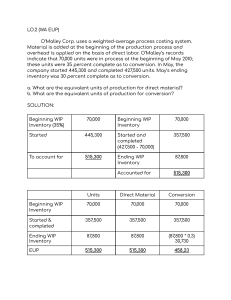

QUIZ #9 Chapter 16 Joint Cost Allocation and By product Feedback: Objective 4: Using NRV method in joint cost allocation may be appropriate when additional processing is often required to make the product sellable. Feedback: Objective 3: The different cost allocation methods are used to determine the approximate cost of goods sold and inventory value. Feedback: NRV of: X = (20,000 lbs x $20) - $150,000 = $250,000; Y = (30,000 lbs x $22) - $110,000 = $550,000; Z = (10,000 lbs x $30) - $100,000 = $200,000 $550,000 ÷ $1,000,000 = 0.55. 0.55 x $120,000 = P66,000. The sales value at the splitoff point does not require information on subsequent decisions. Subtract the NRV of the byproduct from the joint cost to get the cost to be allocated to X and Y. $120,000 – [(10,000 gal x $3) - $10,000] = $100,000. Allocate the $100,000 to X and Y based on their NRV percentages. NRV of: X = (20,000 lbs x $30) - $150,000 = $450,000; Y = (30,000 lbs x $22) - $110,000 = $550,000. For X $100,000 x 0.45 = $45,000. The unit cost will be ($150,000 + $45,000) ÷ 20,000 = P9.75 per gallon. The portion of the total joint product costs allocated to Product J was P9,000. Using the relative slaes value at split-off approach, this means that 60% of the total joint costs have been allocated to Product J (15,000 / 25,000 =.60). Therefore, total joint product costs are calculated as follows: P9,000 divided by .60 = P15,000 The requirement is to determine the effect on gross margin by reporting the sale of a by-product as additional sales revenue instead of a deduction from the major product's cost of goods sold. The solutions approach is to determine what is currently being done, then calculate the effect of the accounting change. To facilitate understanding, assume that peso amounts for sales and cost of goods sold (CGS) are P300,000 and P200,000, respectively. * 100,000 units x (P1 selling price — P0.10 selling cost) Note that the change in accounting treatment has no effect on gross margin. Product AA (15,000 units x P2) Php 30,000 CC (15,000 units x P5) 75,000 Php 105,000 The ratio therefore are AA= 30/105 or 29% BB = 75/105 or 71% The byproduct is not recognized until it is sold under the sales method for accounting for byproducts. The problem indicates that the relative sales value at split-off is used to allocate joint costs. Product H has been allocated 15% (P18,000 / P120,000) of the total joint costs. Therefore, Product H has 15% of the total sales value at split-off of P30,000 (15% x P200,000). Since the Product F has a sales value at split-off of P120,000, Product |G's sales value at split-off is P50,000 (P200,000 -P30,000 - P120,000). The product G sales value just computed represents 25% (50,000 / 200,000) of the total sales value at split-off. The joint costs allocated to Product G is 120,000 x 25% = P30,000. Feedback: The decision to sell a product at the split-off point or further process the product is made by comparing the sales value of the product at the split-off point with the NRV at the split-off point. Sales value = P5 x 75,000 lbs = P60,000 vs. NRV = (P6 x 15,000) - P20,000 = P70,000. So, an additional P5,000 will be made if B is further processed. If any of the joint process outputs are processed further, additional joint costs after split-off will be incurred. Any costs after split-off are assigned to the separate products for which those costs are incurred, and therefore, not allocated to joint products in a manner similar to joint costs. Decision to sell or process further is based on whether costs of further processing exceeds additional revenue and whether the product can or cannot be sold as it is. Feedback: Joint cost includes all costs incurred up to the slit off point for direct material, direct labor, and overhead. Joint cost is allocated, at split off point, to the joint products only. Allocation is necessary because of the cost principle.Joint cost is necessary and reasonable cost of producing the joint products and, therefore, should be attached to them. Steniel Paper Steniel Paper CONTINUATION Steniel Paper CONTINUATION True - Cost allocation for joint products on the basis of assigned weights is also called the survey method. False - All products yielded from joint product processing have some positive value to the firm. - CORRECT. Some product from a joint product process actually cost the firm additional money to dispose of. False - The sales-value at splitoff method of joint cost allocation involves computation of the relative amounts of the sales value of the amount of each joint product sold during the period. - INCORRECT. The sales-value at splitoff method involves computation of the relative amounts of the sales value of the amount of each joint product PRODUCED during the period. False - The constant gross-margin percentage NRV method allocates joint costs to joint products in such a way that the gross margin on each joint product is the same as it was in the previous year. - CORRECT. The constant gross-margin percentage NRV method allocates joint costs to joint products in such a way that the overall gross margin percentage is identical for the individual products. False - Joint processing costs are always relevant for pricing decisions of the final product. - INCORRECT. Joint costs are not relevant in pricing decisions. Feedback : Refer to Guerrero revised 2006 ed. No 22 p 523 answer key The use of net realizable value (or offset) approach of accounting the by-product requires that the net realizable value (selling price of by-product minus further processing and disposal costs) be treated as a reduction in the joint cost of manufacturing the primary products. On the other hand, the net realizable value at split-off allocation of joint costs assigns the joint cost based on the joint products' proportional net realizable values at the point of split-off. Net realizable value is equal to product sales revenue minus any costs necessary to prepare and dispose of the product. Based on the foregoing information, the revenue from sales of by-product is treated as a reduction of joint costs, thus the amount of joint costs to be allocated to main products is P252,000 (P262,000 - 10,000). Also note, the basis of allocation is the sales value at split-off of the main products, thus the above computation. Feedback : Refer to Guerrero revised 2006 ed. No 23 p 524 answer key. Since the inventory of the by product was recorded at net realizable value when produced in 2023, and likewise, when the units of the byproduct were sold in 2024 the proceeds equaled the inventory cost plus disposal costs, thus, no profit will be recognized in 2024. See problem 7-6 page 331 Chapter 7 joint cost Punzalan The cost incurred for materials, labor and overhead during a joint process are referred to as the joint cost of the production process. Although joint cost allocations are necessary to determine financial statement valuations, such allocations should not be used in internal decision making. Since joint costs are production costs incurred prior to split-off point, the joint cost allocation is not relevant to decision making. Once the split-off point is reached, the joint cost has already been incurred and is a sunk cost that cannot be changed no matter future course of action is taken. The distinction between joint products and byproducts rests solely on its physical proportions in production. Under the production method, where the by product is accounted at the time of production, the net realizable value of the by-product produced is deducted from the cost of the main products produced. Therefore, no cost of sales is reported for the by-product, and the total joint production costs will be reduced by the net realizable value of the by product, thereby reducing the cost of sales of the main product. Feedback: Objective 1: A good reason for cost allocation is to measure income and assets for external reporting. The gross profit on this sale is the ultimate sales price less the cost of goods sold. In a joint processing situation, the cost of the goods sold includes both the allocation of joint costs up to the split-off point and all further processing costs. The allocation of joint costs incurred prior to split-off is based on relative sales value at the split-off point. For W, relative sales value is its sales value at split-off divided by total sales value at split-off or P60,000/ P750,000 = 8%. The allocation of joint costs is then 8% of total joint costs, or (8%) (P450,000) = P36,000. The gross profit is computed as follows: Under the relative sales value approach, the joint production cost of P52,000 (P24,000 + 28,000) is allocated based on the relative market values of the products. One of the accepted methods for costing by products is to show the revenue from sales of by product as additional sales revenue. In this regard, joint production cost is not allocated to the by-product. Feedback: Objective 1: Income first option: (2000 × 47.50) + (3000 × 39) + (5000 × 2.50) = 224,500. Second option: same as above except for P: (3000 × .90) × 57 = 153,900. Both options are profitable. However, the second option increases the profit even more. Feedback: Objective 2: 3000 × .90 × 57) – (3000 × 39) = 36,900; 36,900 – 31,500 = P5,400. Feedback: Output of zeron (20,000 lbs.) ÷ total input (100,000) = .20. Then, P50,000 x .20 = P10,000 allocated to zeron. Feedback: 1st subtract the NRV of the byproduct from the joint costs (P50,000 - P20,000) = P30,000. Then, allocate the P30,000 to the main products based on their NRV percentages. For the zeron, P200,000 ÷ P320,000 = 0.625 x P30,000 = P18,750. Feedback: 1st subtract the NRV of the byproduct from the joint costs (P50,000 - P20,000) = P30,000. Then, allocate the P30,000 to the main products based on their physical quantity percentages. For the zeron, 40,000 lbs. ÷ 80,000 = 0.50 x P30,000 = P15,000. Feedback: NRV of: Simplex = P225,000; Duplex = P90,000; Triplex = P85,000. (P90,000 ÷ P400,000) x P80,000 = P18,000 Feedback: Total quantity = 100,000 lbs. Allocation to Duplex: (20,000 lbs ÷ 100,000 lbs) x P80,000 = P16,000 Feedback: Objective 6: (3,400 × 62) + (4400 × 23) + (2200 × 18) = $351,600; M as a % of total = 28.90%; 178,400 × 28.78% = 51,344. Feedback: Objective 4: 2200 / (3400 + 4400 + 2200) = 22%; 178,400 × 22% = P39,248. Feedback: Objective 4: (4,400 × 23) – 31,200 = P70,000. Feedback: Objective 4: (2,200 × 18) – 9,600 = P30,000. Feedback: Objective 6: [(3,400 × 62) – 40,800] + [(4400 × 23) – 31,200] + [(2200 × 18) – 9,600] = $270,000; 62.96% + 25.93% + 11.11%= 100%; M: 29.34% × 178,400 = $46,259; 46,259 + 31,200 = $77,459; (4400 × 23) – 77,459 = P23,741. Feedback: Objective 4: (3,400 × 62) – (34% × 178,400) = P150,144. Feedback: Objective 4: Accounts receivable Sales 39,600 39600 Feedback: Objective 1: (3,400 × 62) + (4400 × 23) + (2200 × 18) – (178,400 + 81,600] = P91,600. Coke per no 65 Pop (2,000 -1,400) x P2 23,200 1,200 QUIZ #10 Chapter 17 Process Costing & Chapter 18 Spoilage Determination of EUP is the 4th step, and the last step is the allocation of cost to the transferred-in finished goods during the period and determining the ending WIP Similar rates of conversion because set standards should be meet The underlined words made the student false. Weighted Average Method prior and current period. FIFO Method current period. Work back. Total units to account for less WIP, beg = Units started 49,000 – 15,000 = 34,000 units WIP, beg Physical Units 15,000 Started 34,000 Units to Account for 49,000 Completed and Transferred Out Started &Completed 24,000 24,000 WIP BEG WIP, end Units accounted for 15,000 10,000 49,000 6,000 7,500 EUP Conversion 37,500 WIP, beg Started Units to Account for Physical Units Conversio n 10,000 80,000 90,000 Completed and Transferred Out Started &Completed 65,000 65,000 WIP BEG WIP, end Units accounted for 10,000 15,000 90,000 3,000 6,000 EUP 74,000 Physical Units Materials WIP, beg Started Units to Account for 10,000 80,000 90,000 Completed and Transferred Out Started &Completed WIP BEG WIP, end Units accounted for EUP 65,000 65,000 10,000 15,000 90,000 0 15,000 80,000 Physical Units Conversi on WIP, beg 10,000 Started 80,000 Units to Account for 90,000 Completed and TO WIP, end 75,000 75,000 15,000 6,000 Units accounted for 90,000 EUP 81,000 Physical Units Materials WIP, beg 10,000 Started 80,000 Units to Account for 90,000 Completed and TO WIP, end 75,000 75,000 15,000 15,000 Units accounted for 90,000 EUP 90,000 Assign the costs to inventories is also considered as an answer to this question Horngren: assign the costs to inventories. Raiborn: calculate the cost per equivalent unit. None because normal defective unit costs were already included in the standard unit cost Transferred In DM CC (9.75+4) 620 x 12.50 620 x 8 620 x (9.75+4) x 45% 7,750 4,960 3,836.25 16,546.25 32850 x (800/1200) = 21,900 12,000 + (4,800*65%) + (1200-800) = 15,520 EUP 21900 x ((4800*.65)/15520) =4,402.58 300-(7500*.03) Units 7,500 Started & Completed 75 Abnormal Spoilage 550 WIP end (80%) 8,125 EUP 7,500 75 550 8,125 CC 7,500 75 440 8,015 3,340 1,219.50 Cost per EUP x EUP completed total cost 0.41108 7,500 3,083 0.15215 7,500 1,141 total cost 4,224.22 Current Cost DM Answer will be corrected should be A instead of D. 300-(7500*.03) Units 7,500 75 550 8,125 DM Started & Completed Abnormal Spoilage WIP end (80%) EUP 7,500 75 550 8,125 CC 7,500 75 440 8,015 Current Cost 3,340 1,219.50 0.41108 75 31 0.15215 75 11 Cost per EUP x EUP completed total cost total cost 42.24 Physical Units WIP, beg Material Labor s 7500 Started 64,000 Units to Account for 71,500 Completed and TO WIP, end 66,500 66,500 66,500 5,000 5,000 3,000 Units accounted for EUP 71,500 71,500 69,500 Physical Units Material s Labor 59,000 59,000 59,000 WIP BEG 7,500 0 3,000 WIP, end Units accounted for 5,000 71,500 5,000 3,000 64,000 65,000 WIP, beg 7,500 Started 64,000 Units to Account for 71,500 Completed and Transferred Out Started &Completed EUP Saleable Unsaleable (abnormal spoilage) Total units (5,000 ÷ 5,300) x 99,000 = 93,396.23 5,000 300 5,300 Physical Units Materials Conver sion 54,000 54,000 38,000 0 26,600 WIP, end 26,000 26,000 5,200 Units accounted for 118,000 80,000 85,800 WIP, beg 38,000 Started 80,000 Units to Account for 118,000 Completed and Transferred Out Started &Completed 54,000 WIP BEG EUP WIP, end (DM) = 26,000 x 1.875 = 48,750 Production Costs DM CC COST ADDED 150,000 343,200 DIVIDE BY EUP 80,000 1.875 85,800 4 106,400 317,250 66,200 69,550 0 101,250 22,200 48,750 106,400 216,000 44,000 20,800 559,400 172,200 387,200 EUP PER UNIT Step 4 WIP, beg Cost added Total cost to account for 66,200 493,200 559,400 Step 5 Assignment of costs CTO Beg Started Beg inventory WIP, end Total costs accounted for WIP, end (Conversion) = 5,200 x 4 = 20,800 Production Costs DM CC COST ADDED 150,000 343,200 DIVIDE BY EUP 80,000 1.875 85,800 4 106,400 317,250 66,200 69,550 0 101,250 22,200 48,750 106,400 216,000 44,000 559,400 172,200 387,200 EUP PER UNIT Step 4 WIP, beg Cost added Total cost to account for 66,200 493,200 559,400 Step 5 Assignment of costs CTO Beg Started Beg inventory WIP, end Total costs accounted for 20,800 Production Costs DM CC COST ADDED 150,000 343,200 DIVIDE BY EUP EUP PER UNIT 80,000 1.875 85,800 4 0 101,250 22,200 106,400 216,000 44,000 123,450 366,400 48,750 20,800 172,200 387,200 Step 4 WIP, beg Cost added Total cost to account for Step 5 66,200 493,200 559,400 Assignment of costs CTO Beg Started Beg, inventory 106,400 317,250 66,200 Total 489,850 Completed and Transferred out WIP, end 69,550 Total costs accounted for 559,400 FIFO (9000-4000) Units 4,000 WIP beg(3/8) 5,000 Started & Completed 4,000 WIP end (1/2) 4,000 WIP end (3/4) 17,000 EUP 2,500 5,000 2,000 3,000 12,500 Weighted 4,000 5,000 2,000 3,000 14,000 Units (1200-200) 200 200 WIP beg(100%,25%) 1,000 Started & Completed 200 WIP end (100%,50%) 1,400 EUP Weighted Average DM CC 200 200 1,000 1,000 200 100 1,400 1,300 FIFO Units (1200-200) 200 200 WIP beg(100%,25%) 1,000 Started & Completed 200 WIP end (100%,50%) 1,400 EUP DM CC 1,000 200 1,200 150 1,000 100 1,250 Physical Units WIP, beg 15,000 Started 150,000 Units to Account for 165,000 Materials Conver sion Completed and Transferred Out Started &Completed WIP BEG 105,000 105,000 105,000 15,000 0 9,000 WIP, end 45,000 45,000 13,500 Units accounted for 165,000 150,000 127,500 EUP Physical Units WIP, beg 80,000 Started 600,000 Units to Account for 680,000 Conversi on Completed and Transferred Out Started &Completed 480,000 480,000 WIP BEG 80,000 24,000 WIP, end 120,000 96,000 Units accounted for 680,000 EUP 600,000 Physical Units WIP, beg 12,000 Started 30,000 Units to Account for 42,000 Conversion Completed and Transferred Out Started &Completed 16,000 16,000 WIP BEG 12,000 9,000 WIP, end 14,000 8,000 Units accounted for 42,000 EUP 33,000 DM Beg Inv 1,000 Transfers from extracting 2,000 Units added to Mixing 6,000 Total EUP for DM 9,000 CC Transfer to packaging Ending Inv (1,200 x 50%) Total EUP for CC 7,800 600 8,400 (85,000-40,000) 45,000 Units 40,000 WIP beg 45,000 Started & Completed 45,000 WIP end (100% as to DM) 130,000 EUP DM 40,000 45,000 45,000 130,000 Physical Units Materials WIP, beg 15,000 Started 40,000 Units to Account for 55,000 Completed and TO 42,500 42,500 WIP, end 12,500 12,500 Units accounted for 55,000 EUP Cost, beg 55,000 5,500 Cost Added 18,000 Total Costs 23,500 Divided by EUP 55,000 EUP per unit 0.43 (200,000-50,000) 50,000+270,000-200,000 Units 50,000 WIP beg (1-0.80) 20% 150,000 Started & Completed 120,000 WIP end (50%) EUP CC 10,000 150,000 60,000 220,000 Current Cost RM 572,000 Cost per EUP for CC x EUP in WIP end for CC RM in ending WIP 3 60,000 156,000 CC 4,000 150,000 WIP, beg Physical Units 6,000 Transferred In Materials Conversion Started 14,000 Units to Account for 20,000 Completed and TO WIP, end 12,000 12,000 12,000 12,000 8,000 8,000 8,000 6,000 Units accounted for 20,000 EUP 20,000 20,000 18,000 Cost, beg Cost Added 12,000 29,000 2,500 5,500 1,000 5,000 Total Costs Divided by EUP 41,000 20,000 8,000 20,000 6,000 18,000 2.05 0.40 0.33 EUP per unit Total cost per EUP 2.05+0.40+0.33 = 2.78 DM WIP beg Started & Completed WIP end EUP WIP, beg. RM Current Cost RM Total RM EUP per RM x EUP in WIP end for RM RM in ending WIP 4,000 16,000 5,000 25,000 456,000 2,284,000 2,740,000 110 5,000 548,000 CC 4,000 16,000 (20,000-4,000) (4000+21,000-20,000) To be excluded in the quiz items.