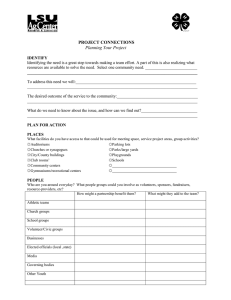

FINAL CLASS! PRINCIPLES OF MANAGEMENT SPRING 2022 [NOTE:THIS SESSION IS BEING RECORDED] TODAY’S SESSION 1. Course Summary 2. Your Presentations 3. Class Grades 4. Final Exam WHY STUDY MANAGEMENT? Why did Apple overtake the early leader Blackberry in the smartphone industry? WHY STUDY MANAGEMENT? Why has Patagonia focused on sustainability – increasing its raw materials costs and even encouraging customers not to buy its new products? WHY STUDY MANAGEMENT? Why does Costco pay its employees an average wage 50% higher than Walmart’s? MANAGERIAL DECISION-MAKING Managerial decision-making is hard! Often no clear ‘right’ answers Complex challenges with considerable uncertainty Need to integrate diverse data points Have to manage trade-offs and multiple goals in the organization But we have tools and frameworks that can be applied to help simplify analysis and identify core issues WHAT IS A STRATEGY? Formulating a strategy requires an organization to Choose a position – who is the target customer and what value will they be offered Identify the key activities in how to deliver this value efficiently and in ways that are hard to imitate We can distil this into the Who, What, How choices These choices must fit together (more about this in the session on business models) Implement a set of policies that support this and guide lower-level decisions and actions Needs to be driven be analysis! Challenges and opportunities in the external environment The organization’s (actual and possible) strengths and weaknesses PESTEL FRAMEWORK Groups macro-level environmental factors into six segments: Political Economic Sociocultural Technological Ecological Legal/Regulatory Effective way of grouping salient trends for monitoring ongoing developments, horizon scanning, and evaluating the firm’s risks and opportunities WHY ARE SOME INDUSTRIES MORE PROFITABLE THAN OTHERS? HOW DO FIRMS CAPTURE VALUE? HOW DOES INDUSTRY STRUCTURE AFFECT VALUE CAPTURE? Industry Price PORTER’S FIVE FORCES How do the ‘Five Forces’ shape the nature of competition and profit potential of an industry? Buyer Power: How much negotiating leverage do buyers have? How easily can they switch to consuming an alternative firm’s output or a different product type? Supplier Power: How much negotiating leverage do suppliers have? How easily can they switch find an alternative firm or industry to use their product? Threat of Entry: How difficult is it for a new entrant to compete with incumbents? Are the cost structures different (e.g. economies of scale, high brand loyalty, harder to access resources)? Substitutes & Complements: How attractive is it for consumers switch to an alternative type of product (e.g. close price-value characteristics, value lost from complementarities) Internal Rivalry: How intense is price competition (e.g. many firms compete for market share, limited growth, less (non-price) competition through differentiation)? FIRM’S INTERNAL CHOICES Firms compete in the same external environment! Internal firm differences that lead to competitive advantage What the firm has What the firm does Firms need to be able to do things others can’t do (or at least can’t do as effectively) BREAKING DOWN THE FIRM’S BUSINESS MODEL Who is the customer we are targeting (implies who are we not targeting)? Customer Segments (age, income, demographics etc) Geographic Regions What is the value proposition we are offering them (implies what are we not offering)? Products/Services (identify key value we offer customers that can set us apart from competitors?) How do we leverage competencies and align the support activities of the firm to deliver this value? Creating the Product/Service Marketing the Product/Service Delivering the Product/Service VALUE CURVES Value Curves are a tool to understand the different positions in an industry and potential new positions a firm could take What is each product’s price and other value attributes? What new types of trade-off can we make? What new sources of value can we introduce? What values can we reduce or eliminate in order to increase or introduce other values? Draw value curves to show firms’ relative performance on attributes customers’ value Identify key attributes (actual/potential) on the x-axis Plot the firms’ performance on these attributes on the y-axis CREATING NEW TRADE-OFFS: AIRLINES Full-Service Carriers Southwest CREATING NEW VALUES: NINTENDO PlayStation Xbox Nintendo Wii CHOOSING A POSITION A firm acting strategically attempts to take a position in the market in terms of a set of customers and a value proposition – a Who and a What Goal: Maximize the gap between the Customers’ Willingness-To-Pay and Firms’ Costs Two ‘generic strategies’ Differentiation/Benefit Leadership: Increase customers’ WTP through a more valuable product – but this typically comes with higher costs Cost Leadership: Drive down costs as low as possible without losing too much WTP – since the trade-off of lower costs is typically a less (or at least not more) valuable product Can do this with a broad competitive scope or narrow focus on a segment of customers for which this is a profitable trade-off GENERIC STRATEGIES WHAT DOES THIS MEAN IN PRACTICE? In industries like grocery, firms offer different trade-offs with respect to price and product attributes and many can be successful Multiple valuable positions because different customer segments have different preferences WHAT DOES THIS MEAN IN PRACTICE? In industries where customers’ preferences are much more similar, one type of position may be dominant Only small niches of consumers care about other attributes ACHIEVING BENEFIT LEADERSHIP Unique features that increase value, so that consumers pay a higher price The firms focuses competitive efforts on Unique or higher quality product features Customer service New product launches Reputation through marketing and promotion Complements for product/service that enhance value Likely to increase costs Investment in R&D to facilitate innovation Investment in human capital to improve service and product Investment in marketing and advertising ACHIEVING COST LEADERSHIP Have lower costs than competitors while maintaining acceptable quality in customers’ eyes: Reduce cost below competitors Offer adequate value Reduce prices for customers Optimize the value chain for low cost What are the key considerations? Cost of Input Factors – Raw materials, capital, labor, and IT services Economies of scale – Decreases in cost per unit as output increases Learning-curve effects – Improvements to technology and production processes EXPLOITING ADVANTAGE THROUGH PRICING Optimal pricing strategy depends on homogeneity of industry customers’ preferences If product differentiation is weak the firm should follow a market share strategy Cost Advantage – underprice rivals and build share Benefit Advantage – maintain price parity and let the benefit build the share If product differentiation is strong the firm should follow a profit margin strategy (since more costly to incentivize customers to switch between different products) Cost Advantage – maintain price parity with rivals and enjoy higher margins Benefit Advantage – charge a price premium over the competitors SUSTAINING ADVANTAGE THROUGH VRIO RESOURCES Valuable, Rare, and Costly to Imitate resources can sustain a firm’s advantage because they prevent rivals without them from competing as equals Pharma: Patents legally prevent competition (for a period of time) Google Ads: Accumulated data on consumers that others cannot replicate Airbnb: Network effects; Reviews reduce buyer uncertainty New York Times: Reputation for honest reporting (at least among a segment of customers) Apple: Complexity of understanding how its design and product teams work together makes it difficult to imitate its creativity; Patents protect existing products from direct imitation, Customers got into Apple’s ecosystem and face high switching costs PUTTING THIS TOGETER TO CREATE A STRATEGY Analyzing the external environment What are the key general trends affecting firms? – PESTEL How does the industry structure affect firms’ ability to capture profits? – Five Forces Breaking down the firm’s business model and opportunities What does/should the firm do (target customers, value proposition, key activities)? – Who,What, How How does/should the firm try to make profit? – Positioning, Value Curves What does (or could) give the firm has a sustainable advantage over rivals? – VRIO resources Putting the pieces together How consistent are the firm’s current business model choices with each other and the external environment? How should the firm change its Who,What, How, Positioning, Value Curves, or better use/develop VRIO resources to sustain superior performance? WHAT IS AN ORGANIZATION? “Organizations are systems of coordinated action among individuals and groups whose preferences, information, interests or knowledge differ… converting conflict into cooperation, mobilizing resources and coordinating effort” (Simon & March,1958) So how do we create the right systems? WHAT MUST ORGANIZATIONS DO? Division of Labor Task division – break up tasks that need to completed to achieve the organization’s goals Task allocation – assign tasks to the organization’s members Integration of Actions Reward provision – motivate the organization’s members to exert effort on assigned tasks Information provision – ensure the organization’s members have the necessary information to execute their tasks and coordinate with others TWO CORE ORGANIZATIONAL STRUCTURES Functional Built around centers of expertise in the organization TWO CORE ORGANIZATIONAL STRUCTURES Divisional Built around products, customers, or regions Beauty & Wellbeing Personal Care Home Care Nutrition Ice Cream FUNDAMENTAL STRUCTURAL TRADE-OFFS Functional: Greater functional specialization of knowledge/expertise and economies of scale & scope Divisional: Value of product/customer/geography specific-knowledge and responsiveness in carrying out activities? Which offers greatest benefits? Do all product lines draw on similar functional specialized knowledge? Do product lines/customers/geographies vary significantly in needs? WHAT IS CORPORATE STRATEGY? Corporate strategy: the decision about which industries/markets to compete in and how to allocate resources in support of these efforts 1. Vertical Integration: In what stages of the industry value chain should the company participate? 2. Horizontal Diversification: What range of products/services should the company offer? 3. Geographic scope: Where should the company compete geographically in terms of regional, national, or international markets? DRIVERS OF CORPORATE STRATEGY DECISIONS The underlying concepts that guide these decisions are (or should be): Core Competencies: monetize assets/strengths in multiple markets (revenue-side synergies) Economies of Scale/Scope: share key value chain activities (cost-side synergies) Transaction Costs: lower the costs associated with costly or complex negotiations with other parties to acquire inputs or sell outputs DIVERSIFICATION IN DISNEY Disney in the 1930s-40s was a film-making business Why did it diversify into theme parks in 1955? WHY DID DISNEY DIVERSIFY INTO THEME PARKS (AND BEYOND)? What is at the core of Disney’s competitive advantage across a wide range of business? Hotels Cruise Lines Films Theme Parks DISNEY’S DIVERSIFICATION Franchise strategy Expand the core by developing or acquiring big franchises (purchasing Pixar, Lucasfilm, Marvel) Target core customers with wider range of products (e.g. Theme Parks) Expand to new markets by adapting products (e.g. Streaming Services, Global Theme Parks) Build on core strengths (character IP, creating experiences) to be in a wide range of product markets where you can monetize these assets (e.g. Cruise Lines) DISNEY’S DIVERSIFICATION Synergies Cost of development/acquisition/marketing franchise characters spread over wide scope (use as an input to multiple channels, e.g. streaming/films/parks/games/toys) Revenue enhanced because customers are willing-to-pay for a wide range of products incorporating popular characters (apply resources to new markets to capture WTP) Implication: Disney can generate more value from franchises than anyone else and so can spend more to develop them MERGERS & ACQUISITIONS Acquiring organizations is one way to expand the firm’s range of activities But most acquisitions fail to generate value 70-80% of acquisitions don’t create (stock market) value Wrong motivations – CEOs’ personal interests in empire-building, risk-sharing Overestimating synergies – Not always clear ex ante, can be mistakes made, subject to motivated reasoning in analysis Integration problems – Difficult to integrate firms with different cultures etc (even if synergies exist in theory, challenges integrating work prevent them from being realized) GOING GLOBAL: PROCTOR & GAMBLE GOING GLOBAL: NETFLIX TRADE-OFFS IN ORGANIZING THE GLOBAL FIRM Two opposing forces in profiting from global operations Cost reductions: key competitive weapon (move activities to lowest cost global location) Local responsiveness: tailoring offering to specific local preferences Cultural globalization… Consumer needs and preferences are increasingly converging Makes it more profitable to sell overseas (fewer uncertain/costly product adaptations needed) E.g. Food, music, movies, clothing Reflected in global brands in McDonalds, Coca-Cola, Music – BTS, Taylor Swift, Netflix, Starbucks WHAT IS INNOVATION? Innovations are the commercialization of new ideas Innovative products/services have three core characteristics They are novel (otherwise not innovative by definition) They are useful (otherwise they don’t solve any need) They are implemented (otherwise they don’t become used) WHAT IS INNOVATION? Innovation can be in products, processes, or business models WHAT IS INNOVATION? Innovation can be in products, processes, or business models WHAT IS INNOVATION? Innovation can be in products, processes, or business models Over the industry lifecycle: Number and size of competitors change Market Size INDUSTRY LIFECYCLE Different types of consumers enter market Different competencies are needed for the firm to perform well at different points Introduction Growth Shakeout Maturity Decline Time PROFITING FROM INNOVATION captures value from innovations Does an innovation utilize existing or new knowledge/technologies? Does an innovation create a product for an existing or new product category (i.e. will incumbents existing complementary assets matter)? MARKETS Existing New Two crucial features determine who Architectural Innovation Radical Innovation Incremental Innovation Disruptive Innovation Existing New TECHNOLOGIES PLATFORM BUSINESS MODELS Create value by improving or creating new matches of supply and demand Can scale more efficiently by leveraging wider range of producers Uber leverages drivers’ cars, Airbnb leverages renters’ homes, App Stores leverage app producers – the platform owner doesn’t need to develop these in-house production capabilities Key strategic decision is where to find the sources of revenue: Which side of the market (or both) to monetize – which side has the highest switching costs (i.e. customers’ willingness-to-pay and suppliers’ analogous ‘willingness-to-supply’)? How much to charge the respective actors without undoing network effects – losing some buyers/suppliers due to price may lower the value of the platform to those remaining (who would have still been willing-to-pay/willing-to-supply at that price with prior network value) FOCUS ON YOUR PEOPLE! Firms with happier employers perform better! From 1984-2009, firms in the ‘100 Best Companies to Work For in America’ outperformed their industry benchmark by 2.1% annually (or 70% over 25 years) – Edmans, 2011 Firms that focus more on internal and external stakeholders perform better and are more innovative – Eccles, Ioannou, & Serafim, 2014; Flammer & Kacperczyk, 2016 WHY DO PEOPLE MATTER? People drive an organization’s success! Source of new ideas for products and services Essential for carrying out underlying tasks to fulfill strategy Better employers outperform other firms! Need to hire the right people, ensure they continue to develop the right skills, work well together, and motivate them to perform DIVERSITY CAN IMPROVE ORGANIZATIONAL EFFECTIVENESS At the organization-level, attention to diversity can improve effectiveness Don’t miss out on talented employees by being narrow-minded about who to hire/promote Don’t lose good staff who don’t feel valued by having inflexible career paths that don’t attend to different needs etc Advantages from diverse sources of information in the workforce Diverse workforces can provide different ways of thinking about situations, new ideas to the organization Bring knowledge about different types of potential customers and markets But this also requires that people in the organization are open to new ideas and difference MAKING DIVERSE TEAMS WORK People with similar backgrounds share norms and assumptions When team members come from different backgrounds, these taken-for-granted habits can clash Can lead too misunderstanding and frustration (even where people are well intentioned) Past research suggests that diversity can have a negative effect on teams’ outcomes when organizations don’t address these issues With greater ‘psychological safety’, diversity improves performance Team members need to be open to ideas, respectful of one another Managers need it to be clear that there won’t be negativity, embarrassment, or recriminations to sharing and discussing ideas PUTTING IT TOGETHER Need to choose organizational structure that meets specific needs Do products rely on different knowledge and skills? Are there gains to organizing at the firm scale? Choose which markets to compete in What core strengths can we build on to develop new products or attract new types of customer How do we ensure people have the right skills for their tasks Develop effective hiring processes, minimize subjectivity in evaluations, train people in key job skills Harness diverse knowledge and skillsets available to the organizations and build cultures that respect different ideas and where people look to learn from one another in pursuit of shared goals Sustainability in the Athletic Apparel Industry By, Coco Klisivitch, Olivia Gee, Nick Lakata, Olivia Bergman, and Evan Wood Sustainability in Management Our overarching theme is sustainability, which concerns itself with how a company’s interdependence with the environment affect the business. ● Extreme weather can create risks for facilities/factories overseas and domestically ● Temperature/general climate conditions can affect the facilities ability to operate and employees ability work ○ If a factory is in a place with a hot climate, seasonally or throughout the year, will the employees work effectively? ○ If your product requires a cool climate to stay per quality standards, but the factory is located in geographically hot places, you will need air conditioning. What effect will this have on the environment? ● Societal attitudes towards companies who are sustainable versus those who are not ● Soil degradation can negatively impact agricultural productivity ● How much waste do you produce during manufacturing? What kind of waste? Do you make an effort to reduce or recycle waste? Firms should be concerned with sustainability because… ● 60% of consumers say that sustainability of a company and/or product is an important characteristic during purchases ● Sustainability can make or break a firm as consumers become more aware of a firm's practices and the impact large corporations have on the environment Within this topic, we plan to focus on the question of: ● Is sustainability an important factor in the athletic apparel industry? ● How impactful is sustainability towards different demographics of customers? ○ Do different demographics have different expectations regarding sustainability of companies they choose to support? Why or why not? Case Study Our two chosen firms or industries for the case study will be Lululemon and Nike ● We want to observe the extent to which sustainability affects athletic apparel company's strategy. ● Both firms are part of the athleisure industry but have different target markets. We would like to see how different target markets (with differing views on sustainability) affect the way in which a company will respond to consumer demands concerning sustainability. ● Athleisure companies focus on promoting fashion and healthy lifestyles. They cannot ignore the growing importance of sustainable efforts especially in the eyes of the public. ● As a result, this social pressure on athleisure brands affects the way in which managers will have to deal with resource selection and the stages in the production process (supply chain). Athleisure Industry The ways in which sustainability affects these firms are: The particular challenges created for managers are: ● Carbon emissions ● Promoting sustainability across the organization ● Accessibility / cost of unique materials and fabrics ● Making decisions aligned with the company's values ● Corporate social responsibility ● Fast fashion ○ ● Rapidly growing fashion trends Ethical labor practices ○ ● Uphold public image Ensuring ethical business practices Similarities and Differences This trend is affecting different firms/industries in some similar ways ● In general, sustainability affects the athletic apparel industry through: ○ The use of harmful chemicals and high consumption of water and energy in the production process ○ The use of resources that take over a year to regenerate ○ Slow fashion (the opposite of fast fashion) is easier to implement into smaller companies This trend is also affecting different firms/industries in some different ways ● Lululemon ○ The company has made steps towards sustainability through working in accordance with the UK Modern Slavery Act and the California Transparency Act ○ Likewise, they do have some of the components of slow fashion listed in the authenticity, longevity, and exclusivity sections ● Nike ○ Because the company is so large, it is difficult for them to commit to slow fashion and achieve things like local production, exclusivity, and longevity due the enormous scale they are producing on. ○ In order to combat they’re fast fashion production, they do try to make shoes out of recycled materials such as the Space Hippies. Likewise, they have programs like Reuses-a-Shoe and Refurbished shoes where the try to reduce waste from customers of their products. Strategy Recommendations: Lululemon ● ● ● ● ● ● Innovate more sustainable materials ○ improvements in the sourcing of polyester, nylon and cotton types ○ improvements in the traceability of animal-derived materials ○ ensure forest-based cellulosic fibres to be audited/certified by a third party, etc Continue improving recycling efforts ○ aim for zero waste global distribution centers (4 out of 5 of the way already!) Review packaging decisions for shipping ○ find alternatives to polybags Hire third parties (Power Purchase Agreements (PPAs)) to manage electricity for the company Transparency in carbon footprint and accountability Encourage circularity through new guest options ○ offer opportunities to resell, repair, and/or recycle Lululemon products to extend product life ○ invest in design improvements required to sustain this circularity Why are they effective? These efforts will allow Lululemon products to remain exclusive and high quality, whilst improving longevity, therefore supporting slow fashion, and improving reputation as a sustainable company. Strategy Recommendations: Nike ● ● ● ● Switch to low-carbon alternatives to produce high volume products Review and collaborate with independent factories and material suppliers to find better alternatives for production methods and energy sourcing Upcycling programs ○ I.e. “Nike Refurbished” ○ Accepting returned products, reconditioning them, and putting them back in the market Optimizing packaging ○ Using paper mailers, removing plastic air pillows etc Why are they effective? These efforts will allow Nike to minimize as much waste as possible, whilst still catering to meet the demands of a large market. CLASS GRADES Exam 1, 2, & 3 are each worth 15% Project 1 & 2 are each worth 15% Four Highest Quizzes are worth a combined 15% Class Participation is worth 5% Peer Evaluation is worth 5% I will email this to you later this week; deadline is Thursday, 11 May at 11.59.59pm You can look at your percentage scores for Exam 1 & 2, Project 1, and the Quizzes to work out your current percentage score out of those 60 points There won’t be much additional scaling of your current scores except at the lower end of distribution EXAM THREE Similar to Exam Two Closed book exam on paper Multiple choice Takes place here in Mahar on Monday, 9 May Exam starts at 8.00am and will finish by 8.50am Scores will be scaled if needed during exam week based on distribution of grades Exam Two median score was 92 so was not scaled like Exam One (but I may lift some of the lower scores, e.g. below a B)