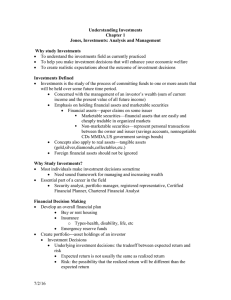

“A STUDY ON STOCK MARKET AWARENESS AMONG MANAGEMENT STUDENTS IN DELHI” Submitted To New Delhi Institute of Management 50 (B&C), 60, Tughlakabad Institutional Area, New Delhi-110062 E-mail:placement@ndimdelhi.org Website: www.ndimdelhi.org Submitted By Aviral Kumar Jha (21416) Ayushi Singh (21150) Siddhanth Sharma (21457) Shivangi Kumari (21120) Ritika Pratihari (21446) Post Graduate Diploma in Management Batch (2021-2023) Under The Guidance of Dr. Prof Anand Jaiswal New Delhi Institute of Management 50 (B&C), 60, Tughlakabad Institutional Area, New Delhi-110062 Chapter 1 Introduction & Research Methodology 1.1 Introduction Successful companies thrived and survived in this huge competitive world due to presence of major factor- strong financial conditions. And today one of the most prominent mediums that has contributed in raising the finance of big companies like Reliance industries, Infosys, HDFC Bank Ltd., TCS is Stock Market. It is basically a facility that has let companies to list their stocks (that are claims of ownership) in market in return of finance or capital. It allows businesses to raise additional capital by selling shares in public market. A stock exchange is designated market for exchanging different types of securities in a controlled and secure environment. As it unites a huge number of market participants who wish to purchase and sell shares, it guarantees fair pricing practices. While earlier it used to operate through paper-based physical share certificates, today the system works electronically. It has also given an opportunity for common man to become a shareholder of a company. The concept of Stock Market consists of various aspects such as portfolio of investments, financial literacy, raising capital, listing shares, investments options such as shares, bonds and mutual funds, growth of companies, performance of industry and so on. It has become so important that it is considered as one of the indicators to assess the social-economic dynamics of a country. If the stock market shows up trending phase, it depicts the probable economic growth and development of a country. Stock Market is directly related to factors present in economy; therefore, it rises or crashes depending on such factors. Market conditions that create an impact on stock market performance are volatile in nature and are ought to change due to different factors existing in economy. The situation leads one to emphasize the importance of quantum of financial knowledge one has to possess to understand the working of stock market. The changing dynamics of market cannot be easily grasped by stakeholders unless the terms and aspects are known to the market participants. This is such a vast concept that it has to be introduced to people at early stage, especially the students so as to understand the operations of Stock market. Commerce and Stock market are interrelated to each other as the exchange market is a part of Commerce. Since it is a major determinant of progress of economy, it is important to develop financial literacy among students who are the future of a country. Students especially of Management background who are more updated with commercial world and are used to the financial terms are comparatively familiar to working of Stock market system. Management students are enlightened and encouraged to come up with innovative business practices and realize the importance of raising funds through listing shares in market. Apart from considering Stock market as a means to raise capital, it also serves as a means for Management students to trade, invest and hedge funds. They realize the importance of finance and the applicable ways to use it. So, acquiring financial knowledge is an important aspect to understand, expertise and predict the probable effects of factors existing in economy so as to adapt the volatility arising in stock market and to assess the right mix of portfolio and diversification of funds. This would ultimately build an inclination towards wide investments options available in market in the form of equities, mutual funds, bonds and so on. Basically, it can be concluded by saying that they are such prospects who could contribute in developing the investment and saving habit among younger generations. Stock market functioning requires one to be well versed with the aspects related to it. So, in the light of developing financial literacy, understanding the elements associated with Stock market and to gain insight about the interests and investment pattern in Stock market among Management students, the study focuses on Stock market awareness among Management students in Delhi. Meaning and concept of Stock market 3.1 Introduction Stock market are the most dynamic type of market for securities which basically trade in financial assets, whether of government and semi government bodies or other public bodies as well as shares and debentures issued by joint stock companies. Securities market or Stock market is a component of the wider financial market where securities can be bought and sold between parties on the basis of demand and supply. It encompasses equity market, bond market and derivatives market where prices and participants can be determined and exchange is facilitated. It has established a nationwide trending facility for all types of securities, ensuring equal access to all investors all over the country through an appropriate communication network. It provides a fair, efficient and transparent system of trading using electronic trading system. A Stock Exchange can operate only if it is recognized by the Government under the Securities Contracts (Regulation) Act 1956. The recognition is granted under section 3 of the Act by the Central Government, Ministry of Finance. Besides the above Act, the Securities Contract (Regulation) Rules were also made in 1957 to regulate certain matters relating to trading on the Stock Exchanges such as: Opening/ Closing of the Stock Exchanges, administration, timing of trading, control of the settlement and other activities of the Exchange, regulation of brokers’ trading, brokerage charges, arbitration and settlement of disputes etc. Stock market is recognized only after the government is satisfied that its rules and Byelaws conform to the conditions prescribed for ensuring fair dealings and protection to investors. The first stock market was set up in Bombay in 1875. Since then, the number of Stock Exchanges in the country grew to 23 including the Over-the-Counter Exchange of India and the NSE. Currently seven Stock Exchanges exist in India- BSE Ltd, Calcutta Stock Exchange Ltd, India International Exchange (India INX), Magadh Stock Exchange Ltd, Metropolitan Stock Exchange of India Ltd. National Stock Exchange of India Ltd, NDE IFSC Ltd, out of which four has been given permanent recognition. Stock Market is considered as a subset of Commerce that clearly contributes in the development of the economy by enacting as a thread so as to connect to different constituents of market such as brokers firms, financial institutions, investment companies which actively participate as dealers, traders or as intermediaries. Today, stock market constitutes of small individual stock investors to large traders’ investors who can be based anywhere in the world and may include banks or insurance companies. But this was not the case earlier when there were many restrictions on private sector on the account of Industrial licensing. Their fund requirements were met through loans from nationalized banks and from public sector development banks. Even post Bombay Securities Contract Control Act 1925, there were limits on the role of private sector and on the issue of securities by the private sector which did not develop the Indian stock market as a whole. The trading and settlement infrastructure was weak back then and settlement system was completely paper based. Market intermediaries were largely unregulated, disclosure requirements were inadequate and the regulatory structure was fragmented and administered by different agencies. There was no apex institution for regulation of securities markets. In fact, many issues were faced in Securities market before liberalization, some of which are as follows: Multiplicity of administration Poor disclosure in prospectus, balance sheet was not made available to investors Investors faced problems of fund delays Management of exchanges was dominated by brokers Capital adequacy concept did not exist back then No prohibition on insider trading and fraudulent and unfair trade practices It was then after the establishment of Securities Exchange Board of India (SEBI) in 1988 and post economic reforms in 1991, securities market went through broader changes and wider acceptance. It aimed at boosting the private sector of the economy and at the allocation of capital through market channels. From just being the medium of raising funds earlier, to now being the crux of the financial system, it has evolved in many ways and serves in different ways to economy. It has played multiple roles in an economy which makes it vital. Some of them are as follows: Mobilizing savings into investments so as to promote healthy habit of investments among public. Facilitating funds between market participants such as between business organizations and investors. Information dissemination Better allocation of capital to different alternatives. Acts as an indicator of status of economy. Investor protection and education A Stock market may be physical or entirely virtual. The Bombay Stock Exchange (BSE) is physically located in Dalal Street in Mumbai. As almost all major stock markets across the globe now operate electronically, the exchange maintains trading systems that efficiently manage the buy and sell orders from various market participants. They perform the price matching function to facilitate trade execution at a price fair to both buyers and sellers. Stock market has boosted the liquidity in the market through smooth flow of funds to different market participants. Following are few of the functions of Stock market mechanism: i. Listing of securities: One of the major of the Stock market is to provide for listing of securities of companies with a view to facilitate trading in them. Listing means ii. iii. iv. v. vi. vii. admission of shares of a company to trading on the stock exchange and to a quotation of its share price. This helps the process of investment and disinvestment by savers and imparts liquidity to the investments made by the public. Hence it provides a venue for savings to flow into the corporate sector through trading in the securities of the companies and providing liquidity to them. Price determination: Continuous price formation of securities is the main function of a stock market. Based on the demand and supply in market, it has facilitated in putting a value on the securities which provides logical estimates to both buyers and sellers and thus helps in fixation of price securities. Helps to raise capital: Stock market has contributed in economy by raising funds through domestic means as well through raising capital through foreign market. Due to which currency rate improves and more international trade is undertaken by government. Regulates conduct of business: Stock market requires corporations to submit their audited balance sheet and annual reports to Stock Exchanges. Company dealing in fair transactions only can have their shares transacted and could submit the relevant documents. If not, strict actions are taken and such companies are blacklisted. Helps in speculation: Stock market has facilitated speculators to exchange securities in order to reap high profits due to the fluctuations in securities prices. Moreover, SEBI strictly regulates this aspect by issuing guidelines for such practices so that it is conducted within controlled environment. Fair dealing: Rules and bylaws are clearly defined under Stock market mechanism, so it helps to transact securities among various market participants with great measure of safety and provides adequate protection to investors. Contributes to Economic growth: While making investments or raising funds by business organizations or other entities, capital flows from savers or investors to entities. This will ensure healthy habits of wealth creation among investors and would facilitate businesses to conduct operations uninterruptedly. Stock market has ensured not only adequacy of capital in market but has mobilized funds from investors to entities through the trade in financial assets. It has acted as a plank between business organizations, investors, traders and speculators, since the industry performance was clearly visible through stock market operations which facilitated investors to lay their funds to prospective companies. But stock market mechanism involves many risks too while transacting securities such as market fluctuations, performance of the overall sector and capital issues. This focuses upon the fact that securities market operates under variable factors and it is important to have a control over its mechanism. Due to existence of regulatory bodies like SEBI, stock market has thrived to be successful in market today as investors have started understanding the importance of trading through it. Stock market Awareness 4.1 Introduction Stock markets are vital components of a free-market economy because they enable a democratized access to trading and exchange of capital for investors of all kinds. It is a catalyst to the development of the nation. It is highly sensitive to the factors existing in economy, due to which its ever-changing nature makes it difficult for an investor to understand the parameters or dynamics of economy. This is the reason which makes awareness about the Stock market system important so as to build a better understanding of its functioning and to inculcate a healthy habit of investments among prospective investors. Awareness leads one to be cautious against the fluctuating factors existing in system and to be well prepared with a viable solution. Investors’ awareness includes not only the knowledge of various financial products available in the market but also facilitates decision making, particularly among the less educated as well as of those committed to long term financial decision. This will help the investors to be well versed with the different factors and to deal with it accordingly. Many factors consist in Stock market that influences its working and the changing trends. Such as capital, risk factors, financial literacy, political environment, economic factors, industrial performance. Few of the factors such as risk are dynamic in nature and have to be studied thoroughly to predict the probable outcomes in future. But it is financial literacy which acts as the foundation based on which a prospective investor starts building interest towards aspects of trading and investments. It is the prime step based on which the investor is able to know the vast options available to him/her for making investments as well as helps to know the techniques one can adopt for optimum utilization of funds. Financial literacy is the component, the foundation based on which the likeliness to invest in stock market increases especially among students. In light of this, few of the aspects are discussed briefly that contributes in enhancing the awareness level of investors and enhances their investment skills. 4.1.1 Financial literacy It is about being familiar with and understanding financial market products and terms, especially rewards and risks in order to make informed choices. According to Investopedia.com, “Financial literacy is the education and understanding of various financial areas including topics related to managing personal finance, money and investing.” Financial literacy involves skills, rather than just knowledge. It depends on the ability to work with numbers. Ignorance of financial matters or financial literacy negatively hampers stock market participation, even for those people who have wealth and education. Today, an investor has vast investment alternatives, moreover they have an option to invest their limited funds to diversified financial products. In this context there could be such situations when due to lack of financial knowledge about alternatives, investor may choose unsuitable stock option and may affect their financial outcome. This makes financial literacy an important pillar which helps the investor to equip fundamental knowledge and skills to evaluate their alternatives and to study their probable economic consequences. This is the preliminary stage in which an investor must equip knowledge about financial products and their financial repercussions so as to invest wisely in market. It also creates an impact on the risk tolerance capacity of an individual and investment decision making. Financial literacy leads one to gain more information about diversification, interest rates, inflation and many other economic indicators as well. 1.4 Research Methodology It includes the strategies used in collecting and analyzing the data to accomplish the research objectives and to test the hypothesis. It is a systematic plan to conduct the study. The study is descriptive in nature. Quantitative methods are used to conduct research which aims to classify features and establish statistical models to test hypothesis and explain observations. In the study both primary and secondary data has been used. Primary Data: It is the first-hand data which is collected for the purpose of research. Instruments used in this research are: Structured Questionnaire Observations Secondary Data: It is the data that has already been collected and is readily available in market from other sources. The following study is descriptive in nature. The sources of data used are journals, articles, research papers and other web sources. Chapter 2 Literature Review Insights gained Literature gaps noticed Literature review It is a comprehensive compilation of the information obtained from the published sources and unpublished sources of data in the specified area of interest to the researcher. Following literature has been reviewed: According to author, investments should be made by a person based on their own instincts and analysis and should not be dependent on any financial advisor who is compensated by the way of commission. The publication highlights basically two basic necessities of investment decision- menu of investment choices available to a market participant and risk-return relationship. It states higher returns are possible by accepting greater risks. Investing is a matter of time and not timing and it is never too early to invest for retirement. Also, huge difference lies between capacity for risk and attitude towards risk. While the latter focuses on psychological comfort, former focuses on financial survival. The author highlighted factors to save money so as to focus on fruitful investments options be it in the form of Real Estate, cash, bonds or common stocks. The kind of investment which is possible for an investor depends upon the source of income as well as the age and earning power factor. One must keep the temperament to accept the risks due to volatility in market conditions. Rebalancing’ i.e. allocating funds into investment alternatives that is based on one’s ideal mix of portfolio is the right response to save money. Investors who rebalance their portfolios are generously rewarded. Diversifying portfolios could minimize risk probabilities. One should not be over confident while investing in market as it is dynamic in nature and fluctuations are frequent, also they should not keep a herd attitude. The investments should be based on the age factor and risk tolerance capacity (The Random walk guide to Investing (2011) by Burton G Malkiel). It is due to changing time and increasing focus towards awareness the investors started adopting calculative practices while making investments rather than relying on misconceptions that was very much followed earlier. The author highlights few misconceptions on financial matters so as to break free the concerned parties from the flawed assumptions. The mutual fund investments are associated with context of compounding (addition of interest to the interest already accumulated till then) whereas equity and mutual funds do not result fixed returns, therefore it does not involve power of compounding. The investors suppose that their money will grow despite volatility which is not the case in real. Other aspect that was covered was, it is considered that Systematic Investment plans are safe way to average out costs over time, to mitigate risks of equity investments and gives a safeguard against market volatility, but the fact is it does not remove the associated risks altogether. It is meant to inculcate discipline so that benefits and returns could be gained if it is invested for longer period (7 money myths bustedan article by Shipra Singh in economic times wealth weekly publication for the week (January 21-27)) Equities are high risk securities, as for some it is a no profit game or some equate it with gambling. It is not acceptable to many as it does not guarantee returns. But the editor highlights the fact that equity investing is neither of the two situations. It cannot be considered as gambling as it is a legitimate and democratic way to multiply funds. Investing in equities is about investing in the future of a business which holds uncertainty. So, one has to accept the reality that these uncertain factors only make it more exciting, thrilling and worth more to invest. Also, it is not easy to brilliantly predict the track of a stock in the years to come as it involves unstable variables, so an efficient opportunity is to be given for making it a successful investment. It actually requires expertise of many years and intuitive judgments to spot warning signs. Different market participant would have different parameter to trade and invest. Like a stock trader sets a price target, short term investor sets a margin of safety and value investor sets a margin of safety and so on. Other aspect that was being highlighted was it is important not to stake in single business. Fruitful returns can only be possible if much importance is given to the composition of portfolio i.e., what it holds and how much rather than placing small bets in many stocks. Also, equity investment requires deliberations and wide access to information as partial information would lead to losses. On the basis of the performance of stocks it is evidently seen that investing in equity mutual fund is efficient way to invest in equities while index Exchange Traded Funds (ETF) is both efficient and cheap (Why you must invest in Equities- an article by Uma Shashikant (chairperson, center for investment education and learning) in economic times wealth weekly publication for the week February (25-march)). Planning in advance, conducting research and alignment of estimates with budgets can help to deal financial stress. Today Indian investors are educating themselves about the functions of stock market system. But still a temptation exists to redeem investments in case of market fall. Although the reality is, one should not react but should respond to market movements. Short term losses should not be the prime concern whereas time horizon has to be looked upon. To manage financial strain, it is important to study company fundamentals and to see that market is stable. SIP’s is a viable investment option to invest for long term (Financial stress- an article by Riju Mehta in economic times wealth weekly publication for the week (Feb4-10 2019)). According to author, investing in Stock market leads to wealth creation. Wealth creation is result of maximization of returns while minimizing volatility and risks associated with the investments. So, the right formula to invest in Stock market is having right information, to have a feasible plan and to make good choices. The golden principles to be followed by a person are budget to save, save and invest regularly, invest for a long term, control debt. Wealth creation should be seen as a long-term proposition and this could only be possible if adequate diversification among asset classes is made. Keystones of investing were highlighted as: (i) (ii) Power of Compounding-Income gradually leads to higher absolute returns each year, Long term investing is second keystone which helps to tide away short-term market volatilities, especially in high-risk high returns assets. This is possible through Systematic investing which reduces the chance of making an investment wrong at times. But this widely requires discipline in order to increase the corpus and the habit of investing consistently. Focusing upon the aspect of good investment alternative, Equity investment is all about growth. It is important to choose right company which offers wide growth and profitable opportunities. Parameters to consider while studying a company are: Promoters, Industry outlook, Business plans, Financial, Risk factors, Pricing and listing. IPO investments should be done only if one has the aptitude and information to take rigid decisions. Moreover, dividend earned on shares through an IPO is tax free. It is recommended that one should hold around 15-20 stocks. Tax is incidental to investment decisions and not the objective of making investment. Mutual funds is also such viable option for investors as these are such investment vehicles that are managed by professional fund managers who regulates and offers to investors to analyze and evaluate track records. Apart from keeping an update about the investment alternatives, technical analysis is one of the important factors to survive in Stock market as it helps to track movement of stocks and share trends. So, a combination of all these factors makes Wealth creation possible which is based on life cycle and that is being defined through an individual’s financial status and needs. (Everything you wanted to know about Investing by Deepa Venkatraghvan) It can be a smart strategy to invest stocks in underperforming industries due to the factor of changing external environmental aspects and dynamic trends. It is expected that a growing trend can be seen in a struggling sector since high risks is involved in it which implies high returns. But this could be suitable only for those investors who intend to keep the investments tied up at least for 5 years, since industry turnaround takes time. But those underperforming sectors should be avoided that are not likely to turn around in near term. A clear example of this is Telecom sector where cut throat competition exists and the issues are not such that are going to end soon. So, it is better to avoid teleservices stocks. Also, Price Earnings ratio (PE) which investors very much rely on works only, when it is evaluated for well performing sectors. It can mislead in case of stocks from troubled sectors. For example, despite of 57% fall in stock price, PE ratio of TATA Motors rose to 110 because of bigger fall in earnings. However, sectors such as textiles, metals, infrastructure, are such sectors that might be currently underperforming but has a prospect to grow in market, has potential for high opportunities and of stable cash flows. But futuristic approach is what expected from investors to select stocks (Select stocks from troubled sectors can be winners- an article by Narendra Nathan in Economic Times wealth weekly publication (February (4-10 2018). DEMAT account has facilitated investors with smooth flow of securities and funds. But instances of fraud have focused upon the fact that investors have to be more cautious while dealing with same. Even though SEBI has standardized the norms for Power of Attorney (POA) agreements, where broker’s authority has been limited to transfer of securities and funds for the purpose of settlement and they cannot transfer securities for off market trades and execute trades in client’s name without written consent. Still the case of forgery exists as in the case of Dalmia Bharat, where the broker forged the signature of the company’s authorized signatory to transfer units. Loopholes still exists in electronic system so investors need to be vigilant and should keep a tab on the movement of share units. Investors must make sure to update the mobile no. and email Id associated with DEMAT account and depository (CDSL and NDSL), only then it would be possible to check SMS and email statements sent by depositories for every transaction in DEMAT account. Holding statements which is issued by broker every month should be verified. In case of any fraud or inaction by brokers, timely complaints should be registered with depository. Investors should avoid keeping excess money in broking account and transfer money from savings account only at the time of purchase. Also, investors should avoid keeping any signed delivery instruction slip with broker for offline trades. These steps would lead to more awareness on part of investors in handling their securities (DEMAT account is safe, but still investor needs to be vigilant- an article by Sanket Dhanorkar in Economic Times wealth weekly publication (March (11-19 2019)). According to the author there are four ways to approach equity investing. First is, regardless of the established source, one should never be dependent upon the stock advices given by others and should rely on the gut instinct of oneself. Before investing, deep research of company is required to do thorough analysis even if there is no financial background of the investor. It is possible by studying the financial statements of the corporations which help to assess the general functioning of stocks. Second rule is to apply parameters while opting certain securities. Such as market capitalization, dividend yield, debt accumulation, diversification are some of the factors that has to be kept in mind and after then combination of stocks has to be chosen that fits the investment cycle. Thirdly one should not always be relying on stocks that are generating greater strong returns at present as there could be situation when the growth trend may get disturb in the near future. So futuristic approach should be kept and long-term intentions to invest should be studied before investing. Lastly, cyclical stocks which are subject to changes in business cycle should be avoided in case of long-term investment plans as they tend to suffer losses in case cycle reverse (Four rules of investing: Things to remember to avoid losses- an article by Rahul Jain dated (6th April 2019) in the online portal MoneyControl.com) The author highlighted the factors that are necessary for a viable portfolio construction: Needs and circumstances of investor should be clear, Identification of appropriate asset class and sectors. Assessment of expected behavior of portfolio over a given period of time. Under this, for the suggested portfolio, the level of returns and the level of risks expected from each individual investment made within portfolio is assessed and defined. The return and risk relationship are main constituent of portfolio. It is to maximize investment return while minimizing investment risks. For example, if a young investor is interested in pension plans, then that would be investment vehicle and asset can be equity based, fixed interest investment, cash etc. Implementation of the rules and making investments in different portfolios. Regular review of portfolio and their performance against initial targets and assumptions. It also highlighted that equities are considered as relatively high volatile alternative than any other option and suitable for investors that have high acceptance or tolerance to risks. Reasonable consistent dividend yields make equities integral of all structured portfolios. Thus, it can be said that valuation of the portfolio is affected by many factors: Interest risks, Currency fluctuations, Company profile developments, Diversification of stocks (risks reduce when investments spread across different sectors and industries) (How to develop an Investment Portfolio (2008) by Keith Popplewell). According to author one should not invest in Stock market unless a clear perspective is formed by investor. The aim should not be general but rather focus should be on investing in particular company. Focus should be laid on where stock may go rather than where it has been. If it is not going up faster, sell it and buy the alternative. One may always look for growing trend stock. So, in light of this aspect an acronym known as GARP- Growth at reasonable price has been formulated. According to this approach, investor is looking for undervalued growth stock, i.e., cheap growth stocks. Another aspect is-Momentum which means identifying company that has above average trends in terms of earning acceleration in near future (Beyond Wall Street, Art of investing (1998) by S.L Mintz, DamaDalkin, Thomas Willison) Insights gained The objectives of investments should be very clear, based on that only the time period of investment and the type of asset to be invested is identified. Self-assessment and analysis of investment plans according to one’s own risk bearing capacity especially in case of students is vital to opt the most suitable portfolio mix. Market conditions updates investors about new investment alternatives and helps to diversify limited funds so as to earn higher returns. Higher returns is possible if futuristic approach is intended by investor i.e. long term investment plans. Investor should not get affected by short term fluctuations and withdraw stocks due to interval volatilities. Exchange traded funds (ETF) is an efficient way of investments as it is convenient and cheap form of investment. Mutual funds are considered as one of the sought-after investment options due to involvement of fund management professionals and higher returns. But it does not imply that they do not result negative returns, one should be patient while investing in market irrespective of market movements. Investments in stocks of underperforming sectors can also yield fruitful result, if growth prospects exist. The trends have to be analyzed of different sectors using technical analysis. Literature Gaps Noticed Scope of the research study is Commerce students of Pune. However, while reviewing of literature, it was observed there were no research studies based on Commerce students’ perception towards Stock market participation and their awareness level towards different stock alternatives available in market. This acted as a gap to assess their level of interest, level of literacy in Stock market and the probable hindrances caused to them while making investments in securities.