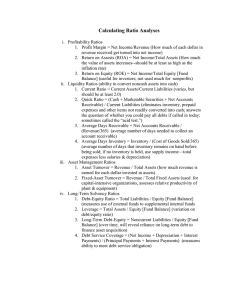

Chapter 28 - Financial Analysis Chapter 28 Financial Analysis Multiple Choice Questions 1. The following groups are stakeholders of a public company: I) Shareholders II) The government III) Suppliers IV) Employees V) Bondholders VI) Management A. I and II only B. I, II, and III only C. I, II, III, and IV only D. I, II, III, IV, V, and VI 2. In the U.S.A. and the U.K. laws and accounting procedures are designed, generally, to benefit the: A. Shareholders B. Managers C. Creditors D. Employees 3. German laws and accounting procedures are designed, generally, to protect interests of the: A. Shareholders B. Managers C. Creditors D. Employees 28-1 Chapter 28 - Financial Analysis 4. Assets are listed on the balance sheet in order of: I) Decreasing liquidity II) Decreasing size III) Increasing size IV) Relative life A. I only B. III and IV only C. II only D. IV only 5. The following are known as current assets: I) Cash II) Marketable securities III) Receivables IV) Inventories V) Payables A. I, II and III only B. I, II, III and IV only C. II, III, IV and V only D. III, IV and V only 6. The difference between Total Assets of a firm and its Total Liabilities is called. A. Net working capital B. Net current assets C. Net worth D. None of the above 7. Inventory consists of: A. finished goods B. raw material and finished goods C. raw material, work in process, and finished goods D. none of the above 28-2 Chapter 28 - Financial Analysis 8. The difference between Current Assets of a firm and its Current Liabilities is called. A. Net worth B. Net working capital C. Gross working capital D. None of the above 9. Net working capital (NWC) is calculated as: A. Total assets-total liabilities B. Current assets + current liabilities C. Current assets-current liabilities D. None of the above 10. Earnings before interest and taxes is calculated as: A. Total revenues-costs B. Total revenues-costs-depreciation C. Total revenues-costs-depreciation-taxes D. None of the above 11. Total uses of funds are calculated as: A. investments in net working capital + investments in fixed assets B. investments in fixed assets + dividend paid to shareholders C. investments in net working capital + investments in fixed assets + dividend paid to shareholders D. investments in net working capital + investments in fixed assets-dividend paid to shareholders 12. Total sources of funds are calculated as: A. operating cash flows + new issues of equity B. operating cash flows + new issues of equity + new issues of long-term debt C. operating cash flows + new issues of equity-new issues of long-term debt D. operating cash flows + new issues of equity-dividend paid to shareholders 28-3 Chapter 28 - Financial Analysis 13. If the debt ratio is 0.5 what is the debt-equity ratio? (assume no leases) A. 0.5 B. 1.0 C. 2.0 D. 4.0 14. Which of the following is an example of leverage ratios? A. Debt-Equity ratio B. Quick ratio C. Payout ratio D. Return on equity 15. Given the following data: Long term debt = 100; Value of leases = 20; Book value of equity = 80; Market value of equity = 100, calculate the debt ratio. A. 0.56 B. 0.50 C. 0.55 D. 0.60 16. Given the following data: Long term debt = 100; Value of leases = 20; Book value of equity = 80; Market value of equity = 100, calculate the debt-equity ratio. A. 0.50 B. 0.60 C. 1.50 D. 1.0 17. Given the following data: EBIT = 100; Depreciation = 40; Interest = 20; Dividends = 10; calculate the Times Interest Earned (TIE) ratio. A. 7.0 B. 5.0 C. 4.7 D. 14.0 28-4 Chapter 28 - Financial Analysis 18. Which of the following is an example of liquidity ratios? A. Times interest earned (TIE) B. P/E ratio C. Return on equity D. Quick ratio 19. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the current ratio: A. 2.0 B. 1.0 C. 1.5 D. None of the above 20. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the quick ratio: A. 1.0 B. 2.0 C. 1.2 D. None of the above 21. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the cash ratio: (assume that the firm has no marketable securities) A. 0.4 B. 2.0 C. 1.5 D. None of the above 22. Given the following data: Sales = 3200; Cost of goods sold = 1600; Average total assets = 1600; Average inventory = 200, calculate the asset turnover ratio: A. 2.0 B. 0.9375 C. 1.33 D. None of the above 28-5 Chapter 28 - Financial Analysis 23. Given the following data: Sales = 3200; Cost of goods sold = 1600; Average total assets = 1600; Average inventory = 200, calculate the days in inventory: A. 18.3 B. 45.6 C. 22.8 D. None of the above 24. Given the following data: Sales = 3200; Cost of good sold = 1600; Average receivables = 200, calculate the average collection period: A. 24.3 B. 22.8 C. 137 D. None of the above 25. When a firm improves (lowers) its days in inventories it generally: A. Requires additional cash investment in inventory B. Releases cash locked up in inventory C. Does not alter its cash position D. A firm cannot reduce its inventories 26. When a firm improves (lowers) its average collection period it generally: A. Requires additional cash investment in inventory B. Releases cash locked up in accounts receivables C. Does not alter its cash position D. A firm cannot reduce its inventories 27. Given the following data: EBIT = 400; Tax = 100; Sales = 3000; Average Total Assets = 1500, calculate net profit margin: A. 10% B. 18.3% C. 7.5% D. None of the above 28-6 Chapter 28 - Financial Analysis 28. Given the following data: EBIT = 400; Tax = 100; Sales = 3000; Average Total Assets = 1500, calculate the ROA (Return on Assets): A. 10% B. 20% C. 7.5% D. None of the above 29. Net profit margin is calculated as: A. (EBIT-tax)/Sales B. Net income/sales C. Net income/Cost of goods sold D. none of the above 30. Given the following data: EBIT = 400; NI = 100; Average Equity = 1000, calculate the ROE (Return on Equity): A. 10% B. 12% C. 7.5% D. None of the above 31. Given the following data: Earnings per share = $5; Dividends per share = $3; Price per share = $50. calculate the dividend yield: A. 10% B. 5% C. 60% D. None of the above 32. Given the following data: Earnings per share = $6; Dividends per share = $3; Price per share = $60, calculate the P/E ratio: A. 16.7 B. 10 C. 25 D. None of the above 28-7 Chapter 28 - Financial Analysis 33. Given the following data: Earnings per share = $5; Dividends per share = $3; Price per share = $50. Calculate the payout ratio: A. 10% B. 5% C. 60% D. None of the above 34. Which measure would be most useful in comparing the operating profitability of two firms in different industries? A. Net profit margin B. Return on equity C. Sales to total assets D. Return on assets 35. Efficiency ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by investors. A. I only B. II only C. III only D. III and IV only 36. Profitability ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by the investors. A. I only B. II only C. III only D. III and IV only 28-8 Chapter 28 - Financial Analysis 37. Market value ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by the investors. A. I only B. II only C. II and III only D. IV only 38. Which of the following factors would be influential in a typical financial plan? I) how a firm can generate superior long-term returns II) choice of industry III) position within the industry A. I only B. I and II only C. II and III only D. I, II and III 39. Given a book value per share of $10 and a market value of $24, what is the market capitalization of a firm with 2,000,000 outstanding shares? A. $2,000,000 B. $20,000,000 C. $28,000,000 D. $48,000,000 40. Given a book value per share of $5 and a market value of $12, what is the market value added of a firm with 2,000,000 outstanding shares? A. $1,000,000 B. $10,000,000 C. $14,000,000 D. $24,000,000 True / False Questions 28-9 Chapter 28 - Financial Analysis 41. Net working capital is equal to total assets minus total liabilities. True False 42. Total uses of funds is equal to investments in net working capital plus investments in fixed assets plus dividends paid to shareholders. True False 43. Leverage ratios show how heavily the company is in debt. True False 44. Ratios can help you to ask the right questions, they rarely answer these questions. True False 45. Efficiency ratios indicate how productively the company is using its assets to generate profits. True False 46. Market value ratios indicate how highly the firm is valued by the managers. True False 47. P/E ratio measures the price that investors are prepared to for each dollar of earnings. True False 48. According to the Du Pont system: True False 28-10 Chapter 28 - Financial Analysis 49. The calculation of market value added for a firm requires the use of the book value per share. True False 50. ROA can be increased by increasing asset turnover. True False Short Answer Questions 51. Briefly explain the relationship between accounting standards and the legal traditions. 52. What are the three basic financial statements? 53. How are "uses and sources" of funds are calculated? 28-11 Chapter 28 - Financial Analysis 54. What are the common ratios used to measure liquidity of a firm? 55. Briefly explain the different categories of financial ratios. 56. What are the primary reasons for a company to use debt in its capital structure? 57. Discuss the DuPont system. 28-12 Chapter 28 - Financial Analysis 58. Why is liquidity relevant? 28-13 Chapter 28 - Financial Analysis Chapter 28 Financial Analysis Answer Key Multiple Choice Questions 1. The following groups are stakeholders of a public company: I) Shareholders II) The government III) Suppliers IV) Employees V) Bondholders VI) Management A. I and II only B. I, II, and III only C. I, II, III, and IV only D. I, II, III, IV, V, and VI Type: Easy 2. In the U.S.A. and the U.K. laws and accounting procedures are designed, generally, to benefit the: A. Shareholders B. Managers C. Creditors D. Employees Type: Medium 3. German laws and accounting procedures are designed, generally, to protect interests of the: A. Shareholders B. Managers C. Creditors D. Employees Type: Medium 28-14 Chapter 28 - Financial Analysis 4. Assets are listed on the balance sheet in order of: I) Decreasing liquidity II) Decreasing size III) Increasing size IV) Relative life A. I only B. III and IV only C. II only D. IV only Type: Easy 5. The following are known as current assets: I) Cash II) Marketable securities III) Receivables IV) Inventories V) Payables A. I, II and III only B. I, II, III and IV only C. II, III, IV and V only D. III, IV and V only Type: Easy 6. The difference between Total Assets of a firm and its Total Liabilities is called. A. Net working capital B. Net current assets C. Net worth D. None of the above Type: Easy 28-15 Chapter 28 - Financial Analysis 7. Inventory consists of: A. finished goods B. raw material and finished goods C. raw material, work in process, and finished goods D. none of the above Type: Easy 8. The difference between Current Assets of a firm and its Current Liabilities is called. A. Net worth B. Net working capital C. Gross working capital D. None of the above Type: Easy 9. Net working capital (NWC) is calculated as: A. Total assets-total liabilities B. Current assets + current liabilities C. Current assets-current liabilities D. None of the above Type: Medium 10. Earnings before interest and taxes is calculated as: A. Total revenues-costs B. Total revenues-costs-depreciation C. Total revenues-costs-depreciation-taxes D. None of the above Type: Easy 28-16 Chapter 28 - Financial Analysis 11. Total uses of funds are calculated as: A. investments in net working capital + investments in fixed assets B. investments in fixed assets + dividend paid to shareholders C. investments in net working capital + investments in fixed assets + dividend paid to shareholders D. investments in net working capital + investments in fixed assets-dividend paid to shareholders Type: Medium 12. Total sources of funds are calculated as: A. operating cash flows + new issues of equity B. operating cash flows + new issues of equity + new issues of long-term debt C. operating cash flows + new issues of equity-new issues of long-term debt D. operating cash flows + new issues of equity-dividend paid to shareholders Type: Medium 13. If the debt ratio is 0.5 what is the debt-equity ratio? (assume no leases) A. 0.5 B. 1.0 C. 2.0 D. 4.0 Debt ratio = D/(D + E) = 0.5, D/E = 1 Type: Medium 14. Which of the following is an example of leverage ratios? A. Debt-Equity ratio B. Quick ratio C. Payout ratio D. Return on equity Type: Easy 28-17 Chapter 28 - Financial Analysis 15. Given the following data: Long term debt = 100; Value of leases = 20; Book value of equity = 80; Market value of equity = 100, calculate the debt ratio. A. 0.56 B. 0.50 C. 0.55 D. 0.60 Debt ratio = (100 + 20)/(100 + 20 + 80) = 0.6 Type: Medium 16. Given the following data: Long term debt = 100; Value of leases = 20; Book value of equity = 80; Market value of equity = 100, calculate the debt-equity ratio. A. 0.50 B. 0.60 C. 1.50 D. 1.0 D/E = 120/80 = 1.5 Type: Medium 17. Given the following data: EBIT = 100; Depreciation = 40; Interest = 20; Dividends = 10; calculate the Times Interest Earned (TIE) ratio. A. 7.0 B. 5.0 C. 4.7 D. 14.0 TIE = (100 + 40)/20 = 7 Type: Medium 28-18 Chapter 28 - Financial Analysis 18. Which of the following is an example of liquidity ratios? A. Times interest earned (TIE) B. P/E ratio C. Return on equity D. Quick ratio Type: Easy 19. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the current ratio: A. 2.0 B. 1.0 C. 1.5 D. None of the above Current Ratio = 500/250 = 2.0 Type: Medium 20. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the quick ratio: A. 1.0 B. 2.0 C. 1.2 D. None of the above Quick ratio = (500 - 200)/250 = 1.2 Type: Medium 28-19 Chapter 28 - Financial Analysis 21. Given the following data: Current assets = 500; Current liabilities = 250; Inventory = 200; Account receivables = 200; calculate the cash ratio: (assume that the firm has no marketable securities) A. 0.4 B. 2.0 C. 1.5 D. None of the above Cash ratio = (500 - 200 - 200)/250 = 0.4 Type: Medium 22. Given the following data: Sales = 3200; Cost of goods sold = 1600; Average total assets = 1600; Average inventory = 200, calculate the asset turnover ratio: A. 2.0 B. 0.9375 C. 1.33 D. None of the above Asset turnover ratio = 3200/1600 = 2.0 Type: Medium 23. Given the following data: Sales = 3200; Cost of goods sold = 1600; Average total assets = 1600; Average inventory = 200, calculate the days in inventory: A. 18.3 B. 45.6 C. 22.8 D. None of the above Days in inventory = 200/(1600/365) = 45.6 days Type: Medium 28-20 Chapter 28 - Financial Analysis 24. Given the following data: Sales = 3200; Cost of good sold = 1600; Average receivables = 200, calculate the average collection period: A. 24.3 B. 22.8 C. 137 D. None of the above Average collection period = 200/(3200/365) = 22.8 days Type: Medium 25. When a firm improves (lowers) its days in inventories it generally: A. Requires additional cash investment in inventory B. Releases cash locked up in inventory C. Does not alter its cash position D. A firm cannot reduce its inventories Type: Medium 26. When a firm improves (lowers) its average collection period it generally: A. Requires additional cash investment in inventory B. Releases cash locked up in accounts receivables C. Does not alter its cash position D. A firm cannot reduce its inventories Type: Medium 28-21 Chapter 28 - Financial Analysis 27. Given the following data: EBIT = 400; Tax = 100; Sales = 3000; Average Total Assets = 1500, calculate net profit margin: A. 10% B. 18.3% C. 7.5% D. None of the above Net profit margin = (400 - 100)/3000 = 0.1 = 10% Type: Medium 28. Given the following data: EBIT = 400; Tax = 100; Sales = 3000; Average Total Assets = 1500, calculate the ROA (Return on Assets): A. 10% B. 20% C. 7.5% D. None of the above ROA = (400 - 100)/1500 = 20% Type: Medium 29. Net profit margin is calculated as: A. (EBIT-tax)/Sales B. Net income/sales C. Net income/Cost of goods sold D. none of the above Type: Medium 28-22 Chapter 28 - Financial Analysis 30. Given the following data: EBIT = 400; NI = 100; Average Equity = 1000, calculate the ROE (Return on Equity): A. 10% B. 12% C. 7.5% D. None of the above ROE = NI/Average Equity = 100/1000 = 10% Type: Medium 31. Given the following data: Earnings per share = $5; Dividends per share = $3; Price per share = $50. calculate the dividend yield: A. 10% B. 5% C. 60% D. None of the above Dividend yield = 3/60 = 5% Type: Easy 32. Given the following data: Earnings per share = $6; Dividends per share = $3; Price per share = $60, calculate the P/E ratio: A. 16.7 B. 10 C. 25 D. None of the above P/E ratio = 60/6 = 10 Type: Easy 28-23 Chapter 28 - Financial Analysis 33. Given the following data: Earnings per share = $5; Dividends per share = $3; Price per share = $50. Calculate the payout ratio: A. 10% B. 5% C. 60% D. None of the above Dividend yield = 3/5 = 60% Type: Easy 34. Which measure would be most useful in comparing the operating profitability of two firms in different industries? A. Net profit margin B. Return on equity C. Sales to total assets D. Return on assets Type: Difficult 35. Efficiency ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by investors. A. I only B. II only C. III only D. III and IV only Type: Easy 28-24 Chapter 28 - Financial Analysis 36. Profitability ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by the investors. A. I only B. II only C. III only D. III and IV only Type: Easy 37. Market value ratios indicate: I) How productively is the firm utilizing its assets. II) How liquid is the firm. III) How profitable is the firm. IV) How highly is the firm valued by the investors. A. I only B. II only C. II and III only D. IV only Type: Easy 38. Which of the following factors would be influential in a typical financial plan? I) how a firm can generate superior long-term returns II) choice of industry III) position within the industry A. I only B. I and II only C. II and III only D. I, II and III Type: Medium 28-25 Chapter 28 - Financial Analysis 39. Given a book value per share of $10 and a market value of $24, what is the market capitalization of a firm with 2,000,000 outstanding shares? A. $2,000,000 B. $20,000,000 C. $28,000,000 D. $48,000,000 24 x 2,000,000 = 48,000,000 Type: Medium 40. Given a book value per share of $5 and a market value of $12, what is the market value added of a firm with 2,000,000 outstanding shares? A. $1,000,000 B. $10,000,000 C. $14,000,000 D. $24,000,000 (12 - 5) x 2,000,000 = 14,000,000 Type: Medium True / False Questions 41. Net working capital is equal to total assets minus total liabilities. FALSE Type: Easy 42. Total uses of funds is equal to investments in net working capital plus investments in fixed assets plus dividends paid to shareholders. TRUE Type: Medium 28-26 Chapter 28 - Financial Analysis 43. Leverage ratios show how heavily the company is in debt. TRUE Type: Easy 44. Ratios can help you to ask the right questions, they rarely answer these questions. TRUE Type: Easy 45. Efficiency ratios indicate how productively the company is using its assets to generate profits. FALSE Type: Difficult 46. Market value ratios indicate how highly the firm is valued by the managers. FALSE Type: Medium 47. P/E ratio measures the price that investors are prepared to for each dollar of earnings. TRUE Type: Medium 28-27 Chapter 28 - Financial Analysis 48. According to the Du Pont system: TRUE ROE = (assets/equity) × (sales/assets) × [(EBIT - Tax)/sales] × [(EBIT - Tax - Interest)/(EBIT - Tax)] Type: Medium 49. The calculation of market value added for a firm requires the use of the book value per share. TRUE Type: Medium 50. ROA can be increased by increasing asset turnover. TRUE Type: Medium Short Answer Questions 51. Briefly explain the relationship between accounting standards and the legal traditions. Generally, companies from countries with English or Scandinavian legal traditions provide more accounting information and have higher accounting standards than companies from countries with French or German legal traditions. Type: Medium 28-28 Chapter 28 - Financial Analysis 52. What are the three basic financial statements? The three basic financial statements are the balance sheet, the income statement, and the sources and uses of funds. Type: Easy 53. How are "uses and sources" of funds are calculated? Sources and uses of funds are calculated as follows: Total uses of funds = Investment in net working capital + investment in fixed assets + dividends paid to shareholders Total sources of funds = operating cash flow + new issues of long-term debt + new issues of equity Type: Medium 54. What are the common ratios used to measure liquidity of a firm? The ratios commonly used to measure liquidity are the current ratio, quick ratio, and cash ratio. Type: Medium 55. Briefly explain the different categories of financial ratios. There are five categories of financial ratios. They are: leverage ratios, liquidity ratios, efficiency ratios, profitability ratios, and market value ratios. Type: Easy 28-29 Chapter 28 - Financial Analysis 56. What are the primary reasons for a company to use debt in its capital structure? Companies use debt for two main reasons: (a) debt is less expensive due to the taxdeductibility of interest charges, and (b) the use of debt does not dilute shareholders' equity position. Type: Difficult 57. Discuss the DuPont system. The DuPont system is a quick way of looking at the performance of a firm or a division. ROA and ROE can be thought of as comprising of several ratios and hence provide some useful information about the interaction of these ratios. Type: Medium 58. Why is liquidity relevant? Firms have a need to convert assets into cash quickly. This is necessary to meet short term obligations. Without liquidity, even the most short term loans could force a company into bankruptcy. Type: Medium 28-30