Inventory Costing Methods: FIFO & Weighted Average Explained

advertisement

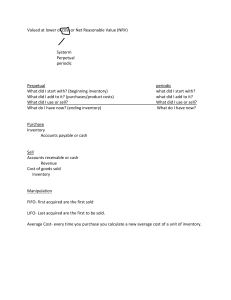

Cost formulas PAS 2, paragraph 25, expressly provides that the cost of inventories shall be determined by using a. First in, First out b. Weighted average The standard does not permit anymore the use of the last in, first out (LIFO) as an alternative formula in measuring cost of inventories. First in, First out (FIFO) The FIFO method assumes that "the goods first purchased are first sold" and consequently the goods remaining in the inventory at the end of the period are those most recently purchased or produced. In other words, the FIFO is in accordance with the ordinary merchandising procedure that the goods are sold in the order they are purchased. The rule is "first come, first sold". The inventory is thus expressed in terms of recent or new prices while the cost of goods sold is representative of earlier or old prices. This method favors the statement of financial position in that the inventory is stated at current replacement cost. The objection to the method is that there is improper matching of cost against revenue because the goods sold are stated at earlier or older prices resulting in understatement of cost of sales. Accordingly, in a period of inflation or rising prices, the FIFO method would result to the highest net income. SP- @P3 200,000@2=400,000 100,000@1=100,000 300,000 500,000 Unit cost WA= 500,000/300,000=1.67 However, in a period of deflation or declining prices, the FIFO method would result to the lowest net income. SP- @P.25 200,000@2=400,000 100,000@1=100,000 300,000 500,000 Illustration – FIFO The following data pertain to an inventory item: Jan. 1 8 18 Beginning balance Sale Purchase Units 800 Unit cost 200 Total cost 160,000 700 210 147,000 Sales (in units) 500 22 31 Sale Purchase 800 500 220 110,000 The ending inventory is 700 units. FIFO – Periodic Units 200 500 700 From Jan. 18 Purchase From Jan. 31 Purchase Unit cost 210 220 Total cost 42,000 110,000 152,000 Cost of goods sold Inventory - January 1 Purchases (147,000 + 110,000) Goods available for sale Inventory - January 31 Cost of goods sold 160,000 257,000 417,000 (152,000) 265,000 FIFO – Perpetual This requires preparation of stock card. Purchases Date Jan Units Unit cost Sales Total cost Units Unit cost Balance Total cost 1 8 18 500 700 210 500 220 100,000 147,000 22 31 200 300 200 60,000 500 210 105,000 110,000 Units Unit cost Total cost 800 200 160,000 300 200 60,000 300 200 60,000 700 210 147,000 200 210 42,000 200 210 42,000 500 220 110,000 NOTA BENE Note well that under FIFO-periodic and FIFO-perpetual, the inventory costs are the same. In both cases, the January 31, inventory is P152,000. The cost of goods sold is determined for the stock card as follows: January 8 sale 22 sale (60,000 + 105,000) Cost of goods sold Weighted average – Periodic 100,000 165,000 265,000 The cost of the beginning inventory plus the total cost of purchases during the period is divided by the total units purchased plus those in the beginning inventory to get a weighted average unit cost. Such weighted average unit cost is then multiplied by the units on hand to derive the inventory value. In other word, the average unit cost is computed by dividing the total cost of goods available for sale by the total number of units available for sale. The preceding illustrative data are used. Jan Units Unit cost Total cost Beginning balance 800 200 160,000 18 Purchase 700 210 147,000 31 Purchase 500 220 110,000 1 Total goods available for sale Weighted average unit cost (417,000/2,000) Inventory cost (700 x 208.50) 2,000 417,000 208.50 149,950 Cost of goods sold Inventory - January 1 Purchases (147,000 + 110,000) Goods available for sale Inventory - January 31 Cost of goods sold 160,000 257,000 417,000 (149,950) 271,050 OR 1,300x208.5=271,050 Weighted average – Perpetual When used in conjunction with the perpetual system, the weighted average method is popularly known as the moving average method. PAS 2, paragraph 27, provides that the weighted average may be calculated on a periodic basis or as each additional shipment is received depending upon the circumstances of the entity. Under this method, a new weighted average unit cost must be computed after every purchase and purchase returns. Thus, the total cost of goods available after every purchase and purchase return is divided by the total units available for sale at this time to get a new weighted average unit cost. Such new weighted average unit cost is then multiplied by the units on hand to get the inventory cost. This method required the keeping of stock card in order to monitor the “moving” unit cost after every purchase. Jan 1 8 18 22 31 Beginning balance Sale Balance Purchase Total Sale Balance Purchase Total Units 800 (500) 300 700 1,000 (800) 200 500 700 Unit cost 200 200 200 210 207 207 207 220 216 Total cost 160,000 (100,000) 60,000 147,000 207,000 (165,600) 41,400 110,000 151,400 Observe that a new weighted average unit cost is computed after every purchase. Thus, after the January 18 purchase, the total cost of P207,000 is divided by 1,000 units to get a weighted average unit cost of P207. After the January 31 purchase, the total cost of P151,400 is divided by 700 units to get a new weighted average unit cost of P216. Cost of goods sold from the stock card January 8 Sale 22 Sale Cost of goods sold 100,000 165,600 265,600 The argument for the weighted average method is that it is relatively easy to apply, especially with computers. Moreover. The weighted average method produces inventory valuation that approximates current value if there is a rapid turnover of inventory. The argument against the weighted average method is that there may be a considerable lag between the current cost and inventory valuation since the average unit cost involves early purchases. Last in, Fist out (LIFO) The LIFO method assumes that “the good last purchased are first sold” and consequently the goods remaining in the inventory at the end of the period are those first purchased or produced. The inventory is thus expressed in terms of earlier or old prices and the cost of goods sold is representative of recent or new prices. The LIFO favors the income statement because there is matching of current cost against current revenue, the cost of goods sold being expressed in terms of current or recent cost. The objection of the LIFO is that the inventory is stated at earlier or older prices and therefore there may be a significant lag between inventory valuation and current replacement cost. Moreover, the use of LIFO permits income manipulation, such as by making year-end purchases designed to preserve existing inventory layers. At times these purchases may not even be in the best economic interest of the entity. Actually, in a period of rising prices, the LIFO method would result to the lowest net income. In a period of declining prices, the LIFO method would result to the highest net income. LIFO – Periodic In the preceding illustration, the cost of 700 units under the LIFO is computed as follows. Units 700 From January 1 balance Unit cost 200 Total cost 140,000 Cost of goods sold under LIFO – periodic Inventory - January 1 Purchases (147,000 + 110,000) Goods available for sale Inventory - January 31 Cost of goods sold 160,000 257,000 417,000 (140,000) 277,000 LIFO – Perpetual This requires the preparation of stock card. Purchases Date Jan Units Unit cost Sales Total cost Units Unit cost Balance Total cost 1 8 18 500 700 210 500 220 100,000 147,000 22 31 200 700 210 147,000 100 200 20,000 110,000 Units Unit cost Total cost 800 200 160,000 300 200 60,000 300 200 60,000 700 210 147,000 200 200 40,000 200 220 40,000 500 220 110,000 Note well the LIFO-periodic and LIFO-perpetual differ in inventory value. Under LIFO periodic, the January 31 inventory is P140,000 and under LIFO perpetual, the January 31 inventory is P150,000. Another illustration Jan. 1 10 15 16 30 Beginning balance Purchase Sale Sale return Purchase Units 5,000 5,000 (7,000) 1,000 16,000 Unit cost 200 250 Total cost 1,000,000 1,250,000 150 2,400,000 31 Purchase return Ending balance (2,000) 18,000 150 300,000 FIFO – whether periodic or perpetual Jan Units Unit cost Total cost 10 Purchase 4,000 250 1,000,000 30 Purchase 14,000 150 2,100,000 18,000 3,100,000 Specific Identification The January 30 purchase of 16,000 units is reduced by the purchase return of 2,000 units or net purchase of 14,000 units. Note that under FIFO perpetual, the sale return of 1,000 units on January 16 would be costed back to inventory at the latest purchase unit cost of P250 before the sale. Moving average – Perpetual Jan 1 10 15 16 30 31 Jan 1 10 15 15 16 30 31 Beginning balance Purchase Balance Sale Balance Sale return Balance Purchase Balance Purchase return Balance Units 5,000 5,000 10,000 (7,000) 3,000 1,000 4,000 16,000 20,000 (2,000) 18,000 Unit cost 200 250 225 225 225 225 225 150 165 150 167 Total cost 1,000,000 1,250,000 2,250,000 (1,575,000) 675,000 225,000 900,000 2,400,000 3,300,000 (300,000) 3,000,000 Beginning balance Purchase Balance Sale Balance Purchase Balance Sale return Balance Purchase Balance Purchase return Balance Units 5,000 5,000 10,000 (7,000) 3,000 5,000 8,000 1,000 9,000 16,000 20,000 (2,000) 18,000 Unit cost 200 250 225 225 225 260 247 225 225 150 165 150 167 Total cost 1,000,000 1,250,000 2,250,000 (1,575,000) 675,000 1,300,000 1,975,000 225,000 900,000 2,400,000 3,300,000 (300,000) 3,000,000 Observe that the moving average unit cost changes every time there is a new purchase or a purchase return. The moving average unit cost is not affected by a sale or a sale return. Weighted average – Periodic Jan Units Unit cost Total cost Beginning balance 5,000 200 1,000,000 10 Purchase 5,000 250 1,250,000 30 Purchase 16,000 150 2,400,000 31 Purchase return (2,000) 150 (300,000) 1 24,000 Weighted average unit cost (P4,350,000/24,000 units) Cost of ending inventory (18,000 x 181.25) 4,350,000 181.25 3,262,500 Specific identification Specific identification means that specific costs are attributed to identified items of inventory. The cost of the inventory is determined by simply multiplying the units on hand by their actual unit cost. This requires records which will clearly determine the actual costs of the goods on hand. PAS 2, paragraph 23, provides that this method is appropriate for inventories that are segregated for a specific project and inventories that are not ordinarily interchangeable. The major argument for this method is that the flow of the inventory cost corresponds with the actual physical flow of goods. With specific identification, there is an actual determination of cost of units sold and on hand. The major argument against this method is that it is very costly to implement even with high-speed computers. Standard costs Standard costs are predetermined product costs established on the basis of normal levels of materials and supplies, labor, efficiency and capacity utilization. Observe that a standard cost is predetermined and, once determined, is applied to all inventory movements – inventories, goods available for sale, purchases and goods sold or placed in production. PAS 2, paragraph 21, states that the standard cost method may be used for convenience if the results approximate cost. However, the standards set should be realistically attainable and are reviewed and revised regularly in the light of current conditions. Standard costing is taken up in higher accounting course and is not discussed further in this book. Relative sales price method When different commodities are purchased at a lump sum, the single cost is apportioned among the commodities based on their respective sales price. This is based on the philosophy that cost is proportionate to selling price. For example, products A, B, and C are purchased at “basket price” of P3,000,000. Assume that the said products have the following sales price: A P500,000, B P1,500,000, and C P3,000,000. Computation of cost of each product Product A Product B Product C 500,000 1,500,000 3,000,000 5,000,000 5/50 x 3,000,000 15/50 x 3,000,000 30/50 x 3,000,000 300,000 900,000 1,800,000 3,000,000 References Valix, C. & Valix, C.A. (2018). Practical Accounting 1 vol 1. GIC Enterprises and Co., Inc. Manila, Philippines Valix, C. & Valix, C.A. (2013). Theory of Accounts 2013 edition. GIC Enterprises and Co., Inc. Manila, Philippines Valix, C. Valix, C.A. (2019). Intermediate Accounting 1. GIC Enterprises and Co., Inc. Manila, Philippines Robles, N. & Empleo P. (2016). The Intermediate Accounting Series Vol 2. Millenium Books, Inc., Mandaluyong City Uberita, C. (2012). Practical Accounting 1 2013 Edition. GIC Enterprises and Co, Inc. Manila, Philippines