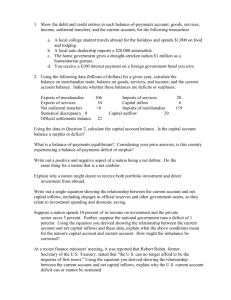

Chapter 1 Payments among Nations Balance of Payment Learning Objectives • Explain what is meant by a country’s “balance-of-payments” statement and how it is constructed. • Analyze the difference between alternative accounting balances within the balance of payments. • Describe the recent balance-of-payments experience of some countries. • Define the international investment position of a country. Key words The balance of payments The financial assets Double-entry bookkeeping Current account balance Capital account balance Trade deficit Official international reserve assets Statistical discrepancy international investment position Understanding ➢ Trade deficits harmful or may not?? ➢ What Does a Current Account Deficit (Surplus) Mean? ➢ Understanding Capital and Financial Accounts in the Balance of Payments ➢ In May 2021, The United States was the world's biggest debtor nation, posting a trade deficit of more than $71.2 billion © 2019 Cengage. All rights reserved. 4 1-1 The balance of payments 国际收支及国际收支平衡表 1-1 The balance of payments --- Definition The balance of payments(BOP) is the set of accounts recording all flows of value between a nation’s residents and the residents of the rest of the world during a period of time. The balance of payments is a statistical statement that systematically summarizes, for a specific time period, the economic transactions of an economy with the rest of the world. • IMF 1993 edition of the Balance of Payments Manual(the Manual5, BP5) • The balance of payments and international investment position manual (the Manual6,BPM6) (2010-3) The Balance of Payments The Balance of Payments is a record of the economic transactions between the residents of one country and the rest of the world during a period of time • flow of value, during a period of time ,not stock of value,not at one point of time. Records are kept annually and quarterly. • An international transaction is an exchange of goods, services, or assets between residents of one country and those of another • between resident and non-residents .Residents include businesses, individuals, and government agencies that make the country their legal domicile Accounting principles Double-entry bookkeeping/accounting • An international transaction involves two parties, and each transaction enters the accounts twice: once as a credit (+) and once as a debit (-). • A credit (+) is a flow for which the country is paid; • A debit (--) is a flow for which the country must pay. Credit transaction (+) Receipt of a payment from foreigners Debit transaction (-) Payment to foreigners Double-entry bookkeeping Credit transaction (+) Debit transaction (-) Receipt of a payment from foreigners Payment to foreigners • U.S. credit transaction (+) • Merchandise exports • Transportation and travel receipts • Income received from investments abroad • Gifts received from foreign residents • Aid received from foreign governments • Increase in short-term private assets abroad • Investments in the United States by overseas residents U.S. debit transaction (-) •Merchandise imports •Transportation and travel expenditures •Income paid on the investments of foreigners •Gifts to foreign residents •Aid given by the U.S. government •Overseas investment by U.S. residents •Decrease in short-term private assets in the U.S. • Total balance-of-payments account • Must always be in balance • Surplus • Balance on a subaccount (subaccounts) is positive • Deficit • Balance on a subaccount (subaccounts) is negative 10 Balance-of-Payments Structure • A. Current Account 1. Goods 2. Service 3. Income 4.Current Transfers • B. Capital and Financial Account 1. Capital Account 2. Financial Account Direct Investment Portfolio Investment Other Investment • Reserve Assets • . C. Errors and Omissions Account Balance-of-Payments Structure • Current account of the balance of payments (CA) • Monetary value of international flows:,transactions in • goods, import& export,---Merchandise trade • services, invisible trade • income flows, Agricultural products, machinery, autos, petroleum, electronics, textiles • unilateral transfers transportation travel or tourism services, insurance, education, telecommunications ,financial, technical and other business and professional services, trade mark, royalties , 12 Balance-of-Payments Structure • Current account of the balance of payments (CA) --Monetary value of international flows:,transactions in • goods, import& export,---Merchandise trade • services, invisible trade • income flows(BP5)(Primary Income ,BP6) Employee Compensation: Investment Income: • unilateral transfers/Current Transfer(BP5) -- (Secondary Income, BP6) government foreign aid, individual, non-government: international migrants’ remittance Secondary Income The secondary income account reports current transfers between residents and nonresidents. Various types of current transfers are recorded in this account to show their role in the process of income distribution between the economies. 13 unilateral transfers—US example • Transfers under US military grant programs • US Government grants, excluding military grants of goods and services • US Government pensions and other transfers: (1) payments of social security, railroad retirement, and other social insurance benefits to eligible persons residing abroad, (2) payments under retirement and compensation programs for former US Government civilian employees, military personnel, and veterans residing abroad, (3) payments under US educational, cultural exchange, and research programs, (4) membership contributions to international nonfinancial organizations, (5) damage claims paid by the US armed services in countries where they have installations, and (6) other transfers. • Private remittances and other transfers: This account measures net private unilateral transfers of goods, services, and cash and other financial assets between US private residents and foreign residents. Balance-of-Payments Structure • Current account of the balance of payments (CA) • Monetary value of international flows:,transactions in • goods, import& export,---Merchandise trade • services, invisible trade • income flows, • unilateral transfers Merchandise trade balance: trade deficit/ surplus To calculate a goods-and-services balance, add services to the merchandise trade account When balance +, surplus of goods-and-services transactions When balance −, deficit of goods-and-services transactions Goods-and-services balance is part of a nation’s gross domestic product (GDP) 15 Balance-of-Payments Structure • Merchandise/ trade balance (1) • Credit (+): If positive: trade surplus, the dollar value of merchandise exports • Debit (-): If negative: trade deficit—the dollar value of merchandise imports • Goods and services balance---Net export of goods and services (2) • Services and merchandise trade account • If positive: Surplus of goods and services transactions • Excess exports over imports, Add to GDP • If negative: Deficit of goods and services transactions • Current account balance (surplus, deficit) (2)+ net Income receipts and payments +unilateral transfer • Balance on goods and services • Investment income Net earnings= Earnings on U.S. investments • Unilateral transfers abroad - payments on foreign assets in the U.S. Compensation to employees 16 U.S. balance of payments, 1980–2008 (billions of dollars) (1) (2) (3)=(1)+(2) (4) (5) (6)=(3)+(4)+(5) The formula for the current account balance is: CAB = (X − M) + (N Y + NCT ) where X Exports of goods and services M Impots of goods and services NY Net income abroad NCT Net current transfers 17 © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password‐protected website for classroom use Balance-of-Payments Structure • Capital and Financial Account (cont’d) • Capital account Financial account • Major types of capital transfers are debt forgiveness and migrants’ goods and financial assets accompanying them as they leave or enter country • Acquisition and disposal of nonfinancial assets include sale and purchase of rights to natural resources, patents, copyrights, and trademarks Balance-of-Payments Structure ➢Capital account capital transfers :capital transfer related to the purchase and sale of fixed assets such as real estate. flows of special categories of assets (capital): typically non-market, non-produced, or intangible assets like debt forgiveness, copyrights and trademarks Major types of capital transfers are debt forgiveness and migrants’ goods and financial assets accompanying them as they leave or enter country Acquisition and disposal of nonfinancial assets include sale and purchase of rights to natural resources, patents, copyrights, and trademarks Deference between FDI and indirect investment • Foreign direct investment (FDI) • Investments that a non-resident entity realizes with the aim of acquiring a durable interest in a resident enterprise (long-term relationship and influence on the enterprise’s management) • The investor holds at least 10% of the shares or the voting rights in the enterprise(IMF,10%, China,25%) Portfolio investment ---indirect investment Does not involve influence of foreign owners interest income, dividend?—current account Balance-of-Payments Structure • Private Sector Financial Transactions • Capital and financial transactions recorded in balance-of-payments statement by applying + (credit) to capital and financial inflows and − sign (debit) to capital and financial outflows • Financial inflow (credit entry +) might occur when • (1) U.S. liabilities to foreigners rise (French resident purchases securities of IBM); • (2) U.S. claims on foreigners decrease (Citibank receives repayment of loan to Mexican firm); • (3) foreign-held assets in U.S. rise (Toyota builds plant in U.S.); • or (4) U.S. assets overseas decrease (Coca-Cola sells Japanese bottling plant to Japanese buyer). • Financial outflows imply opposite movements © 2019 Cengage. All rights reserved. 21 Balance-of-Payments Structure • Private Sector Financial Transactions • Vast majority of transactions in capital and financial account come from private financial transactions; include • Direct investment: residents of one country acquire controlling interest (stock ownership of 10 percent or more) in business of another country • Securities: private-sector purchases of debt issued by governments and private companies • Bank claims and liabilities: loans, overseas deposits, acceptances, foreign commercial paper, and foreign government obligations © 2019 Cengage. All rights reserved. 22 Balance-of-Payments Structure • Official settlements transactions • Movement of financial assets among official holders • Official reserve assets • Liabilities to foreign official agencies • Reserve assets • Official reserve assets are assets that are held by governments and that are recognized by governments as fully acceptable for payments between them. • Transactions involving the assets of which monetary authorities consider that they dispose in order to finance the balance of payments, including IMF loans 23 Balance-of-Payments Structure (10 of 13) Official reserve assets • Stock of gold reserves held by U.S. government • Convertible currencies such as Japanese yen, readily acceptable as payment in international transactions • Reserve position of U.S. in International Monetary Fund (IMF) © 2019 Cengage. All rights reserved. 24 Balance-of-Payments Structure (12 of 13) Special drawing rights, new reserve asset created by the IMF as a supplement to the existing reserves of member countries. • can be transferred among nations in settlement of balance-ofpayments deficits or stabilization of exchange rates • Is basket of currencies that includes U.S. dollar, Japanese yen, UK pound, Chinese yuan and euro © 2019 Cengage. All rights reserved. 25 Balance-of-Payments Structure • Official Settlements Transactions (cont’d) Purposes: international liquidity to finance short run trade deficits and weather periodic currency crises provide ability to buy or sell reserve assets in private markets in order to stabilize exchange rates • Official holdings of reserves used for two purposes • Provide a country sufficient international liquidity to finance short-run trade deficits, currency crises, etc. • Central banks sometimes buy or sell official reserve assets in the private sector to stabilize their currencies’ exchange rates © 2019 Cengage. All rights reserved. 26 Balance-of-Payments Structure • Statistical Discrepancy: Errors & Omissions • The current account balance may not exactly equal the financial account balance due to incomplete or imperfect data, illegal activities, and mismatches on the timing of data collection. • Data collection process for balance-of-payments figures imperfect • Government statisticians base figures partly on information collected & partly on estimates • When statisticians sum credits & debits, rarely match • Since debits must equal credits, residual is inserted to make them equal • This correcting entry is statistical discrepancy, or errors and omissions © 2019 Cengage. All rights reserved. 28 Balance of payments account (Double-Entry Accounting) Credits (+) (leading to the receipt of payments from foreigners) ⚫ Merchandise exports ⚫ Service exports ⚫ Income received from investments abroad ⚫ Gifts received from foreign residents ⚫ Aid received from foreign governments ⚫ Investments in the home country by overseas residents ⚫ Official reserve asset reduced Debits (-) (Leading to payments to foreigners) ⚫ Merchandise imports ⚫ Service imports ⚫ Income paid on investments of foreigners ⚫ Gifts to foreign residents ⚫ Aid given by the home country’s government ⚫ Overseas investment by home country’s residents ⚫ Official reserve asset added Balance of payments of Europa (C= millions) HOME WORK 1-1 • Use the information in the following table on Mexico’s 1996 international transactions to answer the questions ( US $ in millions) • Merchandise imports $ 89,469 - 89469 6531 • Merchandise exports $96,000 • Services exports $10,901 • Services imports $10,819 -10819 • Investment income receipts $4,032 • Investment income payments $17,099 • Unilateral transfer $4,531 • A. what is the balance of trade? • (trade balance6531, trade and service balance 6613) • B. What is the current account balance? IMF balance of payments summary: the United States, Japan, Germany, France, Italy, Canada and the United Kingdom, 2002 (US$ billions) U.S. Balance of Payments (1 of 3) Merchandise trade balance commonly referred to as trade balance In 2016, U.S. had merchandise trade deficit of -$749.9 billion — difference between U.S. merchandise exports and imports Trade deficits not popular with U.S. residents & policymakers • Negatively affect terms of trade, employment levels, stability of international money markets © 2019 Cengage. All rights reserved. 33 Taken as a whole, U.S. international transactions always balance Any force leading to an increase or decrease in one balance-of-payments account leads to exactly offsetting changes in balances of other accounts In Table 10.3, U.S. had deficit of -$465.9 billion ,Offsetting this deficit was a combined surplus of $465.9 billion in remaining capital & financial accounts Merchandise trade balance commonly referred to as trade balance In 2016, U.S. had merchandise trade deficit of -$749.9 billion — difference between U.S. merchandise exports and imports © 2019 Cengage. All rights reserved. 35 U.S. Balance of Payments (2 of 3) Table 10.3 U.S. Balance of Payments, 1980–2016 (Billions of Dollars) Year Merchandise Trade-Balance Services Balance Goods and Services-Balance Income Receipts and Payments-Balance Unilateral Transfers-Balance Current Account-Balance 1980 −25.5 6.1 −19.4 30.1 −8.3 2.4 1984 −112.5 3.3 −109.2 30.0 −20.6 −99.8 1988 −127.0 12.2 −114.8 11.6 −25.0 −128.2 1992 −96.1 55.7 −40.4 4.5 −32.0 −67.9 1996 −191.3 87.0 −104.3 17.2 −42.1 −129.2 2000 −452.2 76.5 −375.7 −14.9 −54.1 −444.7 2004 −665.4 47.8 −617.6 30.4 −80.9 −668.1 2008 −820.8 139.7 −681.1 127.6 −119.7 −673.2 2012 −735.3 195.8 −539.5 198.6 −134.1 −475.0 2016 −749.9 249.3 −500.6 180.6 −161.2 −481.2 Source: From U.S. Department of Commerce, Survey of Current Business, various issues. © 2019 Cengage. All rights reserved. 36