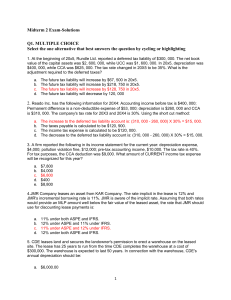

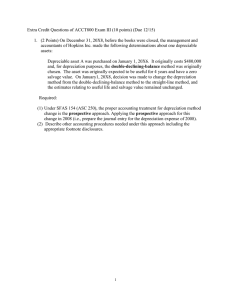

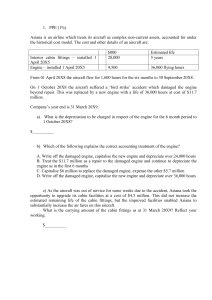

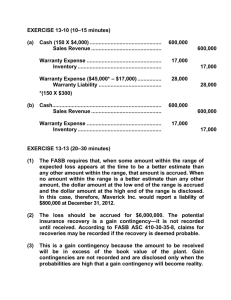

BUSD2004 A01, HD01, XL Midterm 2 Exam-Solutions Instructor: David Sun, CPA, CMA, MA March 23, 2022 Total time: 90 minutes Total marks: 60 (approximately 1.5 minutes per mark) Student name: _______________________ Id: _________________________ INSTRUCTIONS TO STUDENTS 1. Download your exam file from your Moodle course exam, and your work on your computer desktop, complete the tasks. This exam consists of numerous parts. Complete the easy parts first, then go back and to the more difficult parts. For each parts, complete the tasks in the order that the tasks appear. Once you have completed your exam, please upload your files to Moodle (Midterm Exam 2) then submit it: Your name_ID 2. During the exam you are NOT PERMITTED to use: → Programmable calculators (unless memory is cleared) → Electronic organizers → Cell phones → Pagers → Head phones → Text messaging 3. No extra time will be provided. When the end of the exam is announced, all students must stop writing and hand in their paper immediately to avoid penalty. 4. This exam consists of: 5 questions on 7 pages (including cover sheet). CHECK THAT YOU HAVE A COMPLETE EXAM 5. Where appropriate: → Clearly show any calculations and explanations. → Be sure to state any assumptions you find necessary. → Organize your thoughts. It is your responsibility to communicate clearly to the marker. For Instructor Use Only: Questions Total Points 1 10 2 15 3 15 4 10 5 10 1 Points Rewarded Total 60 Q1. MULTIPLE CHOICE (10 marks) Select the one alternative that best answers the question by cycling or highlighting 1. At the beginning of 20x5, Rundle Ltd. reported a deferred tax liability of $300, 000. The net book value of the capital assets was $2, 600, 000, while UCC was $1, 600, 000. In 20x5, depreciation was $400, 000, while CCA was $625, 000. The tax rate changed in 20X5 to be 35%. What is the adjustment required to the deferred taxes? a. b. c. d. The future tax liability will increase by $67, 500 in 20x5. The future tax liability will increase by $218, 750 in 20x5. The future tax liability will increase by $128, 750 in 20x5. The future tax liability will decrease by 120, 000 2. Reado Inc. has the following information for 20X4: Accounting income before tax is $400, 000; Permanent difference is a non-deductible expense of $53, 000; depreciation is $260, 000 and CCA is $310, 000. The company's tax rate for 20X3 and 20X4 is 30%. Using the short cut method: a. b. c. d. The increase to the deferred tax liability account is: (310, 000 - 260, 000) X 30% = $15, 000. The taxes payable is calculated to be $120, 900. The income tax expense is calculated to be $120, 000. The decrease to the deferred tax liability account is: (310, 000 - 260, 000) X 30% = $15, 000. 3. A firm reported the following in its income statement for the current year: depreciation expense, $4,000; pollution violation fine, $12,000; pre-tax accounting income, $10,000. The tax rate is 40%. For tax purposes, the CCA deduction was $9,000. What amount of CURRENT income tax expense will be recognized for this year? a. b. c. d. e. $7,800 $4,000 $6,800 $400 $8,800 4.JMR Company leases an asset from KAR Company. The rate implicit in the lease is 12% and JMR's incremental borrowing rate is 11%. JMR is aware of the implicit rate. Assuming that both rates would provide an MLP amount well below the fair value of the leased asset, the rate that JMR should use for discounting lease payments is: a. b. c. d. 11% under both ASPE and IFRS. 12% under ASPE and 11% under IFRS. 11% under ASPE and 12% under IFRS. 12% under both ASPE and IFRS. 5. CDE leases land and secures the landowner's permission to erect a warehouse on the leased site. The lease has 25 years to run from the time CDE completes the warehouse at a cost of $300,000. The warehouse is expected to last 50 years. In connection with the warehouse, CDE's annual depreciation should be: a. $6,000.00 b. $7,500.00 2 c. $12,000.00 d. The entire $300,000 should be expensed the first year. 6. Title to a right-of-use asset with a remaining economic life of 20 years does not transfer to the lessee at the end of the 10 year lease term, but the lessor anticipates an unguaranteed residual value of $2,000. What is the period and residual value used by the lessee to depreciate the leased asset? 1 2 3 4 Period Remaining life at inception Remaining life at inception Lease term Lease term Residual value $0 $2,000 $2,000 $0 a. Choice 1 b. Choice 2 c. Choice 3 d. Choice 4 7. A company makes the following calculations to its defined benefit plan for funding purposes for an employee that is 40 years of age. The accumulated benefit method - $2, 111; projected unit credit method $3, 324 and the level contribution method: $4, 227. The company uses the accumulated benefit for funding the defined benefit plan. Record the journal entries for the pension expense and the pension payment. a. b. c. d. Dr. Pension expense $3, 324 Cr. Cash $3, 324 Dr. Pension expense $4, 227 Cr. Cash $2, 111 and Cr. Accrued pension liability $2, 116. Dr. Pension expense $2, 111 Cr. Cash $2, 111 Dr. Pension expense $3, 324 Cr. Cash $2, 111 and Cr. Accrued pension liability $1, 213. 8. Pension data for ABC for three separate cases were: Case 1 Case 2 Case 3 APO $300,000 $300,000 $300,000 Plan assets at fair value $315,000 $300,000 $280,000 The funded status of the APO for each case is: Case 2 Case 3 1 Fully funded Case 1 Overfunded Underfunded 2 Underfunded Fully funded Overfunded 3 Overfunded Underfunded Fully funded 4 Overfunded Fully funded Underfunded a. b. c. d. Choice 1 Choice 2 Choice 3 Choice 4 3 9. The accrued obligation at the beginning of the year was $456,000 and the current service cost for the year is $67,000. Assuming an interest factor of 6%, what is the accrued obligation at the end of the year? a. b. c. d. $523,000 $389,000 $550,360 $554,380 10. An example of an experience gain or loss is: a. b. c. d. The actual employee turnover rate is higher than projected. The discount rate used for an obligation is increased from 5% to 6%. The assumption for salary increases is reduced from 3% to 2.5%. The funding method is changed to the accumulated benefit method. Q2. Problem Solving (15 marks) Olong Ltd. started operations in 20X6. The company provided the following information for its warranty balances for the past four years: 20X6 20X7 20X8 20X9 $ 34,000 $ 29,000 $ 32,000 $ 49,000 27,000 22,000 39,000 32,000 54,000 59,000 69,000 34,000 0 9,000 23,500 34,000 40 % 38% 38% 36% Warranty costs accrued Costs incurred—warranty work Costs incurred—development costs Amortization—development costs Tax rate Required: 1. What is the tax basis for development costs and the provision for warranty costs in each year? Please feel free to enter your answer(s) in the template below: 20X6 20X7 Development costs: Tax basis Warranty costs: Tax basis 4 20X8 20X9 Solutions: 2. What is the accounting basis for development costs and the provision for warranty costs in each year? Please feel free to enter your answer(s) in the template below: 20X6 20X7 20X8 20X9 Development costs: Accounting basis Warranty costs: Accounting basis Solutions: 3. What is the deferred tax balance in each year? Please feel free to enter your answer(s) in the template below: 20X6 20X7 Development costs: Deferred income tax balance Warranty costs: Deferred income tax balance 5 20X8 20X9 Solutions: 20X6 20X7 20X8 20X9 Development costs: Deferred income tax balance $(21,600) $(39,520) $(56,810) $(53,820) Warranty costs: Deferred income tax balance $2,800 $5,320 $2,660 $8,640 4. Is the balance an asset or a liability? Please feel free to enter your answer(s) in the template below: Deferred Income Tax Balance: Development cost Warranty cost Solutions: Deferred Income Tax Balance: Development cost Liability Warranty cost Asset Explanation: 1. & 2. Development Costs Tax basis Accounting basis Temporary difference 20X6 $ Warranty Costs Tax basis Accounting basis Temporary difference 20X7 0 $ 0 54,000 104,000 (54,000) (104,000) $ 20X6 0 (7,000) 7,000 $ 20X7 0 (14,000) 14,000 20X8 0 149,500 (149,500) $ $ 20X8 0 (7,000) 7,000 20X9 0 149,500 (149,500) $ 20X9 $ 0 (24,000) 24,000 Q3 Problem Solving (15 marks) The pre-tax income statements for Moonstone Ltd. for two years (summarized) were as follows: Revenues Expenses Pre-tax income 20X8 $274,000 185,000 $ 89,000 20X9 $338,000 241,000 $ 97,000 For tax purposes, the following income tax differences existed: 6 a. Revenues on the 20X9 statement of profit and loss include $41,000 rent, which is taxable in 20X8 but was unearned at the end of 20X8 for accounting purposes. b. Expenses on the 20X9 statement of profit and loss include political contributions of $14,500, which are not deductible for income tax purposes. c. Expenses on the 20X8 statement of profit and loss include $21,300 of estimated warranty costs, which are not deductible for income tax purposes until 20X9. Required: 1. What was the accounting carrying value and tax basis for unearned revenue and the warranty liability at the end of 20X8 and 20X9? Please feel free to enter your answer(s) in the template below: Year 20X8 20X9 Unearned Rent Warranty Unearned Rent Warranty Accounting carrying value Tax basis Solutions: Year 20X8 20X9 Unearned Rent Warranty Unearned Rent Warranty Accounting carrying value 41,000 21,300 0 0 0 0 0 0 Tax basis 2. Compute (a) income tax payable, (b) deferred income tax, and (c) income tax expense for each period. Assume a tax rate of 30%. Please feel free to enter your answer(s) in the template below: 20X8 20X9 a. Income tax payable b. Deferred income tax c. Total income tax expense Solutions: a. Income tax payable b. Deferred income tax c. Total income tax expense 20X8 20X9 $45,390 $14,760 $(18,690) $18,690 $26,700 $33,450 3. Give the entry to record income taxes for each period. Please feel free to enter your answer(s) in the template below: 7 No Transaction 1 20X8 2 20X9 General Journal Credit Debit Solutions: No Transaction 1 20X8 General Journal Debit Credit Income tax expense 26,700 Deferred income tax 18,690 Income tax payable 2 20X9 45,390 Income tax expense 33,450 Deferred income tax 18,690 Income tax payable 14,760 Q4 Problem Solving (10 marks) Sotherlin Inc. has a defined contribution plan. It has agreed to pay $210,000 now at the end of 20X4 and another payment of $135,000 at the end of 20X6 for employees’ services for 20X4. The current interest rate is 5%. Required: Prepare the journal entry for the pension expense for 20X4. Please feel free to enter your answer(s) in the template below: No Transaction 1 1 General Journal Solutions 8 Debit Credit Explanation: The defined contribution expense for 20X4 is equal to: Payment made in the year Present value of the delayed payment, discounted at 5% 5% $135,000 × (P/F, 5%, 2 = 0.90703) Total expense $210,000 122,449 $332,449 Q5 Problem Solving (10 marks) USLM Inc. has a defined benefit pension plan. At the end of the year 20X4, the pension fund assets were $7,690,000 and the defined benefit obligation was $7,260,000. Invoking the asset ceiling caps the net defined benefit asset at $319,000. Required: Prepare the journal entry to correctly recognize the net defined benefit asset. Please feel free to enter your answer(s) in the template below: No Transaction 1 1 General Journal Solutions: ----End of Exam--- 9 Debit Credit