Business Law: Sole Proprietorships, Partnerships, Contracts

advertisement

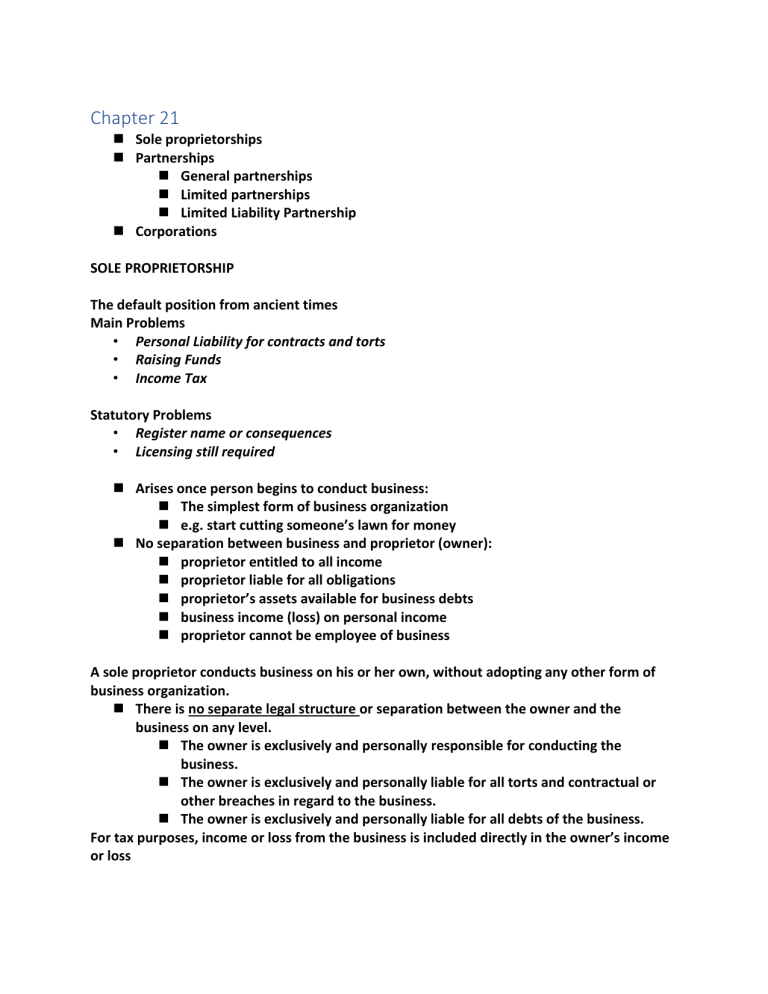

Chapter 21 Sole proprietorships Partnerships General partnerships Limited partnerships Limited Liability Partnership Corporations SOLE PROPRIETORSHIP The default position from ancient times Main Problems • Personal Liability for contracts and torts • Raising Funds • Income Tax Statutory Problems • Register name or consequences • Licensing still required Arises once person begins to conduct business: The simplest form of business organization e.g. start cutting someone’s lawn for money No separation between business and proprietor (owner): proprietor entitled to all income proprietor liable for all obligations proprietor’s assets available for business debts business income (loss) on personal income proprietor cannot be employee of business A sole proprietor conducts business on his or her own, without adopting any other form of business organization. There is no separate legal structure or separation between the owner and the business on any level. The owner is exclusively and personally responsible for conducting the business. The owner is exclusively and personally liable for all torts and contractual or other breaches in regard to the business. The owner is exclusively and personally liable for all debts of the business. For tax purposes, income or loss from the business is included directly in the owner’s income or loss Conclusion: A Sole Proprietor is best suited for small businesses. Advantages Simple to start; simple to administer Possible tax advantages Disadvantages Unlimited personal liability Can only raise money by personal borrowing As business grows, these problems continue to grow No formal registration as a “sole proprietorship” is required. (Compare this to incorporation, where formal steps are required.) But sole proprietors must comply with the general requirements imposed on all businesses. May need to register a “doing business as” (DBA) name May need to acquire a particular licence, e.g., hot dog vendor permit or spectrum licence PARTNERSHIP General Partnership Most Partnerships Limited Liability Partnership Professionals Limited Partnership Investments Joint Venture Natural Resources extraction, high risk Definition of Partnerships Two or more parties… Carrying on a business… With a view to a profit There are no formal requirements for creating a partnership. The creation of a partnership is automatic: a partnership comes into existence in law when “two or more people carry on business together with a view to profit”, without the need for any further formality. This means that a person can become part of a partnership without necessarily realizing it! General Partnership Not a separate legal entity Each partner an agent for the partnership Each partner liable for the contracts and torts of the partnership, whether or not he or she signed the contract or committed the injury Partner cannot be an employee Exists when two or more people carry on business together with a view to profit Example: You and James agreed that he will buy a lawnmower, you will cut the lawns for interested homeowners and you will split the profit. You created a partnership even if you never made any money. Characteristics “Carrying on business together”: Not a casual, one-off transaction” Two or more people carry on a business with a view to a profit. It is not a legal entity separate from the partners. A partner cannot be employed by partnership All benefits and liabilities of the partnership accrue directly to the partners. All partners are personally liable for all obligations and debts of the partnership, for the full extent of the obligation or debt. In other words, there is joint and several and personal liability personal assets available to satisfy partnership debt creditworthy partners make a creditworthy partnership Partners have unlimited personal liability: their liability is not restricted to business assets. It extends to the partner’s personal assets, whether or not used in the business. extends risk of unauthorized obligations and torts to all partners Unless the partners agree otherwise, the default termination rules are: any partner may terminate partnership on notice termination on death or insolvency of partner (ask prof) RISK MANAGEMENT: FRONT END STRATEGIES Be careful to avoid creating the impression that you are in a partnership Get compensated for the risk that you may be held to be a partner If you wish to have a partnership, draft a contract and have a lawyer review the contract Enter into partnership agreements that protect your interests (e.g. ensure that the agreement provides for a right to indemnification Consider creating a limited liability partnership or a limited partnership to manage the risks Consider incorporation as an alternative to a partnership Other Risk Management Tools Qualifying the scope of liability: “In the ordinary course of the business of the partnership” Fiduciary Duty: Partners must act honestly and with a view to the best interests of the partnership Fiduciary Duty: Partners must act honestly and with a view to the best interests of the partnership SPECIAL VERSIONS of a Partnership Limited Partnerships Limited Liability Partnerships Joint Ventures LIMITED LIABILITY PARTNERSHIPS (LLPS Aimed at certain professions that cannot carry on business as corporations. Partner’s risk of liability for professional negligence of fellow partner is essentially limited to the non-negligent partner’s investment in the partnership LIMITED PARTNERSHIP: A form of partnership where the liability of at least one partner is limited to that partner’s investment in the partnership. LPs must be registered. An LP must have at least one general partner whose liability is not limited. Limited partners have very limited rights to manage the partnership Typically an investment vehicle JOINT VENTURE A collection of partners or corporations that gather together for one project and form a partnership Used in extreme high risk commercial endeavours CORPORATIONS - Foremost A corporation is a legal person, with a separate legal existence from its directors, shareholders, and officers. Separate Legal Entity Perpetual Taxed as its own entity SH can be an employee, creditor SH not liable for action of corporation Shareholders: residual claimants to the assets of the corporation and elect directors Directors: responsible for managing or supervising the management of the corporation business and its internal affairs Officers: appointed by directors and usually exercise substantial management powers delegated by directors Shares: represent a claim on the residual value of the corporation after the claim of all creditors have been paid Chapter 7 of Law deals with Contract formation All contracts are legally enforced agreements • Remember: the normal rule is that there is no requirement that contracts be in writing to be enforceable. (Some exceptions apply.) Contracts do not have to be in writing to be enforceable. Essential Elements for Contract Formation • • • Intention to create legal relations Meeting of the Minds Consideration (i.e. exchange of value) All elements must be present Some will be implied Some have rebuttal presumption Do contract have to be in writing? • • • • Only Statute of Frauds (land) Sale of Goods Contracts lasting longer than a year Consumer Protection Legislation the four presented here must be in writing. Intention to create Legal Relations • Rule: Parties must intend to create legal relations Objective test: Would a Reasonable Person think that the parties intended to create a legally binding agreement Some Presumptions in Law If you are in a family or social contract there is a presumption that there is no intent to create a legal relationship If you are in a commercial setting there is a presumption that there is intent to create a legal relationship * But the presumptions can be proven wrong or rebuttable* If you work with a family, you must act as if you are in a legal relationship Meeting of the Minds Must be a meeting of the minds: shared decision to enter into a legal agreement on specific terms and conditions. *The normal process between meeting of the minds is offer and acceptance* Offeror – Person who makes the offer • • • • • Offeree – Person who receives an offer Offeror is the master of the offer • offeror can set (almost) any terms desired Offer = willingness to contract on stated terms Offer must be communicated: • written document • oral statement • conduct Contract created as soon as offer is accepted. Contract does not have to be in writing, unless it falls within one of the special categories (e.g. sale of land). • Risk Management - Once the offeror communicates the offer, a contract comes into existence as soon as reasonable notification of acceptance is given to the offeror. Once the contract exists, neither party can change it unilaterally. • So, making an offer carries risk. What if you change your mind, but the offeree already has accepted? What if you make the offer to more than one person and they all accept at the same time? (Can’t change you mind contract has been formed) Invitation for Treat • Invitation to treat is an indication of a willingness to receive an offer (not an offer) • invitation to treat = willingness to receive offer • person responding to invitation = offeror • person making invitation = offeree • offers vs. invitations to treat • • objective reasonable person test advertisements + catalogues: presumed to be invitations (so as not to overexpose businesses who may have insufficient inventory) Kijiji posts are an example of – Invitation to treat The Life of an Offer • • offer turned into contract by acceptance offer may be terminated before acceptance • revocation • lapse of time • death or insanity • rejection • counter offer • Rule: if any of these things happen, the offer does not exist and can’t be accepted Revocation of Offer • • • Revocation = withdraw by offeror • offeror normally free to revoke at any time with notice to the offeree But what if the offeror promised to “hold the offer open” for a set period of time? Outcome depends on whether the Offeree received a firm offer or purchased an option. • Firm offers: offeror promises to hold an offer open for acceptance for a certain period of time • gratuitous promise to not revoke is unenforceable • despite terminology, firm offers can be revoked at any time • Options • contractual promise to not revoke is enforceable • offeror receives some value in exchange for a binding promise to hold an offer open for acceptance for a specific period of time (or promise is put under seal) Counter offer: • offeree responds to an offer but modifies the terms • effect: rejects old offer and creates new offer • indicates willingness to enter into contract, but on different terms • inquiry isn’t counter offer • original offeree = new offeror • original offeror = new offeree Acceptance • Definition of acceptance: offeree agrees to enter into the contract proposed by the offeror contract created immediately upon acceptance Acceptance by Promise • words • words may be written or spoken • offeror is the master of the offer and can dictate how words must be communicated (e.g. in writing to my office, via email, etc.) • conduct • conduct may signify acceptance (e.g. handshake) • silence • silence alone cannot be acceptance (e.g. receipt of unsolicited goods) • silence plus prior agreement may be acceptance (e.g. book club – receive book every month) When Acceptance Arises at a Distance Instantaneous (= no substantial delay): • The general rule is communication effective when received, where received and only if received. Non-Instantaneous (= substantial delay): • The postal rule provides that the acceptance is effective where and when the offeree sends it (even if not received). Chapter 8 of Law deals with Contract formation Consideration • • • • Contract must be supported by consideration. Law will not enforce gratuitous promises (promises given for free). The main goal of contract law is to enforce bargains. A promise is (generally) unenforceable unless mutual. Consideration can be either a benefit or a detriment • each party must either… • (promise to) provide benefit to someone or • (promise to) suffer detriment to self • E.G (detriment) If someone was building a tower and you didn’t want it built you can pay $1000 for it not to built and you will suffer a detriment to self Element of Exchange • Must move from each party – but not necessarily to other party “I will pay $5000 to your brother if you transfer a car to my sister” $5000 to brother Car to Sister “If the car is not given you can sue the sister which was apart of the contract, only the people in the contract can sue.” Sufficient v. Adequate Consideration Consideration must be sufficient (ANYTHING THAT HAS VALUE IS SUFFICIENT) Consideration does not need to be adequate (Does not need to add up) The law doesn't care if you make a bad deal DOES NOT NEED TO BE AN EQUAL SOMETHING FOR SOMETHING Past Consideration • Consideration involves an exchange of value • the law also requires “mutuality of consideration” • each party must provide consideration in return for the other party’s consideration • consideration must be exchanged under contract • e.g. promise to pay $100 traded for promise of service Past Consideration – the law requires mutuality (each party must provide consideration in return for the other parties’ consideration e.g., IF YOU shovel someone's property as a kind act, then I come over give thanks and say ill pay you $100 for doing it, then I change my mind can he sue no because “past consideration” because the work was done before, and nothing was offered in exchange because something was already preformed. Past consideration = no consideration • Past consideration • consideration given before contract contemplated • no mutuality and therefore no consideration • e.g. landscape company performs work and, afterwards, you promise to pay $100 Pre – Existing Third-Party Obligation • Past consideration • consideration given before contract contemplated • no mutuality and therefore no consideration • e.g. landscape company performs work and, afterwards, you promise to pay $100 Pre-Existing Same Party Obligation • • • promise to perform obligation owed to same party Pre existing same party obligation is NOT valid consideration e.g; page 193 (Gilbert Steel Rule) • E.g. I have a contract with you and you are starting a new yoga business and decide to pay me 10k to ship 1000 yoga pants to me if you tell me your having issues on the delivery date and will require an extra 5k to do the same job and I agree then you deliver the pants on the day of and i pay you 10k I am not obligated to pay you because we have a contract already and he is legally obliged to deliver yoga pants to me for 10k Promise to Forgive Existing Debt • Unenforceable because no new consideration • Some exceptions….(next slide) • • • promise under seal (= special mark on document) (ask instructor to explain) promise exchanged for new benefit • payment early ($200 in June instead of July) • payment in different form (cash instead of cheque) • payment and new benefit ($200 plus a book) statute (not all jurisdictions) (Ontario, Mercantile Law Amendment Act) • promise enforceable if part payment actually received and when expressly received by the creditor for that purpose A promise under seal is: If you say I promise to do something and this promise is made under seal the other party does not have to give you anything in return. And it can be a gratuitous gift. Under seal you will be obligated to preform anything even if there is no exchange because it is under seal. Privity of Contract • Privity is the relationship between contractual parties • Parties: people who created contract, provided consideration • General rule: only parties to a contract can sue or be sued under the contract • Stranger (or third party): someone without privity • cannot sue or be sued under contract • irrelevant that stranger is beneficiary of contract • “I will pay $5,000 to your sister if you give me your car” • Sister cannot sue if you give the car to X Exceptions to Privity of Contract • assignment: a process of transferring contractual rights to a third party. • the assignor transfers her rights under the contract to the assignee; • debtor now owes obligation to the assignee Chapter 9 of Law is Terms of the Contract Pre-Contractual Statements Contractual Term: Meant to be included in the contract (If untrue, it is a breach of contract) Pre-contractual representation: Meant to convince the hearer to enter into the contract (If untrue, it may be a tort.)- Tort of Deceit) A Puff: If untrue, there are no legal consequences. Reasonable people do not rely on puffs. • • “This car outranks and outpaces all others in its class!” e.g of Puff “This car has leather interior.” E.G of Fact Representations • • • statements made to induce contract do not become contractual promises may be actionable if they falsely induce contract • actionable if misrepresentation (i.e. if pre-contractual representation is false) Misrepresentations • • • a statement of an existing fact (i.e. statement about the past or present) … that is false when made… may be actionable if it induced a contract Contractual Terms • • • Express Terms - terms expressly included by parties oral agreement • primarily a question of evidence: if conflict, whose version is more believable? • must prove what words were spoken written agreement • written terms are easier to prove: encourage parties to contemplate terms more carefully Implied Terms (Ask prof) • A contract may also contain implied terms • express terms may not fully reflect intention of parties • Parties’ remaining intentions may be implied by law • common law (implied by court) • statutory law (implied by statute) (A court will not generally imply a term unless that term is necessary to implement the presumed intention of the parties) Methods of Interpretation 1. Literal approach • Words are given their plain and ordinary meaning 2. Contextual approach • Intentions and surrounding circumstances considered 3. Contra proferentem • Ambiguities interpreted against person who wrote the clause Standard Form Agreements Standard Form Agreement = Mass produced documents usually drafted by a party who is in an economic position to offer certain terms on a “take-it-or-leave-it” basis. Examples: Mortgage - A bank does not want to negotiate a completely new contract every time it lends money to a customer Advantages ✔ Using a model that has been refined and tested over the years reduces risks ✔ It saves time and cost of negotiating new terms with every new customer Disadvantages ✔ Take-it-or-leave-it basis: Customers do not have opportunity to bargain for better terms. ✔ Few customers actually read and understand them ✔ From this perspective, standard form agreements may lack the consensus ad idem Signed Standard Form Contracts • • • General Rule: People who sign standard form agreements are bound by all of the terms expressed in them (even if not actually read or understood them) Possible exception: If there is no reasonable chance to read • e.g.: Customer required to quickly sign the document without enjoying a reasonable opportunity to study its terms Standard form agreements may take the form of a ticket or a receipt (terms are incorporated into the contract by printing them on the back of a ticket issued to customers) Standard Form Ticket Contracts (No Signature) • Standard form agreements may take the form of a ticket or a receipt (terms are incorporated into the contract by printing them on the back of a ticket issued to customers) • Terms often printed on tickets and receipts • Ski tickets Enforcement depends upon notice • Reasonable notice must occur before contract is created • Heavier burden for unusual or harsh terms • Perhaps no burden for obvious terms Enforcement depends upon assent • Signature is best evidence of acceptance • Generally effective even if term not read • • • *The enforcement of the terms in a ticket contract depends upon reasonable notice to customers** • Risk management and Standard Form Contracts: • use well tested contracts with proven record of use over time • use clear, unambiguous language for onerous terms • consider using plain language throughout contract • for onerous and unusual terms • ensure staff gives reasonable notice to customers • require customers to indicate agreement to be bound (e.g. initials) Exclusion Clauses • • Standard form agreements usually contain exclusion clauses, that customers are asked to accept An exclusion clause is a contractual term that seeks to protect one party from various sorts of legal liability E.g. clause may limit or eliminate liability. For example: • may exempt party entirely • “X is not liable for any loss or damage” • may exclude types of liability • “X is not liable for carelessly caused damage” (but would be liable if intentionally caused, etc.) • may reduce or eliminate damages “X is not liable for more than $500” • Exclusion Clauses Four requirements for enforceability: 1. Term must be clear and unambiguous • Ambiguities interpreted against drafter 2. Reasonable notice to affected party • Heavier onus for unusual or harsh terms 3. Assent by affected party • Signature is best evidence of acceptance of clause 4. Usually not enforced if unconscionable or unfair Boilerplate Clauses (Chapter 11) Force Majeure Clauses "Force Majeure Event" means an event, or a series of related events, that is outside the reasonable control of the party affected (including power failures, industrial disputes affecting any third party, changes to the law, disasters, explosions, fires, floods, riots, terrorist attacks and wars). Chapter 10 of Law Defects to Get Out of Contract Misrepresentation • “Misrepresentation is a false statement of an existing fact that causes recipient to enter into a contract” 1. a statement of an existing fact… 2. that is false when made… 3. may be actionable if it induced a contract • • Opinions, predictions, or statement of law are not statements of fact Opinion vs. Fact = (car is reliable v. the mechanic examined and said the car is reliable) When is it not a statement? i.e. silence • General rule: parties are not required to disclose material facts during negotiations, unless: • Silence distorts a previous assertion • A statement is a half-truth • Contract being negotiated is of utmost good faith • A special relationship exists between the parties • A statutory provision requires disclosure, or • Facts are actively concealed • If any of this happens, it will be a misrepresentation Inducement • In order to be a “misrepresentation”, the false statement of fact must have induced deceived party to enter into the contract Legal Consequences of Misrepresentation • Potential remedies for misrepresentation: • rescission • termination of contract ab initio • restitution • restoring parties to original position • damages • monetarily reparation of losses Note: Rescission and restitution are usually combined, and apply to all kinds of misrepresentations, namely: innocent, fraudulent and negligent. Damages apply only to fraudulent and negligent misrepresentations, not innocent misrepresentation. • Potential remedies for misrepresentation: • rescission • termination of contract ab initio • restitution • restoring parties to original position • damages • monetarily reparation of losses Rescission: • discretionary equitable remedy • terminates contract ab initio • contract treated as if it never existed • parties restored to pre-contractual status • often accompanied by order for restitution • available for all types of misrepresentation • innocent, negligent, fraudulent Restitution: • restoration of money, land, or goods • available for all types of misrepresentation • restitution may be denied • if restoration is impossible in specie • e.g. paint may already be applied to house • restitution may be denied if third party rights • e.g. house may already be re-sold to honest purchaser • restitution may be denied if contract “affirmed” • e.g. purchaser may already have acted as owner Types of Misrepresentation Innocent Misrepresentation: • defendant innocent of wrongdoing • no knowledge of falsity of statement • no carelessness in making statement (was careful in making statement) • remedy • rescission (law of contract) • possibly restitution • no damages (no tort) Negligent Misrepresentation: • Tort of Negligent Misrepresentation (covered in Chapter 6) • defendant guilty of negligence (i.e. statement made in careless or unreasonable manner) • statement made in careless disregard of facts • statement is false and induced creation of contract • remedies • rescission (law of contract) • possibly restitution • damages (tort of Hedley Byrne) Fraudulent Misrepresentation: • a statement or misleading silence • known to be false, or • made with no honest belief in its truth, or • made recklessly without regard to the truth • remedies • rescission (law of contract) • possibly restitution • damages (tort of deceit) Incapacity to Contract • • Cannot enter into a contract unless have the legal power to give consent Capacity is the legal power to give consent Minors: • most minors’ contracts are voidable at the option of the minor • voidable: minor is entitled to avoid the obligations that the contract created • protection against exploitation and immaturity • process of avoidance • minor has option to accept or avoid contract (if accept: contract becomes binding) • must choose soon after reaching majority • must return benefits if avoid contract (ex: if rent stereo equipment for 12 months, can avoid it after 1 month, not pay rent for 11 months, but must also return the stereo equipment) Mentally disabled persons: • Regardless of age, a person may lack capacity because of a deficient intellect • judicially declared mentally incompetent • total incapacity to contract: contracts are void and cannot be enforced at all • mentally incompetent but not judicially declared • • even if no court or judicial declaration, a person may still lack the mental capacity to contract at the time the contract is formed most contracts voidable if other party knew of disability (in case of minors, knowledge of age is not a criteria) Intoxicated persons: • rules are similar to those for mental incapacity • an otherwise capable person may enter into a contract while intoxicated. The agreement is voidable if 2 conditions are met (i.e. intoxication may render contract voidable if): • too drunk to understand circumstances and • other party aware of extent of intoxication • voidable contract must be avoided promptly once the person becomes sober (otherwise, contract will be deemed to be “affirmed”) • incapacity often balanced against fairness UNFAIRNESS DURING BARGAINING DURESS Problems with the circumstances around the creation of the contract • Different kinds of duress that may allow the “innocent party” not to perform and/or recover any payments made under the agreement • duress = illegitimate threat of harm • contract voidable at victim’s option • duress of person • threat of physical harm to party or loved one • duress of goods • threat to detain, damage, or destroy goods Economic Duress - economic duress occurs when a person enters into a contractual arrangement after being threatened with financial harm • harder to determine economic duress UNDUE INFLUENCE (Unfairness) Problems with the relationship between the parties • Even if the elements of Duress cannot be established, may get relief under the equitable principles of Undue Influence • Duress occurs when the contract if formed • Undue Influence focuses on the power relationship between the parties • undue influence is the abuse of a relationship in order to influence someone and induce an agreement - Influence: the ability of a person to dominate the will of another, through manipulation, coercion or subtle abuse of power • • • • • Undue influence = overpowering will duress is external threat of harm undue influence is internal manipulation • manipulation may be deliberate or inadvertent • “innocence” is no defence • rules depend upon parties’ relationship pre-existing fiduciary relationship no pre-existing fiduciary relationship • Fiduciary relationship occurs when a person is in position of dominance over another • e.g. physician-patient, law-client, priest-penitent • No Fiduciary Relationship - Party alleging undue influence must prove it • there is no presumption of undue influence • difficult proof if no imbalance in power UNCONSCIONABILITY (Terms) Problems with the agreement itself • unconscionable bargain is one that… • no fair-minded person would offer • no right-minded person would accept • • Unconscionable Transaction, cont’d: Legislation (e.g. Consumer Protection Act) • disclosure requirements • cooling off periods • • prohibited use of unfair terms, such as exclusion clauses broad discretion to the court to render harsh or unconscionable agreements ineffective Illegality (Ask prof) • • • • contract may be void for illegality statutory • illegal to transact contrary to regulatory statute • e.g. apples cannot be sold unless graded • interest rate violating Criminal Code common law • illegal to contract to commit crime or tort • e.g. repentant hit man cannot be sued for breach of contract • Corrupt politician, lobbyist cannot recover $ public policy • illegal to contract contrary to public policy • a vague and occasionally abused head of judicial power Restraint of trade: • prohibition on carrying on business • may be limited temporally (e.g. two years) • may be limited geographically (e.g. 200 kms) • common to certain types of contracts • eg keep ex-employee from competitor • eg keep store vendor from new establishment • burden to prove that restraint is reasonable • restraint tested against total circumstances Restraint of trade, cont’d: • will be presumed contrary to public policy unless the party seeking to enforce it can demonstrate that the restriction is reasonable • prohibiting an owner selling a convenience store to you from opening or operating another convenience store within a six-block radius is reasonable, whereas a nation-wide prohibition is not • is often found in employment contracts • requiring an employee to promise not to use trade secrets or processes acquired during employment in any other business capacity Slide 10 has practice questions Discharging a Contract 11 When Do your Contractual Obligations • some contracts end in avoidance or rescission • treated as if they never existed (Chapters 9 & 10) • most contracts end in discharge • parties relieved of the need to perform (or do anything more) in the future Discharge: • When a contract has been discharged, it means that it has been performed and is no longer a pending, legal obligation • A contract is discharged when the parties are relieved of the obligation to do anything further under the contract • To discharge a contract is to end the obligation by agreement or by carrying it out Defect Problem • • The formal requirements for create a contract are met; the parties are not fighting about the terms, either. However, now A wants out. A will try to avoid the contract by pointing to a problem with the wider circumstances when the contract was formed: a misrepresentation; capacity; unfairness; or illegality. Discharge Problem • The formal requirements for create a contract are met; the parties are not fighting about the terms, either. • Something happens during the life of the contract (e.g. performance or a frustrating event). • After the event, A wants to know, “Can I walk away, given this event?” Four Ways to Get to Discharge Discharging Contract through Performance • • • • The most common form of discharge is discharge by performance A contract can be discharged through the performance of its terms (obligations) Performance = when the parties fulfill all of the obligations under the contract Usually, contract has to be performed exactly as required - otherwise, breach Time of performance: • time of performance not usually grounds for discharge • • time usually not of the essence (damages for lateness) can usually perform late - even if contract sets a specific date - and discharge the contract, but could be held liable for late delivery (e.g. car rental) IF someone does not deliver pants on time you can sue for damages, but you cannot be discharged from your own contractual obligations. Even if they are late, you still have to pay • • may change by contract (boilerplate “time is of the essence” clause) or notice if no time specified, then must be performed within a reasonable time (question of fact). Tender of performance: • When performance involves provision of goods or services (rather than money) obligations must be exactly performed • • Exception to Rule: if contract is substantially performed Performance generally satisfies the contract, but incomplete in some minor way, can treat contract as discharged • Entitled to contractual damages for defect • Exception to Exception - difficulties with entire contracts: no payment due unless all work performed • Everything in the contract must be performed or the contract can be discharged and this is possible by stating this in the contract. If you deliver wrong quantity the party who has to pay is not discharged, they still have to pay unless there is an entire agreement clause. But you can sue for breach of contract and collect damages. Discharge by Agreement Parties can agree to end their contractual agreement. 1) Give fresh consideration (accord & satisfaction) Example: Parties agree (accord) that one party will give the other some new consideration (satisfaction) to give up right to performance. • Arises where one party has completed their contractual promise and agrees to discharge the second party from further performance if the second party gives some new consideration. 2) Make a contract under seal (release) Example: Parties agree (under seal) to ‘release’ each other from their obligations (without fresh consideration) • Arises where one party has completed their contractual promise, and agrees to discharge the other party from further performance of the contract. Example of both cases in Chapter 11 slide 21-23 Discharge by Breach When there is a breach (failure to fulfill contractual promise) when can the innocent party discharge? A: Two conditions 1. If the breach substantially deprives the innocent party of the expected benefit of the agreement; and 2. It depends upon type of term breached • condition: substantial term • warranty: lesser term • intermediate: hybrid term The innocent party only has the right to discharge if the other party has breached a condition, i.e., if the other party has done something that substantially deprives the innocent party of the benefit of the contract • • breach = failure to fulfill contractual promise precisely as promised not every breach will result in the discharge of a contract • contract may be discharged for breach Breach of Condition v. Warranty • A term is a condition if innocent party would be substantially deprived of expected benefit of contract due to its breach (ex: ask for a large moving truck, get a minivan) • innocent party generally has option • affirm contract and claim damages; or • discharge contract and claim damages Warranty: relatively less important term Sue for damages • A term is a warranty if innocent party would NOT be substantially deprived of expected benefit of contract due to its breach (ex: ask for a fully cleaned large moving truck, get a dirty large moving van instead) • innocent party has no significant option • must affirm contract, no option to discharge agreement • may claim damages (e.g. cost of cleaning the truck before use) Effect of Discharge – ask for clarification • parties relieved of need to perform in future • contract not wiped out altogether • Compare with contracts that are rescinded or voided where contracts are treated as if they never existed • parties are relieved from their obligations to perform their primary obligations • but contract still effective for some purposes • e.g. exclusions clauses, liquidated damages When Contract is Frustrated [when it looks like a breach but isn’t] • • • Test: Contract is frustrated when a (faultless) event makes performance impossible or radically undermines its purpose • Does not apply if performance just more difficult or expensive Example: After contract is signed, beach house burns down Governing rule: doctrine of frustration applies only if neither party is responsible for the frustrating event • if X carelessly burns down the beach house that X rented on the 1st night of a week long rental, X is responsible – X bears the loss • • • doctrine of frustration tries to strike a fair balance among the parties, but parties can agree to carry risk contract may determine consequences of event: “force majeure” clause (“irresistible force”) states which party bears the hardship if subject matter of the contract is destroyed or unforeseen event occurs • Insurance default rules at law and under statute • statutory in Alberta, British Columbia, Manitoba, Newfoundland and Labrador, New Brunswick, Ontario, Prince Edward Island Chapter 12 Remedies Rule: you are entitled to damages for breach of contract (money) not performance as remedy Exceptions: you can sometimes get performance • Equitable relief • specific performance and injunctions Type Description Example Expectation Victim placed as if contract performed Give me what I expected to get! Reliance Victim placed as if contract never arose Give me back what I lost! Account of Profits Defendant placed as if breach never occurred Give me what you never should have received! Nominal Symbolize wrongdoing without loss Give me a small token Liquidated Contract sets the quantum of damages Give me what we agreed I’d get on breach Punitive Intended to punish outrageous conduct Give me enough to hurt you. Expectation Damages • expectation damages • plaintiff receives expected benefit of contract • plaintiff does not receive performance • plaintiff receives value of performance forward-looking damages • plaintiff monetarily placed as if contract performed • “Give me what I expected to get!” • integrity of promises protected • compare with Tort Law – backward looking; placing the plaintiff in the position it was in before the wrongdoing Calculation of Expectation Damages** • calculation of expectation damages: • expected benefits minus expected costs • Three examples on the following slides… Remember: expected benefits minus expected costs Issues for Expectation Damages, cont’d 1. difficulty of calculation • Awarded even if calculation is imprecise (e.g. damages for lost chance in beauty contest) • Not awarded if calculation is totally speculative (e.g. value of treasure in supposedly sunken ship) 2.alternative performance • Difficulty in calculating expectation damages may arise if the contract allows the defendant to perform in a variety of ways: • e.g. if the contract allows an employer to terminate an agreement in one of the following ways: • Right to terminate contract at any time, without notice, if employee acts in a manner“detrimental to the reputation” of the company • Right to terminate contract, at any time after 18 months, by giving three months’ notice • Damages are calculated on the basis of the least onerous option – “what is the minimum acceptable performance?” Issues for Expectation Damages • • 3. Usually fairly easy to calculate expectation damages Complications in calculation of damages in some situations: 1. difficulty of calculation 2. alternative performance 3. intangible losses and emotional distress 4. remoteness 5. mitigation of damages intangible losses and emotional distress • • • • Intangible loss: no apparent economic value disappointment, anger, frustration, sadness Damages for emotional distress traditionally denied rationale: difficult to assess value, and contracts are commercial arrangements for money not feelings • Now usually available if peace of mind was expected contractual benefit (vacation/dog died). • Emotional distress treated in same manner as other types of loss 4. Causation and remoteness • In order to recover losses: • loss must in fact be caused by breach • loss must not be legally remote from breach • Loss is not remote if either: • defendant knew or should have known of risk of loss • Test applied at time contract is created (no hindsight) • Remoteness as a rule of fairness • contract price reflects exposure to risk • defendant not paid to accept unforeseeable risks • Risk management • before entering contract, ensure other party aware of any unusual losses you may suffer as a result of contractual breach UNLESS you are prepared to accept such risk yourself • • The party that breached the contract are not responsible for damages if they are to remote E.x. of remoteness: if you had a driver scheduled to drive you to the airport can sue her for flight price replacement Equitable Relief – Injunction • Court order to obey contractual prohibition “Don’t do what you promised not to do!” Injunctions v. Specific Performance Injunction • • “Don’t do what you promised not to do!” Larger scope of availability because it poses a smaller restriction on defendant’s freedom • “You can do anything other than the prohibited act” Specific Performance • • “Do what you promised to do!” Narrower scope of availability because it poses a larger restriction on the defendant’s freedom • “You MUST do this required act!” Exclusion Clauses • • • contractual term that excludes or limits liability for breach of contract (see Chapter 9) parties are generally free to reject or modify the remedies that are generally available for breach of contract: allocation of risk exclusion clauses allowed by freedom of contract • court nevertheless protects consumer • clause should be unambiguous, read narrowly against drafter • clause must be reasonably drawn to consumer’s attention • must prove other party agreed to exclusion clause • exclusion clause cannot apply to fundamental breach