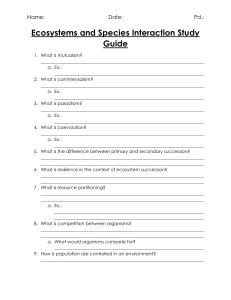

Succession Attack Outline:

PART 1: Successions

Intestate Succession

Order of people in intestate succession:

Community Property

(anything earned through effort by

either spouse during the marriage)

Separate Property

1.

Descendants

1.

Descendants

2.

Siblings (and siblings' children)

2.

Surviving spouse

3.

Parents

4.

Surviving Spouse (not judicially separated)

5.

More remote (than parents) ascendants (895) - nearest in degree excludes all others

6.

More remote (than siblings and siblings' children) collaterals (896) - nearest in degree

excludes all others

Anomalous return if:

(1) Immovable property

(2) Is donated

(3) By the ascendant

(4) And decedent lacks descendants

(5) And the property is found in the succession

1

Filiation

Maternity: established by a preponderance of the evidence that child was born of a particular woman

Requirements to establish maternity:

o Standard of proof: preponderance of the evidence

o Types of proof: by any evidence (testimonial, documentary, scientific)

o Time limitations: at ANY TIME

Paternity

Two ways to establish paternity:

1) A presumption of paternity if:

1. Child is born during the father’s marriage to the mother or within 300 days of the termination of marriage

DISAVOWAL:

o Requirements for HIS disavowal action:

Standard of proof: clear and convincing evidence

Types of proof: testimony of the husband (required); also documentary & scientific

Time limitations: 1 year liberative prescription

General rule: Begins to run the later of…

1) The day of the child’s birth OR

2) The day the husband knew or should have known that he was not

the father

Exception: if the couple lived separate and apart during the 300 days

preceding the birth of the child, then the prescriptive period does not

begin to run until the husband is notified in writing that a party asserts the

husband is the father of the child

o

Requirements for HIS SUCCESSORS’ disavowal action:

Time limitation: 1 year liberative prescription

If prescription commenced before husband died (if while alive, child is born

or he knew/should have known he was the father), prescription

commences against his successors upon the death of the husband

If prescription did not commence before husband died, prescription

commences against his successors when notified in writing that a party in

interest asserts the husband is the father

2.

Child is born within 300 days of the termination AND the mother remarries within 90 days of the divorce

being finalized

3.

Child is born within 300 days of the termination AND the mother remarries within 90 days of the divorce

being finalized AND H1 disavows, H2 is presumed to be the father

DISAVOWAL:

o Requirement’s for H2’s disavowal action:

Standard of proof: clear and convincing evidence

Types of proof: testimony of the husband (required); also documentary & scientific

BUT Time limitations: 1 year peremptive prescription from the judgment of

disavowal by H1

o

Requirements for H2’s SUCCESSORS’ disavowal action:

Time limitation: 1 year liberative prescription:

If prescription commenced before husband died (if child born while he was

alive or if he knew/should have known of the child while he was alive),

prescription commences against his successors upon the death of the

husband

If prescription did not commence before husband died, prescription

commences against his successors when notified in writing that a party in

interest asserts the husband is the father

2

MOTHER’S CONTESTATION ACTION:

o Prerequisites:

(1) Prove that H1 is not the father and prove that H2 is the father

(2) W is married to H2

(3) H2 acknowledges child in authentic act

o Standard of proof: clear and convincing evidence

o Types of proof: testimony by H2 (required); Also documentary & scientific evidence

o Time limitation: dual peremptive periods:

(1) Within 180 days from her marriage to H2, AND

(2) Within 2 years from the birth of the child

THREE-PARTY ACKNOWLEDGEMENT:

o Mother, former husband, and current husband/boyfriend get together and acknowledge

that H1 is not father and H2 is

o

o

4.

Types of proof: 99.9% scientific match is required

Time limitation: Peremptive period of 10 years from child’s birth AND more than 1 year from

child’s death

(1) Child not filiated to another man, (2) Father acknowledges child in proper form and with mother's

concurrence, and (3) Father marries mother

Acknowledgment must be through authentic act after 2016; before 2016, just sign birth certificate

Filiation runs both ways

DISAVOWAL:

o Time limitation: Peremptive period of 180 days from the later of:

1) marriage or

2) acknowledgment

o

5.

Successors of the father can probably disavow

(1) Child not filiated to another man and (2) Father acknowledges child in proper form

Filiation runs only one way (only in favor of child)

2) A judicial action to establish paternity:

1. Child’s action to establish paternity

Prerequisites: None since dual paternity permitted

Standard of proof

o Before father’s death preponderance of the evidence

o After father’s death clear and convincing

Types of proof: All types are relevant. Blood test results of 99.9% create a presumption of paternity

Time limitations: For succession only, one year from father’s death; peremptive

2.

Successors of the child can probably bring an action to establish paternity

Father’s action to establish paternity

Prerequisites: None since dual paternity permitted

Standard of proof: preponderance of the evidence

Types of proof: All types are relevant. Blood test results of 99.9% create a presumption of paternity

Time limitations: depends:

o If child not filiated to another man then none

o If child is filiated to another man then peremptive period:

1) 1 year from birth of child

2) If father was deceived, 1 year from the day he knew or should have known, but

always within 10 years of birth of child

o After child dies, 1 year from death of child

Successors cannot bring this action

3

Surviving Spouse

Who can be a surviving spouse? Valid Spouse and Putative Spouse

Valid Spouse – must have valid marriage. Requirements for valid marriage:

(1) Absence of legal impediment

o Possible Impediments:

1) Existing marriage (bigamy)

2) Same sex

3) Impediment of relationship:

Ascendants and decedents

Collaterals within the 4th degree whether whole or half-blood or adoption (siblings,

aunts/uncles, first cousins)

4) Impediment of age:

No minor under 16 can get married.

If 16 or 17, then can get married only to someone of majority if not 3 years or older (so 16

can marry someone 17 and 18 but not 19)

(2) Marriage ceremony

o Ceremony requires:

(1) Officiant (priests, judges (including retired state judges but not 5th Cir.), as well as anyone w/ license)

(2) Physical presence (no procuration)

(3) Free consent of the parties

o Consent - not free if:

1) Under duress (so fraud and error are okay since divorce is available)

2) Person incapable of discernment (such as someone very young)

Putative Spouse

o How these spouses are treated depends on whether the marriage is a relative or absolute nullity: 1

Relative nullity:

When consent was not freely given

Spouse gets civil effects until marriage is declared relatively null (it is a valid marriage until not)

Remember: Relative nullities are prescriptive and can be raised only by the person who can render it null

Absolute nullity

When there is an impediment, no ceremony, or procuration

Whether they get civil effects depends on good/bad faith of the parties

o Non-bigamous party:

If in good faith, then will get civil effects for as long as they remain in good

faith. Civil effects will continue even after she loses good faith until she

contracts a valid marriage or until the marriage is pronounced null

o Bigamous party:

When in bad faith, he loses his ½ of the property

When in good faith, he keeps his ½ of the property with regard to each

marriage, with his overlapping spouses sharing equally

1

ON EXAM: If there is a bigamous marriage – need to discuss what kind of nullity (absolute or relative) and the effects of the nullity.

Since a nullity renders a marriage as never having existed, then effects that need to be addressed are:

Do the spouses get civil effects (community property)? How much? (depends on if/how long in good faith)

If they have children, then that raises a presumption of paternity issue if the parents were not actually married when

the child was born (only issue for absolute nullities though)

4

Divorce actions – who can bring them? Only that person since it is a strictly personal action (but see Ricks (husband’s succession rep)

and Larocca (wife’s child)). Caselaw shows though that one party can continue the action when the other dies IF there are ancillary

issues in the case (such as property interests, like legacies and testamentary provisions in a will)

Spousal Usufructs

Legal usufruct: (“890 usufruct”): Arises by virtue of law when a decedent dies having community property, the usufruct

or full ownership of which is not dispensed of by testament

o Property: community property only

o Duration: terminates at death or remarriage, whichever occurs first (*regular usufructs end only upon death)

o Security is not owned, unless:

1) The naked owner is not a biological child of the usufructuary (e.g., when naked owner is a step child

of the usufructuary), OR

2) The naked owner is a FH (can demand security only to the extent of the legitime)

2

Testamentary usufruct: (“1499 usufruct”): Arises by virtue of will when decedent leaves any property to SS. Can

burden the legitime of a forced heir

o Property: Community and/or separate property

o Duration: Terminates at death, unless testament says otherwise

o Security is not owed, unless:

(naked owner must request it)

1) The usufruct burdens the legitime of a FH AND the FH is a stepchild of the usufructuary, OR

2) The usufruct burdens the legitime of a FH AND affects separate property, OR

3) The testator requests security in the will

Which law applies when the will just repeats the laws of 890 usufruct? Nowadays, laws of 1499 would apply

Retirement plans: Recurring payments under retirement plan that are classified as community property

o When funded with community property and the non-employee spouse dies while those payments are being

made, then the employee spouse enjoys a legal usufruct over the non-employee spouse’s share in the

payment2

o This usufruct exists “despite any provision to the contrary” contained in a testament

o This usufruct is treated as a legal usufruct, not an impingement on the legitime, so no security is owed

Reason for this = to keep non-employee spouse from willing away their half of the retirement account (goes back to the earner)

5

Marital Portion

This is a protective device. It is an incident of marriage and not inheritance, so cannot be renounced through prenup

Applies when one spouse dies “rich in comparison” to the surviving spouse.

o Standard = 5 to 1 ratio

Right to claim marital portion is personal and nonheritable

It prescribes 3 years from death

Post-Separation Fault Deprives wife of MP. SS doesn’t get MP because adultery is a ground of fault. Reconciliation

wipes any prior fault clean though.

Periodic allowance is allowed during the administration (SS’s portion placed in trust)

Always capped at $1M

Quantum:

No descendants

3 or fewer descendants

4 or more children

o

1/4 of succession

1/4 of succession

A child’s share (count SS as a child)

SS gets full ownership

SS gets usufruct

SS gets usufruct

IF there are descendants and thus SS gets usufruct over the property:

Duration: Usufruct terminates at death

Security is owed if naked owner is child of the decedent but not child of the SS

Other interesting aspects:

If the usufruct is in cash, the SS receives cash in the amount of the percentage value of the

succession. No reduction for “present value” should be made

Deductions: deduct for legacies of cash and “payments” (e.g., social security death benefit,

life insurance, pension payments)

o This means you must figure out what SS is entitled to under marital portion and

take out the stuff she is already getting (so that she doesn’t get more than what she

is entitled to)

6

Absent Persons

Absent person: person who has no representative in this state and whose whereabouts are (1) unknown AND (2) cannot be

ascertained by diligent effort

Absent person’s property:

o If owns property in LA, the state may (upon petition of an interested party with a showing of necessity), appoint a

curator to manage the property

o

What property? Curatorship is limited to SEPARATE PROPERTY

When curatorship is established, the absent person is not deprived of their capacity to make judicial acts.

However, disposition of property is not effective towards third persons and curator unless filed in public

records (in parish where property is) first to file wins

Curatorship ceases if 1) absent person appoints someone else to be the curator or 2) absent person dies

Presumption/Judicial Declaration of Death

How long does someone have to wait before an absent person is presumed dead? Depends on reason:

1) Mere passage of time:

Presumed dead 5 years after absence

Day of death = date of absence + 5 years

Succession is opened as of the date of death fixed in the judgement. So anyone dying within

those 5 years following absence cannot inherit

2) Passage of time following Katrina/Ida:

If the absence commenced between August 26, 2005 – September 30, 2005, and was related to or

caused by Hurricane Katrina or Rita, and if absent person not a felon, then presumed dead after two

years

Day of death = date of absence + 2 years

Succession is opened as of the date of death fixed in the judgement. So anyone dying within

those 5 years following absence cannot inherit

3) Suspicious Circumstances:

Person (1) disappears and (2) death seems certain, then they are presumed dead on the day of the

event. Burden of proof = preponderance of the evidence

Day of death = day of the event

Succession is opened as of the date of the event. So anyone dying after the event can still

inherit

7

Opening of Successions

SUBSTANTIVE PART – Commencement of Succession

Commences at death. Person is dead if:

Doctor declaration:

1) Doctor declares that there is an irreversible cessation of spontaneous respiratory and circulatory functions

2) Person is on life support and doctor declares that there is an irreversible cessation of brain function

3

Judicial declaration:

3) Person disappears under circumstances where death seems certain

4) Military person disappears under circumstances where his branch presumed he is dead

5) Person is absent for 5 years

Simultaneous deaths:

o If you seek to inherit from one, burden is on YOU to prove that they did in fact outlive the other. If you cannot

meet this burden then:

All of H’s separate property + ½ of community property goes to H’s family

All of W’s separate property + ½ of community property goes to W’s family

o

BUT: For life insurance, you are presumed to have outlived your beneficiary (so that if a policy holder and their

named beneficiary die together, the proceeds go to the policy holder’s family and not the family of the named

beneficiary) – assuming no contingent beneficiary

Transferring ownership and possession of decedent’s estate

o Universal successors acquire ownership of the estate and particular successors acquires ownership of the things

immediately at the death of the decedent. If no will, all are universal

Regardless of whether the successor accepted or not, his rights are transmitted to his successors upon his

death

o

HOWEVER, there is SEIZIN:

Defined: The legal investiture of one class of heirs with possession of the succession upon the death of the

decedent, enabling those heirs to bring all actions the decedent could have brought (NOT ownership). The

ability to exercise rights:

Personal rights before a succession representative is qualified, only a universal successor may

represent the decedent with respect to the decedent’s heritable rights and obligations

[So

particular legatees do not have seizin]

Property rights before a succession representative is qualified, a successor may exercise

rights of ownership with respect to his interests in a thing of the estate or in the estate as a

whole.

o

o

If a successor sells something but the estate needs it back to pay costs, then estate takes it back

Person with seizin can kick out owners while administering estate. Owners can 1) seek to remove the

administrator, or 2) can petition for possession

There exists “conditional seizin” you can make seizin conditional/can suspend seizin, but only up to 6

months. When condition is fulfilled, there is retroactive application

Tacking possession: Tacking possessor is basically a continuation of the decedent

o A universal successor continues the possession of the decedent with all its advantages and defects,

and with no alteration in the nature of the possession.

o A particular successor may commence a new possession for purposes of acquisitive prescription

8

PROCEDURAL PART – Judicial Opening of Succession

Succession proceedings are not required to transfer ownership of the estate (that’s substantive). All proceedings culminate

in a “judgment of possession” (JOP)

o JOP is prima facie evidence of the relationship of the deceased to heirs/legatees and of their rights in the estate

o

JOP is an act declarative of title; not translative of title (doesn’t give you more rights than you already have absent the JOP)

Succession procedure:

1) Simple possession without administration

Intestate: available if heirs are competent, heirs accept, and estate is relatively free of debt

Testate: available if all are universal and general legatees, all are competent, all agree, and no

creditor has demanded an administration

What it entails:

o Petition to probate a will (if applicable)

o Petition for possession

o Affidavits (2) of death, domicile, and heirship

o Detailed descriptive list of assets (to show relatively free from debts)

o JOP

Note: Small successions pay lower court fees (this is only for estates worth $125k or less, or if death

occurred 25 years before filing)

Administration (when situation is more complicated; needs supervisor)

2) Formal administration (no one does this anymore)

What it entails:

o Succession representative

Intestate: administrator (chosen by court)

Testate : executor (chosen by will, or court)

o A fiduciary, charged with “collecting, preserving, and managing the property” as a “prudent

administrator”

o Dealing with creditors, managing estate property, accurate accounting

o All the same procedures for “simple possession” PLUS

Confirm/appoint succession rep; detailed list; collect/preserve/manage assets

(seizin); pay debts; close succession, etc.

3) Independent administration

The independent administrator exercises the rights and duties of succession rep without actually

being appointed by court. Designed to reduce the time and expense of administering the estate.

What it entails: All the same procedures for simply putting into possession, BUT…

o No need for court approval for administrator’s actions

o No need to file annual accountings

Not discretionary (not up to the court to decide if you get one) if

1) Testator has demanded it (put in the will), or

2) All successors agree

Notes:

o JOP is not required for ownership to transfer – they’re sometimes helpful, but you don’t need them. When

someone dies, the rights transfer to successor immediately. Burden is on the defendant to prove it did not.

Usually, defendant cannot require you to get a JOP. HOWEVER, EXCEPTIONS:

Insurance companies, for policies payable to the estate, can require a JOP, as can banks and certain

corporations, before paying out proceeds under a policy. Statutes also give them immunity if they

pay the wrong person.

Life insurance:

First, life insurance is a non-probate asset – it first goes to named beneficiary.

Second, if no beneficiary, must prove you are the only heir

Third, even if she is the only heir, insurance company can require JOP

9

Loss of Succession Rights

Reasons to not inherit: 1) incapacity or 2) unworthiness

1) Incapacity = incapable if doesn’t exist at the time of the decedent’s death

Capacity = existence at the time of the death

o Existence = alive. But also includes those conceived before decedent died and born alive after decedent died.

But if not born alive, then deemed never to have existed

What is conception though? Does it include in vitro fertilization? Yes, if born alive, but does it have to

be implanted first? Does it include posthumous conception?

2) Unworthiness

Declared unworthy if:

1) Convicted of a crime involving the intentional killing, or attempted killing, of the decedent, OR

2) Judicially determined to have participated in the intentional, unjustified killing, or attempted killing (such as

civil suits for wrongful death)

o

o

Includes conspiracy but excludes involuntary manslaughter

Other notes:

Unworthiness action is brought in the succession proceeding

An executive pardon or pardon by operation of law does not affect the unworthiness of a successor

BUT Cannot be declared unworthy if:

o If successor proves reconciliation or forgiveness by decedent

o Action prescribed: unworthiness claims are subject to liberative prescription

Must bring action within 5 years of the decedent’s death for intestate successors

Must bring action within 5 years of probating will for testate successors.

Who can bring unworthiness action?

o Only a person who would succeed in place of or in concurrence with the successor to be declared unworthy,

or by one who claims through such a person.

But if that person is a minor or interdict, then the court, on its own motion, or on the motion of any

family member, may appoint an attorney to represent the minor/interdict for purposes of

investigating and pursuing an action to declare a successor unworthy.

Effects of declaring someone unworthy:

o Takes away succession rights. Property gets diminished and you have to return it

o Also, testator shall be removed as executor, trustee, or attorney in intestate or testate

Devolution of succession rights of successor declared unworthy

o If decedent dies intestate:

When successor is declared unworthy, the unworthy successor’s succession rights devolve as if he

had predeceased the decedent (ignore the unworthy person)

o

If decedent dies testate:

When successor is declared unworthy, the unworthy successor’s succession rights devolve in

accordance with the provisions for testamentary accretion as if the unworthy successor had

predeceased the testator

o

When a parent is deemed unworthy and the succession rights devolve to their child, they cannot claim a legal

usufruct upon the property inherited by their child

Summary: When can someone not be declared unworthy?

1) When they were not convicted of killing/attempting to kill decedent

2) When they were not judicially determined to have participated in killing/attempted killing of decedent

3) When they reconciled with decedent/decedent forgave them

4) When they are an intestate successor and it has been over 5 years since decedent’s death

5) Whey they are a testate successor and it has been over 5 years since probating the will

10

Acceptance and Renunciation Succession Rights

General rules

Don’t have to accept

Can also partially accept

Once a successor accepts or renounces, the decision is irrevocable

When one renounces, they are treated as dead

Timing of acceptance/renunciation

o Need to know (1) that the decedent died and (2) successor had rights as a successor

o Premature acceptance is absolutely null

Form > substance for purposes of renunciation: if someone renounces his intestate rights and then finds out he was in

the will, he has not renounced

Other matters:

o Conditional legacies – may be accepted before OR after condition satisfied

o Retroactivity – the effects of acceptance/renunciation are retroactive to the death of the decedent (CC 954)

If I renounce, I never had those rights. Went right to daughter - this is good for creditor reasons

o Successor/creditor – a successor who is a creditor does not impact his claim against the estate as creditor

through acceptance/renunciation

Acceptance

Can be formal or informal

o Formal acceptance: in writing or judicial proceeding

o Informal acceptance: act that clearly implies one’s intention to accept

Simply preserving estate is NOT tacit acceptance since anyone can do that. BUT selling property is

informal acceptance only an owner can do that

In the absence of a renunciation, one is presumed to accept. But, for good cause, court may compel one to choose

Effects of acceptance: ownership, seizin, and liability for debts

o Liability for debts

ONLY a universal successor is liable for estate debts in proportion to the part he has in the succession,

BUT only to the extent of the value received by him, valued at the time of receipt. Broken down:

Estate debts = debts of the decedent and administration expenses.

o Debts of the decedent: decedent’s obligations or those obligations arising as a

result of his death (funeral expenses)

o Administration expenses: obligations incurred in the collection, preservation,

management, and distribution of the estate of the decedent.

Proportional liability: each successor is liable for % of the liability. but it is limited to amount

of property received (so would never have to take money out of their own pockets)

Direct liability to creditors vs. responsibility of successors among themselves

Rights of Creditors (vertical effects)

o If there is a judicial proceeding, universal successors who have accepted are directly

liable to creditors for debts. Particular successors are not personally liable to creds

o After universal successors have paid creditors or after the administrator (if there is

an administration) has paid creditors, responsibility for debts is worked out as

shown below in “rights of successors among themselves”

o If creditor asserts claim after other creditors have been paid pursuant to a court

order, claim must be satisfied in this order:

Assets remaining under administration

Successors to whom distribution has been made

Unsecured creditors who received payments

11

Rights of successors among themselves (horizontal effects)

o Universal successors have the ability to talk with creditors, and may agree to pay off

the mortgage, and then they can go after the rest of the successors to be paid back

o Unless otherwise provided by the testament/ successor agreement/ law, estate

debts are charged against the property of the estate and its fruits/products as

follows:

**Default: Charge universal successors ratably

But exception for identifiable debt and encumbered property:

Estate debts attributable to identifiable property or to the

production of its fruits/products are charged to THAT property

and its fruits/products.

Also, when the decedent has encumbered property to secure a

debt, the debt is presumptively charged to THAT property and its

fruits/products. But can rebut this presumption by showing by a

preponderance of the evidence that the secured debt is not

attributable to the encumbered property

o How this works out: the universal will pay the bills and

then will charge the person getting the property (the

particular successor). For example, if mortgage taken out

not to buy the house but to start a business, then

wouldn’t go after the person receiving the house

Renunciation

Renunciation must be:

(1) express and

(2) in writing

How it works: In BOTH intestate and testate successions, rights accrete to universal successors as if the renouncing

successor predeceased the decedent

o For intestate successions: “Quasi-representation” when representation is allowed. This is not really

representation because the person that renounced is still alive, but we pretend that she is dead (same effect

as when deemed unworthy) 3

o

3

If truly don’t want any property, then must renounce both the succession and the accretion if more than one

successor renounces:

Donative renunciation: donative renunciation is not really renunciation; it is an acceptance of the succession and

donation of the succession to someone who would not usually be entitled to it

Revoking renunciation:

(1) You can contract away your own succession but not what you will receive from another’s succession (third

party not in k)

o The rule that states that an individual cannot contract on the succession of a living person applies

only when two people are contracting on the succession of a third party who is not involved in the

contract; law has always allowed an individual to contract in his own succession.

(2) A promise to leave something in your will in return for counter-performance is an enforceable, onerous

contract (detrimental reliance)

o Art. 1967 cmt. f: A promise to make a disposition mortis causa is enforceable against the promisor’s

estate when the formal disposition is not made.

o But if purely gratuitous, then unable to recover for breach

But remember, representation only works for children and descendants of brothers and sisters (nieces and nephews, not cousins)

12

Prescription

o Successions are subject to a 30 year liberative prescription commencing upon death; means that if successors

don’t accept succession within 30 years of the death, then cannot accept it

o

BUT may still prescribe before 30 year-mark due to acquisitive prescription between co-owners

A co-owner (or his universal successor) may commence to prescribe when he demonstrates by overt

and unambiguous acts sufficient to give notice to his co-owner that he intends to possess the

property for himself. The acquisition and recordation of a title from a person other than a co-owner

thus may mark the commencement of prescription.

o

Note: Also a 30-year prescription on the right of partition

Acceptance by Creditor

o A successor’s creditor may (with judicial authorization) accept succession rights in the successor’s name if the

successor has renounced them in whole or in part to the prejudice of his creditor’s rights. When this happens,

the renunciation may be annulled in favor of the creditor to the extent of his claim against the successor, but it

remains effective against the successor.

This is the cousin to oblique/revocatory actions

Revocatory action - If do something to increase the insolvency of a creditor to prejudice the creditor

o

(e.g., give property to brother before creditor come after you), creditor can revoke that action

Oblique action - rather than giving away property, suppose brother owes you something but you tell

him not to pay you because then the creditor can come and take the property. Can force brother to

pay you so that the creditor can then take it

Requirements for a creditor to be able to do this:

(1) Have judicial authorization

(2) Prove “prejudice” to creditor’s rights

(3) AND prove fraudulent intent

See Succession of Neuhauser La. Supreme Court held that fraudulent intent is required

to allow a creditor to accept the succession in the renouncing successor’s name.

So it adds to code article - what you have to prove: have to show fraudulent intention on the

part of the successor. While fraud is not mentioned in the article, the court is analogizing to

the old articles on revocatory actions which used to require the showing of fraud.

Since the case, it has been revised but still doesn’t say fraud is required. Nonetheless, they

interpret 967 as containing a requirement that fraud be proven

13

Collation

Collation: the return of property which was received in advance of his share so that the property may be divided together

with the other effects of the succession

o Children/grandchildren, coming to the succession of their fathers/mothers/other ascendants, must collate what

they have received from them by donation inter vivos and they cannot claim the legacies made to them unless

the donations and legacies have been made to them expressly as an advantage over their coheirs

**Default: Collation is presumed

o But no collation if:

1) The donor dispenses with collation (opts out)

2) Or the law exempts a gift from collation 4

Disposing of collation:

o Substantive requirement: Decedent must have the intent to dispense with collation.

Reasons for collation: 1) Mom and Dad love every child equally; 2) What a child receives from his

parents while they are alive is an advance on his inheritance.

Declaration must be explicit. Declaration must, in equivalent terms, say that he intends the

gift/legacy to be an advantage or extra portion

The following two cases together show that for inter vivos you must be more clear than for legacies:

Jordan v. Filmore rule: Legacies are NOT collated. A bequest of the entire estate (or

disposable portion) to one child to the exclusion of another dispenses with the obligation of

the legatee to collate the legacy (this was enough)

Succession of Fakier rule: Parent’s desire to have her 3 children “share equally” in the

amount received does NOT constitute a dispensation from collation (needs to be more

specific – this was not enough)

While collation is only subject to 3 years, can go back farther if you want. 3 is just the default

o

4

Formal requirements: Need dispensation via one:

1) The act of donation

2) A subsequent authentic act

3) The will & testament --- easiest option

IF put blanket dispensation - covers both prior gifts and future gifts

Note: Art. 1235 - disguised donations are donations of the immovable itself and are collatable only if

made within 3 years from death (from notes)

BUT, for manual gifts facts and circumstances: Looser form requirement for corporeal movables

If the facts and circumstances surrounding the donation are strong enough, that might be

sufficient.

Donee would have the burden of establishing the intent to dispense by STRONG AND

CONVINCING PROOF so as to overcome the presumption of collation

o Succession of Fakier and Succession of Gomez: Both held that if dealing with a

corporeal movable, can exempt something from collation without the formalities as

long as there is strong and convincing proof to overcome the presumption

LIMITS ON COLLATION:

1. Applies only to gifts given within 3 years of parent's death

2. If within 3 years, subject to collation unless subject to one of the exemptions

3. Only person who can make a demand for collation is a forced heir of the first degree (23 years or younger or permanently

incapable, and must be decedent's child)

14

Things not subject to collation:

o Expenditures

Expenditures for board, support, education, and apprenticeship are NOT subject to collation. Not

collated: Food, Housing, School (all school is covered), and marriage presents

o

Gifts

o

Arms-Length Business Transactions

Do not collate the profit one makes from contracts with his parents, unless the contract gives the

child advantage

Also, no collation is due for a partnership made without fraud, if the partnership is proved by an

authentic act (art. 1247)

o

Simulated Sales

When a father has sold a thing to his son at a very low price, or has paid for him the price of some

purchase, for [or] has spent money to improve his son’s estate, all that is subject to collation.

Gifts “by their own hands” that are “usual and customary” that are for their “pleasure or use” are

NOT subject to collation

According to Fakier this does not refer to all manual gifts, but only manual gifts that are

“usual and customary” (i.e., birthday gifts, holiday presents, etc.)

Simulations may be absolute or relative

Absolute - mom and son execute an act of sale in which mom purports to sell her house to

son. In fact, neither party intends a transfer of any kind

o Not really selling it (or giving it away at all), just pretending like I am

Relative - mom and son exclude an act of sale in which mom purports to sell her house to

son. In fact, the parties intend that the transaction is a donation

o Not really selling, really giving it away -- subject to collation because really a gift

o

Other Advantages

Technically, “any advantage” received by a child is subject to collation BUT Courts have imposed “de

minimus” exception, in which in situations where child did work in return, and value was really so

little when balanced together, court will not collate it

o

Collation of Debts

When a debt owed to the deceased has been the object of a remission by the latter, there is actually

a donation, subject to collation as such

o

Collation of Fruits

Must collate fruits/revenue of the thing being collated only for those fruits earned after written

demand. Thus, all fruits gathered BEFORE someone demands collation are NOT subject to collation;

but all fruits gathered after demand IS subject to collation

Who receives collation?

o Only descendants in the first-degree who qualify as FHs

o NOT FHs by representation since not in the first degree. Yet they still must collate in favor of other FHs

15

Who must collate?

o All children and grandchildren called to the succession

o Special rules for grandchildren: Must collate if affirmatively answer these 3 questions:

(1) Did the grandchild get the gift while in the quality of an heir (heir in intestacy if grandparent died

right then when got the gift)

(2) If situation is such that the parent who has predeceased grandparent got the gift, then grandchild

only has to collate if representing the parent that got the gift

(3) Must be a FH

o

Avoiding collation

If children, or other lawful descendants holding property or legacies subject to be collated, should

renounce the succession of the ascendant, from whom they have received such property, they may

retain the gift, or claim the legacy to them made, without being subject to any collation.

If, however, the remaining amount of the inheritance should not be sufficient for the legitimate

portion of the other children, including in the succession of the deceased the property which the

person renouncing would have collated, had he become heir, he shall then be obliged to collate up to

the sum necessary to complete such legitimate portion.

o

Other considerations

Creditors of forced heirs cannot demand collation on the forced heirs behalf (unless in bankruptcy)

The testator may demand collation in the last will and testament, in which case collation takes place

according to the dictates of the will

Prescription: The right to demand collation is subject to dual prescriptive periods:

(1) 10 years from the death of the decedent AND

(2) And once heirs unconditionally accept a succession and obtain a JOP

o Also, the right to demand collation is cut off by a JOP in which the child is recognized as an heir

How Collation is Made

Collation is made 1) in kind or 2) by taking less

o Immovables - the donee has the option to choose whether to collate in kind or by taking less

Exception - the testator can require the donee to collate in kind

o Movables - the donee must collate by taking less. If the gift was one of money, the donee can pay money to

the estate

Valuation

o Donee is required to collate the value of the gift at the time the gift was made

o This conflicts with other provisions of the code - other articles say that value when succession is opened (when

decedent dies); since above rule is newer, assume it is right

16

PART 2: Donations (Inter Vivos and Mortis Causa)

General Dispositions

Two Types of Donations = inter vivos or mortis causa

Donation inter vivos – contract by which a person (donor) gratuitously divests himself of a thing in favor of another

(donee), who accepts it

o Present, irrevocable divestiture

o Requires authentic act unless exception applies

Donation mortis causa – Act to take effect at donor’s death in which he dispenses of whole/part of property

o Unilateral (don’t need 2 people), juridical act (has legal effect, meaning voluntary and intended)

o It is revocable during lifetime

o NOT a contract

What is not allowed?

1. Donation “a cause de mort”

o Inter vivos donation that became definitive only upon the death of the donor (could be revoked by donor

during lifetime). Deemed as never having been made if donee predeceased the donor

o Examples:

2.

Conditional donations if dependent on WHIM of donor

o “I leave you my property if you outlive me” conceptually allowable because you are presently divesting

yourself of something. I can’t sell it to someone else, because pending the fulfillment of the thing (my death),

you have a right to the thing.

o Therefore, only valid if you are currently divesting yourself of something – irrevocable.

Reading the articles together, they say that a condition dependent on the whim of the donor is NULL

but a condition dependent on the will of the donor is valid

3.

Common law methods of transferring ownership, including

o Joint tenancy with the right of survivorship Listing an individual on a joint account is NOT a valid DIV

o

Pay on death bank accounts

Does not help successors. When a person dies, the bank pays out the money to the listed beneficiary.

That does NOT mean the beneficiary owns the money though, since succession law could affect this

(if put gf as beneficiary, wife could still bring action to claw back the funds). Therefore, by bank

paying the beneficiary, they are not actually transferring ownership from the decedent to the

beneficiary

Pay on death Statutes:

Form requirement – Affidavit in authentic form or act under private signature executed in

the presence of a bank officer

This does not effect a transfer of ownership

o

Transfer of deposit to spouse:

If a decedent dies intestate, bank may disburse funds to heirs/spouse – up to 20k from all

deposit accounts

Form requirement – Affidavit of death and heirship

Does not effect a transfer of ownership

Transfer on death securities (TOD)

Brokerage/investment accounts: other states allow a person listed as a transfer of death beneficiary

of those financial assets. Not Louisiana

17

o

Exceptions though: “Other Allowable Gratuitous Transfers”

1.

Life insurance beneficiary designations

Enforceable pursuant to state statutory law

Exempt from claims of other successors, creditors of the estate, and creditors of the

beneficiary.

Exempt from claims for reduction and collation, as explained below:

o Life insurance proceeds are exempt from the claims of heirs and legatees of the

decedent and creditors of the decedent

o Life insurance is exempt from the claims of the beneficiary's creditors

o Life insurance proceeds are exempt from claims of FHs for reduction

o Life insurance proceeds are exempt from collation

2.

Annuity death beneficiary designations

Gratuitous; Take effect at death, no will or authentic act required

Enforceable pursuant to state statutory law

Exempt from the claims of successors and creditors

NOT exempt from claims of FHs for reduction or collation

3.

US Savings bond co-ownership and death beneficiary designations

Gratuitous; Take effect at death, no will or authentic act required

Enforceable gratuitous dispositions pursuant to federal preemption

Exempt from claims of successors and creditors

Exempt from claims of FHs for collation (bc of Osterland)

NOT exempt from claims of FHs for reduction (bc of Guerre, but shaky grounds)

Retirement account and pension death beneficiary designations

Take effect at death, no will or authentic act required

Enforceable gratuitous dispositions, as a result of LA jurisprudence and state statutory law

Exempt from the claims of successors and creditors

Exempt from the claims of FHs for reduction

Exempt from the claims of FHs for collation

18

Capacity to Give and to Receive

(1) MUST HAVE TRADITIONAL CAPACITY

Capacity to receive:

o Donee must exist

Donation inter vivos: Must exist at the time the donee accepts the donation

Donation mortis causa: Must exist at the time of testator’s death

BUT if conditional: Must exist at the time the condition is fulfilled

o

In order to exist, must have legal personality:

Natural persons (humans) receive legal personality at live birth, or when a child is conceived and later

born alive. Therefore, child must at least be in utero at the time of the donation (at testator’s death for

mortis causa; when accept donation for inter vivos)

BUT posthumous conception allowed (child not yet in utero at time of donation) if:

(1) Child born within 3 years of death of decedent

(2) To the SS of the decedent

(3) And the decedent authorized the use of gametes in writing

Juridical persons – entities to which the law gives legal personality

Corps, LLCs, pships, and some unincorp. associations (depends on whether had intent to create

an entity with distinct personality, not simply a group of people). But NOT cemetery funds

However, court will sometimes bend over backwards to find a donation valid:

o If will calls for an entity to be established, then court may find it as having capacity even

though not in existence yet by concluding that the donation was actually conditional or

that the donation was not actually to the entity but for the benefit of those served by it

Capacity to Give

o Capacity is presumed. However, some persons lack capacity:

1. {some} minors

2. Interdicts

3. Persons deprived of reason

o

Incapacity to give is based on Quantitative and Qualitative standards

Quantitative standard is about age

Qualitative standard is about mental capacity

Must be able to comprehend generally the nature and consequences of the disposition he is

making. This is the ability to understand, not the actual understanding of the donation.

Therefore, the donor need not understand the exact instrument or technical details

Proving incapacity: Capacity is presumed, so opponent’s burden

(1) Clear and convincing evidence

Types of proof:

o Illness, age, delusions, sedation, unusual behavior

o Med records and expert testimony

o First-hand accounts of friends/family

o Psychological autopsy

(2) That donor lacked capacity at the time the gift was made

But lucid interval doctrine – show they were lucid for the general amount of time

CAPACITY TO GIVE

Age 16 or less

MINORS

Ages 16-17

Can donate both only to spouse and children

Can donate mortis causa to anyone

Can donate inter vivos only to spouse and children

BUT if emancipated

INTERDICTS

Full interdict

Limited Interdict

May gain capacity for both

Cannot donate both to anyone

Property under

curator’s authority

Lack capacity for inter vivos

Presumed to lack capacity for mortis causa

Property not under

curator’s authority

19

Presumed to lack capacity for both

(2) MUST HAVE FREE CONSENT

Vices of consent

1) FRAUD5

(1) A misrepresentation or suppression of the truth

(2) Made with the intent to obtain an unjust advantage or cause a loss

2) DURESS

(1) Cause a reasonable fear of unjust and considerable injury

(2) To a party’s person, property, or reputation

Donation is declared null if it is the product of fraud or duress. But the act may be severable (may sever the portion

affected by the vice and uphold the rest).

3) UNDUE INFLUENCE6

(1) When a donee or someone else’s influence so impaired the volition of the donor so as to substitute the

volition of the donee/other for the volition of the donor

Donation is declared null if it is the product of such influence

Remember, capacity is a threshold question still. The closer a donor is to lacking capacity, the more likely

it is that the influencer can substitute his will for that of the donor. Often brought together 7

Burden of proof for proving fraud, duress, or undue influence:

o Clear and convincing evidence (default)

o Exception: Preponderance of the evidence IF

(1) At the time of the donation or execution of testament

(2) The wrongdoer was in a relationship of confidence with the donor

(3) The wrongdoer was not related by marriage, blood, or adoption

5

6

7

Usually, fraud must be pretty egregious to vitiate consent

Note: Doesn’t exist for contracts, only donations

EXAM TIP: first allege incapacity, then allege undue influence

Usually 3 kinds of cases:

1. Parent leaves everything to 1 kid

2. Dad remarries and leaves everything to her

3. Old person leaves everything to errand boy/housekeeper

20

FORCED HEIRSHIP:

TERMS

Forced heirs: Certain descendants who are entitled to a certain % of a person’s estate. Who that includes:

1) First degree descendants that are…

a) 23 years of age or younger

(those not yet 24)

b) Permanently incapable at the death of the decedent, or

“Permanently” applies to duration NOT severity; thus, temporary incapacity never counts,

regardless of severity

c)

Potentially incapable in the future

Must meet all requirements:

(1) Disease or condition

(2) Inherited

(3) Incurable

(4) Medical documentation

(5) At the time of the decedent’s death

2) Representatives of the decedent’s predeceased descendant and…

a) The predeceased descendant would’ve been 23 years of age or younger at the decedent’s death

i.e., baby’s mom dies. Then baby’s grandma dies. If mom would have been 23 or younger when grandma

died, then baby can stand in the shoes of mom and receive property

b) Representative is permanently incapable

~~ regardless of anyone’s age ~~

i.e., if grandchild is permanently incapable and mom predeceased grandma, the grandchild can inherit from

the grandma regardless of whether grandchild’s age and regardless of whether mom would’ve been < 24

Forced portion: What is susceptible to reduction via forced heirship

Legitime: What each FH receives out of the forced portion

o If someone renounces, is declared unworthy, or is disinherited, his legitime reverts to the disposable portion and

the forced portion is thereby reduced. Thus, do not recalculate everyone’s legitime – they still get the same

amount

o FHs received their legitime in full ownership, free of all conditions, charges, or burdens. BUT permissible burdens:

1. Spousal Usufruct – okay to subject legitime to usufruct in favor of SS; FH would get legitime fraction

in naked ownership.

The usufruct can affect community property and/or separate property

Terminates at death by default

Security not automatically required but may be demanded if: 1) Testator requires; OR 2) FH

is stepchild of SS AND FH is naked owner and usufruct affects both legitime and separate

property

SS may be granted additional powers to dispose of nonconsumables

2. Legitime in trust (ok to subject legitime to trust as long as FH is both the income beneficiary and

principal beneficiary… this is deemed full ownership)

Disposable portion: The part of the estate in which the decedent can freely give away

RIGHTS OF FH’S (primary ways to satisfy the forced portion):

Reduction (aka “fictitious collation”) – reducing donations inter vivos and mortis causa that impinge on legitime

o Each FH is entitled to their legitime. If donations inter vivos or mortis causa impinge on that legitime, the FH can

bring an action to reduce the excessive donation

Collation – reducing donations inter vivos given by parents to descendants

o Ensures each child is treated equally

21

CALCULATING ACTIVE MASS & LEGITIME

STEP 1: Calculate the active mass

Active mass = Net Estate + Value of Donations Made Within 3 Years )

o

Net estate = aggregate value of property – debts

Aggregate property = generally all movables and immovables at the date of decedent’s death

Movables: all included as long as decedent is domiciled in LA

Immovables located in LA are included unless both decedent and FH are not domiciled in LA

Immovables not located in LA are included only if both decedent and FH are domiciled in LA

o

But net estate does not include:

o Life insurance proceeds8

o Retirement accounts and pension benefits

o Annuity death benefits

o US Savings bonds naming beneficiaries

Debts = all debts owed by decedent + admin expenses

If net estate is a negative number, zero it out. Cannot be a negative number

Donations:

Included: US Savings bonds and Annuities

Excluded:

Life insurance proceeds

Retirement accounts and pension benefits

Some Remunerative donations and Onerous donations9 (exclude if the value of the condition >

2/3 gift value

Donations during marriage to former spouse (even if within 3 years)

STEP 2: Calculate the forced portion, since forced heirs together are entitled to that portion

Forced portion = Active mass x applicable fraction )

1 FH 1/4 of the estate

2 or more FHs 1/2 of the estate

STEP 3: Calculate each FH’s legitime

o

FHs in first degree inherit by heads, those via representation inherit by roots

BUT Greenlaw rule if fraction that would otherwise be used to calculate the legitime is greater than

the fraction of the decedent’s estate to which the FH would succeed by intestacy (regardless of whether

actually use intestacy or not), then use the fraction of intestacy instead

In other words, if have 5 or more kids, then have to use intestacy fraction (since with 5 kids, each kid gets

1/5 in intestacy but if 1 is a FH, then he would get ¼, so have to use 1/5)

8

EXAM TIP – this is an easy loophole. Just take all your money and put it in a life insurance policy and name kids as beneficiary. That

way it is excluded from this calculation

9

Onerous donation = I give you a gift card for $120 on condition you do legal research for me

Remunerative donation = to repay you for 5 hours of legal research, I give you a gift card worth #120

22

SATISFYING THE LEGITIME

STEP 4: Impute property ALREADY received by FHs

(Each heir’s legitime – property received already – property subject to collation) =

o

. Remainder of .

legitime still. .

needing to be..

. satisfied

.

Property needing to be imputed:

Property received by intestacy

Property received by testament

Proceeds of insurance policies (if FH is beneficiary)

Proceeds of retirement plans

Property subject to collation (includes donations inter vivos made within 3 years of death if collatable)

STEP 5: Distribute available assets (those remaining in the succession)

o Available assets = net estate, which is net assets – debts

STEP 6: Reduce excessive donations in this order:

1. Donations mortis causa

a. Exhaust universal and general legacies first

b. Then Particular legacies in this order:

i. Money legacies

ii. Legacies of groups or collections of things

iii. Legacies of specific things

2.

Donations inter vivos within last 3 years, exhausting most recent donations first

If a donee is insolvent, skip them and go after the next. They can bring action against the skipped donee

Remunerative and onerous donations – not reducible unless the condition is worth less than 2/3rd of the

value of the things given, in which case you reduce the gratuitous component only

Fruits and products derived from DIV – not reducible unless they are accrued after written demand for

reduction has been made

o

Note on reducing legacy to SS: Must reduce only the extent necessary to eliminate the impingement on the

legitime. If H dies leaving entire estate to W, then reduction would simply be giving naked ownership to FH with

usufruct to W

Prescription: subject to 5 year liberative prescription (for both annulling testament and reducing excessive donation)

23

Disinherison

Must be:

(1) Express

(2) For just cause

12 allowed “just causes”:

1. Child struck parent or almost did

2. Child has been cruel towards parent or committed crime/grievous injury to parent

3. Child attempted to kill parent

4. Child, without reasonable basis, accused parent of committing a crime punishable by life

imprisonment or death

5. Child used any act of violence or coercion to hinder parent from making a testament

6. Minor child married without the consent of parent.

7. Child convicted of a crime punishable by life imprisonment or death

8. Child, after turning 18 and knowing how to contact parent, failed to communicate with parent

without just cause for a period of 2 years, unless the child was in military

Cause must have occurred before executing the instrument

Grandparents can disinherit grandchild for all reasons except #6 (marriage)

Testator must express in the instrument the reason, facts, or circumstances constituting cause. The

reasons are presumed true but can rebut by preponderance of the evidence. Person being disinherited

must be identified or otherwise identifiable.

3 ways to challenge the disinherison

1) Rebut by preponderance what you did/the cause

2) Prove reconciliation by clear and convincing evidence

3) Prove by a preponderance that you were incapable of understanding the behavior

4) Show by a preponderance that the behavior was unintentional or justified

Donations Omnium Bonorum act of giving all your property away while alive. Makes the donation absolutely null,

therefore the action is imprescriptible. Can only be brought by the donor and his FHs

24

Prohibited Dispositions

Those dispositions that have some kind of restriction/charge that is against law/morals. Therefore, the condition is

inapplicable and donee gets to keep the property anyway.

3 baskets of cases:

1. Restrictions on alienation: Provision giving property to someone but conditioning it by saying they can never

sell it or saying they cannot sell for x years.

But court upheld provision that person could use property if they don’t mortgage it for 10 years

2.

Restrictions on marriage: Give property to someone and say you get it provided you don't get married)

But courts have held that provisions restricting remarriages are okay, and provisions postponing

someone’s marriage is okay since not actually restricting the ability

3.

Penalty clauses / interarm clauses: Provisions in wills saying you give property to these people and if anyone

challenges your will they get nothing). Courts have side-stepped addressing whether this is allowed though

Prohibited substitutions:

o Cannot transfer property to another on condition that they give it to another upon their death

o

The 3 elements of prohibited substitutions: (from Baten v. Taylor)

(1) A double liberality, or a double disposition of full ownership, of the same thing to persons called to

receive it, one after the other

But has to be upon DEATH. If instead has charge to preserve and remit after for example 30

years, then NOT prohibited substitution.

(2) Charge to preserve and transmit, imposed on the first beneficiary for the benefit of 2nd beneficiary

(3) Establishment of a successive order that causes the substituted property to leave the inheritance of

the burdened beneficiary and enter into the patrimony of the substituted beneficiary

o

If can read as allowable and unallowable, read it as allowable

Allowable: Non-explicit usufructs

Provision giving property to brother for his sole use and at his death, to his other brother’s kids.

Allowed because really usufruct to first brother and naked ownership to kids, then all goes to

kids upon his death

Allowable: Residual substitutions

Situation where give property to someone and if anything is left over, then gives to another

o

Not allowable: Joint usufruct with sole ownership going to whoever outlives the other. Not prohibited

substitution since full ownership is only going to one, but still not allowed since takes naked ownership out of

commerce for too long

o

Allowable: Vulgar substitutions – allows testator to name a substitute legatee in the event that the first legatee

does not accept the legacy (i.e., if predeceases the testator)

25

TYPES OF CONTRACTS

Gratuitous (Donations

Onerous

Lease

Sale

Inter Vivos)

Exchange

Purely Gratuitous

Mixed Motive

Transactions

Remunerative

Repayment for the past (2/3rds test:

at the time of the donation, the value

of the service must be less than 2/3rds

of the value of the thing donated)

Onerous

Obligation in the future (2/3rd

test: at the time of the donation,

the value of the service must be

less than 2/3rds of the value of the

thing donated)

Donations Inter Vivos

Donation inter vivos = Contract by which a person (donor) gratuitously divests himself at present and irrevocably of the thing given

in favor of donee, who accepts it.

Requires a PRESENT, IRREVOCABLE divestiture

o No donations of future property

o No donations conditioned upon the will of the donor

o No donations burdened with an obligation to pay future debts (unless debts are expressed in the act of donation)

Requirements for Donating the Property:

Substantive requirement: Gratuitous Cause (i.e., “donative intent”)

o Must be clear. The donor may impose on the donee ANY charges/conditions he pleases, provided they contain

nothing contrary to law or good morals

Donor may stipulate that the donee return the thing ONLY if the donor outlives the donee or outlives both

the donee and donee’s descendants

Condition that parent get gift back if they outlive the child valid

Condition that other sibling gets gift if the parents outlive the other child invalid, prohibited substitution

EFFECT: Returns to donor free of any alienation, lease, or encumbrance made by donee or

successors of donee. But no right of return if donee sells the thing to a transferee in good faith.

Instead, the donee and his successors are accountable to the donor for the loss

Formal Requirement: Authentic Act – notary and 2 witnesses. They must sign after both donor and donee sign

o Without authentic act, donation is an absolute nullity. But a donation that is null for improper form can be

confirmed by donor if the confirmation is made in the form required for the donation (thus, authentic act)

o

BUT EXCEPTIONS:

1. “Manual delivery exception” for Corporeal Movables

Donation inter vivos of a corporeal moveable may be made by delivery of the thing to the

donee. No monetary limitation (checks are not corporeal movables)

2.

10

Exceptions for Incorporeal Movables

If evidenced by a certificate/doc/instrument and transferable by endorsement or delivery,

then can donate in accordance with the thing’s usual requirements: 10

o This includes bonds, stocks, checks, CDs, promissory notes, etc.

o Examples:

BUT REMEMBER – Still need DONATIVE INTENT

26

Negotiable instruments must be delivered by a person who is not the

issuer

Stock Securities

When have the certificate Must indorse and deliver

When do not have the certificate Must contact broker and

have them transfer your shares to the other person

If investment property, then can be donated by a writing signed by the donor evidencing

donative intent and directing the transfer of the property to the donee (mutual funds)

Accepting the Donation

Acceptance makes donation effective and transfer ownership to the donee. Acceptance must be made during the lifetime

of the donor and donee (successors cannot accept for them). Acceptance must be explicit. Donee acquirees the thing

subject to all of its charges at the time of acceptance

How to accept:

1) In the act of donation (authentic act)

2) Subsequently in writing

3) By taking possession of the thing (like the manual gift exception)

4) By alienating or encumbering an immovable

Who can accept?

o The donee or a mandatary for the donee

o A parent or other ascendant can accept for an unemancipated minor, even if that person is also the donor

o NOT a creditor

27

Donor’s ability to revoke - Exceptions to the Rule of Irrevocability

Inter vivos donations can be revoked for:

1. Ingratitude of the donee only IF:

1) The donee has attempted to take the life of the donor; or

2) The donee has been guilty towards donee of cruel treatment, crimes, or grievous injuries.

Prescription: Must be brought within 1 year of the donor knowing of the act of ingratitude or from when

he should have known

If donor dies, his successors can bring the action. Their prescription rules:

o If donor knew about the act before death, they only have whatever time was remaining

o If donor did not know about the act before death, then they have 1 year from his death

Note:

o If the action was already brought by the donor, they can take over in his place

o Donor (or his successors) may also bring the action against the donee’s successors if the

donee is deceased

Effect on Alienation/Encumbrances: if made AFTER filing for revocation for ingratitude, then effective

against donor only when it is an onerous transaction made in good faith by the transferee/lessee/creditor

2.

Nonfulfillment of a suspensive condition, the occurrence of a resolutory condition, or the nonperformance of

other conditions or charges

If a donation is subject to a suspensive condition,11 the donation is dissolved of right when the condition

can no longer be fulfilled.

If a donation is subject to a resolutory condition,12 the occurrence of the condition does not of right

operate a dissolution of the donation. It may be dissolved only by consent of the parties or by judicial

decree.

Effect on Alienation/Encumbrances:

If donee fails to fulfill conditions or perform charges, the property returns to donor free from all

alienations, leases, or encumbrances. If donor cannot receive it free from all those things, then can

accept it with them but donee shall be accountable for the lowering of the value, or donee may have

to retore the full value of the thing

Alienation/encumbrance effective against donor only if it was an onerous transaction made in good

faith

Prescription: Donor or his successors have 5 years from the day the donee fails to perform the charge/fulfill

obligation

Churches – when a church has possession donation for 10 years and fulfilled the condition (did what you

wanted them to), they can then maybe do what they want

We know they can alienate/dispose of it after that time without regard to the conditions.

But can they do this even if they don’t decide to sell it? Unsure

11

Suspensive condition = rights are suspended until the event occurs (when condition satisfied, it breathes life into the otherwise

inoperative rights)

12

Resolutory condition = immediately get the rights but if condition is fulfilled, then rights cease (ends the existence of the rights)

28

Dispositions Mortis Causa – Wills

It is an act taking effect at death of the donor, disposing his property to a donee. Revocable during lifetime of donor.

Therefore, they are unilateral, juridical acts

Rules for making testaments:

o Cannot be executed by a mandatary

o No more than one person can execute a testament for the same instrument

o Cannot leave the choice to a third person

BUT executor can pick the ASSETS to make up a legacy

“I leave 1/4th of my entire estate to my children, and I authorize my executor to pick and choose which assets make up that 1/4”

BUT executor can pick the ASSETS and the LEGATEES for charities

“I leave 1/4th of my estate to charity, and I authorize my executor to pick and choose which assets make up that quarter and

which charities will receive the property”

Formalities

(1) Donative intent (animus testandi)

Must intend for THAT document to be her will

(2) Correct form – wills can be either olographic or notarial

Olographic Wills

o 3 requirements:

(1) Entirely handwritten by testator

Not really entirely handwritten though. Pre-filled forms are okay. Follow Surplusage theory,

which says that anything not in handwriting can be ignored

But additions and deletions on the testament are effective only if handwritten

(2) Dated

An olographic will with no date is invalid (and the date must be filled in by testator, not notary)

An olographic will with an incomplete or wrong date can be corrected/completed using extrinsic

evidence

(3) Signed

Signature must be at the end of the testament. If anything is added after the signature, court has

discretion about whether to include it

Are signatures always required? Yes but note Hamilton v. Kelly, in which court probated a will

even though the testator’s signature was torn off by his family members

What is a signature?

Ronald Joseph Scalise Jr. – yes

Ron Scalise – yes

RJS - initials are questionable

Nicknames – yes, case law seems to allow it ("auntie" or "dad")

o

Rule from Succession of Toney – signature must be:

(1) Spelled out (not initials)

(2) In cursive (not print)

29

NOTARIAL WILLS

o Form Requirements

(1) Testament shall be in writing

Handwritten not required. In fact, typewriting is standard

Note: Doesn’t have to be on paper

(2) Dated

(Day, month, and year)

(3) Signed at the end and at the end of each page

Which standard? Substantial compliance (Toney) vs Strict compliance (Guezuraga)

(4) Executed in the presence of a notary and two witnesses

“PRESENCE” = “in line of sight.” Physical proximity is what matters

“NOTARY” = covers both non-lawyer notaries (notary notaries) and lawyer notaries

o If notary notary is not commissioned in the parish for which she notarized a will, still

valid will because she is a “de facto notary.” Applies if these are met:

(1) office involved must exist as a de jure office

(2) holder must have attained that office under some color of title, and

(3) he or she must be in actual physical possession of the office

o

Split courts over whether disbarred lawyers can be de facto notaries

“WITNESSES”

o Who cannot be a witness? Someone who is insane, blind, under the age of sixteen, or

unable to sign his name. But don’t have to have a detailed understanding of the

transaction - just to be there to make sure they are doing so freely

o Interested witnesses – parties receiving property should not be witnesses, but if they

are, then will is still valid but your portion is purged (don’t receive anything unless you

would also receive under intestacy. Then you receive the lesser of the intestate share

and testamentary share)

o Spouses of legatees/interested parties – extends purging provisions above to the

spouse

(5) Declared by the testator to be his testament

Because this requirement seems unnecessary, courts have bent over backwards to find a

declaration even when there isn’t one (nod is enough)

(6) Include “attestation clause” that is signed by notary and two witnesses in the presence of the testator and

each other

When there is defective compliance with the statute (especially in the attestation clause), need

to ask: what is the risk of fraud? Is someone alleging funny business is going on? Then look at the

context as a whole and ask whether the protected purpose of the will’s formalities have been

complied with (using extrinsic evidence) (Liner)

o

Note other “Specialized” Types of Notarial Wills for people who can’t read, are deaf/blind

E-Wills – not outright permitted in LA but due to our permissible conflict of laws statutes, an E-Will made in another state is

valid in LA if:

o Valid if valid in the state you make it

o Valid if valid in location in which it is made

o Valid if valid in state you die

30

Probating Testaments

Testament is only effective if it is probated in accordance with the Code of Civil Procedure. Procedures for probating

notarial vs olographic wills:

o Notarial wills: Automatically effective upon producing it to court, unless challenged

o Olographic wills: Must be proved by the testimony of 2 witnesses that it was entirely written, dated, and signed by

the testator

Prescription: An action for annulment of a testament is subject to 5 year prescription (only applies to relative nullities – so

incapacity, duress, undue influence, or fraud)

Testamentary Dispositions

Categorizing portions of legacies:

Universal, General, or Particular

1) Universal legacy: It is a disposition of all of the estate, or the balance of the estate remaining after particular

legacies. It may be made jointly for the benefit of more than one legatee without changing its nature (but

can’t be separate)

Good: “All to Bob” or “Watch to my son and residue to Bob” or “All to Tom and Bob”

Bad: “All of my watches to Bob” or “½ to Tom and ½ to Bob”

2) General legacies: It is a disposition by which the testator gives a fraction or a certain proportion of the estate

OR a fraction or certain proportion of the balance of the estate that remains after particular legacies. Also

includes disposition of property as “all” or a fraction/certain proportion of one the following categories of

property:

Separate or community property

Movable or immovable property

Corporeal or incorporeal property

Good: “All incorporeal property to Sally” or “All movable to sally”

Bad: “all my separate movables” (cannot combined categories)

3) Particular legacies

Disposition that is neither general nor universal