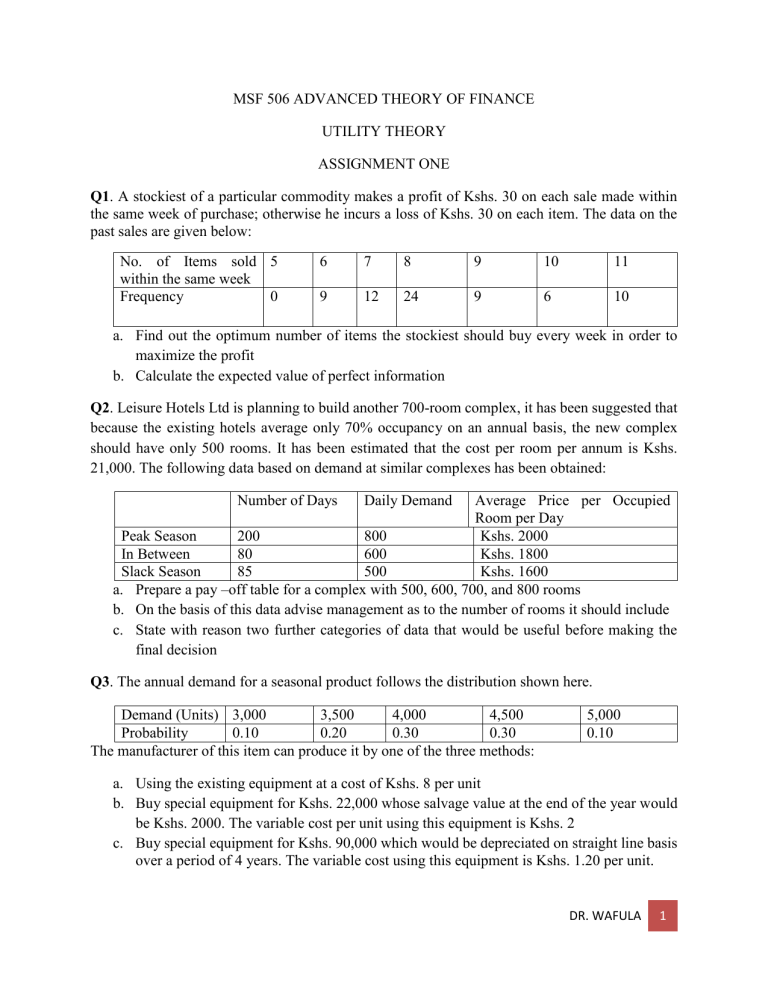

MSF 506 ADVANCED THEORY OF FINANCE UTILITY THEORY ASSIGNMENT ONE Q1. A stockiest of a particular commodity makes a profit of Kshs. 30 on each sale made within the same week of purchase; otherwise he incurs a loss of Kshs. 30 on each item. The data on the past sales are given below: No. of Items sold 5 within the same week Frequency 0 6 7 8 9 10 11 9 12 24 9 6 10 a. Find out the optimum number of items the stockiest should buy every week in order to maximize the profit b. Calculate the expected value of perfect information Q2. Leisure Hotels Ltd is planning to build another 700-room complex, it has been suggested that because the existing hotels average only 70% occupancy on an annual basis, the new complex should have only 500 rooms. It has been estimated that the cost per room per annum is Kshs. 21,000. The following data based on demand at similar complexes has been obtained: Number of Days Daily Demand Average Price per Occupied Room per Day Peak Season 200 800 Kshs. 2000 In Between 80 600 Kshs. 1800 Slack Season 85 500 Kshs. 1600 a. Prepare a pay –off table for a complex with 500, 600, 700, and 800 rooms b. On the basis of this data advise management as to the number of rooms it should include c. State with reason two further categories of data that would be useful before making the final decision Q3. The annual demand for a seasonal product follows the distribution shown here. Demand (Units) 3,000 3,500 4,000 4,500 Probability 0.10 0.20 0.30 0.30 The manufacturer of this item can produce it by one of the three methods: 5,000 0.10 a. Using the existing equipment at a cost of Kshs. 8 per unit b. Buy special equipment for Kshs. 22,000 whose salvage value at the end of the year would be Kshs. 2000. The variable cost per unit using this equipment is Kshs. 2 c. Buy special equipment for Kshs. 90,000 which would be depreciated on straight line basis over a period of 4 years. The variable cost using this equipment is Kshs. 1.20 per unit. DR. WAFULA 1 Which method of production should the manufacturer follow in order to maximize profit, assuming that production must meet all the demand? Q4. The Operations Manager of Qwetu limited has two alternatives to choose from for the next quarter. a. To take a contract to supply an item to a company this would result in a sure profit of Kshs.500,000 b. To make and introduce a new product in the market. The likely profit/loss possibilities along with the likely probabilities are also given. Also shown are the utility values associated with the various profit levels. Profit/Loss -450000 0 500,000 800,000 1,600,000 Probability 0.1 0.2 0.3 0.3 0.1 Utility (Utils) -0.50 0 0.45 0.70 1.20 Determine which course of action would be preferred by the manager when she wants to maximize: i. ii. The EMV and The expected utility DR. WAFULA 2