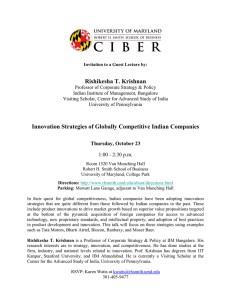

ISB 1 Binder Bank: Pulling a risky campaign in recession Pg 4 -Aashish Sharma 2 Goldred’s Case Pg 9 - Vipul Jain 3 Rohan’s Dilemma: The big decision Pg 13 - Vivek Khandelwal 4 ADM Vendor Consolidation: XYZ Corp Pg 18 - Smruthi Bangera IIMC 5 Agri Business Corporation Pg 27 -Mamtesh Sugla 6 E-education in India Pg 30 - Shubkarman Singh Sidhu 7 Sprocket Electrical & Automation Pg 34 - Vishwas Sugla IIMB 8 Crossroads & Co Pg 39 -Madhur Bansal 9 Chintamani’s Dilemma Pg 42 - Aadit Devanand 10 Purchase Descision Pg 45 - Vikram Bodavula 11 Rajat Gupta & Company Pg 47 - Madhur Bansal 12 India 2012: Risk of default -Kunal Ashok 13 Nikology Private Limited - Nikhil Jalan 14 Fraud or not! -Nikhil Jalan Pg 50 Pg 53 Pg 55 IIMA 15 E-Commerce Industry Pg 58 -Somwrita 16 Guessestimate: Railway track estimate - Rohit Garhwal Pg 61 17 Growth Strategy: Education website problem Pg 63 - Rohit Garhwal 18 Sustainable Growth Strategy: Healthcare industry in India Pg 66 -Amit Kumar Kushawaha 19 Non Profitable Personal Care Product Pg 69 - K Dinesh 20 Secondary Steel Manufacturer -Kuldeep Singh Pg 72 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 2 1 Binder Bank: Pulling a risky campaign in recession Pg 4 -Aashish Sharma 2 Goldred’s Case Pg 9 - Vipul Jain 3 Rohan’s Dilemma: The big decision Pg 13 - Vivek Khandelwal 4 ADM Vendor Consolidation: XYZ Corp Pg 18 - Smruthi Bangera This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 3 Binder Bank Pulling a risky campaign in recession Looking at her Bloomberg terminal, all Heather could think of was, “recession is coming”. A renowned analyst at Binders Bank, Heather had convinced her group CEO last year (2010) to roll out a ‘balance transfer (BT)’ scheme for a dying credit card portfolio. Things were running smooth for over 14 months with good number of customers signing in for the campaign but last week in the risk department monthly call, the Collections department gave a hint that with increasing unemployment rates in USA (Exhibit-1), all BT campaign is going to bring is bad and debt ridden customers to the banks book. Youth unemployment was at its max and the number of people filing for bankruptcy and IVA in the age group 24-28 has touched its peak since Lehman’s fall in 2008. Famous companies were undergoing restructuring and many youths and fresh employees were being asked to leave. Total deposits in savings accounts were rising, a clear indication of consumers shaken confidence in the economy (Graph 1 & 2). Many credit card issuers were losing their young customers who, prior to the recession were a prime source of improved business margins (because of their undisciplined financial habits). This category of customers was normally fresh graduates, who were in the initial years of their professional careers. Binder’s BT campaign See Exhibit-2 for USA general credit card customer profile segmentation. Before the BT campaign, the near- credit card portfolio of Binders Bank was facing a customer churn rate of 18% per year. The BT campaign was designed for customers with 5+ year credit history. The life-saving new BT campaign was selectively targeted towards consumers that already have a savings bank account with Binders. Various promotions like ‘10% discount on kids’ school uniforms’, ‘5% discount on International hotel stay’ and ‘10% discount on Foreign transactions’ were packaged with the BT promo and have enjoyed huge success as well. The campaign was an instant hit with only 4% of customers flowing into delinquency in first 7 months as compared to industry average of 7% (1% better than the average binder’s portfolios). All the risk metrics of the bank were looking This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 4 fine at the moment but there was no denying in the fact that outside economy was gloomy. Decision BT campaign has been a major source of revenue for Binders but current risk scenario points towards pulling the campaign off. Heather knew that she is missing something in her assessment. Shouldn’t Binders continue with the campaign? After all environments like these only differentiates winners and laggards. 1: Near Prime: Customers with Fico scores in the range of 600 to 680 are classified under near prime segment. These customers carry relatively lesser risk; have not defaulted on any loans in last 18 months & have salaries above $65K. Limited use of credit pushes them towards lower FICO scores. FICO is a trademark score generated by Fair Issac and Co. and is one of the most popular credit score in USA. Exhibit 1 : USA Unemployment Graph 1: Savings vs Credit usage (across USA) Graph 2: Savings vs Credit usage (Binders) Exhibit 2: USA Credit Card Customer Profile Metrics. *Last Column is specific to Binders Bank This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 5 Note: This case is based on pure imagination and data + definitions have been created to fit the case scenario. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 6 Case Solution Generic economic environment looks gloomy and it seems like banks have been hit hard by the rising unemployment amongst youths. In the past, many youths were signing up for credit cards and due to their habit of not paying on or before the due date, the banks were making huge profits by charging late fees and interest charges. Now as the unemployment has risen, these banks have cut on their card issuance to a larger degree fearing the event of credit defaults. Also, as people are filing for IVA (voluntary agreements) and bankruptcy, it should be advisable for financial institutions to cut back on their lending and make credit policies more stringent. Is Binders “Recession Proof”? USA unemployment rates by age-group clearly indicate that it has increased only in the age group of 19 thru 30. In fact for age group 30+, the unemployment figures have improved or remained flat. Historically, during the time of recession, people tend to save more and spend less. This has been indicated by the savings vs. credit graph. One strange point to notice here is that Binder Bank’s customer book doesn’t follow the normal trend. It is clearly shown that Binders customers are not taking a flight towards safety by saving more during tough times. This normally is the case with affluent customers or with customers that are not impacted by recessionary trends (like unemployment rate) Binder’s BT campaign target customers with 5+ years of credit history, ensuring that it is not getting too many young professionals on the customer book. This again points towards why Binder’s risk metrics are still showing no red flags as they might be safe against young customers defaulting on credit Binder’s overall default rate of 5% in much below industry average of 7% and its BT campaign is much better with rates at 4%. This clearly is due to stringent credit policies, wherein bank does a lot of homework before giving out credit Binder’s promotional offers that are tagged along with BT campaign are indicating towards a customer profile that has kids and travels internationally. This again points towards the affluent, matured customer group that might not have been impacted by the global economy crisis Exhibit 2 indicates that Binder customers are primarily towards the higher income range and as such the bank is less exposed towards “non prime” segment This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 7 Conclusion Binder targets customers with decent credit history that are probably in the age group of 30+ and have high salaries. Overall the bank has enjoyed relatively lesser default rates than the industry average indicating its risk practices have outperformed competitors in the past. As BT campaign is offered to customers that already have Savings account with the bank (thus making sure that Binders have full visibility to their saving accounts activities), & savings vs. credit graph shows no anomalies, it is evident that Binder’s risk practices are still functioning as desired (& are not red-flagging inappropriate risks). Overall Binder is doing just great! This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 8 Goldred’s Case Anthony Merz, the 42 year old, Managing Principal of Golred Associates Consulting India (GACI, Indian arm of Golred Associates) is worried about the call he got 5 mins ago. The CEO of Vandetta Group has asked for the project report which has been due for the last 2 months. Anthony knew that this is Golred’s one of the most important client and nothing has been done in the project in last 4 months, despite his best efforts to gather a team to work on it. The best thing Anthony could do on the phone was to ask for a fortnight more. Golred Associates as an organization Golred Associates is an employee-owned, global company providing consulting and design services in civil engineering services. Headquartered in Toronto, Golred has over 180 offices worldwide and more than 8,000 employees working with clients to manage their engineering activities. Any engineering firm will envy its work culture and global success. It was also awarded the world’s 2th best place to work for by Hewitt in engineering consulting space. The organization has a flat structure with only 3 levels of hierarchy–Engineers, Associates, Principals. Golred Associates Consulting India (GACI) Golred Associates started its Indian operations in late 2008 with Hitesh Bhagat as Office Manager (a 39 yr old experienced Engineer and Project manager) and Anthony Merz (13 year old Golred employee) as Managing Principal with all of its funding coming from its parent company. Including both of them, GACI was a company of 10 employees with 1 PhDs, 2 M.Techs, 3 B.Techs, 1 HR manager and an accountant in October 2010. All of the employees were graduates or post graduates from top-tier colleges of India and abroad. Most of them were on international training assignments during the time of case. Even after 2 years of This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 9 their operations, GACI hasn’t been able to breakeven due to recession and the senior management looks apprehensive about the future of GACI. Anthony Merz While born as a Canadian, he has spent almost a quarter of his life in India. He joined Golred in 1996 and since then progressed slowly and steadily to become one of the 100 Principals in this 8000 employee organization. He is a charming person with positive attitude and entrepreneurial spirit. It was due to his efforts that GACI came into shape in 2008. He has been well-recognized as the next VicePresident of Golred Associates. The Problem: Vandetta Group commissioned GACI in July, 2010 to study its various iron ore mines across Goa, and suggest improvements in current processes for oreextraction and waste management. A lot of their mining operations were dependent on the recommendations given by Golred Associates. It was known to Anthony that the kind of expertise that is required in this project is not available in GACI, so he gathered support from other offices in winning this project. He got an overwhelming response from Australian operations during the project bidding stage, but later on, people started moving away from the project. The reason was clear. As the recession was getting over, people in other offices were becoming busier and not ready to do charity work. In the past two months, he has been interviewing people almost regularly to find the right fit for the job in the short and long term, but all in vain. Anthony was also concerned whether to call its employees back who are currently travelling internationally and working on other projects to help him do geotechnical studies and analysis which will again incur huge costs. What would you recommend Anthony in such a situation? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 10 Case Solution This case is a strategy case with a strong focus on entrepreneurial and management aspects of senior management in finding solutions in tough situations. This case directly pertains to the organizational culture where an in-depth understanding of the 7S framework is absolutely necessary. A lot of questions can be answered if we look at each aspect of this framework more deeply and find solution for short term and long term challenges. While GACI had a very good balance in the level of expertise in its office, but was missing was the right set of people for the right kind of job. While most of the employees were getting trained on some other projects, that too internationally, GACI as a company was hurting for not being able to deliver the projects that they took. It is visible that Anthony’s soft spoken and charming personality isn’t helping in this situation. What happened was that many offices which committed to help and got busier didn’t appreciate the urgency of the situation. Most of them felt that things can be taken care of by the Indian office by themselves. The company has taken pride in calling itself “One Golred” and “a global firm” (and not a multinational firm). What is visible in this case is that despite management’s efforts to create such a philosophy, things are This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 11 different at the ground level. Because each office is concerned about its own profitability rather than the company as a whole, employees are still disconnected and do not care about the company as a whole. This case also raises question on how successful a flat structure can be, given that the size of the organization is that large. What Happened After much deliberation, and working on some numbers, Anthony asked two of his employees to come back for international training. He also asked one of the experts from Golred’s Australian office to come down to India for a week and help GACI in finishing the project. The project eventually went into a loss for GACI, but profitable for Golred on the whole. The project also finished on time. The expert stayed almost three weeks to build relationships with the client and generate more business for Indian office. In the meantime, a very good candidate was also identified who led such projects afterwards under the mentorship of the same expert. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 12 Rohan's Dilemma: The Big Decision As Rohan Sood, a recent business school graduate pursuing the Leadership Programme at Ryan Bank, sat down with his friends for a cup of coffee, he knew that he had to make a challenging decision about his career. Rohan was discussing a recent opportunity to lead the Asia Pacific (APAC) business for SkillPro, a renowned financial training company headquartered in London. Since his university days, Rohan had made various presentations to the partners at SkillPro and had finally received the green signal for leading the company's APAC setup. It was now time for Rohan to make a decision. Were the terms of the offer from SkillPro attractive enough? Could Rohan afford to take on the business risks at this stage of his career? Should he work for a few more years to gain industry experience and to build a stronger network before taking the plunge? About SkillPro SkillPro was founded in 2003 by a group of senior banking professionals in London. With over 150 years of banking experience amongst them, the 6 founding partners had worked extensively across various domains of banking. Currently, the company had no regional offices. Built on the philosophy of 'learning by doing', SkillPro had developed an array of simulation software to offer an unparalleled learning experience to the participants of its programme. With its ability to replicate the real world environment in a classroom and to produce comprehensive feedback reports, the simulation tools provided the participants with a novel and enhanced training experience. With 2008 revenues of over £1.4 million, the company offered short 3-5 day programs to students/industry professionals (18% share in revenues) and comprehensive training programs to banks (82% share in revenues). With leading European banks as clients, SkillPro had made previous attempts to make its foray into the APAC market. Even though it had conducted a few workshops in HK and Singapore over the years, in the absence of a regional office, the company had struggled in making any substantial mark in the region. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 13 Decision time When Rohan first approached the partners at SkillPro in August 2007 for starting and managing their APAC office, he was confident about the potential of the company's products/services in the region. Having participated in SkillPro's Asset Management workshop in HK, Rohan had experienced SkillPro's unique training methodology first hand. In addition, HK's banking sector was booming in 2007, growing at 18.5% per year. Other regional financial hubs also presented huge opportunities, with Singapore and India posting 8.6% and 19.7% growth in their banking sectors respectively. As an aspiring entrepreneur, Rohan knew that this could be a great breakthrough opportunity for him. As of 2009, no other training firm in Asia offered training services with the use of simulation tools. Although SkillPro's partners were initially reluctant in bestowing huge responsibilities on a student, several rounds of teleconference calls and face to face meetings, allowed Rohan to earn the trust of the partners. In September 2009, SkillPro finally made an offer. In spite of Rohan's best efforts to persuade the partners to provide a fixed stipend to him for the first six months (to cover his monthly living expense of £2000 a month and the office's monthly operational expense of £3000 ), the offer made by SkillPro entailed a substantial amount of risk. SkillPro had agreed to absorb the initial setup costs of £10,000 but all operational expenses would be borne by Rohan. On the upside, the revenue sharing arrangement entitled Rohan to receive 25% of all new revenues. In his preliminary analysis conducted in 2007, Rohan had forecasted revenues of £200,000 in the first year of operations. However, 2009 was a turbulent year for the financial markets and many of the Asian markets had taken a significant hit (growth was expected to slow down by 30%). Prospects seemed subdued compared to 2007. Moreover, Rohan had managed to secure a handsome £100,000 offer for a leadership program from a leading global investment bank earlier that year and had been working since February. With little savings, Rohan faced the dilemma of whether to take up the big entrepreneurial opportunity, to take it up after a few years or to ignore it altogether. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 14 Case Solution Rohan has the 3 options as of now: Quit his job and accept SkillPro's offer Continue with job for a few more years and then take up the opportunity Ignore the offer completely and focus on his career in the bank Rohan should take various factors into consideration when taking the decision of whether to accept SkillPro's entrepreneurial offer in current form. Some of the most important considerations are assessed below: Alignment with career aspirations The case mentions that Rohan is an aspiring entrepreneur. From this we can infer that SkillPro's offer is well aligned with his career aspirations. Running SkillPro's APAC business on a revenue sharing model would offer Rohan a great entrepreneurial stint and allow him to gain the skills and experiences to possibly start a company fully owned by him at some point. Attractiveness of the opportunity Health of the banking sector can be considered as the most important metric for opportunity assessment. Since over three quarters (82% to be precise) of company's revenue were derived from programmes to banks, the ability of banks to pay for employee training would be a crucial factor When Rohan first initiated his discussions with SkillPro in 2007, the banking sector was characterized by high growth. The HK market was growing at 18.5% annually, whereas the Singapore and India market were growing at 8.6% and 19.7% respectively. However, the decision to proceed with an office setup in APAC was made only in September 2009 by SkillPro's partners. The case mentions a global financial meltdown during this period, dimming prospects in the sector significantly over this period. Even though banks may still have training budgets, it was unlikely that they would spend a lot on value added training programs. The opportunity's attractiveness had clearly subdued in the short term. At the same time, no other firm in Asia had the resources and capabilities possessed by SkillPro. Building simulations tools similar to SkillPro's can be assumed to be capital and time intensive. Thus, from a competition and substitution perspective, the opportunity still seemed to be attractive. Rohan should also try to match the demands of the startup with the resources/capabilities he possesses. One would imagine that having a strong network in the banking sector would be of enormous help. Even though Rohan had spent close to 6 months (February to September) in a leading bank, spending more time there could help him develop a stronger network. It would also give him more industry knowledge and experience before leading SkillPro's business. This This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 15 delay, of course, entails the risk of SkillPro choosing another partner for the APAC setup or changing their mind about setting up a new office altogether. Financial viability Rohan's current salary is £8500 a month (£100,000/ 12 months) and he has living expenses of £2,000. Assuming he saves the rest of his monthly salary, we can expect £6500 savings per month or £39,000 savings over the 6 months during which Rohan has been with the bank. The case outlines an ongoing expense of £5000 a month (£2000 for living expenses + £3000 operational expenses of the new office) for Rohan. This suggests that Rohan could survive for £39,000/£5,000 = 8 months (approx), without external support. In spite of the product's attractiveness, an 8 month buffer during a financial crisis must be considered risky. Thus, unless Rohan can source external funds for beyond the 8 months, he should forego the offer. The opportunity cost of not continuing in his current role must be factored in. Rohan had forecasted a £200,000 of revenues in the first year of operations, resulting in £50,000 (25% commission * £2, 00,000) of annual revenue. With an expected 30% hit due to the financial crisis, £35,000 (70% * £50,000) income can be expected in the first year. This represents only 35% of Rohan's current salary in Ryan Bank. If we assume that Rohan can replicate the European growth experienced by SkillPro in its 6 years (2003-2009) of operations in APAC, we can expect APAC's annual revenue to be £1.4 million in 6 years and a corresponding commission of £350,000 for Rohan. We can safely state that the upside potential of this business seems to be far more attractive than continuing to work in the bank. The main findings have been summarized in the table below: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 16 From an assessment of the various options, it seems most reasonable for Rohan to choose the second option: working for a few more years in the bank and then taking up the venture in its current form. In order to minimize risks, he should try and strike a deal with SkillPro right away, with an option to start later. He should explain to them the various advantages of delaying the startup including a stronger network, broader skill set, hopefully an improved marketplace and an enhanced financial buffer. He should be candid about his financial constraints to the partners. If SkillPro strongly fears competition in the region, they may also eventually give in to Rohan's demand of a stipend and give him the option of starting with the venture right away, Rationale for chosen approach For a young and aspiring entrepreneur, career goals are critical. However, other considerations such as industry environment, financial viability and availability of the right set of capabilities/skills play an important role in determining the success of any new venture. The approach gives these factors due consideration and comes up with the final decision. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 17 ADM Vendor Consolidation-XYZ Corp March 2011. Aditya V., the newly recruited Management Consultant at XYZ Corporation, pondered over his first assignment in the organization. He had recently graduated from the Indian School of Business. The CIO, Mr. Murthy, had conferred upon him the responsibility of coming up with a solution to the rising vendor inefficiency and the resulting costs in the Applications development and Maintenance (ADM) space. The productivity of the organization was at stake and customer complaints were on the rise. All enthusiastic to crack his first case, Aditya began with collecting data on various aspects of the business problem. Company Background Established in the year 2000, XYZ Corporation is a financial services company based in India, whose major business comes from discounted online brokerage services for self-directed traders who invest in stocks, options, mutual funds, bonds and exchange-traded funds. The investor can trade through various channels like the Website, Interactive Voice Response (IVR) and smartphone apps. The firm employs in-house brokers and Wealth Management advisors who look into the holdings and the trade settlement procedures in the company. The firm also employs Business Analysts/Product Managers for the IT department, who spin out the new requirements required for the trading platforms The revenues of XYZ Corp flow in through trade commissions, brokerage fees, interest on funds in the margin accounts, and interest on bank products. The firm reported revenues of Rs 10 billion in the fiscal year 2011. As part of providing the online brokerage, service to its customers, XYZ Corp has outsourced many of its vital business functions, like ADM for website, smartphone apps, and Interactive Voice Response (IVR), and maintenance of vital applications like ERP, CRM and HR tool. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 18 The departments for Website Development, website maintenance, Mobile App development and maintenance, IVR system development and maintenance, and the Customer Call Centre work as onshore-offsite models. The Business Problem With 9 applications and 13 vendors for ADM alone, XYZ Corp had been incurring major costs with respect to the yearly IT spend and the Management of Vendors. Moreover, due to synchronization inefficiency across vendors, the firm had witnessed a drop in the productivity and commitment from the vendors. The productivity of the applications had dropped tremendously also affecting the productivity of the organization as a whole. Customer complaints regarding application downtime had been on the rise leading to loss of customers to competitors. The firm houses about 65 onsite vendor managers, an average of 5 per division which further contributes to the IT spend. The reported IT spend for the year was 5.22% of revenues, i.e. Rs 522 million and IT Vendor Management charges was 2% of the IT spend, i.e. Rs 10.4 million. The different costs incurred by XYZ in order to procure services from the IT vendors are given in Exhibit 1. Proposed Solution On analyzing the data, Aditya suggested that the IT space in the organization should go through a Vendor Consolidation exercise, in order to optimize the resources and improve efficiency. Vendor Consolidation is a process of eliminating low performing suppliers and retaining only a small number of high performing suppliers, in order to reduce costs and improve the efficiency of the organization. Having a small number of active suppliers lets the suppliers enjoy economies of scale and hence they are able to provide the same services at much lower costs and better quality. The redundant cost drivers common across suppliers are eliminated. Accountability of the suppliers increases. The downside of having very few suppliers is that it can lead to a monopoly situation. Hence the idea is to strike the right balance and maintain the optimum number of suppliers in order to enjoy the benefits of economies of scale while also maintaining a healthy competition amongst suppliers. The solution proposed for XYZ Corp states that the IT vendors should be rated on 2 dimensions: Performance and Cost efficiency. Performance Scoring: In order to rate the vendors on this scale, data pertaining to Vendor Service Quality, Number of incident breaches in the past year, Customer satisfaction and Rapport with internal staff were This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 19 collected. Each vendor was scored based on their performance on each of these 4 metrics. Cost efficiency Scoring: The rating for cost efficiency was based on the cost incurred by XYZ due to Application Development and Maintenance, and also due Change request and ticket breaches. The cost efficiency for each of the above was rated based on the following parameters: Application Development costs – Development cost per 100 lines of code Application Maintenance costs – Unit cost per service request Breach costs – Unit Cost per Maintenance ticket breach & Unit cost per development change request breach The scores thus obtained were used along with other factors like availability of another vendor with the same capability but better efficiency in order to decide whether the contract with a particular vendor should be retained or eliminated. (Exhibit 2) Results The solution thus was implemented in XYZ Corp, and yielding beneficial results. The projected NPV for a span of 5 years after implementation was estimated to be Rs.0.59 billion with an IRR of 36%. 4 vendors were eliminated completely whereas, the services of one of the vendors was partially terminated, i.e., the vendor was retained for application development, whereas the maintenance services were terminated. The number of onsite vendor managers reduced from 65 to 43. The productivity of the firm improved which reflected in the year-on-year 10% increase in revenues. The reduction in costs and improvement in cash flow observed were attributed to the following: Improved productivity and speed in delivery at the supplier side Reduced service costs due to economies of scale at the supplier side Reduced recurring IT costs Reduced vendor-management costs Reduced incident and ticket breaches due to exit of the unproductive vendors, better co-ordination amongst the remaining productive vendors, improved accountability and better goal alignment amongst vendors Lesser number of onsite vendor managers thus reducing labour costs Improved customer satisfaction and thus increased use of website for order placing This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 20 The improved customer satisfaction also helped in brand-building thus leading to inflow of new customers Concluding Remarks: Thus, the consolidation of vendors comes with a lot of advantages, the main being improved efficiency and reduced costs. Though, it has certain challenges like the complexity of vendor evaluation, overcoming vendor biases amongst the managers who are instrumental in taking decisions and amongst the internal staff. To implement a successful vendor consolidation, one must ensure that the goals one seeks to achieve through vendor consolidation are well-aligned with the strategic goals of the organization as a whole. Exhibit 1: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 21 Exhibit 2: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 22 Exhibit 3: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 23 Exhibit 4: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 24 Sources: 1. Consolidating Vendors Brings Operational Benefits As Well As Dollar Savings: http://www.forrester.com/Consolidating+Vendors+Brings+Operational+Benefits+As+Well+ As+Dollar+Savings/fulltext/-/E-RES46127 2. The Hidden Costs and Complexity of Managing Multiple ADM Suppliers: http://www.accenture.com/Microsites/itoptimisation/ITVC/Documents/pdf/Accenture_Application_Outsourcing_Cost_and_Comple xity_of_ADM_Relationships.pdf 3. The value of IT vendor consolidation: http://www.informationmanagement.com/newsletters/merger-acquisition-consolidation-business-intelligence-Kamen10021411-1.html This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 25 1 Agri Business Corporation Pg 27 -Mamtesh Sugla 2 E-education in India Pg 30 - Shubkarman Singh Sidhu 3 Sprocket Electrical & Automation Pg 34 - Vishwas Sugla This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 26 Agri Business Corporation AgriBusiness Corporation (ABC) is a fast growing private company engaged in the business of irrigation systems & solar products. It has revenues of Rs. 4000 Crores and a net profit margin of 30%. However, the company has recently started facing a serious cash crunch and now doesn’t have enough funds to purchase raw materials & continue its operations. Why is it facing a liquidity crisis & what can it do to avoid such a situation in future? Data: State governments and central government offer 70%-90% subsidy to small and medium farmers in both solar products & irrigation systems sectors. Small & medium farmers constitute 80% of the customer base for ABC. ABC has outstanding subsidy dues of up to Rs. 1.5 bn for the past 3 years. Many governments are also in the process of changing policy to release subsidy directly to farmers not companies. The dealers of ABC are responsible for filing the procedural documents at the regional offices of agriculture ministry. ABC has a built-in interest for 3 months delay of subsidy disbursement in its price structure. ABC currently pays 15% commission to its dealers (its stated net profit margin accounts for this cost). This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 27 Case Solution ABC has a net income of about Rs. 1200 Crore, but is still not generating cash flows and has been unable to do anything about it in the past 3-4 years (this hints at a structural issue rather than credit policy issue). The small & medium category farmers comprise 80% of the company’s revenue base which implies that subsidies play a major role in its business. ABC’s core business with a margin of 30% is highly lucrative, however, as the subsidies get delayed above its in-built cost of 3 months, the financing cost keeps on accumulating along with the sizeable miscellaneous costs involved in getting funds released from govt. ministries. The subsidy disbursement takes time due to delay by dealers in fulfilling procedural requirement & postponement by govt. If the proposed policy of releasing subsidy directly to farmers is implemented, ABC will incur additional costs due to increased credit risk. As the best case scenario, ABC would like to retain the subsidy driven revenues & growth, without having to shoulder the subsidy financing burden itself in the following ways: Sell only in those states where disbursement is on time, limiting business and growth. Increase the prices to account for higher financing costs. However, this approach is limited due to price regulation & competition in various states. Give dealers higher commission and make them bear the uncertainty of subsidy disbursement (hence, on time compliance of subsidy claim procedures). However, in some regions the dealers may lack the financial or risk taking capacity. Tie up with a bank to arrange financing for the farmers and make farmers themselves pay for subsidy disbursement uncertainty. This way of doing business would also align with the possibility of new regulation shifting subsidy payment from company to farmers. The farmer is expected to pay interest to the bank in the future wherein he would also have improved his productivity & hence his financial position by reaping the advantages of company’s products (irrigation systems & solar products). Also, he is likely to attribute this cost to the delay in release of subsidies and hence is likely to blame the government & not ABC. While, the government may find it easy to delay subsidy disbursement to ABC (just one company), it is likely to face pressure from various farmers & their representatives if it delays paying thousands of farmers. One of the good ways to profit from this predicament and continue its existing business is to setup a Non-Banking Financial Company (NBFC) which will finance the subsidy for the farmers instead of using banks. While this would retain the merits discussed in bank financing case, this NBFC would earn additional interest from the farmer for the delayed arrival of subsidies. NBFC’s in priority sectors like agriculture get tax advantages and get access to cheaper sources of government funds. They also have the This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 28 advantage of taking farmer’s land & assets as collateral to lower their credit risk while ABC can’t do that in any form. The NBFC would also help company sell its products in regions where neither the banks nor the dealers are ready to finance the subsidy disbursement delay. The optimum solution would be a combination of the above solutions. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 29 E-education in India NewAge Ltd. is newly launched venture in the e-education space using a Direct to home (DTH) technology. The company aims to provide internet solutions like email, social networking, education on TV through their patented digital media platform that makes use of DTH and set top boxes to deliver customized content to the viewers. The company is focussing on launching products in the eeducation sector and provide interactive educational tools to students on their TV sets. Currently NewAge Ltd., is in its nascent stages. It has recently received USD 20 Mn in multiple rounds of PE funding. Data India has the largest student population in the world and a literacy rate of 74%. Indian govt. lays special emphasis on primary education & 80% of schools are government aided, During FY 2011-12, Govt. allocated INR 38, 957 Cr for education in India. This allocation is expected to increase along with GDP growth in the coming years. Approx 50K private schools concentrated in urban areas. India faces a backlog of approximately 2, 00,000 schools to accommodate students and provide easy access to education for all children. Average student to teacher ratio is 1:42 indicating a shortfall of teachers, drop-out rates at both primary and secondary levels are still very high as compared to other countries India has second largest internet using population in Asia after China but internet penetration stands at merely 10.2% DTH penetration has been steadily increasing and is expected to be available to 48 million homes by 2015. As of 2011, total households that own a TV set are 231 Million Demand for education Parents in urban areas are opting for expensive private schools Several companies that provide an end-to-end education solutions This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 30 o Educomp - The fastest-growing education solutions company in India and a leader in providing end-to end solutions to government and private schools. It has developed extensive multimedia content for schools and provides infrastructure to government schools, full-time instructors, etc., as a part of its offerings. o NIIT - India's largest IT training company. It is leveraging its knowledge base in IT to expand into talent development in other sectors of education as well. o Everonn - pioneer in the Institutional Education and IT Infrastructure Services (IEIS) business. Currently, Everonn caters to over 3,000 Government schools by providing content & computer infrastructure on contract basis to govt schools Internet penetration will prove to be a tough challenge for providing end-toend solutions like virtual classes and reaching most inaccessible of the student population With respect to above case facts, what is the best approach for NewAge Ltd, to enter the education landscape of India? Should it consider launching the technology on a Pan-India basis or target particular regions? Should it consider collaborating with bigger players or should it sell its patented technology to other players on a contract basis? Evaluate all the options and give a solution. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 31 Case Solution The aim of the case is to design an entire goto market strategy for the company. Keeping this view in mind, all the relevant perspectives need to be looked upon so that the company can adapt to the challenges and establish itself as a dominant player in the industry despite of starting late in this category. The key issues in this case are NewAge Ltd., has got a new technology but can it implement the same on a varied and diverse landscape such as India. Identify the key entry barriers, feasibility study, threat from competition, etc. An analysis of the value chain of the company and identify gaps in the same. For instance, suppliers of content i.e. content developing, technology infrastructure required to implement solutions on a country wide basis, execution ability of the sales team. Also the scope of expanding the market beyond primary, secondary and higher secondary levels of education should be considered. Adult literacy in India is also abysmally low, and there is a need for better vocational training/specialized skill-set training for employment opportunities. Such a technology definitely opens up a new area of providing education through television. The competitors of NewAge Ltd., have established themselves in the market, a thorough analysis of their unique strengths is required to decide whether NewAge Ltd., should launch on its own or collaborate. Estimate the feasibility and market potential of different market segments that this product can cater to. Some of these markets are primary and secondary school children, technical and graduate level training, adult dropouts, and corporate trainings. How to approach the problem? Who is your consumer? o Define the needs of the consumer o Identify the demographics and characteristics of the target audience. What are the characteristics of your industry? o Study the industry evolution and current stage, i.e., is it fragmented industry, emerging industry, maturing industry. o Suggest strategies that can be implemented corresponding to the current nature and stage of the industry How to manage the content delivery? o Superior content delivery is absolute necessary for this business o Who will be the key resources/collaborators that NewAge Ltd needs to leverage to gain an edge in the business? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 32 What are the Key success factors of NewAge Ltd vis a vis its competitors? o Is it the superior in the operational factors, competitive positioning, and organizational structure? How to build long term loyalty among the consumers? o Steps that can be used to increase the switching costs for consumers and ensure that remain with the company for longer periods o Aspects of contract negotiation between company and vendors, schools, government, etc. How will the external factors affect the company in offering its services? o R&D and technological innovations in the market o Government influence in the education industry o Current macro- economic scenario that will affect supply-demand of this industry. For instance, high employment opportunities will encourage more parents to provide for good education to their children and will lead to growth of e-education industry. In-depth competitor analysis of at least top industry player. o Identify current strategy and future goals/strategy for the company o What are the key capabilities that can be used to reach the desired position by the competitor? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 33 Sprocket Electrical & Automation Sprocket E&A wanted to establish its footprint in the new emerging markets. The company identified a huge tender floated by Rand Water, South African water Distribution Company, for pipeline automation. Sprocket E&A purchased the tender on its name and a dedicated proposals team started preparing the bid. Rand Water had listed the following criteria for the project award: Price: 30 points, Quality: 40 points & BBBEE: 30 points. As expected, Sprocket E&A didn’t qualify for the BBBEE criteria and would be evaluated only out of 70 points. Murthy, Chief Executive of Sprocket E&A made the following comment: “Although this is a beautiful opportunity to enter the African market, there’s no point in bidding for this project. South African market is highly competitive and we stand no chance of winning if we lose those 30 points.” What should the company do? Additional Data to be provided on relevant questions: Background of the company: Sprocket E&A is a $70 mn Automation company based out of Dubai. It’s a group subsidiary of Sprocket Ltd., a major Indian EPC (Engineering & Procurement Company). Why entry in emerging markets is important: Sprocket Ltd. is experiencing sluggish growth in India as infrastructure projects are getting delayed/cancelled due to the dwindling investments. What is BBBEE: BBBEE (Broad-Based Black Economic Empowerment) is the affirmativeaction policy of South African Government to protect the interests of local population. BBBEE criteria of point award: o Equity Ownership of a Black employee – 15 points o Management by Black Employee(s) – 10 points This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 34 o Black Employee content > 30% – 5 points Price breakup of the commercial offer that was prepared by the proposal team: o Material Costs: $ 12,000,000 ($ 6,000,000 Automation & $ 6,000,000 Solar system o outsourced from a third party) o Service Costs (Installation & On-site testing) : $ 4,000,000 o Markup: 25% o Sales Price: $20,000,000 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 35 Case Solution Sprocket should not bid for the tender directly as South African market is very competitive. Sprocket can look at establishing a project specific strategic partnership with a local South African company. However, the following factors should be accounted while on the look-out for a partner: The local South African company should not be directly engaged in Sprocket’s core business i.e. Automation. (can be future threat to Sprocket in the South African market) Also, the partner company should be in a related business as it would be in direct contact with the client. The partner company should have brief understanding of the automation domain. Sprocket can therefore look at companies present in Electrical, Instrumentation etc. line of businesses. The local South African company should have a good repute and reference projects to not to lose on the quality points ascribed in the tender. The local South African company should ideally have an organizational structure that maximizes the BBBEE points i.e. it should be locally managed and have equity ownership of a Black employee. Also, the black employee content in its work force should be greater than 30%. Also, the project specific agreement should identify all the terms of revenue sharing and risk assessment. It should also specifically enlist the exhaustive scope of works (i.e. division of supply and services amongst the two companies in case of a project award) Currently, Sprocket has an 80% cost portion ($16,000,000/$20,000,000). After partnership, Sprocket assumes the role of a sub contractor, the local South African company being the main contractor. It is not in Sprocket’s interest to carry such a high risk portion in the project as the client will be paying the local company. Hence, the risk should be shared by both the companies. This can be done as follows: The services (installation & testing) portion can be passed on to the local company as it would be more efficient for them to serve the client locally. Also, Sprocket is outsourcing the entire solar system which is unrelated to its core business. The local partner company can be asked to procure this system. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 36 So in all, the cost distribution would be as follows: Sprocket Material Cost (Automation): $ 6,000,000 Total on Sprocket’s account: $ 6,000,000 Local Partner Company Material Cost (Solar System): $ 6,000,000 Services (Installation & Testing): $ 4,000,000 Total on Partner Company’s account: $ 10,000,000 Hence Sprocket’s cost portion will get reduced to just 30% in this arrangement. In summary, Sprocket E&A should look to form a project specific partnership with an “able” local South African company. Also, Sprocket should look to reduce its risks as it would be acting as a sub-contractor. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 37 1 Crossroads & Co Pg 39 -Madhur Bansal 2 Chintamani’s Dilemma Pg 42 - Aadit Devanand 3 Purchase Descision Pg 45 - Vikram Bodavula 4 Rajat Gupta & Company Pg 47 - Madhur Bansal 5 XYZ -Kunal Ashok Pg 50 6 Nikology Private Limited - Nikhil Jalan Pg 53 7 Fraud or not! -Nikhil Jalan Pg 55 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 38 Crossroads & Co Crossroads & Co is a major Original Equipment Manufacturer (OEM) based in Illinois, USA. It is the fourth largest player in terms of market share. Last year, the company decided to extend its product range and made large investments in developing more versions of its existing products (It did not diversify its product line, just added more variants to the existing ones). A recent study revealed that the market share has gone down by 10% and profitability declined by ~ 26%. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 39 Case Solution I’d like to start by analysing the fall in market share as it is possible that profitability is declining due to the same reason. I’d adopt a top-down approach where we will study the changes in the market first and then boil down to the company itself. Did Crossroads raise the prices in recent times or did any competitor slashed down the prices considerably thus winning our market share? The prices have risen uniformly to account for the inflation in the economy. Has some new company entered the OEM industry and gained a considerable share – it may be due to technological innovation in the industry? No, apart from our product variations, there has been no significant innovation or new entries in the industry. Since ours is a derived demand, has the market for automobiles, and particularly our customers, taken a hit? No, the demand for automobiles has been growing at a reasonable rate. Does that imply that the OEM industry has grown overall and we have faced a decline in the share? Yes, the industry has grown and our sales also have increased from $220mn to $225mn. It can be concluded that the loss in market share is primarily due to the company’s internal factor. What has been the pattern of sales of the two segments – existing and new variants last year ? The new variants are selling (they have a market) but the sales for the original product have reduced considerably. But we will continue with the new variants. Is it possible that the similarity among the products hasn’t been communicated well, thereby confusing our customers and ending up in multiplied effect of cannibalization? Well, some customers did expressed concerns of the products being too similar, so it is possible. So it seems that this cannibalization, due to close similarities, and lack of education about the same among the customers is the reason for declining market share. Let’s look at profitability. Has the cost of production risen significantly after the new variants or did they require some heavy investment in machinery or likewise? The cost of goods has risen from $150mn 50 $155mn for the corresponding sales and the fixed expenses have remain constant at $18.6mn. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 40 Did the company made some significant investments for the marketing of the products? Sales and promotional expenses stand at $32mn as against $25mn last year, often we set up a dedicated promotion team for the individual variants. Since the production and administrative costs are fairly stable, it appears that the increased burden of marketing and promotion has cut into profits. Can’t the entire bundle be promoted together to cut costs and at the same time highlight the subtle differences in the technical specifications? Well, that is possible. I guess we can try that. Analysis Product cannibalization, due to similarities that were not properly highlighted, is the reason for decline in market share. Marketing expenditure for individual products reduced profitability which can be tackled by bundled marketing, emphasizing on the need for the variations and its specifications. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 41 Chintamani’s Dilemma Chintamani is the CEO of Global Solutions, a mid-size software company catering to US and Eurozone markets. The past few years have been turbulent for the industry, but Global Solutions, owing to its niche work has managed to retain its clients at competitive rates. This has earned them the praise of most analysts tracking the industry. Not just that, the company is sitting currently sitting on a cash pile of Rs. 35 crores thanks to its prudent operational decisions. Chintamani has to decide on investing this money in the best possible manner. Many small companies in the industry are in a bad shape, their rising costs have put pressure on their margins due to stagnant revenues. However, most of them have managed to retain their largest clients. A significant number of these however, wish to exit the industry as they find it difficult to face the competition. Chintamani believes that the industry is entering into a consolidation phase, and hence it this is the right time to go in for acquisition. The different business segments companies in the industry operate in and their expected returns (as a percentage of sales) are given in Exhibit 1. Global Solutions has shortlisted three prospective targets, each of which are similar in size (measured by total sales), functioning, organization and whose share prices trade at a similar P/E multiples. The segment wise break-up in percentage of sales of the four companies are given in Exhibit 2. Chintamani believes that as a result of business re-engineering and ownership diversification in the prospective targets, variance in returns can be eliminated by upto 63%, 17% and 50% in Happy Services, Next Up and Right Answers respectively. Given a risk-free return of 4%, which of the three do you suggest as the best buy for Global Solutions? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 42 Exhibit 1: Business Segment Returns Customized Solutions 15% Long Term Contracts Branded Software -7% Short Term Contracts Maintenance Contracts Standardised Software 9% -5% 6% 10% Exhibit 2: Customized Solutions Long Term Contracts Branded Software Short Term Contracts Maintenance Contracts Standardised Software Global Solutions Happy Services Next Up Right Answers 50 10 10 10 10 10 10 15 25 25 15 10 24 10 24 10 22 10 25 15 10 10 15 25 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 43 Case Solution Since each target company is priced at a similar P/E ratio, expected return cannot be a yardstick for deciding on the best company, since a more profitable company would become more expensive. Global Solutions in addition, has a portfolio which is concentrated in Customized Solutions(50%). It is hence advisable to acquire target which results in maximum synergistic benefits. This can be done by acquiring the company whose portfolio will have the maximum Sharpe Ratio as calculated by expected returns over risk free rate for each unit of risk measured by post-acquisition standard deviation. Right Answers has the maximum post acquisition Sharpe Ratio of 0.217 as compared to Happy Services (0.212) and Next Up (0.205), and hence should be selected Appendix I: Computation of Sharpe Ratio This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 44 Purchase Decision Old Bridge Systems is a channel partner for market leader Kinovo PinkPad Laptops. It got an opportunity to sell 1000 laptop boxes in the pan-iim/isb laptop deal. The main competitors in the field New Wood Systems and Classic Computers are also positioning Laptops from UP [World Number 2] and Hell Computers [World Number 3] with exactly same configuration. Whom should the Pan-IIM/ISB Systems Club Committee buy from and why? Exhibit 1: Laptop Model Kinovo PinkPad UP Chameleon Hell Dispiron Lead Time 4 weeks 0.5 weeks 2 weeks Segment Business Consumer SMB On Site Warranty 2 1 2 Service Camps 2 4 2 Price/unit 40000 37000 39500 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 45 Case Solution Solution It should buy from Kinovo PinkPad Reasons 4 weeks lead time is easily manageable for most of the iim’s since first lists are out 2 months in advance and there is a buffer of 1 orientation week after the start, which effectively means lead time is not a criteria. Business Segment laptops are built to last 20hrs of non-stop work for a prolonged period which is typical in iim/isb environment (6hrs for consumer and 10hrs for SMB). Students who graduate out of these institutes will get an office computer/laptop in most cases and warranty in third year is not a great value add. Since there is on-site warranty, service camps are useful only in case of minor repairs which do not affect the day-to-day work. Even if Lead Time is assigned 1250/-additional value per week, PinkPad service network and brand name ( World Number one) should be taken in to consideration while placing the order. Effective Value Laptop Model Kinovo PinkPad UP Chameleon Hell Dispiron Lead Time 0 0 0 Value Assigned (Relative) On Site Segment Warranty Service Camps 5000 4000 0 0 0 1000 2500 4000 0 Additional Value 9000 1000 6500 Effective Price 31000 36000 33000 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 46 Rajat Gupta & Company Rajat Gupta and company is a CA Firm (sole proprietorship) with two offices in Delhi. It was established by Rajat Gupta, the proprietor, in 1991. The revenues increased at an average rate of 15% every year till 2006 but have been stagnant since. The total revenue in the form from client fee last year was INR 21 lakh. The distribution of clients and break up of revenue are given in Exhibit 1. Mr. Gupta is contemplating the prospects of opening a new office for direct tax clients. He has his funds invested in a mutual fund that is currently giving him a return of 10%; he plans on selling his portfolio. The details of the different office locations are given in Exhibit 2. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 47 Exhibit 1: Distribution of Clients Revenue Break Up Exhibit 2: This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 48 Case Solution The current scenario is to be juxtaposed with the proposed options and if the latter is more profitable, decision has to be made regarding the location of the office. In terms of absolute profits per year also Option I scores over the other and the current situation as well. The two alternatives can be compared by analyzing the NPV and the breakeven point for each of the two. The initial cost outlay – 42 lakhs and 30 lakhs for Gurgaon and Noida respectively. The revenues from the direct tax clients can be calculated from the two charts o Revenue from direct taxation services : 25% of 21 Lakh i.e. INR 5,25,000 o Revenue per client – INR 17,500 The net annual cash flows for the two locations are: o Gurgaon: 5 L, 6.05L, 7.675L, 8.675L, 10.25L, 12L, 12L, 12L… o Noida: 2.575L, 3.45L, 4.5L, 5.725L, 7.3L, 9.05L, 9.05L, 9.05L… The discount rate will be the opportunity cost of the investment – 12%. The discounted payback period is 7 years 2 months for Option I and 7 years 5 months for II. NPV is higher for the office in Gurgaon and its NPV becomes in a period of 7 years implying that it is advisable to open a new office in Gurgaon. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 49 India 2012: Risk of default? There are some amazing similarities between the BoP situation that India found itself in 1991 and 2012. Does the nation stand the risk of defaulting on its international payment obligation in the coming years? Data Current Account – Capital Account = Δ Forex reserve (or) (Trade balance + NFIA + Remittances) – (FDI +FII +Loans) = Δ Forex reserve High oil and gold price with inelastic demand meant $471 bn import bill (2012) .Trade deficit highest ever ($168 bn) – (Trade balance ↓↓) Despite strong Remittances (↑) ($64bn in 2012), (Current account deficit) CAD to GDP ratio at -3.7% - lowest ever GDP growth Q4 2012 at 5.3% - lowest in 9 years. High inflation (average 8.3% 2012) limits scope for rate cut (repo @ 8%) Fiscal deficit at 5.9% rating downgrade (BBB- by S&P) limits govt borrowing (Loans↔) High inflation, interest rate, weak rupee affect investor sentiments – portfolio investors withdraw (FII ↓). Policy paralysis caused FDI to dip 59% in 2 months in fiscal 2013. (FDI ↓) Above events led to Forex drawdown ↓ of $12bn ($307 bn to $294 bn) – 2nd highest fall in a decade. Crisis - when Forex is too low to meet payment obligation. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 50 Exhibit 1: Indicator 1991 2012 Debt and Deficits Fiscal Deficit Total as % of GDP Fiscal Deficit Center as % of GDP Govt debt as % of GDP Indicator -12.7% -8.3% GDP in bn USD -8.4% -5.9% GDP growth 76% 68% 30.2% 4.6% Trade and BOP External debt in bn USD $88 $326 CAD in bn USD External debt as % of GDP 27% 18% Debt Service ratio Forex Reserves Forex reserves in bn USD 1991 2012 GDP Gross Domestic savings CAD as % of GDP FDI in bn USD $5.64 $294 Forex cover in months of imports 2.0 6.0 Forex cover 6% 90% Forex draw down in bn USD $326 $1,848 1.4% 6.9% 22% 33% $7.82 $78.20 2.4% 3.7% $0.13 $32.95 Too low ($12.80) 10.3% 8.3% Inflation and interest rates Inflation Source: RBI data, Word bank, www.tradingeconomics.com This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 51 Case Solution Current account Moderate steady oil prices ($90+), lower gold imports (higher import tariff) but weaker overall exports due to slowdown in western markets (17% growth (NCAER)) means trade deficit at ($187.14 bn – 12% hike 2013).Remittances to grow 15% due to RBI’s NRI interest rate deregulation and weak rupee. Consequently total CAD at $80 bn – same level as last year in line with S&P prediction that CAD = 4% of GDP in 2013 Capital account FII continuing with buying trend this year will pour in $17bn while FDI reduce 25% to $24bn. Loans targeted at 15 bn (ET news) total capital inflow of $58.5bn Fiscal account GDP growth at 6.1% (IMF) and fiscal deficit at 5.6% (NCAER) overshooting budget estimates Consequent forex drawdown = $21.5 bn – highest ever forex drawdown. Reserves to drop to $265 bn USD from $286 presently Verdict No immediate crisis. Inherent strength in Indian economy and large NRI inflows save the day but with a clear trend that should the current policy paralysis continue the FII, FDI will drop and continue to threaten India with a funding crisis – not to mention an S&P downgrade if GDP growth remains low and fiscal deficit is set right. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 52 Nikology Private Limited (Hereinafter, ‘Company’) Financial year (FY): April’11 – March’12 Company has been selling industrial goods to diverse set of SMEs on credit. During the year, company has been able to earn a Net profit of $12mn without launching any new products or undergoing any restructuring drive. More surprisingly, the company has still not been able to meet its loan and interest payment obligations to banks for month of April’12. Why are they facing liquidity problems despite having profits? During the year, Inventory turnover ratio (ITR)* was 12. Turnover was $1200mn. Average closing inventory during last fortnight of March was $25mn. For the rest of the year inventory was fairly stable. During the year, Debtor turnover ratio (DTR)* was 6. Debtors outstanding on the last day of March were $300mn. Company has generally been able to recover its dues on time. During the release of unaudited financial accounts for Q1 of FY12-13, CEO of the company attributed the dismal topline and net profit margin to the tough external environment. He reiterated that the spectacular margins achieved in FY11-12, and particularly in Q4 FY11-12, would be difficult to maintain. Q4 FY11-12 had significantly better Net profit margin but almost similar Gross profit margin as compared to the rest of FY11-12. *ITR & DTR are calculated basing on the average of closing inventory/balance of each day during year. For simplicity sake, 1 year = 360 days This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 53 Case Solution Using data in first bullet, average closing inventory for second fortnight of March should have been around $100mn, but the same is significantly lower at $25mn. Using first & second bullet, the closing debtor of $300mn should have been around $200mn. This shows the company has billed a significantly part of goods (i.e. around $100mn) during the last fortnight of March, which may be reversed in the following year. Using data in Third bullet, stable GP margin and significantly better NP margin in Q4 11-12 shows that there has been deferment of certain administrative and selling expenses. Both these suspicions are confirmed in the third bullet, where the CEO is referring to dismal topline and NP margin in the Q1 of next FY and how it will be difficult to maintain the similar performance. Using this device of over-reporting the sales and under-reporting expenses during Q4 of FY 11-12, the company has been able to jack up the operating performance. But none of these would improve the operating cash flow of the company. Hence the company has not been able to meet its external loan obligation despite the net profit in its books. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 54 Fraud or not! Mr. A, the accountant of Nikology private limited, is the only employee in the accounting department of the company. He has been so trustworthy that management entrusted him with the work of collection from debtors and payment to creditors as well. Obviously, he continues to discharge his responsibility of maintain the books of accounts. At the time of audit, auditor calls for account confirmation from all the three debtors of the company, and discovers some discrepancy. He suspects some fraud in the cash management of the company. Comment if any fraud can be established from the given data. Exhibit 1: Ledger account of all the three debtors and the account confirmation from them are as given below: In books of Nikology Private limited Date 01-Apr-12 10-Apr-12 Date 01-Apr-12 10-Apr-12 15-Apr-12 Date 01-Apr-12 15-Apr-12 30-Apr-12 Ledger account of X ltd Particular Debit Opening balance 10,000 Cash received Ledger account of Y ltd Particular Debit Opening balance 17,000 Cash received Cash received Ledger account of Z ltd Particular Debit Opening balance 25,000 Cash received Closing balance In books of Respective parties Credit 10,000 Credit 7,000 10,000 Credit 15,000 10,000 Ledger account of Nikology Pvt ltd (in books of X ltd) Date Particular Debit Credit 01-Apr-12 Opening balance 10,000 07-Apr-12 Cash paid 10,000 Ledger account of Nikology Pvt ltd (in books of Y ltd) Date Particular Debit Credit 01-Apr-12 Opening balance 17,000 10-Apr-12 Cash paid 17,000 Ledger account of Nikology Pvt ltd (in books of Z ltd) Date Particular Debit Credit 01-Apr-12 Opening balance 25,000 15-Apr-12 Cash paid 25,000 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 55 Case Solution Auditor has been correct in suspecting fraud, it seems the practice of ‘Teeming and lading’ is going on in the company. In this type of fraud, the fraudster pockets cash received from the first party, and subsequently when the cash is received from some other party the same is allocated to the first party. When the cash is received from third party the same is allocated to second party. In this way the practice is continued. At all the times the debtors are overstated and cash is understated. In the given example, cash of Rs 10,000 was received from X ltd on 07/04/2012 that has been pocketed by the fraudster. Subsequently when the cash was received from Y ltd on 10/04/2012, an amount of Rs 10,000 from the same was allocated to X ltd. Continuing the same practice, out of the cash received from the Z ltd on 15/04/2012 an amount of Rs 10,000/- was allocated to Y ltd. At the end of month a balance of Rs 10,000 is appearing against Z ltd, which is non-existent. At the same time the fraudster has pocketed cash of Rs 10,000. In the given case, Mr. A appears to be the fraudester as the internal control of the company is loose, and he is responsible for both receiving the cash and accounting the same in books of accounts. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 56 1 E-Commerce Industry Pg 58 -Somwrita 2 Guessestimate: Railway track estimate Pg 61 - Rohit Garhwal 3 Growth Strategy: Education website problem Pg 63 - Rohit Garhwal 4 Sustainable Growth Strategy: Healthcare industry in India Pg 66 -Amit Kumar Kushawaha 5 Non Profitable Personal Care Product Pg 69 - K Dinesh 6 Secondary Steel Manufacturer -Kuldeep Singh Pg 72 This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 57 E-Commerce Industry Our client is a renowned e-commerce company in India. The CEO is worried about its profitability and has approached you to solve the problem. As a consultant you are expected to explore the possible issues and suggest areas of improvement to make significant profits. Case Discussion Sir, before proceeding to the analysis, I would like to understand your question better. Sure. Go ahead. You mentioned about both profitability and profit. As per my understanding these two terms are different. Profit is the absolute monetary difference between sales revenue and operating costs whereas profitability measures how well a company is making use of its capital by investing in resources that generates profit. Yeah you are absolutely right. I want you to look at the profit side only. Sir, before I analyze the reasons, I would like to understand more about our client and the e-commerce sector as a whole. Our client initially focused on selling books online but later expanded to electronic goods and a variety of other products like stationeries, baby care, health care, toys etc. It maintains warehouse in different parts of the country. They offer multiple payment methods like credit card, debit card, net banking and Cash on Delivery . But the company registered losses of 1.37 lakh in 2008-09, which by next year rose to 91.27 lakh. What about the overall e-commerce industry? Is it booming or shrinking? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 58 E-commerce sector was touted to be the next big game changer after IT industry. But despite the hype surrounding the sector, very few online retailers have been able to achieve profitability. Unfortunately, our client is not among those few profitable firms. So there is tough competition with other market players. I feel there must be some problem with the business model of our client. So let us look into the probable factors. As you had mentioned that our client is dealing in a variety of products, so are there any specific product where the loss is significant? Or is it an issue for all the products? It is a problem with all the products. Coming to the business model, can you throw some light on different aspects like average cost of customer acquisition, customer incentives, supplier network, warehousing etc. The cost of acquiring a new customer is between Rs 900 to 1,200. The main cost is in delivery, customer acquisition, search engine optimization and warehouse maintenance. The portal sells a book at an average of Rs 400. So the magnitude of losses is apparent. To top it off, giving discounts only add to their woes. Using discounting to lure the customers is proving costly for online retailer players. Customers can avail bargain buys with discounts ranging from 10% to 30% depending on the product category. For instance, books draw the maximum discount of 30%. Hence there is not much profit in selling books. Our client doesn’t sell apparel and footwear but industry records show that their discount level is around 15%. So we see that giving discounts is not a sustainable model. Is there a price bar above which they offer more discount or free shipping? Yeah. Currently they offer free shipping on any purchase beyond Rs 200. But they don’t offer discount on the total amount like many other e-commerce companies. I feel Rs 200 is too less a limit to offer free shipping. Also offering a discount on the total cart value can incentivize customers to increase their basket size in order to avail such discounts. May be. Can you notice some difference in the profit for high end products like TV, AC, home theatres etc. I am asking because I feel beyond a certain price range; the touch-and-feel factor plays a decisive role in buyer’s mind. I don’t think many people buy a television set without closely inspecting it. Correct. And this might be one of the reasons why sales volume is not so significant in these products. You had mentioned at the beginning that company has warehouses in different parts of the country. Despite suffering huge losses, what can be the reason to continue to build more warehouses? You should tell me that. Can you think of some reason behind this? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 59 I am not sure but may be because they do not have strong supplier network and also they would like to cut down on the delivery time and cost of delivery by reaching out to different places in the country. In India the customer is ready to wait for 3-4 days on an average for the delivery of his order. Yeah. This might seem like a risky move but actually local players think otherwise. According to them profitability will come only after you achieve a certain scale. To achieve profitability and to reach a certain scale, we need to invest money in warehouses and brand marketing. But again it depends on you as to which model you will follow. For instance, few companies have a model similar to our client, while others follow a structure like that of e-Bay having a better network with suppliers than investing more in warehousing. Okay. Sir, do you think there is any issue with the payment mode? I mean if some method of payment is more profitable than others to the company? Good question. Online purchases are often done through credit card though cash on delivery is the most popular model. By the time the online players receive cash from their sale, there is already a lag of 10-15 days. Sir, we know that payment through credit card is a cash-rich model whereas cash on delivery results to a cash deficit model. Hence the mode of payment can be an issue for our client. We see that a number of players vying for the same space leading to price war. Other than that the higher logistics cost and models like cash on delivery, poor quality, return of goods and poor addressing of customer grievances have a direct impact on margins, which are in any case low. I guess we have pretty much addressed all the possible issues by now. Can you please summarize and give your recommendations? I would recommend changing their business model. They should: 1. Raise their price bar from Rs 200 to Rs 400 to avail free shipping. 2. Offer discounts on a total purchase of Rs 1200 or more to incentivize the customers to buy more at a time and increase the revenue per transaction. 3. Keep fewer inventories of high end products to save some cost since those are not likely to be sold at a higher rate since the touch-and-feel factor plays a decisive role in the Indian buyer’s mind. So customers will not prefer to buy such products from our client. 4. Consider entering the apparel and footwear segments since the profit margin in these segments is higher. 5. Offer extra buyer points to those paying with credit cards to encourage use of the cash rich model. Good. I think you have covered all the points. Thank you for your time. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 60 Guessestimate Railway track estimate Estimate the length of railway track in your home country. (Home country in this case is India) Case Discussion Would you like me to go for passenger tracks only or include the commercial (freight) rail lines as well? Don’t bother about the freight lines. Concentrate only on the passenger lines. In passenger track, India has three types of railways – broad gauge, meter gauge and narrow gauge. Should I proceed by considering all three of them? Since majority of people travel by broad gauge, estimate the length for it only. I would like to proceed by using a bit of geometry approach. I believe I can fairly approximate India as a rhombus with two equal diagonals of length 2000 Km each. Though the India’s maximum territorial distance along east to west and along North to South would be somewhere 2500 km or so, parts of Himalayas in North and parts in eastern India (hilly area) and parts in western (desert) are not available. Hence would 2000kms be a good approximate? Fair enough, that’s a well justified assumption. Also in central India some portion is not available due to dense forests and mountain ranges. By the way your geometric approach seems interesting. Go on. There is one issue of presence of multiple tracks at some places, especially on the major lines such as Delhi – Jaipur. Just consider uniformity of single track line between any two stations (major or minor) and proceed. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 61 Thank you. That’s helpful. In my experience of rail travel, normally superfast trains travelat an average speed of 60-65 km/hr. This is based on the fact that 300 kms between Jaipur and Delhi are covered in approximately 5 hours. Also, every two hours or so a major station / stoppage comes. This average speed considers the waiting time also, right? Does waiting time impacts your calculations? At this stage I am not able to think of any reason why waiting time should present a problem. So, basically what I can get from my estimates is two major stations are approximately 120-130 km apart. Now I divide the diagonals of rhombus representing India (figure below) into patches of 120 km. That would give me roughly 2000/120 = 17 stations or say 8 on each half diagonal. I would now consider a very simple network of rail tracks to cover the geography. Let’s join the corresponding cities on the half diagonals OA and OB. Though this may not be a very efficient network in terms of cost, still it can generate a simple path between any two major cities in the triangle OAB. I see where you are getting to. Nice and simple approach. Keep it on. So, the railnetwork would be the sum of the length of these 8 lines you have drawn in the triangle OAB. Yes Sir, exactly that. A multiple of these lines can be used to estimate the entire rail network in India. Can you think of some other method to proceed with rail line estimation? Well something else I can think of is to go by estimating number of important cities in a benchmark state and using that calculate the rail network by using some aspects of permutation and combinations. Then multiple this numbers by 20, as many states do not have such dense rail network (especially in north and north east). That may be a fine way to approach. Great work. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 62 Growth Strategy Education website problem Your client is in the business of professional education in India for some time. It targets the school, college and young professionals. Now they have initiated web based e-learning in India. It has been over 10 months of existence and still hasn’t seen any significant ramp up or crowd on the website as expected earlier. Identify the major issues and recommend them a growth strategy to achieve the desired level of revenues from the new channel. Case Discussion I would like to clarify a few things before starting my analysis. Yes please, go ahead. What kind of professional tutoring they provide currently? I guess it must be different across the three segments. Yes. For school students they focus on soft skill developments, coaching for their routine courses and a few other things such as simple robotics, web designing. Also, they provide coaching for a few entrance exams. The focus in on spoken English, communication and presentation skills and job interview preparations for college students. They also provide personalised career guidance. On technical side, they provide courses on robotics, programming languages, animation, web designing. Services to young professionals are into business communication, confidence building, and group activity development. So, I understand they are a lot diversified in their offerings. What are the geographical areas they operate in? Are they well diversified in that respect also? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 63 Tier-I cities being too much crowded by number of such players, they have centres in around 10 Tier-II cities and a couple of Tier-III cities. Also, they have done good tie-ups with a range of schools and colleges in these areas where they offer customized products. How has been their profitability before in this business? Was revenue growth good? In past 4 years they have registered on an average 50% annual growth in revenues. They have maintained a 20-25% of profit margins. Are all the centres are owned by the firm or they have franchised some of these? Well four out of 12 centres are owned, rest all are in some way franchised. Now, I would like you to focus on the growth issue their e-platform is facing. One of the issues I see here is a conflict of interest between the various revenue/delivery channels. The franchisee won’t be interested in promoting the echannel because they do not get any share from it. In fact for them this looks to be a cannibalizing effect. Now locally, these franchisees are the ones who understand the customers and are in direct contact with them. They need to be brought into this loop in order to promote web-platform. That’s a well thought point. Good going. So how can we leverage our franchise? Before going into that, I would like to clarify one thing. What all is being offered on the online platform? Well there are numerous videos on the topics covered above. Lot of tests have been developed which a student can take at their own pace. And to supplement these, there is range of learning documents. The web offering is such that it allows a very high degree of customization for the user. In fact there are very few bundled or packaged courses and a user can make his/her own progress by paying on per video basis (per view basis). That sounds like a good platform. What can be a good idea is make the course offering mix. What I mean to say that is necessarily include some portion of elearning into the regular classroom/ contact programs. This will make the gradual entry of the online portal into the learning style of users. At first, starting can be done by evaluative tests. Every user will be provided a homepage from where they can access these tests. This will also reduce the burden of centres in terms of managing the logistics of conducting tests etc. Also, the benefit to user will be they can do it at their own convenience. Good idea, but why the franchisee will support it? I was coming to that now. Run this business as the way offline mode was running. Define e-zones which correspond to geographical areas. A candidate registering online will have to provide a choice for the offline centre he want to be associated with. The revenue coming from the webbased mode would be shared with that centre as was done in offline mode. Also, since a user can even pay for a single video or test, this can actually help the centre owners to attract customers by This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 64 providing a sample lesson. Providing such a sample lesson would be difficult in offline mode. Candidates can also judge better what to expect. Now with the addition of web portal the franchisee also tend to benefit in terms of customer reach and acquisition. That was a brilliant idea. Do you see any other problem in web-based platform of the client? Well I would like to ask a few questions before going to that. First, how do the target segment access internet in these cities? Do majority have a laptop and broadband access at their disposal? Being Tier II and Tier –III cities we cannot expect the infrastructure and broadband penetration to be as good as a Tier-I or metro city. Roughly, only 15-20% of the target segment access via broadband or internet connection at home. Ok, but the majority of the remaining do have access to mobile devices? Yes, that can be safely assumed. Does the client have a mobility application for their web learning portal? No, they haven’t considered it yet. Well then this can be a good idea to venture into. A mobile based app will enhance the usability and value of their e-learning portal as more people will be able to access it. And this also fits in with the current trend of people accessing internet via hand-held devices. Hence, I believe such a thing can generate more user traffic to their website. Yes, that’s a reasonable solution. Is there anything else you would like me to look into? No, that would be. Have a great day. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 65 Sustainable Growth Strategy Healthcare Industry in India The global pharmaceutical companies in India are being threatened by companies producing generic drugs, high pricing pressure and regulatory environment. Your client is a major pharmaceutical manufacturer with multibillion dollar sales globally. You have been hired to suggest a sustainable growth strategy for the future. Case discussion This Company is a pharmaceutical manufacturing company and due to the changing scenario is looking for new avenues for growth. That’s right. Can you tell me more about the macroeconomic scenario in pharmaceutical and related industries in healthcare? Why has the pricing and regulation issue become a threat? India is witnessing a surge driven by structural demand drivers say rising household incomes, increasing prevalence of lifestyle related diseases, and government focus on improving healthcare infrastructure. However the arena also has lot of patents expiring soon and thus opens opportunities for local generic players. Markets are moving away from branded generics to commoditized un-branded generics. It’s witnessing price erosion while the government is focussed on making healthcare more accessible to its people. Ok. The way I see it is the demand portfolio from healthcare is changing, and more so with the socio-economic changes that India is witnessing. Also the phenomenon signals that for a long term growth increased penetration in smaller towns and rural areas will be a strong driver. Firms will have to come up with This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 66 delivery ways to make healthcare accessible to more people. Since medicine as a product is already flooded with competition the company needs to find ways to not only keep growing in coming years. Hmm...That’s a fair understanding of the impending situation, so what do you think the company should do. I think the problem has three different aspects to it- one is to grow, second to be sustainable and third to integrate these two aspects in a way to suit the current scenario. On the growth front I see two ways to address the problem. There can be ways to grow the market share or the market itself. In this case the company should focus on growing the market itself through increased awareness among patients, doctors and community. Please illustrate your point and its impact on the market size? For example if the company involves itself into partnering with community for a life style disease like diabetes in societies at a tier 2 city with population of 2 million. If it engages 10 societies and doctors in a area to get some 500 possible patients for health check up of which 10% say 50 do show positive results and form part of the patient pool of the company. Such activities at 30 tier 2 cities with assumption of 5 such camps leads to a figure of 5*30*50= 7500 patients and for a chronic disease like diabetes involving annual expenses to tune of 12000 a revenue stream of 12000*7500 = Rs. 9 million. Further the complete act creates value for patient, doctor and community. But to succeed the company needs to get involved in provisioning the components of the complete value chain - education, medical diagnostics instruments, treatment therapies and post treatment care. This brings on to the new avenues for the company to be present to enable the complete ecosystem of healthcare. Very interesting. And how do you see the sustainability and the integration issue? The model reaches both the upstream and downstream aspects of provisioning healthcare wherein medicines currently manufactured by the firm becomes one of the components. It unlocks the value of healthcare and enhances accessibility in tune with goals of government. Also the use of IT to enable services and enhance accessibility can be a field to look out for changing the dynamics of healthcare delivery in resource constrained Indian setup. Fine. So how do you suggest the company go forward executing this model? In my opinion, company should setup an internal corporate venture capital fund. They should begin investing in early stage or growth companies in various healthcare related segments and leverage their industry knowledge. They should have a portfolio of funds into each identified segment and integrate them to develop the complete model. How do you suggest the company identifies its target investments? This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 67 The Company should look at the targets’ existing market size, historical growth, future share, share of top players, the stage of growth it is in, its product fit, team and the financials. Good. I think you have addressed the issues in a holistic manner. That will be all. Thank You. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 68 Non Profitable Personal Care Product A leading FMCG company is facing losses in its Shampoo business under the personal care division. It has historically been the market leader in the segment. Diagnose the reason. Case Discussion Before proceeding into the case analysis, can you brief me on some facts that would help me understand the current scenario? I would like to know where the company operates, the growth trend in the segment and market share of the product. The market under consideration is India, though the company has presence in several countries. The brand in question has a market share of around 20% (19.1% to be precise) in the shampoo market. The market has been growing at a rapid rate of 15% in value terms YOY. Additionally, the market is very competitive with several players vying for market share. Fine. Are competitive pressures forcing the company to set prices of the shampoo low? Well, that is true with most FMCG product categories. However, in this particular instance that is not the reason enough for the company to continue operating in losses. Let me give you some more information. The shampoo market is primarily divided into two segments – the sachet and the bottle. While the company is making profits on the bottles, it is facing losses in the sachet segment. Thanks. Is it a safe assumption to make that consumers of sachets are primarily SEC B and SEC C? And also that consumption would be higher in the semi – urban and rural areas? You are right in the fact that consumption levels are higher in the rural areas as compared with urban locales. However, sachet consumption is not limited to the lower socio economic classes as people from SEC A also consume sachets on as required basis. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 69 A fall in profitability could either be because of falling revenue or escalating costs. You had mentioned that the shampoo market is growing at 15% YOY in terms of value. Is this true for the Sachet market as well? Yes, the revenues are in fact growing at a faster rate for the sachet market. You can safely assume that there is no concern due to decrease in revenues. Please explore more from the cost perspective. Ok, I gather that the costs have been rising. Before I diagnose the reason for the company not being able to address this, let me understand the problem better. I will check for industry wide phenomenon before I explore problems from within the company. Have the prices of raw materials been increasing? Or is it because of transportation costs going up? Cost of both the raw materials and transportation have been growing at a very rapid rate in the last few years. This has placed serious pressure on the shampoo industry as a whole. So, the company has not been able to transfer the hike in prices to consumers. Has it explored the possibility of reducing the quantity of shampoo that is packed into a sachet? Quantity of shampoo that is contained in a sachet has been brought down from 8 ml to 5 ml. Any further reduction in quantity will result in one sachet not being enough for a single use. Interesting. Is the reason for not being able to raise the price the competitive pressure imposed on the company by other shampoo manufacturers? Because, I see that the sachet shampoo market is growing at a fair rate and hence customers do value the product. What is the price of a sachet sold by the company? Has the company made any commitment for selling the sachet at the particular price? See, the customers make the purchase in this segment having a brand name in their mind. So, it is very difficult for a customer to shift ship to another competitor. Additionally, other shampoo manufacturers are facing the same cost side pressures as us. The company sells sachets of 5 ml at 1 rupee/sachet, a conscious managerial decision and not due to any prior promise for price. Is the customer not willing to pay beyond 1 rupee for the brand’s sachet? You had mentioned that most customers have brand names in their mind when they purchase. Is it the case that the price point of 1 Rupee is also fixed in the mind of the consumer and the company is finding this price stickiness very difficult to break? That is exactly right. The company had introduced sachets with the idea of increasing penetration. But now, majority of the sales happens through the sachets. With the extent of cost escalation, the company has found it impossible to be profitable in the sachet business without hiking the price. Now that you have found the reason, what would be your recommendations? Ideally, the company should reposition the product such that it highlights additional features to what has been currently projected. Customers must believe that there is some value addition to the product that they were buying for 1 rupee when they make the purchase. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 70 Do you think that would be accepted by the consumers? I mean, would such positioning alone be enough to make them pay a higher price? Definitely not. The company needs to identify the value that the customer places on the 1 Rupee price point and add features & positioning attributes that he perceives would add more value to him than the current price point. In that way, the company can ensure that it maintains a majority of the customer base. Thanks. That would be all. I had a very interesting discussion with you. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 71 Secondary Steel Manufacturer Your client is a medium sized secondary steel manufacturer producing steel gratings and conveyors based in India. They have recently started a new product line for manufacturing structural steel products. The structural steel products have been very successful in countries like US and Japan, but the market is India is still nascent. This product line is not doing very well presently and MD of the company wants you to analyse the situation and charter the path ahead. Case Discussion I would like to clarify a few aspects regarding the case before I begin analysing it. Sure, go ahead. Firstly I would like to know more about the product. You mentioned that structural steel products are quite successful in US and Japan. In which sectors are they used in there and, is the usage in India in the same sectors? Well, in US and Japan structural steel products find application in industrial sector like construction of power plants, refineries, chemical plants and commercial sector like construction of bridges and buildings. In India, the usage is restricted to the industrial sector only. Why is the usage restricted to industrial sector in India? Also, are there any other players operating in the industry in India? Structural steel products provide a significant reduction in construction time required for the projects but at the same time cost more than RCC, the commonly used material for commercial sector in India. Hence, major demand in the industry is from the industrial sector only. Further, the production of structural products is usually subcontracted by large players to a number of smaller players. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 72 Going forward, I would like to know what problem the company is facing exactly. There could be multiple issues related to the product not doing well. The company might be facing declining market share, reduction in revenues/top line growth, reduction in profits/ bottom line growth, or issues with profitability of the product. Good that you asked this question. The major issue with the company as of now is its top line as the demand of the structural products of the company has been very low. Further, what is the industry-wide outlook for demand of this product? I want to know whether the problem is specific to the company or there is an industry-wide slack in demand. You can assume that the problem is specific to the company only. Since the problem is specific to the company only and the competitors are doing fine, it means that there could be a problem with the quality of the product or the price. Information regarding the same can be obtained from the customers of the company. The company takes sufficient quality control measures to ensure that the product quality is as per customer requirements. Since quality of the product is not an issue, price seems to be the major concern. However, I would like to know more about the purchase process to ensure that I am not missing out on any other important consideration that customer might have while making the purchase decision. The purchase decision is based on negotiable tender method wherein lowest cost supplier meeting certain conditions provided by customers are selected. The conditions are based on a set of quality control instructions and a fixed delivery schedule. So we have three key factors driving the purchase decision: price, quality and delivery time. The inclusion of delivery time as a key factor driving purchase decision makes sense because the inherent advantage that the product provides is reduction in construction time. Late delivery of the product can offset this advantage. Good observation, go on. Since the quality is assured, the factors contributing to low demand levels can be price and delivery time. This can be verified benchmarking company prices with This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 73 that of competitors, finding out the bid to win ratio for the company and benchmarking the mean tardiness of the projects that the company finally wins. Suppose that you observed that company has higher prices than competitors, lower bid to win ratio and higher mean tardiness as compared with the industry average. In that case, both pricing and delivery time seem to be the problem. To find the core issue, information regarding the pricing process and production planning process followed by the company would be required. I would firstly like to concentrate on the pricing issues. Ok, you are provided that the company follows a cost plus pricing method with 5% margin which is the industry standard. In that case, the problem seems to be with the costing of the products. I would like to know the cost breakup or if any component contributes significantly towards the cost of the product. The exact cost breakup is not available but it is known that raw material cost which contribute to 70% of the cost of production. In that case, I would more about the what are the raw materials used and what is the industry outlook for these raw materials, especially whether there have been major fluctuations in the price of the raw materials. Well, the major raw material used is rolled steel beams. There is only a single supplier of the beams in India who manufactures them on order. Price fluctuations are common in case of short term contracts. Further, the demand for rolled steel beams has always outstripped the supply. Well, then it might be the case that, since the client has just started this product line, it has entered in a short term contract with the raw material supplier which might be causing price fluctuations. As the demand is outstripping the supply, the price of raw material must be rising, leading to higher costs which cannot be passed to the customers due to lowest cost being the basis of awarding tenders. Good, in fact the client had actually entered into a short term contract with the raw material supplier. Can you relate this with higher than average delivery time? Well, I don’t know the exact production planning of the company but it has to start with the purchase of raw material. Since there is a single supplier who manufactures the beams on order, there might be issues regarding late delivery from the supplier to the company in case of short term contracts. This in turn might cause late delivery on the part of the company. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 74 Great job, this indeed was the case. What recommendation would you provide to the client going forward? The client should begin by entering into long term supply contracts with the raw material supplier for future production to lower down the cost and cut back on price fluctuation. They can also maintain sufficient raw material inventory to avoid delays in production though this will increase the working capital requirement. The increase in working capital requirement could be partly offset by negotiating for a longer credit period for long term contract with the raw material supplier. That seems fair. I think you have identified the main issues in the case and provided crisp recommendations. We’ll close here. Thank you. This document is meant for private circulation in IIM Ahmedabad, IIM Bangalore, IIM Calcutta and the Indian School of Busi ness only. 75