The Dinar versus the Ducat

Author(s): Jere L. Bacharach

Source: International Journal of Middle East Studies, Vol. 4, No. 1 (Jan., 1973), pp. 77-96

Published by: Cambridge University Press

Stable URL: http://www.jstor.org/stable/162226

Accessed: 23/01/2010 20:00

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=cup.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Cambridge University Press is collaborating with JSTOR to digitize, preserve and extend access to

International Journal of Middle East Studies.

http://www.jstor.org

Int. J. MiddleEast Stud. 4 (I973), 77-96 Printedin GreatBritain

77

Jere L. Bacharach

THE DINAR

VERSUS

THE

DUCAT

Since the Second World War, United States currency has been accepted in almost

every country in the world, and in many locations the 'George Washington'

dollar has been in greater demand than local monies. In ancient, medieval and

modern times, other currencies have had a similar success. Examples of this

phenomenon are the ancient Athenian silver 'owl', the Byzantine gold solidus,

the Florentine gold florin, and the Maria Theresa silver taler. In the late fourteenth century A.D.the florin was replaced by the gold coin of Venice, the ducat,

as the 'dollar of the Middle Ages'; that is, the international currency par excellence. The position of the ducat was associated with the international trading

position of Venice as well as the fact that 'the Venetian ducato, which was first

coined in 1284, kept both its weight and fineness remarkably intact up to the

end of the Venetian Republic'. The ducat's domination of the Eastern Mediterranean money market led to the appearance of a series of imitations, including

Islamic imitations which were produced in response to the introduction of ducats

into the internal economy of Mamluk Egypt.z All the accounts based on Arabic

sources date the domination of the ducat in the Mamluk market from A.H.8oi/

A.D. 1399. These same sources describe the various attempts by Mamluk sultans

to meet the challenge of the ducat by coining imitations. Their efforts culminated

in the ashraft, first issued in 829/1425, which successfully replaced the ducat as

the principal gold currency of the Mamluk Empire until the Ottoman conquest

of 922/1517.

The appearance of these Muslim gold coins has been described by a number of

modern scholars. The first full account was written by A. Rauge van Gennep in

1897, in which he described the various Muslim coins issued from 801/I399

through 829/1425, noted the references to the Venetian ducat, and listed a few

exchange rates for Cairo for the various coins.3 Almost all of the scholarly

works which have touched upon this topic have relied upon van Gennep's work,

I Carlo M. Cipolla, Money, Prices and Civilization in the Mediterranean World

(Princeton, 1956), pp. 3-26. An excellent introduction to medieval banking and the money

market is Raymond de Roover, Money, Banking and Credit in Medieval Bruges (Cambridge, Mass., I948).

2 For a

general discussion of imitations of the ducat see Herbert E. Ives, The Venetian

Gold Ducat and Its Imitations, edited and annotated by Philip Grierson (New York, 954).

3 A.

Rauge van Gennep, 'Le ducat venitien en Egypte, son influence sur le monnayage

de l'or dans ce pays au commencement du XVe siecle', Revue Numismatique, ser. 4,

vol. I (1897), pp. 373-8i, 494-508.

78 Jere L. Bacharach

although they have added more information about exchange rates.I The basic

interpretation, again beginning with the 1897 article, was that the ducat was

preferred for its uniform weight and purity and could be traded by number

rather than by weight.2 On the other hand, it was stated that the Muslim coins

were rejected because they lacked a uniform weight or were of uncertain purity.

An additional explanation was that the Mamluks failed to end the domination of

the internal market by the ducat before or even with the ashrafi because they did

not have enough bullion to meet the needs of the market.3

There are a number of problems with these explanations. First, there is no real

attempt to explain why the ducat's domination dates from 80o/1399, which is

especially curious since there is no indication of a major shift in the MamlukVenetian trade pattern or Egyptian economic conditions. Secondly, Egypt was

always short of bullion, as she lacked internal sources of mined gold, and thus

always had to melt 'foreign' coins and ingots for local needs.4

There seems, therefore, to be no good reason why the eighth-/fourteenthcentury sultans were able to mint an adequate supply of dinars while their successors were unable to do so. The obvious explanation would be a radical decline in

the stock of bullion theoretically available to the Mamluks, but no such decline

has been demonstrated. Thirdly, if the ducat was as good and the dinar as poor

as scholars claim, then from 80o/I399 through 829/1425 it would appear that the

'good' money drove the 'bad' money off the market, or just the opposite of the

so-called Gresham's Law.5

In light of the problems associated with the earlier interpretations, this study

will reinvestigate the topic by concentrating on the following questions: (I) Why

did the use of the ducat change from an international currency to a local one

beginning with the year 80o/1399? (II) Why did the Mamluks feel it necessary

to respond to the challenge of the ducat and not just accept it as their own gold

coin as other states had done? (III) What was the exact nature of the Mamluk

I Paul Balog, 'The Coinage of the Mamluk Sultans of Egypt and Syria', American

Numismatic Society, Numismatic Studies, no. 12 (New York, I964), pp. 39-49. Michel de

Bouard, 'Sur l'Evolution monetaire de l'Egypte medievale', L'lgypte Contemporaine,

vol. xxx (1939), pp. 427-59.

Paul Casanova, 'Note sur le dinar ifrinti', Revue Numismati-

que, ser. 4, vol. I (I897), pp. 535-6. Subhi Y. Labib, HandelsgeschichteAgyptens im Spatmittelalter (Wiesbaden, I965), pp. 423-35. Ahmad Darrag, L'tLgypte sous le regne de

Barsbay (Damascus,

William Popper,

1961), pp. 9I-107.

Circassian Sultans, 1382-1468

A.D.',

Philology, vol. xvi (1957), pp. 41-51.

'Egypt

and Syria under the

University of California Publications in Semitic

Eliayhu Ashtor, Histoire des prix et des salaires dans

l'orient medieval (Paris, I969), pp. 274-82, 388-92. Robert Lopez, Harry Miskimin and

Abraham

Udovitch,

'England

to Egypt,

1350-1500:

Long-term

Trends

and Long-

Distance Trade', Studies in the EconomicHistory of the Middle East from the Rise of Islam

to the Present Day, ed. M. A. Cook (London, 1970), pp. 117-28.

2

Cipolla, p. 24.

3 Balog, p. 43; Lopez, p. 125.

4 Lopez, pp. 125-6.

'Gresham's Law was not the invention of Sir Thomas Gresham, but of Henry D.

MacLeod, a nineteenth century economist' (Raymond de Roover, Gresham on Foreign

5

Exchange (Cambridge,

Mass., 1949), p. 91).

The dinar versus the ducat 79

response? In particular, why did Mamluk monetary policies fail to achieve their

objective of replacing the ducat with a Muslim gold coin for internal usage for

over a quarter of a century? (IV) What can this study tell us about the level of

economic and monetary sophistication in the Mamluk Empire?

I

The early history of the appearance of the ducat in the Mamluk Empire is

obscure, although once the regular convoy trade system, or muda, was established

in 1345, the number of ducats reaching the Near East had to increase. A major

expansion of Venetian trade, and by extension, circulation of the ducat, took place

after the Genoese-Venetian War of Chioggia (I378-8I) when Venice established

a permanent supremacy over Genova for the Levant trade.I The exact quantities

of Venetian gold available cannot be established, although, unlike the case for

Mamluk coinage, there is some indication of the order of magnitude.2 It is estimated that in 1423 I,200,000 ducats were minted, of which 300,000 ducats (or

300,000 coins including gold and silver issues) were exported eastward.3 The

estimated number of ducats exported to Egypt and Syria in 1433 was 460,000,

although this was considered unusually high for one year.4

While these figures would seem to prove that large quantities of European coin

were reaching the Mamluk Empire, it does not prove that they were in circulation within the Empire. The methods by which the Mamluks controlled the

transit spice trade, the primary 'hard' currency money earner, enabled them to

control the circulation of most of the European coins brought to pay for the spices.

Specifically, European traders were only allowed to buy transit and local goods in

specific hotels (funduqs) where the transactions were supervised and taxed.5

The coin and ingot acquired by the Mamluk officials and traders were then sent

to the mint, where they were melted as bullion for the Islamic gold coin, the

dinar. Some ducats entered the Mamluk Empire through illegal transactions and

with Christian pilgrims, but there is no evidence to prove that large numbers of

coins were involved.

The evidence for the circulation of the ducat within the Mamluk Empire for

the period after 801/1399 is based upon textual evidence, primarily Arab chronicles. This widespread circulation of the Christian gold coin is demonstrated by

I Tewfik Iskendar, 'Les relations commerciales et politiques de Venise avec l'fEgypte

au XIVe et XVe siecles', Position de Theses, SEcole

Nationale des Chartes (Paris, 1953), pp.

94-6. Frederic Lane, Andrea Barbarigo, Merchant of Venice (Baltimore, I944), p. 77.

2 An isolated

figure for the Ayyubid mint cannot be used for generalization purposes.

Charles Owens, 'Scandal in the Egyptian Treasury', JNES, vol. xIv (I955), pp. 75-6.

3

Philip Grierson, 'La Moneta Veneziana nell'Economia Mediterranea del Trecento e

Quattrocento', La Civilta Venezian del Quattrocento (Florence, 1957), pp. 86, 97.

4 Darrag, p. 96.

5 The standard account for medieval Mediterranean trade can be found in Wilhelm

Heyd, Histoire du commercedu Levant au moyen dge, trans. Furcy Raynaud (2 vols.,

Leipzig, i885-6).

80 Jere L. Bacharach

the recording of over ioo exchange rates for it in Cairo.I It is also evidenced by

the citing of prices in ducats for Cairo, Damascus, Alexandria and even for the

most sacred of Muslim cities, Mecca.2 As one medieval contemporary Muslim

source wrote, the ducat was 'used in all the cities of the world such as Cairo, old

Cairo, Syria, Asia Minor, the East, Hijaz and Yemen'.3 After 829/1425 isolated

Muslim and Christian sources attest the circulation of the ducat but its largescale usage had ended.4

When the Mamluks became rulers of Egypt in 648/1250, they continued the

monetary policies of their predecessors, the Ayyubids, by minting dinars (gold),

dirhams (silver) and fulus (copper). During the first period of Mamluk rule, the

Bahri (648-784/I250-I382), there were only minor changes initiated in monetary

policy, the most significant of which was the increased use of copper at the expense of silver. The Bahri dinars were of a high degree of fineness, but the weight

of individual pieces varied from under 5 to over I5 grams.5 This meant that all

transactions involving gold had to be made by weight. The usual official exchange

rate of i dinar to 20 dirhams referred not to a real dinar but a theoretical gold

coin of 4-25 grams. This weight was known as the mithqal. The same term,

mithqdl, was used for real gold coins whose intended weight was 4-25 grams as

well as a theoretical coin given in official exchange rates.

In 784/1382 the amir Barquq removed from office the titular Bahri sultan, thus

establishing the second Mamluk era, the Circassian or Burji (784-922/I382I517). The reign of Barquq was far from peaceful, and political and military

events increased the financial burdens of the state and affected the methods which

he used to meet his financial needs. During the last years of his life Barquq

remained in Cairo, bought large numbers of slaves, confiscated money from

those who were out of favor, and tried to amass as much money as possible. Just

before he died he summoned the Caliph, the leading judges and the important

as his

amirs and had them swear an oath to his son Faraj (80I-815/I399-I412)

successor. As Faraj was still a minor, two amzrswere chosen as regents. In this

way Barquq attempted to avoid a problem over succession. He died on 15

Shawwdl 80oi/20 June I399, leaving a well-filled treasury of 1,400,000 dinars and

goods worth an equal amount.6

Popper, pp. 45-7. For a complete list of exchange rates for the ducat, Jere L.

Bacharach,'A Study of the Correlationbetween Textual Sources and Numismatic

Evidence for Mamluk Egypt and Syria, A.H. 784-872/A.D.

unpublished Ph.D.

1382-1468',

dissertation, University of Michigan (Ann Arbor, I967), pp. 326-340.

2 Ferdinand

Wiistenfeld, Chronikender Stadt Mekke (Leipzig, I859), vol. II, pp. 31619.

3 Suluk, vol. Iv, p. 5I2; Nujuim,vol. vi, p. 596.

4 Examples of the outlawing of the ducat are the following: 8i8/1415 - al-'Ayni, vol.

Iv, p. 408; Suluk, vol. iv, pp. 169; Nujiim, vol. vI, p. 351; 819/1416- Suluk, vol. iv, p.

196; 821/1418 - al-'Ayni, vol. Iv, p. 464; Sulik, vol. Iv, p. 282; Inba', vol. I, p. 134, a;

al-Jawhari, p. 99, a; 823/1420 - Inb', vol. II, p. I58, b.

5 The weights of the Bahrl dinars are listed in Balog. The degree of fineness was

determined in an unpublished study by this author.

6 Suluk, vol. III, p. 9, a; Nujim, vol. v, p. 597.

The dinar versus the ducat 8i

Unfortunately Barquq's attempt to avoid a struggle over his son's succession

failed. During his reign, al-Nasir Faraj had to face almost continuous civil

strife, including the sending of eight expeditions to Syria to put down revolts.

He was also temporarily deposed in 8o8/1405. The troubles which he encountered

were an inherent part of the Mamluk system of rule. When a Turkish slave was

brought to the Mamluk Empire, he developed a series of loyalties to his barrack

mates and the master who emancipated him. The allegiance of a Mamluk was

to a person, not an institution. When Faraj became sultan he had few mamluks

directly loyal to himself, and could only win the support of other mamluks,

including those of his father, through bribery and coercion.

It is just after Barquq's death that the first dated exchange rates for the

mithqdl and ducat are listed together in the Arabic sources.' The appearance of

official Muslim rates for the ducat and the accession of Faraj are not an accidental

coincidence. It is possible that large numbers of ducats were lying in the treasury

and Faraj used these coins to pay his supporters. A second possibility is that the

ducats were in greater demand than the Muslim coin because it was assumed that

the ducats were a safer, more reliable currency.

The initial breakdown of central authority in 80o/I399 had led to a demand for

European ducats rather than the Muslim coin. At the same time, it must be assumed that this change in attitude about using the Venetian coin led to a relaxation of the restrictions against the importation of ducats into the interior of the

Empire. Thus, the role of the ducat changed from that of a coin used exclusively

for international transactions to one in which the coin competed in the local

money market and was available in large numbers. In theory, the rate of exchange

for the ducat should have been based upon its gold content in comparison with

the amount of gold in a Muslim coin. However, the interference by the sultans in

the operations of the market meant that a free market situation did not exist and

exchange rates reflected an arbitrary relationship rather than a natural one.

II

Establishing motives for a specific Mamluk policy is difficult, but their constant

attempts to replace the ducat with their own gold coins indicate a general policy.

There are two possible factors which can be considered as crucial for motivating

the sultans; one was economic and the other religious.

If the sultan paid his troops in ducats, there were two potential sources of

profit for him. In the first place, he saved minting costs, as he no longer had to

melt down foreign coins and reissue them as his own Muslim coin. However,

since the minting fee, called brassage, was charged to those who brought

foreign coin to the mint, it is questionable if anything was gained by the sultan

except time. In the second place, when the sultan intervened in the market by

I

6

Suhlk, vol. III, p. 10, a; Inba', vol. I, p. 466.

MES

t I

82 Jere L. Bacharach

setting official exchange rates, he could set rates favorable to the use of one coin

over another. An example of this policy of intervening is the following:I

On Thursday, the 2Ist [Rabi'a, 819/18 June, 1416], a great number of the money

changersand tradersgatheredand they were present on Friday,the 22nd at the Stable

[in the CairoCitadel]in the presenceof the Sultan [al-Mu'ayyadShaykh].On that day

it was announcedthe price of the dinar [maktum- sealed] will be 250 [trade]dirhams,

ducat [mushhakkhas- figured] 230 [trade] dirhams and the Nasiri dinars are to be

collected and to be weighed accordingto the price of the 'sealed' dinar.

In theory this right to fix exchange rates for personal profit, or whatever

reason, was one of the prerogatives of medieval rulers, and with sufficient coercive power, which the Mamluks had, these official rates could become market rates.

However, custom could limit the power of the rulers to manipulate exchange

rates, and this also happened in the Mamluk Empire. From 648/1250 when the

Mamluks took over Egypt (if not from Saladin's rule in 566/1171), the ratio of

gold to silver in Egypt was fixed at I: 9.3. The typical exchange rate was i dinar

to 20 dirhams (silver coins), which really meant that the rates were announced

as if each gold coin weighed exactly 4-25 grams and was pure gold, while the

dirham weighed 2-975 grams and was 662 per cent silver. If the dirham was debased to 331 per cent silver, the rate of exchange rose to 40 dirhams per dinar

because the gold-to-silver ratio remained constant. Thus, this gold-to-silver

ratio (not exchange rate) limited the ability of the Mamluk sultan to manipulate

exchange rates in his favor, at leastforthe canonical 4-25-gram dinar. In 805/1403

the traditional gold-to-silver ratio changed and was accompanied by a change in

the accounting system.2 From this date the sultan could set exchange rates for all

coins for his personal profit and he had the power, through the size of his financial operations as well as through the use of the market inspector (muhtasib), to

enforce his decrees. In the half-dozen cases where official (mu'amala) and

market (sarf) rates are given, the latter are usually 5-10 units (not percentage

points) below the former, and thus appear to move parallel to the official rates and

not independent of nor as a percentage of them. Rates calculated from food

prices appear to be the same as the announced rates and thus the official rates

were the market rates.3

While the setting of official exchange rates could bring the sultan an immediate

profit on the difference between old rates and new or by calculating salaries in a

coin with a low exchange rate and then paying with a coin which had a higher

exchange rate, the policy demanded constant interference in the market. A far

easier policy which guaranteed a more regular income and probably a greater

long-term profit was for the sultan to call in all coins which had not been minted

Suluk, vol. Iv, p. 196.

Popper, pp. 5 -67. A full discussion of the problem of gold-silver exchange rates can

be found in Jere L. Bacharach, 'Circassian Monetary Policy: Silver', Numismatic

I

2

Chronicle, 197I.

3 See note 4, p. 8o.

The dinar versus the ducat 83

in his name and reissue them as his own. The profit came from seignorage,

which was the fee charged for converting coins and ingots into new coins above

the cost of minting (brassage). All medieval rulers had charged seignorage, and

the Mamluks had followed the practice before 80I/I399 and were aware of the

economic benefits of the policy.

If this potential monetary gain for minting their own coinage had been the only

factor influencing the Mamluks, then it is very doubtful that they would have

tried so hard to replace the ducat, or even that they would have tried at all. The

critical factor was the position of the Mamluks as Muslim rulers in Egypt and

Syria.

The fact that the ducat was a Christian coin was obvious to all, including the

illiterate. Even if popular belief, as reflected in the Arabic sources, was wrong in

assuming that the two figures on the ducat were Peter and Paul (they were the

Doge kneeling before St Mark), this did not change the clearly Christian character

of the coin.' The Mamluks had justified their original seizure of power as defenders of the Ddr al-Isldm against the Christian crusaders and the pagan Mongols. As alien rulers, the Mamluks had actively sought the support of the local

religious leaders in order to gain their cooperation.2 With the widespread use of

the ducat, including its appearance in large number in Mecca itself, the Mamluk

Muslim world had been invaded by a new Christian force, and it was the responsibility of the Mamluks to defeat that enemy. Thus, monetary goals and religious

responsibilities acted as the motivating forces which brought about a series of

changes in the Mamluk gold coinage all aimed at meeting the challenge of the

ducat.

III

Before detailing the specific Muslim policies, it is necessary to trace the value

of the ducat in the Mamluk market. Most of the specific data for the ducat and

the Muslim coins is related to Cairo, although generalizations will be made for

the rest of the Mamluk Empire. All historians assume that the ducat was of a

very high degree of fineness, uniform weight of about 3-51 grams, and could be

traded by number rather than only by weight. As acceptance of this assumption

does not affect the basic argument of this study, it will be used. A critique of it is

given, however, in the appendix to this study.

Since the ducat weighed 3-51 grams of pure gold and the theoretical Muslim

dinar, referred to in the exchange rates, weighed a mithqdl(4-25 grams), then the

ducat's intrinsic value was 82-5 per cent of the mithqdl's. If the exchange rate

of the ducat as a percentage of the mithqdl rate was slightly higher, this would

reflect the value placed on being able to trade the ducat by number. Therefore,

I Al-Qalqashandl,

2

vol. III, p. 441.

Ira M. Lapidus, Muslim Cities in the Later Middle Ages (Cambridge, Mass., 1967),

pp. 116-42.

84 Jere L. Bacharach

the critical relationship was not how many dirhams or trade dirhams the ducat

and the mithqdl were worth, but the value of the former as a percentage of the

latter.

the ducat was usually worth about 93 per

For the years 8I0-805/1399-1403

cent of the mithqal in exchange (although its intrinsic value remained at 82-5 per

cent). Individual variations indicate a lack of a constant relationship. During the

great Egyptian economic crisis of 805/I403 and for the following three years, the

exchange value of the ducat declined to about 78 per cent of the mithqdl.This rate

indicates that the ducats were traded for their bullion content or less, with no

added value for being coined. By 808/I405 the exchange value of the ducat had

increased to about 85 per cent of the mithqdl, and by 8I2/I409

it was over 90 per

cent, where it remained for almost every recorded exchange rate until the introduction of the ashraft in 829/I425 by Sultan al-Ashraf Barsbay (825-84I/I422-

1435).

The conclusion to be drawn from these figures is that the ducat vis-a-vis the

mithqdl was overvalued. By calculating his expenses in theoretical mithqals and

by paying in ducats, a sultan could save as much as io per cent. Although there

were a number of official decrees before 829/1425 outlawing the ducat, they had

no impact.I As long as the exchange rates over-valued the ducat, edicts outlawing

it would have very little effect.

The traditional Muslim coin was the dinar with a canonical weight standard,

the mithqdl, of 4-25 grams. With the advent of Saladin's rule in Egypt (566/1171)

this traditional weight standard for individual dinars was dropped and stamped

pieces of coined gold of varying weight were issued. This policy was continued

under Saladin's descendants, the Ayyubids (566-648/117I-1250), then during

the first period of Mamluk rule, the Bahri, and finally into the Circassian period.

While the weight of individual pieces varied from under 5 to over 15 grams, almost all the issues had a very high degree of fineness. By the end of the reign of

Barqiuq,a number of terms for these stamped, round ingots had appeared in the

Arabic sources. The most common was harja (or haraja), whose vocalization,

form and etymology are uncertain.2 Writing in his chronicle under the year

815/1415, the noted Mamluk historian al-Maqrizi (d. 845/I442) described the

harja as follows:3

It is a gold Islamic coin free of debasementand is circularlyengravedon one of its

faces with the shahdda(Muslim creed) that 'There is no God but Allah' and that

'Muhammadis the Prophetof Allah' and on the other side is [the name of] the sultan,

the date it was struckand the nameof the city it was mintedin, that is Cairo,Damascus

or Alexandria...

Other terms which appeared less frequently in the Arabic sources were

makhtum 'sealed', maskuk 'coined', dhahab 'ayn 'pure gold', and Misri 'Egyptian',4 and while any of those may originally have had a specific reference, the

I See note

4, p. 80.

3 Suluk, vol. iv, p. I49.

2

Popper, p. 45.

4 Suluk, vol. III, p. 89, a.

The dinar versus the ducat 85

authors writing under the Circassian sultans do not use them systematically.

However, all but the last term may be interpreted as an indication of the maintenance of a high standard of purity, as this was the only control the government

could assert once the mithqdl weight standard was dropped.

As the harja could not be traded by number, it had to be traded by weight, and

exchange rates were announced as if each coin weighed one mithqal. Therefore,

while there are a number of harja-style dinars of varying weights, minted in the

name of Barqufq,the official exchange rates of i dinar to 20 dirhams and later

30 assumed that each coin weighed 4-25 grams. The same is true for the relationship between the harja dinars minted by Barqufq's son Faraj and the official

exchange rates. However, numismatic evidence indicates the harja dinars were

rarely minted after 8I0/I407, although there are over seventy exchange rates for

the mithqdl until the appearance of rates for the ashrafi after 830/1428. Unlike

the previous example, in which exchange rates for the ducat were used to prove

the availability of the coin, rates for the mithqal do not prove the availability of the

harja. The appearance of a mithqdl rate indicates that some coins were being

traded as if they each weighed 4-25 grams, but not which ones. Even the Arab

historians noted the absence of the harja. Under the year 817/14I4 the historian

al-'Ayni (d. 855/1451) recorded that harja dinars were lacking, as the Europeans

were taking them to strike ducats, and the people in authority ('ahl al-dawla)

withdrew them to mint other types of Muslim gold coins., He was absolutely

correct.

The next Circassian attempt to meet the challenge of the ducat was made by

the Amir YalbughS al-Salimi (d. 3II/I408) in 803/1401, when the Sultan Faraj

was in Damascus facing the threat of Timur. On io Jumddd I 803/6 January

1401 a new gold coin was ordered to be minted based on the weight of the mithqdl;

it was to be traded by number and not by weight; and it was known as the

Sdlimz.2 Not only was a I mithqdl weight coin minted, but according to alQalqashandi and al-'Ayni coins of i, I,I and 2 mithqdlunits were also minted.3

Al-Qalqashandi then wrote that the rapid disappearance during the reign of

Faraj of the Sdlimi was due to the fact that the coin was light in weight and cost

too much to mint.4 In an almost nostalgic manner al-'Ayni referred to the

Sdlimz and the advantages of using it by number rather than by weight, but then

added that a debasement (zaghl) was ordered because of the differences between

it and the other kinds of coins circulating in Egypt.5 Another historian, alMaqrizi, stated that the Sdlimi disappeared because it was replaced by another

Muslim coin, the Ndsiri.

The attempt to institute a mithqdl weight standard during the reign of Faraj

was not completely forgotten, and the sultan al-Mu'ayyad Shaykh repeated the

al-'Ayn, vol. iv, p. 397. Other references to the scarcity of the harja, Suluk, vol. iv,

pp. 370, 605, 7372 Sulak, vol. III, 25, 2; Ibn Qadi Shuhba,

3

vol. III, p.

al-Qalqashandi,

4 al-Qalqashandi,

p. 177, b.

441; al-'Ayni, vol. IV, p. 323; Balog, pp. 279-80.

vol. III, p. 441.

5 al-'Ayni, vol. Iv, p. 322.

86 Jere L. Bacharach

policy of Yalbughh al-Salimi. There is numismatic evidence, not written. There

are three published coins issued in the name of Shaykh and inscribed with the

terms mithqdlor nisf (half), whose weights correspond to the theoretical mithqdl

weight standards.I It is possible that their issuance was related to Shaykh's

announcements forbidding the use of the ducat in 821/1418.2 However, the edict

came to nothing; the reformed coin all but disappeared and the policy of replacing the ducat with a Muslim coin whose weight standard was based upon a

mithqdl weight failed.

If the crucial conditions for the acceptance of one type of gold coin over another

were the uniformity of weight and standard of purity, then the Sdlimi should

have replaced the ducat. The Sdliml had a degree of fineness as good as the ducat.

Its weight was based upon a Muslim standard, the mithqdl, and it was therefore

easier to use in an Islamic country than a Christian coin whose weight standard

was unknown. However, the critical factor was the exchange value of the two

coins. As indicated earlier, the exchange value of the ducat in relation to a theoretical mithqdlwas as much as io per cent more than its bullion content warranted.

The Sdlima equalled the theoretical mithqdl. Therefore, as long as the relationship between the rates of exchange for the ducat and Sdlimi/mithqdl did not

adjust to their respective gold contents, the Sdlimi was worth less, proportionately,

than the ducat. In simpler terms, the Sdlimi was undervalued in comparison to

the ducat.

The next attempt to meet the challenge of the ducat was also made during the

reign of Sultan al-Nasir Faraj, when a gold coin whose weight was based upon

the ducat was issued and called the Ndsirt. The exact day or even year the

Ndsirt was issued cannot be established. One historian credits the innovation to

the Amir Jamal al-Din Yusuf al-Ustadar (d. 812/I409).3 If this were true it would

explain why there was no announcement by the sultan about a new coin carrying

his honorific title. However, the date most frequently given for the initiation of

the reform is 81I/I411 although Dr Paul Balog in his corpus of Mamluk coins

has listed Ndsiris with the date A.H. 8I0 inscribed on them.4

All the sources agree that the coin was originally minted with a weight based

upon that of the ducat, and that the Ndsirz was to be traded by number and not

by weight. The average weight of the Ndsiris issued during Faraj's rule is a little

under 3-50 grams, and their percentage of purity was about 98 per cent.5 As

exchange rates for the Ndsirz are not recorded until the year 813/1410, it is possible that the ducat and the Ndsiri were treated (exchanged) as equal. This

assumption would help explain the disappearance of most of the harjas from

circulation after 8I0/I407, as suggested by al-'Ayni.

Balog, pp. 300-I. Tests by this author of a similar coin in the Dar al-Kutub

(Khedival)collectionfound the coin, number 679, to weigh about 4'3 grams.

2 Al-'Ayni, vol. IV, p. 464; Suluk, vol. xv, p. 282; Inbd', vol. II, p. 134, a; al-Jawhari,

99, a.

3 Al-'Ayni, vol. IV, p. 323.

4 Balog, p. 280.

s For weights, Balog, pp. 280-I. For degree of fineness, Bacharach, Study, pp. 357-60.

The dinar versus the ducat 87

Beginning in 8I3/1410, the Arab chronicles record how the nobles (al-nds)

preferred the ducat, complaining that the weight of the Ndsiri had declined.'

This observation is supported by a study of the weights of the later Ndsirts.z It is

possible that if the sultans had maintained its weight, the degree of fineness and

an exchange rate equal to that of the ducat, the Ndsirt could have replaced the

ducat. The Ndsiri had the psychological advantage of being a Muslim coin and

the initial economic advantage of weighing slightly less than the ducat but being

treated on a par. The primary reason for the failure of the Nd.sirzto become the

common gold coin of the Mamluk Muslim world was Faraj's unwillingness or

inability to enforce an economic and monetary policy which would favor its use.

Ndsirts were still being minted during the early years of al-Mu'ayyad Shaykh's

reign (8I5-824/I412-I42I) but the individual issues weighed less, the distribution of weights was greater, and the degree of fineness declined compared to the

original Ndsiri. The recorded exchange rates indicate that its market value was

significantly less than that of the ducat, reflecting the lower bullion content of this

Muslim coin. Finally, Shaykh actively sought to remove the Ndsiri from circulation. The chroniclers claim that he did this in order to issue his own Mu'ayyadi

dinars, but neither the textual data nor the numismatic evidence indicate that

this policy had any effect on the ducat's role as the primary coin of the realm.3

An example of Shaykh's monetary policy is the following, recorded by the

chroniclers under Safar 8i8/April 1415.4 On the 23rd of the Muslim month, a

meeting was held in the Citadel to forbid the use of the Ndsiri, and on the next

day the money changers and many of the traders met at the Salihiyya Madrasa,

in the Bayn al-Qasrayn street, to hear the new exchange rates for the mithqdl,

ducat and Ndsiri. The Ndsiri was to be traded by weight, as it was too light to be

traded by number. On the 26th of the same month, it was announced that the

Ndsirz was to be brought to the mint at a low exchange rate, and the chronicles

add that great sums were lost by holders of Ndsirl coins as a result of this edict.s

A similar example for the year 819/1416 was given earlier in the paper where

again the intent was to withdraw the Ndsirz from circulation.

The impact of Shaykh's actions was to end any advantage the Ndsirt had over

the ducat. The Ndsiri now became another form of the harja, as it was traded by

weight based on exchange rates for a mithqdl. As had been stated before, once a

Muslim coin was traded at this exchange rate, it was undervalued in relation to

the ducat.

The reassertion of a Muslim coin over its European counterpart on the Cairo,

and by extension Mamluk, market took place during the sultanate of al-Ashraf

Barsbay. His coin, the ashraft, gave its name to almost all the gold coins issued by

I

2

3

4

Al-'Ayni, vol. Iv, pp. 322-3; Sul1uk,vol. III, p. 89, a.

Balog, pp. 299-300; Bacharach, Study, pp. 357-60.

Al-'Ayni, vol. iv, p. 438; Inbi', vol. II, p. o09, b; Sulzk, vol. iv, p. 50o.

Suluk, vol. iv, pp. I50-1.

5 Al-'Ayni,

vol. IV, p. 402; Inba', vol.

II,

p. 77, b.

88 Jere L. Bacharach

the succeeding Mamluk sultans. Even the Ottoman sultans used the name for

their Egyptian gold coins.

After acquiring the sultanate in 825/1422, Barsbay quickly consolidated his

position and was so successful that, with one minor exception, his rule was

free of the type of internal revolts which had plagued his predecessors. Once

established in power, Barsbay sought ways to increase his sources of revenues. The

idea of monopolizing the supply and distribution of certain products had been

occasionally used by Mamluk sultans, but Barsbay set out to use this economic

tool on a much wider scale and in a more systematic manner. While the sultan's

control over the spice trade in 832/I428 was his most famous application of this

policy, he began it as early as 826/1423 when he temporarily monopolized the

sale of sugar. Another source of revenue he developed was the selling of offices.

All of these activities meant that the sultan was increasing his personal wealth.

Unfortunately, the Muslim sources do not give any specific background information as to why Barsbay on 15 Safar 829/27 December 1425 called a meeting

of the leading amtrs,judges and traders and announced that the ducat was not to

be used and that it was to be replaced by the ashrafi.' The sources also give no

indication of the intended weight, purity or exchange value of the ashraft.

Eleven days later the ducat was again outlawed, but this time the weight of the

ashrafi was given as equal to the ducat. Finally in Rabi'a I 829/February I426

the ducat was called in at an exchange rate of 220 trade dirhams (225 by cash).

However, for each grain weight (gamba, or 4 carat) each ducat was to be valued

down by 7- trade dirhams.2 The weight of the ashraft, calculated from numismatic evidence, was about 3-41 grams and of almost pure gold. Therefore, in a

completely free market, the ashrafi should have been worth 97 per cent of the

ducat's (3-51 grams) value. This meant that for each ducat turned into the mint in

exchange for one ashrafi, the holder of the European coin lost 3 per cent, and if

the coin was worn, as most must have been, the loss would have been even

greater. In simpler terms, Barsbiy's edict made the ashrafi, rather than the ducat,

the overvalued coin.

It is possible that the profits accumulated by this financial action enabled

Barsbay to pay for the expedition which he sent against Cyprus in 829/1426.3

The success of the campaign guaranteed the eventual success of Barsbay's

monetary reform. Not only was a large quantity of booty secured, but also

I,060 Christians, including the Cypriot king James I. The sale and ransoming

of James I was particularly lucrative as he promised to pay 200,000 ducats.4 In

Muharram 83I/October

1429 the first payment of 50,000 ducats reached Barsbay,

and he had them reminted as ashraft.5 Barsbay also announced new exchange

rates favorable to the use of the ashrafi.

x Inbt',

vol. II, p. 223, b; Suluk, vol. iv, p. 512; Nujim, vol. vI, p. 596.

Hawadith, p. 473; Ibn Iyas, vol. I, p. 40; Ibn Iyas, UnpublishedPages, p. 7.

3 Gaston Wiet, 'L'Egypte Arabe', Histoire de la nation egyptienne, ed. Gabriel Hano-

2

taux (Paris,n.d.), vol. iv, p. 446.

4 Darrag, p. 259.

5 Nujfim, vol. vi, p. 626.

The dinar versus the ducat 89

Four times in 829/1426 and twice in 831/1429 Barsbay outlawed the use of the

ducat, but if he was not enforcing rates favorable to the use of the ashraft and

using all the available bullion resources to mint it, then these edicts would have

been ineffectual.' Limited textual and numismatic data indicates that he was not

following through on his policy.2 The acquisition of the 50,000 ducats made a

significant difference, as large numbers of ashraft came into circulation and

exchange rates favorable to its usage were enforced. In the few cases after 831/

1429 when exchange rates for both the ashraft and ducat were listed in the Arabic

sources, the latter was worth less than the former. This new relationship was a

complete reversal of the earlier relationship between the Christian and Muslim

gold coins, as now the Muslim coin was the overvalued issue. In specific terms,

although there was more gold in a ducat than in an ashraft, the exchange rate for

the ducat was between 93 and 98 per cent of that of the ashraft.

A different trend in terms of exchange rates began in 86I/I45I. The ducat and

the ashraft were always listed as equal, but this does not mean that the weight

and purity of the coins were equal. While there is no evidence that the weight of

the ducat was lowered or that it was debased, this is not true for the ashraft.

During the long reign of Qayitbay (872-901/1468-96) the weights of the

ashrafi were all below 3-40 g, and the percentage of gold dropped to below 95 per

cent; it was debased.3 Besides numismatic data there is indirect textual evidence

that the ashraft had less gold in it than the ducat. In a reference dated 886-7/1452

listing exchange rates in the Ottoman Empire and hence beyond the control of

the Mamluk sultan, the exchange value of the ashrafz was 79 per cent of a

mithqal, while the ducat was 8i1 per cent.4 Therefore, although Qayitbay's

ashraft and the ducat had equal exchange rates, the Muslim coin was very much

overvalued in relation to the Christian one.

The reason Qayitbay found it necessary to lower the weight of the ashraft as

well as debase it was to meet his rapidly increasing financial needs. The numerous

Anatolian campaigns plus the necessity for new slaves cost millions of dinars and

represented an outflow of bullion rather than just a redistribution of gold among

warring Mamluks.5 The bullion squeeze was even greater because an OttomanVenetian naval war disrupted the spice trade, and by extension the supply of gold

I

223,

2

Suluk, vol. IV, pp. 512, 516, 524; Nujim, vol. vi, p. 596; Inba', vol. ii, p.

- Inba', vol. II, p. 240, b.

An isolated reference for the year 830/1427 indicates that the ashrafi was worth about

829/1425

-

b; 83I/1427

trade dirhams or 97 per cent of the value of the ducat; this would accurately reflect

the difference in weight (gold content) between the two coins (Suluk, vol. Iv, p. 555).

Dr Balog discovered two harja-style dinars from the reign of Barsbay for the years A.H.

829 and 830 (Balog, p. 398).

3 Bacharach, Study, p. 360.

4 Nicoaro

Beldicianu, Actes de Mehmed II et de Bayezid II du MS Fonds Turc ancien

214

39 (Paris, 1960), vol.

ii,

p. I56.

5 David Ayalon, 'The System of Payment in Mamluk Military Society', JESHO,

vol.

I (957),

p. 273.

go Jere L. Bacharach

to Egypt. The last Mamluk sultans continued to lower the weight and degree of

fineness until the ashrafi became a 'yellowed copper coin'.1

To summarize the monetary developments in ninth-/fifteenth-century Egypt

and Syria: the ducat dominated the internal money market from 8oi/1399; the

Mamluk policy of trying to meet this challenge with the standard gold coin, the

harja, failed; the attempt to use another coin, the Sdlimi, whose weight was

based upon a traditional mithqalstandard, failed; the attempt to replace the ducat

with an imitation, the Ndsirz, eventually failed; a second imitation, the ashrafi,

issued by Barsbay, succeeded in replacing the ducat; and later Mamluk issues,

generally called ashraft, while traded at par with the ducat, had less gold per

coin. Most of these facts have been known to historians, but why one policy

succeeded and others failed has not been clear.

Without reviewing the arguments of earlier historians, their fixation on the

ducat, with its reputation for a high degree of fineness and uniformity of weight,

led them to believe that it was superior to Islamic gold coins. As already suggested,

this was not necessarily true. In many cases the ducat was overvalued in relation

to the Muslim coin, or in simplistic terms was 'bad' money. Once the ducat is

treated as overvalued or 'bad', a relatively simple economic model can be applied

to the problem. This is Gresham's Law.

When Gresham's Law is given as 'bad money drives out good money', it is a

case of oversimplifying a more complicated explanation of monetary behaviour.2

A fuller explanation would be that 'bad' (or overvalued) money drives out 'good'

(or undervalued) money if (i) there is a large enough supply of 'bad' money in

circulation and (2) exchange rates exist so that one coin is overvalued in relation

to another. In the case of the Mamluk Empire, the first condition was met when

large numbers of ducats entered the internal market after 80o/I399. While it is

theoretically possible that large quantities of a Muslim coin could have been

minted before 83I/1429, it was only with the reminting of James I's ransom that

the market had an adequate supply of Muslim coins to make the law work in favor

of the ashrafi. Had the Mamluk market been free of outside interference, then the

relative exchange rates for the ducat and other Muslim coins would have adjusted

themselves to reflect the intrinsic value of each coin. However, the proclamation of

particularrates of exchange established relationships which tended to make one coin

overvalued in comparison with another, and Gresham's Law became operative.

An interesting developmenttook place during the reign of al-Mansur 'Uthman

(857/1453) when a gold coin, called the Mansuri,was minted. Accordingto the textual

sourcesit was supposedto weigh i dirhamand havean exchangerateequalto 88 per cent

of the ashrafi.This coin wouldhaverepresentedthe logicalsequenceof weightreductions

for the Muslim coins and would have placedthe weights of the Muslim gold coins back

into a Muslim standard.However,the numismaticevidence is contradictoryas to what

was the intendedweight of the Mansurtand the reign too short for any real programto

develop. (.Iawadith, p. 186; Ibn Iyas, vol. II, p. 37; Ibn Iyas, UnpublishedPages, p. 7;

Balog, p. 328.)

2 Frank W.

Fetter, 'Some Neglected Aspects of Gresham's Law', QuarterlyJournal of

Economics, vol. XLVI(1931-2),

p. 487.

The dinar versus the ducat 91

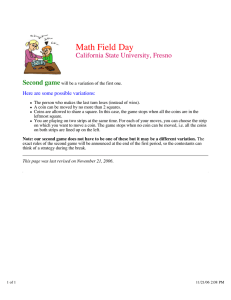

Table i illustrates the various relationships between the coins surveyed in this

section. Most variations for each coin have been neglected for purposes of

generalization.

TABLE

Coin

I

Circulating coins, 80o-829/1399-I427

Average wt.

(grams)

Ducat

Harja

3'51

-

Salimi

4'25

Ndsiri

Ndsiri*

3'50

-

Average wt.

as %

of mithqdl

Average

exchange

rate as %

of mithqal

82-5 %

oo %

Ioo %

82%

100%

90 %

oo %

Relation to

ducat's value

Equal

Undervalued

Ioo %

Undervalued

90%

IOO%

Overvalued

Undervalued

* After

813/140o .

TABLE II

Coin

Ducat

Ashraft

Barsbay

Qayitbay

Circulating coins, post 829/1427

Average wt.

(grams)

Average wt.

as %

of mithqdl

Average

exchange

rate as %

of mithqdl

3'51

ioo %

ioo %

Equal

3'41

97%

I05 %

Overvalued

3'37

96%

oo %

Relation to

ducat's value

Overvalued

If one were to compare the value of a ducat with a theoretical Muslim coin

weighing a mithqdl, then the ducat would have weighed 82-5 per cent of it, but

would have been worth go per cent of it or one would gain 7-5 per cent by calculating costs in these theoretical mithqdls and paying in ducats. Therefore, the

ducat was overvalued, or 'bad', in relation to a theoretical mithqdl.The traditional

Mamluk coin, the harja, was very heavy and composed of almost pure gold, but

was traded as if each coin weighed I mithqdl. Therefore, it was undervalued in

relation to the ducat and disappeared from the market. The Sdlimi weighed

exactly a mithqdl, was composed of almost pure gold, was undervalued ('good')

in relation to the ducat, and disappeared from the market. The initial Ndsiri

issues weighed less than the ducat but were traded as equal to it. This meant that

initially the Ndsirt was the overvalued coin, but once the Ndsiri was traded by

weight on a mithqdlstandard, the old relationship returned and the Muslim coin

once again became the undervalued money. Obviously no Muslim coin could

replace the ducat as long as exchange rates made the ducat the overvalued coin.

The reverse situation can be seen in Table 2, where the ducat became the

Jere L. Bacharach

92

undervalued coin in relation to a Muslim one. The ducat now fitted the reputation

historians had given to it. But, as the 'good' coin, it disappeared from the market

as the main money of exchange.

IV

Since the preceding explanation was so simple and so obvious, why did the

Mamluks fail to issue an ashraft-like coin first and avoid all the other problems?

This question leads into the more general question of what this study can tell us

about the level of economic sophistication in Mamluk Egypt and Syria.

There is a great deal of evidence to prove that the Mamluks as well as other

Near Eastern peoples were fairly sophisticated when it came to monetary and

economic questions. Professor Ira Lapidus has discussed the Mamluk policy of

manipulating the internal grain trade for their own advantage.' Professor John

Smith and this author have treated the monetary policies for silver coins for the

Ilkhanids and Mamluks respectively, and the policies of both dynasties demonstrated a sophisticated awareness of monetary problems and a knowledge of how

Gresham's Law worked, even if they did not know it by name.2 What is intriguing is that at the same time the Mamluks were demonstrating a knowledge

of how Gresham's Law worked in respect to their silver issues, they failed to apply

it to their gold issues.

The resolution of this contradiction rests with the attitude of men, ancient,

medieval and even modern, toward gold. There is something sacred about gold

coins, and it is widely believed that the bigger and better the coin the more people

will want it. As defenders of the Islamic tradition, the Circassians felt it their duty

to issue a Muslim gold coin and not rely upon the infidel piece. Thus their first

step was to continue minting as large a coin as possible. Once this failed, they

then tried one whose weight was based on a Muslim standard, but was still

bigger (and better? - see Appendix) than the European coin. When this failed

they reduced the weight to that of the ducat, but failed to follow through on this

policy. Only under Barsbay was the final and logical step reached when a smaller

coin was issued and favorable exchange rates promulgated. After Barsbay, an

occasional call for the return to the traditional Muslim mithqdl was recorded in

the Arabic sources, but the sultans knew they had won the battle and it was the

ashraft which became the name for gold coins from Northern Syria to Yemen

if not beyond.3

OF WASHINGTON,

WASHINGTON

UNIVERSITY

SEATTLE,

I

pp.

Ira M. Lapidus, 'The Grain Economy of Mamluk Egypt', JESHO, vol. xII (I969),

I-I5.

2

John M. Smith, 'The Silver Coinage of Mongol Iran', JESHO, vol. xII (1969), pp.

16-4I;

Bacharach, in Numismatic Chronicle, 1971.

A return to the traditional Muslim weight standard was advocated by a Syrian, alAsadi, in 855/1451 (al-Asadi, al-Taysir..., ed. 'Abd al-Qadir (Cairo, 1968), p. I29).

3

The dinar versus the ducat 93

APPENDIX.

THE DUCAT IN EGYPT:

ITS WEIGHT,

PURITY

AND EXCHANGE

VALUE

While the weight, purity and exchange value of the Muslim gold coin circulatingin Egypt at the end of the eighth/fourteenth century can be easily established

from the numismatic and textual sources, the same is not true for the Venetian

ducat. The numismatic data are scarce and mostly unpublished, while the textual

citations relevant to the Mamluk world are scattered and unclear.

This author's investigation of the holdings in the cabinets of the American

Numismatic Society, Ashmolean Museum, Bibliotheque Nationale, the British

Museum and the private collection of Th. Horovitz has yielded only 34 Venetian

ducats minted in the names of the Doges Andres Contarini (I368-82; 2 coins),

Antonio Venier (I382-1400; 15 coins) and Michel Steno (I400-13; 17 coins).

Most of them weighed between 3-48 and 3-5I grams, with an average of 3-50

grams. This figure is so far below the theoretical 3'559-gram standard for a ducat

that a 'loss due to wear' factor raises a serious question about the intended weight

of the actual issues.' The Horovitz collection (Venier - 9 ducats, and Steno 9 ducats) is very important as it was acquired in Egypt and was possibly part of a

hoard. The fact that the individual weights in his collection varied from 3-20 to

3.67 grams poses a further problem regarding the size of transactions that could

be made with the ducats by number before they would have to be weighed. The

constant Arabic reference to the initial advantage of being able to trade the ducat

by number appears to draw a contrast to the extreme variations in the harja

type of Muslim dinar. Finally, and even more remarkably, specific-gravity tests

undertaken by this author on the Horovitz collection and listed at the end of this

appendix indicated that the tested ducats had a degree of fineness significantly

less than that of their Muslim counterparts, and in fact ranged from 96 to 90 per

cent gold. Therefore, the available numismatic data do not indicate what the ducat

should have weighed nor what its degree of fineness should have been.

The textual references to the weight and purity of the ducat for this century

are even more confusing than the numismatic data. It has become impossible to

solve all the inconsistencies between the various Arabic data, the Muslim data

and European data, and the textual and numismatic material. To illustrate this

dilemma, the following examples from Arabic and European sources are presented. In a discussion of the weight of the ducat, possibly for the 790s/I390s,

the encyclopedist al-Qalqashandi (d. 821/1418) wrote that each ducat weighed

I9- Egyptian carats; al-Maqrizi, under the year 818/1415, stated that Ioo ducats

once yielded 81 mithqals; and a mid-fifteenth century Florentine merchant handbook stated that oo00ducats equalled 8i bisants (mithqals) and I6 carats (2

mithqdl).2 If the mithqdl, composed of 24 carats, weighed 4-25 grams as every

Islamic scholar claims it must, then the calculated weight of the circulating ducat,

Ives, p. 5 n. 12.

Suluk, vol. iv, p. 149; al-Qalqashandi, vol. III, p. 441; Anon. (Ps.-Chiarini),

Mercatantie et Usanze de' Paesi, ed. Franco Bollandi (Turin, 1936), p. 8i.

2

Libro di

94 Jere L. Bacharach

based on these three independent observations, was 3'46 grams. This is very unusual in that the weight calculated from the medieval documents is less than the

average weight of the surviving specimens, just the opposite of what would have

been predicted. If it is claimed that the mithqdl weighed 4-32 grams,' then the

ducat would weigh 3-5I grams and the problem would be solved. However, alQalqashandi gave a second equivalency for the ducat, along with the one cited

above, when he wrote that the ducat weighed a little more than i dirham and

2 kharruba(which is usually translated as 2 carats or X dirham) according to the

Egyptian silver weights.2 If the equation is solved for the weight of the ducat

using known gram equivalents for a dirham coin weight or a dirham trading

weight, the resulting number does not agree with any of the above data. Finally,

the Arab chronicles say that the ducat eventually weighed the same as the Muslim gold coin, the ashraft (average weight circa 3.4I grams), which replaced the

ducat after 829/1425 and give as the common weight of the coin I- dirhams.

Even if all the mathematical relationships could be solved using either a mithqdl

of 4-25 or a ducat of 3-5I or 3-559 grams, the resulting numbers would not agree

either with the known specimens or with any known Muslim unit of weight. Not

the least of the problems in analysing the coinage of this period is the fact that the

term 'dirham' had at least four meanings and it is not always clear which definition

was intended by a chronicler, assuming that he knew which one he was using.3

How pure was the ducat circulating in the Near East? Modern scholars have

identified the degree of fineness of the ducat, without distinction as to date, as 997

parts gold, and medieval Arab chroniclers write of it as a coin free of impurities.4

However, three pieces of textual data raise some doubt about the accuracy

of the previous statement. After writing that Ioo ducats had once weighed 8I1

mithqdls, the Arab historians complain that now, in 818/1415, they only weigh

78? mithqdls, or less than 3*33 grams (or, if a mithqdl of 4-32 grams is assumed,

3-338 grams).5 Only two ducats out of fifty coins examined covering the years

1368 to I47I weighed less than 3-33 grams, and only seven less than 3-48 grams.

Therefore either those coins in modern collections are totally unrepresentative of

the medieval sample or the Arab historians are referring to pure gold and not

weight. If the latter is true, then the ducat was between 93 and 95 per cent gold.

A second example comes from the period immediately following the great

economic crisis of 805-6/I403, when the value of the ducat vis-a-vis the mithqdl

was less than the calculated value of its bullion content, assuming that the ducat

was composed of pure gold. In the third case, the I442 European handbook

compiled by Giovanni di Antonio da Uzzano, possibly using earlier sources, gave

I Islamic weights are discussed in detail in Walther Hinz, Islamische Masse und

Gewichte (Leiden, 1955).

2

Al-Qalqashandi, vol. III, p. 44I.

3 The numerous definitions of the 'dirham' are analysed in Bacharach, Numismatic

Chronicle.

4 Ives, p. 5.

5 Al-'Ayni, vol. iv, p. 464; Inba', vol. II, p. I34, a; Suluk, vol. IV, p. 282.

The dinar versus the ducat 95

Tests on the fineness of Venetian Ducats in the collection of

Th. Horovitz, Geneva

Doge

A. Venier, 1382-1400

M. Steno, 1400-13

T. Mocengigo,

I413-23

C. Moro, 1462-71

Weight

% gold

3'52

90

3'53

93

3'32

3'55

90

90

3'54

95

3'46

3'50

93

91

3'53

95

3'54

3'54

92

92

3*43

93

3-56

3'53

87

96

3'27

3-52

3'20

3'52

90

90

93

87

3'37

87

3'53

92

3'37

92

3'53

87

the weights of the mithqdl and the ducat as 24 and 223 carats respectively.'

Calculating the carats into grams produces numbers as confusing as those in the

last paragraph, but using the term 'carati' as an indication of fineness, the ducat

has a 95 per cent degree of purity. In conclusion it is not absolutely clear that the

Venetian ducate was purer than, let alone as pure as, the Muslim gold coin.

The third variable, after weight and purity, is the value of the ducat in the

Mamluk Empire at the end of the eighth/fourteenth century. European sources

for greater Syria, with data scattered between

I344 and 1382, give i ducat as

equal to i8 dirhams, which indicates that the ducat was worth go per cent or less

of the dinar.2 The European references for exchange rates in Cairo and Alexandria

indicate a lower value for the ducat and show a wider range of percentages 80-87 per cent.3 The only Muslim reference, al-Qalqashandi, for Cairo in the

790s/I390s,

gives a relationship of 85 per cent.4 Considering

all the above per-

centages, the ducat had a value relative to the mithqal slightly above its assumed

gold content. This advantage can be explained by the value placed upon a coin of

I Giovanni di Antonio da Uzzano, 'La Practica della Mercatura,

ed. Giovanni Grancesco Pagnini (Lisbon, 1767), vol. Iv, p. II3.

2

Bacharach, Study, pp. 352-55.

3 Ibid. p. 352.

4

Al-Qalqashandi, vol. III, p. 44I.

1442',

Della Decima,

96

Jere L. Bacharach

relative uniform weight and size in contrast to the Muslim coin which had to be

weighed for all transactions.

The purpose of this rather long and detailed discussion is to indicate how little

we know about the 'dollar' of the late Middle Ages and why certain assumptions

about the ducat were made for the arguments in this study. It was assumed that

the ducat was composed of almost pure gold, had a uniform weight of at least

3'5 grams and was worth 82-5 per cent of the mithqal weight of Muslim gold in

terms of bullion alone. All of these assumptions are biased in favor of the ducat,

so that any one acquiring these coins could never hope to receive more gold nor

find a greater uniformity of weight, although he might get less. In terms of the

third section of this paper, this means that the ducat could possibly increase its

'overvaluedness' but could never be less 'overvalued'.

ARABIC

SOURCES:

ABBREVIATIONS

al-'Aynl

Al-'Ayni, 'Iqd al-Jumdn fi Ta'rkh Ahl Al-Zamdn, MS (Cairo),

Hawddith

Ibn Taghri Birdi, 'Hawadith al-Duhur fi Mada' al-Ayyam wa-lShuhur', edited by William Popper, University of California

Publications in Semitic Philology, vII (i930-I).

Ibn Iyas

Bada'i'

Ibn Qadi Shuhba

Ibn Qadi Shuhbah, al-A'lam bi-Ta'rikh Ahl al-Isldm, MS (Paris),

Inba'

Ibn Hajar al-'Asqalain, Inba' al-Ghumr bi-Anbd' al-'Umr, MS

(Cairo), Dar al-Kutub al-Misriyya, Ta'rikh, no. 2476.

al-Jawhari, Inbd' al-Hasr fi Anba' al-'Asr, MS (Paris), Bibliotheque

Dar al-Kutub

al-Zuhur fi Waqa'i' al-Duhur,

Nationale,

al-Qalqashandi

Suluk

vol.

ii

(Bulaq, A.H. 1311),

edited by M. Mustafa (Cairo, I959).

Bibliotheque

Nujum

Ta'rikh no. 1044.

vol. iv, edited by M. Mustafa (Cairo, I96I), UnpublishedPages of

...,

al-Jawhari

al-Misriyya,

Nationale,

no. I599.

no. I79I.

Ibn Taghri Birdi, 'al-Nujum al-Zahirah fl Muluk Misr wa-lQahirah', edited and translated by William Popper, University of

California Publications in Semitic Philology.

Al-Qalqashandi, Subh al-A'shd' (Cairo, 1914-28).

Al-Maqrizi, al-Suluk li-Ma'rifa Duwal al-Muluk, vol. II, MS

(Paris), Bibliotheque Nationale, no. 1727; vol. iv, MS (Cairo),

Dar al-Kutub al-Misriyya, Ta'rikh no. 339.