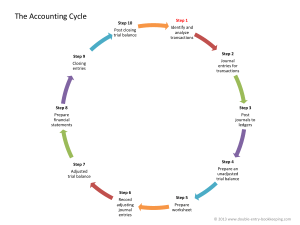

In a Nutshell 1. Reversing entries can be helpful in simplifying the recording of journal entries especially if there had been adjustments at year-end. Although reversing is optional, it is highly useful. 2. A reversing entry is very simple. It is one that you make at the end of the period, typically the end of the year. The entry could be any type of accrual, but the objective is that on the following day after, the exact same entry is made but in reverse. So, for example, if you are crediting a liability and debiting and expense, on the following day you would debit and credit the expense. The idea here is that the expense has already been recorded in the current period. So, by reversing it you are avoiding a double entry in that period. 3. Reversing entries are OPTIONAL accounting procedures which may sometimes prove useful in simplifying record keeping. A reversing entry is a journal entry to "undo" an adjusting entry. Reversing entries are typically the journal entries that are made in the beginning of the current accounting year to cancel the adjusting entries made in the previous year. 4. Because it's so simple to forget to manually reverse an entry in the next period, it's common practice to mark the initial journal entry as a reversing entry in the accounting software when it's mad. 5. A common reversing entry is to reverse a mistake. Reverse it in the same period that it was entered to correct the mistake and zero the effect. 6. Deferral is similar to accrual in basic principle, deferring an expense or revenue to the period in which it applies usually involves cash on the side of the transaction. One isn’t going to reverse the cash side of an entry unless it actually taking or giving back money also. 7. Reversing entries are entries which requires to reverse in next period or at the end of the period. Through example will helpful for accountant. To avoid this double booking, accountant must reverse accruals made in last period or before the end of the period.