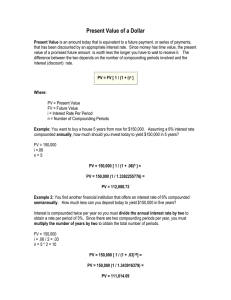

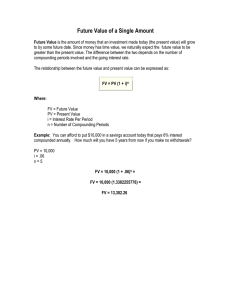

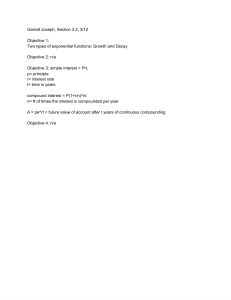

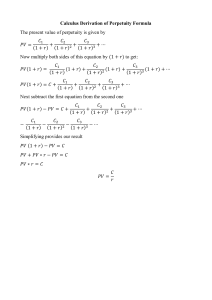

UNIVERSITY OF SOUTHERN CALIFORNIA Marshall School of Business FBE 506 Quantitative Methods in Finance M. Safarzadeh Assignment # 1 Student Name: ___ 1. Solve the following equations: a. x2 + 2x - 8 = 0. b. x2 – 9 = 0 c. x3 - x2 + 4x - 4 = 0. d. x5 + 3x2 – 8 = 0. 2. Future Value Problem: Find the compounded value of $100 deposited at a rate of 6% for 5 years, if the interest is compounded annually, quarterly, monthly, daily and continuously. Note: For a discrete compounding, the formula is S = A(1 + r/n )nt, where S is the compounded value, A is the initial investment, r is the interest rate, n is the number of time the interest is compounded a year, and t is the number of years. If the interest is compounded continuously, the compounding formula is S = Aert. 3. Present Value Problem: An investment is expected to have a return of $22000 at the end of the first year, $28500 at the end of the second year, $32000, at the end of the third year, $18000 at the end of the fourth year, and $12000 at the end of the fifth year. At the end of the fifth year the business is expected to have a market value of $52000. What is the present value of the future returns if the interest rate is 6%? What is the present value of the investment? Note: The present value of the expected future returns for the next n years is PV = R1/(1+ r)1+ R2/(1+r)2+ R3/(1+r)3 + ...... +Rn/(1+r)n, where PV is the present value, Ri is the return in the ith year, r is the rate of return or interest rate, and n is the number of years. 4. Net Present Value Problem: Net present value, NPV is the difference between the value of the initial investment, Io and the present value of investment, PVI. If NPV > 0, the investment is profitable. If NPV < 0, the investment will have a loss. Suppose an investment is expected to have returns of $22000, $28500, $32000, $18000, and $12000 at the end of each year for the next five years. At the end of the fifth year, the business is expected to have a market value of MV = $52000. Given that the initial investment is $120000, what is the net present value of the investment if the discount rate is 6%? 5. Perpetuity: A Perpetuity is a security that yields a stream of annual payments at an annual rate of r forever. The value of the perpetuities is decided by the sum of the present value of the stream of payments for infinite number of years. That is, PV = sum(R/(1+r)t) when t =∞. Here, R is the annual payments and r is the discount factor. Suppose a perpetuity yields an annual payments of $1 forever. What is the present value of the perpetuity if discount rate is 5%? 6. Internal Rate of Return: Internal rate of return is the interest rate at which NPV = 0 or PVI = Io. a. For the present value problem in question 4 find the internal rate of return. 0.09894825 b. Find the rate of return on a $24,000 investment with an annual return of $4,500 for five years and a scrap value of $2,500 at the end of the fifth year.