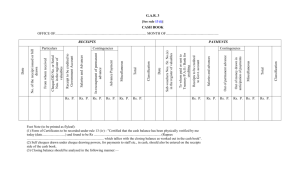

Bank statement Document produced by the bank which shows the cash held by a business with the bank. It lists the deposits, withdrawals and balance of the business's bank account over a stated time period usually one month. Bank reconciliation statement This document brings into agreement the balance of the business's bank account with the bank's records of the business's account, after all outstanding transactions have been taken into consideration. Unpresented cheques Cheques which have been drawn on the business's account but which have not yet been presented at the bank for payment. The bank statement shows only those cheques it has honoured (ie paid). Night safe deposits Deposits made by the business at night to the bank. These items are usually not recorded by the bank at the end of the month. EFT items Electronic funds transfers may be received or paid electronically (directly) into or out of the business's bank account. Bank charges When the bank has transactions with the business, various bank fees can apply. These include fees for account keeping, merchant services (bankcard/visa transactions) and fees for the use of EFTPOS facilities. These are shown in the bank statement in the debit column. Direct deposits The business can authorise the bank to accept deposits on its behalf. Only whent the bank statement is issued does the business receive confirmation of the increase in its deposits. Rent Revenue is commonly deposited directly inot the business's bank account. Interest revenue Interest earned by the business for money invested in the bank. Usually earned through a cash management account or term deposits. This is shown in the bank statement in the credit column. Dishonoured cheques These are cheques that have been deposited by the business into its bank account and recorded through the CRJ as a deposit. However, due to insufficient funds in the customer's bank account these cheques are returned to the business without the funds being deposited into the bank account. Additional charges apply when cheques have insufficient funds. Business errors These are errors made by the business in recording its receipts or payments in the Cash Receipts Journal or the Cash Payments Journal. These errors are corrected by reversing the incorrect amount and reentering the correct entry into the appropriate journal. Bank errors These are errors made by the bank and can include overcharging of fees, entering incorrect amounts for deposits or cheques. The bank needs to be notified of these errors and an adjustment made in the Bank Reconciliation Statement until the error has been confirmed and corrected. Overdraft When the business's bank statement shows a Debit balance. This means the business is now an asset to the bank because it owes the bank back the money it has overdrawn its account by. Final balance When preparing the bank reconciliation statement this figure from the bank statement is used as the first entry. Added If the bank statement shows an overdraft then this will be done with unpresented cheques in the bank reconciliation statement. Asset From the business's point of view money in the bank represents this. Liability From the bank's point of view money the business has in the bank represents this. Credit column Deposits recorded in the cash receipts journal are checked with this column in the bank statement. Debit column Cheques recorded in the caspayments journal are checked with this column in the bank statement.