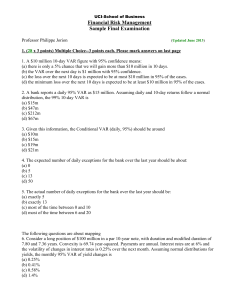

Value at Risk MGT 4850 Spring 2009 University of Lethbridge

advertisement

Value at Risk MGT 4850 Spring 2009 University of Lethbridge Who can use VaR? • Financial Institutions – not to expose themselves to expensive failure (Barings, Daiwa, Société Générale, Amaranth Advisors LLC) • Regulators – Basel Committee • Nonfinancial corporations (cash flow at risk) • Asset Managers - funds Steps in Constructing VaR • • • • • Current portfolio value Measure the variability per year Set time horizon Set the confidence interval Report the worst loss Definition • The worst expected loss under normal market conditions over a specific time interval at a given confidence level. – Confidence level – Time period • Example – daily VaR equal to $1mil at 1% (i.e. only one chance in 100 that a daily loss bigger than 1 mil occurs under normal market conditions) Portfolio example - 394 • Value $100mil;mean return 20%; std 30% Probability of 20 mil loss (9.12%) PDF • The probability density function of the normal distribution is a Gaussian function • density function of the "standard" normal distribution: Probability density vs. Cumulative PDF and CDF CALCULATING THE QUANTILES p.211-212 B6 B7 Continuous compounding • Exponential function ex • Natural logarithm - ln(x) • Mean value of a portfolio in 1 year: – ln(int. value) + (mean ret.+σ2/2)T Now we need “loginv” function for the cutoff point Inverse of the lognormal cumulative distribution function p.213 VaR for 3 asset problem p. 215 p.216