Future Interests & RAP Outline: Property Law

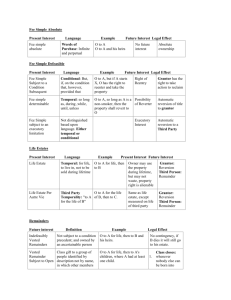

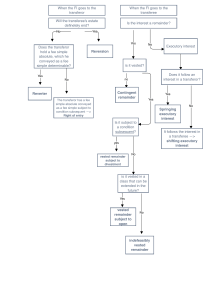

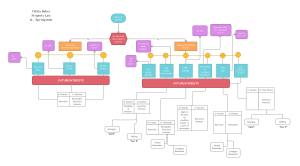

advertisement

FIRST, DETERMINE WHAT THE “FUTURE” INTERESTS ARE-- O = original grantor ; A = grantee (1) Does the interest go back to the grantor or a third party? - THE GRANTOR (N.B.: these are currently owned interests that become possessory at a later date) - Does it become possessory in owner naturally or after a condition subsequent? - NATURALLY (after termination of Life Estate; Fee Tail, etc) - O has a REVERSION in fee simple - AFTER BREACH OF A CONDITION SUBSEQUENT - Does it revert automatically? - YES → Fee Simple Determinable (FSD) - (O has Possibility of Reverter) (so if O doesn’t kick him out -- after SOL, A gets by adverse possession) - LANGUAGE: “so long as,” “while,” “during,” “until,” “revert automa” - NO → Fee Simple Subject to Condition Subsequent (FSSCS) - (O has Right of Entry) - LANGUAGE: “on condition that,” “provided that,” “provided, however,” “but if,” “O’s heirs may reenter + repossess” - - N.B.: if it’s ambiguous can look outside plain language to extrinsic evidence → rule of construction - courts prefer the FSSCS to avoid automatic forfeiture THIRD PARTY - remainder or executory interest - Does it become possessory immediately after the NATURAL termination of the prior interest or after prior interest is cut short (by failure of condition, etc) (or after a gap between prior interest)? - IMMEDIATELY after NATURAL termination of estate (usually after Life Estate) → REMAINDER - ((((((((******N.B.: REMEMBER THE MERGER RULE**********)))))) → ex: if you successive vested interests (ex: a life estate and a reversion), they can merge into the greater estate (ex: fee simple)-destroys contingent remainders that branched off of the original life estate - N.B.: This usually happens when one person acquires someone else’s interest (ex: reversion) - Is it (1) given to a BORN AND ASCERTAINED person AND (2) NOT subject to a CONDITION PRECEDENT? - YES → A has a VESTED REMAINDER (N.B.: these are currently owned interests that become possessory at later date) - If it’s CERTAIN to become possessory → INDEFEASIBLY VESTED - N.B.: if after a Fee Tail - If conveyed to a CLASS, BUT the whole CLASS has not yet been ascertained BUT AT LEAST ONE MEMBER IS BORN/ASCERTAINED WHEN WILL BECOMES EFFECTIVE → VESTED SUBJECT TO OPEN - - - Ex: “to A for life, then to A’s children” (N.B.when class closes, own as tenants in common) - If A has two kids but A is still alive → 2 kids have remainder in fee simple vested subject to open If class member dies after meeting condition precedent - their heirs/devisees take their share of the interest - If it’s subject to CONDITION SUBSEQUENT → If condition is not met, Does it go back to Grantor or another 3rd Party (B)? - If goes back to GRANTOR (explicitly or by default,) → (A has VESTED REMAINDER SUBJECT TO TOTAL DIVESTITURE IN FEE SIMPLE); (O has a REVERSION) - If it goes to another 3rd PARTY - Would the divesting event/condition occur BEFORE holder of vested remainder takes possession? - YES -- (A has VESTED REMAINDER SUBJECT TO TOTAL DIVESTITURE IN FEE SIMPLE) (B has SHIFTING EXECUTORY INTEREST) - NO -- A has a VESTED REMAINDER WITH EXECUTORY LIMITATION in a FEE SIMPLE SUBJECT) (B has SHIFTING EXECUTORY INTEREST) - REMEMBER: IF THERE’S CONDITIONS SUBSEQUENT ATTACHED, GRANTOR RETAINS RIGHT OF ENTRY NO → A has a CONTINGENT REMAINDER - (N.B.: If it’s to “HEIRS” of someone who is still alive -- it’s CONTINGENT cuz they’re unascertained) - RULE IN SHELLEY’S CASE → if deed is “to A for life, remainder to A’s heirs” → treat it as a FEE SIMPLE in A (unless there’s condition precedent to heirs’ rem) - DOCTRINE OF WORTHIER TITLE → Converts a REMAINDER to the GRANTOR’s HEIRS into a REVERSION TO THE GRANTOR - - IF CONDITION PRECEDENT IS NOT MET: - (1) goes back to GRANTOR (explicitly or by default, O retains a REVERSION) - N.B.: if condition precedent is just not met YET (ex: kid hasn’t died, he’s just not 21), then O owns a FSSEL; B owns springing executory interest) - UNLESS THE RULE OF DESTRUCTIBILITY OF CONTINGENT REMAINDERS APPLIES (in which, B owns nothing; O owns FSA) - (2) another 3rd person - if grantor provided that another person take if contingency fails (ALTERNATIVE CONTINGENT REMAINDER) - (N.B.: a contingent remainder can BECOME vested - ex: if kid born; kid turns 21) - REMEMBER to say O has a Reversion in Fee Simple (Defeasible) If does NOT follow the natural termination of a prior estate → EXECUTORY INTEREST (N.B. usually comes after another fee simple) - If it divests the original grantor → SPRINGING EXECUTORY INTEREST - (O has a Fee Simple subject to an Executory Limitation) (B has a springing executory interest) - Ex: conveyance from O “to A one year after O’s death” ; or “to A after he graduates from school” - If it divests another third party’s interest → SHIFTING EXECUTORY INTEREST - (A has a Fee Simple subject to an Executory Limitation) (B has a shifting executory interest) - N.B.: If an executory interest COULD possibly be a contingent remainder, treat it as contingent remainder instead (cuz court disfavors EI) --- Rule in Purefroy’s Case - N.B.: vested in interest at time of grant (so for RAP purposes it depends if governing jurisdiction requires only that executory interests vest in interest in the period, or if it requires them to vest in possession) STANDARD PHRASES FOR CONTINGENT AND VESTED REMAINDERS CONTINGENT VESTED To B for life, remainder to C’s children and their heirs. C has no children To B for life, remainder to C’s children and their heirs. C has children, or later has them To his children alive (ascertainable) at his death At his death to his lawful children To such children that/who survive him Remainder to children, but if any children die Remainder to the HEIRS of C - (Cuz you only have heirs after death) Remainder to C and her heirs, but not if C dies before 21 Remainder to C and her heirs if and when C reaches 21 “But if” /// “provided that” /// “on condition that” Then to C and his heirs IF C is married at B’s death Then to C and his heirs subject to the condition that….. - (Would be clearer with comma before “subject” tho) Then to B’s wife and her heirs → meaning B’s wife at the time of B’s death [who is W? -- look at who granted, was it W’s dad?] Then to B’s wife and her heirs ---> meaning B’s current wife Then if B survives A, to B and her heirs When A dies, to B and her heirs IF THE FUTURE INTEREST IS A “CONTINGENT REMAINDER,” “VESTED REMAINDER SUBJECT TO OPEN,” OR AN “EXECUTORY INTEREST” → APPLY THE RULE AGAINST PERPETUITIES - MAIN RULE: NO INTEREST IS GOOD UNLESS IT MUST VEST, IF AT ALL, NO LATER THAN 21 YEARS AFTER SOME LIFE IN BEING AT THE CREATION OF THE INTEREST STEPS TO FOLLOW: - (1) What are the intended interests and estates in the original grant as written? (SEE ABOVE) - (2) Identify which of the interests are contingent remainders, executory interests, vested remainders subject to open. (If none, all the interests are vested and therefore good under the Rule Against Perpetuities) - (3) WHEN DOES IT VEST? -- Determine the vesting event, which is the event or events that must occur before the contingent future interest vests. (N.B.: It does NOT matter when vests in possession, just when vests in interest) - Will this vesting occur within some human life now in existence (+21 year)? - (4) Does the grant set an outside number of years no greater than 21 years from the creation of the interest. - - - If YES → the interest is good - If NO → proceed to Step (5) - (5) Is a NAMED person essential to the happening/nonhappening of the vesting event? If so, determine if the event must occur (or be certain to fail to occur) during that person’s life (or within 21 years of her death if 21 years or less is stipulated in the original grant)? - If YES(ex: it’s contingent on Eileen marrying)→the interest is good - If NO -- proceed to Step (6) - (6) Is an UNNAMED BUT DESCRIBED person or class of persons essential to the happening of the vesting event (even if all they must do is die, have children, or survive someone)? - N.B.: described but unnamed persons/classes canNOT be validating lives UNLESS the class is closed - Ex: A’s children may be a closed group IF A IS DEAD (but if A was still alive, it’s not closed -- so kids not validating) - (7) If the contingent future interest does not vest or be certain to vest immediately upon the death of a named person or of an identifiable person or class of persons essential to the vesting who are alive at the creation of the interest, use your imagination to create a scenario where the contingent future interest does NOT vest in the perpetuities period. If the RAP voids a contingent future interest, STRIKE THE INVALID CONTINGENT INTEREST FROM THE ORIGINAL GRANT. (Rewrite the grant with the invalidated interest stricken and determine what interests and estates remind after the invalidated interest is omitted from the grant.) - Often it becomes -- “A has a fee simple determinable. O has a possibility of reverter.” TIPS: - RAP likely invalidates a contingent interest that depends on the occurrence / nonoccurrence of an EVENT to vest (UNLESS the event must be accomplished by a life in being) - Red Flag Events that run afoul of RAP: “when a decedent’s estate is settled,” “when all gravel is taken from the land,” “when my estate is settled,” “when a bridge [or building or road] is completed,” “as long as used for school [church] purposes,” “after the next Democrat is elected president” - Note when use labels like “husband,” “wife,” “mayor,” “president,” etc. - IMPORTANT WHETHER VESTOR/PARENT IS ALIVE OR DEAD → assume they can still have kids until they die - Ex: If alive, often violate RAP -- cuz (ex) A may have a future child who outlives A and A’s three sisters by more than 21 years - Ex: T → A for life, then to A’s children for life, then to A’s sisters who survive A by 22 years and their heirs. At T’s death, A is alive + has no children; A has three sisters; A’s parents are alive. VOID under RAP cuz in theory, parents could have more children (so class of sisters isn’t closed yet) so in theory this could vest in life in being + 21 years, since parents could have more sisters (who don’t count as lives in being) Unborn Widow of the Fertile Octogenarian: T→A for life,then to A’s widow for life, then to A’s children who survive A’s widow and their heirs. At T’s death, A is married to W and has 2 kids (B+C). A is 80. - INALID → cuz W could die (so wouldn’t be A’s widow);A remarries at age 100 to 19 year old not alive when T devised land (so not life in being). A+new wife have kids (also not life in being); A, B, C die. A’s new wife + kids live for more than 21 years. - -