Economics Homework: Monopoly & Price Discrimination

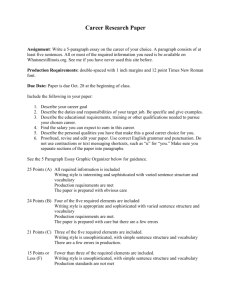

advertisement

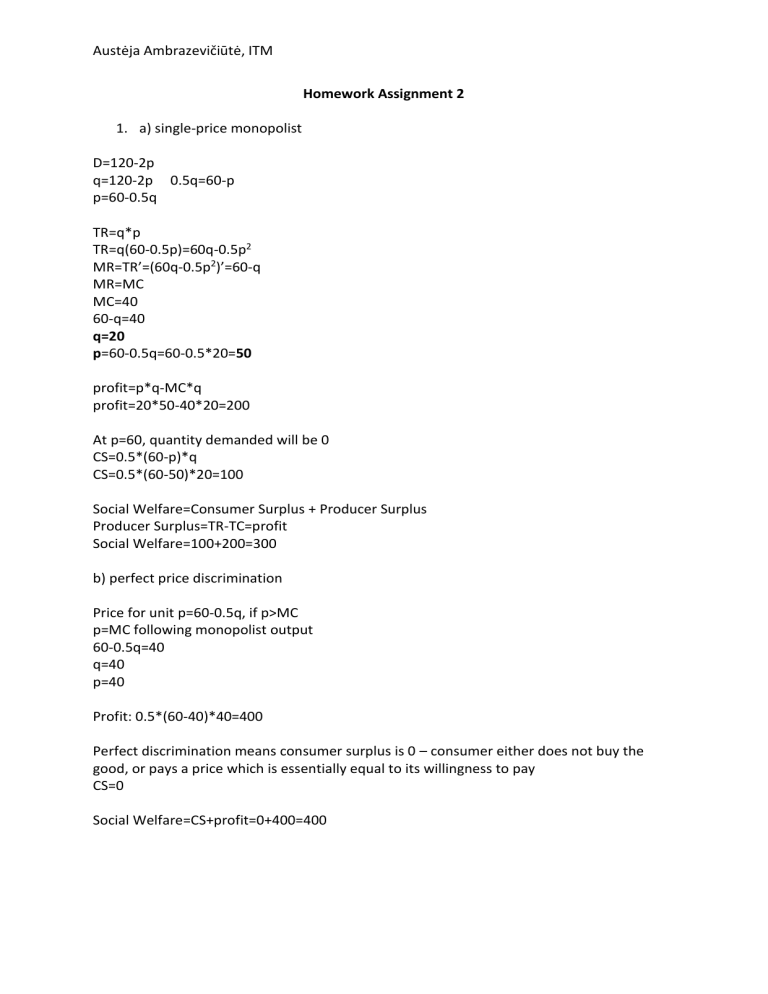

Austėja Ambrazevičiūtė, ITM Homework Assignment 2 1. a) single-price monopolist D=120-2p q=120-2p 0.5q=60-p p=60-0.5q TR=q*p TR=q(60-0.5p)=60q-0.5p2 MR=TR’=(60q-0.5p2)’=60-q MR=MC MC=40 60-q=40 q=20 p=60-0.5q=60-0.5*20=50 profit=p*q-MC*q profit=20*50-40*20=200 At p=60, quantity demanded will be 0 CS=0.5*(60-p)*q CS=0.5*(60-50)*20=100 Social Welfare=Consumer Surplus + Producer Surplus Producer Surplus=TR-TC=profit Social Welfare=100+200=300 b) perfect price discrimination Price for unit p=60-0.5q, if p>MC p=MC following monopolist output 60-0.5q=40 q=40 p=40 Profit: 0.5*(60-40)*40=400 Perfect discrimination means consumer surplus is 0 – consumer either does not buy the good, or pays a price which is essentially equal to its willingness to pay CS=0 Social Welfare=CS+profit=0+400=400 Austėja Ambrazevičiūtė, ITM 2. I would look at his problem as a form of price discrimination rather than promotional strategy. This could be categorized as price discrimination by selfselection, indirectly sorting the customers, since by proposing coupons, somewhat a lower price for particular buyers, the supermarket provides a different product offerings and can enforce a high price elasticity at different price for the other buyers. Thus, for a supermarket to increase profits with one price, they should implement a high constant price. Therefore, empirical evidence is consistent with my interpretation of price discrimination. 3. a) D1(p)=1-p D2(p)=2-2p MC=c=0 D(p)= D1 + D2 D(p)=3-3p maxprofit: 3-3p FOC: MC=MR Π(p)= π(p)+f= π(p)+CS(p) π(p)=(p-c)D π(p)=(p-0)D π(p)=(p)D π(p)=p(3-3p)=3p-3p2=3p-3p2 π’(p)=(3p-3p2)’=3-6p 1-2p=0 p=0.5 π(0.5)=0.75 W= Π+ CS(p)= 3p-3p2+CS(p) CS(p)=A+B CS(p)=0.5(1-p)(2(1-p)=(1-p)2 The firm is operating at monopoly price hence CS which is associated with social welfare level of outcome is area A and B Austėja Ambrazevičiūtė, ITM W= Π+ CS(p)= 3p-3p2+CS(p) CS(p)=(1-p)2 Wa=3p-3p2+(1-p)2=1 b) f=9/32 p=0.25 demand is the same, but now a fixed fee is charged f D(p)= D1 + D2 D(p)=3-3p maxprofit: 3-3p+2f 0.5(1-p)2>=f Wb=3p-3p2+(1-p)2+0+0.5(1-p)2=45/32>Wa Constrains comes from the fact that the consumer of type 1 must have a positive surplus, otherwise it will not buy; when the constraint for the type 1 consumer is satisfied, constraint for type 2 is also satisfied – it can be ignored. Monopolist is better off when as much surplus as it is possible from customers. Therefore, it’s best when fixed fee is equal to type 1 consumer surplus – the constraint becomes mandatory and problem becomes: maxprofit: 3p-3p2+(1-p)2 FOC: MC=MR 3-6p-2+2p=0, therefore we get p=0.25 and f=9/32 4. MC=0 Market is equally divided into two types of users, sophisticated and unsophisticated. MAX willingness to pay: Unsophisticated Sophisticated a) STANDARD – can distinguish Standard 20 35 Deluxe 20 100 Austėja Ambrazevičiūtė, ITM Firm will not charge less than 20 because at this price point, both users (sophisticated and unsophisticated) will buy the standard software, thus going anywhere below 20, will not result in more demand, but a reduction of price would equal lower revenue. Additionally, the firm will not charge more than 35 because at this price point the demand would be 0, as it would go beyond sophisticated customers willingness to pay. Firm should charge: - Standard should cost 20 for unsophisticated. - Standard should cost 35 for sophisticated, so it would be possible to prevent sophisticated users from buying standard. DELUXE – can distinguish Using the same logic as provided in previous section, it does not make any financial sense to price deluxe software between 20 and 100, as this would lead to loss of half of the market. Additionally, pricing at less than 20 will not result in more demand, thus reduction would result in lower revenue. Firm should charge: - Deluxe should cost 20 for unsophisticated, as here firm does not need necessary prevent unsophisticated clients from buying deluxe version as they are the same price. - Deluxe should cost 100 for sophisticated, so it would be possible to prevent sophisticated users from buying standard. TOTAL PROFIT: continuing this logic, unsophisticated user will buy standard, and sophisticated user will buy deluxe: 20*1+100*1=120 b) STANDARD - cannot distinguish If firm charges more than 20, they instantly lose half of the market (unsophisticated users), as it goes beyond their willingness to pay. In this case charging less than 35 for sophisticated client does not make any economical sense, as 35 is maximum willingness to pay for sophisticated users; any less than such price point will not result in more demand, thus a reduction of price would equal lower revenue. Therefore, few optimal choices are either 20 or 35. If firm charges 20 for standard version, the whole market (sophisticated and unsophisticated users) will buy at this point. 20*2=40 If firm charges 35 for standard version, it loses half of the market (unsophisticated users – as it goes beyond their willingness to pay) and only sophisticated users will buy at this point. 35*1=35 40>35, so for the standard software optimal price is 20. If EasyTax sells Ps=20, then we have surplus from sophisticated users from buying the standard version CS=35-20=15 Austėja Ambrazevičiūtė, ITM DELUXE – cannot distinguish Using the same logic as provided in previous section, it does not make any financial sense to price deluxe software between 20 and 100, as this would lead to loss of half of the market. Additionally, pricing at less than 20 will not result in more demand, thus reduction would result in lower revenue. That means firm has 2 options, to charge either 20 or 100. If the firm charges 20, the whole market (sophisticated and unsophisticated users) will buy at this point. 20*2=40 If the firm chargers 100, it loses half of the market (unsophisticated users - it goes beyond their willingness to pay) and only sophisticated users will buy at this point. 100*1=100 40<100, thus the firm will charge 100 for the deluxe, however in order to incite sophisticated users to buy the deluxe version, the price should be set Pd=100-15=85. TOTAL PROFIT: 20+85=105