BREAKDOWN OF VARIOUS INDIANAPOLIS PROPERTY MANAGEMENT FEES

advertisement

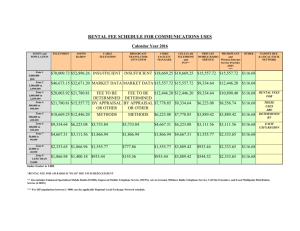

BREAKDOWN OF VARIOUS INDIANAPOLIS PROPERTY MANAGEMENT FEES Leasing Fee – Most management companies will charge you to lease the property. These fees can vary from a flat-rate fee, or a percentage of the first month’s rent – usually anywhere from 50%-100%).This fee compensates a management company for its various marketing and Tenant screening efforts, as well as lease signing, move-in coordination, etc. Note: Some management companies will charge a reduced Leasing Fee, but will then charge either set-up fees, marketing fees, or vacancy fees to makeup the difference. Management Fee – As you might guess, a Management Fee is a fee management companies charge for the day-to-day management of a property, including rent collection, numerous Tenant relations issues and, maybe most importantly, being on call to resolve issues at the property 24/7/365. Most management companies charge a percentage of the monthly rent (anywhere from 8%-12%, usually) while others may charge a flat management fee each month. Renewal Fee – This is a fee a management company charges to renew a lease. Again, this fee can vary from a flat charge, to a percentage of rent. Renewing a lease can be very time consuming, so almost all management companies will charge this fee. Set-Up Fee – Some companies will charge what is known as a set-up or onboarding fee. This is typically a flat fee that covers the initial set-up of a property and establishment of the partnership. Marketing Fee – As you can probably guess, this is a fee some management companies may charge for their various marketing efforts to get your home rented. Vacancy Fee – This is a fee some companies charge to cover management activities while your property is vacant.This is basically the equivalent to the management fee that is collected when your home is occupied and bringing in rent. Mark-Up Fee – This is a fee some management companies will charge to coordinate bill payments for its owners. It’s typically a percentage of the amount of the bill and can include things such as HOA dues, utilities, or maintenance. Project Management Fee – This fee works much like a mark-up fee, but typically involves larger projects. This could be charged for a large turnover, a complicated insurance job, etc. Generally, because more work is involved, a Project Management Fee is more than a mark-up fee. A QUICK BREAKDOWN OF T&H REALTY’S PROPERTY MANAGEMENT FEES First, I’d like to mention the fees that T&H does NOT charge. No vacancy fees No marketing fees No set-up fees If you’ve visited our Pricing Page, you know that we have 3 pricing plans: 1. Silver Plan: Leasing fee equal to one month’s rent* plus a 10% monthly management fee 2. Gold Plan: Leasing fee equal to one month’s rent* plus an 11% monthly management fee 3. Platinum Plan: Leasing Fee equal to one month’s rent* plus a 12% monthly management fee. *Our Leasing Fee is capped at $1,500. We also charge a 10% Mark-Up Fee on any non-maintenance related bill that we pay on your behalf and a $250 Renewal Fee for any lease that we renew for a term 6 months or greater ($125 for less than 6 months). Also, please note that we have a Vendor discount program in place, where we keep any preferred discounts that our Vendors provide do to our volume of business we provide. WHY IS T&H REALTY WORTH PAYING MORE? Good property management doesn’t just happen. There are hundreds of moving parts, thousands of details and all these surround very expensive assets that property managers are charged with protecting. Investors, rightfully so, expect property managers to communicate and handle their assets with care. With all these details, things can slip. And when they do, these failures of the property manager can result in financial damage to the investor Client. So, to run a successful property management company – one in which both the property management company and the investor are both profitable – requires an extreme amount of work. Here are a few reasons why we’re able to be successful, why our Clients are generally successful and why we charge what we charge: 1. Experience – I was chatting with an investor the other day and he asked what I considered to be the biggest differentiator to consider when hiring a Property Manager. I responded that experience, in my opinion, mattered the most.Experience is important for a few reasons. First, every property manager out there will make mistakes. I’m not going to pretend that we’re flawless, because that’s simply not the truth. However, an experienced property manager should have detailed processes that they develop, and continue develop, that will help prevent their Clients from exposure due to sheer negligence or inexperience. You are entrusting one of the largest assets to someone. That someone should have a lot of for a lot of reasons. experience At T&H, we have written processes for nearly everything we do. We’re talking well in excess of 100 detailed processes that our employees use daily. And, we’re always changing them. Always looking for better ways to do things to benefit our Client experience. If something new comes along, we’ll write a process for it. 2. Staffing – Having the right staff – and a large enough staff – is fundamental to being successful. The number one reason property managers are fired is a lack of communication. This is a direct result of not having the proper staffing in place. Because, let’s face it, hiring people is expensive.When PMs cut fees to a minimum, and create a false illusion that they’re a better value, it’s nearly impossible be profitable without sacrificing staff. We talk to investors nearly every day who are frustrated with their PM because of communication. We’re almost always more expensive than their current PM, but they understand the importance communication plays and agree to our fees. We employ a large staff – possibly the largest staff of any single family property manager in Central Indiana. And that staff is loaded with experience and, therefore, command higher salaries. As a result, payroll is easily our largest expense, and it’s, well, large. So, we do charge more, but our Clients enjoy the benefits of having a large and experienced staff managing their property. 3. Marketing/Technology – Vacancy, as we always say, is a cash flow killer. Effective rental marketing is a key to getting your home leased and generating income. As we’ve discussed in other blogs, most PMs do a good job of advertising your property to the top rental websites. The reality is that most property management software out there will do this automatically. Leads will, of course, start to come in. And the key is what happens next. In our experience, the vast majority of management companies do not have the proper staffing in place to respond to these leads in a timely manner, if at all. So, if no one responds to the leads, your home will not rent NEARLY as quickly as it should. We employ someone full-time whose main job is to respond to every single rental lead. We’re certain this plays a HUGE role in getting our properties leased much faster than our collective competition. In addition, we spend a lot of money each money utilizing dozens of Rently boxes that allow Tenant prospects to view homes 12 hours per day, 365 days a year. It’s not cheap, but the Rently system does rent houses more quickly, saving our Clients a lot of money in vacancy costs. T&H’S PROPERTY MANAGEMENT PRICING VERSUS THE COMPETITION While on paper it may seem like you will be spending more money on our services, the example below shows how we might actually be saving you money in the long run. This example is based on a property that generates $1,000 in monthly rent on our Silver Plan. While our initial Leasing Fee may be higher, we do not charge a management fee on the first month’s rent, we do not charge any vacancy, set-up, or marketing fees, and we typically lease homes around 21 days faster than the competition. What Are The Typical Property Management Fees Paid to the Management Company? 1. Start-up Fee: Many companies charge a start-up fee ranging from $100 to several hundred. This usually covers administrative time associated with getting your contract processed and even an initial inspection. Since this fee can vary widely, be sure to ask! 2. Monthly Management Fee: You can expect to pay between 8 to 12% of the monthly rental income of the property. Depending on the rental amount, some companies may instead charge a $100 or higher, per month flat rate. That said, confirm whether this fee is on the rent collected or the rent due. If it is rent due, you may be paying them even if the tenant isn’t paying rent. 3. Leasing Fee: Leasing fees cover the advertising costs and leasing agent commission for them to show rent, and prepare paperwork for your tenants. You can expect to pay around 50% up to a full month rent as a leasing fee. 4. Renewal Fee: A renewal fee helps cover administrative time in processing renewals for your property. This includes but is not limited to market research, preparing renewal offers, negotiating with tenants, and preparing new lease documents. That said, they can range from $100 to several hundred dollars but are typically less than one month’s rent. 5. Inspection Fees: Inspections are vital! Most companies charge a fee to send technicians out for detailed move-out or periodic inspections. 6. Early Termination Fee: If you break a property management contract early, you will often pay an early termination fee. This fee varies greatly from company to company, so carefully read the terms of your agreement. HONESTY, INTEGRITY, PRIDE OF WORKMANSHIP Since our inception in 1982 we have been fortunate to have worked with leading organizations across all real estate asset classes. Over 30 years of experience provides us with a unique perspective to implement best practices on behalf of our clients to ensure a successful real estate development and construction project. We are able to provide a wide range of services, depending on the needs of the client. From comprehensive services that see the project from initial idea through to completion, to a portion of services that supplement a larger project. PROPERTY BUYER SERVICES MPM Real Estate Consultants offers bespoke buyer services especially in and around Marbella. With our team of real estate consultants we give you advice to the highest ethical standards. When an agreement has been reached our specialists coordinate the legal process to complete the acquisition. Essentially, we work with you to identify your aspirations, to get a sense of your current needs and future lifestyle. We also do this to gain an understanding of more practical matters, such as location, use for holidays or permanent residence, and the subtle balance between buying a home and investing. We use our Property Profile Tool to gather this detailed information and we work for you to find the best properties that meet your needs. We will quickly schedule viewings from your short list of selected properties, analyse the pros and cons, the locations and the mind-set of the selling party. Only when you, the client, is ready to take the next step, we will take action and discuss with you the best purchase strategy. Then we can negotiate on your behalf, completely managing the entire purchasing process. This approach saves you a lot of time and money, and helps give peace of mind. OUR BUYER SERVICES INCLUDE Assistance to you, the client, during the entire purchasing process The sourcing of properties that correspond to your requirements Previewing of properties on your behalf, shortlisting the most suitable Negotiation of the best possible price and terms with the Seller Airport transfers and scheduling of other potential amenities Full support from our lawyers, tax advisers, architects and valuers Access to a range of luxury properties through our property network Advice to the highest ethical standards THE BUYING PROCESS IN 4 STEPS STEP 1. FINDING THE BEST PROPERTY Using our unique selection tool, your personal adviser will create a Property Profile based on your requirements and preferences, according to the budget you have in mind. Then a maximum of 7 properties will be presented in detail back to you within 10 days. We can always adjust the Property Profile based on your initial feedback. We will then make appointments for you to visit your preferred properties so that you can make a well-informed decision. STEP 2. HOLDING DEPOSIT The purchase process begins by reserving the property and signing a Reservation Contract. A deposit, usually 1%-2%, is payable at this time and is deemed part of the purchase price and will be refunded to you in the event of any irregularities or failure to meet any special conditions. If applicable an application for a mortgage should be started at this time. Our team of specialist advisers can provide a competitive quote to undertake any of the formal procedures required during the process. STEP 3. THE PRIVATE PURCHASE CONTRACT After the lawyers have checked everything (legal due diligence) and agree on the accuracy and completeness, the private Purchase Agreement is drawn up. It includes a full description and the cadastral dimensions of the property, as stated in the property and land register. This is a legally binding agreement and requires a larger deposit, usually 10% for resale and 20% for new developments, to be paid. STEP 4. COMPLETION The Purchase Contract also defines the additional terms and conditions of the purchase and the date by which the remaining amount of the purchase prices must be paid at the time of final transfer or the payment schedule for new developments. To complete the purchase process all the main parties, together with the Notary, must be present at the time of signing. Congratulations! You’ve just bought your dream home! The average cost of property management is between 7% and 10% of the monthly rent, according to Kevin Ortner, chief executive officer of Renters Warehouse — a company that manages around 23,000 properties throughout the U.S. However, the total rental property management cost you’ll incur may be higher if there are any additional fees in the contract for things like evicting a tenant or contracting out repairs. How property management costs are billed Costs can be percentage-based, billed at a flat fee or billed per project. Percentage-based: a consistent percentage of the monthly rent Flat fee: a consistent monthly rate regardless of services Per project: a varying cost depending on the services performed during that billing period Ortner’s company, Renters Warehouse, uses a flat-fee model. Here are the property management fees they charge in their Minneapolis, MN, market for a 12-month lease of a single-family unit (fees are lower for multi-unit management): While time is the main reason why investors decide to pay a rental management fee, according to Ortner, you should make sure to ask the property management company what fees to expect and how they’re billed before you hire a property manager. Property management fee breakdown Rental property management fees can vary quite heavily from one property management company to the next. Here is a breakdown of property management fees you should expect to pay: Setup fee. This typically runs up to $300 and covers the time involved with setting up a new account. New tenant fee. For the time, effort and cost involved with signing a new tenant, you may be charged anywhere from 25% to 100% of the first month’s rent. Advertising fee. In addition to a new tenant fee, you may be charged around $100 to $200 for advertising costs. Lease renewal fee. If a tenant renews their lease, you may incur a cost up to $200. But, some property management companies charge much less or nothing at all. Vacancy fee. Most companies don’t charge for vacancies — it’s their job to find a tenant — but some will charge around $50 a month for a vacant property. Reserve fund fee. For a single-family home, this may be around $200 to $500. It’s used to pay day-to-day expenses like bills and maintenance services. Maintenance fee. These will vary based on the scope of the project. Ask if all maintenance tasks are run through you first, or if only jobs over a certain amount require your approval. Eviction fee. You may be charged an hourly rate around $25 to $50 an hour or a flat fee. Property managers will typically charge for serving the eviction notice, dealing with attorneys, appearing in court and other services that take up their time. Unpaid property management fee. Any past-due invoices for the monthly property management cost may incur a small fee each day — typically around 1.5% of the invoice. Late service payment fee. Any property management services that aren’t paid for by the due date may incur a fee ranging from 25% to 50%. Bill payment fee. A property management company may handle your mortgage, HOA, insurance or other regular home expense for a small fee. Returned check fee. A bounced check from either you or the tenant may result in a charge around $35. In some cases, the actual rental property management cost may be much higher than the standard monthly cost you’re initially quoted. Ortner says, “It’s important to know what’s included for each fee and to ask, ‘What are they going to do for me for that fee?’ Because it might be worth paying for it if there’s some reasoning behind it.” Choosing a property management company Outsourcing property management gives investors a sense of freedom while “getting time back,” according to Ortner. “And being able to spend that time doing the things you want with the people you want to do them with.” Before you choose a property manager, here is what you should know: A lower cost isn’t always best. A lower upfront cost may reflect poor work quality or more back-end fees or expenses. All fees can be negotiated. Before making your decision, go through the property management company’s fees and see if there’s room to negotiate certain items. You can choose to manage some of the responsibilities yourself or hire a property manager to handle all of the responsibilities. According to Ortner, the level of assistance an investor pays for comes down to how involved they want to be. “It’s more of a communication cadence — what kind of approvals are they going to see, or are they just going to get a statement at the end of the month that shows what happened on their property?” If you do decide to handle some or all of the landlord responsibilities, Zillow Rental Manager provides online property management tools to easily list your rental, screen applicants, manage tenants and collect rent — all in one place. For more articles, tips and trends about property management, property maintenance and being a landlord, visit our Rental Resource Center. 1. Find a tenant There are many ways to find a great tenant — try these tactics to fill your rental: Advertise the property for rent. Write a rental ad, take photos of the interior and exterior and market your property online. Host a rental open house or schedule individual showings. Set an open house date or schedule appointments with interested renters. Send reminders for appointments, and make sure to give the current tenant advance notice (if the property is occupied). Send out applications. Invite interested renters to apply online and then see if they meet your rental requirements. With Zillow Rental Manager, you can easily accept applications online. 2. Screen tenants Zillow Rental Manager makes screening tenants easy — and there’s no cost to you. During the tenant screening process, you will: Accept or deny rental applications. Be sure to comply with all applicable fair housing laws, which prohibit discrimination based on race, color, nationality, age, sex, familial status and other criteria. Run a background check. This will show you the applicant’s rental and criminal history. Verify the applicant’s credit. In addition to a background check, you’ll also run a credit check. 3. Sign a lease agreement with your tenant Once you find an applicant who meets your qualifications, you’ll have them sign a lease agreement. Here are the steps: Create your lease. Run the lease by a legal adviser. Review the lease with your tenant. Sign and date the lease with your tenant. Provide your tenant with a copy of the lease and store your own copy securely. 4. Protect your tenant’s rights Understand the rights that apply to your tenant once they sign a lease agreement: Fair housing laws State-specific tenant laws Landlord repair obligations 5. Give tenants proper notice You must notify your tenant about certain things, including: When you need to enter the property. Whether it’s for routine maintenance, an inspection or fixing a problem, you need to give your tenant notice if you’re planning to enter the premises. When you’re pursuing an eviction. Laws vary by state, but typically eviction notices must be delivered to a tenant 30-60 days before an eviction. If they must purchase renters insurance. Advise all tenants in advance if you are requiring them to purchase renters insurance by their move-in date. 6. Provide a safe and habitable property As a landlord, you should make sure: All smoke and carbon monoxide detectors work. There’s hot water and heat in the rental. Proper safety equipment is available, such as a fire extinguisher or flotation device (if you have a pool). All locks are re-keyed before the tenant moves in. The property is free from lead-based paint. The property is free from mold, rodents, roaches or bedbugs. The tenant knows about any other repair issues and when they’ll be resolved. Property maintenance obligations Maintaining your property doesn’t just help the tenant — it also preserves your investment. Some benefits of regular maintenance include: Increased or stable property value Reduced tenant turnover Reduced number of emergency repairs Extended life for flooring, appliances and fixtures Make sure your property is up to code and is inspected annually for any issues that may not be easily identifiable. Here are the best practices for taking care of your property: 1. Perform routine maintenance While it’s primarily the landlord’s responsibility to manage a property and ensure it’s habitable, both you and your tenant can perform maintenance. Make sure to establish who’s responsible for what in your lease agreement, and use a maintenance checklist to track monthly, seasonal and yearly tasks. Monthly tasks: Check for pests and exterminate if necessary. Test smoke and carbon monoxide detectors. Check that fire extinguishers are in working order. Seasonal tasks: Check for water damage and leaks, especially after a rainy season. Inspect the roof after heavy snow, hail or wind. Clean the gutters. Trim trees that are near structures, power lines or property lines. Yearly tasks: Examine shower caulking and grout between tiles to prevent mold. Change filters in your forced air systems (do this twice a year). Flush your water heater to remove sediment. 2. Handle emergency maintenance promptly Some repairs require immediate attention. Handle these issues as soon as possible: Broken furnace or heater Gas leak or the smell of gas Electrical issues Water leaks Clogged sewer lines 3. Supervise all hired personnel If you’re handy, you may prefer to manage your rental property yourself — but some states have laws dictating that electrical and plumbing work must be handled by a professional. Whenever someone is performing maintenance, you need to ensure they’re supervised. This includes: Contractors Vendors Maintenance workers Inspectors Electricians Plumbers It’s important to respect your tenant’s privacy. Most states require a landlord to give at least 24-48 hours of notice before entry, or a longer period specified in your lease or by applicable laws. In the event of an emergency repair, you may not need to give notice, or you may be able to provide notice afterward. Check your state’s landlord-tenant laws for regulations about the management of properties. Tenant management obligations It’s important for a landlord to understand the basics of how to manage tenants. You should dedicate time to keeping up with tenant requests and rental property maintenance issues, along with your other landlording responsibilities. 1. Communicate with tenants regularly Make sure you’re approachable and easy to reach. Tenants may have questions about property rules or need subtle prompting to report minor issues. Communication and flexibility go a long way in attracting and retaining quality tenants. If you manage multiple units: Use a property management tool to keep track of when you last communicated, as well as each tenant’s preferred method of communication. If you manage a single property: Calling or texting may be the easiest way to manage a single unit. Just be sure to find out what the tenant prefers. 2. Respond promptly to repair requests Not only is it your obligation under landlord-tenant laws, it’s crucial to maintaining your investment. Fixing issues while they’re small can save money in the long run by preventing larger problems. Your state’s landlord-tenant laws may even dictate how quickly you need to respond to certain requests. Minor issues: Many states allow up to 30 days to repair things like broken blinds or a dead lightbulb. Major issues: If the furnace goes out or there’s a water leak, you will likely have to get it fixed as soon as possible. 3. Send rent reminders This is one of the best property management tips for new landlords: give formal notice when the rent is due. These reminders are helpful for the tenant, but they also help you be clear and firm about your expectations. While you want to maintain a friendly relationship with your renters and be considerate of extenuating circumstances, this is your business. If you manage multiple units: A property management tool can send out rent reminder emails to each of your tenants. If you use Zillow Rental Manager to receive payments from your tenant, the system automatically sends a reminder email a few days before the rent is due. If you manage a single unit: Consider setting up a recurring email to remind your tenant their rent is due (three to five days before the deadline). 4. Ensure proper safety measures are taken If you’re managing your own rental property, be sure to remind tenants to be safe during inclement weather or when using the property’s amenities, such as a grill or elevated porch. If there’s any large safety hazard, like a pool, make sure your lease covers it. In the summer: Send safety reminders for outdoor activities like barbecues or fires (if you have a fire pit). In the winter: Provide tips on how to avoid freezing pipes, and remind tenants to watch for ice on walkways. Rental property record keeping One of the most important aspects of the management of properties is keeping a record of landlord documents. Store all documents securely, and consider keeping paper or digital backups. This will help avoid any liabilities and make sure you’re organized during tax season. 1. Store proof of property and landlord insurance This will protect your rental property from accidents and sudden loss due to a fire or severe weather — and help protect your financial assets in the event of a liability claim. If you’re going to manage property, you may want landlord insurance in addition to your standard homeowners insurance. Depending on what your existing policy covers, landlord insurance may cover additional costs associated with renting a property, including: Damages by tenants to the home’s structure Legal costs in the event of a lawsuit or eviction Medical expenses in the event of an accident Loss of rental income if major repairs are needed 2. Keep a copy of all rental applications Many states have laws about this. Regardless of the legal requirements, we recommend keeping a copy of all applications (whether they were accepted or denied) for at least four years. They will be useful if: An applicant files a discrimination claim. You’ll need to prove that you didn’t violate any fair housing laws when accepting or denying an applicant. There’s a tenant emergency. Most applications contain an emergency contact section. To make it easier for you and your prospective tenants, consider having all interested renters apply online — 58% of renters prefer to apply online according to Zillow Group Consumer Housing Trends Report 2019 survey data2, and digital records are easy to back up and print out if needed. 3. Securely store all rental lease agreements Lease agreements hold you and your tenant accountable — and if you don’t have a copy of the signed lease, it may be more difficult to settle disputes. Having a copy of your lease agreement can help: Protect you, the landlord, from additional liability. Prevent confusion over the terms and rules of renting the property. Ensure you and your tenant understand your responsibilities. Protect your tenant’s rights. Properly file a petition for eviction. 4. Keep a record of rent receipts Some cities and states require landlords to provide rent receipts upon request. Even if your area doesn’t, it’s a good idea to keep rent receipts, because they: Show proof of payment. Simplify your rental property bookkeeping. Help minimize payment disputes. 5. Document your rental walkthrough checklists During move-in and move-out, you should inspect the property with the tenant and document the condition of the rental with a walkthrough checklist. Make a copy for yourself and the tenant, so you can account for any new damage when they move out and it’s time to return their security deposit. To complete the walkthrough: Inspect each room and record anything that needs to be cleaned, painted, repaired or replaced. Track the cost of any repairs that are needed. Write down what was discussed during the walkthrough. Have all parties sign the tenant move-in checklist. Rental property accounting Managing your own rental property means you’ll also have to handle financial details. Once you’ve set the rent price, you’ll need to know how to manage rental property income and expenses. Rental property bookkeeping includes: 1. Collecting rent There are many ways to collect rent, but doing it online is often easiest for you and your tenant. In fact, 57% of renters say they want to pay rent online, but only 38% are given the option3. In addition to collecting rent, you may have to: Increase the rent price by a reasonable amount each year, if allowed by your lease. Enforce late fees and collect late rent payments. 2. Managing security deposits When you manage property, you also need to manage security deposits that you choose to collect. Security deposits can help cover any damage or issues that are captured in a tenant’s move-out checklist. To properly manage security deposits, you’ll need to: Securely store deposits while the tenant is renting your property. Comply with state security deposit limits and return regulations. Account for pet damages. 3. Filing taxes and reporting expenses It may be beneficial to hire an accountant who can help you understand the tax rules for rental property. They’ll help maximize your deductions and report your expenses. Potential sources of rental income: Monthly rent payments Advance rent payments for future months Common rental property expenses: Landlord insurance for accidents, sudden loss and liability Maintenance and repair Rental licensing, mandatory inspections and annual registration fees Property and rental income tax Mortgage payments Basic utilities like gas, electric and water Property taxes Marketing or advertising fees Additional expenses to prepare for: Bookkeeping or accounting fees Property management fees (if you choose to hire a property manager) Legal costs in the event of an eviction — you’ll have filing, court and lawyer fees If you have more than one rental property, you may be required to complete additional tax forms. Talk to an accounting professional to ensure your rental property income and expenses are reported properly. Those are the basics of how to manage property. For more articles and information on being a landlord, visit our Rentals Resource Center. Source: 1. Zillow Group Consumer Housing Trends Report 2018 2, 3. Zillow Group Consumer Housing Trends Report 2019 survey data