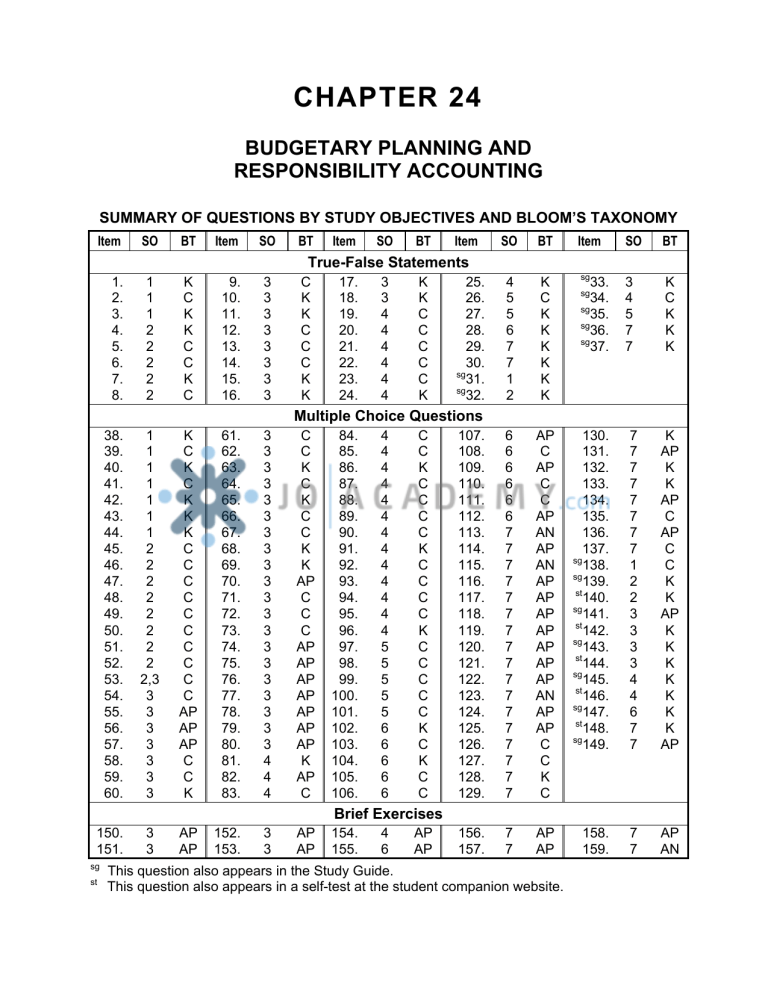

CHAPTER 24 BUDGETARY PLANNING AND RESPONSIBILITY ACCOUNTING SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S TAXONOMY Item SO BT Item SO BT Item SO BT Item SO BT Item SO BT 4 5 5 6 7 7 1 2 K C K K K K K K 3 4 5 7 7 K C K K K 107. 108. 109. 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. 6 6 6 6 6 6 7 7 7 7 7 7 7 7 7 7 7 7 7 7 7 7 7 AP C AP C C AP AN AP AN AP AP AP AP AP AP AP AN AP AP C C K C 130. 131. 132. 133. 134. 135. 136. 137. sg 138. sg 139. st 140. sg 141. st 142. sg 143. st 144. sg 145. st 146. sg 147. st 148. sg 149. 7 7 7 7 7 7 7 7 1 2 2 3 3 3 3 4 4 6 7 7 K AP K K AP C AP C C K K AP K K K K K K K AP 156. 157. 7 7 AP AP 158. 159. 7 7 AP AN True-False Statements 1. 2. 3. 4. 5. 6. 7. 8. 1 1 1 2 2 2 2 2 K C K K C C K C 9. 10. 11. 12. 13. 14. 15. 16. 3 3 3 3 3 3 3 3 C K K C C C K K 17. 18. 19. 20. 21. 22. 23. 24. 3 3 4 4 4 4 4 4 K K C C C C C K 25. 26. 27. 28. 29. 30. sg 31. sg 32. sg 33. 34. sg 35. sg 36. sg 37. sg Multiple Choice Questions 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2,3 3 3 3 3 3 3 3 K C K C K K K C C C C C C C C C C AP AP AP C C K 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 3 4 4 4 C C K C K C C K K AP C C C AP AP AP AP AP AP AP K AP C 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. 102. 103. 104. 105. 106. 4 4 4 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 6 6 6 6 6 C C K C C C C K C C C C K C C C C C K C K C C Brief Exercises 150. 151. sg st 3 3 AP AP 152. 153. 3 3 AP AP 154. 155. 4 6 AP AP This question also appears in the Study Guide. This question also appears in a self-test at the student companion website. 24 - 2 Test Bank for Accounting Principles, Eighth Edition SUMMARY OF QUESTIONS BY STUDY OBJECTIVES AND BLOOM’S TAXONOMY Exercises 160. 161. 162. 163. 2 2,3 3 3 AP AP AP AP 164. 165. 166. 167. 3 3 3 3 AP AP AP AP 168. 169. 170. 171. 3 3 3,6 4,5 AP AP AP AP 172. 173. 174. 175. 5 5 6 7 AN AP AN AP 7 7 7 K K K 176. 177. 178. 179. 7 7 7 7 AN AN AN AN Completion Statements 180. 181. 182. 1 1 1 K K K 183. 184. 185. 3 3 4 K K K 186. 187. 188. 4 4 4 K K K 189. 190. 191. SUMMARY OF STUDY OBJECTIVES BY QUESTION TYPE Item Type Item Type Item 1. 2. 3. TF TF TF 31. 38. 39. TF MC MC 40. 41. 42. 4. 5. 6. TF TF TF 7. 8. 32. TF TF TF 45. 46. 47. 9. 10. 11. 12. 13. 14. 15. 16. 17. TF TF TF TF TF TF TF TF TF 18. 33. 53. 54. 55. 56. 57. 58. 59. TF TF MC MC MC MC MC MC MC 60. 61. 62. 63. 64. 65. 66. 67. 68. 19. 20. 21. 22. 23. TF TF TF TF TF 24. 25. 34. 81. 82. TF TF TF MC MC 83. 84. 85. 86. 87. 26. 27. TF TF 35. 97. TF MC 98. 99. 28. 102. 103. TF MC MC 104. 105. 106. MC MC MC 107. 108. 109. Type Item Type Item Study Objective 1 MC 43. MC 180. MC 44. MC 181. MC 138. MC 182. Study Objective 2 MC 48. MC 51. MC 49. MC 52. MC 50. MC 53. Study Objective 3 MC 69. MC 78. MC 70. MC 79. MC 71. MC 80. MC 72. MC 141. MC 73. MC 142. MC 74. MC 143. MC 75. MC 144. MC 76. MC 150. MC 77. MC 151. Study Objective 4 MC 88. MC 93. MC 89. MC 94. MC 90. MC 95. MC 91. MC 96. MC 92. MC 145. Study Objective 5 MC 100. MC 171. MC 101. MC 172. Study Objective 6 MC 110. MC 147. MC 111. MC 155. MC 112. MC 170. Type Item Type Item Type MC MC MC 139. 140. 160. MC MC Ex 161. Ex MC MC MC MC MC MC MC BE BE 152. 153. 161. 162. 163. 164. 165. 166. 167. BE BE Ex Ex Ex Ex Ex Ex Ex 168. 169. 170. 183. 184. Ex Ex Ex C C MC MC MC MC MC 146. 154. 171. 185. 186. MC BE Ex C C 187. 188. C C Ex Ex 173. Ex MC BE Ex 172. 173. 174. Ex Ex Ex C C C Budgetary Planning and Responsibility Accounting 29. 30. 36. 37. 113, 114. 115. TF TF TF TF MC MC MC 116. 117. 118. 119. 120. 121. 122. MC MC MC MC MC MC MC 123. 124. 125. 126. 127. 128. 129. Note: TF = True-False MC = Multiple Choice Study Objective 7 MC 130. MC 137. MC 131. MC 148. MC 132. MC 149. MC 133. MC 156. MC 134. MC 157. MC 135. MC 158. MC 136. MC 159. MC MC MC BE BE BE BE BE = Brief Exercise Ex = Exercise 175. 176. 177. 178. 179. 189. 190. Ex Ex Ex Ex Ex C C 191. 24 - 3 C C = Completion The chapter also contains one set of twelve Matching questions and four Short-Answer Essay questions. CHAPTER STUDY OBJECTIVES 1. Describe the concept of budgetary control. Budgetary control consists of (a) preparing periodic budget reports that compare actual results with planned objectives, (b) analyzing the differences to determine their causes, (c) taking appropriate corrective action, and (d) modifying future plans, if necessary. 2. Evaluate the usefulness of static budget reports. Static budget reports are useful in evaluating the progress toward planned sales and profit goals. They are also appropriate in assessing a manager's effectiveness in controlling costs when (a) actual activity closely approximates the master budget activity level, and/or (b) the behavior of the costs in response to changes in activity is fixed. 3. Explain the development of flexible budgets and the usefulness of flexible budget reports. To develop the flexible budget, it is necessary to: (a) Identify the activity index and the relevant range of activity; (b) Identify the variable costs, and determine the budgeted variable cost per unit of activity for each cost; (c) Identify the fixed costs, and determine the budgeted amount for each cost; (d) Prepare the budget for selected increments of activity within the relevant range. Flexible budget reports permit an evaluation of a manager's performance in controlling production and costs. 4 Describe the concept of responsibility accounting. Responsibility accounting involves accumulating and reporting revenues and costs on the basis of the individual manager who has the authority to make the day-to-day decisions about the items. The evaluation of a manager's performance is based on the matters directly under the manager's control. In responsibility accounting, it is necessary to distinguish between controllable and noncontrollable fixed costs and to identify three types of responsibility centers: cost, profit, and investment. 5. Indicate the features of responsibility reports for cost centers. Responsibility reports for cost centers compare actual costs with flexible budget data. The reports show only controllable costs, and no distinction is made between variable and fixed costs. 6. Identify the content of responsibility reports for profit centers. Responsibility reports show contribution margin, controllable fixed costs, and controllable margin for each profit center. 24 - 4 Test Bank for Accounting Principles, Eighth Edition 7. Explain the basis and formula used in evaluating performance in investment centers. The primary basis for evaluating performance in investment centers is return on investment (ROI). The formula for computing ROI for investment centers is: Controllable margin ÷ Average operating assets. TRUE-FALSE STATEMENTS 1. Budget reports comparing actual results with planned objectives should be prepared only once a year. 2. If actual results are different from planned results, the difference must always be investigated by management to achieve effective budgetary control. 3. Certain budget reports are prepared monthly, whereas others are prepared more frequently depending on the activities being monitored. 4. The master budget is not used in the budgetary control process. 5. A master budget is most useful in evaluating a manager's performance in controlling costs. 6. A static budget is one that is geared to one level of activity. 7. A static budget is changed only when actual activity is different from the level of activity expected. 8. A static budget is most useful for evaluating a manager's performance in controlling variable costs. 9. A flexible budget can be prepared for each of the types of budgets included in the master budget. 10. A flexible budget is a series of static budgets at different levels of activities. 11. Flexible budgeting relies on the assumption that unit variable costs will remain constant within the relevant range of activity. 12. Total budgeted fixed costs appearing on a flexible budget will be the same amount as total fixed costs on the master budget. 13. A flexible budget is prepared before the master budget. 14. The activity index used in preparing a flexible budget should not influence the variable costs that are being budgeted. 15. A formula used in developing a flexible budget is: Total budgeted cost = fixed cost + (total variable cost per unit × activity level). 16. Flexible budgets are widely used in production and service departments. Budgetary Planning and Responsibility Accounting 24 - 5 17. A flexible budget report will show both actual and budget cost based on the actual activity level achieved. 18. Management by exception means that management will investigate areas where actual results differ from planned results if the items are material and controllable. 19. Policies regarding when a difference between actual and planned results should be investigated are generally more restrictive for noncontrollable items than for controllable items. 20. A distinction should be made between controllable and noncontrollable costs when reporting information under responsibility accounting. 21. Cost centers, profit centers, and investment centers can all be classified as responsibility centers. 22. More costs become controllable as one moves down to each lower level of managerial responsibility. 23. In a responsibility accounting reporting system, as one moves up each level of responsibility in an organization, the responsibility reports become more summarized and show less detailed information. 24. Decentralization means that the control of operations is delegated by top management to many individuals throughout the organization. 25. A cost item is considered to be controllable if there is not a large difference between actual cost and budgeted cost for that item. 26. A cost center incurs costs and generates revenues and cost center managers are evaluated on the profitability of their centers. 27. The terms "direct fixed costs" and "indirect fixed costs" are synonymous with "traceable costs" and "common costs," respectively. 28. Controllable margin is subtracted from controllable fixed costs to get net income for a profit center. 29. The denominator in the formula for calculating the return on investment includes operating and nonoperating assets. 30. The formula for computing return on investment is controllable margin divided by average operating assets. Additional True-False Questions 31. Budget reports provide the feedback needed by management to see whether actual operations are on course. 32. A static budget is an effective means to evaluate a manager's ability to control costs, regardless of the actual activity level. 24 - 6 Test Bank for Accounting Principles, Eighth Edition 33. The flexible budget report evaluates a manager's performance in two areas: production and (2) costs. (1) 34. The terms controllable costs and noncontrollable costs are synonymous with variable costs and fixed costs, respectively. 35. Most direct fixed costs are not controllable by the profit center manager. 36. The manager of an investment center can improve ROI by reducing average operating assets. 37. An advantage of the return on investment ratio is that no judgmental factors are involved. Answers to True-False Statements Item 1. 2. 3. 4. 5. 6. Ans. F F T F F T Item 7. 8. 9. 10. 11. 12. Ans. F F T T T T Item 13. 14. 15. 16. 17. 18. Ans. F F T T T T Item 19. 20. 21. 22. 23. 24. Ans. F T T F T T Item 25. 26. 27. 28. 29. 30. Ans. Item F F T F F T 31. 32. 33. 34. 35. 36. Ans. T F T F F T Item 37. Ans. F MULTIPLE CHOICE QUESTIONS 38. What is budgetary control? a. Another name for a flexible budget b. The degree to which the CFO controls the budget c. The use of budgets in controlling operations d. The process of providing information on budget differences to lower level managers 39. A major element in budgetary control is a. the preparation of long-term plans. b. the comparison of actual results with planned objectives. c. the valuation of inventories. d. approval of the budget by the stockholders. 40. Budget reports should be prepared a. daily. b. monthly. c. weekly. d. as frequently as needed. 41. On the basis of the budget reports, a. management analyzes differences between actual and planned results. b. management may take corrective action. c. management may modify the future plans. d. all of these. Budgetary Planning and Responsibility Accounting 24 - 7 42. The purpose of the departmental overhead cost report is to a. control indirect labor costs. b. control selling expense. c. determine the efficient use of materials. d. control overhead costs. 43. The purpose of the sales budget report is to a. control selling expenses. b. determine whether income objectives are being met. c. determine whether sales goals are being met. d. control sales commissions. 44. The comparison of differences between actual and planned results a. is done by the external auditors. b. appears on the company's external financial statements. c. is usually done orally in departmental meetings. d. appears on periodic budget reports. 45. A static budget a. should not be prepared in a company. b. is useful in evaluating a manager's performance by comparing actual variable costs and planned variable costs. c. shows planned results at the original budgeted activity level. d. is changed only if the actual level of activity is different than originally budgeted. 46. A static budget report a. shows costs at only 2 or 3 different levels of activity. b. is appropriate in evaluating a manager's effectiveness in controlling variable costs. c. should be used when the actual level of activity is materially different from the master budget activity level. d. may be appropriate in evaluating a manager's effectiveness in controlling costs when the behavior of the costs in response to changes in activity is fixed. 47. A static budget is appropriate in evaluating a manager's performance if a. actual activity closely approximates the master budget activity. b. actual activity is less than the master budget activity. c. the company prepares reports on an annual basis. d. the company is a not-for-profit organization 48. When budgeted and actual results are not the same amount, there is a budget a. error. b. difference. c. anomaly. d. by-product. 49. Top management's reaction to a difference between budgeted and actual sales often depends on a. whether the difference is favorable or unfavorable. b. whether management anticipated the difference. c. the materiality of the difference. d. the personality of the top managers. 24 - 8 Test Bank for Accounting Principles, Eighth Edition 50. If costs are not responsive to changes in activity level, then these costs can be best described as a. mixed. b. flexible. c. variable. d. fixed. 51. Assume that actual sales results exceed the planned results for the second quarter. This favorable difference is greater than the unfavorable difference reported for the first quarter sales. Which of the following statements about the sales budget report on June 30 is true? a. The year-to-date results will show a favorable difference. b. The year-to-date results will show an unfavorable difference. c. The difference for the first quarter can be ignored. d. The sales report is not useful if it shows a favorable and unfavorable difference for the two quarters. 52. A static budget is appropriate for a. variable overhead costs. b. direct materials costs. c. fixed overhead costs. d. none of these. 53. What is the primary difference between a static budget and a flexible budget? a. The static budget contains only fixed costs, while the flexible budget contains only variable costs. b. The static budget is prepared for a single level of activity, while a flexible budget is adjusted for different activity levels. c. The static budget is constructed using input from only upper level management, while a flexible budget obtains input from all levels of management. d. The static budget is prepared only for units produced, while a flexible budget reflects the number of units sold. 54. A flexible budget a. is prepared when management cannot agree on objectives for the company. b. projects budget data for various levels of activity. c. is only useful in controlling fixed costs. d. cannot be used for evaluation purposes because budgeted data are adjusted to reflect actual results. 55. The master budget of Benedict Company shows that the planned activity level for next year is expected to be 50,000 machine hours. At this level of activity, the following manufacturing overhead costs are expected: Indirect labor Machine supplies Indirect materials Depreciation on factory building Total manufacturing overhead $240,000 60,000 70,000 50,000 $420,000 A flexible budget for a level of activity of 60,000 machine hours would show total manufacturing overhead costs of Budgetary Planning and Responsibility Accounting a. b. c. d. 24 - 9 $494,000. $420,000. $504,000. $454,000. 56. Rickets Crickets prepared a 2008 budget for 60,000 units of product. Actual production in 2008 was 65,000 units. To be most useful, what amounts should a performance report for this company compare? a. The actual results for 65,000 units with the original budget for 60,000 units b. The actual results for 65,000 units with a new budget for 65,000 units. c. The actual results for 65,000 units with last year's actual results for 67,000 units d. It doesn't matter. All of these choices are equally useful. 57. A department has budgeted monthly manufacturing overhead cost of $270,000 plus $3 per direct labor hour. If a flexible budget report reflects $522,000 for total budgeted manufacturing cost for the month, the actual level of activity achieved during the month was a. 264,000 direct labor hours. b. 84,000 direct labor hours. c. 174,000 direct labor hours. d. Cannot be determined from the information provided. 58. Which one of the following would be the same total amount on a flexible budget and a static budget if the activity level is different for the two types of budgets? a. Direct materials cost b. Direct labor cost c. Variable manufacturing overhead d. Fixed manufacturing overhead 59. In developing a flexible budget within a relevant range of activity, a. only fixed costs are included. b. it is necessary to relate variable cost data to the activity index chosen. c. it is necessary to prepare a budget at 1,000 unit increments. d. variable and fixed costs are combined and are reported as a total cost. 60. What budgeted amounts appear on the flexible budget? a. Original budgeted amounts at the static budget activity level b. Actual costs for the budgeted activity level c. Budgeted amounts for the actual activity level achieved d. Actual costs for the estimated activity level 61. The flexible budget a. is prepared before the master budget. b. is relevant both within and outside the relevant range. c. eliminates the need for a master budget. d. is a series of static budgets at different levels of activity. 62. A flexible budget can be prepared for which of the following budgets comprising the master budget? a. Sales b. Overhead c. Direct materials d. All of these 24 - 10 Test Bank for Accounting Principles, Eighth Edition 63. Another name for the static budget is a. master budget. b. overhead budget. c. permanent budget. d. flexible budget. 64. If a company plans to sell 24,000 units of product but sells 30,000, the most appropriate comparison of the cost data associated with the sales will be by a budget based on a. the original planned level of activity. b. 27,000 units of activity. c. 30,000 units of activity. d. 24,000 units of activity. 65. Within the relevant range of activity, the behavior of total costs is assumed to be a. linear and upward sloping. b. linear and downward sloping. c. curvilinear and upward sloping. d. linear to a point and then level off. 66. Sales results that are evaluated by a static budget might show 1. favorable differences that are not justified. 2. unfavorable differences that are not justified. a. b. c. d. 67. 1 2 both 1 and 2. neither 1 nor 2. The selection of levels of activity to depict a flexible budget 1. will be within the relevant range. 2. is largely a matter of expediency. 3. is governed by generally accepted accounting principles. a. b. c. d. 1 2 3 1 and 2 68. Management by exception a. causes managers to be buried under voluminous paperwork. b. means that all differences will be investigated. c. means that only unfavorable differences will be investigated. d. means that material differences will be investigated. 69. Under management by exception, which differences between planned and actual results should be investigated? a. Material and noncontrollable b. Controllable and noncontrollable c. Material and controllable d. All differences should be investigated Budgetary Planning and Responsibility Accounting 70. 24 - 11 Romano Roofing's budgeted manufacturing costs for 25,000 squares of shingles are: Fixed manufacturing costs Variable manufacturing costs $15,000 $20.00 per square Romano produced 20,000 squares of shingles during March. How much are budgeted total manufacturing costs in March? a. $400,000 b. $515,000 c. $500,000 d. $415,000 71. A flexible budget depicted graphically a. is identical to a CVP graph. b. differs from a CVP graph in the way that fixed costs are shown. c. differs from a CVP graph in the way that variable costs are shown. d. differs from a CVP graph in that sales revenue is not shown. 72. The activity index used in preparing the flexible budget a. is prescribed by generally accepted accounting principles. b. is only applicable to fixed manufacturing costs. c. is the same for all departments. d. should significantly influence the costs that are being budgeted. 73. A static budget is not appropriate in evaluating a manager's effectiveness if a company has a. substantial fixed costs. b. substantial variable costs. c. planned activity levels that match actual activity levels. d. no variable costs. 74. Trepid Manufacturing Company prepared a fixed budget of 40,000 direct labor hours, with estimated overhead costs of $200,000 for variable overhead and $60,000 for fixed overhead. Trepid then prepared a flexible budget at 38,000 labor hours. How much is total overhead costs at this level of activity? a. $190,000 b. $250,000 c. $247,000 d. $260,000 75. For June, Mark Manufacturing estimated sales revenue at $200,000. It pays sales commissions that are 4% of sales. The sales manager's salary is $95,000, estimated shipping expenses total 1% of sales, and miscellaneous selling expenses are $5,000. How much are budgeted selling expenses for the month of July if sales are expected to be $180,000? a. $14,000 b. $109,000 c. $9,000 d. $110,000 24 - 12 Test Bank for Accounting Principles, Eighth Edition 76. Ziglar’s Sipit Company budgeted manufacturing costs for 25,000 sipits are: Fixed manufacturing costs Variable manufacturing costs $25,000 per month $12.00 per sipit Ziglar’s produced 20,000 sipits during March. How much is the flexible budget for total manufacturing costs for March? a. $260,000 b. $325,000 c. $240,000 d. $265,000 77. True Masons budgeted costs for 25,000 linear feet of block are: Fixed manufacturing costs Variable manufacturing costs $12,000 per month $16.00 per linear True Masons installed 20,000 linear feet of block during March. How much is budgeted total manufacturing costs in March? a. $320,000 b. $412,000 c. $400,000 d. $332,000 78. In the Klugman Company, indirect labor is budgeted for $36,000 and factory supervision is budgeted for $12,000 at normal capacity of 80,000 direct labor hours. If 90,000 direct labor hours are worked, flexible budget total for these costs is a. $48,000. b. $54,000. c. $52,500. d. $49,500. 79. Wayman Company uses flexible budgets. At normal capacity of 8,000 units, budgeted manufacturing overhead is: $48,000 variable and $135,000 fixed. If Wayman had actual overhead costs of $187,500 for 9,000 units produced, what is the difference between actual and budgeted costs? a. $1,500 unfavorable b. $1,500 favorable c. $4,500 unfavorable d. $6,000 favorable 80. A company's planned activity level for next year is expected to be 100,000 machine hours. At this level of activity, the company budgeted the following manufacturing overhead costs: Variable Fixed Indirect materials $140,000 Depreciation $60,000 Indirect labor 200,000 Taxes 10,000 Factory supplies 20,000 Supervision 50,000 A flexible budget prepared at the 80,000 machine hours level of activity would show total manufacturing overhead costs of a. $288,000. b. $360,000. c. $384,000. d. $408,000. Budgetary Planning and Responsibility Accounting 24 - 13 81. The accumulation of accounting data on the basis of the individual manager who has the authority to make day-to-day decisions about activities in an area is called a. static reporting. b. flexible accounting. c. responsibility accounting. d. master budgeting. 82. Cart Company recorded operating data for its shoe division for the year. Sales Contribution margin Controllable fixed costs Average total operating assets $750,000 150,000 90,000 300,000 How much is controllable margin for the year? a. 20% b. 50% c. $150,000 d. $60,000 83. A cost is considered controllable at a given level of managerial responsibility if a. the manager has the power to incur the cost within a given time period. b. the cost has not exceeded the budget amount in the master budget. c. it is a variable cost, but it is uncontrollable if it is a fixed cost. d. it changes in magnitude in a flexible budget. 84. As one moves up to each higher level of managerial responsibility, a. fewer costs are controllable. b. the responsibility for cost incurrence diminishes. c. a greater number of costs are controllable. d. performance evaluation becomes less important. 85. A responsibility report should a. be prepared in accordance with generally accepted accounting principles. b. show only those costs that a manager can control. c. only show variable costs. d. only be prepared at the highest level of managerial responsibility. 86. Top management can control a. only controllable costs. b. only noncontrollable costs. c. all costs. d. some noncontrollable costs and all controllable costs. 87. Not-for-profit entities a. do not use responsibility accounting. b. utilize responsibility accounting in trying to maximize net income. c. utilize responsibility accounting in trying to minimize the cost of providing services. d. have only noncontrollable costs. 24 - 14 Test Bank for Accounting Principles, Eighth Edition 88. Which of the following is not a true statement? a. All costs are controllable at some level within a company. b. Responsibility accounting applies to both profit and not-for-profit entities. c. Fewer costs are controllable as one moves up to each higher level of managerial responsibility. d. The term segment is sometimes used to identify areas of responsibility in decentralized operations. 89. Costs incurred indirectly and allocated to a responsibility level are considered to be a. nonmaterial. b. mixed. c. controllable. d. noncontrollable. 90. Management by exception a. is most effective at top levels of management. b. can be implemented at each level of responsibility within an organization. c. can only be applied when comparing actual results with the master budget. d. is the opposite of goal congruence. 91. Which responsibility centers generate both revenues and costs? a. Investment and profit centers b. Profit and cost centers c. Cost and investment centers d. Only profit centers 92. The linens department of a large department store is a. not a responsibility center. b. a profit center. c. a cost center. d. an investment center. 93. The foreign subsidiary of a large corporation is a. not a responsibility center. b. a profit center. c. a cost center. d. an investment center. 94. The maintenance department of a manufacturing company is a(n) a. segment. b. profit center. c. cost center. d. investment center. 95. Which of the following is not a correct match? 1. Incurs costs 2. Generates revenue 3. Controls investment funds a. Investment Center 1, 2, 3 b. Cost Center 1 c. Profit Center 1, 2, 3 d. All are correct matches. Budgetary Planning and Responsibility Accounting 24 - 15 96. A cost center a. only incurs costs and does not directly generate revenues. b. incurs costs and generates revenues. c. is a responsibility center of a company which incurs losses. d. is a responsibility center which generates profits and evaluates the investment cost of earning the profit. 97. A manager of a cost center is evaluated mainly on a. the profit that the center generates. b. his or her ability to control costs. c. the amount of investment it takes to support the cost center. d. the amount of revenue that can be generated. 98. Performance reports for cost centers compare actual a. total costs with static budget data. b. total costs with flexible budget data. c. controllable costs with static budget data. d. controllable costs with flexible budget data. 99. In the performance report for cost centers, a. controllable and noncontrollable costs are reported. b. fixed costs are not reported. c. no distinction is made between fixed and variable costs. d. only materials and controllable costs are reported. 100. Of the following choices, which contain both a traceable fixed cost and a common fixed cost? a. Profit center manager's salary and timekeeping costs for a responsibility center's employees. b. Company president's salary and company personnel department costs. c. Company personnel department costs and timekeeping costs for a responsibility center's employees. d. Depreciation on a responsibility center's equipment and supervisory salaries for the center. 101. Which of the following is not an indirect fixed cost? a. Company president's salary b. Depreciation on the company building housing several profit centers c. Company personnel department costs d. Profit center supervisory salaries 102. A profit center is a. a responsibility center that always reports a profit. b. a responsibility center that incurs costs and generates revenues. c. evaluated by the rate of return earned on the investment allocated to the center. d. referred to as a loss center when operations do not meet the company's objectives. 103. The best measure of the performance of the manager of a profit center is the a. rate of return on investment. b. success in meeting budgeted goals for controllable costs. c. amount of controllable margin generated by the profit center. d. amount of contribution margin generated by the profit center. 24 - 16 Test Bank for Accounting Principles, Eighth Edition 104. Controllable margin is defined as a. sales minus variable costs. b. sales minus contribution margin. c. contribution margin less controllable fixed costs. d. contribution margin less noncontrollable fixed costs. 105. Controllable margin is most useful for a. external financial reporting. b. preparing the master budget. c. performance evaluation of profit centers. d. break-even analysis. 106. Which of the following will not result in an unfavorable controllable margin difference? a. Sales exceeding budget; costs under budget b. Sales exceeding budget; costs over budget c. Sales under budget; costs under budget d. Sales under budget; costs over budget 107. Given below is an excerpt from a management performance report: Contribution margin Controllable fixed costs Budget $1,000,000 $ 500,000 Actual $1,050,000 $ 450,000 Difference $50,000 $50,000 The manager's overall performance a. is 20% below expectations. b. is 20% above expectations. c. is equal to expectations. d. cannot be determined from information given. 108. Which of the following are financial measures of performance? 1. Controllable margin 2. Product quality 3. Labor productivity a. b. c. d. 109. 1 2 3 1 and 3 Given below is an excerpt from a management performance report: Contribution margin Controllable fixed costs Budget $600,000 $200,000 Actual $580,000 $220,000 The manager's overall performance a. is 10% above expectations. b. is 10% below expectations. c. is equal to expectations. d. cannot be determined from the information provided. Difference $20,000 U $20,000 U Budgetary Planning and Responsibility Accounting 24 - 17 110. A responsibility report for a profit center will a. not show controllable fixed costs. b. not show indirect fixed costs. c. show noncontrollable fixed costs. d. not show cumulative year-to-date results. 111. The dollar amount of the controllable margin a. is usually higher than the contribution margin. b. is usually lower than the contribution margin. c. is always equal to the contribution margin. d. cannot be a negative figure. 112. Garrison Company recorded operating data for its shoe division for the year. The company’s desired return is 5%. Sales Contribution margin Total direct fixed costs Average total operating assets $500,000 100,000 60,000 200,000 Which one of the following reflects the controllable margin for the year? a. 20% b. 50% c. $30,000 d. $40,000 113. The area manager of the Steak House Restaurants is considering two possible expansion alternatives. The required investments, expected controllable margins, and the ROIs of each are as follows: Project Charlotte Richmond Investment $120,000 $540,000 Controllable Margin $30,000 $50,000 ROI 25% 9.25% The Steak House segment has currently $2,000,000 in invested capital and a controllable margin of $250,000. Which one of following projects will increase the Steak House division’s ROI? a. Both the Charlotte and Richmond options b. Only the Charlotte option c. Only the Richmond option d. Neither the Charlotte nor the Richmond options 114. Timex Corporation recorded operating data for its Cheap division for the year. Timex requires its return to be 10%. Sales Controllable margin Total average assets Fixed costs What is the ROI for the year? a. 4% b. 35% c. –6% d. 1.5% $ 700,000 80,000 2,000,000 50,000 24 - 18 Test Bank for Accounting Principles, Eighth Edition 115. Halpern Division’s operating results include: controllable margin of $150,000, sales totaling $1,200,000, and average operating assets of $500,000. Halpern is considering a project with sales of $100,000, expenses of $86,000, and an investment of average operating assets of $200,000. Halpern’s required rate of return is 9%. Should Halpern accept this project? a. Yes, ROI will drop by 6.6% which is still above the required rate of return. b. No, the return is less than the required rate of 9%. c. Yes, ROI still exceeds the cost of capital. d. No, ROI will decrease to 7%. 116. Perot Manufacturing reported the following items for 2008: Income tax expense Contribution margin Controllable fixed costs Interest expense Total operating assets $ 30,000 100,000 40,000 20,000 325,000 How much is controllable margin? a. $100,000 b. $60,000 c. $30,000 d. $10,000 117. Merck Pharmaceuticals is evaluating its Vioxx division, an investment center. The division has a $45,000 controllable margin and $300,000 of sales. How much will Merck’s average operating assets be when its return on investment is 10%? a. $450,000 b. $495,000 c. $300,000 d. $255,000 118. An investment center generated a contribution margin of $200,000, fixed costs of $100,000 and sales of $1,000,000. The center’s average operating assets were $400,000. How much is the return on investment? a. 25% b. 175% c. 50% d. 75% 119. Safety Seats Company recorded operating data for its auto accessories division for the year. Sales $375,000 Contribution margin 75,000 Total direct fixed costs 45,000 Average total operating assets 200,000 How much is ROI for the year if management is able to identify a way to improve the contribution margin by $15,000, assuming fixed costs are held constant? a. 45.0% b. 22.5% c. 15.0% d. 12.0% Budgetary Planning and Responsibility Accounting 24 - 19 120. The current controllable margin for Claremont Division is $62,000. Its current operating assets are $200,000. The division is considering purchasing equipment for $60,000 that will increase annual controllable margin by an estimated $10,000. If the equipment is purchased, what will happen to the return on investment for Claremont Division? a. An increase of 16.1% b. A decrease of 13.3% c. A decrease of 3.3% d. A decrease of 7.2% 121. CinRich Corporation recorded operating data for its Waterhole division for the year. CinRich requires its return to be 9%. Sales Controllable margin Total average assets Fixed costs $500,000 90,000 300,000 30,000 How much is ROI for the year? a. 10% b. 16.7% c. 20% d. 30% 122. Lou Alabassi is the North Division manager and his performance is evaluated by executive management based on Division ROI. The current controllable margin for North Division is $46,000. Its current operating assets total $210,000. The division is considering purchasing equipment for $40,000 that will increase sales by an estimated $10,000, with annual depreciation of $10,000. If the equipment is purchased, what will happen to the return on investment for the division? a. An increase of 0.5% b. A decrease of 0.5% c. A decrease of 3.5% d. It will remain unchanged. 123. Cruise Division of Harrah’s Company’s operating results include: controllable margin, $200,000; sales $2,200,000; and operating assets, $800,000. The Cruise Division’s ROI is 25%. Management is considering a project with sales of $100,000, variable expenses of $60,000, fixed costs of $40,000; and an asset investment of $150,000. Should management accept this new project? a. No, since ROI will be lowered. b. Yes, since ROI will increase. c. Yes, since additional sales always mean more customers. d. No, since a loss will be incurred. 124. The Eastern Division of Flint Corp. had an ROI of 25% when sales were $1 million and controllable margin was $200,000. What were the average operating assets? a. $50,000 b. $250,000 c. $800,000 d. $4,000 24 - 20 Test Bank for Accounting Principles, Eighth Edition 125. Cart Company recorded operating data for its shoe division for the year. Sales Contribution margin Total fixed costs Average total operating assets $500,000 90,000 60,000 200,000 How much is ROI for the year if management is able to identify a way to improve the contribution margin by $20,000, assuming fixed costs are held constant? a. 25% b. 18% c. 45% d. 12% 126. A distinguishing characteristic of an investment center is that a. revenues are generated by selling and buying stocks and bonds. b. interest revenue is the major source of revenues. c. the profitability of the center is related to the funds invested in the center. d. it is a responsibility center which only generates revenues. 127. A measure frequently used to evaluate the performance of the manager of an investment center is a. the amount of profit generated. b. the rate of return on funds invested in the center. c. the percentage increase in profit over the previous year. d. departmental gross profit. 128. Return on investment is calculated by dividing a. contribution margin by sales. b. controllable margin by sales. c. contribution margin by average operating assets. d. controllable margin by average operating assets. 129. Which one of the following will not increase return on investment? a. Variable costs are increased b. An increase in sales c. Average operating assets are decreased d. Variable costs are decreased 130. If an investment center has generated a controllable margin of $75,000 and sales of $300,000, what is the return on investment for the investment center if average operating assets were $500,000 during the period? a. 15% b. 25% c. 45% d. 60% Budgetary Planning and Responsibility Accounting 24 - 21 131. Which statement is true? a. An investment center is responsible for revenues and expenses, as well as earning a return on assets. b. An investment center is only responsible for its investments. c. An investment center is only responsible for revenues and expenses. d. A profit center is evaluated using contribution margin, while an investment center is evaluated using ROI. 132. The denominator in the formula for return on investment calculation is a. investment center controllable margin. b. dependent on the specific type of profit center. c. average investment center operating assets. d. sales for the period. 133. In the formula for ROI, idle plant assets are a. included in the calculation of controllable margin. b. included in the calculation of operating assets. c. excluded in the calculation of operating assets. d. excluded from total assets. 134. In computing ROI, land held for future use a. will hurt the performance measurement of an investment center's manager. b. is important in evaluating the performance of a profit center manager. c. is included in the calculation of operating assets. d. is considered a nonoperating asset. 135. Dodge City Parts has a current return on investment of 10% and the company has established an 8% minimum rate of return for the division. The division manager has two investment projects available, for which the following estimates have been made: Project A - Annual controllable margin = $24,000, operating assets = $400,000 Project B - Annual controllable margin = $60,000, operating assets = $550,000 Which project should be funded? a. Both projects b. Project A c. Project B d. Neither project 136. If an investment center has a $45,000 controllable margin and $600,000 of sales, what average operating assets are needed to have a return on investment of 10%? a. $60,000 b. $105,000 c. $450,000 d. $600,000 137. Which of the following valuations of operating assets is not readily available from the accounting records? a. Cost b. Book value c. Market value d. Both cost and market value 24 - 22 Test Bank for Accounting Principles, Eighth Edition Additional Multiple Choice Questions 138. Which of the following would not be considered an aspect of budgetary control? a. It assists in the determination of differences between actual and planned results. b. It provides feedback value needed by management to see whether actual operations are on course. c. It assists management in controlling operations. d. It provides a guarantee for favorable results. 139. A static budget is usually appropriate in evaluating a manager's effectiveness in controlling a. fixed manufacturing costs and fixed selling and administrative expenses. b. variable manufacturing costs and variable selling and administrative expenses. c. fixed manufacturing costs and variable selling and administrative expenses. d. variable manufacturing costs and fixed selling and administrative expenses. 140. A static budget report is appropriate for a. fixed manufacturing costs. b. fixed selling and administrative expenses. c. variable selling and administrative expenses. d. both fixed manufacturing costs and fixed selling and administrative expenses. 141. Weiser Company uses flexible budgets. At normal capacity of 8,000 units, budgeted manufacturing overhead is $64,000 variable and $180,000 fixed. If Weiser had actual overhead costs of $250,000 for 9,000 units produced, what is the difference between actual and budgeted costs? a. $2,000 unfavorable b. $2,000 favorable c. $6,000 unfavorable d. $8,000 favorable 142. To develop the flexible budget, management takes all of the following steps except identify the a. activity index and the relevant range of activity. b. variable costs and determine the budgeted variable cost per unit. c. fixed costs and determine the budgeted fixed cost per unit. d. All of these options are steps in developing the flexible budget. 143. A flexible budget is appropriate for a. b. c. d. 144. Direct Labor Costs No Yes Yes No Manufacturing Overhead Costs No Yes No Yes All of the following statements are correct about management by exception except it a. enables top management to focus on problem areas that need attention. b. means that management has to investigate every budget difference. c. requires that there must be some guidelines for identifying an exception. d. means that top management's review of a budget report is focused primarily on differences between actual results and planned objectives. Budgetary Planning and Responsibility Accounting 24 - 23 145. Controllable costs for responsibility accounting purposes are those costs that are directly influenced by a. a given manager within a given period of time. b. a change in activity. c. production volume. d. sales volume. 146. All of the following statements are correct about controllable costs except a. all costs are controllable at some level of responsibility within a company. b. all costs are controllable by top management. c. fewer costs are controllable as one moves up to each higher level of managerial responsibility. d. costs incurred directly by a level of responsibility are controllable at that level. 147. Which of the following will cause an increase in ROI? a. An increase in variable costs b. An increase in average operating assets c. An increase in sales d. An increase in controllable fixed costs 148. Costs that relate specifically to one center and are incurred for the sole benefit of that center are a. common fixed costs. b. direct fixed costs. c. indirect fixed costs. d. noncontrollable fixed costs. 149. If controllable margin is $300,000 and the average investment center operating assets are $1,000,000, the return on investment is a. .33%. b. 3.33%. c. 10%. d. 30%. Answers to Multiple Choice Questions Item 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. Ans. c b d d d c d c d a b c d a c b Item 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. Ans. b a b b d b c d d a c a c d d c Item 70. 71. 72. 73. 74. 75. 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. Ans. Item Ans. Item Ans. d d d b b b d d c b d c d a c b 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. c c c d b a b d c c a b d c c d 102. 103. 104. 105. 106. 107. 108. 109. 110. 111. 112. 113. 114. 115. 116. 117. b c c c a b a b b b d b a b b a Item 118. 119. 120. 121. 122. 123. 124. 125. 126. 127. 128. 129. 130. 131. 132. 133. Ans. Item Ans. a b c d c a c a c b d a a a c c 134. 135. 136. 137. 138. 139. 140. 141. 142. 143. 144. 145. 146. 147. 148. 149. d c c c d a d b c b b a c c b d 24 - 24 Test Bank for Accounting Principles, Eighth Edition EXERCISES BE 150 Shirk Productions makes a single product. Expected manufacturing costs are as follows: Variable costs Direct materials Direct labor Manufacturing overhead $6.50 per unit 2.40 per unit 1.10 per unit Fixed costs per month Supervisory salaries Depreciation Other fixed costs $12,600 3,500 2,200 Instructions Determine the amount of manufacturing costs for a flexible budget level of 3,200 units per month. Solution 150 (4 min.) 3,200 × ($6.50 + $2.40 + $1.10) + ($12,600 + $3,500 + $2,200) = $50,300 BE 151 Sekine Company uses flexible budgets. Items from the budget for March in which 2,000 units were produced and sold appear below: Direct materials Indirect materials - variable Supervisor salaries Depreciation on factory equipment Direct labor Property taxes on factory $18,000 2,000 15,000 4,000 10,000 1,000 Instructions If Sekine prepares a flexible budget at 3,000 units, compute its total variable cost. Solution 151 (4 min.) Variable cost per unit: ($18,000 + $2,000 + $10,000) ÷ 2,000 = $15 per unit Variable cost at 3,000 units: $15 × 3,000 = $45,000 Budgetary Planning and Responsibility Accounting 24 - 25 BE 152 SugarTown’s manufacturing costs for August when production was 1,000 units appear below: Direct material Direct labor Variable overhead Factory depreciation Factory supervisory salaries Other fixed factory costs $12 per unit $6,500 5,000 9,000 7,800 2,500 Instructions Compute the flexible budget manufacturing cost amount for a month when 800 units are produced. Solution 152 (5 min.) Direct material ($12 × 800) Direct labor [($6,500 ÷ 1,000) × 800] Variable overhead [($5,000 ÷ 1,000) × 800] Factory depreciation—fixed Factory supervisory salaries—fixed Other fixed factory costs—fixed Total $ 9,600 5,200 4,000 9,000 7,800 2,500 $38,100 BE 153 Butterfly World’s budgeted sales for April were estimated at $500,000, sales commissions at 4% of sales, and the sales manager's salary at $80,000. Shipping expenses were estimated at 1% of sales and miscellaneous selling expenses were estimated at $1,000, plus 0.5% of sales. Instructions Determine the budgeted selling expenses on a flexible budget for April. Solution 153 (min.) Sales commissions 4% × $500,000 Sales manager’s salary Shipping expenses 1% × $500,000 Miscellaneous selling: Fixed portion Variable: 0.5% × $500,000 Budgeted selling expenses $ 20,000 80,000 5,000 1,000 2,500 $108,500 24 - 26 Test Bank for Accounting Principles, Eighth Edition BE 154 Ranger Company produces men’s shirts. The following budgeted and actual amounts are for 2008: Cost Budget at 2,500 units Actual Amounts at 2,900 units Direct materials $55,000 $65,500 Direct labor 70,000 81,000 Fixed overhead 35,000 34,500 Instructions Prepare a performance report for Ranger Company for the year. Solution 154 (5 min.) RANGER COMPANY Manufacturing Performance Budget Report For the Year Ended December 31, 2008 Direct materials Direct labor Fixed overhead Total costs Budget $ 63,800 81,200 35,000 $180,000 Actual $ 65,500 81,000 34,500 $181,000 Differences $1,700 U 200 F 500 F $1,000 U BE 155 Lincoln Inc. reported the following items for 2008: Controllable fixed costs Contribution margin Interest expense Variable costs Total assets $ 77,000 142,000 20,000 80,000 $925,000 Instructions Compute the controllable margin for 2008. Solution 155 (2 min.) $142,000 – $77,000 = $65,000 BE 156 The data for an investment center is given below. January 1, 2008 Current Assets $ 400,000 Plant Assets 3,000,000 The controllable margin is $615,000. Instructions Compute the return on investment for the center for 2008. December 31, 2008 $ 800,000 4,000,000 Budgetary Planning and Responsibility Accounting Solution 156 24 - 27 (4 min.) Average current assets ($400,000 + $800,000) ÷ 2 = $600,000 Plant assets ($3,000,000 + $4,000,000) ÷ 2 = $3,500,000 ROI = Controllable Margin ÷ Average Operating Assets = $615,000 ÷ $4,100,000 = 15% BE 157 Data for the Electric Division of Bowden Baseball Company which is operated as an investment center follows: Sales $6,000,000 Contribution Margin 800,000 Controllable Fixed Costs 500,000 Return on Investment 12% Instructions Calculate controllable margin and average operating assets. Solution 157 (3 min.) Controllable Margin ($800,000 – $500,000) = $300,000 Average Operating Assets ($300,000 ÷ .12) = $2,500,000 BE 158 Wimmer Division’s operating results include: • • • Controllable margin, $150,000 Sales revenue, $1,200,000 Operating assets, $500,000 Wimmer is considering a project with sales of $120,000, expenses of $84,000, and an investment of $180,000. Wimmer’s required rate of return is 15%. Instructions Determine whether Wimmer should accept this project. Solution 158 (5 min.) Current ROI = $150,000 ÷ $500,000 = 30% ROI of new project = $36,000 ÷ $180,000 = 20% New ROI with project = [$150,000 + $36,000] ÷ [$500,000 + $180,000] = 27.4% While ROI decreases, that does not make this a bad investment, since many projects cause total ROI to fall even though they increase value of the division. The determination is based on how the ROI of the project compares to the required rate of return. The company is not willing to accept any projects with an investment less than 15%, so the 20% project should be accepted. 24 - 28 Test Bank for Accounting Principles, Eighth Edition BE 159 An investment center manager is considering three possible investments. The company’s required return is 10%. The required asset investment, controllable margins, and the ROIs of each investment are as follows: Project Bud Wise Er Average Investment $160,000 140,000 220,000 Controllable Margin $32,000 16,000 66,000 ROI 20.0% 11.4% 30% The investment center is currently generating an ROI of 25% based on $1,200,000 in operating assets and a controllable margin of $300,000. Instructions If the manager can select only one project, determine which one is the best choice to increase the investment center's ROI. Compute how much the investment center’s ROI will be if the manager selects your recommendation. Solution 159 (4 min.) Er is the best choice because it increases the ROI (30% is greater than 25%). Project Bud Wise Er New ROI ($300,000 + $32,000) ÷ ($1,200,000 + $160,000) = 24.4% ($300,000 + $16,000) ÷ ($1,200,000 + $140,000) = 23.6% ($300,000 + $66,000) ÷ ($1,200,000 + $220,000) = 25.8% EXERCISES Ex. 160 Doonan Company's master budget reflects budgeted sales information for the month of June, 2008, as follows: Budgeted Quantity Budgeted Unit Sales Price Product A 20,000 $7 Product B 24,000 $9 During June, the company actually sold 19,500 units of Product A at an average unit price of $7.10 and 24,800 units of Product B at an average unit price of $8.90. Instructions Prepare a Sales Budget Report for the month of June for Doonan Company which shows whether the company achieved its planned objectives. Solution 160 (10–15 min.) DOONAN COMPANY Sales Budget Report For the Month Ended June 30, 2008 Product Line Product A Product B Total sales Budget $140,000 216,000 $356,000 Actual $138,450 220,720 $359,170 Difference $1,550 U 4,720 F $3,170 F Budgetary Planning and Responsibility Accounting 24 - 29 Ex. 161 Colaw Manufacturing Co.'s static budget at 6,000 units of production includes $36,000 for direct labor and $6,000 for direct materials. Total fixed costs are $24,000. Instructions a. Determine how much would appear on Colaw's flexible budget for 2008 if 9,000 units are produced and sold. b. How would this comparison differ if a static budget were used instead of a flexible budget for performance evaluation? Solution 161 (8–10 min.) a. Variable costs: Direct labor Direct materials Fixed costs Total costs b. 6,000 Units Unit Variable Cost 9,000 Units $36,000 6,000 42,000 24,000 $66,000 $6.00 1.00 $54,000 9,000 63,000 24,000 $87,000 If a static budget were used, budgeted variable costs would be only $42,000 because they would be based on the static budget level of 6,000 units. The company would appear way over budget since the costs incurred would be related to a higher level of activity. Ex. 162 Jenner Company developed its annual manufacturing overhead budget for its master budget for 2008 as follows: Expected annual operating capacity Variable overhead costs Indirect labor Indirect materials Factory supplies Total variable Fixed overhead costs Depreciation Supervision Property taxes Total fixed Total costs 120,000 Direct Labor Hours $420,000 90,000 30,000 540,000 180,000 120,000 96,000 396,000 $936,000 The relevant range for monthly activity is expected to be between 8,000 and 12,000 direct labor hours. Instructions Prepare a flexible budget for a monthly activity level of 8,000 and 9,000 direct labor hours. 24 - 30 Test Bank for Accounting Principles, Eighth Edition Solution 162 (15–20 min.) JENNER COMPANY Monthly Flexible Manufacturing Overhead Budget Activity level Direct labor hours Variable costs Indirect labor Indirect materials Factory supplies Total variable Fixed costs Depreciation Supervision Property taxes Total fixed Total costs 8,000 9,000 $28,000 6,000 2,000 36,000 $31,500 6,750 2,250 40,500 15,000 10,000 8,000 33,000 $69,000 15,000 10,000 8,000 33,000 $73,500 Ex. 163 Dailey Company has prepared the following monthly flexible manufacturing overhead budget for its Mixing Department: DAILEY COMPANY Monthly Flexible Manufacturing Overhead Budget Mixing Department Activity level Direct labor hours Variable costs Indirect materials Indirect labor Factory supplies Total variable Fixed costs Depreciation Supervision Property taxes Total fixed Total costs 3,000 4,000 $ 1,500 15,000 4,500 21,000 $ 2,000 20,000 6,000 28,000 20,000 10,000 15,000 45,000 $66,000 20,000 10,000 15,000 45,000 $73,000 Instructions Prepare a flexible budget at the 5,000 direct labor hours of activity. Budgetary Planning and Responsibility Accounting Solution 163 24 - 31 (15–20 min.) DAILEY COMPANY Monthly Flexible Manufacturing Overhead Budget Mixing Department Activity level Direct labor hours Variable costs Indirect materials Indirect labor Factory supplies Total variable Fixed costs Depreciation Supervision Property taxes Total fixed Total costs 5,000 $ 2,500 25,000 7,500 35,000 20,000 10,000 15,000 45,000 $80,000 Ex. 164 Fagan Company uses a flexible budget for manufacturing overhead based on machine hours. Variable manufacturing overhead costs per machine hour are as follows: Indirect labor Indirect materials Maintenance Utilities Fixed overhead costs per month are: Supervision Insurance Property taxes Depreciation $5.00 2.50 .50 .30 $600 200 300 900 The company believes it will normally operate in a range of 2,000 to 4,000 machine hours per month. Instructions Prepare a flexible manufacturing overhead budget for the expected range of activity, using increments of 1,000 machine hours. 24 - 32 Test Bank for Accounting Principles, Eighth Edition Solution 164 (15–20 min.) FAGAN COMPANY Monthly Flexible Manufacturing Overhead Budget Activity level Machine hours 2,000 3,000 4,000 Variable costs Indirect labor Indirect materials Maintenance Utilities Total variable $10,000 5,000 1,000 600 16,600 $15,000 7,500 1,500 900 24,900 $20,000 10,000 2,000 1,200 33,200 Fixed costs Supervision Insurance Property taxes Depreciation Total fixed Total costs 600 200 300 900 2,000 $18,600 600 200 300 900 2,000 $26,900 600 200 300 900 2,000 $35,200 Ex. 165 Dashboard Corporation's manufacturing costs for July when production was 1,000 units appears below: Direct materials $10 per unit Factory depreciation $8,000 Variable overhead 5,000 Direct labor 2,000 Factory supervisory salaries 5,800 Other fixed factory costs 1,500 Instructions How much is the flexible budget manufacturing cost amount for a month when 1,100 units are produced? Solution 165 (8–10 min.) Direct materials ($10 × 1,100) Direct labor [($2,000 ÷ 1,000) × 1,100] Variable overhead [($5,000 ÷ 1,000) × 1,100] Factory depreciation—fixed Factory supervisory salaries—fixed Other fixed factory costs Total $11,000 2,200 5,500 8,000 5,800 1,500 $34,000 Budgetary Planning and Responsibility Accounting 24 - 33 Ex. 166 Fagan Company uses a flexible budget for manufacturing overhead based on machine hours. Variable manufacturing overhead costs per machine hour are as follows: Indirect labor $5.00 Indirect materials 2.50 Maintenance .50 Utilities .30 Fixed overhead costs per month are: Supervision Insurance Property taxes Depreciation $600 200 300 900 The company believes it will normally operate in a range of 2,000 to 4,000 machine hours per month. During the month of August, 2008, the company incurs the following manufacturing overhead costs: Indirect labor $14,000 Indirect materials 8,100 Maintenance 1,400 Utilities 950 Supervision 720 Insurance 200 Property taxes 300 Depreciation 930 Instructions Prepare a flexible budget report, assuming that the company used 3,000 machine hours during August. Solution 166 (20–25 min.) FAGAN COMPANY Manufacturing Overhead Budget Report (Flexible) For the Month Ended August 31, 2008 Budget at 3,000 hrs. Actual at 3,000 hrs. Difference Favorable F Unfavorable U Variable costs Indirect labor Indirect materials Maintenance Utilities Total variable $15,000 7,500 1,500 900 24,900 $14,000 8,100 1,400 950 24,450 $1,000 600 100 50 450 F U F U F Fixed Costs Supervision Insurance Property taxes Depreciation Total fixed Total costs 600 200 300 900 2,000 $26,900 720 200 300 930 2,150 $26,600 120 — — 30 150 $ 300 U U U F 24 - 34 Test Bank for Accounting Principles, Eighth Edition Ex. 167 Molle Company uses flexible budgets to control its selling expenses. Monthly sales are expected to be from $200,000 to $240,000. Variable costs and their percentage relationships to sales are: Sales commissions Advertising Traveling Delivery 6% 4% 5% 1% Fixed selling expenses consist of sales salaries $40,000 and depreciation on delivery equipment $10,000. Instructions Prepare a flexible budget for increments of $20,000 of sales within the relevant range. Solution 167 (17–22 min.) MOLLE COMPANY Monthly Flexible Selling Expense Budget Activity level Sales Variable expenses Sales commissions Advertising Traveling Delivery Total variable Fixed expenses Sales salaries Depreciation Total fixed Total costs $200,000 $220,000 $240,000 $12,000 8,000 10,000 2,000 32,000 $13,200 8,800 11,000 2,200 35,200 $14,400 9,600 12,000 2,400 38,400 40,000 10,000 50,000 $82,000 40,000 10,000 50,000 $85,200 40,000 10,000 50,000 $88,400 Ex. 168 Molle Company uses flexible budgets to control its selling expenses. Monthly sales are expected to be from $200,000 to $240,000. Variable costs and their percentage relationships to sales are: Sales commissions Advertising Traveling Delivery 6% 4% 5% 1% Fixed selling expenses consist of sales salaries $40,000 and depreciation on delivery equipment $10,000. Budgetary Planning and Responsibility Accounting Ex. 168 24 - 35 (cont.) The actual selling expenses incurred in February, 2008, by Molle Company are as follows: Sales commissions Advertising Traveling Delivery $13,700 8,000 11,300 1,600 Fixed selling expenses consist of sales salaries $41,000 and depreciation on delivery equipment $10,000. Instructions Prepare a flexible budget performance report, assuming that February sales were $220,000. Solution 168 (17–22 min.) MOLLE COMPANY Selling Expense Budget Report (Flexible) For the Month Ended February 29, 2008 Variable expenses Sales commissions Advertising Traveling Delivery Total variable Fixed expenses Sales salaries Depreciation Total fixed Total expenses Difference Favorable F Unfavorable U Budget $220,000 Actual $220,000 $13,200 8,800 11,000 2,200 35,200 $13,700 8,000 11,300 1,600 34,600 $ 500 800 300 600 600 40,000 10,000 50,000 $85,200 41,000 10,000 51,000 $85,600 1,000 U — 1,000 U $ 400 U U F U F F Ex. 169 A flexible budget graph for the Assembly Department shows the following: 1. At zero direct labor hours, the total budgeted cost line intersects the vertical axis at $60,000. 2. At normal capacity of 50,000 direct labor hours, the line drawn from the total budgeted cost line intersects the vertical axis at $180,000. Instructions Develop the budgeted cost formula for the Assembly Department and identify the fixed and variable costs. 24 - 36 Test Bank for Accounting Principles, Eighth Edition Solution 169 (5 min.) Budgeted Costs: Assembly $60,000 + $2.40. Fixed costs are $60,000. Variable costs are $2.40 per labor hour. ($180,000 – $60,000) ÷ 50,000. Ex. 170 Pele Clothing Company's static budget at 2,000 units of production includes $8,000 for direct labor, $2,000 for utilities (variable), and total fixed costs of $16,000. Actual production and sales for the year was 6,000 units, with an actual cost of $47,200. Instructions Determine if Pele Clothing is over or under budget. Solution 170 Variable costs: Direct labor Utilities Fixed costs Total costs (8–10 min.) 2,000 Units Unit Variable Cost 6,000 Units $ 8,000 2,000 10,000 16,000 $26,000 $4.00 1.00 $24,000 6,000 30,000 16,000 $46,000 The company is over budget by $1,200. The flexible budget amount allowed was $46,000, and the company incurred $47,200 of actual costs. Ex. 171 Colter Company produces men's ties. The following budgeted and actual amounts are for 2008: Cost Direct materials Direct labor Equipment depreciation Indirect labor Indirect materials Rent and insurance Budget at 5,000 Units $60,000 75,000 5,000 7,500 9,000 12,000 Actual Amounts at 5,800 Units $71,000 86,500 5,000 8,600 9,600 13,000 Instructions Prepare a performance budget report for Colter Company for the year. Budgetary Planning and Responsibility Accounting Solution 171 24 - 37 (8–10 min.) COLTER COMPANY Manufacturing Performance Budget Report For the Year Ended December 31, 2008 Direct materials Direct labor Equipment depreciation Indirect labor Indirect materials Rent and insurance Total costs Budget $ 69,600 87,000 5,000 8,700 10,440 12,000 $192,740 Actual $ 71,000 86,500 5,000 8,600 9,600 13,000 $193,700 Differences $1,400 U 500 F 0 100 F 840 F 1,000 U $ 960 U Ex. 172 Data concerning manufacturing overhead for Friendly Company are presented below. The Mixing Department is a cost center. An analysis of the overhead costs reveals that all variable costs are controllable by the manager of the Mixing Department and that 50% of supervisory costs are controllable at the department level. The flexible budget formula and the cost and activity for the months of July and August are as follows: Flexible Budget Per Direct Labor Hour Actual Costs and Activity July August Direct labor hours 6,000 7,000 Overhead costs Variable Indirect materials $3.50 $ 20,500 $ 25,100 Indirect labor 6.00 39,500 40,700 Factory supplies 1.00 7,600 8,200 Fixed Depreciation $20,000 15,000 15,000 Supervision 25,000 23,000 26,000 Property taxes 10,000 12,000 12,000 Total costs $117,600 $127,000 Instructions (a) Prepare the responsibility reports for the Mixing Department for each month. (b) Comment on the manager's performance in controlling costs during the two month period. 24 - 38 Test Bank for Accounting Principles, Eighth Edition Solution 172 (20–25 min.) (a) FRIENDLY COMPANY Mixing Department Manufacturing Overhead Cost Responsibility Report For the Months of July and August Controllable Cost Indirect materials Indirect labor Factory supplies Supervision Total costs (b) Budget 21,000 36,000 6,000 12,500 75,500 July Actual 20,500 39,500 7,600 11,500 79,100 Difference 500 F 3,500 U 1,600 U 1,000 F 3,600 U Budget 24,500 42,000 7,000 12,500 86,000 August Actual Difference 25,100 600 U 40,700 1,300 F 8,200 1,200 U 13,000 500 U 87,000 1,000 U The manager did a better job of controlling costs in August ($1,000 U) than in July ($3,600 U). Ex. 173 Gentry Company's manufacturing overhead budget for the first quarter of 2008 contained the following data: Variable Costs Indirect materials Indirect labor Utilities Maintenance $20,000 12,000 10,000 6,000 Fixed Costs Supervisor's salary Depreciation Property taxes $40,000 8,000 4,500 Actual variable costs for the first quarter were: Indirect materials Indirect labor Utilities Maintenance $18,600 13,200 10,500 5,300 Actual fixed costs were as expected except for property taxes which were $4,500. All costs are considered controllable by the department manager except for the supervisor's salary. Instructions Prepare a manufacturing overhead responsibility performance report for the first quarter. Budgetary Planning and Responsibility Accounting Solution 173 24 - 39 (15–20 min.) GENTRY COMPANY Manufacturing Overhead Cost Responsibility Report For the Quarter Ended March 31, 2008 Controllable Costs Indirect materials Indirect labor Utilities Maintenance Depreciation Property taxes Total costs Budget $20,000 12,000 10,000 6,000 8,000 4,000 $60,000 Actual $18,600 13,200 10,500 5,300 8,000 4,500 $60,100 Difference $1,400 F 1,200 U 500 U 700 F — 500 U $ 100 U Ex. 174 The Ace Division, a profit center of Berek Engineering Company, reported the following data for the first quarter of 2008: Sales Variable costs Controllable direct fixed costs Noncontrollable direct fixed costs Indirect fixed costs $6,000,000 4,200,000 800,000 530,000 200,000 Instructions (a) Prepare a performance report for the manager of the Ace Division. (b) What is the best measure of the manager's performance? Why? (c) How would the responsibility report differ if the division was an investment center? Solution 174 (a) (15–20 min.) BEREK ENGINEERING COMPANY Ace Division Management Performance Report For the Quarter Ended March 31, 2008 Sales ............................................................................................. Variable costs................................................................................ Contribution margin....................................................................... Controllable fixed costs ................................................................. Controllable margin ....................................................................... $6,000,000 4,200,000 1,800,000 800,000 $1,000,000 (b) Controllable margin is the best measure of the manager's performance because this amount equals the excess of controllable revenues over controllable costs. (c) For an investment center, the responsibility report would also show the return on investment for the period. 24 - 40 Test Bank for Accounting Principles, Eighth Edition Ex. 175 RTO Rental Company reported the following: Beginning of year operating assets End of year operating assets Contribution margin Sales Controllable fixed costs $2,200,000 2,000,000 1,000,000 5,000,000 643,000 Its required return is 10%. Instructions Compute the company’s ROI. Solution 175 (3 min.) ($1,000,000 – $643,000) ÷ [($2,200,000 + $2,000,000) ÷ 2] = 17% Ex. 176 Reese Company has two investment centers and has developed the following information: Departmental controllable margin Average operating assets Sales ROI Department A $120,000 ? 800,000 10% Department B ? $400,000 250,000 12% Instructions Answer the following questions about Department A and Department B. 1. What was the amount of Department A's average operating assets? $____________. 2. What was the amount of Department B's controllable margin? $____________. 3. If Department B is able to reduce its operating assets by $100,000, Department B's new ROI would be ____________. 4. If Department A is able to increase its controllable margin by $60,000 as a result of reducing variable costs, Department A's new ROI would be _________________. Solution 176 1. 2. 3. 4. (8–12 min.) $1,200,000 ($120,000 ÷ .10) $48,000 ($400,000 × .12) 16% [$48,000 ÷ ($400,000 – $100,000)] 15% [($120,000 + $60,000) ÷ $1,200,000] Budgetary Planning and Responsibility Accounting 24 - 41 Ex. 177 The Appliance Division of Malone Manufacturing Company reported the following results for 2008: Sales $4,000,000 Variable costs 3,200,000 Controllable fixed costs 300,000 Average operating assets 2,000,000 Management is considering the following independent alternative courses of action in 2009 in order to maximize the return on investment for the division. 1. Reduce controllable fixed costs by 20% with no change in sales or variable costs. 2. Reduce average operating assets by 20% with no change in controllable margin. 3. Increase sales $400,000 with no change in the contribution margin percentage. Instructions (a) Compute the return on investment for 2008. (b) Compute the expected return on investment for each of the alternative courses of action. Solution 177 (a) (15–20 min.) Controllable margin Return on investment = ———————————— Average operating assets $500,000 2008 ROI = —————— = 25% $2,000,000 (b) $560,000 (a) 1. ——————— = 28% $2,000,000 $500,000 2. ———————— = 31.3% $1,600,000 (b) $580,000 (c) 3. ——————— = 29% $2,000,000 (a) $500,000 + ($300,000 × 20%) = $560,000. (b) $2,000,000 – ($2,000,000 × .20) = $1,600,000. (c) Contribution margin 20% $4,000,000 – $3,200,000 (———————————— ); $4,000,000 $500,000 + ($400,000 × 20%) = $580,000. 24 - 42 Test Bank for Accounting Principles, Eighth Edition Ex. 178 Data for the following subsidiaries of Timmons Company, which are operated as investment centers, are as follows: Black Company Greer Company Sales $3,000,000 $2,000,000 Controllable margin (1) (3) Average operating assets (2) 4,000,000 Contribution margin 1,200,000 800,000 Controllable fixed costs 500,000 200,000 Return on Investment 10% (4) Instructions Compute the missing amounts using the ROI formula. Solution 178 (1) (2) (3) (4) (9–14 min.) Controllable margin ($1,200,000 – $500,000) = $700,000 Average operating assets ($700,000 ÷ .10) = $7,000,000 Controllable margin ($800,000 – $200,000) = $600,000 ROI ($600,000 ÷ $4,000,000) = 15% Ex. 179 The data for an investment center is given below. 1/1/08 $ 300,000 3,000,000 250,000 1,200,000 Current assets Plant assets Idle plant assets Land held for future use 12/31/08 $ 500,000 4,000,000 330,000 1,200,000 The controllable margin is $780,000. Instructions What is the return on investment for the center for 2008? Solution 179 (4–5 min.) ROI = Controllable margin ÷ Average operating assets Plant assets Average current assets ($3,000,000 + $4,000,000) ÷ 2 = $3,500,000 ($300,000 + $500,000) ÷ 2 = 400,000 $3,900,000 Note: Idle plant assets and land held for future use are not included in average operating assets. ROI = $780,000 ÷ $3,900,000 = 20% Budgetary Planning and Responsibility Accounting 24 - 43 COMPLETION STATEMENTS 180. The use of budgets in controlling operations is known as ________________. 181. A major aspect of budgeting control is the use of budget reports that compare _____________________ with _______________________. 182. In analyzing differences from planned objectives, management may ___________________, or it could decide to modify ___________________. take 183. The master budget is a __________________ budget which is based on operating at one budgeted activity level. 184. A __________________ budget projects budget data for various levels of activity. 185. Total ________________ costs will be the same on the master budget and on a flexible budget which reflects the actual level of activity. 186. Under ___________________ accounting, the evaluation of a manager's performance is based on the costs and revenues directly under that manager's control. 187. A cost is __________________ at a given level of managerial responsibility if a manager has the authority to incur the cost in a given time period. 188. In general, costs ____________________ directly by the level of responsibility are _______________, whereas costs that are ____________________ to the responsibility level are __________________. 189. Responsibility centers may be classified into three types: (1)____________________, (2)___________________ and, (3)____________________. 190. The primary basis for evaluating the performance of a manager of an investment center is _________________. 191. Return on investment is calculated by dividing _________________________ by ________________________. Answers to Completion Statements 180. 181. 182. 183. 184. 185. 186. budgetary control actual results, planned objectives corrective action, future plans static flexible fixed responsibility 187. controllable 188. incurred, controllable, allocated, noncontrollable 189. cost centers, profit centers, investment centers 190. return on investment (ROI) 191. controllable margin, average operating assets 24 - 44 Test Bank for Accounting Principles, Eighth Edition MATCHING 192. Match the items below by entering the appropriate code letter in the space provided. A. B. C. D. E. F. Budgetary control Static budget Flexible budget Responsibility accounting Controllable costs Management by exception G. H. I. J. K. L. Responsibility reporting system Return on Investment Profit center Investment center Indirect fixed costs Direct fixed costs ____ 1. The review of budget reports by top management directed entirely or primarily to differences between actual results and planned objectives. ____ 2. A part of management accounting that involves accumulating and reporting revenues and costs on the basis of the individual manager who has the authority to make the day-to-day decisions about the items. ____ 3. The preparation of reports for each level of responsibility shown in the company's organization chart. ____ 4. A projection of budget data at one level of activity. ____ 5. Costs that a manager has the authority to incur within a given period of time. ____ 6. The use of budgets to control operations. ____ 7. A projection of budget data for various levels of activity. ____ 8. A responsibility center that incurs costs, generates revenues, and has control over the investment funds available for use. ____ 9. Costs that relate specifically to a responsibility center and are incurred for the sole benefit of the center. ____ 10. A responsibility center that incurs costs and also generates revenues. ____ 11. Costs which are incurred for the benefit of more than one profit center. ____ 12. A measure of the profitability of an investment center computed by dividing controllable margin (in dollars) by average operating assets. Answers to Matching 1. 2. 3. 4. 5. 6. F D G B E A 7. 8. 9. 10. 11. 12. C J L I K H Budgetary Planning and Responsibility Accounting 24 - 45 SHORT-ANSWER ESSAY QUESTIONS S-A E 193 The master budget and flexible budgets are important aids to management in performing the management functions of planning and control. Briefly describe how planning and control are facilitated by preparing a master budget and flexible budgets. How are these two types of budgets interrelated with planning and control? Solution 193 The system of responsibility reporting begins with the lowest level of responsibility and moves up through each level. At the lowest level each manager receives detailed information concerning the controllable costs for which they are responsible. At higher levels of responsibility the detail of the lower levels may be omitted but the report encompasses all the areas for which the higher level has responsibility. For example, a plant manager will receive reports concerning the controllable costs of each of the plant departments. Management by exception is possible in such a system because, if management at the higher levels of responsibility identifies a significant variance, they can receive detailed reports for each lower level of responsibility. This allows management to investigate causes and remedies for variances as they feel necessary. S-A E 194 Managers are motivated to accomplish objectives if they feel that their efforts will be fairly evaluated. Explain why an organization may use different bases for evaluating the performance of managers of different types of responsibility centers. Solution 194 Because a manager should only be evaluated based on the performance results of matters that are controllable by the manager, it is necessary to use different bases for evaluation. An investment center manager can control the investment funds available as well as costs and revenues. Return on investment is therefore an appropriate basis for evaluation. A profit center, however, controls only revenues and expenses but not investment, so controllable margin is a more appropriate basis relating only to the areas controllable by the profit center. Similarly, because only costs are controllable for a cost center, such a center is evaluated only on the basis of its controllable costs. S-A E 195 (Ethics) Howard Corporation evaluates its managers based on return on investment (ROI). Ann Wilsen and Jill Reese, managers of the electronics and housewares departments respectively, have recently suffered from declining profits in their departments. Over lunch, they discuss the problem, and how they could improve performance. Most of the discussion centers around ways to increase sales. Near the end of the lunch period, however, Jill remarks that there are two components to consider, and that they have considered only one. She wonders whether there is some way to reduce investment, and by decreasing the denominator of the ROI fraction, to improve the final result. 24 - 46 Test Bank for Accounting Principles, Eighth Edition S-A E 195 (cont.) Back at work, Ann continues to mull over Jill's remarks. She decides to pursue the matter further, and before the end of the quarter she has sold quite a bit of older equipment and replaced it with equipment obtained with a short-term lease. Her performance, measured by ROI, is markedly improved, although sales continue to be disappointing. Required: 1. Who are the stakeholders in this situation? 2. Is Ann's action ethical? Briefly explain. Solution 195 1. The stakeholders include Ann Wilsen Jill Reese managers of Howard Corporation shareholders of Howard Corporation 2. Ann's action is probably not ethical. It appears that she has replaced equipment that had been purchased only because such a move would improve her ROI. Of course, it is possible that the leased equipment will allow her department to function better, resulting in a benefit for the company. Any action to promote one's own benefit at the expense of the company's welfare is unethical. S-A E 196 (Communication) Clara County Electronics manufactures circuit boards for computer-controlled appliances for the home. The sales have been very volatile, sometimes stressing the plant's capacity, and sometimes depressingly slow. During a recent slow period, Mike Farmer, a production supervisor, complained to Sue Stein, accounting manager, about the flexible budget. "I try as hard as I can to meet the budget," he says, "and then I find out that just meeting the budget's not good enough. Last month, when we sold 8,000 units, I was $10,000 under my budget, and then you all blow me out of the water with your report that I actually was $5,000 over, because sales were slow. I thought this responsibility accounting business was supposed to mean we are held accountable just for things we can control. How do we control sales? At the beginning of the year, you gave us all targets. Mine says that for an average month of 10,000 unit sales, I should spend about $82,000. I spend less, and get an unfavorable budget report. What gives?" Required: Write a short memo to respond to Mr. Farmer. Budgetary Planning and Responsibility Accounting Solution 196 TO: Mike Farmer FROM: Sue Stein RE: Budget results I appreciate your coming to me with your questions about the budget. I understand that the new procedures can be frustrating, especially when you receive an unfavorable report that you were not expecting. Actually, the flexible budget does mean that you are held accountable only for the costs that you can control. Last month, we calculated the cost of producing 8,000 units that were actually sold (and not the 10,000 that were estimated to be sold). Your costs were greater than that, although still less than the amount you would have been allowed had the full 10,000 been sold. Please check the individual items on your budget report. We noted which ones exceeded the budget. You can then focus attention on those items for cost control. Please contact the Accounting Department if you have further questions. (signed) 24 - 47