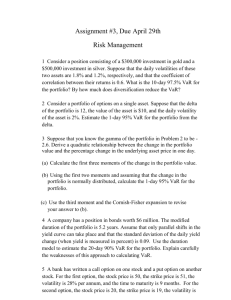

CHAPTER 20 Value at Risk Practice Questions Problem 20.8. A company uses an EWMA model for forecasting volatility. It decides to change the parameter from 0.95 to 0.85. Explain the likely impact on the forecasts. Reducing from 0.95 to 0.85 means that more weight is put on recent observations of u i2 and less weight is given to older observations. Volatilities calculated with = 085 will react more quickly to new information and will “bounce around” much more than volatilities calculated with = 095 . Problem 20.9. Explain the difference between value at risk and expected shortfall. Value at risk is the loss that is expected to be exceeded (100 – X)% of the time in N days for specified parameter values, X and N . Expected shortfall is the expected loss conditional that the loss is greater than the Value at Risk. Problem 20.10. Consider a position consisting of a $100,000 investment in asset A and a $100,000 investment in asset B. Assume that the daily volatilities of both assets are 1% and that the coefficient of correlation between their returns is 0.3. What is the 5-day 99% value at risk for the portfolio? The standard deviation of the daily change in the investment in each asset is $1,000. The variance of the portfolio’s daily change is 1 0002 + 1 0002 + 2 03 1 000 1 000 = 2 600 000 The standard deviation of the portfolio’s daily change is the square root of this or $1,612.45. The standard deviation of the 5-day change is 1,612.45 5 = $3,605.55 From the tables of N ( x) we see that N (−233) = 001 . This means that 1% of a normal distribution lies more than 2.33 standard deviations below the mean. The 5-day 99 percent value at risk is therefore 2.33×3,605.55 = $8,400.93. Problem 20.11. The volatility of a certain market variable is 30% per annum. Calculate a 99% confidence interval for the size of the percentage daily change in the variable. The volatility per day is 30 252 = 189% . There is a 99% chance that a normally distributed variable will be within 2.57 standard deviations. We are therefore 99% confident that the daily change will be less than 257 189 = 486% . Problem 20.12. Explain how an interest rate swap is mapped into a portfolio of zero-coupon bonds with standard maturities for the purposes of a VaR calculation. When a final exchange of principal is added in, the floating side is equivalent a zero-coupon bond with a maturity date equal to the date of the next payment. The fixed side is a couponbearing bond, which is equivalent to a portfolio of zero-coupon bonds. The swap can therefore be mapped into long and short positions in zero-coupon bonds with maturity dates corresponding to the payment dates. A cash flow mapping procedure can then be used to map each of the zero-coupon bonds to positions in the adjacent standard-maturity zero-coupon bonds. Problem 20.13. Explain why the linear model can provide only approximate estimates of VaR for a portfolio containing options. The change in the value of an option is not linearly related to the percentage change in the value of the underlying variable. The linear model assumes that the change in the value of a portfolio is linearly related to percentage changes in the underlying variables. It is therefore only an approximation for a portfolio containing options. Problem 20.14. Some time ago a company entered into a forward contract to buy £1 million for $1.5 million. The contract now has six months to maturity. The daily volatility of a six-month zero-coupon sterling bond (when its price is translated to dollars) is 0.06% and the daily volatility of a six-month zero-coupon dollar bond is 0.05%. The correlation between returns from the two bonds is 0.8. The current exchange rate is 1.53. Calculate the standard deviation of the change in the dollar value of the forward contract in one day. What is the 10-day 99% VaR? Assume that the six-month interest rate in both sterling and dollars is 5% per annum with continuous compounding. The contract is a long position in a sterling bond combined with a short position in a dollar bond. The value of the sterling bond is 153e −00505 or $1.492 million. The value of the dollar bond is 15e−00505 or $1.463 million. The variance of the change in the value of the contract in one day is 14922 000062 + 14632 000052 − 2 08 1492 00006 1463 00005 = 0000000288 The standard deviation is therefore $0.000537 million. The 10-day 99% VaR is 0.000537 10 2.33 = $0.00396 million. Problem 20.15. The most recent estimate of the daily volatility of the U.S. dollar–sterling exchange rate is 0.6%, and the exchange rate at 4 p.m. yesterday was 1.5000. The parameter in the EWMA model is 0.9. Suppose that the exchange rate at 4 p.m. today proves to be 1.4950. How would the estimate of the daily volatility be updated? The daily return is −0005 15000 = −0003333 . The current daily variance estimate is 00062 = 0000036 . The new daily variance estimate is 09 0000036 + 01 00033332 = 0000033511 The new volatility is the square root of this. It is 0.00579 or 0.579%. Problem 20.16. Suppose that the daily volatilities of asset A and asset B calculated at close of trading yesterday are 1.6% and 2.5%, respectively. The prices of the assets at close of trading yesterday were $20 and $40, and the estimate of the coefficient of correlation between the returns on the two assets made at close of trading yesterday was 0.25. The parameter used in the EWMA model is 0.95. (a) Calculate the current estimate of the covariance between the assets. (b) On the assumption that the prices of the assets at close of trading today are $20.5 and $40.5, update the correlation estimate. a) The volatilities and correlation imply that the current estimate of the covariance is 025 0016 0025 = 00001. b) If the prices of the assets at close of trading today are $20.5 and $40.5, the returns are 05 20 = 0025 and 05 40 = 00125 . The new covariance estimate is 095 00001+ 005 0025 00125 = 00001106 The new variance estimate for asset A is 095 00162 + 005 00252 = 000027445 so that the new volatility is 0.0166. The new variance estimate for asset B is 095 00252 + 005 001252 = 0000601562 so that the new volatility is 0.0245. The new correlation estimate is 00001106 = 0272 00166 00245 Problem 20.17. Suppose that the daily volatility of the FT-SE 100 stock index (measured in pounds sterling) is 1.8% and the daily volatility of the dollar/sterling exchange rate is 0.9%. Suppose further that the correlation between the FT-SE 100 and the dollar/sterling exchange rate is 0.4. What is the volatility of the FT-SE 100 when it is translated to U.S. dollars? Assume that the dollar/sterling exchange rate is expressed as the number of U.S. dollars per pound sterling. (Hint: When Z = XY , the percentage daily change in Z is approximately equal to the percentage daily change in X plus the percentage daily change in Y .) The FT-SE expressed in dollars is XY where X is the FT-SE expressed in sterling and Y is the exchange rate (value of one pound in dollars). Define xi as the proportional change in X on day i and yi as the proportional change in Y on day i . The proportional change in XY is approximately xi + yi . The standard deviation of xi is 0.018 and the standard deviation of yi is 0.009. The correlation between the two is 0.4. The variance of xi + yi is therefore 00182 + 00092 + 2 0018 0009 04 = 00005346 so that the volatility of xi + yi is 0.0231 or 2.31%. This is the volatility of the FT-SE expressed in dollars. Note that it is greater than the volatility of the FT-SE expressed in sterling. This is the impact of the positive correlation. When the FT-SE increases, the value of sterling measured in dollars also tends to increase. This creates an even bigger increase in the value of FT-SE measured in dollars. A similar result holds for a decrease in the FT-SE. Problem 20.18. Suppose that in Problem 20.17 the correlation between the S&P 500 Index (measured in dollars) and the FT-SE 100 Index (measured in sterling) is 0.7, the correlation between the S&P 500 index (measured in dollars) and the dollar-sterling exchange rate is 0.3, and the daily volatility of the S&P 500 Index is 1.6%. What is the correlation between the S&P 500 Index (measured in dollars) and the FT-SE 100 Index when it is translated to dollars? (Hint: For three variables X , Y , and Z , the covariance between X + Y and Z equals the covariance between X and Z plus the covariance between Y and Z .) Continuing with the notation in Problem 20.17, define zi as the proportional change in the value of the S&P 500 on day i . The covariance between xi and zi is 07 0018 0016 = 00002016 . The covariance between yi and zi is 03 0009 0016 = 00000432 . The covariance between xi + yi and zi equals the covariance between xi and zi plus the covariance between yi and zi . It is 00002016 + 00000432 = 00002448 The correlation between xi + yi and zi is 00002448 = 0662 0016 00231 Problem 20.19. The one-day 99% VaR is calculated for the four-index example in Section 20.2 as $253,385. Look at the underlying spreadsheets on the author’s web site and calculate a) the 95% oneday VaR and b) the 97% one-day VaR. The 95% one-day VaR is the 25th worst loss. This is $168,612. The 97% one-day VaR is the 15th worst loss. This is $188,758. Problem 20.20. Use the spreadsheets on the author’s web site to calculate the one-day 99% VaR, using the basic methodology in Section 20.2 if the four-index portfolio considered in Section 20.2 is equally divided between the four indices. In the “Scenarios” worksheet the portfolio investments are changed to 2500 in cells L2:O2. The losses are then sorted from the largest to the smallest. The fifth worst loss is $258,355. This is the one-day 99% VaR. Problem 20.21. At the end of Section 20.6, the VaR for the four-index example was calculated using the model-building approach. How does the VaR calculated change if the investment is $2.5 million in each index? Carry out calculations when a) volatilities and correlations are estimated using the equally weighted model and b) when they are estimated using the EWMA model with = 094 . Use the spreadsheets on the author’s web site. The alphas (row 21 for equal weights and row 7 for EWMA) should be changed to 2,500. This changes the one-day 99% VaR to $238,022 when volatilities and correlations are estimated using the equally weighted model and to $510,459 when EWMA with = 094 is used. Problem 20.22. What is the effect of changing from 0.94 to 0.97 in the EWMA calculations in the fourindex example at the end of Section 20.6? Use the spreadsheets on the author’s web site. The parameter is in cell N3 of the EWMA worksheet. Changing it to 0.97 changes the oneday 99% VaR from $488,217 to $404,661. This is because less weight is given to recent observations. Further Problems Problem 20.23. Consider a position consisting of a $300,000 investment in gold and a $500,000 investment in silver. Suppose that the daily volatilities of these two assets are 1.8% and 1.2%, respectively, and that the coefficient of correlation between their returns is 0.6. What is the 10-day 97.5% value at risk for the portfolio? By how much does diversification reduce the VaR? The variance of the portfolio (in thousands of dollars) is 00182 3002 + 00122 5002 + 2 300 500 06 0018 0012 = 10404 The standard deviation is 10404 = 102 . Since N (−196) = 0025 , the 1-day 97.5% VaR is 102 196 = 1999 and the 10-day 97.5% VaR is 10 1999 = 6322 . The 10-day 97.5% VaR is therefore $63,220. The 10-day 97.5% value at risk for the gold investment is 5 400 10 196 = 33 470 . The 10-day 97.5% value at risk for the silver investment is 6 000 10 196 = 37188 . The diversification benefit is 33 470 + 37188 − 63 220 = $7 438 Problem 20.24. Consider a portfolio of options on a single asset. Suppose that the delta of the portfolio is 12, the value of the asset is $10, and the daily volatility of the asset is 2%. Estimate the 1-day 95% VaR for the portfolio. Suppose that the gamma of the portfolio is −26 . Derive a quadratic relationship between the change in the portfolio value and the percentage change in the underlying asset price in one day. An approximate relationship between the daily change in the value of the portfolio, P and the return on the asset x is P = 10 12x = 120x The standard deviation of x is 0.02. It follows that the standard deviation of P is 2.4. The 1-day 95% VaR is 2.4×1.65 = $3.96. From equation (20.5) the quadratic relationship between P and x is 1 P = 10 12x − 102 26(x) 2 2 or P = 120x − 130(x) 2 Problem 20.25. A bank has written a call option on one stock and a put option on another stock. For the first option the stock price is 50, the strike price is 51, the volatility is 28% per annum, and the time to maturity is nine months. For the second option the stock price is 20, the strike price is 19, the volatility is 25% per annum, and the time to maturity is one year. Neither stock pays a dividend, the risk-free rate is 6% per annum, and the correlation between stock price returns is 0.4. Calculate a 10-day 99% VaR using DerivaGem and the linear model. My answer follows the usual practice of assuming that the 10-day 99% value at risk is 10 times the 1-day 99% value at risk. Some students may try to calculate a 10-day VaR directly, which is fine. From DerivaGem, the values of the two option positions are –5.413 and – 1.014. The deltas are –0.589 and 0.284, respectively. An approximate linear model relating the change in the portfolio value to proportional change, x1 , in the first stock price and the proportional change, x2 , in the second stock price is P = −0589 50x1 + 0284 20x2 or P = −2945x1 + 568x2 The daily volatility of the two stocks are 028 252 = 00176 and 025 252 = 00157 , respectively. The one-day variance of P is 29452 001762 + 5682 00157 2 − 2 2945 00176 568 00157 04 = 02396 The one day standard deviation is, therefore, 0.4895 and the 10-day 99% VaR is 233 10 04895 = 361 . Problem 20.26. Suppose that the price of gold at close of trading yesterday was $600, and its volatility was estimated as 1.3% per day. The price at the close of trading today is $596. Update the volatility estimate using the EWMA model with = 094 . The return on gold is −4 3600 = −000667 . Using the EWMA model the variance is updated to 094 00132 + 006 000667 2 = 000016154 so that the new daily volatility is 000016154 = 001271 or 1.271% per day. Problem 20.27. Suppose that in Problem 20.28 the price of silver at the close of trading yesterday was $16, its volatility was estimated as 1.5% per day, and its correlation with gold was estimated as 0.8. The price of silver at the close of trading today is unchanged at $16. Update the volatility of silver and the correlation between silver and gold using the EWMA model with = 094 . The return on silver is zero. Using the EWMA model the variance is updated to 094 00152 + 006 0 = 00002115 so that the new daily volatility is 00002115 = 001454 or 1.454% per day. The initial covariance is 08 0013 0015 = 0000156 Using EWMA the covariance is updated to 094 0000156 + 006 0 = 000014664 so that the new correlation is 000014664 (001454 001271) = 07933 Problem 20.28. (Excel file) An Excel spreadsheet containing daily data on a number of different exchange rates and stock indices can be downloaded from the author’s Web site: http://www.rotman.utoronto.ca/ hull/data Choose one exchange rate and one stock index. Estimate the value of in the EWMA model that minimizes the value of (vi − i )2 i where vi is the variance forecast made at the end of day i −1 and i is the variance calculated from data between day i and i + 25 . Use Excel’s Solver tool. Set the variance forecast at the end of the first day equal to the square of the return on that day to start the EWMA calculations. In the spreadsheet the first 25 observations on (vi-)2 are ignored so that the results are not unduly influenced by the choice of starting values. The best values of for EUR, CAD, GBP and JPY were found to be 0.947, 0.898, 0.950, and 0.984, respectively. The best values of for S&P500, NASDAQ, FTSE100, and Nikkei225 were found to be 0.874, 0.901, 0.904, and 0.953, respectively. Problem 20.29. A common complaint of risk managers is that the model building approach (either linear or quadratic) does not work well when delta is close to zero. Test what happens when delta is close to zero in using Sample Application E in the DerivaGem Application Builder software. (You can do this by experimenting with different option positions and adjusting the position in the underlying to give a delta of zero.) Explain the results you get. We can create a portfolio with zero delta in Sample Application E by changing the position in the stock from 1,000 to 513.58. (This reduces delta by 1 000 − 51358 = 48642 .) In this case the true VaR is 48.86; the VaR given by the linear model is 0.00; and the VaR given by the quadratic model is -35.71. Other zero-delta examples can be created by changing the option portfolio and then zeroing out delta by adjusting the position in the underlying asset. The results are similar. The software shows that neither the linear model nor the quadratic model gives good answers when delta is zero. The linear model always gives a VaR of zero because the model assumes that the portfolio has no risk. (For example, in the case of one underlying asset P = S .) When there are no cross gammas the quadratic model assumes that P is always positive. (For example, in the case of one underlying asset P = 05(S ) 2 .) This gives a negative VaR. In practice many portfolios do have deltas close to zero because of the hedging activities described in Chapter 17. This has led many financial institutions to prefer historical simulation to the model building approach. Problem 20.30 (Excel file) Suppose that the portfolio considered in Section 20.2 has (in $000s) 3,000 in DJIA, 3,000 in FTSE, 1,000 in CAC40, and 3,000 in Nikkei 225. Use the spreadsheet on the author’s web site to calculate what difference this makes to the one-day 99% VaR that is calculated in Section 20.2. First the investments worksheet is changed to reflect the new portfolio allocation. (see row 2 of the Scenarios worksheet for historical simulation). The losses are then sorted from the greatest to the least. The one-day 99% VaR is the fifth worst loss or $230,897. Problem 20.31 (Excel file) The calculations for the four-index example at the end of Section 20.6 assume that the investments in the DJIA, FTSE 100, CAC40, and Nikkei 225 are $4 million, $3 million, \$1 million, and $2 million, respectively. How does the VaR calculated change if the investment are $3 million, $3 million, $1 million, and $3 million, respectively? Carry out calculations when a) volatilities and correlations are estimated using the equally weighted model and b) when they are estimated using the EWMA model. What is the effect of changing from 0.94 to 0.90 in the EWMA calculations? Use the spreadsheets on the author's web site. (a) The portfolio investment amounts have to be changed in row 21 of the Equal Weights worksheet for the model building approach. The worksheet shows that the new oneday 99% VaR is $229,683. This is slightly higher than the one-day VaR for the original portfolio. (b) The portfolio investment amounts have to be changed in row 7 of the EWMA worksheet. The worksheet shows that one-day 99% VaR is $478,895. This is slightly lower than the one-day VaR for the original portfolio. Changing to 0.90 (see cell N3) changes VaR to $537,828. This is higher because recent returns are given more weight.