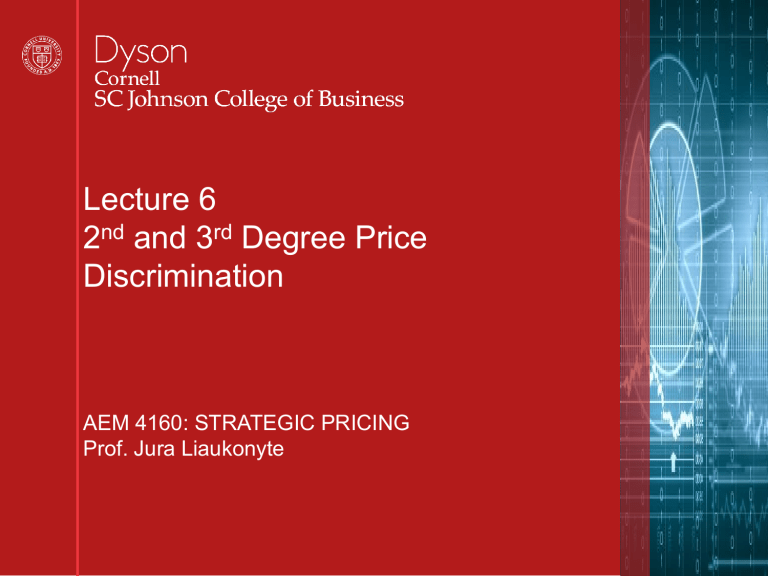

Lecture 6 2nd and 3rd Degree Price Discrimination AEM 4160: STRATEGIC PRICING Prof. Jura Liaukonyte 1 Dyson Two-Part Tariffs 2 Dyson More types of second degree price discrimination • Multiple two-part tariffs – Examples of two-part tariffs: cell phone plans with monthly and per minute fees. – Idea: separate between low volume users and high volume users. A two-part tariff is a lump-sum fee, p1, plus a price p2 for each unit of product purchased. Thus the cost of buying x units of product is p1 + p2x. Q: What is the largest that p1 can be? 3 Dyson Two-Part Tariffs • p1 + p2x • Q: What is the largest that p1 can be? • A: p1 is the “entrance fee” so the largest it can be is the surplus the buyer gains from entering the market. • Set p1 = CS and now ask what should be p2? The monopolist maximizes its profit when using a two-part tariff by setting its per unit price p2 at marginal cost and setting its lumpsum fee p1 equal to Consumers’ Surplus. 4 Dyson Clearvoice Wireless Example • Clearvoice is a wireless telephone monopolist in a rural area • Two types of consumers: high-demand and low-demand – Distinct monthly demand curves for wireless minutes for each group 5 Dyson Clearvoice Wireless Example If we could observe consumer characteristics, we would offer two-part tariff with 10-cent per-minute price Low Demand – Fixed fee: $8 =(40*.4)/2 6 Dyson High Demand Fixed fee : $40.50 = (90*.9)/2 Profit-Maximizing Two-Part Tariff Suppose Clearvoice wants to offer a single two-part tariff High Demand Low Demand • Per-minute price of 10 cents and monthly fee of $40.50 – High-demand customers … – Low-demand customers … • Per-minute price of 10 cents and monthly fee of $8 – High-demand customers … – Low-demand customers … Question • Q: Which plan is better? – A: 7 Dyson Profit-Maximizing Two-Part Tariff Suppose Clearvoice wants to offer a single two-part tariff High Demand Low Demand • Per-minute price of 10 cents and monthly fee of $40.50 – High-demand customers accept – Low-demand customers reject • Per-minute price of 10 cents and monthly fee of $8 – All consumers accept Question • Q: Which plan is better? – A: If there are a large number of low-demand customers, $8 monthly fee is better 8 Dyson Profit-Maximizing Two-Part Tariff • If the monopolist plans on selling to both types of consumers it is always profitable to raise the per-unit price at least a little Max Profits above marginal cost – Regardless of the types’ relative proportions Intuition • Extract some of high-demand consumers’ surplus without changing surplus of low-demand consumer (already zero) – Raise per-unit price to get more surplus from high-demand consumers – Adjust fixed fee so low-demand consumers’ surplus is unchanged • The smaller the fraction of low-demand consumer, the more Conclusion worthwhile it is to raise the per-unit price 9 Dyson Benefits of Raising the Per-Minute Charge 10 Dyson Using Menus to Increase Profit • Even better by offering a menu of two-part tariffs, each designed to attract a specific type of consumer • Intuition: – Extract more surplus from high-demand consumers by making the low-demand plan less attractive to high-demand customers 11 Dyson High-Demand Consumers Suppose Clearvoice offers a pair of two-part tariffs Low Demand • First Option for low-demand consumers: – Per-minute price of 20 cents, fixed fee of $4.50 • Second option intended to attract high-demand customers: High Demand – Per-minute price of 10 cents, equal to Clearvoice’s marginal cost – Fixed fee should be set as high as possible without causing highdemand consumer to choose the other plan • With menu of plans: Effects – Firm profits are higher from high-demand consumers – Profits from low-demand consumers are the same 12 Dyson Menu of Two-Part Tariffs 13 Dyson 18-13 Making the Low-Demand Plan Less Attractive • Can increase profit even more by making the low-demand plan less attractive to high-demand consumers – That plan determines the fixed fee the firm can charge a high-demand consumer – It is the level that makes the high-demand consumer indifferent between the two plans • Limit the number of minutes a consumer can purchase in the 20-cent-per-minute plan – – – – 14 Set the limit equal to the number low-demand consumers want Will have no effect on value a low-demand consumer derives Make the plan less attractive to high-demand customers Will increase the fixed fee Clearvoice can charge high-demand consumers for the 10-cent-per-minute plan Dyson Capping Minutes 15 Dyson Menu of Two-Part Tariffs • A firm can often profit by offering a menu of choices – Designed for different types of consumers • To maximize its profits, firm should try to make each plan attractive to one group only – And unattractive to other consumer groups 16 Dyson Third Degree Price Discrimination 17 Dyson Third-Degree Price Discrimination • Consumers differ by some observable characteristic(s) • A uniform price is charged to all consumers in a particular group – linear price • Different uniform prices are charged to different groups – Subscriptions to professional journals [library/student] – Entry prices by age 18 Dyson Third-Degree Price Discrimination • The pricing rule is very simple: – Consumers with low elasticity of demand should be charged a high price – Consumers with high elasticity of demand should be charged a low price 19 Dyson Third Degree Price Discrimination: Example • Harry Potter volume sold in the United States and Europe • Demand: – United States: PU = 36 – 4QU – Europe: PE = 24 – 4QE • Marginal cost constant in each market – MC = $4 20 Dyson The Example: No Price Discrimination • Suppose that the same price is charged in both markets • What do we need to find out? 21 Dyson The Example: No Price Discrimination • Suppose that the same price is charged in both markets • What do we need to find out? • Use the following procedure: – Calculate aggregate demand in the two markets – Identify marginal revenue for that aggregate demand – Equate marginal revenue with marginal cost to identify the profit maximizing quantity – Identify the market clearing price from the aggregate demand – Calculate demands in the individual markets from the individual market demand curves and the equilibrium price 22 Dyson The Example United States: PU = 36 – 4QU QU = 9 – P/4 for P < $36 Europe: PU = 24 – 4QE QE = 6 – P/4 for P < $24 Invert this: Invert At these prices only the US market is active Aggregate these demands Q = QU + QE = 9 – P/4 for $24 < P < $36 Q = QU + QE = 15 – P/2 for P < $24 23 Dyson Now both markets are active The Example Invert the direct demands P = 36 – 4Q for Q < 3 36 P = 30 – 2Q for Q > 3 Marginal revenue is MR = 36 – 8Q for Q < 3 17 MR = 30 – 4Q for Q > 3 Set MR = MC Q = 6.5 $/unit Demand MR MC 6.5 Price from the demand curve P = $17 24 Dyson Quantity 15 The Example • Substitute price into the individual market demand curves: – QU = 9 – P/4 = 9 – 17/4 = 4.75 million – QE = 6 – P/4 = 6 – 17/4 = 1.75 million • Aggregate profit = (17 – 4)x6.5 = $84.5 million 25 Dyson The Example: Price Discrimination • The firm can improve on this outcome • Check that MR is not equal to MC in both markets – MR > MC in Europe – MR < MC in the US • This requires that different prices be charged in the two markets • Procedure: – take each market separately – identify equilibrium quantity in each market by equating MR and MC – identify the price in each market from market demand 26 Dyson The Example $/unit Demand in the US: PU = 36 – 4QU Marginal revenue: 36 20 MR = 36 – 8QU MC = 4 4 Equate MR and MC QU = 4 Price from the demand curve 27 Dyson Demand MR MC 4 PU = $20 9 Quantity The Example: $/unit Demand in the Europe: PE = 24 – 4QE Marginal revenue: 24 14 MR = 24 – 8QE MC = 4 4 Equate MR and MC QE = 2.5 Price from the demand curve 28 Dyson Deman d MR MC 2.5 PE = $14 6 Quantity The Example • Aggregate sales are 6.5 million books – the same as without price discrimination • Aggregate profit is (20 – 4)x4 + (14 – 4)x2.5 = $89 million – $4.5 million greater than without price discrimination 29 Dyson Some Additional Comments • Suppose that demands are linear – price discrimination results in the same aggregate output as no price discrimination – price discrimination increases profit • For any demand specifications two rules apply – marginal revenue must be equalized in each market – marginal revenue must equal aggregate marginal cost 30 Dyson Price Discrimination and Elasticity • Suppose that there are two markets with the same MC • MR in market i is given by MRi = Pi(1 – 1/ηi) – Where ηi is (absolute value of) elasticity of demand • From rule 1 (above) – MR1 = MR2 – So = P1(1 – 1/η1) = P2(1 – 1/η2) which gives P1 1 1 2 1 2 1 . P2 1 1 1 1 2 2 31 Dyson Price is lower in the market with the higher demand elasticity Takeaways – Firms would prefer to use perfect (aka first-degree) price discrimination, but this may be impossible. – Third-degree PD is one way to approximate perfect PD, but requires that firms can separately identify members different groups. – Second-degree PD induces customers to sort themselves into groups. – Recall the no arbitrage constraint—consumers can’t resell to others. – Price discrimination and other advanced pricing strategies are powerful tools; you now have the economic models to understand them. 32 Dyson BUNDLING AND TYING 33 Dyson Introduction • Firms often bundle the goods that they offer – Microsoft bundles Windows and Explorer – Office bundles Word, Excel, PowerPoint, Access • Bundled package is usually offered at a discount • Bundling may increase market power – GE merger with Honeywell • Tie-in sales ties the sale of one product to the purchase of another • Tying may be contractual or technological – IBM computer card machines and computer cards – Kodak tie service to sales of large-scale photocopiers – Tie computer printers and printer cartridges • Why? To make money! 34 Dyson More Examples of Bundling • Telecommunications – Firms bundle local, long-distance, and mobile telephone services, • Banks – Bundle checking, credit, and investment services • Hospitals bundle an array of medical services 35 Dyson Incentives to Bundle • Bundling may arise in many contexts to sort consumers in a manner similar to second-degree price discrimination. • When consumers have heterogeneous tastes for several products, a firm may bundle to reduce that heterogeneity, earning greater profit than would be possible with component (unbundled) prices. • Bundling—like price discrimination—allows firms to design product lines to extract maximum consumer surplus. 36 Dyson Bundling Advantages • Simplifies consumer choice (as in telecommunications and financial services) • Reduces costs from consolidated production of complementary products • Reduces consumer search costs and product or marketing costs • Bundling to extend market power and/or deter entry – as witnessed by antitrust challenges to Microsoft’s bundling of software applications (e.g. its Internet browser, media player) with its dominant Windows operating system 37 Dyson Cable TV • Crawford’s (2001) empirical study of bundling decisions of cable providers • Bundle several networks into a basic bundle service, cable provider increases its profit on average above unbundled sales by 14% • 13% less CS than from unbundled sales • bundling together similar networks is less profitable than bundling dissimilar ones 38 Dyson Example: Cable and Satellite TV Industry 39 Dyson Third Degree Price Discrimination • Raw Data Analysis – Collected the price of Comcast Xfinity’s basic cable in 11 cities • Chose Comcast because it has the largest market share – Plotted prices relative to geography – Ran regressions against the number of competitors in the market 40 Dyson 30 Geographic Price Discrimination 25 Price of Basic Cable ($) 20 15 Price of Basic Cable 10 5 0 Price vs. Number of Competitors in the Marketplace 30 Price 25 Log. (Price) 20 Price of Basic Cable ($) Linear (Price) y = -1.5295x + 27.735 R² = 0.5554 15 R² = 0.6439 10 5 0 0 1 2 3 4 5 6 Number of Competitors 7 8 9 10 Computer Software Suites • Microsoft and others bundle dissimilar programs—word processors and spreadsheets—into a suite • Gandal (2003): – survey of home PC users: 43% use both programs;50% used only one; 7% used neither – survey business PC users: 63% used both, 37% used only one – A lot of users use only one (but not both) pieces of software – consumers with a high value for spreadsheets had a low value for word processors and vice versa: negative correlation in demand 43 Dyson Tie-In Sales • Generally considered to be an ‘extension of monopoly’ by courts. In other words, courts believed it was an attempt to use one monopoly to create a second. • Frequently, tying good is sold very cheaply, while tied good is very expensive. Famous cases: IBM and computer cards, Xerox and toner, Canning machines and tin plate. 44 Dyson Printers and Ink Cartridges • High-intensity usage consumers => high willingness-topay • Low-intensity usage consumers => print small volumes => a low willingness-to-pay • Strategy: lower the price of the initial, one-time purchase printer and raise the price of the aftermarket, repeat purchase ink cartridge • Ink cartridge becomes the mechanism by which consumers' intensity of usage is metered: – Inducing high-intensity users to pay a higher overall price – Low-intensity users a lower overall price 45 Dyson Examples cont’d • This basic idea holds for a variety of other aftermarket situations: – Razors and razor blades – Video game consoles and video games – Etc. 46 Dyson Anti-Trust and Bundling • The Microsoft case is central – Accusation that used power in operating system (OS) to gain control of browser market by bundling browser into the OS – Need to show • Monopoly power in OS • OS and browser are separate products that do not need to be bundled • Abuse of power to maintain or extend monopoly position – Microsoft argued that technology required integration – Further argued that it was not “acting badly” • Consumers would benefit from lower price because of the complementarity between OS and browser 47 Dyson And now… • This view gained more force and support in Europe – Bundling of Media Player into Windows – Competition Directorate found against Microsoft • No on appeal 48 Dyson Antitrust and tying arrangements • Tying arrangements have been the subject of extensive litigation • Current policy – Tie-in violates antitrust laws if • There exists distinct products: tying product and tied one • Firm tying the products has sufficient monopoly power in the tying market to force purchase of the tied good • Tying arrangement forecloses or has the potential to foreclose a substantial volume of trade 49 Dyson