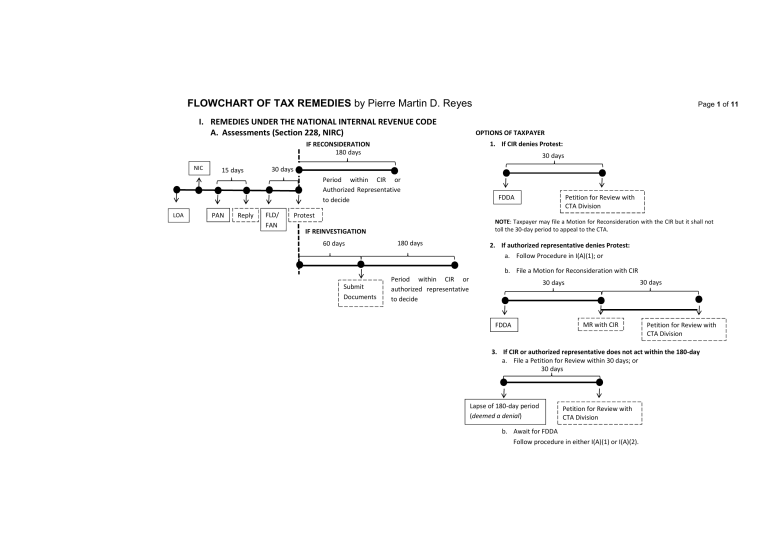

FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes I. REMEDIES UNDER THE NATIONAL INTERNAL REVENUE CODE A. Assessments (Section 228, NIRC) 15 days 30 days 30 days Period within CIR or Authorized Representative to decide LOA PAN Reply OPTIONS OF TAXPAYER 1. If CIR denies Protest: IF RECONSIDERATION 180 days NIC Page 1 of 11 FLD/ FAN Protest NOTE: Taxpayer may file a Motion for Reconsideration with the CIR but it shall not toll the 30-day period to appeal to the CTA. IF REINVESTIGATION 60 days Submit Documents Petition for Review with CTA Division FDDA 180 days Period within CIR or authorized representative to decide 2. If authorized representative denies Protest: a. Follow Procedure in I(A)(1); or b. File a Motion for Reconsideration with CIR 30 days 30 days FDDA MR with CIR Petition for Review with CTA Division 3. If CIR or authorized representative does not act within the 180-day a. File a Petition for Review within 30 days; or 30 days Lapse of 180-day period (deemed a denial) Petition for Review with CTA Division b. Await for FDDA Follow procedure in either I(A)(1) or I(A)(2). FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 2 of 11 B. Recovery of Erroneously or Illegally Collected Taxes and/or Penalties (Section 229, NIRC) 2 years Date of Payment or Withholding of Tax NOTE: Both the administrative and the judicial claim must be filed within the two-year period. Petition for Review with CTA Division File Administrative Claim with CIR (before Judicial Claim) C. VAT Refund/Credit (Section 112, NIRC) 90 days 2 years Close of the Taxable Quarter when the relevant sales were made OPTIONS OF TAXPAYER 1. If CIR or authorized Representative denies claim: 30 days File Administrative Claim with CIR and submit complete documents NOTE: Only the administrative claim must be filed within the two-year period. Period to decide Petition for Review with CTA Division Denial NOTE: Prior to TRAIN, the period to decide is 120 days. 2. If inaction: 30 days Lapse of 90-day period Petition for Review with CTA Division NOTE: Although Section 112 as amended by R.A. No. 10963 (TRAIN) removed the remedy of the taxpayer in case of inaction, R.A. No. 1125, as amended, providing for the jurisdiction of the CTA states that inaction involving refunds of internal revenue taxes where the Tax Code provides a specific period of action shall be deemed a denial and may thus be elevated to the CTA Division. FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes II. Page 3 of 11 REMEDIES UNDER THE LOCAL GOVERNMENT CODE A. Local Business Tax 1. Assessment 60 days Notice of Assessment 60 days Protest to Local Treasurer Period to decide NOTE: Where an assessment is issued, the taxpayer cannot choose to pay the assessment and thereafter seek a refund at any time within the full period of two years from the date of payment. If refund is pursued, the taxpayer must administratively question the validity or correctness of the assessment in the 'letter claim for refund' within 60 days from receipt of the notice of assessment, and thereafter bring suit in court within 30 days from either decision or inaction by the local treasurer. 1. If ≤ P300,000 (or ≤ P400,000 for Metro Manila) 15 days 30 days Denial by LT or Lapse of 60 days Appeal to MTC 30 days Appeal to RTC 2. If ˃ P300,000 (or ˃ P400,000 for Metro Manila) 30 days 30 days Denial by LT or Lapse of 60 days Appeal to RTC Petition for Review to the CTA Division Petition for Review to the CTA en banc NOTE: The period to appeal shall be interrupted by a timely motion for new trial or reconsideration. In any case, if the motion is denied, the movant has a fresh period of 15 days from receipt or notice of order denying or dismissing the motion for reconsideration within which to file the appeal. (Neypes Doctrine) FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes 2. Refund Page 4 of 11 2 years 1. If ≤ P300,000 (or ≤ P400,000 for Metro Manila) Follow procedure in II(A)(1). Date of Payment of Tax Appeal to either MTC or RTC 2. If ˃ P300,000 (or ˃ P400,000 for Metro Manila) Follow procedure in II(A)(2). File Claim for Refund before Local Treasurer NOTE: Both the administrative and the judicial claim must be filed within the two-year period. 3. Assail Tax Ordinance 30 days Effectivity of Tax Ordinance 60 days Appeal to Secretary of Justice Period for the SOJ to decide 30 days Denial by SOJ or lapse of 60 days 15 days Appeal to the RTC 15 days (extendible) Appeal to Court of Appeals Appeal to Supreme Court NOTE: The period to appeal shall be interrupted by a timely motion for new trial or reconsideration. In any case, if the motion is denied, the movant has a fresh period of 15 days from receipt or notice of order denying or dismissing the motion for reconsideration within which to file the appeal (Neypes Doctrine) FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 5 of 11 B. Real Property Tax 1. Assessment a. Erroneous Assessment 30 days Pay with Protest 60 days Protest to Local Treasurer Period to decide 60 days Denial by LT or Lapse of 60 days Appeal to LBAA b. Illegal Assessment 30 days 15 days Issuance of Illegal Assessm ent File Injuncti on with RTC 120 days Petition for Review to the CTA Division 30 days Denial by LBAA or Lapse of 120days 30 days Appeal to the CBAA Adverse Decision of the CBAA Petition for Review to the CTA en banc FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 6 of 11 2. Refund 2 years 60 days If denied or inaction by the Local Treasurer Date Payment of File Claim with Local Treasurer NOTE: Only the administrative claim must be filed within the two-year period. Period to decide Follow Procedure in II(B)(1). - FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes III. Page 7 of 11 REMEDIES UNDER THE CUSTOMS MODERNIZATION AND TARIFF ACT. A. Assessments 15 days 1. If protest is sustained 30 days The COC shall make the appropriate order and the entry reassessed, if necessary. Payment under Protest Protest to Commissioner of Customs (COC) Period to decide 2. If protest is denied 30 days NOTE: Assessment shall be deemed final within 15 days after receipt of the notice of assessment. Denial by the COC Petition for Review to the CTA Division B. Refund 1. If the claim and application is for refund of duties. 12 months If the claim is denied If denied by the COC 30 days 30 days Date payment of File Claim with Bureau NOTE: Only the administrative claim must be filed within the 12-month period. The CMTA did not specify the office within which to file the claim for refund Denial Appeal COC to Period to decide Follow procedure in III(A)(2). FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 8 of 11 2. If the claim and application is for refund of duties and taxes. As to refund of the duties element Follow procedure under III(B). As to refund of internal revenue taxes element Follow procedure under I(B). Note: The Bureau of Customs shall cause the refund of internal revenue taxes after issuance of a certification from the CIR granting claim for refund, whether wholly or partially. C. Forfeiture 1. If importer is aggrieved by decision of District Collector 15 days or 5 days if perishable 30 days or 15 days if perishable 1. If importer aggrieved by decision of COC Follow Procedure in III(A)(2). 2. If no decision rendered (inaction) Adverse decision of District Collector Notice of Appeal to District Collector The District Collector shall transmit records to COC Period for COC to decide The adverse decision of the District Collector is deemed affirmed. Follow Procedure in III(A)(2). FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes Page 9 of 11 2. If government is aggrieved by decision of the District Collector (Automatic Review) 30 days or 10 days if perishable 5 days Adverse decision of District Collector Elevate Records to CoC Receipt of records by CoC If no decision rendered within the said period or when a decision adverse to government is rendered by the COC involving goods with FOB or FCA value of P10,000,000.00 Period for COC to decide 5 days COC Elevate records to SoF If importer aggrieved by decision of COC Follow Procedure in III(A)(2). 3. If the importer is aggrieved by the decision of the Secretary of Finance on automatic review 30 days Adverse decision of SOF Petition for Review to the CTA Division NOTE: The decision of the SOF whether or not a decision was rendered by the COC within 30 days, or within 10 days in the case of perishable goods, from receipt of the records, shall be final upon the Bureau. FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes IV. Page 10 of 11 APPELLATE REMEDIES IN THE COURT OF TAX APPEALS 15 days Petition for Review before the CTA Division Adverse Decision of the CTA Division MR of CTA Div. Decision or MNT 15 days (extendible) Adverse Resolution of the CTA Division Petition for Review before the CTA En Banc 15 days Adverse Decision of the CTA-EB MR of CTA-EB Decision 15 days (extendible) Adverse Resolution of the CTAEB Petition for Review to the Supreme Court NOTE: A petition for review of a decision or resolution of the CTA in Division must be preceded by the filing of a timely MR or MNT with the Division. The filing of a MR or MNT, however, with the CTA en banc is not mandatory. FLOWCHART OF TAX REMEDIES by Pierre Martin D. Reyes V. ASSAILING THE VALIDITY OF TAX LAWS, RULES AND REGULATIONS, AND OTHER ADMINISTRATIVE ISSUANCES A. Tax Laws and Rules and Regulations (i.e. Revenue Regulations) 30 days Tax Laws and Revenue Regulations (i.e. Revenue Regulations) Petition for Review with CTA Division B. Other Administrative Issuances (i.e. Revenue memorandum orders, revenue memorandum circulars, or BIR rulings) 30 days Other Administrative Issuances (i.e. Revenue memorandum orders, revenue memorandum circulars, or BIR rulings) 30 days Review by Secretary of Finance Petition for Review with CTA Division Page 11 of 11