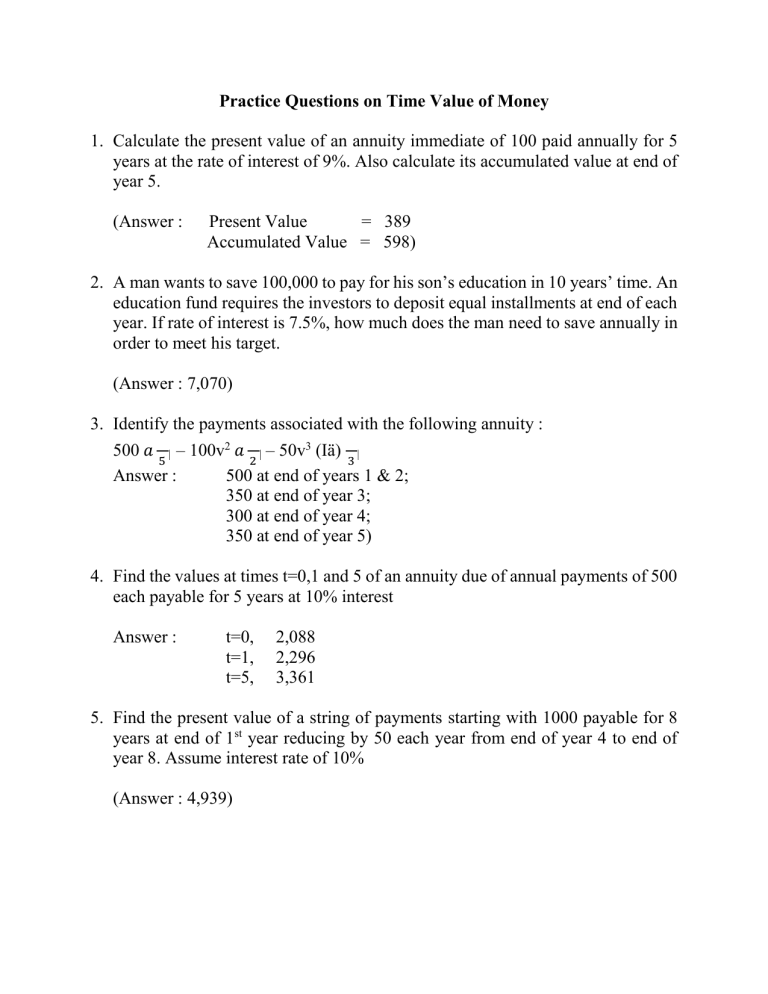

Practice Questions on Time Value of Money 1. Calculate the present value of an annuity immediate of 100 paid annually for 5 years at the rate of interest of 9%. Also calculate its accumulated value at end of year 5. (Answer : Present Value = 389 Accumulated Value = 598) 2. A man wants to save 100,000 to pay for his son’s education in 10 years’ time. An education fund requires the investors to deposit equal installments at end of each year. If rate of interest is 7.5%, how much does the man need to save annually in order to meet his target. (Answer : 7,070) 3. Identify the payments associated with the following annuity : 500 𝑎 | – 100v2 𝑎 | – 50v3 (Iä) | 5 2 3 Answer : 500 at end of years 1 & 2; 350 at end of year 3; 300 at end of year 4; 350 at end of year 5) 4. Find the values at times t=0,1 and 5 of an annuity due of annual payments of 500 each payable for 5 years at 10% interest Answer : t=0, t=1, t=5, 2,088 2,296 3,361 5. Find the present value of a string of payments starting with 1000 payable for 8 years at end of 1st year reducing by 50 each year from end of year 4 to end of year 8. Assume interest rate of 10% (Answer : 4,939) 6. You are given that : 𝑎 5 | = 3.99 and i=8% Calculate (Iä) 5 | (Answer : 12.20) 7. A deposit is to be made today and a second deposit, which is one-half the first, is to be made 2 years from now, to provide for withdrawals of $1,000 one year from now and $2,000, 5 years from now. Interest is at 5% effective. What is the amount of the initial deposit? SOLUTION Using time 0 as the comparison date, the equation of value is : x+(x/2)v2 = 1.000v+ 2.000v5 at 5% x = 1,000𝑣 +2,000𝑣 5 1+𝑣2 / 2 = $1.733.34 8. You are given two loans, with each loan to be repaid by a single payment in the future. Each payment includes both principal and interest. The first loan is repaid by a 3,000 payment at the end of 8 years. The interest is accrued at 5% per annum. The second loan is repaid by a 4,000 payment at the end of 10 years. The interest is accrued at 4% per annum. These two loans are to be consolidated. The consolidated loan is to be repaid by two equal installments of X, with interest at 6% per annum. The first payment is due immediately and the second payment is due 2 year from now. Calculate X. SOLUTION X(1 + v2 .06) = 3.000v8 .05 + 4.000v10 .04 = 3.000(.6768) + 4.000(.675) = 4,732.80 X= 4.732.80 1+.89 = 2.504 9. You are given : (i) a |= 10 𝑛 (ii) The present value of an n-year deferred, n-year annuity-immediate is 5. Determine i. SOLUTION From (ii). vn a | = 5. Since a | = 10, we have vn = 5/10 = 0.5. Now a | =(1𝑛 𝑛 𝑛 vn)/i. Substitute 0.5 for vn a | = 10 = (1-vn)/i = (1-0.5)/i 𝑛 10i = 1 -0.5 = 0.5 i=5% 10.To accumulate 8000 at the end of 3n years, deposits of 98 are made at the end of each of the first n years and 196 at the end of each of the next 2n years. The annual effective rate of interest is i. You are given (1 + i)n= 2.0. Determine i. SOLUTION 98s 3𝑛 | + 98s (1+𝑖)3𝑛 −1 𝑖 + 2𝑛 | = 8 000 (1+𝑖)2𝑛 −1 𝑖 = 8000 98 We are given that (1 + i)n = 2: 23 −1 𝑖 + 22 −1 𝑖 = 81.63 i = 12.25% 11.Leo will make an initial deposit into an account of $1,000 at time t= 0, followed by five annual deposits of $200 at times t = l, 2, 3, 4, 5. Leo will receive payments from the account at times t = 7, 8, 9, starting at $1,500 and decreasing by $Q per year. The balance in the account after the last payment is $0. You may assume this account earns an effective annual interest rate of 7%. Determine Q. SOLUTION At t= 6. PV of deposit = 1000(1.07)6 + 200𝑠̈ PV 1,500a 3 | - Qv(1a) 2 | 5 | = 2731.3885 = 2731.3885 12.Two annuities have equal present values. The first is an annuity-immediate with yearly payments of $X for 10 years. The second is an increasing annuityimmediate with 10 annual payments. The first payment is $500 and subsequent payments increase by $50 per year. You may assume an annual effective interest rate of 5%. Determine X. SOLUTION 450 a |+ 10 50(1a) 10 |= Xa | 10 450(7.7217) + 50(39.3738) = 7.7217X X= 3,474.7807+19,686.8914 7.7217 = 3,000