Taxpayer Education & VAT Compliance: Nairobi Water Bottlers

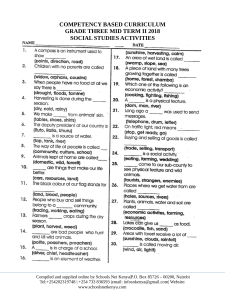

advertisement