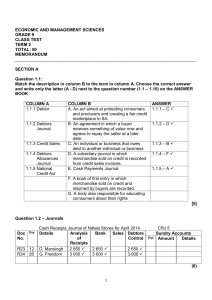

Grade 9 Accounting – Credit Transactions (Posting to the General and Debtors’ Ledgers) Name Class Grade 9 EMS – Term Three Accounting Introducing credit and working with Debtors. ‘Some debts are fun when you are acquiring them, but none are fun when you set about retiring them’ Ogden Nash Words and terms Revenue: This another word for receipt of money or money earned. LESSON ONE: In this lesson we introduce the concept of selling on credit and some of the theory that surrounds this. Up until now we have only dealt with businesses that deal in cash, as a result you have only had to record cash transactions in the Cash Receipts and Cash Payments Journals. In this lesson we introduce businesses that sell their products for cash, as well as on credit. Selling items on credit is simply defined as a ‘buy now, pay later’ situation, something that is quite common in South Africa. There are many retailers in South Africa that offer a credit option as well as a cash one. How Credit works: Before someone is granted a credit facility or an account, their credit history and financial status is first assessed. This is to determine: a) should they be granted credit and b) if so, how much? Words and terms Interest: Interest is defined as the cost on Once granted credit, the customer may then buy goods without having to pay cash immediately for them. The retailer simply records how much the customer, now referred to as a debtor owes them. money. This refers to borrowed money in The debtor is required to repay what is now owed to the retailer according to an agreed set of conditions or terms. From the point of view of the business, it is best if the money owed is collected as quickly as possible, so their cash flow is not negatively affected. Interest can be added to the amount owed, this is one way of encouraging the debtors to pay quickly, another is to send regular reminders using modern communication methods such as SMS and email. this case, as in the case of a credit agreement, the retailer is financing the goods bought. Why do you think retailers offer a credit option to their customers, even though they then have to wait to receive the money? They are happy to offer credit as it allows their customers to purchase goods even when they don’t have money – thus increasing the sales revenue of the retailer. 1 What to check before giving a customer credit: Before giving a customer credit it is important to check their credit worthiness by assessing their financial position and their credit history. Words and terms Credit check: In order to assist businesses that offer credit, we The following customer details need to be checked: 1. Their employment history. 2. Proof of Salary. 3. A copy of three month’s bank statements. 4. A copy of the customer’s ID document. 5. Contact details including: physical address, email address, telephone numbers. 6. It is also necessary to conduct a credit check. have specific companies that specialise in the collection information relating to individuals credit history. A credit check is involves finding out information Recording the Transactions: Credit transactions have their own specific source documents. When a business sells goods on credit to a customer, they issue the customer an invoice, the original invoice is given to the customer, while the business keeps a duplicate invoice as a record of the transaction – this record of the transaction is the source document. All the necessary and relevant information needs to be included on the invoice, this includes: 1. An invoice number. 2. The date the transaction took place. 3. The name of the debtor, as well as a reference number specific to that debtor. 4. What the debtor bought. 5. The cost of the items bough (in other words, what the debtor owes.) about the customer’s credit history 2 Example of an invoice: Kunene Traders Shop 45 Millennium Park Mamelodi Tshwane 0122 Bill to: Date: Shipping date: ITEM Bath Towel Set of Face cloths Printed T’s Khaki chino Invoice number: 349 (t )+27 012 348 9900 (c) 079 445 09800 (e) Kunene@mweb.co.za M. Dunga (Debtor Reference: 029) 23 August 2012 Terms: 23 August 2012 QTY 1 Ship to: Billing address PRICE 89.99 1 3 2 30 days (5 % discount) Interest at 13.5% on overdue accounts. AMOUNT 89.99 56.29 159.99 299.99 56.29 479.97 599.98 1226.23 Subtotal VAT 171.67 Total 1397.90 Activity One Use the information below to draw up an invoice for Muster Buster CC, dealers in computer equipment. On 23 November 2011, Muster Buster CC sold the following on credit to Mr. P Bell debtor number D98. 1 JVC 17″ monitor at R1 350 each, 2 Kingston 4gb flash drives at R69,99 each, 1 Easton 500gb external hard drive at R950. Mr. Bell was issued with invoice number I346. Once you have finished make a list of all the important information that is necessary on an invoice, use a highlighter to identify these on your invoice. 3 LESSON Two: In this lesson we look at the accounting cycle, focussing on the different stages in the cycle as well as how they relate to each other. Accounting is a process through which we keep a written record of each and every transaction the business makes during a consecutive twelve month period called a financial year. Each transaction is recorded in the aptly named books of first entry, with the ultimate goal of summarizing all of the information into two one page documents. These are the Income Statement and the Balance Sheet. The Diagram below is a linear representation of a Financial Year. Many businesses choose to use 1March to 28 February as their financial year. 1 March 2012 28 February 2013 The Financial Year All transactions that take place during these consecutive twelve months are recorded. The summaries, the Income Statement and Balance Sheet are prepared right at the end of the year and include all the information from the rest of the year. A step by step guide to the accounting cycle: Step One: The Transaction and Source Document Source documents are the link between transactions and the accounting system. All Transactions are recorded on source documents, these source documents are then used to prepare the accounting journals (the books of first entry). The source documents for the CRJ are the: Receipt Cash register roll The Source document for the CPJ is the: Cheque counterfoil The Source document for credit transactions is: An Invoice Step Two: The Journals (books of first entry) The journals are known as the books of first entry as they record transactions in the accounting system for the first time. Similar transactions are grouped together with the aim of organizing and summarizing the information. 4 Although there are more, in Grade nine you deal with the following journals: Cash Journals: Cash Receipts Journal Cash Payments Journal Credit Journals: Debtors’ Journal Debtors’ Allowances Journal Creditors’ Journal Creditors’ Allowances Journal Step Three: The Ledger The General Ledger is a further summary of the information contained within the journals. Information from the journals is posted or transferred to the General Ledger, this action brings together information kept separate in the various journals, for example the increase and decrease in the Bank Account. The General Ledger is divided up into two sections: Balance Sheet Section: This includes Capital, Drawings, all asset accounts, and all liability accounts. The Nominal Section: This includes all of the Income accounts and the expense accounts. Subsidiary Ledgers: In addition to the General Ledger, we also have subsidiary ledgers. These are the Debtors’ ledger and the Creditors’ Ledger. In these ledgers, each debtor and creditor will have their own account. Each individual transaction with the debtor or creditor is shown. Thus by looking at the debtor’s or creditor’s ledger account, you can see how much is owed to or by the other party. Step Four: The Trial Balance The drawing up of the Trial Balance follows on from the completion of the General Ledger. The Trial Balance is divided up into the same two sections as the General Ledger, The Balance Sheet Section and the Nominal Section. It is a further summary of the General Ledger and each account is represented as a one line entry, with either a Debit or a Credit Balance or Total. It is a one page summary of the entire financial year of the business. Step Five: The Financial Statements Although it is a one page summary, the Trial Balance is nor a usable accounting statement. It is no indication of the financial performance of the business, nor does it present the financial position of the business. For this purpose we have the Financial Statements. 5 1. The Balance Sheet This Statement uses the Balance Sheet section of the Trial Balance to show the financial position of the business on a particular date, usually the last day of the financial year. The Balance Sheet is divided up into two sections, Assets and Owner’s Equity and Liabilities. It is called a Balance Sheet, as these two section must balance (be equal). The assets section shows us what assets the business owns, while the Owner’s Equity and Liabilities Section shows us where the business got the money from to buy the assets. The Balance Sheet is a reflection of the Accounting Equation: ASSETS = OWNER’S EQUITY + LIABILITIES 2. The Income Statement The Income Statement is prepared using the Nominal Section of the Trial Balance. In the Income Statement all income accounts are added together to calculate total income. Likewise, all expense accounts are added together to calculate total expenses. The total expenses amount is subtracted from the total income amount in order to calculate Net Profit for the year. The following is a summary of the Income Statement: Total Income – Total Expenses = Net Profit 6 Activity Two Draw a diagram that represents the accounting cycle. Your diagram needs to show the order of the accounting cycle, starting with Transactions and ending with the Financial Statements. 7 Activity Three Accounting is said to be a process of recording all the financial transactions made by a business during a given period. 1. Explain why a business owner would want to keep accurate accounting records for his or her business. 2. In addition to the owner of a business, who are the other parties that may express an interest in the financial records of a business? LESSON Three: The focus of this lesson is recording credit sales in the Debtors’ Journal. Words and terms As you are already aware, when a transaction takes place, it is recorded on a source document. This source document is then recorded in one of the books of first entry. In the case of a credit sale, when the business sells on credit to one of its customers, the transaction is recorded on an invoice. As already mentioned, the customer keeps the original, and the business uses a duplicate as their source document. This source document is then recorded in the Debtors’ Journal – the book of first entry used to record credit sales. Contra account: Every transaction in accounting The format of the Debtors’ Journal: The format of this journal is fairly straightforward, and we only have amount columns for Sales and Cost of Sales. The additional columns are for document, day, details (the debtor’s name), and Folio (Fol). The Folio column is an important column as it records the debtor’s reference number. has a debit and a credit entry. The two accounts involved are Example: The transaction below shows how the Debtors’ Journal is used: On 17 June, sold goods to P. Allen, debtor 3, for R900. The cost price of the goods was R450, issued invoice 24. known as each other’s contras. 8 Debtors’ Journal of EX Ample Traders for June 2012 Doc Day Details Fol Sales Cost of Sales Take note: The transaction does not mention whether the goods were sold for cash or on credit. It does, however, mention that an invoice was issued as a source document. This is our clue as to what type of transaction this is. It is important for you to know what source documents are associated with each type of transaction, as it they provide important clues as to where a transaction should be recorded. The double entry of the Debtors’ Journal: You will notice that the amounts in the Sales and the Cost of Sales columns in the Debtors’ Journal are different. This is because each column represents one double entry. We already know that for every debit there must be an equal credit – this is the principle of double entry. The double entry of each column will be discussed in detail below. The double entry of the Sales Column: The sales account in the General Ledger is an income account, and therefore increases on the credit side. As goods are being sold in this example, sales is increasing and therefore credited. The contra account which is debited is the asset Debtors’ Control. This asset represents the money that is owed to the business. The more money that is owed to the business, the bigger the asset Debtors’ Control gets. The double entry of the Cost of Sales Column: This is dealt with in the same way as the cost of sales column in the Cash Receipts Journal. The asset Trading Stock is being used to earn an income, we therefore have less Trading Stock, and therefore credit it. The Trading Stock is becoming the expense Cost of Sales, therefore we debit it. The asset Trading Stock is being converted into the expense Cost of Sales. 9 Activity Four Use the information provided to prepare the Debtors’ Journal of Merlin Stores for August 2012. Then answer the questions that follow. Transactions for August 2012: 3 Issued invoice i32 to M. Morgan, Debtor 1, for R900. Cost price was R600. 8 Sold goods on credit to A. Pendragon, Debtor 2, for R750, cost was R500, issued invoice i33. 12 Issued invoice i34 to M. Morgan for R1 500, cost of goods sold amounted to R1 000. 16 Sold goods on credit to Z. Luther, Debtor 4, issued invoice i35 for R3 900, cost price of goods sold amounted to R2 600. Questions: 1. How much does D1 owe Merlin Stores? 2. What mark-up on cost does Merlin Stores use? 3. Merlin stores has been struggling with debtors paying them late. What could they do in order to encourage quicker payment? Debtors’ Journal of Merlin Stores for August 2012 Debtors’ Doc Day Details Fol Control Cost of Sales Activity Five The object of this exercise is to help you to differentiate between cash and credit sales. You will need to look for the following clues that will indicate whether a sales transaction is cash or credit: The wording of the transaction (Cash or Credit). The source document: Invoice = credit Songololo Stores sells goods for cash as well as on account. Use the information provided below to prepare the Cash Receipts Journal and the Debtors’ Journal for Songololo Stores for April 2012. Songololo Stores uses a 25 % mark-up on cost. 10 Transactions for April 2012: 1 Sold goods to B. Zulu (D4) for R1 250, issued invoice 62. 3 Cash sale to R. Vuka (D1), cost of goods sold amounted to R100. 5 Issued invoice 63 to V. Matlock (D3) for R1 000. 7 Sold goods for cash, R825. 10 B. Zulu was issued with invoice for goods purchased with a cost price of R1 600. 13 Issued invoice 65 to R. Vuka for R3 750. 15 Issued receipt 044 to FNB for R27 for interest received on current account. 18 Sold goods on credit to T. Lourens (D2), issued invoice 66 for R1 500. 19 Cash sale of goods with a cost price of R540. 22 Sold goods on credit to V. Matlock, issued invoice 67 for R2 750. Cash sale to B. Zulu, R1 225. 27 R. Vuka was issued invoice 68 for R200 for goods bought on credit. 29 Issued receipt 045 to P. Gheely, our tenant, for R4 000 for rent received. Debtors’ Journal of Songololo Stores for April 2012 Doc Day Details Fol Cost of Sales Sales Cash Receipts Journal of Songololo Stores for April 2012 Doc Day Details Analysis Bank Sales 11 Cost of Sales Sundry accounts Amount Details Incorporating credit sales into the accounting system: Let’s begin by comparing a credit sale to a cash sale: Cash Sale Description We sell goods to a customer, the customer receives goods, and in return we (the retailer) receive money (payment) Double entry 1 Dr Bank Cr Sales Remember – we are the ones doing the selling! So it is from our point of view as the business Credit sale We sell goods to a customer, the customer receives goods. We do not receive payment, however the customer agrees to pay us at some point in the future. The customer now owes us money, and is referred to as a debtor. Money is received Dr Debtors as a result of the control income sales. Cr Sales In this case, the business is generating an income from sales, but no money is received. Instead, the promise of money in the future is received. Double Dr Cost of sales This records the Dr Cost of sales This records the entry 2 Cr Trading loss of the asset Cr Trading loss of the asset Inventory trading inventory Inventory trading inventory SAME as it is used to SAME as it is used to generate and generate and income. income. As we can see the only difference is that money is not received in a credit transaction. Therefore the bank account is replaced with the Debtors Control Difference account. This asset account represents money that will be received in the near future. 12 Revision Activity Recording transactions in the books of first entry: NB source documents (Use the source documents to help you choose the correct journal) Cheque counterfoil (CPJ) Receipt (CRJ) Cash register roll (CRJ) Invoice (issued to a debtor when they purchase form us) (DJ) Credit note (Issued when a debtor returns stuff to us) (DAJ) You are provided with information from the books of Strummer Stores for the month of April 2012. Strummer Stores are retailers of musical equipment, they sell goods for cash and credit. Strummer Stores uses a mark-up of 100 % on cost. You are required to record these transactions in the following books of first entry: 1. 2. 3. 4. The Cash Receipts Journal The Cash Payments Journal The Debtors’ Journal The Debtors’ Allowances Journal Transactions for April 2012: Day 1 2 4 7 11 15 17 19 21 22 25 26 29 30 Transaction Bought merchandise from Humble Suppliers for R800, issued cheque 89. Sold goods for cash, R1 400. Issued invoice 68 to B. Babatu (D4) for R840 and invoice 69 to K. Karabo (D1) for R220. Paid R2 890 with cheque 90 to Usain Suppliers. R2 200 for merchandise, and R690 for stationery. Sent cheque 91 to Free-fall Formats for advertising, R1 450. Bought packing material from medi-pack, paid R560 with cheque 92. Sold goods for cash, R1 700. B. Babatu returned goods, issued credit note 32 for R84. Sold goods for cash, R400. Issued invoice 70 to D. Diboko (D2) for R660. Issued credit note 33 to D. Diboko for goods not as per invoice, R100. Issued receipt 58 to K. Karabo for R220 paid on account. Sold goods for cash, R4 500. Issued invoice 71 to G. Goloka (D3) for R3 000. Issued cheque 93 to Superior Suppliers for merchandise, R8 000 and stationery R340. Paid Hercules Properties R4 500 with cheque 94 for rent. Cashed a cheque for salaries, R7 500 13 Cash Payments Journal of Strummer Stores for April 2012 Doc Day Details Bank Trading Stock Sundry accounts Stationery Amount Details Cash Receipts Journal of Strummer Stores for April 2012 Doc Day Details Fol Analysis Bank Cost of Sales Sales Debtors’ Control Sundry accounts Amount Debtors’ Journal of Strummer Stores for December 2012 Doc Day Details Fol Sales Cost of Sales Debtors’ Allowances Journal of Strummer Stores for December 2012 Debtors’ Cost of Doc Day Details Fol Allowances Sales 14 Details Transaction by transaction revision: Buying an Asset: An asset is an item of value that is owned by a business. It can be used repeatedly for the benefit of the business. Examples of assets Land and Buildings The premises that a business OWNS. Vehicles Anything used for transportation purposes. Equipment Items used by the business repeatedly without losing value. E.g. data projector, Sewing machines, 3D printers. Buying an Asset: On 3 April Levi purchases a new computer from Mecer Computers for R9 000. He pays with his first cheque, number 001. No: 001 Date: PAY: Amount: R 004556 5858 001 002 Signed: 15 Mr L. Pacioli Can you see a double entry? In the business TWO things have happened: 1. The business has less money in their BANK account. 2. The business now has more EQUIPMENT. 1. Double entry: What do we know: Two accounts are involved namely BANK and EQUIPMENT Assets Bank Account Get bigger on the DEBIT side. Is the Bank getting SMALLER? Get smaller on the CREDIT side ASSET Equipment Account Get bigger on the DEBIT side. Is the Equipment increasing? Get smaller on the CREDIT side 2. In the Cash PAYMENTS Journal: Cash Payments Journal of LEVIS for April 2015 Doc Day Details Bank Materials Wages Sundry accounts Amount Details 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 16 Liabilities Effect Reason Paying for or buying an expense: An expense is something that the business pays for that is consumed when it is used. Another way of saying this is that it is used up when used. Examples of expenses Materials This refers to the ‘stuff’ that is used when rendering a service. All service businesses use different materials when providing their service. e.g. Shampoo to a hairdresser. Water and Electricity This is consumed or used up as it is used. It is therefore an expense. This is the amount paid to workers in a business. Wages As a pen or pen is used, it is being used up. It is therefore classed as an expense. Stationery Advertising Advertising is an expense that businesses pay in order to promote their businesses. 17 Paying for an expense: On 5 April Levi bought materials from Makro for R600. He paid with cheque number 002. No: 002 Date: PAY: Amount: R 004556 5858 001 002 Signed: Mr L. Pacioli In the business TWO things have happened: 1. The business has less money in their BANK account. 2. The business now has more MATERIALS - but the owner now has less money in the business. Can you see a double entry? 1. Double entry: What do we know: Two accounts are involved namely BANK and MATERIALS Assets Bank Account Get bigger on the DEBIT side. Is the Bank getting SMALLER? Get smaller on the CREDIT side Materials 600 Expenses Materials Account Get bigger on the DEBIT side. Is the Materials increasing? Get smaller on the CREDIT side Bank 600 2. In the Cash PAYMENTS Journal: Cash Payments Journal of LEVIS for April 2015 Doc Day Details Bank Materials Wages Sundry accounts Amount Details 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 18 Liabilities Effect Reason Selling goods for Cash: On 7 April Levi stores sold goods with a cost price of R400 for R840, cash. For this transaction there are two double entries: 1. Bank and Sales o Bank increases o Sales increases 2. Trading stock and Cost of Sales o Trading stock decreases o Cost of sales increases 1. Double entries: 1. What do we know: Two accounts are involved namely BANK and SALES Assets Bank Account Get bigger on the DEBIT side. Is the Bank getting BIGGER? Get smaller on the CREDIT side Sales 840 INCOME Sales Account Get smaller on the DEBIT side. Is the Sales account increasing? Get bigger on the CREDIT side Bank 840 2. What do we know: Two accounts are involved namely TRADING STOCK and COST OF SALES Assets Trading Stock Account Get bigger on the DEBIT side. Is the Trading Stock getting SMALLER? Get smaller on the CREDIT side Cost of sales 400 Expense Cost of Sales Account Get bigger on the DEBIT side. Get smaller on the CREDIT side Trading stock 400 19 Is the Cost of Sales account increasing? 2. In the Cash RECEIPTS Journal: Cash Receipts Journal of LEVIS for April 2015 Doc Day Details Analysis Bank Sales Cost of Sales Sundry accounts Amount Details 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 20 Liabilities Effect Reason Selling goods on credit: On 11 April Levi stores sold goods with a cost price of R800 for R1680, issued invoice to D. Prius. For this transaction there are two double entries: 1. Debtors’ control and Sales o Debtors’ Control increases o Sales increases 2. Trading stock and Cost of Sales o Trading stock decreases o Cost of sales increases 1. Double entries: 1. What do we know: Two accounts are involved namely BANK and SALES Assets Debtors’ Control Account Get bigger on the DEBIT side. Is the Bank getting BIGGER? Get smaller on the CREDIT side Sales 1680 INCOME Sales Account Get smaller on the DEBIT side. Is the Sales account increasing? Get bigger on the CREDIT side Debtors control 1680 2. What do we know: Two accounts are involved namely TRADING STOCK and COST OF SALES Assets Trading Stock Account Get bigger on the DEBIT side. Is the Trading Stock getting SMALLER? Get smaller on the CREDIT side Cost of sales 800 Expense Cost of Sales Account Get bigger on the DEBIT side. Get smaller on the CREDIT side Trading stock 800 21 Is the Cost of Sales account increasing? 2. In the Debtor’s Journal: Debtors’ Journal of LEVIS for April 2015 Doc Day Debtors Control Details Cost of Sales 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 22 Liabilities Effect Reason Money received from a debtor: A debtor who owes an amount of R1550 settles his account in full. Receipt 22 is issued. Can you see a double entry? In the business TWO things have happened: 1. The business has more money in their BANK account. 2. The business is now OWED less money by a debtor. 1. Double entry: What do we know: Two accounts are involved namely BANK and DEBTORS’ CONTROL Assets Bank Account Get bigger on the DEBIT side. Is the Bank getting BIGGER? Get smaller on the CREDIT side Debtors control 1550 ASSET Debtors’ Control Get bigger on the DEBIT side. Is the Debtors’ control decreasing? Get smaller on the CREDIT side Bank 1550 2. In the Cash RECEIPTS Journal: Cash Receipts Journal of LEVIS for April 2015 Doc Day Details Analysis Bank Sales Cost of Sales Debtors’ Control Sundry accounts Amount 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 23 Liabilities Effect Reason Details Returns from a debtor: On 17 April D. Prius returned unwanted goods to Levi stores. The goods were originally sold for R84 and had a cost price of R40. For this transaction there are two double entries: 1. Debtor’s control and Debtors’ Allowances (makes sales smaller) o Debtors’ Control decreases o Debtors’ Allowances increases 2. Trading stock and Cost of Sales o Trading stock increases o Cost of sales decreases 1. Double entries: 1. What do we know: Two accounts are involved namely BANK and SALES Assets Debtor’s Control Account Get bigger on the DEBIT side. Debtors’ control gets? Get smaller on the CREDIT side Debtors Allowances 84 INCOME Debtors’ Allowances Account Get bigger on the DEBIT side. Debtors’ Allowances gets? Get smaller on the CREDIT side Debtors Control 84 3. What do we know: Two accounts are involved namely TRADING STOCK and COST OF SALES Assets Trading Stock Account Get bigger on the DEBIT side. Trading Stock gets? Get smaller on the CREDIT side Cost of sales 40 Expense Cost of Sales Account Get bigger on the DEBIT side. 600 Cost of Sales gets? Get smaller on the CREDIT side Trading stock 40 24 2. In the Debtors’ Allowances Journal: Debtor’s Allowances Journal of LEVIS for April 2015 Doc Day Debtors Allowances Details Cost of Sales 3. On the Accounting Equation Assets = Effect Reason The accounting equation OE + Effect Reason 25 Liabilities Effect Reason Posting to the General Ledger from the journals of businesses that offer credit, namely the Cash Receipts Journal, the Debtors’ Journal, and the Debtors’ Allowances Journal. Introduction: We have already covered posting from the Cash Journals to the General Ledger. You are advised to go over those lessons in preparation for this lesson. In the explanations below each journal that records transactions with debtors will be explained separately. Each double entry will be discussed in detail. To assist you in understanding the posting to the General Ledger, you are encouraged to go over the summary below. This summary explains the difference between each of the types of ledger accounts. Summary of the types of ledger accounts: Assets Liabilities E.G. Debtors’ Control E.G. Creditors’ Control + - - + Increase on the debit side Decrease on the credit side Decrease on the debit side Increase on the credit side Expenses Incomes E.G. Cost of Sales E.G. Sales + - - + Increase on the debit side Decrease on the credit side Decrease on the debit side Increase on the credit side 26 1. Posting the Debtors’ Journal: Debtors’ Journal of EX Ample Traders for June 2012 Doc Day Details Fol Sales Dr ____ Cr ____ Cost of Sales Dr ____ Cr ____ The total of the Sales column (R4 600): Debtors’ Control B9 June 1 Balance b/d 6 450 Sales N1 In the above example, you can see the posting of the Sales column total to the General Ledger. Only the total is posted, as it is a summary of all the transactions in the journal. The total of R4 600 represents the income earned from credit sales, as well as the amount that debtors owe. It is therefore posted to the credit side of the Sales account (an income which increases on the credit side) and the debit side of the Debtors’ Control account (an asset which increases on the debit side). The total of the Cost of Sales column (R2 300): Trading Stock B12 June 1 Balance b/d 6 450 Cost of Sales N2 Trading stock is being removed from the store room, and is being used to generate a profit. This needs to be reflected in the accounting records. Therefore the amount of R2 300 is credited to the Trading Stock account (decrease) and debited to the Cost of Sales account (increase). The asset becomes and expense when it is used up to make a sale. 27 Let’s Practice: Post the Debtors’ Journals below to the General Ledger accounts provided from the books of Giant Industries for the month of July 2014. Debtors Journal of Giant Industries for July 2014 Doc Day Details Fol Sales Cost of Sales Dr ____ Cr ____ Dr ____ Cr ____ Extract from the General Ledger of Giant Industries for July 2014 Trading Stock Month Day Details Fol Amount Month Day Details Fol Amount Day Details Fol Amount Day Details Fol Amount Day Details Fol Amount Debtors’ Control Month Day Details Fol Amount Month Sales Month Day Details Fol Amount Month Cost of Sales Month Day Details Fol Amount Month 28 The debtors’ ledger is known as a subsidiary ledger, this is due to it not being part of the actual accounting cycle, but rather a specific tool for managing the amounts owed by debtors. In the Debtors’ Ledger, each debtor has their own account; this allows specific transactions to be recorded individually. As a result, a quick glance at any debtor’s individual ledger account will tell you how much that debtor owes the business. Format of the Debtors’ Ledger Debtor’s Ledger of M. Onster Month Day Document number In this column we record the source document number of the particular transaction Code Debit + Credit - Balance See code table Transactions that result in the debtor owing more are recorded in this column, such as when the debtor purchases goods. Transactions that result in the debtor owing less are recorded in this column, for example payments or returns. The balance column shows a running balance. This means that the effect of every transaction changes the balance. Explanation of Codes: Explanation This is the code for a credit sale This is the code for a payment This is the code for a return Code 1 2 3 D1 The codes are used as a quick means of identifying transactions. Codes are not standardized and businesses use different codes. What is the difference between the Debtors’ Control account in the General Ledger and the Subsidiary Debtors’ Ledger? The Debtors’ Control account is prepared using journal totals and therefore represents transactions with all debtors. In the Debtors’ Ledger, each debtor has an individual account that shows what each debtor owes. Take Note: Posting from the Debtors’ Journal to the Debtors’ Ledger Debtors’ Journal of EX Ample Traders for June 2012 Doc Day Details 66 4 Fol C. Roth Cost of Sales Sales 980 D1 600 Debtor’s Ledger of C. Roth Month Day June Document number 1 Account Rendered 4 Invoice 66 Code The entry on 1 June is the balance owed by debtor C Roth at the beginning of the month. D1 Debit Credit Balance 560 1 980 29 1 540 Explanation: As you can see in the above example, the individual transaction is posted to the individual debtor’s account. In this case, debtor C. Roth. The transaction is posted on the day that it took place, in this case the 4 th of June. The document number as pointed out above is written out in full, so that you can see what type of transaction is being posted (an invoice records a sale to a debtor) and therefore choose the correct code. In this case code 1 (for a sale). The amount in the Debtors’ Control column, which records the value of the sale, and therefore what the debtor owes, is posted to the ‘Debit’ column in the ledger. The debit column represents an increase in what is owed by the debtor. It is therefore added to the amount in the balance column (line above) to get the new balance amount. Thus by looking at the most recent balance column, you can always tell what a debtor owes. Activity 9.1 1 Which business issued the statement? 2 Who owes the business money? 3 How much does the customer owe the business in total? 4 Identify the two types of transactions shown on the statement below. 4.1 4.2 5 Why do you think the current amount (R3 300) and the amount due (R16 000) are different 30 Activity 9.4 (Page 150) Posting the Debtors’ Journal to the General Ledger: The total of the Sales column (R9 750): Debtors’ Control B9 June 1 Balance b/d 14 300 Sales N1 The total of the Cost of Sales column (R6 500): Trading Stock B12 June 1 Balance b/d 11 000 Cost of Sales N2 Debtors’ Ledger of Pippa Photography for March 20.1 Jarred Naidoo D1 Debit Credit Code Date Details (plus) (minus) Kumeul Moodley Date D2 Details James Wood Date Balance Code Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D3 Details Code 31 Activity 9.5 (Page 150) Posting the Debtors’ Journal to the General Ledger: Debtors’ Control B9 Dec 1 Balance b/d Trading Stock B12 Dec 1 Balance b/d Sales N1 Cost of Sales N2 Debtors’ Ledger of Scrunchy Traders for December 20.5 Andrew Smith D4 Debit Credit Code Date Details (plus) (minus) Nebs Khuzwayo Date D3 Details Travis Grigesh Date Code Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D2 Details Jason Galt Date Balance Code D1 Details Code 32 Posting the Debtors’ Allowances Journal to the General Ledger: The Debtors’ Allowances Journal records returns made by debtors to the business. As a result of the return, two changes can be identified. Firstly the debtor owes less, and secondly the business now has more stock. As a result, there are two columns, one to cancel the sale, and the second one to record the increase in stock. Debtors’ Allowances Journal of EX Ample Traders for June 2012 Doc Day Details Fol Debtors’ Allowances Cost of Sales The total of the Debtors’ Allowances column (R500): Debtors’ Control B9 June 1 Balance b/d 6 450 Debtors’ Allowances N3 The total of the Debtors’ Allowances column, R500, is posted to the credit (minus) side of the Debtors’ Control account as the debtors owe R500 less. The amount is also posted to the contra account, Debtors’ Allowances to record the cancellation of the sale. The total of the Cost of Sales Column (R250): Trading Stock B12 June 1 Balance b/d 6 450 Cost of Sales N2 The total of the Cost of Sales column represents the total value of stock that was returned by debtors. As this amount would have been returned to the businesses actual store room, the amount must also be added to the Trading Stock account (the Trading Stock account represents the Store room). The double entry for this is to debit the Trading Stock account as it is increasing, and to credit the Cost of Sales account. 33 Posting from the Debtors’ Allowances Journal to the Debtors’ Ledger: Take note: Debtors’ Allowances Journal of EX Ample Traders for June 2012 Doc Day Details 23 7 C. Roth Fol Debtors’ Allowances D1 98 Cost of Sales 60 Debtor’s Ledger of C. Roth Month Day Document number Code June 1 Account Rendered 4 Invoice 66 1 7 Credit Note 23 3 D1 Debit (Owe more) Credit (Owe less) Balance The amounts in the Debtors’ Ledger of C. Roth from the previous example are shown in grey text. 560 980 1 540 98 1 442 Explanation: In this example, which is a continuation of the previous example, a return by a debtor, recorded in the Debtors’ Allowances Journal is posted to the Debtors’ Ledger. A return by a debtor to a retailer is seen as a reversal of the original sales transaction. As a result of the return, the amount that the debtor owes the retailer decreases. The return is recorded in the DAJ, this is then posted to the individual debtor’s accounts. As the account is an asset, it decreases on the credit side, due to the return, the debtor owes less, and the account is therefore credited. In the above example, debtor C. Roth is returning something previously purchased for R98, C Roth therefore owes EX Ample Traders R98 less. R98 is therefore subtracted from the amount in the balance column, R1 540, resulting in a new balance of R1 442 (this is therefore the amount that debtor C. Roth currently owes EX Ample Traders). Did you know? Asset accounts increase on the Debit side and decrease on the Credit side. 34 Activity Debtors’ Allowances Journal of Crash Hardware for January 20.1 Doc Day Details Fol Debtors’ Allowances Cost of Sales The total of the Debtors’ Allowances column (R1 600): Debtors’ Control B9 Debtors’ Allowances N3 The total of the Cost of Sales Column (R350): Trading Stock B12 Cost of Sales N2 Debtors’ Ledger of Crash Hardware for January 20.1 B. Bean D1 Debit Code Date Details (plus) J. Jones Date Balance Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D2 Details R. Rivers Date Credit (minus) Code D3 Details Code 35 Activity 9.8 (Page156) Debtors’ Journal of Face – It for March 20.8 Doc Day Details Sales Cost of Sales Dr _____ Dr _____ Cr _____ Cr _____ Fol Debtors’ Allowances Journal of Face – It for March 20.8 Doc Day Details Fol Debtors’ Allowances Cost of Sales Dr _____ Dr _____ Cr _____ Cr _____ General Ledger of Face-It for March 20.8 Balance Sheet Section Debtors’ Control B9 Trading Stock B12 Nominal Section Sales N1 31 36 Debtors Control DJ 16 140 Debtors’ Allowances N3 Cost of Sales N2 Debtors’ Ledger of Face-It for March 20.8 R. Naidoo D1 Date Details S. Jackson Date Details Credit (minus) Balance Code Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D3 Details J. Savage Date Debit (plus) D2 M. Gilks Date Code Code D4 Details Code 37 J. Jansen D5 Date Details Debit (plus) Code Credit (minus) Balance What is the total owed by the five debtors? 3. Posting the Cash Receipts Journal to the General Ledger: As this has already been covered, only the posting of the Debtors’ Control column will be covered. Cash Receipts Journal of EX Ample Traders for June 2012 Doc Day Details Fol Analysis Bank Sales Cost of Sales Debtors’ Control Sundry accounts Amount Details Debtors’ Control B9 June 1 Balance b/d 6 450 Being an asset, the Debtors’ control account decreases on the credit side. The total of the Debtors’ control column in the Cash Receipts Journal represents payments received from debtors; the amount is therefore posted to the credit or minus side of Debtors’ Control, as the debtors now owe the business R4 600 less. 38 Posting from the Cash Receipts Journal to the Debtors’ Ledger: Cash Receipts Journal of EX Ample Traders for June 2012 Doc 44 Day Details 15 Fol Analysis D1 C. Roth 560 Bank Cost of Sales Sales 560 Debtors’ Control Sundry accounts Amount 560 Debtor’s Ledger of C. Roth Document number Code Details D1 Month Day Debit Credit Balance June 1 Account Rendered 4 Invoice 66 1 7 Credit note 23 3 98 1 442 15 Receipt 44 2 560 882 560 980 1 540 Explanation: In the cash receipts journal above, you can see the recording of a receipt from a debtor, C. Roth. Like any cash received, cash received from a debtor is recorded in the cash receipts journal. The effect of this receipt is that debtor C. Roth owes EX Ample traders less money. The receipt is for R560, therefore C. Roth owes R560 less, as this is what he has paid on his account. Being an asset, the account decreases on the credit side, and because the debtor owes less, due to payment, the account is decreasing. Hence the account must be credited. As a result of prior transactions, the debtor owed EX Ample Traders an amount of R1 442. The debtor has now paid an amount of R560, and therefore now owes R882. This can be seen in the Balance column which is updated after every transaction. 39 Activity 9.9 (Page 160) R. Duthie Date Debtors’ Ledger of Dlamini Drink Distributors D1 Debit Credit Code Details Balance (plus) (minus) S. Graham Date D2 Details J. Baxter Date Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D3 Details M. Clark Date Code Code D4 Details Code Dlamini Drink Distributors Debtors’ List as at 31 October 20.1 40 Activity Use the Journals below to prepare the account of K. Khoza D1 in the Debtors’ Ledger of Ndebele Traders for the month of November 2012. On 1 November K. Khoza owed an amount of R1 568 to Ndebele Traders. Debtors’ Journal of Ndebele Traders for November 2012 Doc 33 34 35 36 37 Day Details 2 5 9 17 25 Fol Z. Zitha K. Khoza D. Dlamini K. Khoza M. Mabena D1 D3 D4 D3 D2 Debtors’ Control 700 1 400 1 380 1 560 600 5 640 Cost of Sales 350 700 690 780 300 2 820 Debtors’ Allowances Journal of Ndebele Traders for November 2012 Doc 12 13 14 15 Day Details 7 15 22 29 K. Khoza Z. Zitha D. Dlamini K. Khoza Fol Debtors’ Allowances D3 D1 D4 D3 400 50 90 80 200 25 45 40 620 310 Cost of Sales Cash Receipts Journal of Ndebele Traders for November 2012 Doc Day 63 64 65 Details Fol Analysis 1 K. Khoza D3 1 568 1 568 8 Cash 450 450 15 Z. Zitha 8 50 850 22 Cash 940 940 30 K. Khoza 66 D1 D3 FNB Bank Sales Nov 1 Sundry accounts Amount Details 450 225 940 470 850 2 000 2 029 5 837 Date Debtors’ Control 1 568 2 000 29 K. Khoza Cost of Sales 29 1 090 695 4 418 Interest Received 29 D3 Details Code Debit (plus) Account Rendered Credit (minus) Balance 1 568 41 Activity 9.11 (Page 162) General Ledger of JJ Electronics – July 20.6 Balance Sheet Section Capital B1 July 1 Bank B2 July 1 Balance b/d 46 030 Vehicles B3 Trading Stock B4 July 1 Balance b/d 33 500 Debtors’ Control B5 July 1 Balance b/d 11 420 42 Balance b/d 200 000 Nominal Section Sales N1 July 1 Total b/d 185 400 Total b/d 22 500 Total b/d 7 200 Debtors’ Allowances N2 Cost of Sales N3 July 1 Total b/d 116 000 Current Income N4 July 1 Salaries and Wages N5 July 1 Total b/d 85 900 Water and Electricity N6 July 1 Total b/d 22 500 Rent Income N9 July 1 43 B. Ben Date Details Debtors’ Ledger of JJ Electronics D1 Debit Credit Code (plus) (minus) D. Denver Date D2 Details K. Kennedy Date Code Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance Debit (plus) Credit (minus) Balance D3 Details S. Smith Date Balance Code D4 Details Code JJ Electronics Debtors’ List as at 31 July 20.6 44 Activity Study the two ledger accounts below, prepared by a trainee accountant. Although all of the amounts are correct, the trainee has managed to mix-up her debits and credits. Some of the entries are on the incorrect side, and in one case the accountant was so unsure, she put an entry on both sides of an account (effectively cancelling the entry!). You are required to re-draw and correct the accounts in your book. Don’t forget to balance the accounts at the end of the month. Trading Stock B9 July 31 Cost of Sales Bank Dj Cpj 8 340 15 450 July 1 Balance b/d 3 640 31 Cost of Sales Crj 6 200 Balance c/d 4 550 Debtors’ Control B13 July 1 30 Balance Bank b/d Crj 7 400 Sales Dj 6 350 7 000 Answers Trading Stock B9 19 090 Aug 1 Balance 19 090 4 550 b/d Debtors’ Control B13 13 750 Aug 1 Balance b/d 13 750 6 750 45