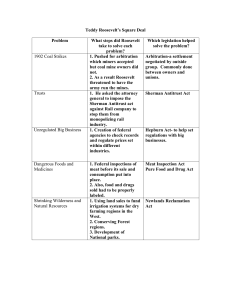

THE U.S POLICY TO DEAL WITH MONOPOLY The U.S have broad laws that protect consumers and regulate how companies operate their businesses. The goal of these laws is to provide an equal playing field for similar businesses that operate in a specific industry while preventing them from gaining too much power over their competition. These are called antitrust laws. 1. What are Antitrust Laws: Assume that Coca-Cola and PepsiCo wanted to merge, the deal would be closely examined by the federal government before it went into effect. The lawyers and economists in the Department of Justice might decide that a combination of two large soft drink brands can greatly affect the wellbeing of the U.S as a whole. Since customers can no longer any desirable substitutes, U.S soft drink market will be substantially less competitive. Therefore, the Department of Justice would challenge the merger in court, and if the judges agreed, the two companies would not be allowed to merge. This power to limit the monopolization of private industries derives from the antitrust laws. According to Investopedia, antitrust laws, also referred to as competition laws, are statutes developed by the U.S. government to protect consumers from predatory business practices. Antitrust laws refer broadly to the group of state and federal laws designed to ensure that businesses are competing fairly. Antitrust laws exist to promote competition among sellers, limit monopolies, and give consumers options. They ensure that fair competition exists in an openmarket economy. These laws have evolved along with the market, vigilantly guarding against would-be monopolies and disruptions to the productive ebb and flow of competition. Antitrust laws are applied to a wide range of questionable business activities, including but not limited to market allocation, bid-rigging, price-fixing, and monopolies. If these laws didn't exist, consumers would not benefit from different options or competition in the marketplace. Furthermore, consumers would be forced to pay higher prices and would have access to a limited supply of products and services. In this essay, we will focus on the main antitrust laws in the United States. The core of U.S. antitrust laws was created by three pieces of legislation: the Sherman Antitrust Act 1890, the Federal Trade Commission Act - which also created the FTC - and the Clayton Antitrust Act. 2. Sherman Antitrust Act 1890 The first and the most important of these laws was the Sherman Antitrust Act, which Congress passed to reduce the market power of the large and powerful “trusts” that were viewed as dominating the economy at the time. The Sherman Antitrust Act - proposed in 1890 by Senator John Sherman from Ohio - was the first measure passed by the U.S. Congress to prohibit trusts, monopolies, and cartels. The Sherman Act also outlawed contracts, conspiracies, and other business practices that restrained trade and created monopolies within industries. For example, the Sherman Act says that competing individuals or businesses can not fix prices, divide markets, or attempt to rig bids. The Act also laid out specific penalties and fines for violating its rules. Violations against the Sherman Anti-Trust Act can have severe consequences, with fines of up to $100 million for corporations and $1 million for individuals, as well as prison terms up to 10 years. However, we need to understand that the Act was not designed to prevent monopolies that were achieved by honest or organic means but to target those monopolies that resulted from a deliberate attempt to dominate the marketplace. The Sherman Antitrust Act is broken into three sections. Section 1 defines and bans specific means of anticompetitive conduct. Section 2 addresses the end results that are by their nature anticompetitive. As such, Sections 1 and 2 act to prevent the violation of the spirit of the law while still remaining within its bounds. Section 3 extends the guidelines and provisions in Section 1 to the District of Columbia and U.S. territories. 3. The Federal Trade Commission Act The Federal Trade Commission (FTC) is an independent agency of the U.S. government that aims to protect consumers and ensure a strong competitive market by enforcing consumer protection and antitrust laws. Its principal purpose is to enforce non-criminal antitrust laws in the United States, by preventing and eliminating anticompetitive business practices, including coercive monopoly. The FTC also seeks to protect consumers from predatory or misleading business practices. The Federal Trade Commission (FTC) was established in 1914 by the Federal Trade Commission Act, as part of the Wilson administration's trust-busting efforts, trust-busting being a significant concern at the time. It was tasked with enforcing the Clayton Act, which banned monopolistic practices. The FTC continues to discourage anticompetitive behavior through the Bureau of Competition, which reviews proposed mergers together with the Department of Justice. The FTC’s regular activities include investigating reports of fraud or false advertising from consumers, business, the media, congressional inquiries, or pre-merger notification filings. The FTC may investigate a single company or an entire industry. If an FTC investigation reveals unlawful activities on the part of one or more companies within an industry, they can seek voluntary compliances via consent order, initiate federal litigation, or file an administrative complaint. Traditionally, such a complaint would be heard in front of an administrative law judge (ALJ) and may be appealed to the U.S. Court of Appeals and then the Supreme Court. The FTC also deals with complaints of unfair business practices such as scams and deceptive advertising. The Bureau of Consumer Protection conducts investigations into alleged abuses, carries out enforcement actions and provides educational materials to consumers. The Bureau of Consumer Protection is in charge of the U.S. National Do Not Call Registry. The Bureau of Economics provides research support to the other two departments of the FTC, including analysis of FTC actions' potential effects. According to the Supreme Court, violations of the Sherman Anti-Trust Act also violate the Federal Trade Commission Act. Therefore, even though the FTC cannot technically enforce the Sherman Antitrust Act, it can bring cases under the FTC Act against violations of the Sherman Antitrust Act. 4. The Clayton Antitrust Act 1914 The third Act is the Clayton Antitrust Act. This Act is a piece of legislation passed by the U.S. Congress in 1914. The act defines unethical business practices, such as price-fixing and monopolies, and upholds various rights of labor. The Federal Trade Commission (FTC) and the Antitrust Division of the U.S. Department of Justice (DoJ) enforce the provisions of the Clayton Antitrust Act, which continue to affect American business practices today. The Clayton Antitrust Act amends and strengthens the Act of Sherman. Although the Sherman Act helped a lot in controlling monopolies, the language was deemed too vague. This allowed businesses to continue engaging in operations that discouraged competition and fair pricing. Therefore, while the Clayton Act continued the Sherman Act's ban on anticompetitive mergers and the practice of price discrimination, it also addressed issues the older act didn't cover by outlawing incipient forms of unethical behavior. For example, while the Sherman Antitrust Act made monopolies illegal, the Clayton Antitrust Act banned operations intended to lead to the formation of monopolies. 5. Drawbacks of Antitrust Laws Antitrust laws have costs as well as benefits. Sometimes companies merge not to reduce competition but to lower costs through more efficient joint production. These benefits from mergers are sometimes called synergies. Synergy is the concept that the combined value and performance of two companies will be greater than the sum of the separate individual parts. Synergy is a term that is most commonly used in the context of mergers and acquisitions (M&A). Synergy, or the potential financial benefit achieved through the combining of companies, is often a driving force behind the merger. For example, many U.S. banks have merged in recent years and, by combining operations, have been able to reduce administrative staff. If antitrust laws are to raise social welfare, the government must be able to determine which mergers are desirable and which are not. That is, it must be able to measure and compare the social benefit from synergies with the social costs of reduced competition. Critics of the antitrust laws are skeptical that the government can perform the necessary cost-benefit analysis with sufficient accuracy. 6. Altria-Juul E-Cigarette Antitrust Violation On December 20, 2018, Altria finalized the acquisition of a 35% stake in JUUL Labs, an ecigarette company based out of San Francisco, California, for $12.8 billion dollars. Altria also allegedly agreed not to compete with JLI and to provide JLI valuable retail shelf space in the ecigarette market. Through this agreement, JLI was able to maintain its dominance in the e-cigarette market and earn monopoly profits. Altria then shared these profits through its ownership stake in JLI. This deal was always going to face significant antitrust headwinds from regulators. Not only is the transaction an agreement by competitors to coordinate efforts and not compete, but it also involves a legacy firm obtaining sought-after market dominance by purchasing a large share of an effective market disruptor. The Federal Trade Commission is paying particularly close attention to these types of transactions, as demonstrated by its recent challenge of the merger between Harry’s, Inc. and Edgewell Personal Care. Unsurprisingly, on April 1, 2020, the FTC filed an administrative complaint to unwind the transaction. On the heels of this announcement, a consumer class action was filed in the U.S. District Court for the Northern District of California on April 7, 2020 (Douglas J. Reese v. Altria Group, Inc. and Juul Labs, Inc., 3:20-cv-02345-WHO, N.D. Calif.). Altria is one of the world’s largest tobacco companies, with popular brands like Marlboro and approximately 25.1 billion dollars in revenue in 2019. But fears over the health effects of nicotine, social stigma, and laws banning smoking in public places cut into Altria’s success in the traditional U.S. cigarette market. Due to declining sales, Altria attempted to enter the e-cigarette market in 2013 through its subsidiary Nu Mark LLC, and products such as the MarkTen and MarkTen Elite. As competitors, Altria and Juul monitored each other’s e-cigarette prices closely and raced to innovate, leading to lower prices and higher quality products for consumers. But Altria was unable to effectively compete against sleeker startups like Juul, which quickly grabbed more than 70% of this market. JLI accomplished this by developing a chemical breakthrough that increased the speed of nicotine delivery, and offering a stylish device and innovative tobacco flavors. Altria dealt with this competitive threat by purchasing a substantial ownership interest in Juul. In return, Altria agreed to not compete in this market for at least six years. Juul also granted Altria the right to appoint a non-voting observer to Juul’s Board of Directors. If Altria converts its shares to voting stock, then Altria would be able to appoint three additional members to Juul’s Board. In its complaint, the FTC alleges that Altria’s acquisition of Juul shares and the associated agreements together constitute an unreasonable restraint of trade in violation of Section 1 of the Sherman Act and Section 5 of the FTC Act, and substantially lessen competition in the e-cigarette market in violation of Section 7 of the Clayton Act. The Commission voted unanimously (5-0) to issue the administrative complaint. On April 1, 2020, the Federal Trade Commission (“FTC”) filed a complaint against Altria and Juul, alleging their agreement violated federal antitrust law. The FTC alleged that Defendants’ conduct unreasonably restrained competition, and that the agreement substantially lessened competition in the U.S. e-cigarette market by eliminating competition between Altria and Juul on price, innovation, promotional activity, and shelf space. References: “Sherman Antitrust Act 1890” - Investopedia “Federal Trade Commission (FTC)” - Investopia “Clayton Antitrust Act 1914” - Investopedia “Altria-Juul E-Cigarette Antitrust Litigation” – Joseph Savari Law Firm “Private Antitrust Action Follows FTC Complaint Against Altria and Juul Over E-Cigarette Deal” – The National Law Review