Economics Tutorial: Industry Supply, Rents, Revenue Maximization

advertisement

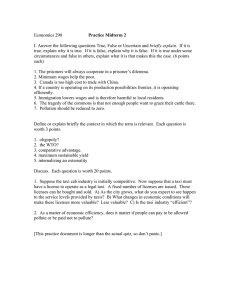

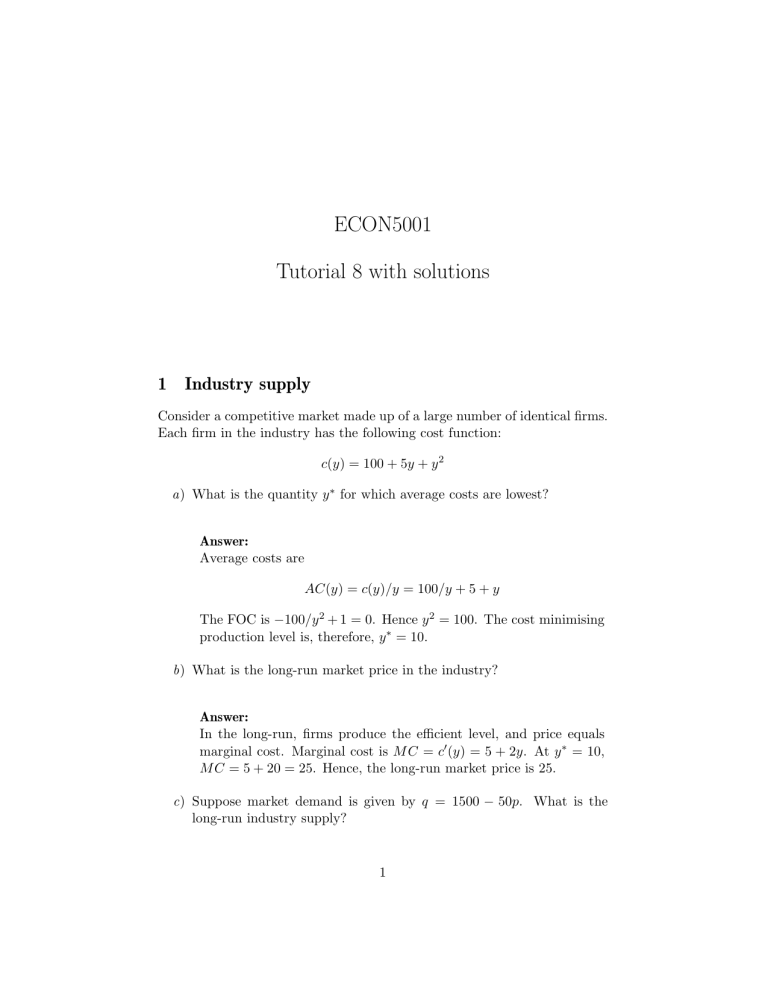

ECON5001 Tutorial 8 with solutions 1 Industry supply Consider a competitive market made up of a large number of identical firms. Each firm in the industry has the following cost function: c(y) = 100 + 5y + y 2 a) What is the quantity y ∗ for which average costs are lowest? Answer: Average costs are AC(y) = c(y)/y = 100/y + 5 + y The FOC is −100/y 2 + 1 = 0. Hence y 2 = 100. The cost minimising production level is, therefore, y ∗ = 10. b) What is the long-run market price in the industry? Answer: In the long-run, firms produce the efficient level, and price equals marginal cost. Marginal cost is M C = c0 (y) = 5 + 2y. At y ∗ = 10, M C = 5 + 20 = 25. Hence, the long-run market price is 25. c) Suppose market demand is given by q = 1500 − 50p. What is the long-run industry supply? 1 Answer: At the long-run market price of 25, q = 1500 − 50p = 1500 − 1250 = 250. In equilibrium, supply equals demand. Hence, the industry supply is also 250. d ) How many firms are there in the long-run equilibrium? Answer: Each firm produces 10 units. Since industry supply is 250, there are 25 firms. e) Suppose a demand shock raises demand to q = 1750 − 50p. What is the new long-run equilibrium (price, quantity, number of firms)? Answer: Since technology is the same, y ∗ is unchanged, and the long-run equilibrium price would remain at 25. Demand would be 1750 − 50p = 500. Therefore, industry supply would be 500, and the number of firms would be 50 instead of 25. f ) Would firms be making an economic profit or loss in the long-run? Calculate revenues and costs to confirm your answer. Answer: In the long-run, firms are making zero economic profits. In the longrun equilibrium, each firm produces 10 units and the market price is 25, so total revenue is 250. Costs are given by c(y) = 100 + 5y + y 2 = 100 + 50 + 100 = 250. Hence, profits are 250 − 250 = 0. g) What would be the short-run equilibrium immediately after the demand shock? (price, quantity, number of firms)? 2 Answer: In the short-run, the number of firms is fixed at 25. MC is 5 + 2y, so each firm would supply y = (p − 5)/2 units for a total industry supply of (25p − 125)/2. That has to equal demand, so 25p − 125 = 1750 − 50p 2 And so, 25p − 125 = 3500 − 100p And so, 125p = 3625 Giving us p = 3625/125 = 29 Plugging that back in, M C = 5 + 2y = 29, giving us y = 12 per firm. Industry supply would equal Y = 25y = 300. We can confirm that this is the right result, by plugging in the market price into the demand function: q = 1750 − 50p = 1750 − 50 ∗ 29 = 1750 − 1450 = 300 Total demand indeed equals industry supply, as should be the case in any market equilibrium. h) Would firms be making an economic profit or loss in the short-run? Calculate revenues and costs to confirm your answer. Answer: A profit. Each firm produces y ∗ = 12 units, earning a revenue of 29 ∗ 12 = 348. Total costs are c(y) = 100 + 5y + y 2 . Plugging in y ∗ = 12 we obtain c(y ∗ ) = 100 + 60 + 144 = 304 Hence, each firm is making a profit of π = 348 − 304 = 44 i ) How would long-run equilibrium be restored? 3 Answer: These economic profits would attract entry, increasing industry supply, and driving down prices—and hence profits. This process would continue until we reach the new long-run equilibrium, in which firms are no longer making economic profits. 2 Rents In 1990, the town of Ham Harbour had a more-or-less free market in taxi services. Any respectable firm could provide taxi service as long as the drivers and cabs satisfied certain safety standards. Let us suppose that the constant marginal cost per trip of a taxi ride is $5 and the average taxi makes 20 trips per day. Let the demand function for taxi rides be given by q = 1200 − 20p, where demand is measured in rides per day, and price is measured in dollars. Assume that the industry is perfectly competitive. a) What is the competitive equilibrium price per ride? What is the equilibrium number of rides per day? How many taxi cabs will there be in equilibrium? Answer: In equilibrium p = M C = 5. We are told that q = 1200 − 20p. Hence, q = 1100. Since each firm makes 20 trips, the number of firms is n = q/20 = 1100/20 = 55. b) In 1990 the city council created a taxicab licensing board and issued a licence to each of the existing cabs. The board stated that it would continue to adjust the taxi fares so that the demand for rides equals the supply of rides, but no new licences will be issued in the future. In 1995 costs had not changed, but the demand curve had become q = 1220 − 20p. What is the equilibrium price of a ride in 1995? Answer: Since no new licenses are issued, the total quantity cannot rise above q = 1100. Since q = 1220 − 20p, p = (1220 − 1100)/20 = 6. c) What was the profit per ride in 1995, neglecting any cost associated with acquiring a taxicab licence? What was the profit per taxicab 4 licence per day? If the taxi operated 365 days per year, what was the profit per taxi licence per year? Answer: Costs are 5 per rise, so profit per ride is π = 6 − 5 = 1. Profit per day is 20, since there are 20 rides per day. Profit per year is π = 20 · 365 = 7300. d ) If the interest rate was 10 per cent and costs, demand and the number of licences were expected to remain constant forever, what would be the market price of a taxi licence? Answer: The interest rate is constant at r = 0.1. Given these assumptions the price of a license should be π/r = 73000, where π is the annual profit per license e) Suppose that the commission were to decide in 1995 to issue enough new licences to reduce the taxi price per ride to $5. How many more licence would this take? Answer: At a price of 5, demand is q = 1220 − 20p = 1120. Each taxi supplies 20 rides, so n = 1120/20 − 56. Thus, one more license would be needed f ) Assuming that demand is not going to grow anymore, how much would a taxi licence be worth at this new fare? Answer: At the new fare, price equals cost, so taxis are making no profit. Hence, π = 0, and a a license to operate a taxi would be worthless. g) Prior to the commission decision, how much would each current taxicab owner be willing to pay to lobby the commission against issuing these new taxi licenses? What is the total amount that all taxi owners together would be willing to pay to prevent any new licences from ever being issued? 5 Answer: Each license owner values their license at $73000, and would therefore be willing to pay up to $73000 to prevent new licenses being issued. There are 55 license owners, who would collectively be willing to spend 55 · 73000 = 4015000—a bit more than 4 million dollars to lobby against this change. h) Suppose that each consumer takes 50 taxi rides each year. How much would each consumer be willing to spend to lobby the commission to issue new licenses? Assume that the interest rate is constant at 10% as before Answer: The licenses cost each consumer $1 per ride. Consumers therefore waste $50 per year. Assuming the 10 i ) Suppose that residents vote according to the policy about taxi licenses if and only if they value this issue at more than $5000. What would be the net vote affected by the commission’s policy on taxi licenses? What would rational and selfish politicians do? Answer: The 55 license owners would vote on this issue, while the far more numerous residents would not. A rational and selfish politician would support the interest of taxi license owners. j ) What is the annual loss to consumers from restricting taxi licenses to 55? What is the dead-weight loss? What is the transfer of surplus from consumers to the owners of taxi licenses? 6 Answer: In the socially efficient solution, price equals marginal cost, which is 5. Demand is given by q = 1220 − 20p = 1120. At q = 0, p = 1220/20 = 61. Thus, consumer surplus is given by a triangle with a base of 1120 and a height of 56 (deducting the price of 5). Total consumer surplus is, therefore, CSfree competition = 1120 · 56/2 = 31360 With the taxi licenses, price is 6, and demand is 1100. Consumer surplus is a triangle with a base of 1100 and a height of 55. Therefore, CStaxi licenses = 1100 · 55/2 = 30250 The loss to consumers is, therefore, 31360−30250 = 1110 per day, or 365·1110 = 405150 per year. The total profit made by license owners is 7300∗55 = 401500. Thus, the annual loss to consumers is 405150− 401500 = 3650 higher than the gain to license owners. We conclude that, in this particular case, the dead-weight loss is relatively small, but there is a very big transfer of surplus from consumers to the owners of taxi licenses. This result is because the dead-weight less is a function only of the quantity supplied, which in this has not changed by much. If demand had increased much more, the deadweight loss would have been a lot greater. 3 Revenue maximisation The demand function for football tickets for a typical game at a large American university is D(p) = 200000 − 10000p. The university has a clever and avaricious athletic director who sets ticket prices so as to maximise revenue. The university’s football stadium holds 100000 spectators. a) Write down inverse demand (price as a function of quantity) Answer: p(q) = 20 − q/10000 b) Write an expression for total revenue and marginal revenue as a function of the number of tickets sold. 7 Answer: R(q) = 20q − q 2 /10000 and therefore M R = 20 − q/5000 c) What quantity will generate the maximum revenue? What should be the price? Answer: Revenue is maximised when MR=0, so 20 − q/5000 = 0, and so q = 100000. The price is p = 20 − q/10000 = 10. d ) At this quantity what is the marginal revenue? What is the price elasticity of demand? Answer: As always when maximising revenue, M R = 0 and = −1. e) A series of winning seasons caused the demand curve for football tickets to shift upwards. The new demand curve is q(p) = 300000 − 10000p. Ignoring the capacity constraint, what price would generate maximum revenue? What quantity would be sold at this price? Answer: p = 30−q/10000, and so R(q) = 30q −q 2 /10000, and M R = R0 (q) = 30 − q/5000. Setting this to zero, we obtain q = 150000 and p = 30 − q/10000 = 30 − 15 = 15. f ) Now considering the capacity constraint faced by the director, how many tickets should he sell and what is the price? Answer: Obviously, q = 100000. The price is p = 30 − q/10000 = 20. g) If he does this, what are the MR and the price elasticity of demand? Answer: M R = 30 − q/5000 = 30 − 100000/20 = 10. Demand is q = 300000 − 10000p, so the price elasticity of demand is = (dq/dp) ∗ p/q = −10000p/q = −200000/100000 = −2. 8