legitime) Exceptions: a. Donor provides otherwise b. Donee renounces the inheritance Instances when donations inter vivos are to be imputed to the free portion: a. When made to strangers b. When made to compulsory heirs and the donor so provides c. When made to compulsory heirs who renounce the inheritance d. When in excess of the compulsory heir’s legitime, as to the excess Art. 1063. Property left by will is not deemed subject to collation, if the testator has not otherwise provided, but Page 66 of 73 the legitime shall in any case remain unimpaired. (1037) Gen. Rule: Testamentary dispostions to compulsory heirs should not be imputed to the legitime, but to the free portion Exception: If the testator provides otherwise Art. 1064. When the grandchildren, who survive with their uncles, aunts, or cousins, inherit from their grandparents in representation of their father or mother, they shall bring to collation all that their parents, if alive, would have been obliged to bring, even though such grandchildren have not inherited the property. They shall also bring to collation all that they may have received from the decedent during his lifetime, unless the testator has provided otherwise, in which case his wishes must be respected, if the legitime of the co‐heirs is not prejudiced. (1038) Grandchildren have to impute to their legitime: a. Whatever the parent whom they are representing would have been obliged to collate; and b. Whatever they themselves have received from the grandparent by gratuitous title (subject to the rules and exceptions under Art. 1062) Art. 1065. Parents are not obliged to bring to collation in the inheritance of their ascendants any property which may have been donated by the latter to their children. (1039) Donation to the grandchild should be imputed to the free portion, since it is a donation to a stranger. Art. 1066. Neither shall donations to the spouse of the child be brought to collation; but if they have been given by the parent to the spouses jointly, the child shall be obliged to bring to collation one‐half of the thing donated. (1040) Donation given to the child’s spouse will not be imputed to the child’s legitime, as it is a donation made to a stranger. Treatment of donations made to the spouses jointly: • ½ belongs to the donor’s child (Art. 1062) • ½ belongs to the child’s spouse (donation to stranger) Art. 1067. Expenses for support, education, medical attendance, even in extraordinary illness, apprenticeship, ordinary equipment, or customary gifts are not subject to collation. (1041) Support – defined in Art. 194, Family Code; does not include expenses for the recipient’s professional, vocational or other career Art. 1068. Expenses incurred by the parents in giving their children a professional, vocational or other career shall not be brought to collation unless the parents so provide, or unless they impair the legitime; but when their collation is required, the sum which the child would have SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI spent if he had lived in the house and company of his parents shall be deducted therefrom. (1042a) Gen. Rule: Expenses for the child’s professional, vocational, or other career, are not inofficious; should not be charged against the recipient’s legitime, but against the free portion Exception: If the parents provide otherwise Art. 1069. Any sums paid by a parent in satisfaction of the debts of his children, election expenses, fines, and similar expenses shall be brought to collation. (1043a) Donations by the parent to the child should be treated like other donations to compulsory heirs under Art. 1062. Art. 1070. Wedding gifts by parents and ascendants consisting of jewelry, clothing, and outfit, shall not be reduced as inofficious except insofar as they may exceed one‐tenth of the sum which is disposable by will. (1044) Wedding gifts in excess of 1/10 of the free portion are inofficious. Art. 1071. The same things donated are not to be brought to collation and partition, but only their value at the time of the donation, even though their just value may not then have been assessed. Their subsequent increase or deterioration and even their total loss or destruction, be it accidental or culpable, shall be for the benefit or account and risk of the donee. (1045a) Value to be computed and imputed: the value of thing donated at the time donation was made Reason: Any appreciation or depreciation of the thing after that time should be for the donee’s account, since donation transfers ownership to him Art. 1072. In the collation of a donation made by both parents, one‐half shall be brought to the inheritance of the father, and the other half, to that of the mother. That given by one alone shall be brought to collation in his or her inheritance. (1046a) Joint donation: Pertaining to equal shares to the estates of the father and mother Donation by one parent: Treated separately Art. 1073. The donee's share of the estate shall be reduced by an amount equal to that already received by him; and his co‐heirs shall receive an equivalent, as much as possible, in property of the same nature, class and quality. (1047) Art. 1074. Should the provisions of the preceding article be impracticable, if the property donated was immovable, the co‐heirs shall be entitled to receive its equivalent in cash or securities, at the rate of quotation; and should there be neither cash or marketable securities in the estate, so much of the other property as may be necessary shall be sold at public auction. Page 67 of 73 adequate security is given. (1050) If the property donated was movable, the co‐heirs shall only have a right to select an equivalent of other personal property of the inheritance at its just price. (1048) Applies if Art. 1073 is not possible. a. Immovables – co‐heirs entitled to cash or securities b. Movables – co‐heirs entitled to similarly‐valued movable Art. 1075. The fruits and interest of the property subject to collation shall not pertain to the estate except from the day on which the succession is opened. For the purpose of ascertaining their amount, the fruits and interest of the property of the estate of the same kind and quality as that subject to collation shall be made the standard of assessment. (1049) Rationale: The obligation to return inofficious donations to the estate arises at the time succession vests (decedent’s death). From that time, the compulsory heir is entitled to the fruits. Extent of compulsory heir’s right to fruits: a. Entirety of fruits – if donation was totally inofficious b. Prorated between heir and donee – if partially inofficious Art. 1076. The co‐heirs are bound to reimburse to the donee the necessary expenses which he has incurred for the preservation of the property donated to him, though they may not have augmented its value. The donee who collates in kind an immovable which has been given to him must be reimbursed by his co‐heirs for the improvements which have increased the value of the property, and which exist at the time the partition if effected. As to works made on the estate for the mere pleasure of the donee, no reimbursement is due him for them; he has, however, the right to remove them, if he can do so without injuring the estate. (n) Totally inofficious Reimburse in full Reimburse in full, if improvement still exists 6. Partition and Distribution of Estate 6.1. Partition Partition is a judicial proceeding that comprises the entire settlement of the decedent’s estate, covered by Rules 73 to 90 of the Rules of Court. 1 Decedent dies 2 Co­ownership of heirs over net hereditary estate or partible estate 3 Subsequent partition by: ‐ extrajudicial agreement (Rule 74, Sec. 1, Rules of Court), OR ‐ through judicial order in appropriate settlement proceedings (Rule 90, Rules of Court) Art. 1078. Where there are two or more heirs, the whole estate of the decedent is, before its partition, owned in common by such heirs, subject to the payment of debts of the deceased. (n) Art. 1079. Partition, in general, is the separation, division and assignment of a thing held in common among those to whom it may belong. The thing itself may be divided, or its value. (n) Kinds of partition: a. Actual – physical division of the thing among the co‐heirs b. Constructive – any act, other than physical division, which terminates the co‐ownership (ex: sale to a 3rd person) Casilang vs. Dizon (2013) Partially inofficious Necessary Partial reimbursement in Useful proportion to the value to be returned Ornamental No reimbursement No reimbursement Only removal, if no Only removal* if no injury to the estate injury to the estate * If the property is physically divided, and the ornament happens to be located in the donee’s portion, donee will have all rights of ownership. F: The decedent’s grandchildren petitioned to have Jose evicted and executed a deed of extrajudicial partition over the lot. Art. 1077. Should any question arise among the co‐heirs upon the obligation to bring to collation or as to the things which are subject to collation, the distribution of the estate shall not be interrupted for this reason, provided A parent who, in the interest of his or her family, desires to keep any agricultural, industrial, or manufacturing enterprise intact, may avail himself of the right granted him in this article, by ordering that the legitime of the other children to whom the property is not assigned, be SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI H: Jose is the lawful owner of the lot. He and his siblings were able to present sufficient evidence that they entered into a verbal partition, while Rosario was unable to show any proof that her father inherited the lot from Liborio. Art. 1080. Should a person make partition of his estate by an act inter vivos, or by will, such partition shall be respected, insofar as it does not prejudice the legitime of the compulsory heirs. Page 68 of 73 paid in cash. (1056a) Partition by the Causante (decedent): Characteristics: a. Takes effect only upon death b. Revocable as long as the causante is alive (hence, can be changed, modified or rescinded) How made: a. By will, or b. By act inter vivos • In writing • In a public instrument Legasto vs. Verzosa (1930) F: During the testatrix's lifetime, she made a partition of the parcels of land to her heirs by virtue of deeds of assignment. However probate of the will was denied. H: Will is not valid as it was not admitted for probate. Partition of the testator's estate inter vivos, as contemplated in the Civil Code, can only be validly made in the presence of a valid will, which is why the (old) provision speaks of a "testator." Limitation on partition by causante: Legitimes of compulsory heirs cannot be impaired Art. 1081. A person may, by an act inter vivos or mortis causa, intrust the mere power to make the partition after his death to any person who is not one of the co‐heirs. The provisions of this and of the preceding article shall be observed even should there be among the co‐heirs a minor or a person subject to guardianship; but the mandatary, in such case, shall make an inventory of the property of the estate, after notifying the co‐heirs, the creditors, and the legatees or devisees. (1057a) Mandatary cannot be a co‐heir, to ensure fairness and impartiality. Art. 1082. Every act which is intended to put an end to indivision among co‐heirs and legatees or devisees is deemed to be a partition, although it should purport to be a sale, and exchange, a compromise, or any other transaction. (n) Tuason vs. Tuason (1951) F: The share of one of the Tuason siblings in a huge parcel of land was sold to Araneta. They executed a MoA where they agreed that no co‐owner shall sell his interest in the land w/o first giving preference to the other co‐owners. Angela argued that the contract is null and void for violating CC400. H: CC400 is not applicable. The contract’s provision preserving the co‐ownership until all lots have been sold, is a mere incident to the main object of dissolving the co‐ ownership. Art. 1083. Every co‐heir has a right to demand the division of the estate unless the testator should have expressly forbidden its partition, in which case the period SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI of indivision shall not exceed twenty years as provided in article 494. This power of the testator to prohibit division applies to the legitime. Even though forbidden by the testator, the co‐ownership terminates when any of the causes for which partnership is dissolved takes place, or when the court finds for compelling reasons that division should be ordered, upon petition of one of the co‐heirs. (1051a) Gen. Rule: Any co‐heir may demand partition at any time Exceptions: a. When forbidden by the testator for a period not exceeding 20 years Exceptions to the exception: • When any of the causes for dissolution of a partnership occurs • When the court finds compelling reasons for partition b. When the co‐heirs agree on indivision for a period not exceeding 10 years (renewable) c. When the law prohibits partition Art. 1084. Voluntary heirs upon whom some condition has been imposed cannot demand a partition until the condition has been fulfilled; but the other co‐heirs may demand it by giving sufficient security for the rights which the former may have in case the condition should be complied with, and until it is known that the condition has not been fulfilled or can never be complied with, the partition shall be understood to be provisional. (1054a) Rationale: Right as heir vests only when the suspensive condition happens. Other heirs can demand parition after furnishing adequate security. Art. 1085. In the partition of the estate, equality shall be observed as far as possible, dividing the property into lots, or assigning to each of the co‐heirs things of the same nature, quality and kind. (1061) Equality among co­heirs: a. Quantitative – Shares of determined by law and by will b. co‐heirs are Qualitative – The law mandates equality in nature, kind and quality Exceptions: • Causante has made the partition himself • Co‐heirs agree otherwise • Qualitative equality is impossible or impracticable Art. 1086. Should a thing be indivisible, or would be much impaired by its being divided, it may be adjudicated to one of the heirs, provided he shall pay the others the excess in cash. Nevertheless, if any of the heirs should demand that the thing be sold at public auction and that strangers be allowed to bid, this must be done. (1062) To whom thing may be sold: Page 69 of 73 a. b. To a 3rd person, or To any of the co‐heirs (if none of them object) Art. 1087. In the partition the co‐heirs shall reimburse one another for the income and fruits which each one of them may have received from any property of the estate, for any useful and necessary expenses made upon such property, and for any damage thereto through malice or neglect. (1063) Upon partition, the co‐heirs shall render a mutual accounting of benefits received and necessary and useful expenses incurred by each of them. Art. 1088. Should any of the heirs sell his hereditary rights to a stranger before the partition, any or all of the co‐heirs may be subrogated to the rights of the purchaser by reimbursing him for the price of the sale, provided they do so within the period of one month from the time they were notified in writing of the sale by the vendor. (1067a) Right of redemption given to a co­heir • Co‐heir sold his undivided share or portion in the estate • Share was sold to a stranger • Written notice by co‐heirs to the vendor Garcia vs. Calaliman (1989) F: There was an extrajudicial partition and deed of sale. Two groups of heirs sold their shares to Calaliman and Trabadillo. The heirs of the vendors filed a case against Calaliman and Trabadillo for legal redemption. Heirs were not notified of the sale so they claim the 30 day period stipulated in Art 1088 has yet to begin. Obvious effect: Termination of co‐ownership Art. 1092. After the partition has been made, the co‐heirs shall be reciprocally bound to warrant the title to, and the quality of, each property adjudicated. (1069a) Obligation of mutual warranty: Liable for defects of title and quality (Art. 501) Warranties are the same as in sales: a. Eviction (title) b. Hidden defects (quality) Art. 1093. The reciprocal obligation of warranty referred to in the preceding article shall be proportionate to the respective hereditary shares of the co‐heirs, but if any one of them should be insolvent, the other co‐heirs shall be liable for his part in the same proportion, deducting the part corresponding to the one who should be indemnified. Those who pay for the insolvent heir shall have a right of action against him for reimbursement, should his financial condition improve. (1071) Proportional liability of co­heirs on warranty: Burdens should be proportional to benefits Art. 1094. An action to enforce the warranty among heirs must be brought within ten years from the date the right of action accrues. (n) Action to enforce warranty: 10 years To be counted from the time the portion was lost or the hidden defect was discovered. H: Written notice is required before the period of one month for the other co‐heirs to redeem begins to run. The redemptioner is entitled to written notice to remove all uncertainty as to the sale, its terms and its validity, and to quiet any doubt that the alienation is not definitive. Art. 1095. If a credit should be assigned as collectible, the co‐heirs shall not be liable for the subsequent insolvency of the debtor of the estate, but only for his insolvency at the time the partition is made. If only 1 co­heir redeems: he will pay the purchase price The warranty of the solvency of the debtor can only be enforced during the five years following the partition. If more than 1 will redeem: they will pay proportionally to their share in the property Art. 1089. The titles of acquisition or ownership of each property shall be delivered to the co‐heir to whom said property has been adjudicated. (1065a) Art. 1090. When the title comprises two or more pieces of land which have been assigned to two or more co‐heirs, or when it covers one piece of land which has been divided between two or more co‐heirs, the title shall be delivered to the one having the largest interest, and authentic copies of the title shall be furnished to the other co‐heirs at the expense of the estate. If the interest of each co‐heir should be the same, the oldest shall have the title. (1066a) 6.2. Effects of Partition Art. 1091. A partition legally made confers upon each heir the exclusive ownership of the property adjudicated to him. (1068) SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Co‐heirs do not warrant bad debts, if so known to, and accepted by, the distributee. But if such debts are not assigned to a co‐heir, and should be collected, in whole or in part, the amount collected shall be distributed proportionately among the heirs. (1072a) Credit assigned to a co­heir in partition: Warranty covers only insolvency of the decedent’s debtor at the time of partition, not subsequent insolvency, for which the co‐heir takes the risk. Prescriptive period: 5 years Art. 1096. The obligation of warranty among co‐heirs shall cease in the following cases: (1) When the testator himself has made the partition, unless it appears, or it may be reasonably presumed, that his intention was otherwise, but the legitime shall always remain unimpaired; (2) When it has been so expressly stipulated in the Page 70 of 73 agreement of partition, unless there has been bad faith; (3) When the eviction is due to a cause subsequent to the partition, or has been caused by the fault of the distributee of the property. (1070a) Instances when there is no mutual warranty: 1. Partition by the testator himself (save where the legitime has been impaired) 2. Agreement among the co‐heirs to suppress the warranty 3. Supervening events causing the loss or the diminution in value 4. Fault of the co‐heir 5. Waiver 6.3. Rescission and Nullity of Partition Art. 1097. A partition may be rescinded or annulled for the same causes as contracts. (1073a) Causes for annulment: Art. 1390 Causes for rescission: Art. 1381‐1382 Art. 1098. A partition, judicial or extra‐judicial, may also be rescinded on account of lesion, when any one of the co‐ heirs received things whose value is less, by at least one‐ fourth, than the share to which he is entitled, considering the value of the things at the time they were adjudicated. (1074a) Lesion is economic injury, where thep arty receives less than he is entitled to receive. Amount of lesion: Minimum is ¼ Art. 1099. The partition made by the testator cannot be impugned on the ground of lesion, except when the legitime of the compulsory heirs is thereby prejudiced, or when it appears or may reasonably be presumed, that the intention of the testator was otherwise. (1075) Gen. Rule: Heirs cannot demand partition on the ground of lesion, if partition was done by the testator. have not been prejudiced nor those have not received more than their just share. (1077a) Co­heir who is sued for rescission has two options: a. Re‐partition, or b. Indemnify the co‐heir the amount of lesion suffered Art. 1102. An heir who has alienated the whole or a considerable part of the real property adjudicated to him cannot maintain an action for rescission on the ground of lesion, but he shall have a right to be indemnified in cash. (1078a) Art. 1103. The omission of one or more objects or securities of the inheritance shall not cause the rescission of the partition on the ground of lesion, but the partition shall be completed by the distribution of the objects or securities which have been omitted. (1079a) Incompleteness of partition is not a ground for rescission. Remedy: Supplemental partition Art. 1104. A partition made with preterition of any of the compulsory heirs shall not be rescinded, unless it be proved that there was bad faith or fraud on the part of the other persons interested; but the latter shall be proportionately obliged to pay to the person omitted the share which belongs to him. (1080) Heir is mistakenly excluded • In good faith ‐ the omitted heir gets his rightful share • In bad faith – partition shall be annulled Art. 1105. A partition which includes a person believed to be an heir, but who is not, shall be void only with respect to such person. (1081a) Heir is mistakenly included. In this case the property will be taken away from him and redistributed among the proper recipients. Exceptions to Art. 1098: a. Impairment of the legitime b. Mistake by the testator or vitiation of his intent Art. 1100. The action for rescission on account of lesion shall prescribe after four years from the time the partition was made. (1076) Congratulations! You are now ready to nail the exam! A few things to remember: • Prescriptive period (lesion): 4 years Art. 1101. The heir who is sued shall have the option of indemnifying the plaintiff for the loss, or consenting to a new partition. Indemnity may be made by payment in cash or by the delivery of a thing of the same kind and quality as that awarded to the plaintiff. • • Spot concepts that might apply (if there’s a will, there’s a way...for preterition to operate, or if there are two transfers—reserva troncal) What rules should apply? Legitimes? Partial Intestacy? Use dark ink. You may now proceed to test your skills. Try the following sample exam questions. If a new partition is made, it shall affect neither those who SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI Page 71 of 73 QUESTIONS: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. A final decree of probate forecloses objections to the will on the ground of preterition. T or F? Full and half‐blood siblings instituted in a will inherit equally unless otherwise provided. T or F? It is not necessary to institute an heir by name. T or F? A person without testamentary capacity may not revoke a will. T or F? An illiterate person does not have testamentary capacity. T or F? In some case, the testator is presumed insane. T or F? A will need not always be witnessed. T or F? A holographic will cannot be probated on the basis solely of testimonial evidence. T or F? Supervening Incapacity does not invalidate a will but deprives the testator the power to revoke it. T or F? Republication of a will that is formally void cannot be done by mere reference. T or F? The date of a holographic will need not be written at the bottom. T or F? The testator may delegate the revocation of his will. T or F? A deaf‐mute person may execute a will but cannot witness one. T or F? If there is preterition, all testamentary dispositions are considered not written. T or F? A will and a codicil have identical formal requirements. T or F? Preterition can never occur if testator died without a will. T or F? The attestation clause must be in a language known to the testator. T or F? A blind man can neither make nor witness a will. T or F? A minor can neither make nor witness a will. T or F? A convicted thief has competence to witness a will. T or F? A foreigner may witness a will. T or F? A testamentary disposition in favour of a witness does not affect his competence as a witness. T or F? A probated will may be ineffective. T or F? An undated will is not ipso facto void. T or F? Robert died intestate, with an estate worth 6M. He is survived by his wife Diane, their only child, Big Bird, and Robert’s 3 illegitimate children: Elmo, Oscar and Ernie. How should Robert’s estate be divided? On his way to the library, Ranulfo, single, childless, died when a meteorite fell on him. He left a will which gave 1/3 of his estate to his girlfriend, Marjorie, and a legacy of P600,000 to the UP Astronomical Society (UPAS). He was survived by his parents Cornelio and Maiska who now contends that the will is ineffective because they are left with nothing. Ranulfo’s estate is worth 900,000 a. Is their contention correct? b. How much will Marjorie and UPAS get? John was married to Shelan but after 60 years of marriage the couple were childless. Shelan had 3 sisters: Claire (full‐blood), Lindsey (half‐blood) and Lorely (half‐blood). SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI The sisters had children: a. Claire: Skull and Spike b. Lindsey: Mahinhin, Makahiya, Makisig and Maliksi c. Lorely: Serafin and Salvi In 2004, Shelan made a will giving ¼ of his total estate to her 3 sisters, with simple substitution of any of them in favor of their respective children. All three sisters predeceased Shelan. When Shelan died in 2007, survived by her husband, nephews and nieces, she had an estate valued at 24M. How should it be apportioned? 28. Jaypee and Amirah, both natives of Surigao, have been married for 30 years. They have one daughter, Jamie, 27 yeasr old, single, no children and a junior executive at Hope Cigarettes Corp. One day in May, Warla invites her parents to spend the weekend with her and her fiance, Nick in a cottage on the beach of San Fabian, Pangasinan. The 4 of them leave Manila at dawn on Saturday in Nick’s new car. In Tarlac, they met a terrible accident: a south‐bound ten‐wheeler truck driven by Cari hits them head on. Nick dies on the spot. The three others survived and were rushed to the hospital where, that evening, Jaypee expired. Amirah and Jamie are transferred to Manila for better treatment. Jamie lingers on for a week but the trauma proves too much and she dies on Monday. Amirah raliies and actually regains consciousness, but unexpected blood clot forms in the brain three weeks after her daughter’s death and she too dies on Friday. The ill‐starred family are survived by Korina and Enrique (Amirah’s parents), Rosalyn and Karren (Jaypee’s sisters), and Jantzen and Jess (Amirah’s siblings). Jaypee owned a piece of land (Surigao property) worth 6M pesos – that was his only property inherited by him from his parents. Amirah owned nothing. Jamie owned a lot in Alabang (Alabang property) worth 3M – he had bought from his bonuses from Hope. To whom shall the two pieces of property go? ANSWERS: (The samplex did not have answers. The following aswers are not necessarily correct. –Rea) 1. F. A decree of probate only concerns the extrinsic validity of a will. 2. T. Distinction between full‐ and half‐blood has no application in testamentary succession. Unless the contrary clearly appears, there is a presumption of equality. 3. T. What is essential is that the heir be identifiable. 4. T. A will is revoked with the participation of the testator only in two ways: by another Page 72 of 73 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. will/codicil or by physical destruction. Both require testamentary capacity. F. T. See Art. 800 par 2. T. Holographic wills. T. The will itself (or a copy) must be presented. T. The testator must have testamentary capacity to revoke a will. See also Art. 801. T. Art. 835. T. The law does not require a specific location for the date of the holographic will. (Labrador v CA) T. Physical destruction. T. Art. 820. F. Only institution of heir is annulled; legacies and devises remain valid so long as they are not inofficious. See Art. 854. T. Art. 826. T. If there is no testamentary disposition, the compulsory heir would always receive something through intestacy. (But what if the T disposed all properties by donation inter vivos? My stand is that there is still no preterition because the donations impinging on the legitime will be inofficious per Art 752. I’m not sure. Really not sure.) F. The AC is not the business of the testator. F. A blind man may make a will! T. 1)No testamentary capacity; 2) Not qualified to be a witness. T. See Art. 821. T. T. The dispositions are void unless there are 3 other witnesses. T. If the will is intrinsically invalid. T. Attested wills need ot be dated. Diane: 1.714M Big Bird: 1.714M Elmo: 0.857M Oscar: 0.857M Ernie: 0.857M a. Yes. They are preterited. (1/3 of estate that will go to Marjorie = 300,000 plus legacy of 600,000 to UPAS equals 900,000. The parents, who are Oyie’s compulsory ehirs are left with nothing.) b. Marjorie will get nothing because in preterition, the institution of heir is annulled . Legacy to UPAS remains valid but should be reduced to 450,000 because it exceeds the free portion. PARTIAL INTESTACY Will: ¼ = 6M This will pass to nephews and nieces by substitution. (2M per set of substitutes) Legitime: John: 1/2 of the estate as his legitime Remaining ¼ goes to nephews and nieces goes by intestacy and by virtue of their right to representation (with distinction between full and half‐blood—2:1:1=3M:1.5M:1.5M) Hence, John = 12M Skull and Spike = 2.5 each Mahinhin, Makahiya, Makisig and Maliksi = 875k each Serafin and Salvi = 1.75M each SUCCESSION – RUBEN F. BALANE REA.PATRICK.LOR.NAOMI 28. First, Jaypee’s estate: 6M Surigao property By intestacy, Jamie = ½ = 3M Amirah = ½ = 3M Next, Jamie’s estate: Ayala property (3M) plus 3M from Jaypee = 6M By intestacy, The whole estate goes to Amirah Finally, Amirah’s estate: ½ of Surigao property from Jaypee + Ayala property (3M) from Jamie + second‐half of Surigao property from Jamie which the latter got from Jaypee = 9M BUT the second‐half of Surigao property is subject to reserva troncal hence, will go to Rosalyn and Karren (1/4 each). Remaining 6M will pass on to Amirah’s intestate heirs: Korina and Enrique (3M each). Jantzen and Jess are excluded. Therefore, Surigao property: Korina, Enrique, Rosalyn and Karren = ¼ undivided interest each Ayala property: Korina and Enrique = ½ undivided interest each. Page 73 of 73