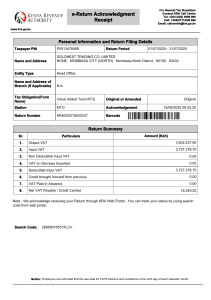

Taxpayer Education & VAT Compliance: Nairobi Water Bottlers

advertisement