APC Privatization Case Study: Stakeholder Analysis & Tech Impact

advertisement

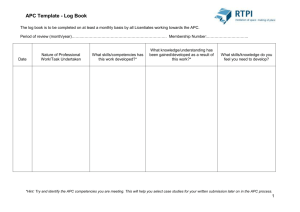

African Publishing Company (APC) Case Study 1. Analyse the benefits to any two stakeholder groups resulting from the privatization of APC. (10 marks) Privatisation is the process by which state-owned cooperations or businesses are sold and thus now controlled by investors of the private sector. As a governmental organization runs on the concept of socialism and labour-intensive strategies to reduce unemployment, they are inefficient in production as well as allocative efficiencies. Secondly, governmental industries make low profitability margins due to the increasing costs of production and high labour. The transition from a government to a state-owned business yields high profits, more efficiency, less marginal costs, more marginal benefits, increased scale of production and diversification of products and technologies. These privatized companies infuse modern accessories and help a nation gain competitive advantage in international markets as well. However, the major downfall can be on window dressing, share fluctuations, low levels of job security and high structural unemployment in the country. The advantage of such state-industries stands on the high job security, low hours of working, affordable products and increased pension and other safety. Working conditions are poor though. Stakeholders groups are individuals or organizations who are impacted by the decisions taken by the company as a whole, and are interested in the corporate actions or decisions. The idea that businesses hold the accountability and responsibility not just to shareholders but also to other range of groups is the stakeholder concept whereby every decision taken by a company significantly impacts them. They can be customers,society, suppliers, employees, local pressure groups, lenders or governmental agencies, etc. Concurrently, the African Publishing Company privatized 5 years ago to a public limited company, one with limited liability, and right to sell shares to the general public with having it’s share prices quoted on the national stock exchanges. As a PLC, it’s a substantially large business, with risks of fluctuations in share prices, entitlement to legal withholding and the risk of takeovers besides influences created by directors on achieving short term objectives to protect shareholders and investors. Since privatization in 2009 to 2014 potentially a 5 year short term of transition benefits all stakeholders with positive and negative externalities. The local NGOs and environmental agencies have reaped benefits due to APC Privatization. In 2009, the % change in annual energy usage was 12% which has fallen down to 4% change in just a span of 5 years. Therefore, the energy consumption has reduced bearing to a negative 0.667 [(4-12)/12 ]. With a few more years, energy usage can reduce drastically. As a state-owned publishing company would have barely considered the printing costs, electricity and other wasteful rampant consumption of electricity, this involves the creation of activists and environmental groups to take mass actions against them. With privatization, such statistics seem to lower the anger and anxiety among such stakeholders groups. Further, the company has reduced costs of production by implementing effective strategies to ensure such decrease. Reduced spending on energy usage implies that more can be invested on development and growth of APC in Country A reducing opportunity costs. The employees and managers can now focus on other arenas of expansion. In 2014, the $108m profit generated by a public limited APC outperformed the mere $13m profit produced by state-owned APC. This ensures to provide reasonable dividends to shareholders, investors and the directors of the company. Before privatization, dividends or gains were low, which restricted growth and expansion of the company. Huge dividends benefit shareholders to keep investing in this public limited company. High share prices mean more value and therefore more labour attraction incentives. APC Privatization has not only brought in huge monetary gains to them but also recognition, reputation and motivation to continue investing in private firms. However, questionable stand the decreased annual salaries paid to employees who are disadvantaged. Clearly indicates that APC has replaced and made redundancies to keep salaries low. Low job security and less salaries create an atmosphere of anger among the working community of APC who are writers, computer typists, printing personnel and logistical workers. Any strike or no extra hours decision taken by them due to less salaries paid or increasing redundancies can create chaos for APC severely who depend on share prices and investors. Work protests keep decreasing the share prices of a company due to labour tension, as people fear the instability in the system and dangers of collapse. In order to prevent their losses, they may sell all shares thereby increasing the supply and reducing the value. Though some stakeholders gain benefit from this transition, there still remains a waning benefit for others. For instance, the customers of APC, those are the retail shops. APC being a vertically forward integration company where it manufactures books as well as ensures distribution to retailers, the increase in average price of books is a downside. The end user, who is a reader, will be required to pay a high price per book after retailers have added their profits and taxes of Country A. These increasing prices of books discourage many potential readers from purchasing books. Society has to pay the costs of a decreasing literacy of young individuals. On proposition of this increasing value, we can neglect the good consumer spending retained from the book industry. Besides, consumer spending encourages investors, budding entrepreneurs, more income to book working individuals and high levels of economic stability given the circular flow of the economy. Also, in a state-owned business the range of books provided are limited, the privatization of APC has given customers the opportunity to read and endorse multiple authors and multiple categories of interests. Increasing prices, seems to however potentially weaken the company with the introduction of digital e-books that are easily reprinted, reproduced, low inventory costs, and holds good environmental significance. This new innovation with a good infrastructure of technology, speed data services and increasing use of tablets in a rapidly evolving system encourages not only customers but also writers to adopt such a new flexible method. This is a situation of trough or contraction for APC, and diversification can be a realistic change. APC privatisation since 2009, has provided advantages to shareholders, investors, directors, suppliers in terms of increased sales, confidence to retails, relaxation to NGO’s and pressure groups, low accidents mean less medical work, however increased book price and less salaries paid. The customers would have satisfaction considering the increasing range of books, and greater customer services due to efficiency. However, this seems to be a short run period of boom for APC, in order to ensure future success it needs to adapt and implement the growth options to remain in the markets of Country A, or else it will impact the stakeholders of the company. 2. Assess the likely impact on APC’s future success of technological change. (12 marks) APC is a company working in the traditional operations scenario with outdated ideas like computer typesetting, printing books and logistical transport services. In an era of digitization, the majority of heavy product or metal services can be recommended to work on such a model, however books constituting the easily portable goods, it’s essential to rapidly evolve to the changes of technology. The dynamic business environment introduces APC to not only change their working conditions, but also their method of vertical integration. APC’s economic gains would keep decreasing in the future due to reduced sales of books in the retail markets. Retail markets would prefer to introduce digital books membership schemes, electronic devices and free book publishing services rather than depending on APC. Customers find digital books convenient, portable and easily available for their needs. The increased use of tablets or laptops in the school environment and the reading community can severely impact APC success to a halt. Besides reproducing books and duplication work will increase drastically marking a complete decrease in the sales of books of APC. The company can be likely to invest heavily in marketing such as niche or social propagating the ill-effects of extensive digital use, which might in cases reduce the trend of e-readers and health conscious people will continue the habit of reading printed material. However, reducing sales and increasing investment on marketing strategies which require a long-run waiting period, the profits gained by APC will slow down. Simultaneously, APC working staff will be under the clutches of structural unemployment due to lacking skills in technical transition, aged authors unavailable to work using laptops and will face the second degree of digital divide which implies low skill level to use technology efficiently. Therefore, APC will be under a labour tension. Many redundancies would take place such as computer typewriters, printing personnel and transport people. This will disrupt the salaries paid and the majority of the machinery will stand of no use in the computerised inventory. However, APC can make use of the proper situation of technological change to attract investments for diversification. Investors will be confident to invest in a well-trusted and established company than a new entrant to the book industry. By proper operations management of the existing industry and use of new technologies and investment to set up computer machinery, APC success would peak high. As the operations planning directors seem to be optimistic of the reduced and considerable costs of latest production methods, APC can make a dent into the retail businesses as well. It depends on the skill level of people employed and good managers to take this leap. This will be a complete balanced integration acting as a manufacturer, distributor and retailer. However, such rapid changes into markets with inefficient production targets and less planning can be dangerous to the success. As APC is a public limited company, the impact created by mere superficial accounting and financing can downgrade the share prices leading to doubt among major investors. APC is a company which has undergone privatization transition, and the risks of digitalization can be severe. While the technological change is evolving APC will need to have internal growth and external expansion with leading subsidiaries. This will ensure APC to take the hold of the market share. The setup of the digital era invites many entrepreneurs therefore turning the monopoly competition of APC to a monopolistic competition where barriers to entry and exit are low and a range of products and services are easily available. APC shareholders will only be able to enjoy normal profits in at least a short-run, if the transition within APC is successful with good management, operations and marketing then APC will soon turn the monopolistic competition to a Oligopoly market. APC needs to properly utilise it’s company loyalty and trust established since 2009 to attract customer and stakeholders support in this transition phase. Therefore, internal growth by setting more branches, providing extensive training to existing employees, upholding the ideals of traditional reading and tactful handling of the rapid situation can increase APC power on the market significantly. 3. Recommend to APC’s directors which growth option , A or B, APC should choose. (12 marks) African Publishing company being a public limited company, along with a vertical integration business it’s decisions on operations expansion in any means has severe impact on all shareholders and stakeholders. Being the leader in introducing an efficient book industry in Country A, it has a good market share as well. Option A is moving forwards with a balanced integration, from holding manufacturing, to distributing to entry to retail industry is a balanced integration form of external growth. Option A, is not only balanced integration but also takeover of a company by buying more than 50% shares in aim of acquisition. It has several advantages and disadvantages given the intense market conditions and the dynamic business environment. Likewise Option B is a synergy expansion where an agreement by shareholders and managers of two businesses to bring both firms together under a common board of directors with shareholders in businesses owning shares in the new firm. It has the power to capitalize the market soon as major competitors join hands together in development of both. The risk of synergy is not unknown and making it a successful operation requires more constructive planning than dominative one. Option A of takeover of the largest chain of book shops and focus on marketing will provide APC with the benefit of economies of scale particularly the marketing economies, purchasing economies and technical economies of scale. As DSF being the largest chain of book shops, marketing costs will reduce as retail outlets are already established. Besides, APC will eliminate the purchaser of the economy who belongs to a different business organization. It will control the supplying prices and maintain a considerable order and inventory will be fast and quick, rather than relying on another firm to place orders at odd times. As flow of production will be in verified and statistical numbers, costs of production will lessen. More production waives of wastage costs. Besides, DSF takeover will provide APC with good managers as vacancies in the firm will increase and restructuring of the business as a whole will take place due to dominative position. The major vulnerability to these economies of scales is the managerial economies. Rapid expansion from a distributor to retail business can be too big and hard to handle. Besides, the increasing inflation in the economy from 4% to 6% will make people limit their consumer spending to only necessities. Further, real GDP output will fall from 1.5% to -2 implying that economic growth in terms of output both actual and potential will decline. At a certain point of diseconomy of a scale, APC in order to reduce the costs of production will make dismisses and redundancies more common. Also, structural changes and increasing trend of laptops and tablets will make investment in this takeover a huge risk as sales and interest of consumers will keep decreasing. This can completely disrupt the economies of scale APC intends to achieve in future with Option A. Takeover of DSF does not guarantee good working conditions for employees of APC as well as DSF. It will be time-consuming to implement the mission, vision and aims of the APC ideologies to the staff that is well-skilled in the retail market. Also, APC is unaware of the inner scenario and working conditions, which can be different and complicated to adjust within the small span. With more employees at all levels, APC’s profits would decrease as operations in terms of inventory, handling and maintenance keep increasing. Further, more employees will find it demotivating to be under new managers and new directors creating resentment among the labour. Labour will require more financial and non-financial motivation to continue working with APC or they might move on with a different industry altogether. Though the short-term transition will make working situations and adaptive nature hard, it will increase the stability of APC. For instance, more population working means more suggestions and better ideas of expansion in future is guaranteed. APC being a public limited company, majority of the employees will find it safe to invest their income savings in the share prices of APC. As these will in turn return to APC as investments, it will ensure to boost up the success of APC. Also, not being a private limited , workers will understand that any disruption in working or less working hours can reduce share prices, thus loss of their savings in APC. Besides, public limited creates fear of redundancies and dismissal in quick manner making disruptions rare. The increase in unemployment from 5.5% to 7% implies that APC will make many redundant in the manufacturing units. However, the more the retail outlets, the more the operations required at each centre, so reinstating their work in other branches and shops is quite beneficial. Option B of synergy with a company in another country Y which is also a publishing company will firstly benefit APC in terms of reduced costs of production and saving on printing costs. The lower the costs of production, the profits gained will increase for APC. These will reduce the average prices of books, helping APC gain a competitive advantage in the origin country A. However, though prices in country Y are low, they will create an offset with the increased legislature and the transportation costs involved in crossing borders of completely two different countries Y and A. Expanding in country Y will introduce APC to a new market customer base of likely potential people. This multinational merger can attract other countries to offer APC big contracts and dealings in the international market as a leading manufacturer of printed books. This can increase share prices values and generate more wealth by the company. By expanding to a different country, APC will gain the knowledge of a different setup of publishing business and high chances of invention of creative ideas to lower further costs of production. On the other hand, the increased currency values of country A in two years will lead to high investment in country Y for future expansions. Nevertheless, country Y’s PAN business works on a different model of short-term contracts where neither the worker nor the bosses take steps to ensure job security. The wide availability of short-term workforce decreases staff motivation and productive potential of the company. Besides many APC workers will be required to shift them to country Y which can be expensive for the company to further charge for permanent accommodation. Joining with a company that produces books made from cheap papers and non-sustainable sources can destroy the brand reputation of APC in both countries. The high pressure from stakeholders and pressure groups can cause APC to withdraw the merger given it’s environmental hazards. Both APC and PAN labour due to differences in terms of country, location, ideologies and other factors would be reluctant to work cooperatively and high risks of protests is plausible. In an era of digitalization, changing economic trends and increasing forecast losses to a printing company, APC will be required to consider the idea of diversification as well. By implementing cost-effective computer technology, it will be able to set up a profitable and futuristic business. On the same side, Option A is practically more possible and resonant than Option B, where short-term risks and long term dangers of changing in economic trends of another country can create more problems for APC. Option A provides them to reduce their operational costs, and also take big gains in retail markets, and marketing costs will be low. APC will be able to effectively diversify and a whopping number of sales is guaranteed with the Option A. Option B can be a further consideration after successful implementation of Option A and impactful diversification and stability. 4. Discuss the likely impact on APC of the forecast economic trends shown in Table 2. (16 marks) As a well-established public limited company, APC faces all impacts whether positive or negative from any changes in the economic nature of the country A. Economic trends play a major role in deciding the adaptability of a company as well as help forecast the phases of the business cycle from boom to slow down. It provides the analysts to include major areas of trough and contraction of the business while also helps in decision making during the peak business periods to gain the maximum amount of profitability. Changes in the economy can be inflation decrease or increase, changes of government fiscal or monetary policies with increased intervention in stock exchanges and forex markets. From the provision of public goods to necessities goods and setting minimum or maximum price levels on a certain set of products are microeconomic and macroeconomic decisions affecting operations of a business. In country A, the annual real GDP will decline from 1.5% to -2%, a negative impact on APC. This implies that overall actual and potential output will be in danger and therefore impacting economic growth. A low or decreasing real GDP, indicates widening unemployment and less consumer income. Less consumer income means less investment on accessories and other materials like printed books. This ultimately reduced the sales of the books for APC, reducing their profits and forcing the company to lower its average costs of books to a great extent. As a low real GDP creates a poor standard of living for the people of the country, the government would increase supply-side policies by collecting higher taxes from the rich population through fiscal policies and investing in supply-side policies to eliminate poverty. This will cause major potential investors of APC to stop their further plans given the high taxes and low output. APC might need to thus increase productivity of the labour force and implement technology which impacts the working community of APC who are at job risk. A low real GDP might however encourage APC to provide more inferior goods promoting good value and low prices and increase the distribution outlets. This will be an opportunity by which APC can look to implmemt it’s cost-effective technological plans, keep wages low, ideate on intensive marketing strategies and therefore extend the services from books to different educational arenas. Inflation increase from 4% to 6% is a major risk for APC. The increase in the average general prices levels due to decreased value of money can cause APC survival in the market. Challenges to APC from inflation can dramatically impact the business success rate. Increased inflation makes employees demand more as the real value of the currency has fallen. As APC is in vertical integration of manufacturer and distributor, it can be vulnerable to facing industrial disputes more than a retail business. On the other hand, retailers will shift from APC books to other companies' books if the average price of each book remains higher. As customers in this case will be in financial instability, the only way to ensure some consumer spending is through discounts and attractive offers. Cash flow will stop and payments will be delayed by major retailers. Increasing interest rates in the inflation period will cause APC to pay higher for past borrowing. Inflation also causes APC to lose price competitiveness and inventory holding costs will increase. The only way to sustain inflation is less spending on risky plans such as Option B, which doesn’t guarantee any returns in the short-term. APC needs to strategically invest in the digitization process which is cheap and less expensive for consumers. APC can think of marketing and second-hand products of books besides scope into the sphere of education as whole and not just publishing. With such an expansion, the customer base will keep increasing. APC can reduce labour costs and other unnecessary financial motivators and therefore collaborate with intellectual and insightful clubs to provide non-financial motivation. Job enlargement, quality circles and enrichment can be done more often so that employees do not protest and at the same time stay motivated to continue further in the uncertainty as well. The appreciation of the currency of country A is due to an increasing amount of exports and less exports which positively increases the aggregate demand curve of the country. This increase in aggregate demand, means more demand of the domestic currency which ultimately causes reduction in supply of the currency. This leads to increase in the prices due to shifts of both demand and supply curves. Such a factor brings a positive business environment to the economy. This appreciation in the value of currency against another currency can provide price competitiveness to the APC, in the domestic publishing markets. APC can make their operational costs of technological change even less by importing raw materials or goods from a country due to the appreciated increase in the value of the currency. These foreign raw materials are cheaper than domestic ones. Thereby, costs of production will certainly lower. On the downside, international markets will find it hard to purchase APC books due to the appreciated currency which causes it to lose competitive advantage. It is necessary for APC to reduce its production costs to the least to not lose the customer base to an foreign market given the more imports possible with the currency. However, this current account surplus caused due to appreciation is short-lived. The appreciation will itself reduce the surplus in a period of time, as prices of imported products will fall heavily and domestic firms will need to keep prices low. Likewise, APC needs to see the correct time to buy imported materials for technological change in order to gain the short-lived benefits of exchange rate appreciation. Unemployment from 5.5% to 7% can be mainly the result of inflation which forces firms like APC to make many redundant and lower wages of the existing. APC being under an dynamic environment of digitalization and rampant growth options will be impacted due to unemployment in the terms of reducing spending on published b0oks on the first-hand. More uncertainty would prevail among the working community of APC, and many would dedicate time to other businesses in search of more pay, reducing the focus and impacting the growth plans. This reduced demand for APC goods and services will cause APC to make layoffs in order to survive in the market given the high fluctuations of a listed company in the span of digitization, high inflation and decreasing GDP level. Therefore, all these economic forecasts are potentially dangerous. However, exchange rates provide an opportunity to APC to reduce its costs of production with permanent tech solutions like use of CAM or using production techniques that are speedy, rather than just labour layoffs. Besides, decearing real GDP provides an arena to explore inferior goods such as second-hand books and increase services to customers. The inflation can only be controlled with measures like no strike agreements with the worker community and influx of non-financial motivation such as free food, more vouchers on books, more clubs, delegation, quality circles and work life balance options which make workers secure in APC. These measures would provide APC with survival stances in the potential threats period, besides also allow it to consider conglomerate integration if necessary with the inferior good markets.