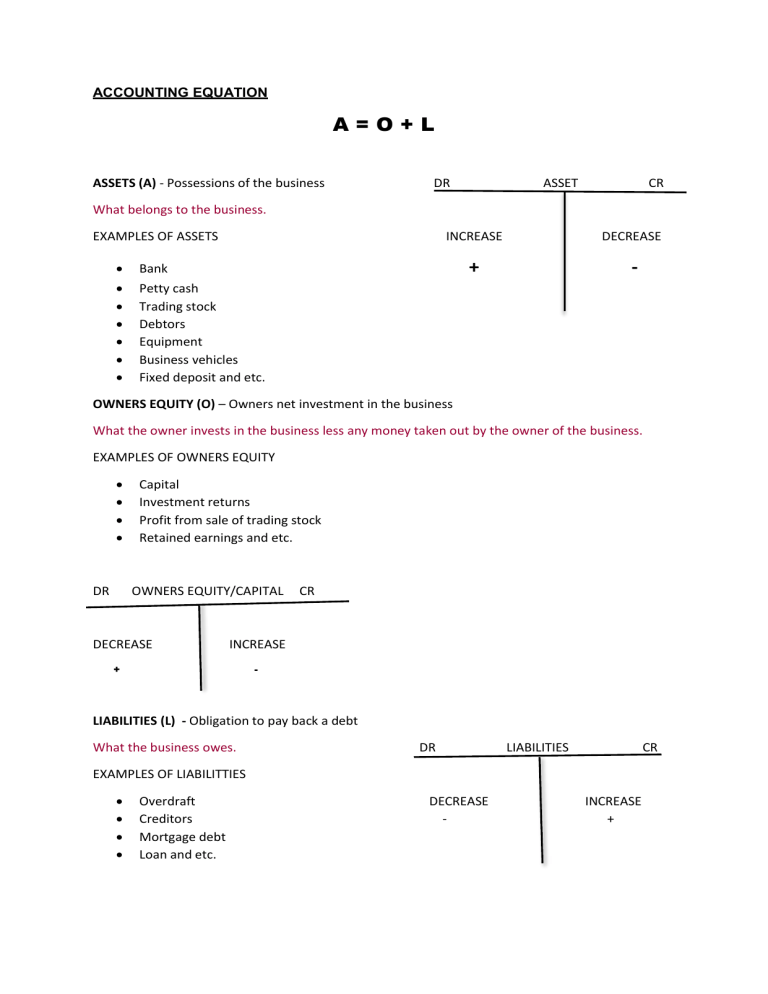

ACCOUNTING EQUATION A=O+L ASSETS (A) - Possessions of the business DR ASSET CR What belongs to the business. EXAMPLES OF ASSETS Bank Petty cash Trading stock Debtors Equipment Business vehicles Fixed deposit and etc. INCREASE DECREASE + - OWNERS EQUITY (O) – Owners net investment in the business What the owner invests in the business less any money taken out by the owner of the business. EXAMPLES OF OWNERS EQUITY DR Capital Investment returns Profit from sale of trading stock Retained earnings and etc. OWNERS EQUITY/CAPITAL DECREASE CR INCREASE + - LIABILITIES (L) - Obligation to pay back a debt What the business owes. DR LIABILITIES CR EXAMPLES OF LIABILITTIES Overdraft Creditors Mortgage debt Loan and etc. DECREASE - INCREASE + EXPENSES – cost incurred for acquiring something. Affects owners equity. What the business spends on. DR EXPENSES CR EXAMPLES Rent Salaries Telephone Advertising Cost of goods sold Bank charges and etc. INCREASE DECREASE + - INCOME- money generated by the business. Affects owners equity. EXAMPLES Revenue Dividend Interest income Operating Income and etc. DR INCOME DECREASE CR INCREASE - + DRAWINGS- money taken from the business for personal use. Affects owners equity. e.g The owner withdrew money from current bank account for his son DR DRAWINGS INCREASE CR DECREASE + - DOUBLE ENTRY PRINCIPLE For every debit there must be a corresponding credit The equation must balance