Cost Accounting and Control - Manufacturing Overhead - Departmentalization

advertisement

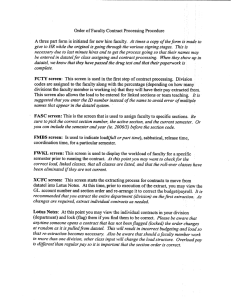

Name: Section: Date: Score: Mid Term Assignment 2 on Cost Accounting and Control – Manufacturing Overhead – Departmentalization MULTIPLE CHOICE: Choose the best answer by indicating the appropriate letter. Indicate your answers by highlighting the letter or listing it on a separate answer sheet. ( 20 points ) 1. A department that would be classified as a producing department is: a. Personnel b. Utilities c. Finishing d. Shipping 2. A department that would be classified as a service department is: a. Refining b. Receiving c. Mixing d. Assembly 3. In determining the right method for allocating depreciation of factory building to departments, the best recommendation is to: a. Use the cost of equipment in the department as a basis for allocation. b. Allocate on the basis of square footage used in a given department. c. Charge the amounts to General Plant. d. Use algebraic technique. 4. The method for allocating service department costs that requires the least clerical work: a. Use of square footage in each department b. Step method c. Allocation to other service departments only d. Direct method 5. In which of the following overhead allocation methods may no other service departmental costs be charged back to a particular service department after the first service department’s cost has been allocated? a. The reciprocal method and the direct method b. The step method and the reciprocal method c. The direct method and the step method d. The step and algebraic method 6. The method of overhead allocation that usually starts with the service department rendering the greatest amount of service to the greatest number of other service departments and progresses in descending order to the service department rendering services to the least number of other service departments is the: 7. 8. 9. 10. a. Step method b. Direct method c. Step and direct methods d. Reciprocal methods Several methods are used to allocate service department costs to the production departments. The method that recognizes allocation of service department cost to another service department but does not allow for two way allocation of costs between service department is the: a. Direct method b. Linear method c. Reciprocal method d. Step method If two service departments service the same number of other service departments when using the step method, which service department’s costs are allocated first? a. The service department with the highest cost. b. The service department with the most employees. c. The service department most crucial to the operation of the production department. d. None of the above, the reciprocal method must be used. A company has two production and two service departments that are housed in the same building. The most reasonable basis for allocating building cost ( rent, insurance, maintenance, security ) to the production and service departments is: a. Direct labor hours b. Number of employees c. Square feet of floor occupied d. Direct materials used Which of the following describes a part of the step method of allocation? a. All services between intermediate cost centers are simultaneously allocated to final cost centers. b. It ignores services between intermediate cost centers. c. Linear algebra is required for the allocation. d. Once an allocation is made from one service department, no further allocation is made to this department.