Policy Bazaar Case Study: Vision, Mission, and Market Analysis

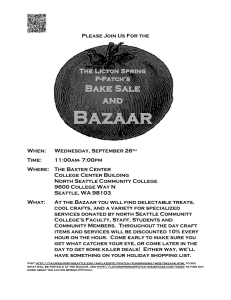

advertisement

POLICY BAZAAR CASE STUDY GROUP- 2 Q1. Analyse vision, mission and objectives of Policy bazaar? Vision: - A healthy and well-protected India Policy bazaar has a vision that every Indian has social security purchased through insurance. They got good digital servicing and claim and they have to keep moving till that is achieved. Mission: - Building a safety net for households in India. In 2008, insurance customers in India faced a slew of issues. Product information was lacking, openness was poor, mis-selling was prevalent, insurance policies were lapsed at a high rate, and consumers had a general apathy toward the insurance industry. Policy surrenders fees benefited insurance companies, and the sector as a whole was in a state of flux. That's when a small group of people with no prior insurance experience began reimagining what the industry could be. They envisioned a site where customers could get completely transparent insurance information as well as the flexibility to explore and compare insurance options to get exactly what they needed. In a sophisticated product like insurance, there should be a place where all communications are kept so that there is a clear audit trail of who said what. All customer claims and services were processed through this site, which acted as a common service layer. This eclectic collection of people set out on their path to what is now Policybazaar.com with this major goal in mind. How does PolicyBazaar’s mission compare with that of its competitors? BankBazaar, CoverFox, EasyPolicy, PolicyAdvisor, Acko and turtlemint BankBazaar: Vision: Making BankBazaar the go-to brand for investors and loan aspirants. Mission: The mission of Bank Bazaar is to access people with right financial products among all the multitude choices. easyPolicy: Vision: Our vision is to make the right insurance reachable till the last person in our country. To accomplish this, we recognise that we must care for the people who will make it possible. With flat hierarchies and an open, friendly, and collaborative work atmosphere, the only thing the team needs to focus on is providing the maximum value to our clients. Mission: to simplify the insurance world for their users and make it understandable and accessible to everyone Policyadvisor: Vision: Insurance buying is opaque and stressful. At PolicyAdvisor, we’re building a new kind of insurance advisor, built for the way you live. We combine modern technology, intuitive design and human expertise to make insurance buying simpler, straightforward and stressfree. What modifications would you recommend in PolicyBazaar’s mission and vision statements in order to align them with future objectives of the company? New Mission: To achieve acceptability through continued elevation of services provided. New Vision: To safeguard the interests of people by bringing in transparency, accountability and convenience in an industry often mired by negativities. Q2. Assess the external business environment to determine uncertainties, industry rivalry and market forces that impact Policy Bazaar’s business. Uncertainties associated with Policy Bazaar’s business 1) India's technological adoption is slower than expected, according to industry reports: Our digital insurance/credit underwriting growth predictions for Policy Bazaar are predicated on the notion that as the number of digitally native millennials/GenZ population grows, so will the number of tech-enabled transactions. 2) However, if the company's ability to scale up and report sustainable profits/free cash flow is harmed or if tech-enabled transactions penetration in India does not materialize/or the rate is significantly lower than forecasted by industry reports, the company's ability to scale up and report sustainable profits/free cash flow may be jeopardised. 3) Conflicts of interest: In August of this year, HDFC Ergo announced plans to delist goods from third-party brokers while investing extensively in its own online platform. As brokers continue to gain negotiating strength for higher margins, other larger businesses are likely to follow suit, reducing the number of items available. 4) Regulatory risks: Regulators continue to scrutinise the insurance industry in terms of commissions, distribution models, capital sufficiency, and other considerations, and there are potential regulatory headwinds. 5) Multi-year motor insurance policy bundling: According to media reports, motor comprehensive insurance will be bundled as a 5-year product at the time of car purchase. While auto dealers have complete control over the transaction upon purchase, preventing any business from reaching marketplaces like PolicyBazaar, this bundling will also eliminate annual renewal opportunities, potentially limiting business growth. Industry rivalry and market forces that impact Policy Bazaar’s business: The online insurance marketspace is very dynamic and highly competitive. Insurers are now compelled to ensure their pricing is competitive and are able to show value for money to the consumer in order to remain relevant. By increasing levels of transparency in product features, cost and services, digital channels are levelling the playing field. Coverfox and Acko who own the insurance and are full-fledged online insurance brokers are making the space even harder to compete. To rise to the competitive forefront, market players are rethinking and realigning their business models and strategies as per customer needs and the expectations of future target groups who soon will be their new consumers in few years. Also, with the decline in relevance of traditional products with decreasing number of customer touchpoints, it is utmost important to innovate the existing insurance product/service offerings to meet changing customer behavior and needs. Among the rest 50% the market is very much fragmented, only 20% of the consumers rely on the online aggregators such as PolicyBazaar, theses 20% are shared among all the players in the market. It is thus critical for PolicyBazaar to develop a future-ready strategy and continue to innovate by having a prudent look at these macro-level disruptions happening in the Indian insurance market and changing consumer behavior. SWOT ANALYSIS: Policy Bazaar's Advantages: True Innovation: For over a decade, Policy Bazaar has been able to achieve this. Not just for the internet business, technology must assist in identifying and meeting a variety of specialised insurance demands. This will ensure that insurers create user-friendly websites and that transactions run efficiently. Various Services: PolicyBazaar's customer portal provides a variety of services to consumers, including the ability to save time and even purchase policies online. Customers can now use the internet to compute premiums, bonuses, taxes, check the status of their policies, calculate loan amounts, download forms, and pay premiums. Weaknesses of PolicyBazaar Employee Diversity: Locals make up the majority of PolicyBazaar's staff, with only a few individuals from other ethnic groups. Employees of various ethnic backgrounds find it difficult to adjust to the workplace due to a lack of variety, resulting in a loss of talent. Frequently slow to respond to changing requirements: Many consumers presently have doubts about their plans and insurances, and PolicyBazaar has been unable to respond to them in a timely manner. Low Current Ratio: The firm's current ratio, which indicates its capacity to satisfy short-term financial obligations, is lower than the industry average. This may indicate that the company will experience liquidity issues in the future. Opportunities for PolicyBazaar: Social Media: Major corporations are relying on such techniques to stay relevant, and they're looking for specialists to help them. If you're interested in learning more, check out our social media marketing course. Technology Advancement: Technology has several advantages in a wide range of industries. Operational costs can be reduced by automating processes. Technology enables for more accurate customer data collection and improves marketing efforts. Lower Cost: As the market evolved and competition grew, PolicyBazaar turned to digital distribution. The average cost of distribution services has decreased significantly as a result of these developments. Threats of PolicyBazaar: Competition has increased in the business, placing downward pressure on prices. It is possible that the policy market will lose market share if it does not respond to pricing changes. Government Regulation: Government rules on areas such as health care, mould, and terrorism have the potential to drastically alter the insurance landscape. Smaller agencies and insurance businesses will be badly hit by rising costs and dwindling profit margins. Newcomers: A number of new businesses have entered the industry and are acquiring market share by displacing older firms. PolicyBazaar is in jeopardy because these newcomers have the potential to usurp its custodianship. Macro environment - Factors affecting PolicyBazaar at a national or global level a change in India's macroeconomic climate, such as an increase in interest rates or inflation; Any exchange rate fluctuations, the imposition of currency controls, and restrictions on the right to convert or repatriate currency or export assets that may adversely affect the Indian economy, and thus our results of operations, may include: to convert or repatriate currency or export assets; to convert or repatriate currency; to convert or repatriate currency; to convert or repatriate currency; to convert or repatriate currency; to convert or repatriate currency; to a credit or other finance shortage in India, leading in a negative impact on the Indian economy and a lack of funding for our expansions; existing income situation among Indian consumers and businesses; a public health epidemic, pandemic, or other public health event in India, the area, or globally, including in India's many neighbouring nations, such as the highly virulent H7N9, H5N1, and H1N1 influenza strains in birds and pigs, and more recently, the COVID-19 pandemic Volatility in India's main stock exchanges, as well as actual or perceived trends in trading activity; Political unrest, terrorism, or military confrontation in India, the area, or the world, including in India's many neighbouring countries; Natural or man-made disasters (such as typhoons, flooding, earthquakes, and fires) that could force us to halt activities; prevailing current regional or worldwide economic situations, especially those in India's major export markets; A number of other key legislative or economic events in or affecting India's consumer sector; transnational business practises that may contradict with other cultures or legal