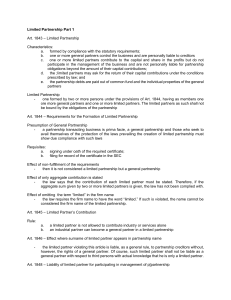

BLP – Partnerships Assessment ● ● ● ● ● ● ● ● ● ● ● Partnership will be examined MCQ closed books one hour, worth 20% Open book 3 hours exam Highly based on workshop work and specifically tasks and test & feedback Test and feedbacks are not checked but good for practice Need to take the time to annotate and highlight the Business and law practice legislation book Must state the law then apply it to get full mark Either partnership purely based on the Act or deal with variations Setting up a partnership Running the partnership Liability for debts Outcomes ❑ Recognise the existence of a partnership; ❑ Recognise the terms of a partnership from the conduct of the partners; ❑ Advise on general provisions from the Partnership Act 1890; o Existence and duration of a partnership; o Profit-sharing; o Decision making; o Retirement; o Expulsion; and o Dissolution. ❑ Advise on the clauses provided by the Partnership Act 1890 and how to exclude them; ❑ PCR implication of advising more than one partner in the draft of a partnership agreement; ❑ Advise on liability of former/current partners. Characteristics of a partnership ● ● ● ● ● ● ● ● ● ● ● A partnership arises where two or more persons agree that they will run a business together in the view of profit and actually do so. Deemed to have begun when the conditions are met, even if it is before the agreement was signed. It is a business relationship based on an agreement (ie: contract)- can be oral or in writing. the right to be involved in making decisions which affect the business; the right to share in the profits and losses of the business; the right to examine the accounts of the business; the right to insist on openness and honesty from fellow partners; the right to veto the introduction of a new partner; the responsibility for sharing any losses made by the business. Does not have separate legal personality Advantages: commercial secrecy, informal in nature and easy to start up, flexible, tax relief for start-up losses, tax transparent Disadvantages: can create fixed charges, full liability of the partners, any partner can act in apparent authority and bind the firm. ● Depends very much on the partners’ relationship with each other, must assert if they are personal or purely commercial ● Khan v Miah [2001]. WLR 2123- HL held partnership commenced even though the restaurant in question had not opened before the partnership relationship broke down. Creation of a partnership sections 1&2 PA 1890 ● ● ● ● ● Two or more persons (individuals or companies) Agree to carry on (e.g. already have capital, started the enterprise) A business in common (e.g. section 48 PA) With a view of profit Name; No duty to disclose names and addresses of partners if the name is only their forenames or their initials (Section 1192(3)b CA 2006). If the CA 2006 applies, more duties about the name which might have to get approval. ● Can be accidental Terms ● ● ● ● ● ● ● ● ● ● ● ● Commencement date- technically from date definition in S1 is met. Can also be from date written into partnership agreement. Name- firm name might be different from might be different from business/ trading name so both and names of partners Financial input -agreement should state how much capital each partner is putting in. Can so deal with Qs such s future increase in contributions. Income Profit/ losses shares -can be equally or based on financial input. If nothing to contrary, under PA 1890 (S24(1)) will be equally split. Must also state losses shares – again under PA 1890 will be equal silent. Salary-Do partners want salaries before division of profits? Can reflect if one putting in more time than another etc. Interest- Interest at a specified rate might be allowed on Ps capital contributions before any surplus profit is divided. Profit sharing – Suitable ratio in which profits remaining after salaries and interest on capital are to be shared should be stated. Also, how should be dealt with if loss- salaries and interest rates still to be awarded meaning a higher loss? Drawings- how much a partner can withdraw in respect of their shares. Monthly limits perhaps, or provision for periodic review. Shares in increase/ decreases in asset values – eg: if business premise is sold how will that be shared between Ps? Implied term under 1890 Act is equal split. If one partner put in higher capital might want higher share of any gain. Place and nature of the business – can include clauses that describe business premise eg: which area etc. Once agreed any changes would need unanimous partnership consent. Ownership of assets – asset where beneficial ownership rests with all the partners- not necessarily in equal shares. Issues can arise where a premise already owned by one P and not clear in terms as to what was intended re ownership. To avoid issues agreement should stipulate what the assess of the partnership are- list in schedule to the agreement. Work input- in PA 1890 in absence to contrary, implied term that all parties are entitled to take part in the management of the business- no obligation to do so. Should express ● ● ● ● ● ● ● ● ● ● expected work eg: full time, part time, or none (sleeping partner). Should include holiday, sickness, maternity etc- PA 1890 has NO guidance in absence of agreement Roles- can define each P’s roles, some may have more than others eg: sleeping partner attend meetings only or more junior ones only able to have authority to make contracts within specified limits. Any limits are binding- breaches mean breach of contract. Decision making – unless agreement to contrary decisions will be by way of simple majorityeach P has a vote. Exception is where decisions change nature of the business or new partner- there must be unanimous. Set out what each can do- can one make staffing choices or must be majority? Etc. Duration- limited for x years or otherwise? Dissolution by notice – If no provision partnership can dissolve at any time by any partner giving notice to the others- partnership at will. However, cannot be partnership at will if there is any limitation placed on his right to terminate the agreement by him alone giving notice (s26 PA). Can have immediate affect and need not be in writing. Unless agreement was by deed. Other dissolution solutions -Can make provision for notice of dissolution to allow a minimum period (eg: 6 months) before taking effect. Can also do fixed no of years- but think about what happens if they want to renew it at end. Can be dealt with by saying partnership will continue automatically on same terms after the fixed term except that henceforth it will be terminally by say 3 months' notice. Can also say continues as long as X remaining partners. Death and bankruptcy- unless anything to contrary, under PA death or bankruptcy of P will automatically cause dissolution of the entire partnership. Often will have term saying upon this, other partners will automatically buy that one out etc. Retirement- no clause for it under PA EXCEPT for partnerships at will where S26 will allow for dissolution if one retires. This will need to be dealt with in the partnership agreement. Should also deal with how bought out, etc. Expulsion- PA does not allow for expulsion by others without the P’s consent (s25) so the agreement should address this too-should also address payment of P’s partnership share etc. Payment for outgoing P’s share- if agreement silent on terms of purchasing the share, S42 of PA. Under this if 1P ceases to be a P but delay in final payment of his partnership share, former partner/ estate entitled to receive either 5% interest on the amount of his share or such a share of the profit as it attributable to the use of the share. Agreement should address these things- how share will be valued, obligations on partnership to buy it, payment due date etc. Restraint of Trade following departure- Competition- no implied term preventing outgoing partner from setting up competing from setting up competing business/ partnership etc. Any such provisions will need to be stated in partnership agreement. Important as any restraint of trade clause which is held to be unreasonable will be void as a matter of public interest. Courts more likely to enforce if it is to protect purchaser of a business rather than to restrict activities of an individual departing partner from continuing business elsewhere. Usually non-competition clause- must be legitimate aim eg: protect confidential data, its employees, business connections etc. MUST be reasonable. Must be limited to geographical area and duration must be what is reasonable to protect the legitimate business interest. also have non dealing clause which seeks to prevent the former partner from entering into contracts with customers/ employees of the partnership he left. Same with non-soliciting clause hitch would stop him from soliciting contracts from employees/ stompers of partnership he left. ● Arbitration – to avoid expense, delay etc partnership agreements can also include provisions for arbitration of disagreements. ● Anything contained in the partnership agreement is a term of contract between the parties and therefore cannot be altered without consent of ALL parties to the contract- ie: all partners. S19 encourages partners to negotiate and agree terms themselves- alludes to Act determining rights and duties if they don’t do it themselves. S24 PA 1890 contains provisions concerning partnership running that will be implied into partnership agreement in the absence of an express provision. Limited in scope and ‘treat all partners equally’ in essence. Partnership agreement- normally deed- can agree whatever terms they wish subject to illegality/ public policy constraints. Under the Act every partner can participate in the management of the partnership business (s24 (5)). Under the Act a simple majority can decide most things apart from a decision to change the nature of the partnership business which must be unanimous- not suitable for all businesses. ● ● ● ● ● Capital and share of property Capital – what put in to business and profit- coming from trading. Capital- fixed assets. Eg: if Pship owned property, capital profit rather than making money from normal buying and selling. Income- profits throughout year. Capital profits- one off. Sell piece of land or machinery once and once only. As not regularly occurring capital only. ● PA – S 24(1) – income and capital profits shared equally. Each would have 25% under the Act. ● In agreement – 8.1 share it equally – reflects the act to say should be shared. Distinct from capital as different to capital – 4 people working full time only fair will get benefit from efforts at the same level as putting in same effort etc. ● Clause 7.4- capital- shared between partnerships in proportions of capital put in- as put in 7.1 and 7.2- 7.2 says partners shall own capital as same proportion as original contributions as put in 7.1. Commercially – unequal initial capital so to be fair it reflects it. In future chance might invest more. Also in terms of getting money out- interest in capital- 7.5 - get interestmore put in, more interest get out. Does PA say can get that interest? PA S24 (4) – not entitled to interest on capital. ● Decisions making ● Changing nature of PShip- S24 (7)- to introduce a new partner must be unanimous. Often Pship agreements keep this as too important a decision- check the partnership agreement. ● New partner- S 24(8)- differences during ‘ordinary matters’ of running the Partershipmajority decision. Pship agreements often keep this. Means MORE in favour than againstnot a 50-50 split. Flexibility often important. ● Changing terms of Pship agreement – Unanimous S19 – agreement reflects- 10.1.9- again too important. ● If there’s a gap- fall back on the Act if it’s covered by it. ● Trying to look at the future and set boundaries, structure etc. There will be times when people disagree etc. It is about people – personal relationships. Partners responsibilities ● ● Good faith; SS 28-30 of the PA partners must divulge to one another all relevant information connected with the business and their relationship Time devoted to the partnership; s 24 (5) effectively allows for sleeping partners Liability for debts Firm liability (not seen in the workshop) ● Joint and severally liable s 9 PA ● Partners have acted jointly ● Partners have expressly instructed one of the partners ● Implied actual authority ● Apparent or ostensible authority (if the firm is apparently engaged, if a partner would usually have authority to act, the other party did not know the partner did not have authority, the other party deals with a person whom he knows or believes to be a partner) s 5 PA ● S6 PA1890 – Partners bound by acts on behalf of the firm – An act done by the firm during the usual course of business and done in the firm’s name/ any other way showing an intention to bind the firm by anyone who is authorised to do so will bind the firm and all of the partners. If an act can be shown to be not in the normal course of business, then the firm will not be liable ( Horst v Etherington [1999] Lloyd’s rep PN 938- Solicitors firm where debt incurred by 1 P was not entered into during the usual course of during the usual course of business.) ● S7 PA 1890 Partner using firm credit for private purposes - If one P uses credit of the firm for a personal matter/ a matter that is not in the firm’s ordinary course of business, then the firm is not bound UNLESS the other partners specifically authorised it. This section does not stop personal liability in regards to the partner in question. ● S8 Where a P acts in breach of authorised power restriction- – If restrictions on P’s power to bind the firm have been pre-agreed then any act which contravenes the agreement is NOT binding on the firm. ● The firm will always be liable for actions which were authorised and in the normal course of business. ● Authority to act can be implied as well as expressed: if all Ps are involved in running business without any agreed limitations then it is implied that each partner has authority for example, to sell firm’s products in ordinary course of business. Personal liability Tortious liability ● Sometimes firm can be liable for tort- eg: negligence. ● S 10- makes firm liable for any wrongful act/ omission made by a partner who acts in the ordinary course of the firm’s business or with the authority of his partners. ● S12- Joint and several liability for the firm’s liabilities under S10. ● Dubai Aluminium Co Ltd v Salaam [2002] 2 WLR 1913 – House of Lords held that S10 is not limited to tort- it covers all types of wrongdoing including a dishonest breach of trust or fiduciary duty. In case Ps liable for fraudulent acts of rouge P who acted dishonestly as it was in the ordinary course of business of that partnership (a law firm.) ● JJ Coughlan v Ruparelia [2003] EWCA Civ 1057 CA held that ss 5 & 10 will not make other Ps liable if the rouge partner ‘s act was not one that was done during the course of ordinary business carried out by the firm. Who the firm’s liabilities are enforced against Liability ● Timing- WHEN WAS IT INCURRED? ● When contracted entered into- if partner- S19,17 and ● IF worried about risk after leave- 36 (1 And 2) and S14 Potential defendants ● The firm – Should be sued in the first instance if the partnership has a name AND it is appropriate (CPR Part 7, PD7, 5A.1 and 5A.3). All those who were partners at the time the debt was incurred are jointly liable to satisfy the judgement (PA s 9s 9 and 17 1890Act and 17 and s3 Civii Liability (Contribution) Act 1978). ● Any Partner at the firm at the time the debt was incurred can be sued individually S 9 – every partner in a firm s jointly liable with the other partners. – In practice unlikely creditor would want to sue just one person. However, if it happens the partner who is sued is entitled to claim indemnity from other Ps to share liability amongst them. ● Someone who left the firm before / not a member of the firm when the debt was incurred s17 PA 1890 - normally not liable. Exceptions: ● S 14 PA 1890- holding out – where creditor had relied on a representation (holding out) that X was a partner in the firm by either X or someone else with X’s knowledge then X can be liable even if he had never been a partner, had actually been retired at the time etc. The holding out can be oral, in writing or by way of conduct – eg: if firm places order on old letterhead paper which says A is a partner when he actually retired and A knows old paper is still being used. S14 – “holding out "Anyone who knowingly allows himself to hold out as being a partner will be liable as if were a partner. Stationary- needs to be removed from all headed note paper, etc. Without it risk she will be liable under S14. 1. S36 PA 1890 -Failure to give appropriate notice of retirement/ expulsion- Under S 36 of the PA 1890 when a P retires/ levels, must give notice. Principle based on creditor having right to assume membership of the firm continues unchanged until any notice of that change. Therefore, S36 only applies where creditor knew partner in question was a partner – if creditor was never aware P was partner notice not required. S36 does not apply where P crashes for death or bankruptcy. Estate of deceased or bankrupt partner is not liable for events occurring after death/ bankruptcy. Notice that S36 states to give: a. Actual notice- eg: sending out standard announcement letter to all those who have dealt with the firm prior to his leaving (s36 (1)). b. Advertisement in the London Gazette (or Edinburgh Gazette in Scotland) (s36(2)). Need to do BOTH S36 1 AND 2 to give proper notice. ALSO BE AWARE OF S14- HOLDING SELF OUT WHICH MEANS OLD STATIONARY ETC 2. Novation agreement- tripartite agreement between creditor, firm and new partner. Creditor agrees to release original partnership from their liability under the contract and instead the newly constituted firm will take over the liability. S 17 liabilities of incoming and outgoing partners ● ● ● ● Someone who comes in to the firm is not liable for existing debts. Under S17 (2) – partner who retires from the firm does not cease to be liable for Pship debts or obligations incurred BEFORE their retirement until the creditor had notice (s36 (1) and 36(2). To protect a partner from this when retiring – If anyone leaves partnership use do ALL THREE- S1 – give actual notice (s36(1), S36 (2) in the London Gazette- S14- remove Partner name from all stationary etc. S17 (3)- an be discharged from existing liabilities by agreement between the other partners and creditors (novation agreement)– express or inferred from course of dealing. Remember- novation in practice- most creditors would not agree to it – would rather have extra person liable. Debts incurred after partner has retired ● Under Partnership act can still be liable for debts incurred when not a partner. ● S 36 (1) – give actual notice to the creditors. Ie: letter. ● S 36 (2) IN ADDITION to S36 (1) – put in advertisement in London Gazette. ● 20.8 in agreement- partners must put in advert Suing in the firm’s name ● In practice normally sue the partners collectively in firm’s name. ● CPR Part 17 and PD 7 and 5A 1 and 5A3 state claim should be against firm if it has a name and is appropriate. ● Benefit is that if win, judgement can be enforced against partnership assets and also potentially against those owned by any of the relevant partners as individuals. Non-Payment generally ● If creditor obtained judgement against 1P who cannot pay, creditor can then take out rest proceedings against the firm. ● If the firm cannot pay out of its assets either because it cannot raise the cash to do so or the total is insufficient then the judgement against the firm can be enforced against the liable partners as individuals and therefore their private assets. ● If creditor’s claim cannot be satisfied from assets of the firm and the liable partners then likely insolvency proceedings will follow. Insolvency ● Partnership insolvency – Insolvent Partnerships Order 1994 (SI 1994/2421) and the Insolvency Act 1986 governs it. ● Complex but in essence although a partnership is not it’s own legal entertainment a insolvency partnership can still be wound up as an unregistered company or avail itself of ● ● the rescue procedures that are available to companies. (Eg: voluntary arrangement with creditors or an administration order from the court). A partnership is not governed by the bankruptcy laws that relate to individuals – partnership may be subject to a winding up order. Individual partners may be subject to bankruptcy orders as individuals. Dissolution ● Notice (partnership ‘at will’), can be served at any point, dissolution will take place on the date specified in the notice or on the date of the notice ● Expiry of fixed term, can be renewed every X year automatically for example ● Charging order over partner’s assets under court order as security for his private debts ● Death or bankruptcy ● Illegality (not seen in workshop) ● Court order for dissolution (not seen in workshop) ● No formal retirement provision at law, partnership must provide itself What is the duration of the partnership? Partnership Act Section 26, partnership at will Section 27, automatic continuation after fixed term Section 32, at the end of the venture Infinite partnership starts when you meet the definition of section 1. Section 26(1) and 32(C) say that any partner may end the partnership at any time by giving notice. What share of profits is a partner entitled to in relation to: - Income - Capital? How are decisions made in relation to: - Changing the nature of the partnership; A new partner joining; Changing the terms of the partnership; and Other day-to-day decisions? Benefit to vary is certainty and security, the PA allows for a very uncertain partnership where any partner is allowed to dissolve the partnership at any point Income profits, regular income (e.g. sales, rent) Capital profits have to do with fixed assets, usually one-off payments (e.g. sale a piece of land) Section 24.1 both income and capital shares are shared equally. Section 24.4 a partner is not entitled to interests in capital Section 24(8) changing the nature of the partnership unanimous Section 24(7) a new partner joining must be unanimously decided Section 19, must be unanimous for changing the terms of the agreement Section 24(8), any other can be a majority If there are two partners, majority is unanimity. Section 24(5) all partners may take part in management How much time must be devoted to the business? What happens if a partner: - Wants to leave; - Dies; or - Is made bankrupt? What happens if the partners want to expel one of the other partners? Although not have to participate to life of the partnership (sleeping partners) Section 32(C) and Section 26(1), just give notice to the other partners at any time and the partnership dissolves Section 33, dissolution of the partnership by the death of a partner Section 33, dissolution Section 25, all of the partners including the partners to be expelled must agree to expel Preparatory task 1 Most JVs are usually created as LLC by shares or guarantee and should be incorporated before business starts. In this case, the parties already started dealing and so a partnership has been created because: ● One or more person (here legal personalities) ● Are carrying a business (develop speech recognition technology) yes + section 45 says any commercial ventures ● Acting in common yes together ● In the view of profit (they agreed they would share the profits) The fact that capital has been introduced is indication that there is a partnership. The quarterly meetings to run the business can be an indicator of a partnership. That means that the agreement is under the Partnership Act and they can be created by mistake and putting their assets at risks without the knowledge of it. This is to ensure that third parties will be repaid and this is a set of rules to “fill in the gaps”. Ultimately, the court is the one who will determine if this actually is a partnership. Look at section 1 + section 2 to clarify The risk here is that there might be an unlimited liability for the partnership, which means that the partners may loose their personal assets. Additionally, there is also the joint and several liability. In section 1, companies are considered as person although not the same as physical individual. Agreement can be express written or oral, or can be implied. Workshop task 1: Debts incurred before the partner has retired Section 9 and Section 17(2) PA 1890. Joint and severely liable. For Mary, that means that she can be sued on her own or with the other partners for the whole debts. Section 17(2) just because you left doesn’t mean you can walk away fro, the debts incurred when you were a partner. Debts are incurred as soon as there has been an agreement to pay. Clause 20.3.2 the third party can still sue Mary for the full amount although she already left the partnership under the act, because of section 17(2) she is still liable. Under 20.6, even if there is no novation, which is not likely, the partners should cover her. 20.4 we buy her shares when she leaves. 20.3.2 says that her buyouts include her money owed to outsiders. That means for Mary she will receive less money because her share will be less from the debts incurred by the partnership. Under section 9 and 17(2), she can still be sued by the creditors for the full amount so you can have a novation agreement for the creditors to agree to let her off. Otherwise, 20.6 says that she has paid everything and says she has paid everything. The risk is that although she walked away and that the partnership agreed to cover her if it goes bust and she is wealthy, because the creditors can sue her, she might not be able to be covered by the partnership. Debts incurred after she retired Under the PA, Mary can still be liable for the new debts. Under 36.1 PA, must give actual notice to existing creditors of the partnership (telling them in writing). 36.2 PA, and in the London Gazette saying you left the partnership. Section 14 even if you are not a partner, if you knowingly hold yourself as a partner, you will be made liable as a partner (stationary, leaflet, group names, heading note papers). Must do all three of those things. Clause 20.8 the other partners must put that notice in the gazette